Banking Sales Resume Examples

Jul 18, 2024

|

12 min read

Crafting your banking sales resume: unlock your potential and bank on your skills. Learn to highlight your experience, achievements, and qualifications to land that dream job. Tailor your resume to impress employers and rise above the competition.

Rated by 348 people

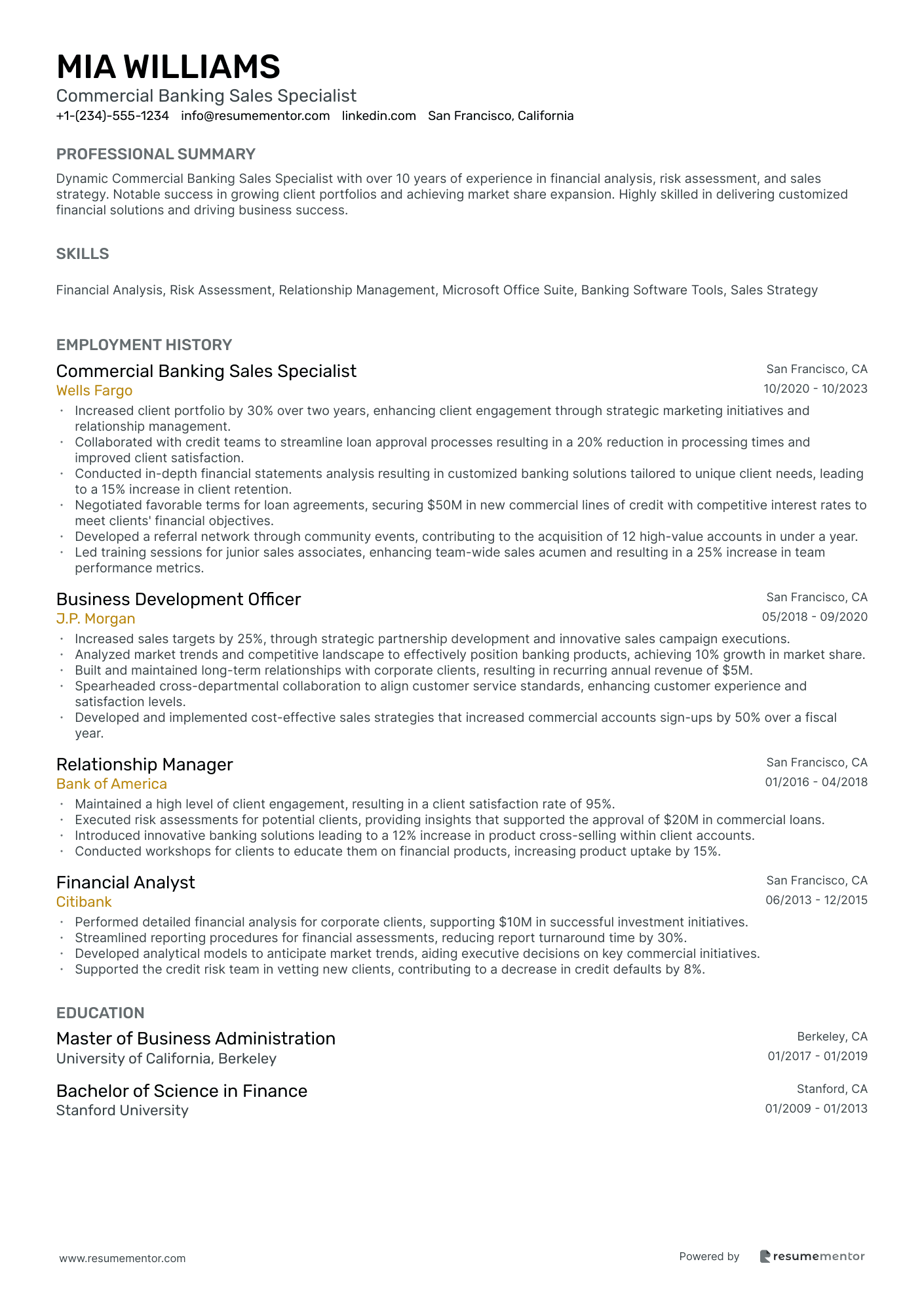

Commercial Banking Sales Specialist

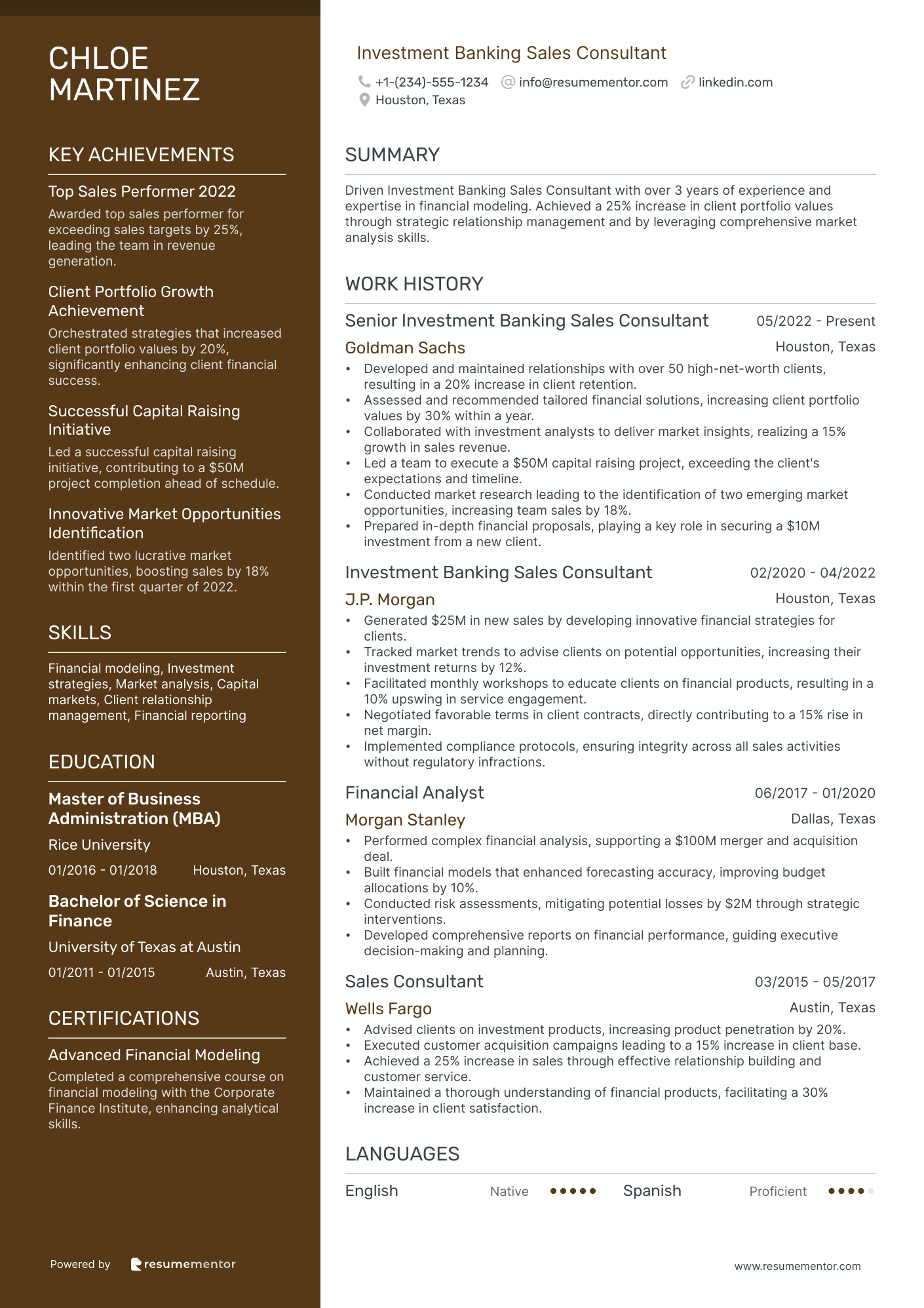

Investment Banking Sales Consultant

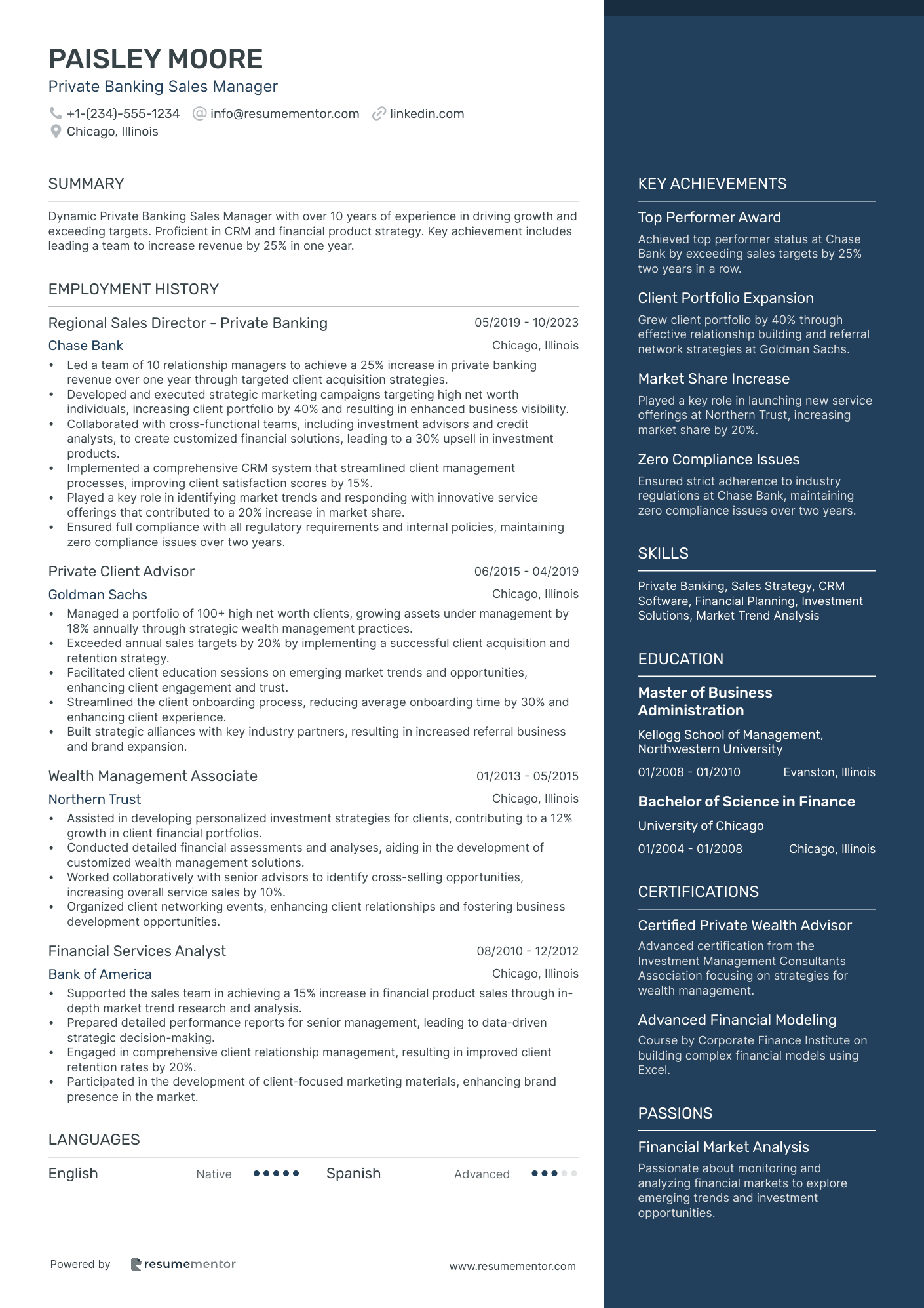

Private Banking Sales Manager

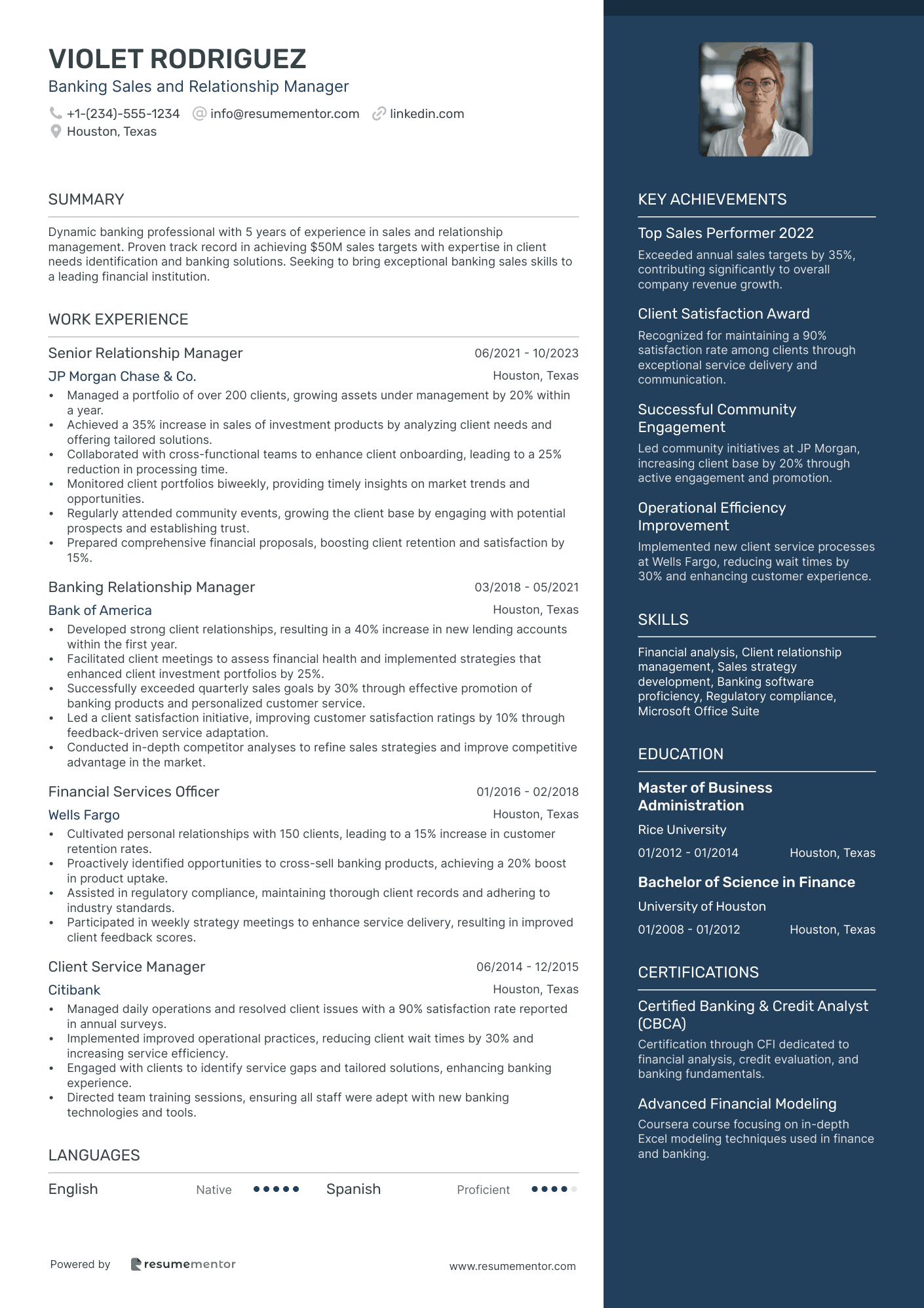

Banking Sales and Relationship Manager

Mortgage Banking Sales Officer

Retail Banking Sales Specialist

Banking Sales and Service Representative

Internet Banking Sales Executive

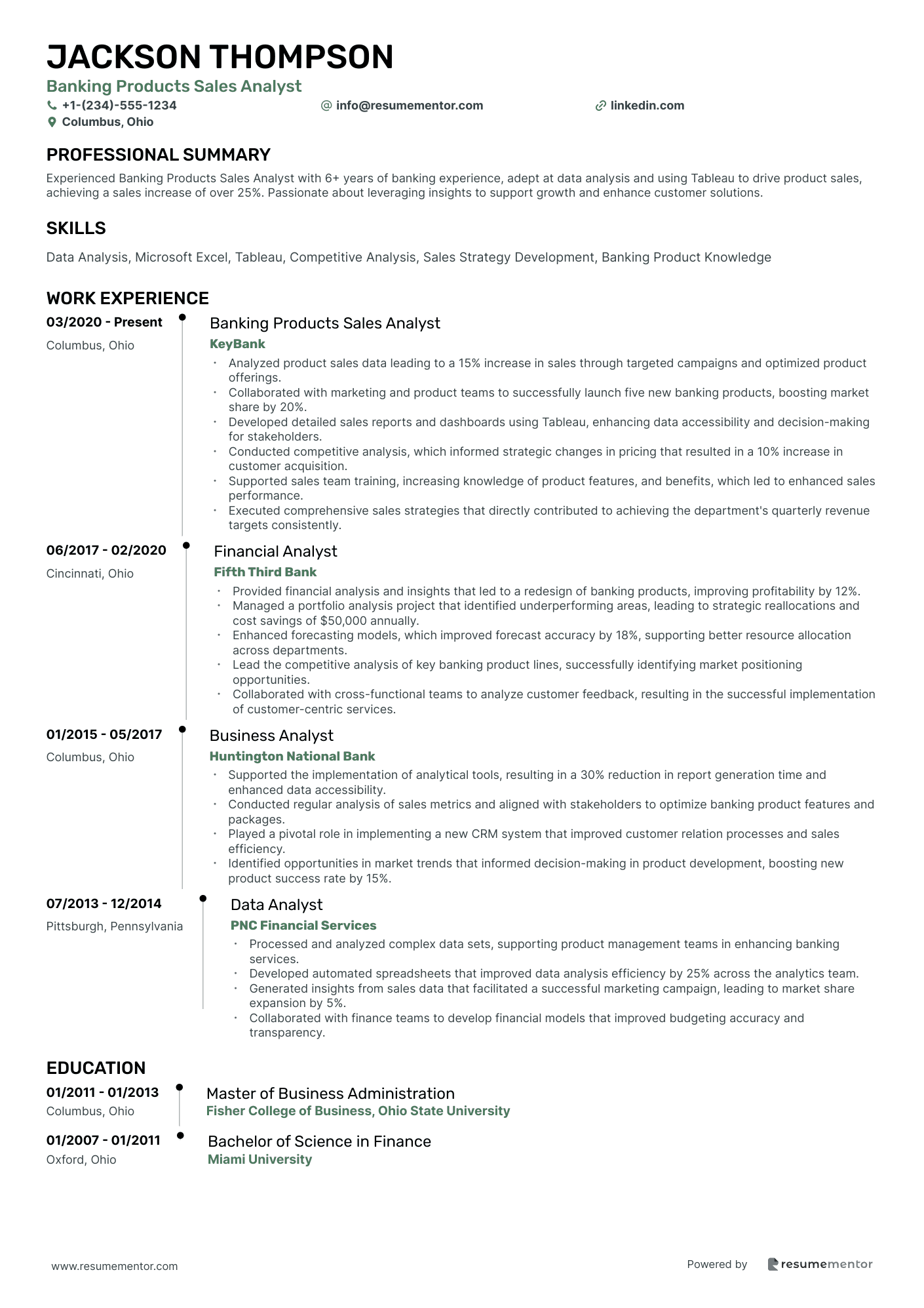

Banking Products Sales Analyst

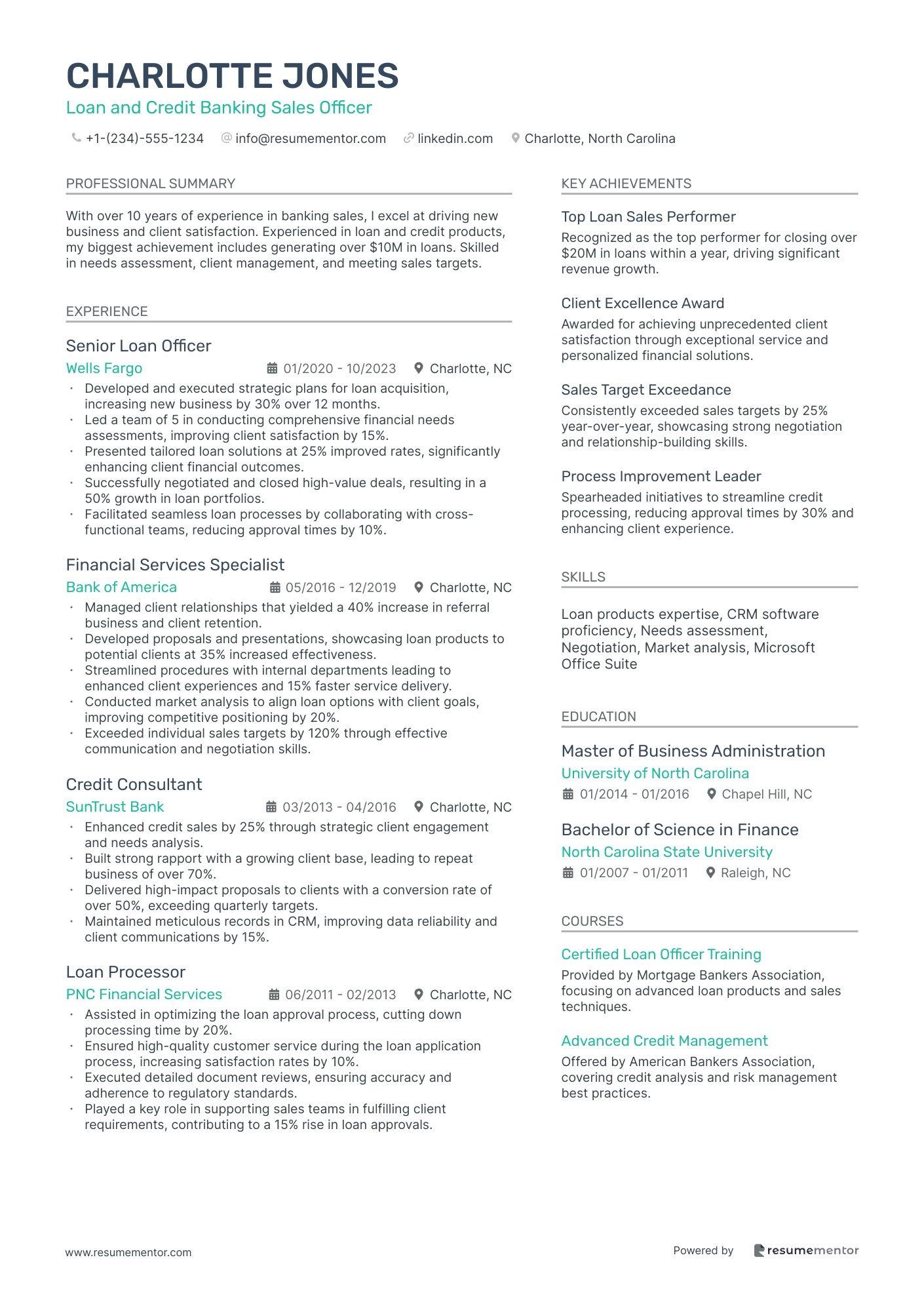

Loan and Credit Banking Sales Officer

Commercial Banking Sales Specialist resume sample

- •Increased client portfolio by 30% over two years, enhancing client engagement through strategic marketing initiatives and relationship management.

- •Collaborated with credit teams to streamline loan approval processes resulting in a 20% reduction in processing times and improved client satisfaction.

- •Conducted in-depth financial statements analysis resulting in customized banking solutions tailored to unique client needs, leading to a 15% increase in client retention.

- •Negotiated favorable terms for loan agreements, securing $50M in new commercial lines of credit with competitive interest rates to meet clients' financial objectives.

- •Developed a referral network through community events, contributing to the acquisition of 12 high-value accounts in under a year.

- •Led training sessions for junior sales associates, enhancing team-wide sales acumen and resulting in a 25% increase in team performance metrics.

- •Increased sales targets by 25%, through strategic partnership development and innovative sales campaign executions.

- •Analyzed market trends and competitive landscape to effectively position banking products, achieving 10% growth in market share.

- •Built and maintained long-term relationships with corporate clients, resulting in recurring annual revenue of $5M.

- •Spearheaded cross-departmental collaboration to align customer service standards, enhancing customer experience and satisfaction levels.

- •Developed and implemented cost-effective sales strategies that increased commercial accounts sign-ups by 50% over a fiscal year.

- •Maintained a high level of client engagement, resulting in a client satisfaction rate of 95%.

- •Executed risk assessments for potential clients, providing insights that supported the approval of $20M in commercial loans.

- •Introduced innovative banking solutions leading to a 12% increase in product cross-selling within client accounts.

- •Conducted workshops for clients to educate them on financial products, increasing product uptake by 15%.

- •Performed detailed financial analysis for corporate clients, supporting $10M in successful investment initiatives.

- •Streamlined reporting procedures for financial assessments, reducing report turnaround time by 30%.

- •Developed analytical models to anticipate market trends, aiding executive decisions on key commercial initiatives.

- •Supported the credit risk team in vetting new clients, contributing to a decrease in credit defaults by 8%.

Investment Banking Sales Consultant resume sample

- •Developed and maintained relationships with over 50 high-net-worth clients, resulting in a 20% increase in client retention.

- •Assessed and recommended tailored financial solutions, increasing client portfolio values by 30% within a year.

- •Collaborated with investment analysts to deliver market insights, realizing a 15% growth in sales revenue.

- •Led a team to execute a $50M capital raising project, exceeding the client's expectations and timeline.

- •Conducted market research leading to the identification of two emerging market opportunities, increasing team sales by 18%.

- •Prepared in-depth financial proposals, playing a key role in securing a $10M investment from a new client.

- •Generated $25M in new sales by developing innovative financial strategies for clients.

- •Tracked market trends to advise clients on potential opportunities, increasing their investment returns by 12%.

- •Facilitated monthly workshops to educate clients on financial products, resulting in a 10% upswing in service engagement.

- •Negotiated favorable terms in client contracts, directly contributing to a 15% rise in net margin.

- •Implemented compliance protocols, ensuring integrity across all sales activities without regulatory infractions.

- •Performed complex financial analysis, supporting a $100M merger and acquisition deal.

- •Built financial models that enhanced forecasting accuracy, improving budget allocations by 10%.

- •Conducted risk assessments, mitigating potential losses by $2M through strategic interventions.

- •Developed comprehensive reports on financial performance, guiding executive decision-making and planning.

- •Advised clients on investment products, increasing product penetration by 20%.

- •Executed customer acquisition campaigns leading to a 15% increase in client base.

- •Achieved a 25% increase in sales through effective relationship building and customer service.

- •Maintained a thorough understanding of financial products, facilitating a 30% increase in client satisfaction.

Private Banking Sales Manager resume sample

- •Led a team of 10 relationship managers to achieve a 25% increase in private banking revenue over one year through targeted client acquisition strategies.

- •Developed and executed strategic marketing campaigns targeting high net worth individuals, increasing client portfolio by 40% and resulting in enhanced business visibility.

- •Collaborated with cross-functional teams, including investment advisors and credit analysts, to create customized financial solutions, leading to a 30% upsell in investment products.

- •Implemented a comprehensive CRM system that streamlined client management processes, improving client satisfaction scores by 15%.

- •Played a key role in identifying market trends and responding with innovative service offerings that contributed to a 20% increase in market share.

- •Ensured full compliance with all regulatory requirements and internal policies, maintaining zero compliance issues over two years.

- •Managed a portfolio of 100+ high net worth clients, growing assets under management by 18% annually through strategic wealth management practices.

- •Exceeded annual sales targets by 20% by implementing a successful client acquisition and retention strategy.

- •Facilitated client education sessions on emerging market trends and opportunities, enhancing client engagement and trust.

- •Streamlined the client onboarding process, reducing average onboarding time by 30% and enhancing client experience.

- •Built strategic alliances with key industry partners, resulting in increased referral business and brand expansion.

- •Assisted in developing personalized investment strategies for clients, contributing to a 12% growth in client financial portfolios.

- •Conducted detailed financial assessments and analyses, aiding in the development of customized wealth management solutions.

- •Worked collaboratively with senior advisors to identify cross-selling opportunities, increasing overall service sales by 10%.

- •Organized client networking events, enhancing client relationships and fostering business development opportunities.

- •Supported the sales team in achieving a 15% increase in financial product sales through in-depth market trend research and analysis.

- •Prepared detailed performance reports for senior management, leading to data-driven strategic decision-making.

- •Engaged in comprehensive client relationship management, resulting in improved client retention rates by 20%.

- •Participated in the development of client-focused marketing materials, enhancing brand presence in the market.

Banking Sales and Relationship Manager resume sample

- •Managed a portfolio of over 200 clients, growing assets under management by 20% within a year.

- •Achieved a 35% increase in sales of investment products by analyzing client needs and offering tailored solutions.

- •Collaborated with cross-functional teams to enhance client onboarding, leading to a 25% reduction in processing time.

- •Monitored client portfolios biweekly, providing timely insights on market trends and opportunities.

- •Regularly attended community events, growing the client base by engaging with potential prospects and establishing trust.

- •Prepared comprehensive financial proposals, boosting client retention and satisfaction by 15%.

- •Developed strong client relationships, resulting in a 40% increase in new lending accounts within the first year.

- •Facilitated client meetings to assess financial health and implemented strategies that enhanced client investment portfolios by 25%.

- •Successfully exceeded quarterly sales goals by 30% through effective promotion of banking products and personalized customer service.

- •Led a client satisfaction initiative, improving customer satisfaction ratings by 10% through feedback-driven service adaptation.

- •Conducted in-depth competitor analyses to refine sales strategies and improve competitive advantage in the market.

- •Cultivated personal relationships with 150 clients, leading to a 15% increase in customer retention rates.

- •Proactively identified opportunities to cross-sell banking products, achieving a 20% boost in product uptake.

- •Assisted in regulatory compliance, maintaining thorough client records and adhering to industry standards.

- •Participated in weekly strategy meetings to enhance service delivery, resulting in improved client feedback scores.

- •Managed daily operations and resolved client issues with a 90% satisfaction rate reported in annual surveys.

- •Implemented improved operational practices, reducing client wait times by 30% and increasing service efficiency.

- •Engaged with clients to identify service gaps and tailored solutions, enhancing banking experience.

- •Directed team training sessions, ensuring all staff were adept with new banking technologies and tools.

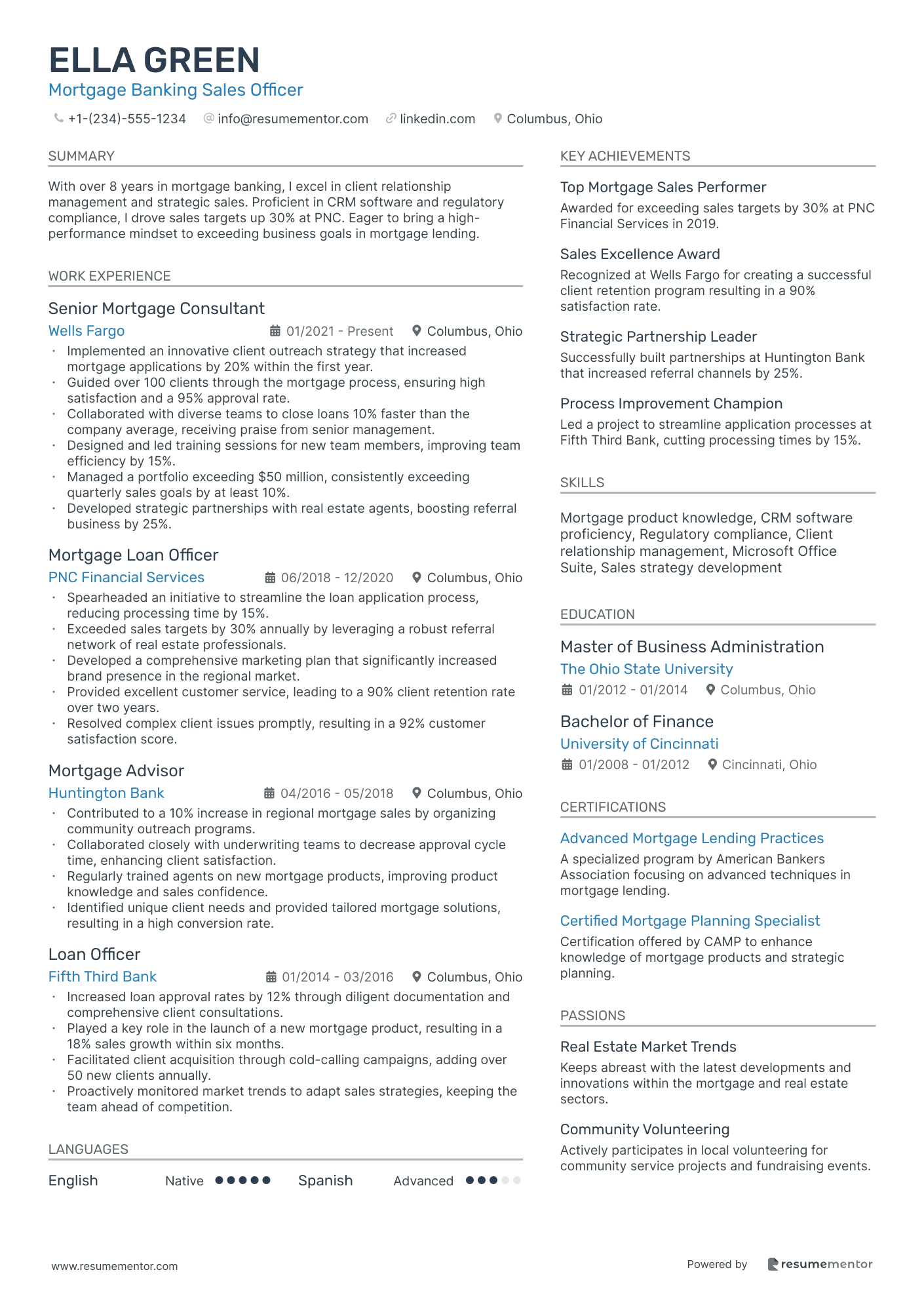

Mortgage Banking Sales Officer resume sample

- •Implemented an innovative client outreach strategy that increased mortgage applications by 20% within the first year.

- •Guided over 100 clients through the mortgage process, ensuring high satisfaction and a 95% approval rate.

- •Collaborated with diverse teams to close loans 10% faster than the company average, receiving praise from senior management.

- •Designed and led training sessions for new team members, improving team efficiency by 15%.

- •Managed a portfolio exceeding $50 million, consistently exceeding quarterly sales goals by at least 10%.

- •Developed strategic partnerships with real estate agents, boosting referral business by 25%.

- •Spearheaded an initiative to streamline the loan application process, reducing processing time by 15%.

- •Exceeded sales targets by 30% annually by leveraging a robust referral network of real estate professionals.

- •Developed a comprehensive marketing plan that significantly increased brand presence in the regional market.

- •Provided excellent customer service, leading to a 90% client retention rate over two years.

- •Resolved complex client issues promptly, resulting in a 92% customer satisfaction score.

- •Contributed to a 10% increase in regional mortgage sales by organizing community outreach programs.

- •Collaborated closely with underwriting teams to decrease approval cycle time, enhancing client satisfaction.

- •Regularly trained agents on new mortgage products, improving product knowledge and sales confidence.

- •Identified unique client needs and provided tailored mortgage solutions, resulting in a high conversion rate.

- •Increased loan approval rates by 12% through diligent documentation and comprehensive client consultations.

- •Played a key role in the launch of a new mortgage product, resulting in a 18% sales growth within six months.

- •Facilitated client acquisition through cold-calling campaigns, adding over 50 new clients annually.

- •Proactively monitored market trends to adapt sales strategies, keeping the team ahead of competition.

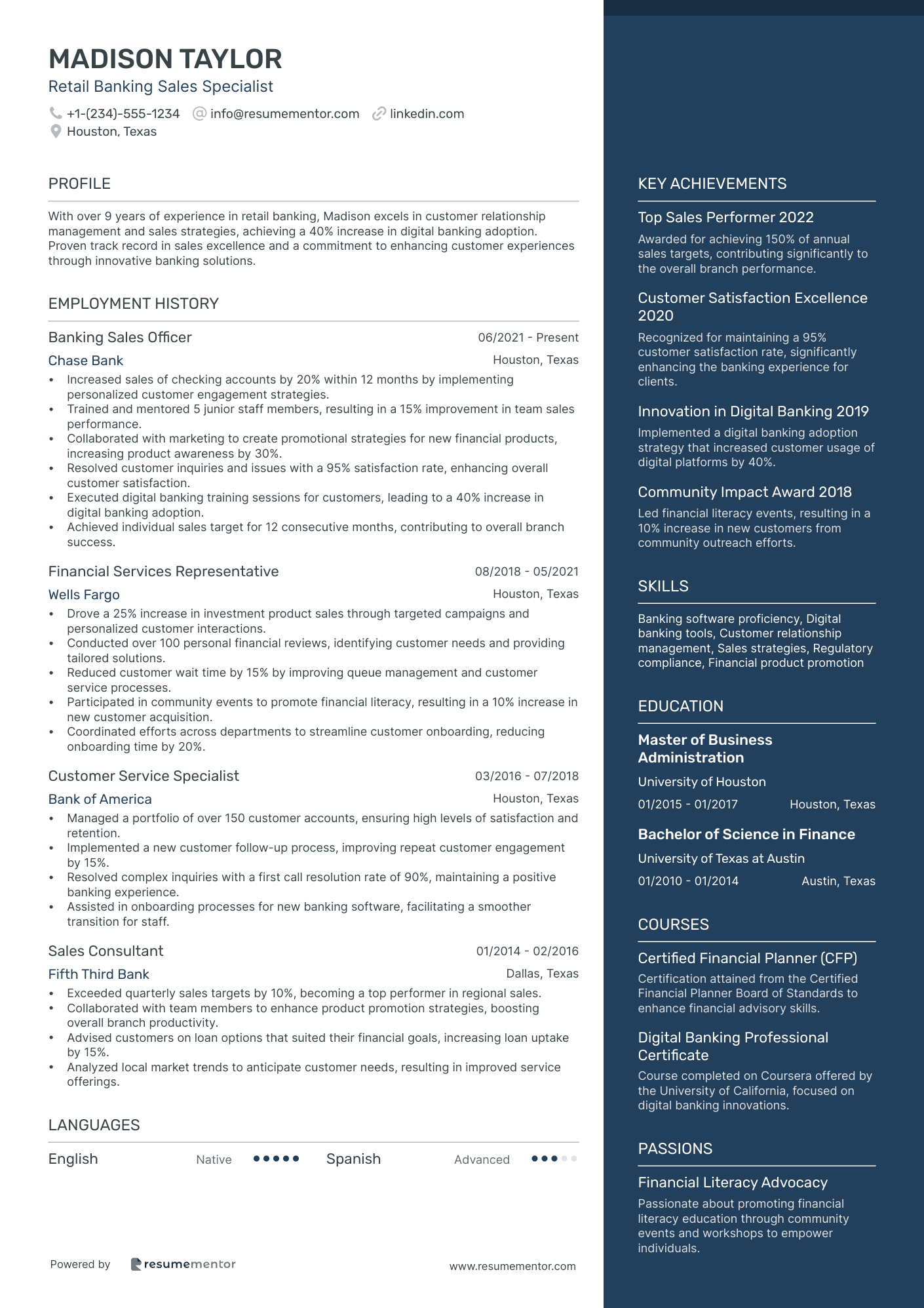

Retail Banking Sales Specialist resume sample

- •Increased sales of checking accounts by 20% within 12 months by implementing personalized customer engagement strategies.

- •Trained and mentored 5 junior staff members, resulting in a 15% improvement in team sales performance.

- •Collaborated with marketing to create promotional strategies for new financial products, increasing product awareness by 30%.

- •Resolved customer inquiries and issues with a 95% satisfaction rate, enhancing overall customer satisfaction.

- •Executed digital banking training sessions for customers, leading to a 40% increase in digital banking adoption.

- •Achieved individual sales target for 12 consecutive months, contributing to overall branch success.

- •Drove a 25% increase in investment product sales through targeted campaigns and personalized customer interactions.

- •Conducted over 100 personal financial reviews, identifying customer needs and providing tailored solutions.

- •Reduced customer wait time by 15% by improving queue management and customer service processes.

- •Participated in community events to promote financial literacy, resulting in a 10% increase in new customer acquisition.

- •Coordinated efforts across departments to streamline customer onboarding, reducing onboarding time by 20%.

- •Managed a portfolio of over 150 customer accounts, ensuring high levels of satisfaction and retention.

- •Implemented a new customer follow-up process, improving repeat customer engagement by 15%.

- •Resolved complex inquiries with a first call resolution rate of 90%, maintaining a positive banking experience.

- •Assisted in onboarding processes for new banking software, facilitating a smoother transition for staff.

- •Exceeded quarterly sales targets by 10%, becoming a top performer in regional sales.

- •Collaborated with team members to enhance product promotion strategies, boosting overall branch productivity.

- •Advised customers on loan options that suited their financial goals, increasing loan uptake by 15%.

- •Analyzed local market trends to anticipate customer needs, resulting in improved service offerings.

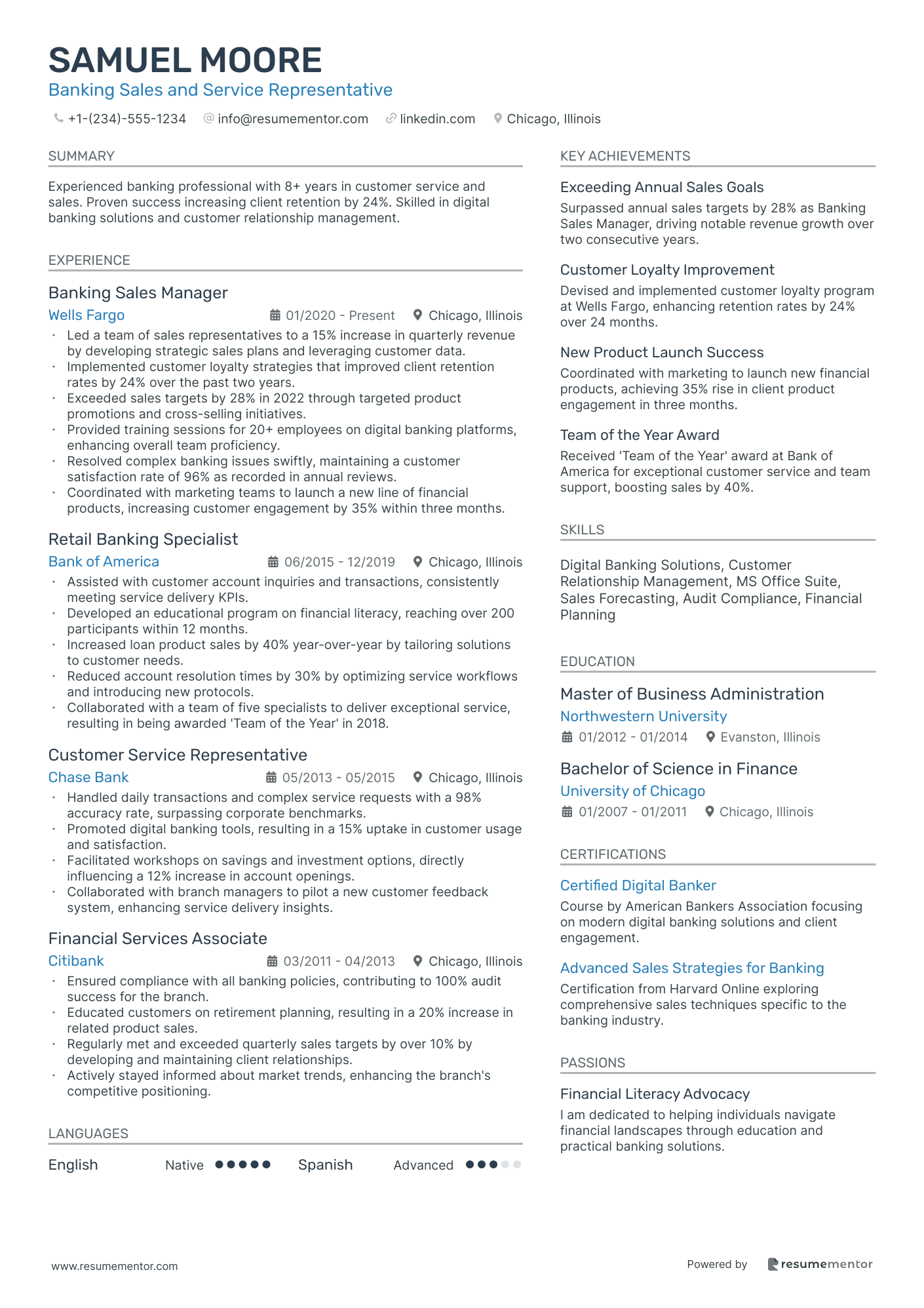

Banking Sales and Service Representative resume sample

- •Led a team of sales representatives to a 15% increase in quarterly revenue by developing strategic sales plans and leveraging customer data.

- •Implemented customer loyalty strategies that improved client retention rates by 24% over the past two years.

- •Exceeded sales targets by 28% in 2022 through targeted product promotions and cross-selling initiatives.

- •Provided training sessions for 20+ employees on digital banking platforms, enhancing overall team proficiency.

- •Resolved complex banking issues swiftly, maintaining a customer satisfaction rate of 96% as recorded in annual reviews.

- •Coordinated with marketing teams to launch a new line of financial products, increasing customer engagement by 35% within three months.

- •Assisted with customer account inquiries and transactions, consistently meeting service delivery KPIs.

- •Developed an educational program on financial literacy, reaching over 200 participants within 12 months.

- •Increased loan product sales by 40% year-over-year by tailoring solutions to customer needs.

- •Reduced account resolution times by 30% by optimizing service workflows and introducing new protocols.

- •Collaborated with a team of five specialists to deliver exceptional service, resulting in being awarded 'Team of the Year' in 2018.

- •Handled daily transactions and complex service requests with a 98% accuracy rate, surpassing corporate benchmarks.

- •Promoted digital banking tools, resulting in a 15% uptake in customer usage and satisfaction.

- •Facilitated workshops on savings and investment options, directly influencing a 12% increase in account openings.

- •Collaborated with branch managers to pilot a new customer feedback system, enhancing service delivery insights.

- •Ensured compliance with all banking policies, contributing to 100% audit success for the branch.

- •Educated customers on retirement planning, resulting in a 20% increase in related product sales.

- •Regularly met and exceeded quarterly sales targets by over 10% by developing and maintaining client relationships.

- •Actively stayed informed about market trends, enhancing the branch's competitive positioning.

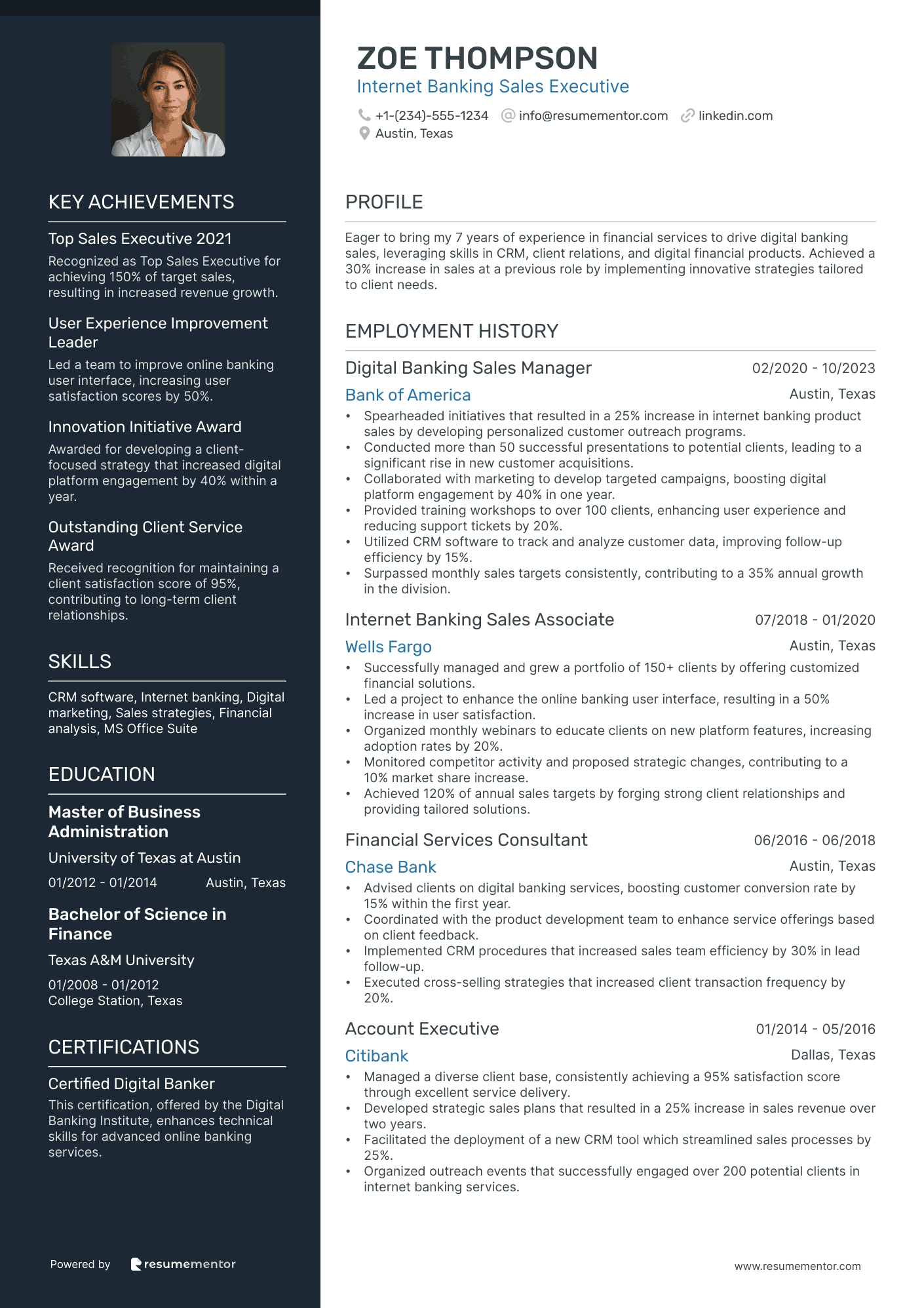

Internet Banking Sales Executive resume sample

- •Spearheaded initiatives that resulted in a 25% increase in internet banking product sales by developing personalized customer outreach programs.

- •Conducted more than 50 successful presentations to potential clients, leading to a significant rise in new customer acquisitions.

- •Collaborated with marketing to develop targeted campaigns, boosting digital platform engagement by 40% in one year.

- •Provided training workshops to over 100 clients, enhancing user experience and reducing support tickets by 20%.

- •Utilized CRM software to track and analyze customer data, improving follow-up efficiency by 15%.

- •Surpassed monthly sales targets consistently, contributing to a 35% annual growth in the division.

- •Successfully managed and grew a portfolio of 150+ clients by offering customized financial solutions.

- •Led a project to enhance the online banking user interface, resulting in a 50% increase in user satisfaction.

- •Organized monthly webinars to educate clients on new platform features, increasing adoption rates by 20%.

- •Monitored competitor activity and proposed strategic changes, contributing to a 10% market share increase.

- •Achieved 120% of annual sales targets by forging strong client relationships and providing tailored solutions.

- •Advised clients on digital banking services, boosting customer conversion rate by 15% within the first year.

- •Coordinated with the product development team to enhance service offerings based on client feedback.

- •Implemented CRM procedures that increased sales team efficiency by 30% in lead follow-up.

- •Executed cross-selling strategies that increased client transaction frequency by 20%.

- •Managed a diverse client base, consistently achieving a 95% satisfaction score through excellent service delivery.

- •Developed strategic sales plans that resulted in a 25% increase in sales revenue over two years.

- •Facilitated the deployment of a new CRM tool which streamlined sales processes by 25%.

- •Organized outreach events that successfully engaged over 200 potential clients in internet banking services.

Banking Products Sales Analyst resume sample

- •Analyzed product sales data leading to a 15% increase in sales through targeted campaigns and optimized product offerings.

- •Collaborated with marketing and product teams to successfully launch five new banking products, boosting market share by 20%.

- •Developed detailed sales reports and dashboards using Tableau, enhancing data accessibility and decision-making for stakeholders.

- •Conducted competitive analysis, which informed strategic changes in pricing that resulted in a 10% increase in customer acquisition.

- •Supported sales team training, increasing knowledge of product features, and benefits, which led to enhanced sales performance.

- •Executed comprehensive sales strategies that directly contributed to achieving the department's quarterly revenue targets consistently.

- •Provided financial analysis and insights that led to a redesign of banking products, improving profitability by 12%.

- •Managed a portfolio analysis project that identified underperforming areas, leading to strategic reallocations and cost savings of $50,000 annually.

- •Enhanced forecasting models, which improved forecast accuracy by 18%, supporting better resource allocation across departments.

- •Lead the competitive analysis of key banking product lines, successfully identifying market positioning opportunities.

- •Collaborated with cross-functional teams to analyze customer feedback, resulting in the successful implementation of customer-centric services.

- •Supported the implementation of analytical tools, resulting in a 30% reduction in report generation time and enhanced data accessibility.

- •Conducted regular analysis of sales metrics and aligned with stakeholders to optimize banking product features and packages.

- •Played a pivotal role in implementing a new CRM system that improved customer relation processes and sales efficiency.

- •Identified opportunities in market trends that informed decision-making in product development, boosting new product success rate by 15%.

- •Processed and analyzed complex data sets, supporting product management teams in enhancing banking services.

- •Developed automated spreadsheets that improved data analysis efficiency by 25% across the analytics team.

- •Generated insights from sales data that facilitated a successful marketing campaign, leading to market share expansion by 5%.

- •Collaborated with finance teams to develop financial models that improved budgeting accuracy and transparency.

Loan and Credit Banking Sales Officer resume sample

- •Developed and executed strategic plans for loan acquisition, increasing new business by 30% over 12 months.

- •Led a team of 5 in conducting comprehensive financial needs assessments, improving client satisfaction by 15%.

- •Presented tailored loan solutions at 25% improved rates, significantly enhancing client financial outcomes.

- •Successfully negotiated and closed high-value deals, resulting in a 50% growth in loan portfolios.

- •Facilitated seamless loan processes by collaborating with cross-functional teams, reducing approval times by 10%.

- •Managed client relationships that yielded a 40% increase in referral business and client retention.

- •Developed proposals and presentations, showcasing loan products to potential clients at 35% increased effectiveness.

- •Streamlined procedures with internal departments leading to enhanced client experiences and 15% faster service delivery.

- •Conducted market analysis to align loan options with client goals, improving competitive positioning by 20%.

- •Exceeded individual sales targets by 120% through effective communication and negotiation skills.

- •Enhanced credit sales by 25% through strategic client engagement and needs analysis.

- •Built strong rapport with a growing client base, leading to repeat business of over 70%.

- •Delivered high-impact proposals to clients with a conversion rate of over 50%, exceeding quarterly targets.

- •Maintained meticulous records in CRM, improving data reliability and client communications by 15%.

- •Assisted in optimizing the loan approval process, cutting down processing time by 20%.

- •Ensured high-quality customer service during the loan application process, increasing satisfaction rates by 10%.

- •Executed detailed document reviews, ensuring accuracy and adherence to regulatory standards.

- •Played a key role in supporting sales teams in fulfilling client requirements, contributing to a 15% rise in loan approvals.

Crafting a successful banking sales resume is like building a sturdy bridge between your skills and dream opportunities. When you try to translate your complex transaction expertise into simple, impactful content, it can feel like a challenge. This guide is here to help your abilities shine on paper in the same way they do at work.

In the world of banking sales, your resume must stand out by clearly highlighting your achievements and client relations. Using your sales acumen and financial know-how can be overwhelming, but organizing your information powerfully is key. This is where using a resume template can make the process straightforward, offering a structured way to present your strengths. Explore these resume templates to find one that complements your style.

Treat your resume as more than just a list of jobs—it's a selling tool, much like the banking products you offer. You want it to showcase your ability to drive revenue and manage client relationships effectively. By emphasizing outcomes and quantifying results, you’ll capture the attention of potential employers.

When you’re on the hunt for a new role or aiming for a promotion, your resume needs to convey your unique value. Focusing on the right experiences and accomplishments will make your resume your best advocate. Let’s dive into how you can make that happen, transforming your resume into a powerful tool for career success.

Key Takeaways

- Your banking sales resume acts as a tool to demonstrate how your skills and experiences align with a banking sales role's demands, with a focus on achieving outcomes and managing client relationships effectively.

- It is crucial to include your contact information, a professional summary, work experience with quantifiable achievements, education, relevant skills, and certifications.

- Using a reverse chronological resume format, modern fonts for a fresh look, and saving the resume as a PDF are important steps to ensure clarity and professionalism.

- Highlight both hard skills like financial analysis and soft skills such as communication and persuasion, to align with employers' expectations and the banking sales field's requirements.

- Extra resume sections, such as language abilities, hobbies, volunteer work, and relevant books, showcase a well-rounded profile that might give you an edge over other candidates.

What to focus on when writing your banking sales resume

Your banking sales resume serves as a vital tool to demonstrate your capabilities to potential employers, focusing on how your skills and experiences align with the demands of a banking sales role. Begin with a solid, professional format that helps your key qualifications stand out.

How to structure your banking sales resume

- Contact Information—Quick access to your contact details is essential. Display your name, phone number, email, and LinkedIn profile prominently at the top so hiring managers can quickly reach out. Ensure no typos, as accuracy here projects professionalism.

- Professional Summary—Craft a powerful and concise summary that ties your past achievements to future goals in banking sales. Highlight any unique accomplishments or experiences that set you apart. This is a snapshot of your career, capturing what you bring to the industry.

- Work Experience—Detail previous jobs by emphasizing specific responsibilities and achievements that relate directly to banking sales. Focus on instances where you exceeded sales targets, increased revenue, or led successful projects. Use active language and quantifiable metrics to paint a clear picture of your contributions.

- Education—Provide details on your academic background, especially degrees and courses relevant to finance or business. Mention institutions, graduation dates, and honors to reinforce your knowledge base in the banking field. This section confirms your foundational understanding of the industry.

- Skills—List skills that are specifically valuable in banking sales, such as financial advising, strategic relationship management, and negotiation abilities. Mention proficiency in tools or software, like CRM systems, which can give you an edge in managing client interactions and sales data effectively.

- Certifications and Licenses—Include relevant industry certifications like Series 7 or CFA. These credentials can boost your credibility and demonstrate your commitment to maintaining standards in the financial sales industry.

Transitioning from resume format to the individual sections, we'll delve deeper into each one, exploring how to craft these elements for maximum impact.

Which resume format to choose

Crafting an impressive banking sales resume requires attention to format, aesthetics, and detail. Starting with the right format is key: in this industry, a reverse chronological format is often the best choice. This style lets you outline your banking sales journey clearly, showcasing your achievements and how you've advanced over time. It aligns with the expectations of employers looking for a strong track record.

Font choice might seem minor, but it plays a significant role in how your resume is perceived. Modern fonts like Lato, Montserrat, or Raleway offer a fresh, professional look that maintains readability and appeal. They convey a contemporary and professional image, setting the right tone for someone in banking sales.

Choosing the right filetype is also crucial. Always save your resume as a PDF to keep your formatting consistent across different devices and software. This ensures that every recruiter sees your document exactly as you intended, reflecting a polished and professional presentation.

Margins, although less discussed, impact the overall appearance of your resume. Keeping them at about 1 inch ensures your document is orderly and easy to read. Ample white space helps draw attention to your accomplishments and keeps the focus on your qualifications rather than cluttered text.

When all these elements are thoughtfully considered and seamlessly integrated, your resume not only appears polished but also effectively highlights the detail-oriented mindset that is essential in the banking sales field. This comprehensive attention to each aspect of your resume presents you as a meticulous professional, ready to excel in the industry.

How to write a quantifiable resume experience section

A strong banking sales resume experience section is key to making a lasting impression. It outlines your professional journey and highlights the impact you’ve made, focusing on achievements you can measure that show your success in driving sales. Include your job titles and tailor your experiences to match the job description, demonstrating that you’re the ideal fit. Arrange your roles in reverse order, starting with the most recent, covering the past 10-15 years to keep it relevant. When you’ve advanced within one company, list roles under a single heading to maintain clarity. Use dynamic action verbs like "increased," "developed," "achieved," and "led" to emphasize your proactive contributions. Tailoring your resume means aligning your entries with the language and responsibilities found in the job ad, making it clear you meet their needs. Here's an example of an effective banking sales experience section:

- •Increased regional loan sales by 25% over two years, contributing to revenue growth.

- •Developed new customer acquisition strategies, boosting client base by 40%.

- •Achieved top salesperson recognition for three consecutive years.

- •Trained and mentored a team of 10 junior sales associates, resulting in improved team performance.

This experience section makes a strong impact by using active language that highlights your accomplishments and the benefits you brought to your past employers. Each bullet point builds on your ability to drive sales and enhance team success, making your contributions clear and compelling. Tailoring your entries to highlight relevant skills and achievements ensures that your resume resonates with potential employers, showing them you're ready to meet their goals and exceed expectations.

Leadership-Focused resume experience section

A leadership-focused banking sales resume experience section should clearly demonstrate your ability to guide teams and drive sales growth. Begin by showcasing roles where you effectively motivated others, leading to increased productivity and success. Highlight significant achievements in revenue growth or the development of effective strategies, using action words and quantifiable results to convey your impact.

To present each experience entry clearly, list the timeframe, job title, and company name. Use bullet points to detail key accomplishments, focusing on leadership actions that delivered tangible results, such as mentoring team members, driving sales increases, or refining sales tactics. By carefully curating your achievements, you illustrate how your leadership has substantially influenced the banking sector's success.

Regional Sales Manager

Prime Bank Corp.

June 2018 - September 2023

- Increased regional sales by 30% within two years by leading a team of 15 sales agents.

- Developed a mentorship program that improved team performance, leading to career advancements for 7 team members.

- Implemented a new sales strategy that enhanced customer satisfaction scores by 25%.

- Spearheaded cross-functional collaboration projects, leading to a 10% reduction in process inefficiencies.

Result-Focused resume experience section

A result-focused banking sales resume experience section should clearly present your ability to deliver measurable outcomes. Begin by selecting a job title and workplace that authentically reflect your career. Indicate the duration of your employment with precise dates to establish credibility. Use dynamic verbs and quantifiable achievements to demonstrate how your actions led to success, supporting your claims with numbers or percentages.

Your bullet points should paint a vivid picture of your accomplishments. Include details of awards you received, goals you exceeded, and the impact of your contributions. Describe how you leveraged your skills to create strategies that significantly boosted sales or improved customer satisfaction. This section should convincingly portray your capacity to drive results in banking sales, underscoring your strengths in developing customer relationships, negotiating effectively, and understanding financial products.

Senior Sales Associate

First National Bank, Inc.

January 2018 - March 2022

- Increased client portfolio by 30% through targeted marketing strategies.

- Achieved 120% of sales targets over four consecutive quarters by enhancing customer relationships.

- Implemented training program for new team members, resulting in a 15% increase in overall sales performance.

- Developed and maintained key relationships with high-net-worth clients, leading to $2M revenue growth.

Industry-Specific Focus resume experience section

A banking sales-focused resume experience section should clearly demonstrate your impact and accomplishments within the industry. Begin by highlighting your achievements and contributions to company success, such as increasing revenue or improving customer satisfaction. Incorporate specific numbers or percentages to illustrate your impact, providing a concrete picture of your success. Offer context for each accomplishment by describing the challenges you faced and the solutions you crafted, showcasing your problem-solving abilities and the breadth of your work.

Begin each position with your job title, employer, and dates of employment. Use bullet points under each position to succinctly outline your responsibilities and achievements, ensuring clarity and conciseness. Prioritize action verbs to enhance the impact of each point and ensure they are relevant to banking sales. By focusing on these key elements, your resume will effectively highlight your qualifications and readiness to excel in similar roles.

Sales Manager

ABC Bank

June 2019 - Present

- Expanded client base by 30% within a year through tailored sales strategies.

- Led a training program for new hires, cutting onboarding time by 15%.

- Worked with marketing to launch a campaign that boosted loan sales by 25%.

- Optimized sales processes, leading to a 20% productivity increase.

Efficiency-Focused resume experience section

An efficiency-focused banking sales resume experience section should emphasize your ability to enhance performance and streamline operations. Start by outlining specific initiatives you took to improve efficiency, incorporating concrete numbers to illustrate successes, such as sales growth percentages or time reductions. This not only highlights your problem-solving skills but also underscores your commitment to driving meaningful improvements within the organization.

Next, use clear and concise bullet points to detail your achievements, beginning each with a strong action verb to demonstrate your proactive approach. Ensure each bullet reflects a distinct accomplishment or responsibility, creating a cohesive narrative of your experience. This approach allows potential employers to easily understand how your previous successes can translate into added value for their team.

Sales Efficiency Manager

XYZ Bank

May 2020 - Present

- Implemented a new CRM system resulting in a 25% increase in client engagement.

- Led a team to revamp the customer onboarding process, reducing onboarding time by 50%.

- Developed training programs that improved team productivity by 20%.

- Streamlined reporting procedures, saving 10 hours of work per week.

Write your banking sales resume summary section

A banking-focused resume summary should highlight your top achievements and skills right from the start. This is your chance to grab attention quickly by showcasing your career journey in a few punchy sentences. Emphasizing your relevant experience and successes, especially those that align with the job, can set you apart. A well-crafted summary conveys your value to potential employers immediately, making a lasting impression. For those with extensive experience, the summary should focus on past accomplishments. Consider this example:

In this example, the summary effectively highlights years of experience, specific skills, and tangible achievements, presenting a compelling case for your candidacy. Quantifying success with clear numbers appeals greatly to employers. When you describe yourself, choose phrases that create a lasting impact, like "results-driven" or "team-oriented." Understanding different resume formats—summaries, objectives, profiles, and qualifications—is crucial. A summary brings out experience and skills, an objective outlines career goals, a profile mixes skills with experience, and a summary of qualifications details your key expertise. Tailor your chosen format based on your experience level and career path to make the best impression.

Listing your banking sales skills on your resume

A banking sales-focused resume should seamlessly blend your skills into a cohesive story. You can highlight them in a standalone section or integrate them into your experience and summary. Emphasizing your strengths and soft skills, like communication and teamwork, is vital. These attributes showcase your ability to connect effectively with colleagues and clients. Hard skills, such as financial analysis and customer relationship management, are specific abilities that play a critical role in the banking sales field.

These skills double as resume keywords, helping recruiters identify you as a strong candidate quickly. Look at the job posting to see which skills are in demand, and reflect them in your resume for maximum impact.

Here's an example of a standalone skills section in JSON format:

This example highlights skills that are directly relevant to banking sales, presenting both technical and industry-specific competencies. These are strategic keywords that align with what employers look for, increasing your resume's attractiveness.

Best hard skills to feature on your banking sales resume

Hard skills are crucial in banking sales, as they demonstrate your technical abilities and industry expertise. They clearly communicate your capability to perform the job effectively.

Hard Skills

- Customer Relationship Management (CRM)

- Financial Analysis

- Sales Forecasting

- Portfolio Management

- Data Analysis

- Risk Management

- Regulatory Compliance Knowledge

- Credit Analysis

- Loan Processing

- Banking Software Proficiency

- Budgeting

- Contract Negotiation

- Market Research

- Strategic Planning

- Digital Banking Tools

Best soft skills to feature on your banking sales resume

Soft skills are equally important, highlighting your interpersonal abilities. They demonstrate how well you work with others and adapt to varying situations, which is essential in banking sales.

Soft Skills

- Communication

- Problem-solving

- Time Management

- Adaptability

- Team Collaboration

- Emotional Intelligence

- Leadership

- Critical Thinking

- Conflict Resolution

- Attention to Detail

- Active Listening

- Decision Making

- Stress Management

- Networking

- Persuasion Skills

How to include your education on your resume

An education section is an essential part of your banking sales resume because it highlights your academic achievements and can set you apart from other candidates. Tailoring this section to the job you’re applying for is crucial. Only include relevant education and courses that align with the skills needed for a sales position in banking. If your GPA was high, especially if it exceeds a 3.5 on a 4.0 scale, consider including it to demonstrate your academic excellence. Additionally, mentioning any honors like cum laude adds further credibility to your qualifications. When listing your degree, include the full name of the degree, the institution, and the dates attended.

Here is an incorrect education section example:

Now, here is an accurate and effective example:

This example is effective because the candidate's degree is directly relevant to a banking sales position. Specifying a BBA with a finance major showcases relevant financial knowledge. Listing a GPA of 3.7 on a 4.0 scale highlights academic success, while the cum laude distinction adds to the candidate's credibility as a well-qualified applicant.

How to include banking sales certificates on your resume

Including a certificates section in your banking sales resume is essential. It showcases your qualifications and unique skills, setting you apart from other candidates. You may also highlight key certificates in your resume header for quick visibility.

List the name of each certificate. Include the date when you obtained it. Add the issuing organization to give credibility. If space allows, mention key modules or skills covered in the certification to show relevance.

For example, in JSON format:

The example above is effective because it includes certificates relevant to banking sales. It lists respected issuing organizations, boosting credibility. Including multiple certificates indicates a broad skillset. Detailing significant certificates in your header can attract immediate attention. By following this approach, you can effectively display your qualifications.

Extra sections to include in your banking sales resume

Writing a solid resume for a banking sales career can make all the difference in landing a job. Including sections like language skills, hobbies and interests, volunteer work, and books you've read can add depth to your resume and present you as a well-rounded candidate.

- Language section — List languages you speak fluently to show your ability to communicate with a diverse clientele. Indicate your proficiency level to give a clear sense of your capabilities.

- Hobbies and interests section — Include hobbies that highlight relevant skills like leadership or teamwork. This helps hiring managers see you as a person and not just a list of qualifications.

- Volunteer work section — Detail your volunteer activities to show your commitment to community service. This section can demonstrate that you possess strong teamwork and charitable skills, which are valuable in banking.

- Books section — Mention books you've read related to finance or personal development to show your commitment to ongoing learning. This can make you stand out as someone who takes their professional growth seriously.

Adding these sections can show that you are a well-rounded person with both professional skills and personal interests. As you detail these areas, remember to keep your sentences concise and relevant. With these enhancements, your resume will better attract the attention of prospective employers.

In Conclusion

In conclusion, building an effective banking sales resume requires a blend of strategy, precision, and personal touch. By highlighting achievements with clear, quantifiable examples, you position yourself as a results-oriented professional. A well-crafted resume should reflect not just your past successes but also how your skills align with career goals. Personalizing each section to showcase both hard and soft skills solidifies your image as a well-rounded candidate ready to tackle challenges. Incorporating elements like education and certifications paints a comprehensive picture of your qualifications. Each section, from contact information to extra-curricular activities, adds value, presenting you as a dynamic individual in a competitive field. The sections on leadership and efficiency demonstrate your proactive nature in influencing success. Tailoring language and using action verbs reinforce your proactive and driven approach. A compelling resume summary caps off your experience, leaving a strong impression on potential employers. Through attention to detail in elements like margins and format, you convey professionalism and diligence. Ultimately, a thoughtfully constructed resume becomes a powerful bridge to your next career opportunity.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.