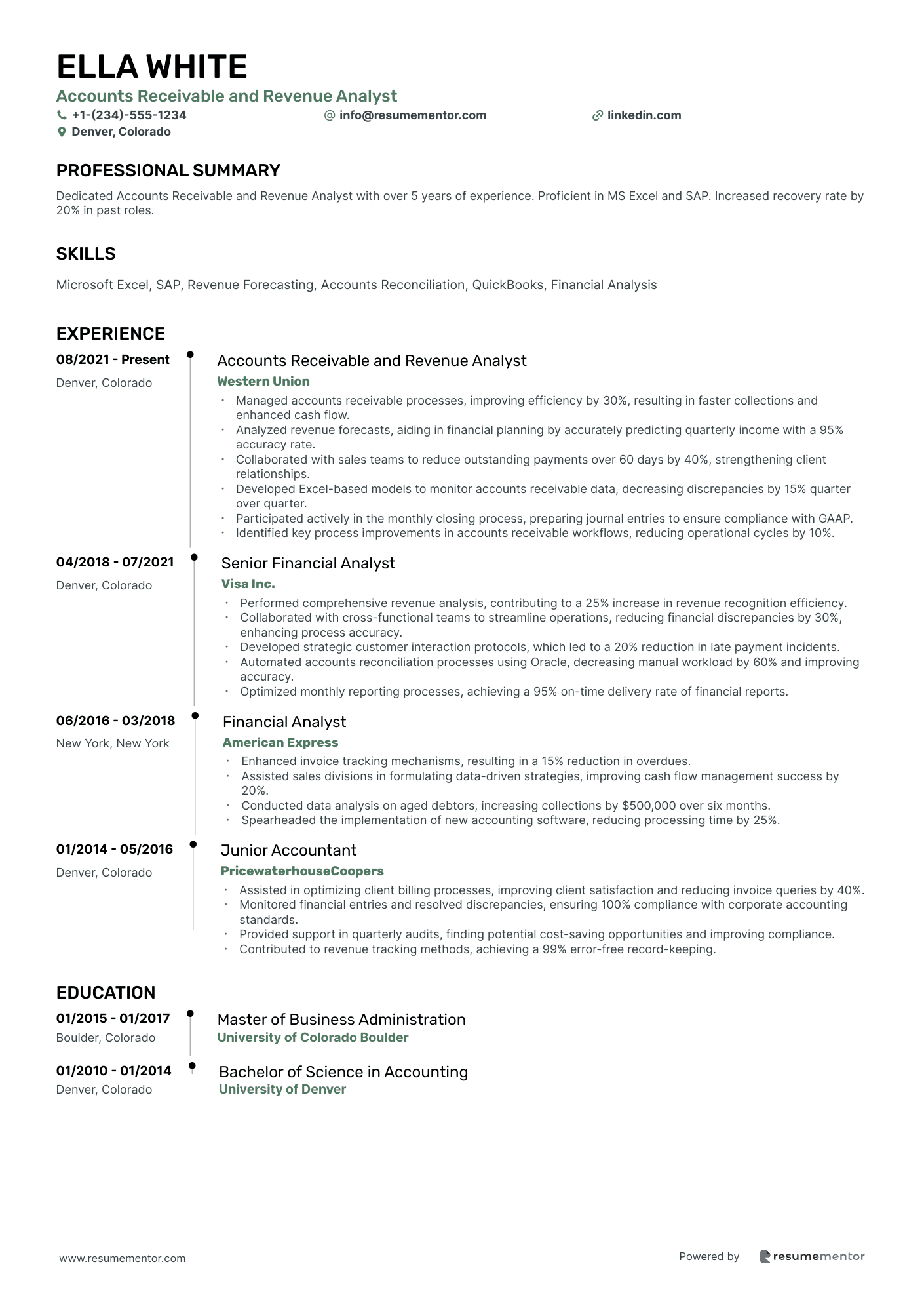

Accounts Receivable Resume Examples

Mar 26, 2025

|

12 min read

Craft an effective accounts receivable resume by highlighting your skills with numbers, payment tracking, and invoice management, and make your next job hunt an outstanding "account of" your abilities. Learn how to "bill" up your experience here.

Rated by 348 people

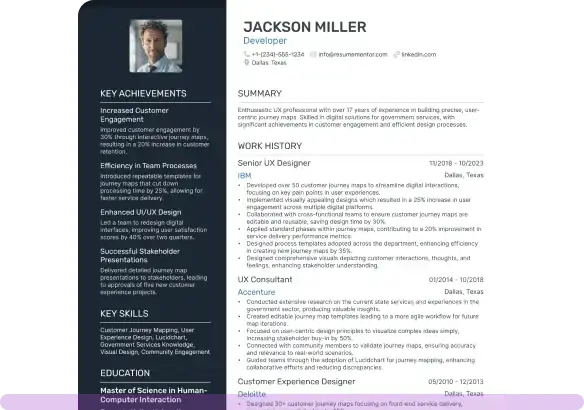

Accounts Receivable and Collection Specialist

Medical Accounts Receivable Clerk

Accounts Receivable and Billing Specialist

Accounts Receivable reconciliation Analyst

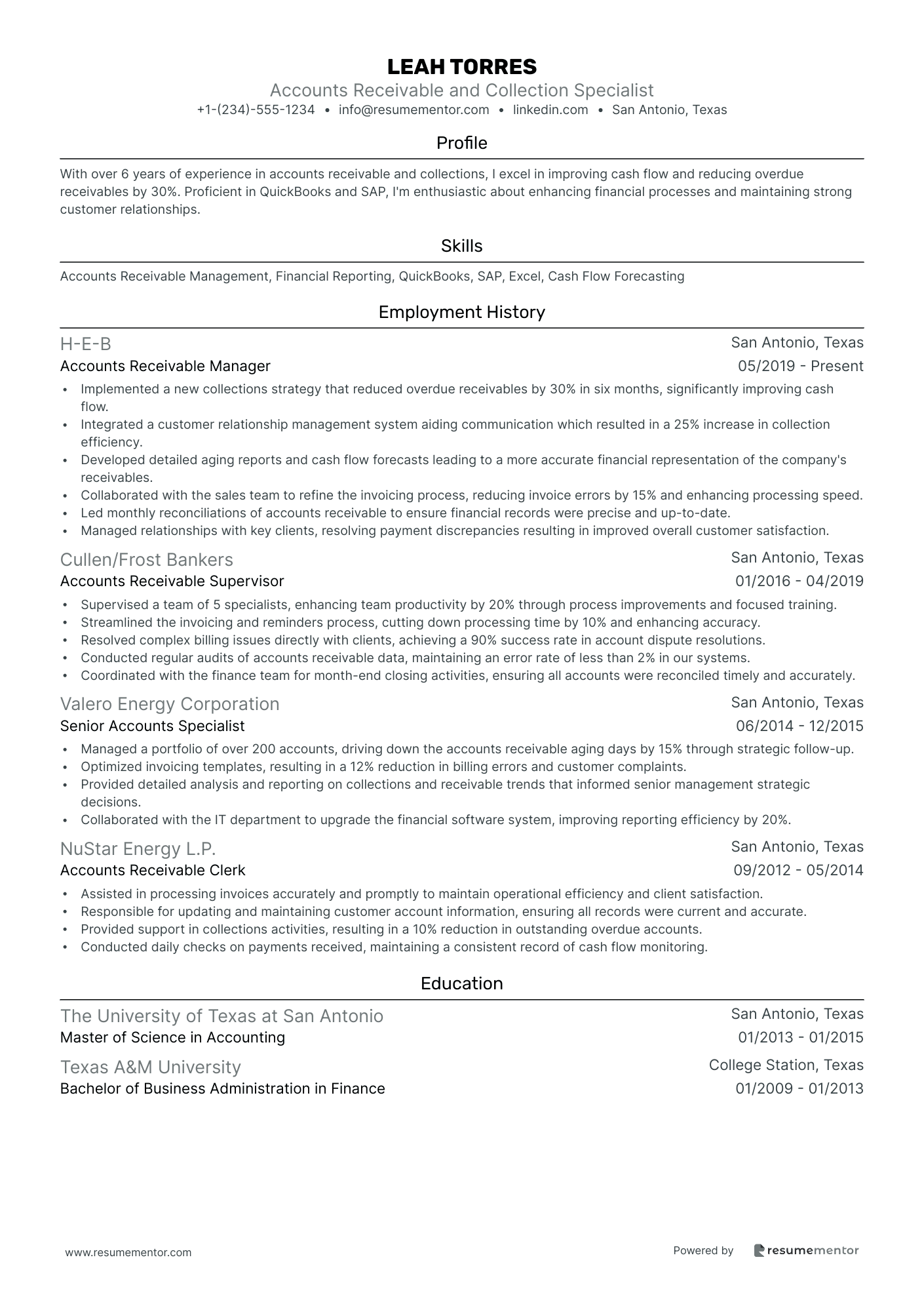

Senior Accounts Receivable Coordinator

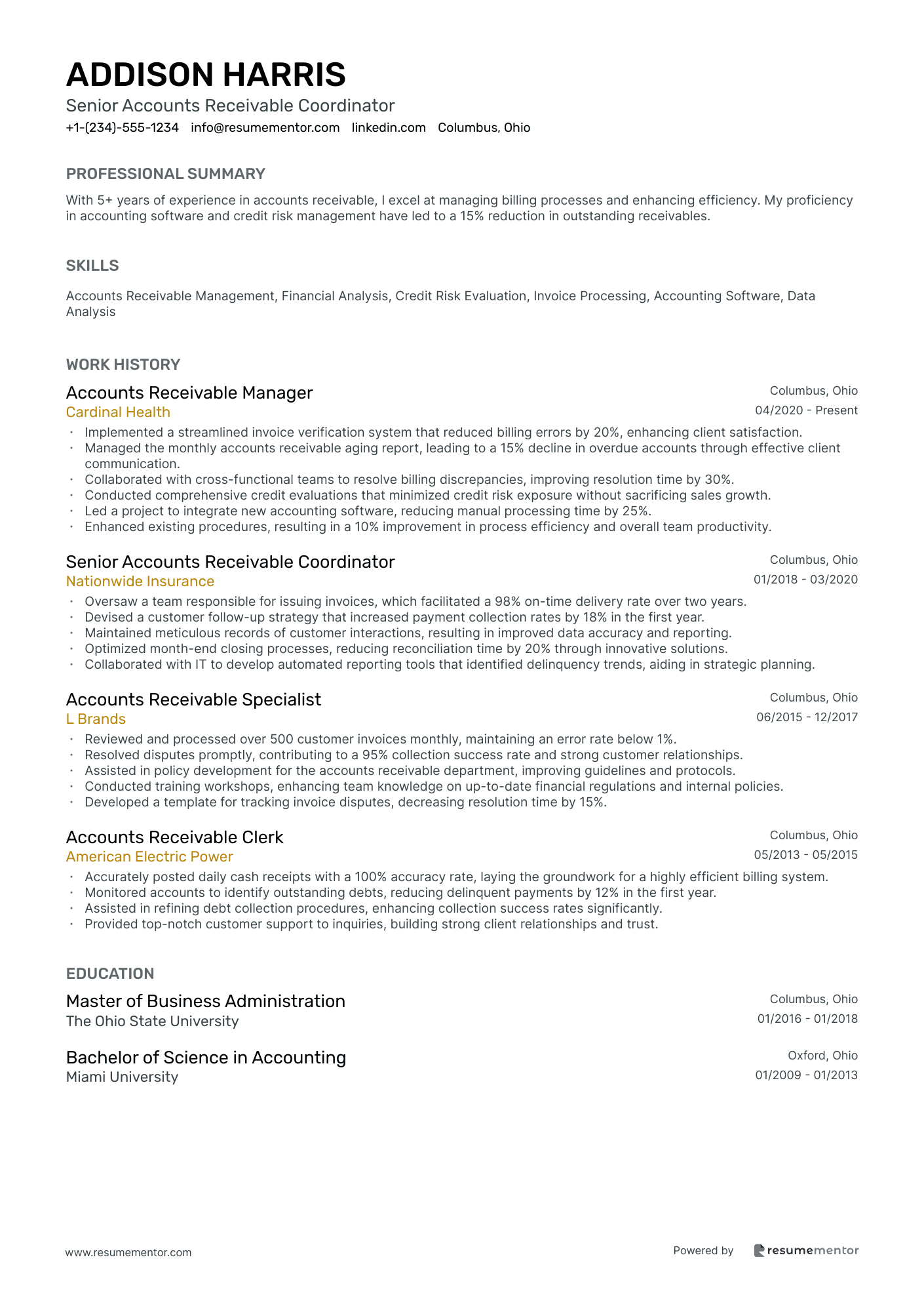

Accounts Receivable and Revenue Analyst

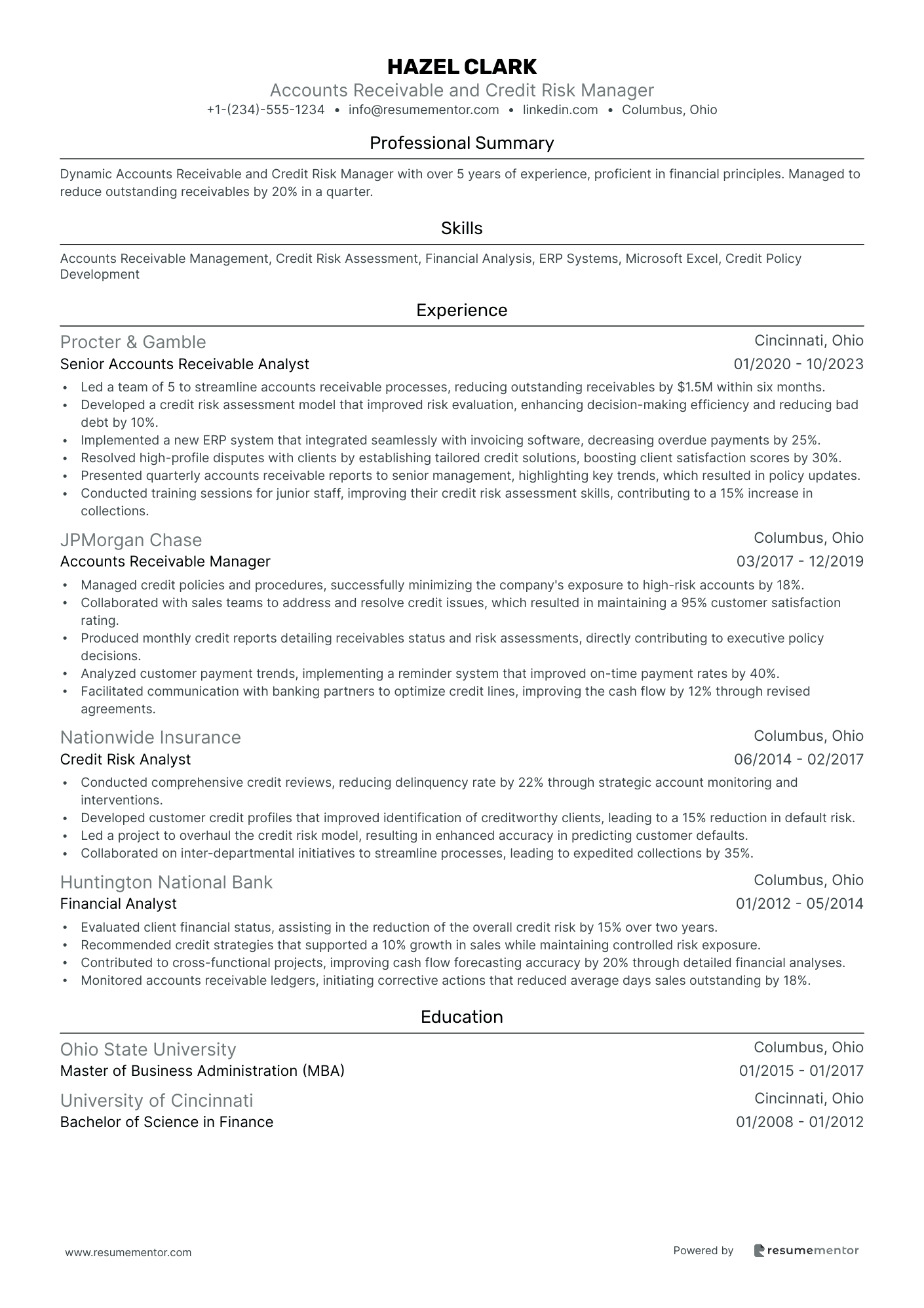

Accounts Receivable and Credit Risk Manager

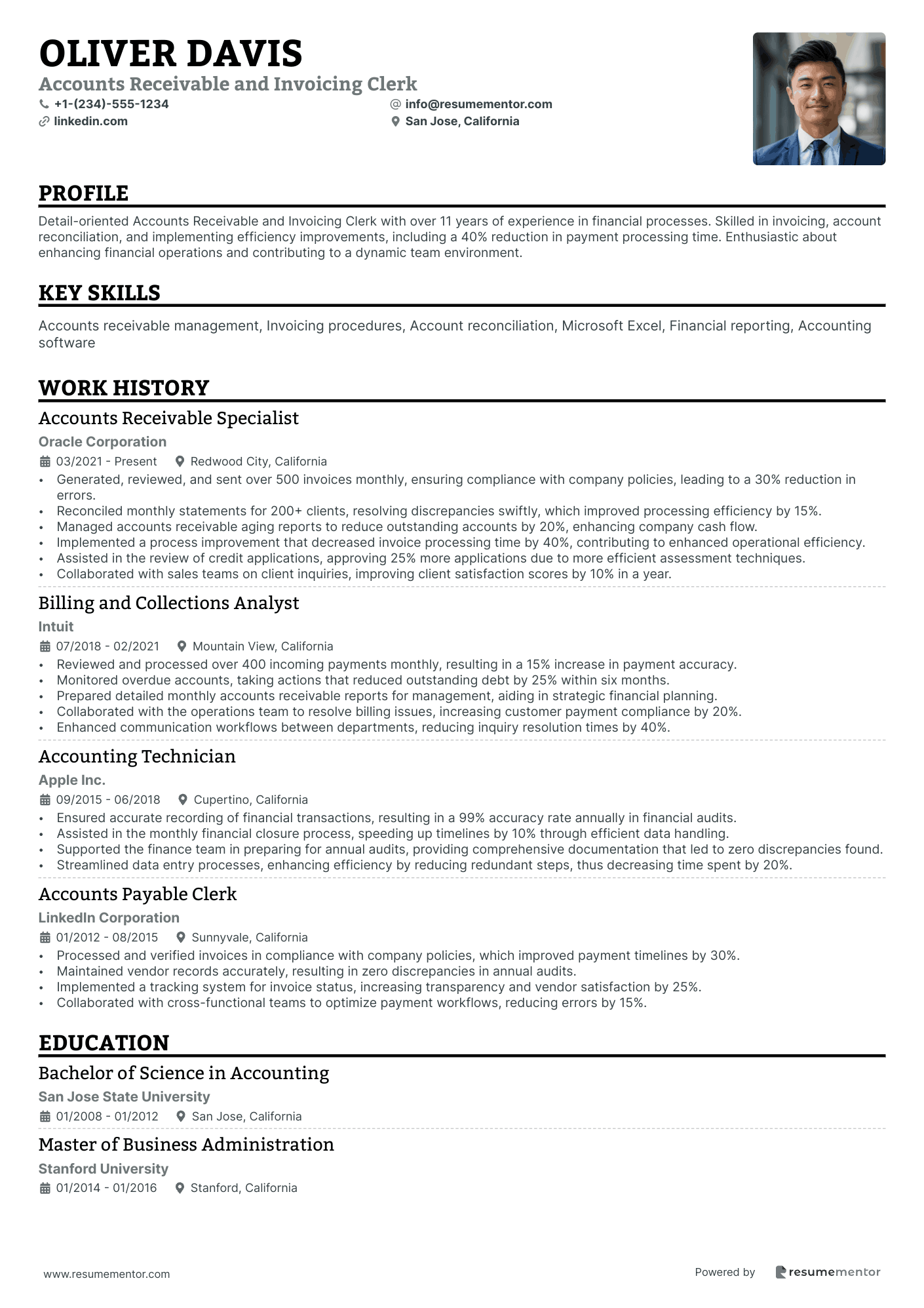

Accounts Receivable and Invoicing Clerk

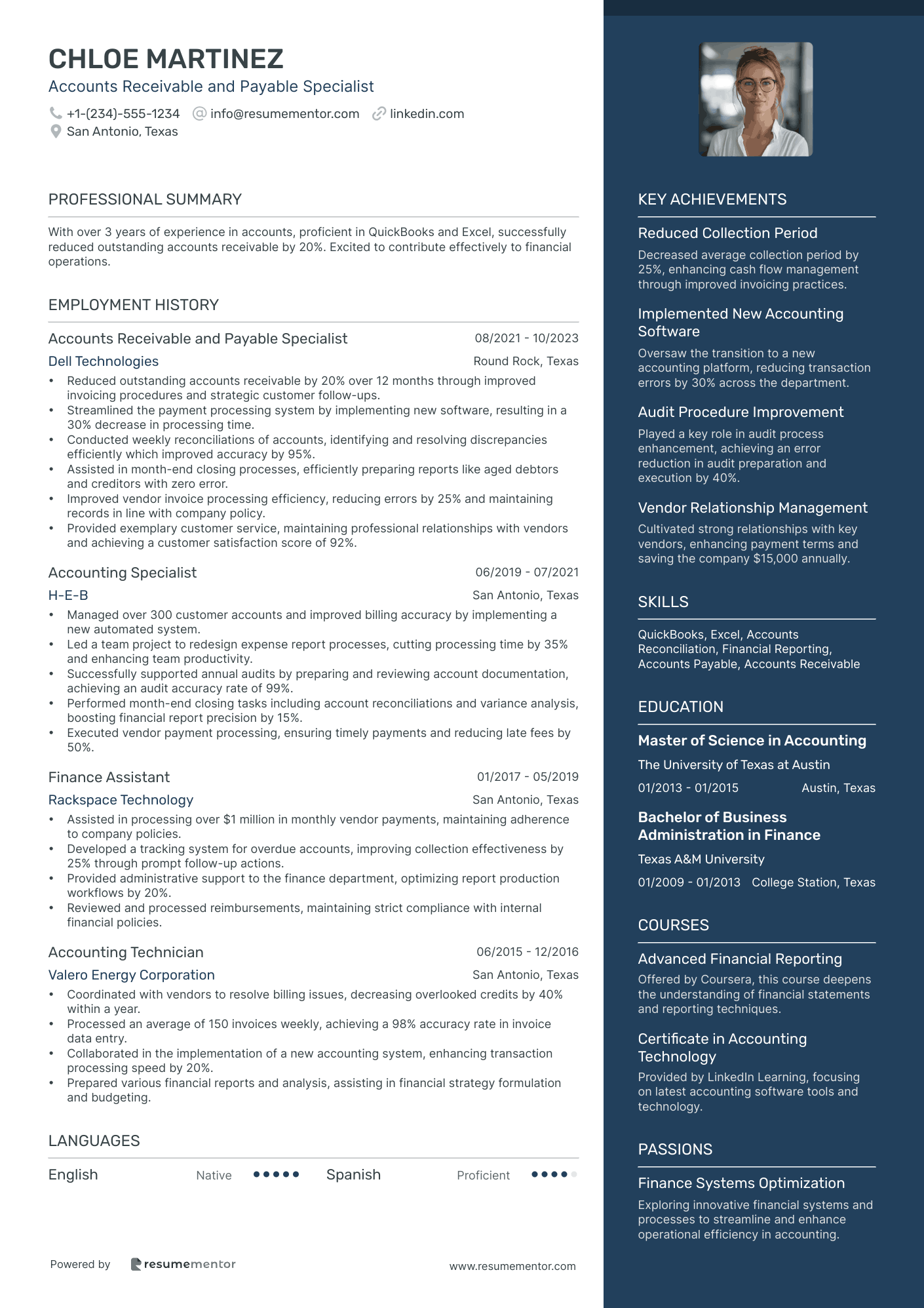

Accounts Receivable and Payable Specialist

Accounts Receivable and Collection Specialist resume sample

- •Implemented a new collections strategy that reduced overdue receivables by 30% in six months, significantly improving cash flow.

- •Integrated a customer relationship management system aiding communication which resulted in a 25% increase in collection efficiency.

- •Developed detailed aging reports and cash flow forecasts leading to a more accurate financial representation of the company's receivables.

- •Collaborated with the sales team to refine the invoicing process, reducing invoice errors by 15% and enhancing processing speed.

- •Led monthly reconciliations of accounts receivable to ensure financial records were precise and up-to-date.

- •Managed relationships with key clients, resolving payment discrepancies resulting in improved overall customer satisfaction.

- •Supervised a team of 5 specialists, enhancing team productivity by 20% through process improvements and focused training.

- •Streamlined the invoicing and reminders process, cutting down processing time by 10% and enhancing accuracy.

- •Resolved complex billing issues directly with clients, achieving a 90% success rate in account dispute resolutions.

- •Conducted regular audits of accounts receivable data, maintaining an error rate of less than 2% in our systems.

- •Coordinated with the finance team for month-end closing activities, ensuring all accounts were reconciled timely and accurately.

- •Managed a portfolio of over 200 accounts, driving down the accounts receivable aging days by 15% through strategic follow-up.

- •Optimized invoicing templates, resulting in a 12% reduction in billing errors and customer complaints.

- •Provided detailed analysis and reporting on collections and receivable trends that informed senior management strategic decisions.

- •Collaborated with the IT department to upgrade the financial software system, improving reporting efficiency by 20%.

- •Assisted in processing invoices accurately and promptly to maintain operational efficiency and client satisfaction.

- •Responsible for updating and maintaining customer account information, ensuring all records were current and accurate.

- •Provided support in collections activities, resulting in a 10% reduction in outstanding overdue accounts.

- •Conducted daily checks on payments received, maintaining a consistent record of cash flow monitoring.

Medical Accounts Receivable Clerk resume sample

- •Managed and streamlined billing operations, enhancing the claim approval rate by 20% through targeted process improvements.

- •Resolved patient billing inquiries professionally, reducing payment discrepancies by 30% and improving client satisfaction scores.

- •Led a team to maintain aged receivable reports, consistently keeping outstanding balances under the 60-day threshold.

- •Developed a training program for junior staff on insurance protocols, improving efficiency and lowering error rates by 15%.

- •Achieved a 25% reduction in denied claims by establishing effective appeals procedures for disputed insurance claims.

- •Collaborated with IT to automate billing processes, resulting in a savings of 200 work hours per month.

- •Conducted weekly audits of billing processes, leading to a 10% increase in claim accuracy.

- •Implemented new strategies for collections, which increased monthly revenue by 18%.

- •Worked closely with insurance companies to resolve billing issues and reduce outstanding claims by 25%.

- •Processed large volumes of insurance claims, ensuring compliance with all federal and state regulations.

- •Assisted in financial audits by supplying detailed documentation and reconciling accounts efficiently.

- •Managed patient accounts and facilitated timely payments, improving collection rates significantly.

- •Resolved billing issues promptly by effectively communicating with patients and insurance companies.

- •Maintained accurate financial records and prepared detailed monthly reports of account activities.

- •Contributed to process efficiency by identifying key areas for improvement in the billing workflow.

- •Coordinated billing operations and facilitated smooth processes for 1000+ accounts.

- •Maintained compliance with all regulatory and payer requirements, reducing audit risks.

- •Optimized cash flow through effective account management, resulting in a significant revenue increase.

- •Handled sensitive information with utmost confidentiality, ensuring data privacy.

Accounts Receivable and Billing Specialist resume sample

- •Led a team of 5 to streamline billing processes, improving invoice delivery time by 30% and minimizing errors.

- •Reduced outstanding receivables over 90 days by 15% through diligent follow-ups and client rapport building.

- •Implemented a new accounting software solution, decreasing billing discrepancies by 25% each quarter.

- •Collaborated closely with sales teams to reconcile accounts, ensuring 100% accuracy in monthly billing reports.

- •Resolved client payment inquiries promptly, enhancing client satisfaction scores by 10% year over year.

- •Facilitated financial audits concerning accounts receivables, resulting in zero compliance issues and high auditor praise.

- •Streamlined monthly billing cycle, reducing cycle time by two days and improving cash flow predictability.

- •Maintained over 98% accuracy in accounts receivable records, ensuring comprehensive invoice tracking.

- •Negotiated payment plans with clients accounting for 10% of total receivables, optimizing company cash inflow.

- •Contributed to month-end closing processes resulting in 100% on-time financial reporting.

- •Coordinated with internal teams to update client data and prevent invoicing errors, maintaining data integrity at a high standard.

- •Monitored and managed a portfolio of 200+ accounts, achieving collection targets consistently for 12 consecutive months.

- •Enhanced the accuracy of accounts aging reports by implementing new tracking procedures and reducing errors by 20%.

- •Developed reports detailing client payment patterns, providing actionable insights that helped adjust client credit limits.

- •Conducted account reconciliations to ensure all financial data matched across systems, resulting in balanced accounts.

- •Processed invoices for over 100 clients monthly, achieving a 95% on-time invoice delivery rate.

- •Collaborated with project management to verify 100% billing correctness, reducing client disputes by one-third.

- •Managed client communications regarding billing queries, resolving issues promptly to maintain positive client relationships.

- •Supported audit preparations by ensuring documentation accuracy, contributing to a successful audit outcome.

Accounts Receivable reconciliation Analyst resume sample

- •Managed monthly reconciliations of accounts receivable, reducing outstanding discrepancies by 15% within a year.

- •Analyzed and resolved differences between general ledger and subsidiary ledger, improving accuracy by 20%.

- •Collaborated with cross-departmental teams to streamline invoice processes, resulting in a 10% increase in processing speed.

- •Implemented a tracking system for aging reports, which increased collections efficiency by 25% over six months.

- •Supported external audits by providing comprehensive documentation, leading to a 50% reduction in audit queries.

- •Identified process improvements that enhanced reconciliation efficiency by 30%, contributing to overall department goals.

- •Led the financial analysis of accounts receivable, identifying opportunities to improve cash flow by $500,000.

- •Directed a team that resolved aging report issues, enhancing the collection rate by 12% over one year.

- •Enhanced data reconciliation processes, resulting in a $300,000 reduction in overdue invoices.

- •Collaborated with IT to automate financial report generation, decreasing manual errors by 40%.

- •Provided insights into receivables performance, guiding strategic decisions that boosted profit margins by 8%.

- •Conducted full-cycle accounts receivable reconciliation, improving processing efficiency by 35% over three years.

- •Resolved discrepancies in large financial accounts, reducing balances by 18% across high-value clients.

- •Developed comprehensive documentation for reconciliation activities, standardizing procedures across the department.

- •Monitored outstanding receivables, contributing to a 22% improvement in timely collections.

- •Supported financial projects focused on enhancing reconciliation accuracy, achieving a 10% error reduction.

- •Assisted in the preparation of financial audits, leading to streamlined audit processes and faster completion times.

- •Managed multiple accounts receivable projects simultaneously, enhancing time management skills.

- •Provided detailed financial forecasts that informed strategic planning and improved resource allocation by 15%.

Senior Accounts Receivable Coordinator resume sample

- •Implemented a streamlined invoice verification system that reduced billing errors by 20%, enhancing client satisfaction.

- •Managed the monthly accounts receivable aging report, leading to a 15% decline in overdue accounts through effective client communication.

- •Collaborated with cross-functional teams to resolve billing discrepancies, improving resolution time by 30%.

- •Conducted comprehensive credit evaluations that minimized credit risk exposure without sacrificing sales growth.

- •Led a project to integrate new accounting software, reducing manual processing time by 25%.

- •Enhanced existing procedures, resulting in a 10% improvement in process efficiency and overall team productivity.

- •Oversaw a team responsible for issuing invoices, which facilitated a 98% on-time delivery rate over two years.

- •Devised a customer follow-up strategy that increased payment collection rates by 18% in the first year.

- •Maintained meticulous records of customer interactions, resulting in improved data accuracy and reporting.

- •Optimized month-end closing processes, reducing reconciliation time by 20% through innovative solutions.

- •Collaborated with IT to develop automated reporting tools that identified delinquency trends, aiding in strategic planning.

- •Reviewed and processed over 500 customer invoices monthly, maintaining an error rate below 1%.

- •Resolved disputes promptly, contributing to a 95% collection success rate and strong customer relationships.

- •Assisted in policy development for the accounts receivable department, improving guidelines and protocols.

- •Conducted training workshops, enhancing team knowledge on up-to-date financial regulations and internal policies.

- •Developed a template for tracking invoice disputes, decreasing resolution time by 15%.

- •Accurately posted daily cash receipts with a 100% accuracy rate, laying the groundwork for a highly efficient billing system.

- •Monitored accounts to identify outstanding debts, reducing delinquent payments by 12% in the first year.

- •Assisted in refining debt collection procedures, enhancing collection success rates significantly.

- •Provided top-notch customer support to inquiries, building strong client relationships and trust.

Accounts Receivable and Revenue Analyst resume sample

- •Managed accounts receivable processes, improving efficiency by 30%, resulting in faster collections and enhanced cash flow.

- •Analyzed revenue forecasts, aiding in financial planning by accurately predicting quarterly income with a 95% accuracy rate.

- •Collaborated with sales teams to reduce outstanding payments over 60 days by 40%, strengthening client relationships.

- •Developed Excel-based models to monitor accounts receivable data, decreasing discrepancies by 15% quarter over quarter.

- •Participated actively in the monthly closing process, preparing journal entries to ensure compliance with GAAP.

- •Identified key process improvements in accounts receivable workflows, reducing operational cycles by 10%.

- •Performed comprehensive revenue analysis, contributing to a 25% increase in revenue recognition efficiency.

- •Collaborated with cross-functional teams to streamline operations, reducing financial discrepancies by 30%, enhancing process accuracy.

- •Developed strategic customer interaction protocols, which led to a 20% reduction in late payment incidents.

- •Automated accounts reconciliation processes using Oracle, decreasing manual workload by 60% and improving accuracy.

- •Optimized monthly reporting processes, achieving a 95% on-time delivery rate of financial reports.

- •Enhanced invoice tracking mechanisms, resulting in a 15% reduction in overdues.

- •Assisted sales divisions in formulating data-driven strategies, improving cash flow management success by 20%.

- •Conducted data analysis on aged debtors, increasing collections by $500,000 over six months.

- •Spearheaded the implementation of new accounting software, reducing processing time by 25%.

- •Assisted in optimizing client billing processes, improving client satisfaction and reducing invoice queries by 40%.

- •Monitored financial entries and resolved discrepancies, ensuring 100% compliance with corporate accounting standards.

- •Provided support in quarterly audits, finding potential cost-saving opportunities and improving compliance.

- •Contributed to revenue tracking methods, achieving a 99% error-free record-keeping.

Accounts Receivable and Credit Risk Manager resume sample

- •Led a team of 5 to streamline accounts receivable processes, reducing outstanding receivables by $1.5M within six months.

- •Developed a credit risk assessment model that improved risk evaluation, enhancing decision-making efficiency and reducing bad debt by 10%.

- •Implemented a new ERP system that integrated seamlessly with invoicing software, decreasing overdue payments by 25%.

- •Resolved high-profile disputes with clients by establishing tailored credit solutions, boosting client satisfaction scores by 30%.

- •Presented quarterly accounts receivable reports to senior management, highlighting key trends, which resulted in policy updates.

- •Conducted training sessions for junior staff, improving their credit risk assessment skills, contributing to a 15% increase in collections.

- •Managed credit policies and procedures, successfully minimizing the company's exposure to high-risk accounts by 18%.

- •Collaborated with sales teams to address and resolve credit issues, which resulted in maintaining a 95% customer satisfaction rating.

- •Produced monthly credit reports detailing receivables status and risk assessments, directly contributing to executive policy decisions.

- •Analyzed customer payment trends, implementing a reminder system that improved on-time payment rates by 40%.

- •Facilitated communication with banking partners to optimize credit lines, improving the cash flow by 12% through revised agreements.

- •Conducted comprehensive credit reviews, reducing delinquency rate by 22% through strategic account monitoring and interventions.

- •Developed customer credit profiles that improved identification of creditworthy clients, leading to a 15% reduction in default risk.

- •Led a project to overhaul the credit risk model, resulting in enhanced accuracy in predicting customer defaults.

- •Collaborated on inter-departmental initiatives to streamline processes, leading to expedited collections by 35%.

- •Evaluated client financial status, assisting in the reduction of the overall credit risk by 15% over two years.

- •Recommended credit strategies that supported a 10% growth in sales while maintaining controlled risk exposure.

- •Contributed to cross-functional projects, improving cash flow forecasting accuracy by 20% through detailed financial analyses.

- •Monitored accounts receivable ledgers, initiating corrective actions that reduced average days sales outstanding by 18%.

Accounts Receivable and Invoicing Clerk resume sample

- •Generated, reviewed, and sent over 500 invoices monthly, ensuring compliance with company policies, leading to a 30% reduction in errors.

- •Reconciled monthly statements for 200+ clients, resolving discrepancies swiftly, which improved processing efficiency by 15%.

- •Managed accounts receivable aging reports to reduce outstanding accounts by 20%, enhancing company cash flow.

- •Implemented a process improvement that decreased invoice processing time by 40%, contributing to enhanced operational efficiency.

- •Assisted in the review of credit applications, approving 25% more applications due to more efficient assessment techniques.

- •Collaborated with sales teams on client inquiries, improving client satisfaction scores by 10% in a year.

- •Reviewed and processed over 400 incoming payments monthly, resulting in a 15% increase in payment accuracy.

- •Monitored overdue accounts, taking actions that reduced outstanding debt by 25% within six months.

- •Prepared detailed monthly accounts receivable reports for management, aiding in strategic financial planning.

- •Collaborated with the operations team to resolve billing issues, increasing customer payment compliance by 20%.

- •Enhanced communication workflows between departments, reducing inquiry resolution times by 40%.

- •Ensured accurate recording of financial transactions, resulting in a 99% accuracy rate annually in financial audits.

- •Assisted in the monthly financial closure process, speeding up timelines by 10% through efficient data handling.

- •Supported the finance team in preparing for annual audits, providing comprehensive documentation that led to zero discrepancies found.

- •Streamlined data entry processes, enhancing efficiency by reducing redundant steps, thus decreasing time spent by 20%.

- •Processed and verified invoices in compliance with company policies, which improved payment timelines by 30%.

- •Maintained vendor records accurately, resulting in zero discrepancies in annual audits.

- •Implemented a tracking system for invoice status, increasing transparency and vendor satisfaction by 25%.

- •Collaborated with cross-functional teams to optimize payment workflows, reducing errors by 15%.

Accounts Receivable and Payable Specialist resume sample

- •Reduced outstanding accounts receivable by 20% over 12 months through improved invoicing procedures and strategic customer follow-ups.

- •Streamlined the payment processing system by implementing new software, resulting in a 30% decrease in processing time.

- •Conducted weekly reconciliations of accounts, identifying and resolving discrepancies efficiently which improved accuracy by 95%.

- •Assisted in month-end closing processes, efficiently preparing reports like aged debtors and creditors with zero error.

- •Improved vendor invoice processing efficiency, reducing errors by 25% and maintaining records in line with company policy.

- •Provided exemplary customer service, maintaining professional relationships with vendors and achieving a customer satisfaction score of 92%.

- •Managed over 300 customer accounts and improved billing accuracy by implementing a new automated system.

- •Led a team project to redesign expense report processes, cutting processing time by 35% and enhancing team productivity.

- •Successfully supported annual audits by preparing and reviewing account documentation, achieving an audit accuracy rate of 99%.

- •Performed month-end closing tasks including account reconciliations and variance analysis, boosting financial report precision by 15%.

- •Executed vendor payment processing, ensuring timely payments and reducing late fees by 50%.

- •Assisted in processing over $1 million in monthly vendor payments, maintaining adherence to company policies.

- •Developed a tracking system for overdue accounts, improving collection effectiveness by 25% through prompt follow-up actions.

- •Provided administrative support to the finance department, optimizing report production workflows by 20%.

- •Reviewed and processed reimbursements, maintaining strict compliance with internal financial policies.

- •Coordinated with vendors to resolve billing issues, decreasing overlooked credits by 40% within a year.

- •Processed an average of 150 invoices weekly, achieving a 98% accuracy rate in invoice data entry.

- •Collaborated in the implementation of a new accounting system, enhancing transaction processing speed by 20%.

- •Prepared various financial reports and analysis, assisting in financial strategy formulation and budgeting.

Crafting the perfect accounts receivable resume is like organizing a balanced ledger—every detail needs to be precise and aligned. Your job isn't just about managing invoices and tracking payments; it also involves translating your skills and experiences into words that make an impact. This can be tough, especially when you're trying to convey your financial expertise and achievements.

When it comes to writing your resume, expressing your skills in managing accounts and ensuring timely payments is crucial. But how do you make these skills stand out to a potential employer? This is where effectively highlighting your ability to balance the books and maintain strong controls becomes essential.

Using a professional resume template can help guide you through this process. It ensures that your resume is formatted to highlight your strengths, allowing you to concentrate on crafting the content. If you’re looking for a starting point, consider exploring these resume templates to find one that fits your needs.

Think of your resume as your first financial statement to potential employers. It’s an opportunity to showcase not just your expertise in accounts receivable but also your attention to detail, communication skills, and ability to thrive in a business environment.

Key Takeaways

- Writing an effective accounts receivable resume involves precisely detailing your skills in managing financial transactions and emphasizing your organizational skills and accuracy.

- Using a professional resume template helps to format your resume effectively, allowing you to highlight your strengths and focus on crafting the content.

- A chronological resume format is ideal, emphasizing your experience and growth in the field, while modern fonts like Rubik, Lato, or Montserrat enhance readability.

- Highlight quantifiable results in your experience section to showcase your expertise and achievements in managing accounts receivable tasks.

- Additional sections, such as certifications, education, skills, and extra elements like languages or volunteer work, can differentiate your resume and showcase a well-rounded personality.

What to focus on when writing your accounts receivable resume

Your accounts receivable resume should effectively convey your proficiency with financial transactions, accuracy in detail, and strong organizational skills—attributes that build confidence in your ability to manage invoices, handle collections, and maintain precise accounting records.

How to structure your accounts receivable resume

- Contact Information: This section should be straightforward yet comprehensive. Include your full name, phone number, and professional email address, ensuring it mirrors the professional tone of your resume. Your LinkedIn profile should be up-to-date to reflect your career milestones and endorsements, providing a quick glance at your professional identity.

- Professional Summary: Capture the essence of your accounts receivable expertise in a few compelling sentences. Highlight the years of experience, key strengths in billing, collections, and financial management, and your ability to contribute to a company’s financial success. This sets the tone for the rest of your resume, drawing the recruiter in to learn more about your contributions.

- Work Experience: Provide details on positions held, emphasizing not just your responsibilities but your accomplishments. Discuss how you implemented systems or practices that reduced outstanding debts or improved billing efficiency. Specific examples and quantifiable results will demonstrate your impact and success in previous roles.

- Skills: List skills that directly relate to the role, focusing on accounting software expertise like QuickBooks or SAP, which are indispensable in managing accounts receivable tasks. Analytical skills and communication abilities are equally important, allowing you to effectively interpret data and interact with both internal teams and external clients.

- Education: Include relevant degrees, certifications, or courses, focusing on accounting or finance education that equips you with the foundational knowledge necessary for accounts receivable roles. Mention the school name and graduation date to provide context and verify your educational background.

- Certifications: Detail any additional certifications that enhance your credentials, such as Certified Credit Executive (CCE), which can signify a higher level of expertise and dedication within the field.

This structured format will not only help you craft a professional accounts receivable resume, but also prepare you to dive into each section with more in-depth coverage, ensuring a comprehensive portrayal of your qualifications and achievements.

Which resume format to choose

Crafting an accounts receivable resume that gets noticed begins with selecting a format that aligns with your experience. A chronological layout is ideal if you have a solid work history, as it emphasizes your experience and growth in the field. For fonts, opt for Rubik, Lato, or Montserrat, as these modern choices can enhance readability while giving your resume a fresh, professional appearance. Always save your resume as a PDF to ensure it retains its formatting and looks consistent, no matter where or how it's viewed. Finally, use one-inch margins to keep your layout clean and balanced, ensuring that your information is presented clearly and professionally. By focusing on these elements, you make a strong case for your skills and experience in the accounts receivable sector.

How to write a quantifiable resume experience section

An impressive accounts receivable experience section is key for your resume, clearly showcasing your expertise and achievements. Focus on highlighting quantifiable results to make your impact unmistakable. Structure your experiences in reverse chronological order, keeping the most recent roles at the top to immediately highlight your latest skills and responsibilities. Tailoring your resume to match the job ad is crucial; use keywords and phrases that resonate with the employer’s needs. Integrate action words like "increased," "accelerated," "streamlined," and "reconciled" to effectively convey your authority and efficiency. Generally, cover the past 10-15 years of experience, emphasizing accounts receivable and related finance roles that are most relevant to your desired position.

- •Reduced average days sales outstanding (DSO) by 15% through effective collections strategies.

- •Implemented a new receivables tracking system, improving accuracy by 20% and reducing errors.

- •Led a team of 3 in a reconciliations project that successfully cleared $500,000 in outstanding payments.

- •Increased revenue recovery by 25% through targeted follow-ups and negotiation with clients.

This experience section stands out by presenting clear, quantifiable results, illustrating your substantial impact at the company. Each bullet point uses action-oriented language to reflect your proactive approach and dedication to detail. These achievements weave a narrative of efficiency and growth, directly linking to the skills employers seek. By focusing on common industry challenges like reducing DSO and improving revenue recovery, you show an understanding of the field’s key issues and your ability to solve them. Presenting specifics like percentages and monetary values adds weight to your statements, allowing employers to see the precise nature of your contributions. This structured approach ensures your capabilities are quickly and effectively communicated, helping you make a strong impression in a competitive job market.

Project-Focused resume experience section

An accounts receivable-focused resume experience section should seamlessly highlight the contributions and skills that enhance and manage financial processes. Start by identifying impactful projects that showcase your problem-solving skills and ability to implement systems that improve workflows. This might include experiences where you reduced outstanding debts, ensured timely invoicing, or collaborated with colleagues to streamline operations, demonstrating how your expertise added value.

Organize specific achievements and responsibilities in bullet points under each job title to clearly illustrate your strengths. Emphasize accomplishments such as developing effective collection strategies or implementing software solutions that sped up payment processing. By using action words and quantifying successes, you can vividly portray the positive changes your efforts brought to the team or organization, making the section flow naturally from one point to the next.

Accounts Receivable Specialist

XYZ Corporation

June 2020 - Present

- Reduced outstanding receivables by 20% through implementation of an automated reminder system.

- Collaborated with the finance team to streamline the invoicing process, reducing errors by 15%.

- Trained junior staff on new accounts receivable software, increasing department efficiency by 30%.

- Developed and executed a strategy to recover aged debt, recovering $150,000 in overdue payments.

Training and Development Focused resume experience section

A training and development-focused accounts receivable manager resume experience section should clearly illustrate how you've led and improved processes in this area. Start by detailing initiatives where you've enhanced efficiency in managing accounts receivable. This can include specific training programs you've developed that significantly boosted team knowledge and performance. Use quantifiable achievements to demonstrate the tangible results of your efforts, making your contributions stand out. Furthermore, highlight your ability to foster a collaborative environment through effective communication.

By incorporating metrics, you give weight to your accomplishments and showcase the real impact of your work. Be specific about your role and how your actions benefited the organization. Describe challenges you faced and how you strategically overcame them, demonstrating both leadership and problem-solving skills. This approach not only highlights what you did but also articulates the difference you made. Here’s an example of how it could be formatted on a resume:

Accounts Receivable Manager

Tech Solutions Inc.

January 2020 - Present

- Led and developed a comprehensive training program that reduced billing errors by 30% within one year.

- Implemented cross-training sessions, enhancing team versatility and efficiency by 20%.

- Pioneered an innovative mentoring system that increased employee retention and satisfaction by 15%.

- Collaborated with IT to create an online training platform that improved accessibility and learning outcomes.

Collaboration-Focused resume experience section

A collaboration-focused accounts receivable resume experience section should highlight your teamwork skills in achieving financial goals. Emphasize instances where working with others helped improve processes or solve issues. Use dynamic action verbs and quantifiable results to showcase your accomplishments. Paint a picture of how your cooperative approach led to positive outcomes, such as reducing overdue accounts or enhancing the efficiency of invoice processing.

Start by clearly stating your role and the duration you held that position. Follow this with a brief overview of your main responsibilities, focusing on team-based efforts and successes. Use bullet points to outline your achievements, stressing collaboration and teamwork. This format underscores your ability to thrive in group settings, foster positive workplace relationships, and contribute to more efficient accounts receivable processes.

Accounts Receivable Specialist

ABC Corp

June 2018 - Present

- Coordinated with the sales and customer service teams to resolve billing issues, reducing past due accounts by 15%.

- Facilitated weekly team meetings to discuss accounts receivable strategies, resulting in quicker payment cycles.

- Collaborated with external partners to streamline invoicing processes, increasing overall efficiency by 20%.

- Worked closely with the finance team to implement a new reconciliation system, improving accuracy by 25%.

Achievement-Focused resume experience section

A results-focused accounts receivable resume experience section should clearly showcase your impact in previous roles. Start by identifying the key achievements that highlight your expertise in improving collections and reducing outstanding balances. Use action verbs and quantify your successes to illustrate how you streamlined processes for greater efficiency. By structuring this section around measurable success stories, you can effectively demonstrate what makes you stand out in your field. Present your experiences in an easy-to-read format, ensuring that even those unfamiliar with the jargon can appreciate your contributions.

Accounts Receivable Specialist

XYZ Corp

June 2020 - September 2023

- Boosted collections by 25% in one year with a new follow-up strategy.

- Cut outstanding balances by $50,000 by speeding up invoice processing.

- Enhanced customer communication with a monthly newsletter, increasing timely payments by 15%.

- Reduced data entry errors by 10% through training junior staff on best practices.

Write your accounts receivable resume summary section

A results-focused accounts receivable resume summary should effectively highlight your skills and experience in managing financial records. It's vital to keep this section concise and emphasize your organizational skills and attention to detail. Begin with an engaging statement that captures attention and conveys your reliability and expertise in the field.

This example offers a cohesive overview of your strengths and achievements, focusing on specific successes and skills that align with the job role. Unlike a resume objective that outlines your career goals—ideal for those just starting—a professional summary encapsulates your achievements in a few impactful lines. A resume profile provides a personalized touch, while a summary of qualifications lists key skills succinctly. Each format serves its purpose, but if you have significant experience, a strong summary is critical for showcasing your accomplishments and expertise. Make sure it's clear and directly relevant to the position you’re pursuing.

Listing your accounts receivable skills on your resume

An accounts receivable-focused resume should effectively highlight your skills and strengths to capture the attention of hiring managers. You can choose to feature your skills as a standalone section or integrate them into other parts of your resume, like your experience and summary. Showcasing your strengths, such as your communication skills, indicates your ability to work well with people and manage tasks efficiently. Meanwhile, hard skills, such as invoice processing, represent the specific abilities you've mastered. Together, these skills and strengths act as resume keywords that can help your application stand out.

Here's how a skills section might look in JSON format:

This skills section effectively communicates your relevant abilities in just a few lines. Each skill listed directly relates to the core duties of accounts receivable roles, making it easier for employers and software to pick up on your qualifications. By including precise terms like "Credit Management" and "Invoice Processing," your resume becomes more noticeable.

Best hard skills to feature on your accounts receivable resume

In the world of accounts receivable, hard skills are crucial as they reflect your ability to manage financial tasks with accuracy. These skills demonstrate your proficiency in handling the financial aspects of a company.

Hard Skills

- Invoice Processing

- Payment Collection

- Account Reconciliation

- Credit Management

- Financial Analysis

- Aging Report Analysis

- General Ledger Knowledge

- Data Entry

- Spreadsheet Software (e.g., Excel)

- ERP Software Proficiency

- Customer Billing Systems

- Payment Posting

- Tax Compliance

- Budgeting

- SAP Proficiency

Best soft skills to feature on your accounts receivable resume

Equally important are soft skills, which enable you to build relationships and improve processes within the role. These skills highlight your ability to interact with others, stay organized, and troubleshoot issues effectively.

Soft Skills

- Communication

- Attention to Detail

- Problem Solving

- Time Management

- Customer Service

- Adaptability

- Conflict Resolution

- Accountability

- Critical Thinking

- Teamwork

- Negotiation

- Patience

- Organizational Skills

- Stress Management

- Interpersonal Skills

How to include your education on your resume

An education section on your resume is crucial, especially when applying for an accounts receivable position. It's where you highlight relevant academic qualifications that set you apart. It should be tailored specifically for the job you're pursuing, so anything irrelevant should be left out. If you've got a strong GPA, you can include it to strengthen your application. You should specify your GPA if it's impressive, mentioning it as "GPA: 3.8/4.0" for clarity.

Honors like cum laude can also enhance this section; include them next to your degree, such as "Bachelor of Science in Accounting, cum laude." When listing a degree, stick to a clear format, stating the degree type, major, and institution. Here's a wrong example and a right example to illustrate that.

The first example lists an irrelevant degree for accounts receivable work. The second example is good because it provides relevant education in accounting, includes a high GPA, and emphasizes academic achievement with cum laude. This information directly aligns with an accounts receivable role, showcasing applicable skills and dedication.

How to include accounts receivable certificates on your resume

When crafting an accounts receivable resume, the certificates section is a crucial part that can showcase your qualifications and enhance your candidacy. List the name of each relevant certificate to give employers a clear understanding of your skills. Include the date of certification to demonstrate how current your knowledge is. Add the issuing organization to lend credibility to your certifications. This section is often placed prominently within your resume, but you can also include the most significant certificate in the header for quick visibility. For example, "Certified Credit Professional – National Association of Credit Management."

To create a strong certificates section, ensure it's concise and pertains to the job you're seeking. Here's an example:

This example is effectively structured by listing certifications that directly relate to accounts receivable roles. The named certificates add value by demonstrating specialized knowledge, while the inclusion of well-known issuers strengthens your credibility. Properly highlighting these qualifications can make your resume stand out in the hiring process.

Extra sections to include on your accounts receivable resume

Creating an accounts receivable resume that stands out involves more than just listing your work experience. Strategic sections can highlight your unique skills and interests, setting you apart from other candidates. Including diverse sections can show your well-rounded personality and make your resume more memorable.

Language section — Display multilingual skills to show effective global communication and expand your professional reach. Highlight relevant languages that might give you an edge in international business.

Hobbies and interests section — Illustrate personal interests to humanize your resume and demonstrate well-roundedness. Keep them related to skills beneficial to your role, such as analytical games or financial podcasts.

Volunteer work section — Include volunteer experiences to showcase your community involvement and transferable skills. Demonstrate qualities like teamwork and leadership that are valuable in any workplace.

Books section — Detail influential books to show a commitment to learning and industry knowledge. Mention titles related to accounting or business to underscore your interest in continuous professional development.

In Conclusion

In conclusion, crafting the ideal accounts receivable resume involves more than listing your job experience; it’s about presenting a comprehensive picture of your qualifications and accomplishments. By strategically structuring your resume, focusing on the right skills, and showcasing relevant experiences, you can make a strong impression. It’s important to communicate clearly and keep details precise, using quantifiable results to highlight your successes. Choose a resume format that showcases your career path while using modern fonts to add a professional polish. Tailor every section to match the job requirements, including a vivid summary and focused skills. Incorporating additional sections such as language abilities and volunteer work can also set you apart, demonstrating your rounded personality and commitment to personal development. Ensure your education and certifications align with the role, mentioning relevant achievements like honors or specialized training. Each element should work together to reinforce your expertise and show your potential value to future employers. By presenting an organized, detailed, and personal resume, you paint a compelling picture of your capabilities in accounts receivable management. Whether you’re just starting or a seasoned professional, the way you present your resume can define your next career step.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.