Accounts and Finance Manager Resume Examples

Jul 18, 2024

|

12 min read

Nail your accounts and finance manager resume with these expert tips – accounting for every detail is a must. Learn how to highlight your skills, experience, and achievements to boost your job prospects.

Rated by 348 people

Accounts Payable and Receivable Manager

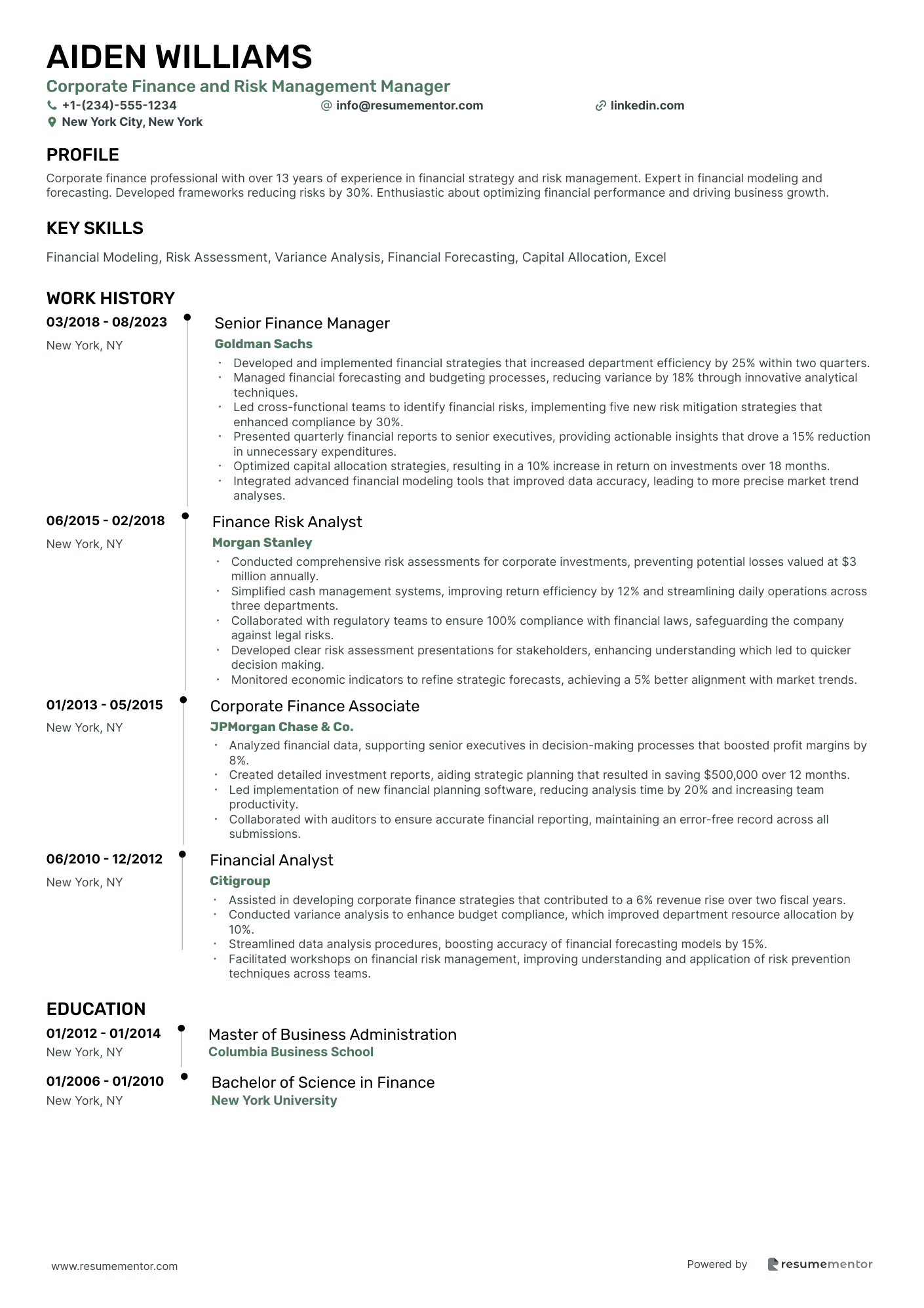

Corporate Finance and Risk Management Manager

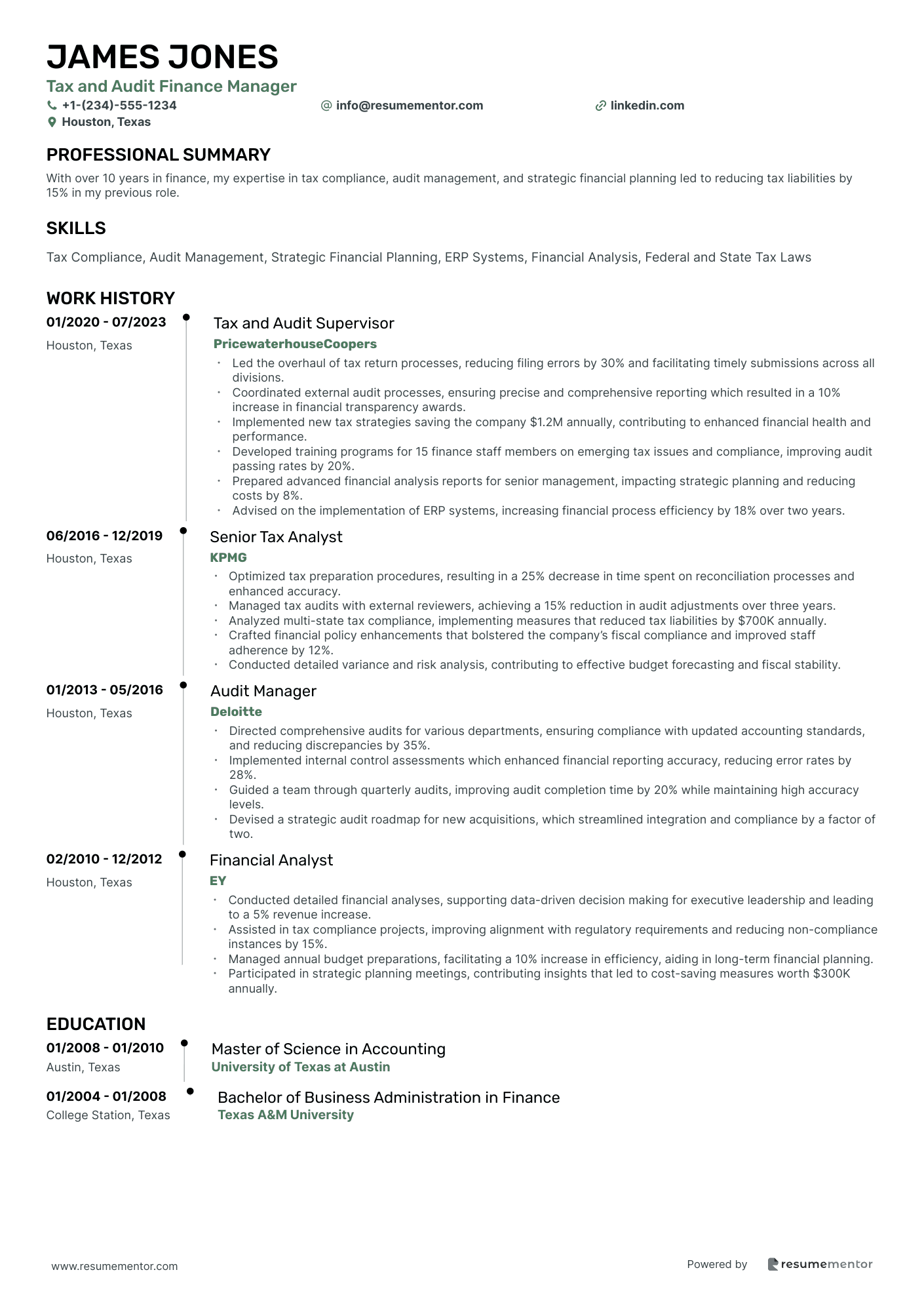

Tax and Audit Finance Manager

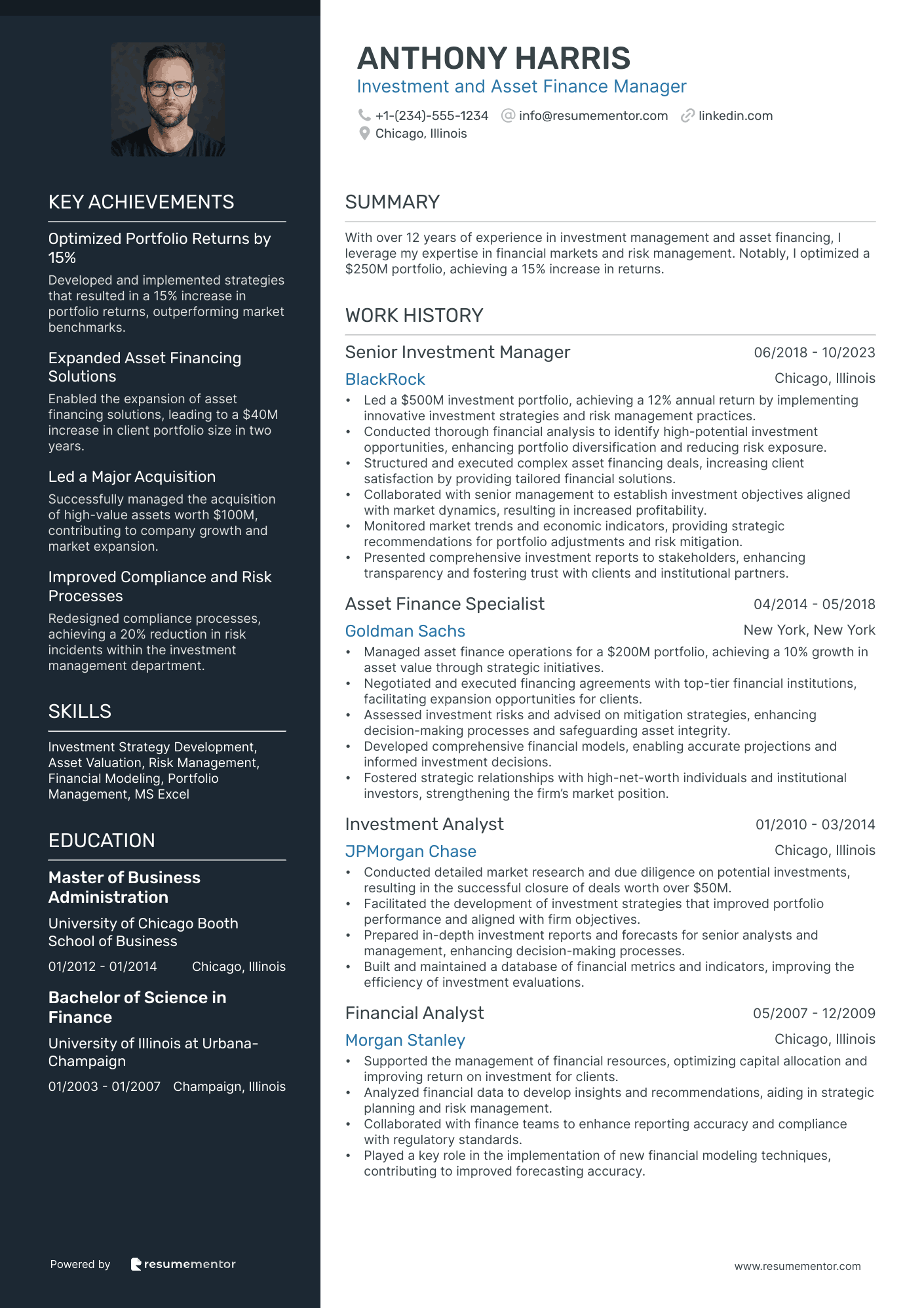

Investment and Asset Finance Manager

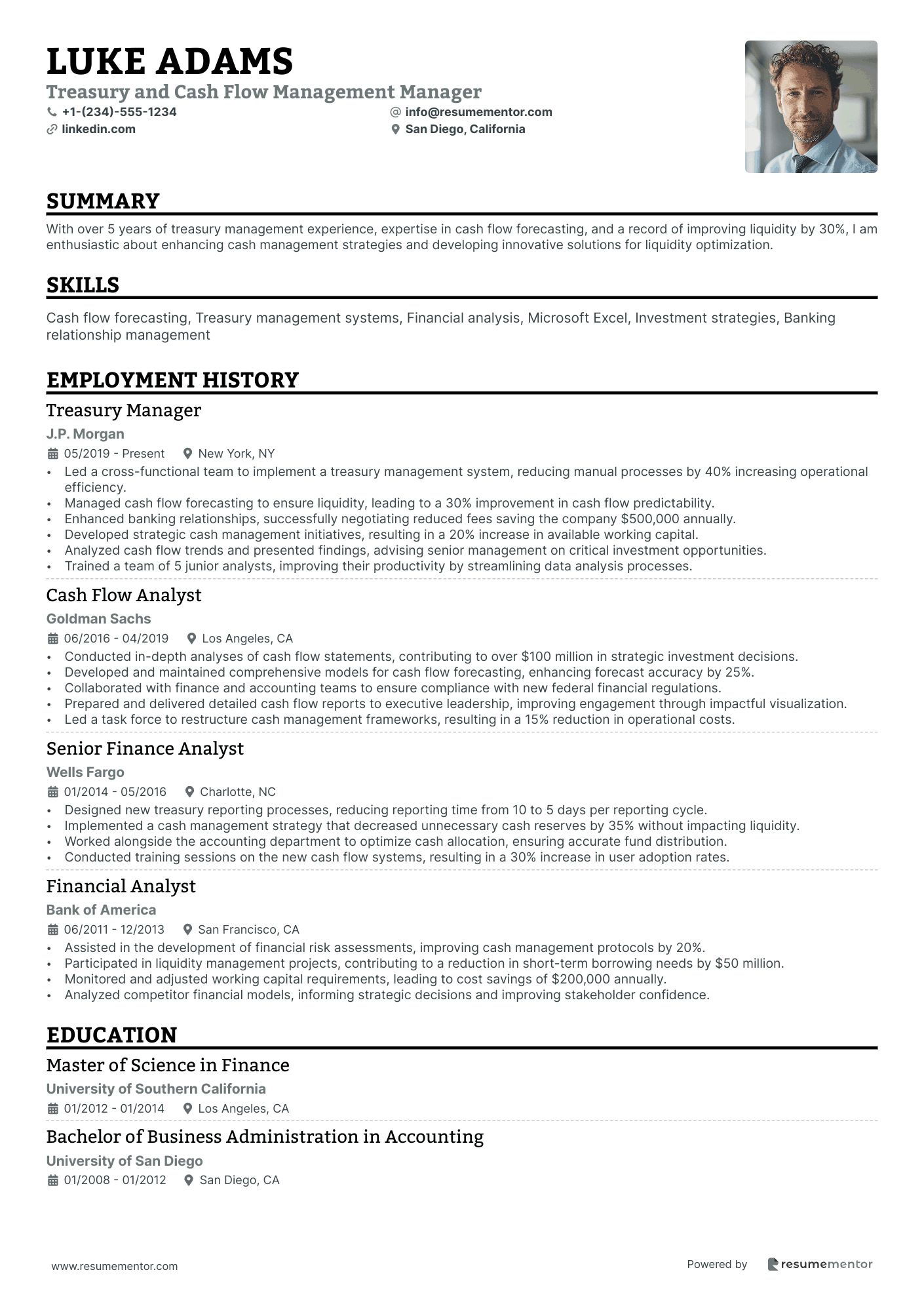

Treasury and Cash Flow Management Manager

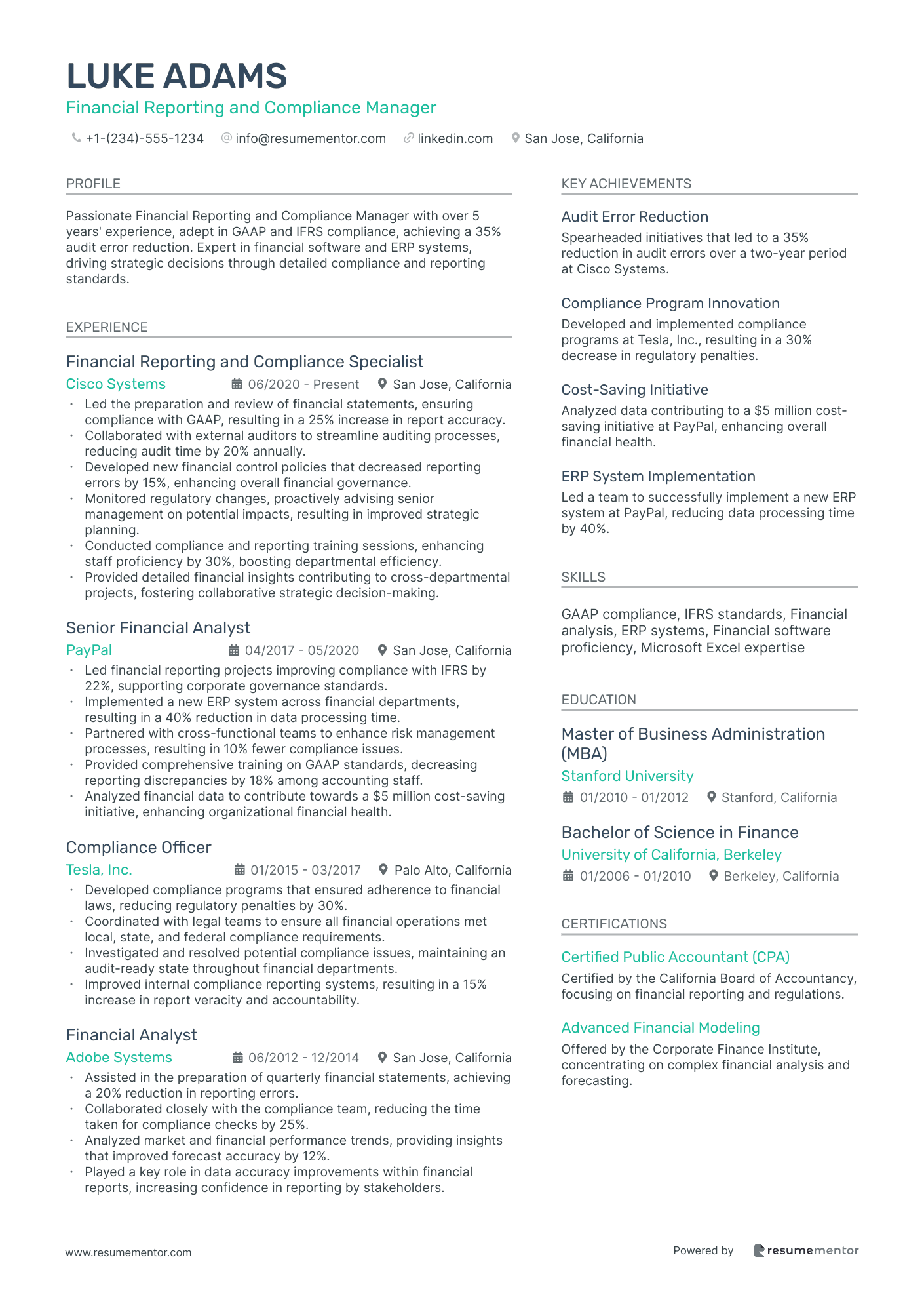

Financial Reporting and Compliance Manager

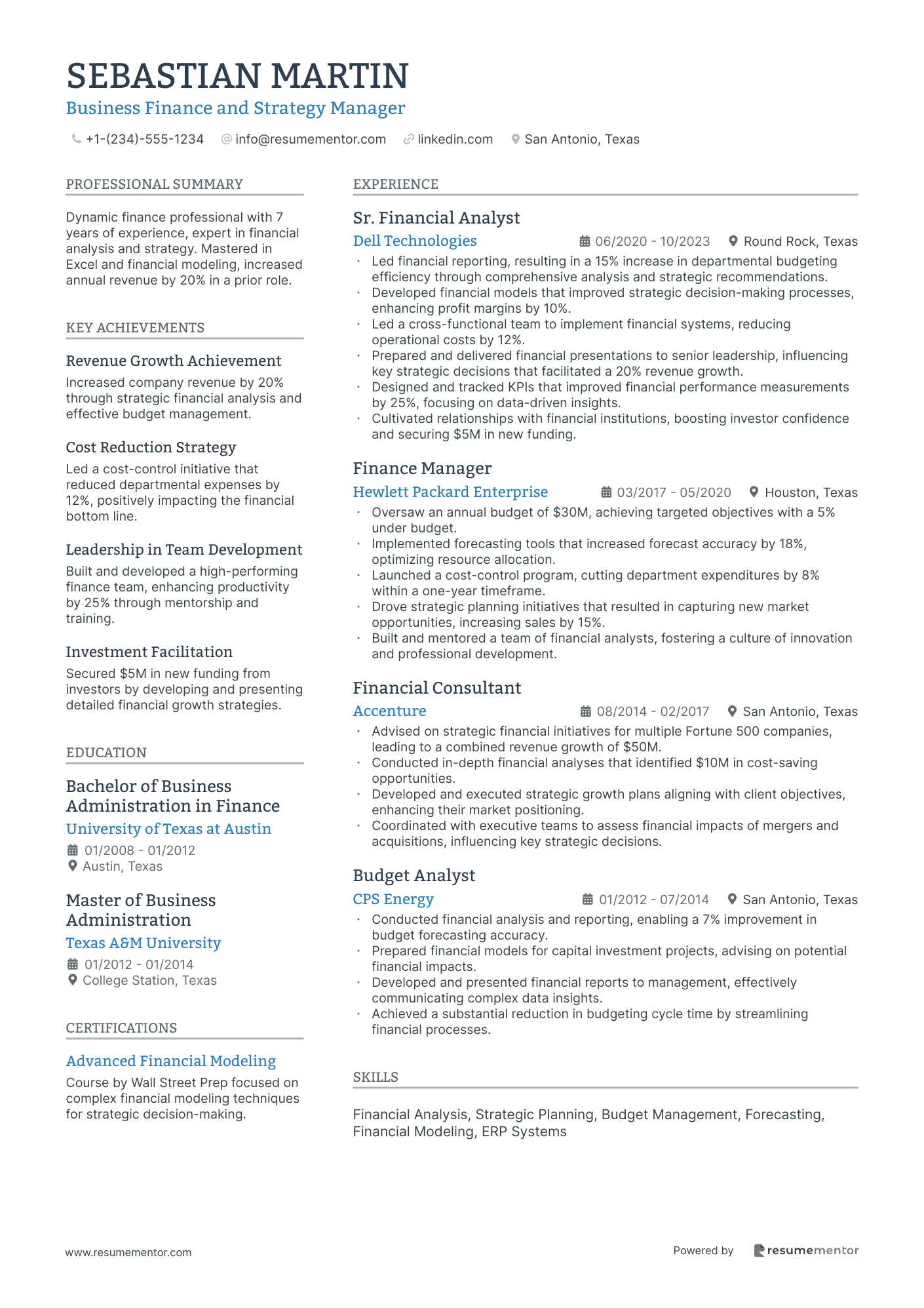

Business Finance and Strategy Manager

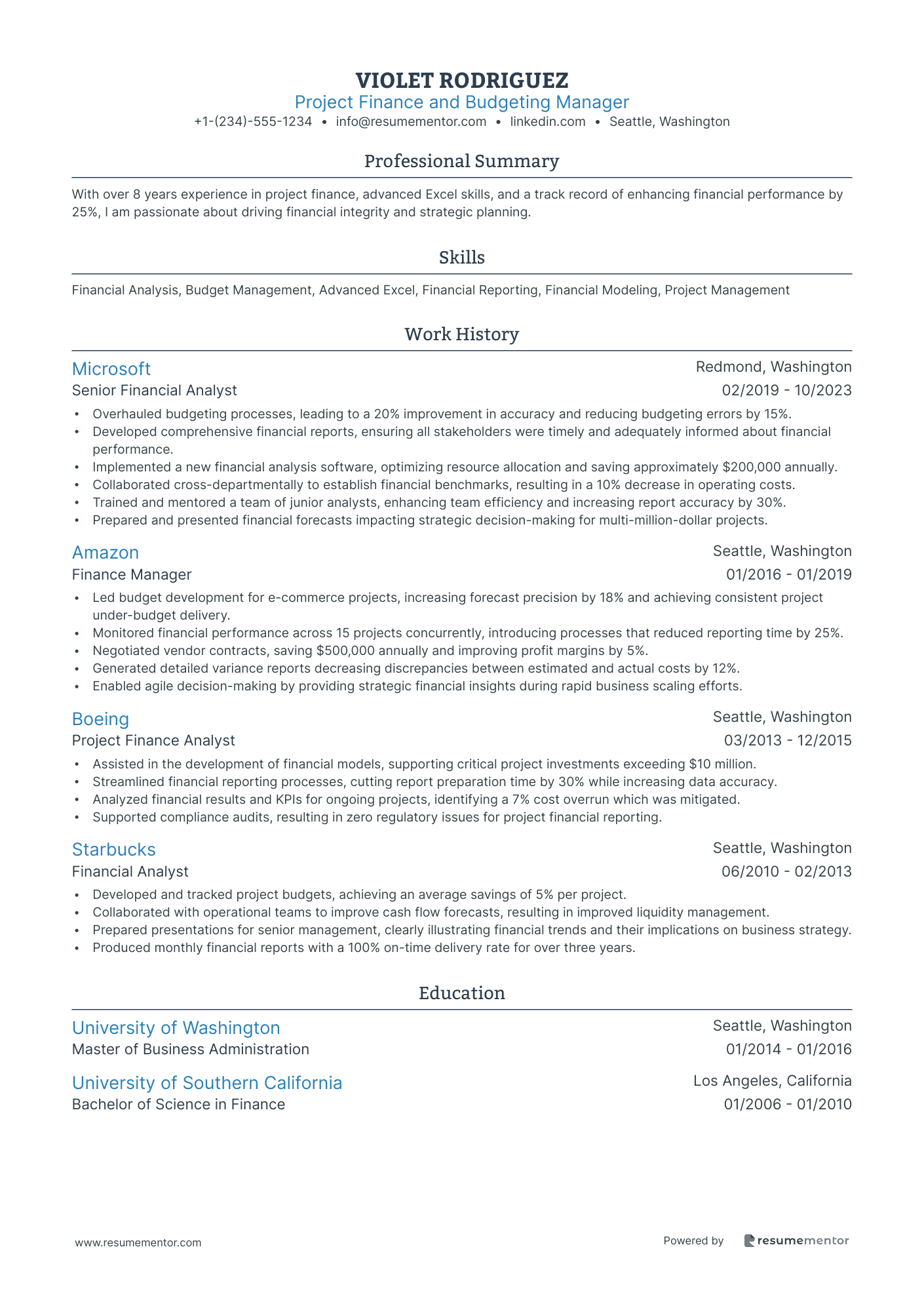

Project Finance and Budgeting Manager

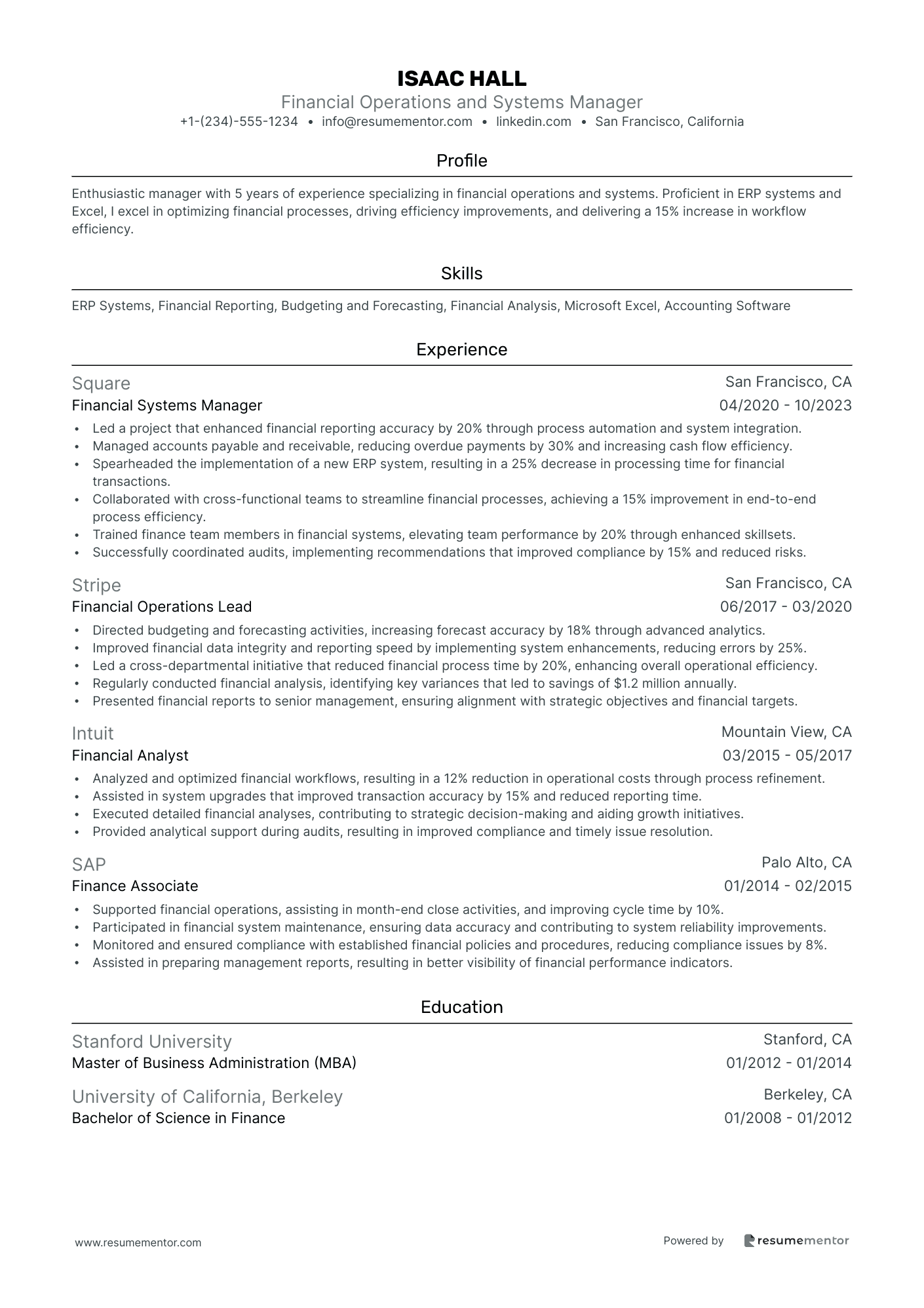

Financial Operations and Systems Manager

Accounts Payable and Receivable Manager resume sample

- •Managed a team of 8 professionals, resulting in a 25% increase in overall productivity and efficiency.

- •Implemented a new accounts reconciliation process that reduced discrepancies by 40% within the first year.

- •Developed and enforced financial policies resulting in 100% compliance with corporate guidelines and regulations.

- •Led monthly audits of payable and receivable accounts, achieving a 15% improvement in error detection.

- •Collaborated with IT to streamline invoicing, reducing processing times by 30% and improving customer satisfaction.

- •Created comprehensive cash flow reports used in strategic planning, enhancing financial decision-making by 20% more accurate forecasts.

- •Supervised daily operations of a team of 5 accountants, increasing team performance by 20% within the first year.

- •Streamlined vendor payment procedures, leading to reduced delays and 35% improved vendor satisfaction.

- •Conducted regular training sessions improving team skills and resulting in a 15% decrease in processing errors.

- •Enhanced month-end closing procedures, reducing closing time by 20% and improving financial reporting accuracy.

- •Resolved escalated issues promptly, maintaining a rating of 95% satisfaction from internal departments.

- •Processed and reconciled over $5M monthly transactions, ensuring accuracy and timely updates to financial records.

- •Worked with cross-functional teams to improve invoicing process, increasing collection rate by 15% within a 6-month period.

- •Implemented new policy procedures that led to a 10% increase in cash flow during fiscal quarters.

- •Assisted in financial audits, resulting in comprehensive reports with 95% accuracy.

- •Supported accounts payable operations, processing 500+ invoices monthly with high accuracy and timeliness.

- •Participated in the implementation of a new accounting software system, reducing manual errors by 25%.

- •Collaborated with senior accountants to ensure compliance with GAAP, contributing to successful audits.

- •Maintained detailed records of transactions, aiding in monthly financial closing processes and accuracy.

Corporate Finance and Risk Management Manager resume sample

- •Developed and implemented financial strategies that increased department efficiency by 25% within two quarters.

- •Managed financial forecasting and budgeting processes, reducing variance by 18% through innovative analytical techniques.

- •Led cross-functional teams to identify financial risks, implementing five new risk mitigation strategies that enhanced compliance by 30%.

- •Presented quarterly financial reports to senior executives, providing actionable insights that drove a 15% reduction in unnecessary expenditures.

- •Optimized capital allocation strategies, resulting in a 10% increase in return on investments over 18 months.

- •Integrated advanced financial modeling tools that improved data accuracy, leading to more precise market trend analyses.

- •Conducted comprehensive risk assessments for corporate investments, preventing potential losses valued at $3 million annually.

- •Simplified cash management systems, improving return efficiency by 12% and streamlining daily operations across three departments.

- •Collaborated with regulatory teams to ensure 100% compliance with financial laws, safeguarding the company against legal risks.

- •Developed clear risk assessment presentations for stakeholders, enhancing understanding which led to quicker decision making.

- •Monitored economic indicators to refine strategic forecasts, achieving a 5% better alignment with market trends.

- •Analyzed financial data, supporting senior executives in decision-making processes that boosted profit margins by 8%.

- •Created detailed investment reports, aiding strategic planning that resulted in saving $500,000 over 12 months.

- •Led implementation of new financial planning software, reducing analysis time by 20% and increasing team productivity.

- •Collaborated with auditors to ensure accurate financial reporting, maintaining an error-free record across all submissions.

- •Assisted in developing corporate finance strategies that contributed to a 6% revenue rise over two fiscal years.

- •Conducted variance analysis to enhance budget compliance, which improved department resource allocation by 10%.

- •Streamlined data analysis procedures, boosting accuracy of financial forecasting models by 15%.

- •Facilitated workshops on financial risk management, improving understanding and application of risk prevention techniques across teams.

Tax and Audit Finance Manager resume sample

- •Led the overhaul of tax return processes, reducing filing errors by 30% and facilitating timely submissions across all divisions.

- •Coordinated external audit processes, ensuring precise and comprehensive reporting which resulted in a 10% increase in financial transparency awards.

- •Implemented new tax strategies saving the company $1.2M annually, contributing to enhanced financial health and performance.

- •Developed training programs for 15 finance staff members on emerging tax issues and compliance, improving audit passing rates by 20%.

- •Prepared advanced financial analysis reports for senior management, impacting strategic planning and reducing costs by 8%.

- •Advised on the implementation of ERP systems, increasing financial process efficiency by 18% over two years.

- •Optimized tax preparation procedures, resulting in a 25% decrease in time spent on reconciliation processes and enhanced accuracy.

- •Managed tax audits with external reviewers, achieving a 15% reduction in audit adjustments over three years.

- •Analyzed multi-state tax compliance, implementing measures that reduced tax liabilities by $700K annually.

- •Crafted financial policy enhancements that bolstered the company’s fiscal compliance and improved staff adherence by 12%.

- •Conducted detailed variance and risk analysis, contributing to effective budget forecasting and fiscal stability.

- •Directed comprehensive audits for various departments, ensuring compliance with updated accounting standards, and reducing discrepancies by 35%.

- •Implemented internal control assessments which enhanced financial reporting accuracy, reducing error rates by 28%.

- •Guided a team through quarterly audits, improving audit completion time by 20% while maintaining high accuracy levels.

- •Devised a strategic audit roadmap for new acquisitions, which streamlined integration and compliance by a factor of two.

- •Conducted detailed financial analyses, supporting data-driven decision making for executive leadership and leading to a 5% revenue increase.

- •Assisted in tax compliance projects, improving alignment with regulatory requirements and reducing non-compliance instances by 15%.

- •Managed annual budget preparations, facilitating a 10% increase in efficiency, aiding in long-term financial planning.

- •Participated in strategic planning meetings, contributing insights that led to cost-saving measures worth $300K annually.

Investment and Asset Finance Manager resume sample

- •Led a $500M investment portfolio, achieving a 12% annual return by implementing innovative investment strategies and risk management practices.

- •Conducted thorough financial analysis to identify high-potential investment opportunities, enhancing portfolio diversification and reducing risk exposure.

- •Structured and executed complex asset financing deals, increasing client satisfaction by providing tailored financial solutions.

- •Collaborated with senior management to establish investment objectives aligned with market dynamics, resulting in increased profitability.

- •Monitored market trends and economic indicators, providing strategic recommendations for portfolio adjustments and risk mitigation.

- •Presented comprehensive investment reports to stakeholders, enhancing transparency and fostering trust with clients and institutional partners.

- •Managed asset finance operations for a $200M portfolio, achieving a 10% growth in asset value through strategic initiatives.

- •Negotiated and executed financing agreements with top-tier financial institutions, facilitating expansion opportunities for clients.

- •Assessed investment risks and advised on mitigation strategies, enhancing decision-making processes and safeguarding asset integrity.

- •Developed comprehensive financial models, enabling accurate projections and informed investment decisions.

- •Fostered strategic relationships with high-net-worth individuals and institutional investors, strengthening the firm’s market position.

- •Conducted detailed market research and due diligence on potential investments, resulting in the successful closure of deals worth over $50M.

- •Facilitated the development of investment strategies that improved portfolio performance and aligned with firm objectives.

- •Prepared in-depth investment reports and forecasts for senior analysts and management, enhancing decision-making processes.

- •Built and maintained a database of financial metrics and indicators, improving the efficiency of investment evaluations.

- •Supported the management of financial resources, optimizing capital allocation and improving return on investment for clients.

- •Analyzed financial data to develop insights and recommendations, aiding in strategic planning and risk management.

- •Collaborated with finance teams to enhance reporting accuracy and compliance with regulatory standards.

- •Played a key role in the implementation of new financial modeling techniques, contributing to improved forecasting accuracy.

Treasury and Cash Flow Management Manager resume sample

- •Led a cross-functional team to implement a treasury management system, reducing manual processes by 40% increasing operational efficiency.

- •Managed cash flow forecasting to ensure liquidity, leading to a 30% improvement in cash flow predictability.

- •Enhanced banking relationships, successfully negotiating reduced fees saving the company $500,000 annually.

- •Developed strategic cash management initiatives, resulting in a 20% increase in available working capital.

- •Analyzed cash flow trends and presented findings, advising senior management on critical investment opportunities.

- •Trained a team of 5 junior analysts, improving their productivity by streamlining data analysis processes.

- •Conducted in-depth analyses of cash flow statements, contributing to over $100 million in strategic investment decisions.

- •Developed and maintained comprehensive models for cash flow forecasting, enhancing forecast accuracy by 25%.

- •Collaborated with finance and accounting teams to ensure compliance with new federal financial regulations.

- •Prepared and delivered detailed cash flow reports to executive leadership, improving engagement through impactful visualization.

- •Led a task force to restructure cash management frameworks, resulting in a 15% reduction in operational costs.

- •Designed new treasury reporting processes, reducing reporting time from 10 to 5 days per reporting cycle.

- •Implemented a cash management strategy that decreased unnecessary cash reserves by 35% without impacting liquidity.

- •Worked alongside the accounting department to optimize cash allocation, ensuring accurate fund distribution.

- •Conducted training sessions on the new cash flow systems, resulting in a 30% increase in user adoption rates.

- •Assisted in the development of financial risk assessments, improving cash management protocols by 20%.

- •Participated in liquidity management projects, contributing to a reduction in short-term borrowing needs by $50 million.

- •Monitored and adjusted working capital requirements, leading to cost savings of $200,000 annually.

- •Analyzed competitor financial models, informing strategic decisions and improving stakeholder confidence.

Financial Reporting and Compliance Manager resume sample

- •Led the preparation and review of financial statements, ensuring compliance with GAAP, resulting in a 25% increase in report accuracy.

- •Collaborated with external auditors to streamline auditing processes, reducing audit time by 20% annually.

- •Developed new financial control policies that decreased reporting errors by 15%, enhancing overall financial governance.

- •Monitored regulatory changes, proactively advising senior management on potential impacts, resulting in improved strategic planning.

- •Conducted compliance and reporting training sessions, enhancing staff proficiency by 30%, boosting departmental efficiency.

- •Provided detailed financial insights contributing to cross-departmental projects, fostering collaborative strategic decision-making.

- •Led financial reporting projects improving compliance with IFRS by 22%, supporting corporate governance standards.

- •Implemented a new ERP system across financial departments, resulting in a 40% reduction in data processing time.

- •Partnered with cross-functional teams to enhance risk management processes, resulting in 10% fewer compliance issues.

- •Provided comprehensive training on GAAP standards, decreasing reporting discrepancies by 18% among accounting staff.

- •Analyzed financial data to contribute towards a $5 million cost-saving initiative, enhancing organizational financial health.

- •Developed compliance programs that ensured adherence to financial laws, reducing regulatory penalties by 30%.

- •Coordinated with legal teams to ensure all financial operations met local, state, and federal compliance requirements.

- •Investigated and resolved potential compliance issues, maintaining an audit-ready state throughout financial departments.

- •Improved internal compliance reporting systems, resulting in a 15% increase in report veracity and accountability.

- •Assisted in the preparation of quarterly financial statements, achieving a 20% reduction in reporting errors.

- •Collaborated closely with the compliance team, reducing the time taken for compliance checks by 25%.

- •Analyzed market and financial performance trends, providing insights that improved forecast accuracy by 12%.

- •Played a key role in data accuracy improvements within financial reports, increasing confidence in reporting by stakeholders.

Business Finance and Strategy Manager resume sample

- •Led financial reporting, resulting in a 15% increase in departmental budgeting efficiency through comprehensive analysis and strategic recommendations.

- •Developed financial models that improved strategic decision-making processes, enhancing profit margins by 10%.

- •Led a cross-functional team to implement financial systems, reducing operational costs by 12%.

- •Prepared and delivered financial presentations to senior leadership, influencing key strategic decisions that facilitated a 20% revenue growth.

- •Designed and tracked KPIs that improved financial performance measurements by 25%, focusing on data-driven insights.

- •Cultivated relationships with financial institutions, boosting investor confidence and securing $5M in new funding.

- •Oversaw an annual budget of $30M, achieving targeted objectives with a 5% under budget.

- •Implemented forecasting tools that increased forecast accuracy by 18%, optimizing resource allocation.

- •Launched a cost-control program, cutting department expenditures by 8% within a one-year timeframe.

- •Drove strategic planning initiatives that resulted in capturing new market opportunities, increasing sales by 15%.

- •Built and mentored a team of financial analysts, fostering a culture of innovation and professional development.

- •Advised on strategic financial initiatives for multiple Fortune 500 companies, leading to a combined revenue growth of $50M.

- •Conducted in-depth financial analyses that identified $10M in cost-saving opportunities.

- •Developed and executed strategic growth plans aligning with client objectives, enhancing their market positioning.

- •Coordinated with executive teams to assess financial impacts of mergers and acquisitions, influencing key strategic decisions.

- •Conducted financial analysis and reporting, enabling a 7% improvement in budget forecasting accuracy.

- •Prepared financial models for capital investment projects, advising on potential financial impacts.

- •Developed and presented financial reports to management, effectively communicating complex data insights.

- •Achieved a substantial reduction in budgeting cycle time by streamlining financial processes.

Project Finance and Budgeting Manager resume sample

- •Overhauled budgeting processes, leading to a 20% improvement in accuracy and reducing budgeting errors by 15%.

- •Developed comprehensive financial reports, ensuring all stakeholders were timely and adequately informed about financial performance.

- •Implemented a new financial analysis software, optimizing resource allocation and saving approximately $200,000 annually.

- •Collaborated cross-departmentally to establish financial benchmarks, resulting in a 10% decrease in operating costs.

- •Trained and mentored a team of junior analysts, enhancing team efficiency and increasing report accuracy by 30%.

- •Prepared and presented financial forecasts impacting strategic decision-making for multi-million-dollar projects.

- •Led budget development for e-commerce projects, increasing forecast precision by 18% and achieving consistent project under-budget delivery.

- •Monitored financial performance across 15 projects concurrently, introducing processes that reduced reporting time by 25%.

- •Negotiated vendor contracts, saving $500,000 annually and improving profit margins by 5%.

- •Generated detailed variance reports decreasing discrepancies between estimated and actual costs by 12%.

- •Enabled agile decision-making by providing strategic financial insights during rapid business scaling efforts.

- •Assisted in the development of financial models, supporting critical project investments exceeding $10 million.

- •Streamlined financial reporting processes, cutting report preparation time by 30% while increasing data accuracy.

- •Analyzed financial results and KPIs for ongoing projects, identifying a 7% cost overrun which was mitigated.

- •Supported compliance audits, resulting in zero regulatory issues for project financial reporting.

- •Developed and tracked project budgets, achieving an average savings of 5% per project.

- •Collaborated with operational teams to improve cash flow forecasts, resulting in improved liquidity management.

- •Prepared presentations for senior management, clearly illustrating financial trends and their implications on business strategy.

- •Produced monthly financial reports with a 100% on-time delivery rate for over three years.

Financial Operations and Systems Manager resume sample

- •Led a project that enhanced financial reporting accuracy by 20% through process automation and system integration.

- •Managed accounts payable and receivable, reducing overdue payments by 30% and increasing cash flow efficiency.

- •Spearheaded the implementation of a new ERP system, resulting in a 25% decrease in processing time for financial transactions.

- •Collaborated with cross-functional teams to streamline financial processes, achieving a 15% improvement in end-to-end process efficiency.

- •Trained finance team members in financial systems, elevating team performance by 20% through enhanced skillsets.

- •Successfully coordinated audits, implementing recommendations that improved compliance by 15% and reduced risks.

- •Directed budgeting and forecasting activities, increasing forecast accuracy by 18% through advanced analytics.

- •Improved financial data integrity and reporting speed by implementing system enhancements, reducing errors by 25%.

- •Led a cross-departmental initiative that reduced financial process time by 20%, enhancing overall operational efficiency.

- •Regularly conducted financial analysis, identifying key variances that led to savings of $1.2 million annually.

- •Presented financial reports to senior management, ensuring alignment with strategic objectives and financial targets.

- •Analyzed and optimized financial workflows, resulting in a 12% reduction in operational costs through process refinement.

- •Assisted in system upgrades that improved transaction accuracy by 15% and reduced reporting time.

- •Executed detailed financial analyses, contributing to strategic decision-making and aiding growth initiatives.

- •Provided analytical support during audits, resulting in improved compliance and timely issue resolution.

- •Supported financial operations, assisting in month-end close activities, and improving cycle time by 10%.

- •Participated in financial system maintenance, ensuring data accuracy and contributing to system reliability improvements.

- •Monitored and ensured compliance with established financial policies and procedures, reducing compliance issues by 8%.

- •Assisted in preparing management reports, resulting in better visibility of financial performance indicators.

As an accounts and finance manager, your resume is like a financial report—it shows your ability to manage, analyze, and optimize resources. This task can feel daunting because translating your technical expertise into a compelling narrative isn't easy. You want to convey your skills and achievements so that they resonate with potential employers.

In a competitive job market, standing out is crucial. This means highlighting your ability to navigate complex financial landscapes and communicate strategic insights. Here, a well-chosen resume template can make a world of difference. By using a structured resume template, you ensure your resume carries the professional polish it needs, offering a clear and engaging format.

A well-organized resume not only showcases your background but also reflects your attention to detail—an essential trait in the finance world. Your resume becomes a financial statement in itself, demonstrating your strengths and leadership qualities. It sets you up as a valuable asset to potential employers.

In this guide, you'll learn how to turn those achievements into a resume that stands out. You'll discover how to make your credentials shine, positioning you confidently among skilled professionals. Equip yourself to boost your professional presence with a resume as dynamic as your career.

Key Takeaways

- A well-organized resume highlights your financial management expertise and conveys your ability to drive business success.

- Use a structured resume template to ensure clarity, professionalism, and attention to detail, essential traits in finance.

- Incorporate measurable achievements and quantifiable results in the experience section to demonstrate your impact.

- Choose a chronological resume format to clearly showcase your career progression and growth.

- Include a summary to succinctly highlight your experience, skills, and accomplishments, making a strong first impression.

What to focus on when writing your accounts and finance manager resume

An accounts and finance manager resume should seamlessly convey your financial management expertise and show how you can drive business success.

How to structure your accounts and finance manager resume

- Contact Information: Your contact details should be prominently placed at the top of your resume. This includes your full name, phone number, email address, and LinkedIn profile, ensuring the recruiter has quick and professional reference points.

- Professional Summary: A compelling professional summary provides an engaging snapshot of your key financial management skills and achievements. This draws the reader in and sets the stage for the detailed information to follow.

- Skills: Focus on essential skills such as financial analysis, budgeting, and proficiency in software like QuickBooks or SAP. Highlight how these abilities enhance management efficiency and support strategic planning.

- Professional Experience: In this section, emphasize how your contributions, such as cost reductions or successful audits, have made tangible impacts, showcasing your ability to influence an organization's financial health positively.

- Education: Clearly list your degrees and certifications such as a CPA or CFA to underscore your qualifications and dedication to the financial field.

- Achievements: Spotlighting specific accomplishments provides concrete evidence of your leadership and success in financial management, convincing the recruiter of your capabilities.

Adding optional sections, like professional memberships or volunteer work, enriches the narrative by illustrating your dedication and broader involvement in the industry. As we now explore the resume format, each section above will be covered more in-depth to guide you in crafting a comprehensive and impactful resume.

Which resume format to choose

Creating a resume as an accounts and finance manager requires the right format to effectively highlight your experience, skills, and achievements. A chronological format is ideal since it clearly displays your career progression, making it easier for hiring managers to track your growth in the finance industry. Pair this format with modern fonts like Lato, Raleway, and Montserrat to ensure your resume looks polished and professional. These fonts are not only easy to read but also add a contemporary touch that aligns with the precision and professionalism expected in finance roles. To preserve your hard work, always save your resume as a PDF; this keeps your layout intact across all devices and platforms, demonstrating your meticulous attention to detail—a key trait for finance professionals. Don't overlook the importance of well-set margins; using one-inch margins on all sides will ensure your resume maintains a clean, organized appearance with plenty of whitespace, making it inviting to read. By thoughtfully combining these elements, your resume will effectively convey both your competence and professionalism, making a strong impression on potential employers.

How to write a quantifiable resume experience section

The experience section of your accounts and finance manager resume is vital for showcasing your accomplishments and impact in the finance sector. This is where you present the measurable successes you've achieved, emphasizing the value you bring to potential employers. Begin by listing your roles in reverse chronological order, focusing on the most recent and relevant positions that align with the job description you’re targeting. This keeps your experience current and engaging. Use strong action verbs like "led," "improved," and "optimized" to vividly illustrate your achievements. When you tailor your resume, align your past experiences with keywords and responsibilities from the job ad. This ensures that the employer easily recognizes your direct relevance and suitability for the role.

- •Increased annual revenue by 20% through strategic financial planning and cost-cutting measures.

- •Implemented a new budgeting process that improved forecasting accuracy by 30%.

- •Reduced operational costs by 15% by renegotiating supplier contracts and streamlining procurement.

- •Led a team of 10 finance professionals, boosting team productivity by 25% through leadership development and training.

This section effectively highlights your achievements, demonstrating your ability to drive financial success as an Accounts and Finance Manager. By using action words such as "increased," "implemented," and "reduced," you clearly convey how you took initiative and delivered impactful results. Each bullet point is a testament to your significant contributions, making your value evident to employers. The way you tailor your resume ensures that your accomplishments align well with typical expectations for finance roles, showing that you can meet and exceed those requirements. This approach not only narrates your story but also provides concrete proof of your proficiency in enhancing financial performance, thereby strengthening your application.

Achievement-Focused resume experience section

An achievement-focused accounts and finance manager resume experience section should clearly emphasize the tangible impacts you've created in your previous roles. Highlight your specific accomplishments in financial performance, effective budget management, and leadership in a way that feels cohesive. Begin by identifying the significant differences you've made, such as boosting revenue, cutting costs, or streamlining operations, and support these achievements with quantifiable data. Using numbers or percentages will not only substantiate your claims but also paint a vivid picture of your successes. Each bullet point should start with a strong action verb to underscore your contributions and expertise.

Shift the narrative from simply listing tasks to focusing on measurable results. Instead of merely stating you managed budgets, explain how your strategic oversight led to a 15% reduction in expenses. This approach gives potential employers a clear understanding of the value you offer and your capacity for future achievements. By using straightforward and direct language, you create a compelling story of your professional journey that highlights your skills and impact.

Accounts and Finance Manager

June 2018 - July 2023

- Reduced operating costs by 20% through strategic budget analysis and renegotiating vendor contracts.

- Led a team of 10 in implementing a new accounting software, boosting efficiency by 30%.

- Developed a forecasting model that improved cash flow, resulting in a 25% increase in net income.

- Streamlined the financial reporting process, cutting preparation time by 40% and enhancing accuracy.

Training and Development Focused resume experience section

A training-focused accounts and finance manager resume experience section should seamlessly illustrate your ability to lead and elevate your team’s performance. Start by detailing the training programs you've created or been part of, and highlight the lasting improvements they brought to team efficiency and productivity. Describe specific scenarios where these initiatives led to smoother financial operations or sharpened accuracy, showcasing your leadership and motivation skills. It's essential that your experience section narrates the story of your impact, weaving in your capacity to foster a supportive and collaborative work environment.

To draw attention from potential employers, emphasize the results of your training efforts with concrete numbers. Clearly convey how your initiatives reduced errors, heightened accuracy, or boosted team capability. Structuring your contributions into concise bullet points helps hiring managers swiftly appreciate your value. Craft a cohesive narrative by linking your past achievements directly to the needs of the prospective role, positioning yourself as the candidate who not only fits the bill but elevates the team.

Accounts and Finance Manager

Global Finance Corp.

March 2017 - Present

- Led the creation of a comprehensive financial training program that increased team efficiency by 30%

- Implemented a peer-to-peer mentoring initiative that reduced accounting errors by 20%

- Facilitated quarterly workshops for the finance team focused on compliance and risk reduction strategies

- Developed and delivered onboarding sessions for new hires, ensuring a smooth transition and quick adaptation

Technology-Focused resume experience section

A technology-focused accounts and finance manager resume experience section should showcase your ability to weave technology into financial operations seamlessly. This helps illustrate your adaptability and skill in using digital tools to drive efficiency, improve accuracy, and support strategic decision-making. By highlighting achievements that demonstrate how you've leveraged technology to enhance financial processes, you provide a clear view of your impact on organizational growth. Use straightforward and factual language to show how your contributions have benefited your previous workplaces.

When crafting bullet points, direct attention to achievements that highlight your technical skills and business insight. Include numbers wherever possible to underscore the tangible effects of your work. Mention experiences that reveal your capability to work across departments, implement cutting-edge software, and use technological advancements in strategic financial planning. This approach not only showcases your technical expertise but also your strategic vision, both of which are essential for thriving in modern finance roles.

Accounts and Finance Manager

Tech Solutions Inc.

2020 - 2023

- Led the implementation of a new financial software, reducing monthly closing time by 30%.

- Developed a digital dashboard for real-time budget and forecast monitoring, enhancing decision-making accuracy.

- Collaborated with IT to automate reconciliation processes, cutting error rates by 20%.

- Trained and supported finance team on utilizing new technologies, increasing overall productivity by 15%.

Growth-Focused resume experience section

A growth-focused accounts and finance manager resume experience section should demonstrate your ability to drive financial success and strategic development. Begin by using strong action verbs to highlight the initiatives you've led and the impact they had, emphasizing tangible results like revenue increases, cost reductions, or process enhancements with specific numbers or percentages. This approach goes beyond listing tasks and truly showcases the value you bring.

By crafting a clear narrative, you can effectively align your experiences with potential employers' needs. Describe how you’ve used your skills to integrate financial strategies with the company’s goals, highlighting your role in long-term success and sustainable growth. Tailor each experience to underline your most relevant achievements for the job you’re targeting, focusing on how your strategic insights and leadership have improved the financial health of your past employers.

Accounts and Finance Manager

GrowthCorp Solutions, Inc.

Jan 2020 - Present

- Led a team of five to develop a budgeting process that reduced company expenses by 15% within one year.

- Collaborated with cross-functional teams to identify growth opportunities, boosting revenue by 20%.

- Implemented a new financial reporting system, increasing accuracy by 30% and cutting report-preparation time by 40%.

- Negotiated with vendors to decrease supply costs, achieving annual savings of over $200,000.

Write your accounts and finance manager resume summary section

A finance-focused accounts and finance manager resume should start with a well-crafted summary that highlights your experience, skills, and accomplishments succinctly. This section is crucial for making a strong first impression, quickly conveying your career highlights and unique strengths. It offers a quick snapshot of your professional journey, demonstrating your leadership in managing teams, overseeing budgets, and driving financial success. Precise language helps you communicate effectively.

Consider this example:

This example is impactful because it combines extensive experience, quantifiable results, and key skills in a way that matters for the role. Leadership qualities are also emphasized, which are crucial for a managerial position.

Understanding the nuances between a resume summary and other sections helps tailor your resume more effectively. A resume summary is best for those with experience, offering a brief yet comprehensive career overview. In comparison, a resume objective is suited for newcomers, focusing on career goals. Meanwhile, a resume profile centers on personal attributes. A summary of qualifications offers a bulleted list of skills and achievements. Each has its place and purpose. A good summary section highlights why you’re a standout candidate, demonstrating your experience and achievements while setting an impressive tone for the rest of your resume.

Listing your accounts and finance manager skills on your resume

A skills-focused accounts and finance manager resume should clearly highlight your expertise and strengths. This begins by deciding whether to feature your skills in a dedicated section or integrate them into your experience and summary. Your strengths and soft skills, such as leadership and communication, demonstrate your ability to connect with others, while hard skills like budgeting and financial analysis highlight your technical expertise.

Identifying these skills is about more than just listing attributes; they act as essential keywords that can elevate your resume. Employers often look for these keywords to find top candidates, making it crucial that they feature prominently in your resume.

Here is a streamlined example of how a standalone skills section could be represented:

This layout provides a clear, structured skills section that effectively communicates your qualifications. By listing relevant skills concisely, it allows potential employers to quickly recognize your capabilities and experience.

Best hard skills to feature on your accounts and finance manager resume

As an accounts and finance manager, highlighting hard skills is vital. These skills demonstrate your ability to manage financial information, optimize systems, and ensure compliance. They underscore your proficiency in analyzing, managing, and strategic planning. Here are some essential hard skills for this role:

Hard Skills

- Budgeting

- Financial Analysis

- Forecasting

- Accounts Payable/Receivable

- Compliance

- Financial Reporting

- Project Management

- Risk Management

- Taxation

- Auditing

- Cost Accounting

- Treasury Management

- Financial Modeling

- ERP Systems

- Strategic Planning

Best soft skills to feature on your accounts and finance manager resume

Equally important are soft skills for an accounts and finance manager, which highlight your capacity to lead, communicate, and collaborate effectively. These skills show that you can manage teams and adapt to diverse environments. Consider including these soft skills on your resume:

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Time Management

- Attention to Detail

- Critical Thinking

- Adaptability

- Negotiation

- Decision-Making

- Teamwork

- Interpersonal Skills

- Conflict Resolution

- Organization

- Empathy

- Stress Management

How to include your education on your resume

An education section is an important part of your resume. It shows your academic background and skills relevant to the job you want. Tailoring this section to the specific role you’re applying for is crucial; leave out any education that does not relate to the financial management field. When listing education for an accounts and finance manager position, indicating your GPA can help if it is above 3.0, like 3.5/4.0. Recognitions like cum laude should also be mentioned, as they highlight your academic achievements. When listing a degree, specify the type, major, institution, and graduation date.

Here's an example of a wrong education section setup:

Here is an example of a good education section:

The second example is effective because it includes relevant education for an accounts and finance manager position. It highlights an MBA from a prestigious school with an impressive GPA. This section clearly marks the qualification date, focusing on finance-related education. The exclusion of unrelated degrees keeps the section concise and targeted, capturing the reader's attention with only pertinent details.

How to include accounts and finance manager certificates on your resume

Including a certificates section in your accounts and finance manager resume is essential. List the name of the certificate, include the date you earned it, and add the issuing organization. Certificates can also be featured in the header for immediate visibility. For example:

In this example, the certificates are highly relevant, making the candidate more attractive for the position. It shows their commitment and expertise. The CPA and CFA certifications are well-respected in the field, increasing the candidate's credibility. Adding the issuing organizations adds authenticity. The certificates section stands out, helping hiring managers easily spot essential qualifications.

Extra sections to include in your accounts and finance manager resume

Crafting a compelling resume as an accounts and finance manager involves showcasing your varied skills and experiences. Including diverse sections can highlight your multifaceted abilities and show how well-rounded you are.

- Language section—Demonstrate your multilingual skills by listing the languages you speak and your proficiency level. This can appeal to employers with diverse client bases or international reach.

- Hobbies and interests section—Show your unique personality by sharing activities that you enjoy outside of work. It can make you more relatable and demonstrate a balanced lifestyle.

- Volunteer work section—Highlight your community involvement by including the organizations you have volunteered with and your roles. This can show that you possess a well-developed sense of responsibility and teamwork skills.

- Books section—Mention books that have influenced your career in accounts and finance. This can underscore your commitment to ongoing learning and staying updated in your field.

By including these sections, you can present yourself as a dynamic and dedicated professional. This approach not only shows your technical skills but also your soft skills and broader interests. Make this resume uniquely yours, and you'll likely stand out to potential employers.

In Conclusion

In conclusion, creating an impactful resume as an accounts and finance manager involves a thoughtful combination of structure, content, and presentation. Your resume serves as your professional blueprint, showcasing your abilities to manage financial operations and lead strategic initiatives. A well-structured resume clearly outlines your skills and achievements, making it easy for potential employers to see your value. By choosing the right format and ensuring your resume is visually appealing, you reflect the meticulousness expected in financial roles. Remember, action verbs and quantifiable results narrate your success story convincingly.

As you highlight your experiences, focus on achievements that demonstrate your financial acumen and leadership qualities. Tailor each section to emphasize the skills and experiences that align with the job you are applying for. Use a compelling summary to capture the attention of hiring managers right from the start. Don’t forget to include your education and any relevant certifications, as they underscore your commitment and expertise in the field.

Moreover, incorporating personal interests and volunteer experiences can enrich your resume, adding a personal touch that makes you stand out. This holistic approach showcases you not only as a skilled professional but as a well-rounded individual. Embrace these strategies, and your resume will serve as a powerful tool in advancing your career to new heights.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.