Accounting Manager Resume Examples

Jul 18, 2024

|

12 min read

"Balance your career chances: Craft your accounting manager resume with our easy guide. Show you can handle the job and numbers, and make employers notice your skills."

Rated by 348 people

Financial Accounting Manager

Cost Accounting Manager

Tax Accounting Manager

Project Accounting Manager

Accounts Payable Manager

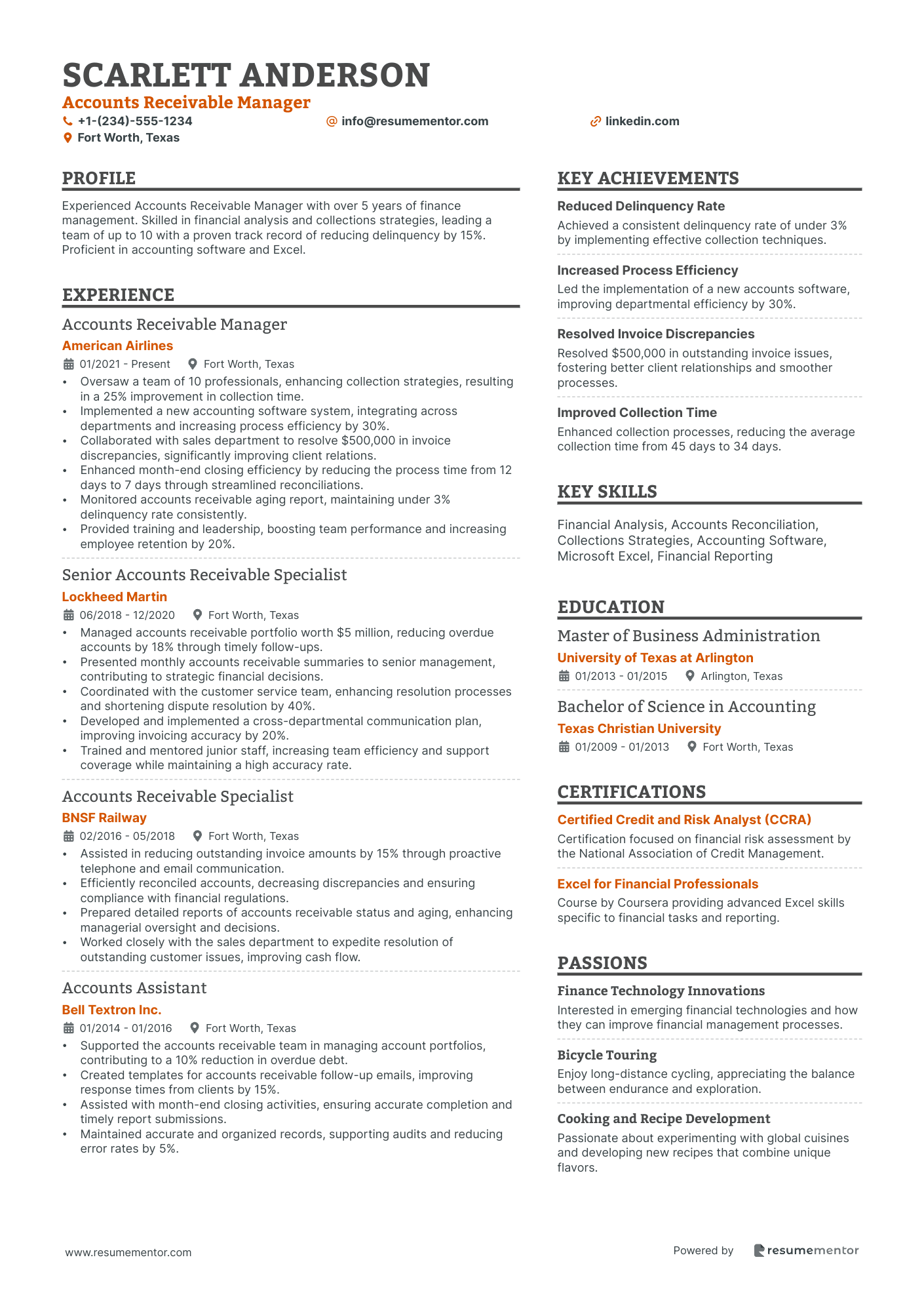

Accounts Receivable Manager

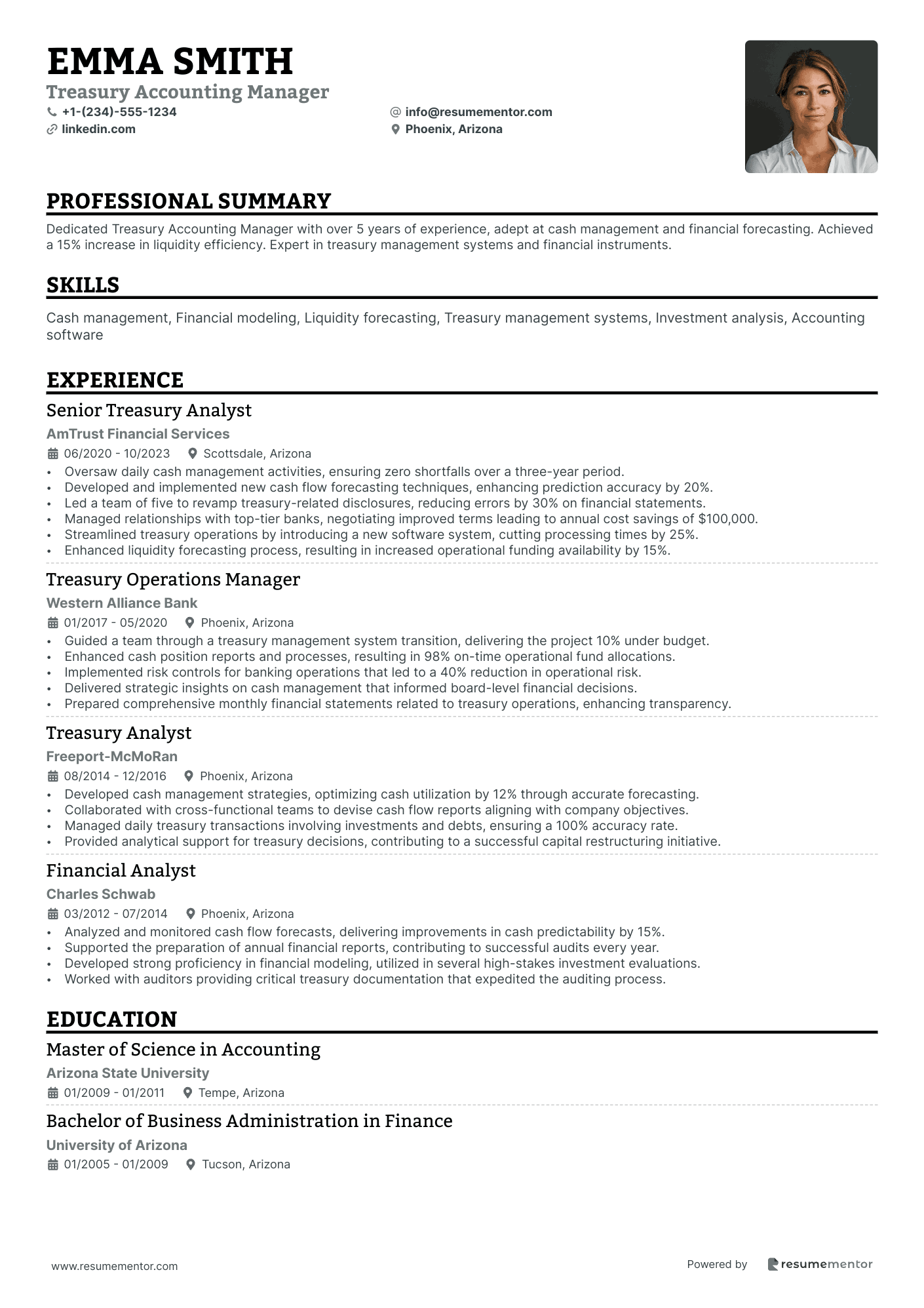

Treasury Accounting Manager

International Accounting Manager

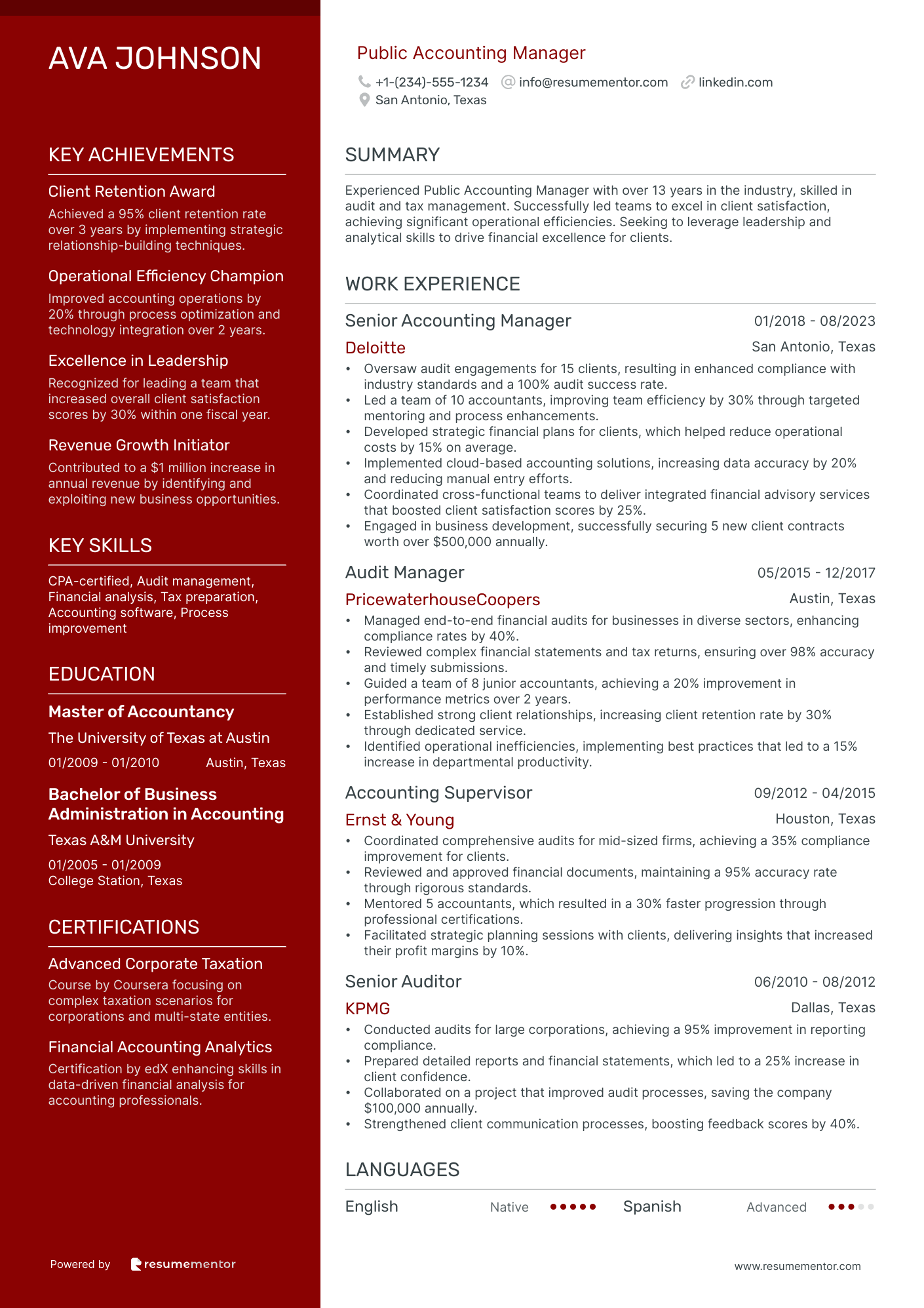

Public Accounting Manager

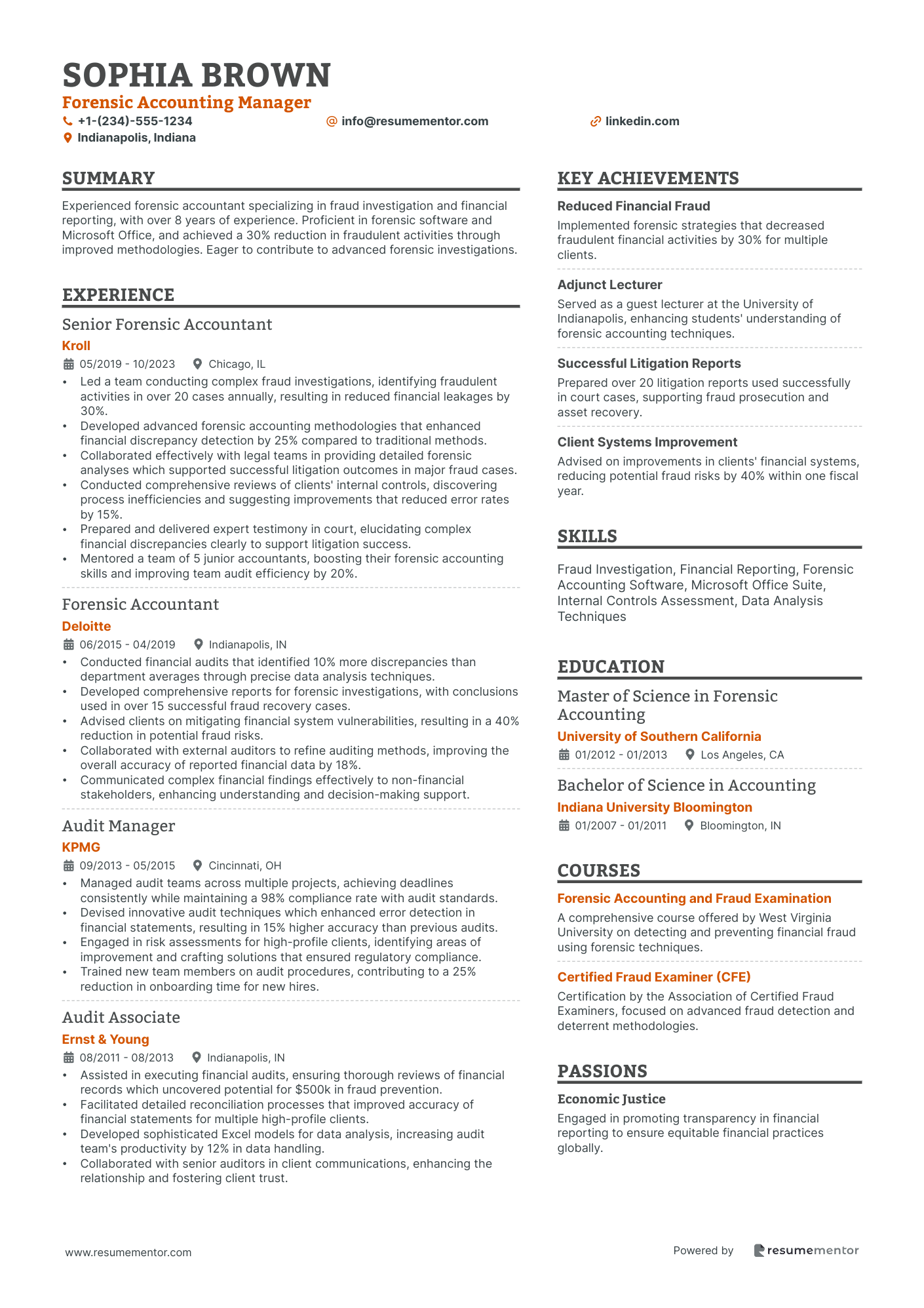

Forensic Accounting Manager

Financial Accounting Manager resume sample

- •Led a team of eight accounting professionals, improving reporting accuracy by 25% and reducing month-end close processes by 20%.

- •Designed and implemented new accounting procedures that enhanced operational efficiency, resulting in a cost reduction of 15%.

- •Collaborated with cross-departmental teams to streamline financial planning processes, leading to a 30% improvement in forecast accuracy.

- •Spearheaded a project to transition accounting software to SAP, which decreased processing time by 40% and improved regulatory compliance.

- •Mentored junior accountants, increasing the department's overall performance rating by 12% over the fiscal year.

- •Developed internal audit procedures which identified areas of financial risk and reduced inconsistencies by 30%.

- •Managed the preparation and dissemination of monthly, quarterly, and annual financial statements for executive management.

- •Reduced external audit adjustment rates by 18% through the development of comprehensive internal review processes.

- •Directed a project modifying the company's revenue recognition policy, improving compliance and enhancing transparency.

- •Trained and supervised a team of six accountants, contributing to an increase in departmental annual objectives.

- •Improved collaboration with IT for financial systems upgrades, leading to a 25% reduction in data processing errors.

- •Contributed to month-end financial reconciliations that consistently met or exceeded accuracy standards.

- •Supported the annual budgeting process by executing reports that facilitated data-driven decision-making.

- •Enhanced accounts payable and receivable processes, reducing processing time by 20% through effective procedural updates.

- •Communicated financial information and analyses to department heads, improving their understanding and strategic planning capabilities.

- •Accurately prepared balance sheets, income statements, and other financial documents for quarterly reviews.

- •Implemented a new payroll system which saved 10 hours of processing time per month.

- •Played a key role in ensuring on-time completion of the financial statements for the annual state audit.

- •Reconciled monthly bank statements with increased efficiency, leading to a 5% decrease in errors over time.

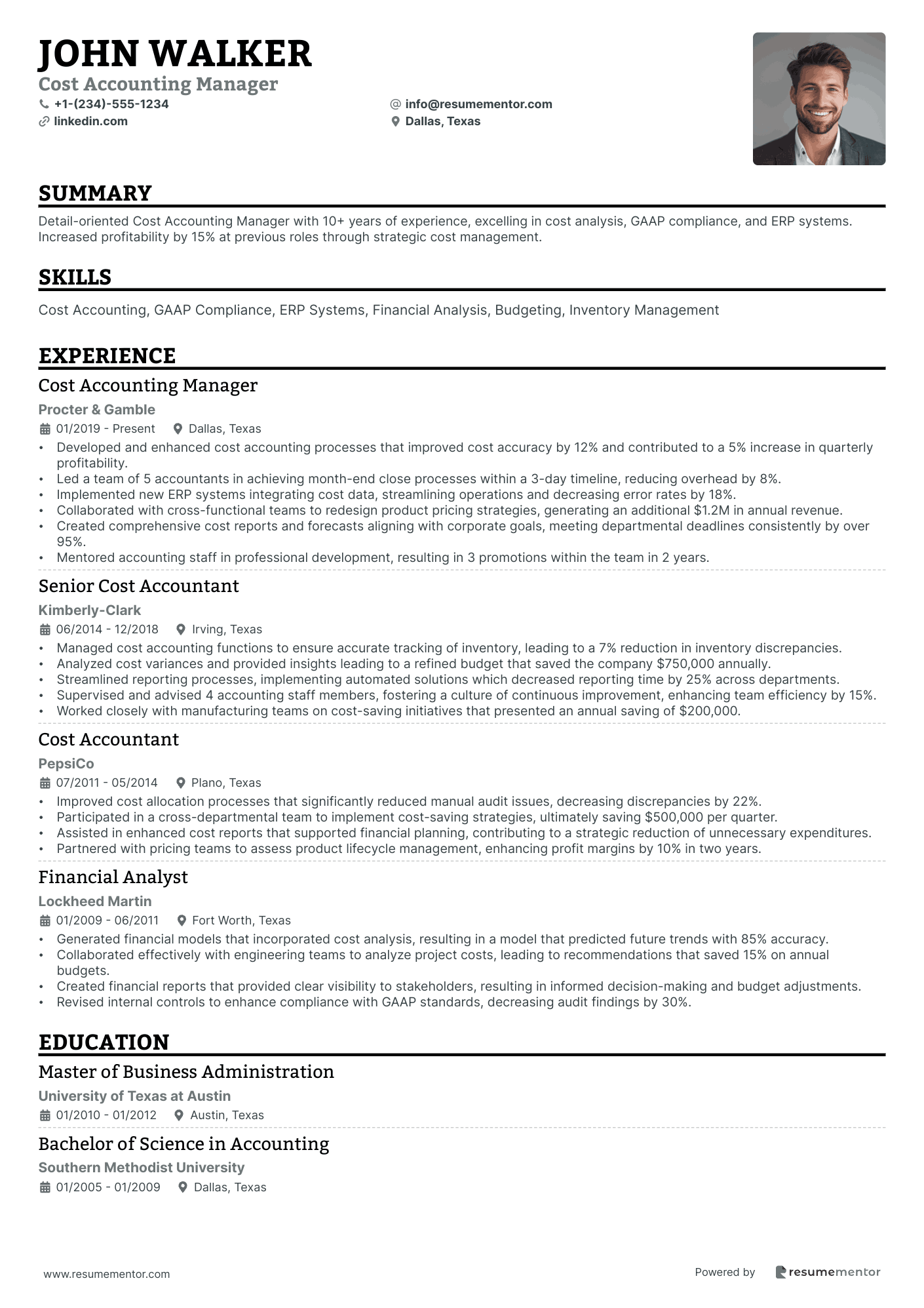

Cost Accounting Manager resume sample

- •Developed and enhanced cost accounting processes that improved cost accuracy by 12% and contributed to a 5% increase in quarterly profitability.

- •Led a team of 5 accountants in achieving month-end close processes within a 3-day timeline, reducing overhead by 8%.

- •Implemented new ERP systems integrating cost data, streamlining operations and decreasing error rates by 18%.

- •Collaborated with cross-functional teams to redesign product pricing strategies, generating an additional $1.2M in annual revenue.

- •Created comprehensive cost reports and forecasts aligning with corporate goals, meeting departmental deadlines consistently by over 95%.

- •Mentored accounting staff in professional development, resulting in 3 promotions within the team in 2 years.

- •Managed cost accounting functions to ensure accurate tracking of inventory, leading to a 7% reduction in inventory discrepancies.

- •Analyzed cost variances and provided insights leading to a refined budget that saved the company $750,000 annually.

- •Streamlined reporting processes, implementing automated solutions which decreased reporting time by 25% across departments.

- •Supervised and advised 4 accounting staff members, fostering a culture of continuous improvement, enhancing team efficiency by 15%.

- •Worked closely with manufacturing teams on cost-saving initiatives that presented an annual saving of $200,000.

- •Improved cost allocation processes that significantly reduced manual audit issues, decreasing discrepancies by 22%.

- •Participated in a cross-departmental team to implement cost-saving strategies, ultimately saving $500,000 per quarter.

- •Assisted in enhanced cost reports that supported financial planning, contributing to a strategic reduction of unnecessary expenditures.

- •Partnered with pricing teams to assess product lifecycle management, enhancing profit margins by 10% in two years.

- •Generated financial models that incorporated cost analysis, resulting in a model that predicted future trends with 85% accuracy.

- •Collaborated effectively with engineering teams to analyze project costs, leading to recommendations that saved 15% on annual budgets.

- •Created financial reports that provided clear visibility to stakeholders, resulting in informed decision-making and budget adjustments.

- •Revised internal controls to enhance compliance with GAAP standards, decreasing audit findings by 30%.

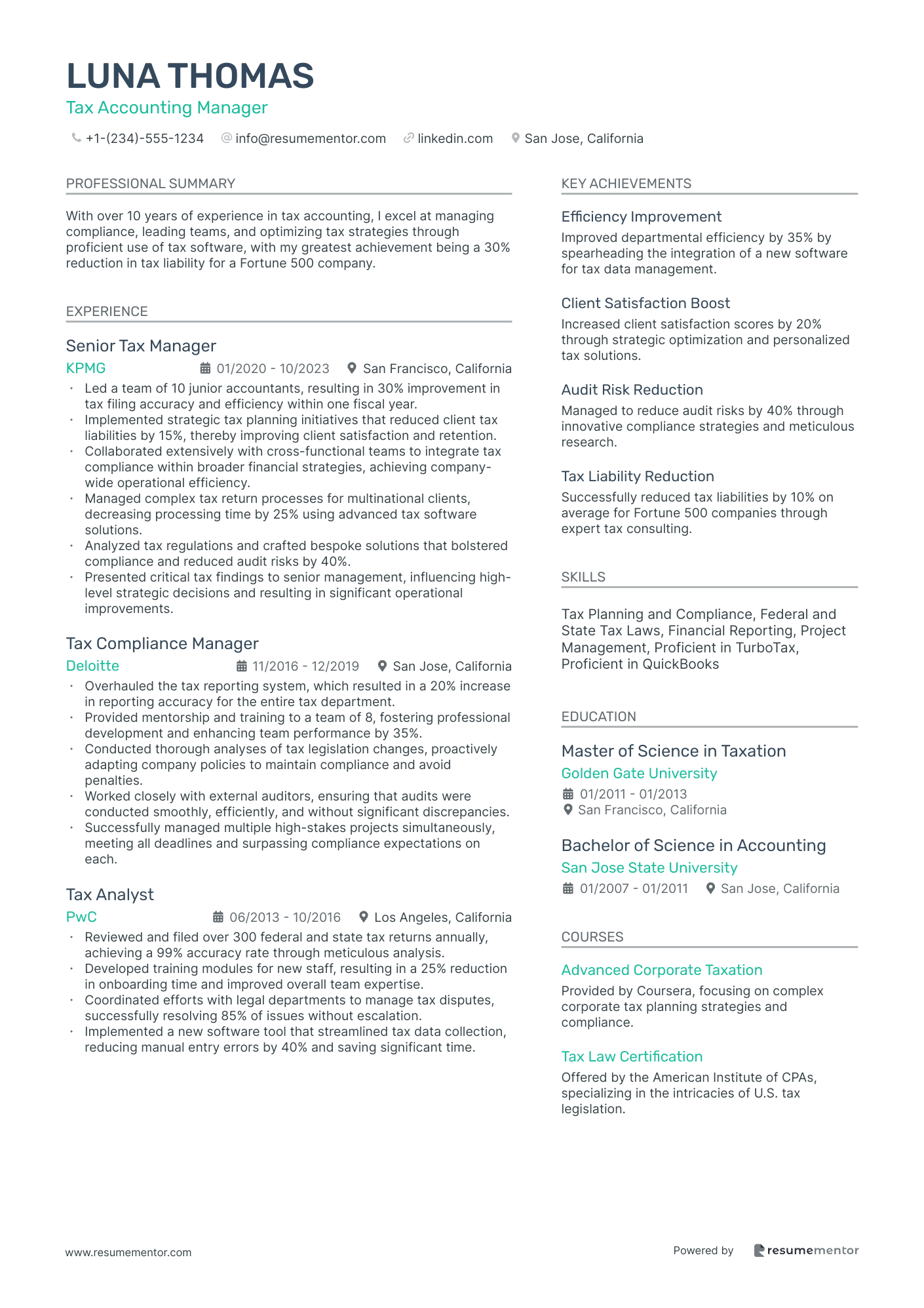

Tax Accounting Manager resume sample

- •Led a team of 10 junior accountants, resulting in 30% improvement in tax filing accuracy and efficiency within one fiscal year.

- •Implemented strategic tax planning initiatives that reduced client tax liabilities by 15%, thereby improving client satisfaction and retention.

- •Collaborated extensively with cross-functional teams to integrate tax compliance within broader financial strategies, achieving company-wide operational efficiency.

- •Managed complex tax return processes for multinational clients, decreasing processing time by 25% using advanced tax software solutions.

- •Analyzed tax regulations and crafted bespoke solutions that bolstered compliance and reduced audit risks by 40%.

- •Presented critical tax findings to senior management, influencing high-level strategic decisions and resulting in significant operational improvements.

- •Overhauled the tax reporting system, which resulted in a 20% increase in reporting accuracy for the entire tax department.

- •Provided mentorship and training to a team of 8, fostering professional development and enhancing team performance by 35%.

- •Conducted thorough analyses of tax legislation changes, proactively adapting company policies to maintain compliance and avoid penalties.

- •Worked closely with external auditors, ensuring that audits were conducted smoothly, efficiently, and without significant discrepancies.

- •Successfully managed multiple high-stakes projects simultaneously, meeting all deadlines and surpassing compliance expectations on each.

- •Reviewed and filed over 300 federal and state tax returns annually, achieving a 99% accuracy rate through meticulous analysis.

- •Developed training modules for new staff, resulting in a 25% reduction in onboarding time and improved overall team expertise.

- •Coordinated efforts with legal departments to manage tax disputes, successfully resolving 85% of issues without escalation.

- •Implemented a new software tool that streamlined tax data collection, reducing manual entry errors by 40% and saving significant time.

- •Consulted with Fortune 500 companies, devising tax strategies that reduced annual tax liabilities by an average of 10%.

- •Conducted in-depth research on tax codes and legislation, assessing impacts and advising clients on potential operational adjustments.

- •Prepared and presented tax strategy reports to senior executives, demonstrating potential efficiency gains and risk mitigations.

- •Provided expert tax guidance during critical financial audits, contributing to the identification of compliance gaps and recommending improvements.

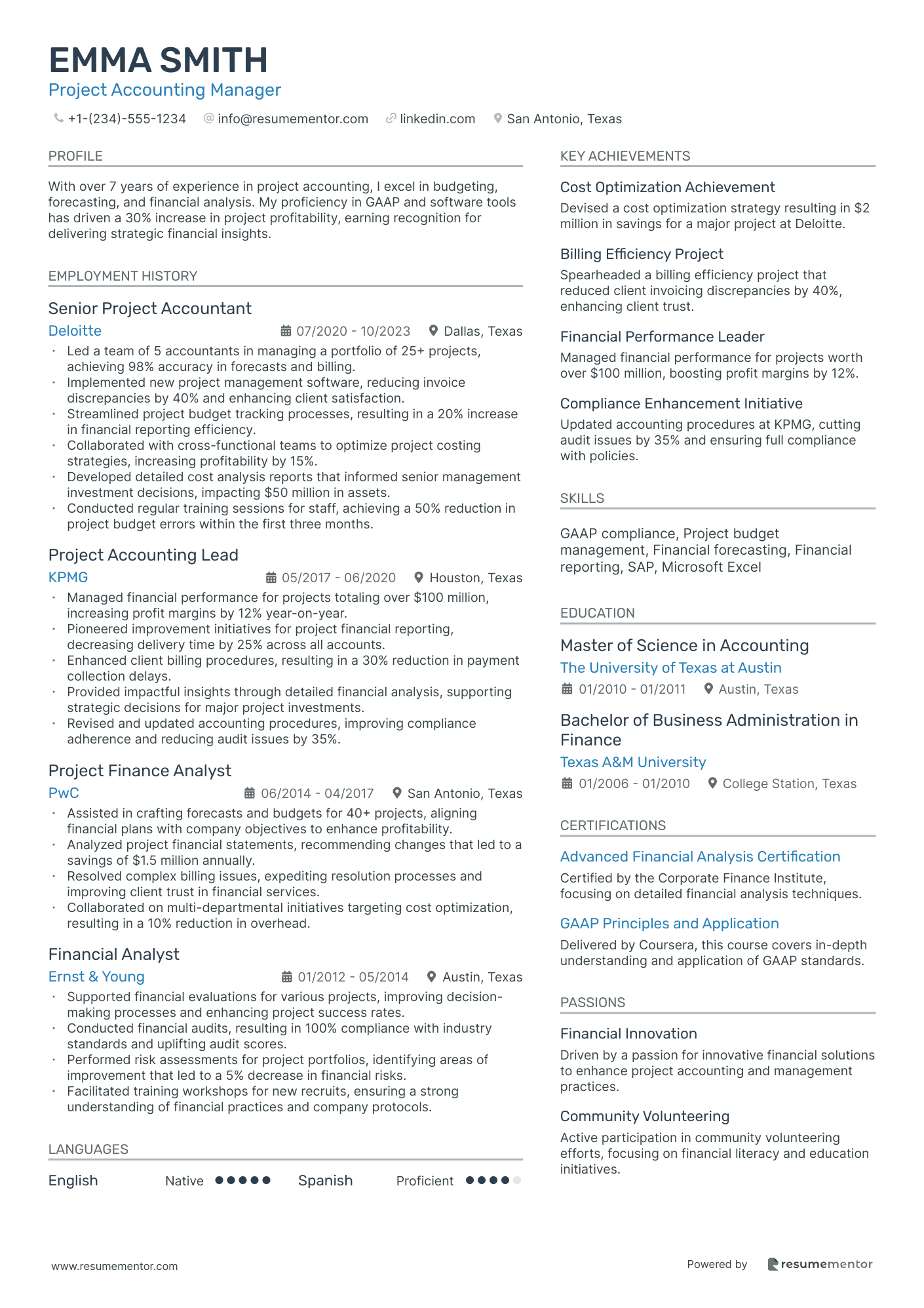

Project Accounting Manager resume sample

- •Led a team of 5 accountants in managing a portfolio of 25+ projects, achieving 98% accuracy in forecasts and billing.

- •Implemented new project management software, reducing invoice discrepancies by 40% and enhancing client satisfaction.

- •Streamlined project budget tracking processes, resulting in a 20% increase in financial reporting efficiency.

- •Collaborated with cross-functional teams to optimize project costing strategies, increasing profitability by 15%.

- •Developed detailed cost analysis reports that informed senior management investment decisions, impacting $50 million in assets.

- •Conducted regular training sessions for staff, achieving a 50% reduction in project budget errors within the first three months.

- •Managed financial performance for projects totaling over $100 million, increasing profit margins by 12% year-on-year.

- •Pioneered improvement initiatives for project financial reporting, decreasing delivery time by 25% across all accounts.

- •Enhanced client billing procedures, resulting in a 30% reduction in payment collection delays.

- •Provided impactful insights through detailed financial analysis, supporting strategic decisions for major project investments.

- •Revised and updated accounting procedures, improving compliance adherence and reducing audit issues by 35%.

- •Assisted in crafting forecasts and budgets for 40+ projects, aligning financial plans with company objectives to enhance profitability.

- •Analyzed project financial statements, recommending changes that led to a savings of $1.5 million annually.

- •Resolved complex billing issues, expediting resolution processes and improving client trust in financial services.

- •Collaborated on multi-departmental initiatives targeting cost optimization, resulting in a 10% reduction in overhead.

- •Supported financial evaluations for various projects, improving decision-making processes and enhancing project success rates.

- •Conducted financial audits, resulting in 100% compliance with industry standards and uplifting audit scores.

- •Performed risk assessments for project portfolios, identifying areas of improvement that led to a 5% decrease in financial risks.

- •Facilitated training workshops for new recruits, ensuring a strong understanding of financial practices and company protocols.

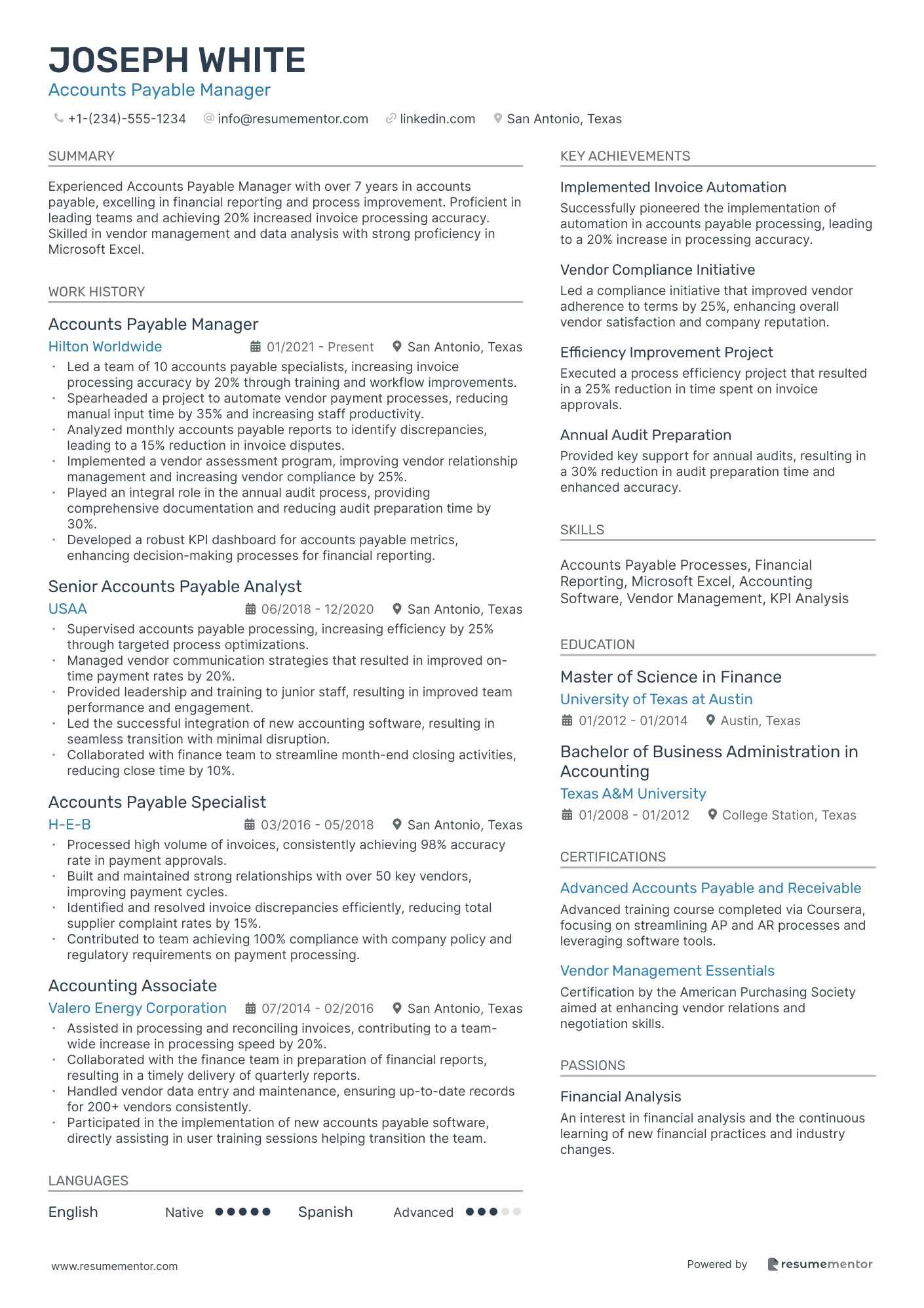

Accounts Payable Manager resume sample

- •Led a team of 10 accounts payable specialists, increasing invoice processing accuracy by 20% through training and workflow improvements.

- •Spearheaded a project to automate vendor payment processes, reducing manual input time by 35% and increasing staff productivity.

- •Analyzed monthly accounts payable reports to identify discrepancies, leading to a 15% reduction in invoice disputes.

- •Implemented a vendor assessment program, improving vendor relationship management and increasing vendor compliance by 25%.

- •Played an integral role in the annual audit process, providing comprehensive documentation and reducing audit preparation time by 30%.

- •Developed a robust KPI dashboard for accounts payable metrics, enhancing decision-making processes for financial reporting.

- •Supervised accounts payable processing, increasing efficiency by 25% through targeted process optimizations.

- •Managed vendor communication strategies that resulted in improved on-time payment rates by 20%.

- •Provided leadership and training to junior staff, resulting in improved team performance and engagement.

- •Led the successful integration of new accounting software, resulting in seamless transition with minimal disruption.

- •Collaborated with finance team to streamline month-end closing activities, reducing close time by 10%.

- •Processed high volume of invoices, consistently achieving 98% accuracy rate in payment approvals.

- •Built and maintained strong relationships with over 50 key vendors, improving payment cycles.

- •Identified and resolved invoice discrepancies efficiently, reducing total supplier complaint rates by 15%.

- •Contributed to team achieving 100% compliance with company policy and regulatory requirements on payment processing.

- •Assisted in processing and reconciling invoices, contributing to a team-wide increase in processing speed by 20%.

- •Collaborated with the finance team in preparation of financial reports, resulting in a timely delivery of quarterly reports.

- •Handled vendor data entry and maintenance, ensuring up-to-date records for 200+ vendors consistently.

- •Participated in the implementation of new accounts payable software, directly assisting in user training sessions helping transition the team.

Accounts Receivable Manager resume sample

- •Oversaw a team of 10 professionals, enhancing collection strategies, resulting in a 25% improvement in collection time.

- •Implemented a new accounting software system, integrating across departments and increasing process efficiency by 30%.

- •Collaborated with sales department to resolve $500,000 in invoice discrepancies, significantly improving client relations.

- •Enhanced month-end closing efficiency by reducing the process time from 12 days to 7 days through streamlined reconciliations.

- •Monitored accounts receivable aging report, maintaining under 3% delinquency rate consistently.

- •Provided training and leadership, boosting team performance and increasing employee retention by 20%.

- •Managed accounts receivable portfolio worth $5 million, reducing overdue accounts by 18% through timely follow-ups.

- •Presented monthly accounts receivable summaries to senior management, contributing to strategic financial decisions.

- •Coordinated with the customer service team, enhancing resolution processes and shortening dispute resolution by 40%.

- •Developed and implemented a cross-departmental communication plan, improving invoicing accuracy by 20%.

- •Trained and mentored junior staff, increasing team efficiency and support coverage while maintaining a high accuracy rate.

- •Assisted in reducing outstanding invoice amounts by 15% through proactive telephone and email communication.

- •Efficiently reconciled accounts, decreasing discrepancies and ensuring compliance with financial regulations.

- •Prepared detailed reports of accounts receivable status and aging, enhancing managerial oversight and decisions.

- •Worked closely with the sales department to expedite resolution of outstanding customer issues, improving cash flow.

- •Supported the accounts receivable team in managing account portfolios, contributing to a 10% reduction in overdue debt.

- •Created templates for accounts receivable follow-up emails, improving response times from clients by 15%.

- •Assisted with month-end closing activities, ensuring accurate completion and timely report submissions.

- •Maintained accurate and organized records, supporting audits and reducing error rates by 5%.

Treasury Accounting Manager resume sample

- •Oversaw daily cash management activities, ensuring zero shortfalls over a three-year period.

- •Developed and implemented new cash flow forecasting techniques, enhancing prediction accuracy by 20%.

- •Led a team of five to revamp treasury-related disclosures, reducing errors by 30% on financial statements.

- •Managed relationships with top-tier banks, negotiating improved terms leading to annual cost savings of $100,000.

- •Streamlined treasury operations by introducing a new software system, cutting processing times by 25%.

- •Enhanced liquidity forecasting process, resulting in increased operational funding availability by 15%.

- •Guided a team through a treasury management system transition, delivering the project 10% under budget.

- •Enhanced cash position reports and processes, resulting in 98% on-time operational fund allocations.

- •Implemented risk controls for banking operations that led to a 40% reduction in operational risk.

- •Delivered strategic insights on cash management that informed board-level financial decisions.

- •Prepared comprehensive monthly financial statements related to treasury operations, enhancing transparency.

- •Developed cash management strategies, optimizing cash utilization by 12% through accurate forecasting.

- •Collaborated with cross-functional teams to devise cash flow reports aligning with company objectives.

- •Managed daily treasury transactions involving investments and debts, ensuring a 100% accuracy rate.

- •Provided analytical support for treasury decisions, contributing to a successful capital restructuring initiative.

- •Analyzed and monitored cash flow forecasts, delivering improvements in cash predictability by 15%.

- •Supported the preparation of annual financial reports, contributing to successful audits every year.

- •Developed strong proficiency in financial modeling, utilized in several high-stakes investment evaluations.

- •Worked with auditors providing critical treasury documentation that expedited the auditing process.

International Accounting Manager resume sample

- •Led a team of 10 accountants in evaluating international financial reports, resulting in a $5M cost reduction over two years.

- •Developed and implemented new international financial reporting procedures, which reduced the close cycle time by 40%.

- •Managed the financial consolidation process across subsidiaries in 8 countries, improving reporting accuracy by 15%.

- •Facilitated international audits with a streamlined approach, achieving 100% compliance in accordance with IFRS.

- •Trained and mentored accounting staff, enhancing team efficiency by 30% and contributing to high employee retention.

- •Collaborated with cross-functional teams across global offices on a project that improved financial forecasting accuracy by 20%.

- •Supervised an international accounting team handling financial data for 5 overseas subsidiaries, ensuring timely and accurate monthly closings.

- •Enhanced financial data analysis processes, increasing data processing speed by 25% while maintaining high accuracy.

- •Successfully coordinated with external auditors across three countries to pass the first-stage audit with zero non-conformities.

- •Directed a project to integrate new software, reducing report generation time by 35% and facilitating more effective decision-making.

- •Contributed to a strategic overhaul of the general ledger process, resulting in a 20% improvement in transaction accuracy.

- •Analyzed financial statements from 3 international subsidiaries, identifying anomalies that led to corrective actions.

- •Played a central role in transitioning to a new ERP system, which reduced processing errors by 50%.

- •Supported senior accountants during international audits, contributing to a 95% audit pass rate across global offices.

- •Developed a training module for new accounting software, leading to a 20% reduction in onboarding time for new employees.

- •Prepared detailed financial reports for international branches that improved quarterly tax compliance by 30%.

- •Identified inefficient tax processes, proposing solutions that saved the company over $2M annually.

- •Ensured adherence to international tax laws, preventing penalties and maintaining a 100% compliance rate.

- •Collaborated with international teams to streamline cross-border transactions, improving timeliness by 25%.

Public Accounting Manager resume sample

- •Oversaw audit engagements for 15 clients, resulting in enhanced compliance with industry standards and a 100% audit success rate.

- •Led a team of 10 accountants, improving team efficiency by 30% through targeted mentoring and process enhancements.

- •Developed strategic financial plans for clients, which helped reduce operational costs by 15% on average.

- •Implemented cloud-based accounting solutions, increasing data accuracy by 20% and reducing manual entry efforts.

- •Coordinated cross-functional teams to deliver integrated financial advisory services that boosted client satisfaction scores by 25%.

- •Engaged in business development, successfully securing 5 new client contracts worth over $500,000 annually.

- •Managed end-to-end financial audits for businesses in diverse sectors, enhancing compliance rates by 40%.

- •Reviewed complex financial statements and tax returns, ensuring over 98% accuracy and timely submissions.

- •Guided a team of 8 junior accountants, achieving a 20% improvement in performance metrics over 2 years.

- •Established strong client relationships, increasing client retention rate by 30% through dedicated service.

- •Identified operational inefficiencies, implementing best practices that led to a 15% increase in departmental productivity.

- •Coordinated comprehensive audits for mid-sized firms, achieving a 35% compliance improvement for clients.

- •Reviewed and approved financial documents, maintaining a 95% accuracy rate through rigorous standards.

- •Mentored 5 accountants, which resulted in a 30% faster progression through professional certifications.

- •Facilitated strategic planning sessions with clients, delivering insights that increased their profit margins by 10%.

- •Conducted audits for large corporations, achieving a 95% improvement in reporting compliance.

- •Prepared detailed reports and financial statements, which led to a 25% increase in client confidence.

- •Collaborated on a project that improved audit processes, saving the company $100,000 annually.

- •Strengthened client communication processes, boosting feedback scores by 40%.

Forensic Accounting Manager resume sample

- •Led a team conducting complex fraud investigations, identifying fraudulent activities in over 20 cases annually, resulting in reduced financial leakages by 30%.

- •Developed advanced forensic accounting methodologies that enhanced financial discrepancy detection by 25% compared to traditional methods.

- •Collaborated effectively with legal teams in providing detailed forensic analyses which supported successful litigation outcomes in major fraud cases.

- •Conducted comprehensive reviews of clients' internal controls, discovering process inefficiencies and suggesting improvements that reduced error rates by 15%.

- •Prepared and delivered expert testimony in court, elucidating complex financial discrepancies clearly to support litigation success.

- •Mentored a team of 5 junior accountants, boosting their forensic accounting skills and improving team audit efficiency by 20%.

- •Conducted financial audits that identified 10% more discrepancies than department averages through precise data analysis techniques.

- •Developed comprehensive reports for forensic investigations, with conclusions used in over 15 successful fraud recovery cases.

- •Advised clients on mitigating financial system vulnerabilities, resulting in a 40% reduction in potential fraud risks.

- •Collaborated with external auditors to refine auditing methods, improving the overall accuracy of reported financial data by 18%.

- •Communicated complex financial findings effectively to non-financial stakeholders, enhancing understanding and decision-making support.

- •Managed audit teams across multiple projects, achieving deadlines consistently while maintaining a 98% compliance rate with audit standards.

- •Devised innovative audit techniques which enhanced error detection in financial statements, resulting in 15% higher accuracy than previous audits.

- •Engaged in risk assessments for high-profile clients, identifying areas of improvement and crafting solutions that ensured regulatory compliance.

- •Trained new team members on audit procedures, contributing to a 25% reduction in onboarding time for new hires.

- •Assisted in executing financial audits, ensuring thorough reviews of financial records which uncovered potential for $500k in fraud prevention.

- •Facilitated detailed reconciliation processes that improved accuracy of financial statements for multiple high-profile clients.

- •Developed sophisticated Excel models for data analysis, increasing audit team's productivity by 12% in data handling.

- •Collaborated with senior auditors in client communications, enhancing the relationship and fostering client trust.

Crafting a winning accounting manager resume can often feel like balancing the books under a deadline—stressful and tricky. Many accounting managers find it challenging to highlight their skills and experience on paper effectively. Common issues include not knowing which achievements to spotlight, how to format their resume, and making their responsibilities sound compelling rather than mundane. This guide will show you how to write an accounting manager resume that stands out in today's competitive job market. With concise examples and actionable tips, you'll meet all your career goals.

Choosing the right resume template is crucial to showcasing your expertise effectively. A well-structured template helps you organize your information clearly, making it easier for hiring managers to see why you're the right fit for the job. Don't underestimate the power of a great template; it acts like the perfect ledger for balancing your career’s accomplishments.

Unlock your potential with over 700 tailored resume examples designed to help you shine.

Key Takeaways

- A well-structured resume template is crucial for organizing information clearly, making it easier for hiring managers to see your qualifications.

- Your resume should include key sections such as Contact Information, Professional Summary, Work Experience, Skills, and Education.

- Using a reverse-chronological format and modern fonts like Rubik or Montserrat can make your resume look up-to-date and clean.

- Action words and quantifiable achievements help showcase the scope and success of your work, making your resume stand out to employers.

- Including relevant certifications and tailored sections like Languages, Volunteer Work, and Hobbies can enhance your resume's depth and relatability.

What to focus on when writing your accounting manager resume

An accounting manager resume should convey your expertise in financial management, your ability to lead and motivate a team, and your strong analytical skills. It should also highlight your experience with financial reporting, budgeting, and compliance with accounting standards. Achievements such as cost savings, successful audits, or improved financial processes can set you apart.

To boost your resume's impact, include:

- Led a team of [X] accountants to achieve [specific financial goal]

- Reduced operational costs by [%] through [specific action]

- Streamlined financial reporting process, reducing errors by [%]

- Managed budgets totaling [$ amount], ensuring compliance and accuracy

Must have information on your accounting manager resume

When crafting your accounting manager resume, ensure it includes key sections that effectively showcase your skills and experience.

- Contact Information

- Professional Summary

- Work Experience

- Skills

- Education

Adding extra sections like "Certifications" and "Professional Affiliations" can further demonstrate your qualifications and dedication to the field. These additional sections help you stand out and provide a more comprehensive view of your background.

Which resume format to choose

For an accounting manager resume, the best format is the reverse-chronological format, which highlights your most recent and relevant experience first. Modern fonts like Rubik and Montserrat are recommended as fresh alternatives to Arial and Times New Roman, making your resume look up-to-date and clean. Always save your resume as a PDF to maintain the format across different devices and systems. Use standard one-inch margins for a balanced look, and ensure section headings are clear and optimized for ATS (Applicant Tracking Systems) by using standard titles.

An accounting manager resume should have the following sections:

- Contact Information

- Summary or Objective

- Work Experience

- Education

- Skills

- Certifications

- Achievements

- Additional Information (optional)

Resume Mentor's free resume builder handles all of this, making it easy for you to create a polished, professional resume effortlessly.

How to write a quantifiable resume experience section

Writing your resume experience section as an accounting manager requires focusing on the key points employers want to see. Your resume should always be in reverse chronological order, starting with your most recent job. It’s wise to include experience up to 10-15 years back, focusing on roles that are relevant to accounting or finance. Job titles should clearly reflect your accounting expertise.

Tailor your resume for each job application. Use action words like "managed," "led," "implemented," and "reduced" to describe your duties and achievements. Numbers make a huge impact; they show the scope and success of your work. Including specific achievements such as cost savings, revenue increases, or efficiency improvements will make your resume stand out.

Here are two examples of an experience section. The first one is poorly written, while the second one shows an excellent example.

- •Handled all accounting tasks for the company

- •Worked on financial reports

- •Dealt with budgets and forecasts

This example is bad because it lacks specifics. The bullets are vague and do not provide any clear achievements. Words like “handled,” “worked on,” and “dealt with” do not describe the scope or success of your work.

- •Increased operational efficiency by 15% through automating accounting processes

- •Reduced monthly closing time by 30% by implementing a new reporting system

- •Managed a $10M annual budget, achieving a cost reduction of 10% year-over-year

This example is excellent. It uses clear and impactful language. Each bullet point includes numbers and shows quantifiable achievements. Words like “increased,” “reduced,” and “managed” clearly define your role and accomplishments. This makes it evident what you brought to the company and how you can add value to future employers.

Accounting manager resume experience examples

Welcome to your next career chapter! Prepare to dive into different facets of the accounting realm as we showcase your incredible journey. Don't worry, we promise to make it add up!

Achievement-focused

Show off your biggest wins in accounting management. Highlight figures and accolades to demonstrate your impact.

Accounting Manager

ABC Corporation

2019-2023

- Implemented new cost-saving procedures

- Negotiated more favorable vendor contracts

- Optimized resource allocation strategies

Skills-focused

Highlight your key competencies and how they make you an outstanding accounting manager. Make sure you connect your skills to your achievements.

Accounting Manager

XYZ Enterprises

2017-2021

- Utilized advanced Excel functions for complex data analysis

- Introduced and trained staff on GAAP best practices

- Developed robust internal controls

Responsibility-focused

Emphasize the duties and responsibilities you've handled. Give a clear picture of your day-to-day activities.

Accounting Manager

FinCo Solutions

2018-2022

- Managed month-end and year-end close processes

- Supervised accounts payable and receivable

- Conducted quarterly financial risk assessments

Project-focused

Show your experience managing specific projects from start to finish. Detail any special projects you led.

Accounting Manager

TechSavvy Inc.

2020-2023

- Led a cross-functional team to launch SAP

- Provided training and ongoing support to staff

- Streamlined financial reporting processes

Result-focused

Concentrate on the outcomes of your actions. Use quantifiable metrics to show your successes.

Accounting Manager

RevenueGenius Corp.

2015-2019

- Identified key areas for revenue growth

- Optimized pricing strategies and financial models

- Improved cash flow management

Industry-Specific Focus

Tailor your experiences to showcase industry-specific expertise. Highlight the unique aspects relevant to the accounting sector.

Accounting Manager

Global Accountant LLP

2016-2020

- Stayed updated with latest industry regulations

- Implemented Sarbanes-Oxley compliance measures

- Collaborated with auditors to ensure regulatory adherence

Problem-Solving focused

Demonstrate your critical thinking and problem-solving skills. Highlight instances where you have overcome challenges.

Accounting Manager

BalancePro Inc.

2019-2022

- Led investigations into discrepancies

- Implemented reconciliation procedures

- Prevented future discrepancies with internal checks

Innovation-focused

Showcase your creativity and innovation in the field. Detail new methodologies or technologies you've introduced.

Accounting Manager

Innovative Accounts Ltd.

2018-2023

- Implemented robotic process automation (RPA)

- Streamlined data entry and reduced errors

- Cut reporting time by 30%

Leadership-focused

Illustrate your capabilities in leading and managing teams. Highlight how you cultivate growth and motivation in your team.

Accounting Manager

Leadership Finance Group

2016-2021

- Mentored junior accountants

- Led regular training sessions

- Implemented team-building activities

Customer-focused

Emphasize your dedication to customer service and satisfaction. Showcase how you maintain strong relationships.

Accounting Manager

ClientCare Financial Services

2017-2023

- Customized financial reporting for clients

- Addressed client queries promptly

- Maintained high client satisfaction scores

Growth-focused

Highlight your contributions that fostered growth within the organization. Use measurable indicators to show growth.

Accounting Manager

Growth Industries

2015-2020

- Identified and seized new market opportunities

- Optimized existing financial processes

- Facilitated mergers and acquisitions

Efficiency-focused

Show how you've improved processes and increased organizational efficiency. Highlight time-saving and cost-reduction techniques.

Accounting Manager

Efficiency Experts Inc.

2018-2023

- Automated manual processes

- Reduced monthly reporting time by 50%

- Implemented lean accounting principles

Technology-focused

Detail your experience with technology in the accounting field. Highlight any software proficiencies and tech-driven innovations.

Accounting Manager

TechFinance Solutions

2019-2024

- Proficient in QuickBooks and MS Excel

- Implemented cloud-based accounting systems

- Integrated AI for predictive analytics

Collaboration-focused

Show how you work effectively with different teams and departments. Highlight collaborative projects and team efforts.

Accounting Manager

CollabFin Corp.

2016-2021

- Coordinated with sales and marketing for budget planning

- Worked closely with IT for system integration

- Collaborated with HR for payroll management

Training and Development focused

Illustrate your experience in training team members and developing talent. Detail mentoring and coaching experiences.

Accounting Manager

TalentGrow Financials

2018-2023

- Conducted regular training workshops

- Mentored junior team members to senior roles

- Designed performance improvement plans

Write your accounting manager resume summary section

Crafting the summary section of your accounting manager resume can significantly impact your job hunt. It gives potential employers a snapshot of your skills and achievements. You should keep it brief but packed with key points that showcase your expertise.

Choose words that reflect your experience and how you stand out. You want to describe yourself in a way that resonates with hiring managers. Focus on your strengths, years of experience, and any noteworthy accomplishments.

The terms "summary," "objective," "profile," and "summary of qualifications" all serve different purposes. A resume summary highlights your professional experience and career achievements. A resume objective states your career goals. A resume profile combines elements of a summary and an objective. A summary of qualifications is a bullet-point list of your most relevant skills and achievements.

The first example is vague and lacks detail. It doesn't specify the duration of experience, the industries worked in, or any specific accomplishments. Words like "lots" and "many" are too broad, and "very hardworking and reliable" is subjective without offering examples to back up these claims.

The second example clearly outlines the candidate's experience, expertise, and specific achievements. It mentions over 10 years of experience, key skills in financial reporting and budget management, and a quantifiable accomplishment that adds significant value. This level of detail makes it compelling and informative.

Listing your accounting manager skills on your resume

When writing your skills section on an accounting manager resume, you can either have a dedicated skills section or incorporate your skills into other sections like your experience and summary. Highlighting your strengths and soft skills is important as it showcases your ability to effectively manage your team and communicate well. Hard skills are specific, teachable abilities or knowledge sets you can quantify, such as financial analysis or budget management.

By intertwining your skills and strengths into your resume, you can use them as keywords that stand out to employers, increasing your chances of getting noticed. These keywords are what savvy hiring managers and applicant tracking systems (ATS) look for.

The example is concise and focused, making it easy for hiring managers to quickly see your relevant skills. Each skill is pertinent to the role of an accounting manager, which adds value to your candidacy.

Best hard skills to feature on your accounting manager resume

Hard skills are vital for an accounting manager as they show you have the necessary technical expertise to handle the financial activities of a company. They should communicate your ability to perform specific tasks and responsibilities effectively.

Hard Skills

- Financial Analysis

- Budget Management

- Audit Management

- Tax Planning

- Accounts Payable/Receivable

- Financial Reporting

- Cost Accounting

- Payroll Management

- Regulatory Compliance

- Risk Management

- Cash Flow Management

- Financial Forecasting

- Asset Management

- Operational Efficiency

- Advanced Excel Skills

Best soft skills to feature on your accounting manager resume

Soft skills are essential as they highlight your interpersonal abilities, leadership, and problem-solving skills. They should communicate your capability to manage teams, make strategic decisions, and contribute positively to the workplace culture.

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Time Management

- Attention to Detail

- Team Collaboration

- Adaptability

- Decision Making

- Conflict Resolution

- Critical Thinking

- Negotiation

- Emotional Intelligence

- Organization

- Stress Management

- Strategic Planning

How to include your education on your resume

An education section is an important part of any resume, especially for an accounting manager. It shows the relevant qualifications and learning experiences you have. Tailoring this section to the job you're applying for ensures that only relevant education is highlighted, helping your resume stand out. Irrelevant education should be left out.

If your GPA was high, include it to show your strong academic performance. Note your GPA, like "GPA: 3.8/4.0," for a polished touch. If you graduated with honors, such as "cum laude," list that next to your degree. Always clearly state your degree and the institution — e.g., "Bachelor of Science in Accounting, XYZ University." Providing these details makes it easy for employers to see your educational credentials and assess your qualifications. Below is an example of a poorly written education section followed by a well-crafted one for an accounting manager.

The first example is bad because it lists an irrelevant degree for an accounting manager position. It also includes location but fails to highlight a relevant GPA or honors, and the timeline does not align with a career in accounting.

The second example is good because it lists relevant degrees for an accounting manager. The GPA is highlighted, showing strong performance in accounting studies. The MBA with honors "cum laude" adds to the candidate's qualifications and relevance for managerial roles. This concise and focused section makes it easy for hiring managers to see your qualifications.

How to include accounting manager certificates on your resume

Including a certificates section in your accounting manager resume is crucial. Certifications validate your expertise and distinguish you from other applicants. List the name of each certificate clearly. Include the date you earned it. Add the issuing organization to provide context and credibility. Sometimes, it's effective to feature your top certifications in the header for quick visibility. For instance:

"Certified Public Accountant (CPA) – AICPA"

A standalone certificates section could look like this:

This example is effective because it highlights certifications relevant to an accounting manager role, thus reinforcing your qualifications. Listing the CPA, CMA, and CIA certifications shows a broad skill set in accounting, management, and auditing. Including the issuing organizations adds credibility and context, which is crucial for hiring managers.

Extra sections to include in your accounting manager resume

As an accounting manager, you need a resume that highlights your skills, experience, and unique attributes to stand out to potential employers. Including various sections such as languages, hobbies and interests, volunteer work, and books can demonstrate your individuality and breadth of character. These sections can make your resume more engaging and comprehensive.

Language section — Include other languages you speak fluently to show your versatility. Highlighting multiple languages can show your ability to handle international transactions or clients.

Hobbies and interests section — Share personal interests like hiking or painting to provide a sense of your personal balance. Including hobbies can make you more relatable and showcase soft skills like teamwork or creativity.

Volunteer work section — Detail any volunteer activities you have participated in to display your commitment to community service. This can also reflect positively on your leadership and organizational abilities.

Books section — List relevant books you’ve read to show your dedication to ongoing professional development. Mentioning industry-related books can show you keep up-to-date with current accounting practices and trends.

By including these sections, you can enrich your resume beyond the standard work history and education entries. This will help you present a well-rounded profile to potential employers.

Pair your accounting manager resume with a cover letter

A cover letter is a document sent with your resume to provide additional information on your skills and experiences. It explains why you are a perfect fit for the job and highlights achievements that may not be evident from your resume alone.

This document helps you stand out by giving employers a better sense of your personality and enthusiasm. It's a chance to tell your story and make a personal connection with the hiring manager. For an accounting manager, a cover letter should focus on your leadership skills, experience managing financial records, and proficiency with accounting software. Highlight specific achievements, such as successful audits or cost-saving initiatives, to show you bring real value.

Get started on creating a compelling cover letter with Resume Mentor’s cover letter builder. Its easy-to-use interface will have you ready in minutes, and exporting to PDF ensures your content and formatting stay intact. Give it a try today, and make your cover letter stand out!

Scarlett Anderson

San Antonio, Texas

+1-(234)-555-1234

help@resumementor.com

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.