Accountans Receivable Accountant Resume Examples

Jul 18, 2024

|

12 min read

Master the art of creating an accounts receivable accountant resume: tips to ensure you efficiently handle your own "account" and stand out to employers.

Rated by 348 people

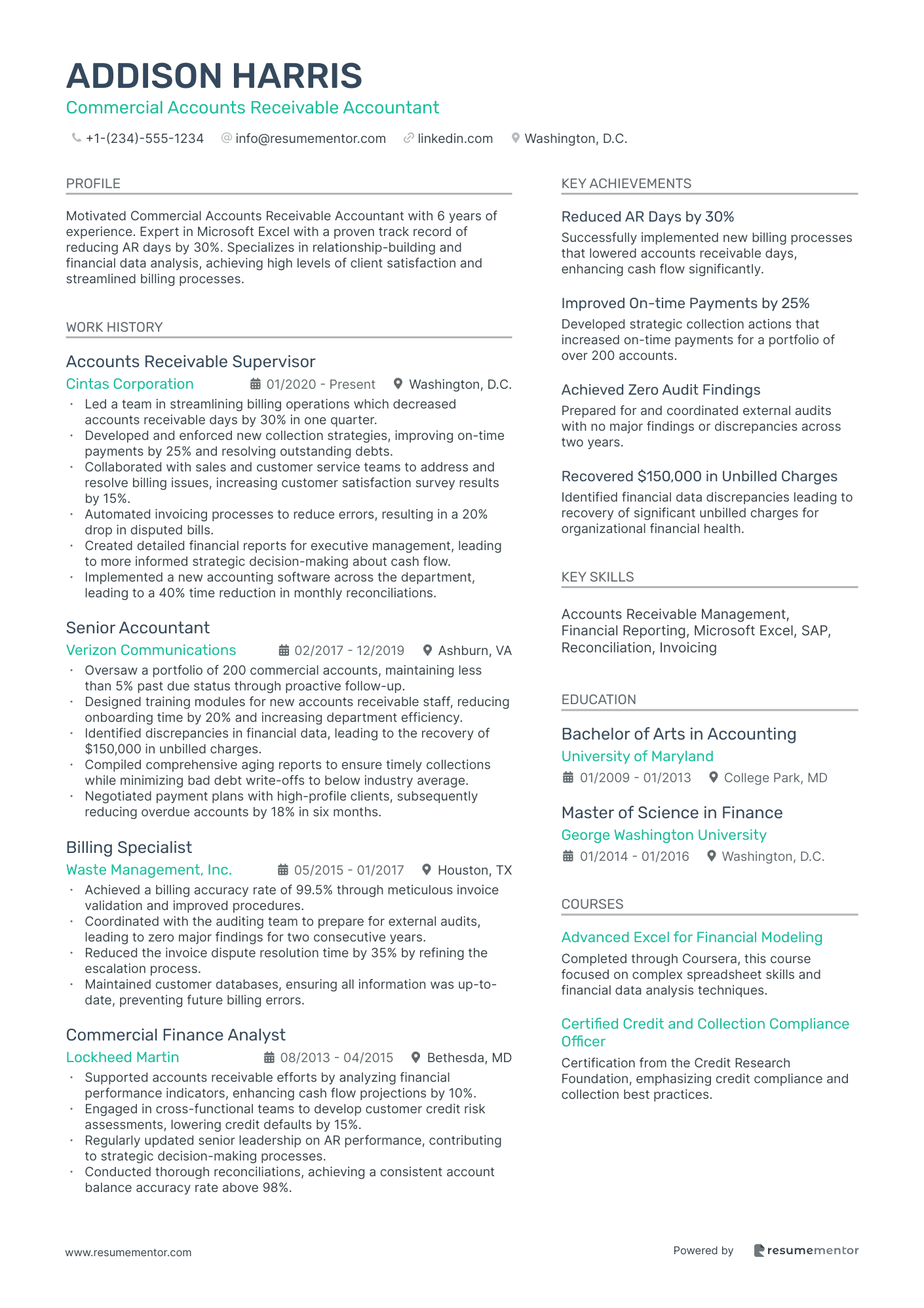

Commercial Accounts Receivable Accountant

Corporate Accounts Receivable Accountant

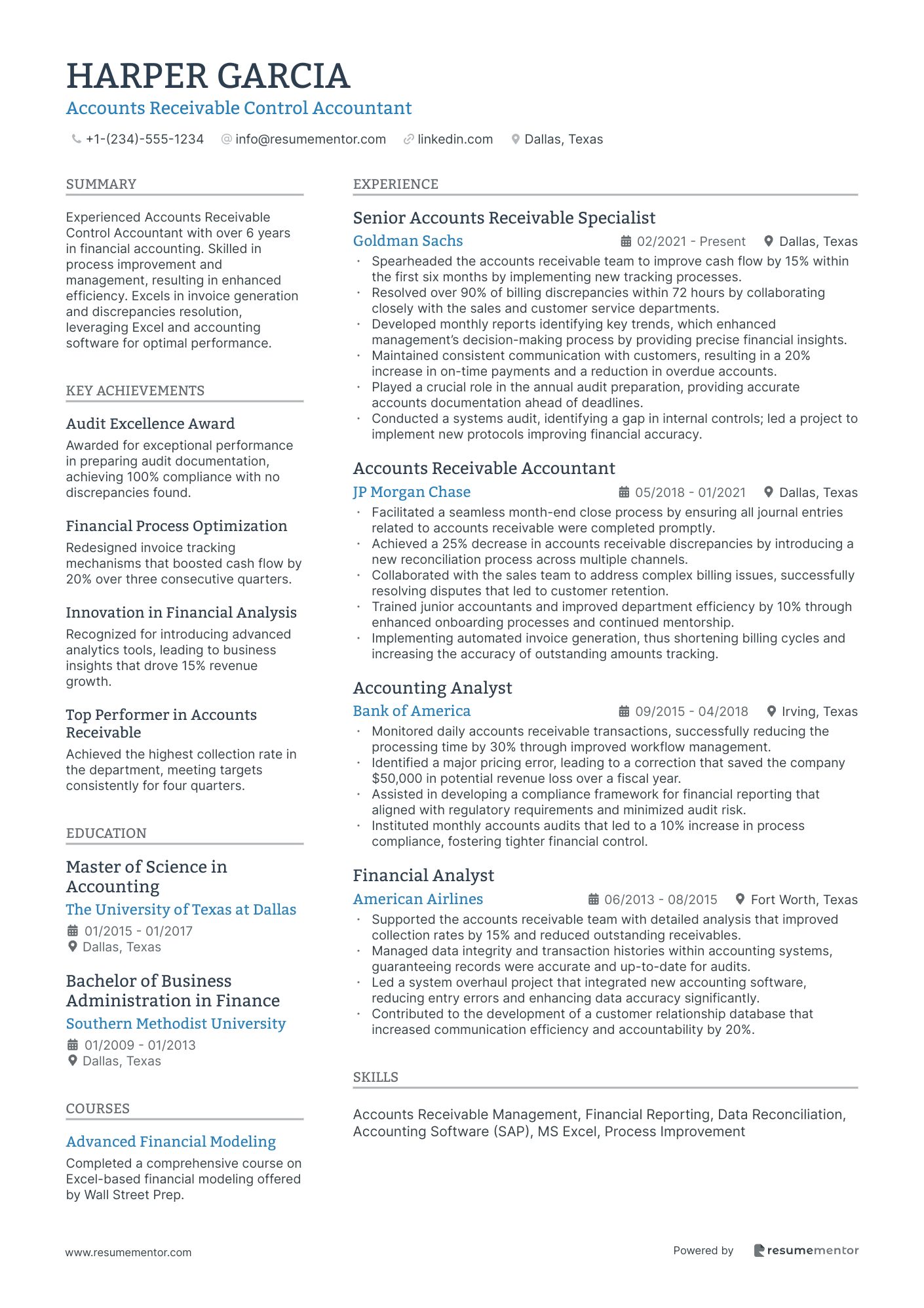

Accounts Receivable Control Accountant

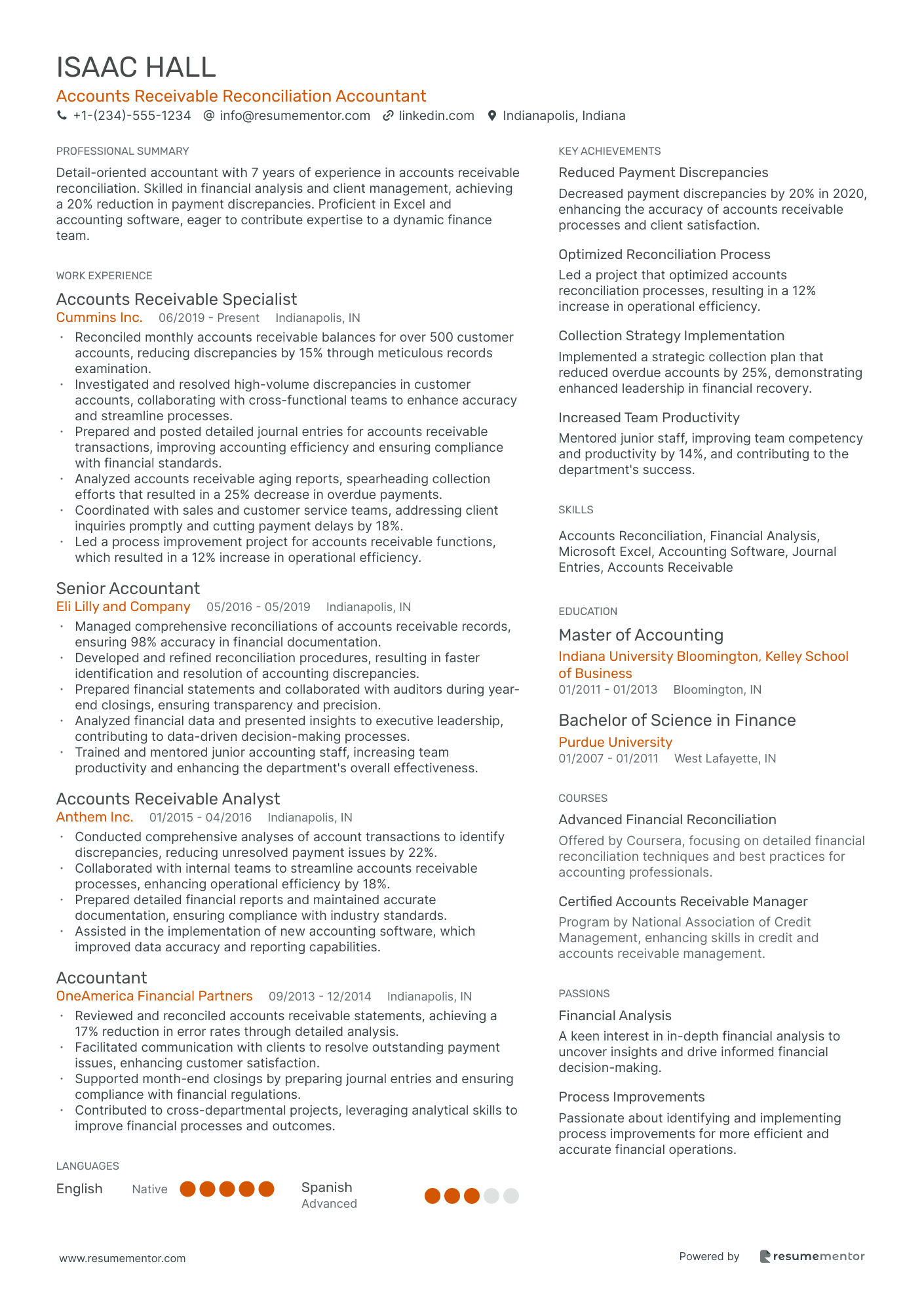

Accounts Receivable Reconciliation Accountant

Senior Accounts Receivable Accountant

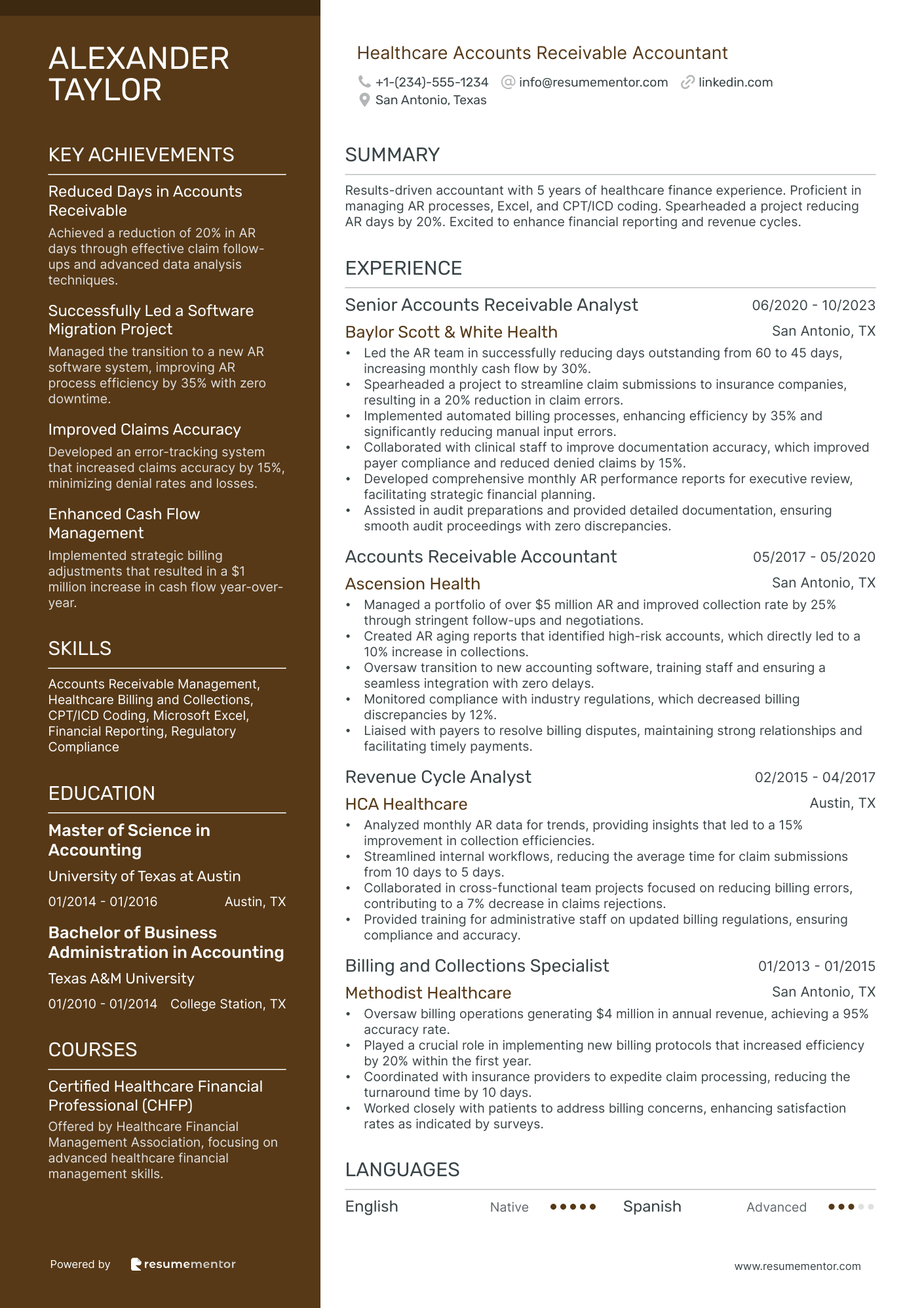

Healthcare Accounts Receivable Accountant

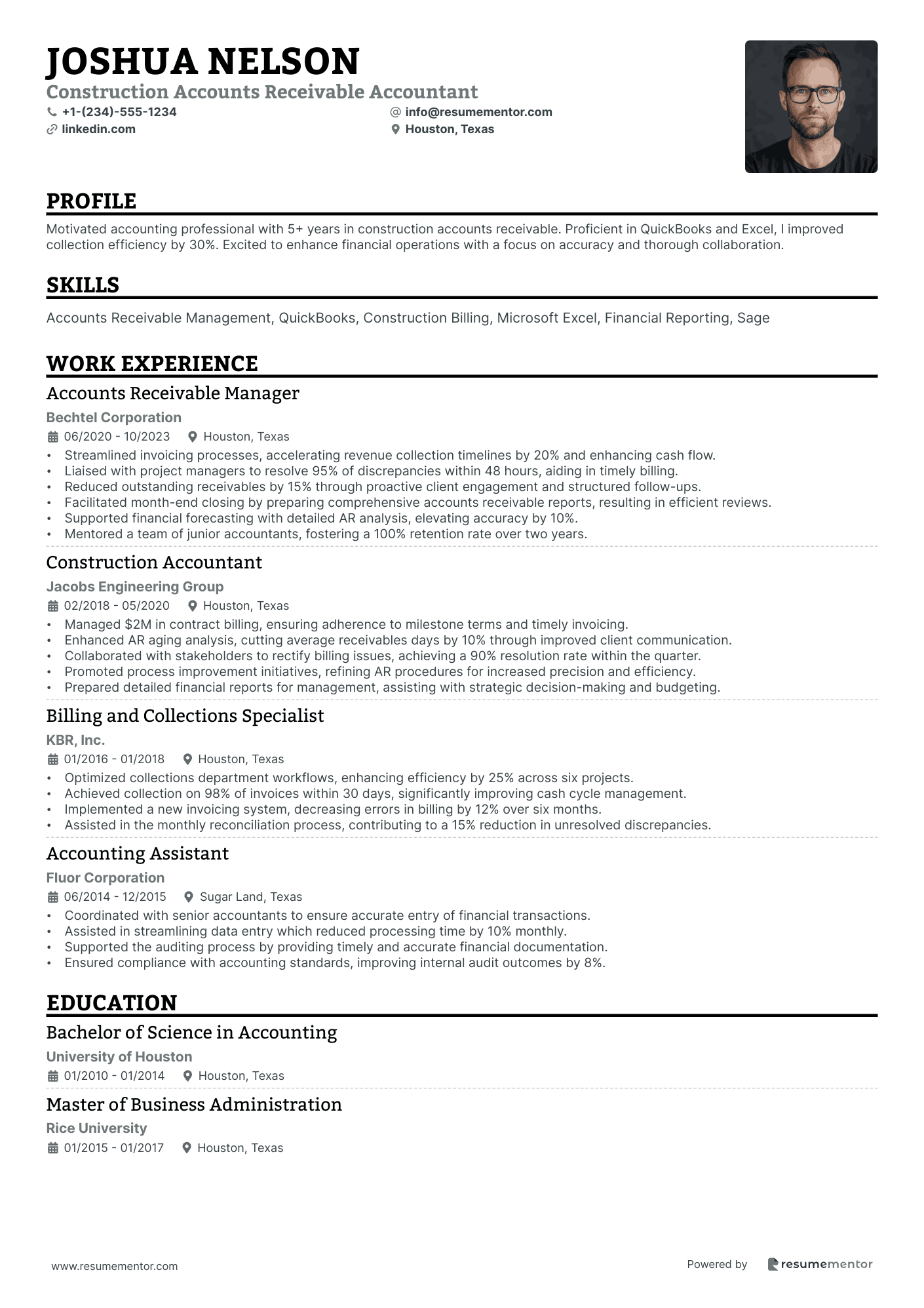

Construction Accounts Receivable Accountant

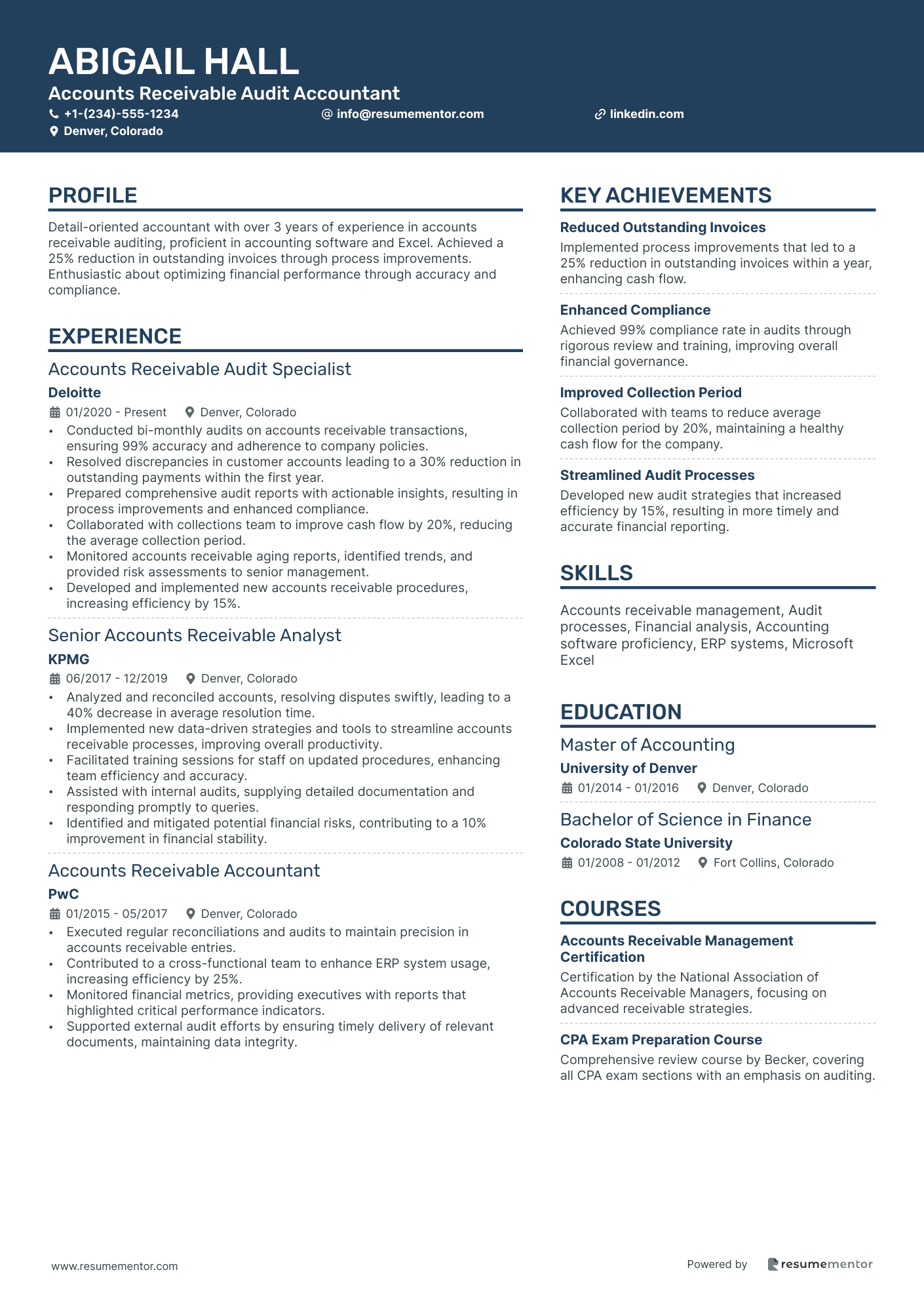

Accounts Receivable Audit Accountant

Commercial Accounts Receivable Accountant resume sample

- •Led a team in streamlining billing operations which decreased accounts receivable days by 30% in one quarter.

- •Developed and enforced new collection strategies, improving on-time payments by 25% and resolving outstanding debts.

- •Collaborated with sales and customer service teams to address and resolve billing issues, increasing customer satisfaction survey results by 15%.

- •Automated invoicing processes to reduce errors, resulting in a 20% drop in disputed bills.

- •Created detailed financial reports for executive management, leading to more informed strategic decision-making about cash flow.

- •Implemented a new accounting software across the department, leading to a 40% time reduction in monthly reconciliations.

- •Oversaw a portfolio of 200 commercial accounts, maintaining less than 5% past due status through proactive follow-up.

- •Designed training modules for new accounts receivable staff, reducing onboarding time by 20% and increasing department efficiency.

- •Identified discrepancies in financial data, leading to the recovery of $150,000 in unbilled charges.

- •Compiled comprehensive aging reports to ensure timely collections while minimizing bad debt write-offs to below industry average.

- •Negotiated payment plans with high-profile clients, subsequently reducing overdue accounts by 18% in six months.

- •Achieved a billing accuracy rate of 99.5% through meticulous invoice validation and improved procedures.

- •Coordinated with the auditing team to prepare for external audits, leading to zero major findings for two consecutive years.

- •Reduced the invoice dispute resolution time by 35% by refining the escalation process.

- •Maintained customer databases, ensuring all information was up-to-date, preventing future billing errors.

- •Supported accounts receivable efforts by analyzing financial performance indicators, enhancing cash flow projections by 10%.

- •Engaged in cross-functional teams to develop customer credit risk assessments, lowering credit defaults by 15%.

- •Regularly updated senior leadership on AR performance, contributing to strategic decision-making processes.

- •Conducted thorough reconciliations, achieving a consistent account balance accuracy rate above 98%.

Corporate Accounts Receivable Accountant resume sample

- •Developed streamlined billing processes reducing invoice discrepancies by 30%, bolstering client satisfaction and efficiency.

- •Enhanced accounts receivable turnover by 15%, resulting in more timely collection of outstanding invoices.

- •Managed portfolio of high-value accounts equivalent to $3M monthly, ensuring accurate and timely processing of payments.

- •Collaborated cross-functionally with sales teams, resolving complex billing issues, leading to a 25% decrease in overdue payments.

- •Provided critical data for month-end closing activities, supporting accurate financial reporting and improved decision-making.

- •Spearheaded implementation of new accounting software, improving user experience and reducing processing time by 10%.

- •Analyzed accounts receivable aging reports to initiate collections on overdue accounts, improving cash flow by $500K annually.

- •Led training sessions on effective invoice management for juniors, enhancing team performance and reducing errors by 15%.

- •Negotiated favorable payment terms with clients, reducing average days sales outstanding by 8%.

- •Assisted in the preparation and execution of internal audits, ensuring compliance with financial standards and policies.

- •Championed an initiative to update customer records, increasing data accuracy and supporting better forecasting and planning.

- •Reconciled high-volume accounts, ensuring accuracy in transaction records and securing payments within contractual terms.

- •Processed and applied incoming payments with a 99% accuracy rate, enhancing client trust and operational reliability.

- •Collaborated with customer service teams to resolve billing disputes, gaining a 20% improvement in service levels.

- •Generated detailed reports on collections and account status, aiding management decision-making and strategic planning.

- •Assisted in reducing outstanding receivables by 25%, through effective communication and negotiation with clients.

- •Maintained up-to-date and accurate financial records ensuring compliance with company and regulatory standards.

- •Supported finance team in achieving error-free monthly closing, promoting cohesive teamwork and operational excellence.

- •Developed new templates for invoicing that improved clarity and client understanding, resulting in fewer disputes.

Accounts Receivable Control Accountant resume sample

- •Spearheaded the accounts receivable team to improve cash flow by 15% within the first six months by implementing new tracking processes.

- •Resolved over 90% of billing discrepancies within 72 hours by collaborating closely with the sales and customer service departments.

- •Developed monthly reports identifying key trends, which enhanced management’s decision-making process by providing precise financial insights.

- •Maintained consistent communication with customers, resulting in a 20% increase in on-time payments and a reduction in overdue accounts.

- •Played a crucial role in the annual audit preparation, providing accurate accounts documentation ahead of deadlines.

- •Conducted a systems audit, identifying a gap in internal controls; led a project to implement new protocols improving financial accuracy.

- •Facilitated a seamless month-end close process by ensuring all journal entries related to accounts receivable were completed promptly.

- •Achieved a 25% decrease in accounts receivable discrepancies by introducing a new reconciliation process across multiple channels.

- •Collaborated with the sales team to address complex billing issues, successfully resolving disputes that led to customer retention.

- •Trained junior accountants and improved department efficiency by 10% through enhanced onboarding processes and continued mentorship.

- •Implementing automated invoice generation, thus shortening billing cycles and increasing the accuracy of outstanding amounts tracking.

- •Monitored daily accounts receivable transactions, successfully reducing the processing time by 30% through improved workflow management.

- •Identified a major pricing error, leading to a correction that saved the company $50,000 in potential revenue loss over a fiscal year.

- •Assisted in developing a compliance framework for financial reporting that aligned with regulatory requirements and minimized audit risk.

- •Instituted monthly accounts audits that led to a 10% increase in process compliance, fostering tighter financial control.

- •Supported the accounts receivable team with detailed analysis that improved collection rates by 15% and reduced outstanding receivables.

- •Managed data integrity and transaction histories within accounting systems, guaranteeing records were accurate and up-to-date for audits.

- •Led a system overhaul project that integrated new accounting software, reducing entry errors and enhancing data accuracy significantly.

- •Contributed to the development of a customer relationship database that increased communication efficiency and accountability by 20%.

Accounts Receivable Reconciliation Accountant resume sample

- •Reconciled monthly accounts receivable balances for over 500 customer accounts, reducing discrepancies by 15% through meticulous records examination.

- •Investigated and resolved high-volume discrepancies in customer accounts, collaborating with cross-functional teams to enhance accuracy and streamline processes.

- •Prepared and posted detailed journal entries for accounts receivable transactions, improving accounting efficiency and ensuring compliance with financial standards.

- •Analyzed accounts receivable aging reports, spearheading collection efforts that resulted in a 25% decrease in overdue payments.

- •Coordinated with sales and customer service teams, addressing client inquiries promptly and cutting payment delays by 18%.

- •Led a process improvement project for accounts receivable functions, which resulted in a 12% increase in operational efficiency.

- •Managed comprehensive reconciliations of accounts receivable records, ensuring 98% accuracy in financial documentation.

- •Developed and refined reconciliation procedures, resulting in faster identification and resolution of accounting discrepancies.

- •Prepared financial statements and collaborated with auditors during year-end closings, ensuring transparency and precision.

- •Analyzed financial data and presented insights to executive leadership, contributing to data-driven decision-making processes.

- •Trained and mentored junior accounting staff, increasing team productivity and enhancing the department's overall effectiveness.

- •Conducted comprehensive analyses of account transactions to identify discrepancies, reducing unresolved payment issues by 22%.

- •Collaborated with internal teams to streamline accounts receivable processes, enhancing operational efficiency by 18%.

- •Prepared detailed financial reports and maintained accurate documentation, ensuring compliance with industry standards.

- •Assisted in the implementation of new accounting software, which improved data accuracy and reporting capabilities.

- •Reviewed and reconciled accounts receivable statements, achieving a 17% reduction in error rates through detailed analysis.

- •Facilitated communication with clients to resolve outstanding payment issues, enhancing customer satisfaction.

- •Supported month-end closings by preparing journal entries and ensuring compliance with financial regulations.

- •Contributed to cross-departmental projects, leveraging analytical skills to improve financial processes and outcomes.

Senior Accounts Receivable Accountant resume sample

- •Managed end-to-end accounts receivable process, decreasing overdue invoices by 30% within the first six months.

- •Prepared detailed AR aging reports which improved collection rates by identifying key trends and issues.

- •Worked cross-functionally with sales and customer support to resolve billing discrepancies, reducing open invoice issues by 20%.

- •Analyzed customer payment patterns, resulting in 25% faster payment cycles through strategic recommendations.

- •Created comprehensive monthly AR reports integrated with the general ledger for informed financial decision-making.

- •Played a vital role in the annual audit process by providing precise AR schedules, leading to a flawless audit.

- •Supervised a team to streamline AR processes, enhancing efficiency and reducing manual entry errors by 40%.

- •Implemented automated invoicing systems, cutting down processing time by 50% and boosting team productivity.

- •Collaborated with finance to align AR processes, which improved cash forecasting accuracy by 20%.

- •Led a project on process improvement initiatives, saving the company $250,000 annually.

- •Monitored payment risks and developed plans to mitigate them, maintaining an excellent collection rate.

- •Handled high-volume AR operations for a portfolio worth $200 million, maintaining less than 1% default rate.

- •Coordinated with corporate clients to expedite payments, reducing days sales outstanding by 25%.

- •Executed customer account reconciliations, providing clarity in financial statements and improving cash flow.

- •Developed reports and shared insights with the management team, influencing financial strategies in collections.

- •Assisted senior accountants in managing receivables, contributing to a 15% efficiency increase in invoice processing.

- •Conducted financial analysis which supported a project to reduce overhead costs resulting in significant savings.

- •Managed a database and improved tracking systems, resulting in a more efficient retrieval of AR data.

- •Ensured compliance with industry standards, aiding a successful internal audit verification.

Healthcare Accounts Receivable Accountant resume sample

- •Led the AR team in successfully reducing days outstanding from 60 to 45 days, increasing monthly cash flow by 30%.

- •Spearheaded a project to streamline claim submissions to insurance companies, resulting in a 20% reduction in claim errors.

- •Implemented automated billing processes, enhancing efficiency by 35% and significantly reducing manual input errors.

- •Collaborated with clinical staff to improve documentation accuracy, which improved payer compliance and reduced denied claims by 15%.

- •Developed comprehensive monthly AR performance reports for executive review, facilitating strategic financial planning.

- •Assisted in audit preparations and provided detailed documentation, ensuring smooth audit proceedings with zero discrepancies.

- •Managed a portfolio of over $5 million AR and improved collection rate by 25% through stringent follow-ups and negotiations.

- •Created AR aging reports that identified high-risk accounts, which directly led to a 10% increase in collections.

- •Oversaw transition to new accounting software, training staff and ensuring a seamless integration with zero delays.

- •Monitored compliance with industry regulations, which decreased billing discrepancies by 12%.

- •Liaised with payers to resolve billing disputes, maintaining strong relationships and facilitating timely payments.

- •Analyzed monthly AR data for trends, providing insights that led to a 15% improvement in collection efficiencies.

- •Streamlined internal workflows, reducing the average time for claim submissions from 10 days to 5 days.

- •Collaborated in cross-functional team projects focused on reducing billing errors, contributing to a 7% decrease in claims rejections.

- •Provided training for administrative staff on updated billing regulations, ensuring compliance and accuracy.

- •Oversaw billing operations generating $4 million in annual revenue, achieving a 95% accuracy rate.

- •Played a crucial role in implementing new billing protocols that increased efficiency by 20% within the first year.

- •Coordinated with insurance providers to expedite claim processing, reducing the turnaround time by 10 days.

- •Worked closely with patients to address billing concerns, enhancing satisfaction rates as indicated by surveys.

Construction Accounts Receivable Accountant resume sample

- •Streamlined invoicing processes, accelerating revenue collection timelines by 20% and enhancing cash flow.

- •Liaised with project managers to resolve 95% of discrepancies within 48 hours, aiding in timely billing.

- •Reduced outstanding receivables by 15% through proactive client engagement and structured follow-ups.

- •Facilitated month-end closing by preparing comprehensive accounts receivable reports, resulting in efficient reviews.

- •Supported financial forecasting with detailed AR analysis, elevating accuracy by 10%.

- •Mentored a team of junior accountants, fostering a 100% retention rate over two years.

- •Managed $2M in contract billing, ensuring adherence to milestone terms and timely invoicing.

- •Enhanced AR aging analysis, cutting average receivables days by 10% through improved client communication.

- •Collaborated with stakeholders to rectify billing issues, achieving a 90% resolution rate within the quarter.

- •Promoted process improvement initiatives, refining AR procedures for increased precision and efficiency.

- •Prepared detailed financial reports for management, assisting with strategic decision-making and budgeting.

- •Optimized collections department workflows, enhancing efficiency by 25% across six projects.

- •Achieved collection on 98% of invoices within 30 days, significantly improving cash cycle management.

- •Implemented a new invoicing system, decreasing errors in billing by 12% over six months.

- •Assisted in the monthly reconciliation process, contributing to a 15% reduction in unresolved discrepancies.

- •Coordinated with senior accountants to ensure accurate entry of financial transactions.

- •Assisted in streamlining data entry which reduced processing time by 10% monthly.

- •Supported the auditing process by providing timely and accurate financial documentation.

- •Ensured compliance with accounting standards, improving internal audit outcomes by 8%.

Accounts Receivable Audit Accountant resume sample

- •Conducted bi-monthly audits on accounts receivable transactions, ensuring 99% accuracy and adherence to company policies.

- •Resolved discrepancies in customer accounts leading to a 30% reduction in outstanding payments within the first year.

- •Prepared comprehensive audit reports with actionable insights, resulting in process improvements and enhanced compliance.

- •Collaborated with collections team to improve cash flow by 20%, reducing the average collection period.

- •Monitored accounts receivable aging reports, identified trends, and provided risk assessments to senior management.

- •Developed and implemented new accounts receivable procedures, increasing efficiency by 15%.

- •Analyzed and reconciled accounts, resolving disputes swiftly, leading to a 40% decrease in average resolution time.

- •Implemented new data-driven strategies and tools to streamline accounts receivable processes, improving overall productivity.

- •Facilitated training sessions for staff on updated procedures, enhancing team efficiency and accuracy.

- •Assisted with internal audits, supplying detailed documentation and responding promptly to queries.

- •Identified and mitigated potential financial risks, contributing to a 10% improvement in financial stability.

- •Executed regular reconciliations and audits to maintain precision in accounts receivable entries.

- •Contributed to a cross-functional team to enhance ERP system usage, increasing efficiency by 25%.

- •Monitored financial metrics, providing executives with reports that highlighted critical performance indicators.

- •Supported external audit efforts by ensuring timely delivery of relevant documents, maintaining data integrity.

- •Conducted financial analyses, providing insights that drove strategic decisions and improved revenue streams.

- •Assisted in developing financial models that supported budgeting and forecasting activities, increasing planning accuracy.

- •Engaged in process optimization projects, contributing to a 20% reduction in operational costs.

- •Prepared detailed financial reports that were utilized by senior management for decision-making processes.

Navigating the job market as an accounts receivable accountant can feel like solving a complex equation, where each piece of your financial expertise and attention to detail must fit perfectly. Your resume plays a crucial role here, reflecting not just your job history but your ability to manage invoices and improve cash flow efficiently.

To stand out, you need to present your technical skills and financial acumen in a way that's both concise and impactful. Many find this challenging, but a professional resume template can be your secret weapon. With a resume template, you can seamlessly highlight your skills and streamline your experience into a compelling narrative.

This guide is your companion in crafting a resume that grabs employers’ attention and lands you interviews. Whether you’re experienced or just starting out, aligning your resume with what employers seek is essential. You’ll learn to distill your experiences into impactful bullet points and tailor achievements to job descriptions. By the end, you’ll have a polished resume that not only looks professional but also effectively tells your career story. Let’s begin this journey to bring you closer to your next accounts receivable role.

Key Takeaways

- Present your technical skills and financial acumen in a concise and impactful way using a professional resume template to stand out in the job market.

- Emphasize your expertise in managing financial transactions and maintaining accurate records, reflecting skills like financial analysis and proficiency with accounting software.

- Consider using a chronological resume format for its ability to showcase a steady work history and highlight relevant experience, which is essential in the accounts receivable field.

- Include sections like Volunteer Experience, Languages, or Professional Affiliations to demonstrate a well-rounded persona and enhance your resume's impact.

- Incorporate both hard and soft skills on your resume, use a clear and professional font, and save your document as a PDF for consistent formatting across devices.

What to focus on when writing your accountans receivable accountant resume

For an accounts receivable accountant, your resume should effectively highlight your skills in managing financial transactions, demonstrating a keen eye for detail and ensuring the prompt collection of receivables. Recruiters seek candidates who exhibit expertise in financial analysis combined with a talent for maintaining accurate records.

How to structure your accountans receivable accountant resume

- Contact Information — To facilitate easy communication, include your full name, phone number, email address, and LinkedIn profile, ensuring recruiters can quickly reach you. Consistency is key, so make sure your LinkedIn profile matches the information on your resume, reinforcing your professional brand.

- Professional Summary — Begin with a compelling overview of your experience, capturing your years in the field and emphasizing key strengths alongside notable achievements in accounts receivable. Including specifics, like your ability to optimize invoicing cycles or improve cash flow, can set you apart. Mention your proficiency with essential accounting software like QuickBooks or SAP, showcasing technical acumen that supports your summary.

- Work Experience — Share your previous roles, focusing on responsibilities like managing invoices, reconciling accounts, and highlighting your skills in credit risk analysis. Use dynamic action verbs and quantify your successes, such as reducing overdue receivables or increasing collections efficiency. You can also highlight communication techniques, such as sending a gentle reminder email before escalating to formal notices, to demonstrate professionalism and tact in managing receivables. This section should illustrate how you have added value in past positions, connecting your contributions to business outcomes.

- Education — Enhance your credibility by listing your highest degree along with relevant coursework. Any additional certifications in accounting or finance further bolster your professional image and show your commitment to continued learning. Academic achievements can complement your field experience, showcasing a well-rounded candidate.

- Skills — To portray your comprehensive expertise, highlight your strengths in financial reporting and data entry accuracy. Couple these with your proficiency in accounting software, underscoring your attention to detail and problem-solving abilities—key traits for resolving account discrepancies. Including soft skills such as communication and teamwork can also be advantageous, reflecting your ability to collaborate effectively.

- Certifications — Elevate your professional standing by featuring certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant), demonstrating a higher level of competence. These certifications indicate a dedication to the field and may help differentiate you from other candidates.

To further enrich your resume, consider adding sections like Volunteer Experience, Languages, or Professional Affiliations—these elements can showcase a more well-rounded professional persona. In the upcoming sections, we'll delve deeper into each part of the resume format to maximize its impact.

Which resume format to choose

Creating a standout resume as an accounts receivable accountant starts with choosing the right format. A chronological format is ideal because it showcases a steady work history and highlights relevant experience—key elements that hiring managers in this field look for. This format directly aligns with the skills and steady track record often desired for this role, helping you make an impactful first impression.

For your font choice, consider Lato, Montserrat, or Raleway. These fonts are clean and modern, ensuring that your resume is easy to read. While font choice might seem minor, it plays a crucial role in how your information is perceived. A clear, professional font sets the stage for your skills and experience to shine through without distractions.

Always save your resume as a PDF. This file type maintains your formatting exactly as you intend it, ensuring your resume looks polished no matter what device a recruiter uses. Consistent formatting reflects attention to detail, which is essential in the accounts receivable field where precision is key.

Keep your margins at about one inch on all sides. Proper margins provide balanced white space, which helps your resume look organized and approachable. This attention to layout shows that you understand the importance of clarity and structure—traits valued in accounting roles.

Combined, these thoughtful choices create a resume that not only looks professional but also effectively communicates your qualifications as an accounts receivable accountant. This strategic approach helps you stand out in a competitive job market.

How to write a quantifiable resume experience section

To create an impactful accounts receivable accountant resume, highlight the improvements you've driven in past roles and their positive effects. Start with your most recent position to emphasize your current skills and accomplishments. Align your resume with the job ad by incorporating similar language and focusing on relevant duties. Including experiences from the last 10-15 years ensures you present a comprehensive view of your expertise. Use strong action verbs like "streamlined," "reduced," "implemented," and "enhanced" to vividly illustrate your contributions.

- •Cut outstanding receivables by 25% in a year through targeted strategies and customer engagement, enhancing overall cash flow.

- •Implemented a new invoicing system that reduced errors by 15%, which sped up payment times and improved efficiency.

- •Collaborated with teams to resolve discrepancies, leading to a 60% drop in billing errors and increased accuracy.

- •Upgraded the AR reporting system, boosting both accuracy and speed of financial reports by 30%, aiding strategic decision-making.

This section effectively integrates achievements that paint a clear picture of your impact on financial operations. Each bullet builds on the previous one, demonstrating a pattern of consistent improvement and teamwork. By using quantifiable results, you tangibly show your value, while the connected flow maintains focus on your ability to drive positive outcomes. This approach makes your resume engaging and appealing to potential employers, who will appreciate the depth and clarity of your contributions.

Collaboration-Focused resume experience section

A collaboration-focused accounts receivable accountant resume experience section should highlight your adeptness at working with others to achieve financial goals. Since collaboration is key in this role, where interaction with departments like billing, sales, and customer service is frequent, it's crucial to choose roles and responsibilities that showcase your team-oriented approach. Highlight how working together played a pivotal role in your achievements, whether it was managing projects or improving payment processes.

Reflect on initiatives where collaboration was essential, such as leading a team to integrate a new invoicing system or partnering with customer service to resolve issues. By quantifying your achievements, such as reducing overdue invoices by significant percentages, you demonstrate your impact. Ensure your experience illustrates how teamwork directly contributed to boosting productivity and improving financial outcomes, making your resume stand out.

Accounts Receivable Accountant

XYZ Corporation

January 2022 - September 2023

- Led a project team of 5 to integrate the new invoicing software, resulting in a 30% reduction in billing errors.

- Coordinated with sales and customer service departments to resolve outstanding account issues, reducing overdue balances by 25%.

- Organized monthly collaboration meetings with 3 different departments to identify and solve process inefficiencies.

- Developed and implemented a shared document system to enhance communication and reduce response times by 15%.

Innovation-Focused resume experience section

An innovation-focused accounts receivable accountant resume experience section should highlight your ability to introduce new ideas that drive efficiency and enhance financial operations. Start by identifying key achievements where you implemented new systems or methods to streamline processes and improve outcomes. For instance, if you've used technology to automate reminders, mention how this boosted collection efficiency significantly.

It's beneficial to use strong action verbs and quantify your results to clearly demonstrate your impact. Tailor your accomplishments to match what's most relevant to the position you’re targeting. Present your achievements in bullet points, focusing on how your innovative thinking led to practical improvements. This approach showcases your capability to bring fresh ideas that result in measurable benefits for your team and organization.

Accounts Receivable Accountant

ABC Financial Services

March 2020 - Present

- Boosted collection efficiency by 20% by implementing an automated reminder system.

- Created new reporting dashboards that cut report preparation time in half, helping teams access critical data faster.

- Transitioned to a digital invoicing system, reducing processing errors by 15% and speeding up invoice delivery.

- Led a project using machine learning to predict payment delays, enhancing cash flow forecasting accuracy by 30%.

Achievement-Focused resume experience section

An achievement-focused Accounts Receivable Accountant resume experience section should effectively showcase the impact you've made in your previous roles. Begin by identifying the key responsibilities you’ve handled and consider the tangible results you've achieved. For instance, think about whether you reduced outstanding balances, streamlined invoicing processes, or enhanced the accuracy of financial reports. Highlighting these quantifiable outcomes demonstrates your effectiveness in managing accounts receivable.

Once these accomplishments are clear, convert them into well-crafted bullet points. Start each with a strong action word to clearly convey your role and the impact you made. Keep your language straightforward while focusing on concrete results, ensuring a smooth reading experience. Each bullet should highlight a specific achievement, challenge overcome, or skill employed. By presenting your accomplishments in this connected manner, you offer potential employers a compelling narrative of your skills and successes.

Accounts Receivable Accountant

ABC Corporation

January 2020 - Present

- Reduced outstanding accounts receivable by 30% over 12 months through improved invoicing strategies.

- Streamlined billing processes, resulting in a 20% decrease in invoice disputes.

- Implemented a new reporting system to increase financial reporting accuracy by 15%.

- Collaborated with the sales team to create payment plans, enhancing client relationships and ensuring consistent cash flow.

Growth-Focused resume experience section

A growth-focused accounts receivable accountant resume experience section should emphasize achievements that showcase your ability to enhance and streamline financial systems. Start by describing instances where you took initiative and implemented strategies that boosted efficiency or resulted in significant cost savings. Be sure to include quantifiable results, like numbers or percentages, which help potential employers grasp the impact of your contributions. Furthermore, it's crucial to mention any collaborations with other teams or leadership roles, as these experiences highlight your capacity to drive organizational growth through teamwork and guidance.

Seamlessly transition into discussing your problem-solving abilities by explaining how you identified inefficiencies and developed effective solutions. Employers are particularly interested in your capability to optimize processes, so underline how your efforts led to improved cash flow or better risk management. Ensure that each bullet point is succinct and builds on the previous one, creating a cohesive and compelling narrative that convincingly demonstrates your growth-oriented skills and achievements.

Accounts Receivable Accountant

XYZ Corporation

June 2020 - Present

- Reduced overdue invoices by 30% through diligent follow-up and improved record-keeping practices.

- Streamlined billing processes by introducing new software, saving the company 15 hours per month.

- Collaborated with sales and customer service teams to develop a more accurate billing system.

- Trained new team members on updated procedures, improving department efficiency by 20%.

Write your accountans receivable accountant resume summary section

A result-focused accounts receivable accountant resume summary should clearly highlight your skills and accomplishments in a succinct manner. This brief snapshot of your career journey is designed to grab an employer's attention and quickly communicate your value. Emphasizing achievements, like improving collection rates or mastering essential software, can make you stand out. Consider this example:

This summary effectively combines experience with specific skills and measurable achievements, such as reducing outstanding debt by 25%, to convey your professional impact. This kind of tangible evidence can be persuasive to employers.

Understanding the difference between similar resume elements is important. While some might confuse a resume summary with an objective, profile, or summary of qualifications, each serves its own purpose. A resume objective is suited for those starting out or changing careers, as it clarifies specific goals. A resume profile offers a more general overview of your professional life, while a summary of qualifications focuses on listing key skills and accomplishments.

For experienced professionals, especially in accounts receivable, a well-crafted summary acts as an inviting entry point that captures an employer's interest. It creates a strong foundation for the rest of your resume, helping you stand out in a competitive job market.

Listing your accountans receivable accountant skills on your resume

A skills-focused accounts receivable accountant resume should effectively showcase your strengths and abilities. These skills can stand alone in a dedicated section or be woven into other parts of your resume, like your experience and summary. Your strengths include valuable soft skills such as communication and teamwork, which play a key role in how you interact with others. On the other hand, hard skills are specific abilities, like proficiency with accounting software, that you bring to the table.

Incorporating both types of skills is essential since they can act as powerful keywords to capture the attention of employers. By carefully selecting relevant skills, you not only ensure your resume passes through applicant tracking systems but also impress hiring managers. Focus on skills directly related to the position to clearly demonstrate your qualifications and readiness for the role.

For example, a standalone skills section might look like this:

A skills section like this is effective because it's focused and highly relevant to the role. By highlighting both technical and soft skills, you demonstrate that you're a well-rounded candidate capable of excelling in various aspects of the job.

Best hard skills to feature on your accounts receivable accountant resume

As an accounts receivable accountant, you'll need hard skills that address financial operations and software tools. These skills demonstrate your capacity to handle crucial financial tasks and maintain precise records.

Hard Skills

- Accounts Receivable Management

- Financial Analysis

- Reconciliation

- Billing and Invoicing

- Data Entry

- Microsoft Excel

- Financial Reporting

- QuickBooks

- SAP ERP

- Account Reconciliation

- Ledger Maintenance

- Debt Collection

- Credit Management

- GAAP Knowledge

- Tax Preparation

Best soft skills to feature on your accounts receivable accountant resume

To complement your hard skills, emphasizing soft skills that showcase your reliability and interpersonal excellence is important. These qualities highlight your ability to collaborate well and navigate workplace challenges smoothly.

Soft Skills

- Communication Skills

- Problem-Solving

- Time Management

- Adaptability

- Teamwork

- Customer Service

- Attention to Detail

- Organization Skills

- Analytical Thinking

- Stress Management

- Conflict Resolution

- Reliability

- Flexibility

- Multitasking

- Decision-Making

How to include your education on your resume

An education section is a crucial part of your resume, especially when applying for an accounts receivable accountant position. Tailoring this section to match the job is key. Include only relevant education to better highlight your qualifications. Listing your GPA can be beneficial if it's strong and reflects well on you; however, if it's not, it's okay to leave it out. If you've graduated with honors, such as "cum laude," those distinctions should be included to showcase your accomplishments. When listing degrees, make sure they're clearly stated and relevant to the accounting field.

Here's an education section structured poorly:

Now here's a better example:

The second example is effective because it provides the relevant degree and honor, which aligns with the job. It also includes a strong GPA, reinforcing expertise in the field. The date range clearly indicates the duration of study, helping employers understand your educational timeline accurately. This precise information is key in painting a comprehensive picture of your academic background for a potential employer.

How to include accountans receivable accountant certificates on your resume

Including a certificates section is essential for an Accounts Receivable Accountant resume. List the name of each certificate alphabetically. Include the date of issuance to show your commitment to ongoing education. Add the issuing organization to provide credibility. You can also place certificates in the header for immediate visibility.

Here's a good example:

This example is good because it lists relevant and recognized certificates for an accounting role. Employers recognize CPA and CMA, and these show your expertise. It also has each certificate's issuing organization, adding credibility. This clear format helps hiring managers quickly see your qualifications.

Extra sections to include in your accountans receivable accountant resume

Creating a resume for an accounts receivable accountant involves highlighting skills and experiences that demonstrate your ability to manage financial accounts effectively. Your resume sections should showcase your professional experience, educational background, and additional attributes that make you a well-rounded candidate. Including sections like languages, hobbies and interests, volunteer work, and books can add a personal touch and help you stand out to potential employers.

Language section — List additional languages you speak. Show your ability to communicate with diverse client backgrounds.

Hobbies and interests section — Mention hobbies that align with skills needed in accounting, like attention to detail or strategic thinking. Indicate you manage your time well and maintain work-life balance.

Volunteer work section — Include any volunteer experiences related to financial management. Demonstrate your commitment to giving back and applying your accounting skills in different contexts.

Books section — List books related to accounting, finance, or personal development you’ve read. Highlight your continuous learning and interest in staying updated with industry trends.

These sections not only enhance your resume but also offer employers insight into your personality and capabilities that go beyond your work experience and education.

In Conclusion

In conclusion, creating an effective resume as an accounts receivable accountant requires a balance of technical skills and storytelling. Your resume acts as your professional identity, providing a snapshot of what you bring to the table. Use it to highlight your expertise in managing invoices, improving cash flow, and maintaining accurate financial records. Strong formatting choices, like clean fonts and strategic use of white space, ensure clarity and readability. Quantifying your accomplishments with numbers or percentages can vividly demonstrate your impact and effectiveness. By including both hard and soft skills, you paint a picture of a well-rounded candidate. Remember, a well-curated resume sets the stage for presenting your education and certifications, further showcasing your dedication and competence within the field. Extras like language skills or volunteer work can add a unique touch, subtly hinting at your versatility. Precision and organization in your resume reflect your professional habits, essential traits for success in accounts receivable roles. Tailoring each application to align with specific job descriptions shows foresight and dedication. Ultimately, your resume is a tool that not only reflects your abilities but also showcases your potential to future employers. Armed with these insights, you are well-prepared to craft a resume that stands out in today's competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.