Budget Analyst Resume Examples

Jul 18, 2024

|

12 min read

Crafting your budget analyst resume: balance your skills, experience, and achievements to make cents to employers.

Rated by 348 people

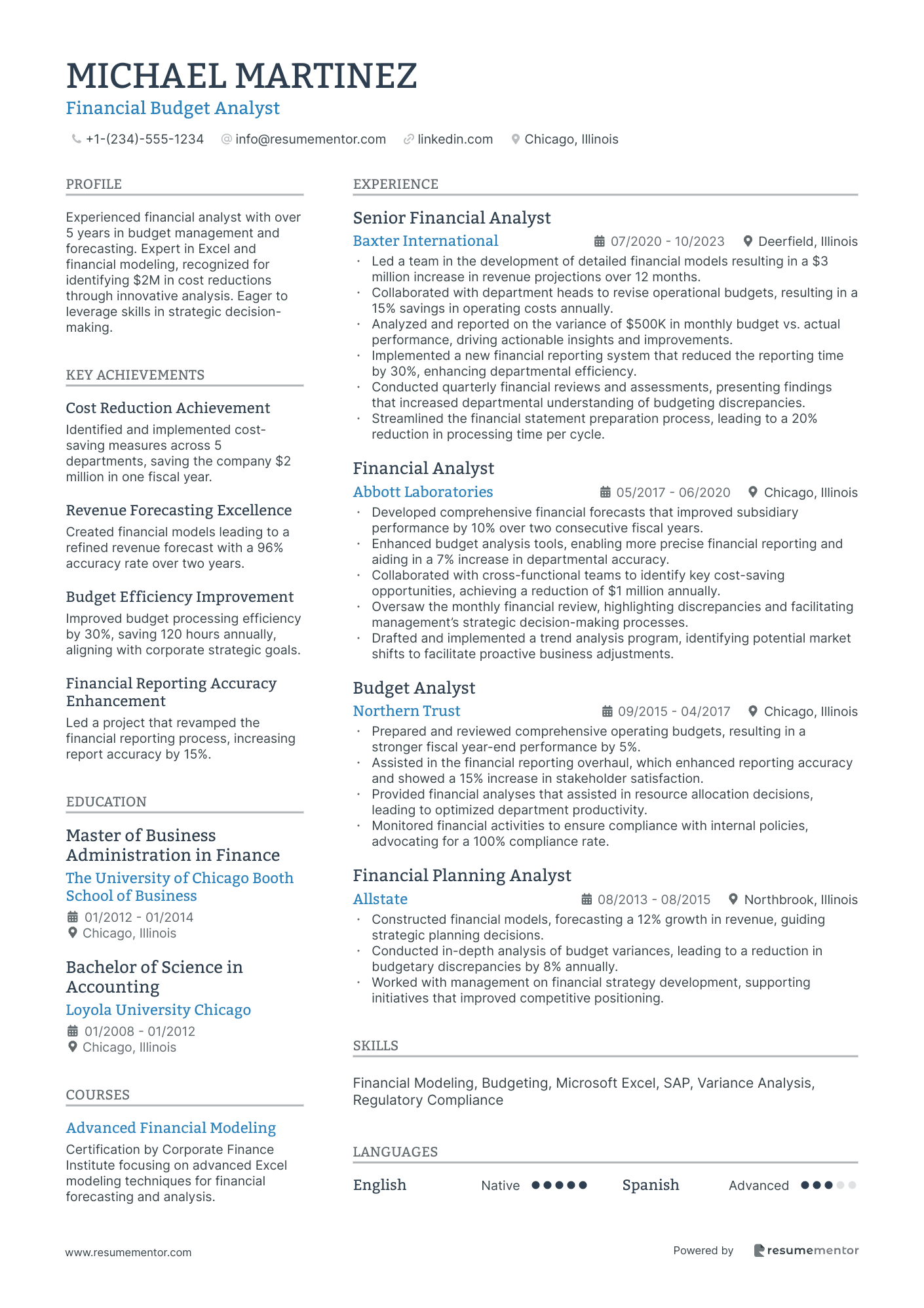

Financial Budget Analyst

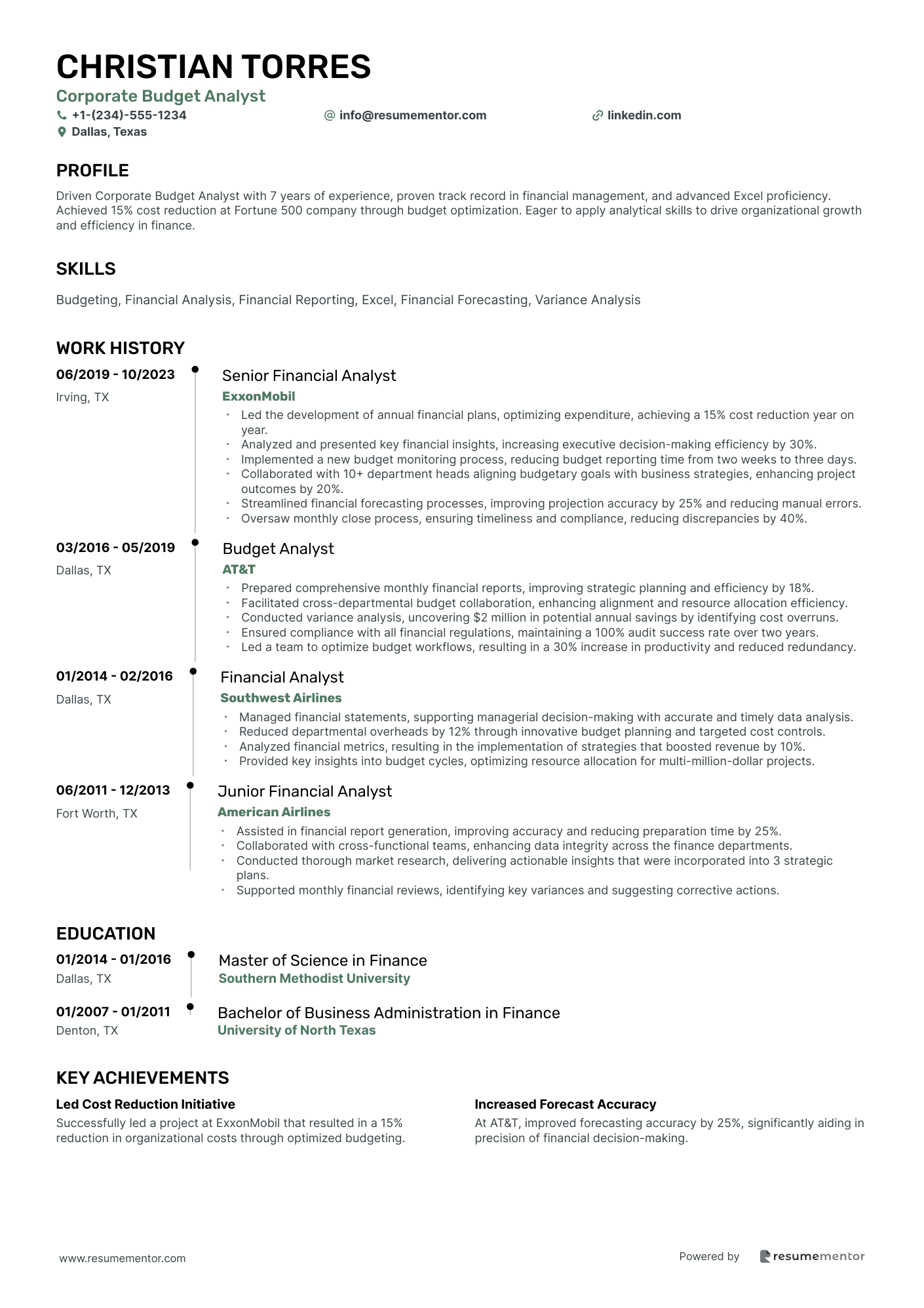

Corporate Budget Analyst

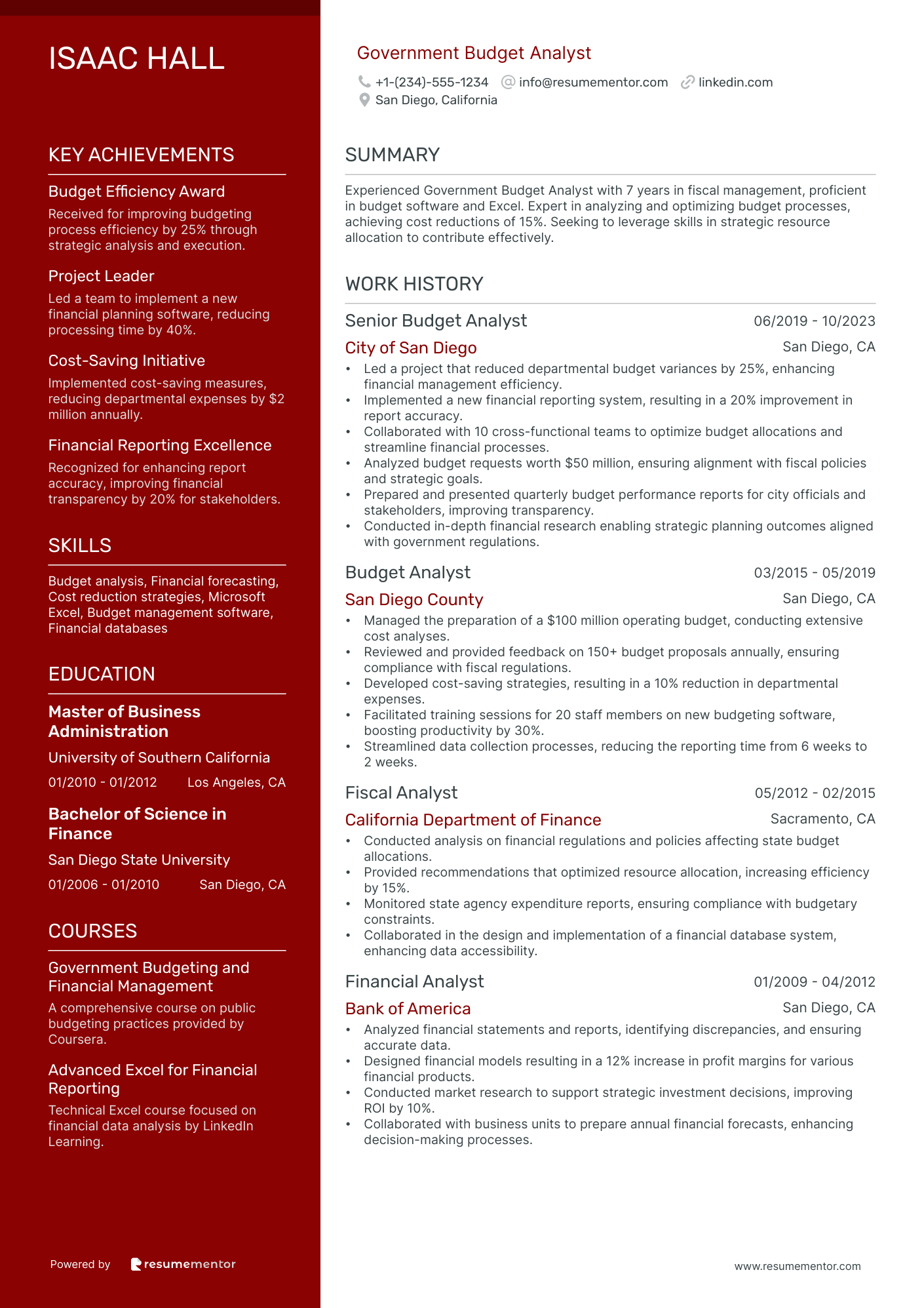

Government Budget Analyst

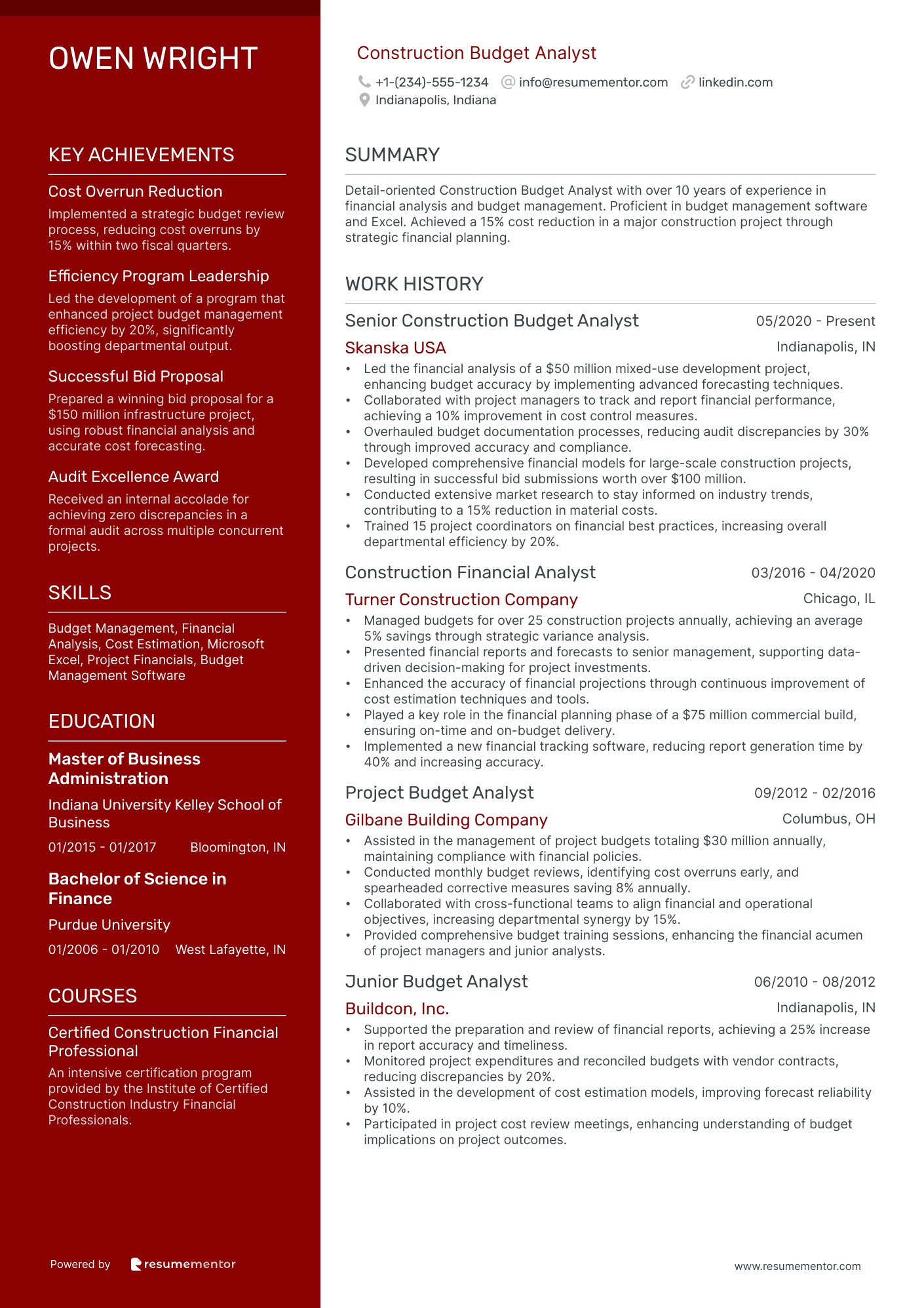

Construction Budget Analyst

Healthcare Budget Analyst

Education Budget Analyst

Retail Budget Analyst

Non-Profit Budget Analyst

Capital Budgeting Analyst

IT Budget Analyst

Financial Budget Analyst resume sample

- •Led a team in the development of detailed financial models resulting in a $3 million increase in revenue projections over 12 months.

- •Collaborated with department heads to revise operational budgets, resulting in a 15% savings in operating costs annually.

- •Analyzed and reported on the variance of $500K in monthly budget vs. actual performance, driving actionable insights and improvements.

- •Implemented a new financial reporting system that reduced the reporting time by 30%, enhancing departmental efficiency.

- •Conducted quarterly financial reviews and assessments, presenting findings that increased departmental understanding of budgeting discrepancies.

- •Streamlined the financial statement preparation process, leading to a 20% reduction in processing time per cycle.

- •Developed comprehensive financial forecasts that improved subsidiary performance by 10% over two consecutive fiscal years.

- •Enhanced budget analysis tools, enabling more precise financial reporting and aiding in a 7% increase in departmental accuracy.

- •Collaborated with cross-functional teams to identify key cost-saving opportunities, achieving a reduction of $1 million annually.

- •Oversaw the monthly financial review, highlighting discrepancies and facilitating management’s strategic decision-making processes.

- •Drafted and implemented a trend analysis program, identifying potential market shifts to facilitate proactive business adjustments.

- •Prepared and reviewed comprehensive operating budgets, resulting in a stronger fiscal year-end performance by 5%.

- •Assisted in the financial reporting overhaul, which enhanced reporting accuracy and showed a 15% increase in stakeholder satisfaction.

- •Provided financial analyses that assisted in resource allocation decisions, leading to optimized department productivity.

- •Monitored financial activities to ensure compliance with internal policies, advocating for a 100% compliance rate.

- •Constructed financial models, forecasting a 12% growth in revenue, guiding strategic planning decisions.

- •Conducted in-depth analysis of budget variances, leading to a reduction in budgetary discrepancies by 8% annually.

- •Worked with management on financial strategy development, supporting initiatives that improved competitive positioning.

Corporate Budget Analyst resume sample

- •Led the development of annual financial plans, optimizing expenditure, achieving a 15% cost reduction year on year.

- •Analyzed and presented key financial insights, increasing executive decision-making efficiency by 30%.

- •Implemented a new budget monitoring process, reducing budget reporting time from two weeks to three days.

- •Collaborated with 10+ department heads aligning budgetary goals with business strategies, enhancing project outcomes by 20%.

- •Streamlined financial forecasting processes, improving projection accuracy by 25% and reducing manual errors.

- •Oversaw monthly close process, ensuring timeliness and compliance, reducing discrepancies by 40%.

- •Prepared comprehensive monthly financial reports, improving strategic planning and efficiency by 18%.

- •Facilitated cross-departmental budget collaboration, enhancing alignment and resource allocation efficiency.

- •Conducted variance analysis, uncovering $2 million in potential annual savings by identifying cost overruns.

- •Ensured compliance with all financial regulations, maintaining a 100% audit success rate over two years.

- •Led a team to optimize budget workflows, resulting in a 30% increase in productivity and reduced redundancy.

- •Managed financial statements, supporting managerial decision-making with accurate and timely data analysis.

- •Reduced departmental overheads by 12% through innovative budget planning and targeted cost controls.

- •Analyzed financial metrics, resulting in the implementation of strategies that boosted revenue by 10%.

- •Provided key insights into budget cycles, optimizing resource allocation for multi-million-dollar projects.

- •Assisted in financial report generation, improving accuracy and reducing preparation time by 25%.

- •Collaborated with cross-functional teams, enhancing data integrity across the finance departments.

- •Conducted thorough market research, delivering actionable insights that were incorporated into 3 strategic plans.

- •Supported monthly financial reviews, identifying key variances and suggesting corrective actions.

Government Budget Analyst resume sample

- •Led a project that reduced departmental budget variances by 25%, enhancing financial management efficiency.

- •Implemented a new financial reporting system, resulting in a 20% improvement in report accuracy.

- •Collaborated with 10 cross-functional teams to optimize budget allocations and streamline financial processes.

- •Analyzed budget requests worth $50 million, ensuring alignment with fiscal policies and strategic goals.

- •Prepared and presented quarterly budget performance reports for city officials and stakeholders, improving transparency.

- •Conducted in-depth financial research enabling strategic planning outcomes aligned with government regulations.

- •Managed the preparation of a $100 million operating budget, conducting extensive cost analyses.

- •Reviewed and provided feedback on 150+ budget proposals annually, ensuring compliance with fiscal regulations.

- •Developed cost-saving strategies, resulting in a 10% reduction in departmental expenses.

- •Facilitated training sessions for 20 staff members on new budgeting software, boosting productivity by 30%.

- •Streamlined data collection processes, reducing the reporting time from 6 weeks to 2 weeks.

- •Conducted analysis on financial regulations and policies affecting state budget allocations.

- •Provided recommendations that optimized resource allocation, increasing efficiency by 15%.

- •Monitored state agency expenditure reports, ensuring compliance with budgetary constraints.

- •Collaborated in the design and implementation of a financial database system, enhancing data accessibility.

- •Analyzed financial statements and reports, identifying discrepancies, and ensuring accurate data.

- •Designed financial models resulting in a 12% increase in profit margins for various financial products.

- •Conducted market research to support strategic investment decisions, improving ROI by 10%.

- •Collaborated with business units to prepare annual financial forecasts, enhancing decision-making processes.

Construction Budget Analyst resume sample

- •Led the financial analysis of a $50 million mixed-use development project, enhancing budget accuracy by implementing advanced forecasting techniques.

- •Collaborated with project managers to track and report financial performance, achieving a 10% improvement in cost control measures.

- •Overhauled budget documentation processes, reducing audit discrepancies by 30% through improved accuracy and compliance.

- •Developed comprehensive financial models for large-scale construction projects, resulting in successful bid submissions worth over $100 million.

- •Conducted extensive market research to stay informed on industry trends, contributing to a 15% reduction in material costs.

- •Trained 15 project coordinators on financial best practices, increasing overall departmental efficiency by 20%.

- •Managed budgets for over 25 construction projects annually, achieving an average 5% savings through strategic variance analysis.

- •Presented financial reports and forecasts to senior management, supporting data-driven decision-making for project investments.

- •Enhanced the accuracy of financial projections through continuous improvement of cost estimation techniques and tools.

- •Played a key role in the financial planning phase of a $75 million commercial build, ensuring on-time and on-budget delivery.

- •Implemented a new financial tracking software, reducing report generation time by 40% and increasing accuracy.

- •Assisted in the management of project budgets totaling $30 million annually, maintaining compliance with financial policies.

- •Conducted monthly budget reviews, identifying cost overruns early, and spearheaded corrective measures saving 8% annually.

- •Collaborated with cross-functional teams to align financial and operational objectives, increasing departmental synergy by 15%.

- •Provided comprehensive budget training sessions, enhancing the financial acumen of project managers and junior analysts.

- •Supported the preparation and review of financial reports, achieving a 25% increase in report accuracy and timeliness.

- •Monitored project expenditures and reconciled budgets with vendor contracts, reducing discrepancies by 20%.

- •Assisted in the development of cost estimation models, improving forecast reliability by 10%.

- •Participated in project cost review meetings, enhancing understanding of budget implications on project outcomes.

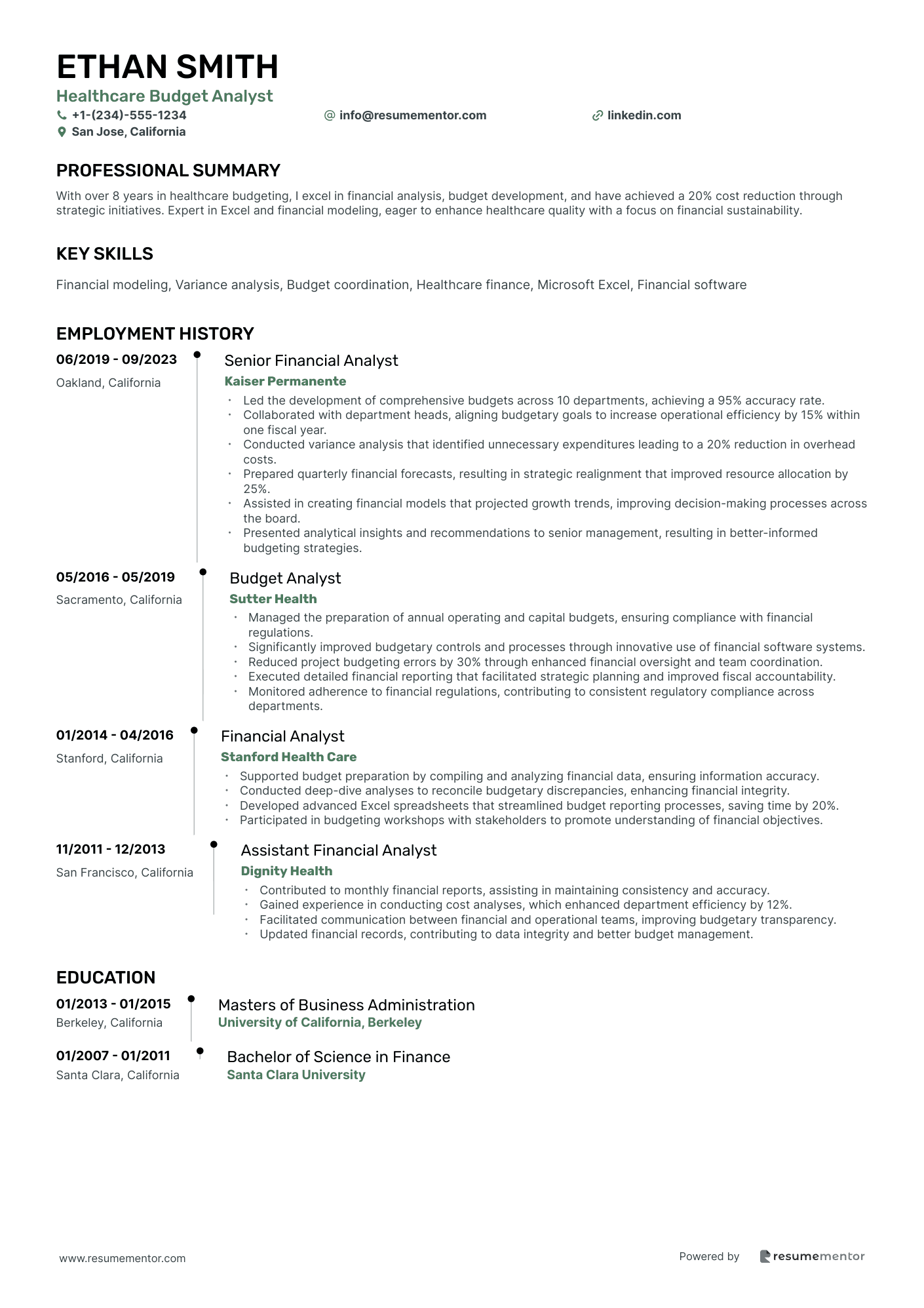

Healthcare Budget Analyst resume sample

- •Led the development of comprehensive budgets across 10 departments, achieving a 95% accuracy rate.

- •Collaborated with department heads, aligning budgetary goals to increase operational efficiency by 15% within one fiscal year.

- •Conducted variance analysis that identified unnecessary expenditures leading to a 20% reduction in overhead costs.

- •Prepared quarterly financial forecasts, resulting in strategic realignment that improved resource allocation by 25%.

- •Assisted in creating financial models that projected growth trends, improving decision-making processes across the board.

- •Presented analytical insights and recommendations to senior management, resulting in better-informed budgeting strategies.

- •Managed the preparation of annual operating and capital budgets, ensuring compliance with financial regulations.

- •Significantly improved budgetary controls and processes through innovative use of financial software systems.

- •Reduced project budgeting errors by 30% through enhanced financial oversight and team coordination.

- •Executed detailed financial reporting that facilitated strategic planning and improved fiscal accountability.

- •Monitored adherence to financial regulations, contributing to consistent regulatory compliance across departments.

- •Supported budget preparation by compiling and analyzing financial data, ensuring information accuracy.

- •Conducted deep-dive analyses to reconcile budgetary discrepancies, enhancing financial integrity.

- •Developed advanced Excel spreadsheets that streamlined budget reporting processes, saving time by 20%.

- •Participated in budgeting workshops with stakeholders to promote understanding of financial objectives.

- •Contributed to monthly financial reports, assisting in maintaining consistency and accuracy.

- •Gained experience in conducting cost analyses, which enhanced department efficiency by 12%.

- •Facilitated communication between financial and operational teams, improving budgetary transparency.

- •Updated financial records, contributing to data integrity and better budget management.

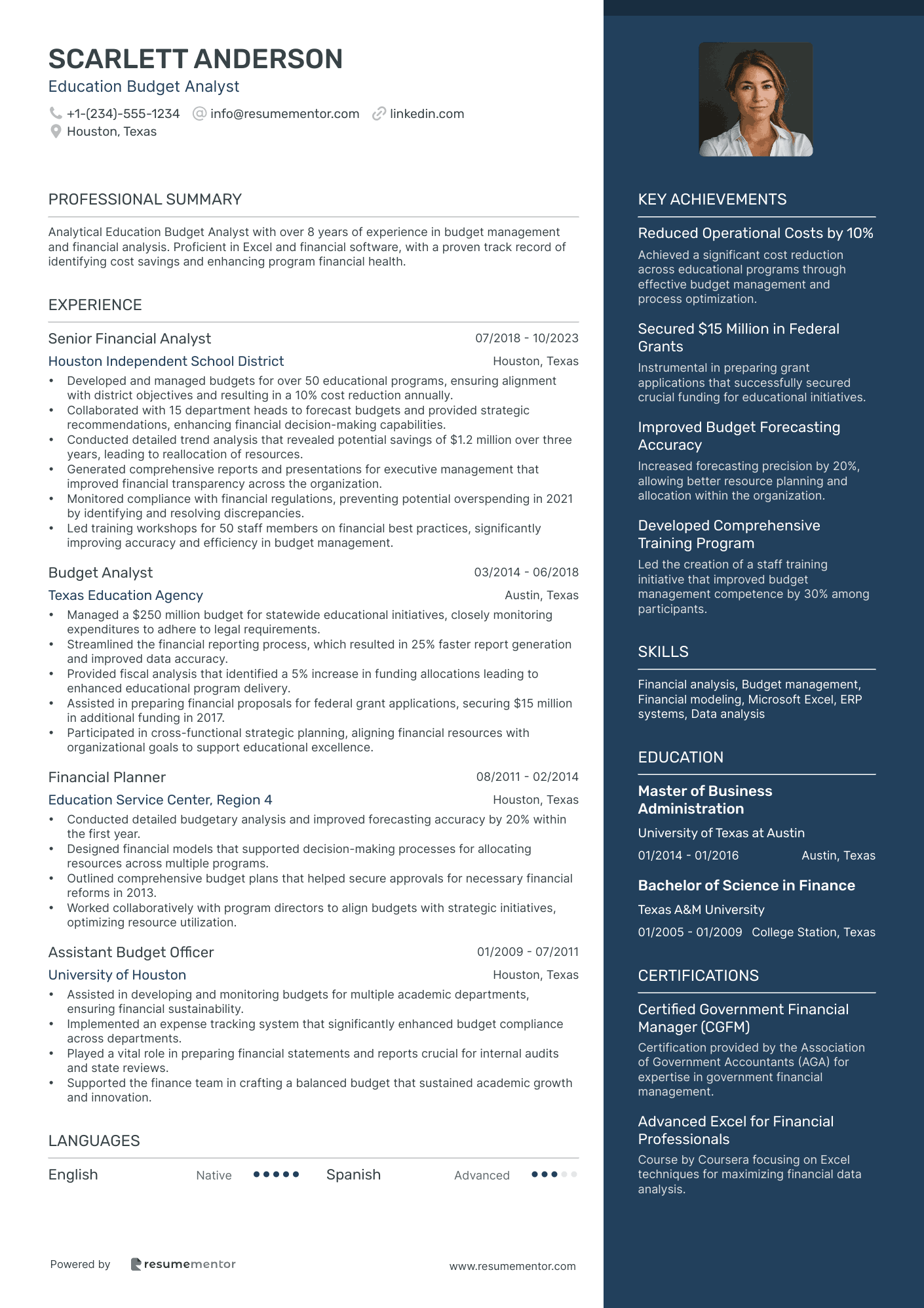

Education Budget Analyst resume sample

- •Developed and managed budgets for over 50 educational programs, ensuring alignment with district objectives and resulting in a 10% cost reduction annually.

- •Collaborated with 15 department heads to forecast budgets and provided strategic recommendations, enhancing financial decision-making capabilities.

- •Conducted detailed trend analysis that revealed potential savings of $1.2 million over three years, leading to reallocation of resources.

- •Generated comprehensive reports and presentations for executive management that improved financial transparency across the organization.

- •Monitored compliance with financial regulations, preventing potential overspending in 2021 by identifying and resolving discrepancies.

- •Led training workshops for 50 staff members on financial best practices, significantly improving accuracy and efficiency in budget management.

- •Managed a $250 million budget for statewide educational initiatives, closely monitoring expenditures to adhere to legal requirements.

- •Streamlined the financial reporting process, which resulted in 25% faster report generation and improved data accuracy.

- •Provided fiscal analysis that identified a 5% increase in funding allocations leading to enhanced educational program delivery.

- •Assisted in preparing financial proposals for federal grant applications, securing $15 million in additional funding in 2017.

- •Participated in cross-functional strategic planning, aligning financial resources with organizational goals to support educational excellence.

- •Conducted detailed budgetary analysis and improved forecasting accuracy by 20% within the first year.

- •Designed financial models that supported decision-making processes for allocating resources across multiple programs.

- •Outlined comprehensive budget plans that helped secure approvals for necessary financial reforms in 2013.

- •Worked collaboratively with program directors to align budgets with strategic initiatives, optimizing resource utilization.

- •Assisted in developing and monitoring budgets for multiple academic departments, ensuring financial sustainability.

- •Implemented an expense tracking system that significantly enhanced budget compliance across departments.

- •Played a vital role in preparing financial statements and reports crucial for internal audits and state reviews.

- •Supported the finance team in crafting a balanced budget that sustained academic growth and innovation.

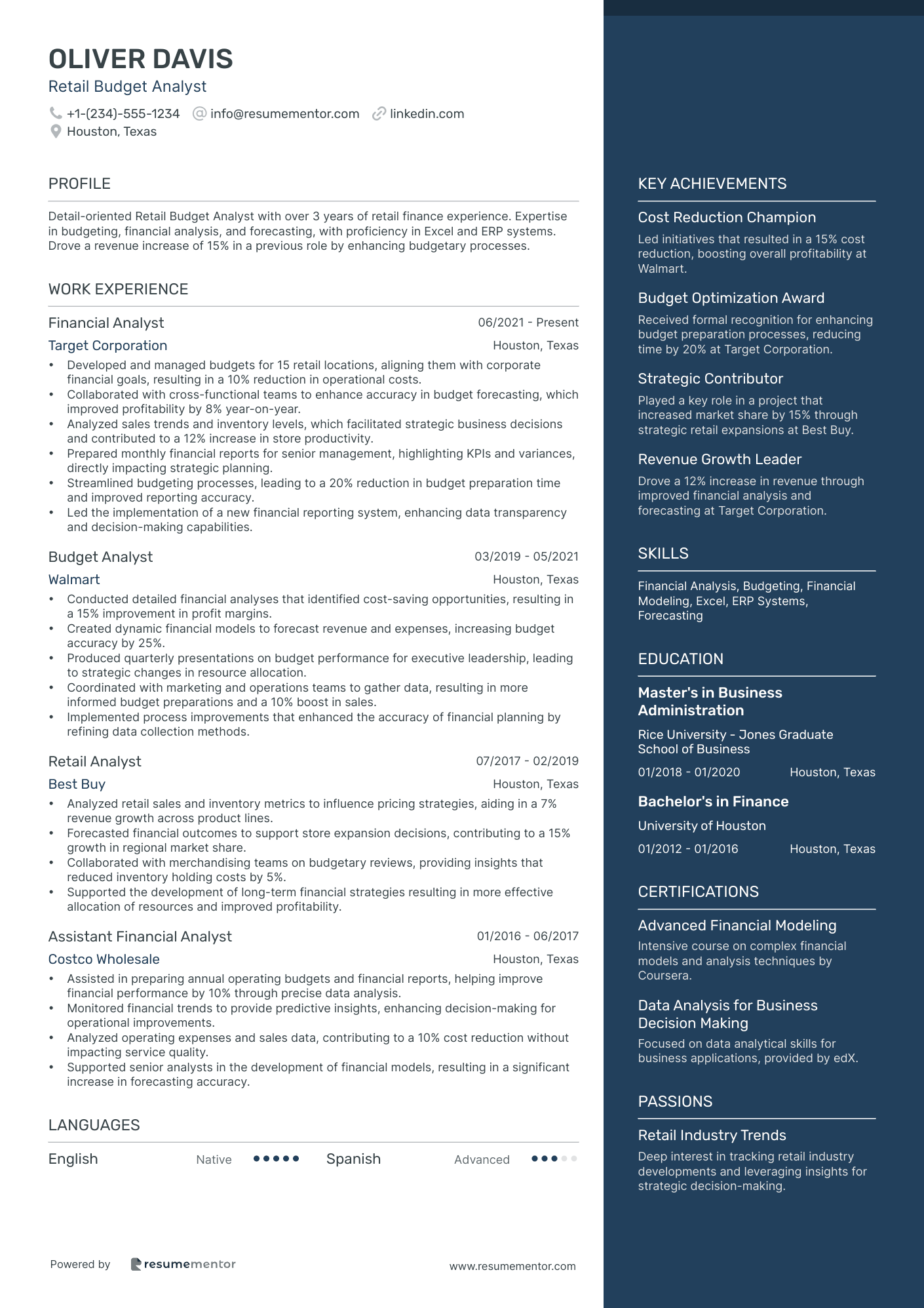

Retail Budget Analyst resume sample

- •Developed and managed budgets for 15 retail locations, aligning them with corporate financial goals, resulting in a 10% reduction in operational costs.

- •Collaborated with cross-functional teams to enhance accuracy in budget forecasting, which improved profitability by 8% year-on-year.

- •Analyzed sales trends and inventory levels, which facilitated strategic business decisions and contributed to a 12% increase in store productivity.

- •Prepared monthly financial reports for senior management, highlighting KPIs and variances, directly impacting strategic planning.

- •Streamlined budgeting processes, leading to a 20% reduction in budget preparation time and improved reporting accuracy.

- •Led the implementation of a new financial reporting system, enhancing data transparency and decision-making capabilities.

- •Conducted detailed financial analyses that identified cost-saving opportunities, resulting in a 15% improvement in profit margins.

- •Created dynamic financial models to forecast revenue and expenses, increasing budget accuracy by 25%.

- •Produced quarterly presentations on budget performance for executive leadership, leading to strategic changes in resource allocation.

- •Coordinated with marketing and operations teams to gather data, resulting in more informed budget preparations and a 10% boost in sales.

- •Implemented process improvements that enhanced the accuracy of financial planning by refining data collection methods.

- •Analyzed retail sales and inventory metrics to influence pricing strategies, aiding in a 7% revenue growth across product lines.

- •Forecasted financial outcomes to support store expansion decisions, contributing to a 15% growth in regional market share.

- •Collaborated with merchandising teams on budgetary reviews, providing insights that reduced inventory holding costs by 5%.

- •Supported the development of long-term financial strategies resulting in more effective allocation of resources and improved profitability.

- •Assisted in preparing annual operating budgets and financial reports, helping improve financial performance by 10% through precise data analysis.

- •Monitored financial trends to provide predictive insights, enhancing decision-making for operational improvements.

- •Analyzed operating expenses and sales data, contributing to a 10% cost reduction without impacting service quality.

- •Supported senior analysts in the development of financial models, resulting in a significant increase in forecasting accuracy.

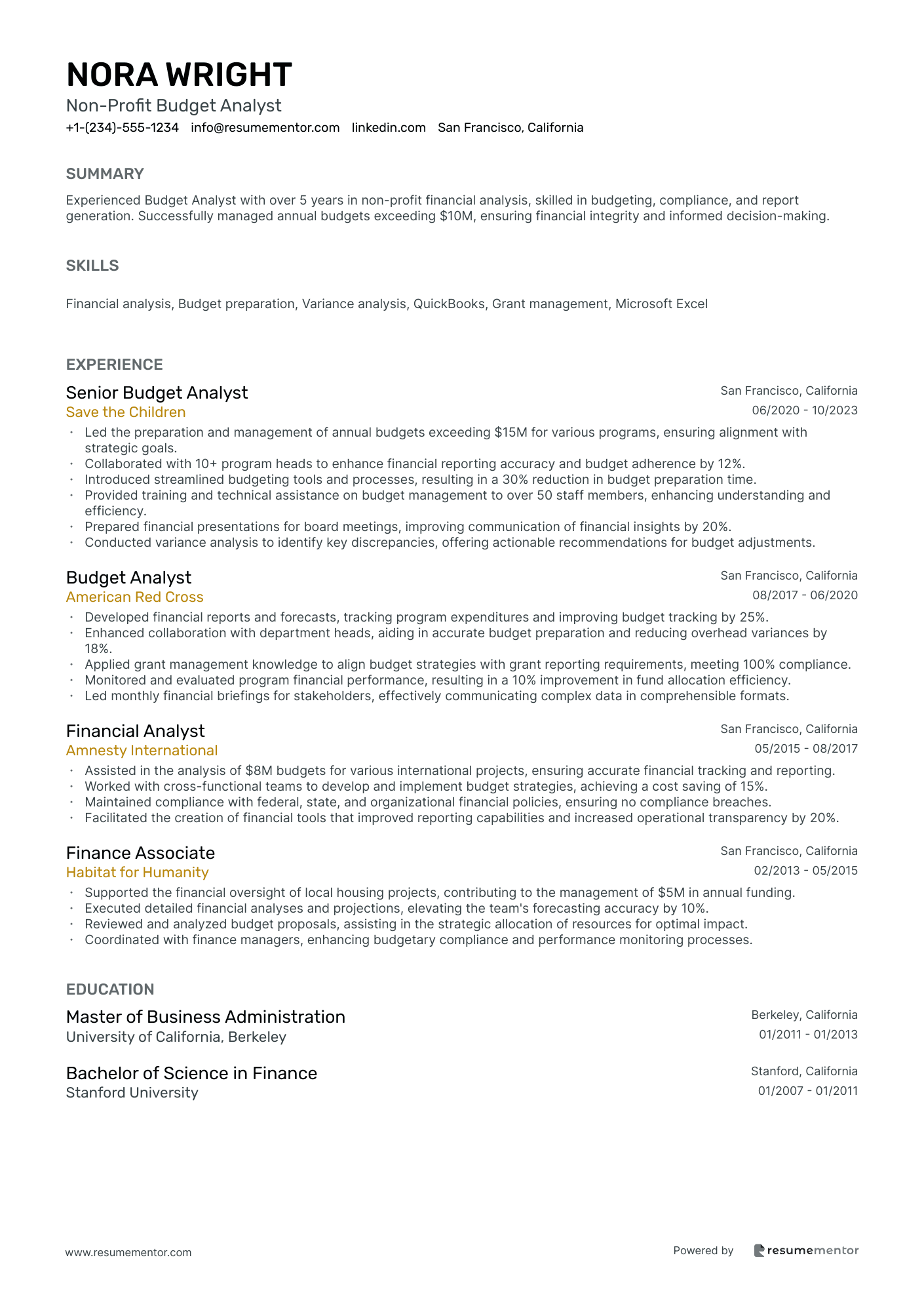

Non-Profit Budget Analyst resume sample

- •Led the preparation and management of annual budgets exceeding $15M for various programs, ensuring alignment with strategic goals.

- •Collaborated with 10+ program heads to enhance financial reporting accuracy and budget adherence by 12%.

- •Introduced streamlined budgeting tools and processes, resulting in a 30% reduction in budget preparation time.

- •Provided training and technical assistance on budget management to over 50 staff members, enhancing understanding and efficiency.

- •Prepared financial presentations for board meetings, improving communication of financial insights by 20%.

- •Conducted variance analysis to identify key discrepancies, offering actionable recommendations for budget adjustments.

- •Developed financial reports and forecasts, tracking program expenditures and improving budget tracking by 25%.

- •Enhanced collaboration with department heads, aiding in accurate budget preparation and reducing overhead variances by 18%.

- •Applied grant management knowledge to align budget strategies with grant reporting requirements, meeting 100% compliance.

- •Monitored and evaluated program financial performance, resulting in a 10% improvement in fund allocation efficiency.

- •Led monthly financial briefings for stakeholders, effectively communicating complex data in comprehensible formats.

- •Assisted in the analysis of $8M budgets for various international projects, ensuring accurate financial tracking and reporting.

- •Worked with cross-functional teams to develop and implement budget strategies, achieving a cost saving of 15%.

- •Maintained compliance with federal, state, and organizational financial policies, ensuring no compliance breaches.

- •Facilitated the creation of financial tools that improved reporting capabilities and increased operational transparency by 20%.

- •Supported the financial oversight of local housing projects, contributing to the management of $5M in annual funding.

- •Executed detailed financial analyses and projections, elevating the team's forecasting accuracy by 10%.

- •Reviewed and analyzed budget proposals, assisting in the strategic allocation of resources for optimal impact.

- •Coordinated with finance managers, enhancing budgetary compliance and performance monitoring processes.

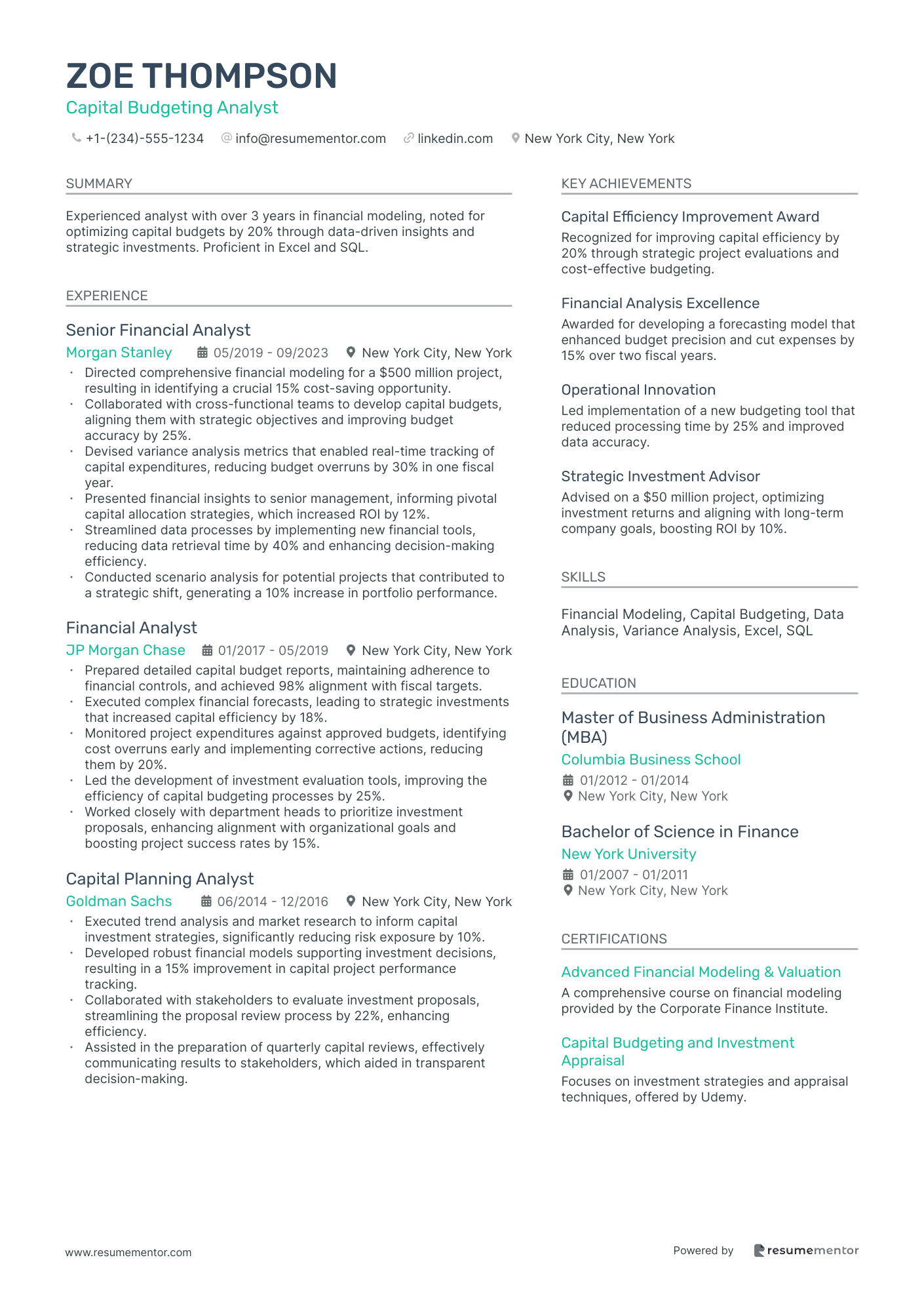

Capital Budgeting Analyst resume sample

- •Directed comprehensive financial modeling for a $500 million project, resulting in identifying a crucial 15% cost-saving opportunity.

- •Collaborated with cross-functional teams to develop capital budgets, aligning them with strategic objectives and improving budget accuracy by 25%.

- •Devised variance analysis metrics that enabled real-time tracking of capital expenditures, reducing budget overruns by 30% in one fiscal year.

- •Presented financial insights to senior management, informing pivotal capital allocation strategies, which increased ROI by 12%.

- •Streamlined data processes by implementing new financial tools, reducing data retrieval time by 40% and enhancing decision-making efficiency.

- •Conducted scenario analysis for potential projects that contributed to a strategic shift, generating a 10% increase in portfolio performance.

- •Prepared detailed capital budget reports, maintaining adherence to financial controls, and achieved 98% alignment with fiscal targets.

- •Executed complex financial forecasts, leading to strategic investments that increased capital efficiency by 18%.

- •Monitored project expenditures against approved budgets, identifying cost overruns early and implementing corrective actions, reducing them by 20%.

- •Led the development of investment evaluation tools, improving the efficiency of capital budgeting processes by 25%.

- •Worked closely with department heads to prioritize investment proposals, enhancing alignment with organizational goals and boosting project success rates by 15%.

- •Executed trend analysis and market research to inform capital investment strategies, significantly reducing risk exposure by 10%.

- •Developed robust financial models supporting investment decisions, resulting in a 15% improvement in capital project performance tracking.

- •Collaborated with stakeholders to evaluate investment proposals, streamlining the proposal review process by 22%, enhancing efficiency.

- •Assisted in the preparation of quarterly capital reviews, effectively communicating results to stakeholders, which aided in transparent decision-making.

- •Supported the finance team in conducting feasibility analysis for projects, enhancing decision quality and reducing planning time by 25%.

- •Created financial reporting systems that improved analytics accuracy, leading to a 30% improvement in budget monitoring outcomes.

- •Participated in capital expenditure reviews and successfully aggregated data for capital allocation efficiency, increasing budgeting coherence.

- •Engaged with finance leaders to adopt new reporting standards, resulting in operational enhancements and strategic clarity.

IT Budget Analyst resume sample

- •Developed and managed a $10M annual IT budget, implementing strategic cost-saving measures for a 12% reduction in total expenditures.

- •Collaborated with IT leadership to realign $3M in budgetary priorities, fostering improved alignment with corporate objectives.

- •Executed comprehensive financial analyses of IT contracts, leading to renegotiation opportunities and a 10% decrease in contract costs.

- •Prepared and delivered financial reports that provided critical insights to senior management, resulting in data-driven decision-making.

- •Monitored IT project expenditures totaling $5M and supported project managers in achieving financial targets ahead of deadlines.

- •Conducted regular audits of IT spending, developing corrective actions that resulted in improved compliance and financial accuracy.

- •Managed financial tracking for IT projects worth $8M, ensuring accurate reporting and budget compliance.

- •Generated detailed financial presentations for stakeholders, improving communication and understanding of IT financials.

- •Conducted in-depth analyses of IT spending trends and provided actionable recommendations for a 15% cost optimization.

- •Collaborated with budget managers to enhance forecasting accuracy, resulting in 98% forecast precision over two years.

- •Monitored contract compliance, ensuring all IT departments were aligned with financial policies and protocols.

- •Led the preparation of quarterly financial statements for a $7M IT budget, achieving deadlines consistently.

- •Identified cost-saving opportunities through detailed expense analysis, resulting in $500K annual savings.

- •Streamlined financial documentation processes, which improved accuracy and reduced processing time by 20%.

- •Assisted with annual budget planning, contributing to a collaborative approach in establishing fiscal goals.

- •Supported IT budget planning and management activities, contributing to a 10% increase in budget efficiency.

- •Performed variance analyses on IT spending, providing insights that led to improved budgetary controls.

- •Assisted in financial auditing and reporting, ensuring compliance with industry regulations and standards.

- •Contributed to enhanced financial monitoring systems, improving data accuracy and availability for financial reviews.

Navigating the job market as a budget analyst often feels like managing a complex financial report—balancing intricate details while clearly presenting your skills. Employers today want more than just qualifications; they need someone who can demonstrate precision and effective resource management. To stand out, it’s crucial to craft a resume that highlights both your analytical insights and your problem-solving prowess.

Condensing your extensive experience into an engaging resume can be challenging. Your work requires exceptional attention to detail, which makes deciding what to include even more difficult. Using a professional resume template can streamline this process, ensuring that your vital information is organized clearly. Templates from reliable sources like these resume templates help you focus on content over format, so your expertise shines through.

A well-structured resume goes beyond listing skills; it communicates your financial forecasting abilities and strategic thinking. Our guide will help you create a resume that reflects your analytical talent, pushing you to the top of any employer's list. From showcasing your proficiency with budget management software to detailing cost-saving initiatives, each section is crucial. Let’s explore how you can transform your resume into a compelling narrative of your career journey.

Key Takeaways

- The resume should effectively convey your analytical skills, financial expertise, and problem-solving abilities to stand out in the competitive job market.

- Utilizing a professional resume template can streamline the process by focusing on content rather than format, ensuring that vital information is clearly organized.

- Showcase your experience, skills, and technical proficiencies in a well-structured resume that communicates your budgeting and forecasting abilities.

- A chronological layout is recommended to best highlight your work history, career growth, and achievements in budget management.

- Include education, certifications, and relevant skills sections to demonstrate your qualifications and commitment to continued professional development.

What to focus on when writing your budget analyst resume

Your budget analyst resume should effectively convey your financial expertise and analytical skills to the recruiter, demonstrating your ability to manage complex budgeting processes and provide insights for improved financial efficiency. Throughout, it should showcase your attention to detail, critical thinking, and problem-solving abilities.

How to structure your budget analyst resume

- Contact Information — This is your first point of connection with the recruiter, so clarity is key. Ensure your full name, phone number, email address, and LinkedIn profile are up-to-date and professional. Using a consistent format will help streamline the initial evaluation process, making it easier for recruiters to reach you when they decide to proceed with your application. The way you present this section gives recruiters their first impression of your professionalism.

- Professional Summary — This section offers a snapshot of your career, giving recruiters a quick yet effective overview of your experience and how you can add value. Highlight your key skills in budget analysis with concrete examples, such as achievements in enhancing financial processes or implementing successful budget strategies. By showcasing your qualifications right from the start, you set a strong foundation for everything that follows on your resume, intensifying their interest as they read further.

- Skills — In this section, detail specific abilities that align closely with budget analyst roles, such as financial analysis, budget forecasting, and proficiency in budgeting tools like Excel or SAP. Also, emphasize attributes like your strong attention to detail, which are critical in maintaining accuracy in budget reports. An effectively tailored skills section can help set you apart from other candidates, signaling you possess the necessary competencies to meet the job requirements successfully.

- Work Experience — This is where you demonstrate your real-world application of the skills you've listed. Elaborate on your previous roles, focusing on significant responsibilities and achievements, such as managing budgets, developing financial reports, or leading cost-saving initiatives. Use quantifiable metrics where possible to highlight the scope and impact of your work. Paint a picture of how your experiences have shaped you into a results-driven budget analyst who can bring that same level of success to their organization.

- Education — Your academic background should reinforce your suitability for the role. Include details of your degree(s) in finance, economics, or accounting, and highlight relevant certifications, such as Certified Budget Analyst, that add to your qualifications. This part of the resume not only establishes your foundational knowledge but also shows your commitment to continuous learning and professional development in your field.

- Technical Proficiencies — This section underscores your capability to handle the technical demands of the role. Highlight your competence with data analysis tools, advanced features of Excel, and financial modeling software, which are essential in performing detailed budget analyses and creating accurate financial models. An impeccable technical skill set assures recruiters of your potential in delivering precise and insightful budgets within their organization.

Next, we'll look at the best resume format for a budget analyst and cover each section in more depth.

Which resume format to choose

Creating a standout budget analyst resume is key to making an impression in your field. Begin with the right format; a chronological layout is ideal because it effectively highlights your work history and growth over time. This is important for a budget analyst, as employers want to see your progression in handling financial data and insights.

Next, consider the appearance of your resume. Using modern fonts such as Lato, Montserrat, or Raleway can give your document a professional and contemporary edge. These fonts help convey clarity and precision, reflecting the meticulous nature of budget analysis without overwhelming the reader with overly stylized text.

Saving your resume as a PDF is a crucial step. This ensures that your careful formatting and design remain consistent across different devices and platforms, which is critical in maintaining a polished professional impression. As a budget analyst, attention to detail is paramount, and a problem-free PDF reinforces your commitment to precision.

Finally, set your margins to one inch. This small adjustment improves the readability of your resume and ensures it prints cleanly, offering a straightforward way to present your information. All of these elements combined—format, font choice, file type, and layout—work together to create a resume that not only showcases your skills as a budget analyst but also highlights your ability to present data clearly and professionally.

How to write a quantifiable resume experience section

A strong experience section on your budget analyst resume effectively captures the attention of hiring managers and potential employers by focusing on relevant achievements, particularly quantifiable results that illustrate your impactful contributions. By organizing this section to highlight your career path, key skills, and accomplishments tailored to the specific job, you create a cohesive narrative that aligns with the expectations outlined in the job description. Using reverse chronological order ensures your most recent and relevant experiences are front and center, covering up to 10-15 years or a selection of 3-5 key job titles, depending on your background. Tailoring each entry using keywords from the job ad optimizes your resume’s relevance, while action words like “analyzed,” “forecasted,” “improved,” and “optimized” powerfully convey your role and achievements.

For an example experience section in JSON format:

- •Analyzed departmental budgets to find financial efficiencies, leading to a 15% cost savings organization-wide.

- •Created improved forecasting models that boosted budget accuracy by 20%, aiding in better planning.

- •Worked with cross-functional teams to optimize budget allocations, increasing project funding by 10%.

- •Streamlined reporting processes, cutting turnaround time by 25% and enhancing data access for stakeholders.

This well-crafted experience section stands out by weaving a coherent story centered around specific, quantifiable successes. By showing your impact as a budget analyst, this section creates a direct connection between your past achievements and the employer’s future needs. Each bullet point articulates actionable accomplishments, illustrating how your strategic efforts led to tangible benefits for the company. The structured format and clear, engaging language throughout ensure your contributions are easily understood, eliminating ambiguity. This approach not only makes your resume memorable but also ensures it remains competitive in a crowded job market by seamlessly integrating relevant keywords and measurable results.

Responsibility-Focused resume experience section

A responsibility-focused budget analyst resume experience section should clearly highlight how your actions contributed to your organization's financial success. Start by describing your involvement in activities such as tracking financial data, participating in budget planning, and developing financial reports with clarity and emphasis on their impact. This helps demonstrate your role's significance and the changes you initiated. Use numbers to quantify achievements, illustrating improvements, cost savings, or efficiencies.

Keep your descriptions straightforward yet impactful to easily show how your past roles have prepared you for new challenges. Clearly explain how you’ve improved processes or assisted in crafting financial strategies. This makes it easy for hiring managers to see your value. Ensure your responsibilities are tailored to match the job description, focusing on the skills and experiences that align best with the new role.

Budget Analyst

ABC Corporation

Jan 2020 - Dec 2022

- Managed a $5 million budget annually, ensuring resources were optimally allocated across departments.

- Created detailed budget reports that enhanced decision-making by 30%.

- Predicted financial trends, leading to 15% savings on operational costs over two years.

- Worked with teams to implement new financial software, cutting report prep time by 40%.

Leadership-Focused resume experience section

A Leadership-Focused budget analyst resume experience section should emphasize your ability to guide and influence financial planning. Start by spotlighting roles where you played a key part in decision-making or financial strategy development. Illustrate moments where you led teams, directed projects, or crafted financial guidelines, highlighting how your leadership helped achieve company goals like boosting efficiency, cutting costs, or improving the precision of financial reports.

Use clear and simple language to make your past roles and accomplishments relatable and impressive. Craft each point to detail an action you took and the positive result it yielded. Share specific examples of leading cost-saving initiatives or streamlining processes to demonstrate your effectiveness as a leader. Include quantifiable outcomes using numbers and percentages for a more impactful presentation. By focusing on how your leadership contributed to past successes, you can show potential employers how you can bring those same strengths to future opportunities.

Senior Budget Analyst

XYZ Corp

May 2019 - Present

- Led a team of 5 analysts to revamp the company's annual budgeting process, resulting in a 15% reduction in overhead costs.

- Managed a project to adopt new financial software, boosting forecast accuracy by 20% and cutting monthly reporting time by 30%.

- Mentored junior staff in financial analysis and reporting, enhancing team performance and efficiency.

- Implemented a monthly review system that boosted budget adherence by 25% and improved financial transparency across departments.

Growth-Focused resume experience section

A growth-focused budget analyst resume experience section should effectively highlight your ability to enhance financial performance through strategic actions. Demonstrate how you've increased revenue, reduced costs, or refined financial processes by incorporating numbers that clearly illustrate your impact. Share any tools or techniques you introduced, such as new software or financial plans, which have led to significant improvements.

To ensure your experience stands out, organize it to captivate the reader's attention. Begin by listing your job title and the workplace, followed by the duration of your employment. Use bullet points to detail your key responsibilities and achievements, ensuring each one highlights a growth-related accomplishment or skill. By emphasizing the outcomes of your efforts, you make it easy for potential employers to see the positive difference you've made in your previous roles.

Budget Analyst

TechCorp Solutions

June 2018 - September 2022

- Led a financial improvement project that slashed departmental costs by 20%.

- Implemented a new budgeting software system, increasing accuracy by 30%.

- Streamlined financial reporting processes, cutting report preparation time in half.

- Developed strategies that boosted company revenue by $2 million annually.

Skills-Focused resume experience section

A skills-focused budget analyst resume experience section should highlight your unique strengths and accomplishments in a way that clearly demonstrates your impact on budget processes. By using active verbs, you can effectively show how you've contributed to significant improvements in financial operations. Think about your major projects, such as developing financial forecasts or implementing cost-saving measures, and explain how these initiatives resulted in positive changes like increased efficiency or enhanced reporting accuracy.

In your bullet points, focus on concrete, quantifiable achievements, such as the percentage of cost reductions, the magnitude of the budgets you managed, or the improvements in report accuracy. Use straightforward yet powerful language to ensure each point highlights your main abilities and the value you brought to your workplace. Strive for a blend of detail and succinctness to effectively convey your skills and contributions.

Budget Analyst

XYZ Corporation

June 2020 - Present

- Managed budget planning for a $5M project, increasing efficiency by 15%.

- Implemented a new reporting system that improved accuracy by 20%.

- Trained 10 team members on budget analysis techniques, boosting team output by 30%.

- Developed financial forecasts that resulted in $200K savings.

Write your budget analyst resume summary section

A budget-focused resume summary should effectively highlight your qualifications as a budget analyst. This section sets the stage for your resume by showcasing your key skills and achievements in financial analysis. As a budget analyst, it's crucial to display your strength with numbers, meticulous attention to detail, and hands-on experience with financial data. To make a lasting impression, focus on what makes you uniquely valuable for the role you're pursuing. Here's an example of how to do that:

This example effectively communicates your experience, skills, and results in a captivating manner. It clearly outlines your time in the field and shows how you've made a positive impact. Adding specific achievements can further complete the picture of your potential.

To describe yourself in a resume summary, maintain clarity and simplicity. Concentrate on the skills and experiences that closely match the job description. Employ active verbs to convey your accomplishments. Ensure that your language remains straightforward and free of jargon, making it easy for anyone to understand. This approach helps you capture the hiring manager's attention swiftly.

Understanding the distinctions between a resume summary and other sections enhances your presentation. A resume summary gives a concise overview of your career and strengths, ideal for seasoned professionals. A resume objective, in contrast, suits entry-level roles by focusing on career aspirations. A resume profile offers a brief but insightful snapshot for all experience levels. Finally, a summary of qualifications lists specific skills and achievements, providing a quick reference to your professional attributes. Carefully selecting and tailoring these elements will help you create a powerful impression according to your career stage and the job you're targeting.

Listing your budget analyst skills on your resume

A skills-focused budget analyst resume should clearly demonstrate your technical abilities and strengths, seamlessly connecting these elements across different sections like your experience and summary. Highlighting your strengths and soft skills shows your ability to collaborate effectively and adapt to various scenarios. On the other hand, hard skills refer to your technical know-how and specialized expertise. These skills and strengths double as resume keywords, helping your application get through the applicant tracking systems that many employers use.

For instance, consider this example of a standalone skills section:

This skills section is effective because it focuses on abilities specific to a budget analyst. It's concise, allowing recruiters to quickly identify your core competencies, which ties back to how a strategically crafted resume should communicate your qualifications.

Best hard skills to feature on your budget analyst resume

For a budget analyst, hard skills demonstrate your ability to perform technical tasks and manage financial data. These skills should communicate your expertise in areas such as data collection and financial reporting. Here are some hard skills that are essential for this role:

Hard Skills

- Financial Modeling

- Budgeting and Forecasting

- Cost-Benefit Analysis

- Data Analysis

- Financial Software Proficiency

- Accounting Principles

- Performance Metrics

- Risk Management

- ERP Systems

- Variance Analysis

- Financial Reporting

- Strategic Planning

- Cost Management

- Resource Allocation

- Business Intelligence Tools

Best soft skills to feature on your budget analyst resume

Soft skills emphasize how you connect and collaborate with others, an integral part of a budget analyst’s role. They also showcase your ability to solve problems and think critically. These are important soft skills to include:

By intertwining these hard and soft skills in your resume, you present a well-rounded profile that resonates with potential employers.

Soft Skills

- Communication

- Problem-Solving

- Attention to Detail

- Analytical Thinking

- Team Collaboration

- Time Management

- Adaptability

- Interpersonal Skills

- Decision-Making

- Conflict Resolution

- Leadership

- Creativity

- Listening Skills

- Negotiation

- Project Management

How to include your education on your resume

The education section is a crucial part of your budget analyst resume. It highlights your academic background, showing your qualifications for the job. Tailoring this section to the job is important; leave out any irrelevant education. Include your GPA if it is strong, generally 3.5 or above, and write it like this: "GPA: 3.8/4.0". If you graduated with honors, such as cum laude, mention it right after your degree, like "Bachelor’s degree in Finance, Cum Laude". List your degree clearly, for instance, "Master of Business Administration". Here’s how a poor example looks:

- •Note key learnings, experience and skills gained relevant to the job.

In contrast, a well-crafted example is:

This example is effective because it includes a relevant degree for a budget analyst position, shows a strong GPA, and avoids unnecessary information clutter. Highlighting this relevant education can help you stand out as a candidate who is well-prepared for the job.

How to include budget analyst certificates on your resume

Including a certificates section in your budget analyst resume is crucial. Certificates can showcase specialized knowledge and skills, making you stand out to employers. You can also add the certificates in the header.

List the name of the certificate clearly. Include the date you received it. Add the issuing organization for each certificate. Make sure to keep it clean and organized.

Consider this example:

Why is this example good? These certificates are directly related to budgeting and financial analysis. The titles and issuers are clear. The section is concise yet effective in conveying relevant qualifications. Employers can easily see your additional skills and credentials. Organizing certificates in this manner keeps your resume professional and readable.

A well-crafted certificates section can greatly enhance your resume.

Extra sections to include in your budget analyst resume

Creating a compelling resume for a budget analyst involves more than just listing your professional experience and education. Including sections that highlight your language skills, hobbies, volunteer work, and reading interests can provide a fuller picture of who you are. These elements can set you apart from other candidates.

Language section — Include your language proficiency to show you can work with diverse teams or international clients. Demonstrate your versatility; for example, "Fluent in Spanish and proficient in Mandarin."

Hobbies and interests section — Mention hobbies that require analytical skills, like chess or puzzles, to indicate your problem-solving abilities. Show a well-rounded personality by also incorporating team activities such as joining a local sports league.

Volunteer work section — Highlight your commitment to your community by listing volunteer experiences. Emphasize relevant activities, such as accounting work for a non-profit, to showcase your practical financial skills.

Books section — Share your interest in professional development by listing books on finance or economics you've read. Demonstrate a commitment to continual learning by mentioning titles like "The Intelligent Investor" by Benjamin Graham.

By incorporating these sections, you make your resume more engaging and memorable, offering a deeper insight into your qualifications and character.

In Conclusion

In conclusion, crafting a resume as a budget analyst is similar to crafting a compelling story—every element should align to highlight your strengths and achievements. It's not merely about listing your skills and experiences; it's about how you present those attributes in a clear, structured manner. Using a professional resume template can guide you in organizing your thoughts and ensuring that your qualifications stand out. Your resume should reflect not only your capability in handling complex budgets but also your proficiency in strategic thinking and problem-solving. By including quantifiable achievements and demonstrating your expertise, you strengthen your application. Remember to use clear language and active verbs to describe your roles and the impact you've had in previous positions. Tailoring your resume to include relevant education, certificates, and even extracurricular sections gives a fuller picture of who you are as a professional. With attention to detail, each section of your resume works together to create a compelling narrative of your career journey, ultimately positioning you as an ideal candidate in the eyes of potential employers.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.