Associate Accountant Resume Examples

Jul 18, 2024

|

12 min read

Crafting the Perfect Associate Accountant Resume: Balancing Your Skills with Financial Precision and Detail

Rated by 348 people

Associate Tax Accountant

Associate Financial Accountant

Associate Cost Accountant

Associate Management Accountant

Associate Forensic Accountant

Associate Project Accountant

Associate Auditing Accountant

Associate Chartered Accountant

Associate Payroll Accountant

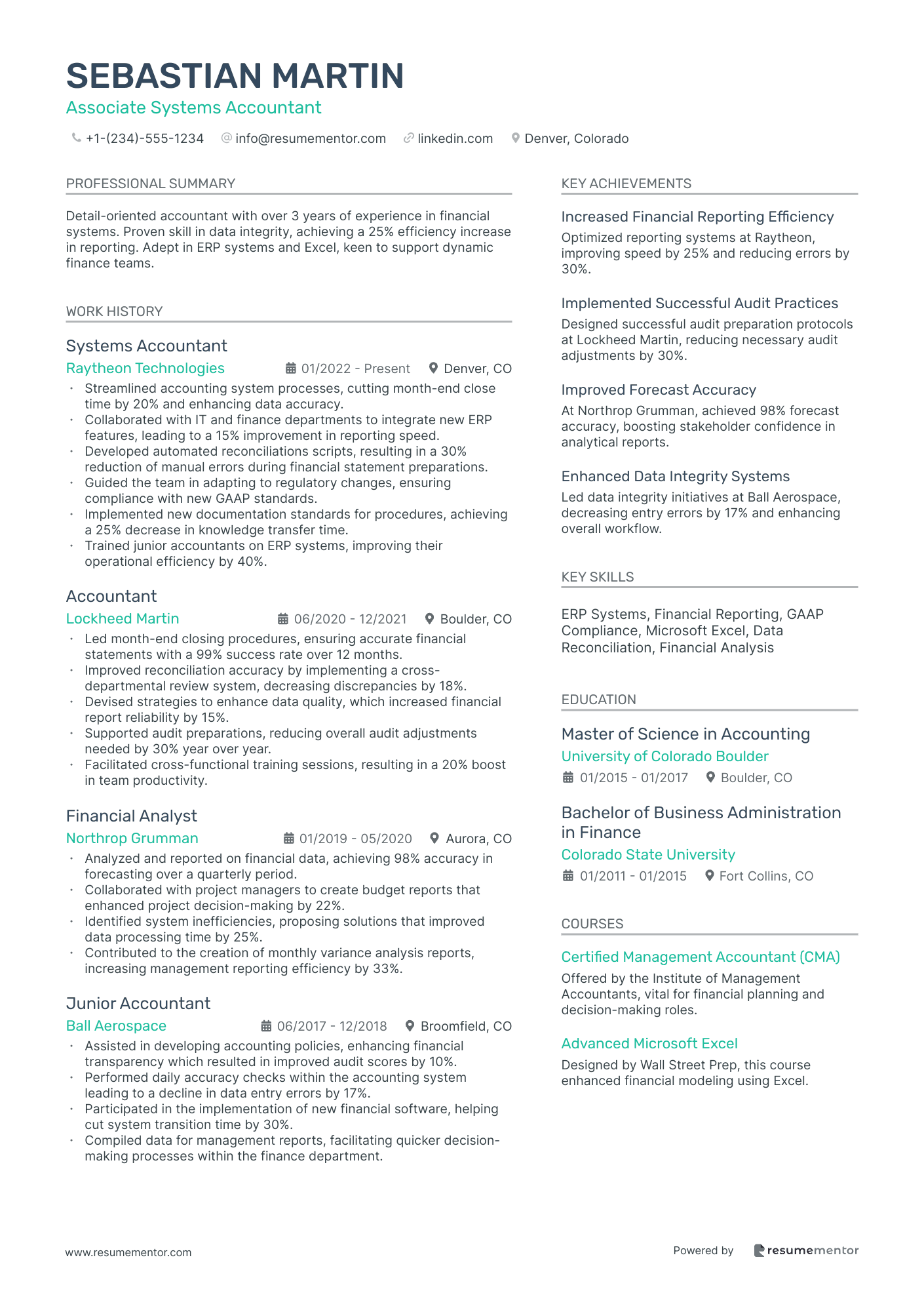

Associate Systems Accountant

Associate Tax Accountant resume sample

- •Developed and implemented strategies to optimize tax savings, leading to a 20% reduction in tax liabilities for clients.

- •Prepared and reviewed tax returns for a diverse portfolio of clients, ensuring a 98% on-time filing rate.

- •Collaborated with senior accountants to identify tax planning opportunities, increasing client savings by $500,000 annually.

- •Managed and supported team through a comprehensive audit, resulting in a favorable outcome with minimal adjustments.

- •Streamlined tax documentation process, reducing preparation time by 25% and improving accuracy of filings.

- •Conducted research on state tax regulations, contributing to a 15% improvement in compliance programs.

- •Assisted in analyzing financial statements and preparing tax returns, achieving an accuracy rate of 99%.

- •Coordinated with cross-functional teams to ensure compliance with tax laws, resulting in zero penalties for non-compliance.

- •Conducted detailed analyses to support tax audits, significantly reducing the time spent by 30%.

- •Contributed to a project focused on identifying cost-effective tax practices, leading to $100,000 in savings.

- •Prepared detailed reports on tax liabilities and deferred tax assets, facilitating senior management decision-making processes.

- •Assessed and improved tax planning strategies for partnerships, resulting in a 10% reduction in effective tax rate.

- •Led preparation and filing of federal and state tax returns for corporate clients with assets over $2 million.

- •Monitored industry trends and regulatory changes, providing insights for business strategy adjustments.

- •Conducted thorough research and analysis on complex tax issues, contributing to informed policy-making decisions.

- •Supported audit teams with tax consultation services, improving client satisfaction by 15%.

- •Prepared and controlled documentation for tax filing, reducing discrepancies by 20%.

- •Assessed client financial statements, ensuring compliance with federal tax regulations.

- •Participated in workshops to refine technical tax skills, enhancing department efficiency.

Associate Financial Accountant resume sample

- •Led monthly financial audits, identifying discrepancies that improved accuracy by 25% in financial reporting.

- •Collaborated with cross-functional teams to streamline budgeting processes, reducing processing time by 15%.

- •Conducted reconciliations for high-volume accounts, resolving discrepancies and ensuring compliance with regulations.

- •Prepared financial reports leveraging advanced Excel techniques, enhancing insights for senior management.

- •Assisted in implementing new accounting software, resulting in a 30% increase in departmental efficiency.

- •Maintained general ledger accuracy by implementing systematic updates, cutting error rates by 10%.

- •Managed inter-company transactions, leading to a reduction of errors by 20% through thorough reconciliations.

- •Supported external audits by preparing comprehensive documentation, facilitating smooth audit processes.

- •Developed detailed financial statements and reports, improving clarity and decision-making for stakeholders.

- •Coordinated month-end close activities, ensuring timely and accurate reporting across all departments.

- •Collaborated with IT department to enhance accounting software functionality, improving data integrity.

- •Executed daily journal entries for various departments, maintaining accuracy and integrity in financial records.

- •Monitored cash flow forecasts, providing insights that aided in optimizing liquidity by 12%.

- •Prepared schedules and reconciliations supporting month-end closing, enhancing efficiency by 18%.

- •Assessed compliance with internal controls, recommending improvements for better risk management.

- •Processed financial data and assisted in preparing essential reports for executive review.

- •Provided support during annual budgeting processes, contributing to streamlined operational planning.

- •Evaluated cost centers and provided financial insights that led to a 5% reduction in operational costs.

- •Facilitated training for new hires, enabling smooth team integration and improved productivity.

Associate Cost Accountant resume sample

- •Enhanced monthly cost report accuracy by 15% through detailed variance analysis and continuous system improvement.

- •Implemented a new cost accounting process, reducing reporting time by 10% while increasing data reliability.

- •Developed labor and overhead rate tracking system, leading to a 5% increase in cost reporting efficiency.

- •Collaborated with cross-functional teams to improve forecasting accuracy by incorporating detailed cost data analysis.

- •Streamlined monthly closing procedures, resulting in a 20% faster cycle and improved financial insights.

- •Conducted internal audits on cost data, identifying discrepancies and recommending changes that improved data integrity.

- •Assisted in creating standard cost records, improving the accuracy of overhead rate calculations by 12%.

- •Played a key role in the preparation of budget reports, aiding the finance team in achieving a 98% budget adherence rate.

- •Conducted thorough cost audits, leading to the identification and correction of $50k in inventory discrepancies.

- •Improved cost variance reporting processes, enhancing efficiency and clarity for management review.

- •Provided timely and detailed responses to management inquiries, increasing transparency of cost variances.

- •Supported financial planning by offering insights from detailed cost analysis, enhancing decision-making efficiency.

- •Optimized cost data management systems, improving data retrieval times by 30% and increasing reporting accuracy.

- •Collaborated on ERP system enhancements, contributing to improved financial tracking capabilities and user experience.

- •Monitored production costs closely, ensuring compliance with organizational policies and resulting in cost control improvements.

- •Conducted detailed variance analysis, improving the accuracy of cost reports and aiding budget forecasting processes.

- •Enhanced standard cost record maintenance, resulting in a 25% reduction in data inconsistencies.

- •Developed innovative solutions to streamline cost control processes, contributing to a 10% reduction in unnecessary expenses.

- •Provided critical insights into cost variances, facilitating higher accuracy in management forecasting and budgeting.

Associate Management Accountant resume sample

- •Led the financial modeling team to enhance budget accuracy by 10%, supporting revenue growth strategies.

- •Developed a streamlined reporting mechanism, saving 5 hours weekly and resulting in enhanced team productivity.

- •Collaborated with cross-functional teams to integrate KPIs, aligning 7 departments towards shared financial goals.

- •Prepared and analyzed monthly financial reports, offering insights that improved decision-making accuracy by 20%.

- •Assisted with the annual audit process, organizing financial documents that reduced processing time by 30%.

- •Conducted variance analysis on budget expenditures, identifying a cost-saving opportunity that reduced waste by 12%.

- •Implemented financial forecasting models, improving the accuracy of forecasts by 20% year-over-year.

- •Prepared quarterly financial analytics, contributing to a 25% increase in efficiency for the finance department.

- •Managed departmental budgets collaboratively, resulting in a 15% reduction in unnecessary expenditures.

- •Assisted in preparing board presentations that effectively communicated key financial results and strategies.

- •Enhanced Excel reporting tools, decreasing reporting time by 30% and supporting faster decision-making.

- •Collaborated with senior analysts to produce monthly variance reports, increasing accuracy by 15%.

- •Supported the budget preparation process, aiding departments to meet financial targets 10% more effectively.

- •Utilized accounting software to maintain financial data integrity, leading to a 25% improvement in audit readiness.

- •Contributed to the development of new financial KPIs, optimizing financial tracking for high-priority projects.

- •Processed and reconciled financial transactions, maintaining a 99% accuracy rate.

- •Assisted in preparing the monthly close, shortening close time by 3 days on average.

- •Performed account analysis, identifying a potential fraud instance which saved the company $10,000.

- •Maintained journal entry accuracy, enhancing day-to-day accounting processes across multiple departments.

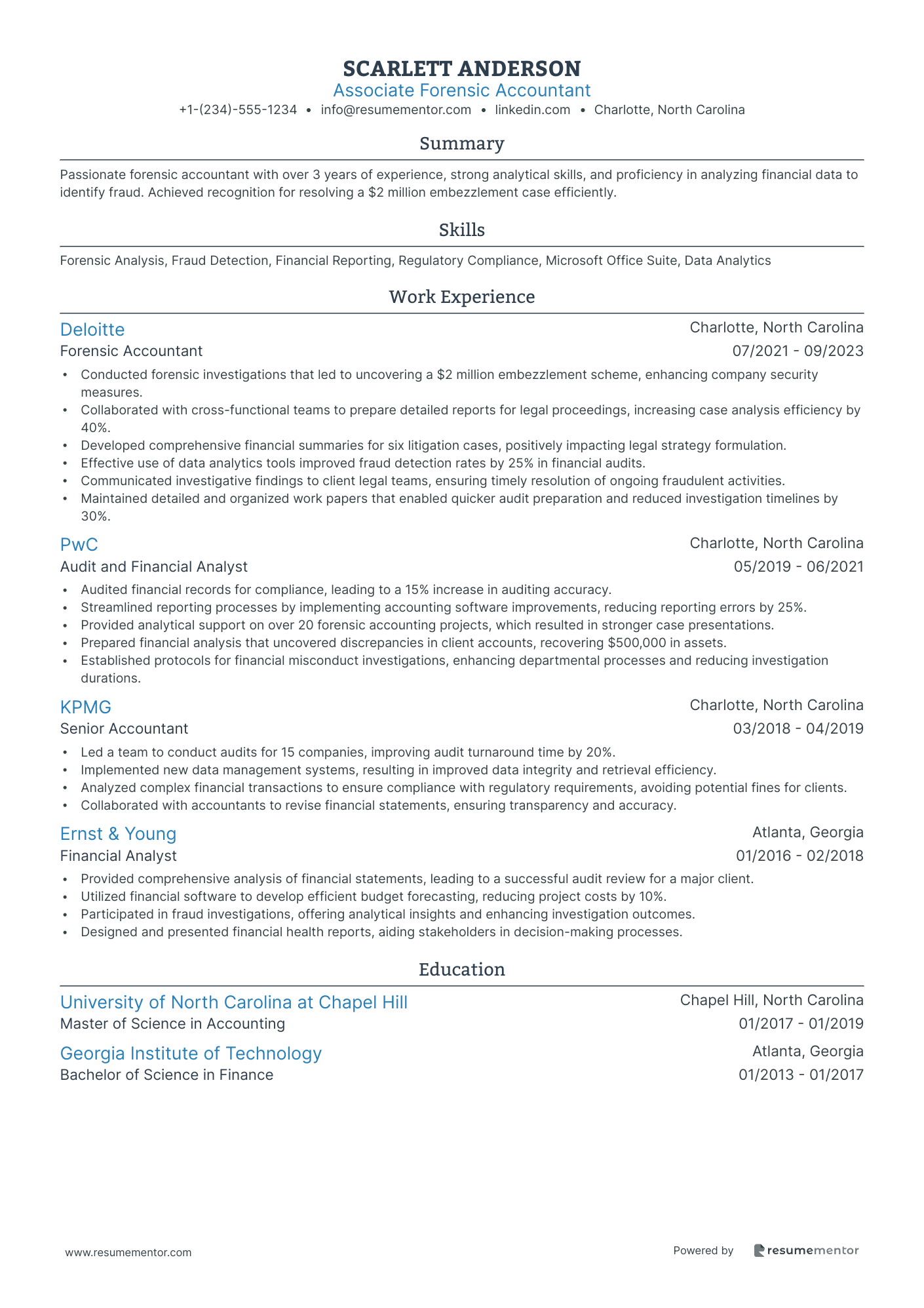

Associate Forensic Accountant resume sample

- •Conducted forensic investigations that led to uncovering a $2 million embezzlement scheme, enhancing company security measures.

- •Collaborated with cross-functional teams to prepare detailed reports for legal proceedings, increasing case analysis efficiency by 40%.

- •Developed comprehensive financial summaries for six litigation cases, positively impacting legal strategy formulation.

- •Effective use of data analytics tools improved fraud detection rates by 25% in financial audits.

- •Communicated investigative findings to client legal teams, ensuring timely resolution of ongoing fraudulent activities.

- •Maintained detailed and organized work papers that enabled quicker audit preparation and reduced investigation timelines by 30%.

- •Audited financial records for compliance, leading to a 15% increase in auditing accuracy.

- •Streamlined reporting processes by implementing accounting software improvements, reducing reporting errors by 25%.

- •Provided analytical support on over 20 forensic accounting projects, which resulted in stronger case presentations.

- •Prepared financial analysis that uncovered discrepancies in client accounts, recovering $500,000 in assets.

- •Established protocols for financial misconduct investigations, enhancing departmental processes and reducing investigation durations.

- •Led a team to conduct audits for 15 companies, improving audit turnaround time by 20%.

- •Implemented new data management systems, resulting in improved data integrity and retrieval efficiency.

- •Analyzed complex financial transactions to ensure compliance with regulatory requirements, avoiding potential fines for clients.

- •Collaborated with accountants to revise financial statements, ensuring transparency and accuracy.

- •Provided comprehensive analysis of financial statements, leading to a successful audit review for a major client.

- •Utilized financial software to develop efficient budget forecasting, reducing project costs by 10%.

- •Participated in fraud investigations, offering analytical insights and enhancing investigation outcomes.

- •Designed and presented financial health reports, aiding stakeholders in decision-making processes.

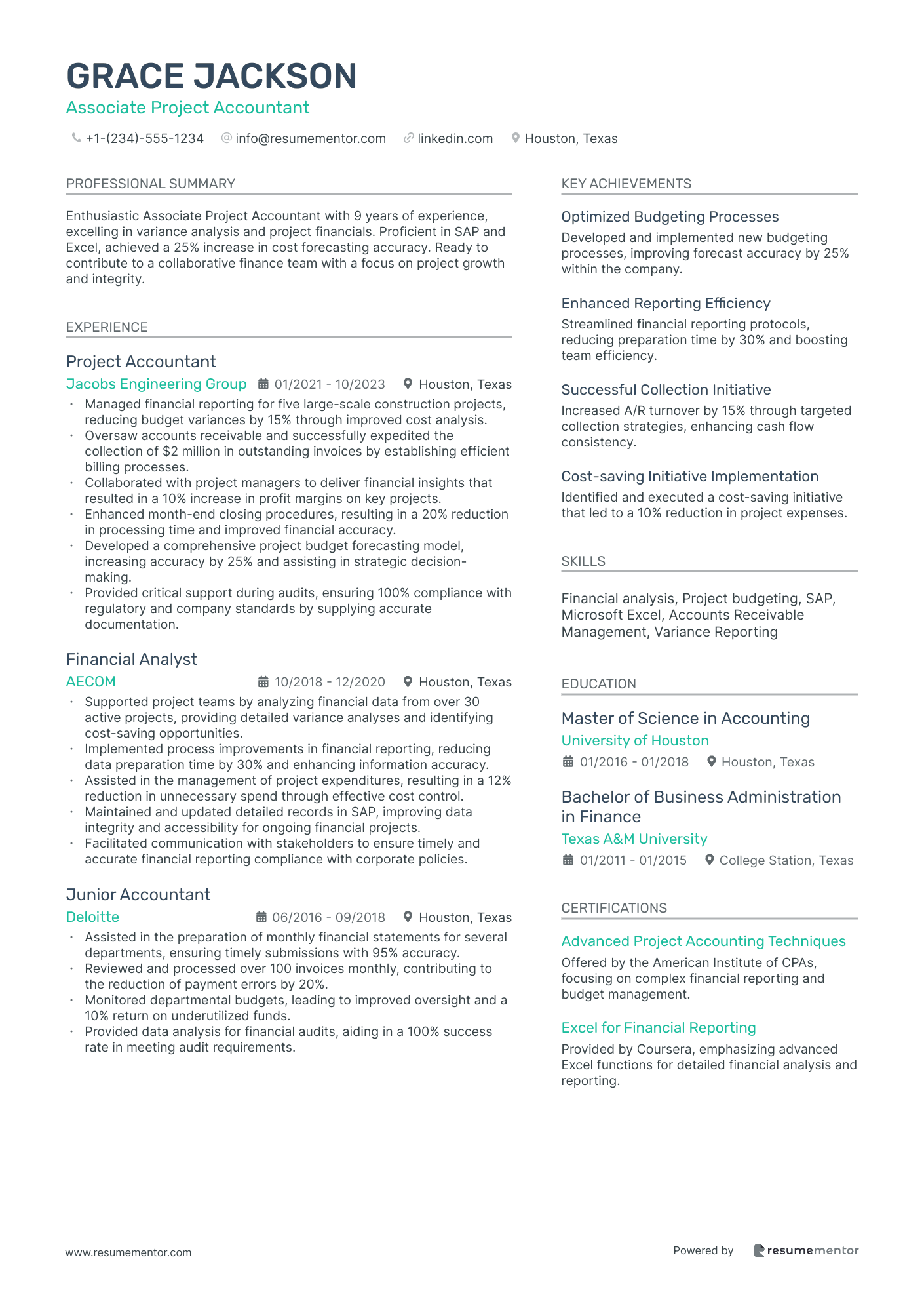

Associate Project Accountant resume sample

- •Managed financial reporting for five large-scale construction projects, reducing budget variances by 15% through improved cost analysis.

- •Oversaw accounts receivable and successfully expedited the collection of $2 million in outstanding invoices by establishing efficient billing processes.

- •Collaborated with project managers to deliver financial insights that resulted in a 10% increase in profit margins on key projects.

- •Enhanced month-end closing procedures, resulting in a 20% reduction in processing time and improved financial accuracy.

- •Developed a comprehensive project budget forecasting model, increasing accuracy by 25% and assisting in strategic decision-making.

- •Provided critical support during audits, ensuring 100% compliance with regulatory and company standards by supplying accurate documentation.

- •Supported project teams by analyzing financial data from over 30 active projects, providing detailed variance analyses and identifying cost-saving opportunities.

- •Implemented process improvements in financial reporting, reducing data preparation time by 30% and enhancing information accuracy.

- •Assisted in the management of project expenditures, resulting in a 12% reduction in unnecessary spend through effective cost control.

- •Maintained and updated detailed records in SAP, improving data integrity and accessibility for ongoing financial projects.

- •Facilitated communication with stakeholders to ensure timely and accurate financial reporting compliance with corporate policies.

- •Assisted in the preparation of monthly financial statements for several departments, ensuring timely submissions with 95% accuracy.

- •Reviewed and processed over 100 invoices monthly, contributing to the reduction of payment errors by 20%.

- •Monitored departmental budgets, leading to improved oversight and a 10% return on underutilized funds.

- •Provided data analysis for financial audits, aiding in a 100% success rate in meeting audit requirements.

- •Processed and verified over 200 supplier invoices monthly for accuracy, enhancing processing efficiency by 15%.

- •Collaborated with the finance team to synchronize account reconciliations, reducing discrepancies by 25% and improving ledger accuracy.

- •Implemented a centralized invoicing system that improved data access and reduced retrieval times by 20%.

- •Supported expense management initiatives resulting in a 5% reduction in operational costs.

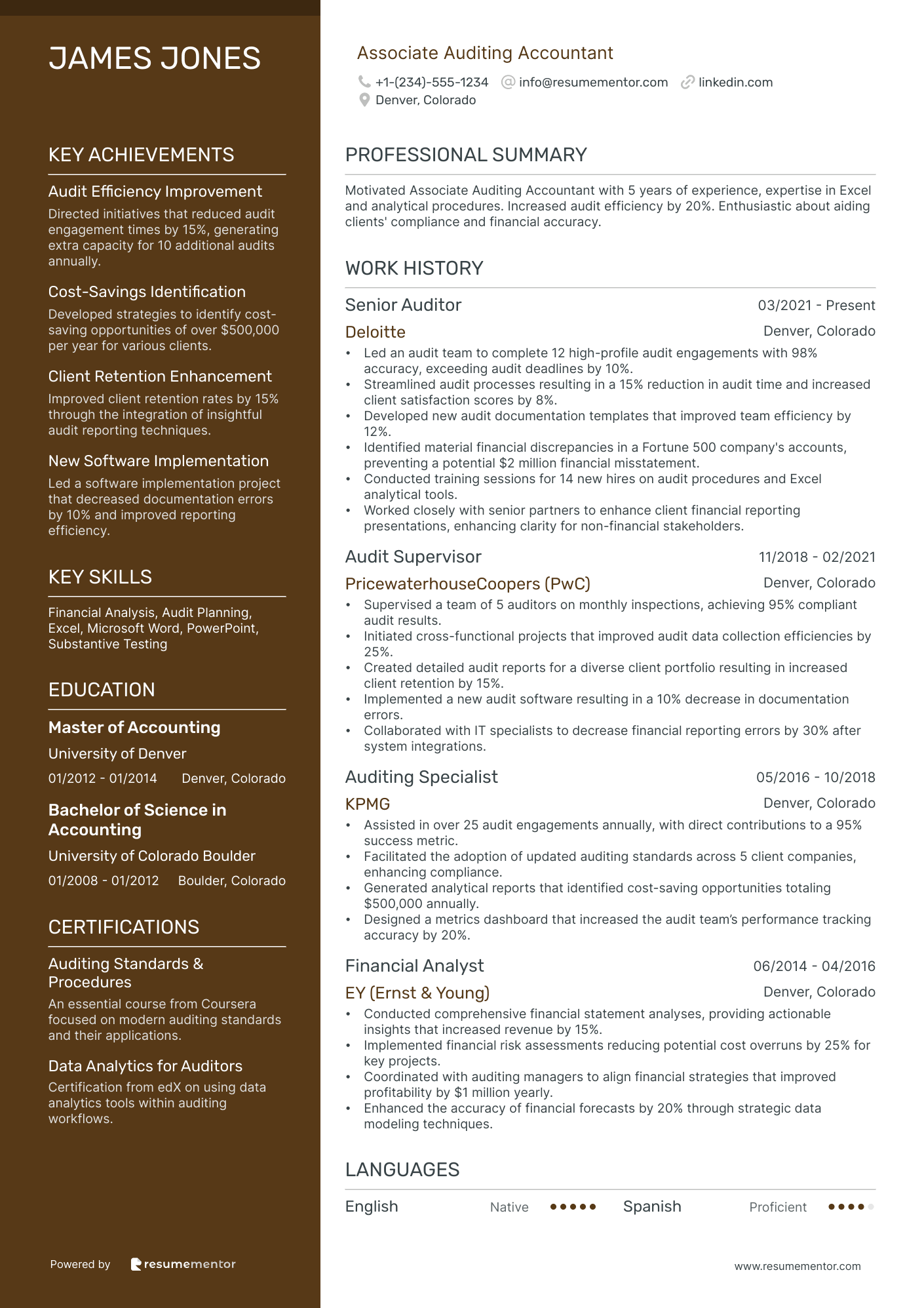

Associate Auditing Accountant resume sample

- •Led an audit team to complete 12 high-profile audit engagements with 98% accuracy, exceeding audit deadlines by 10%.

- •Streamlined audit processes resulting in a 15% reduction in audit time and increased client satisfaction scores by 8%.

- •Developed new audit documentation templates that improved team efficiency by 12%.

- •Identified material financial discrepancies in a Fortune 500 company's accounts, preventing a potential $2 million financial misstatement.

- •Conducted training sessions for 14 new hires on audit procedures and Excel analytical tools.

- •Worked closely with senior partners to enhance client financial reporting presentations, enhancing clarity for non-financial stakeholders.

- •Supervised a team of 5 auditors on monthly inspections, achieving 95% compliant audit results.

- •Initiated cross-functional projects that improved audit data collection efficiencies by 25%.

- •Created detailed audit reports for a diverse client portfolio resulting in increased client retention by 15%.

- •Implemented a new audit software resulting in a 10% decrease in documentation errors.

- •Collaborated with IT specialists to decrease financial reporting errors by 30% after system integrations.

- •Assisted in over 25 audit engagements annually, with direct contributions to a 95% success metric.

- •Facilitated the adoption of updated auditing standards across 5 client companies, enhancing compliance.

- •Generated analytical reports that identified cost-saving opportunities totaling $500,000 annually.

- •Designed a metrics dashboard that increased the audit team’s performance tracking accuracy by 20%.

- •Conducted comprehensive financial statement analyses, providing actionable insights that increased revenue by 15%.

- •Implemented financial risk assessments reducing potential cost overruns by 25% for key projects.

- •Coordinated with auditing managers to align financial strategies that improved profitability by $1 million yearly.

- •Enhanced the accuracy of financial forecasts by 20% through strategic data modeling techniques.

Associate Chartered Accountant resume sample

- •Led a team to streamline financial statement preparations, increasing process accuracy by 25% and reducing review time by 10%.

- •Managed complex audits for clients, resulting in a 15% increase in compliance adherence, enhancing client trust.

- •Co-developed a tax planning strategy that optimized client tax savings by approximately $350,000 over two fiscal years.

- •Facilitated key client meetings to present financial insights, enhancing client understanding of revenue growth drivers.

- •Implemented a new accounting software, reducing bookkeeping errors by 30%, improving data integrity.

- •Conducted in-depth market research for strategic projects, supporting a major client acquisition resulting in $1 million revenue increase.

- •Collaborated with a team to complete audits for forward-thinking clients, increasing client satisfaction scores by 40%.

- •Prepared comprehensive financial reports that improved business decision-making for stakeholders leading to a 10% profitability increase.

- •Developed tax solving strategies with a team, ensuring a reduction in quarterly tax burdens by 12% for corporate clients.

- •Enhanced reporting processes and detailed analysis, improving reporting speed by 15% and reliability by 20%.

- •Conducted financial training sessions for junior accountants, boosting team productivity by 25%.

- •Assisted in preparing audit working papers resulting in improving compliance metrics by 10% across various client sectors.

- •Supported tax advisory projects for emerging clients, reducing their tax liabilities by 15% over 18 months.

- •Participated in 20+ client meetings to gain insights and delivered tailored financial strategies to enhance profitability.

- •Developed and maintained accurate financial records, increasing data accuracy by 30%.

- •Provided financial analysis for client accounts that resulted in a detailed understanding of cost-saving measures.

- •Oversaw monthly reconciliations and financial documentation, resulting in a 20% improvement in reporting accuracy.

- •Assisted in the preparation of financial statements in line with industry standards, reducing auditing discrepancies.

- •Analyzed accounting trends to provide strategic growth insights resulting in aligning client growth trajectories with market forecasts.

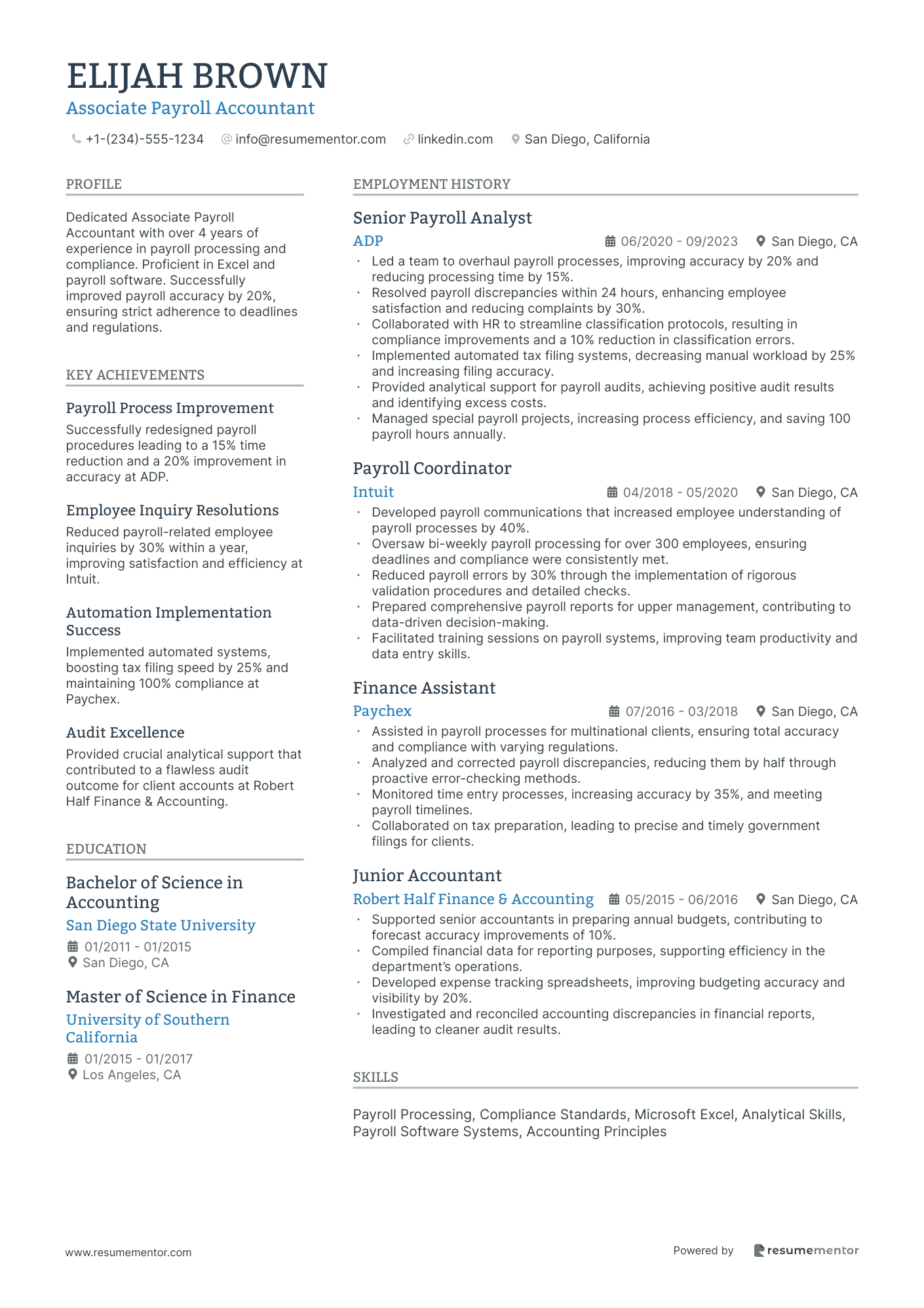

Associate Payroll Accountant resume sample

- •Led a team to overhaul payroll processes, improving accuracy by 20% and reducing processing time by 15%.

- •Resolved payroll discrepancies within 24 hours, enhancing employee satisfaction and reducing complaints by 30%.

- •Collaborated with HR to streamline classification protocols, resulting in compliance improvements and a 10% reduction in classification errors.

- •Implemented automated tax filing systems, decreasing manual workload by 25% and increasing filing accuracy.

- •Provided analytical support for payroll audits, achieving positive audit results and identifying excess costs.

- •Managed special payroll projects, increasing process efficiency, and saving 100 payroll hours annually.

- •Developed payroll communications that increased employee understanding of payroll processes by 40%.

- •Oversaw bi-weekly payroll processing for over 300 employees, ensuring deadlines and compliance were consistently met.

- •Reduced payroll errors by 30% through the implementation of rigorous validation procedures and detailed checks.

- •Prepared comprehensive payroll reports for upper management, contributing to data-driven decision-making.

- •Facilitated training sessions on payroll systems, improving team productivity and data entry skills.

- •Assisted in payroll processes for multinational clients, ensuring total accuracy and compliance with varying regulations.

- •Analyzed and corrected payroll discrepancies, reducing them by half through proactive error-checking methods.

- •Monitored time entry processes, increasing accuracy by 35%, and meeting payroll timelines.

- •Collaborated on tax preparation, leading to precise and timely government filings for clients.

- •Supported senior accountants in preparing annual budgets, contributing to forecast accuracy improvements of 10%.

- •Compiled financial data for reporting purposes, supporting efficiency in the department’s operations.

- •Developed expense tracking spreadsheets, improving budgeting accuracy and visibility by 20%.

- •Investigated and reconciled accounting discrepancies in financial reports, leading to cleaner audit results.

Associate Systems Accountant resume sample

- •Streamlined accounting system processes, cutting month-end close time by 20% and enhancing data accuracy.

- •Collaborated with IT and finance departments to integrate new ERP features, leading to a 15% improvement in reporting speed.

- •Developed automated reconciliations scripts, resulting in a 30% reduction of manual errors during financial statement preparations.

- •Guided the team in adapting to regulatory changes, ensuring compliance with new GAAP standards.

- •Implemented new documentation standards for procedures, achieving a 25% decrease in knowledge transfer time.

- •Trained junior accountants on ERP systems, improving their operational efficiency by 40%.

- •Led month-end closing procedures, ensuring accurate financial statements with a 99% success rate over 12 months.

- •Improved reconciliation accuracy by implementing a cross-departmental review system, decreasing discrepancies by 18%.

- •Devised strategies to enhance data quality, which increased financial report reliability by 15%.

- •Supported audit preparations, reducing overall audit adjustments needed by 30% year over year.

- •Facilitated cross-functional training sessions, resulting in a 20% boost in team productivity.

- •Analyzed and reported on financial data, achieving 98% accuracy in forecasting over a quarterly period.

- •Collaborated with project managers to create budget reports that enhanced project decision-making by 22%.

- •Identified system inefficiencies, proposing solutions that improved data processing time by 25%.

- •Contributed to the creation of monthly variance analysis reports, increasing management reporting efficiency by 33%.

- •Assisted in developing accounting policies, enhancing financial transparency which resulted in improved audit scores by 10%.

- •Performed daily accuracy checks within the accounting system leading to a decline in data entry errors by 17%.

- •Participated in the implementation of new financial software, helping cut system transition time by 30%.

- •Compiled data for management reports, facilitating quicker decision-making processes within the finance department.

Crafting an effective associate accountant resume can feel overwhelming, but it's your guide to new career opportunities. As you enter the accounting world, your resume is your beacon, showcasing your expertise to potential employers. Highlighting your financial skills and accuracy is essential, yet putting these on paper can be challenging.

In a crowded job market, it's important to stand out. Your resume isn't merely a list of skills; it's a narrative of reliability and precision. It allows you to show your understanding of accounting principles and how you've applied them in real-world situations. This is where many feel stuck without a clear starting point.

A resume template can be your roadmap. Offering a structured layout, it helps you effectively present your achievements, ensuring no crucial detail gets overlooked. Templates guide you in logically organizing your experiences and skills, making them clear to employers.

Think of your resume as your personal story in the accounting field. Your experiences with numbers, precision, and dedication are the core themes that need to shine through. The template provides a framework, but it's your unique touch that makes it stand out. Keep it focused, concise, and centered on the value you bring as an associate accountant.

When preparing your resume, treat it like compiling a precise financial statement: detailed, clear, and impactful. With the right tools and approach, your resume can open doors to the next stage in your career.

Key Takeaways

- Crafting a teacher resume involves more than listing skills; it's a narrative showcasing your reliability and precision in applying teaching principles in real-world contexts.

- A structured resume template helps organize your achievements effectively, ensuring important details are highlighted while maintaining clarity for potential employers.

- Highlight your experiences that emphasize dedication, precision, and expertise in a way that makes you stand out, with a clear focus on the value you bring to an educational role.

- Using a chronological format in your resume can help present a clear career growth narrative, which is highly valued by employers in assessing potential candidates.

- Incorporate an experience section that uses quantifiable achievements to clearly demonstrate your contributions and impacts in previous roles, enhancing the resume's effectiveness in attracting employer attention.

What to focus on when writing your associate accountant resume

Your associate accountant resume should seamlessly convey your accounting skills and meticulous attention to detail. This document should effectively highlight your ability to manage financial records and assist in business decision-making, ensuring recruiters recognize your relevant expertise and experience in the field of accounting.

How to structure your associate accountant resume

- Contact Information — Begin with your name, phone number, email, and LinkedIn profile to provide first-impression details. It's important to keep these elements current and professional to ensure seamless communication. Including a well-maintained LinkedIn profile can add value by showcasing any additional accomplishments that might not fit in the resume. Solid contact information sets the stage for a professional resume presentation.

- Professional Summary — Craft a brief paragraph that ties together your key qualifications, years of experience, and passion for accounting. Highlighting your motivation can differentiate you from similar candidates. Make sure to include significant experiences with financial analysis or bookkeeping that corroborate your professional journey. A compelling summary acts as a snapshot of your entire career.

- Work Experience — List your professional roles, beginning with the most recent and moving backward. This section should relate to accounting tasks like managing accounts, preparing financial reports, and assisting with audits, providing solid evidence of your hands-on experience. Quantifying achievements can demonstrate impact and value, giving recruiters a clear picture of how you contribute to business success. Highlighting your experience will naturally lead into discussions about educational background.

- Education — Detail your educational background, ensuring it aligns with your career goals. Include your degree, university, graduation date, and any academic honors or relevant coursework to demonstrate a well-rounded educational foundation. If you participated in any accounting-specific projects or extracurriculars, mention those to show commitments beyond standard classroom learning. This well-established educational section can transition smoothly into a focus on acquired skills.

- Skills — Highlight your proficiency in accounting software such as QuickBooks and Excel, emphasizing essential skills like financial reporting and payroll management. Here, listing both technical and soft skills, such as analytical thinking and teamwork, can paint a fuller picture of your capabilities. Considering the interconnected nature of these skills brings us to industry-recognized qualifications.

- Certifications — If applicable, conclude with any certifications like a CPA. Clearly specify certifying bodies and the dates obtained to add credibility and weight to your professional profile. Having these certifications demonstrates ongoing professional development and commitment to accounting standards. As we transition, let's explore the appropriate resume format and examine each section in more detail.

Which resume format to choose

In the accounting field, writing an effective resume is crucial for standing out. For an associate accountant position, a chronological format is your best bet. This approach not only highlights your latest experiences but also provides a clear narrative of your career growth, which is something employers value when assessing candidates in the financial sector.

Choosing the right font also plays a role in creating a professional impression. Fonts like Lato, Raleway, and Montserrat give your resume a modern edge. They are easy to read and lend a sleek, professional look, which reflects well on your attention to detail—a key trait for accountants.

Saving your resume as a PDF is important. PDFs maintain your formatting, so your document looks the same no matter where or how it is viewed. This uniformity is crucial in ensuring that employers see your resume exactly as you intended, emphasizing your professionalism.

Finally, paying attention to the layout is essential. Keeping one-inch margins on all sides ensures that your resume isn’t cluttered. A well-organized document with adequate white space helps maintain readability, making it easier for employers to focus on your qualifications and experiences. This neat presentation mirrors the precision and organization expected in accounting roles.

How to write a quantifiable resume experience section

The experience section of your associate accountant resume is essential because it shows how your skills and achievements align with the job you want. Begin with your most recent role and move backward to cover the past 10-15 years, ensuring that you focus on accounting-related titles for clarity and relevance.

Tailoring your resume to the job ad is crucial. Carefully reading the job description and incorporating similar language in your resume ensures that your profile matches what employers seek. This strategy helps your resume pass through applicant tracking systems more effectively. Use action words like "managed" or "coordinated" to clearly convey your contributions.

Quantifying your achievements adds a clear picture of your impact, helping employers see tangible results from your past roles. Including numbers, percentages, or specific outcomes explains the significance of your work. Here’s how to integrate these ideas effectively:

- •Reduced month-end closing process time by 30% through improved workflow processes.

- •Managed accounts for over 50 clients, maintaining a 98% accuracy rate in financial reporting.

- •Implemented a new expense tracking system leading to a 15% reduction in company expenses.

- •Collaborated with cross-functional teams to develop financial strategies, increasing client revenue by 20%.

This experience section seamlessly connects your skills to the associate accountant role, highlighting how your job titles and achievements are what hiring managers look for. The structure is logical, using reverse-chronological order for clarity. Each bullet point starts with a strong action verb and includes quantifiable achievements, making the impact of your contributions evident. By matching your language to the job description, your resume stands a better chance of catching the hiring manager's attention.

Problem-Solving Focused resume experience section

A problem-solving-focused associate accountant resume experience section should vividly illustrate how you tackle challenges and enhance financial processes. Begin by highlighting key achievements and responsibilities that demonstrate your analytical prowess and decision-making skills. Use active language to show how your actions have driven the company towards success or more efficient financial operations. Paint a clear picture of scenarios where you identified issues, took decisive measures, and achieved successful outcomes.

To make your experience stand out, zero in on specific achievements rather than everyday tasks. Back up your accomplishments with numbers whenever possible, as they provide clear evidence of your impact. For instance, specifying a percentage increase in efficiency or a decrease in error rates highlights the tangible benefits of your efforts. Make each bullet point concise and focused on the core problem-solving aspect, and use strong action verbs to enhance the dynamics of your statements. This approach not only showcases your qualifications but also emphasizes your proactive nature, ensuring that your resume leaves a lasting impression on hiring managers.

Associate Accountant

ABC Financial Inc.

Jan 2020 - Present

- Improved efficiency of monthly close process by 15% by implementing new accounting software.

- Reduced account discrepancies by 30% through the development of a detailed reconciliation process.

- Led a team in redesigning budget reports, resulting in a 20% improvement in accuracy.

- Identified areas of cost savings, contributing to a $50,000 annual reduction in expenses.

Achievement-Focused resume experience section

An achievement-focused associate accountant resume experience section should effectively showcase your contributions in previous roles by presenting them as impactful stories. Begin by highlighting tasks or projects where you made a significant impact, using strong action verbs like "coordinated," "implemented," and "streamlined" to convey your initiative. Follow this by emphasizing the results of your efforts, quantifying achievements when possible to illustrate the tangible benefits of your work. These outcomes could include cost savings, improved efficiency, or enhanced accuracy, which demonstrate how your contributions positively influenced the organization.

Ensure each bullet point tells a cohesive story, beginning with your action and ending with the result. By tailoring your language to align with the job description—while maintaining your unique voice—you create a narrative that speaks directly to the needs of potential employers. This approach helps hiring managers easily recognize your value and visualize how you could successfully integrate into their team.

Associate Accountant

XYZ Financial Services

June 2019 - Present

- Reduced month-end closing process time by 25% through improved procedures and automation, streamlining operations.

- Boosted financial statement accuracy by assisting in their preparation, ensuring compliance and reliability.

- Identified and rectified discrepancies through audits, enhancing report accuracy by 10% and maintaining GAAP standards.

- Collaborated with cross-functional teams to devise budgeting strategies, leading to a 15% reduction in costs.

Industry-Specific Focus resume experience section

A well-crafted associate accountant-focused resume experience section should showcase your industry-relevant skills and achievements in a cohesive manner. Start by highlighting the accounting tasks you've handled, clearly showing their relevance to the industry you're targeting. It's essential to illustrate how your efforts have benefitted your previous employers, offering potential new employers a glimpse of the value you can bring to their organization. This clear and relevant presentation helps the reader quickly see your potential fit within their team.

List your job titles and dates of employment, optionally including a brief company introduction to provide context. Use bullet points to narrate your responsibilities and accomplishments, ensuring a seamless flow by connecting your achievements with the challenges you addressed and the outcomes you delivered. Dynamic action verbs paired with specific numbers or results help paint a vivid picture of your impact, ensuring your experience is both compelling and easy to follow.

Associate Accountant

XYZ Manufacturing Inc.

June 2020 - Present

- Analyzed financial statements for a manufacturing company, ensuring compliance with industry standards for both accuracy and regulatory adherence.

- Implemented new reporting procedures, leading to a 20% reduction in discrepancies within the first year and enhancing the overall data reliability.

- Collaborated with cross-functional teams to develop budgeting strategies, resulting in a $500,000 improvement in cash flow annually.

- Managed a $10 million asset portfolio, optimizing investment opportunities and driving a 15% increase in returns.

Efficiency-Focused resume experience section

An efficiency-focused associate accountant resume experience section should highlight your skills in streamlining processes and enhancing productivity. Start by describing your relevant experiences and provide specific examples of how you improved tasks or developed solutions that saved time or resources. Incorporate numbers or percentages to emphasize the impact of your work, weaving in instances where you identified inefficiencies and initiated proactive measures. Use active language to convey your contributions to reaching team or company goals.

Tailoring each entry to the job you're applying for is crucial; focus on skills and achievements that align with the role’s requirements. Highlight your most recent and relevant experiences, ensuring your bullet points focus on results and practical benefits. This well-crafted section not only lists duties but also demonstrates how you added value and drove improvements, showcasing your dedication to continuous enhancement and operational success.

Associate Accountant

Tech Solutions Inc.

June 2020 - Present

- Streamlined month-end reporting process, reducing completion time by 25% through automation tools.

- Developed a training module for department staff to enhance accuracy in financial data entry.

- Implemented cost-saving measures that cut operational expenses by 10% annually.

- Collaborated with cross-functional teams to drive improvements that increased productivity by 15%.

Write your associate accountant resume summary section

A well-focused associate accountant resume summary should effectively convey your professional experience and skills to capture an employer's attention. Start by creating a concise snapshot of your career journey, highlighting the unique strengths and achievements you bring to the role. Tailoring your summary to match the specific job application is crucial to making a strong impression. For instance, consider this example for an associate accountant position:

This summary effectively combines essential skills, experience, and achievements in a way that signals your value to potential employers. By emphasizing skills like analytical expertise and proficiency with accounting software, and by quantifying your experience as "over 3 years," you make your qualifications clear and impressive.

When describing yourself, choose terms that reflect your commitment and effectiveness, such as "dedicated," "results-driven," and "skilled." Providing context helps avoid clichés. Understanding the difference between a resume summary and a resume objective is important: a summary focuses on your achievements and skills, while an objective highlights your career goals. While resume profiles and summaries often overlap, profiles tend to offer more detail. A summary of qualifications uses a bulleted list to spotlight top skills and experiences. If you are applying for an entry-level position, a resume objective can be beneficial in directing attention to your aspirations. For those with more experience, a summary demonstrates how your past successes align with the company's needs.

Listing your associate accountant skills on your resume

A skills-focused associate accountant resume should clearly highlight what you're good at and where your talents lie. You can either create a separate section just for skills or seamlessly incorporate them into other parts of your resume, such as your experience and summary. This approach ensures your abilities are front and center, making them easy for employers to spot.

Your strengths often revolve around soft skills like effective communication and teamwork. These personal qualities complement your technical expertise and make you an attractive candidate. On the other hand, hard skills are specific and teachable abilities, such as mastering accounting software or understanding financial regulations. These skills are essential for success in your career.

When you use skills and strengths as keywords in your resume, they can catch the attention of both employers and ATS systems. Keywords are your ticket to standing out, increasing the likelihood of landing a job interview.

Example standalone skills section in JSON format:

This skills section efficiently balances both technical and soft skills crucial for an associate accountant. It’s straightforward, informative, and tells potential employers precisely what you're capable of.

Best hard skills to feature on your associate accountant resume

For an associate accountant, showcasing certain hard skills is vital to demonstrating your technical proficiency. These skills make you stand out as a knowledgeable and qualified candidate.

Hard Skills

- Financial Reporting

- General Ledger Accounting

- Tax Preparation

- Data Analysis

- Budgeting

- Proficiency in Excel

- QuickBooks and other Accounting Software

- Accounts Reconciliation

- Audit Support

- Financial Statement Analysis

- Payroll Processing

- Regulatory Compliance

- Accounts Payable/Receivable

- Cost Accounting

- Bookkeeping

Best soft skills to feature on your associate accountant resume

In addition to hard skills, featuring soft skills is equally important. These skills highlight your ability to work well in diverse environments and handle various situations adeptly.

Soft Skills

- Communication Skills

- Attention to Detail

- Teamwork

- Time Management

- Problem-Solving

- Analytical Thinking

- Adaptability

- Critical Thinking

- Decision Making

- Organization Skills

- Interpersonal Skills

- Leadership Potential

- Customer Service Orientation

- Integrity

- Stress Management

How to include your education on your resume

Including an education section on your resume is important because it highlights your academic achievements and qualifications relevant to the job. Tailor this section for each job application by only including education that aligns with the associate accountant position you are targeting. If your GPA is above 3.0, consider including it to emphasize your academic performance. List cum laude honors clearly, as they showcase your dedication and success in your studies. When listing a degree, specify the exact title and any relevant major or minor.

Here is an example of a poorly structured education section:

This example falls short because "Bachelor of Arts" does not relate directly to an accounting role, and a GPA of 2.8 is not typically highlighted. Here is how an effective education section could look:

This example is effective because it displays a relevant degree for accounting, includes a strong GPA, and lacks unnecessary location details. The clear degree title and high GPA demonstrate focused study and achievement in the field, making it attractive to potential employers.

How to include associate accountant certificates on your resume

Including a certificates section on your associate accountant resume is crucial. This section highlights your additional qualifications, showcasing skills and knowledge relevant to the field. You can also include certificates in your resume header for quick visibility.

To list certificates effectively, start by listing the name of the certificate. Include the date you earned the certification to show its relevance. Add the issuing organization to validate the authenticity of the certificate.

For example, you can present it in the header like this: "John Doe, CPA, QuickBooks Certified User." This format immediately catches the recruiter's eye.

This example is effective because it includes relevant certification titles and respected issuing organizations. The information is straightforward, which makes it easier for employers to quickly assess your qualifications. For an associate accountant position, having CPA and QuickBooks certifications shows both your knowledge and practical skills, increasing your chances of getting hired.

Extra sections to include in your associate accountant resume

Creating a well-rounded resume for an associate accountant can give you an edge over other candidates. Highlighting key experiences and unique sections can make your resume stand out. Here’s how you can effectively incorporate various sections into your resume for maximum impact.

Language section — Include this section to showcase any additional languages you speak. It can highlight your ability to work with diverse clients or international firms.

Hobbies and interests section — Mentioning relevant hobbies and interests can humanize your resume and reveal transferable skills. It allows potential employers to see you as a well-rounded individual.

Volunteer work section — List relevant volunteer work to show your commitment to community and teamwork. It can also reflect initiative and leadership qualities that are attractive in an associate accountant.

Books section — Share a list of books you've read that pertain to finance or accounting. It demonstrates continuous learning and passion for your field, which can set you apart from other candidates.

In Conclusion

In conclusion, preparing an associate accountant resume is about more than just detailing your job history; it is about crafting a narrative that highlights your strengths, skills, and unique experiences. Your resume acts as both a personal story and a professional document, working to captivate potential employers by showcasing your reliability and precision in the accounting field. Using tools like resume templates can help in organizing and presenting your experiences effectively, ensuring that you don't miss any important details. Remember to emphasize both hard and soft skills, weaving them into your past work experiences for a comprehensive presentation. Whether you're showcasing certifications, educational background, or past achievements, your resume should reflect your continuous professional growth and commitment to the field. Select a resume format that best portrays your career progression, and choose fonts and layouts that enhance readability and professionalism. By quantifying your achievements and tailoring your resume to specific job ads, you strengthen your profile against applicant tracking systems and draw in human recruiters. Including additional sections like hobbies, languages, or volunteer efforts can paint a fuller picture of who you are beyond your professional life. Ultimately, by focusing on accurate and engaging storytelling, you can craft a resume that not only stands out but also effectively propels you towards your next career opportunity as an associate accountant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.