Banking Accountant Resume Examples

Jul 18, 2024

|

12 min read

Master the art of crafting your banking accountant resume: Unlock your career potential by highlighting key skills and experiences. Make every word count as you balance your way to an interview.

Rated by 348 people

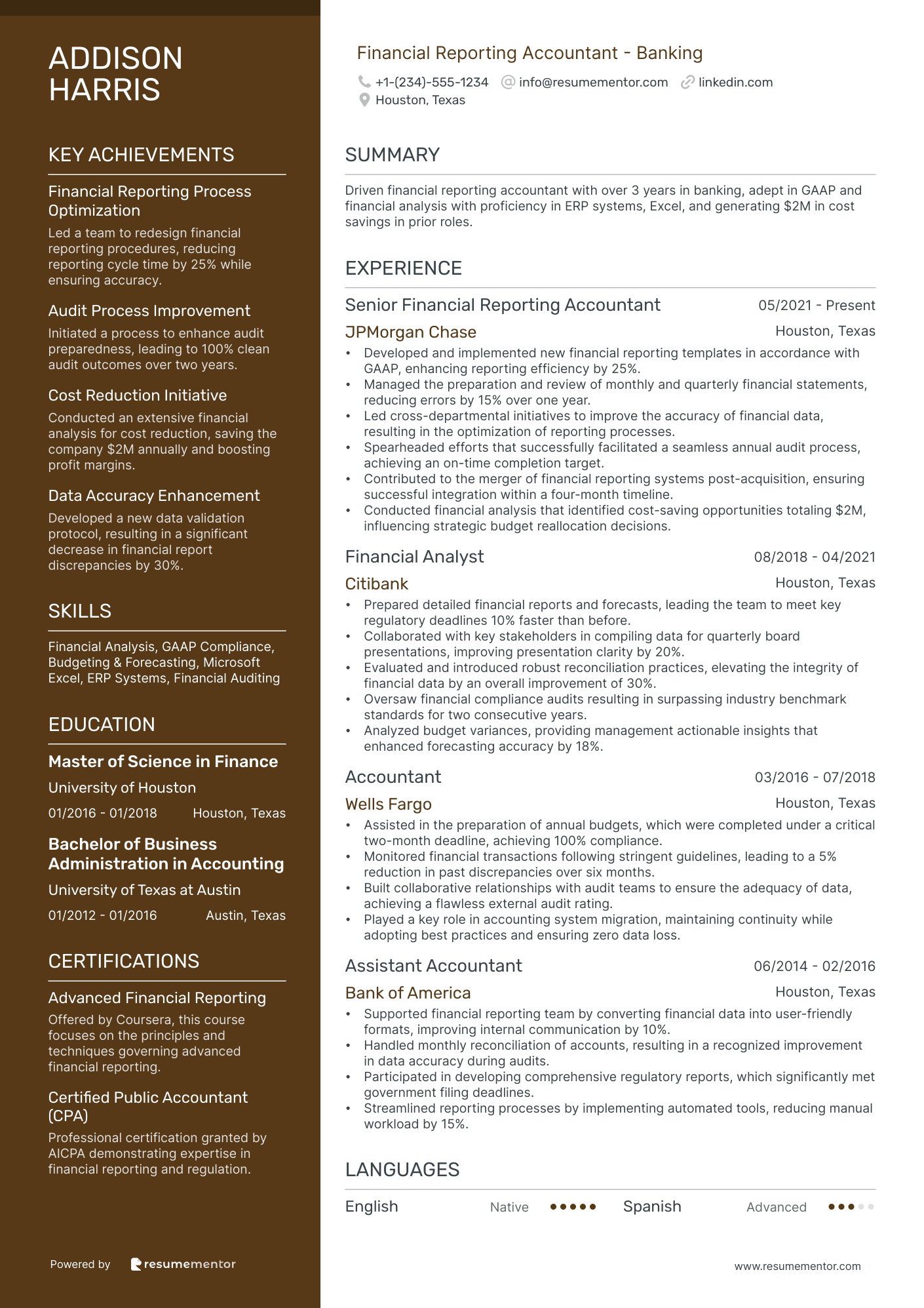

Financial Reporting Accountant - Banking

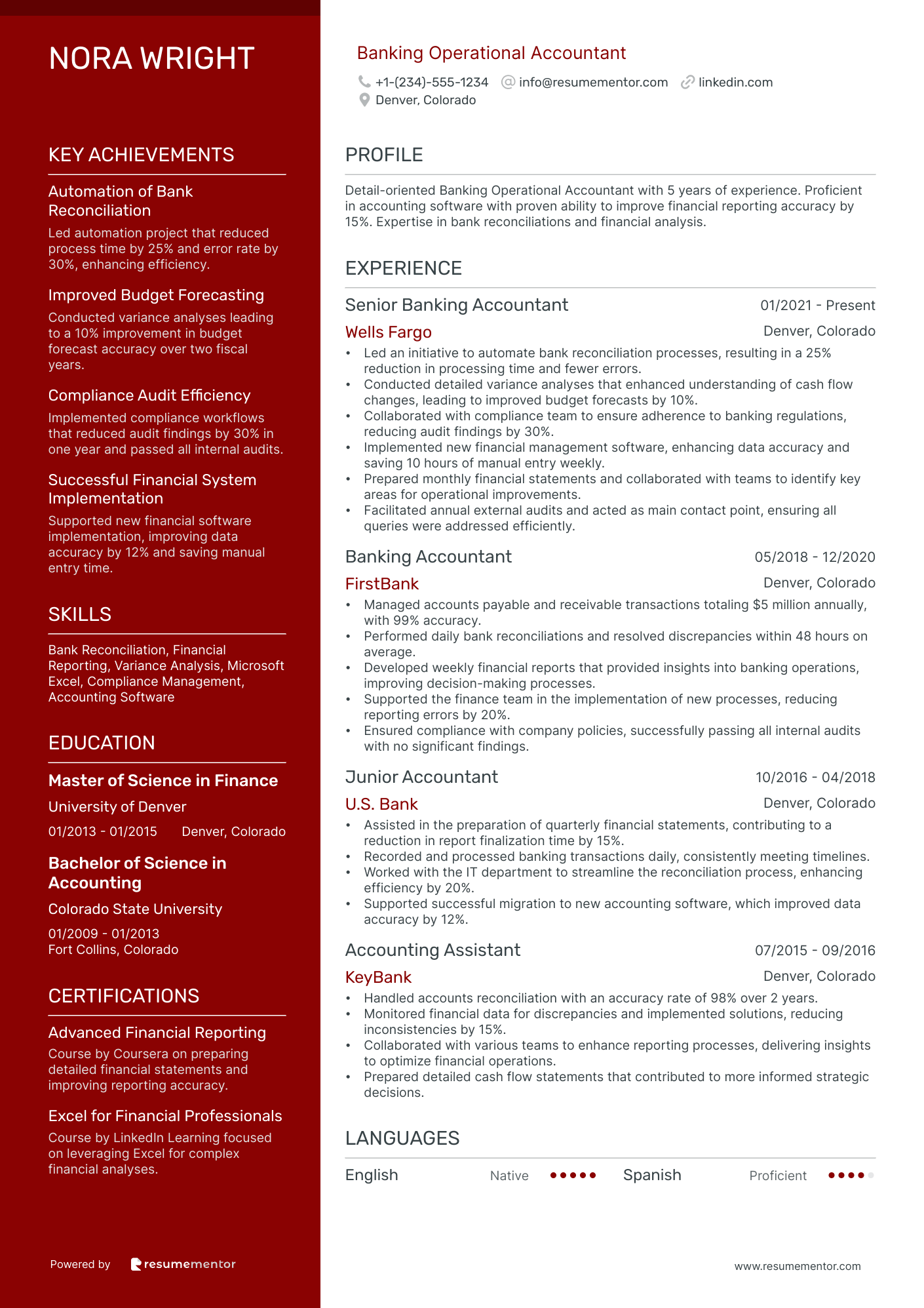

Banking Operational Accountant

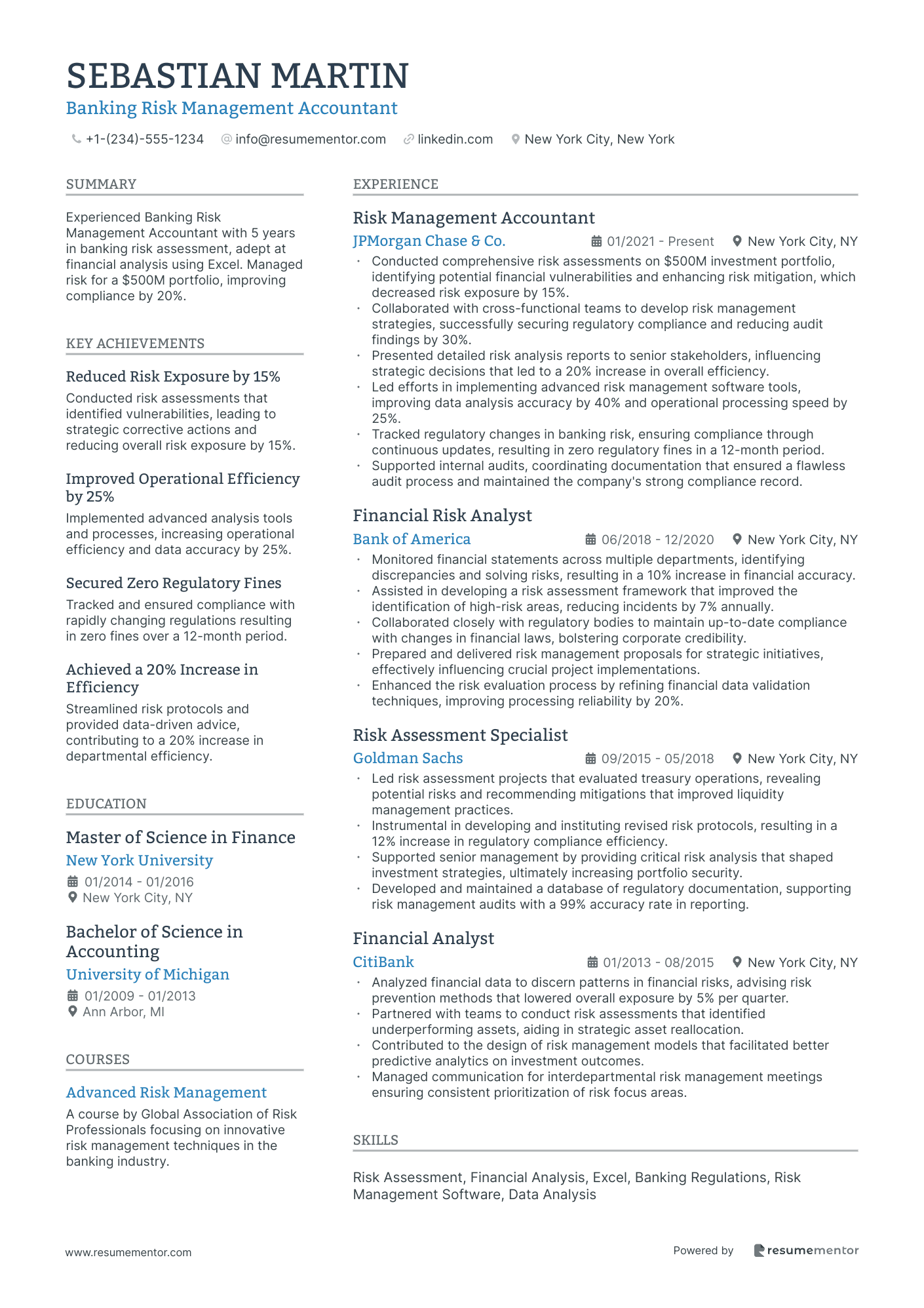

Banking Risk Management Accountant

International Banking Accountant

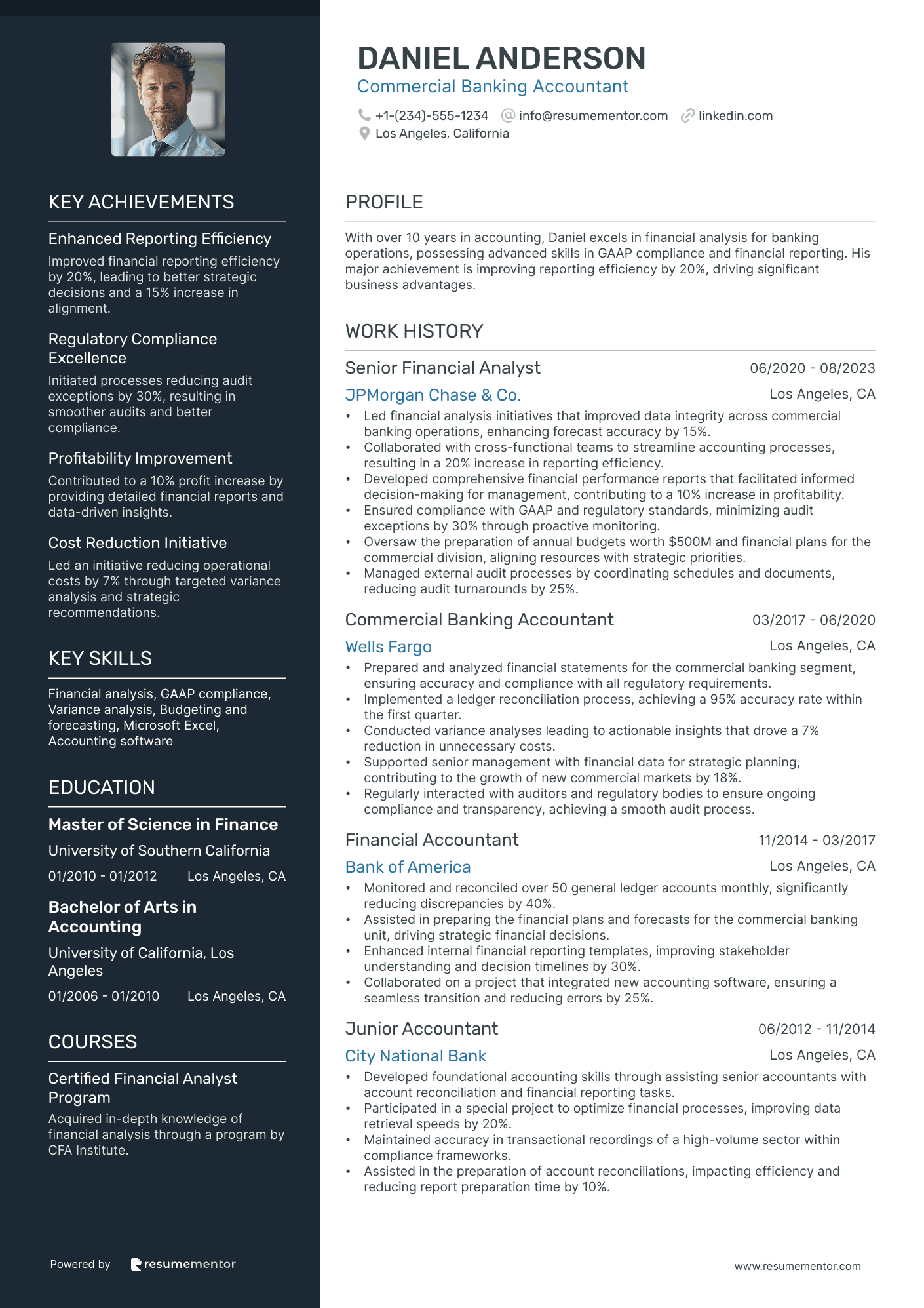

Commercial Banking Accountant

Banking Tax Accountant

Investment Banking Accountant

Banking Compliance Accountant

Retail Banking Accountant

Banking Audit Accountant

Financial Reporting Accountant - Banking resume sample

- •Developed and implemented new financial reporting templates in accordance with GAAP, enhancing reporting efficiency by 25%.

- •Managed the preparation and review of monthly and quarterly financial statements, reducing errors by 15% over one year.

- •Led cross-departmental initiatives to improve the accuracy of financial data, resulting in the optimization of reporting processes.

- •Spearheaded efforts that successfully facilitated a seamless annual audit process, achieving an on-time completion target.

- •Contributed to the merger of financial reporting systems post-acquisition, ensuring successful integration within a four-month timeline.

- •Conducted financial analysis that identified cost-saving opportunities totaling $2M, influencing strategic budget reallocation decisions.

- •Prepared detailed financial reports and forecasts, leading the team to meet key regulatory deadlines 10% faster than before.

- •Collaborated with key stakeholders in compiling data for quarterly board presentations, improving presentation clarity by 20%.

- •Evaluated and introduced robust reconciliation practices, elevating the integrity of financial data by an overall improvement of 30%.

- •Oversaw financial compliance audits resulting in surpassing industry benchmark standards for two consecutive years.

- •Analyzed budget variances, providing management actionable insights that enhanced forecasting accuracy by 18%.

- •Assisted in the preparation of annual budgets, which were completed under a critical two-month deadline, achieving 100% compliance.

- •Monitored financial transactions following stringent guidelines, leading to a 5% reduction in past discrepancies over six months.

- •Built collaborative relationships with audit teams to ensure the adequacy of data, achieving a flawless external audit rating.

- •Played a key role in accounting system migration, maintaining continuity while adopting best practices and ensuring zero data loss.

- •Supported financial reporting team by converting financial data into user-friendly formats, improving internal communication by 10%.

- •Handled monthly reconciliation of accounts, resulting in a recognized improvement in data accuracy during audits.

- •Participated in developing comprehensive regulatory reports, which significantly met government filing deadlines.

- •Streamlined reporting processes by implementing automated tools, reducing manual workload by 15%.

Banking Operational Accountant resume sample

- •Led an initiative to automate bank reconciliation processes, resulting in a 25% reduction in processing time and fewer errors.

- •Conducted detailed variance analyses that enhanced understanding of cash flow changes, leading to improved budget forecasts by 10%.

- •Collaborated with compliance team to ensure adherence to banking regulations, reducing audit findings by 30%.

- •Implemented new financial management software, enhancing data accuracy and saving 10 hours of manual entry weekly.

- •Prepared monthly financial statements and collaborated with teams to identify key areas for operational improvements.

- •Facilitated annual external audits and acted as main contact point, ensuring all queries were addressed efficiently.

- •Managed accounts payable and receivable transactions totaling $5 million annually, with 99% accuracy.

- •Performed daily bank reconciliations and resolved discrepancies within 48 hours on average.

- •Developed weekly financial reports that provided insights into banking operations, improving decision-making processes.

- •Supported the finance team in the implementation of new processes, reducing reporting errors by 20%.

- •Ensured compliance with company policies, successfully passing all internal audits with no significant findings.

- •Assisted in the preparation of quarterly financial statements, contributing to a reduction in report finalization time by 15%.

- •Recorded and processed banking transactions daily, consistently meeting timelines.

- •Worked with the IT department to streamline the reconciliation process, enhancing efficiency by 20%.

- •Supported successful migration to new accounting software, which improved data accuracy by 12%.

- •Handled accounts reconciliation with an accuracy rate of 98% over 2 years.

- •Monitored financial data for discrepancies and implemented solutions, reducing inconsistencies by 15%.

- •Collaborated with various teams to enhance reporting processes, delivering insights to optimize financial operations.

- •Prepared detailed cash flow statements that contributed to more informed strategic decisions.

Banking Risk Management Accountant resume sample

- •Conducted comprehensive risk assessments on $500M investment portfolio, identifying potential financial vulnerabilities and enhancing risk mitigation, which decreased risk exposure by 15%.

- •Collaborated with cross-functional teams to develop risk management strategies, successfully securing regulatory compliance and reducing audit findings by 30%.

- •Presented detailed risk analysis reports to senior stakeholders, influencing strategic decisions that led to a 20% increase in overall efficiency.

- •Led efforts in implementing advanced risk management software tools, improving data analysis accuracy by 40% and operational processing speed by 25%.

- •Tracked regulatory changes in banking risk, ensuring compliance through continuous updates, resulting in zero regulatory fines in a 12-month period.

- •Supported internal audits, coordinating documentation that ensured a flawless audit process and maintained the company's strong compliance record.

- •Monitored financial statements across multiple departments, identifying discrepancies and solving risks, resulting in a 10% increase in financial accuracy.

- •Assisted in developing a risk assessment framework that improved the identification of high-risk areas, reducing incidents by 7% annually.

- •Collaborated closely with regulatory bodies to maintain up-to-date compliance with changes in financial laws, bolstering corporate credibility.

- •Prepared and delivered risk management proposals for strategic initiatives, effectively influencing crucial project implementations.

- •Enhanced the risk evaluation process by refining financial data validation techniques, improving processing reliability by 20%.

- •Led risk assessment projects that evaluated treasury operations, revealing potential risks and recommending mitigations that improved liquidity management practices.

- •Instrumental in developing and instituting revised risk protocols, resulting in a 12% increase in regulatory compliance efficiency.

- •Supported senior management by providing critical risk analysis that shaped investment strategies, ultimately increasing portfolio security.

- •Developed and maintained a database of regulatory documentation, supporting risk management audits with a 99% accuracy rate in reporting.

- •Analyzed financial data to discern patterns in financial risks, advising risk prevention methods that lowered overall exposure by 5% per quarter.

- •Partnered with teams to conduct risk assessments that identified underperforming assets, aiding in strategic asset reallocation.

- •Contributed to the design of risk management models that facilitated better predictive analytics on investment outcomes.

- •Managed communication for interdepartmental risk management meetings ensuring consistent prioritization of risk focus areas.

International Banking Accountant resume sample

- •Managed international financial transactions, ensuring 100% compliance with international banking regulations, thus reducing audits by 20%.

- •Collaborated with cross-functional teams to streamline reporting processes, resulting in a 15% reduction in reporting errors.

- •Developed effective foreign currency conversion strategies, improving profit margins by an average of $500,000 annually.

- •Led the preparation of financial statements for international operations, contributing to 30% faster completion times.

- •Conducted in-depth financial data analysis, providing actionable insights that improved decision-making in 3 major international banking projects.

- •Implemented cost optimization strategies across departments, cutting operational costs by 10% within the first year.

- •Analyzed international banking trends, providing detailed reports that enhanced financial forecasting accuracy by 25%.

- •Supervised account reconciliations to identify discrepancies, achieving a 98% accuracy rate in financial records.

- •Ensured compliance with international regulations, minimizing regulatory risks by 40% in key banking sectors.

- •Developed a comprehensive system for tracking foreign currency hedging, resulting in a 20% increase in hedge effectiveness.

- •Collaborated with tax and legal teams to streamline processes, improving compliance with international standards across departments.

- •Prepared detailed financial statements for international operations, reducing processing time by 15%.

- •Managed complex transactions for international clients, ensuring accuracy and compliance with global standards.

- •Conducted thorough account reconciliations, achieving a 95% resolution rate for discrepancies within the first 48 hours.

- •Contributed to the development of budgeting tools, enhancing the accuracy of financial forecasts across international accounts.

- •Assisted in maintaining accurate financial records for a portfolio of international clients, achieving 100% compliance.

- •Supported senior accountants in preparing financial reports, which improved accuracy by 10% over a two-year period.

- •Utilized ERP systems to track financial performance, contributing to a 20% improvement in tracking efficiency.

- •Participated in audits for international operations, decreasing external audit findings by 15% through improved internal controls.

Commercial Banking Accountant resume sample

- •Led financial analysis initiatives that improved data integrity across commercial banking operations, enhancing forecast accuracy by 15%.

- •Collaborated with cross-functional teams to streamline accounting processes, resulting in a 20% increase in reporting efficiency.

- •Developed comprehensive financial performance reports that facilitated informed decision-making for management, contributing to a 10% increase in profitability.

- •Ensured compliance with GAAP and regulatory standards, minimizing audit exceptions by 30% through proactive monitoring.

- •Oversaw the preparation of annual budgets worth $500M and financial plans for the commercial division, aligning resources with strategic priorities.

- •Managed external audit processes by coordinating schedules and documents, reducing audit turnarounds by 25%.

- •Prepared and analyzed financial statements for the commercial banking segment, ensuring accuracy and compliance with all regulatory requirements.

- •Implemented a ledger reconciliation process, achieving a 95% accuracy rate within the first quarter.

- •Conducted variance analyses leading to actionable insights that drove a 7% reduction in unnecessary costs.

- •Supported senior management with financial data for strategic planning, contributing to the growth of new commercial markets by 18%.

- •Regularly interacted with auditors and regulatory bodies to ensure ongoing compliance and transparency, achieving a smooth audit process.

- •Monitored and reconciled over 50 general ledger accounts monthly, significantly reducing discrepancies by 40%.

- •Assisted in preparing the financial plans and forecasts for the commercial banking unit, driving strategic financial decisions.

- •Enhanced internal financial reporting templates, improving stakeholder understanding and decision timelines by 30%.

- •Collaborated on a project that integrated new accounting software, ensuring a seamless transition and reducing errors by 25%.

- •Developed foundational accounting skills through assisting senior accountants with account reconciliation and financial reporting tasks.

- •Participated in a special project to optimize financial processes, improving data retrieval speeds by 20%.

- •Maintained accuracy in transactional recordings of a high-volume sector within compliance frameworks.

- •Assisted in the preparation of account reconciliations, impacting efficiency and reducing report preparation time by 10%.

Banking Tax Accountant resume sample

- •Led tax filings for over 30 banking entities, achieving 100% accuracy and a 20% faster submission rate.

- •Developed tax optimization strategies reducing tax costs by 15%, focusing on compliance and fiscal sustainability.

- •Collaborated with cross-functional teams to gather and audit financial data, greatly enhancing reporting accuracy.

- •Monitored tax regulatory changes, resulting in preemptive compliance adaptations to mitigate risks.

- •Facilitated training initiatives for tax compliance, elevating team knowledge and performance by 25%.

- •Orchestrated successful audits, streamlining processes by 30%, significantly lowering audit times.

- •Reviewed federal and state returns for financial subsidiaries, ensuring compliance and eliminating penalty risks.

- •Played a critical role in identifying tax-saving opportunities, contributing to a $500K reduction in tax liability.

- •Supported tax planning for future fiscal years, enhancing budget accuracy by 15% through detailed forecasts.

- •Participated in audit processes, responding to authority inquiries with 0 unresolved issues.

- •Maintained up-to-date tax documentation, ensuring alignment with current legislation and regulations.

- •Analyzed complex tax scenarios for major clients, providing strategic guidance on legislative compliance.

- •Assisted in tax forecasting and budgeting tasks, improving accuracy by 10% across client engagements.

- •Facilitated collection of financial metrics, enhancing data accuracy through efficient management practices.

- •Collaborated with senior advisors on special projects, advancing process improvements by 20%.

- •Supported the preparation of tax documents, achieving 98% correctness upon initial state assessments.

- •Explored new tax software, leading adoption that reduced error margins by 5%.

- •Contributed to team workshops, enhancing understanding of federal tax processes within the organization.

- •Managed tax filing schedules for diverse accounts, consistently meeting deadlines with 100% compliance.

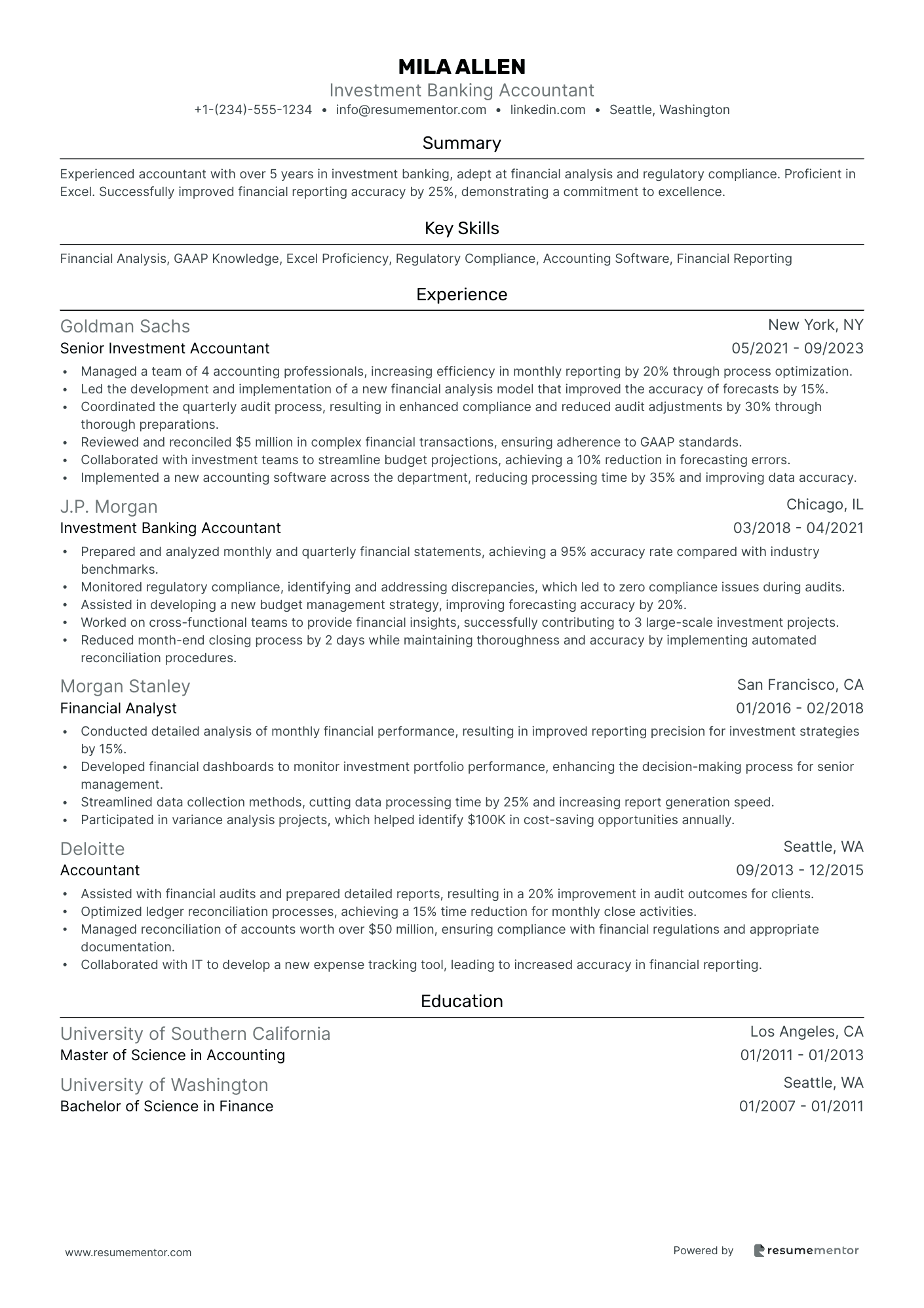

Investment Banking Accountant resume sample

- •Managed a team of 4 accounting professionals, increasing efficiency in monthly reporting by 20% through process optimization.

- •Led the development and implementation of a new financial analysis model that improved the accuracy of forecasts by 15%.

- •Coordinated the quarterly audit process, resulting in enhanced compliance and reduced audit adjustments by 30% through thorough preparations.

- •Reviewed and reconciled $5 million in complex financial transactions, ensuring adherence to GAAP standards.

- •Collaborated with investment teams to streamline budget projections, achieving a 10% reduction in forecasting errors.

- •Implemented a new accounting software across the department, reducing processing time by 35% and improving data accuracy.

- •Prepared and analyzed monthly and quarterly financial statements, achieving a 95% accuracy rate compared with industry benchmarks.

- •Monitored regulatory compliance, identifying and addressing discrepancies, which led to zero compliance issues during audits.

- •Assisted in developing a new budget management strategy, improving forecasting accuracy by 20%.

- •Worked on cross-functional teams to provide financial insights, successfully contributing to 3 large-scale investment projects.

- •Reduced month-end closing process by 2 days while maintaining thoroughness and accuracy by implementing automated reconciliation procedures.

- •Conducted detailed analysis of monthly financial performance, resulting in improved reporting precision for investment strategies by 15%.

- •Developed financial dashboards to monitor investment portfolio performance, enhancing the decision-making process for senior management.

- •Streamlined data collection methods, cutting data processing time by 25% and increasing report generation speed.

- •Participated in variance analysis projects, which helped identify $100K in cost-saving opportunities annually.

- •Assisted with financial audits and prepared detailed reports, resulting in a 20% improvement in audit outcomes for clients.

- •Optimized ledger reconciliation processes, achieving a 15% time reduction for monthly close activities.

- •Managed reconciliation of accounts worth over $50 million, ensuring compliance with financial regulations and appropriate documentation.

- •Collaborated with IT to develop a new expense tracking tool, leading to increased accuracy in financial reporting.

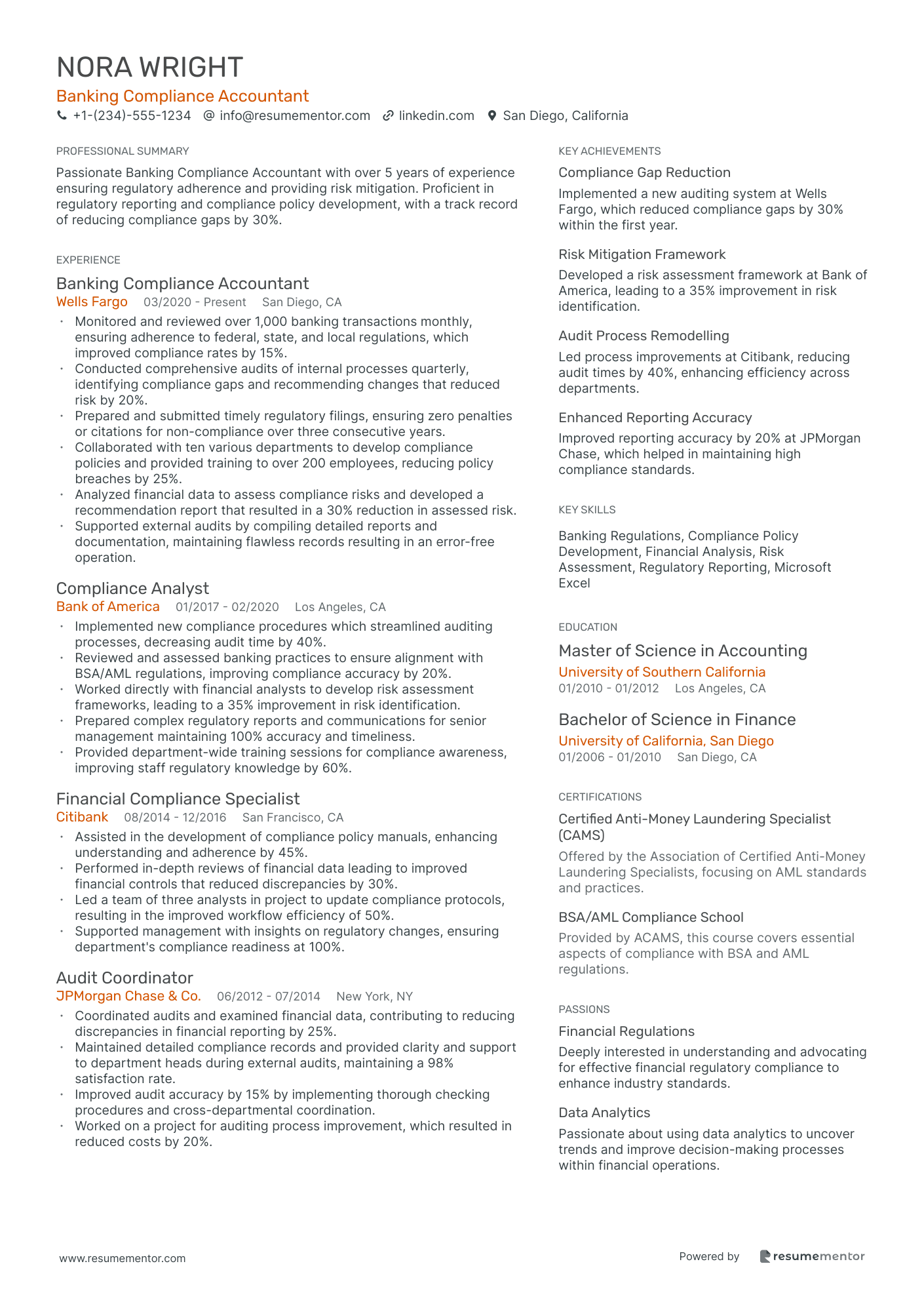

Banking Compliance Accountant resume sample

- •Monitored and reviewed over 1,000 banking transactions monthly, ensuring adherence to federal, state, and local regulations, which improved compliance rates by 15%.

- •Conducted comprehensive audits of internal processes quarterly, identifying compliance gaps and recommending changes that reduced risk by 20%.

- •Prepared and submitted timely regulatory filings, ensuring zero penalties or citations for non-compliance over three consecutive years.

- •Collaborated with ten various departments to develop compliance policies and provided training to over 200 employees, reducing policy breaches by 25%.

- •Analyzed financial data to assess compliance risks and developed a recommendation report that resulted in a 30% reduction in assessed risk.

- •Supported external audits by compiling detailed reports and documentation, maintaining flawless records resulting in an error-free operation.

- •Implemented new compliance procedures which streamlined auditing processes, decreasing audit time by 40%.

- •Reviewed and assessed banking practices to ensure alignment with BSA/AML regulations, improving compliance accuracy by 20%.

- •Worked directly with financial analysts to develop risk assessment frameworks, leading to a 35% improvement in risk identification.

- •Prepared complex regulatory reports and communications for senior management maintaining 100% accuracy and timeliness.

- •Provided department-wide training sessions for compliance awareness, improving staff regulatory knowledge by 60%.

- •Assisted in the development of compliance policy manuals, enhancing understanding and adherence by 45%.

- •Performed in-depth reviews of financial data leading to improved financial controls that reduced discrepancies by 30%.

- •Led a team of three analysts in project to update compliance protocols, resulting in the improved workflow efficiency of 50%.

- •Supported management with insights on regulatory changes, ensuring department's compliance readiness at 100%.

- •Coordinated audits and examined financial data, contributing to reducing discrepancies in financial reporting by 25%.

- •Maintained detailed compliance records and provided clarity and support to department heads during external audits, maintaining a 98% satisfaction rate.

- •Improved audit accuracy by 15% by implementing thorough checking procedures and cross-departmental coordination.

- •Worked on a project for auditing process improvement, which resulted in reduced costs by 20%.

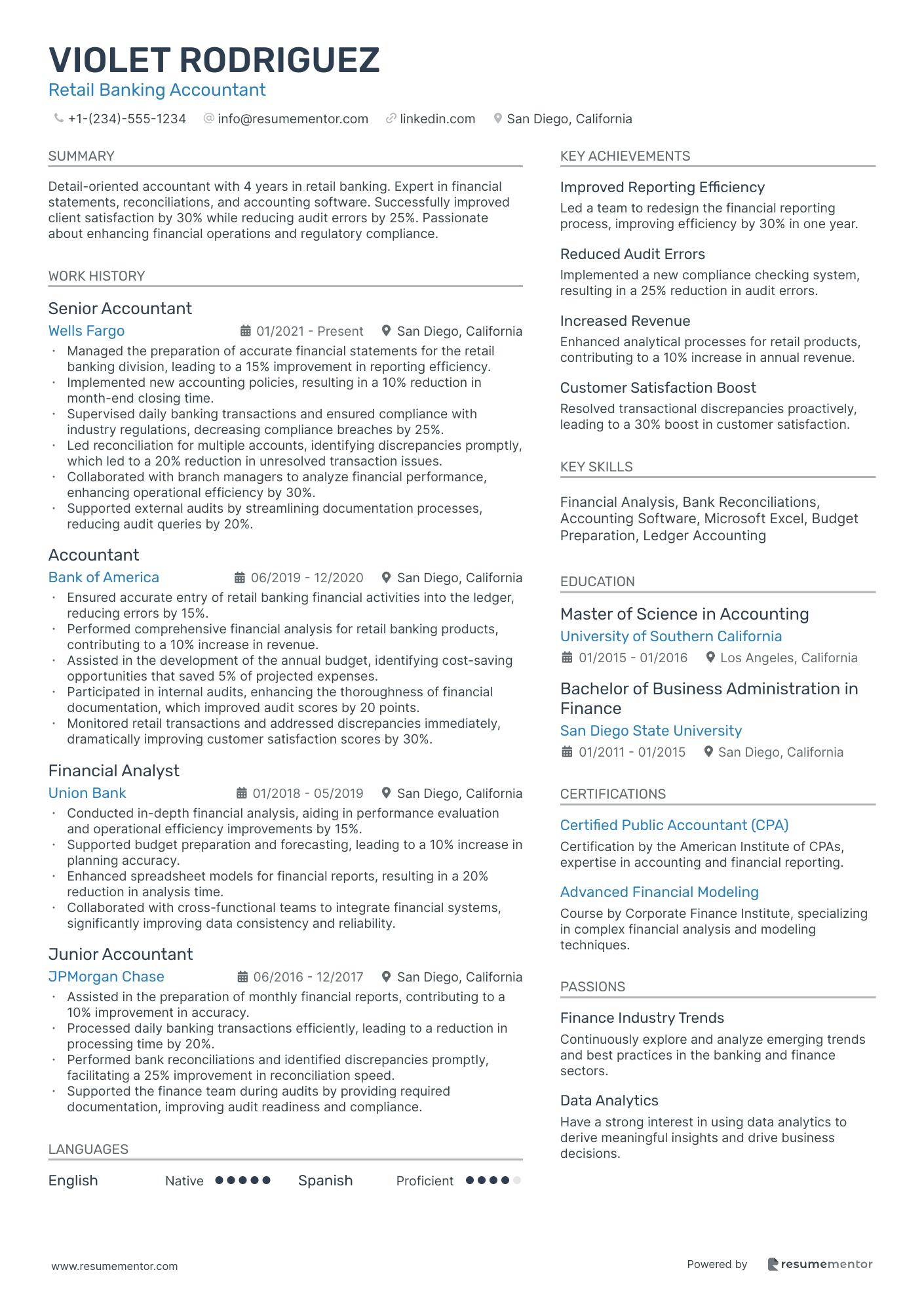

Retail Banking Accountant resume sample

- •Managed the preparation of accurate financial statements for the retail banking division, leading to a 15% improvement in reporting efficiency.

- •Implemented new accounting policies, resulting in a 10% reduction in month-end closing time.

- •Supervised daily banking transactions and ensured compliance with industry regulations, decreasing compliance breaches by 25%.

- •Led reconciliation for multiple accounts, identifying discrepancies promptly, which led to a 20% reduction in unresolved transaction issues.

- •Collaborated with branch managers to analyze financial performance, enhancing operational efficiency by 30%.

- •Supported external audits by streamlining documentation processes, reducing audit queries by 20%.

- •Ensured accurate entry of retail banking financial activities into the ledger, reducing errors by 15%.

- •Performed comprehensive financial analysis for retail banking products, contributing to a 10% increase in revenue.

- •Assisted in the development of the annual budget, identifying cost-saving opportunities that saved 5% of projected expenses.

- •Participated in internal audits, enhancing the thoroughness of financial documentation, which improved audit scores by 20 points.

- •Monitored retail transactions and addressed discrepancies immediately, dramatically improving customer satisfaction scores by 30%.

- •Conducted in-depth financial analysis, aiding in performance evaluation and operational efficiency improvements by 15%.

- •Supported budget preparation and forecasting, leading to a 10% increase in planning accuracy.

- •Enhanced spreadsheet models for financial reports, resulting in a 20% reduction in analysis time.

- •Collaborated with cross-functional teams to integrate financial systems, significantly improving data consistency and reliability.

- •Assisted in the preparation of monthly financial reports, contributing to a 10% improvement in accuracy.

- •Processed daily banking transactions efficiently, leading to a reduction in processing time by 20%.

- •Performed bank reconciliations and identified discrepancies promptly, facilitating a 25% improvement in reconciliation speed.

- •Supported the finance team during audits by providing required documentation, improving audit readiness and compliance.

Banking Audit Accountant resume sample

- •Led audit assignments and successfully identified process improvements increasing efficiency by 30% over a 12-month period.

- •Prepared comprehensive audit findings reports with actionable insights, reducing compliance-related incidents by 25%.

- •Collaborated with cross-functional teams, optimizing information flow and reducing time spent on audits by 15%.

- •Implemented audit programs that resulted in reducing detection time for non-compliance issues by 40%.

- •Monitored regulatory compliance, maintaining adherence to the latest banking standards and reducing risk exposure.

- •Mentored junior audit staff, improving team performance and increasing audit project success rates by 20%.

- •Conducted risk-based audits, identifying inadequacies that resulted in strategic improvements in banking procedures.

- •Analyzed operations to ensure compliance with internal policies, saving the department $150K annually.

- •Enhanced audit procedures, which improved scrutiny on bank loans processing and compliance adherence by 35%.

- •Presented audit insights to management, leading to the implementation of 15 key policy changes.

- •Played a central role in the development of internal controls, reducing error rates in transactions by 18%.

- •Participated in over 25 internal audits, recommending improvements that increased compliance adherence by 22%.

- •Developed audit documentation practices that improved accuracy and support for final reporting.

- •Engaged in compliance checks during audits resulting in the detection and resolution of significant control lapse.

- •Managed and maintained audit software systems, improving data collection speed and accuracy by 15%.

- •Contributed to financial projections, assisting the company in securing a 10% increase in quarterly financing.

- •Performed thorough analysis on financial statements resulting in improved investment decision accuracy.

- •Collaborated with audit teams to develop risk avoidance plans, keeping non-compliance incidents at a minimum.

- •Delivered financial insights and recommendations that led to a 12% reduction in overhead expenses.

As a banking accountant, you hold the keys to financial stability, ensuring every transaction is in its rightful place. This responsibility requires a resume that reflects your financial acumen and professionalism, which can be challenging to capture in a concise way. Crafting such a document might seem daunting, especially when trying to convey your extensive experience and technical expertise.

To stand out in the competitive world of banking, your resume needs to do more than list jobs—it's your first impression, showcasing your skills in interpreting complex financial data and solving problems with precision. Many banking accountants find it difficult to create resumes that engage potential employers, often overlooking the key elements that make them shine.

Using the right resume layout is crucial for structuring your achievements in a clear and compelling way. A well-designed resume template can help you present your skills and experiences cohesively. By selecting the right template, you make it easier for hiring managers to immediately grasp your value.

This guide will help you understand these nuances, ensuring your expertise shines through. Whether refining a current resume or creating a new one, you'll find insights here to help you stand out. Let’s transform your resume into a gateway for your next banking opportunity.

Key Takeaways

- To make a strong first impression in banking, your resume should not only list jobs but also showcase your skills in financial data interpretation and problem-solving.

- A proper resume layout is crucial to clearly and compellingly present your achievements, making it easier for hiring managers to recognize your value.

- Your resume should detail strengths in financial management and accuracy in financial records, including software expertise, to support your team and improve financial health.

- A chronological resume format is preferred, featuring a clear timeline of experience, modern fonts, and saving it as a PDF to ensure consistent formatting across devices.

- Highlighting quantifiable achievements in your experience section is key, using action words and aligning with job requirements to emphasize your impact and value to potential employers.

What to focus on when writing your banking accountant resume

A banking accountant resume should convey your strengths in financial management and detail-oriented skills—essentials for excelling in this role. To write an effective resume, it's crucial to focus on how you can manage financial records accurately and support your banking team. Recruiters value your expertise with accounting software and your contribution to improving the institution's financial health. Carefully considering each section's content is key to making a lasting impression.

How to structure your banking accountant resume

- Contact Information—Your contact information should be clear and straightforward. Include your full name, phone number, and a professional email address to ensure recruiters can easily reach you. Adding your LinkedIn profile enhances your professional credibility, allowing recruiters to view your endorsements and connections, providing a more comprehensive view of your expertise in banking accounting.

- Professional Summary—Crafting a compelling professional summary is essential. Here, distill your extensive experience and skills into a succinct snapshot. Highlight your financial expertise, illustrating how your background and specific achievements can benefit a banking environment. This introductory section sets the tone and piques the interest of hiring managers, encouraging them to delve deeper into your qualifications.

- Work Experience—This section should focus on detailing your past positions with an emphasis on banking and accounting roles. Clearly articulate your responsibilities and accomplishments, using metrics where possible—such as how you maintained ledgers, conducted compliance checks, or generated financial reports. Demonstrating your commitment to accuracy and reliability will instill confidence in your ability to contribute positively to the team.

- Education—When listing your educational qualifications, emphasize your degrees in accounting, finance, or related fields. Mention the institution name and your graduation date. This serves as your foundational knowledge, supporting the claims in your professional summary and work experience by showing you possess the necessary academic preparation.

- Certifications—Including certifications like CPA or CFA illustrates your dedication to professional growth and adherence to industry standards. These accolades not only highlight your professionalism but also establish your specialized knowledge and commitment to the field of banking accounting.

- Technical Skills—Make sure to emphasize your proficiency in accounting software like QuickBooks or SAP. Also, showcase your understanding of banking regulations, as this proves your readiness to tackle industry challenges. Your technical skills underline your capability to efficiently manage tasks and improve operational processes.

To further enrich your resume, consider adding sections like “Volunteer Experience” or “Continuing Education” if they relate to financial projects or courses. These can offer more depth and illustrate your ongoing dedication to professional growth. Next, we'll explore each of these sections more in-depth and discuss how to format your resume effectively for an impactful presentation.

Which resume format to choose

Crafting a banking accountant resume requires both style and precision. Start with a chronological resume format, as employers in the financial sector appreciate seeing a clear timeline of your experience and skills. This allows you to highlight your career growth and relevant achievements. Choose modern fonts such as Rubik, Lato, or Montserrat to give your resume a contemporary yet professional appearance; these fonts ensure your text is easy to read and looks polished. Saving your resume as a PDF is crucial because it locks in your formatting across different devices, preventing any mishaps when it's viewed by potential employers. Maintain one-inch margins on all sides to provide ample white space, which not only makes your resume aesthetically pleasing but also easier to read and digest. This approach ensures your resume is both visually appealing and functionally effective.

How to write a quantifiable resume experience section

Your experience section is the heart of your banking accountant resume, showing employers how you've driven success. By listing your roles in reverse from the most recent, you naturally highlight recent skills and achievements. Focus on the last 10-15 years, ensuring each job features relevant accounting and banking experience. Tailor your resume to each job ad by weaving in their language and key terms, connecting your past work directly to their needs. Use strong action words like “managed,” “implemented,” “analyzed,” and “developed” to tell your story powerfully. Always quantify your achievements to showcase the concrete impact you've made.

- •Boosted annual revenue by 15% through strategic financial planning and analysis.

- •Streamlined a new financial reporting system, cutting reporting errors by 25%.

- •Led a team of 5 accountants, enhancing productivity by 20%.

- •Crafted risk management policies to reduce financial losses by 10%.

This experience section flows seamlessly by focusing on your achievements and their specific impact. By highlighting recent and relevant positions, it not only showcases your growth but also aligns you with the needs of banking and accounting firms. The use of action words paired with quantifiable results tells a compelling story of your contributions. Each bullet point connects your strategic actions with tangible outcomes, presenting a cohesive picture of your abilities. Tailoring the content to match industry-specific language ensures your resume speaks directly to potential employers, making your qualifications immediately apparent.

Skills-Focused resume experience section

A skills-focused banking accountant resume experience section should clearly highlight where you’ve made a significant impact. Start by identifying the most relevant skills and experiences for the job you’re targeting. Instead of merely listing job duties, focus on achievements that showcase your expertise in areas like financial analysis, regulatory compliance, and fiscal management. Your goal is to demonstrate how you used your skills to deliver concrete outcomes, whether that’s saving money or improving efficiency.

When describing your roles, use straightforward language and ensure each bullet point emphasizes a critical achievement or responsibility. Whenever possible, quantify your accomplishments to show tangible results, like stating how much money you saved or the percentage by which you improved a process. This strategy not only captures the attention of hiring managers but also clearly illustrates the value you can bring to their team. By painting a vivid picture of how your skills benefited past workplaces, you make a strong case for why you’d be an excellent addition in a new role.

Banking Accountant

ABC National Bank

January 2020 - Present

- Reduced monthly financial closing time by 30% through improved data management processes.

- Enhanced accuracy of financial statements by implementing a double-check system, decreasing errors by 15%.

- Collaborated with teams to streamline auditing processes, resulting in a 20% reduction in audit costs.

- Trained new team members, improving department productivity and client satisfaction.

Result-Focused resume experience section

A result-focused banking accountant resume experience section should highlight how you effectively drive success and make valuable contributions. Concentrate on the impact you've made rather than just listing your tasks. Begin by selecting experiences where your efforts led to clear improvements, such as enhancing financial processes or boosting efficiency. Specific metrics can help employers quickly gauge the concrete results of your work.

For a smooth flow of ideas, use action verbs to convey initiative, making it clear how your work aligns with the job you’re targeting. Focus on outcomes by showing how your actions benefited the organization. This cohesive approach not only highlights your achievements but also helps employers understand the value you can bring to their team.

Senior Accountant

XYZ Bank

June 2018 - Present

- Led a team to streamline financial reporting processes, reducing report generation time by 30%.

- Developed a forecasting model that improved budget accuracy by 15%.

- Implemented new compliance checks, resulting in a 25% decrease in financial errors.

- Collaborated with IT to automate accounts reconciliation, increasing efficiency by 20%.

Technology-Focused resume experience section

A technology-focused banking accountant resume experience section should highlight how you've used tech solutions to enhance financial processes. Begin by detailing the duties and projects that showcase your tech skills in banking, using active language and measurable results to grab attention. This approach not only demonstrates your ability to work with banking software and streamline reports but also underscores your role in enhancing data security measures.

To craft each bullet point effectively, connect your experience with specific technologies to the benefits they've brought to your workplace. Incorporating relevant software and tools helps to emphasize your expertise, while mentioning certifications or workshops highlights your continuous growth in tech knowledge. By crafting a well-integrated, tech-focused experience section, you can effectively demonstrate your adaptability and innovation, making you stand out in the competitive banking industry.

Senior Banking Accountant

XYZ National Bank

June 2020 - Present

- Implemented new financial software that reduced processing time by 30%.

- Developed a secure database system to improve data retention and accuracy.

- Conducted training for 50 employees on new digital tools and programs.

- Collaborated with IT team to resolve technical issues promptly, boosting efficiency.

Project-Focused resume experience section

A project-focused banking accountant resume experience section should shine a spotlight on your specific achievements and contributions. Begin by selecting key projects that best demonstrate your financial expertise and problem-solving skills. Highlight your involvement with action verbs that capture your role and responsibilities. It's important to detail the results and the impact of your work to give potential employers a clear picture of your value.

Organize this information so it flows seamlessly, focusing on how you made a difference. Your ability to work both independently and as part of a team should be clear. Make sure to show your leadership with examples of successful project leadership or initiatives. Here’s a structured approach to presenting your experience, with emphasis on projects and their positive outcomes:

Senior Banking Accountant

ABC Financial Services

January 2020 - December 2021

- Led a team of five to analyze and restructure the annual budget, achieving a 15% cost reduction.

- Implemented a financial reporting system to enhance data accuracy and cut reporting time by 30%.

- Conducted risk assessments for strategic projects, trimming potential financial risks by 10%.

- Worked with IT to introduce an automated invoicing system, reducing processing time by half.

Write your banking accountant resume summary section

A career-focused banking accountant resume experience section should highlight your skills and the value you bring to potential employers. If you’re an experienced professional, begin with a summary that emphasizes your key achievements and expertise. Consider this example:

This summary effectively showcases your extensive experience and accomplishments, making it clear that you are knowledgeable and results-driven. If you’re just beginning your career, a resume objective might be more appropriate, as it focuses on your career aspirations and how you plan to contribute. Here is an example:

[here was the JSON object 2]

This objective clearly communicates your skills and enthusiasm, highlighting your direction and eagerness to contribute. Understanding the differences between these components is crucial. A resume summary showcases your achievements, while an objective outlines your future goals. A resume profile includes broader personal traits, while a summary of qualifications offers a quick snapshot of your top skills. Each approach serves a unique purpose, so choosing the right one depends on your experience and what you can offer to potential employers. Keep your section clear, focused, and relevant for maximum impact.

Listing your banking accountant skills on your resume

A banking-focused accountant resume should clearly highlight your skills in a way that attracts attention. You can choose to either create a standalone skills section or integrate your skills into sections like experience and summary. Your strengths and soft skills reflect your personal abilities, such as teamwork and communication, which are crucial at work. Meanwhile, your hard skills showcase your technical expertise in areas like financial analysis and compliance. Listing your skills and strengths strategically is important because they act as keywords that employers look for during the hiring process.

Here's an example of what a standalone skills section might look like for a banking accountant resume:

This section works well because it focuses on the essential competencies required for a banking accountant, avoiding unnecessary details. By listing eight relevant skills, it makes it easy for recruiters to quickly identify your qualifications.

Best hard skills to feature on your banking accountant resume

Hard skills are crucial in highlighting your technical expertise and ability to efficiently handle financial tasks. These skills show how you manage financial data, ensure compliance, and analyze performance accurately.

Hard Skills

- Financial Statement Analysis

- Creating Financial Statements

- Compliance Auditing

- Tax Preparation

- Budget Management

- Financial Reporting

- Risk Management

- Accounts Payable and Receivable

- Asset Management

- Data Analysis

- Accounting Software Proficiency

- Payroll Management

- Investment Analysis

- Internal Auditing

- Cost Accounting

Best soft skills to feature on your banking accountant resume

Soft skills play an essential role in facilitating good interactions and a positive work environment. They should demonstrate your ability to communicate, collaborate effectively, and solve problems efficiently.

Soft Skills

- Communication

- Teamwork

- Problem-solving

- Attention to Detail

- Time Management

- Adaptability

- Ethical Judgment

- Leadership

- Critical Thinking

- Decision Making

- Client Relationship Management

- Emotional Intelligence

- Negotiation Skills

- Stress Management

- Organizational Skills

How to include your education on your resume

The education section is an essential part of your banking accountant resume. It should be crafted with care, ensuring that your academic background aligns with the requirements of the job you're pursuing. Only include relevant education that showcases your qualifications for the banking accountant role. When listing your degree, state the type, such as Bachelor’s or Master’s, followed by the field of study. Including your GPA can be beneficial if it was notably high—typically, a GPA of 3.5 or above is worth mentioning. If applicable, noting any honors like cum laude adds further distinction to your credentials.

Here’s a look at a poorly written education section:

Here’s a well-crafted education section that effectively highlights relevant accomplishments:

This second example excels because it showcases a relevant degree for a banking accountant position. The inclusion of a strong GPA and honors like Cum Laude communicates academic excellence, which is compelling to prospective employers. By omitting the location, it keeps the focus on achievements and education history. It clearly positions you as a candidate with a solid academic background tailored for success in banking accounting.

How to include banking accountant certificates on your resume

Including a certificates section in your banking accountant resume is crucial. Certificates demonstrate your dedication and expertise in specific areas. It's a good idea to include certificate names, dates, and issuing organizations. You can even add certificates in your resume header for easy visibility.

List the name of the certificate first. Include the date you received it next. Add the issuing organization last.

A good example could look like this:

This example is great for several reasons. The titles are clear and relevant. The issuers are well-recognized, adding credibility. The section itself is concise, keeping the resume tidy. Both certificates align with the skills and knowledge a banking accountant needs.

Extra sections to include in your banking accountant resume

Navigating the world of finance requires a keen eye for detail, a strong understanding of numbers, and excellent organizational skills. As a banking accountant, your resume should reflect these strengths by showcasing your qualifications and experiences effectively.

- Language section — Include any additional languages you speak fluently to show clients you can communicate with diverse populations.

- Hobbies and interests section — Share relevant interests like financial markets or economic trends to demonstrate your passion for the field.

- Volunteer work section — Detail your involvement in community financial literacy programs to highlight your commitment to service.

- Books section — List finance-related books you’ve read to display continuous learning and subject-matter expertise.

Each section enriches your resume by showing skills and interests that make you a well-rounded candidate. Including these details can help your application stand out in the competitive banking industry.

In Conclusion

In conclusion, crafting an effective banking accountant resume requires focusing on several key elements to ensure you stand out in the job market. It's vital that your resume is not just a summary of your job history but a well-structured document that clearly highlights your achievements and the impact you've made in your roles. A modern, easy-to-read format helps in presenting this information clearly and professionally. Tailoring your resume to each job description by using industry-specific language and keywords can greatly enhance your chances of capturing the attention of hiring managers. Including quantifiable achievements in your experience section demonstrates your measurable contributions and value to potential employers. An impactful professional summary can set the stage for your resume by briefly outlining your experience and the benefits you bring to a financial organization. Don't overlook the importance of showcasing your education, certifications, and relevant skills; these factors are pivotal in highlighting your professional qualifications. Additionally, adding sections like volunteer work or hobbies related to finance can further distinguish you as a well-rounded candidate. By paying attention to each of these aspects, your resume will not only be a reflection of your professionalism but also a compelling advocacy for your candidacy in the field of banking accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.