Assistant Finance Director Resume Examples

Jul 18, 2024

|

12 min read

Mastering your assistant finance director resume: ensure your skills make cents in the finance world. Learn how to highlight your expertise and experience to land the role you deserve.

Rated by 348 people

Assistant Director of Financial Planning

Assistant Finance Director - Risk Management

Assistant Director of Finance and Investments

Assistant Finance Director - Financial Analysis

Assistant Finance Director - Mergers and Acquisitions

Assistant Finance Director – Budgeting

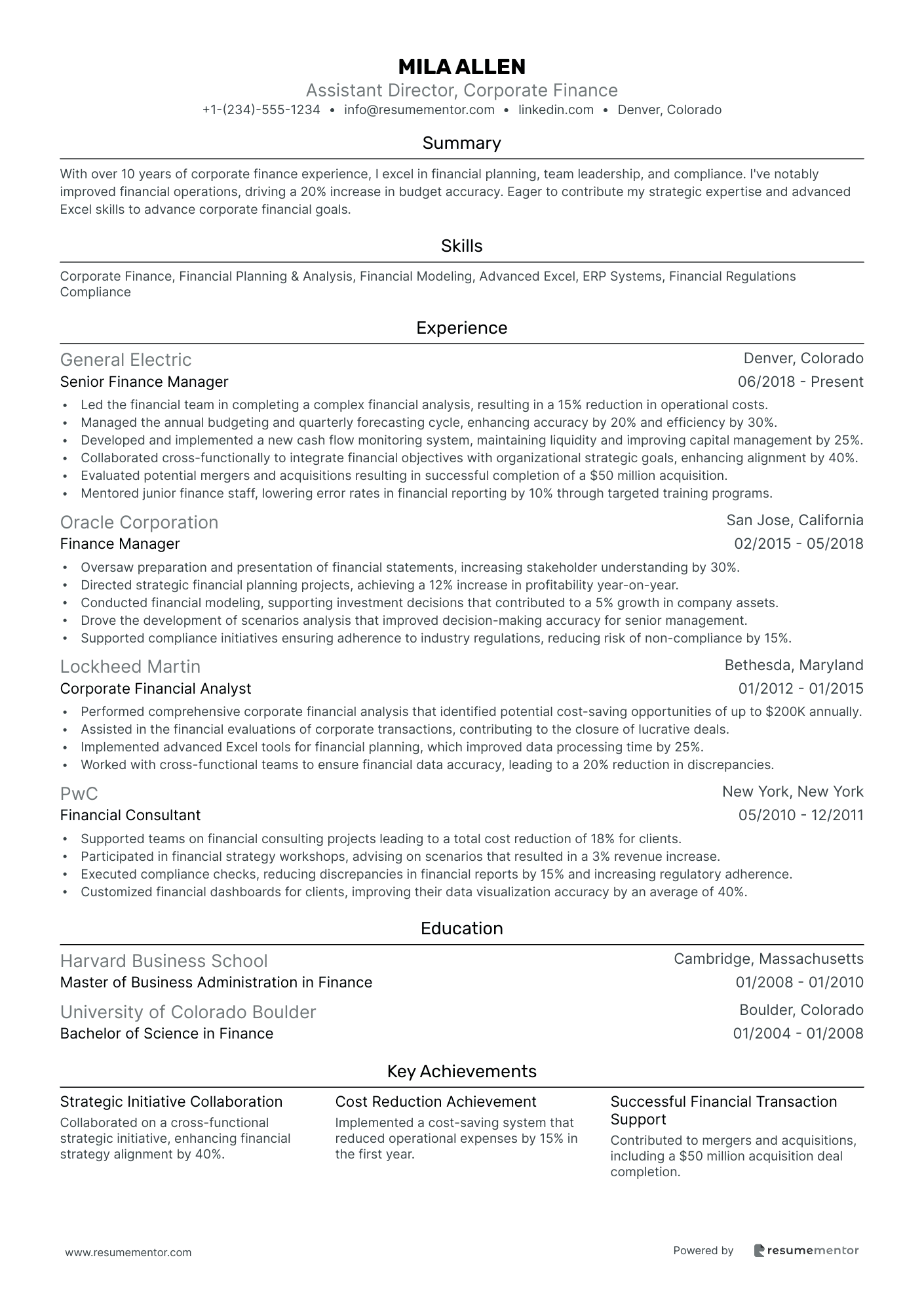

Assistant Director, Corporate Finance

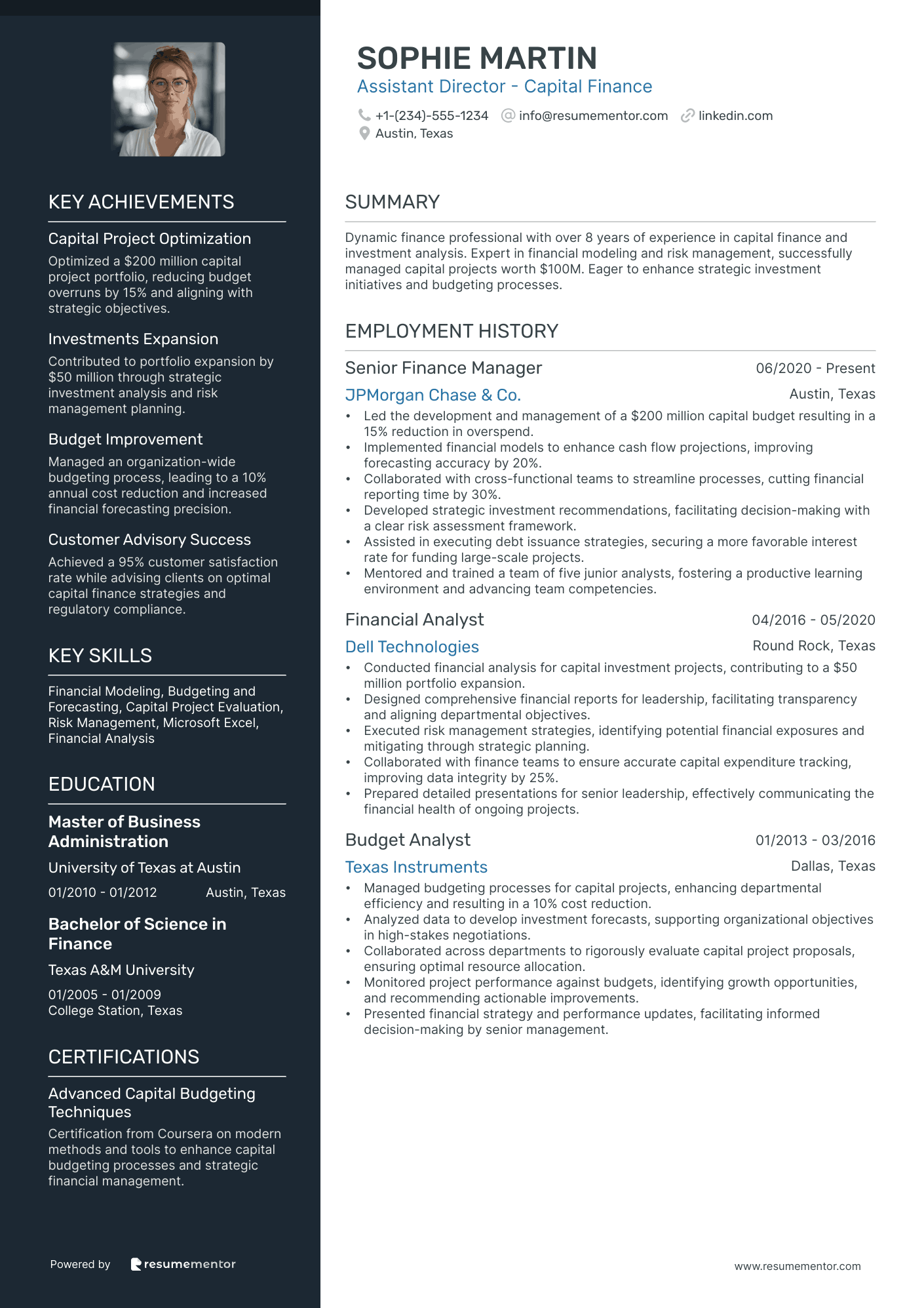

Assistant Director - Capital Finance

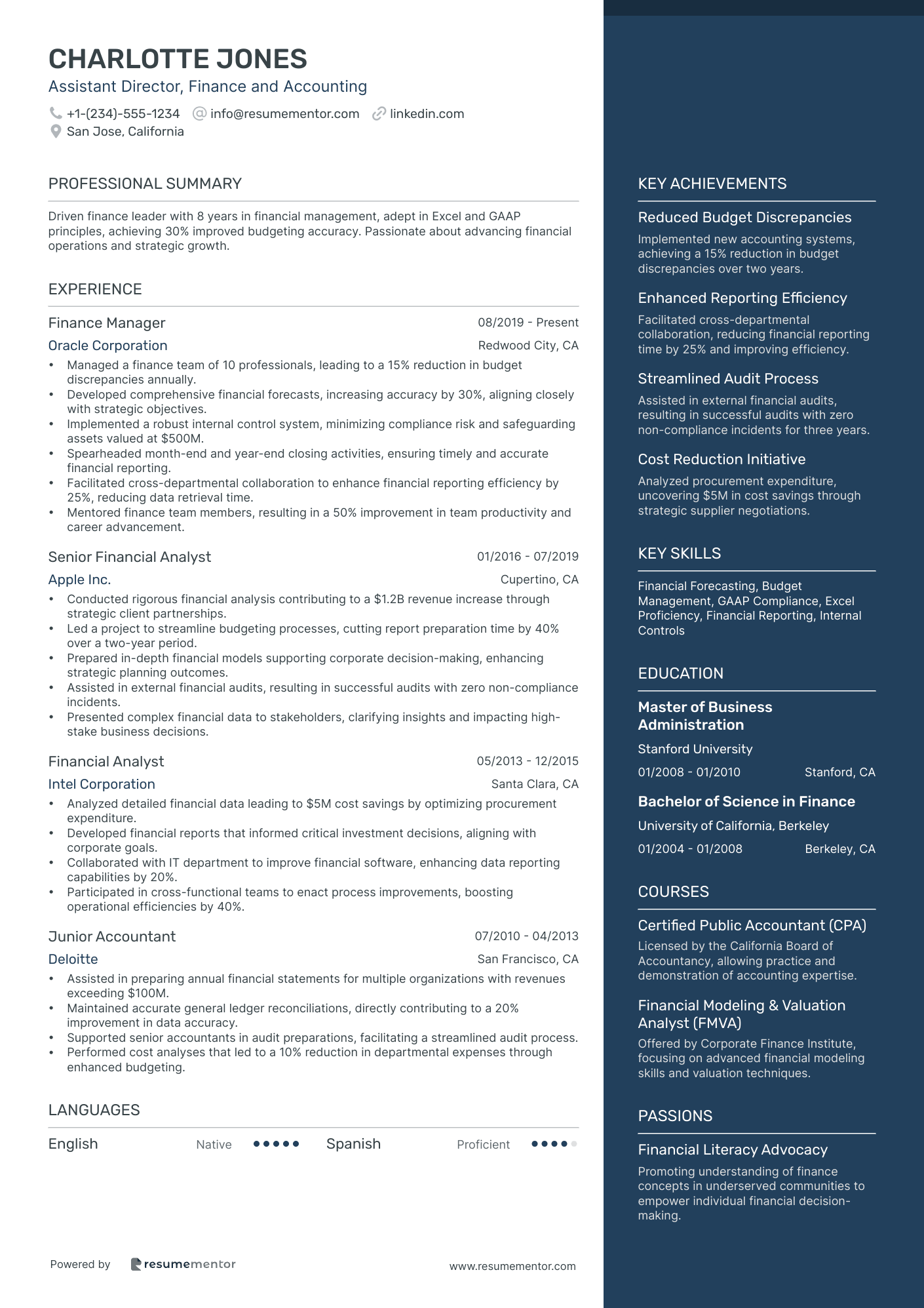

Assistant Director, Finance and Accounting

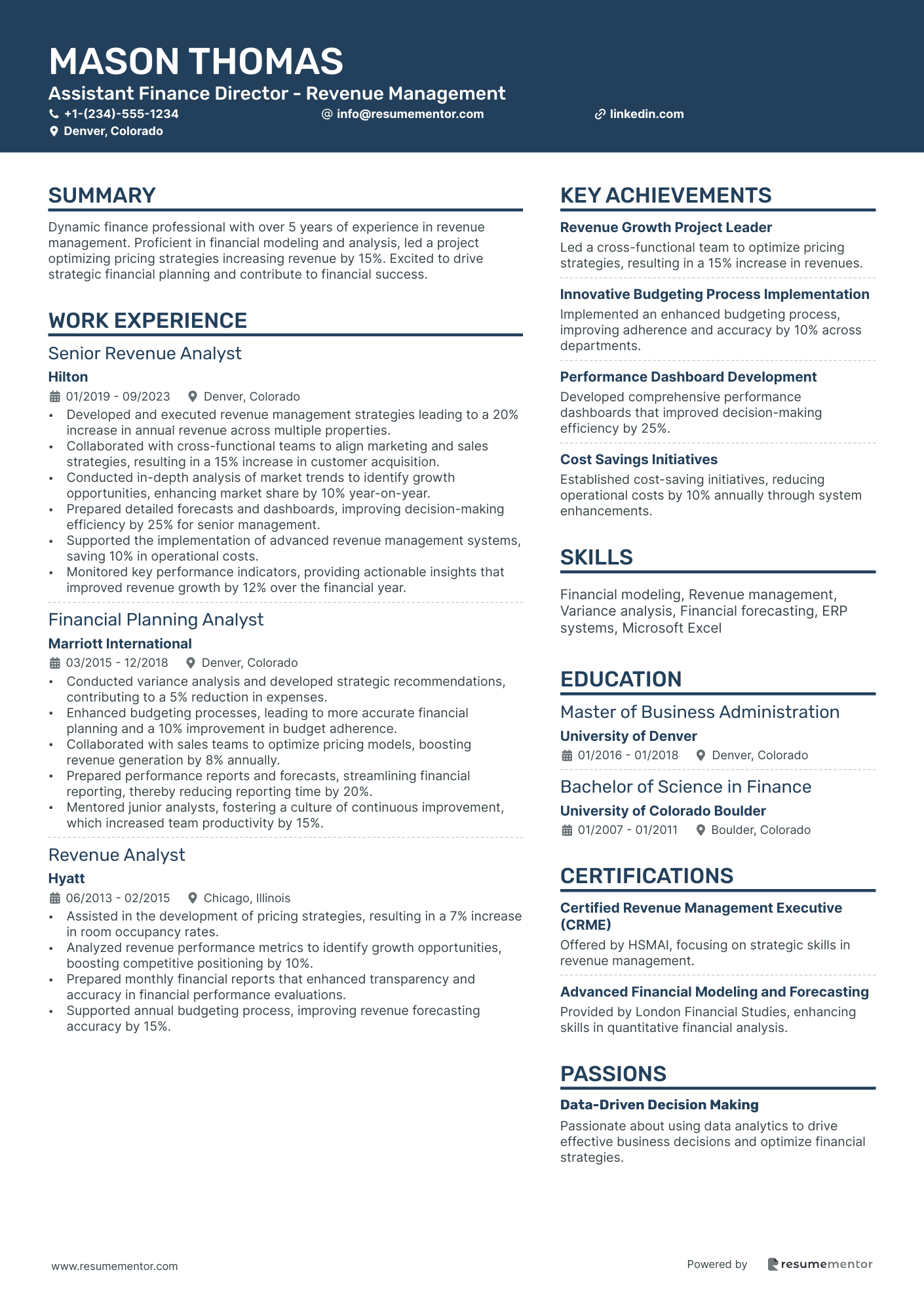

Assistant Finance Director - Revenue Management

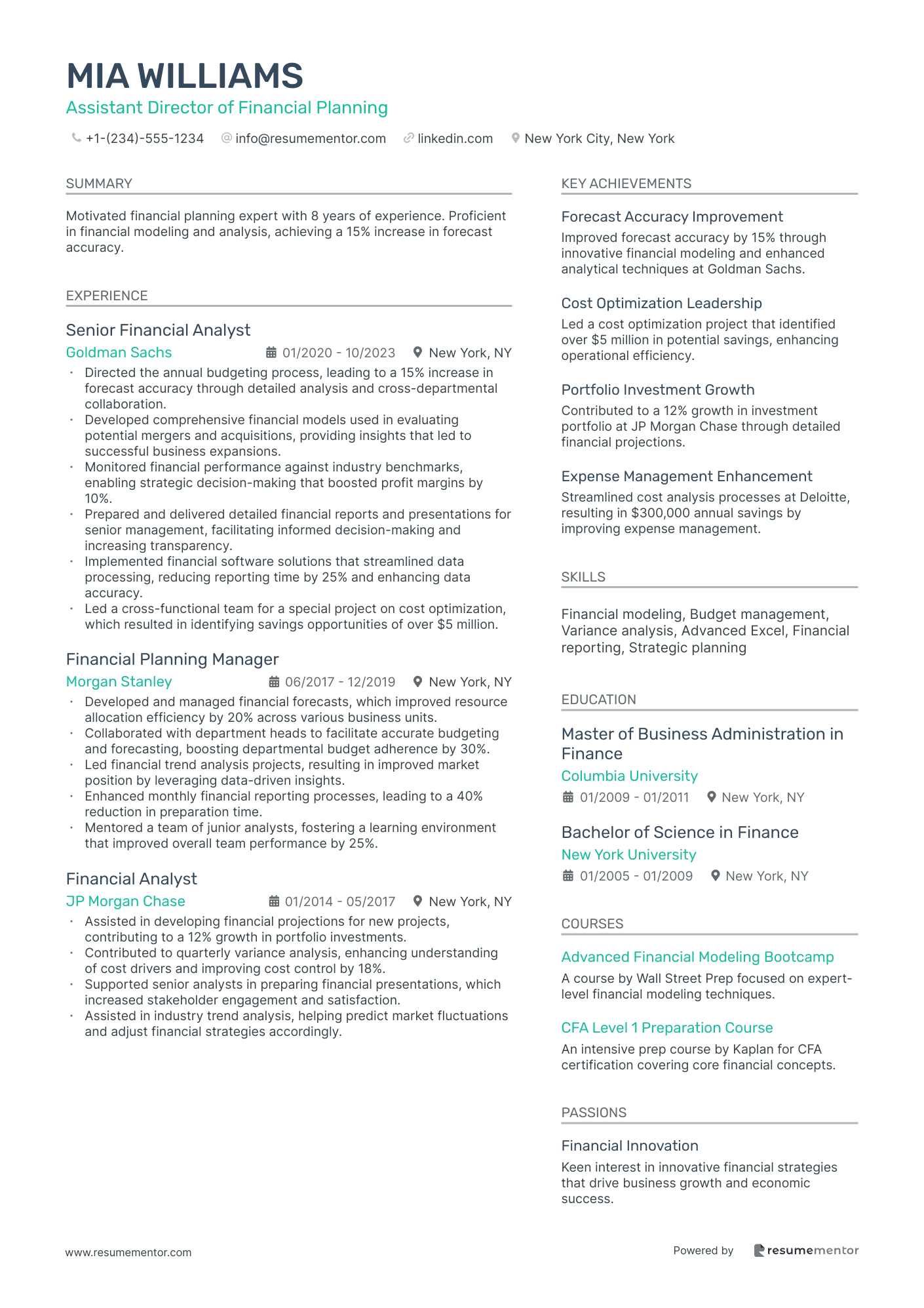

Assistant Director of Financial Planning resume sample

- •Directed the annual budgeting process, leading to a 15% increase in forecast accuracy through detailed analysis and cross-departmental collaboration.

- •Developed comprehensive financial models used in evaluating potential mergers and acquisitions, providing insights that led to successful business expansions.

- •Monitored financial performance against industry benchmarks, enabling strategic decision-making that boosted profit margins by 10%.

- •Prepared and delivered detailed financial reports and presentations for senior management, facilitating informed decision-making and increasing transparency.

- •Implemented financial software solutions that streamlined data processing, reducing reporting time by 25% and enhancing data accuracy.

- •Led a cross-functional team for a special project on cost optimization, which resulted in identifying savings opportunities of over $5 million.

- •Developed and managed financial forecasts, which improved resource allocation efficiency by 20% across various business units.

- •Collaborated with department heads to facilitate accurate budgeting and forecasting, boosting departmental budget adherence by 30%.

- •Led financial trend analysis projects, resulting in improved market position by leveraging data-driven insights.

- •Enhanced monthly financial reporting processes, leading to a 40% reduction in preparation time.

- •Mentored a team of junior analysts, fostering a learning environment that improved overall team performance by 25%.

- •Assisted in developing financial projections for new projects, contributing to a 12% growth in portfolio investments.

- •Contributed to quarterly variance analysis, enhancing understanding of cost drivers and improving cost control by 18%.

- •Supported senior analysts in preparing financial presentations, which increased stakeholder engagement and satisfaction.

- •Assisted in industry trend analysis, helping predict market fluctuations and adjust financial strategies accordingly.

- •Participated in budget preparation processes resulting in a more accurate financial planning cycle.

- •Performed detailed cost analysis, leading to improved expense management and savings of $300,000 annually.

- •Involved in developing financial reports for review, enhancing the accuracy of financial insights for decision-making.

- •Engaged in cross-departmental projects, supporting integration of financial information that aligned with strategic goals.

Assistant Finance Director - Risk Management resume sample

- •Developed and executed comprehensive risk management strategies, reducing financial risks by 25% and ensuring compliance with regulatory standards.

- •Conducted detailed financial analysis and forecasting, identifying potential risks and presenting actionable insights to senior management.

- •Streamlined risk assessment processes by implementing new software, leading to a 30% increase in efficiency of risk reporting.

- •Facilitated inter-departmental workshops, enhancing risk awareness and improving cross-departmental communication by 20%.

- •Collaborated with auditors during compliance reviews, successfully minimizing audit-related issues by 15%.

- •Led financial risk assessment projects, resulting in enhanced risk mitigation strategies which saved $2 million annually.

- •Established risk management frameworks in collaboration with cross-functional teams, improving the organization's risk profile significantly.

- •Prepared comprehensive risk management reports, which were instrumental in strategic decision-making for the Board of Directors.

- •Regularly interfaced with high-level stakeholders to communicate complex risk and financial analyses clearly and effectively.

- •Optimized financial planning processes by 18% by integrating risk considerations into budget forecasting and operational planning.

- •Assessed financial data and risk analytics, contributing to the identification of emerging risks and the recommendation of mitigation tactics.

- •Managed and interpreted data requiring differentiation among comparable variables to ascertain the financial health of operations.

- •Supported risk management strategies through detailed analysis that improved cost efficiency by 12% over a fiscal year.

- •Worked on compliance projects in alignment with financial regulations, minimizing potential fines by ensuring strict adherence.

- •Coordinated financial analysis and reporting for strategic projects, resulting in enhanced risk assessment capabilities.

- •Assisted in the automation of financial workflows and reporting tools, improving data accuracy by 15%.

- •Conducted and participated in workshops that trained over 100 staff members on risk awareness and financial compliance.

- •Played a pivotal role in the preparation of annual financial statements, ensuring all risk elements were comprehensively covered.

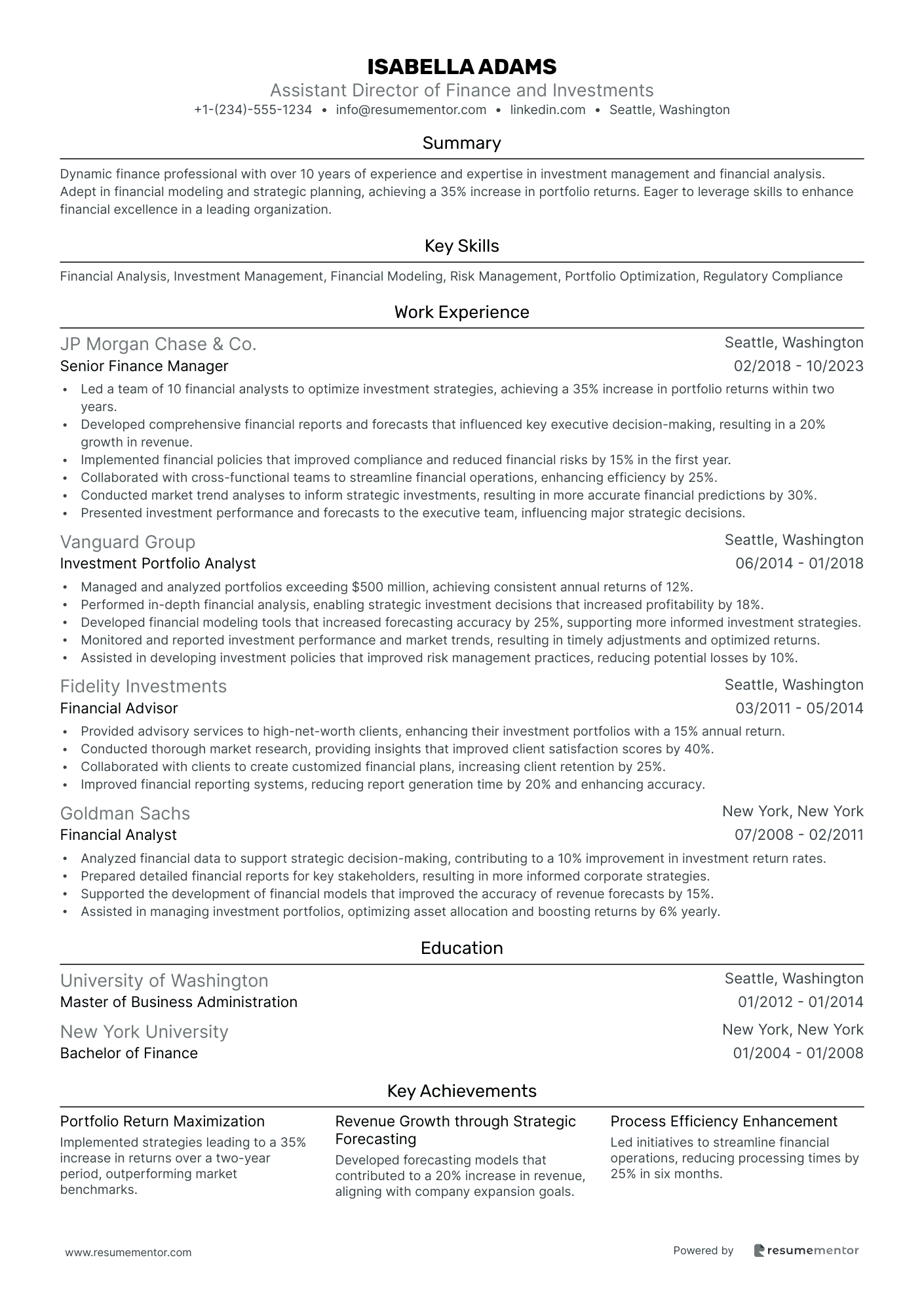

Assistant Director of Finance and Investments resume sample

- •Led a team of 10 financial analysts to optimize investment strategies, achieving a 35% increase in portfolio returns within two years.

- •Developed comprehensive financial reports and forecasts that influenced key executive decision-making, resulting in a 20% growth in revenue.

- •Implemented financial policies that improved compliance and reduced financial risks by 15% in the first year.

- •Collaborated with cross-functional teams to streamline financial operations, enhancing efficiency by 25%.

- •Conducted market trend analyses to inform strategic investments, resulting in more accurate financial predictions by 30%.

- •Presented investment performance and forecasts to the executive team, influencing major strategic decisions.

- •Managed and analyzed portfolios exceeding $500 million, achieving consistent annual returns of 12%.

- •Performed in-depth financial analysis, enabling strategic investment decisions that increased profitability by 18%.

- •Developed financial modeling tools that increased forecasting accuracy by 25%, supporting more informed investment strategies.

- •Monitored and reported investment performance and market trends, resulting in timely adjustments and optimized returns.

- •Assisted in developing investment policies that improved risk management practices, reducing potential losses by 10%.

- •Provided advisory services to high-net-worth clients, enhancing their investment portfolios with a 15% annual return.

- •Conducted thorough market research, providing insights that improved client satisfaction scores by 40%.

- •Collaborated with clients to create customized financial plans, increasing client retention by 25%.

- •Improved financial reporting systems, reducing report generation time by 20% and enhancing accuracy.

- •Analyzed financial data to support strategic decision-making, contributing to a 10% improvement in investment return rates.

- •Prepared detailed financial reports for key stakeholders, resulting in more informed corporate strategies.

- •Supported the development of financial models that improved the accuracy of revenue forecasts by 15%.

- •Assisted in managing investment portfolios, optimizing asset allocation and boosting returns by 6% yearly.

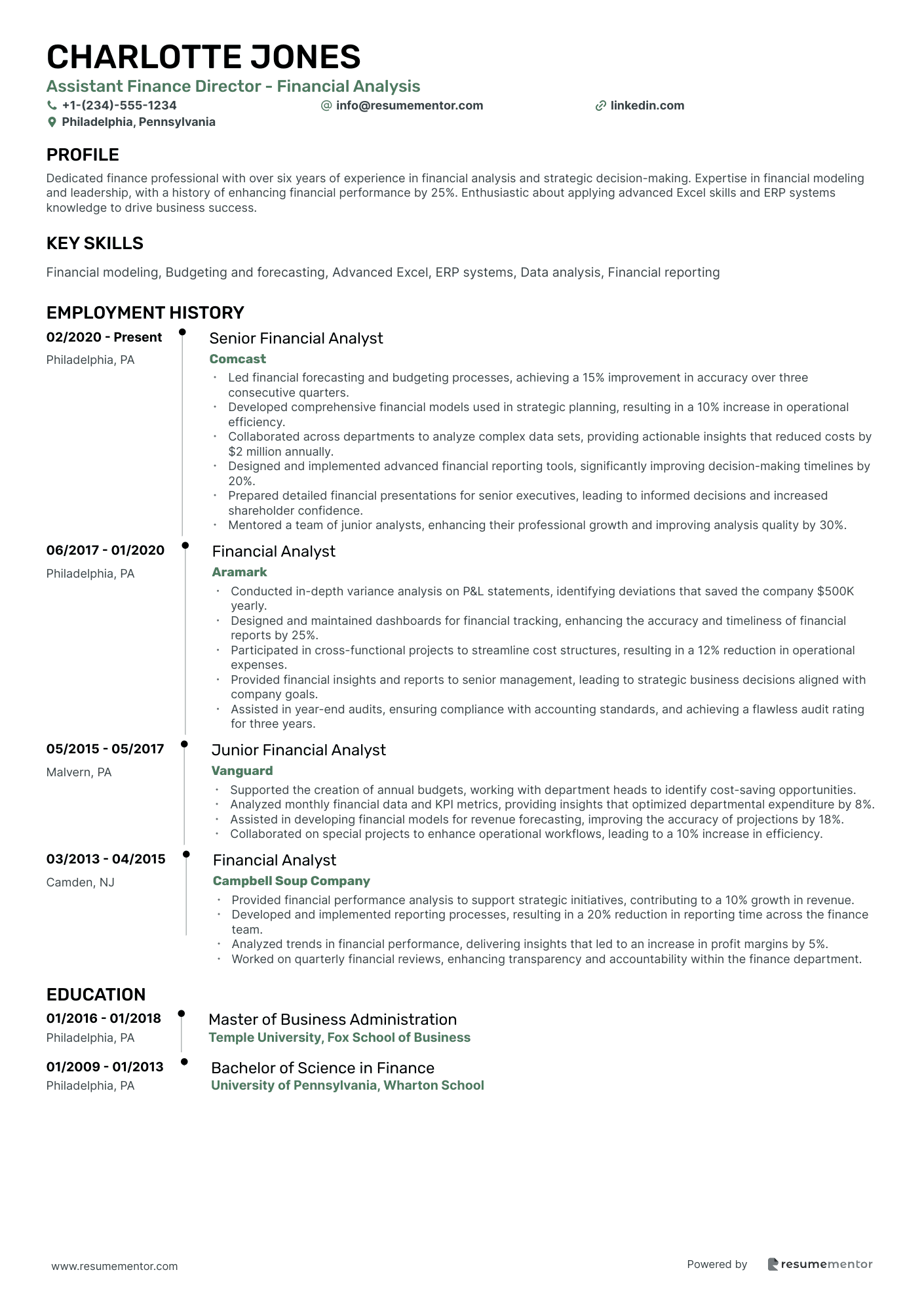

Assistant Finance Director - Financial Analysis resume sample

- •Led financial forecasting and budgeting processes, achieving a 15% improvement in accuracy over three consecutive quarters.

- •Developed comprehensive financial models used in strategic planning, resulting in a 10% increase in operational efficiency.

- •Collaborated across departments to analyze complex data sets, providing actionable insights that reduced costs by $2 million annually.

- •Designed and implemented advanced financial reporting tools, significantly improving decision-making timelines by 20%.

- •Prepared detailed financial presentations for senior executives, leading to informed decisions and increased shareholder confidence.

- •Mentored a team of junior analysts, enhancing their professional growth and improving analysis quality by 30%.

- •Conducted in-depth variance analysis on P&L statements, identifying deviations that saved the company $500K yearly.

- •Designed and maintained dashboards for financial tracking, enhancing the accuracy and timeliness of financial reports by 25%.

- •Participated in cross-functional projects to streamline cost structures, resulting in a 12% reduction in operational expenses.

- •Provided financial insights and reports to senior management, leading to strategic business decisions aligned with company goals.

- •Assisted in year-end audits, ensuring compliance with accounting standards, and achieving a flawless audit rating for three years.

- •Supported the creation of annual budgets, working with department heads to identify cost-saving opportunities.

- •Analyzed monthly financial data and KPI metrics, providing insights that optimized departmental expenditure by 8%.

- •Assisted in developing financial models for revenue forecasting, improving the accuracy of projections by 18%.

- •Collaborated on special projects to enhance operational workflows, leading to a 10% increase in efficiency.

- •Provided financial performance analysis to support strategic initiatives, contributing to a 10% growth in revenue.

- •Developed and implemented reporting processes, resulting in a 20% reduction in reporting time across the finance team.

- •Analyzed trends in financial performance, delivering insights that led to an increase in profit margins by 5%.

- •Worked on quarterly financial reviews, enhancing transparency and accountability within the finance department.

Assistant Finance Director - Mergers and Acquisitions resume sample

- •Led a team in the acquisition of 3 companies, increasing total assets by $200 million while ensuring financial alignment.

- •Developed comprehensive financial models that improved decision-making processes, resulting in a 15% increase in deal efficiency.

- •Collaborated with cross-functional teams to perform due diligence on over 10 acquisition targets, ensuring strategic alignment.

- •Enhanced stakeholder communication by creating presentations that articulated complex financial data to senior leadership.

- •Strengthened post-merger integrations by implementing strategies that boosted operational efficiency by 20%.

- •Maintained relationships with investment banks, driving successful transactions valued at $500 million.

- •Execited financial analysis for acquisitions totaling $150 million, leading to successful strategic expansions.

- •Managed valuation processes, leading to 10% more accurate forecasting, enhancing investment decisions.

- •Prepared 25 comprehensive market trend reports, identifying potential growth opportunities for strategic partnerships.

- •Streamlined processes with legal teams, reducing acquisition timeframes by 3 months.

- •Contributed to board presentations that supported M&A proposals valued at over $300 million.

- •Performed financial due diligence on potential acquisitions, influencing $50 million in beneficial transactions.

- •Provided insightful data analysis contributing to a 25% reduction in financial reporting errors.

- •Presented financial findings to senior managers, clarifying impacts of potential mergers and acquisitions.

- •Assisted in the integration of 2 acquired companies, achieving seamless finance function alignment.

- •Developed financial models for various scenarios, increasing management forecasting accuracy by 30%.

- •Identified optimization opportunities, resulting in the enhancement of internal financial processes by 15%.

- •Collaborated with teams to execute integration plans efficiently, completing projects 20% faster than historical averages.

- •Contributed to strategic planning discussions, improving the alignment with broader financial goals.

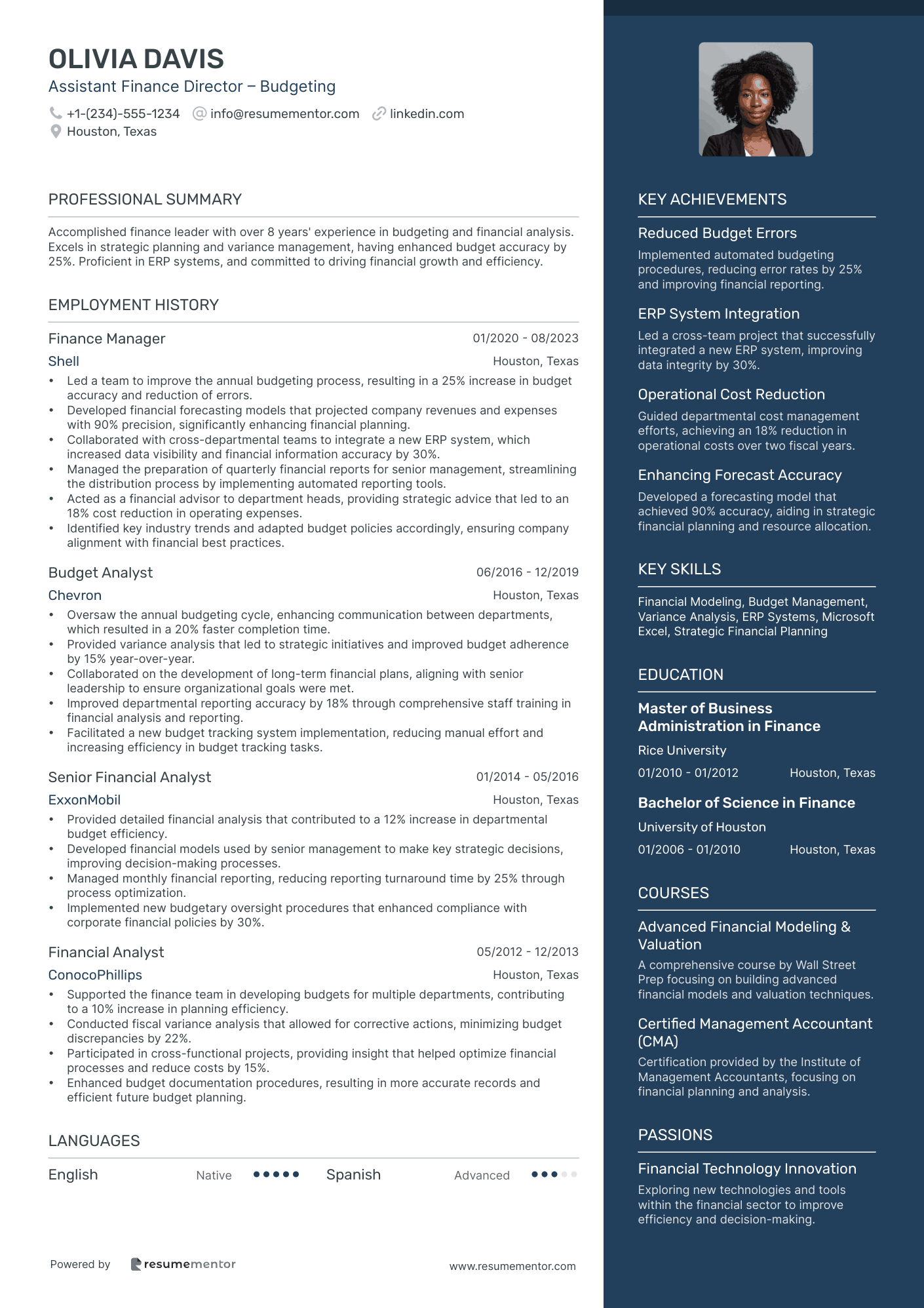

Assistant Finance Director – Budgeting resume sample

- •Led a team to improve the annual budgeting process, resulting in a 25% increase in budget accuracy and reduction of errors.

- •Developed financial forecasting models that projected company revenues and expenses with 90% precision, significantly enhancing financial planning.

- •Collaborated with cross-departmental teams to integrate a new ERP system, which increased data visibility and financial information accuracy by 30%.

- •Managed the preparation of quarterly financial reports for senior management, streamlining the distribution process by implementing automated reporting tools.

- •Acted as a financial advisor to department heads, providing strategic advice that led to an 18% cost reduction in operating expenses.

- •Identified key industry trends and adapted budget policies accordingly, ensuring company alignment with financial best practices.

- •Oversaw the annual budgeting cycle, enhancing communication between departments, which resulted in a 20% faster completion time.

- •Provided variance analysis that led to strategic initiatives and improved budget adherence by 15% year-over-year.

- •Collaborated on the development of long-term financial plans, aligning with senior leadership to ensure organizational goals were met.

- •Improved departmental reporting accuracy by 18% through comprehensive staff training in financial analysis and reporting.

- •Facilitated a new budget tracking system implementation, reducing manual effort and increasing efficiency in budget tracking tasks.

- •Provided detailed financial analysis that contributed to a 12% increase in departmental budget efficiency.

- •Developed financial models used by senior management to make key strategic decisions, improving decision-making processes.

- •Managed monthly financial reporting, reducing reporting turnaround time by 25% through process optimization.

- •Implemented new budgetary oversight procedures that enhanced compliance with corporate financial policies by 30%.

- •Supported the finance team in developing budgets for multiple departments, contributing to a 10% increase in planning efficiency.

- •Conducted fiscal variance analysis that allowed for corrective actions, minimizing budget discrepancies by 22%.

- •Participated in cross-functional projects, providing insight that helped optimize financial processes and reduce costs by 15%.

- •Enhanced budget documentation procedures, resulting in more accurate records and efficient future budget planning.

Assistant Director, Corporate Finance resume sample

- •Led the financial team in completing a complex financial analysis, resulting in a 15% reduction in operational costs.

- •Managed the annual budgeting and quarterly forecasting cycle, enhancing accuracy by 20% and efficiency by 30%.

- •Developed and implemented a new cash flow monitoring system, maintaining liquidity and improving capital management by 25%.

- •Collaborated cross-functionally to integrate financial objectives with organizational strategic goals, enhancing alignment by 40%.

- •Evaluated potential mergers and acquisitions resulting in successful completion of a $50 million acquisition.

- •Mentored junior finance staff, lowering error rates in financial reporting by 10% through targeted training programs.

- •Oversaw preparation and presentation of financial statements, increasing stakeholder understanding by 30%.

- •Directed strategic financial planning projects, achieving a 12% increase in profitability year-on-year.

- •Conducted financial modeling, supporting investment decisions that contributed to a 5% growth in company assets.

- •Drove the development of scenarios analysis that improved decision-making accuracy for senior management.

- •Supported compliance initiatives ensuring adherence to industry regulations, reducing risk of non-compliance by 15%.

- •Performed comprehensive corporate financial analysis that identified potential cost-saving opportunities of up to $200K annually.

- •Assisted in the financial evaluations of corporate transactions, contributing to the closure of lucrative deals.

- •Implemented advanced Excel tools for financial planning, which improved data processing time by 25%.

- •Worked with cross-functional teams to ensure financial data accuracy, leading to a 20% reduction in discrepancies.

- •Supported teams on financial consulting projects leading to a total cost reduction of 18% for clients.

- •Participated in financial strategy workshops, advising on scenarios that resulted in a 3% revenue increase.

- •Executed compliance checks, reducing discrepancies in financial reports by 15% and increasing regulatory adherence.

- •Customized financial dashboards for clients, improving their data visualization accuracy by an average of 40%.

Assistant Director - Capital Finance resume sample

- •Led the development and management of a $200 million capital budget resulting in a 15% reduction in overspend.

- •Implemented financial models to enhance cash flow projections, improving forecasting accuracy by 20%.

- •Collaborated with cross-functional teams to streamline processes, cutting financial reporting time by 30%.

- •Developed strategic investment recommendations, facilitating decision-making with a clear risk assessment framework.

- •Assisted in executing debt issuance strategies, securing a more favorable interest rate for funding large-scale projects.

- •Mentored and trained a team of five junior analysts, fostering a productive learning environment and advancing team competencies.

- •Conducted financial analysis for capital investment projects, contributing to a $50 million portfolio expansion.

- •Designed comprehensive financial reports for leadership, facilitating transparency and aligning departmental objectives.

- •Executed risk management strategies, identifying potential financial exposures and mitigating through strategic planning.

- •Collaborated with finance teams to ensure accurate capital expenditure tracking, improving data integrity by 25%.

- •Prepared detailed presentations for senior leadership, effectively communicating the financial health of ongoing projects.

- •Managed budgeting processes for capital projects, enhancing departmental efficiency and resulting in a 10% cost reduction.

- •Analyzed data to develop investment forecasts, supporting organizational objectives in high-stakes negotiations.

- •Collaborated across departments to rigorously evaluate capital project proposals, ensuring optimal resource allocation.

- •Monitored project performance against budgets, identifying growth opportunities, and recommending actionable improvements.

- •Presented financial strategy and performance updates, facilitating informed decision-making by senior management.

- •Advised clients on financial planning and capital investment strategies, achieving a customer satisfaction rate of 95%.

- •Conducted financial risk assessments, aligning investment portfolios with client goals, improving return rates by 18%.

- •Led workshops on financial regulation compliance, ensuring adherence to industry standards and reducing audit findings.

- •Collaborated with account teams to deliver customized financial solutions, enhancing client relationship management.

Assistant Director, Finance and Accounting resume sample

- •Managed a finance team of 10 professionals, leading to a 15% reduction in budget discrepancies annually.

- •Developed comprehensive financial forecasts, increasing accuracy by 30%, aligning closely with strategic objectives.

- •Implemented a robust internal control system, minimizing compliance risk and safeguarding assets valued at $500M.

- •Spearheaded month-end and year-end closing activities, ensuring timely and accurate financial reporting.

- •Facilitated cross-departmental collaboration to enhance financial reporting efficiency by 25%, reducing data retrieval time.

- •Mentored finance team members, resulting in a 50% improvement in team productivity and career advancement.

- •Conducted rigorous financial analysis contributing to a $1.2B revenue increase through strategic client partnerships.

- •Led a project to streamline budgeting processes, cutting report preparation time by 40% over a two-year period.

- •Prepared in-depth financial models supporting corporate decision-making, enhancing strategic planning outcomes.

- •Assisted in external financial audits, resulting in successful audits with zero non-compliance incidents.

- •Presented complex financial data to stakeholders, clarifying insights and impacting high-stake business decisions.

- •Analyzed detailed financial data leading to $5M cost savings by optimizing procurement expenditure.

- •Developed financial reports that informed critical investment decisions, aligning with corporate goals.

- •Collaborated with IT department to improve financial software, enhancing data reporting capabilities by 20%.

- •Participated in cross-functional teams to enact process improvements, boosting operational efficiencies by 40%.

- •Assisted in preparing annual financial statements for multiple organizations with revenues exceeding $100M.

- •Maintained accurate general ledger reconciliations, directly contributing to a 20% improvement in data accuracy.

- •Supported senior accountants in audit preparations, facilitating a streamlined audit process.

- •Performed cost analyses that led to a 10% reduction in departmental expenses through enhanced budgeting.

Assistant Finance Director - Revenue Management resume sample

- •Developed and executed revenue management strategies leading to a 20% increase in annual revenue across multiple properties.

- •Collaborated with cross-functional teams to align marketing and sales strategies, resulting in a 15% increase in customer acquisition.

- •Conducted in-depth analysis of market trends to identify growth opportunities, enhancing market share by 10% year-on-year.

- •Prepared detailed forecasts and dashboards, improving decision-making efficiency by 25% for senior management.

- •Supported the implementation of advanced revenue management systems, saving 10% in operational costs.

- •Monitored key performance indicators, providing actionable insights that improved revenue growth by 12% over the financial year.

- •Conducted variance analysis and developed strategic recommendations, contributing to a 5% reduction in expenses.

- •Enhanced budgeting processes, leading to more accurate financial planning and a 10% improvement in budget adherence.

- •Collaborated with sales teams to optimize pricing models, boosting revenue generation by 8% annually.

- •Prepared performance reports and forecasts, streamlining financial reporting, thereby reducing reporting time by 20%.

- •Mentored junior analysts, fostering a culture of continuous improvement, which increased team productivity by 15%.

- •Assisted in the development of pricing strategies, resulting in a 7% increase in room occupancy rates.

- •Analyzed revenue performance metrics to identify growth opportunities, boosting competitive positioning by 10%.

- •Prepared monthly financial reports that enhanced transparency and accuracy in financial performance evaluations.

- •Supported annual budgeting process, improving revenue forecasting accuracy by 15%.

- •Conducted comprehensive financial modeling, contributing to strategic initiatives resulting in a 12% increase in profit margins.

- •Provided detailed variance analysis, allowing for prompt corrective action and saving 5% in yearly expenditures.

- •Coordinated with IT to enhance financial software, improving data accuracy by 15%.

- •Ensured compliance with financial policies, reducing audit discrepancies by 10% and increasing regulatory compliance.

Crafting an effective assistant finance director resume can feel like managing a complex project with many moving parts. You possess a wealth of skills and financial expertise, but condensing these into a compelling narrative is essential. Highlighting your experience and leadership skills in a way that resonates with employers is your goal.

When organizing your achievements and financial know-how, it’s easy to feel overwhelmed. This is where a resume template becomes invaluable, offering structure and ensuring your top accomplishments catch the eye.

Your resume should act as your professional executive summary, capturing attention at a glance. Without a clear focus, your potential might be missed by busy employers. They seek talents like budget management, strategic decision-making, and team leadership—qualities you must present clearly.

In this guide, you'll discover how to transform your skills and experience into a cohesive and impactful resume. By addressing common challenges, you can uncover new career opportunities. With the right approach, your resume will not only inform but also captivate and engage future employers, paving the way for your next career step.

Key Takeaways

- Creating an assistant finance director resume requires effectively highlighting financial expertise and leadership skills to make a strong impression on employers.

- Using a resume template can help organize accomplishments and skills to ensure they stand out in a professional manner.

- Structure the resume to showcase contact information, a professional summary, work experience, education, skills, and achievements that relate directly to the finance sector.

- Choose a chronological resume format with modern fonts while maintaining a consistent and polished appearance through a PDF format.

- Highlight both hard and soft skills, including technical abilities like financial analysis and interpersonal skills like leadership, to demonstrate capabilities in managing teams and tasks efficiently.

What to focus on when writing your assistant finance director resume

Your assistant finance director resume should weave together your expertise in financial management and leadership, clearly demonstrating your ability to effectively support a finance team. This document is your chance to present a cohesive picture of your professional journey, showcasing experience, skills, and achievements that underscore your value to an organization’s success.

How to structure your assistant finance director resume

- Contact Information — Include your full name, phone number, email, and LinkedIn profile, ensuring these details are easy to find and read. A professional format sets a positive first impression and offers recruiters quick access to contact you for further steps. Properly formatted contact details create the foundation for the rest of your resume, setting the stage for a professional presentation.

- Professional Summary — This section is your opening statement, summarizing the breadth of your experience and calling attention to key achievements. Use this space to briefly touch on your core competencies and leadership approach, offering a snapshot that draws the recruiter in and compels them to read further. This summary serves as a trailer that piques interest and offers a glimpse of your story before diving into the details.

- Work Experience — Detail each role you’ve held within the finance sector, placing a strong emphasis on leadership roles and the tangible impact you’ve made, such as managing large budgets or achieving cost reductions. Demonstrating measurable successes not only provides proof of your skills but also shows your ability to contribute to an organization’s bottom line. Each position you list should build on the last, offering a coherent narrative of your career progression.

- Education — List your academic accomplishments to solidify your resume, highlighting degrees in finance or relevant fields and including certifications like CPA or CMA to verify your expertise. This informative section supports your experience and demonstrates your commitment to continued growth in the finance sector. Your educational background provides context to your career trajectory, creating a natural flow into the skills you’ve honed over the years.

- Skills — Highlight critical skills that underscore your capacity as a finance leader, such as financial analysis, budget preparation, and strategic planning. Show your proficiency with industry-standard tools like Excel, QuickBooks, or SAP to bolster your technical capabilities. This section ties your experience and education together, providing a comprehensive view of what you bring to the table beyond job titles and dates.

- Achievements — Conclude your professional narrative with accolades and recognitions that add credibility and emphasize your successes. Whether it’s awards for innovative projects or acknowledgments for fiscal responsibility, this section reinforces the strengths showcased throughout your resume. With the groundwork laid, we’ll now delve deeper into crafting each of these sections in a format that ensures maximum impact.

Which resume format to choose

Crafting a resume for your assistant finance director role is crucial in securing your next position. A chronological format suits finance professionals well by emphasizing your career progression and reliability, key qualities in the financial sector. As for fonts, selecting modern ones like Raleway, Lato, or Montserrat can make a subtle yet impactful difference. These typefaces are not just stylish and professional but also ensure clarity and readability, which are essential in conveying complex financial experiences effectively.

Furthermore, consistency in your resume's appearance is vital, and saving it as a PDF ensures this. PDFs retain your carefully chosen format and layout, making a polished impression on any device a recruiter might use. Additionally, setting margins at around one inch on all sides helps create a clean and organized document. This setup reflects the precision and attention to detail that are important traits in the finance field. Altogether, these elements work together to clearly present your skills and experience, making you a standout candidate for potential employers.

How to write a quantifiable resume experience section

The experience section of your assistant finance director resume is your chance to catch the attention of hiring managers by demonstrating the value you bring. This part of your resume should highlight your career achievements, focusing on relevant experience and accomplishments that align with the job you're eyeing. Organize it in reverse chronological order, starting with your most recent job, typically covering the last 10-15 years unless older roles are crucial for the position. For each role, include your job title, company, location, and dates of employment. Tailoring your resume is key—study the job ad closely and adjust your descriptions to highlight skills and accomplishments that match what the employer seeks. Dynamic action words like "led," "improved," and "streamlined" create an engaging narrative and help showcase your impact.

- •Increased departmental efficiency by 20% through implementing automated reporting tools.

- •Reduced annual costs by $300,000 by renegotiating vendor contracts and streamlining operations.

- •Led a cross-functional team on a budgeting project that improved forecast accuracy by 15%.

- •Developed a financial risk management plan that mitigated losses by up to 18% in volatile markets.

This experience section stands out because it seamlessly highlights leadership and strategic skills in alignment with the job ad. Each bullet point reflects quantifiable accomplishments, providing employers with a clear picture of your contributions, bolstered by specific metrics like percentages and dollar amounts. By customizing your resume to include such targeted details, you demonstrate understanding of the employer's needs along with the skills to fulfill them. This well-structured section, combined with powerful action verbs, ensures that hiring managers can quickly grasp your value.

Project-Focused resume experience section

A project-focused assistant finance director resume experience section should highlight specific projects where your leadership and strategic planning have driven significant results. Start by selecting projects that best showcase your ability to handle both financial and operational tasks effectively. Emphasize how your involvement led to positive changes, illustrating a complete narrative of the project's journey. By doing so, you demonstrate your capacity for leading initiatives to success.

Include quantifiable metrics to underscore your accomplishments, such as cost reductions or enhanced revenue growth. Keep your explanations concise yet informative, detailing your responsibilities and the challenges you overcame to display your problem-solving skills. Use action verbs to indicate your initiative and impact on the projects. When applicable, mention innovative strategies you introduced that contributed to improving the project's outcomes. This approach not only highlights your achievements but also connects them in a cohesive story of your professional impact.

Assistant Finance Director

XYZ Corp.

June 2018 - March 2023

- Led a team of 5 in implementing a cost-reduction initiative that saved the company $2 million annually.

- Enhanced revenue forecasting models, boosting accuracy by 15% and enabling better strategic decisions.

- Introduced new budgeting software that improved reporting efficiency by 20% and increased financial accuracy.

- Collaborated with multiple departments to streamline processes and strengthen the organization’s financial health.

Leadership-Focused resume experience section

A leadership-focused assistant finance director resume experience section should capture your ability to guide teams and achieve financial milestones. Begin by emphasizing your primary responsibilities and highlight successful projects that demonstrate your leadership skills. Share specific examples of how you’ve managed and led initiatives to reach significant financial objectives. Employ clear, concise language to showcase your achievements and the tangible impacts you’ve had in your previous roles.

Ensure each bullet point illustrates your blend of technical proficiency and leadership capability. Highlight experiences that reflect your expertise in managing budgets, analyzing financial data, and improving processes. By doing so, you align your previous roles with the essential qualifications needed for the assistant finance director position you are targeting.

Assistant Finance Director

XYZ Corporation

June 2018 - Present

- Led a team of 10 finance professionals to manage a $50 million annual budget, cutting operational costs by 10% while maintaining service quality.

- Created a new financial forecasting model that improved accuracy by 15% over previous years, showcasing analytical proficiency.

- Collaborated in a cross-functional team to streamline the procurement process, resulting in a 20% reduction in processing times, demonstrating effective teamwork.

- Mentored junior finance staff, boosting their skills in financial reporting and analysis, which resulted in promotions for 3 team members, underscoring leadership and development capabilities.

Responsibility-Focused resume experience section

A responsibility-focused Assistant Finance Director resume experience section should spotlight your capacity to efficiently manage financial activities. Start by using a clear header that captures key responsibilities or skills relevant to the job, such as "Financial Analysis and Reporting." Within this section, make sure to emphasize your achievements, like refining budget management, ensuring accuracy in financial reporting, and enhancing cost control measures. By using precise bullet points, you can effectively outline your responsibilities and successes, quantifying them with numbers or percentages to illustrate the tangible impact you've made. This strategy effectively communicates your contribution and expertise in the financial sector.

To ensure your experience aligns seamlessly with the job you're pursuing, focus on highlighting tasks and projects directly related to the role. Employ action verbs to vividly depict your contributions, and mention any initiatives you spearheaded or supported, along with their positive outcomes. This approach not only demonstrates your competence but also underscores your potential as a candidate. By maintaining a simple and direct language style, you ensure that anyone reviewing your resume can easily grasp the depth of your experience and the value you bring to an organization.

Assistant Finance Director

XYZ Corporation

Jan 2018 - Present

- Managed a $5 million budget, ensuring alignment with organizational objectives.

- Led implementation of a new financial reporting system, decreasing end-of-month closing time by 20%.

- Developed and streamlined financial forecasting methods, improving accuracy by 15%.

- Collaborated with departments to identify cost-saving opportunities, reducing expenses by $100,000 annually.

Achievement-Focused resume experience section

A success-centered assistant finance director resume experience section should highlight your accomplishments in a way that demonstrates your true impact. Begin by focusing on significant achievements that underscore your contributions to the company’s success, such as boosting revenue, cutting costs, or enhancing efficiency. Specific examples and data bring these accomplishments to life, showing your potential as a valuable asset to future employers. Highlighting these unique contributions effectively also showcases your skills and worth.

Making your achievements relatable often involves tying them to measurable outcomes that reflect your leadership and influence. For instance, provide metrics that illustrate enhancements in financial reporting or budgeting processes. By anchoring your successes in data, you craft a persuasive narrative about your ability to bring value. Finally, ensure each bullet point is not only concise and directly related to the job application but also keeps the hiring manager engaged throughout.

Assistant Finance Director

ABC Corporation

2019 - Present

- Led a cross-functional team to implement a new budgeting system, resulting in a 15% reduction in budget preparation time.

- Implemented cost-saving strategies that reduced departmental expenses by 10% without compromising service quality.

- Streamlined financial reporting processes, cutting report preparation time by 20% and increasing accuracy.

- Developed financial models to support strategic decision-making, enabling a 12% increase in profitability.

Write your assistant finance director resume summary section

A results-focused Assistant Finance Director resume summary should clearly articulate your strengths and achievements to make you stand out. It needs to weave together your skills in financial management, leadership, and any standout achievements. This condensed story of your professional journey should detail your years of experience and areas of expertise, making it obvious why you're the right candidate for the role.

Take a look at this example:

This summary works because it weaves experience and achievements into a compelling narrative. It strategically uses action-oriented language and gives specific examples, like cost savings and key skills, making it both impactful and concise.

Describing yourself in the resume summary calls for highlighting your most impressive talents and what truly distinguishes you. While keeping it brief, aim to leave a memorable impression that is confidently stated yet approachable, allowing hiring managers to see your value.

Understanding the nuances between a resume summary and a resume objective is crucial. A resume summary is ideal for seasoned professionals, focusing on past achievements and skills. Meanwhile, a resume objective is suited for entry-level applicants or those changing careers, highlighting future aspirations and potential. A summary of qualifications is more structured, listing skills and experiences tailored to the job, while a resume profile blends the summary and objective formats, injecting a bit of personal flair with professional goals. Choosing the appropriate format based on your career phase allows you to prominently feature your qualifications in the most effective way.

Listing your assistant finance director skills on your resume

A finance-focused assistant finance director resume should seamlessly integrate both technical prowess and interpersonal capabilities. Presenting your skills effectively means considering whether to create a dedicated section or blend them into your experience or summary. Showcasing your strengths and soft skills highlights your ability to lead and communicate effectively. Meanwhile, listing hard skills demonstrates your command of specific tools and techniques like financial analysis or budgeting, which act as eye-catching keywords in your resume.

To effectively present your skills, clarity and relevance are key. For instance:

This format is designed for quick reading, making it easy for both hiring managers and software to recognize your qualifications as an assistant finance director.

Best hard skills to feature on your assistant finance director resume

Your role demands hard skills that highlight your technical and analytical strength, crucial for managing finances and supporting strategic initiatives. These skills should tell a story of your competence in financial operations. Important ones to consider are:

Hard Skills

- Financial Analysis

- Budgeting and Forecasting

- Financial Reporting

- Risk Management

- Data Analysis

- Accounting Software Proficiency

- Regulatory Compliance

- Cost Control and Reduction

- Strategic Financial Planning

- Financial Modeling

- Investment Analysis

- Performance Metrics

- Taxation Knowledge

- Asset Management

- Auditing Techniques

Best soft skills to feature on your assistant finance director resume

Equally important are soft skills that convey leadership, communication, and decision-making abilities. These skills ensure you can manage teams effectively, navigate challenges, and cultivate a positive work environment. Consider these:

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Decision-Making

- Adaptability

- Team Collaboration

- Analytical Thinking

- Conflict Resolution

- Time Management

- Attention to Detail

- Interpersonal Skills

- Emotional Intelligence

- Negotiation

- Stress Management

- Influencing Skills

How to include your education on your resume

The education section of your resume is crucial when applying for an assistant finance director position. This section highlights your academic qualifications and demonstrates your expertise in finance. Tailor the education section to the job you are applying for, including only relevant coursework or degrees. Excluding irrelevant education can help keep your resume focused and concise. If your GPA is impressive, include it; a GPA above 3.5 is usually noteworthy. Similarly, showcasing honors like "cum laude" adds value and should appear next to your degree. When listing your degree, prioritize clarity — state the degree, institution, and date of completion.

The second example excels by listing a degree that is directly relevant to an assistant finance director role. The inclusion of a 3.8 GPA emphasizes academic achievement and capability in the field. Listing the University and graduation date clearly denotes credibility and prestige, which strengthens the overall impact. The degree's focus on finance aligns directly with job expectations, presenting the candidate as a strong fit. Highlighting such relevant education and achievements makes your application stand out.

How to include assistant finance director certificates on your resume

Including a certificates section on a resume is crucial for an Assistant Finance Director. List the name of each certificate and include the date you received it. Add the issuing organization to give credibility.

Certificates can also be placed in the resume header. For instance: "Certified Management Accountant (CMA) - IMA, Certified Public Accountant (CPA) - AICPA".

A well-organized certificates section not only highlights your qualifications but also shows your commitment to finance. Use certificates relevant to the job you’re aiming for, like financial management or accounting certifications.

A good example of a standalone certificates section for an Assistant Finance Director resume looks like this:

This example is good because it highlights certificates that directly relate to finance and accounting, showcasing specialized skills. The clear structure makes it easy for recruiters to see your qualifications. Always keep your certificates section current to reflect your latest achievements.

Extra sections to include in your assistant finance director resume

In the competitive world of finance, a well-rounded resume can be the key to securing your ideal job. Beyond showcasing your professional experience and skills, including additional relevant sections can demonstrate your unique qualifications and interests.

- Language section — Highlight any additional languages you speak. This shows your ability to communicate with diverse clients and colleagues, which is a valuable asset in any finance role.

- Hobbies and interests section — Share relevant hobbies that display analytical or soft skills. This can make you more relatable and help you stand out to hiring managers.

- Volunteer work section — List volunteer activities related to finance or community service. This showcases your dedication and well-rounded character.

- Books section — Mention any finance-related books you have read. This shows your commitment to staying informed and improving your industry knowledge.

These additional sections not only present a more complete picture of you but also add depth to your resume, helping you connect with potential employers on multiple levels. Make sure each section is concise and relevant to the role you're applying for.

In Conclusion

In conclusion, creating a strong resume as an assistant finance director requires careful thought and strategic planning. Your aim is to craft a document that not only highlights your proficiency in financial management and leadership but also captures the attention of potential employers quickly. By focusing on a clear professional summary, detailed work experience with quantifiable achievements, and relevant educational background, your resume can effectively communicate your career trajectory and potential.

Remember to tailor your resume to the specific job you’re aiming for by incorporating keywords and skills outlined in the job description. This enhances the likelihood that your resume will stand out during the review process, both to hiring managers and automated screening systems. Additionally, don’t overlook the impact of clean formatting and a modern font, which can make your resume easier to read and more appealing.

Including a skills section that highlights both hard and soft skills ensures that you present a balanced view of your capabilities. Moreover, featuring certifications and a concise education section adds credibility to your application, underscoring your expertise and commitment to the finance field.

Finally, consider adding extra sections that reflect your broader qualifications and interests, such as languages, hobbies, or volunteer work. These can provide a well-rounded picture of your personality, making you more relatable and memorable to hiring managers. A thoughtful blend of these elements can transform your assistant finance director resume from a simple list of duties into a powerful narrative that opens doors to new opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.