Canadian Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Mastering your Canadian accountant resume: Numbers don't lie, and neither will your credentials—learn how to showcase your skills in the best way."

Rated by 348 people

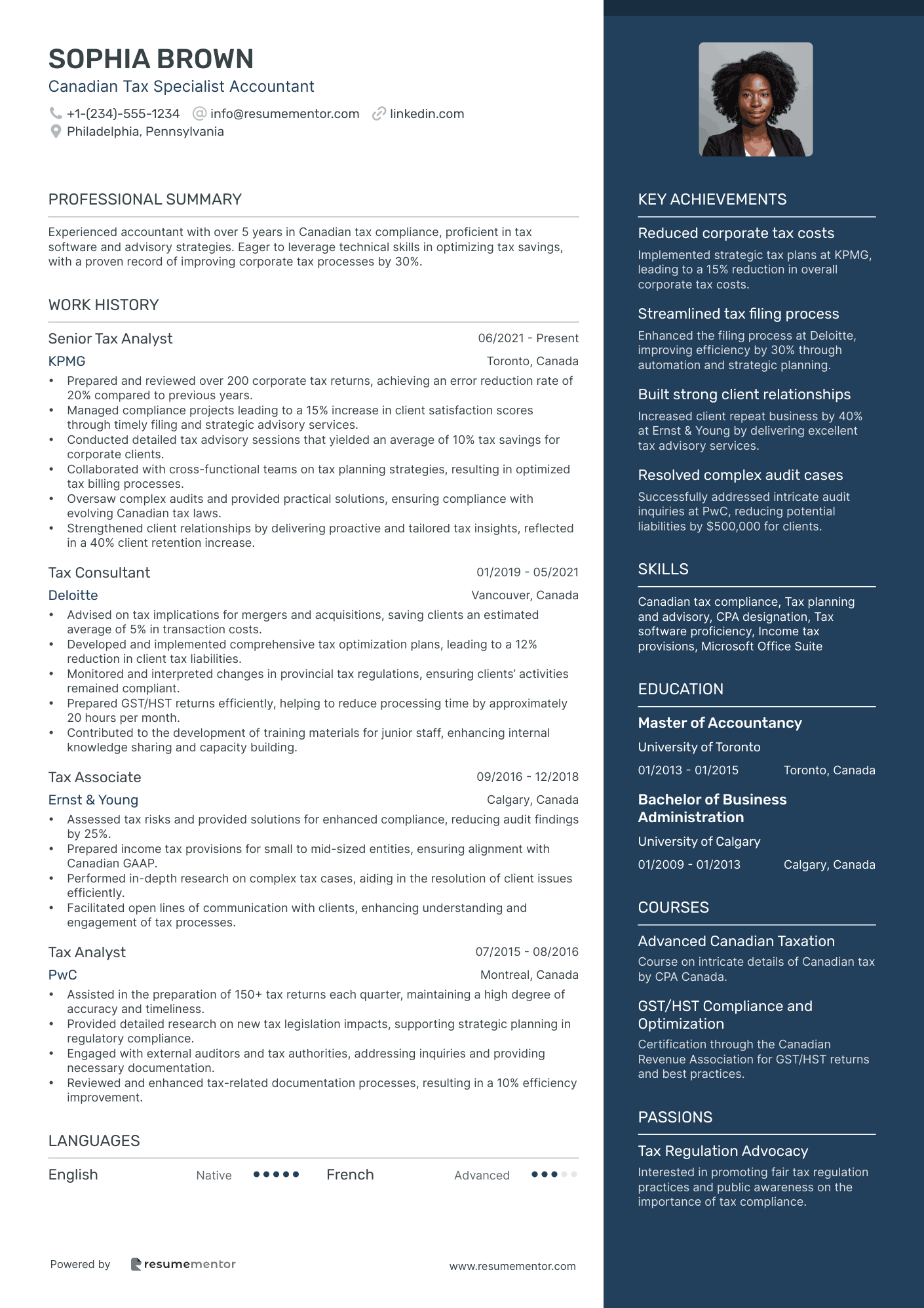

Canadian Tax Specialist Accountant

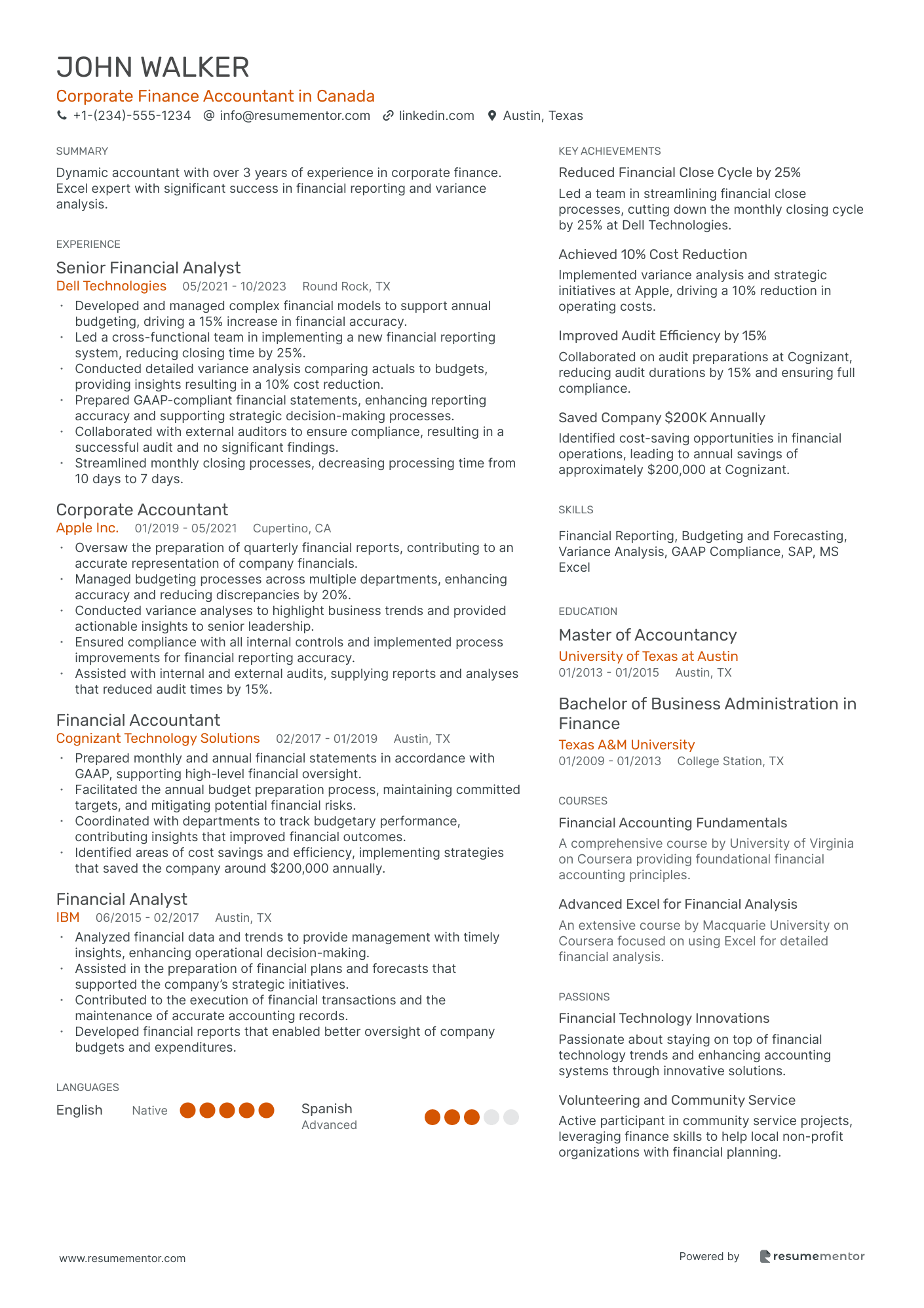

Corporate Finance Accountant in Canada

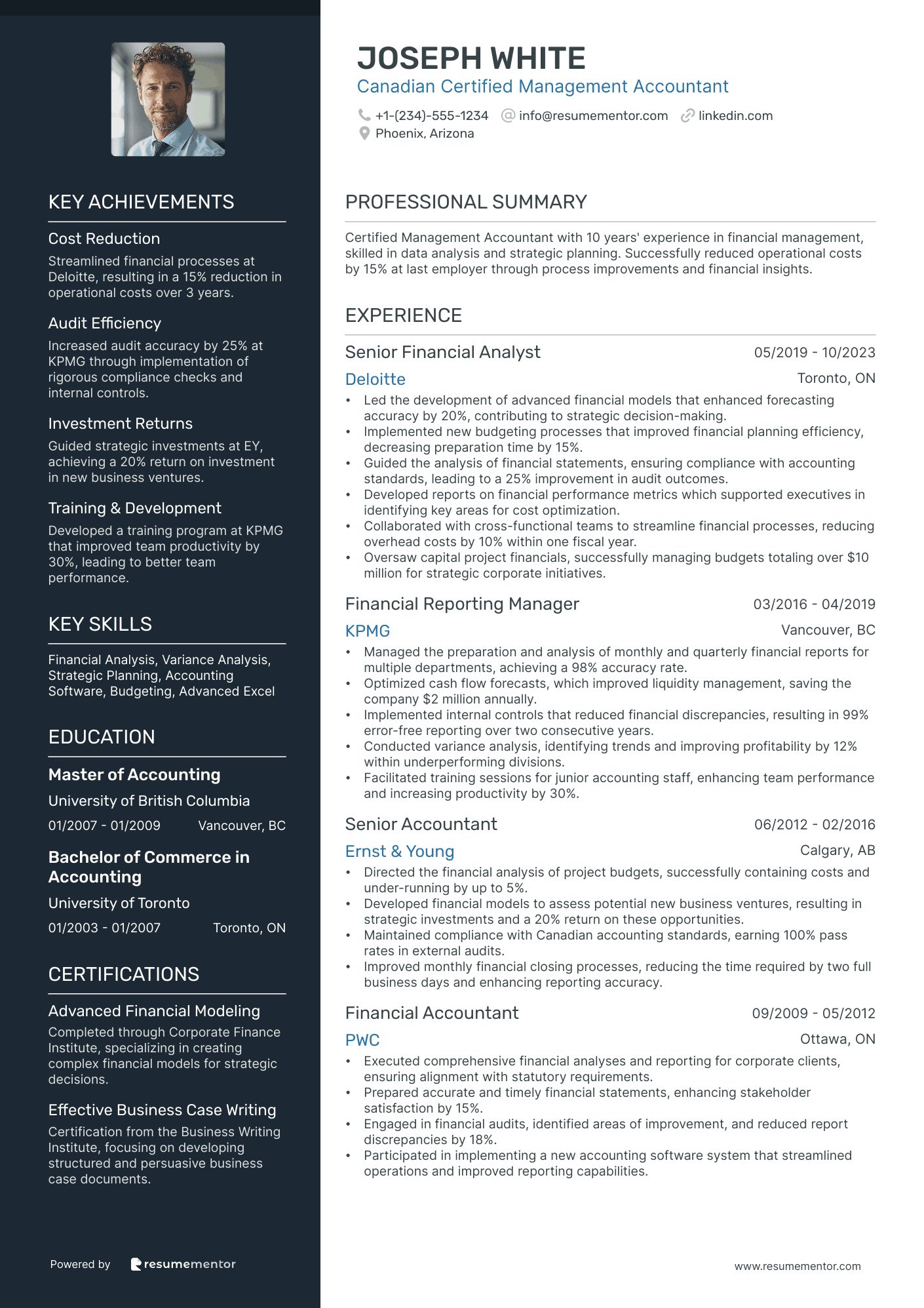

Canadian Certified Management Accountant

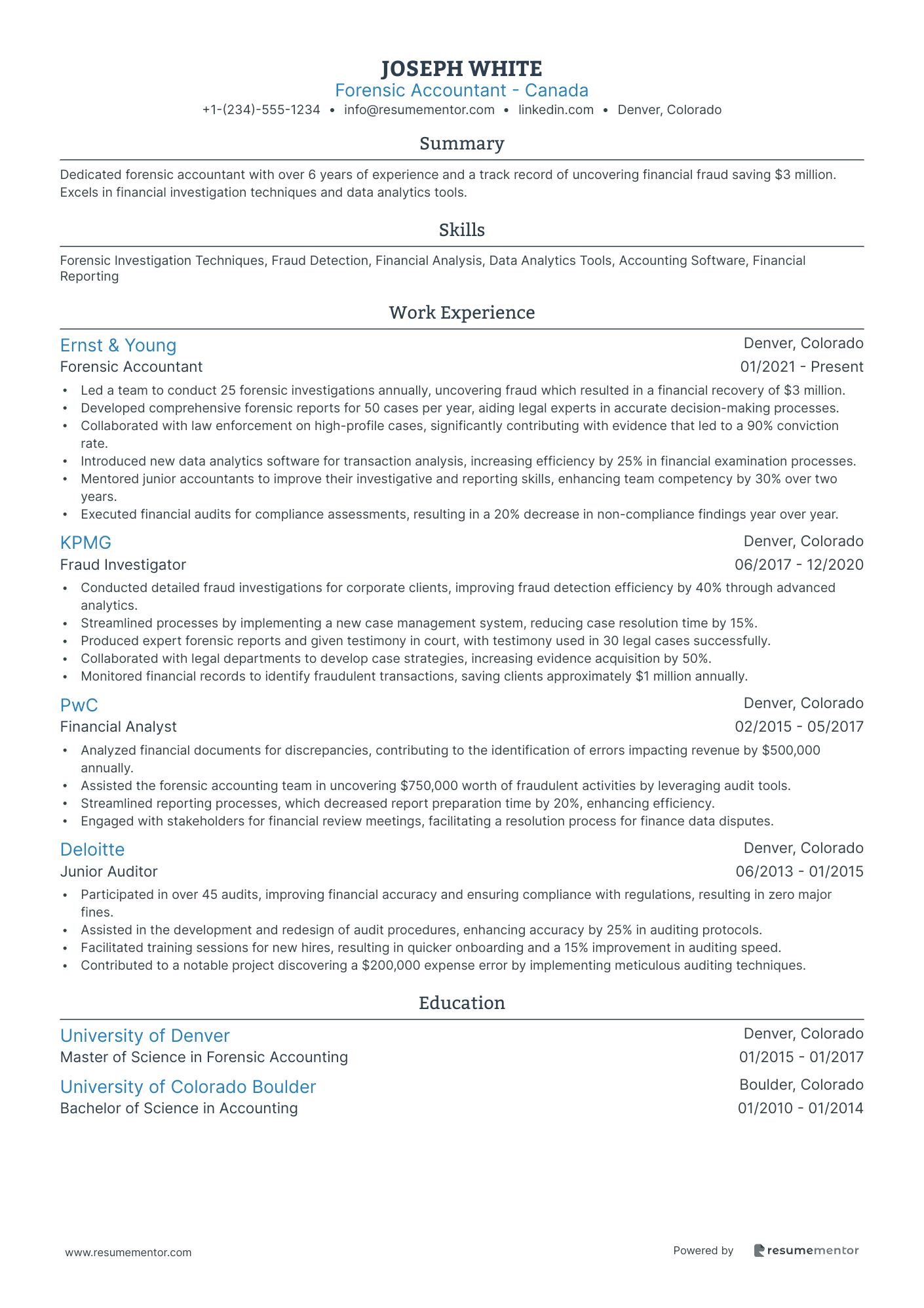

Forensic Accountant - Canada

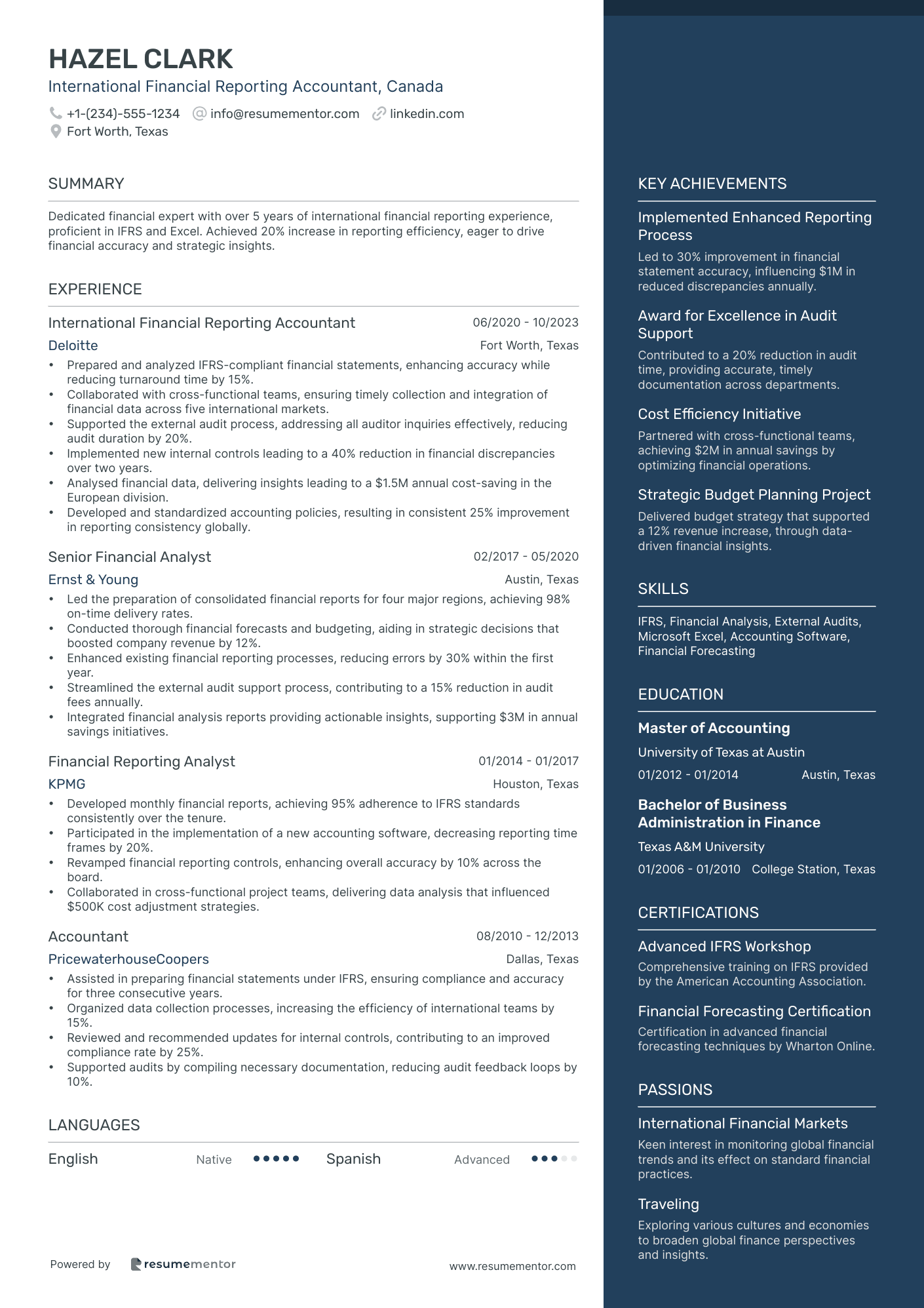

International Financial Reporting Accountant, Canada

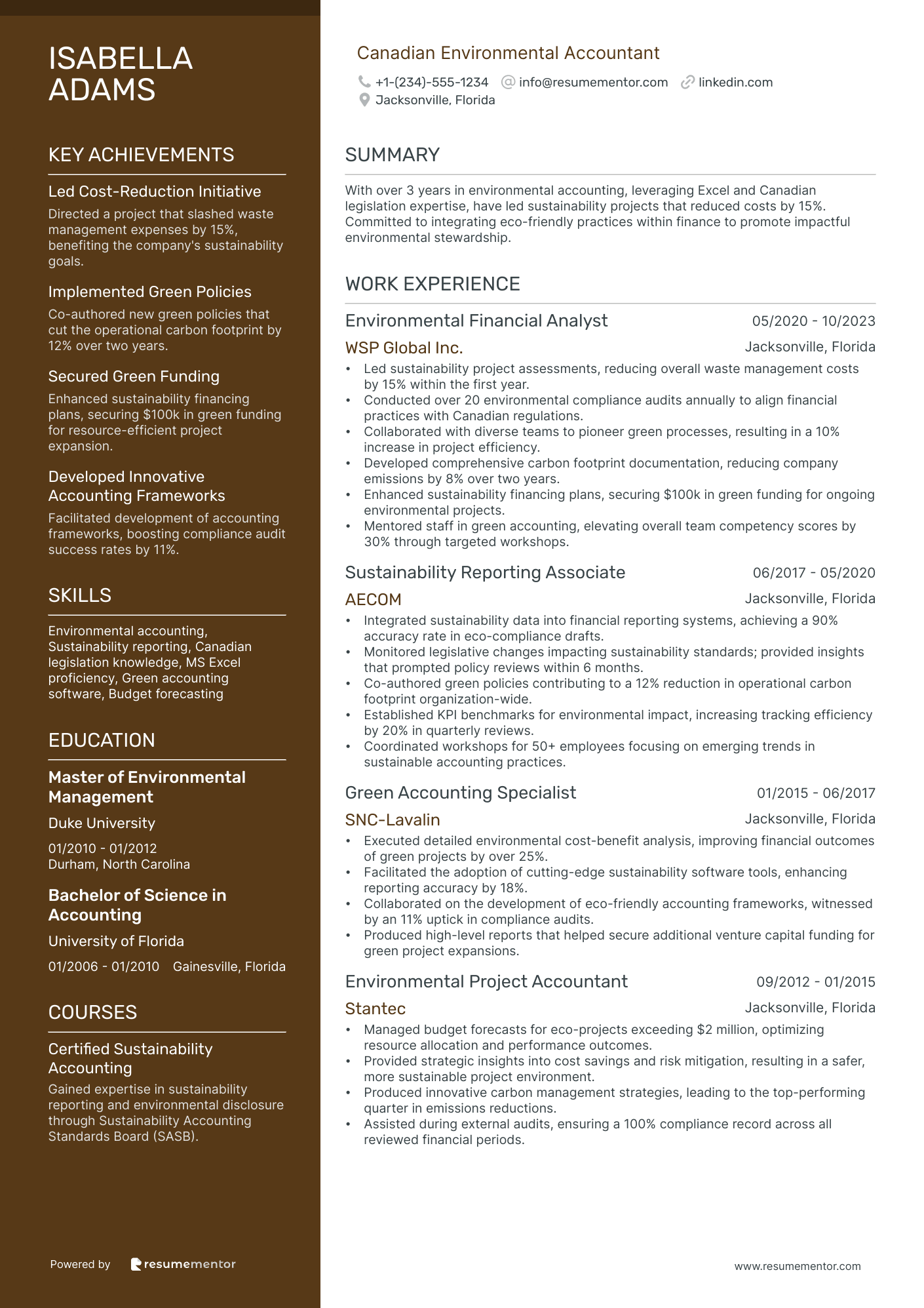

Canadian Environmental Accountant

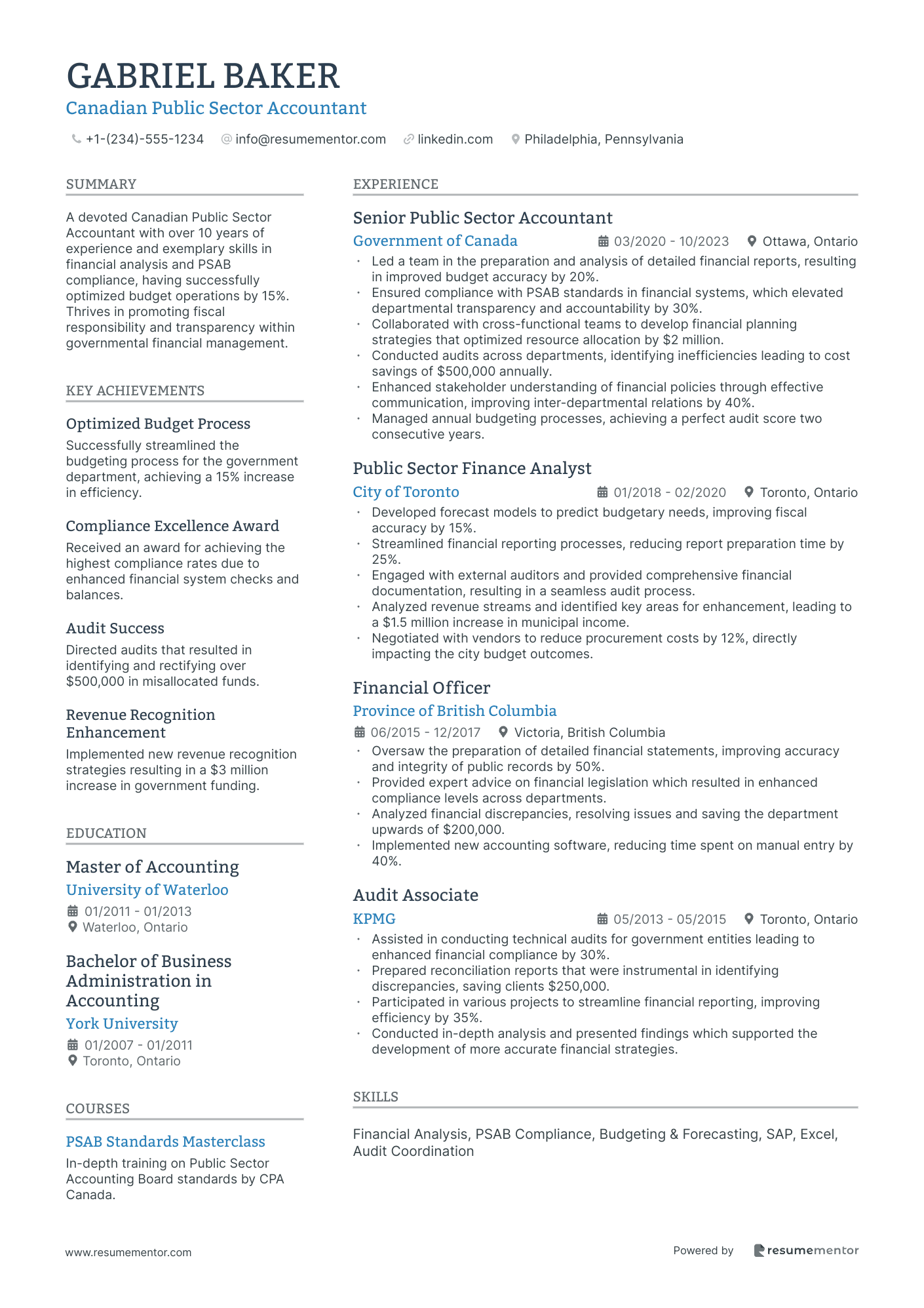

Canadian Public Sector Accountant

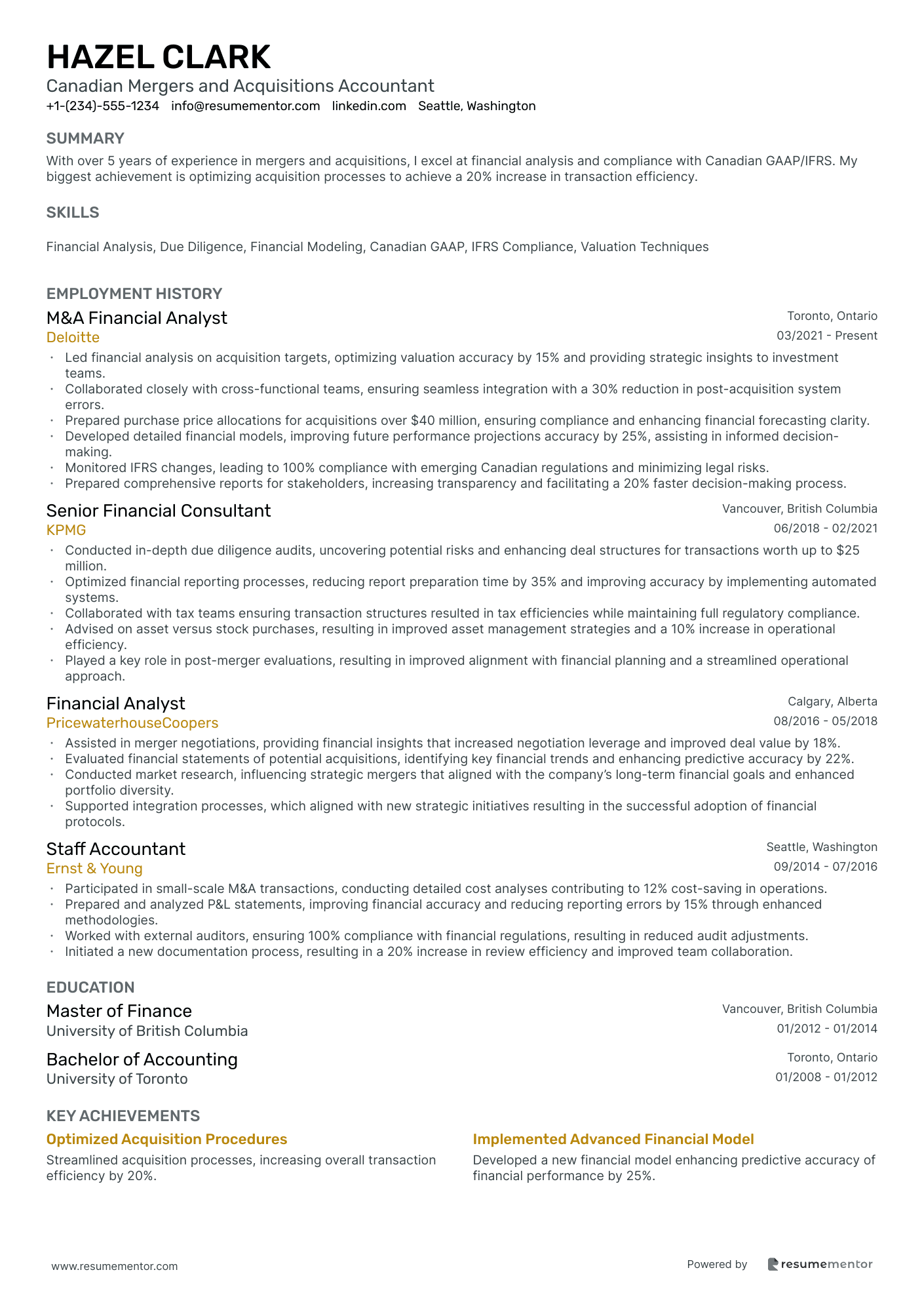

Canadian Mergers and Acquisitions Accountant

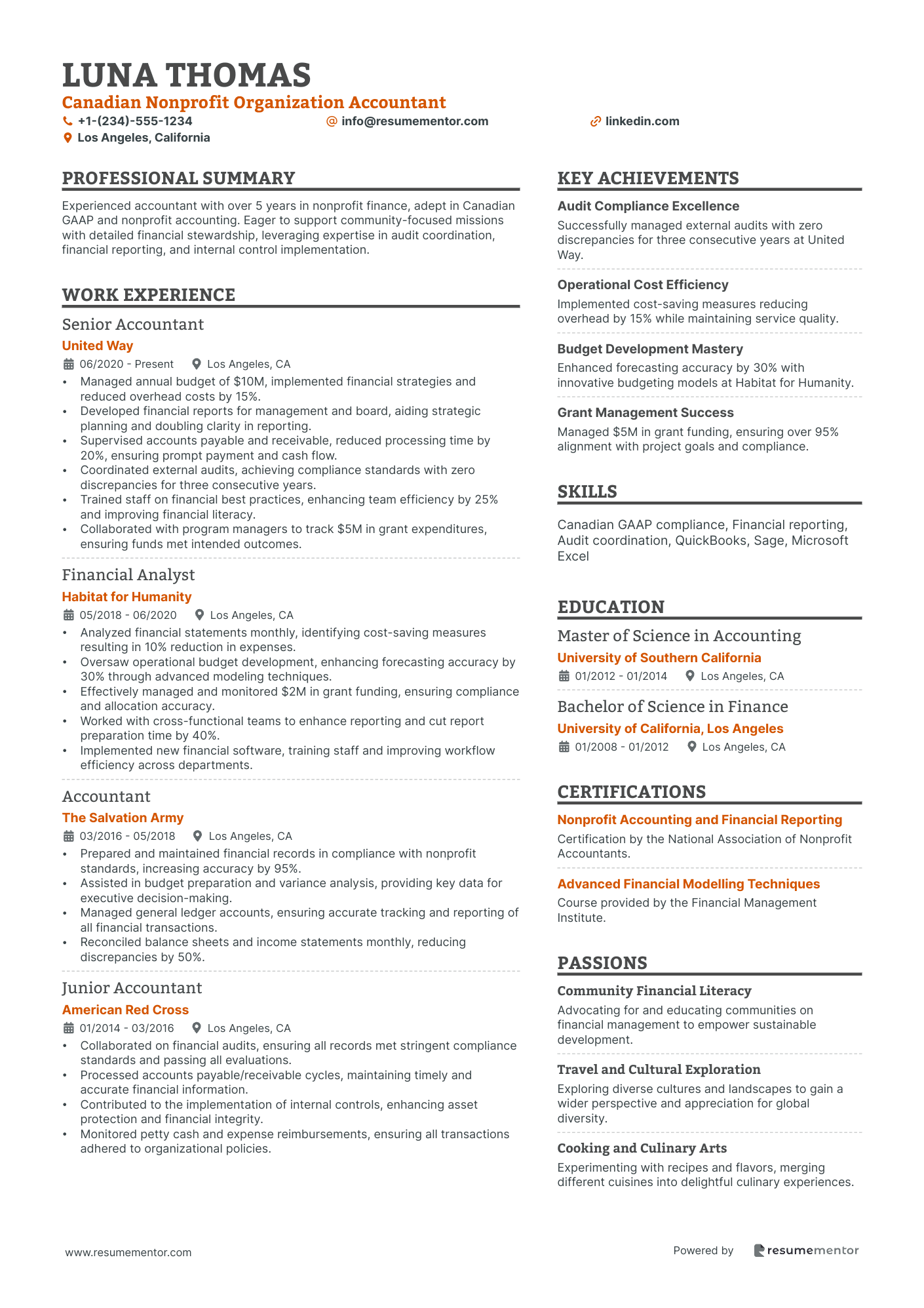

Canadian Nonprofit Organization Accountant

Canadian Certified Information Systems Auditor Accountant

Canadian Tax Specialist Accountant resume sample

- •Prepared and reviewed over 200 corporate tax returns, achieving an error reduction rate of 20% compared to previous years.

- •Managed compliance projects leading to a 15% increase in client satisfaction scores through timely filing and strategic advisory services.

- •Conducted detailed tax advisory sessions that yielded an average of 10% tax savings for corporate clients.

- •Collaborated with cross-functional teams on tax planning strategies, resulting in optimized tax billing processes.

- •Oversaw complex audits and provided practical solutions, ensuring compliance with evolving Canadian tax laws.

- •Strengthened client relationships by delivering proactive and tailored tax insights, reflected in a 40% client retention increase.

- •Advised on tax implications for mergers and acquisitions, saving clients an estimated average of 5% in transaction costs.

- •Developed and implemented comprehensive tax optimization plans, leading to a 12% reduction in client tax liabilities.

- •Monitored and interpreted changes in provincial tax regulations, ensuring clients’ activities remained compliant.

- •Prepared GST/HST returns efficiently, helping to reduce processing time by approximately 20 hours per month.

- •Contributed to the development of training materials for junior staff, enhancing internal knowledge sharing and capacity building.

- •Assessed tax risks and provided solutions for enhanced compliance, reducing audit findings by 25%.

- •Prepared income tax provisions for small to mid-sized entities, ensuring alignment with Canadian GAAP.

- •Performed in-depth research on complex tax cases, aiding in the resolution of client issues efficiently.

- •Facilitated open lines of communication with clients, enhancing understanding and engagement of tax processes.

- •Assisted in the preparation of 150+ tax returns each quarter, maintaining a high degree of accuracy and timeliness.

- •Provided detailed research on new tax legislation impacts, supporting strategic planning in regulatory compliance.

- •Engaged with external auditors and tax authorities, addressing inquiries and providing necessary documentation.

- •Reviewed and enhanced tax-related documentation processes, resulting in a 10% efficiency improvement.

Corporate Finance Accountant in Canada resume sample

- •Developed and managed complex financial models to support annual budgeting, driving a 15% increase in financial accuracy.

- •Led a cross-functional team in implementing a new financial reporting system, reducing closing time by 25%.

- •Conducted detailed variance analysis comparing actuals to budgets, providing insights resulting in a 10% cost reduction.

- •Prepared GAAP-compliant financial statements, enhancing reporting accuracy and supporting strategic decision-making processes.

- •Collaborated with external auditors to ensure compliance, resulting in a successful audit and no significant findings.

- •Streamlined monthly closing processes, decreasing processing time from 10 days to 7 days.

- •Oversaw the preparation of quarterly financial reports, contributing to an accurate representation of company financials.

- •Managed budgeting processes across multiple departments, enhancing accuracy and reducing discrepancies by 20%.

- •Conducted variance analyses to highlight business trends and provided actionable insights to senior leadership.

- •Ensured compliance with all internal controls and implemented process improvements for financial reporting accuracy.

- •Assisted with internal and external audits, supplying reports and analyses that reduced audit times by 15%.

- •Prepared monthly and annual financial statements in accordance with GAAP, supporting high-level financial oversight.

- •Facilitated the annual budget preparation process, maintaining committed targets, and mitigating potential financial risks.

- •Coordinated with departments to track budgetary performance, contributing insights that improved financial outcomes.

- •Identified areas of cost savings and efficiency, implementing strategies that saved the company around $200,000 annually.

- •Analyzed financial data and trends to provide management with timely insights, enhancing operational decision-making.

- •Assisted in the preparation of financial plans and forecasts that supported the company’s strategic initiatives.

- •Contributed to the execution of financial transactions and the maintenance of accurate accounting records.

- •Developed financial reports that enabled better oversight of company budgets and expenditures.

Canadian Certified Management Accountant resume sample

- •Led the development of advanced financial models that enhanced forecasting accuracy by 20%, contributing to strategic decision-making.

- •Implemented new budgeting processes that improved financial planning efficiency, decreasing preparation time by 15%.

- •Guided the analysis of financial statements, ensuring compliance with accounting standards, leading to a 25% improvement in audit outcomes.

- •Developed reports on financial performance metrics which supported executives in identifying key areas for cost optimization.

- •Collaborated with cross-functional teams to streamline financial processes, reducing overhead costs by 10% within one fiscal year.

- •Oversaw capital project financials, successfully managing budgets totaling over $10 million for strategic corporate initiatives.

- •Managed the preparation and analysis of monthly and quarterly financial reports for multiple departments, achieving a 98% accuracy rate.

- •Optimized cash flow forecasts, which improved liquidity management, saving the company $2 million annually.

- •Implemented internal controls that reduced financial discrepancies, resulting in 99% error-free reporting over two consecutive years.

- •Conducted variance analysis, identifying trends and improving profitability by 12% within underperforming divisions.

- •Facilitated training sessions for junior accounting staff, enhancing team performance and increasing productivity by 30%.

- •Directed the financial analysis of project budgets, successfully containing costs and under-running by up to 5%.

- •Developed financial models to assess potential new business ventures, resulting in strategic investments and a 20% return on these opportunities.

- •Maintained compliance with Canadian accounting standards, earning 100% pass rates in external audits.

- •Improved monthly financial closing processes, reducing the time required by two full business days and enhancing reporting accuracy.

- •Executed comprehensive financial analyses and reporting for corporate clients, ensuring alignment with statutory requirements.

- •Prepared accurate and timely financial statements, enhancing stakeholder satisfaction by 15%.

- •Engaged in financial audits, identified areas of improvement, and reduced report discrepancies by 18%.

- •Participated in implementing a new accounting software system that streamlined operations and improved reporting capabilities.

Forensic Accountant - Canada resume sample

- •Led a team to conduct 25 forensic investigations annually, uncovering fraud which resulted in a financial recovery of $3 million.

- •Developed comprehensive forensic reports for 50 cases per year, aiding legal experts in accurate decision-making processes.

- •Collaborated with law enforcement on high-profile cases, significantly contributing with evidence that led to a 90% conviction rate.

- •Introduced new data analytics software for transaction analysis, increasing efficiency by 25% in financial examination processes.

- •Mentored junior accountants to improve their investigative and reporting skills, enhancing team competency by 30% over two years.

- •Executed financial audits for compliance assessments, resulting in a 20% decrease in non-compliance findings year over year.

- •Conducted detailed fraud investigations for corporate clients, improving fraud detection efficiency by 40% through advanced analytics.

- •Streamlined processes by implementing a new case management system, reducing case resolution time by 15%.

- •Produced expert forensic reports and given testimony in court, with testimony used in 30 legal cases successfully.

- •Collaborated with legal departments to develop case strategies, increasing evidence acquisition by 50%.

- •Monitored financial records to identify fraudulent transactions, saving clients approximately $1 million annually.

- •Analyzed financial documents for discrepancies, contributing to the identification of errors impacting revenue by $500,000 annually.

- •Assisted the forensic accounting team in uncovering $750,000 worth of fraudulent activities by leveraging audit tools.

- •Streamlined reporting processes, which decreased report preparation time by 20%, enhancing efficiency.

- •Engaged with stakeholders for financial review meetings, facilitating a resolution process for finance data disputes.

- •Participated in over 45 audits, improving financial accuracy and ensuring compliance with regulations, resulting in zero major fines.

- •Assisted in the development and redesign of audit procedures, enhancing accuracy by 25% in auditing protocols.

- •Facilitated training sessions for new hires, resulting in quicker onboarding and a 15% improvement in auditing speed.

- •Contributed to a notable project discovering a $200,000 expense error by implementing meticulous auditing techniques.

International Financial Reporting Accountant, Canada resume sample

- •Prepared and analyzed IFRS-compliant financial statements, enhancing accuracy while reducing turnaround time by 15%.

- •Collaborated with cross-functional teams, ensuring timely collection and integration of financial data across five international markets.

- •Supported the external audit process, addressing all auditor inquiries effectively, reducing audit duration by 20%.

- •Implemented new internal controls leading to a 40% reduction in financial discrepancies over two years.

- •Analysed financial data, delivering insights leading to a $1.5M annual cost-saving in the European division.

- •Developed and standardized accounting policies, resulting in consistent 25% improvement in reporting consistency globally.

- •Led the preparation of consolidated financial reports for four major regions, achieving 98% on-time delivery rates.

- •Conducted thorough financial forecasts and budgeting, aiding in strategic decisions that boosted company revenue by 12%.

- •Enhanced existing financial reporting processes, reducing errors by 30% within the first year.

- •Streamlined the external audit support process, contributing to a 15% reduction in audit fees annually.

- •Integrated financial analysis reports providing actionable insights, supporting $3M in annual savings initiatives.

- •Developed monthly financial reports, achieving 95% adherence to IFRS standards consistently over the tenure.

- •Participated in the implementation of a new accounting software, decreasing reporting time frames by 20%.

- •Revamped financial reporting controls, enhancing overall accuracy by 10% across the board.

- •Collaborated in cross-functional project teams, delivering data analysis that influenced $500K cost adjustment strategies.

- •Assisted in preparing financial statements under IFRS, ensuring compliance and accuracy for three consecutive years.

- •Organized data collection processes, increasing the efficiency of international teams by 15%.

- •Reviewed and recommended updates for internal controls, contributing to an improved compliance rate by 25%.

- •Supported audits by compiling necessary documentation, reducing audit feedback loops by 10%.

Canadian Environmental Accountant resume sample

- •Led sustainability project assessments, reducing overall waste management costs by 15% within the first year.

- •Conducted over 20 environmental compliance audits annually to align financial practices with Canadian regulations.

- •Collaborated with diverse teams to pioneer green processes, resulting in a 10% increase in project efficiency.

- •Developed comprehensive carbon footprint documentation, reducing company emissions by 8% over two years.

- •Enhanced sustainability financing plans, securing $100k in green funding for ongoing environmental projects.

- •Mentored staff in green accounting, elevating overall team competency scores by 30% through targeted workshops.

- •Integrated sustainability data into financial reporting systems, achieving a 90% accuracy rate in eco-compliance drafts.

- •Monitored legislative changes impacting sustainability standards; provided insights that prompted policy reviews within 6 months.

- •Co-authored green policies contributing to a 12% reduction in operational carbon footprint organization-wide.

- •Established KPI benchmarks for environmental impact, increasing tracking efficiency by 20% in quarterly reviews.

- •Coordinated workshops for 50+ employees focusing on emerging trends in sustainable accounting practices.

- •Executed detailed environmental cost-benefit analysis, improving financial outcomes of green projects by over 25%.

- •Facilitated the adoption of cutting-edge sustainability software tools, enhancing reporting accuracy by 18%.

- •Collaborated on the development of eco-friendly accounting frameworks, witnessed by an 11% uptick in compliance audits.

- •Produced high-level reports that helped secure additional venture capital funding for green project expansions.

- •Managed budget forecasts for eco-projects exceeding $2 million, optimizing resource allocation and performance outcomes.

- •Provided strategic insights into cost savings and risk mitigation, resulting in a safer, more sustainable project environment.

- •Produced innovative carbon management strategies, leading to the top-performing quarter in emissions reductions.

- •Assisted during external audits, ensuring a 100% compliance record across all reviewed financial periods.

Canadian Public Sector Accountant resume sample

- •Led a team in the preparation and analysis of detailed financial reports, resulting in improved budget accuracy by 20%.

- •Ensured compliance with PSAB standards in financial systems, which elevated departmental transparency and accountability by 30%.

- •Collaborated with cross-functional teams to develop financial planning strategies that optimized resource allocation by $2 million.

- •Conducted audits across departments, identifying inefficiencies leading to cost savings of $500,000 annually.

- •Enhanced stakeholder understanding of financial policies through effective communication, improving inter-departmental relations by 40%.

- •Managed annual budgeting processes, achieving a perfect audit score two consecutive years.

- •Developed forecast models to predict budgetary needs, improving fiscal accuracy by 15%.

- •Streamlined financial reporting processes, reducing report preparation time by 25%.

- •Engaged with external auditors and provided comprehensive financial documentation, resulting in a seamless audit process.

- •Analyzed revenue streams and identified key areas for enhancement, leading to a $1.5 million increase in municipal income.

- •Negotiated with vendors to reduce procurement costs by 12%, directly impacting the city budget outcomes.

- •Oversaw the preparation of detailed financial statements, improving accuracy and integrity of public records by 50%.

- •Provided expert advice on financial legislation which resulted in enhanced compliance levels across departments.

- •Analyzed financial discrepancies, resolving issues and saving the department upwards of $200,000.

- •Implemented new accounting software, reducing time spent on manual entry by 40%.

- •Assisted in conducting technical audits for government entities leading to enhanced financial compliance by 30%.

- •Prepared reconciliation reports that were instrumental in identifying discrepancies, saving clients $250,000.

- •Participated in various projects to streamline financial reporting, improving efficiency by 35%.

- •Conducted in-depth analysis and presented findings which supported the development of more accurate financial strategies.

Canadian Mergers and Acquisitions Accountant resume sample

- •Led financial analysis on acquisition targets, optimizing valuation accuracy by 15% and providing strategic insights to investment teams.

- •Collaborated closely with cross-functional teams, ensuring seamless integration with a 30% reduction in post-acquisition system errors.

- •Prepared purchase price allocations for acquisitions over $40 million, ensuring compliance and enhancing financial forecasting clarity.

- •Developed detailed financial models, improving future performance projections accuracy by 25%, assisting in informed decision-making.

- •Monitored IFRS changes, leading to 100% compliance with emerging Canadian regulations and minimizing legal risks.

- •Prepared comprehensive reports for stakeholders, increasing transparency and facilitating a 20% faster decision-making process.

- •Conducted in-depth due diligence audits, uncovering potential risks and enhancing deal structures for transactions worth up to $25 million.

- •Optimized financial reporting processes, reducing report preparation time by 35% and improving accuracy by implementing automated systems.

- •Collaborated with tax teams ensuring transaction structures resulted in tax efficiencies while maintaining full regulatory compliance.

- •Advised on asset versus stock purchases, resulting in improved asset management strategies and a 10% increase in operational efficiency.

- •Played a key role in post-merger evaluations, resulting in improved alignment with financial planning and a streamlined operational approach.

- •Assisted in merger negotiations, providing financial insights that increased negotiation leverage and improved deal value by 18%.

- •Evaluated financial statements of potential acquisitions, identifying key financial trends and enhancing predictive accuracy by 22%.

- •Conducted market research, influencing strategic mergers that aligned with the company’s long-term financial goals and enhanced portfolio diversity.

- •Supported integration processes, which aligned with new strategic initiatives resulting in the successful adoption of financial protocols.

- •Participated in small-scale M&A transactions, conducting detailed cost analyses contributing to 12% cost-saving in operations.

- •Prepared and analyzed P&L statements, improving financial accuracy and reducing reporting errors by 15% through enhanced methodologies.

- •Worked with external auditors, ensuring 100% compliance with financial regulations, resulting in reduced audit adjustments.

- •Initiated a new documentation process, resulting in a 20% increase in review efficiency and improved team collaboration.

Canadian Nonprofit Organization Accountant resume sample

- •Managed annual budget of $10M, implemented financial strategies and reduced overhead costs by 15%.

- •Developed financial reports for management and board, aiding strategic planning and doubling clarity in reporting.

- •Supervised accounts payable and receivable, reduced processing time by 20%, ensuring prompt payment and cash flow.

- •Coordinated external audits, achieving compliance standards with zero discrepancies for three consecutive years.

- •Trained staff on financial best practices, enhancing team efficiency by 25% and improving financial literacy.

- •Collaborated with program managers to track $5M in grant expenditures, ensuring funds met intended outcomes.

- •Analyzed financial statements monthly, identifying cost-saving measures resulting in 10% reduction in expenses.

- •Oversaw operational budget development, enhancing forecasting accuracy by 30% through advanced modeling techniques.

- •Effectively managed and monitored $2M in grant funding, ensuring compliance and allocation accuracy.

- •Worked with cross-functional teams to enhance reporting and cut report preparation time by 40%.

- •Implemented new financial software, training staff and improving workflow efficiency across departments.

- •Prepared and maintained financial records in compliance with nonprofit standards, increasing accuracy by 95%.

- •Assisted in budget preparation and variance analysis, providing key data for executive decision-making.

- •Managed general ledger accounts, ensuring accurate tracking and reporting of all financial transactions.

- •Reconciled balance sheets and income statements monthly, reducing discrepancies by 50%.

- •Collaborated on financial audits, ensuring all records met stringent compliance standards and passing all evaluations.

- •Processed accounts payable/receivable cycles, maintaining timely and accurate financial information.

- •Contributed to the implementation of internal controls, enhancing asset protection and financial integrity.

- •Monitored petty cash and expense reimbursements, ensuring all transactions adhered to organizational policies.

Canadian Certified Information Systems Auditor Accountant resume sample

- •Led team to assess IT controls, enhancing operational efficiency by 25% and compliance across organizational levels.

- •Evaluated financial systems and regulations, resulting in an audit compliance rate improvement of 20% annually.

- •Coordinated with departments to gather and analyze data, ensuring accurate reporting and compliance with Canadian standards.

- •Developed insights leading to a 35% enhancement in data security protocols, safeguarding sensitive financial data.

- •Prepared and presented detailed audit reports to stakeholders, suggesting solutions adopted for system robustness.

- •Conducted follow-up audits, verifying corrective actions, achieving a 90% implementation success rate across departments.

- •Managed IT audits that identified vulnerabilities and improved governance frameworks, reducing risks by 40%.

- •Led comprehensive risk assessments, enhancing governance and achieving a 95% client satisfaction score.

- •Integrated new technologies leading to improved audit processes, boosting accuracy by 30%.

- •Collaborated across departments, streamlining procedures and achieving 100% compliance with new regulations.

- •Authored training programs improving department awareness and adhering to best practices in information systems.

- •Performed complex audits enhancing data integrity by 25%, improving internal controls substantially.

- •Implemented audit software tools, which increased auditing efficiency by 30% over two years.

- •Recommended system improvements that were implemented, leading to a 20% reduction in audit findings.

- •Prepared audit reports with actionable insights, improving stakeholder decision-making and compliance rates.

- •Conducted information systems audits that identified control weaknesses, improving organizational security posture by 15%.

- •Engaged with multi-department teams to gather financial data, enhancing report accuracy and audit effectiveness.

- •Developed audit guidelines adopted across the company, resulting in standardized and streamlined processes.

- •Provided recommendations on IT infrastructure improvements, boosting efficiency and data protection levels significantly.

As a Canadian accountant, your financial expertise and attention to detail are invaluable assets. Transferring these skills onto a resume, however, can often feel as puzzling as solving a complex equation without a formula. Given the competitive job market, a well-crafted resume becomes your essential tool for standing out. Capturing your extensive experience and technical know-how in a succinct document can indeed pose a challenge.

The first step in overcoming this challenge is understanding how to present your skills effectively. A professional and organized resume isn’t just a formality—it serves as your introduction to employers and a crucial factor in securing an interview.

To streamline this process, using a resume template can guide you in structuring your information clearly and effectively. These templates assist in highlighting your qualifications, experience, and skills that comply with Canadian accounting standards. Exploring a variety of resume templates is a great starting point for crafting a powerful resume.

By focusing on relevant experience and using language specific to the industry, you create a significant impact. Tailoring each resume to the job at hand ensures that you're not just listing your skills, but also demonstrating how they fit the employer’s needs. Starting with the right template simplifies this task, showcasing your professionalism and preparedness in the best light.

In this guide, you’ll learn how to transform your expertise into a resume that captures attention and opens doors to interviews.

Key Takeaways

- Understanding how to effectively present skills and experience is key to creating a standout Canadian accountant resume.

- A well-structured resume, ideally using a template, helps highlight qualifications and experience that meet Canadian accounting standards.

- Emphasizing achievements and tailoring each resume to specific job applications ensures relevance and impact.

- The functional resume format focuses on skills and achievements, which is beneficial for showing expertise or addressing employment gaps.

- Additional sections such as certifications, languages, and volunteer work can further enhance your resume's relevance and appeal.

What to focus on when writing your canadian accountant resume

A Canadian accountant resume should seamlessly convey your financial expertise and your ability to contribute significantly to a company’s success. Clearly highlight your skills in financial reporting, budgeting, and tax preparation, as these competencies signal to recruiters your capability to handle key financial tasks. Emphasizing your commitment to accuracy, along with a deep understanding of Canadian accounting standards, showcases your ability to analyze data effectively for informed decision-making.

How to structure your canadian accountant resume

- **Contact Information**—your full name, phone number, email address, and a LinkedIn profile that reflects your professional journey. Each element must be current, as this section serves as the first point of contact for recruiters.

- **Professional Summary**—a brief overview focusing on your career objectives as an accountant while outlining your most relevant skills, like financial analysis and problem-solving. Personalize this summary to resonate with your experience and accomplishments within the Canadian accounting landscape, providing a snapshot of what you bring to the table.

- **Work Experience**—enumerate your previous roles with a focus on achievements directly related to accounting. Use metrics to illustrate your accomplishments, such as cost reductions you’ve achieved or efficiencies you’ve implemented, thereby demonstrating your tangible impact in those positions.

- **Education**—list your degrees and relevant certifications, such as the CPA (Chartered Professional Accountant). Include the institution’s name and your graduation date to complete this section, underscoring your foundational knowledge and formal training in accounting.

- **Skills**—emphasize specific abilities like expertise in Canadian tax law, adeptness in financial forecasting, and fluency in accounting software such as QuickBooks or Sage. This section should solidify your technical proficiency and ability to leverage these tools effectively.

- **Certifications and Professional Affiliations**—mention credentials like CPA or other accounting certifications, and detail your involvement in relevant professional organizations. This section highlights your ongoing commitment to continual learning and staying updated with the latest industry practices.

Consider optional sections such as Awards, Languages, or Volunteer Experience that might relate to accounting. These can provide additional context and demonstrate personal strengths that reinforce your career persona. Now that we understand the key components of a Canadian accountant resume, let's delve into the resume format where we’ll examine each section more in-depth.

Which resume format to choose

Creating the ideal resume for a Canadian accountant starts with selecting the right format. The functional format is your best bet, as it emphasizes skills and achievements over work history. This is especially useful if you're looking to showcase expertise in complex accounting tasks or cover employment gaps. By starting with your strengths, prospective employers can quickly identify how you can add value to their organization.

Next, the font you choose plays a pivotal role in the overall presentation of your resume. For a modern and professional look, consider using Rubik, Lato, or Montserrat. These fonts offer a clean appearance that complements your skill-focused layout. Keeping the font size between 10 and 12 points ensures readability while maintaining a sleek style, helping your resume stand out in a stack of applications.

When it comes to file type, always opt for saving your resume as a PDF. PDFs preserve your formatting and layout across all devices, ensuring that your resume looks exactly as you intended. This consistency is crucial, as it reflects your attention to detail—an essential trait for any accountant.

Finally, margins are a subtle yet crucial component of your resume's design. Setting margins to one inch on all sides not only provides a balanced amount of white space but also ensures your content is easy to scan. This creates an inviting and professional appearance, helping recruiters quickly find the information they need.

By focusing on these nuanced details, you craft a resume that not only highlights your qualifications as a Canadian accountant but also positions you effectively for new opportunities.

How to write a quantifiable resume experience section

Your resume experience section is crucial because it highlights your professional growth and showcases the skills you've developed over time. By focusing on quantified achievements, you make this section impactful and relevant. Structure it with your most recent experience first to capture attention immediately, keeping entries from the last 10 to 15 years for relevance. Tailoring your resume for each job is essential; mirroring the language from the job ad ensures it speaks directly to the employer's needs. Action words like “managed,” “analyzed,” and “optimized” effectively convey your responsibilities and accomplishments.

- •Boosted financial efficiency by 20% with new budgeting software and streamlined processes.

- •Led a team of 5 accountants in reconciling and preparing financial reports, cutting errors by 30%.

- •Managed end-to-end audit processes with zero findings during regulatory reviews.

- •Created a financial strategy that increased revenue by $500,000 in the first year.

In this section, action verbs like "Boosted," "Led," "Managed," and "Created" weave together a narrative of your roles that keeps the reader engaged. Each bullet point builds on the last, not only providing measurable success but also emphasizing your leadership and strategic thinking. By highlighting achievements in a cohesive manner, your experience stands out, making a direct connection between your skills and what employers are looking for. This approach clearly demonstrates your value through specific, quantifiable metrics and ensures your resume speaks directly to the job at hand.

Achievement-Focused resume experience section

A well-crafted achievement-focused resume experience section should clearly illustrate how you've made a positive impact in your previous roles as a Canadian accountant. Start by reflecting on your most significant accomplishments that underscore your skills and contributions. By using specific numbers or percentages, you can easily demonstrate the tangible results of your efforts. This approach helps potential employers quickly understand the value you provided to past employers.

To effectively convey your achievements, kick off each bullet point with a strong action verb that highlights your initiative and leadership. Keep your language straightforward and centered on your achievements, rather than just listing tasks. Additionally, tailoring your resume to align with the job you're applying for can make it more engaging. This strategic presentation of your successes will clearly show employers why you are an ideal candidate for their team.

Senior Accountant

Maple Leaf Finance

June 2018 - August 2023

- Managed a team that cut the monthly closing process by 20% through the automation of reporting tasks.

- Boosted financial reporting accuracy by 15% by implementing a new internal audit system.

- Led cost-saving efforts, reducing overhead by 10% annually by renegotiating vendor contracts.

- Increased client retention by 25% by creating personalized financial strategies.

Skills-Focused resume experience section

A skills-focused Canadian accountant resume experience section should effectively showcase your unique expertise and the value you've added in previous roles. Instead of listing tasks, highlight specific accomplishments that clearly demonstrate your impact. Use action verbs and quantify your achievements to provide a vivid picture of your contributions. This makes it easy for potential employers to understand the direct benefits your skills can bring to their organization.

Begin by outlining your achievements in a clear and concise manner, making sure to focus on key skills or accomplishments for each point. Tailor this section according to the job you're applying for by emphasizing the skills that align with the job description. Turn your responsibilities into engaging stories using the STAR method (Situation, Task, Action, Result), which helps prove your effectiveness as an accountant. Keep the section rich with impactful content to really capture the attention of hiring managers.

Senior Accountant

Maple Finance Group

January 2020 - Present

- Led a team to implement a new accounting software, resulting in a 30% increase in efficiency.

- Managed monthly closing processes, reducing closing time by 20%.

- Developed a financial forecasting model that improved budget accuracy by 15%.

- Conducted an internal audit that identified potential savings of $50,000 annually.

Problem-Solving Focused resume experience section

A problem-solving-focused Canadian accountant resume experience section should highlight your skills in tackling financial challenges effectively. Start by identifying key projects or situations where you successfully addressed accounting issues. Use specific, measurable examples, such as reducing expenses or improving budgeting processes, to clearly illustrate your contributions. Keep each bullet point concise and impactful, ensuring they all convey a strong sense of your abilities.

Describe scenarios where you demonstrated strong analytical and critical thinking skills, smoothly transitioning to mention any strategic or innovative approaches you employed. Providing context can enhance how your achievements are perceived. Emphasize improvements you've made in financial processes, regulatory compliance, or contributions to a company's financial health. Your capacity to analyze data, detect discrepancies, and implement practical solutions should stand out in every example.

Senior Accountant

Financial Visionaries Inc.

June 2019 - Present

- Implemented a budgeting process that cut waste by 15% over six months.

- Created a forecasting tool boosting accuracy by 20%, which aided decision-making.

- Streamlined report preparation, saving 30% of time spent on financial reports.

- Revamped compliance protocols to ensure 100% adherence to Canadian regulations.

Innovation-Focused resume experience section

An innovation-focused Canadian accountant resume experience section should clearly highlight how you've used creativity to drive improvements and deliver results. Start by showcasing where you've introduced new tools or methods that made a tangible difference, such as streamlining processes or enhancing reporting accuracy. Detail the benefits your innovations brought, whether through cost savings, efficiency improvements, or accurate forecasts, to illustrate the value you added.

Use straightforward language to connect your role with the positive outcomes achieved, reinforcing your impact with specific metrics. By providing multiple examples of your innovative contributions, you demonstrate your consistent ability to transform ideas into effective solutions that benefit the organization.

Senior Accountant

Maple Financial Services

2018 - 2021

- Developed a streamlined financial reporting system, reducing monthly closing time by 20%.

- Implemented innovative software tools that improved data accuracy by 15%.

- Led a team to identify and eliminate redundancies, achieving cost savings of $50,000 annually.

- Introduced new budget forecasting techniques that enhanced accuracy and efficiency.

Write your canadian accountant resume summary section

A focused Canadian accountant resume summary should spotlight the unique skills and experiences that make you stand out in the finance industry. It's essential to capture attention quickly by highlighting your knowledge of Canadian tax laws, financial regulations, and proficiency in relevant software systems. Clear, strong language helps convey your value to prospective employers. Reflect on how your accomplishments and skills have made significant impacts in your past roles. To illustrate these achievements effectively, consider including specific numbers or percentages.

This example effectively communicates the accountant's ability to manage finances while fostering strong relationships. Notable achievements, like cost reduction and software expertise, further emphasize their skill set.

Understanding the differences between resume elements is key. A resume summary provides an overview of your career journey, while an objective highlights your future goals, which is ideal for those starting out or changing directions. Meanwhile, a resume profile presents a broader view of your professional capabilities, often in more detail. A summary of qualifications, on the other hand, quickly lists key achievements in bullet points. Recognizing these distinctions allows you to tailor your resume to various applications, aligning your personal strengths with the specific needs of each position to make a memorable impact.

Listing your canadian accountant skills on your resume

A skills-focused Canadian accountant resume should clearly present your competencies in a way that both stands alone and complements sections like experience or summary. Your strengths and soft skills are vital to highlight since they showcase your ability to work well with teams, communicate effectively, and manage your time efficiently. Hard skills, on the other hand, are the specific, learned abilities such as expertise in accounting software and financial analysis that demonstrate your technical proficiency.

Skills and strengths act as powerful resume keywords, boosting your resume's visibility to recruiters and applicant tracking systems (ATS). Using keywords that reflect your technical abilities and personal traits will make a strong impact.

Here's an example of a standalone skills section:

This section effectively lists eight essential skills for accounting roles in Canada. Each skill is relevant, enhancing the overall clarity, while serving as valuable keywords for ATS searches. These competencies reflect what is crucial for the role.

Best hard skills to feature on your Canadian accountant resume

Hard skills for Canadian accountants center on your technical abilities. They show your expertise and readiness to tackle accounting tasks with precision.

Hard Skills

- Financial Reporting

- Tax Preparation

- Audit Management

- Risk Assessment

- Financial Analysis

- Budgeting and Forecasting

- IFRS and ASPE Knowledge

- Internal Controls

- Microsoft Excel

- QuickBooks

- SAP Accounting Software

- Data Analysis

- ERP Systems

- Transactional Accounting

- Cost Analysis

Best soft skills to feature on your Canadian accountant resume

Soft skills demonstrate your ability to work collaboratively and manage day-to-day tasks effectively.

Ensure a balance between these technical and interpersonal skills in your resume to offer a comprehensive view of your capabilities.

Soft Skills

- Communication

- Teamwork

- Attention to Detail

- Problem-Solving

- Time Management

- Adaptability

- Critical Thinking

- Leadership

- Interpersonal Skills

- Organizational Skills

- Emotional Intelligence

- Conflict Resolution

- Decision-Making

- Analytical Skills

- Integrity

How to include your education on your resume

An education section is a crucial part of a Canadian accountant's resume. This section showcases your schooling and helps potential employers understand your qualifications. It's important to tailor this section to the job you're applying for, which means excluding irrelevant education. For instance, if you studied something unrelated, omit it to keep the focus on your accounting credentials. When listing your degree, start with the name of the degree, followed by your field of study. Include your institution name and location, then date of completion. If your GPA is strong, it can be added in the education section. Additionally, if you graduated with honors like cum laude, include that to showcase your academic achievements. Here are some examples of how to do it wrong and right:

- •Graduated with honors (Cum Laude)

The second example is well-crafted for an aspiring accountant. It focuses on a degree in accounting and highlights the prestigious University of Toronto. Including the GPA shows academic excellence, and noting the cum laude honors further reinforces your qualifications. This tailored approach ensures you present yourself as a strong candidate for the accounting role you're targeting.

How to include canadian accountant certificates on your resume

A well-crafted Certificates section on your Canadian accountant resume can make a significant impact. List the name of the certificate to start this section effectively. Include the date you received the certification to show its relevance. Add the issuing organization so potential employers know the credibility of the certificate.

You can also highlight a key certification in the header for added visibility. For example, a heading like "John Doe, CPA, CGA" can immediately show your qualifications. Here’s a more detailed example of a Certificates section:

This example is strong because it lists relevant certifications for the accounting field and adds credibility by mentioning recognized issuing bodies. These certifications directly align with the job of a Canadian accountant, signaling you are well-qualified. Including dates and issuers ensures transparency and enhances trust in your qualifications.

Extra sections to include in your canadian accountant resume

Landing a job as a Canadian accountant requires keen attention to detail and a well-crafted resume. Your resume is your opportunity to present who you are, showcasing your qualifications and experiences that make you the right fit for the role. Including sections beyond basic qualifications can highlight your well-rounded personality and demonstrate additional skills that set you apart.

Language section — List languages you are fluent in. Reveal your proficiency to show your ability to communicate with a diverse client base.

Hobbies and interests section — Identify activities that demonstrate valuable traits like diligence and precision. Add a personal touch to make your resume more memorable.

Volunteer work section — Document unpaid experiences that developed your skills. Show that you contribute to your community and are committed to social responsibility.

Books section — Mention books that have influenced your professional growth. Indicate that you continually seek knowledge to enhance your expertise.

In Conclusion

In conclusion, creating an effective Canadian accountant resume requires careful attention to detail and strategic presentation of your skills and experiences. Your resume should serve as a clear reflection of your professional capabilities and readiness for the demands of the accounting field. It's important to highlight both your technical skills, such as proficiency in financial analysis and tax preparation, and soft skills like communication and problem-solving. Tailoring your resume for each job application by demonstrating how your skills align with the employer’s needs is crucial. Using a modern format with appropriate fonts and maintaining professional layout in a PDF format ensures your document is both visually appealing and functional on all devices. Including certifications and educational background further solidifies your credibility and expertise. By weaving in stories of your past achievements, you create a narrative that not only captures attention but also positions you as a strong candidate. Optional sections like volunteer work or hobbies can add depth and showcase a well-rounded personality that may resonate with potential employers. With these components combined, your resume can effectively open doors to interviews and new opportunities in the competitive Canadian job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.