Assistant Accountant Resume Examples

Jul 18, 2024

|

12 min read

Gain the edge you need! Learn how to write an assistant accountant resume that balances skills and experience like a pro, helping you stand out to employers and secure your next role in accounting.

Rated by 348 people

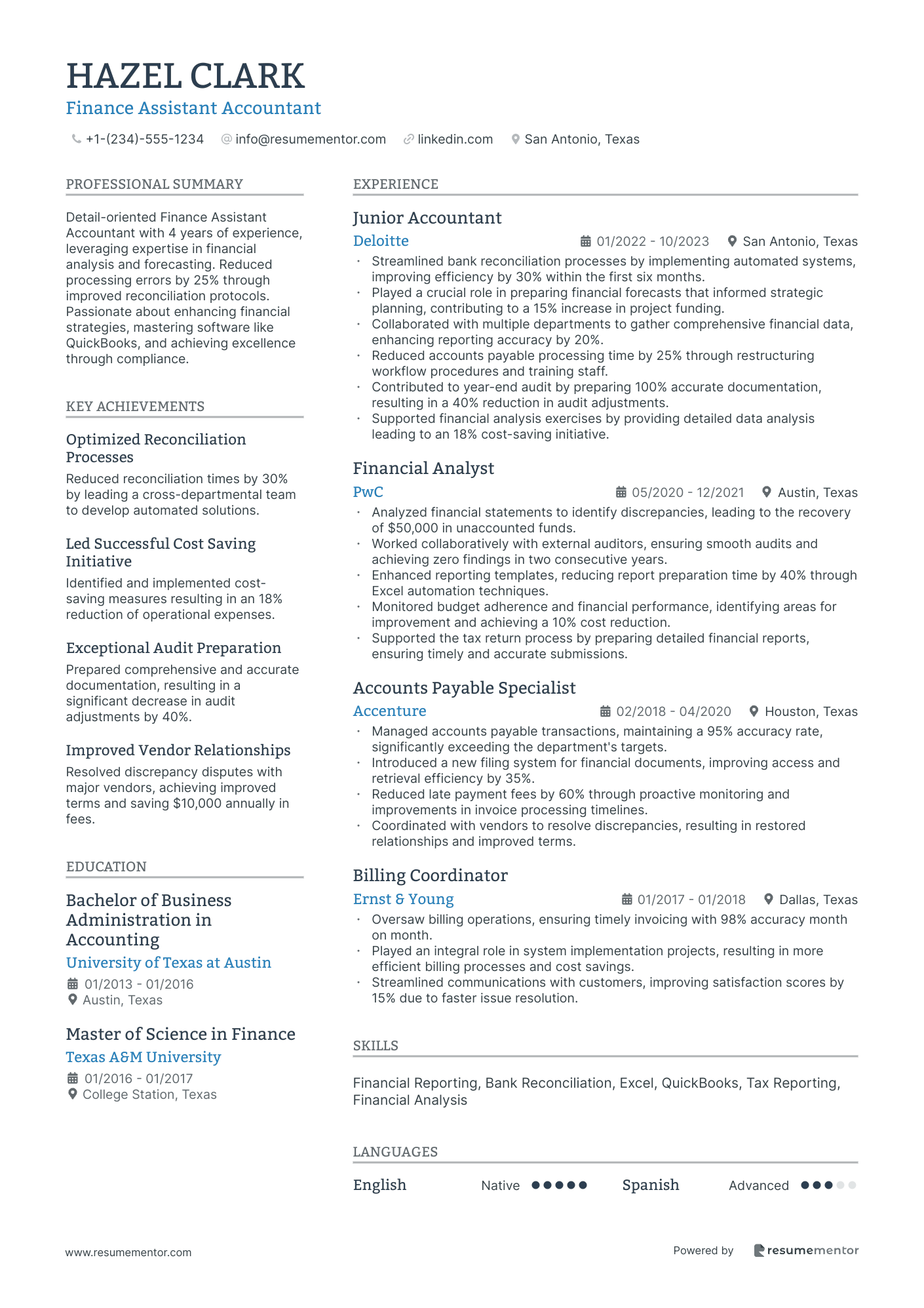

Finance Assistant Accountant

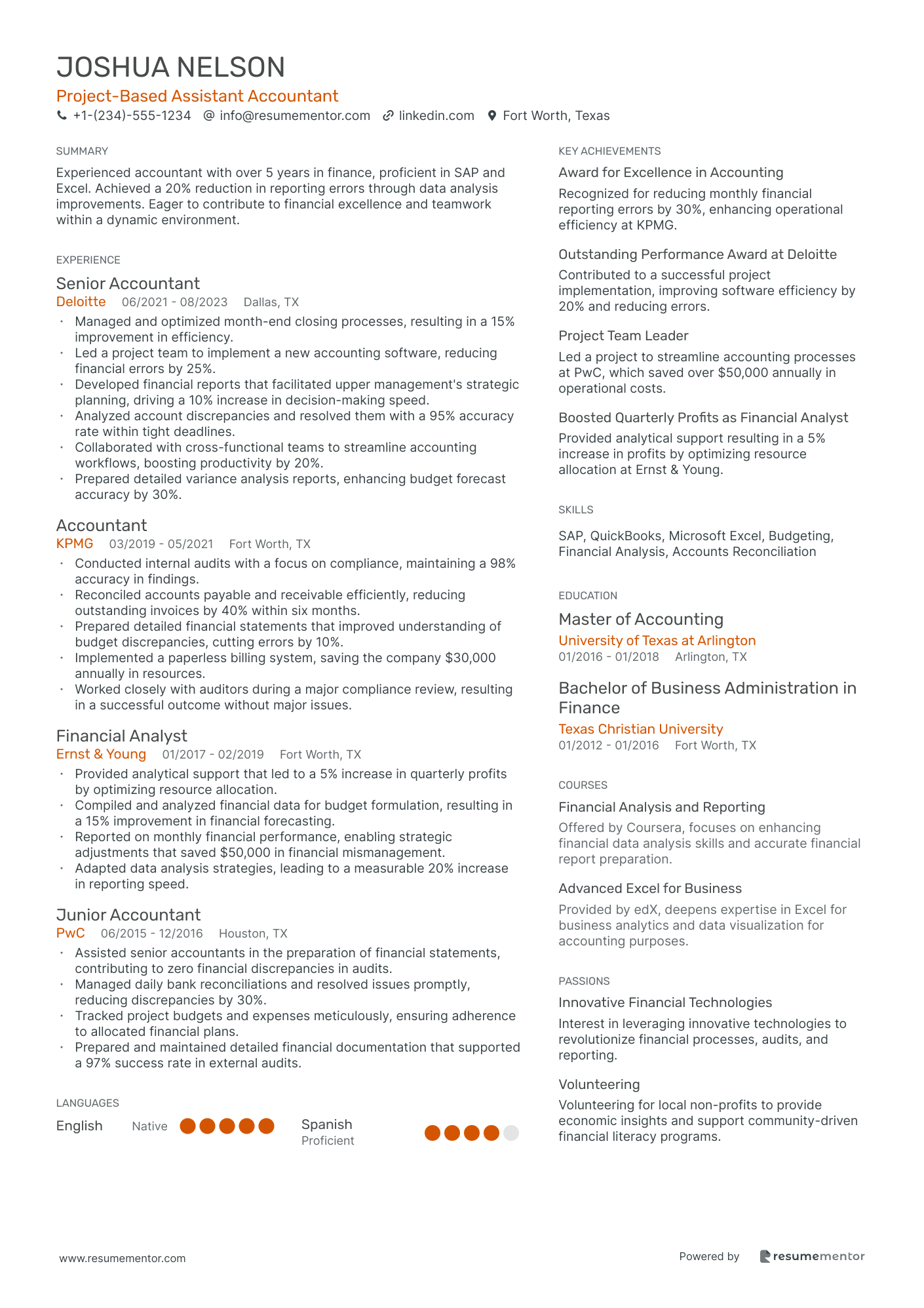

Project-Based Assistant Accountant

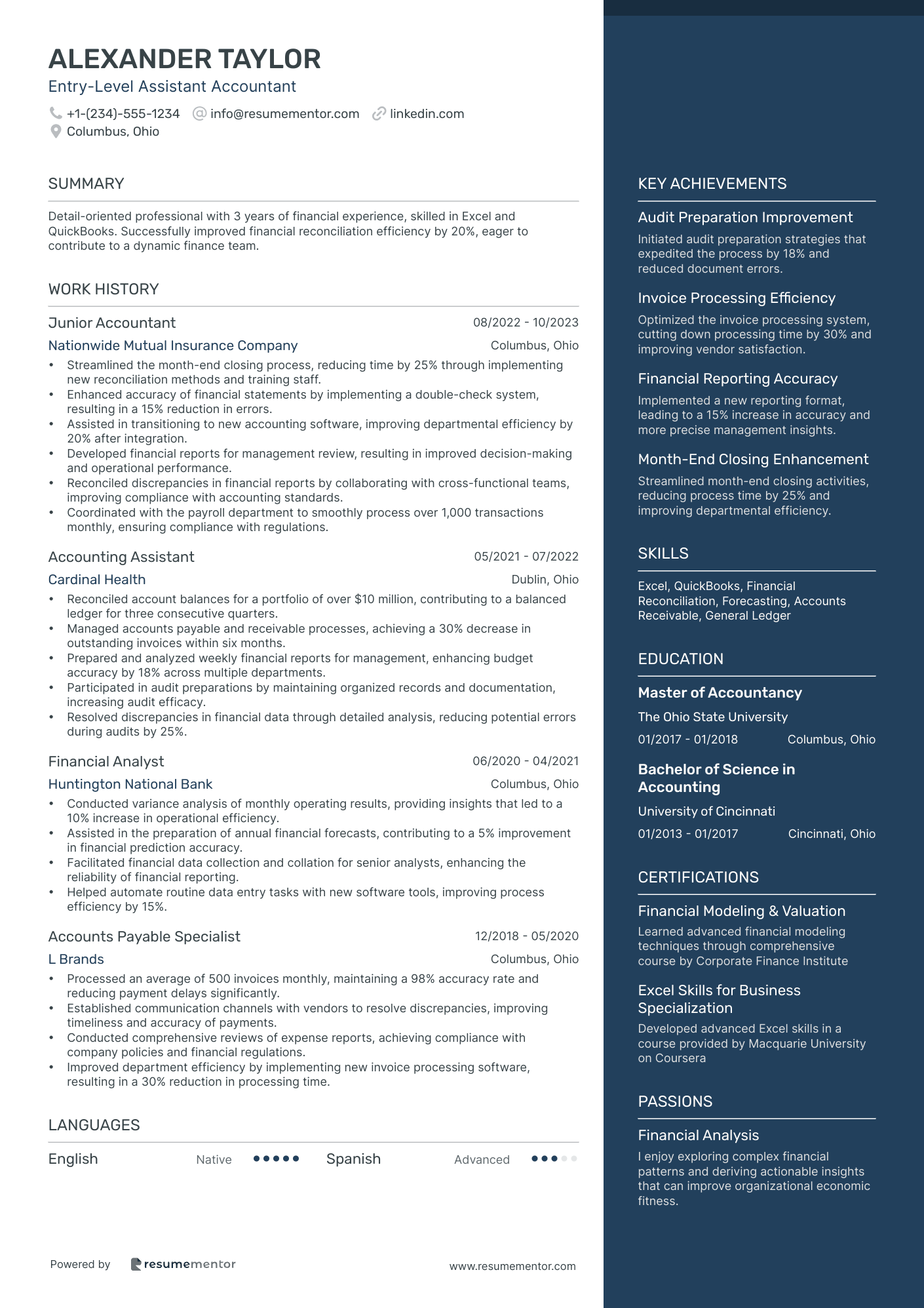

Entry-Level Assistant Accountant

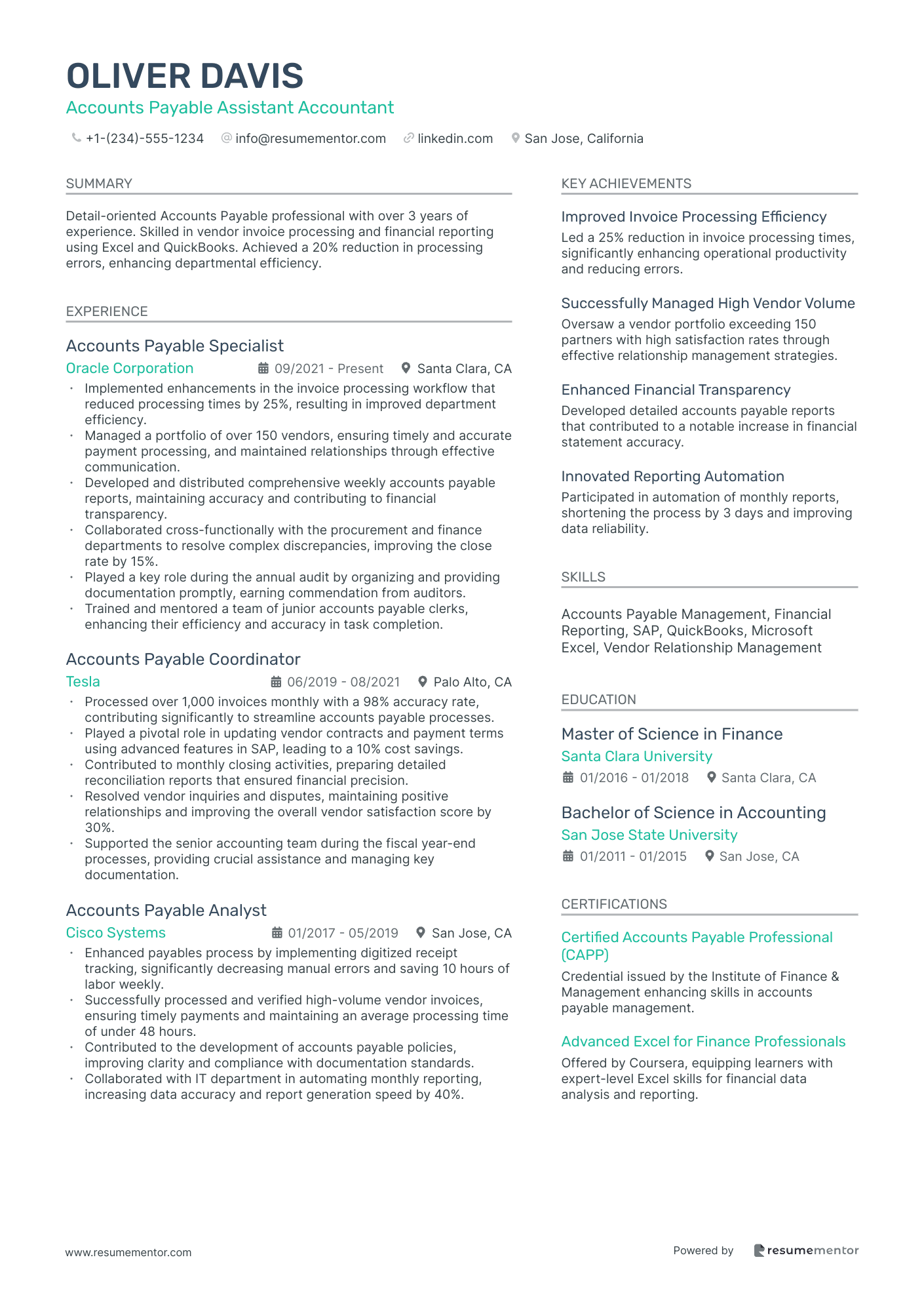

Accounts Payable Assistant Accountant

Tax Assistant Accountant

Corporate Finance Assistant Accountant

Chartered Assistant Accountant

General Ledger Assistant Accountant

Assistant Accountant for Not-for-Profit Organizations

Assistant Accountant in Audit Services

Finance Assistant Accountant resume sample

- •Streamlined bank reconciliation processes by implementing automated systems, improving efficiency by 30% within the first six months.

- •Played a crucial role in preparing financial forecasts that informed strategic planning, contributing to a 15% increase in project funding.

- •Collaborated with multiple departments to gather comprehensive financial data, enhancing reporting accuracy by 20%.

- •Reduced accounts payable processing time by 25% through restructuring workflow procedures and training staff.

- •Contributed to year-end audit by preparing 100% accurate documentation, resulting in a 40% reduction in audit adjustments.

- •Supported financial analysis exercises by providing detailed data analysis leading to an 18% cost-saving initiative.

- •Analyzed financial statements to identify discrepancies, leading to the recovery of $50,000 in unaccounted funds.

- •Worked collaboratively with external auditors, ensuring smooth audits and achieving zero findings in two consecutive years.

- •Enhanced reporting templates, reducing report preparation time by 40% through Excel automation techniques.

- •Monitored budget adherence and financial performance, identifying areas for improvement and achieving a 10% cost reduction.

- •Supported the tax return process by preparing detailed financial reports, ensuring timely and accurate submissions.

- •Managed accounts payable transactions, maintaining a 95% accuracy rate, significantly exceeding the department's targets.

- •Introduced a new filing system for financial documents, improving access and retrieval efficiency by 35%.

- •Reduced late payment fees by 60% through proactive monitoring and improvements in invoice processing timelines.

- •Coordinated with vendors to resolve discrepancies, resulting in restored relationships and improved terms.

- •Oversaw billing operations, ensuring timely invoicing with 98% accuracy month on month.

- •Played an integral role in system implementation projects, resulting in more efficient billing processes and cost savings.

- •Streamlined communications with customers, improving satisfaction scores by 15% due to faster issue resolution.

Project-Based Assistant Accountant resume sample

- •Managed and optimized month-end closing processes, resulting in a 15% improvement in efficiency.

- •Led a project team to implement a new accounting software, reducing financial errors by 25%.

- •Developed financial reports that facilitated upper management's strategic planning, driving a 10% increase in decision-making speed.

- •Analyzed account discrepancies and resolved them with a 95% accuracy rate within tight deadlines.

- •Collaborated with cross-functional teams to streamline accounting workflows, boosting productivity by 20%.

- •Prepared detailed variance analysis reports, enhancing budget forecast accuracy by 30%.

- •Conducted internal audits with a focus on compliance, maintaining a 98% accuracy in findings.

- •Reconciled accounts payable and receivable efficiently, reducing outstanding invoices by 40% within six months.

- •Prepared detailed financial statements that improved understanding of budget discrepancies, cutting errors by 10%.

- •Implemented a paperless billing system, saving the company $30,000 annually in resources.

- •Worked closely with auditors during a major compliance review, resulting in a successful outcome without major issues.

- •Provided analytical support that led to a 5% increase in quarterly profits by optimizing resource allocation.

- •Compiled and analyzed financial data for budget formulation, resulting in a 15% improvement in financial forecasting.

- •Reported on monthly financial performance, enabling strategic adjustments that saved $50,000 in financial mismanagement.

- •Adapted data analysis strategies, leading to a measurable 20% increase in reporting speed.

- •Assisted senior accountants in the preparation of financial statements, contributing to zero financial discrepancies in audits.

- •Managed daily bank reconciliations and resolved issues promptly, reducing discrepancies by 30%.

- •Tracked project budgets and expenses meticulously, ensuring adherence to allocated financial plans.

- •Prepared and maintained detailed financial documentation that supported a 97% success rate in external audits.

Entry-Level Assistant Accountant resume sample

- •Streamlined the month-end closing process, reducing time by 25% through implementing new reconciliation methods and training staff.

- •Enhanced accuracy of financial statements by implementing a double-check system, resulting in a 15% reduction in errors.

- •Assisted in transitioning to new accounting software, improving departmental efficiency by 20% after integration.

- •Developed financial reports for management review, resulting in improved decision-making and operational performance.

- •Reconciled discrepancies in financial reports by collaborating with cross-functional teams, improving compliance with accounting standards.

- •Coordinated with the payroll department to smoothly process over 1,000 transactions monthly, ensuring compliance with regulations.

- •Reconciled account balances for a portfolio of over $10 million, contributing to a balanced ledger for three consecutive quarters.

- •Managed accounts payable and receivable processes, achieving a 30% decrease in outstanding invoices within six months.

- •Prepared and analyzed weekly financial reports for management, enhancing budget accuracy by 18% across multiple departments.

- •Participated in audit preparations by maintaining organized records and documentation, increasing audit efficacy.

- •Resolved discrepancies in financial data through detailed analysis, reducing potential errors during audits by 25%.

- •Conducted variance analysis of monthly operating results, providing insights that led to a 10% increase in operational efficiency.

- •Assisted in the preparation of annual financial forecasts, contributing to a 5% improvement in financial prediction accuracy.

- •Facilitated financial data collection and collation for senior analysts, enhancing the reliability of financial reporting.

- •Helped automate routine data entry tasks with new software tools, improving process efficiency by 15%.

- •Processed an average of 500 invoices monthly, maintaining a 98% accuracy rate and reducing payment delays significantly.

- •Established communication channels with vendors to resolve discrepancies, improving timeliness and accuracy of payments.

- •Conducted comprehensive reviews of expense reports, achieving compliance with company policies and financial regulations.

- •Improved department efficiency by implementing new invoice processing software, resulting in a 30% reduction in processing time.

Accounts Payable Assistant Accountant resume sample

- •Implemented enhancements in the invoice processing workflow that reduced processing times by 25%, resulting in improved department efficiency.

- •Managed a portfolio of over 150 vendors, ensuring timely and accurate payment processing, and maintained relationships through effective communication.

- •Developed and distributed comprehensive weekly accounts payable reports, maintaining accuracy and contributing to financial transparency.

- •Collaborated cross-functionally with the procurement and finance departments to resolve complex discrepancies, improving the close rate by 15%.

- •Played a key role during the annual audit by organizing and providing documentation promptly, earning commendation from auditors.

- •Trained and mentored a team of junior accounts payable clerks, enhancing their efficiency and accuracy in task completion.

- •Processed over 1,000 invoices monthly with a 98% accuracy rate, contributing significantly to streamline accounts payable processes.

- •Played a pivotal role in updating vendor contracts and payment terms using advanced features in SAP, leading to a 10% cost savings.

- •Contributed to monthly closing activities, preparing detailed reconciliation reports that ensured financial precision.

- •Resolved vendor inquiries and disputes, maintaining positive relationships and improving the overall vendor satisfaction score by 30%.

- •Supported the senior accounting team during the fiscal year-end processes, providing crucial assistance and managing key documentation.

- •Enhanced payables process by implementing digitized receipt tracking, significantly decreasing manual errors and saving 10 hours of labor weekly.

- •Successfully processed and verified high-volume vendor invoices, ensuring timely payments and maintaining an average processing time of under 48 hours.

- •Contributed to the development of accounts payable policies, improving clarity and compliance with documentation standards.

- •Collaborated with IT department in automating monthly reporting, increasing data accuracy and report generation speed by 40%.

- •Assisted in processing over $5 million in annual expenditure, ensuring adherence to budget constraints and financial objectives.

- •Provided support in maintaining accounting ledgers by verifying and posting detailed transaction information.

- •Developed improved filing systems for financial records, increasing retrieval speed and accuracy by 30%.

- •Coordinated with various departments to collect and organize data for monthly financial reports, contributing to accurate fiscal planning.

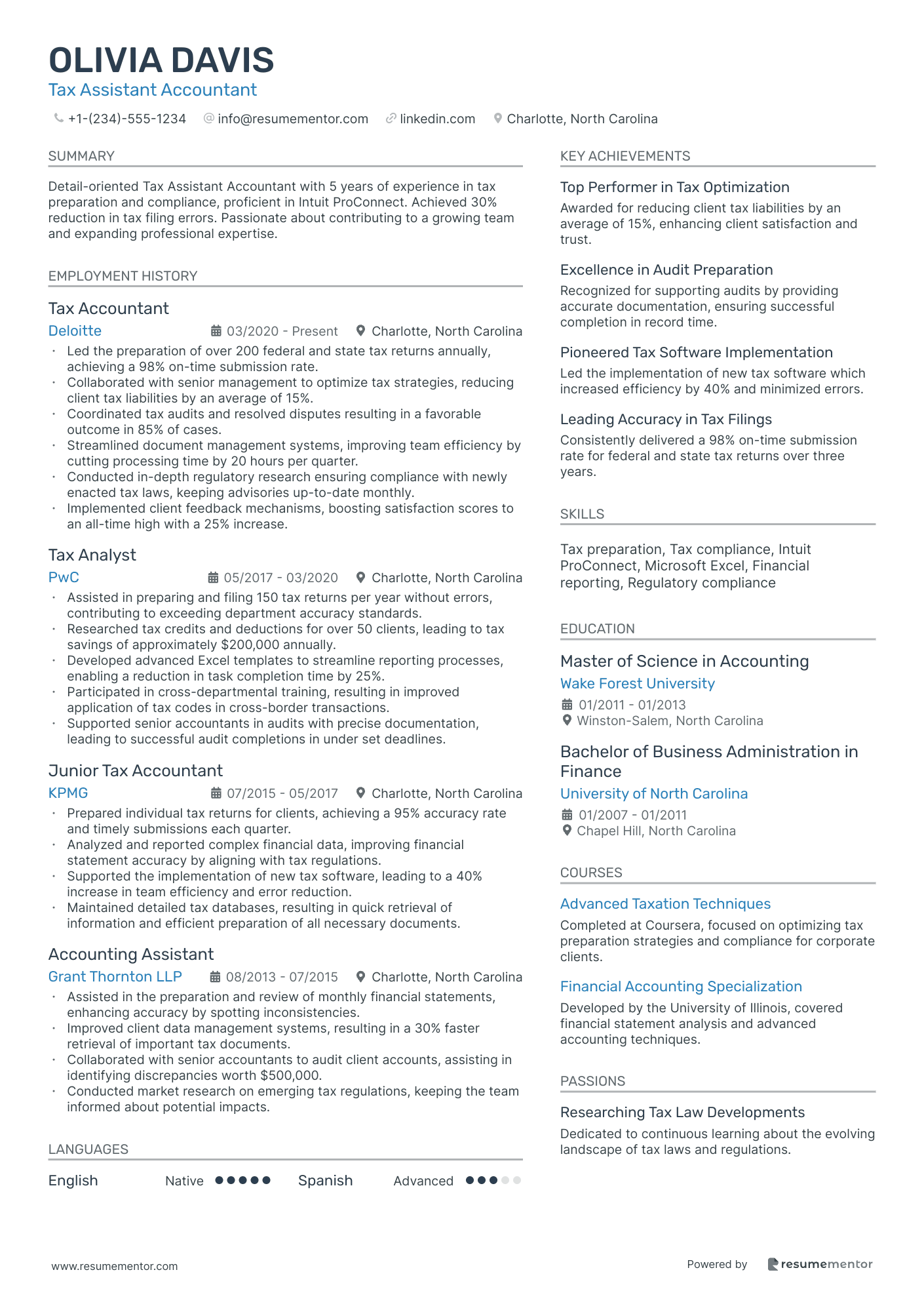

Tax Assistant Accountant resume sample

- •Led the preparation of over 200 federal and state tax returns annually, achieving a 98% on-time submission rate.

- •Collaborated with senior management to optimize tax strategies, reducing client tax liabilities by an average of 15%.

- •Coordinated tax audits and resolved disputes resulting in a favorable outcome in 85% of cases.

- •Streamlined document management systems, improving team efficiency by cutting processing time by 20 hours per quarter.

- •Conducted in-depth regulatory research ensuring compliance with newly enacted tax laws, keeping advisories up-to-date monthly.

- •Implemented client feedback mechanisms, boosting satisfaction scores to an all-time high with a 25% increase.

- •Assisted in preparing and filing 150 tax returns per year without errors, contributing to exceeding department accuracy standards.

- •Researched tax credits and deductions for over 50 clients, leading to tax savings of approximately $200,000 annually.

- •Developed advanced Excel templates to streamline reporting processes, enabling a reduction in task completion time by 25%.

- •Participated in cross-departmental training, resulting in improved application of tax codes in cross-border transactions.

- •Supported senior accountants in audits with precise documentation, leading to successful audit completions in under set deadlines.

- •Prepared individual tax returns for clients, achieving a 95% accuracy rate and timely submissions each quarter.

- •Analyzed and reported complex financial data, improving financial statement accuracy by aligning with tax regulations.

- •Supported the implementation of new tax software, leading to a 40% increase in team efficiency and error reduction.

- •Maintained detailed tax databases, resulting in quick retrieval of information and efficient preparation of all necessary documents.

- •Assisted in the preparation and review of monthly financial statements, enhancing accuracy by spotting inconsistencies.

- •Improved client data management systems, resulting in a 30% faster retrieval of important tax documents.

- •Collaborated with senior accountants to audit client accounts, assisting in identifying discrepancies worth $500,000.

- •Conducted market research on emerging tax regulations, keeping the team informed about potential impacts.

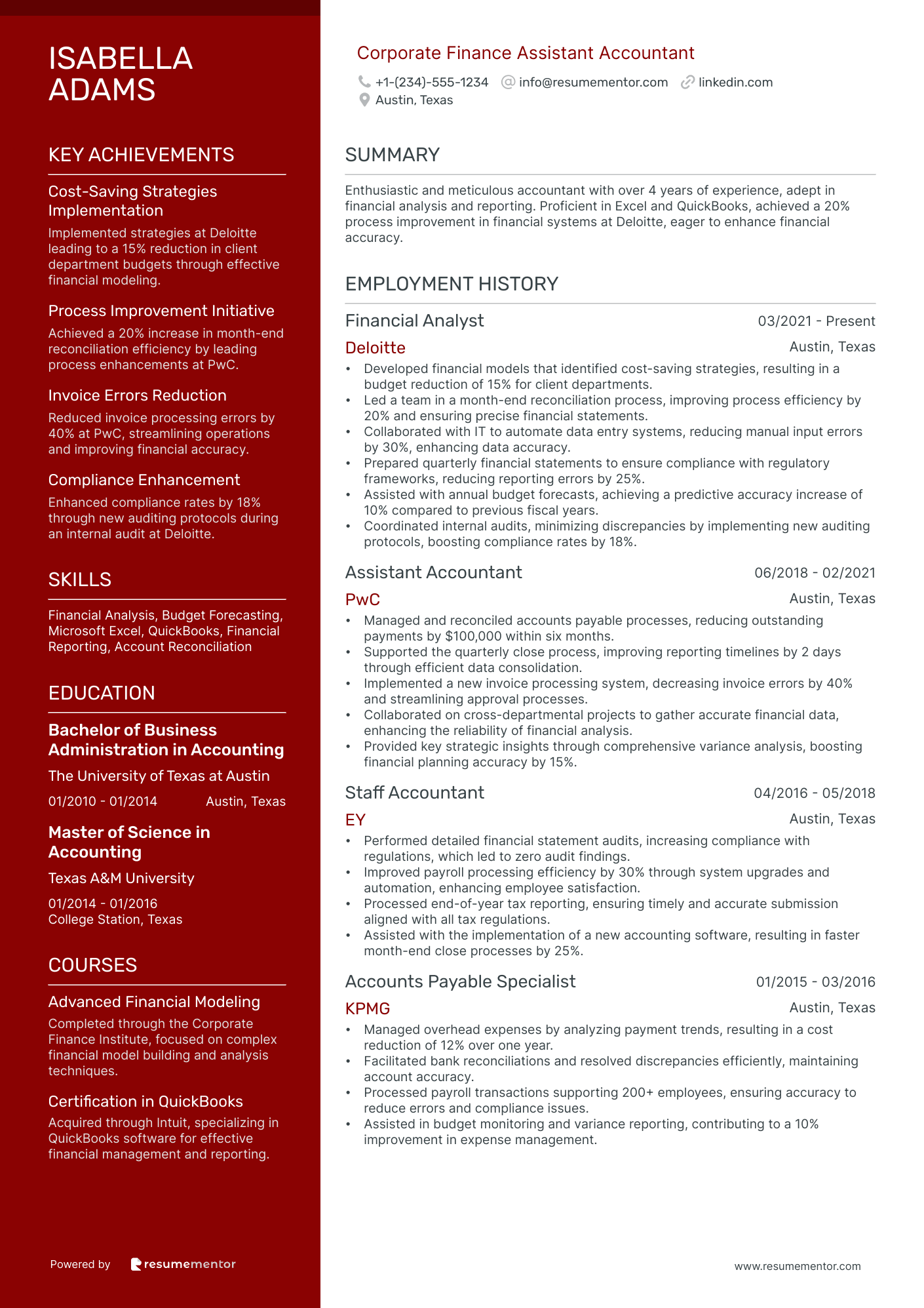

Corporate Finance Assistant Accountant resume sample

- •Developed financial models that identified cost-saving strategies, resulting in a budget reduction of 15% for client departments.

- •Led a team in a month-end reconciliation process, improving process efficiency by 20% and ensuring precise financial statements.

- •Collaborated with IT to automate data entry systems, reducing manual input errors by 30%, enhancing data accuracy.

- •Prepared quarterly financial statements to ensure compliance with regulatory frameworks, reducing reporting errors by 25%.

- •Assisted with annual budget forecasts, achieving a predictive accuracy increase of 10% compared to previous fiscal years.

- •Coordinated internal audits, minimizing discrepancies by implementing new auditing protocols, boosting compliance rates by 18%.

- •Managed and reconciled accounts payable processes, reducing outstanding payments by $100,000 within six months.

- •Supported the quarterly close process, improving reporting timelines by 2 days through efficient data consolidation.

- •Implemented a new invoice processing system, decreasing invoice errors by 40% and streamlining approval processes.

- •Collaborated on cross-departmental projects to gather accurate financial data, enhancing the reliability of financial analysis.

- •Provided key strategic insights through comprehensive variance analysis, boosting financial planning accuracy by 15%.

- •Performed detailed financial statement audits, increasing compliance with regulations, which led to zero audit findings.

- •Improved payroll processing efficiency by 30% through system upgrades and automation, enhancing employee satisfaction.

- •Processed end-of-year tax reporting, ensuring timely and accurate submission aligned with all tax regulations.

- •Assisted with the implementation of a new accounting software, resulting in faster month-end close processes by 25%.

- •Managed overhead expenses by analyzing payment trends, resulting in a cost reduction of 12% over one year.

- •Facilitated bank reconciliations and resolved discrepancies efficiently, maintaining account accuracy.

- •Processed payroll transactions supporting 200+ employees, ensuring accuracy to reduce errors and compliance issues.

- •Assisted in budget monitoring and variance reporting, contributing to a 10% improvement in expense management.

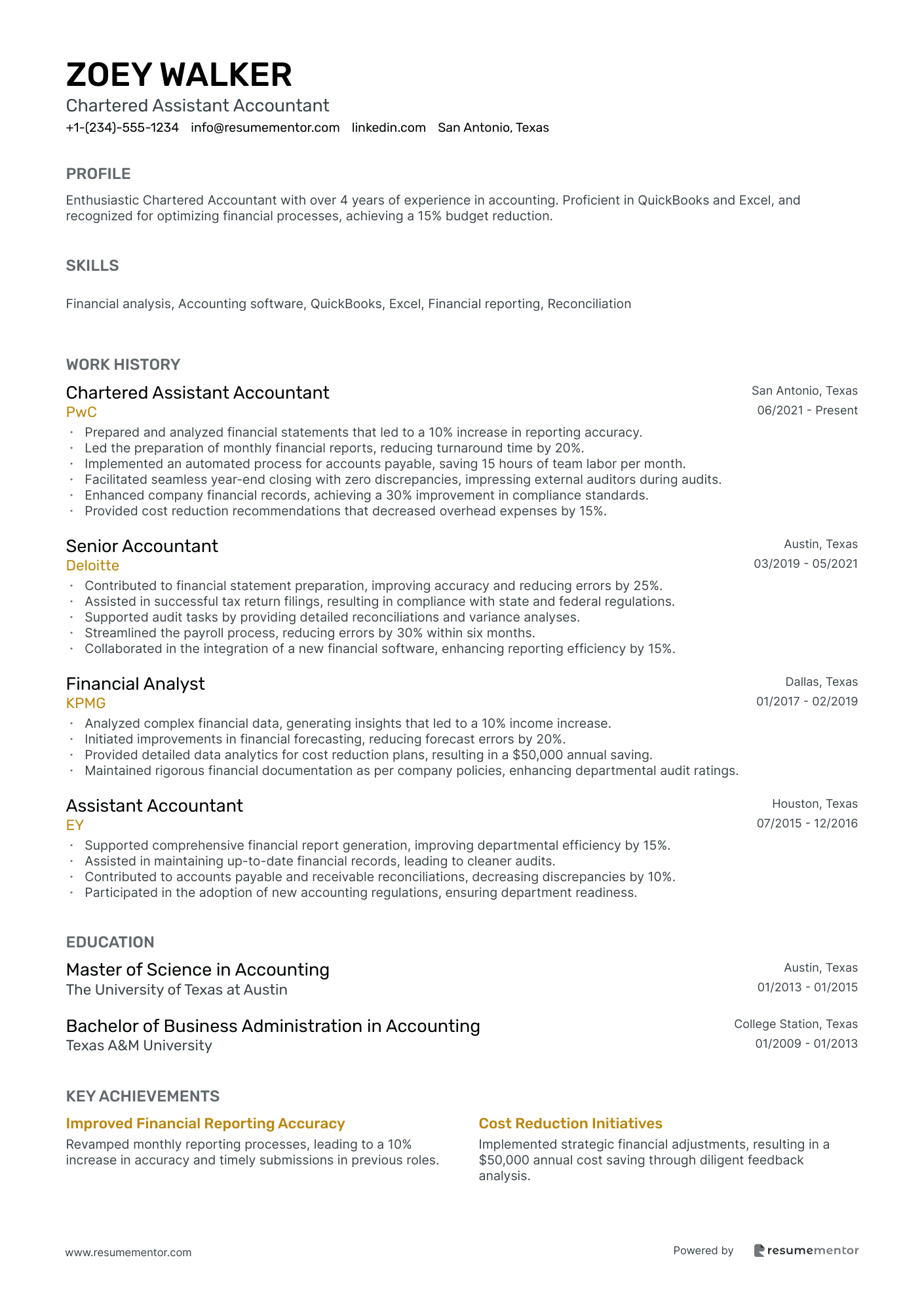

Chartered Assistant Accountant resume sample

- •Prepared and analyzed financial statements that led to a 10% increase in reporting accuracy.

- •Led the preparation of monthly financial reports, reducing turnaround time by 20%.

- •Implemented an automated process for accounts payable, saving 15 hours of team labor per month.

- •Facilitated seamless year-end closing with zero discrepancies, impressing external auditors during audits.

- •Enhanced company financial records, achieving a 30% improvement in compliance standards.

- •Provided cost reduction recommendations that decreased overhead expenses by 15%.

- •Contributed to financial statement preparation, improving accuracy and reducing errors by 25%.

- •Assisted in successful tax return filings, resulting in compliance with state and federal regulations.

- •Supported audit tasks by providing detailed reconciliations and variance analyses.

- •Streamlined the payroll process, reducing errors by 30% within six months.

- •Collaborated in the integration of a new financial software, enhancing reporting efficiency by 15%.

- •Analyzed complex financial data, generating insights that led to a 10% income increase.

- •Initiated improvements in financial forecasting, reducing forecast errors by 20%.

- •Provided detailed data analytics for cost reduction plans, resulting in a $50,000 annual saving.

- •Maintained rigorous financial documentation as per company policies, enhancing departmental audit ratings.

- •Supported comprehensive financial report generation, improving departmental efficiency by 15%.

- •Assisted in maintaining up-to-date financial records, leading to cleaner audits.

- •Contributed to accounts payable and receivable reconciliations, decreasing discrepancies by 10%.

- •Participated in the adoption of new accounting regulations, ensuring department readiness.

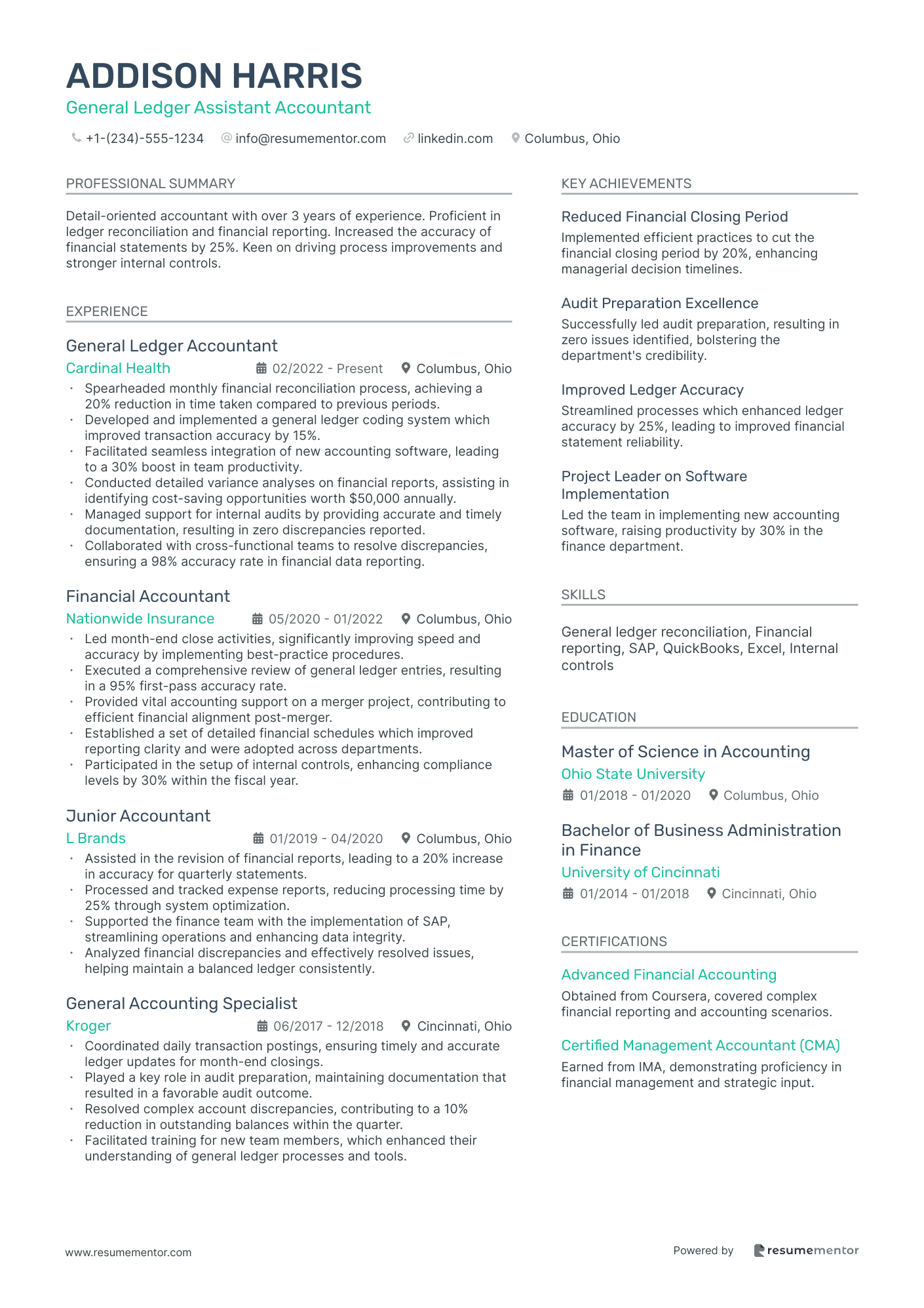

General Ledger Assistant Accountant resume sample

- •Spearheaded monthly financial reconciliation process, achieving a 20% reduction in time taken compared to previous periods.

- •Developed and implemented a general ledger coding system which improved transaction accuracy by 15%.

- •Facilitated seamless integration of new accounting software, leading to a 30% boost in team productivity.

- •Conducted detailed variance analyses on financial reports, assisting in identifying cost-saving opportunities worth $50,000 annually.

- •Managed support for internal audits by providing accurate and timely documentation, resulting in zero discrepancies reported.

- •Collaborated with cross-functional teams to resolve discrepancies, ensuring a 98% accuracy rate in financial data reporting.

- •Led month-end close activities, significantly improving speed and accuracy by implementing best-practice procedures.

- •Executed a comprehensive review of general ledger entries, resulting in a 95% first-pass accuracy rate.

- •Provided vital accounting support on a merger project, contributing to efficient financial alignment post-merger.

- •Established a set of detailed financial schedules which improved reporting clarity and were adopted across departments.

- •Participated in the setup of internal controls, enhancing compliance levels by 30% within the fiscal year.

- •Assisted in the revision of financial reports, leading to a 20% increase in accuracy for quarterly statements.

- •Processed and tracked expense reports, reducing processing time by 25% through system optimization.

- •Supported the finance team with the implementation of SAP, streamlining operations and enhancing data integrity.

- •Analyzed financial discrepancies and effectively resolved issues, helping maintain a balanced ledger consistently.

- •Coordinated daily transaction postings, ensuring timely and accurate ledger updates for month-end closings.

- •Played a key role in audit preparation, maintaining documentation that resulted in a favorable audit outcome.

- •Resolved complex account discrepancies, contributing to a 10% reduction in outstanding balances within the quarter.

- •Facilitated training for new team members, which enhanced their understanding of general ledger processes and tools.

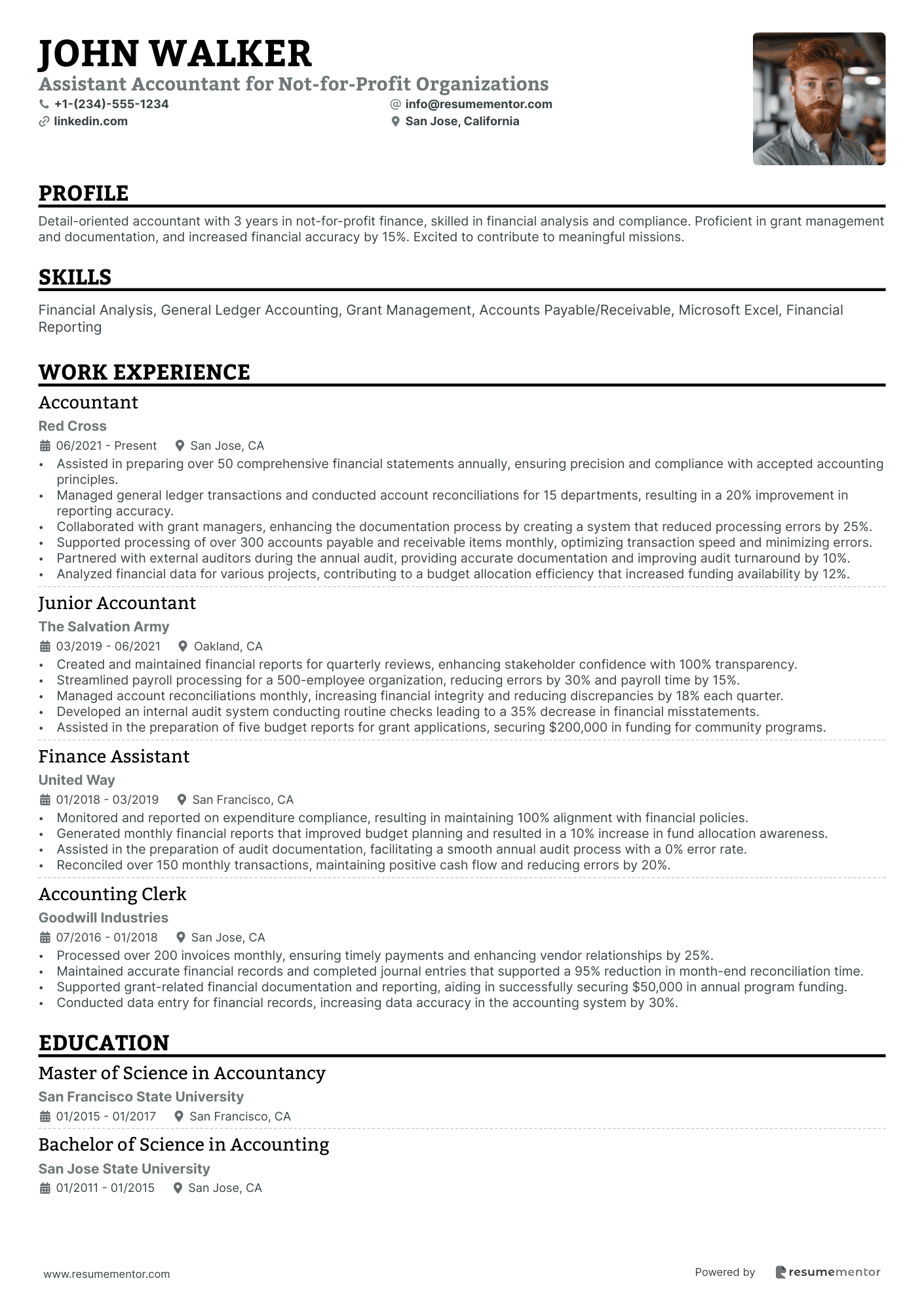

Assistant Accountant for Not-for-Profit Organizations resume sample

- •Assisted in preparing over 50 comprehensive financial statements annually, ensuring precision and compliance with accepted accounting principles.

- •Managed general ledger transactions and conducted account reconciliations for 15 departments, resulting in a 20% improvement in reporting accuracy.

- •Collaborated with grant managers, enhancing the documentation process by creating a system that reduced processing errors by 25%.

- •Supported processing of over 300 accounts payable and receivable items monthly, optimizing transaction speed and minimizing errors.

- •Partnered with external auditors during the annual audit, providing accurate documentation and improving audit turnaround by 10%.

- •Analyzed financial data for various projects, contributing to a budget allocation efficiency that increased funding availability by 12%.

- •Created and maintained financial reports for quarterly reviews, enhancing stakeholder confidence with 100% transparency.

- •Streamlined payroll processing for a 500-employee organization, reducing errors by 30% and payroll time by 15%.

- •Managed account reconciliations monthly, increasing financial integrity and reducing discrepancies by 18% each quarter.

- •Developed an internal audit system conducting routine checks leading to a 35% decrease in financial misstatements.

- •Assisted in the preparation of five budget reports for grant applications, securing $200,000 in funding for community programs.

- •Monitored and reported on expenditure compliance, resulting in maintaining 100% alignment with financial policies.

- •Generated monthly financial reports that improved budget planning and resulted in a 10% increase in fund allocation awareness.

- •Assisted in the preparation of audit documentation, facilitating a smooth annual audit process with a 0% error rate.

- •Reconciled over 150 monthly transactions, maintaining positive cash flow and reducing errors by 20%.

- •Processed over 200 invoices monthly, ensuring timely payments and enhancing vendor relationships by 25%.

- •Maintained accurate financial records and completed journal entries that supported a 95% reduction in month-end reconciliation time.

- •Supported grant-related financial documentation and reporting, aiding in successfully securing $50,000 in annual program funding.

- •Conducted data entry for financial records, increasing data accuracy in the accounting system by 30%.

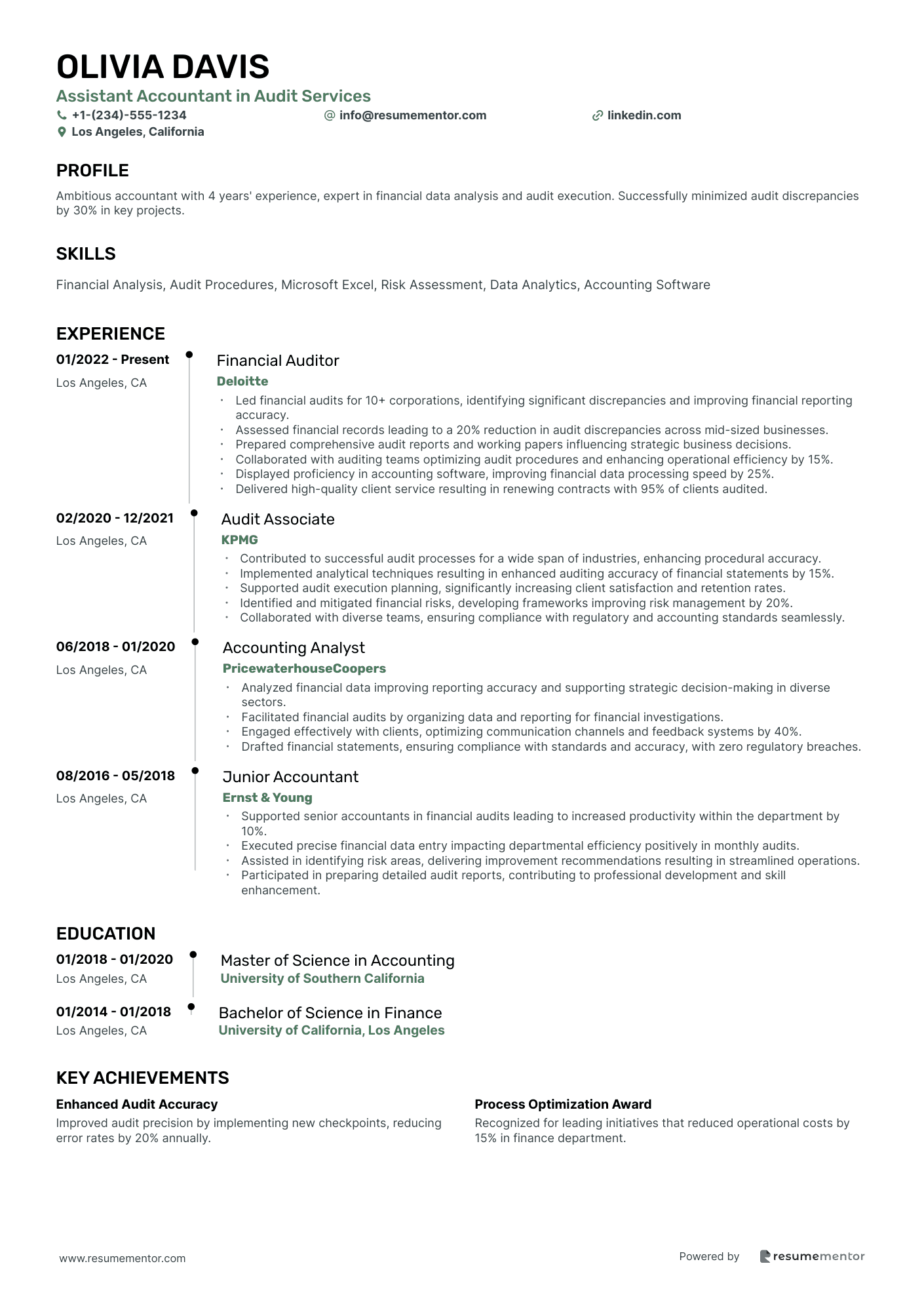

Assistant Accountant in Audit Services resume sample

- •Led financial audits for 10+ corporations, identifying significant discrepancies and improving financial reporting accuracy.

- •Assessed financial records leading to a 20% reduction in audit discrepancies across mid-sized businesses.

- •Prepared comprehensive audit reports and working papers influencing strategic business decisions.

- •Collaborated with auditing teams optimizing audit procedures and enhancing operational efficiency by 15%.

- •Displayed proficiency in accounting software, improving financial data processing speed by 25%.

- •Delivered high-quality client service resulting in renewing contracts with 95% of clients audited.

- •Contributed to successful audit processes for a wide span of industries, enhancing procedural accuracy.

- •Implemented analytical techniques resulting in enhanced auditing accuracy of financial statements by 15%.

- •Supported audit execution planning, significantly increasing client satisfaction and retention rates.

- •Identified and mitigated financial risks, developing frameworks improving risk management by 20%.

- •Collaborated with diverse teams, ensuring compliance with regulatory and accounting standards seamlessly.

- •Analyzed financial data improving reporting accuracy and supporting strategic decision-making in diverse sectors.

- •Facilitated financial audits by organizing data and reporting for financial investigations.

- •Engaged effectively with clients, optimizing communication channels and feedback systems by 40%.

- •Drafted financial statements, ensuring compliance with standards and accuracy, with zero regulatory breaches.

- •Supported senior accountants in financial audits leading to increased productivity within the department by 10%.

- •Executed precise financial data entry impacting departmental efficiency positively in monthly audits.

- •Assisted in identifying risk areas, delivering improvement recommendations resulting in streamlined operations.

- •Participated in preparing detailed audit reports, contributing to professional development and skill enhancement.

Creating an assistant accountant resume is like balancing a financial spreadsheet—every detail has its place. As an assistant accountant, your knack for accuracy and analysis are your key strengths, yet putting these onto paper can be challenging. This challenge becomes even more pronounced when you need to balance showcasing your financial skills with your interpersonal abilities.

Your resume acts as your first impression, helping potential employers quickly understand your ability to manage data, assist with audits, and support decision-making. Without a clear structure, however, these strengths might not stand out as they should. This is where a well-designed resume template becomes invaluable. It helps ensure professionalism and readability, allowing your unique skills to shine. Explore resume templates to show what you bring to the table convincingly.

Presenting your experience in a way that conveys both competence and confidence is key. By using an industry-standard layout, you make sure every section works for you. When you highlight your proficiency with accounting software or your contributions to financial reporting, a clear format enhances the impact of these achievements.

Connecting with the right job fit is part of your professional journey, and your resume is a crucial step in that journey. With the right tools and structure, you can craft a compelling narrative that truly represents who you are and where your talents lie.

Key Takeaways

- Creating an assistant accountant resume requires balancing detailed financial skills and interpersonal abilities.

- A well-structured resume helps highlight your ability to manage data and support decision-making effectively.

- Using an industry-standard layout and format ensures clarity and enhances the impact of your achievements.

- The reverse-chronological format showcases your most recent skills and experiences prominently.

- Including sections like education, certifications, and extra skills enriches your profile and adds to your credibility.

What to focus on when writing your assistant accountant resume

An assistant accountant resume is your gateway to showcasing your expertise in managing financial tasks while demonstrating your keen attention to detail. Your resume should seamlessly communicate your capability in overseeing financial records, supporting daily operations, and delivering accurate reports. Presenting your skills and experiences in a well-organized format helps recruiters and ATS systems easily recognize your qualifications.

How to structure your assistant accountant resume

- Contact Information — This essential section should include your full name, phone number, email, and LinkedIn profile to facilitate easy communication. Always use a professional email address to maintain a polished first impression, as it sets the tone for the rest of your resume.

- Professional Summary — This snapshot of your career should capture your accounting experience succinctly, emphasizing key strengths like your expertise in bookkeeping, proficiency in QuickBooks, and strong analytical skills. This introduction creates a coherent picture of your professional abilities, paving the way for the detailed sections that follow.

- Work Experience — This is where you build upon the foundation set by your summary, detailing previous roles that highlight your involvement in critical accounting activities. Tasks such as financial data entry, invoice processing, and contributing to month-end closures illustrate your practical experience and ability to handle the responsibilities of the position adeptly.

- Education — Your educational background further strengthens your candidacy by listing your degree in accounting or finance, including the institution name, degree, and graduation date. Adding relevant coursework, such as "Principles of Accounting" or "Financial Analysis," provides additional context for your academic skills and their application to your professional life.

- Skills — This section is crucial for showcasing specific proficiencies vital in accounting roles. Highlighting your Excel proficiency, familiarity with tax regulations, and expertise in financial reporting cements your capability to excel in a rigorous accounting environment.

- Certifications — Mentioning certifications such as CPA eligibility or QuickBooks certification adds substantial value, demonstrating your dedication to ongoing professional development and your preparedness to meet industry standards.

As we transition to resume format, which we'll dive into more deeply below, each section of your resume needs to be crafted with layered detail, ensuring that it fully supports your journey to securing an assistant accountant position.

Which resume format to choose

To craft an effective assistant accountant resume, start by using the reverse-chronological format. This structure is particularly beneficial because it prioritizes your most recent and relevant experiences, immediately highlighting your growth and expertise in the field. Potential employers can quickly see how your skills have developed over time, which can be crucial in the accounting industry where precision and experience matter.

When selecting a font, opt for modern choices like Rubik, Lato, or Montserrat. These fonts not only enhance readability but also lend a contemporary feel to your resume. This subtle modern touch can help differentiate your application, suggesting that you're up-to-date with current trends, even in something as simple as document design, which reflects well on your attention to detail.

Saving your resume as a PDF is essential. This file type ensures that your carefully designed format remains consistent across all platforms, preventing any unexpected distortions. Consistency in presentation is key in accounting roles, where precision is paramount, so presenting a neatly organized resume shows that you value these qualities.

Pay attention to the margins on your resume, setting them to 1 inch on all sides. This design choice creates a clean and organized look, underscoring your ability to maintain order—an important trait in accounting. Proper spacing and layout can make a significant difference in how your qualifications are perceived, drawing the reader's eye to the most important information without clutter or distraction.

By carefully considering these aspects—formatting, fonts, filetype, and margins—you ensure that every element of your resume works together to present you as a competent and detail-oriented assistant accountant.

How to write a quantifiable resume experience section

The experience section makes your assistant accountant resume come to life by showcasing your accomplishments and responsibilities from past roles. Employers are eager to see the impact you’ve made, so focus on achievements rather than just listing duties. Begin with your most recent job at the top, following a reverse chronological order. It’s best to include experiences from the last 10-15 years that highlight your expertise in accounting. Clearly defined job titles help recruiters quickly see how your background aligns with the role you’re applying for. Tailoring each resume application ensures your experience aligns with the job ad’s requirements. Strong action words will make your achievements stand out, using terms like “managed,” “implemented,” “increased,” and “streamlined” to convey initiative and impact.

- •Reduced month-end closing process by 20% by streamlining reconciliation procedures.

- •Implemented a new invoicing system, cutting processing time by 30% and minimizing late payments.

- •Collaborated with the finance team to identify cost-saving opportunities, resulting in an annual savings of $50,000.

- •Maintained accuracy in accounts payable/receivable, consistently achieving a 98% accuracy rate.

This experience section stands out by highlighting achievements with concrete numbers, turning general tasks into powerful stories of success. Each bullet point connects a specific accomplishment to a tangible outcome, letting potential employers see the value you bring. By using dynamic action words, you effectively demonstrate a proactive approach, transforming everyday responsibilities into notable achievements. Tailoring the content to the job’s requirements ensures a precise alignment with what employers are looking for in an assistant accountant. By focusing on accomplishments and relevant experiences, you create a compelling case that emphasizes your fit for the role and connects with what hiring managers need to see.

Industry-Specific Focus resume experience section

A financial-focused assistant accountant resume experience section should clearly showcase your relevant experiences and skills in the field. Start by detailing the positions you’ve held, emphasizing the responsibilities where you've made an impact. Each bullet point should connect to a specific accounting task or achievement, allowing employers to quickly grasp your expertise. Continue by customizing each section to align with the job you’re applying for, demonstrating how your past roles have prepared you to excel.

Using simple language, illustrate your proficiency with specific accounting software and financial reports, while providing context through company or team details. By focusing on measurable achievements, such as reducing errors or enhancing efficiency, you create a vivid picture of your contributions. Keep your descriptions concise, centering on your impact and the resulting outcomes of your efforts.

Assistant Accountant

XYZ Retail Co.

June 2018 - Present

- Managed accounts payable and receivable for a mid-sized retail company, ensuring timely payments and reconciliations.

- Implemented a new bookkeeping system, reducing data entry errors by 20%.

- Prepared monthly financial statements and reports for management, increasing accuracy and delivery speed by 30%.

- Assisted in developing budget forecasts, leading to a 10% reduction in operational costs.

Project-Focused resume experience section

A project-focused assistant accountant resume experience section should clearly outline the specific projects you've been involved in while emphasizing your contributions and achievements. Begin by highlighting the main focus of each project and offering a detailed account of your role. Be sure to include the timeline and specific aspects of the projects that stand out, such as unique tasks or challenges faced. By showcasing quantifiable outcomes like cost reductions or increased efficiency, you illustrate your ability to manage and execute tasks effectively.

To ensure clarity and readability, use a consistent format that includes the dates, your role, and the organization you worked with for each project. Utilize bullet points to make your accomplishments easily identifiable, dedicating each point to a specific achievement or task. Add context with details about the tools used, results achieved, or the size of your team. This structured approach provides a comprehensive view of your skills, painting a clear picture of your experience in handling accounting projects.

Assistant Accountant

Tech Solutions Inc.

June 2022 - March 2023

- Reduced project costs by 15% through thorough analysis and budget reallocation.

- Streamlined reporting processes, cutting preparation time in half and increasing accuracy.

- Coordinated a cross-departmental team to ensure accurate tracking of expenses and compliance.

- Implemented a new accounting software system that improved project data accessibility by 25%.

Efficiency-Focused resume experience section

A resume experience section focused on efficiency for an assistant accountant should clearly demonstrate your impact on streamlining processes and saving resources. Start by highlighting your ability to identify areas that need improvement and the proactive steps you took to enhance efficiency. Connect these improvements to concrete results, such as decreasing processing times, increasing accuracy, or cutting costs, to illustrate the value of your efforts. Use vivid, active language to detail your role in implementing changes and how these improvements benefited your team or organization.

Each bullet point should start with a strong action verb to convey your accomplishments clearly. Instead of vague descriptions, provide specific details about your contributions. Align these experiences with the job description by focusing on the most relevant skills and achievements. Substantiate your accomplishments with figures or percentages to further emphasize their impact. Keeping your descriptions concise ensures your resume remains focused and powerful.

Assistant Accountant

FinTech Solutions Inc.

June 2020 - Present

- Reduced data entry errors by 20% through implementing an automated reconciliation system.

- Shortened month-end closing process by 3 days by streamlining data consolidation procedures.

- Decreased invoice processing time by 30%, optimizing vendor payment cycles.

- Saved the company $5,000 annually by improving budget tracking methods.

Customer-Focused resume experience section

A customer-focused assistant accountant resume experience section should highlight achievements and responsibilities that demonstrate your commitment to client satisfaction. Begin by clearly stating your job title, workplace, and dates of employment to set the context. Use bullet points to detail specific duties and accomplishments, focusing on how your interactions with customers and problem-solving skills positively impacted the team or company.

Emphasize your proactive approach by sharing examples of how you resolved issues or enhanced customer satisfaction, backed by data or feedback to highlight these successes. Show that your role involved more than number-crunching by illustrating how you helped streamline processes, reduce errors, or drive company growth. Use clear and concise language so that each point seamlessly contributes to the overall narrative.

Assistant Accountant

XYZ Financial Services

June 2020 - Present

- Cut invoice errors by 15% through careful data checks, boosting client satisfaction.

- Set up a tracking system that reduced client response times by 20%.

- Managed monthly reconciliation with zero discrepancies, building team trust.

- Supported the delivery of financial reports that increased client engagement.

Write your assistant accountant resume summary section

A skills-focused assistant accountant resume summary should effectively showcase what makes you stand out to hiring managers. Begin by stating your role and how long you’ve been working in the field. Emphasize the specific skills that align with the job you’re targeting, highlighting your strengths in a concise way. Consider this summary example:

This summary is effective because it presents your experience upfront and highlights your proficiency with key financial tools, linking them to practical achievements. By showcasing specific accomplishments, such as managing monthly reconciliations, you demonstrate your ability to handle critical tasks. Crafting your own summary this way keeps the focus on your achievements and skills.

Understanding how a resume summary differs from other sections is important. Unlike a resume objective, which often states career goals for newbies, a summary emphasizes your expertise and past successes. A resume profile might tell the longer story of your career, and a summary of qualifications lists key skills. The resume summary, however, captures your unique contributions in a compact, powerful paragraph that stands out in your job search. This clarity makes it an essential part of your application strategy.

Listing your assistant accountant skills on your resume

A skills-focused assistant accountant resume should effectively highlight your capabilities through a well-structured skills section. This section can be a standalone feature or seamlessly integrated into your experience and summary areas, ensuring employers quickly grasp your strengths. Emphasizing soft skills, like communication and teamwork, demonstrates how well you collaborate with others, while showcasing your hard skills proves your technical expertise in areas like accounting software and financial analysis.

By weaving these skills and strengths throughout your resume, you'll make it more appealing to both hiring managers and applicant tracking systems (ATS). Incorporating relevant keywords can significantly boost your visibility and increase your chances of landing an interview.

Here's an example of a standalone skills section formatted in JSON:

This list is impactful because it strikes a balance between hard and soft skills essential for an assistant accountant. Every skill connects directly to job requirements, allowing employers to quickly gauge your fit for the role. Highlighting specific tools, like Microsoft Excel, underscores your technical proficiency, while attention to detail reinforces critical soft skills.

Best hard skills to feature on your assistant accountant resume

Communicating your hard skills effectively on your resume is important because they demonstrate your technical knowledge and capability to handle job-specific tasks efficiently. Consider highlighting these hard skills:

Hard Skills

- Proficiency in Microsoft Excel

- Experience with accounting software like QuickBooks

- Expertise in financial reporting

- Knowledge of bookkeeping

- Skills in budgeting and forecasting

- Ability to analyze data

- Experience with tax preparation and filing

- Understanding of financial regulations and compliance

- Account reconciliation know-how

- Invoice processing experience

- Managing payroll

- Performing cash flow analyses

- Maintaining general ledger knowledge

- Conducting auditing processes

- Proficiency in accounts payable and receivable

Best soft skills to feature on your assistant accountant resume

In addition, showcasing your soft skills is essential as they highlight your interpersonal qualities and ability to work effectively with others. These are the traits employers highly value. Consider emphasizing these soft skills:

Soft Skills

- Keen attention to detail

- Strong communication skills

- Effective problem-solving

- Teamwork and collaboration

- Efficient time management

- Excellent organizational skills

- Adaptability and flexibility

- Critical thinking ability

- A strong work ethic

- Honesty and integrity

- Active listening skills

- Emotional intelligence

- Stress management capabilities

- Proficient multitasking

- Dependability and reliability

How to include your education on your resume

An education section plays a crucial role in your resume, especially when applying for the role of an assistant accountant. Tailor this section to the specific job by listing only relevant education. Avoid including unrelated degrees or courses. For instance, if you have specialized qualifications in accounting, feature those prominently. If you decide to include your GPA and it's an impressive figure (generally 3.5 or above), showcase it. Similarly, honors like cum laude should be highlighted. When listing your degree, start with the title, followed by the institution and completion date.

Here’s how to format this information correctly and incorrectly:

Now, see how an outstanding assistant accountant education section should look:

- •Graduated cum laude

The second example excels by focusing on relevant details like the Accounting degree, highlighting a strong GPA, and listing honors like cum laude. It avoids unnecessary details, sticking to what's relevant to the assistant accountant role.

How to include assistant accountant certificates on your resume

Including a certificates section on your assistant accountant resume is crucial. It highlights your qualifications and proves your expertise. Start by listing the name of the certificate. Include the date when you obtained it. Add the issuing organization to provide authenticity. Ensure the information is clear and concise.

You can also include certificates in the header. For instance, list CPA, Microsoft Excel Certification next to your name. This makes it stand out and shows your qualifications at a glance.

Here is an example of a standalone certificates section:

This example is good because it includes relevant certifications for an assistant accountant. It shows your professional development and skills. The section is straightforward and easy to read. Listing the organization adds credibility to your qualifications. This setup clearly communicates your credentials to potential employers.

Extra sections to include in your assistant accountant resume

Crafting a standout resume requires attention to detail and the inclusion of sections that highlight your diverse skills and experiences. As an assistant accountant, it’s crucial to showcase not only your technical skills but also other attributes that can set you apart.

- Language section—List any languages you speak fluently, like Spanish or Mandarin, to show your ability to communicate with a wider range of clients. This can give you an edge in today's globalized job market.

- Hobbies and interests section—Mention activities like playing chess or participating in marathons to show that you have discipline and strategic thinking. This section helps employers see that you're a well-rounded individual.

- Volunteer work section—Highlight any unpaid work, such as assisting with community tax preparation, to show your dedication to helping others. This demonstrates your commitment to contributing positively to society.

- Books section—Share titles of accounting or business books you’ve read, such as "Rich Dad Poor Dad" or "The Intelligent Investor." This shows that you are invested in continuous learning and personal growth.

By adding these sections to your resume, you enrich your profile and make it more appealing to potential employers. This multifaceted approach helps you stand out in a competitive job market. It also gives hiring managers a fuller picture of who you are beyond just your work experience.

In Conclusion

In conclusion, your resume is a critical piece in your job search, acting as a bridge to your next professional opportunity as an assistant accountant. It is essential to create a document that not only lists your skills and experiences but also highlights your unique strengths. Remember, clarity and precision are key. Utilize the reverse-chronological format to ensure your most relevant experiences are front and center, and don't forget to choose modern, readable fonts to keep your resume looking fresh and professional.

Saving your resume as a PDF ensures it stays in top form, no matter where it's viewed. Paying attention to margins and layout also helps keep your presentation clean and organized. By integrating quantifiable achievements throughout your experience sections, you build a compelling narrative of your professional contributions. Whether your background is centered on efficiency, customer focus, or financial projects, highlighting your successes with concrete examples will make a notable impact.

Incorporate both hard and soft skills to paint a comprehensive picture of your capabilities. Don't overlook the personal touches, like extracurricular interests or volunteer work, which can set you apart in a sea of applicants. Certifications and education should be clearly stated, emphasizing their relevancy to the role. Finally, don't underestimate the power of a crisp, compelling resume summary—it's often the first thing employers see, so make it count. With a well-crafted resume, you're equipped to present yourself as a standout candidate ready to excel in the field of accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.