Bank Teller Resume Examples

Mar 21, 2025

|

12 min read

Count on success with your bank teller resume by highlighting key skills and experience. Discover how to open doors in the financial world, balancing skills and professionalism to make your application stand out and bank on a new opportunity.

Rated by 348 people

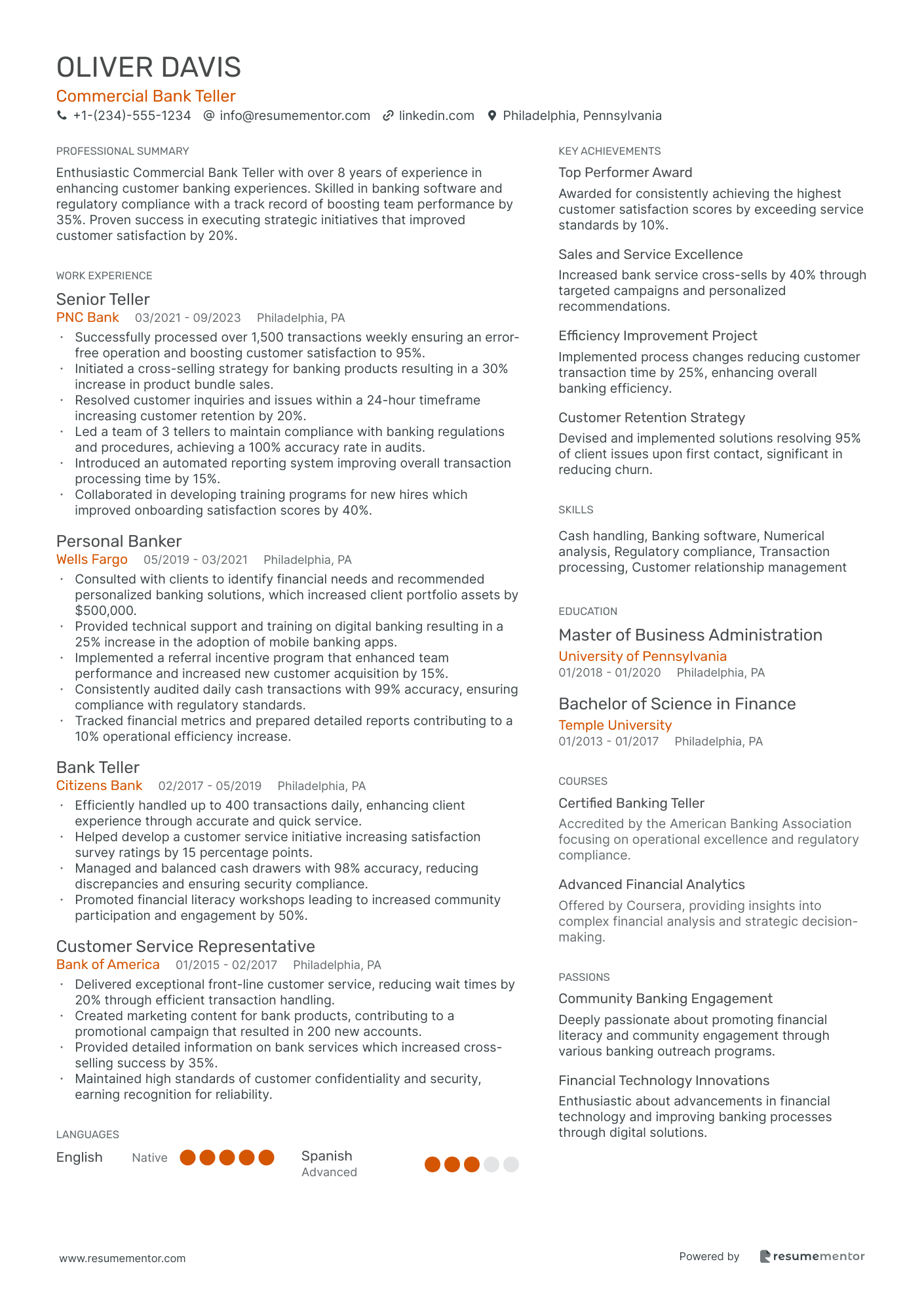

Commercial Bank Teller

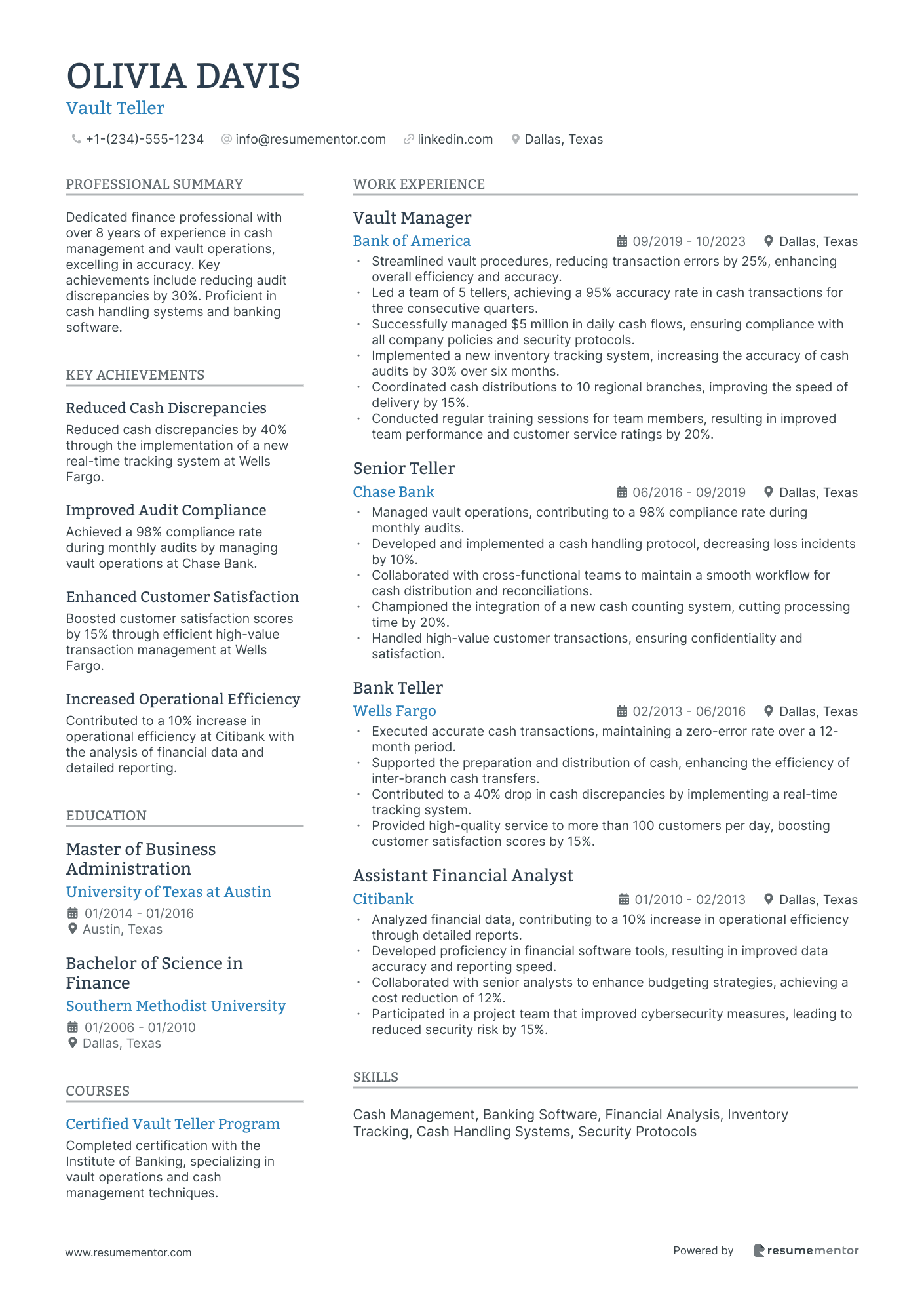

Vault Teller

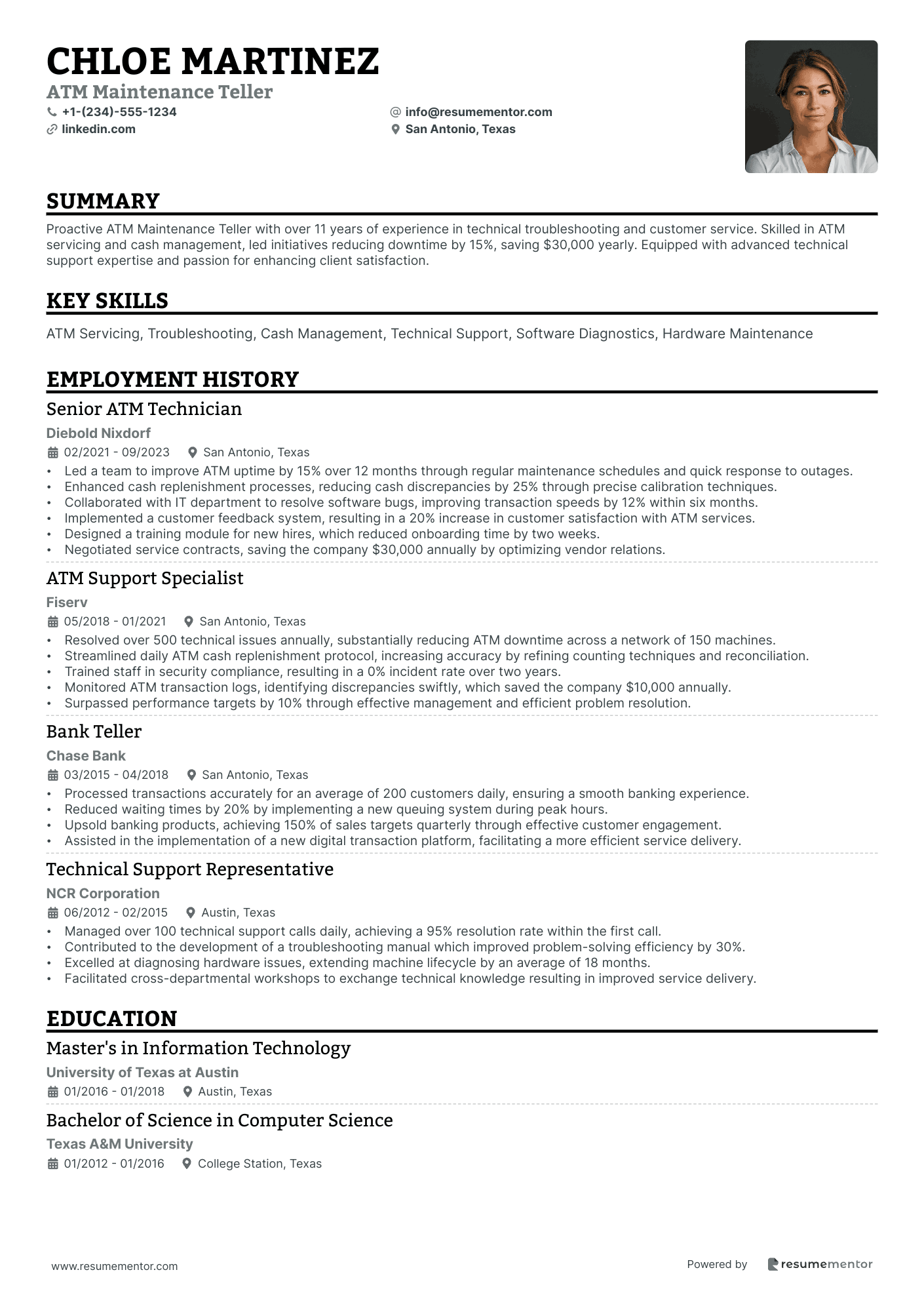

ATM Maintenance Teller

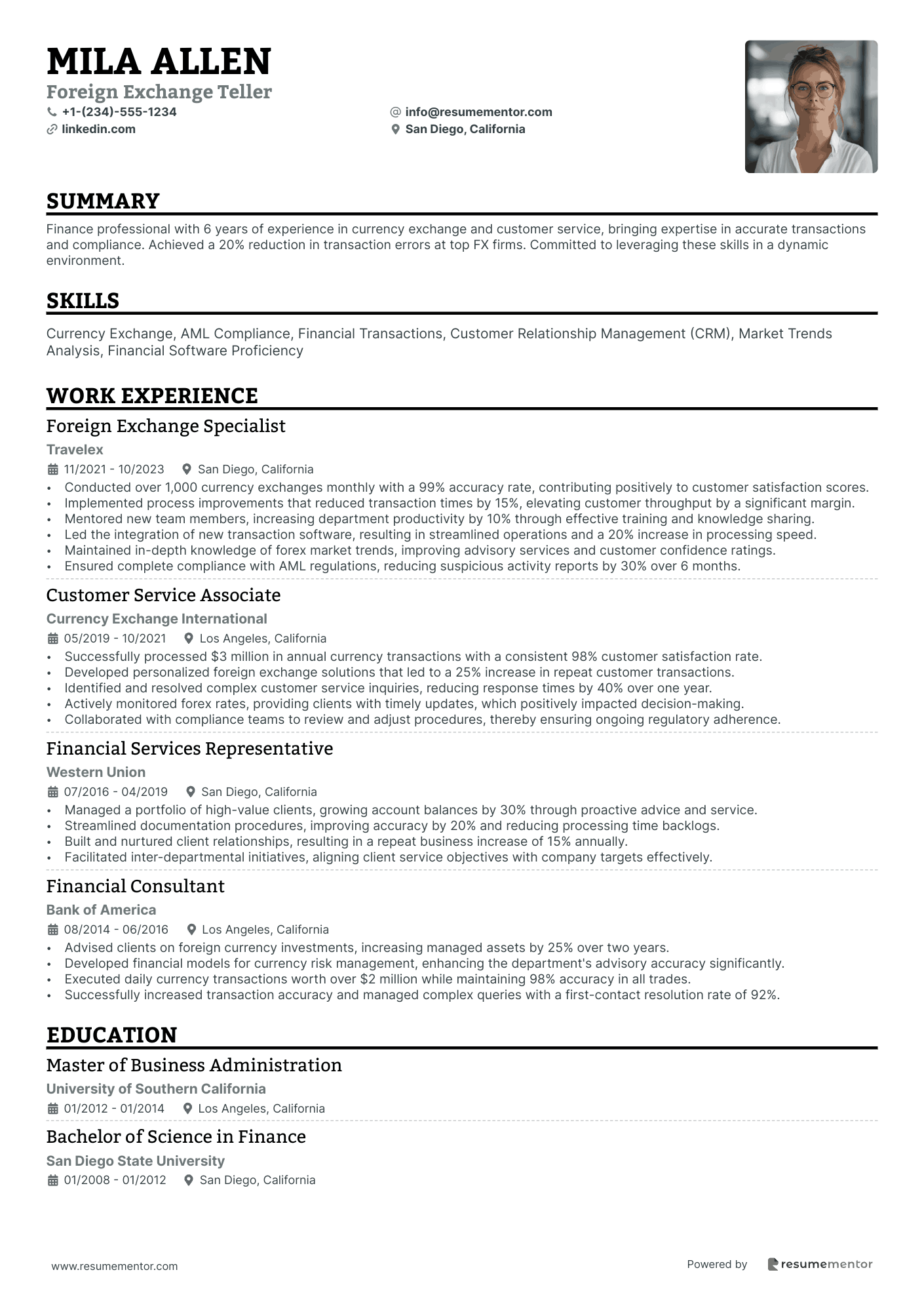

Foreign Exchange Teller

Customer Relations Teller

Senior Sales Teller

Drive-Through Bank Teller

Checking and Savings Teller

Night Deposit Teller

Investment Bank Teller

Commercial Bank Teller resume sample

- •Successfully processed over 1,500 transactions weekly ensuring an error-free operation and boosting customer satisfaction to 95%.

- •Initiated a cross-selling strategy for banking products resulting in a 30% increase in product bundle sales.

- •Resolved customer inquiries and issues within a 24-hour timeframe increasing customer retention by 20%.

- •Led a team of 3 tellers to maintain compliance with banking regulations and procedures, achieving a 100% accuracy rate in audits.

- •Introduced an automated reporting system improving overall transaction processing time by 15%.

- •Collaborated in developing training programs for new hires which improved onboarding satisfaction scores by 40%.

- •Consulted with clients to identify financial needs and recommended personalized banking solutions, which increased client portfolio assets by $500,000.

- •Provided technical support and training on digital banking resulting in a 25% increase in the adoption of mobile banking apps.

- •Implemented a referral incentive program that enhanced team performance and increased new customer acquisition by 15%.

- •Consistently audited daily cash transactions with 99% accuracy, ensuring compliance with regulatory standards.

- •Tracked financial metrics and prepared detailed reports contributing to a 10% operational efficiency increase.

- •Efficiently handled up to 400 transactions daily, enhancing client experience through accurate and quick service.

- •Helped develop a customer service initiative increasing satisfaction survey ratings by 15 percentage points.

- •Managed and balanced cash drawers with 98% accuracy, reducing discrepancies and ensuring security compliance.

- •Promoted financial literacy workshops leading to increased community participation and engagement by 50%.

- •Delivered exceptional front-line customer service, reducing wait times by 20% through efficient transaction handling.

- •Created marketing content for bank products, contributing to a promotional campaign that resulted in 200 new accounts.

- •Provided detailed information on bank services which increased cross-selling success by 35%.

- •Maintained high standards of customer confidentiality and security, earning recognition for reliability.

Vault Teller resume sample

- •Streamlined vault procedures, reducing transaction errors by 25%, enhancing overall efficiency and accuracy.

- •Led a team of 5 tellers, achieving a 95% accuracy rate in cash transactions for three consecutive quarters.

- •Successfully managed $5 million in daily cash flows, ensuring compliance with all company policies and security protocols.

- •Implemented a new inventory tracking system, increasing the accuracy of cash audits by 30% over six months.

- •Coordinated cash distributions to 10 regional branches, improving the speed of delivery by 15%.

- •Conducted regular training sessions for team members, resulting in improved team performance and customer service ratings by 20%.

- •Managed vault operations, contributing to a 98% compliance rate during monthly audits.

- •Developed and implemented a cash handling protocol, decreasing loss incidents by 10%.

- •Collaborated with cross-functional teams to maintain a smooth workflow for cash distribution and reconciliations.

- •Championed the integration of a new cash counting system, cutting processing time by 20%.

- •Handled high-value customer transactions, ensuring confidentiality and satisfaction.

- •Executed accurate cash transactions, maintaining a zero-error rate over a 12-month period.

- •Supported the preparation and distribution of cash, enhancing the efficiency of inter-branch cash transfers.

- •Contributed to a 40% drop in cash discrepancies by implementing a real-time tracking system.

- •Provided high-quality service to more than 100 customers per day, boosting customer satisfaction scores by 15%.

- •Analyzed financial data, contributing to a 10% increase in operational efficiency through detailed reports.

- •Developed proficiency in financial software tools, resulting in improved data accuracy and reporting speed.

- •Collaborated with senior analysts to enhance budgeting strategies, achieving a cost reduction of 12%.

- •Participated in a project team that improved cybersecurity measures, leading to reduced security risk by 15%.

ATM Maintenance Teller resume sample

- •Led a team to improve ATM uptime by 15% over 12 months through regular maintenance schedules and quick response to outages.

- •Enhanced cash replenishment processes, reducing cash discrepancies by 25% through precise calibration techniques.

- •Collaborated with IT department to resolve software bugs, improving transaction speeds by 12% within six months.

- •Implemented a customer feedback system, resulting in a 20% increase in customer satisfaction with ATM services.

- •Designed a training module for new hires, which reduced onboarding time by two weeks.

- •Negotiated service contracts, saving the company $30,000 annually by optimizing vendor relations.

- •Resolved over 500 technical issues annually, substantially reducing ATM downtime across a network of 150 machines.

- •Streamlined daily ATM cash replenishment protocol, increasing accuracy by refining counting techniques and reconciliation.

- •Trained staff in security compliance, resulting in a 0% incident rate over two years.

- •Monitored ATM transaction logs, identifying discrepancies swiftly, which saved the company $10,000 annually.

- •Surpassed performance targets by 10% through effective management and efficient problem resolution.

- •Processed transactions accurately for an average of 200 customers daily, ensuring a smooth banking experience.

- •Reduced waiting times by 20% by implementing a new queuing system during peak hours.

- •Upsold banking products, achieving 150% of sales targets quarterly through effective customer engagement.

- •Assisted in the implementation of a new digital transaction platform, facilitating a more efficient service delivery.

- •Managed over 100 technical support calls daily, achieving a 95% resolution rate within the first call.

- •Contributed to the development of a troubleshooting manual which improved problem-solving efficiency by 30%.

- •Excelled at diagnosing hardware issues, extending machine lifecycle by an average of 18 months.

- •Facilitated cross-departmental workshops to exchange technical knowledge resulting in improved service delivery.

Foreign Exchange Teller resume sample

- •Conducted over 1,000 currency exchanges monthly with a 99% accuracy rate, contributing positively to customer satisfaction scores.

- •Implemented process improvements that reduced transaction times by 15%, elevating customer throughput by a significant margin.

- •Mentored new team members, increasing department productivity by 10% through effective training and knowledge sharing.

- •Led the integration of new transaction software, resulting in streamlined operations and a 20% increase in processing speed.

- •Maintained in-depth knowledge of forex market trends, improving advisory services and customer confidence ratings.

- •Ensured complete compliance with AML regulations, reducing suspicious activity reports by 30% over 6 months.

- •Successfully processed $3 million in annual currency transactions with a consistent 98% customer satisfaction rate.

- •Developed personalized foreign exchange solutions that led to a 25% increase in repeat customer transactions.

- •Identified and resolved complex customer service inquiries, reducing response times by 40% over one year.

- •Actively monitored forex rates, providing clients with timely updates, which positively impacted decision-making.

- •Collaborated with compliance teams to review and adjust procedures, thereby ensuring ongoing regulatory adherence.

- •Managed a portfolio of high-value clients, growing account balances by 30% through proactive advice and service.

- •Streamlined documentation procedures, improving accuracy by 20% and reducing processing time backlogs.

- •Built and nurtured client relationships, resulting in a repeat business increase of 15% annually.

- •Facilitated inter-departmental initiatives, aligning client service objectives with company targets effectively.

- •Advised clients on foreign currency investments, increasing managed assets by 25% over two years.

- •Developed financial models for currency risk management, enhancing the department's advisory accuracy significantly.

- •Executed daily currency transactions worth over $2 million while maintaining 98% accuracy in all trades.

- •Successfully increased transaction accuracy and managed complex queries with a first-contact resolution rate of 92%.

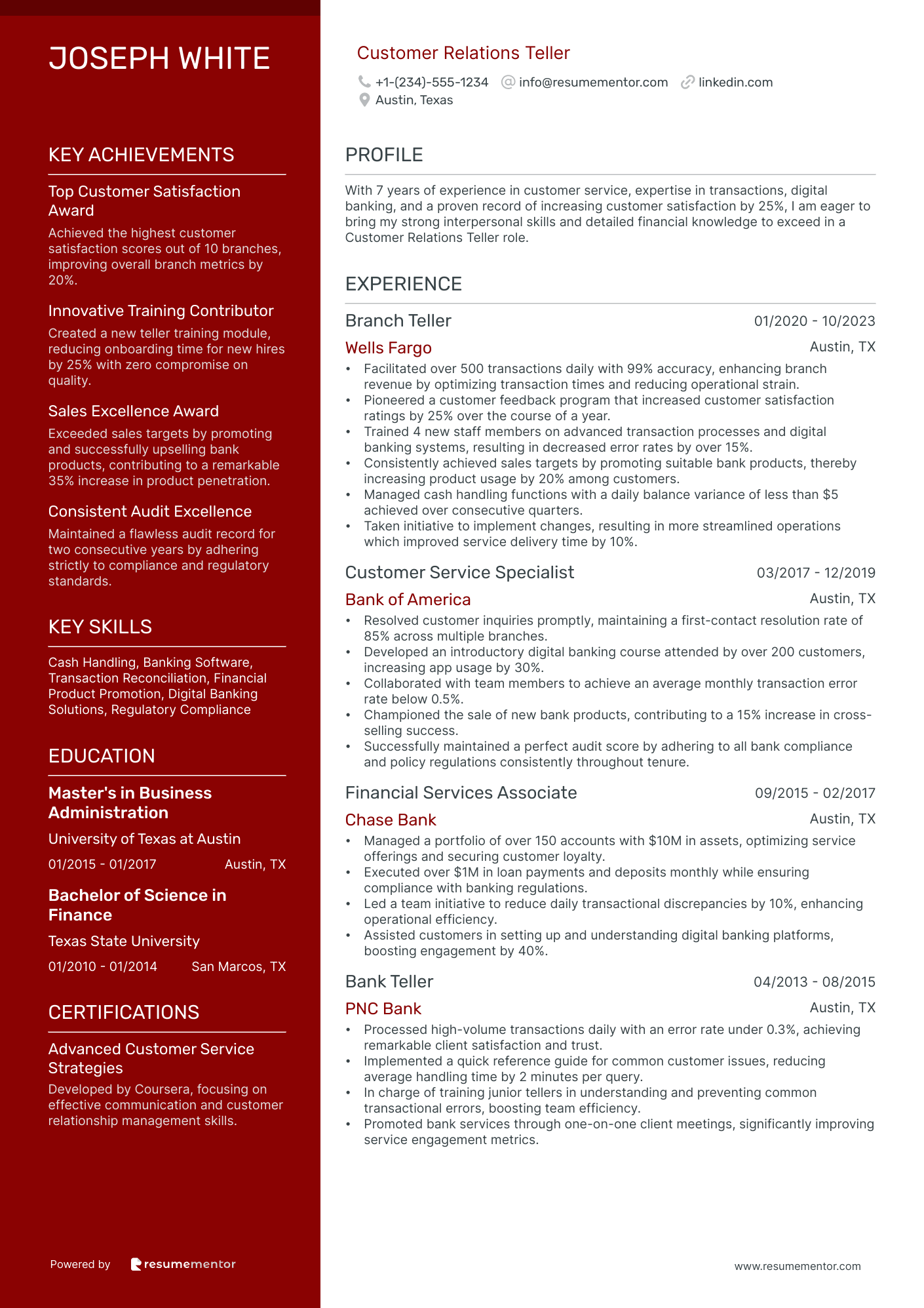

Customer Relations Teller resume sample

- •Facilitated over 500 transactions daily with 99% accuracy, enhancing branch revenue by optimizing transaction times and reducing operational strain.

- •Pioneered a customer feedback program that increased customer satisfaction ratings by 25% over the course of a year.

- •Trained 4 new staff members on advanced transaction processes and digital banking systems, resulting in decreased error rates by over 15%.

- •Consistently achieved sales targets by promoting suitable bank products, thereby increasing product usage by 20% among customers.

- •Managed cash handling functions with a daily balance variance of less than $5 achieved over consecutive quarters.

- •Taken initiative to implement changes, resulting in more streamlined operations which improved service delivery time by 10%.

- •Resolved customer inquiries promptly, maintaining a first-contact resolution rate of 85% across multiple branches.

- •Developed an introductory digital banking course attended by over 200 customers, increasing app usage by 30%.

- •Collaborated with team members to achieve an average monthly transaction error rate below 0.5%.

- •Championed the sale of new bank products, contributing to a 15% increase in cross-selling success.

- •Successfully maintained a perfect audit score by adhering to all bank compliance and policy regulations consistently throughout tenure.

- •Managed a portfolio of over 150 accounts with $10M in assets, optimizing service offerings and securing customer loyalty.

- •Executed over $1M in loan payments and deposits monthly while ensuring compliance with banking regulations.

- •Led a team initiative to reduce daily transactional discrepancies by 10%, enhancing operational efficiency.

- •Assisted customers in setting up and understanding digital banking platforms, boosting engagement by 40%.

- •Processed high-volume transactions daily with an error rate under 0.3%, achieving remarkable client satisfaction and trust.

- •Implemented a quick reference guide for common customer issues, reducing average handling time by 2 minutes per query.

- •In charge of training junior tellers in understanding and preventing common transactional errors, boosting team efficiency.

- •Promoted bank services through one-on-one client meetings, significantly improving service engagement metrics.

Senior Sales Teller resume sample

- •Greeted and assisted over 150 customers daily, resulting in a 95% customer satisfaction rate and repeat business.

- •Successfully achieved 200% of quarterly sales targets by promoting bank services and products effectively.

- •Implemented a streamlined transaction process that improved efficiency by 30% and reduced customer transaction times.

- •Led team training sessions, resulting in a 20% improvement in team productivity and teller operations.

- •Resolved complex customer concerns, maintaining a high standard of customer service excellence and retention.

- •Ensured compliance with regulatory and bank policies while protecting confidential information at all times.

- •Supervised a team of 8 tellers, facilitating a 15% increase in branch sales through effective team leadership.

- •Coordinated and implemented promotional strategies, leading to a 25% rise in product enrollments.

- •Conducted training on new products and policies, resulting in a 98% compliance rate among team members.

- •Maintained a balanced cash drawer at all times and ensured all transactions adhered to bank procedures.

- •Played a key role in branch audits, achieving the highest compliance scores for two consecutive years.

- •Exceeded monthly sales quotas by 120% through strategic product promotion and customer engagement.

- •Developed personalized solutions for clients, enhancing their banking experiences and service satisfaction.

- •Implemented a new customer feedback system that increased service rating from 80% to 90% within 6 months.

- •Managed high-volume transaction processing accurately and efficiently, adhering to bank procedures.

- •Handled over 200 transactions daily with 99% accuracy, supporting branch efficiency and customer contentment.

- •Assisted in the development of a new teller training program, which reduced onboarding time by 50%.

- •Promoted bank products to clients, leading to a 30% increase in product awareness and sign-ups.

- •Managed customer inquiries with tact and professionalism, helping reduce complaint rates by 10%.

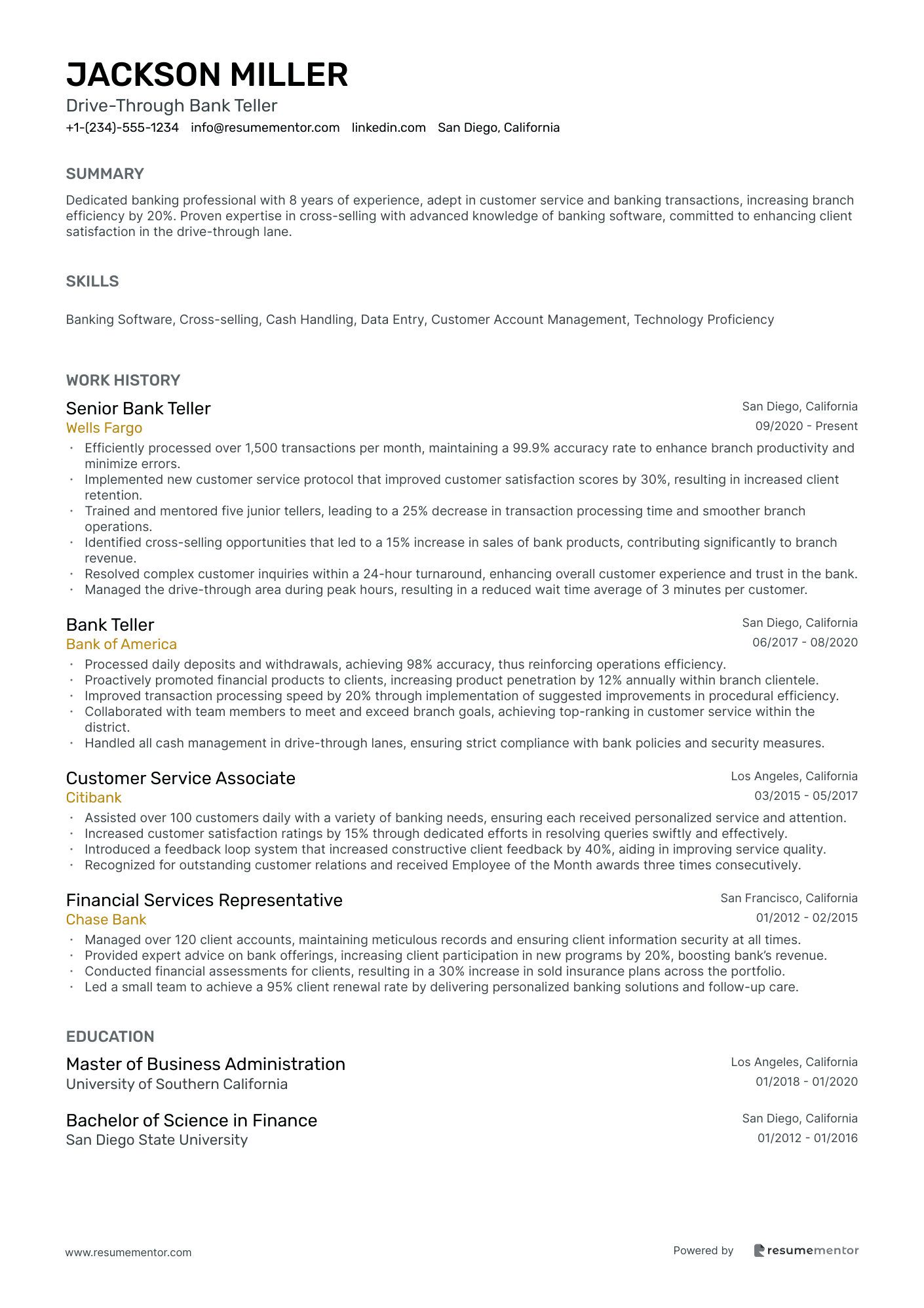

Drive-Through Bank Teller resume sample

- •Efficiently processed over 1,500 transactions per month, maintaining a 99.9% accuracy rate to enhance branch productivity and minimize errors.

- •Implemented new customer service protocol that improved customer satisfaction scores by 30%, resulting in increased client retention.

- •Trained and mentored five junior tellers, leading to a 25% decrease in transaction processing time and smoother branch operations.

- •Identified cross-selling opportunities that led to a 15% increase in sales of bank products, contributing significantly to branch revenue.

- •Resolved complex customer inquiries within a 24-hour turnaround, enhancing overall customer experience and trust in the bank.

- •Managed the drive-through area during peak hours, resulting in a reduced wait time average of 3 minutes per customer.

- •Processed daily deposits and withdrawals, achieving 98% accuracy, thus reinforcing operations efficiency.

- •Proactively promoted financial products to clients, increasing product penetration by 12% annually within branch clientele.

- •Improved transaction processing speed by 20% through implementation of suggested improvements in procedural efficiency.

- •Collaborated with team members to meet and exceed branch goals, achieving top-ranking in customer service within the district.

- •Handled all cash management in drive-through lanes, ensuring strict compliance with bank policies and security measures.

- •Assisted over 100 customers daily with a variety of banking needs, ensuring each received personalized service and attention.

- •Increased customer satisfaction ratings by 15% through dedicated efforts in resolving queries swiftly and effectively.

- •Introduced a feedback loop system that increased constructive client feedback by 40%, aiding in improving service quality.

- •Recognized for outstanding customer relations and received Employee of the Month awards three times consecutively.

- •Managed over 120 client accounts, maintaining meticulous records and ensuring client information security at all times.

- •Provided expert advice on bank offerings, increasing client participation in new programs by 20%, boosting bank’s revenue.

- •Conducted financial assessments for clients, resulting in a 30% increase in sold insurance plans across the portfolio.

- •Led a small team to achieve a 95% client renewal rate by delivering personalized banking solutions and follow-up care.

Checking and Savings Teller resume sample

- •Processed over 250 customer transactions daily with 98% accuracy, enhancing customer trust and retention.

- •Led a team of tellers to achieve branch goals, resulting in a 15% year-over-year increase in account openings.

- •Implemented a new cash management system reducing transaction processing time by 30% and increasing efficiency.

- •Conducted weekly training sessions for new tellers, resulting in a 25% faster competency achievement for new hires.

- •Identified and resolved discrepancies promptly, contributing to a 30% reduction in reported errors.

- •Promoted bank products through customer consultations, achieving a 20% increase in cross-sales.

- •Handled over 200 customer inquiries weekly, maintaining a 95% customer satisfaction rate.

- •Successfully recommended tailored banking solutions, increasing product adoption by 20% within the branch.

- •Managed cash drawers and ensured compliance with bank policies, achieving a perfect audit score each quarter.

- •Collaborated with colleagues during high-traffic periods, boosting team productivity by 40%.

- •Reported suspicious activities promptly, maintaining adherence to safety regulations and achieving a 100% compliance rate.

- •Efficiently processed daily transactions, contributing to a seamless banking experience for over 150 clients.

- •Achieved a 99% accuracy rate in cash handling and transaction processing, exceeding branch standards.

- •Actively participated in bank promotions, leading to a 10% increase in new customer acquisitions.

- •Provided comprehensive assistance to clients, enhancing the overall customer experience and satisfaction levels.

- •Guided clients through product options, resulting in a 20% increase in uptake of checking and savings accounts.

- •Boosted the branch's customer satisfaction score by 10% through personalized service and attention to detail.

- •Facilitated daily financial transactions with a 98% balance accuracy rate, aligning with financial protocols.

- •Collaborated with team members to streamline customer service operations, enhancing team cohesion and goal achievement.

Night Deposit Teller resume sample

- •Managed over 100 customer transactions daily, ensuring 99.9% accuracy in cash handling and deposits.

- •Improved customer satisfaction by 20% through enhanced service techniques, leading to increased customer retention.

- •Collaborated with team members to exceed quarterly branch targets by streamlining cash reconciliation processes.

- •Addressed and resolved 95% of customer inquiries related to account services efficiently and on the first contact.

- •Executed opening and closing procedures proficiently, contributing to 30% reduction in procedural errors.

- •Implemented financial compliance measures, maintaining a 100% audit success rate over the last three years.

- •Provided support to over 200 customers weekly, resulting in an increase in customer satisfaction scores by 15%.

- •Processed cash deposits and withdrawals accurately, handling $20,000+ in daily transactions.

- •Developed a customer query tracking system, enhancing issue resolution times by 25% in the first quarter of implementation.

- •Trained new employees in compliance and customer service policies, enhancing team productivity by 10%.

- •Contributed to a branch project that improved cash transaction processing speed by 30%, enhancing overall operational efficiency.

- •Rectified discrepancies in accounts, reducing inaccuracy by 50% through a new auditing technique.

- •Supported the implementation of a new banking software, resulting in a 20% improvement in processing times.

- •Assisted in drafting reports on account activities, helping improve record accuracy by 30%.

- •Conducted monthly cash audits, consistently ensuring a 100% accuracy rate during evaluations.

- •Increased sales of banking products by 30% through targeted customer engagement strategies.

- •Achieved a 95% customer satisfaction rate by effectively responding to customer inquiries and concerns.

- •Organized financial seminars for customers, contributing to a 15% increase in new account openings.

- •Managed the branch's cash handling and deposit operations efficiently, minimizing errors significantly.

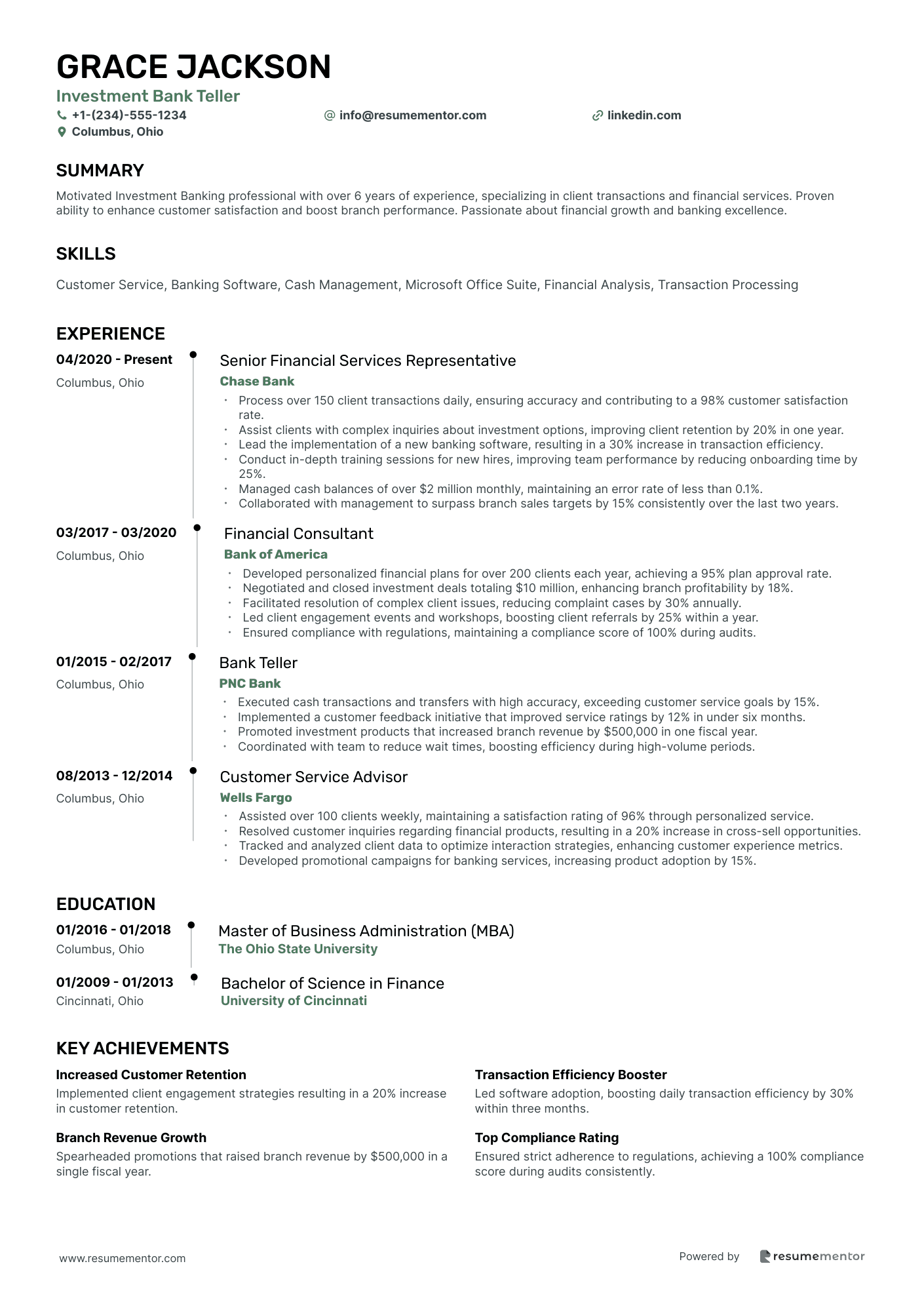

Investment Bank Teller resume sample

- •Process over 150 client transactions daily, ensuring accuracy and contributing to a 98% customer satisfaction rate.

- •Assist clients with complex inquiries about investment options, improving client retention by 20% in one year.

- •Lead the implementation of a new banking software, resulting in a 30% increase in transaction efficiency.

- •Conduct in-depth training sessions for new hires, improving team performance by reducing onboarding time by 25%.

- •Managed cash balances of over $2 million monthly, maintaining an error rate of less than 0.1%.

- •Collaborated with management to surpass branch sales targets by 15% consistently over the last two years.

- •Developed personalized financial plans for over 200 clients each year, achieving a 95% plan approval rate.

- •Negotiated and closed investment deals totaling $10 million, enhancing branch profitability by 18%.

- •Facilitated resolution of complex client issues, reducing complaint cases by 30% annually.

- •Led client engagement events and workshops, boosting client referrals by 25% within a year.

- •Ensured compliance with regulations, maintaining a compliance score of 100% during audits.

- •Executed cash transactions and transfers with high accuracy, exceeding customer service goals by 15%.

- •Implemented a customer feedback initiative that improved service ratings by 12% in under six months.

- •Promoted investment products that increased branch revenue by $500,000 in one fiscal year.

- •Coordinated with team to reduce wait times, boosting efficiency during high-volume periods.

- •Assisted over 100 clients weekly, maintaining a satisfaction rating of 96% through personalized service.

- •Resolved customer inquiries regarding financial products, resulting in a 20% increase in cross-sell opportunities.

- •Tracked and analyzed client data to optimize interaction strategies, enhancing customer experience metrics.

- •Developed promotional campaigns for banking services, increasing product adoption by 15%.

Creating a standout bank teller resume can feel like cracking a challenging code. As a bank teller, you're at the heart of customer interactions and precise transactions, but capturing that on paper can be daunting. When you sit down to write, it’s easy to feel unsure about highlighting what truly matters.

In your job hunt, the challenge is often translating your everyday tasks into compelling resume language. Making financial transactions, customer service moments, and your knack for numbers leap off the page is essential. Highlighting these skills, along with attention to detail and financial experience, is key to catching an employer’s eye.

Think of your resume as a bank statement—it needs to clearly present your value. Using a resume template can help organize your skills and experience in a way that resonates with potential employers. Templates provide structure, ensuring you don’t miss any important details and giving your resume a professional edge.

When you tailor your resume, you’re showing off your problem-solving skills and technical understanding of the financial world. This customization allows potential employers to see the distinct value you bring to their team. With the right guidance and resources, transforming this task from overwhelming to a smooth transaction can open doors to exciting job opportunities.

Key Takeaways

- When writing a teacher resume, focus on clear, concise communication of your skills and experiences to effectively convey your value as an educator.

- Highlight your achievements and specific contributions in previous roles using quantifiable metrics to demonstrate your impact on student learning and classroom management.

- Emphasize relevant skills such as classroom management, curriculum development, and differentiated instruction to align with the job requirements and appeal to school administrators.

- Utilize a clean, professional format with appropriate fonts and clear section headings to ensure readability and make a strong first impression on hiring committees.

- Consider including optional sections like certifications, professional development activities, or extracurricular involvement to provide a comprehensive view of your commitment to education and continuous improvement.

What to focus on when writing your bank teller resume

Your bank teller resume should clearly communicate your reliability, customer service skills, and attention to detail. This helps the recruiter see your ability to handle transactions efficiently and your experience with financial software and banking protocols, which is key to the role. As you prepare to write your resume, consider the essential elements that will make it stand out in the hiring process.

How to structure your bank teller resume

- Contact Information: Start with your name, phone number, email address, and LinkedIn profile—it's essential to keep this section current and easy to read so the recruiter can easily reach you. A polished contact section reflects your professionalism and makes a strong first impression.

- Professional Summary: Craft a brief statement that captures your experience as a bank teller—mention your strengths in customer service, cash handling, and familiarity with banking systems such as Salesforce or TellerPro. This section should encapsulate your core qualifications and offer a snapshot of your professional identity, making the recruiter eager to learn more about you.

- Work Experience: Moving on to your professional history, list previous roles relevant to bank tellering—use bullet points to explain responsibilities and achievements like maintaining cash drawer accuracy and effectively identifying customer needs. This section showcases your hands-on experience, demonstrating your ability to succeed in the bank teller position.

- Skills: Focus on skills essential to being a successful bank teller. Emphasize your abilities in cash handling, attention to detail, Excel proficiency, and communication skills—all of which support your experiences and reinforce your capability to perform efficiently in this role.

- Education: Your educational background follows next—include your high school diploma or GED, and mention any relevant coursework or degrees in finance or accounting as these can enhance your candidacy. This section not only validates your foundational knowledge in relevant areas but also highlights your commitment to learning and growth.

- Certifications: Lastly, highlight any training programs or certifications you've completed, such as Certified Bank Teller or CPR—showcasing these credentials demonstrates your dedication to professional development and readiness for the role.

Consider adding optional sections like volunteer experience or language skills, which provide further insights into your character and enhance your overall profile. Now that you understand what general sections a bank teller resume should contain, let’s dive deeper into formatting your resume and explore each section in more detail.

Which resume format to choose

Creating a bank teller resume is all about highlighting your skills and experiences effectively. Start with a chronological format to present your work history clearly. This helps potential employers see your steady progression and reliability, which are important traits in the banking industry.

When it comes to fonts, the choice can subtly impact how your resume is perceived. Stick with modern, professional options like Raleway, Lato, or Montserrat. These fonts are not only easy on the eyes but also convey a sense of professionalism and attention to detail, qualities every bank looks for in a teller.

The way you save your resume matters too. Opt for a PDF format to preserve your layout and ensure it's viewed consistently on any device. This consistency in presentation underscores your organizational skills, a key requirement for handling transactions accurately.

Lastly, maintain one-inch margins all around your resume. This spacing keeps the document looking clean and organized, allowing hiring managers to focus on your qualifications without distractions. Such attention to detail reflects the precision needed in a role like bank teller, where accuracy is paramount. Each of these elements combines to create a coherent resume that speaks directly to the competencies expected in the banking sector.

How to write a quantifiable resume experience section

A strong bank teller resume experience section is crucial for catching the eye of a potential employer. Start by focusing on your achievements and how you've excelled in your role. Begin your list with your most recent job and work backward, covering the past 10-15 years to keep it relevant. Highlighting your accomplishments using numbers makes your impact clear and tangible. Tailoring your resume to each job by using keywords from the job ad ensures you meet the specific needs of the employer. By using action words like "processed," "managed," and "enhanced," you bring energy and clarity to your achievements, making it easy for hiring managers to see why you belong on their team.

Here’s an example of how a well-crafted bank teller resume experience section can look:

- •Processed over 200 transactions daily with a 98% accuracy rate, reducing errors by 15%.

- •Increased customer satisfaction scores by 20% through personalized service and attention to detail.

- •Trained 5 new tellers, improving onboarding efficiency by 30%.

- •Managed vault operations, ensuring compliance with security protocols and reducing shrinkage by 10%.

This experience section stands out because it highlights your measurable achievements directly related to a bank teller’s responsibilities. By showcasing a 98% accuracy rate, you're providing clear evidence of your reliability and skill level. Action words like "processed" and "managed" keep the narrative dynamic and engaging, illustrating how you took initiative. Each bullet point builds on the last, from reducing transaction errors to boosting customer satisfaction, demonstrating a comprehensive skill set. Tailoring the resume to align with a specific job ad ensures you highlight the most relevant skills, giving you a better chance of catching the employer's attention and landing an interview.

Problem-Solving Focused resume experience section

A problem-solving-focused bank teller resume experience section should highlight your ability to manage a variety of customer scenarios with accuracy and ease. Share your experience in resolving account discrepancies and handling challenging situations in the banking environment. Use your numerical skills to not only address issues but also to build customer confidence. Communication skills are crucial, so illustrate how you've explained banking issues or clarified processes, boosting customer understanding and trust.

Support these points by detailing specific achievements or tasks where your problem-solving abilities made a difference. Emphasize successful resolutions of customer complaints or discrepancies, showing how your skills contributed to efficient operations. Highlight how these efforts improved customer satisfaction and fostered a positive banking atmosphere. Concrete metrics or outcomes can effectively demonstrate your impact in resolving issues.

Bank Teller

Community Trust Bank

June 2019 - Present

- Resolved customer account discrepancies by verifying deposits, utilizing problem-solving skills that improved customer trust by 25%.

- Facilitated accurate currency exchanges, ensuring customers received quick and reliable service, enhancing transaction speed by 15%.

- Developed a standard procedure for addressing account errors, reducing resolution time by 30%.

- Collaborated with team members to streamline operations, resulting in a 20% increase in customer satisfaction scores.

Responsibility-Focused resume experience section

A responsibility-focused bank teller resume experience section should highlight your skills in customer service, transaction management, and maintaining accurate records. Begin by stating your job title and the length of time you held the position, which helps set the framework for your role. Optionally, you can add a brief description of the company to provide context. Your goal is to effectively summarize your key duties to emphasize your reliability and ability to manage essential bank functions, using simple and clear language throughout.

Use bullet points to further illustrate your experience, detailing specific responsibilities and achievements. Select active verbs that clearly convey what you did and the impact you had. For instance, highlight how you consistently exceeded customer satisfaction goals, improved transaction accuracy, or introduced new procedures that increased efficiency. By connecting these aspects, you create a comprehensive view of your skills and contributions. Keeping each point factual and focused on your role delivers a vivid picture of your capabilities.

Bank Teller

Sunset Bank and Trust

January 2020 - August 2023

- Handled over 100 transactions daily with 99.9% accuracy.

- Helped customers with account tasks, building trust and satisfaction.

- Trained new tellers in procedures, ensuring team readiness.

- Spotted fraudulent activities, protecting customer accounts.

Achievement-Focused resume experience section

A bank teller resume experience section should effectively highlight your impact and contributions in previous roles. Begin by pinpointing the key achievements or improvements you've made at work, emphasizing measurable aspects like the amount of money you've managed or the volume of transactions you've handled. Your goal is to clearly convey these achievements using straightforward language, ensuring each bullet point highlights a different facet of your experience. Employers are keenly interested in results, so include outcomes that demonstrate how your efforts positively affected the workplace.

Start each bullet point with a strong action verb to immediately capture attention and maintain a natural flow. Consider moments where you excelled in handling cash flawlessly, maintained high customer satisfaction, or streamlined processes, and make sure to underscore these with numerical data whenever possible. Numbers lend credibility, so mention the average number of customers served daily or error-free transactions completed. This clear, concise format allows potential employers to quickly recognize your accomplishments and appreciate your unique value.

Bank Teller

Community Savings Bank

June 2020 - Present

- Processed over 200 transactions daily with 99% accuracy.

- Increased customer satisfaction scores by 15% through exceptional service.

- Trained 5 new tellers, improving team efficiency by 20%.

- Recommended new banking products to customers, achieving monthly sales targets.

Training and Development Focused resume experience section

A training and development-focused bank teller resume experience section should clearly showcase how you’ve supported others in the banking environment. Start by stating your job title and tenure, then elaborate on your role and contributions at the workplace. Use bullet points to illustrate your specific skills in training new tellers, developing educational materials, and enhancing banking processes. Highlight achievements you can measure, such as increased efficiency or accuracy, to demonstrate the impact of your efforts. Make sure this part of your resume is both concise and informative, allowing each point to reveal an aspect of your experience without relying on overly technical language.

Tailor your experiences to fit the prospective employer’s needs by naturally incorporating keywords from their job description. This shows how you’ve led and adapted within a dynamic banking environment and provides context for your experience. Consider situations where you successfully navigated challenges in training settings. Use action verbs to highlight your accomplishments and indicate a proactive approach. Emphasizing your personal achievements in training and development sets you apart from others, so focus on specific successes in these areas.

Senior Bank Teller

Community Bank, Inc.

June 2020 - Present

- Led onboarding sessions for 50+ new tellers, improving initial performance by 15%.

- Developed comprehensive training guides, adopted by 3 branches, enhancing consistency.

- Implemented a feedback loop with trainees, leading to a 20% increase in job satisfaction.

- Coached peers in technical skills, fostering a 30% reduction in transaction errors.

Write your bank teller resume summary section

A results-focused bank teller resume summary should effectively showcase your strengths in just a few sentences. Highlight your experience, skills, and qualities that make you a prime candidate for the job. Here is an example of a bank teller resume summary:

This example seamlessly ties together the necessary skills, experience, and personal traits for a bank teller. It illustrates a candidate who not only handles transactions with precision but also excels in customer service and sales objectives. By clearly mentioning relevant skills and achievements, you make it easier for potential employers to understand your value. Describing yourself as results-driven, a great communicator, or possessing a meticulous work ethic can further enhance your appeal.

It's essential to distinguish between a resume summary and an objective. A resume summary emphasizes your past experience and skills, while an objective focuses on your future career goals. If you're new to the field, an objective that highlights your eagerness to learn and grow could be more effective. Similarly, a resume profile or a summary of qualifications is akin to a summary but may include more detailed information, often presented as bullet points. Choosing the right section depends on your experience level and the position you're targeting.

Listing your bank teller skills on your resume

A bank teller-focused resume should showcase your unique skills and strengths that make you suitable for the role. The skills section can either stand alone or be woven into your experience or summary. Strengths, notably your soft skills, show up in qualities like your knack for communication and providing excellent customer service. Hard skills, however, center around specific abilities, such as efficiently handling cash or navigating banking software.

These skills and strengths turn into critical keywords for your resume. They help you stand out to recruiters and move past applicant tracking systems by quickly showcasing your capabilities.

Here's an example of how to set up an effective skills section:

This skills section is clear and direct, which makes it incredibly effective. It includes only relevant skills tailored to bank teller duties. The organized layout, with bullet points under "tags," helps readers quickly understand your qualifications.

Best hard skills to feature on your bank teller resume

Your hard skills are crucial for showing expertise in specific areas. They underline your ability to manage numbers, harness technology, and perform daily banking tasks efficiently.

Hard Skills

- Cash handling

- Transaction processing

- Knowledge of banking software

- Financial product sales

- Currency exchange

- Ledger balancing

- Compliance and regulatory knowledge

- Fraud detection

- Data entry accuracy

- Safe deposit procedures

- Account reconciliation

- Check verification

- Automated teller machine (ATM) operation

- Loan processing basics

- Customer account management

Best soft skills to feature on your bank teller resume

Soft skills round out your profile by highlighting interpersonal abilities. These skills illustrate your capacity to connect with customers and work cohesively on a team.

Soft Skills

- Customer service

- Communication

- Problem-solving

- Attention to detail

- Empathy

- Patience

- Time management

- Adaptability

- Teamwork

- Conflict resolution

- Multitasking

- Organizational skills

- Dependability

- Emotional intelligence

- Professionalism

How to include your education on your resume

An education section is a crucial part of your resume, especially if you're applying for a bank teller position. Tailor this section to highlight education that's relevant to the job. Leave out any education that doesn't relate to the role. If you have an impressive GPA, include it to show you're disciplined and hardworking. Put down your GPA as: "GPA: 3.8/4.0" or "GPA: 3.8" if the scale is understood. Highlight honors like cum laude alongside your degree to stand out. List your degree with the title first, then the institution name, and the date range of attendance.

Incorrect example of an education section:

Correct example of an education section:

The second example is effective because it highlights a finance degree relevant for a bank teller. Completing the degree cum laude shows competency and dedication. Listing a solid GPA further underscores a history of academic achievement. Dates of attendance offer a clear timeline of your education journey. Having these components arranged clearly ensures hiring managers can quickly assess your qualifications.

How to include bank teller certificates on your resume

Including a certificates section in your bank teller resume is crucial to showcasing your qualifications. Highlighting your certificates can give you a competitive edge. List the name of each certificate clearly. Include the date you obtained it to provide context. Add the issuing organization to lend credibility. Placing certificates in the header of your resume is also an option. For example, "Certified Bank Teller - American Bankers Association" immediately grabs attention.

Here's an effective standalone certificates section in JSON format:

This example is strong because the included certificates are directly relevant to banking. They make a clear statement about your commitment and skills. The American Bankers Association certificate is reputable and shows industry recognition. The Customer Service Excellence certificate reflects your ability to interact with clients, an important skill for bank tellers. Including reputable organizations assures employers that you have the required skills. These details will help your resume stand out to hiring managers.

Extra sections to include on your bank teller resume

Creating a resume as a bank teller involves highlighting skills and experiences that showcase your ability to manage transactions, assist customers, and handle financial tasks efficiently. To stand out and reflect your diverse skill set, it's beneficial to include additional sections that offer more insight into your abilities and interests.

Language section — Include any languages you speak fluently or conversationally to demonstrate communication skills with diverse customers. This can make you more valuable in regions with diverse language needs.

Hobbies and interests section — List relevant hobbies or interests to show personal qualities like attention to detail or a friendly attitude. Sharing interests like reading finance books can highlight your eagerness to grow in the finance sector.

Volunteer work section — Highlight volunteer work to demonstrate community involvement and valuable soft skills like teamwork and leadership. Employers value candidates who show initiative and community engagement.

Books section — Mention books you've read related to finance or personal development to showcase your commitment to ongoing learning. This can reflect your motivation to grow professionally and personally.

In Conclusion

In conclusion, creating an outstanding bank teller resume requires a keen focus on highlighting your unique skills and experiences. Remember, your resume is like a bank statement that clearly presents your value to potential employers. It's essential to list not only your professional experience but also your soft and hard skills to demonstrate your ability to handle transactions efficiently and engage with customers positively. Consider using a structured template to ensure a professional presentation and to help you focus on what matters most.

Including precise contact information and a compelling professional summary ensures your resume grabs attention right away. Each section of your resume should tell a part of your story—your education, certifications, and achievements are crucial in portraying your comprehensive skill set. Make sure to emphasize quantifiable achievements, as these numbers quickly show your impact and reliability in previous roles.

Additionally, optional sections like language skills, hobbies, volunteer work, or relevant books you've read can further humanize your resume, making you more relatable and well-rounded in the eyes of recruiters. Maintaining professionalism through clean formatting, modern fonts, and a consistent layout also reflects the attention to detail expected in a bank teller role.

By incorporating these elements, you not only catch the eyes of hiring managers but also increase your chances of advancing in the hiring process. Tailoring your resume to each job by using relevant keywords and formats showcases your problem-solving skills and adaptability. Altogether, a focused and well-organized resume can pave your way towards securing an interview and landing the bank teller position you desire.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.