Auto Insurance Claims Adjuster Resume Examples

Mar 26, 2025

|

12 min read

Craft a standout auto insurance claims adjuster resume to ensure you’re always in the driver’s seat of your career. Reveal your knack for navigating claim details and steer your application towards success with these practical resume tips.

Rated by 348 people

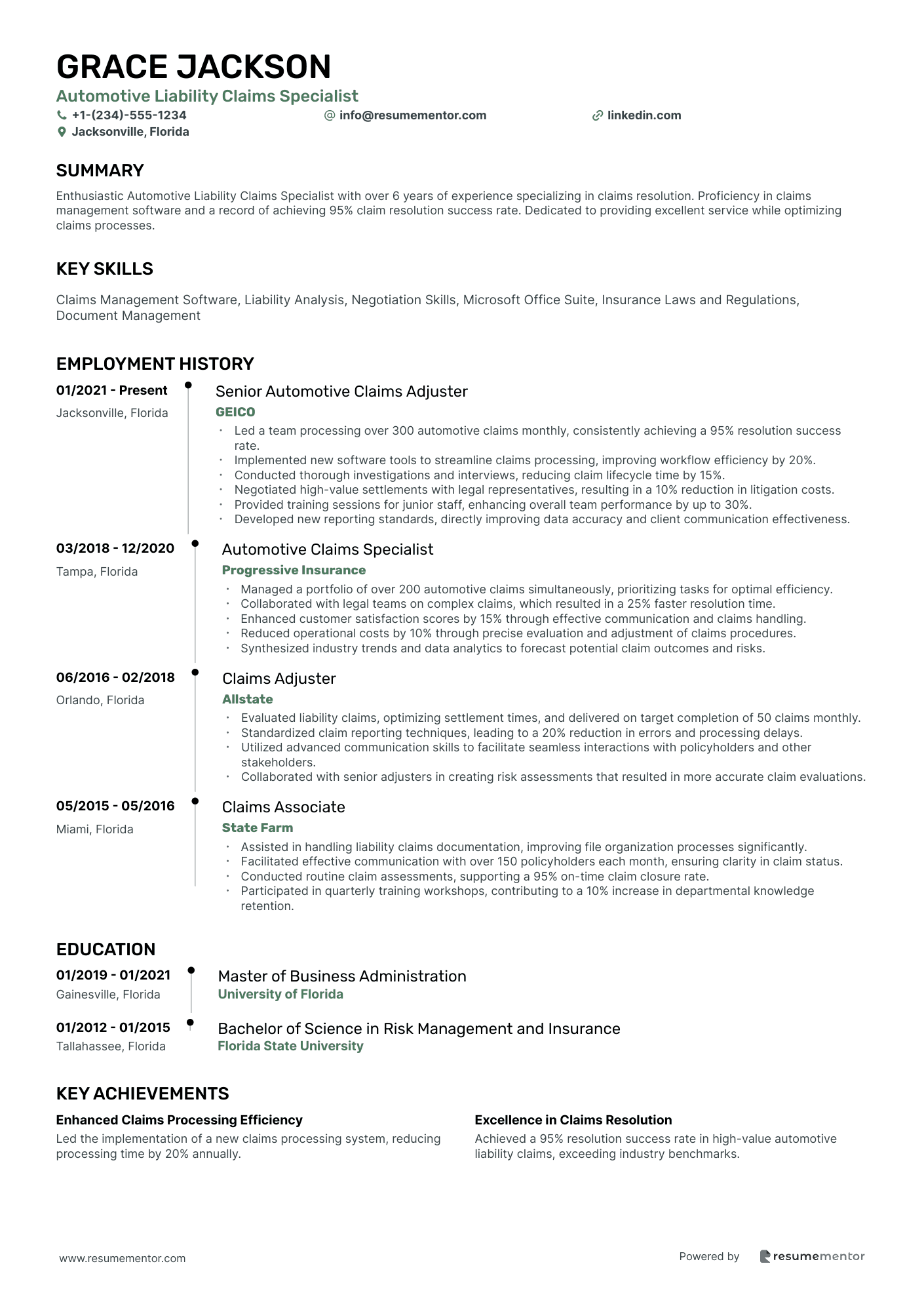

Automotive Liability Claims Specialist

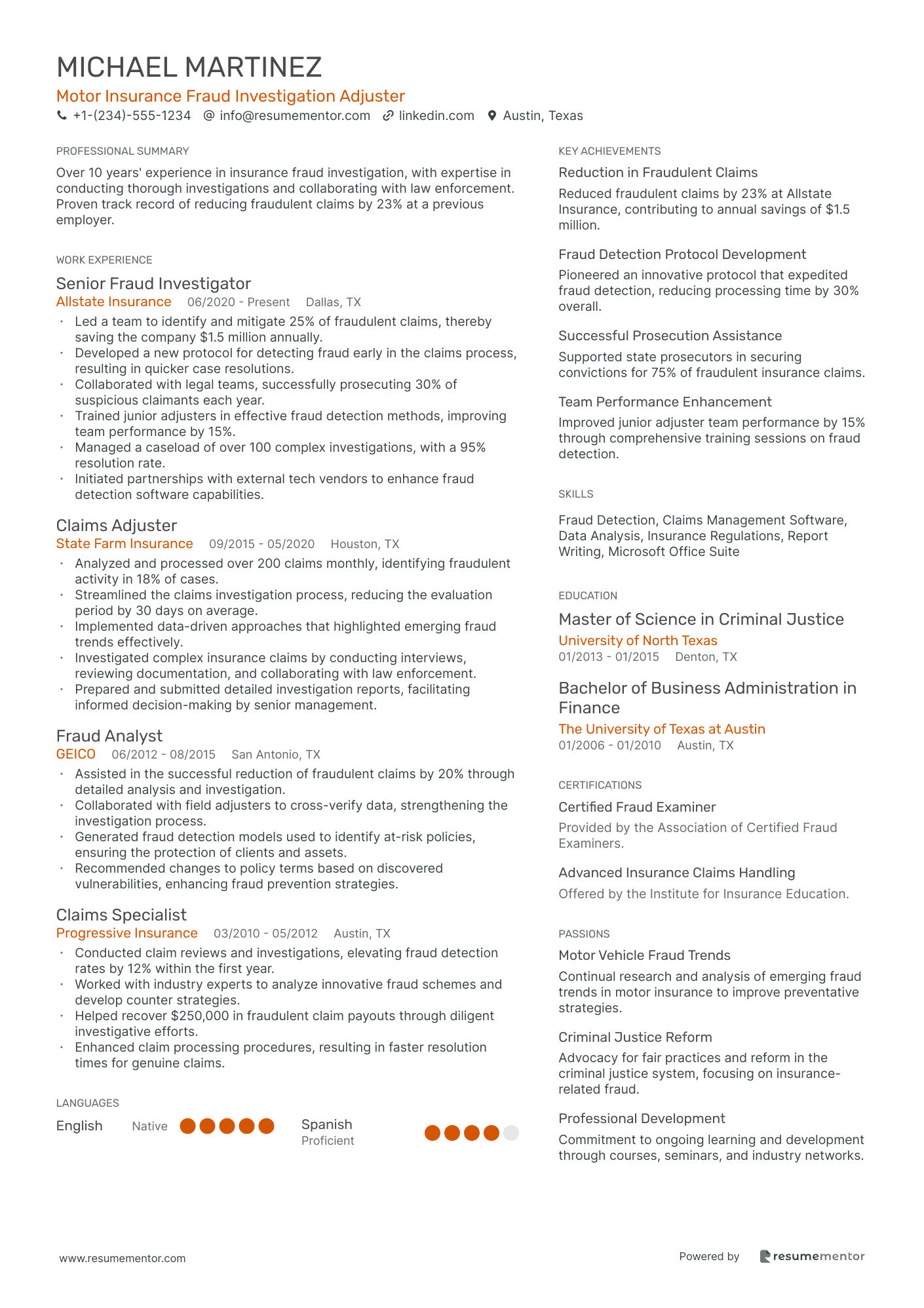

Motor Insurance Fraud Investigation Adjuster

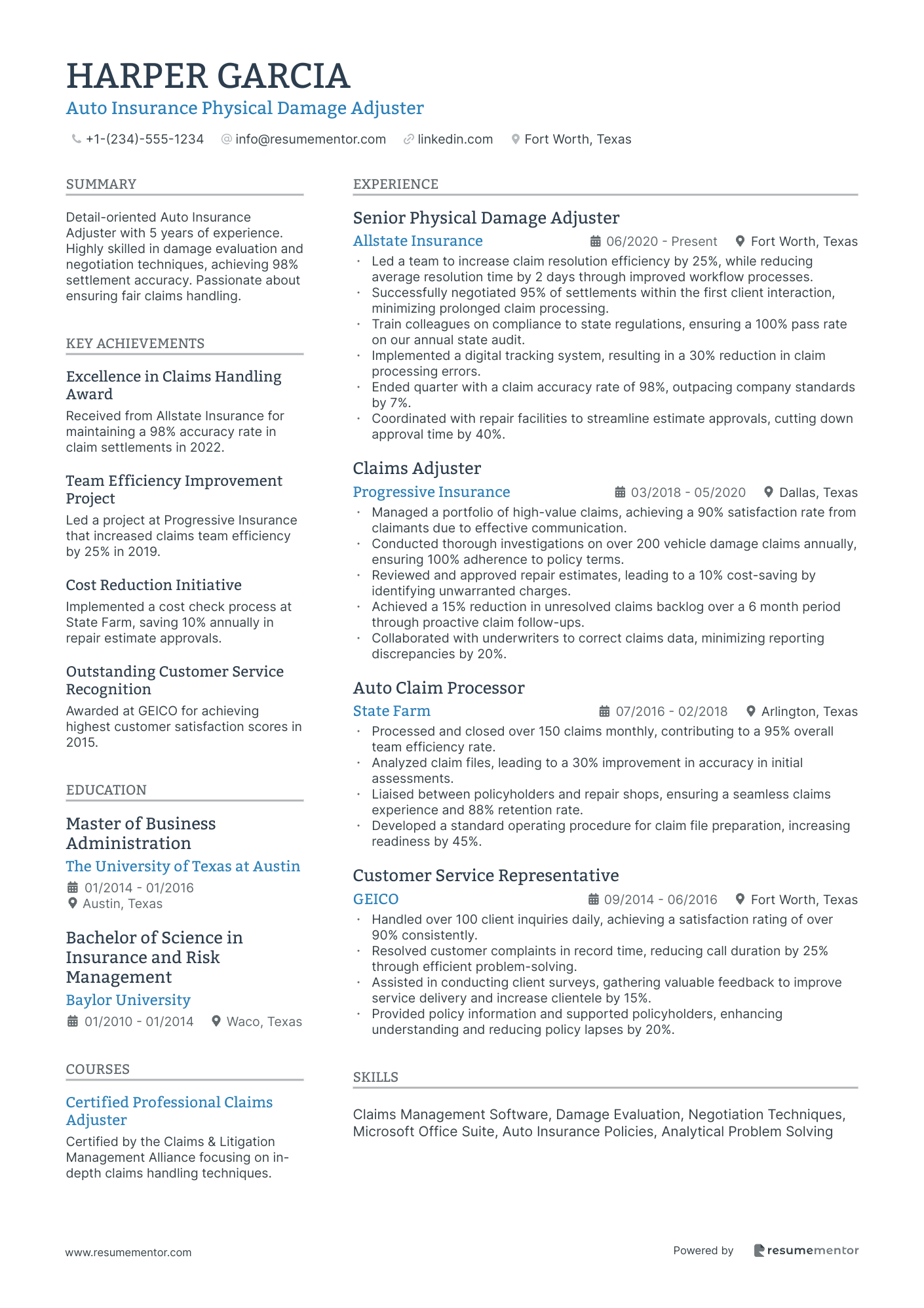

Auto Insurance Physical Damage Adjuster

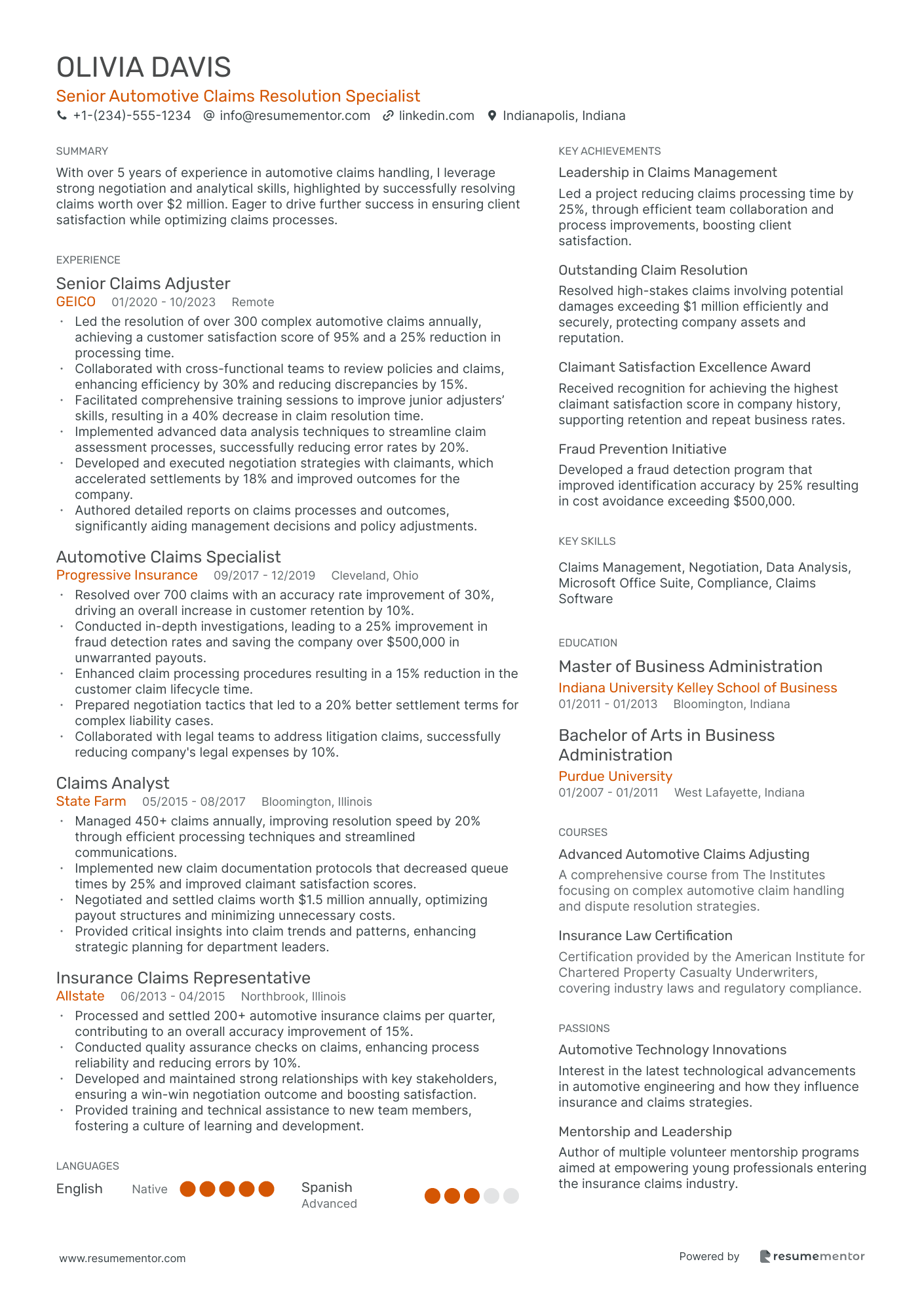

Senior Automotive Claims Resolution Specialist

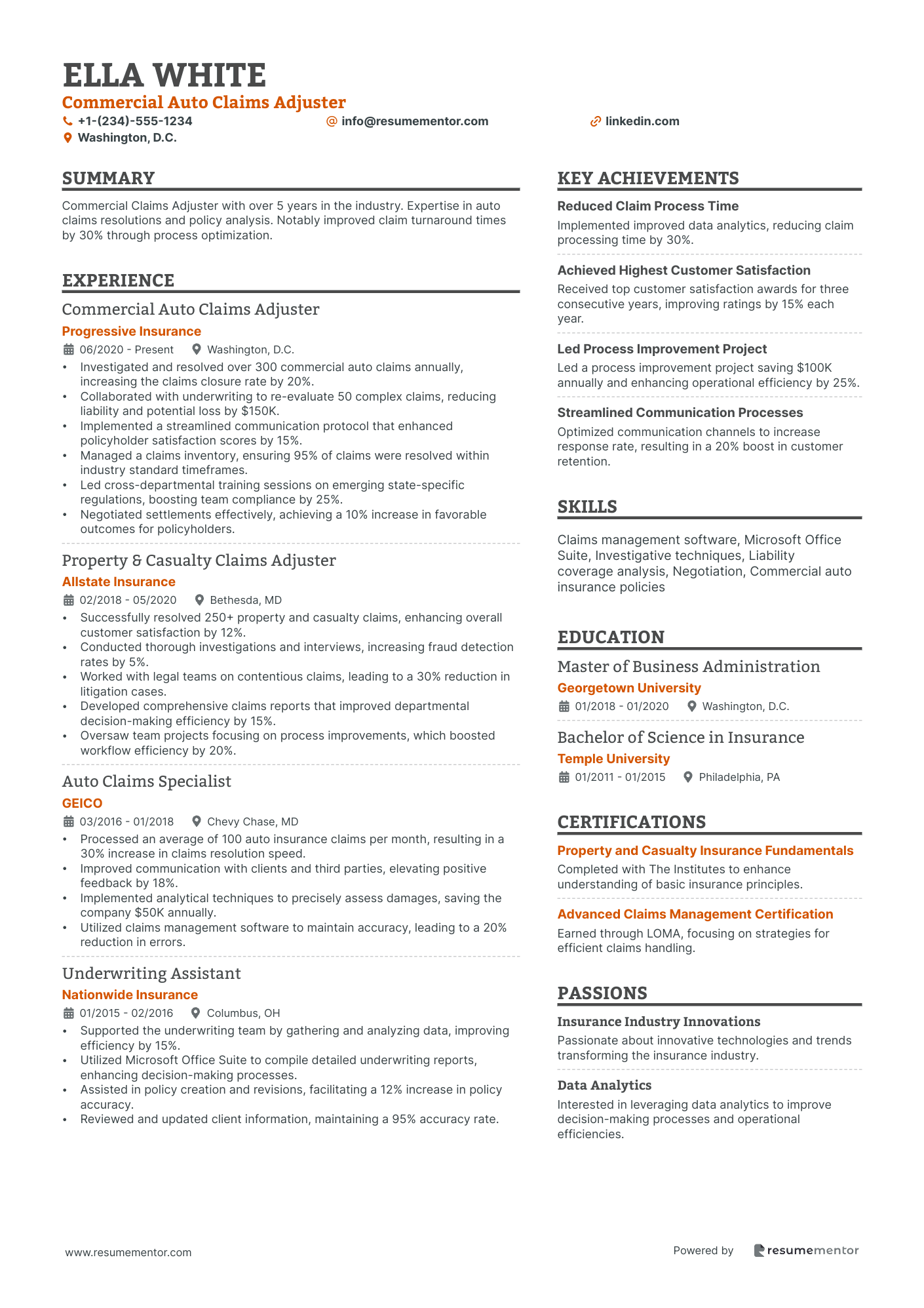

Commercial Auto Claims Adjuster

Vehicle Theft Claims Adjuster

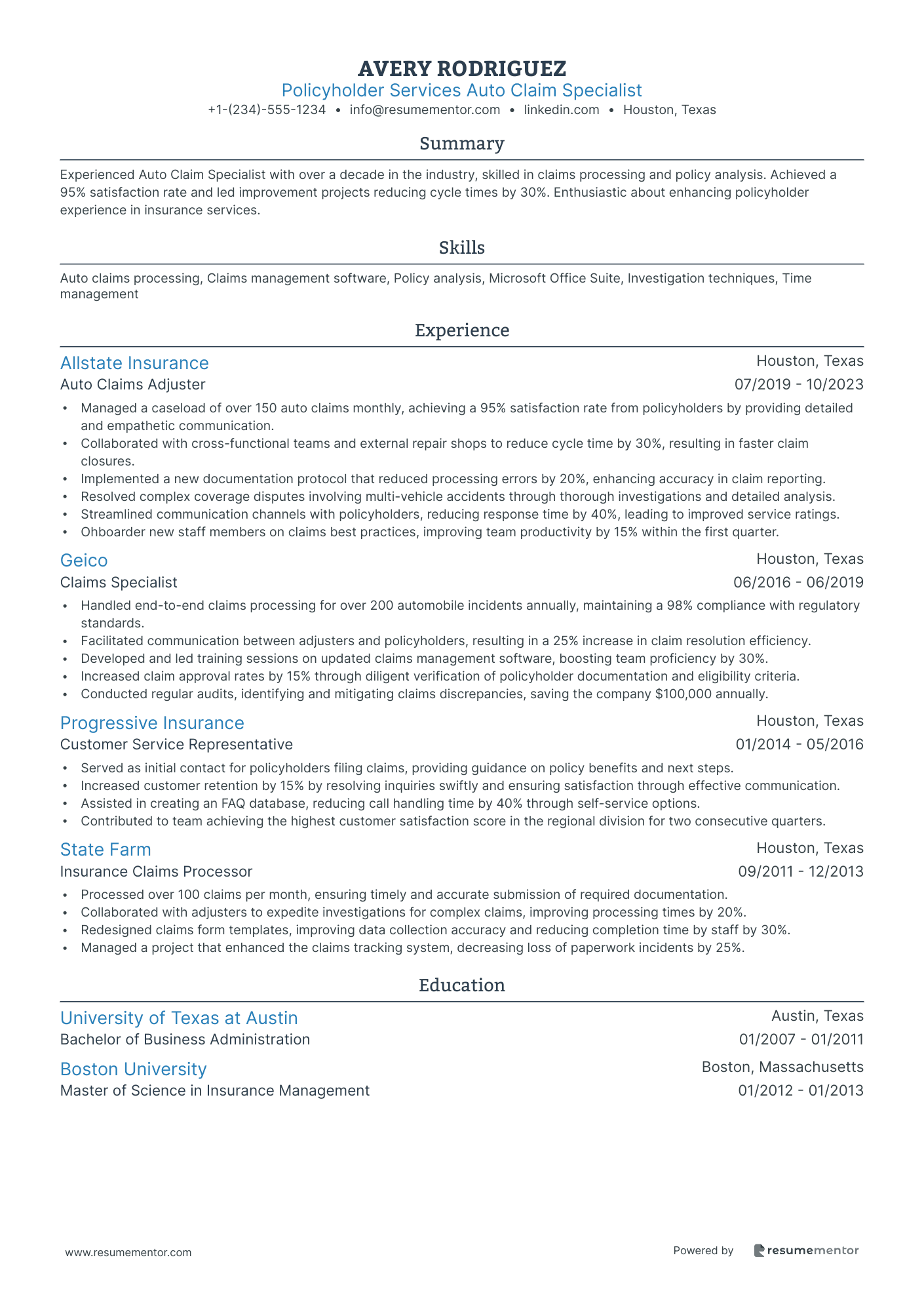

Policyholder Services Auto Claim Specialist

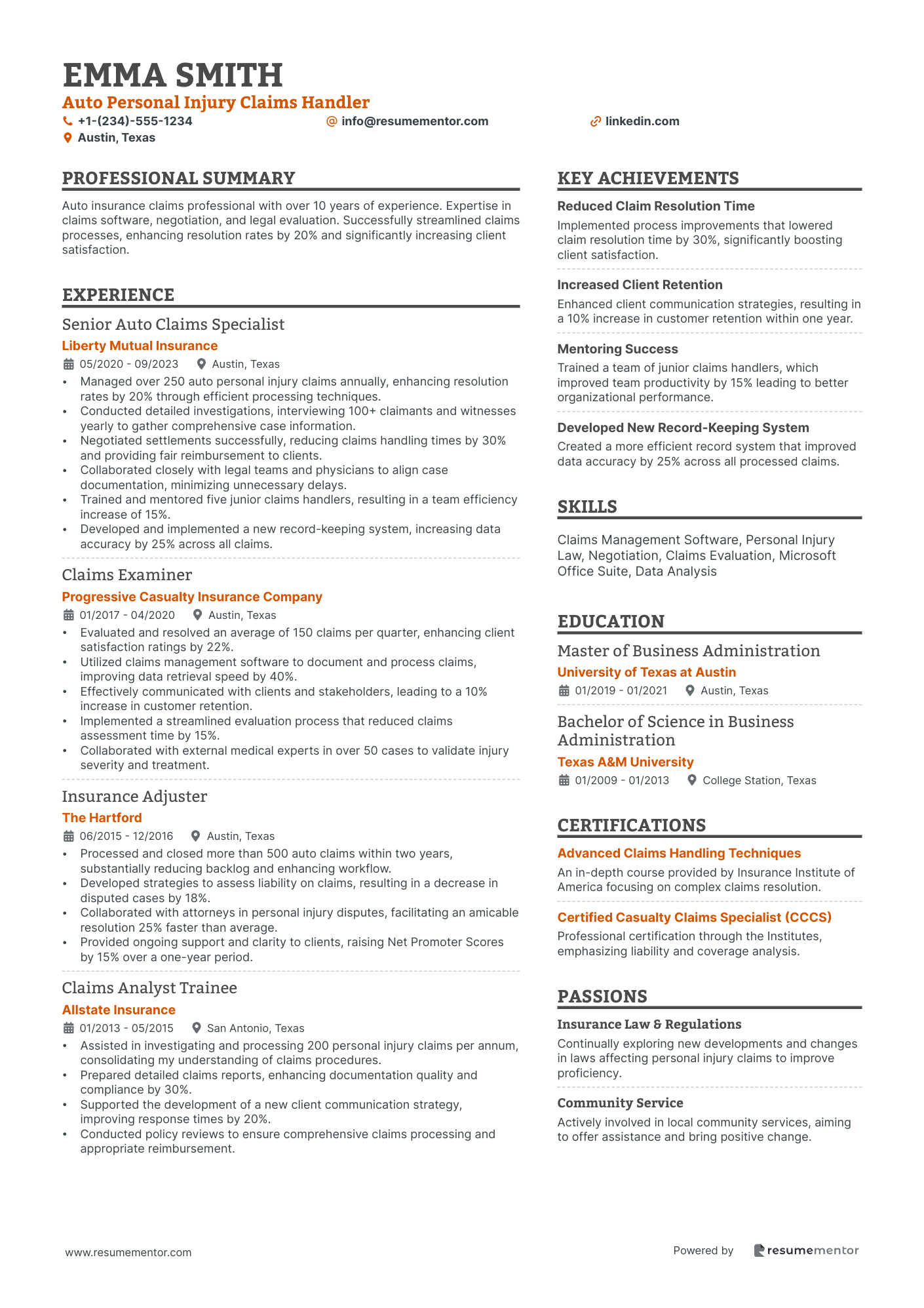

Auto Personal Injury Claims Handler

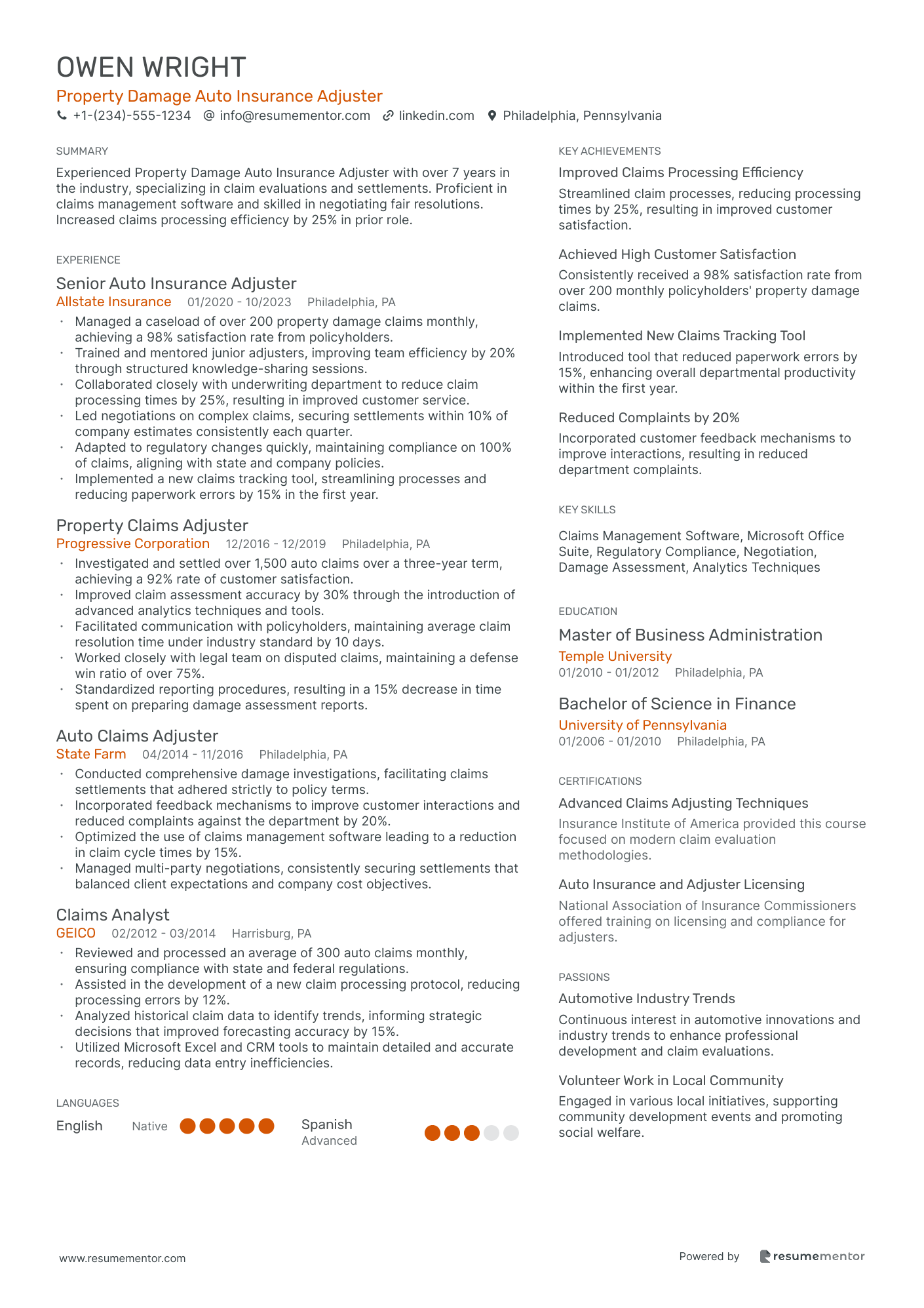

Property Damage Auto Insurance Adjuster

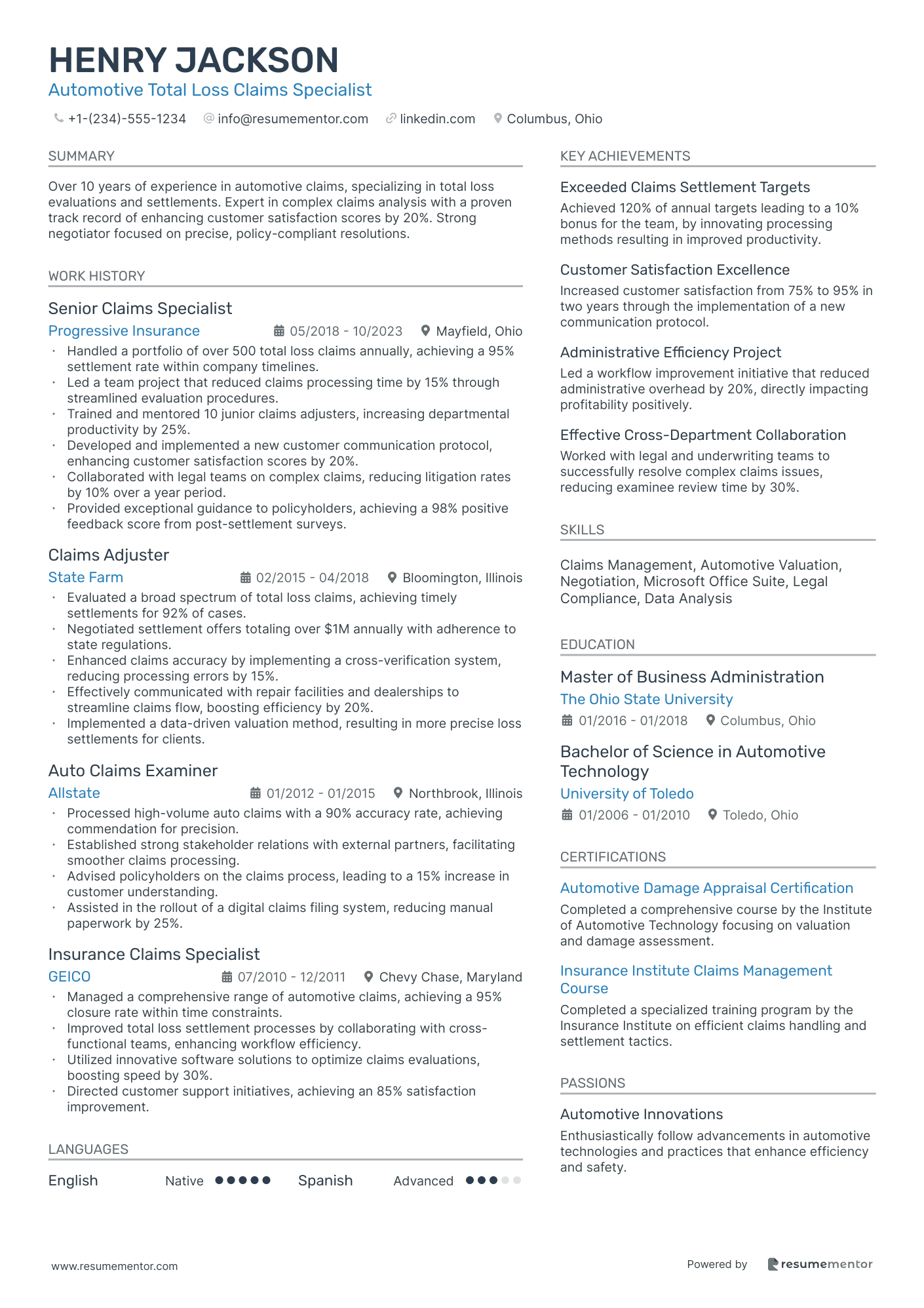

Automotive Total Loss Claims Specialist

Automotive Liability Claims Specialist resume sample

- •Led a team processing over 300 automotive claims monthly, consistently achieving a 95% resolution success rate.

- •Implemented new software tools to streamline claims processing, improving workflow efficiency by 20%.

- •Conducted thorough investigations and interviews, reducing claim lifecycle time by 15%.

- •Negotiated high-value settlements with legal representatives, resulting in a 10% reduction in litigation costs.

- •Provided training sessions for junior staff, enhancing overall team performance by up to 30%.

- •Developed new reporting standards, directly improving data accuracy and client communication effectiveness.

- •Managed a portfolio of over 200 automotive claims simultaneously, prioritizing tasks for optimal efficiency.

- •Collaborated with legal teams on complex claims, which resulted in a 25% faster resolution time.

- •Enhanced customer satisfaction scores by 15% through effective communication and claims handling.

- •Reduced operational costs by 10% through precise evaluation and adjustment of claims procedures.

- •Synthesized industry trends and data analytics to forecast potential claim outcomes and risks.

- •Evaluated liability claims, optimizing settlement times, and delivered on target completion of 50 claims monthly.

- •Standardized claim reporting techniques, leading to a 20% reduction in errors and processing delays.

- •Utilized advanced communication skills to facilitate seamless interactions with policyholders and other stakeholders.

- •Collaborated with senior adjusters in creating risk assessments that resulted in more accurate claim evaluations.

- •Assisted in handling liability claims documentation, improving file organization processes significantly.

- •Facilitated effective communication with over 150 policyholders each month, ensuring clarity in claim status.

- •Conducted routine claim assessments, supporting a 95% on-time claim closure rate.

- •Participated in quarterly training workshops, contributing to a 10% increase in departmental knowledge retention.

Motor Insurance Fraud Investigation Adjuster resume sample

- •Led a team to identify and mitigate 25% of fraudulent claims, thereby saving the company $1.5 million annually.

- •Developed a new protocol for detecting fraud early in the claims process, resulting in quicker case resolutions.

- •Collaborated with legal teams, successfully prosecuting 30% of suspicious claimants each year.

- •Trained junior adjusters in effective fraud detection methods, improving team performance by 15%.

- •Managed a caseload of over 100 complex investigations, with a 95% resolution rate.

- •Initiated partnerships with external tech vendors to enhance fraud detection software capabilities.

- •Analyzed and processed over 200 claims monthly, identifying fraudulent activity in 18% of cases.

- •Streamlined the claims investigation process, reducing the evaluation period by 30 days on average.

- •Implemented data-driven approaches that highlighted emerging fraud trends effectively.

- •Investigated complex insurance claims by conducting interviews, reviewing documentation, and collaborating with law enforcement.

- •Prepared and submitted detailed investigation reports, facilitating informed decision-making by senior management.

- •Assisted in the successful reduction of fraudulent claims by 20% through detailed analysis and investigation.

- •Collaborated with field adjusters to cross-verify data, strengthening the investigation process.

- •Generated fraud detection models used to identify at-risk policies, ensuring the protection of clients and assets.

- •Recommended changes to policy terms based on discovered vulnerabilities, enhancing fraud prevention strategies.

- •Conducted claim reviews and investigations, elevating fraud detection rates by 12% within the first year.

- •Worked with industry experts to analyze innovative fraud schemes and develop counter strategies.

- •Helped recover $250,000 in fraudulent claim payouts through diligent investigative efforts.

- •Enhanced claim processing procedures, resulting in faster resolution times for genuine claims.

Auto Insurance Physical Damage Adjuster resume sample

- •Led a team to increase claim resolution efficiency by 25%, while reducing average resolution time by 2 days through improved workflow processes.

- •Successfully negotiated 95% of settlements within the first client interaction, minimizing prolonged claim processing.

- •Train colleagues on compliance to state regulations, ensuring a 100% pass rate on our annual state audit.

- •Implemented a digital tracking system, resulting in a 30% reduction in claim processing errors.

- •Ended quarter with a claim accuracy rate of 98%, outpacing company standards by 7%.

- •Coordinated with repair facilities to streamline estimate approvals, cutting down approval time by 40%.

- •Managed a portfolio of high-value claims, achieving a 90% satisfaction rate from claimants due to effective communication.

- •Conducted thorough investigations on over 200 vehicle damage claims annually, ensuring 100% adherence to policy terms.

- •Reviewed and approved repair estimates, leading to a 10% cost-saving by identifying unwarranted charges.

- •Achieved a 15% reduction in unresolved claims backlog over a 6 month period through proactive claim follow-ups.

- •Collaborated with underwriters to correct claims data, minimizing reporting discrepancies by 20%.

- •Processed and closed over 150 claims monthly, contributing to a 95% overall team efficiency rate.

- •Analyzed claim files, leading to a 30% improvement in accuracy in initial assessments.

- •Liaised between policyholders and repair shops, ensuring a seamless claims experience and 88% retention rate.

- •Developed a standard operating procedure for claim file preparation, increasing readiness by 45%.

- •Handled over 100 client inquiries daily, achieving a satisfaction rating of over 90% consistently.

- •Resolved customer complaints in record time, reducing call duration by 25% through efficient problem-solving.

- •Assisted in conducting client surveys, gathering valuable feedback to improve service delivery and increase clientele by 15%.

- •Provided policy information and supported policyholders, enhancing understanding and reducing policy lapses by 20%.

Senior Automotive Claims Resolution Specialist resume sample

- •Led the resolution of over 300 complex automotive claims annually, achieving a customer satisfaction score of 95% and a 25% reduction in processing time.

- •Collaborated with cross-functional teams to review policies and claims, enhancing efficiency by 30% and reducing discrepancies by 15%.

- •Facilitated comprehensive training sessions to improve junior adjusters’ skills, resulting in a 40% decrease in claim resolution time.

- •Implemented advanced data analysis techniques to streamline claim assessment processes, successfully reducing error rates by 20%.

- •Developed and executed negotiation strategies with claimants, which accelerated settlements by 18% and improved outcomes for the company.

- •Authored detailed reports on claims processes and outcomes, significantly aiding management decisions and policy adjustments.

- •Resolved over 700 claims with an accuracy rate improvement of 30%, driving an overall increase in customer retention by 10%.

- •Conducted in-depth investigations, leading to a 25% improvement in fraud detection rates and saving the company over $500,000 in unwarranted payouts.

- •Enhanced claim processing procedures resulting in a 15% reduction in the customer claim lifecycle time.

- •Prepared negotiation tactics that led to a 20% better settlement terms for complex liability cases.

- •Collaborated with legal teams to address litigation claims, successfully reducing company's legal expenses by 10%.

- •Managed 450+ claims annually, improving resolution speed by 20% through efficient processing techniques and streamlined communications.

- •Implemented new claim documentation protocols that decreased queue times by 25% and improved claimant satisfaction scores.

- •Negotiated and settled claims worth $1.5 million annually, optimizing payout structures and minimizing unnecessary costs.

- •Provided critical insights into claim trends and patterns, enhancing strategic planning for department leaders.

- •Processed and settled 200+ automotive insurance claims per quarter, contributing to an overall accuracy improvement of 15%.

- •Conducted quality assurance checks on claims, enhancing process reliability and reducing errors by 10%.

- •Developed and maintained strong relationships with key stakeholders, ensuring a win-win negotiation outcome and boosting satisfaction.

- •Provided training and technical assistance to new team members, fostering a culture of learning and development.

Commercial Auto Claims Adjuster resume sample

- •Investigated and resolved over 300 commercial auto claims annually, increasing the claims closure rate by 20%.

- •Collaborated with underwriting to re-evaluate 50 complex claims, reducing liability and potential loss by $150K.

- •Implemented a streamlined communication protocol that enhanced policyholder satisfaction scores by 15%.

- •Managed a claims inventory, ensuring 95% of claims were resolved within industry standard timeframes.

- •Led cross-departmental training sessions on emerging state-specific regulations, boosting team compliance by 25%.

- •Negotiated settlements effectively, achieving a 10% increase in favorable outcomes for policyholders.

- •Successfully resolved 250+ property and casualty claims, enhancing overall customer satisfaction by 12%.

- •Conducted thorough investigations and interviews, increasing fraud detection rates by 5%.

- •Worked with legal teams on contentious claims, leading to a 30% reduction in litigation cases.

- •Developed comprehensive claims reports that improved departmental decision-making efficiency by 15%.

- •Oversaw team projects focusing on process improvements, which boosted workflow efficiency by 20%.

- •Processed an average of 100 auto insurance claims per month, resulting in a 30% increase in claims resolution speed.

- •Improved communication with clients and third parties, elevating positive feedback by 18%.

- •Implemented analytical techniques to precisely assess damages, saving the company $50K annually.

- •Utilized claims management software to maintain accuracy, leading to a 20% reduction in errors.

- •Supported the underwriting team by gathering and analyzing data, improving efficiency by 15%.

- •Utilized Microsoft Office Suite to compile detailed underwriting reports, enhancing decision-making processes.

- •Assisted in policy creation and revisions, facilitating a 12% increase in policy accuracy.

- •Reviewed and updated client information, maintaining a 95% accuracy rate.

Vehicle Theft Claims Adjuster resume sample

- •Led investigation and resolution of over 120 vehicle theft claims annually, achieving a resolution rate of 90% within established timelines.

- •Collaborated with law enforcement agencies to streamline recovery processes, enhancing stolen vehicle recovery rate by 15%.

- •Implemented advanced claims management software systems, resulting in a 20% increase in productivity and faster claim processing times.

- •Developed negotiation strategies, achieving a 95% success rate in amicable settlement agreements with claimants and legal representatives.

- •Analyzed policy coverage meticulously, reducing fraud-related claim approvals by 25% through detailed examinations.

- •Mentored junior adjusters, increasing team efficiency by guiding them on complex claims, which led to a 30% improvement in team performance.

- •Processed over 100 vehicle theft claims annually, maintaining a 92% customer satisfaction rating through diligent investigation and communication.

- •Pioneered a new documentation protocol, resulting in a 10% reduction in processing errors and improved claim validation efficiency.

- •Formulated comprehensive reports for upper management, highlighting key trends and vehicle theft patterns to inform policy adjustments.

- •Engaged in regular training sessions on updated industry regulations, enhancing knowledge base by 30%, and ensuring regulatory compliance.

- •Successfully mediated negotiations with claimants, achieving favorable settlements while safeguarding company’s financial interests.

- •Assisted in the assessment of over 80 claims each quarter, improving accuracy and speeding up the adjudication process.

- •Enhanced theft recovery coordination with salvage yards, resulting in a 10% annual increase in recovered vehicle assets.

- •Undertook detailed evidence gathering and analysis, achieving a claims validation rate improvement of 15% annually.

- •Managed client communication, ensuring a 96% satisfaction rating as evidenced by post-service feedback surveys.

- •Investigated and closed over 150 property claims annually, maintaining a 98% completion rate before deadlines.

- •Optimized documentation processes, reducing error rates by 15% and facilitating quicker claim resolutions.

- •Participated in team workshops, sharing best practices and improving overall team performance by 20%.

- •Coordinated with policyholders and contractors, achieving a 90% rate in successful settlements.

Policyholder Services Auto Claim Specialist resume sample

- •Managed a caseload of over 150 auto claims monthly, achieving a 95% satisfaction rate from policyholders by providing detailed and empathetic communication.

- •Collaborated with cross-functional teams and external repair shops to reduce cycle time by 30%, resulting in faster claim closures.

- •Implemented a new documentation protocol that reduced processing errors by 20%, enhancing accuracy in claim reporting.

- •Resolved complex coverage disputes involving multi-vehicle accidents through thorough investigations and detailed analysis.

- •Streamlined communication channels with policyholders, reducing response time by 40%, leading to improved service ratings.

- •Ohboarder new staff members on claims best practices, improving team productivity by 15% within the first quarter.

- •Handled end-to-end claims processing for over 200 automobile incidents annually, maintaining a 98% compliance with regulatory standards.

- •Facilitated communication between adjusters and policyholders, resulting in a 25% increase in claim resolution efficiency.

- •Developed and led training sessions on updated claims management software, boosting team proficiency by 30%.

- •Increased claim approval rates by 15% through diligent verification of policyholder documentation and eligibility criteria.

- •Conducted regular audits, identifying and mitigating claims discrepancies, saving the company $100,000 annually.

- •Served as initial contact for policyholders filing claims, providing guidance on policy benefits and next steps.

- •Increased customer retention by 15% by resolving inquiries swiftly and ensuring satisfaction through effective communication.

- •Assisted in creating an FAQ database, reducing call handling time by 40% through self-service options.

- •Contributed to team achieving the highest customer satisfaction score in the regional division for two consecutive quarters.

- •Processed over 100 claims per month, ensuring timely and accurate submission of required documentation.

- •Collaborated with adjusters to expedite investigations for complex claims, improving processing times by 20%.

- •Redesigned claims form templates, improving data collection accuracy and reducing completion time by staff by 30%.

- •Managed a project that enhanced the claims tracking system, decreasing loss of paperwork incidents by 25%.

Auto Personal Injury Claims Handler resume sample

- •Managed over 250 auto personal injury claims annually, enhancing resolution rates by 20% through efficient processing techniques.

- •Conducted detailed investigations, interviewing 100+ claimants and witnesses yearly to gather comprehensive case information.

- •Negotiated settlements successfully, reducing claims handling times by 30% and providing fair reimbursement to clients.

- •Collaborated closely with legal teams and physicians to align case documentation, minimizing unnecessary delays.

- •Trained and mentored five junior claims handlers, resulting in a team efficiency increase of 15%.

- •Developed and implemented a new record-keeping system, increasing data accuracy by 25% across all claims.

- •Evaluated and resolved an average of 150 claims per quarter, enhancing client satisfaction ratings by 22%.

- •Utilized claims management software to document and process claims, improving data retrieval speed by 40%.

- •Effectively communicated with clients and stakeholders, leading to a 10% increase in customer retention.

- •Implemented a streamlined evaluation process that reduced claims assessment time by 15%.

- •Collaborated with external medical experts in over 50 cases to validate injury severity and treatment.

- •Processed and closed more than 500 auto claims within two years, substantially reducing backlog and enhancing workflow.

- •Developed strategies to assess liability on claims, resulting in a decrease in disputed cases by 18%.

- •Collaborated with attorneys in personal injury disputes, facilitating an amicable resolution 25% faster than average.

- •Provided ongoing support and clarity to clients, raising Net Promoter Scores by 15% over a one-year period.

- •Assisted in investigating and processing 200 personal injury claims per annum, consolidating my understanding of claims procedures.

- •Prepared detailed claims reports, enhancing documentation quality and compliance by 30%.

- •Supported the development of a new client communication strategy, improving response times by 20%.

- •Conducted policy reviews to ensure comprehensive claims processing and appropriate reimbursement.

Property Damage Auto Insurance Adjuster resume sample

- •Managed a caseload of over 200 property damage claims monthly, achieving a 98% satisfaction rate from policyholders.

- •Trained and mentored junior adjusters, improving team efficiency by 20% through structured knowledge-sharing sessions.

- •Collaborated closely with underwriting department to reduce claim processing times by 25%, resulting in improved customer service.

- •Led negotiations on complex claims, securing settlements within 10% of company estimates consistently each quarter.

- •Adapted to regulatory changes quickly, maintaining compliance on 100% of claims, aligning with state and company policies.

- •Implemented a new claims tracking tool, streamlining processes and reducing paperwork errors by 15% in the first year.

- •Investigated and settled over 1,500 auto claims over a three-year term, achieving a 92% rate of customer satisfaction.

- •Improved claim assessment accuracy by 30% through the introduction of advanced analytics techniques and tools.

- •Facilitated communication with policyholders, maintaining average claim resolution time under industry standard by 10 days.

- •Worked closely with legal team on disputed claims, maintaining a defense win ratio of over 75%.

- •Standardized reporting procedures, resulting in a 15% decrease in time spent on preparing damage assessment reports.

- •Conducted comprehensive damage investigations, facilitating claims settlements that adhered strictly to policy terms.

- •Incorporated feedback mechanisms to improve customer interactions and reduced complaints against the department by 20%.

- •Optimized the use of claims management software leading to a reduction in claim cycle times by 15%.

- •Managed multi-party negotiations, consistently securing settlements that balanced client expectations and company cost objectives.

- •Reviewed and processed an average of 300 auto claims monthly, ensuring compliance with state and federal regulations.

- •Assisted in the development of a new claim processing protocol, reducing processing errors by 12%.

- •Analyzed historical claim data to identify trends, informing strategic decisions that improved forecasting accuracy by 15%.

- •Utilized Microsoft Excel and CRM tools to maintain detailed and accurate records, reducing data entry inefficiencies.

Automotive Total Loss Claims Specialist resume sample

- •Handled a portfolio of over 500 total loss claims annually, achieving a 95% settlement rate within company timelines.

- •Led a team project that reduced claims processing time by 15% through streamlined evaluation procedures.

- •Trained and mentored 10 junior claims adjusters, increasing departmental productivity by 25%.

- •Developed and implemented a new customer communication protocol, enhancing customer satisfaction scores by 20%.

- •Collaborated with legal teams on complex claims, reducing litigation rates by 10% over a year period.

- •Provided exceptional guidance to policyholders, achieving a 98% positive feedback score from post-settlement surveys.

- •Evaluated a broad spectrum of total loss claims, achieving timely settlements for 92% of cases.

- •Negotiated settlement offers totaling over $1M annually with adherence to state regulations.

- •Enhanced claims accuracy by implementing a cross-verification system, reducing processing errors by 15%.

- •Effectively communicated with repair facilities and dealerships to streamline claims flow, boosting efficiency by 20%.

- •Implemented a data-driven valuation method, resulting in more precise loss settlements for clients.

- •Processed high-volume auto claims with a 90% accuracy rate, achieving commendation for precision.

- •Established strong stakeholder relations with external partners, facilitating smoother claims processing.

- •Advised policyholders on the claims process, leading to a 15% increase in customer understanding.

- •Assisted in the rollout of a digital claims filing system, reducing manual paperwork by 25%.

- •Managed a comprehensive range of automotive claims, achieving a 95% closure rate within time constraints.

- •Improved total loss settlement processes by collaborating with cross-functional teams, enhancing workflow efficiency.

- •Utilized innovative software solutions to optimize claims evaluations, boosting speed by 30%.

- •Directed customer support initiatives, achieving an 85% satisfaction improvement.

Navigating the fast-paced world of auto insurance claims can feel like steering through a bustling highway, requiring sharp focus and precision. As an auto insurance claims adjuster, you handle complex details, negotiate settlements, and analyze intricate policy information every day. However, when it comes to translating these skills onto your resume, making it truly shine can be challenging.

Think of your resume as a personal marketing tool that highlights your strengths and experiences to potential employers. You're adept at problem-solving, deeply understand policy nuances, and excel in customer service. Yet, balancing these technical abilities with soft skills on paper is often tricky, which means your unique strengths might not get the spotlight they deserve.

This is where a resume template can become your best ally. Using a well-structured template helps you organize your experience and ensures your key achievements stand out. For clean, organized formats that reflect your professionalism, consider exploring these resume templates designed to highlight your core competencies.

With the right structure, your resume can effectively convey your expertise and open doors to new opportunities. In this guide, you'll learn how to convert your daily experiences into a compelling narrative, ensuring you make a lasting impression on potential employers.

Key Takeaways

- Writing an effective auto insurance claims adjuster resume involves highlighting your ability to manage claims with precision, detail, and excellent communication skills.

- Use a structured resume template to clearly showcase your professional summary, work experience, education, skills, and certifications, ensuring your achievements and competencies stand out.

- Choosing a chronological format can emphasize your career progression and specific roles, while using fonts like Raleway or Montserrat enhances readability.

- Include both hard skills like risk assessment and soft skills like empathy, and align these with the job description to increase interview chances.

- Certain extra sections such as languages, volunteer work, and hobbies can add depth, showing your well-roundedness and alignment with the industry.

What to focus on when writing your auto insurance claims adjuster resume

Your auto insurance claims adjuster resume should convey your ability to manage claims efficiently and accurately—showcasing your expertise in assessing damage and communicating effectively with clients. Emphasize your analytical skills and attention to detail, which ensure fair and precise evaluations. Recruiters are looking for assurance that you can operate under pressure while maintaining company standards. This strong foundation becomes more convincing when structured well, guiding employers through your qualifications with clarity.

How to structure your auto insurance claims adjuster resume

- Contact Information—Start with a clear, easily accessible list of your full name, phone number, email address, and LinkedIn profile. Ensuring this information is prominent facilitates easy communication and reinforces your professional approach right from the start.

- Professional Summary—Craft a brief, impactful summary of your experience. Draw attention to your ability to handle high volumes of claims and resolve complex issues, setting a confident tone for your professional narrative. This introduction to your career serves to engage the reader immediately.

- Work Experience—Detail your relevant roles to highlight your claims handling skills. Include job titles, companies, locations, and dates, complemented by bullet points that describe tasks like damage assessment and settlement negotiation. This section should paint a picture of your day-to-day expertise and achievements.

- Education—Provide a comprehensive view of your educational background with degree details, including institution name, degree type, and graduation year. Mention specific coursework related to insurance or law if it adds depth to your qualifications, linking academic knowledge to your practical skills.

- Skills—List key skills essential to an auto insurance claims adjuster. Emphasize your understanding of insurance policies, negotiation expertise, and proficiency in claims management software. This section connects your abilities to the requirements of the role, showcasing your preparedness.

- Certifications—Mention any relevant certifications such as an AIC (Associate in Claims) to underline your commitment to ongoing professional development. These credentials add credibility and demonstrate your dedication to excellence in your field.

Optional sections like "Professional Affiliations" or "Volunteer Experience" can further enrich your resume, showing your commitment to the industry. Below, we’ll cover each section more in-depth to ensure your resume format effectively presents your strengths.

Which resume format to choose

Creating a resume for an auto insurance claims adjuster demands a careful approach to highlight your unique skills and experience. Start with a chronological format. This method displays your career path clearly, emphasizing your progression and specific roles within the insurance industry, which is critical for employers seeking experienced claims adjusters.

Choosing the right font can subtly enhance your resume's impact. Fonts like Raleway, Montserrat, or Lato not only modernize your document but also make your information readable at a glance, an important factor when employers are quickly scanning through numerous applications.

Always save your resume as a PDF. This choice is crucial because PDFs maintain the integrity of your formatting across different devices and platforms, ensuring that your resume appears professional and polished each time it’s opened by a hiring manager.

Finally, set your margins to about one inch on all sides. This standard not only provides enough white space to avoid overwhelming the reader but also frames your content neatly, allowing key information about your experience and expertise to stand out effectively. Together, these elements form the backbone of a resume that presents you as a well-organized and capable professional in claims adjusting.

How to write a quantifiable resume experience section

Your resume’s experience section should highlight your achievements as an auto insurance claims adjuster, creating a strong narrative of your career. Begin with your most recent job and work backward, covering about 10-15 years of relevant experience. Each role should mention your job title, company, location, and dates, providing a clear timeline of your progression. By tailoring this section to the job description, you ensure that your experiences and skills align with what the employer is looking for, making it compelling. Use action words like "evaluated," "negotiated," and "resolved" to effectively communicate your responsibilities and accomplishments.

This section thrives on clarity and impact, emphasizing your achievements through specific, measurable results. Hiring managers will quickly understand your value by seeing how many claims you resolved successfully or how much you reduced costs. By delivering this information in concise bullet points, you ensure that your contributions are immediately apparent and appreciated.

- •Resolved over 95% of claims within 30 days, beating company goals by 20%.

- •Cut claim processing time by 15% through improved evaluation and negotiation.

- •Recovered $250K annually in subrogation with sharp case analysis and teamwork.

- •Earned a 4.8/5.0 customer satisfaction score by delivering top-notch service and communication.

This experience section stands out by weaving together concrete results into a cohesive story. Each bullet point builds on the last, showing how you not only handle claims efficiently but also exceed performance standards. The use of action verbs energizes the narrative, making your successes come alive and ensuring that your potential impact is clear to potential employers. By aligning your skills with the job ad's requirements, you create a resume that resonates with hiring managers, highlighting your ability to contribute effectively to their team.

Problem-Solving Focused resume experience section

A problem-solving-focused auto insurance claims adjuster resume experience section should seamlessly convey how you tackle claims with efficiency and precision. Begin by showcasing the tangible outcomes you achieved and the distinct methods you employed. Demonstrating your knack for evaluating damage reports and delving into case specifics should be at the forefront, along with your ability to communicate seamlessly with all parties involved. It's vital to underscore how you adapt to changing situations and leverage investigative strategies to gather critical evidence, which in turn enables you to make well-informed decisions. Throughout, emphasize your commitment to regulatory compliance while maintaining a strong focus on customer satisfaction.

To ensure your experience section stands out, use action-oriented language to place a spotlight on achievements rather than merely listing tasks. Each bullet point should encapsulate a specific accomplishment or skill. Discuss your role in accelerating claim processing, highlighting improvements in team efficiency or claim accuracy. Share instances where your problem-solving skills directly enhanced customer experiences or resulted in substantial cost savings for your company. Keep your examples clear and compelling to effectively showcase your expertise and the valuable contributions you've made in your role.

Claims Adjuster

SafeGuard Auto Insurance

June 2018 - August 2023

- Improved claim resolution speed by 30% through streamlined investigative processes.

- Enhanced customer satisfaction scores by 25% by implementing clear communication strategies.

- Recovered over $500,000 in fraudulent claims through effective analysis and investigation.

- Trained a team of 15 adjusters, increasing department efficiency by 40%.

Achievement-Focused resume experience section

A results-focused auto insurance claims adjuster resume experience section should highlight the impact of your work by emphasizing achievements over duties. Start by showcasing key successes, such as improvements in claim process speed, increases in customer satisfaction, or significant recoveries in compensation, all of which illustrate your proactive contributions. Quantifying these successes with specific numbers provides a clearer picture of your influence.

Weave these achievements into each bullet point, ensuring you cover diverse aspects of your role like process optimization, problem-solving, and team collaboration. Use strong action verbs to make your strengths evident and specify your outcomes to add context. This way, you effectively demonstrate to potential employers the tangible value you bring. Here’s how it might look:

Auto Insurance Claims Adjuster

ABC Insurance Group

June 2020 - Present

- Cut claims processing time by 30% by leveraging detailed analysis and modern software tools.

- Boosted customer satisfaction scores by 25% through effective communication and empathetic solutions.

- Recovered over $500,000 in fraudulent claims using rigorous investigation strategies.

- Collaborated with legal and medical teams to resolve complex claims promptly and efficiently.

Efficiency-Focused resume experience section

An efficiency-focused auto insurance claims adjuster resume experience section should highlight your talent for detail and ability to resolve issues swiftly. Begin by outlining roles where you excelled in accurately assessing damages and rapidly evaluating claims to ensure fair settlements. Use strong action verbs to demonstrate your accomplishments, and quantify these with specific results, such as improvements in processing speed. Keeping your language straightforward will help potential employers quickly grasp your capabilities and the value you bring to a team.

In the example, show how you efficiently managed claims by emphasizing improvements in workflow and systems that reduced resolution times. Illustrate your ability to handle a larger workload without compromising on accuracy and customer satisfaction. This approach will effectively convey your efficient work style and the practical benefits you offer to prospective employers.

Auto Insurance Claims Adjuster

ABC Insurance Co.

June 2019 - Present

- Increased claims processing speed by 30% through process optimization and workflow improvements.

- Reduced average claim resolution time from 20 to 14 days by implementing a new tracking system.

- Handled 40% more claims per month while maintaining accuracy and customer satisfaction.

- Trained new team members on efficient claims processing, improving team performance by 25%.

Technology-Focused resume experience section

A technology-focused auto insurance claims adjuster resume experience section should highlight your expertise in seamlessly integrating technology into the claims process. Emphasize your ability to use cutting-edge software to assess car damage quickly and accurately, enhancing the efficiency of the entire process. Showcase your familiarity with industry-specific tools and demonstrate how you employ data management or analytics to both resolve claims effectively and boost policyholder satisfaction.

When detailing your past roles, clearly state your job titles, the companies you worked for, and your accomplishments related to tech-driven claims adjusting. Use bullet points to convey your impact, focusing on measurable outcomes like improved efficiency or reduced processing times. Your aim is to illustrate how you effectively combine technology with customer service to deliver outstanding claims handling that benefits both the company and its clients.

Claims Adjuster

Secure Auto Insurance Inc

2018 - 2022

- Reduced claim processing time by 30% using automated assessment tools.

- Enhanced accuracy of valuations by integrating AI-driven data analysis.

- Trained team on new software, boosting productivity by 20%.

- Developed a digital dashboard for tracking claims stages, improving visibility.

Write your auto insurance claims adjuster resume summary section

A skills-focused auto insurance claims adjuster resume summary should effectively highlight your abilities and achievements, setting you apart from other candidates. If you have experience, concentrate on detailing your expertise in assessing and resolving claims efficiently, highlighting your thorough understanding of insurance policies. Clearly express your ability to analyze data and communicate with clients to demonstrate your competence and appeal to potential employers.

An example summary might be:

This example stands out because it begins with core skills and includes quantifiable experience, making the summary both informative and easy to read. When you highlight what you bring to the table, ensure your skills align with the job requirements.

For those just starting out, consider using a resume objective. It tells employers about your aspirations and is focused on where you want your career to develop. Unlike a summary, a resume objective is typically shorter and more forward-looking. While resume profiles and summaries of qualifications serve similar purposes, they differ slightly. A profile provides a snapshot of your experiences and skills, while a summary of qualifications lists key accomplishments, often using bullet points. Understanding these nuances helps tailor your resume to your career stage.

Listing your auto insurance claims adjuster skills on your resume

A skill-focused auto insurance claims adjuster resume should clearly highlight what makes you a great fit for the job. The skills section can stand alone or be woven into your experience and summary sections. Strengths often highlight your soft skills—traits that help you connect with others and manage complex situations. Meanwhile, hard skills are more technical abilities, like computer proficiency or negotiation. Incorporating these skills as keywords in your resume can better align you with job descriptions and increase your chances of landing an interview.

Here's a template for a standalone skills section:

This standalone skills section is effective because it spotlights key competencies without unnecessary detail, ensuring each skill adds value. Focusing on these skills gives an in-depth view of your readiness to handle the job's challenges.

Best hard skills to feature on your auto insurance claims adjuster resume

Hard skills reflect your ability to perform job-specific tasks and provide insight into your technical competence. These skills should communicate your ability to process claims with accuracy and efficiency.

Hard Skills

- Claims Evaluation

- Risk Assessment

- Negotiation Skills

- Data Analysis

- Legal Knowledge

- Report Writing

- Computer Proficiency

- Policy Interpretation

- Fraud Detection

- Cost Estimation

- Case Management

- MS Office Suite

- Customer Relationship Management (CRM)

- Investigation Skills

- Calculation of Settlements

Best soft skills to feature on your auto insurance claims adjuster resume

Soft skills illustrate how you interact with others and manage pressure. These traits should communicate your proficiency in communication and stress management, as they are crucial for the role.

Soft Skills

- Communication Skills

- Problem-Solving

- Empathy

- Attention to Detail

- Decision-Making

- Time Management

- Organizational Skills

- Teamwork

- Adaptability

- Conflict Resolution

- Patience

- Stress Management

- Active Listening

- Multitasking

- Professionalism

How to include your education on your resume

An education section is a critical part of your resume, especially for a position like an auto insurance claims adjuster. Tailor it to the job you are applying for, excluding any irrelevant education details. This makes your application more focused and appealing to potential employers. Consider including your GPA if it's impressive, generally above 3.0, as it can highlight your academic achievements. Mention any honors, like cum laude, which shows recognition for high performance. Be sure to list your degree clearly, indicating the field of study, the institution, and the graduation date or expected date.

Here's an example of what not to do:

Now, here's a more effective example:

- •Graduated cum laude

The second example is effective because it includes a relevant degree in Business Administration, which aligns well with the analytical and decision-making skills needed for a claims adjuster role. The listed GPA and cum laude honor underscore academic excellence, enhancing your credibility to handle complex claims successfully.

How to include auto insurance claims adjuster certificates on your resume

Listing the certificates you have earned plays a key role in showcasing your expertise as an auto insurance claims adjuster. This section on your resume not only highlights your qualifications but also sets you apart from other candidates. List the name of each certificate clearly. Include the date of achievement next to it. Add the issuing organization to provide authenticity. Certificates can also be included in the header of your resume for quick reference. For example, you can write, "Licensed Insurance Adjuster (State of California) - earned 2022."

Here is a clear and effective standalone certificates section:

This example works well because it is concise, directly related to the job, and includes widely recognized credentials. The certificates listed are relevant to an auto insurance claims adjuster, helping to demonstrate your special skills and legal qualifications for the role. The issuer's name further legitimizes the certification. A certificates section like this provides quick insights into your qualifications, strengthening your resume.

Extra sections to include on your auto insurance claims adjuster resume

Creating a compelling resume for the role of an auto insurance claims adjuster involves showcasing more than just your professional experience. Your resume should present a well-rounded view of you as a candidate by incorporating various sections that highlight valuable skills and personal attributes.

Language section — Include any additional languages you speak to show your communication skills with diverse clients and colleagues.

Hobbies and interests section — List hobbies that demonstrate relevant skills, such as attention to detail or problem-solving, that align with claims adjusting duties.

Volunteer work section — Mention volunteer experiences to reflect your commitment to community service, showing qualities such as empathy and reliability.

Books section — Mention books you've read on insurance topics or related fields to highlight your dedication to continued learning and professional growth.

Alongside these sections, be sure to clearly list your education. Ensure any degrees or certifications, such as a Bachelor’s degree in Business Administration or a related field typically earned over 4 years, are appropriately detailed to underline your educational foundation. Together, these elements can enhance your resume, making you a standout candidate for positions in auto insurance claims adjusting.

In Conclusion

In conclusion, constructing a standout resume as an auto insurance claims adjuster requires a clear and strategic approach. Your resume acts as your personal marketing tool, reflecting both your technical skills and soft abilities in a balanced way. Using a structured template can help organize your experiences effectively, ensuring key achievements capture the attention of potential employers. By focusing on quantifiable accomplishments, such as claim resolutions and customer satisfaction improvements, you present a compelling narrative that aligns with the job description. Highlighting both hard and soft skills, including negotiation abilities and customer service expertise, further strengthens your application. Additionally, choosing the right resume format, focusing on specific action verbs, and saving your document as a PDF ensures professionalism. Optional sections like Professional Affiliations or Volunteer Experience add depth, showcasing your commitment to the industry. While education provides the foundation, demonstrating certification and a history of continuous learning underscores your dedication to excellence. Ultimately, your resume should convey a comprehensive picture of you as an adaptable, skilled, and dedicated professional ready to excel in the field of claims adjusting. By following these guidelines, you enhance your opportunities to stand out in a competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.