Branch Accountant Resume Examples

Jul 18, 2024

|

12 min read

Counting on Your Career: How to Write a Branch Accountant Resume that Balances Skills and Experience

Rated by 348 people

Regional Branch Accountant

Audit and Compliance Branch Accountant

Financial Reporting Branch Accountant

Investment Branch Accountant

Internal Control Branch Accountant

Budgeting and Forecasting Branch Accountant

Taxation Branch Accountant

Accounts Receivable Branch Accountant

Accounts Payable Branch Accountant

Costing Branch Accountant

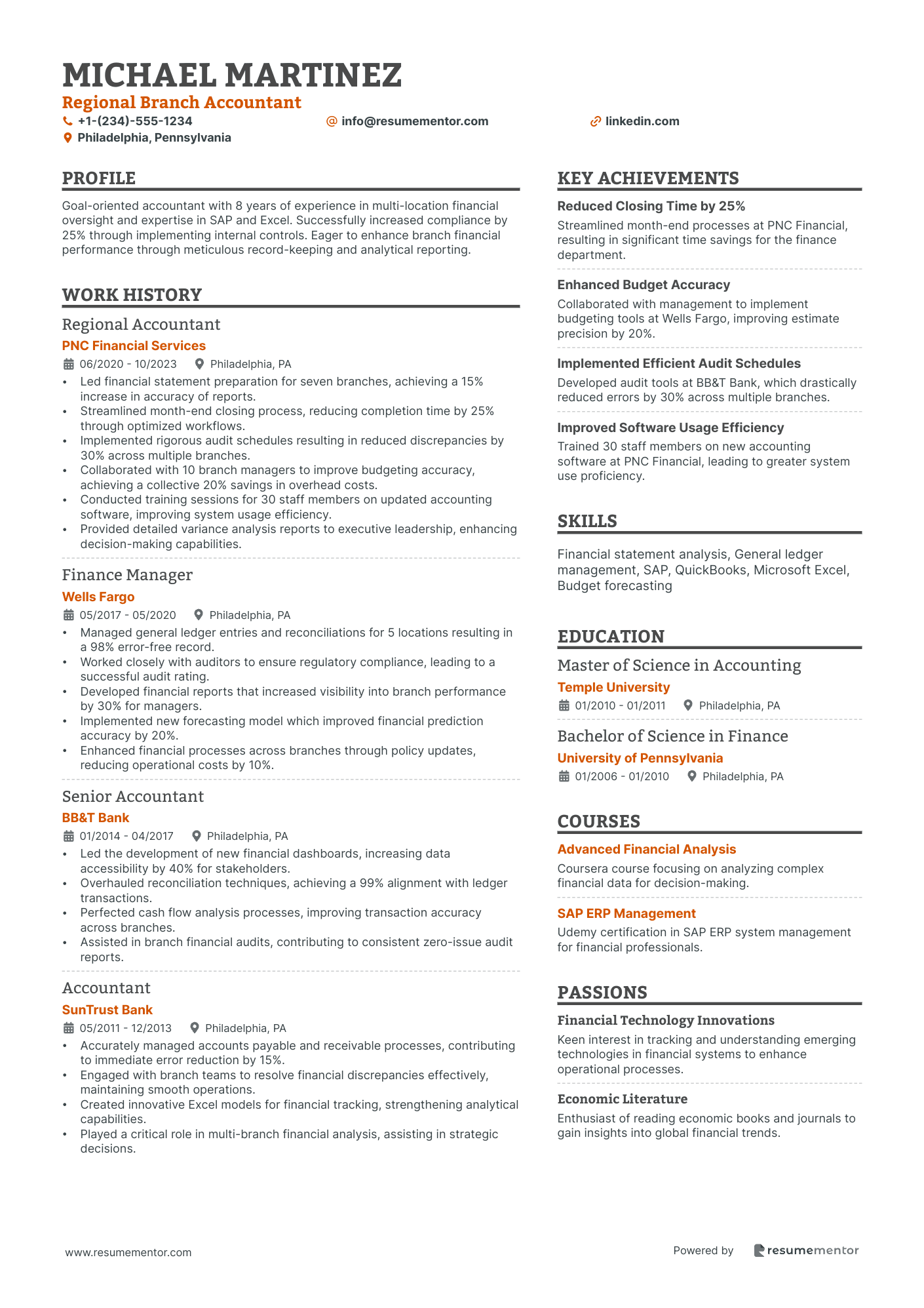

Regional Branch Accountant resume sample

- •Led financial statement preparation for seven branches, achieving a 15% increase in accuracy of reports.

- •Streamlined month-end closing process, reducing completion time by 25% through optimized workflows.

- •Implemented rigorous audit schedules resulting in reduced discrepancies by 30% across multiple branches.

- •Collaborated with 10 branch managers to improve budgeting accuracy, achieving a collective 20% savings in overhead costs.

- •Conducted training sessions for 30 staff members on updated accounting software, improving system usage efficiency.

- •Provided detailed variance analysis reports to executive leadership, enhancing decision-making capabilities.

- •Managed general ledger entries and reconciliations for 5 locations resulting in a 98% error-free record.

- •Worked closely with auditors to ensure regulatory compliance, leading to a successful audit rating.

- •Developed financial reports that increased visibility into branch performance by 30% for managers.

- •Implemented new forecasting model which improved financial prediction accuracy by 20%.

- •Enhanced financial processes across branches through policy updates, reducing operational costs by 10%.

- •Led the development of new financial dashboards, increasing data accessibility by 40% for stakeholders.

- •Overhauled reconciliation techniques, achieving a 99% alignment with ledger transactions.

- •Perfected cash flow analysis processes, improving transaction accuracy across branches.

- •Assisted in branch financial audits, contributing to consistent zero-issue audit reports.

- •Accurately managed accounts payable and receivable processes, contributing to immediate error reduction by 15%.

- •Engaged with branch teams to resolve financial discrepancies effectively, maintaining smooth operations.

- •Created innovative Excel models for financial tracking, strengthening analytical capabilities.

- •Played a critical role in multi-branch financial analysis, assisting in strategic decisions.

Audit and Compliance Branch Accountant resume sample

- •Led a team to complete 15 internal audits annually, lowering financial discrepancies by 30% across the organization.

- •Developed compliance programs aligning with federal regulations, decreasing non-compliance incidents by 25% year over year.

- •Implemented a new financial reporting protocol, reducing preparation time by 40%, and ensuring adherence to GAAP.

- •Collaborated with departments to optimize controls, enhancing accuracy in financial documents while saving 20% of audit-related costs.

- •Coordinated external audit processes, resulting in a 95% success rate in audits with no major findings.

- •Designed and monitored new risk assessment frameworks, lowering company risks by 15% within the first year.

- •Managed financial statement reviews, identifying discrepancies that improved reporting accuracy by 20% in two years.

- •Conducted risk assessments, successfully preventing potential compliance violations that could have cost $200,000.

- •Guided departments in implementing internal measures, reducing financial reporting errors by 35% across divisions.

- •Facilitated quarterly audits that contributed to a first-time clean audit outcome after three years of consistent challenges.

- •Collaborated with IT to automate compliance reports, increasing efficiency by 50% and error detection by 15%.

- •Analyzed financial data to ensure compliance with local, state, and federal laws, maintaining a 98% compliance rate.

- •Assisted in developing a new internal control system, resulting in a 15% reduction in processing errors.

- •Liaised with external auditors, leading to successful and smooth audit processes and maintaining strong work relations.

- •Revised compliance training materials, improving employee understanding and compliance awareness by 30%.

Financial Reporting Branch Accountant resume sample

- •Led the preparation of monthly financial statements, increasing accuracy by 15% and ensuring GAAP compliance.

- •Collaborated with branch managers to identify and rectify discrepancies, enhancing financial operations by 20%.

- •Supported the successful completion of the annual audit within deadlines by providing comprehensive documentation.

- •Improved transparency by generating detailed reports for management, influencing branch financial strategies.

- •Implemented enhanced internal controls, reducing transaction processing errors by 25% over a year.

- •Facilitated budget preparation, streamlining forecasting processes, resulting in 10% more accurate predictions.

- •Reviewed and reconciled general ledgers, achieving 98% accuracy in financial record closing processes.

- •Provided insights through financial reports, aiding a 12% cost reduction in branch operations.

- •Coordinated with auditors, which facilitated a streamlined audit process with 100% compliance.

- •Monitored and ensured adherence to financial regulations, contributing to a 0% compliance lapse over two years.

- •Enhanced financial procedures, leading to a reduction in reporting errors by 18% over the period.

- •Analyzed financial trends, providing forecasts that improved financial planning accuracy by 15%.

- •Assisted in developing new accounting procedures, reducing processing time by 20%.

- •Maintained accurate transaction records, achieving a 100% satisfaction rate from stakeholders.

- •Contributed to the financial compliance team, preventing potential financial discrepancies and legal issues.

- •Produced comprehensive financial reports that supported strategic decision-making and improved performance by 10%.

- •Collaborated on cross-functional projects, leading to more cohesive and effective financial reporting processes.

- •Ensured compliance with GAAP standards, eliminated financial discrepancies during audits.

- •Improved report formatting processes, reducing preparation time by 15%.

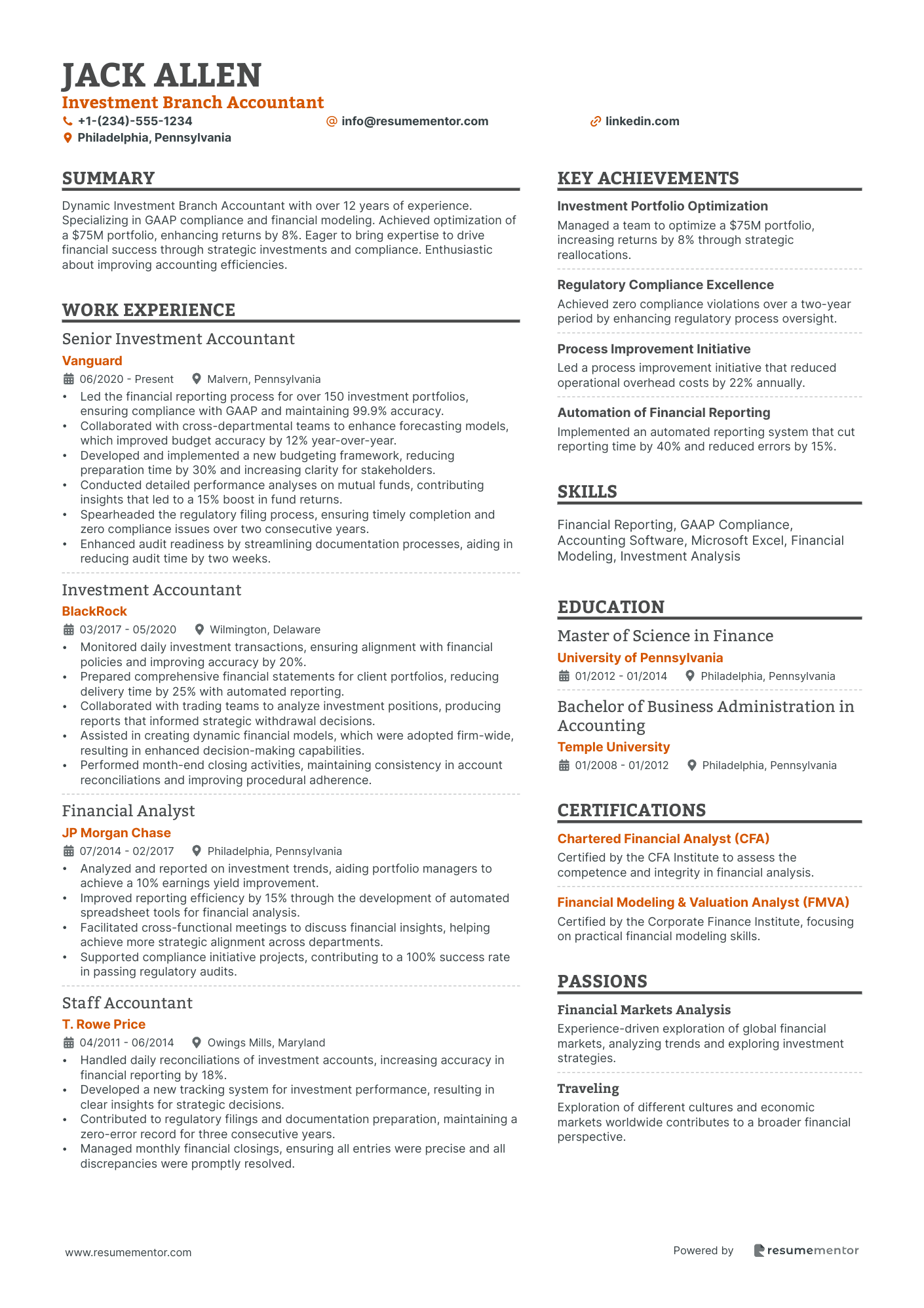

Investment Branch Accountant resume sample

- •Led the financial reporting process for over 150 investment portfolios, ensuring compliance with GAAP and maintaining 99.9% accuracy.

- •Collaborated with cross-departmental teams to enhance forecasting models, which improved budget accuracy by 12% year-over-year.

- •Developed and implemented a new budgeting framework, reducing preparation time by 30% and increasing clarity for stakeholders.

- •Conducted detailed performance analyses on mutual funds, contributing insights that led to a 15% boost in fund returns.

- •Spearheaded the regulatory filing process, ensuring timely completion and zero compliance issues over two consecutive years.

- •Enhanced audit readiness by streamlining documentation processes, aiding in reducing audit time by two weeks.

- •Monitored daily investment transactions, ensuring alignment with financial policies and improving accuracy by 20%.

- •Prepared comprehensive financial statements for client portfolios, reducing delivery time by 25% with automated reporting.

- •Collaborated with trading teams to analyze investment positions, producing reports that informed strategic withdrawal decisions.

- •Assisted in creating dynamic financial models, which were adopted firm-wide, resulting in enhanced decision-making capabilities.

- •Performed month-end closing activities, maintaining consistency in account reconciliations and improving procedural adherence.

- •Analyzed and reported on investment trends, aiding portfolio managers to achieve a 10% earnings yield improvement.

- •Improved reporting efficiency by 15% through the development of automated spreadsheet tools for financial analysis.

- •Facilitated cross-functional meetings to discuss financial insights, helping achieve more strategic alignment across departments.

- •Supported compliance initiative projects, contributing to a 100% success rate in passing regulatory audits.

- •Handled daily reconciliations of investment accounts, increasing accuracy in financial reporting by 18%.

- •Developed a new tracking system for investment performance, resulting in clear insights for strategic decisions.

- •Contributed to regulatory filings and documentation preparation, maintaining a zero-error record for three consecutive years.

- •Managed monthly financial closings, ensuring all entries were precise and all discrepancies were promptly resolved.

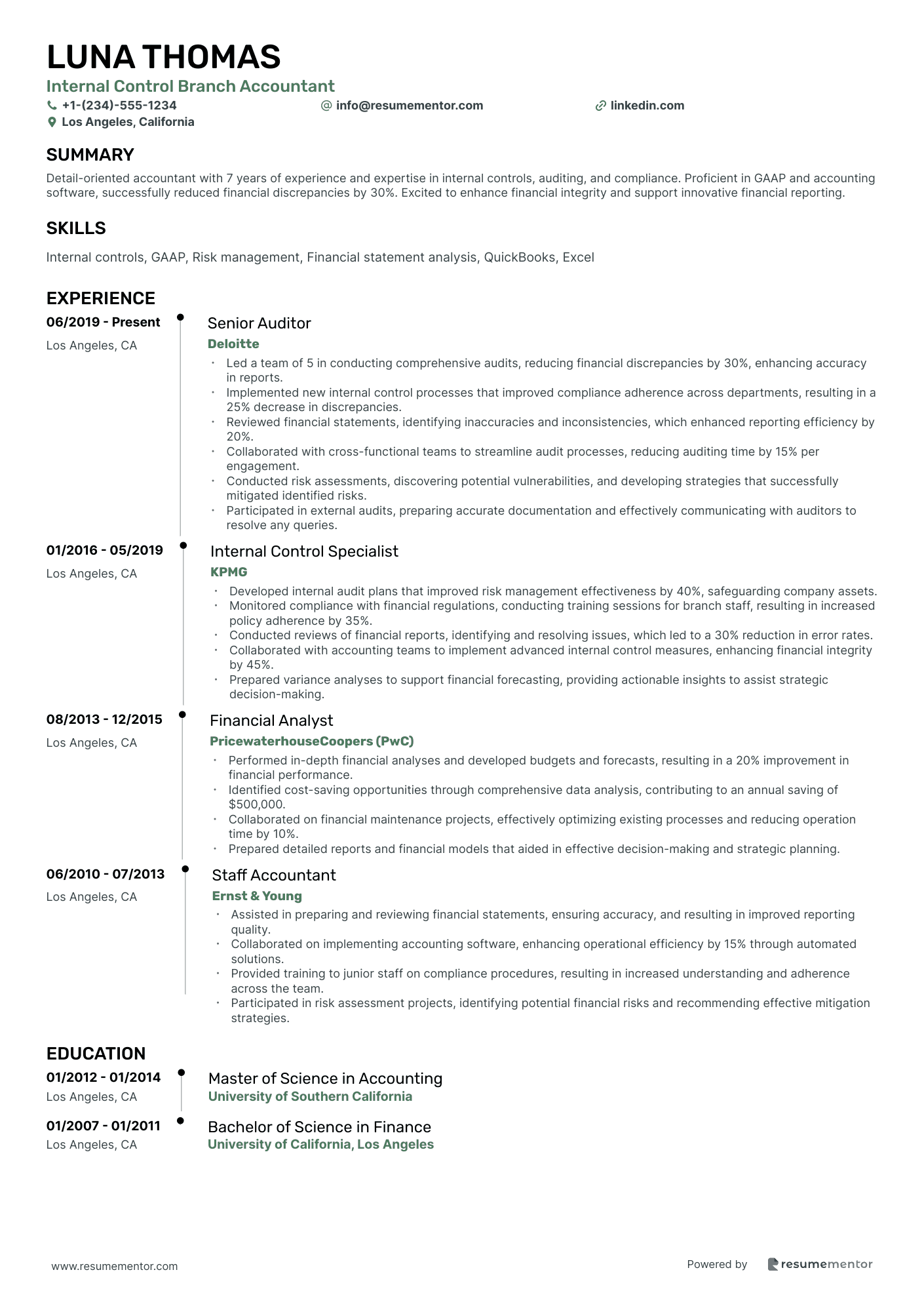

Internal Control Branch Accountant resume sample

- •Led a team of 5 in conducting comprehensive audits, reducing financial discrepancies by 30%, enhancing accuracy in reports.

- •Implemented new internal control processes that improved compliance adherence across departments, resulting in a 25% decrease in discrepancies.

- •Reviewed financial statements, identifying inaccuracies and inconsistencies, which enhanced reporting efficiency by 20%.

- •Collaborated with cross-functional teams to streamline audit processes, reducing auditing time by 15% per engagement.

- •Conducted risk assessments, discovering potential vulnerabilities, and developing strategies that successfully mitigated identified risks.

- •Participated in external audits, preparing accurate documentation and effectively communicating with auditors to resolve any queries.

- •Developed internal audit plans that improved risk management effectiveness by 40%, safeguarding company assets.

- •Monitored compliance with financial regulations, conducting training sessions for branch staff, resulting in increased policy adherence by 35%.

- •Conducted reviews of financial reports, identifying and resolving issues, which led to a 30% reduction in error rates.

- •Collaborated with accounting teams to implement advanced internal control measures, enhancing financial integrity by 45%.

- •Prepared variance analyses to support financial forecasting, providing actionable insights to assist strategic decision-making.

- •Performed in-depth financial analyses and developed budgets and forecasts, resulting in a 20% improvement in financial performance.

- •Identified cost-saving opportunities through comprehensive data analysis, contributing to an annual saving of $500,000.

- •Collaborated on financial maintenance projects, effectively optimizing existing processes and reducing operation time by 10%.

- •Prepared detailed reports and financial models that aided in effective decision-making and strategic planning.

- •Assisted in preparing and reviewing financial statements, ensuring accuracy, and resulting in improved reporting quality.

- •Collaborated on implementing accounting software, enhancing operational efficiency by 15% through automated solutions.

- •Provided training to junior staff on compliance procedures, resulting in increased understanding and adherence across the team.

- •Participated in risk assessment projects, identifying potential financial risks and recommending effective mitigation strategies.

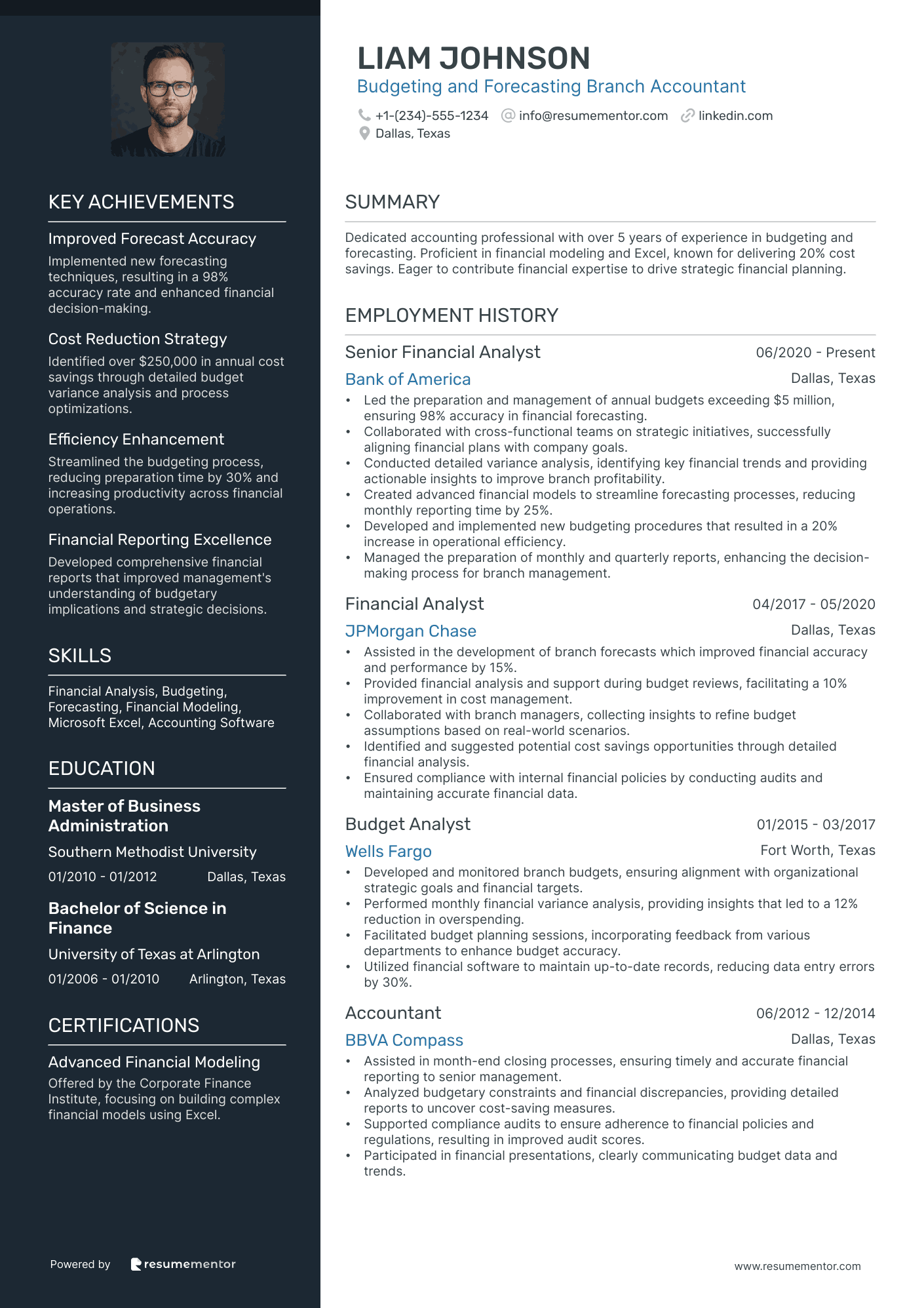

Budgeting and Forecasting Branch Accountant resume sample

- •Led the preparation and management of annual budgets exceeding $5 million, ensuring 98% accuracy in financial forecasting.

- •Collaborated with cross-functional teams on strategic initiatives, successfully aligning financial plans with company goals.

- •Conducted detailed variance analysis, identifying key financial trends and providing actionable insights to improve branch profitability.

- •Created advanced financial models to streamline forecasting processes, reducing monthly reporting time by 25%.

- •Developed and implemented new budgeting procedures that resulted in a 20% increase in operational efficiency.

- •Managed the preparation of monthly and quarterly reports, enhancing the decision-making process for branch management.

- •Assisted in the development of branch forecasts which improved financial accuracy and performance by 15%.

- •Provided financial analysis and support during budget reviews, facilitating a 10% improvement in cost management.

- •Collaborated with branch managers, collecting insights to refine budget assumptions based on real-world scenarios.

- •Identified and suggested potential cost savings opportunities through detailed financial analysis.

- •Ensured compliance with internal financial policies by conducting audits and maintaining accurate financial data.

- •Developed and monitored branch budgets, ensuring alignment with organizational strategic goals and financial targets.

- •Performed monthly financial variance analysis, providing insights that led to a 12% reduction in overspending.

- •Facilitated budget planning sessions, incorporating feedback from various departments to enhance budget accuracy.

- •Utilized financial software to maintain up-to-date records, reducing data entry errors by 30%.

- •Assisted in month-end closing processes, ensuring timely and accurate financial reporting to senior management.

- •Analyzed budgetary constraints and financial discrepancies, providing detailed reports to uncover cost-saving measures.

- •Supported compliance audits to ensure adherence to financial policies and regulations, resulting in improved audit scores.

- •Participated in financial presentations, clearly communicating budget data and trends.

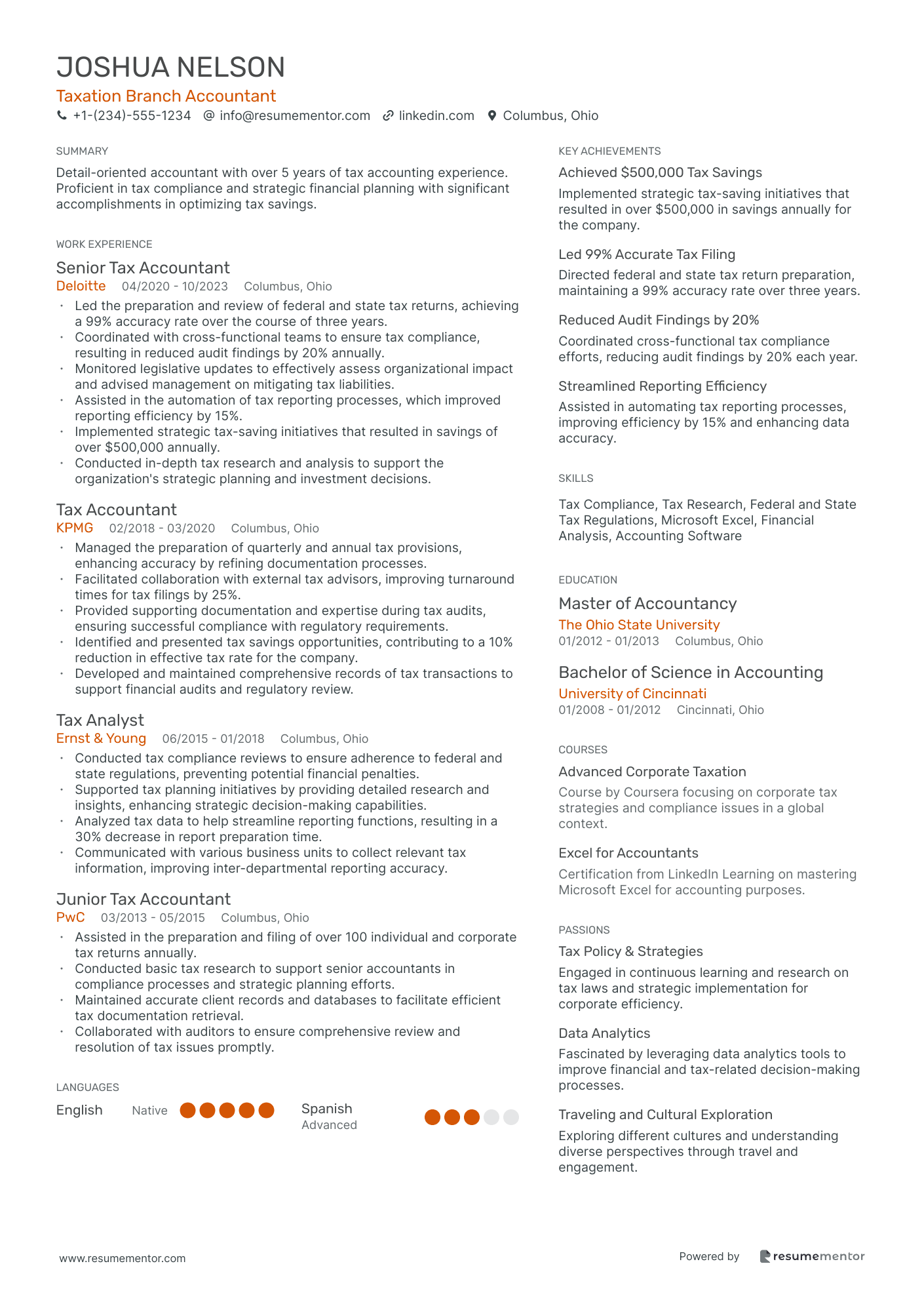

Taxation Branch Accountant resume sample

- •Led the preparation and review of federal and state tax returns, achieving a 99% accuracy rate over the course of three years.

- •Coordinated with cross-functional teams to ensure tax compliance, resulting in reduced audit findings by 20% annually.

- •Monitored legislative updates to effectively assess organizational impact and advised management on mitigating tax liabilities.

- •Assisted in the automation of tax reporting processes, which improved reporting efficiency by 15%.

- •Implemented strategic tax-saving initiatives that resulted in savings of over $500,000 annually.

- •Conducted in-depth tax research and analysis to support the organization's strategic planning and investment decisions.

- •Managed the preparation of quarterly and annual tax provisions, enhancing accuracy by refining documentation processes.

- •Facilitated collaboration with external tax advisors, improving turnaround times for tax filings by 25%.

- •Provided supporting documentation and expertise during tax audits, ensuring successful compliance with regulatory requirements.

- •Identified and presented tax savings opportunities, contributing to a 10% reduction in effective tax rate for the company.

- •Developed and maintained comprehensive records of tax transactions to support financial audits and regulatory review.

- •Conducted tax compliance reviews to ensure adherence to federal and state regulations, preventing potential financial penalties.

- •Supported tax planning initiatives by providing detailed research and insights, enhancing strategic decision-making capabilities.

- •Analyzed tax data to help streamline reporting functions, resulting in a 30% decrease in report preparation time.

- •Communicated with various business units to collect relevant tax information, improving inter-departmental reporting accuracy.

- •Assisted in the preparation and filing of over 100 individual and corporate tax returns annually.

- •Conducted basic tax research to support senior accountants in compliance processes and strategic planning efforts.

- •Maintained accurate client records and databases to facilitate efficient tax documentation retrieval.

- •Collaborated with auditors to ensure comprehensive review and resolution of tax issues promptly.

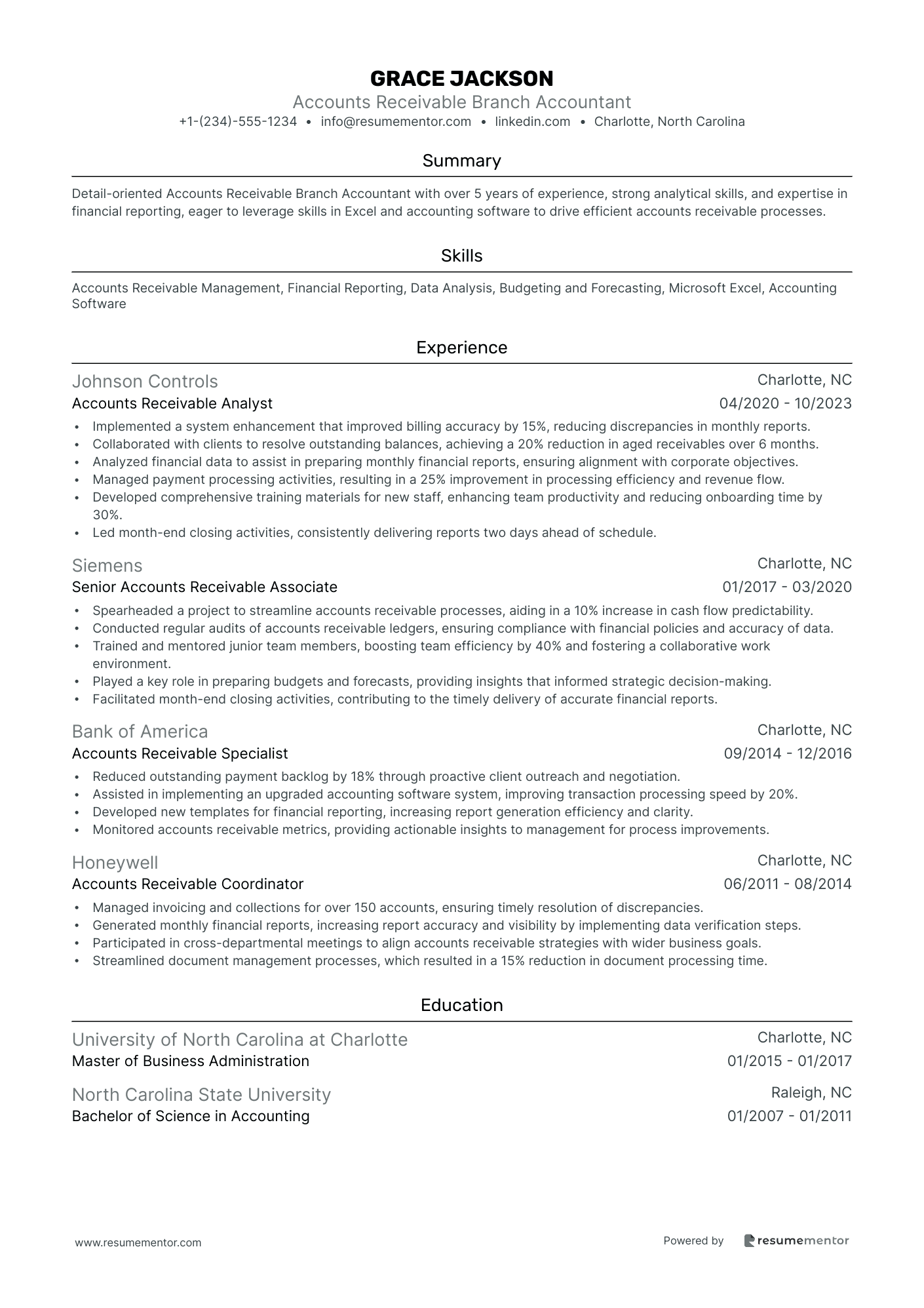

Accounts Receivable Branch Accountant resume sample

- •Implemented a system enhancement that improved billing accuracy by 15%, reducing discrepancies in monthly reports.

- •Collaborated with clients to resolve outstanding balances, achieving a 20% reduction in aged receivables over 6 months.

- •Analyzed financial data to assist in preparing monthly financial reports, ensuring alignment with corporate objectives.

- •Managed payment processing activities, resulting in a 25% improvement in processing efficiency and revenue flow.

- •Developed comprehensive training materials for new staff, enhancing team productivity and reducing onboarding time by 30%.

- •Led month-end closing activities, consistently delivering reports two days ahead of schedule.

- •Spearheaded a project to streamline accounts receivable processes, aiding in a 10% increase in cash flow predictability.

- •Conducted regular audits of accounts receivable ledgers, ensuring compliance with financial policies and accuracy of data.

- •Trained and mentored junior team members, boosting team efficiency by 40% and fostering a collaborative work environment.

- •Played a key role in preparing budgets and forecasts, providing insights that informed strategic decision-making.

- •Facilitated month-end closing activities, contributing to the timely delivery of accurate financial reports.

- •Reduced outstanding payment backlog by 18% through proactive client outreach and negotiation.

- •Assisted in implementing an upgraded accounting software system, improving transaction processing speed by 20%.

- •Developed new templates for financial reporting, increasing report generation efficiency and clarity.

- •Monitored accounts receivable metrics, providing actionable insights to management for process improvements.

- •Managed invoicing and collections for over 150 accounts, ensuring timely resolution of discrepancies.

- •Generated monthly financial reports, increasing report accuracy and visibility by implementing data verification steps.

- •Participated in cross-departmental meetings to align accounts receivable strategies with wider business goals.

- •Streamlined document management processes, which resulted in a 15% reduction in document processing time.

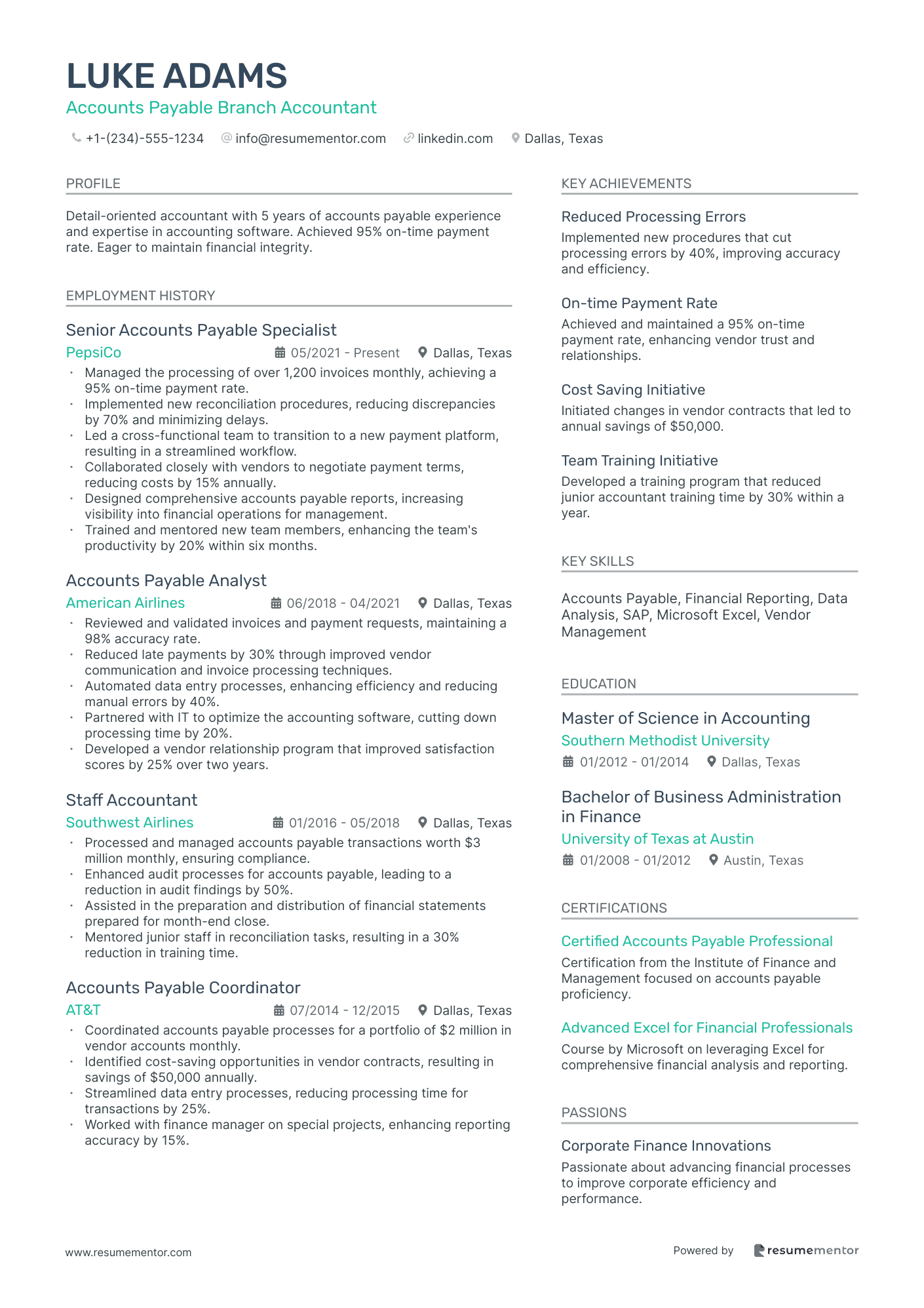

Accounts Payable Branch Accountant resume sample

- •Managed the processing of over 1,200 invoices monthly, achieving a 95% on-time payment rate.

- •Implemented new reconciliation procedures, reducing discrepancies by 70% and minimizing delays.

- •Led a cross-functional team to transition to a new payment platform, resulting in a streamlined workflow.

- •Collaborated closely with vendors to negotiate payment terms, reducing costs by 15% annually.

- •Designed comprehensive accounts payable reports, increasing visibility into financial operations for management.

- •Trained and mentored new team members, enhancing the team's productivity by 20% within six months.

- •Reviewed and validated invoices and payment requests, maintaining a 98% accuracy rate.

- •Reduced late payments by 30% through improved vendor communication and invoice processing techniques.

- •Automated data entry processes, enhancing efficiency and reducing manual errors by 40%.

- •Partnered with IT to optimize the accounting software, cutting down processing time by 20%.

- •Developed a vendor relationship program that improved satisfaction scores by 25% over two years.

- •Processed and managed accounts payable transactions worth $3 million monthly, ensuring compliance.

- •Enhanced audit processes for accounts payable, leading to a reduction in audit findings by 50%.

- •Assisted in the preparation and distribution of financial statements prepared for month-end close.

- •Mentored junior staff in reconciliation tasks, resulting in a 30% reduction in training time.

- •Coordinated accounts payable processes for a portfolio of $2 million in vendor accounts monthly.

- •Identified cost-saving opportunities in vendor contracts, resulting in savings of $50,000 annually.

- •Streamlined data entry processes, reducing processing time for transactions by 25%.

- •Worked with finance manager on special projects, enhancing reporting accuracy by 15%.

Costing Branch Accountant resume sample

- •Prepared and maintained precise product costings, analyzing production data to improve accuracy by 12%.

- •Monitored branch financial performance, implementing cost control measures that increased profitability by 9%.

- •Conducted detailed variance analysis, identifying key discrepancies which resulted in a 15% reduction in forecast errors.

- •Collaborated with cross-functional teams to gather accurate cost inputs, improving costing system efficiency by 20%.

- •Prepared comprehensive monthly and quarterly financial statements, enhancing reporting speed by 25%.

- •Led weekly financial review meetings, driving a 10% increase in cost management effectiveness.

- •Analyzed financial data to drive insightful business decisions, resulting in a 7% boost in operational efficiency.

- •Implemented robust budgeting procedures that decreased deviation from actual costs by 15%.

- •Assisted in the development of strategic financial models, leading to a 20% increase in forecasting accuracy.

- •Enhanced cost-control systems that improved inventory valuation efficiency by 18%.

- •Supported internal audits, facilitating a 10% decrease in audit discrepancies.

- •Reviewed and analyzed branch financial performance to reduce cost inefficiencies by over 15%.

- •Streamlined monthly reporting processes, reducing time spent on financial reporting by 20 hours monthly.

- •Contributed to a team that negotiated supplier contracts, cutting procurement costs by 8%.

- •Coordinated with operations to ensure data accuracy, significantly improving cost reporting integrity.

- •Managed accurate transaction recording to support month-end closing routines, enhancing closing efficiency by 12%.

- •Engaged in cost variance analysis, identifying and explaining significant cost deviations effectively.

- •Supported the compilation of financial reports, fostering more accurate financial oversight.

- •Contributed to cross-departmental projects, aiding the reduction of operational overspending.

Crafting a strong branch accountant resume is like painting a vibrant picture of your career, where balancing your financial skills with the value you offer is key. Your resume serves as a vital tool to express your ability to manage data, analyze trends, and support business decisions. Many branch accountants find that showcasing their talents while making their resume stand out can be quite challenging.

It may feel tricky to present your experience and technical skills in a way that grabs attention, but this is where a resume template comes in handy. A structured format helps you organize your achievements effectively, taking one less worry off your plate. Having a well-organized resume is crucial in a competitive job market, as it ensures that recruiters see your expertise clearly and quickly.

Think of a good template as a valuable roadmap, guiding you to highlight your skills without being tangled in formatting issues. For useful templates to start with, you can explore options here. When you have the right tools, the path to your next role becomes more straightforward.

This guide will teach you to seamlessly present your skills and experience, showing employers just what you can bring to the table. By following simple steps, you can create a resume that truly reflects your strengths as a branch accountant. Let’s get started on building the resume that will open doors to your future.

Key Takeaways

- Choose a chronological format to highlight career progression; modern fonts ensure readability, and saving as a PDF preserves your layout.

- Craft a resume summary emphasizing financial skills, experience, and compatibility with job descriptions while avoiding generic statements.

- Incorporate both hard and soft skills, using them as keywords for ATS systems, and ensure they are relevant, concise, and clear.

- Format the education section to include degree specifics and GPA if strong, aligning qualifications with branch accountant roles.

- Include certificates from reputable organizations, as they enhance credibility and mirror job responsibilities and requirements.

What to focus on when writing your branch accountant resume

Your branch accountant resume must clearly convey your capabilities to recruiters—demonstrating your financial expertise and organizational skills. Highlighting your ability to manage branch accounts, oversee financial reports, and ensure regulatory compliance is key. It's essential to showcase your attention to detail and proficiency in accounting software, as these are crucial for success in this role.

How to structure your branch accountant resume

- Professional Summary—An effective professional summary can set the tone for your resume. This section should offer a snapshot of your experience in branch accounting and financial management. Include details like the total number of years in the field, any leadership roles, and specific industry skills that set you apart. This establishes the foundation of your expertise right from the start.

- Work Experience—Your previous roles should be more than just job titles; they should illustrate your journey in the accounting world. Focus on showcasing responsibilities such as managing branch budgets, preparing financial statements, and handling comprehensive financial operations. Highlight instances where your contributions led to increased efficiency or cost savings within your branch.

- Skills—This section dives deeper into accounting-specific skills. Initially introduced in your professional summary, here you should elaborate on skills like proficiency in QuickBooks, strong analytical abilities, attention to regulatory compliance, and the ability to conduct audits. These skills make you stand out as a branch accountant.

- Education—Your education lays the groundwork for your professional abilities. Include degrees in accounting or finance, and highlight relevant coursework that complements your job function. Mention certifications like CPA to showcase recognized expertise and commitment to professional growth.

- Certifications—Industry-specific certifications such as Certified Management Accountant (CMA) are crucial in proving your commitment to the field. These credentials validate your specialized skills and can effectively distinguish you from other candidates.

- Technical Proficiency—This section highlights your adaptability to modern accounting environments. Mention your familiarity with financial software tools such as Excel, SAP, or Oracle Financials. Proficiency with these systems demonstrates your technical capabilities and efficiency in managing complex financial data.

Moving forward, it is crucial to focus on resume format, ensuring your document is organized and easy to navigate. Below, we'll cover each essential section in more depth to refine your resume and make it stand out.

Which resume format to choose

Your branch accountant resume should seamlessly highlight your skills and experience, beginning with a chronological format. This format is ideal because it accentuates your career progression and stability, which are highly valued in the accounting field. Choose a modern font like Raleway, Lato, or Montserrat; these options not only convey a contemporary feel but also maintain readability, an important aspect when presenting detailed financial information. Saving your resume as a PDF is crucial, as it preserves your layout across all devices, ensuring that potential employers see your document exactly as you intended. Keep the margins at 1 inch on all sides; this standard spacing provides a structured and organized appearance that helps guide the reader's eye smoothly through your qualifications. By thoughtfully integrating each of these elements, you ensure that your resume stands out to potential employers, effectively communicating your readiness for a branch accountant role.

How to write a quantifiable resume experience section

The experience section of your branch accountant resume is a crucial element for making a meaningful impression. It not only highlights your job skills but also quantifies your achievements and aligns your history with the specific job you're targeting. To create a seamless flow, start by placing your most recent relevant experience at the top and work backward chronologically. Focus on the past 10-15 years, unless older experiences are extremely relevant. Tailoring your resume to the job description becomes vital here, so use keywords directly from the job ad. This approach ensures your skills as a branch accountant are clearly communicated. Incorporating action verbs such as “managed,” “optimized,” “reduced,” and “led” can effectively convey a proactive image, enhancing the overall narrative of your experience section.

To make your experience stand out, the key lies in focusing on quantifiable achievements. Share concrete examples of what you did and the measurable results you achieved, using numbers, percentages, and figures to support your claims. Including job titles that resonate with the position you're pursuing can further solidify your alignment with industry standards, sometimes requiring adjustments to previous titles.

- •Managed financial statement preparation, improving efficiency by 25% through streamlined processes.

- •Reduced discrepancies by 30% by implementing a new internal audit procedure across all transactions.

- •Led a team of 5, achieving a 40% reduction in month-end closing time through collaborative effort enhancements.

- •Optimized budget forecasts, contributing to a 15% increase in branch revenue year-over-year.

This experience section stands out because it seamlessly outlines your achievements, offering a clear picture of your impact as a branch accountant. With each bullet point, you effectively showcase your ability to improve processes and lead a team successfully. These points make it easy for potential employers to grasp your value instantly. Tailoring this section to match the branch accountant role with relevant action words and quantifiable outcomes highlights your expertise in a way that connects perfectly with industry expectations.

Customer-Focused resume experience section

A customer-focused branch accountant resume experience section should highlight how effectively you balance meeting customer needs with managing financial operations. Begin by showing how your accounting skills have played a role in boosting customer satisfaction. Demonstrate any specific processes or initiatives you’ve implemented that directly enhanced the customer experience, emphasizing the critical role of communication. By displaying how you collaborate with both customers and colleagues, you underline your ability to ensure a seamless workflow and strong working relationships.

Each bullet point should seamlessly connect to the next, clearly depicting your overarching customer-centric approach. Use action-oriented language and detail specific accomplishments that illustrate your contributions. Quantifying your achievements wherever possible provides a tangible sense of your impact, effortlessly connecting the dots between your actions and customer benefits. This cohesive narrative highlights not only what you have achieved but also how these efforts have directly responded to and fulfilled customer needs.

Branch Accountant

ABC Financial Services

June 2018 - Present

- Elevated customer satisfaction scores by 20% through more efficient accounting procedures.

- Created financial reports that offered clients clearer insights into their accounts.

- Worked closely with customer service teams to resolve accounting issues quickly, cutting resolution time by 30%.

- Introduced a new system that reduced billing errors by 15%, bolstering customer trust.

Growth-Focused resume experience section

A growth-focused branch accountant resume experience section should spotlight achievements that demonstrate how you’ve fueled the company’s expansion and financial efficiency. Begin by clearly defining the role’s main focus to immediately capture the hiring manager’s interest. Incorporate numbers, percentages, and specific examples to paint a vivid picture of your impact, making it easy for potential employers to see the value you bring. As you highlight your achievements, weave in skills essential for growth-focused roles, such as analytical thinking, strategic planning, and financial forecasting. Craft each bullet point to not only present these skills but also to showcase your unique accomplishments. This cohesive approach ensures your experience section not only tells of your past work but also illustrates your ability to drive financial growth and stability.

Branch Accountant

ABC Financial Services

June 2018 - Present

- Boosted branch revenue by 25% over two years through crafty cost-control measures and smart financial strategies.

- Streamlined budget processes, cutting unnecessary expenditures by 15% without compromising on quality.

- Created a financial forecasting model, enhancing the accuracy of budget predictions and aiding long-term planning.

- Led a team to launch a new financial system, bumping up reporting efficiency by 30%.

Technology-Focused resume experience section

A technology-focused branch accountant resume experience section should seamlessly showcase how you leverage technology to enhance financial operations. Start by reflecting on aspects of your role where tech was integral. For instance, did you successfully implement new software or streamline existing tools? By highlighting quantitative results, such as a 25% increase in efficiency or a 30% reduction in report generation time, you can effectively demonstrate the value of your tech skills. Clearly explain how these skills positively influenced your company's financial processes and led to strategic improvements.

Structuring this section is key. Begin with the dates and your job title, followed by a concise summary of your role and achievements. Use bullet points to list specific tasks, the technologies you used, and the results you achieved. This structure allows potential employers to easily grasp how you can make a positive impact by improving their financial systems with technology. Keep a focus on clarity, brevity, and quantifiable outcomes to make your experience compelling.

Branch Accountant

ABC Financial Services

June 2020 - Present

- Implemented a cloud-based accounting system that increased efficiency by 25%

- Developed automated financial reporting tools, reducing monthly close time by 30%

- Trained team members on new software, enhancing team productivity

- Analyzed data trends to forecast fiscal needs, informing strategic decision-making

Project-Focused resume experience section

A project-focused branch accountant resume experience section should clearly showcase your impact and contributions through specific projects. Begin by noting the time frame and the types of initiatives you led or participated in. It’s essential to describe how your efforts improved branch operations, either by saving money, boosting efficiency, or enhancing processes. Highlight your achievements with measurable results, like tangible financial savings or increased accuracy in reporting.

Use bullet points to maintain clarity and let each point flow seamlessly from the last. Start each bullet with a strong action verb to effectively communicate your role. Illustrate your problem-solving abilities, adeptness with accounting software, and commitment to compliance with financial regulations. Use these points to demonstrate your collaborative skills by mentioning teamwork with colleagues or external partners. This cohesive approach helps potential employers see the strong value you add to their team.

Branch Accountant

ABC Financial Services

June 2018 - August 2023

- Led the redesign of the branch’s financial reporting system, which improved accuracy and reduced processing time by 25%.

- Partnered with branch managers to discover and implement cost-saving measures, leading to $50,000 in annual savings.

- Boosted payroll processing efficiency by 30% through the integration of new accounting software.

- Collaborated with the compliance team to align all financial practices with federal and state regulations, enhancing audit readiness.

Write your branch accountant resume summary section

A branch accountant-focused resume summary should highlight your strengths and experiences clearly and concisely. This part of your resume acts as the first impression for potential employers. If you're aiming for a branch accountant role, emphasize your financial skills, attention to detail, and account management capabilities. For example:

This example effectively consolidates the candidate's experience and skills into an engaging snapshot. It presents key achievements and capabilities in a way that draws interest to the rest of the resume. Highlight relevant projects and skills without unnecessary details, and avoid generic statements. A well-crafted resume summary inspires confidence and motivates employers to read further.

When describing yourself, make sure your achievements and skills align with the job description. It's also essential to understand the distinctions between a resume summary, objective, profile, and summary of qualifications. A resume summary provides an overview of your skills and experience, while an objective focuses on your career goals, often for entry-level or career-changing candidates. A resume profile is similar to a summary but generally offers more detail. On the other hand, a summary of qualifications is a bulleted list highlighting key accomplishments. Knowing which section best suits your situation ensures you make a strong and effective introduction.

Listing your branch accountant skills on your resume

A skills-focused branch accountant resume should effectively showcase both your technical abilities and interpersonal strengths. When creating your skills section, you have the option to present it independently or weave it into your experience and summary. Begin with highlighting your strengths and soft skills, which encompass interpersonal abilities like communication and teamwork. Transitioning to hard skills, these are your technical competencies such as financial analysis or bookkeeping, vital for the role. Both types of skills serve as crucial resume keywords that enhance your chance of passing automated resume screening systems.

Using skills as resume keywords is strategic, helping your application catch the eye of hiring managers while highlighting your expertise and adaptability. Focusing on key competencies relevant to a branch accountant role will make your skills section both comprehensive and clear.

This standalone skills section is particularly effective as it succinctly lists the competencies that are crucial for a branch accountant. Using specific industry-relevant terms ensures easy scanning by hiring managers and passing the ATS checks, all while focusing on the most important abilities, keeping the section both concise and informative.

Best hard skills to feature on your branch accountant resume

For accounting professionals, hard skills are a testament to your technical prowess in managing financial tasks. These skills reflect your accuracy, efficiency, and ability to handle financial data with precision.

Hard Skills

- Financial Forecasting

- Profit and Loss Analysis

- Ledger Management

- Financial Software Proficiency

- Accounting Principles

- Budget Planning

- Risk Assessment

- Inventory Management

- Payroll Processing

- Audit Preparedness

- Financial Modeling

- Cost Control

- Credit Management

- Mergers and Acquisitions

- Cash Flow Management

Best soft skills to feature on your branch accountant resume

Soft skills are equally important as they highlight your capacity to work collaboratively and manage tasks effectively. They showcase your strengths in areas like communication, problem-solving, and teamwork, essential for a well-rounded branch accountant.

Soft Skills

- Attention to Detail

- Problem Solving

- Time Management

- Strong Communication

- Adaptability

- Team Collaboration

- Leadership

- Critical Thinking

- Organizational Skills

- Customer Service

- Conflict Resolution

- Ethics and Integrity

- Decision Making

- Initiative

- Stress Management

How to include your education on your resume

The education section on your resume is essential, especially when applying for a position such as a branch accountant. This part of your resume tells employers about your qualifications and shows you have the knowledge for the role. Tailor your education section to match the job you want, leaving out anything unrelated. When listing your degree, include the full name of the degree and the institution, and don't forget to add honors like cum laude if applicable. If your GPA is strong, include it, but make sure you provide the scale, such as 3.7/4.0. Here’s how you can format this section well.

The second example is effective because it specifically highlights education relevant to a branch accountant role. The degree in accounting shows specific preparation for the field. Listing "Cum Laude" boosts your candidacy by showcasing academic excellence. Additionally, including a high GPA with a clear scale reflects your strong performance. Using a clear, concise format helps employers quickly see your qualifications. These details position you as a knowledgeable and capable candidate for a branch accountant role.

How to include branch accountant certificates on your resume

Including a certificates section in your branch accountant resume is crucial. Certificates demonstrate your commitment to professional development and validate your credentials. List the name of each certificate, include the date you obtained it, and add the issuing organization. You can also include certificates in the header of your resume. For example, “Certified Public Accountant (CPA), Issued by the AICPA.”

Here is a practical example to follow. The certificates listed should align closely with the responsibilities and requirements of a branch accountant role. Doing so showcases your qualifications effectively.

This example is good because it includes highly relevant and respected certifications. The titles are specific and the issuing organizations are reputable. The certificates are directly related to the core skills and responsibilities of a branch accountant, thereby enhancing the credibility of your resume.

Extra sections to include in your branch accountant resume

Creating a strong resume for a branch accountant can boost your chances of landing a rewarding job. Your resume should present your skills, experience, and special qualifications in a clear and engaging manner to grab the attention of hiring managers.

Language section —List any languages you speak in addition to English. Highlighting language skills can show you're versatile and can handle a diverse customer base.

Hobbies and interests section —Share hobbies that relate to the job, like financial literacy or puzzles. Demonstrating interests that build relevant skills can make you appear more well-rounded.

Volunteer work section —Include any volunteer roles where you managed budgets or organized events, such as treasurer for a non-profit. Volunteer work can show your commitment and willingness to give back, valuable traits for an accountant.

Books section —Mention books on finance or accounting that you've read, such as "Financial Shenanigans" by Howard Schilit. Showing your dedication to learning through books can boost your credibility and portray you as a dedicated professional.

In Conclusion

In conclusion, crafting a branch accountant resume requires a thoughtful blend of showcasing your skills and structuring the resume to highlight your experiences effectively. A well-prepared resume serves as your personal marketing tool, capturing the essence of your qualifications and career achievements. By opting for a structured format and using a resume template, you can focus on presenting your abilities rather than getting bogged down by layout concerns. Emphasize your strengths in managing financial operations, attention to detail, and proficiency with accounting software, all crucial for thriving in this career. Incorporate quantifiable results in your experiences section to highlight your contributions in concrete terms, demonstrating your impact in previous roles. Just as importantly, your resume should provide a concise education background, underscoring your academic preparedness for the responsibilities of a branch accountant. Certifications can further bolster your qualifications, validating your skills and commitment to the field. Additional sections, like language skills or relevant volunteer work, can offer a more rounded view of your capabilities and interests. By ensuring each component of your resume is meticulously crafted and relevant to the position, you enhance your visibility to potential employers, paving the way for career advancement in branch accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.