Asset Manager Resume Examples

Jul 18, 2024

|

12 min read

Craft a winning asset manager resume that stands out—fine-tune your skills, highlight your achievements, and make a lasting impression in the finance industry.

Rated by 348 people

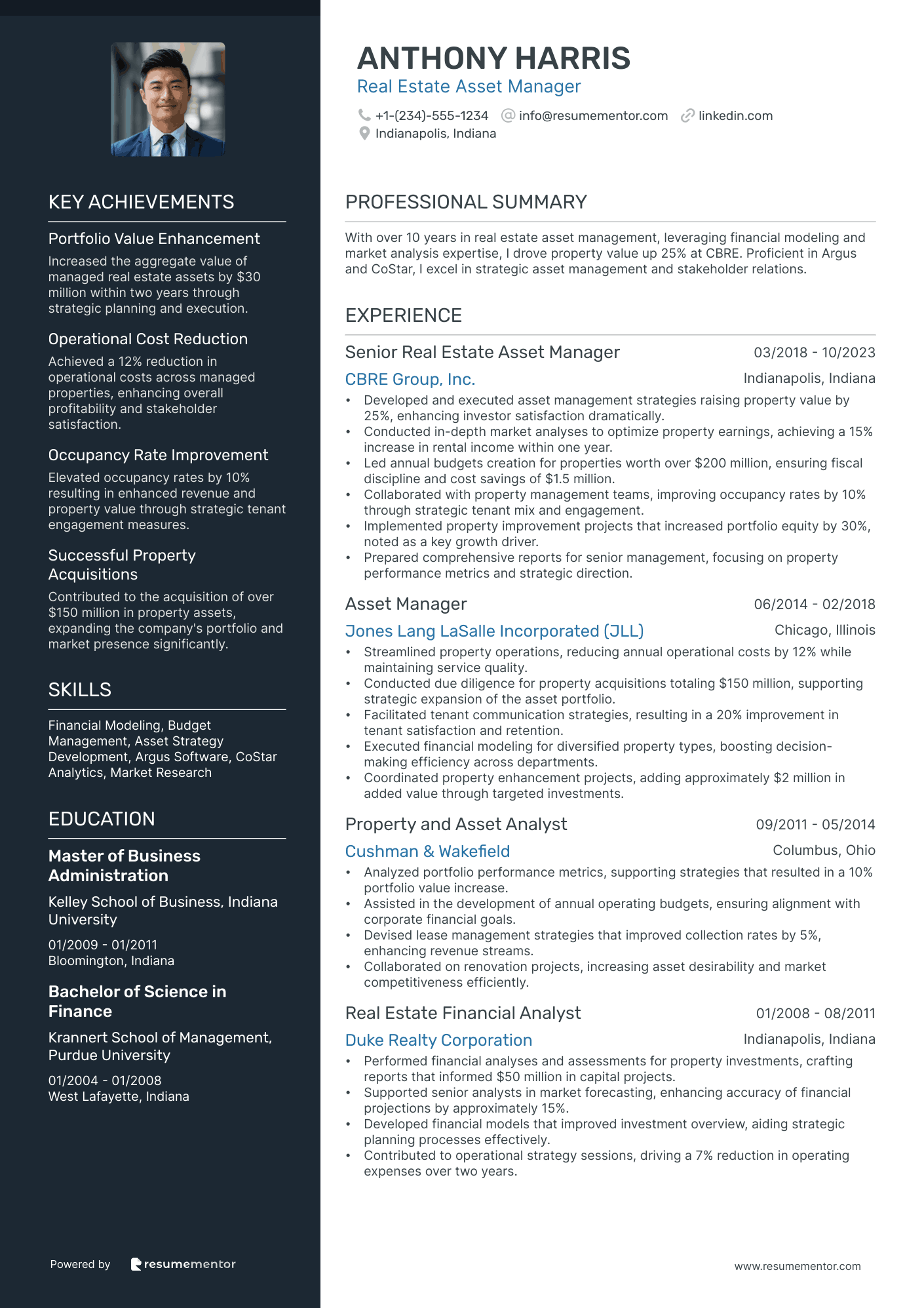

Real Estate Asset Manager

Investment Portfolio Asset Manager

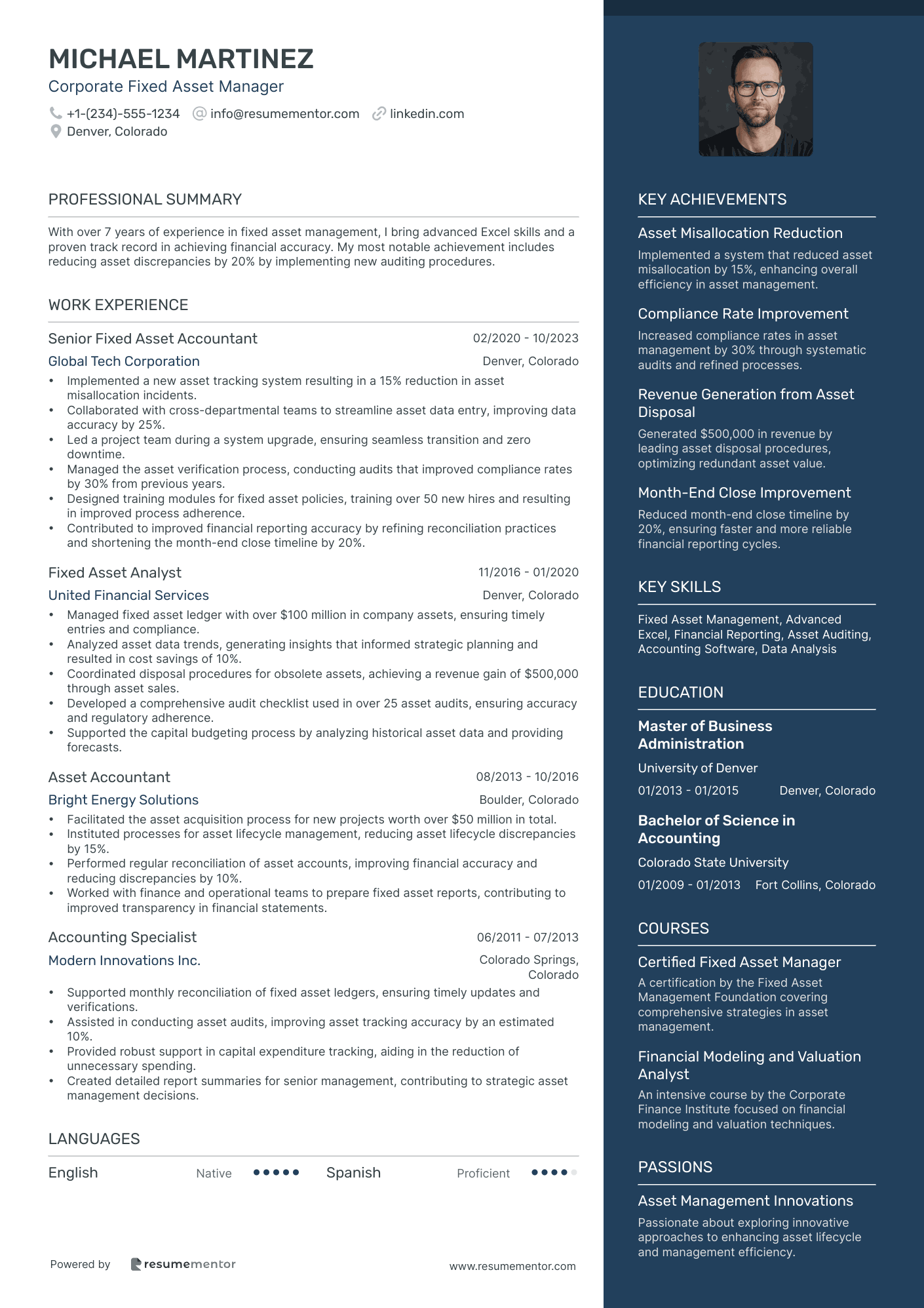

Corporate Fixed Asset Manager

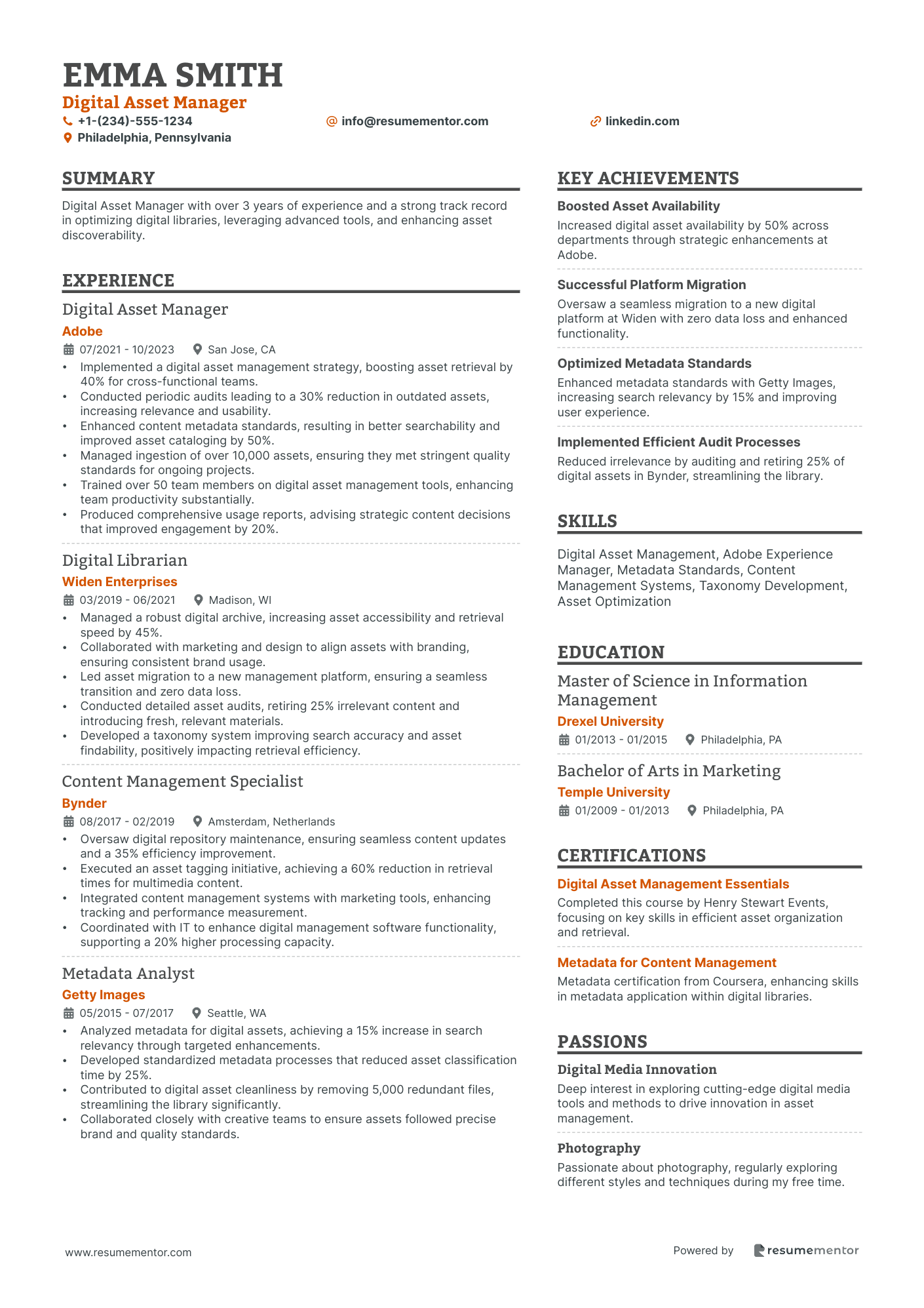

Digital Asset Manager

Asset Liability Manager

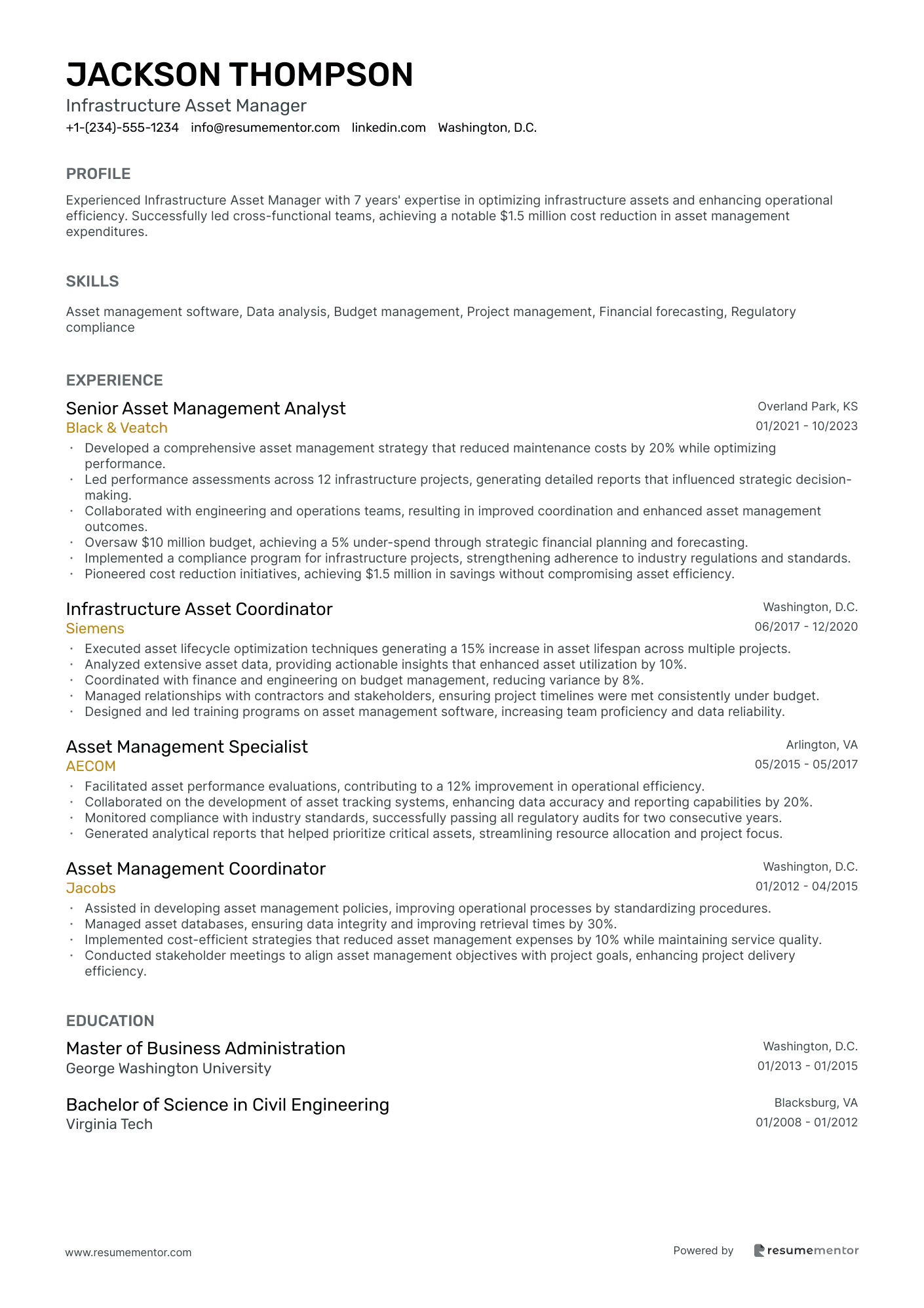

Infrastructure Asset Manager

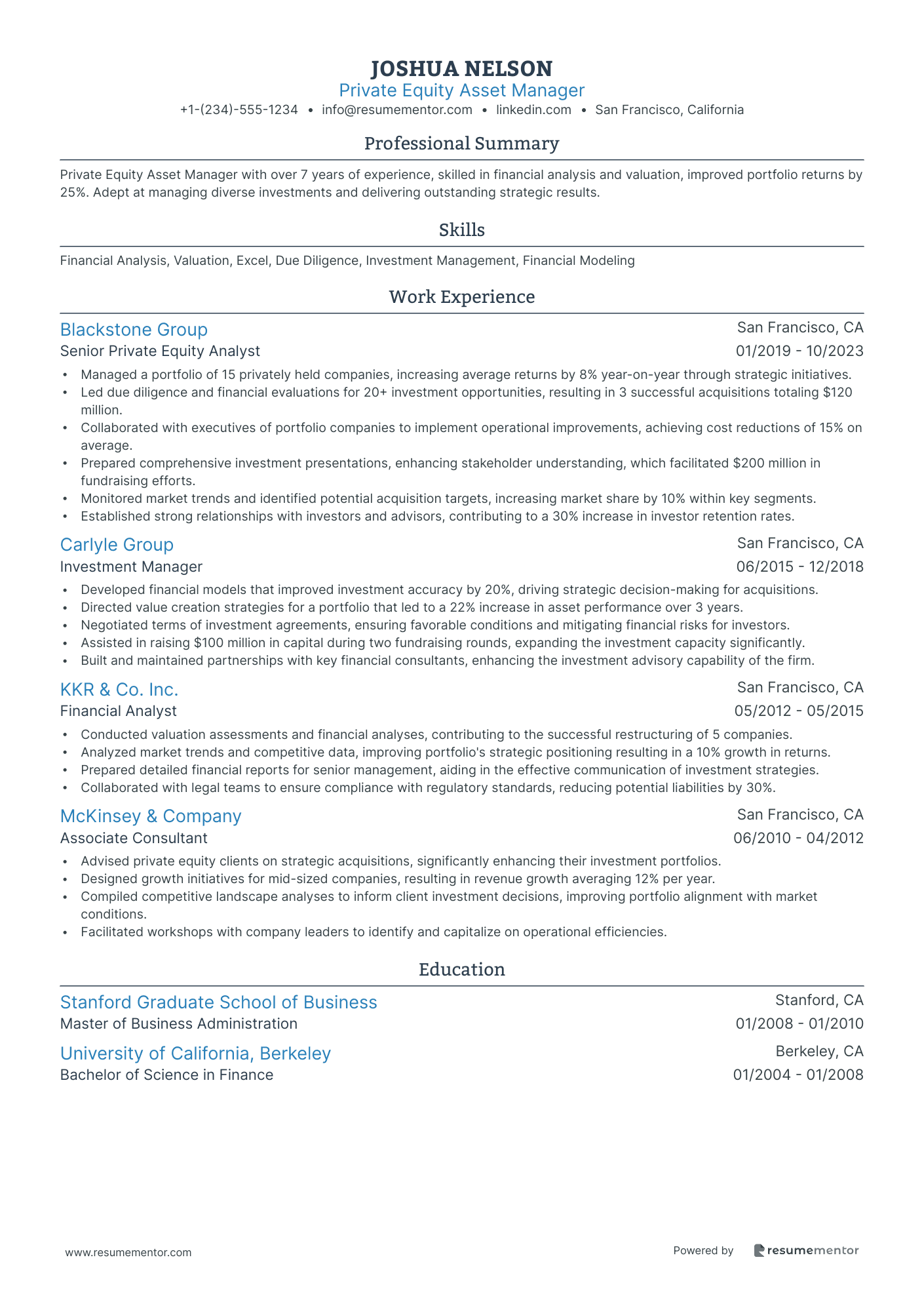

Private Equity Asset Manager

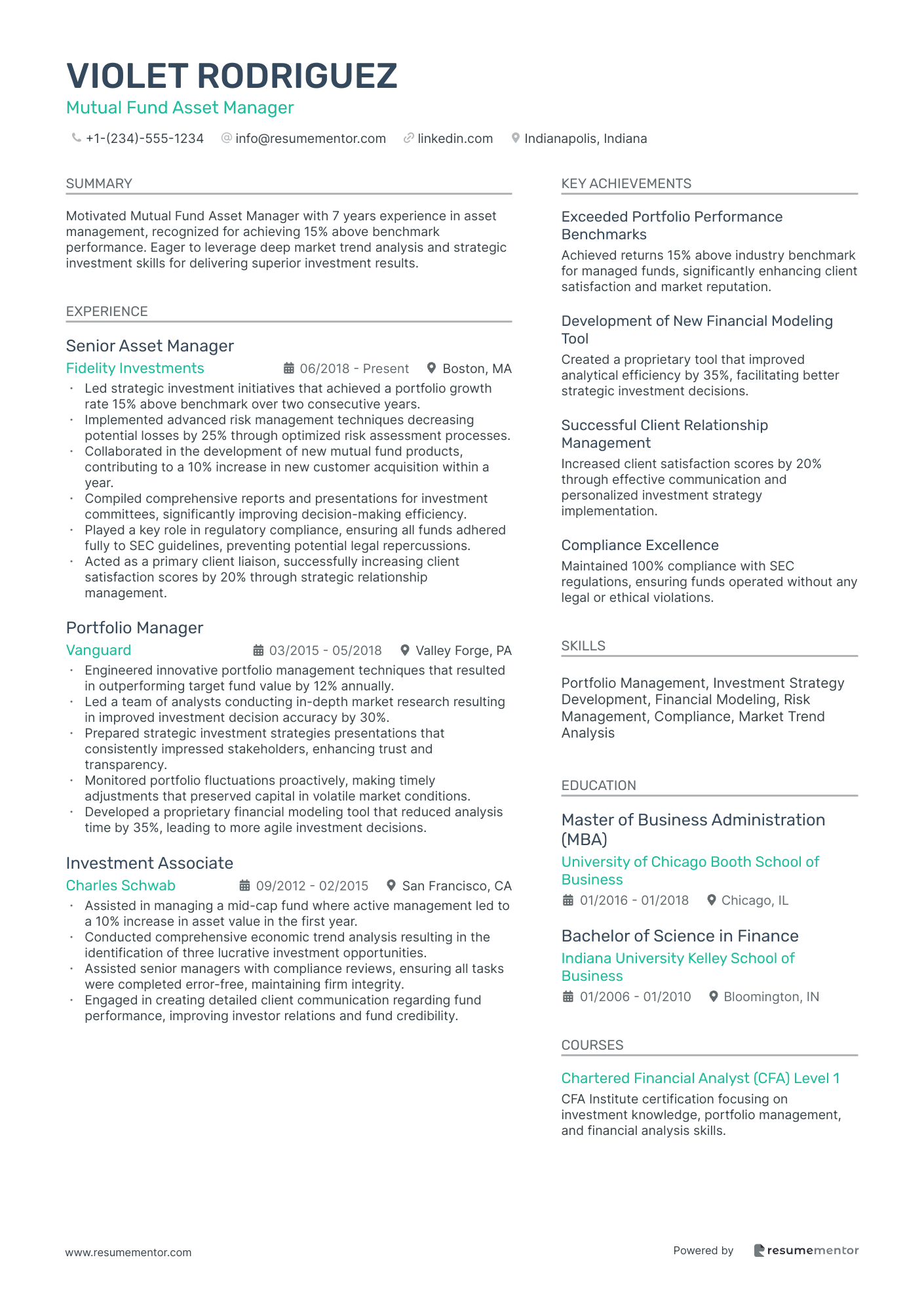

Mutual Fund Asset Manager

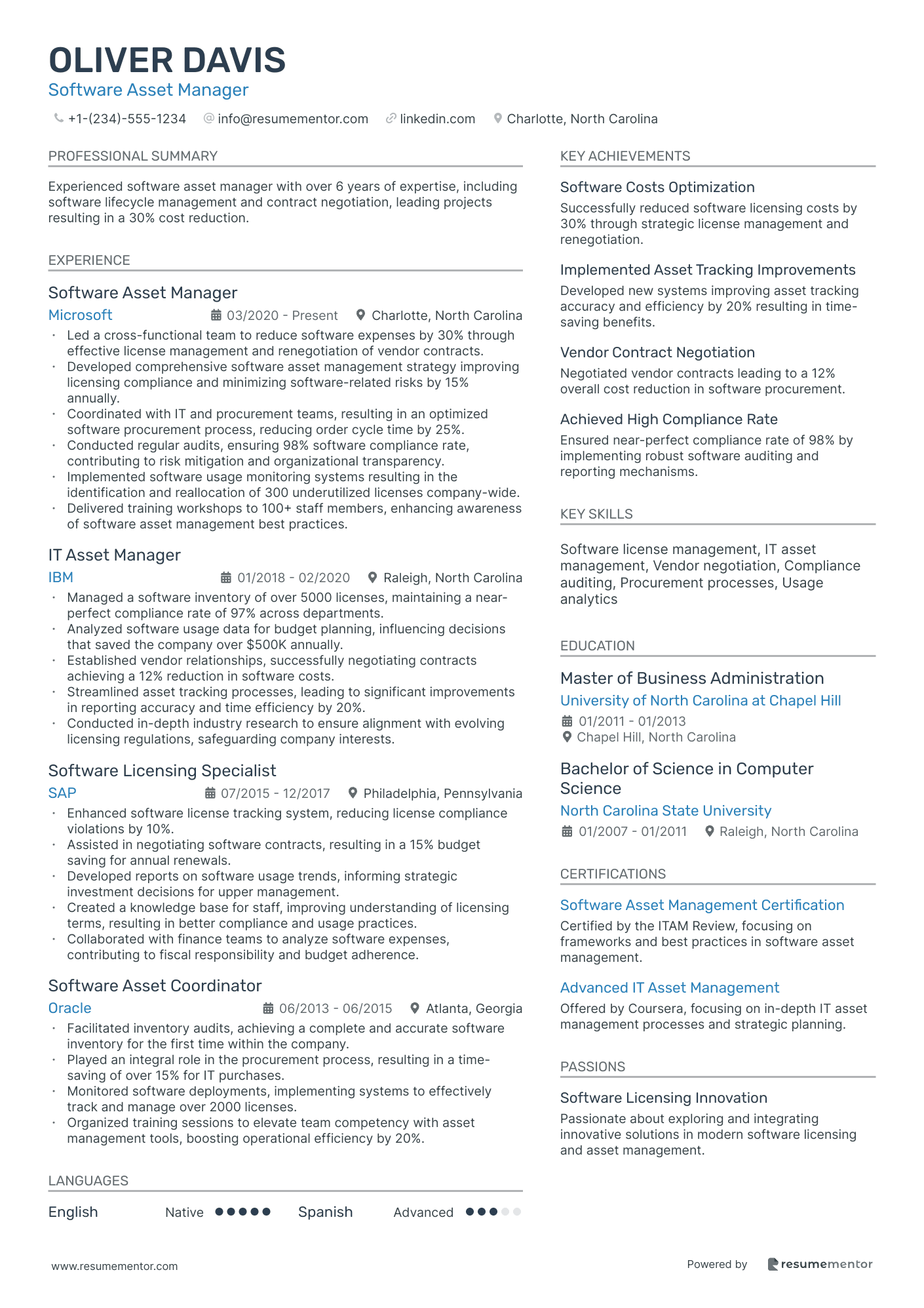

Software Asset Manager

Public Sector Asset Manager

Real Estate Asset Manager resume sample

- •Developed and executed asset management strategies raising property value by 25%, enhancing investor satisfaction dramatically.

- •Conducted in-depth market analyses to optimize property earnings, achieving a 15% increase in rental income within one year.

- •Led annual budgets creation for properties worth over $200 million, ensuring fiscal discipline and cost savings of $1.5 million.

- •Collaborated with property management teams, improving occupancy rates by 10% through strategic tenant mix and engagement.

- •Implemented property improvement projects that increased portfolio equity by 30%, noted as a key growth driver.

- •Prepared comprehensive reports for senior management, focusing on property performance metrics and strategic direction.

- •Streamlined property operations, reducing annual operational costs by 12% while maintaining service quality.

- •Conducted due diligence for property acquisitions totaling $150 million, supporting strategic expansion of the asset portfolio.

- •Facilitated tenant communication strategies, resulting in a 20% improvement in tenant satisfaction and retention.

- •Executed financial modeling for diversified property types, boosting decision-making efficiency across departments.

- •Coordinated property enhancement projects, adding approximately $2 million in added value through targeted investments.

- •Analyzed portfolio performance metrics, supporting strategies that resulted in a 10% portfolio value increase.

- •Assisted in the development of annual operating budgets, ensuring alignment with corporate financial goals.

- •Devised lease management strategies that improved collection rates by 5%, enhancing revenue streams.

- •Collaborated on renovation projects, increasing asset desirability and market competitiveness efficiently.

- •Performed financial analyses and assessments for property investments, crafting reports that informed $50 million in capital projects.

- •Supported senior analysts in market forecasting, enhancing accuracy of financial projections by approximately 15%.

- •Developed financial models that improved investment overview, aiding strategic planning processes effectively.

- •Contributed to operational strategy sessions, driving a 7% reduction in operating expenses over two years.

Investment Portfolio Asset Manager resume sample

- •Led portfolio management for high-net-worth clients, achieving a 20% growth in assets under management annually.

- •Developed customized investment strategies resulting in a 15% average annual return exceeding client objectives.

- •Collaborated with analysts to identify market opportunities, boosting portfolio growth by $75 million.

- •Implemented risk management measures that decreased risk exposure by 12%, securing client financial stability.

- •Enhanced client engagement through strategic communication, resulting in 95% client retention rate.

- •Oversaw team projects and facilitated training, improving strategy development efficiency by 30%.

- •Conducted thorough market analytics, contributing to 10% improvement in investment opportunity identification.

- •Assisted in the development of asset allocation strategies that increased diversification and mitigated risk.

- •Presented performance reviews and strategic outlooks, enhancing client understanding and satisfaction.

- •Contributed to policy development, staying abreast of regulatory changes impacting portfolios.

- •Coordinated with cross-functional teams, improving portfolio risk analysis efficiency by 25%.

- •Advised clients on investment strategies, leading to a 10% increase in client investment returns.

- •Collaborated on the development of a risk assessment tool, enhancing portfolio accuracy and security.

- •Provided financial analysis reports, significantly improving client understanding and decision-making.

- •Worked closely with clients to adjust strategies, resulting in a 12% portfolio performance increase.

- •Conducted detailed investment research, enhancing the identification of high-return opportunities by 15%.

- •Played a key role in developing client portfolios, achieving a 9% better return than industry benchmark.

- •Assisted in regulatory compliance tracking, ensuring adherence to new investment policies.

- •Communicated effectively with clients, improving service satisfaction and promoting client loyalty.

Corporate Fixed Asset Manager resume sample

- •Implemented a new asset tracking system resulting in a 15% reduction in asset misallocation incidents.

- •Collaborated with cross-departmental teams to streamline asset data entry, improving data accuracy by 25%.

- •Led a project team during a system upgrade, ensuring seamless transition and zero downtime.

- •Managed the asset verification process, conducting audits that improved compliance rates by 30% from previous years.

- •Designed training modules for fixed asset policies, training over 50 new hires and resulting in improved process adherence.

- •Contributed to improved financial reporting accuracy by refining reconciliation practices and shortening the month-end close timeline by 20%.

- •Managed fixed asset ledger with over $100 million in company assets, ensuring timely entries and compliance.

- •Analyzed asset data trends, generating insights that informed strategic planning and resulted in cost savings of 10%.

- •Coordinated disposal procedures for obsolete assets, achieving a revenue gain of $500,000 through asset sales.

- •Developed a comprehensive audit checklist used in over 25 asset audits, ensuring accuracy and regulatory adherence.

- •Supported the capital budgeting process by analyzing historical asset data and providing forecasts.

- •Facilitated the asset acquisition process for new projects worth over $50 million in total.

- •Instituted processes for asset lifecycle management, reducing asset lifecycle discrepancies by 15%.

- •Performed regular reconciliation of asset accounts, improving financial accuracy and reducing discrepancies by 10%.

- •Worked with finance and operational teams to prepare fixed asset reports, contributing to improved transparency in financial statements.

- •Supported monthly reconciliation of fixed asset ledgers, ensuring timely updates and verifications.

- •Assisted in conducting asset audits, improving asset tracking accuracy by an estimated 10%.

- •Provided robust support in capital expenditure tracking, aiding in the reduction of unnecessary spending.

- •Created detailed report summaries for senior management, contributing to strategic asset management decisions.

Digital Asset Manager resume sample

- •Implemented a digital asset management strategy, boosting asset retrieval by 40% for cross-functional teams.

- •Conducted periodic audits leading to a 30% reduction in outdated assets, increasing relevance and usability.

- •Enhanced content metadata standards, resulting in better searchability and improved asset cataloging by 50%.

- •Managed ingestion of over 10,000 assets, ensuring they met stringent quality standards for ongoing projects.

- •Trained over 50 team members on digital asset management tools, enhancing team productivity substantially.

- •Produced comprehensive usage reports, advising strategic content decisions that improved engagement by 20%.

- •Managed a robust digital archive, increasing asset accessibility and retrieval speed by 45%.

- •Collaborated with marketing and design to align assets with branding, ensuring consistent brand usage.

- •Led asset migration to a new management platform, ensuring a seamless transition and zero data loss.

- •Conducted detailed asset audits, retiring 25% irrelevant content and introducing fresh, relevant materials.

- •Developed a taxonomy system improving search accuracy and asset findability, positively impacting retrieval efficiency.

- •Oversaw digital repository maintenance, ensuring seamless content updates and a 35% efficiency improvement.

- •Executed an asset tagging initiative, achieving a 60% reduction in retrieval times for multimedia content.

- •Integrated content management systems with marketing tools, enhancing tracking and performance measurement.

- •Coordinated with IT to enhance digital management software functionality, supporting a 20% higher processing capacity.

- •Analyzed metadata for digital assets, achieving a 15% increase in search relevancy through targeted enhancements.

- •Developed standardized metadata processes that reduced asset classification time by 25%.

- •Contributed to digital asset cleanliness by removing 5,000 redundant files, streamlining the library significantly.

- •Collaborated closely with creative teams to ensure assets followed precise brand and quality standards.

Asset Liability Manager resume sample

- •Developed innovative asset-liability management strategies that enhanced balance sheet profitability by 22% within one fiscal year.

- •Monitored risks and crafted mitigation strategies, reducing liability exposure by 18%, resulting in increased financial stability.

- •Led a cross-departmental initiative to integrate advanced economic data models, improving forecasting accuracy by 30%.

- •Presented detailed financial reports to senior executives, influencing strategic decisions that optimized asset utilization by 15%.

- •Undertook scenario analysis, identifying key vulnerabilities and recommending adjustments that mitigated potential market impacts.

- •Collaborated with treasury and investment teams to align objectives, driving a 25% reduction in risk management inefficiencies.

- •Implemented liquidity risk management measures reducing exposure by 20% and enhancing the liquidity coverage ratio effectively.

- •Conducted comprehensive stress testing, uncovering potential pitfalls and delivering risk-averse solutions that fortified the portfolio.

- •Compiled and distributed in-depth analytical reports that informed executives on key asset and liability trends and strategies.

- •Drove cross-functional collaboration with teams, aligning risk management with business goals, improving asset-liability synchronization.

- •Mentored junior analysts in asset-liability practices, fostering a learning environment that boosted team productivity by 25%.

- •Conducted regular risk assessments, developing strategies that reduced credit risks by 15% across various financial products.

- •Utilized quantitative tools and analytics to drive strategic planning efforts, resulting in enhanced decision-making capabilities.

- •Prepared comprehensive asset-liability reports, providing insights that drove strategic initiatives and financial stability.

- •Engaged with senior stakeholders to present actionable insights leading to 10% improvement in operational efficiency.

- •Implemented effective strategies to manage interest rate risks, improving the risk-adjusted performance by 12%.

- •Facilitated important workshops focusing on risk identification and mitigation, enhancing team readiness and resilience by 15%.

- •Assisted in the creation of financial models that optimized risk assessment metrics, influencing key financial decisions.

- •Developed systemized approaches for continuous risk monitoring and adaptive strategic planning, streamlining operations effectively.

Infrastructure Asset Manager resume sample

- •Developed a comprehensive asset management strategy that reduced maintenance costs by 20% while optimizing performance.

- •Led performance assessments across 12 infrastructure projects, generating detailed reports that influenced strategic decision-making.

- •Collaborated with engineering and operations teams, resulting in improved coordination and enhanced asset management outcomes.

- •Oversaw $10 million budget, achieving a 5% under-spend through strategic financial planning and forecasting.

- •Implemented a compliance program for infrastructure projects, strengthening adherence to industry regulations and standards.

- •Pioneered cost reduction initiatives, achieving $1.5 million in savings without compromising asset efficiency.

- •Executed asset lifecycle optimization techniques generating a 15% increase in asset lifespan across multiple projects.

- •Analyzed extensive asset data, providing actionable insights that enhanced asset utilization by 10%.

- •Coordinated with finance and engineering on budget management, reducing variance by 8%.

- •Managed relationships with contractors and stakeholders, ensuring project timelines were met consistently under budget.

- •Designed and led training programs on asset management software, increasing team proficiency and data reliability.

- •Facilitated asset performance evaluations, contributing to a 12% improvement in operational efficiency.

- •Collaborated on the development of asset tracking systems, enhancing data accuracy and reporting capabilities by 20%.

- •Monitored compliance with industry standards, successfully passing all regulatory audits for two consecutive years.

- •Generated analytical reports that helped prioritize critical assets, streamlining resource allocation and project focus.

- •Assisted in developing asset management policies, improving operational processes by standardizing procedures.

- •Managed asset databases, ensuring data integrity and improving retrieval times by 30%.

- •Implemented cost-efficient strategies that reduced asset management expenses by 10% while maintaining service quality.

- •Conducted stakeholder meetings to align asset management objectives with project goals, enhancing project delivery efficiency.

Private Equity Asset Manager resume sample

- •Managed a portfolio of 15 privately held companies, increasing average returns by 8% year-on-year through strategic initiatives.

- •Led due diligence and financial evaluations for 20+ investment opportunities, resulting in 3 successful acquisitions totaling $120 million.

- •Collaborated with executives of portfolio companies to implement operational improvements, achieving cost reductions of 15% on average.

- •Prepared comprehensive investment presentations, enhancing stakeholder understanding, which facilitated $200 million in fundraising efforts.

- •Monitored market trends and identified potential acquisition targets, increasing market share by 10% within key segments.

- •Established strong relationships with investors and advisors, contributing to a 30% increase in investor retention rates.

- •Developed financial models that improved investment accuracy by 20%, driving strategic decision-making for acquisitions.

- •Directed value creation strategies for a portfolio that led to a 22% increase in asset performance over 3 years.

- •Negotiated terms of investment agreements, ensuring favorable conditions and mitigating financial risks for investors.

- •Assisted in raising $100 million in capital during two fundraising rounds, expanding the investment capacity significantly.

- •Built and maintained partnerships with key financial consultants, enhancing the investment advisory capability of the firm.

- •Conducted valuation assessments and financial analyses, contributing to the successful restructuring of 5 companies.

- •Analyzed market trends and competitive data, improving portfolio's strategic positioning resulting in a 10% growth in returns.

- •Prepared detailed financial reports for senior management, aiding in the effective communication of investment strategies.

- •Collaborated with legal teams to ensure compliance with regulatory standards, reducing potential liabilities by 30%.

- •Advised private equity clients on strategic acquisitions, significantly enhancing their investment portfolios.

- •Designed growth initiatives for mid-sized companies, resulting in revenue growth averaging 12% per year.

- •Compiled competitive landscape analyses to inform client investment decisions, improving portfolio alignment with market conditions.

- •Facilitated workshops with company leaders to identify and capitalize on operational efficiencies.

Mutual Fund Asset Manager resume sample

- •Led strategic investment initiatives that achieved a portfolio growth rate 15% above benchmark over two consecutive years.

- •Implemented advanced risk management techniques decreasing potential losses by 25% through optimized risk assessment processes.

- •Collaborated in the development of new mutual fund products, contributing to a 10% increase in new customer acquisition within a year.

- •Compiled comprehensive reports and presentations for investment committees, significantly improving decision-making efficiency.

- •Played a key role in regulatory compliance, ensuring all funds adhered fully to SEC guidelines, preventing potential legal repercussions.

- •Acted as a primary client liaison, successfully increasing client satisfaction scores by 20% through strategic relationship management.

- •Engineered innovative portfolio management techniques that resulted in outperforming target fund value by 12% annually.

- •Led a team of analysts conducting in-depth market research resulting in improved investment decision accuracy by 30%.

- •Prepared strategic investment strategies presentations that consistently impressed stakeholders, enhancing trust and transparency.

- •Monitored portfolio fluctuations proactively, making timely adjustments that preserved capital in volatile market conditions.

- •Developed a proprietary financial modeling tool that reduced analysis time by 35%, leading to more agile investment decisions.

- •Assisted in managing a mid-cap fund where active management led to a 10% increase in asset value in the first year.

- •Conducted comprehensive economic trend analysis resulting in the identification of three lucrative investment opportunities.

- •Assisted senior managers with compliance reviews, ensuring all tasks were completed error-free, maintaining firm integrity.

- •Engaged in creating detailed client communication regarding fund performance, improving investor relations and fund credibility.

- •Developed detailed financial models that improved predictive accuracy of investment outcomes by 20%.

- •Performed due diligence on potential investments, generating reports that informed key investment strategies.

- •Monitored economic trends that influenced fund performance, advising asset managers with actionable insights.

- •Facilitated in preparing comprehensive financial statements, enhancing transparency and accuracy in financial reporting.

Software Asset Manager resume sample

- •Led a cross-functional team to reduce software expenses by 30% through effective license management and renegotiation of vendor contracts.

- •Developed comprehensive software asset management strategy improving licensing compliance and minimizing software-related risks by 15% annually.

- •Coordinated with IT and procurement teams, resulting in an optimized software procurement process, reducing order cycle time by 25%.

- •Conducted regular audits, ensuring 98% software compliance rate, contributing to risk mitigation and organizational transparency.

- •Implemented software usage monitoring systems resulting in the identification and reallocation of 300 underutilized licenses company-wide.

- •Delivered training workshops to 100+ staff members, enhancing awareness of software asset management best practices.

- •Managed a software inventory of over 5000 licenses, maintaining a near-perfect compliance rate of 97% across departments.

- •Analyzed software usage data for budget planning, influencing decisions that saved the company over $500K annually.

- •Established vendor relationships, successfully negotiating contracts achieving a 12% reduction in software costs.

- •Streamlined asset tracking processes, leading to significant improvements in reporting accuracy and time efficiency by 20%.

- •Conducted in-depth industry research to ensure alignment with evolving licensing regulations, safeguarding company interests.

- •Enhanced software license tracking system, reducing license compliance violations by 10%.

- •Assisted in negotiating software contracts, resulting in a 15% budget saving for annual renewals.

- •Developed reports on software usage trends, informing strategic investment decisions for upper management.

- •Created a knowledge base for staff, improving understanding of licensing terms, resulting in better compliance and usage practices.

- •Collaborated with finance teams to analyze software expenses, contributing to fiscal responsibility and budget adherence.

- •Facilitated inventory audits, achieving a complete and accurate software inventory for the first time within the company.

- •Played an integral role in the procurement process, resulting in a time-saving of over 15% for IT purchases.

- •Monitored software deployments, implementing systems to effectively track and manage over 2000 licenses.

- •Organized training sessions to elevate team competency with asset management tools, boosting operational efficiency by 20%.

Public Sector Asset Manager resume sample

- •Developed a comprehensive asset enhancement strategy, increasing asset portfolio valuation by 20% over two years.

- •Conducted regular performance assessments, ensuring alignment with strategic goals, leading to operational improvements by 15%.

- •Guided collaborative efforts with government agencies, securing $15M in funding for infrastructure projects.

- •Managed asset management budget of $5M, achieving a cost savings of 12% by optimizing resource allocation.

- •Enhanced risk mitigation strategies reducing vulnerability to compliance breaches by 30% across asset portfolio.

- •Mentored a team of 8 asset management professionals, improving staff productivity by 25% through ongoing training programs.

- •Implemented new asset assessment framework, resulting in a 15% increase in operational efficiency.

- •Spearheaded inter-agency collaborations, which led to a successful $3M grant acquisition for sustainable asset projects.

- •Produced detailed asset performance reports, contributing to a strategic initiative that boosted financial returns by 10%.

- •Led acquisition and disposition projects of public assets, optimizing asset allocation across a $30M portfolio.

- •Conducted financial modeling for asset forecasting, improving budgeting precision by 18%.

- •Managed property maintenance initiatives, reducing operational downtime by 20% through strategic planning.

- •Established new protocols for property leasing, which elevated occupancy rates to 95%.

- •Developed a tenant relations program enhancing customer satisfaction scores by 30% over a one-year period.

- •Coordinated with local authorities to ensure property compliance, achieving 100% adherence to regulations.

- •Analyzed operational workflows to inform process improvements, cutting waste by 10% and increasing efficiency.

- •Assisted in the development of project management guidelines essential for $5M project execution.

- •Supported asset management lifecycle efforts, resulting in a streamlined process with 15% faster turnaround times.

- •Coordinated stakeholder meetings and communications, enhancing project alignment and satisfaction metrics.

As an asset manager, your resume is like a well-balanced portfolio, showcasing your skills and achievements. Clearly presenting your financial expertise and strategic vision can open doors to the right job opportunities. However, writing a resume can feel overwhelming, especially if your days are spent managing numbers instead of words. This task involves choosing which accomplishments to feature and how to effectively convey your strengths to potential employers.

In the competitive job market, first impressions are crucial. A well-crafted resume not only sets you apart but also highlights your unique capabilities. This is where a strong resume template becomes essential. Providing a reliable framework, it ensures your skills and achievements are front and center, giving you an edge. For a seamless start, explore some resume templates.

Picking a resume template tailored to your industry can save you time and boost your confidence. While the template handles the structural details, you can focus on infusing your resume with your financial acumen and leadership prowess. This combination of a clear format and carefully chosen words makes your professional story both compelling and memorable.

Approaching your resume with the same care and precision as your asset management work ensures it reflects your strengths and goals. Let this guide assist you in creating a resume that not only captures attention but also secures the interviews you aim for.

Key Takeaways

- Choosing the right resume template tailored to your industry is crucial as it saves time and boosts confidence while allowing you to focus on your financial acumen and leadership skills.

- Convey financial expertise and strategic vision effectively to make a strong first impression and set yourself apart in the competitive job market.

- Highlight key achievements and skills in a quantifiable way, using numbers to provide tangible evidence of your capabilities and successful outcomes in asset management.

- A strong resume summary backed with specific achievements should capture your professional persona and showcase key attributes relevant to the asset management field.

- Complementing hard skills such as financial analysis with soft skills like communication and leadership can demonstrate your complete professional package to potential employers.

What to focus on when writing your asset manager resume

An asset manager resume should clearly convey your financial expertise and ability to drive investment growth. Recruiters want to see how your leadership skills translate into managing diverse portfolios effectively. This makes it essential to highlight your strategic insight alongside your analytical abilities.

How to structure your asset manager resume

- Professional Summary—This section is your introduction and should encapsulate your unique investment strategy expertise. Craft a narrative of success in high-stakes environments, using language that speaks to quantitative achievements and qualitative insights. Aim to capture the recruiter’s attention quickly by showcasing your knack for developing and implementing strategies that led to substantial portfolio growth.

- Work Experience—This is where your career timeline becomes a compelling story. Highlight achievements like asset growth percentages and successful risk management initiatives. Focus on specific high-value portfolios you've managed and how you have influenced outcomes. Use numbers to illustrate your impact, such as the amount of capital managed or returns generated, to offer tangible evidence of your capabilities.

- Education—Think of this section as laying the foundation for your financial acumen. Include your degrees, relevant coursework, and certifications like the CFA, demonstrating how each step of your education has prepared you to excel in asset management. Connect your academic experiences to your career achievements to show that you have both the theoretical expertise and practical skills.

- Skills—Illustrate how your capabilities in financial analysis, portfolio management, and client relationship management translate into results. Use this section to provide examples of how you’ve used these skills to solve problems or achieve client goals. Include both technical and soft skills, emphasizing how you effectively communicate complex financial concepts to clients and stakeholders.

- Certifications—Industry-specific certifications like the CFA or CFP should be used to great effect to show your dedication to professional growth and adherence to high standards. This section can underline your commitment to staying current in a rapidly changing field and your readiness to tackle complex challenges.

- Technical Skills—Detail your proficiency with tools like Bloomberg Terminal, Excel for financial modeling, and investment management software. Connect these skills to your ability to enhance decision-making processes and drive portfolio performance. Your technical know-how should back up your strategic and analytical prowess, showcasing your ability to thrive in tech-driven financial environments.

To further enrich your resume, consider adding sections like "Volunteer Experience" or "Professional Affiliations." These can highlight your involvement in industry conferences or finance-related community service, building a fuller picture of your professional engagement. Below we will cover each section more in-depth, giving you a comprehensive understanding of the resume format that best suits an asset manager.

Which resume format to choose

Creating a standout asset manager resume is key in your competitive industry, and using a reverse-chronological format is particularly effective. This format highlights your latest experience and achievements upfront, which is vital for roles where track records speak volumes. Your work history takes center stage, making it easier for hiring managers to see your progression and impact.

Opt for modern fonts like Lato, Montserrat, or Chivo to keep your resume looking professional and current. These fonts are easy on the eyes and leave a positive impression, subtly supporting the professionalism you bring to asset management.

Always save and send your resume as a PDF. This not only preserves your meticulous formatting but also ensures that your resume looks the same on any device or operating system, showcasing your attention to detail.

Maintaining one-inch margins all around is important for a clean, organized presentation. Adequate white space makes your content more approachable and helps guide the reader’s eye naturally through your career story.

Each of these elements plays a role in crafting a cohesive and polished resume, enhancing how you present yourself to potential clients or employers in the asset management field.

How to write a quantifiable resume experience section

- •Drove an annual portfolio growth rate of 12%, surpassing the S&P 500 benchmark by 4%.

- •Implemented risk management strategies, reducing asset volatility by 15%.

- •Managed $500M in assets while maintaining a client satisfaction rate of 98%.

- •Crafted strategic investment plans that boosted client retention by 25% over three years.

Your experience section flows naturally, drawing the reader in with a cohesive story of achievement. Starting with quantifiable results sets a confident tone, showing your real-world impact immediately. Numbers like a 12% growth rate and a 15% reduction in volatility not only highlight your skills but also link directly to how you drive success. Words such as “Drove” and “Crafted” give a sense of initiative and strategic thinking, connecting your ability to manage portfolios effectively with maintaining high client satisfaction. These skills all work together to emphasize your leadership in asset management. Tailoring this section to the job helps ensure that every detail aligns with the employer's needs, showcasing your fit for their team in a seamless way.

The clear format smoothly guides hiring managers through your impressive achievements, making it easy to see how you can add value. By including recent experience that aligns with industry trends, you confirm your role as a current and knowledgeable professional. Choosing relevant job titles and experiences assures employers that you’ve thoughtfully presented your qualifications, directly connecting them to what they’re seeking in their next hire within New York's competitive job landscape.

Project-Focused resume experience section

A project-focused asset manager resume experience section should effectively convey your contributions to various initiatives, highlighting your ability to manage assets strategically. Emphasize instances where your management led to successful outcomes, especially under tight deadlines or when innovative solutions were required. Start by detailing projects that brought significant results, making it clear how your role directly influenced the outcome.

Use bullet points to draw attention to your achievements, specifying your responsibilities and the challenges you navigated. Clearly articulating the results ensures the reader understands your impact. Quantifying your accomplishments with precise numbers adds concrete evidence of your capabilities. This approach provides potential employers with a vivid picture of your proficiency and success in the field of asset management.

Senior Asset Manager

ABC Investment Group

June 2020 - Present

- Managed a $2 million portfolio, increasing its value by 15% over two years through strategic investment.

- Led a team of five in restructuring underperforming assets, resulting in a 20% improvement in overall performance.

- Implemented a new risk assessment tool that reduced potential financial losses by 10%.

- Collaborated with cross-functional teams to develop a sustainable investment strategy focusing on long-term growth.

Responsibility-Focused resume experience section

A responsibility-focused asset manager resume experience section should effectively highlight your leadership and decision-making skills. Begin by showcasing your role in managing significant assets and the tangible impact you had on achieving financial goals. Discuss experiences in portfolio and wealth management, tying in both qualitative and quantitative performance to underline your contributions. Use bullet points to break down your accomplishments, with each one focusing on a distinct achievement or responsibility.

To enhance clarity, start each bullet with a compelling action verb that illustrates your proactive approach, and include the tools or strategies you utilized. Quantifying your achievements with numbers makes your impact more concrete and memorable for potential employers. This section should weave together the tasks you've completed with the results you've achieved, highlighting how you propelled the organization toward success.

Senior Asset Manager

ABC Wealth Management

January 2018 - Present

- Managed a portfolio valued at $500 million, achieving a 15% annual growth rate.

- Implemented risk management strategies that reduced exposure by 20%, minimizing client losses during market downturns.

- Led a team of financial analysts, improving operational efficiency by streamlining data analysis processes.

- Developed client investment strategies resulting in a 25% increase in customer satisfaction.

Collaboration-Focused resume experience section

A collaboration-focused asset manager resume experience section should highlight your ability to work as part of a team and build strong professional relationships. Start by conveying your achievements and demonstrate how you effectively collaborated to achieve shared objectives. Employers look for candidates who function well in team settings, so it's important to use action verbs that emphasize your active involvement and teamwork.

Rather than just listing tasks, focus on the tangible impact you've made. Describe the projects you've spearheaded or contributed to, the colleagues and partners you've engaged with, and the successful outcomes you've achieved together. Keep your descriptions concise yet detailed enough to give a full picture of your abilities. This approach allows potential employers to see you as a crucial team member who can bring value to their organization.

Asset Manager

XYZ Capital Partners

June 2020 - Present

- Led a team of five in developing a successful investment strategy that boosted portfolio performance by 15%.

- Worked closely with cross-functional teams to streamline asset management processes, increasing efficiency by 20%.

- Facilitated weekly team meetings to share updates and address issues, fostering a more cohesive team dynamic.

- Collaborated with senior analysts to improve market analysis reports, enhancing the accuracy and timeliness of insights.

Efficiency-Focused resume experience section

An Efficiency-Focused asset manager resume experience section should clearly show how you enhance processes, cut costs, and boost operational efficiency. It's important to start each bullet with a strong action verb to vividly illustrate the impact you make. When you share specific examples where your skills led to measurable results, like increasing portfolio returns or reducing expenses, it paints a compelling picture of your capabilities. By highlighting the strategic choices and innovations you've driven, you demonstrate how you make operations smoother and more effective.

Focus on the key metrics that matter most in asset management, and back these up with clear examples. Detailing your accomplishments with numbers or percentages not only makes your resume stand out but also gives potential employers a solid sense of the value you bring to their team. This integrated approach not only showcases your expertise but also provides a concrete reason for employers to see you as an essential asset to their organization.

Asset Manager

ABC Asset Management Co.

2019 - 2022

- Reduced portfolio management costs by 15% through streamlined processes.

- Implemented a new asset tracking system, enhancing asset visibility by 30%.

- Led a team to digitize operations, resulting in a 25% increase in response efficiency.

- Developed a quarterly performance dashboard that improved decision-making speed by 20%.

Write your asset manager resume summary section

A well-crafted, outcomes-focused resume summary for an asset manager should capture your professional persona and lay the groundwork for the rest of your resume. This section needs to highlight key achievements, skills, and experiences in a succinct way that catches an employer's attention. For a seasoned asset manager, you might write a summary like this:

This example effectively showcases your experience and key achievements. Starting with words like "dynamic" and mentioning a "proven track record" establishes you as a confident, capable professional. Highlighting specific accomplishments, such as improving client returns by a significant percentage, offers clear evidence of your effectiveness.

When describing yourself, focus on professional traits that offer real value to employers. Use active, positive words like "strategic," "innovative," and "results-oriented." Tailoring your summary to fit the job description helps align your skills with what the employer seeks. Understanding the nuances between a resume summary and similar sections further refines your approach. While a resume summary provides a snapshot of your career and skills, a resume objective conveys your goals. A resume profile combines both elements to give a fuller picture. A summary of qualifications lists your top attributes relevant to the job. Whether you opt for a resume summary or another section depends on your experience level. If you're established, a summary effectively highlights your successes, while an objective may suit those entering the field. Always tailor your section to match your story and the job you aim for.

Listing your asset manager skills on your resume

A skills-focused asset manager resume should clearly convey your capabilities and expertise in the financial sector. You can spotlight your skills in a dedicated section or integrate them into your experience and summary. Highlighting both strengths and soft skills showcases your ability to work effectively with others and handle responsibilities well. In contrast, hard skills like financial analysis and data management reflect your teachable, technical abilities. Incorporating these skills and strengths as keywords throughout your resume not only highlights your qualifications but also helps you stand out to potential employers.

Here's an example of a standalone skills section formatted in JSON:

This skills section is effective because it's succinct and focuses on relevant qualifications tailored to the asset manager role. Industry-recognizable terms are used, making it easy for recruiters and software to identify key competencies.

Best hard skills to feature on your asset manager resume

Your hard skills are crucial in showcasing the specific expertise needed for success in asset management. These skills reflect your technical knowledge and competence within the financial world:

Hard Skills

- Financial Analysis

- Portfolio Management

- Risk Assessment

- Investment Strategies

- Market Research

- Data Analysis

- Compliance Management

- Asset Allocation

- Budgeting

- Performance Evaluation

- Economic Modeling

- Real Estate Investment

- Tax Planning

- Accounting

- Corporate Finance

Best soft skills to feature on your asset manager resume

Alongside technical prowess, soft skills highlight your interpersonal abilities, demonstrating how well you manage relationships and thrive in various situations. These skills showcase your ability to adapt and collaborate effectively in dynamic environments:

Soft Skills

- Communication

- Problem-Solving

- Leadership

- Time Management

- Adaptability

- Attention to Detail

- Negotiation

- Emotional Intelligence

- Decision-Making

- Teamwork

- Client Service

- Critical Thinking

- Conflict Resolution

- Initiative

- Interpersonal Skills

How to include your education on your resume

The education section is a crucial part of your asset manager resume, highlighting your academic background and how it aligns with the job. Your education section should be tailored to the specific job you are applying for, omitting any irrelevant degrees or coursework. When it comes to including your GPA, it can be beneficial to list it if it is impressive, typically 3.5 or higher, and relevant to the role. Honors such as cum laude should be clearly mentioned to highlight your academic achievements.

Degrees should be listed with the most recent first, clearly stating the type of degree, followed by the institution you attended. Ensuring the education section is neatly organized can help make a strong first impression. Here is a wrong example that includes unnecessary information:

The above example includes a non-relevant degree for an asset manager role. The below example correctly aligns the education to the asset management field:

- •Graduated cum laude

- •Focused on investment management strategies

This second example is pertinent because it focuses on finance and investment management, aligning education with the skills needed for an asset manager job. It lists relevant honors and academic achievements, and it includes a strong GPA to highlight academic excellence.

How to include asset manager certificates on your resume

Including a certificates section in your asset manager resume is crucial as it showcases your specialized skills and continued education. Start by listing the name of the certificate. Include the date you received it. Add the issuing organization to provide credibility. You can also place some of these certificates in your resume's header for immediate visibility.

For example:

This example is effective because it lists industry-recognized certificates like CFA and FRM, validated by reputable organizations. Each certificate is clearly titled and dated, making it easy for recruiters to see your qualifications at a glance. This format underscores your expertise and commitment to professional growth in asset management.

Extra sections to include in your asset manager resume

When crafting a resume for an asset manager position, it's important to highlight your professional strengths, but including additional sections can make your resume more dynamic and memorable. These extra sections can give a rounded view of who you are and enhance your qualifications.

• Language section — Show proficiency in multiple languages to enhance your communication skills and emphasize your ability to engage with a diverse market. • Hobbies and interests section — Highlight activities that reflect skills relevant to asset management, such as strategic thinking or analytical abilities. • Volunteer work section — Illustrate your commitment to social responsibility and community involvement, which can resonate with prospective employers and differentiate you from other candidates. • Books section — Include industry-related books you've read to showcase your continuous learning attitude and passion for your field.

These sections can personalize your resume and provide a fuller picture of your skills and interests. Tailor these sections to reflect traits and experiences that make you an exceptional asset manager.

In Conclusion

In conclusion, crafting an asset manager resume requires a careful balance of structure, detail, and personalization. By prioritizing a well-organized format, you highlight your career achievements effectively. Each section, from your professional summary to experience and skills, plays a vital role in showcasing your qualifications. Make sure to use specific examples and quantifiable results, such as managing large portfolios or implementing innovative strategies, to underline your strengths. Selecting a professional design with appropriate fonts not only engages the reader but also reflects your attention to detail, a key trait in asset management. Remember to keep both hard and soft skills visible, illustrating your comprehensive capabilities in managing finances and client relationships. Highlighting relevant education and certifications further boosts your credibility, showcasing your commitment to ongoing improvement in the field. Consider including extra sections such as languages or volunteer work to personalize your resume, creating a broader picture of who you are beyond professional accomplishments. A well-tailored resume can be your strong ally in standing out in a competitive job market, paving the way to valuable connections and job opportunities. With thoughtful execution, your resume can effectively communicate your readiness to bring value in an asset management role.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.