Banking Operations Resume Examples

Jul 18, 2024

|

12 min read

Craft a stellar banking operations resume that balances your skills and achievements. Learn to deposit the right words and withdraw unnecessary fluff to make your application stand out.

Rated by 348 people

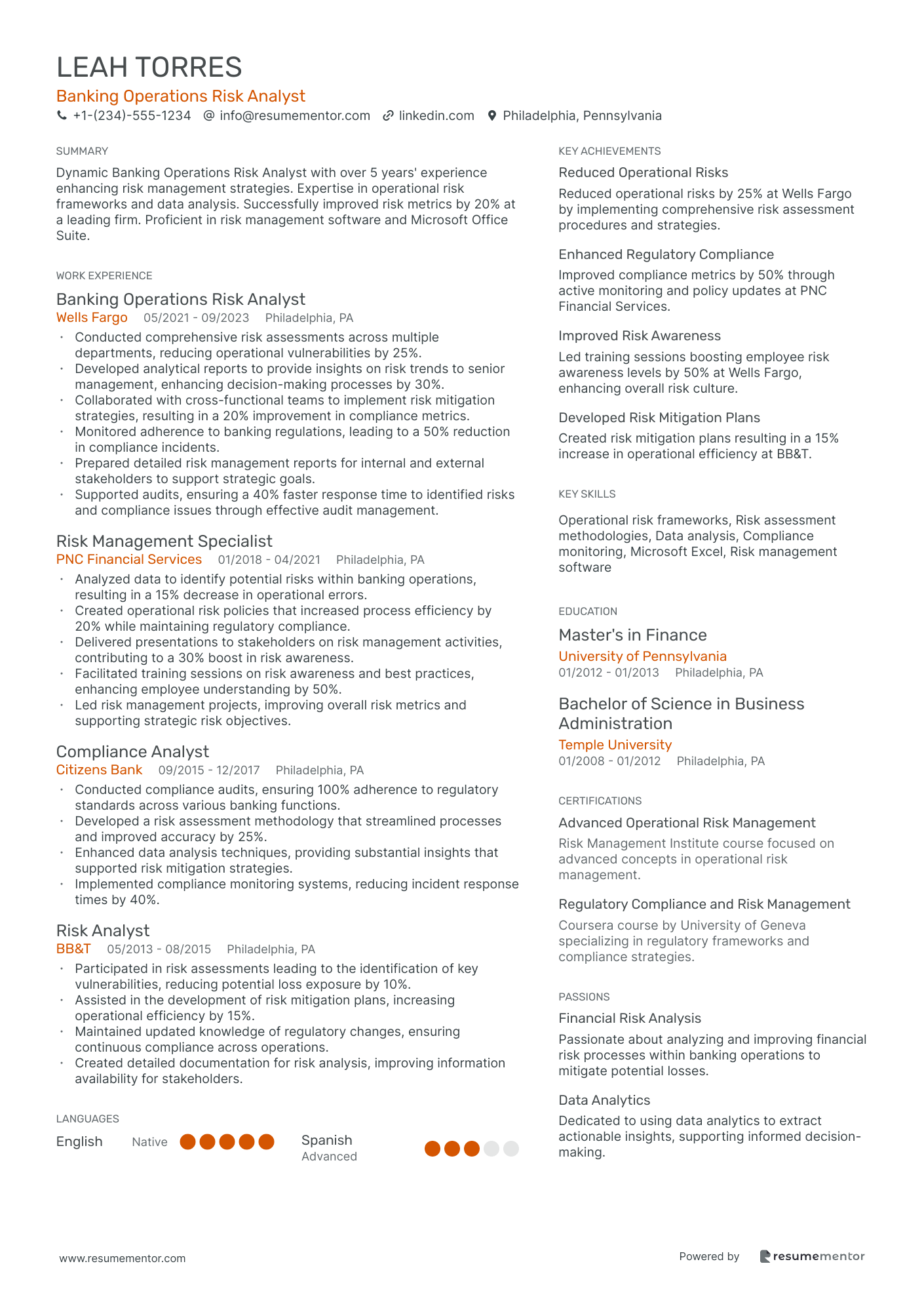

Banking Operations Risk Analyst

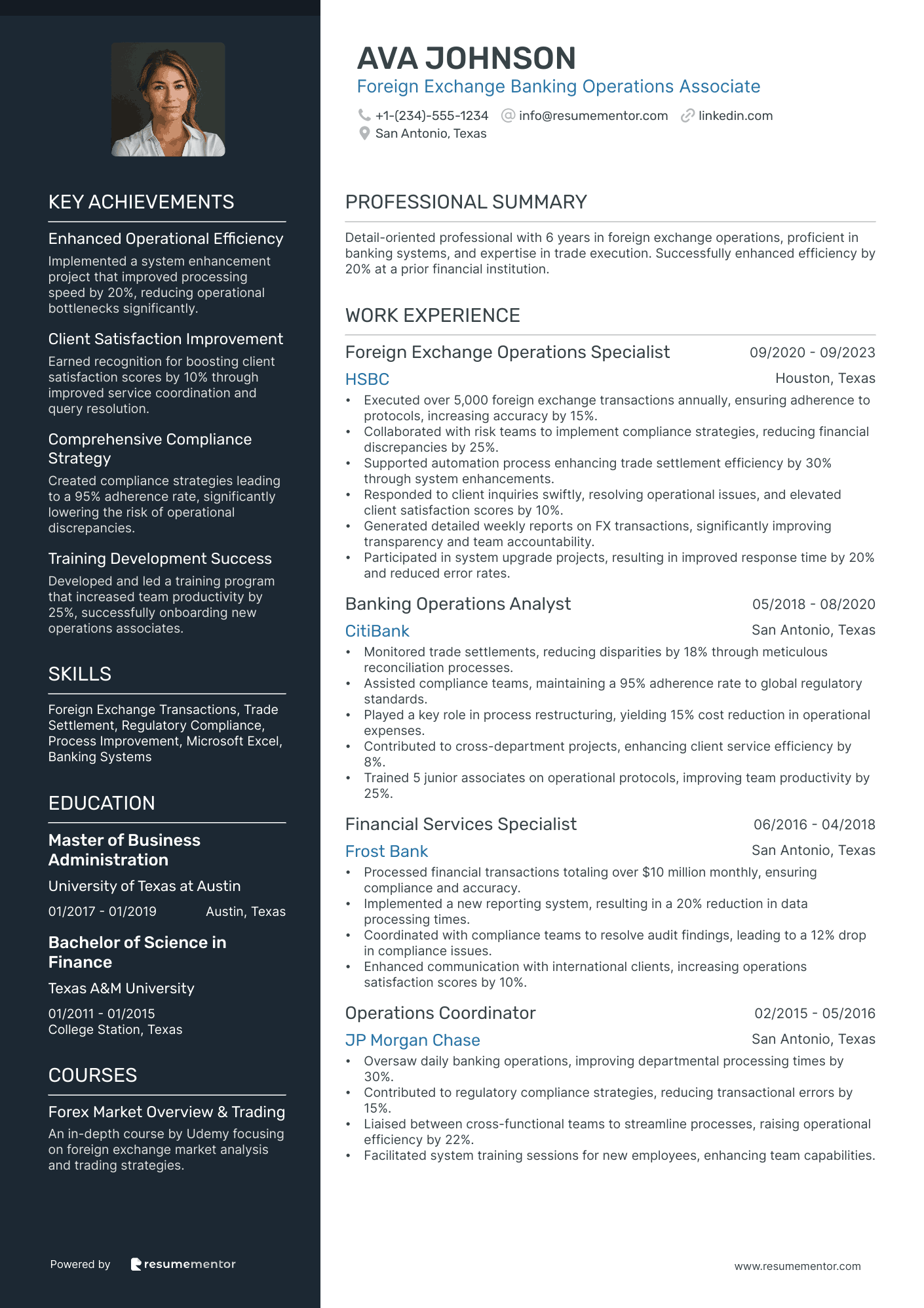

Foreign Exchange Banking Operations Associate

Wholesale Banking Operations Coordinator

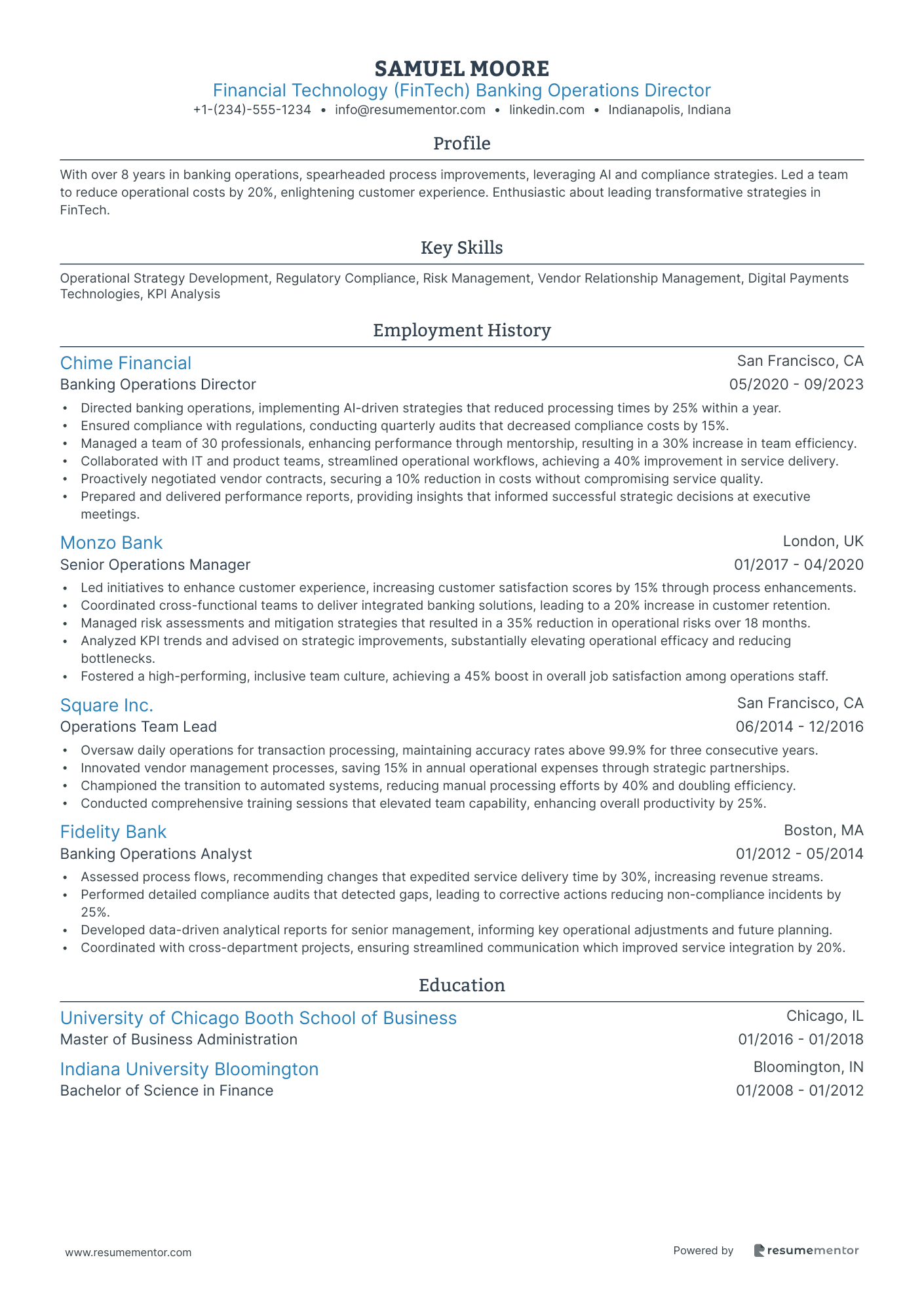

Financial Technology (FinTech) Banking Operations Director

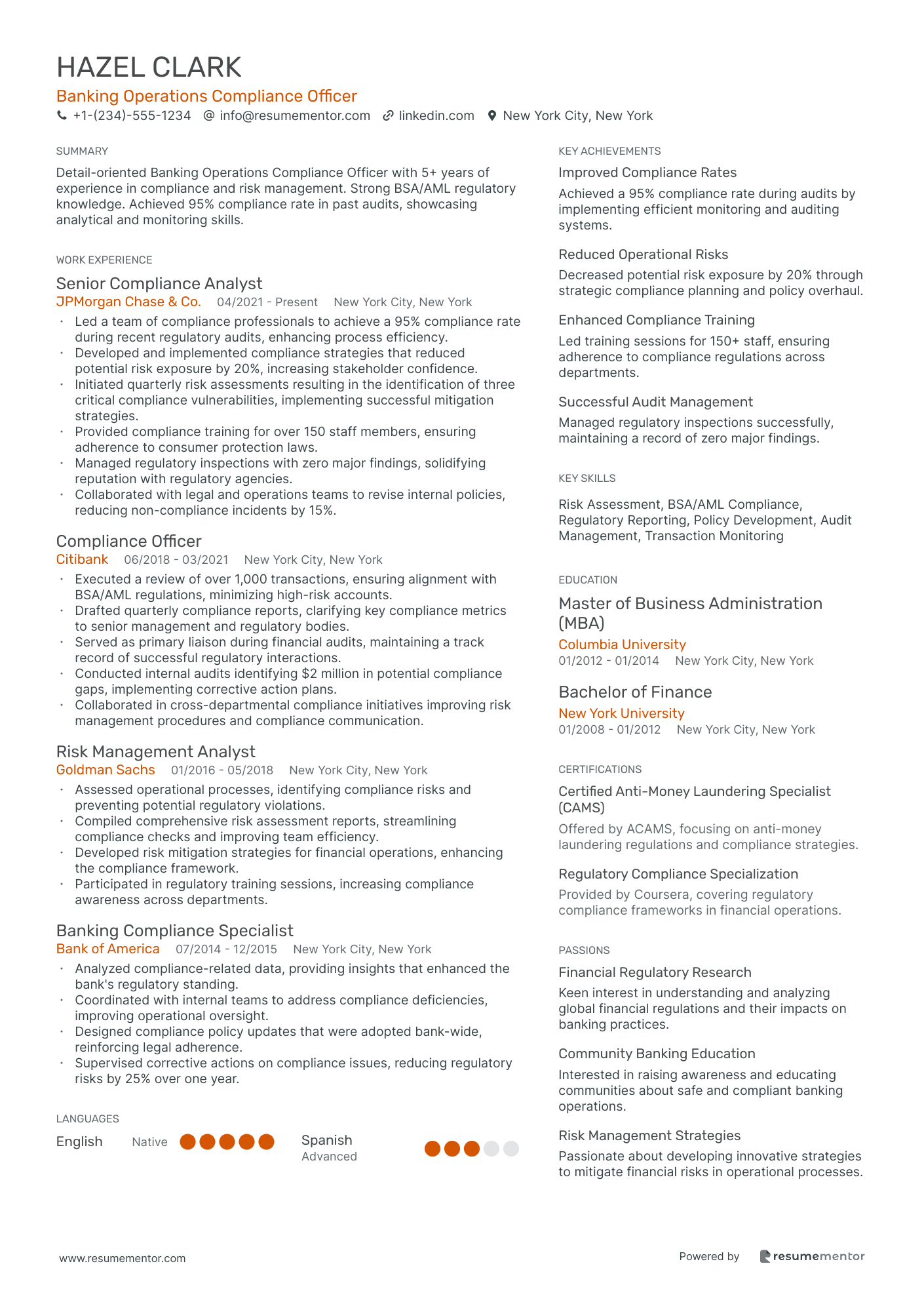

Banking Operations Compliance Officer

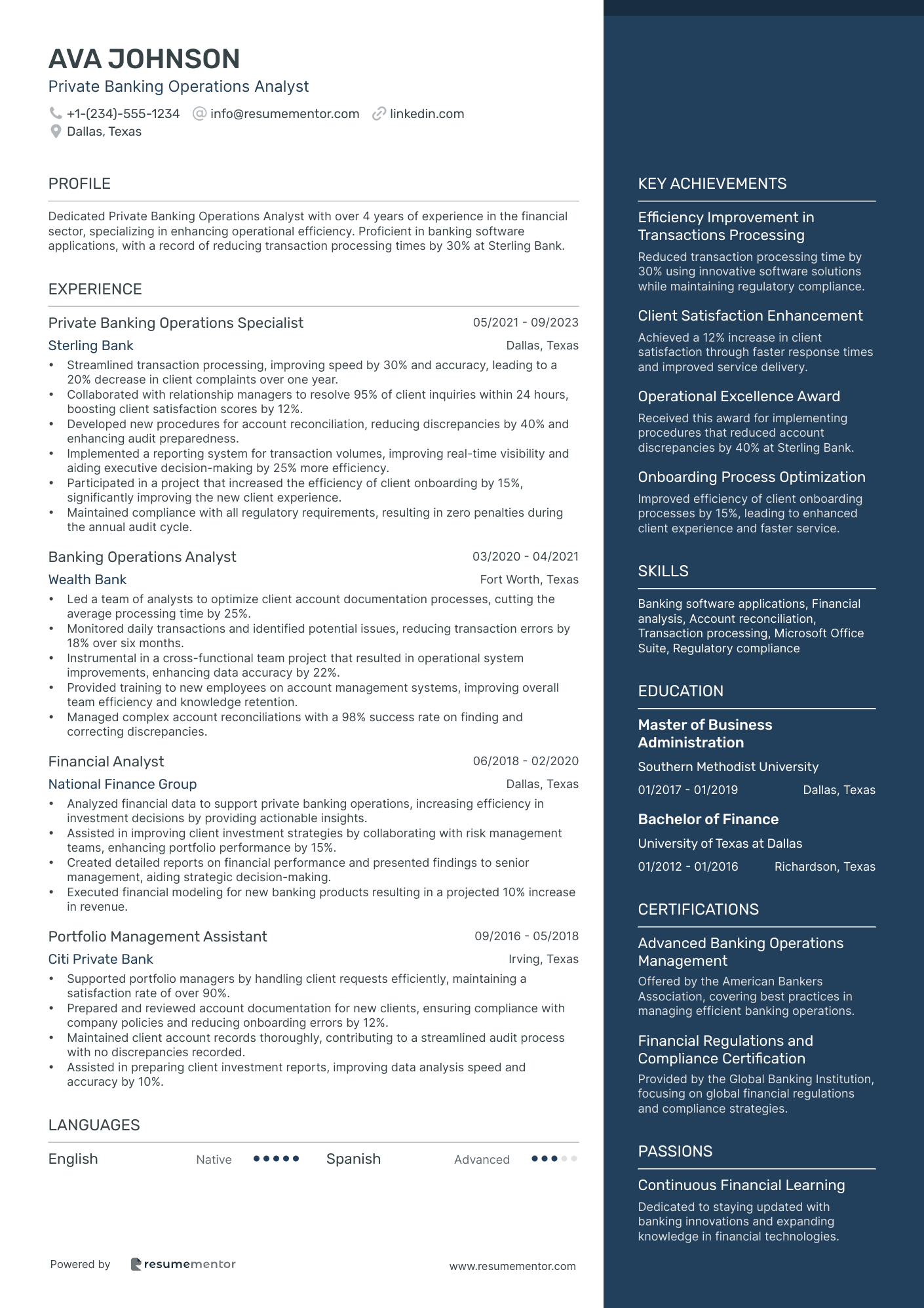

Private Banking Operations Analyst

Consumer Lending Banking Operations Specialist

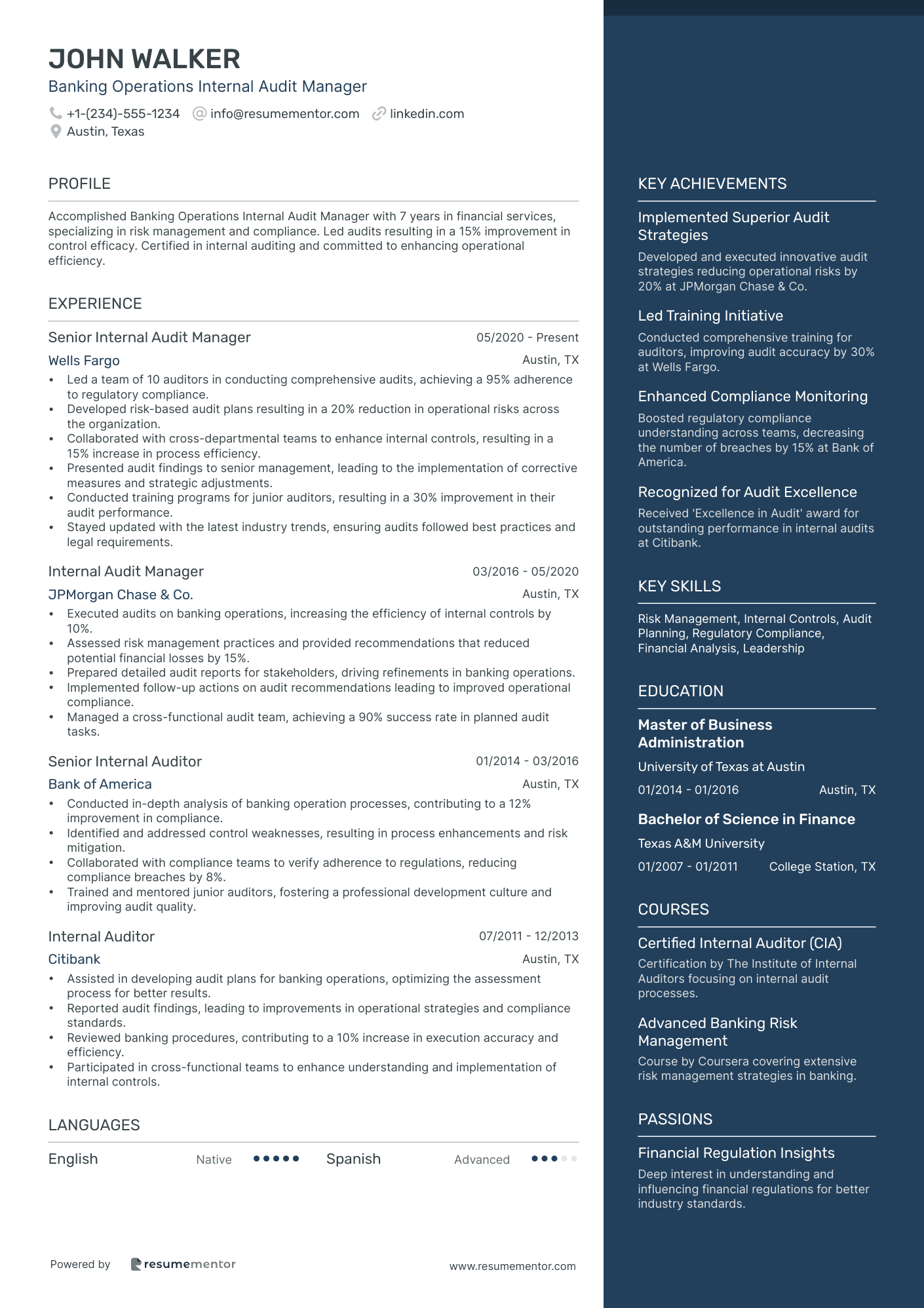

Banking Operations Internal Audit Manager

Banking Operations Risk Analyst resume sample

- •Conducted comprehensive risk assessments across multiple departments, reducing operational vulnerabilities by 25%.

- •Developed analytical reports to provide insights on risk trends to senior management, enhancing decision-making processes by 30%.

- •Collaborated with cross-functional teams to implement risk mitigation strategies, resulting in a 20% improvement in compliance metrics.

- •Monitored adherence to banking regulations, leading to a 50% reduction in compliance incidents.

- •Prepared detailed risk management reports for internal and external stakeholders to support strategic goals.

- •Supported audits, ensuring a 40% faster response time to identified risks and compliance issues through effective audit management.

- •Analyzed data to identify potential risks within banking operations, resulting in a 15% decrease in operational errors.

- •Created operational risk policies that increased process efficiency by 20% while maintaining regulatory compliance.

- •Delivered presentations to stakeholders on risk management activities, contributing to a 30% boost in risk awareness.

- •Facilitated training sessions on risk awareness and best practices, enhancing employee understanding by 50%.

- •Led risk management projects, improving overall risk metrics and supporting strategic risk objectives.

- •Conducted compliance audits, ensuring 100% adherence to regulatory standards across various banking functions.

- •Developed a risk assessment methodology that streamlined processes and improved accuracy by 25%.

- •Enhanced data analysis techniques, providing substantial insights that supported risk mitigation strategies.

- •Implemented compliance monitoring systems, reducing incident response times by 40%.

- •Participated in risk assessments leading to the identification of key vulnerabilities, reducing potential loss exposure by 10%.

- •Assisted in the development of risk mitigation plans, increasing operational efficiency by 15%.

- •Maintained updated knowledge of regulatory changes, ensuring continuous compliance across operations.

- •Created detailed documentation for risk analysis, improving information availability for stakeholders.

Foreign Exchange Banking Operations Associate resume sample

- •Executed over 5,000 foreign exchange transactions annually, ensuring adherence to protocols, increasing accuracy by 15%.

- •Collaborated with risk teams to implement compliance strategies, reducing financial discrepancies by 25%.

- •Supported automation process enhancing trade settlement efficiency by 30% through system enhancements.

- •Responded to client inquiries swiftly, resolving operational issues, and elevated client satisfaction scores by 10%.

- •Generated detailed weekly reports on FX transactions, significantly improving transparency and team accountability.

- •Participated in system upgrade projects, resulting in improved response time by 20% and reduced error rates.

- •Monitored trade settlements, reducing disparities by 18% through meticulous reconciliation processes.

- •Assisted compliance teams, maintaining a 95% adherence rate to global regulatory standards.

- •Played a key role in process restructuring, yielding 15% cost reduction in operational expenses.

- •Contributed to cross-department projects, enhancing client service efficiency by 8%.

- •Trained 5 junior associates on operational protocols, improving team productivity by 25%.

- •Processed financial transactions totaling over $10 million monthly, ensuring compliance and accuracy.

- •Implemented a new reporting system, resulting in a 20% reduction in data processing times.

- •Coordinated with compliance teams to resolve audit findings, leading to a 12% drop in compliance issues.

- •Enhanced communication with international clients, increasing operations satisfaction scores by 10%.

- •Oversaw daily banking operations, improving departmental processing times by 30%.

- •Contributed to regulatory compliance strategies, reducing transactional errors by 15%.

- •Liaised between cross-functional teams to streamline processes, raising operational efficiency by 22%.

- •Facilitated system training sessions for new employees, enhancing team capabilities.

Wholesale Banking Operations Coordinator resume sample

- •Coordinated daily banking operations, improving service efficiency by 25% through streamlined processes and collaboration.

- •Managed compliance checks for large volume transactions, resulting in a 30% reduction in error rates within the team.

- •Implemented new tracking systems for operational performance metrics, enhancing reporting accuracy by 40%.

- •Led a cross-departmental team to address transaction bottlenecks, achieving a 20% decrease in processing times.

- •Developed comprehensive training programs for new hires, significantly decreasing onboarding time by 15%.

- •Collaborated closely with risk management to ensure adherence to regulatory changes, mitigating potential fines and penalties.

- •Directed a team responsible for processing high-value transactions, achieving a 95% client satisfaction rate.

- •Spearheaded the implementation of an updated compliance system, reducing manual errors by 45%.

- •Established new procedures for interdepartmental coordination, resulting in better data accuracy and faster response times.

- •Analyzed operational data to propose process improvements, impacting throughput positively by 12%.

- •Worked with external partners to integrate new software tools, accelerating transaction processing by 20%.

- •Assisted in the development of financial models, providing key insights that led to a 10% increase in process efficiency.

- •Monitored and maintained operational records, ensuring an accuracy rate surpassing company standards by 98%.

- •Developed analytical reports on transaction trends, aiding management in strategic decision-making.

- •Played a pivotal role in the transition of operational software, improving user experience and reducing downtime.

- •Collaborated on cross-functional teams to optimize transaction efficiency, cutting processing times by an average of 15 minutes.

- •Resolved client transaction inquiries with a resolution rate of 97%, significantly enhancing client retention and satisfaction.

- •Facilitated communication between compliance and operations, leading to the overhaul of outdated policies.

- •Tracked and updated transaction records, bolstering data integrity and reducing discrepancies by 20%.

Financial Technology (FinTech) Banking Operations Director resume sample

- •Directed banking operations, implementing AI-driven strategies that reduced processing times by 25% within a year.

- •Ensured compliance with regulations, conducting quarterly audits that decreased compliance costs by 15%.

- •Managed a team of 30 professionals, enhancing performance through mentorship, resulting in a 30% increase in team efficiency.

- •Collaborated with IT and product teams, streamlined operational workflows, achieving a 40% improvement in service delivery.

- •Proactively negotiated vendor contracts, securing a 10% reduction in costs without compromising service quality.

- •Prepared and delivered performance reports, providing insights that informed successful strategic decisions at executive meetings.

- •Led initiatives to enhance customer experience, increasing customer satisfaction scores by 15% through process enhancements.

- •Coordinated cross-functional teams to deliver integrated banking solutions, leading to a 20% increase in customer retention.

- •Managed risk assessments and mitigation strategies that resulted in a 35% reduction in operational risks over 18 months.

- •Analyzed KPI trends and advised on strategic improvements, substantially elevating operational efficacy and reducing bottlenecks.

- •Fostered a high-performing, inclusive team culture, achieving a 45% boost in overall job satisfaction among operations staff.

- •Oversaw daily operations for transaction processing, maintaining accuracy rates above 99.9% for three consecutive years.

- •Innovated vendor management processes, saving 15% in annual operational expenses through strategic partnerships.

- •Championed the transition to automated systems, reducing manual processing efforts by 40% and doubling efficiency.

- •Conducted comprehensive training sessions that elevated team capability, enhancing overall productivity by 25%.

- •Assessed process flows, recommending changes that expedited service delivery time by 30%, increasing revenue streams.

- •Performed detailed compliance audits that detected gaps, leading to corrective actions reducing non-compliance incidents by 25%.

- •Developed data-driven analytical reports for senior management, informing key operational adjustments and future planning.

- •Coordinated with cross-department projects, ensuring streamlined communication which improved service integration by 20%.

Banking Operations Compliance Officer resume sample

- •Led a team of compliance professionals to achieve a 95% compliance rate during recent regulatory audits, enhancing process efficiency.

- •Developed and implemented compliance strategies that reduced potential risk exposure by 20%, increasing stakeholder confidence.

- •Initiated quarterly risk assessments resulting in the identification of three critical compliance vulnerabilities, implementing successful mitigation strategies.

- •Provided compliance training for over 150 staff members, ensuring adherence to consumer protection laws.

- •Managed regulatory inspections with zero major findings, solidifying reputation with regulatory agencies.

- •Collaborated with legal and operations teams to revise internal policies, reducing non-compliance incidents by 15%.

- •Executed a review of over 1,000 transactions, ensuring alignment with BSA/AML regulations, minimizing high-risk accounts.

- •Drafted quarterly compliance reports, clarifying key compliance metrics to senior management and regulatory bodies.

- •Served as primary liaison during financial audits, maintaining a track record of successful regulatory interactions.

- •Conducted internal audits identifying $2 million in potential compliance gaps, implementing corrective action plans.

- •Collaborated in cross-departmental compliance initiatives improving risk management procedures and compliance communication.

- •Assessed operational processes, identifying compliance risks and preventing potential regulatory violations.

- •Compiled comprehensive risk assessment reports, streamlining compliance checks and improving team efficiency.

- •Developed risk mitigation strategies for financial operations, enhancing the compliance framework.

- •Participated in regulatory training sessions, increasing compliance awareness across departments.

- •Analyzed compliance-related data, providing insights that enhanced the bank's regulatory standing.

- •Coordinated with internal teams to address compliance deficiencies, improving operational oversight.

- •Designed compliance policy updates that were adopted bank-wide, reinforcing legal adherence.

- •Supervised corrective actions on compliance issues, reducing regulatory risks by 25% over one year.

Private Banking Operations Analyst resume sample

- •Streamlined transaction processing, improving speed by 30% and accuracy, leading to a 20% decrease in client complaints over one year.

- •Collaborated with relationship managers to resolve 95% of client inquiries within 24 hours, boosting client satisfaction scores by 12%.

- •Developed new procedures for account reconciliation, reducing discrepancies by 40% and enhancing audit preparedness.

- •Implemented a reporting system for transaction volumes, improving real-time visibility and aiding executive decision-making by 25% more efficiency.

- •Participated in a project that increased the efficiency of client onboarding by 15%, significantly improving the new client experience.

- •Maintained compliance with all regulatory requirements, resulting in zero penalties during the annual audit cycle.

- •Led a team of analysts to optimize client account documentation processes, cutting the average processing time by 25%.

- •Monitored daily transactions and identified potential issues, reducing transaction errors by 18% over six months.

- •Instrumental in a cross-functional team project that resulted in operational system improvements, enhancing data accuracy by 22%.

- •Provided training to new employees on account management systems, improving overall team efficiency and knowledge retention.

- •Managed complex account reconciliations with a 98% success rate on finding and correcting discrepancies.

- •Analyzed financial data to support private banking operations, increasing efficiency in investment decisions by providing actionable insights.

- •Assisted in improving client investment strategies by collaborating with risk management teams, enhancing portfolio performance by 15%.

- •Created detailed reports on financial performance and presented findings to senior management, aiding strategic decision-making.

- •Executed financial modeling for new banking products resulting in a projected 10% increase in revenue.

- •Supported portfolio managers by handling client requests efficiently, maintaining a satisfaction rate of over 90%.

- •Prepared and reviewed account documentation for new clients, ensuring compliance with company policies and reducing onboarding errors by 12%.

- •Maintained client account records thoroughly, contributing to a streamlined audit process with no discrepancies recorded.

- •Assisted in preparing client investment reports, improving data analysis speed and accuracy by 10%.

Consumer Lending Banking Operations Specialist resume sample

- •Managed a team of 5, leading to a 20% increase in loan processing speed and a 15% reduction in error rates.

- •Developed a comprehensive training program for new hires, reducing onboarding time by 30% and increasing early-stage productivity.

- •Implemented compliance audits resulting in a 10% increase in adherence to regulatory standards and enhancing operational efficiency.

- •Redesigned the loan documentation verification process, improving client satisfaction scores by 12% within one year.

- •Led the integration of new automated lending systems, resulting in a 25% increase in processing efficiency and reduced manual tasks.

- •Collaborated with cross-functional teams to improve loan processing, which contributed to a 5% year-on-year increase in approved loans.

- •Facilitated the processing of over 100 consumer loan applications monthly, maintaining 98% compliance with banking regulations.

- •Conducted detailed financial analysis of applicants, improving loan approval rates by 15% and minimizing default risks.

- •Streamlined loan application processes, reducing average processing time by two days and enhancing customer service.

- •Collaborated with IT department to enhance loan origination software, leading to a 20% increase in processing speed.

- •Resolved customer queries and concerns, improving customer satisfaction ratings by 10% and reinforcing brand loyalty.

- •Processed consumer loans with an accuracy rate of 99%, exceeding the department benchmark by 5 percentage points.

- •Identified discrepancies in loan files and coordinated corrections, reducing error margins by 8%.

- •Managed and maintained comprehensive records of over 200 loan transactions monthly, ensuring regulatory compliance.

- •Initiated a customer feedback loop that improved loan servicing operations, resulting in a 7% increase in customer retention.

- •Assisted in verifying loan documentation for accuracy and compliance, supporting an 89% loan approval rate.

- •Provided administrative support during loan processing, contributing to a 10% increase in department efficiency.

- •Participated in implementing new consumer lending policies, improving internal processing standards by 12%.

- •Utilized Microsoft Excel to generate comprehensive monthly reports, facilitating strategic decision-making.

Banking Operations Internal Audit Manager resume sample

- •Led a team of 10 auditors in conducting comprehensive audits, achieving a 95% adherence to regulatory compliance.

- •Developed risk-based audit plans resulting in a 20% reduction in operational risks across the organization.

- •Collaborated with cross-departmental teams to enhance internal controls, resulting in a 15% increase in process efficiency.

- •Presented audit findings to senior management, leading to the implementation of corrective measures and strategic adjustments.

- •Conducted training programs for junior auditors, resulting in a 30% improvement in their audit performance.

- •Stayed updated with the latest industry trends, ensuring audits followed best practices and legal requirements.

- •Executed audits on banking operations, increasing the efficiency of internal controls by 10%.

- •Assessed risk management practices and provided recommendations that reduced potential financial losses by 15%.

- •Prepared detailed audit reports for stakeholders, driving refinements in banking operations.

- •Implemented follow-up actions on audit recommendations leading to improved operational compliance.

- •Managed a cross-functional audit team, achieving a 90% success rate in planned audit tasks.

- •Conducted in-depth analysis of banking operation processes, contributing to a 12% improvement in compliance.

- •Identified and addressed control weaknesses, resulting in process enhancements and risk mitigation.

- •Collaborated with compliance teams to verify adherence to regulations, reducing compliance breaches by 8%.

- •Trained and mentored junior auditors, fostering a professional development culture and improving audit quality.

- •Assisted in developing audit plans for banking operations, optimizing the assessment process for better results.

- •Reported audit findings, leading to improvements in operational strategies and compliance standards.

- •Reviewed banking procedures, contributing to a 10% increase in execution accuracy and efficiency.

- •Participated in cross-functional teams to enhance understanding and implementation of internal controls.

In the intricate world of banking operations, you are the conductor ensuring that every part of the financial orchestra plays in harmony. Yet when it comes to crafting a resume, even a seasoned professional like you can face challenges in hitting the right notes. Your vast experience and technical expertise must translate into a clear and compelling narrative on paper, so potential employers can easily recognize your true value.

The job market in banking operations adds unique hurdles that you need to overcome. It's important to highlight your analytical prowess, regulatory knowledge, and problem-solving skills, but fitting this into a single, concise page can feel overwhelming. Without a clear map, writing a resume can seem like navigating through uncharted territory, leading to missed opportunities.

That’s where a resume template becomes invaluable, acting as your guiding star to structure your skills and experiences effectively. A well-chosen template provides a framework that helps you stay concise while telling your story with impact. Consider using these resume templates to keep your credentials organized and professional, making it easier for employers to see what you offer.

Your resume is more than just a list of past roles—it's your story in the realm of banking operations, showcasing the unique expertise you bring. By tailoring each word to reflect your dedication, adaptability, and skill in managing complex financial processes, you set yourself up to catch the recruiter's eye and open doors to exciting new opportunities.

Key Takeaways

- A banking operations resume should effectively highlight expertise in managing financial transactions, ensure compliance, and improve efficiency.

- Choosing the right resume format, such as reverse-chronological, is crucial to showcase work experience and maintain a professional appearance.

- Quantifying achievements in the experience section using bullet points and action verbs enhances credibility and impact.

- Skills listed on the resume should align with the job description, covering both technical and soft skills relevant to the banking sector.

- Additional sections like certifications, languages, and volunteer work can further enrich the resume, presenting a comprehensive view of the candidate's capabilities.

What to focus on when writing your banking operations resume

A banking operations resume should convey your expertise in managing financial transactions, enhancing operational efficiency, and ensuring compliance with industry regulations. By showcasing your ability to thrive in a fast-paced banking environment, you highlight your attention to detail and robust risk management skills. Your resume should reflect your talent for streamlining processes and demonstrate your proficiency with banking software to make a compelling case.

How to structure your banking operations resume

- Contact Information: Provide your full name, phone number, and a professional email address to make it easy for recruiters to reach you. Including your LinkedIn profile can also enhance networking opportunities. A clear and professional contact section sets a strong first impression and ensures you are easily reachable by hiring managers.

- Summary Statement: Offer a compelling overview of your skills in banking operations, experience, and core competencies, such as transaction processing and data analysis, to capture attention quickly. This section should serve as a concise snapshot of your professional value, drawing employers in to read further.

- Work Experience: Share your past roles and emphasize your capability in handling operational tasks, increasing efficiency, and ensuring regulatory compliance. Backing this with achievements and metrics, like reduced processing times or fewer errors, strengthens your narrative. Demonstrating the impact of your work with specific, quantifiable results can highlight your effectiveness and dedication.

- Skills: List essential competencies, including financial analysis, customer service skills, and an understanding of compliance standards like Sarbanes-Oxley, to showcase your readiness for the role. Highlight skills that align closely with the job description to ensure relevance and appeal to the recruiter.

- Education: Note your degree(s) in finance, business, or related fields, along with significant certifications such as Certified Banking & Credit Analyst (CBCA), to underscore your educational background. Education can provide a foundation for your understanding of banking operations and reassure employers of your formal knowledge base.

- Technical Proficiencies: Emphasize your knowledge of crucial banking software and tools, like FIS or Oracle Flexcube, which are integral to modern banking operations. Showcasing your technical skills demonstrates your capability to handle the technological demands of the role.

Including optional sections like "Professional Affiliations" or "Volunteer Experience" can enrich your profile by demonstrating involvement in the banking community or relevant charitable activities. With the format of your resume defined, each section will be covered more in-depth below, focusing on how to tailor each part to the demands of a banking operations role.

Which resume format to choose

Crafting a standout banking operations resume begins with selecting the right format to showcase your strengths. In this field, a reverse-chronological format is most effective because it emphasizes your work experience, which is a key aspect employers look for. To give your resume a modern touch, consider using fonts like Raleway, Lato, or Montserrat, which not only look professional but are also easy to read. When saving your resume, always choose a PDF format to ensure that your carefully designed layout remains intact, regardless of where or how it's viewed. Maintaining clean margins, ideally between 0.5 to 1 inch on all sides, will help create a tidy and organized appearance, making your information easy to digest. Every decision you make, from format to font, contributes to presenting your skills effectively, ensuring a strong first impression in the competitive banking sector.

How to write a quantifiable resume experience section

A strong banking operations experience section is vital for making a lasting impression and showcasing how your skills align with the role you seek. It's important to use clear, concise bullet points that emphasize your accomplishments. Tailoring your resume for each job application by focusing on experiences relevant to the job description ensures a strong connection between your past roles and the employer's needs. Incorporating action verbs like "streamlined," "implemented," "oversaw," and "analyzed" helps convey your efficiency and leadership.

When listing your work experience, keep it chronological, starting with the most recent positions. Going back about 10-15 years ensures you highlight significant roles without overwhelming details. Including job titles and company names that align with the banking operations field adds credibility and context to your experience. By matching the language and requirements of a job description to your experience, you clearly demonstrate that your skills are what the employer is looking for, reinforcing the connection between your experience and the job at hand.

- •Increased transaction processing efficiency by 20% through process optimization.

- •Led a team of 15 staff to reduce operating costs by 15% annually.

- •Implemented a new digital banking system that improved customer satisfaction scores by 30%.

- •Analyzed financial reports to boost annual revenue by $1 million by identifying new market opportunities.

This experience section stands out because it effectively quantifies your achievements, illustrating the concrete value you brought to the organization. Each bullet point connects specific skills, such as leadership and financial analysis, to essential banking operations goals like efficiency and customer satisfaction. By aligning your accomplishments with measurable results, you create a compelling narrative that ties your skills to potential employer needs. This targeted approach ensures recruiters understand the value you bring, encouraging them to delve deeper into your qualifications.

Innovation-Focused resume experience section

A banking operations-focused resume experience section should demonstrate how you've embraced change and introduced creative solutions to improve efficiency. Start by listing your employment dates and job title, honing in on the core of your innovative contributions. Use strong action verbs and specific examples to convey your achievements, showing how your efforts led to measurable improvements or introduced new ways to solve problems. By presenting your information clearly and concisely, each bullet point becomes evidence of your capabilities and impact.

Connect your experiences by detailing how you managed change in various aspects of banking operations. Reflect on challenges you've faced and the inventive methods you employed to overcome them. Highlight any obstacles and how your forward-thinking approach propelled projects forward. This approach paints you as a proactive partner in innovation, consistently making positive strides in enhancing banking operations.

Bank Operations Manager

XYZ Bank

June 2018 - July 2023

- Led a team that developed an automated loan approval system, cutting processing time by 40%.

- Implemented a digital customer onboarding tool that boosted customer engagement by 15%.

- Pioneered an initiative to integrate blockchain technology for enhanced transaction security.

- Designed a data analytics model to anticipate customer needs, increasing service efficiency by 30%.

Achievement-Focused resume experience section

An achievement-focused banking operations resume experience section should emphasize how your specific actions led to positive results. Identify and highlight your key successes, like cost savings, process improvements, or project leadership. These accomplishments should be backed by concrete details, such as percentages, dollar figures, or timelines, to clearly illustrate your impact. By doing so, you effectively communicate the value you bring to a potential employer, making it easy for them to envision your contributions to their team.

Organize your experience in a chronological manner, emphasizing roles where you've driven meaningful change. Avoid simply listing job responsibilities; instead, focus on how your work contributed to overall improvement. Use bullet points to make your achievements stand out, allowing hiring managers to quickly grasp your capabilities. Additionally, illustrate both your independent accomplishments and your ability to lead and work with a team, displaying a balanced skill set that is both self-reliant and collaborative.

Bank Operations Manager

XYZ Bank

June 2020 - September 2023

- Implemented a new digital transaction process that reduced processing time by 30% and cut costs by $50,000 annually.

- Led a team of 10 in restructuring the loan verification protocol, improving accuracy by 25%.

- Coordinated with IT to launch an automated reporting system that decreased reporting errors by 40%.

- Trained and mentored staff on new compliance guidelines, resulting in a 10% increase in policy adherence.

Leadership-Focused resume experience section

A leadership-focused banking operations resume experience section should clearly present your role and highlight achievements that demonstrate your ability to lead effectively. Start by detailing outcomes that show how you streamlined processes and drove organizational success. Describe how you managed teams to improve operations and implemented strategic initiatives, emphasizing the positive changes these efforts brought about. Using strong action verbs can help convey your impact, while each bullet point should stay focused on specific results.

Including quantitative data, such as percentage improvements or cost savings, can strengthen your points and underscore your achievements. Each entry should reflect your professional growth and the insights you've gained in the industry. Highlight your leadership style, focusing on mentoring team members or spearheading projects that boosted productivity and customer satisfaction. When discussing your role, emphasize the collaborative efforts that led to successful outcomes, showcasing the significant contributions you made.

Operations Manager

MetroBank

January 2019 - Present

- Led a team of 10 in streamlining bank operations, achieving a 20% boost in process efficiency.

- Created a training program for new hires, cutting onboarding time by 15%.

- Revamped the customer service process, increasing satisfaction ratings by 30%.

- Worked with cross-functional teams to launch a new online banking feature, lifting user engagement by 25%.

Project-Focused resume experience section

A project-focused banking operations resume experience section should clearly highlight your achievements in managing projects within the banking field. Start by including your job title and the institution where you worked, providing valuable context. Adding the dates of your employment helps set the timeline, painting a clear picture of your career. Use bullet points to describe your key responsibilities and accomplishments, with an emphasis on the successful completion and leadership of projects. An action verb should kick off each bullet to effectively showcase your skills.

Share specific examples where you led or played a crucial role in projects, like implementing new systems or refining processes. It's crucial to detail measurable outcomes, such as cost savings or efficiency improvements, to underline your impact. These insights should paint a cohesive picture of your problem-solving and leadership skills, seamlessly connecting your experiences and showing a comprehensive view of your capabilities in banking operations. Here’s an example of how it should look:

Banking Operations Manager

First Finance Bank

June 2021 - Present

- Led a team of 10 to optimize a document management system, cutting processing time by 30% within six months.

- Coordinated a cross-departmental project to integrate new financial software, boosting workflow efficiency by 20%.

- Developed a training program on new compliance procedures, improving team performance and regulatory compliance.

- Managed the rollout of an online banking feature, leading to a 15% increase in customer satisfaction scores.

Write your banking operations resume summary section

A banking-focused resume summary should let your experience and skills shine in just a few compelling sentences. As the first thing employers see, it needs to be engaging and direct. Focus on past achievements and contributions, highlighting abilities like financial analysis and team leadership. Mention any technical skills critical in banking, such as financial software proficiency or regulatory knowledge, and tailor your summary to the specific job. Describe yourself as detail-oriented and adaptable, showing your readiness to handle large workloads. By expressing genuine passion for banking operations, you set a positive tone for the rest of your resume.

Consider this example for someone with banking operations experience:

This summary links extensive experience and leadership, crucial elements for the role. Highlighting achievements like efficiency improvement adds impact and relevance.

For those new to banking, a resume objective can be more appropriate. It focuses on what you aim to achieve and aligns your skills with the job you're targeting. Here’s an example for an entry-level candidate:

[here was the JSON object 2]

This objective clearly outlines the applicant’s goals and relevant skills, ideal for those starting out.

While resume summaries and objectives both introduce your background and goals, they differ from a profile or a summary of qualifications. Resume profiles dig deeper into personal traits and career paths, while a summary of qualifications lists key skills and achievements in bullets. Choosing the right section and ensuring it's well-connected to the job you're applying for can significantly enhance your application's impact.

Listing your banking operations skills on your resume

A banking-focused resume should effectively showcase your skills, whether in a dedicated section or woven throughout your experience and summary. Highlight your strengths and soft skills alongside your hard skills, which are specific technical abilities and knowledge needed for the job. These skills and strengths can act as resume keywords, helping align your qualifications with the job description and making you a more attractive candidate to potential employers.

Here is an example of a standalone skills section in JSON format:

This skills section is effective because it lists essential abilities relevant to banking operations, presenting you as a well-rounded candidate. The clear and concise language ensures readability and understanding.

Best hard skills to feature on your banking operations resume

Hard skills in banking operations communicate your technical proficiency and your capability to manage industry-specific tasks. Essential hard skills for this field include:

Hard Skills

- Financial Analysis

- Risk Management

- Compliance and Regulation Adherence

- Data Analytics and Interpretation

- Fraud Detection and Prevention

- Budgeting and Cost Control

- Accounting Software Proficiency

- Loan Processing and Underwriting

- Treasury Management

- Cash Flow Analysis

- Performance Metrics Development

- Auditing and Reporting

- Credit Analysis

- Forecasting and Financial Modeling

- Operational Efficiency Improvement

Best soft skills to feature on your banking operations resume

Soft skills in banking operations demonstrate your ability to effectively work with colleagues and clients, as well as handle various challenges. Important soft skills to feature include:

Together, these skills form the backbone of your resume, helping you stand out in the competitive world of banking operations.

Soft Skills

- Communication

- Problem-solving

- Leadership

- Customer Service

- Attention to Detail

- Team Collaboration

- Time Management

- Decision Making

- Adaptability

- Negotiation

- Stress Management

- Conflict Resolution

- Critical Thinking

- Empathy

- Organizational Skills

How to include your education on your resume

The education section is a crucial part of your banking operations resume. It provides potential employers with insights into your academic background and how it fits the job you're applying for. Be sure to tailor this section, focusing only on education that is relevant to banking operations. Unrelated education can be left out. If your GPA is an asset, you might want to include it, especially if it's above 3.5. Listing honors like cum laude can further illustrate your academic dedication and achievement. When listing a degree, include the degree type, institution, and graduation date. Here is an example of how not to write an education section and a good example:

- •Participated in the school's chess club.

The second example is effective because it highlights a relevant degree in finance, which aligns with a career in banking operations. The cum laude honor underscores academic excellence, and the strong GPA further emphasizes this point. This focused educational background can stand out to banking employers looking for candidates with specific skill sets.

How to include banking operations certificates on your resume

Including a certificates section in your banking operations resume is crucial for demonstrating your qualifications and expertise. List the name of each certification clearly. Include the date when you obtained it. Add the issuing organization to lend credibility. Certificates can also be highlighted in the header for quick visibility.

This example is strong because it includes high-value certificates for banking operations. The Financial Risk Manager (FRM) certification shows advanced risk management skills. The Certified Anti-Money Laundering Specialist (CAMS) certification demonstrates expertise in compliance, which is vital in banking. Both certificates are issued by reputable organizations, making them impressive to potential employers. Ensuring these details are neatly listed in your resume will make you stand out in the highly competitive banking industry.

Extra sections to include in your banking operations resume

Pursuing a career in banking operations requires a well-crafted resume that highlights your skills, experiences, and qualifications. While traditional sections like work experience and education are vital, additional sections can offer a more complete picture of who you are and what you bring to the table.

Languages — Highlighting your proficiency in multiple languages can demonstrate your ability to communicate with diverse clients and colleagues. This skill is particularly advantageous in global banking operations.

Hobbies and interests — Including your hobbies and interests can humanize your resume and make you more relatable. Showcase constructive activities that reflect skills relevant to banking, such as strategic thinking or leadership.

Volunteer work — Demonstrating involvement in volunteer work can speak volumes about your character and commitment to the community. This section can offer insight into your teamwork and leadership skills outside a corporate setting.

Books — Listing relevant books you have read can show your commitment to professional development and staying informed about industry trends. This can be an impressive section that highlights your ongoing learning habits and intellectual curiosity.

Adding these sections can enhance your resume by providing a more comprehensive view of your skills and interests, setting you apart in a competitive job market. Make sure each section is tailored to align with the key qualifications and responsibilities of a banking operations role.

In Conclusion

In conclusion, creating a compelling banking operations resume requires both strategy and attention to detail. By carefully selecting the right format, you ensure that your extensive experience captures the recruiter’s attention. Prioritize organizing your achievements and skills into quantifiable results that demonstrate your professional impact. Ensuring your resume is both clear and concise helps convey your readiness for high-pressure roles. Additionally, tailoring each section to meet job-specific requirements shows your alignment with the desired qualifications. Beyond the typical sections, consider incorporating additional areas like certifications, languages, and volunteer work to enrich your profile and highlight your holistic qualifications. The focus should be on presenting a well-rounded picture of your professional journey, ensuring that every aspect of your resume aligns with the demands of a banking operations role. Ultimately, a carefully crafted resume serves as more than a listing of past experiences; it becomes a tailored narrative that demonstrates your potential to excel in the competitive landscape of banking. By linking your skills and achievements to measurable outcomes, you effectively showcase the value you can bring to a prospective employer. This approach not only maximizes the impact of your resume but also increases your chances of landing that coveted role in banking operations, where you can continue to grow and contribute significantly.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.