Capital Markets Lawyer Resume Examples

Jul 18, 2024

|

12 min read

"Market yourself: Craft the perfect capital markets lawyer resume to showcase your skills and experience with precision. Stand out in the legal market and attract top firms with a resume that hits the bullseye."

Rated by 348 people

Securities and Capital Markets Counsel

Mergers and Acquisitions Capital Markets Attorney

Capital Markets Regulatory Compliance Lawyer

Derivatives and Capital Markets Counsel

Capital Markets and Financial Services Attorney

Structured Finance and Capital Markets Lawyer

Debt Capital Markets Solicitor

Equity Capital Markets Attorney

Project Finance Capital Markets Lawyer

Cross-Border Capital Markets Attorney

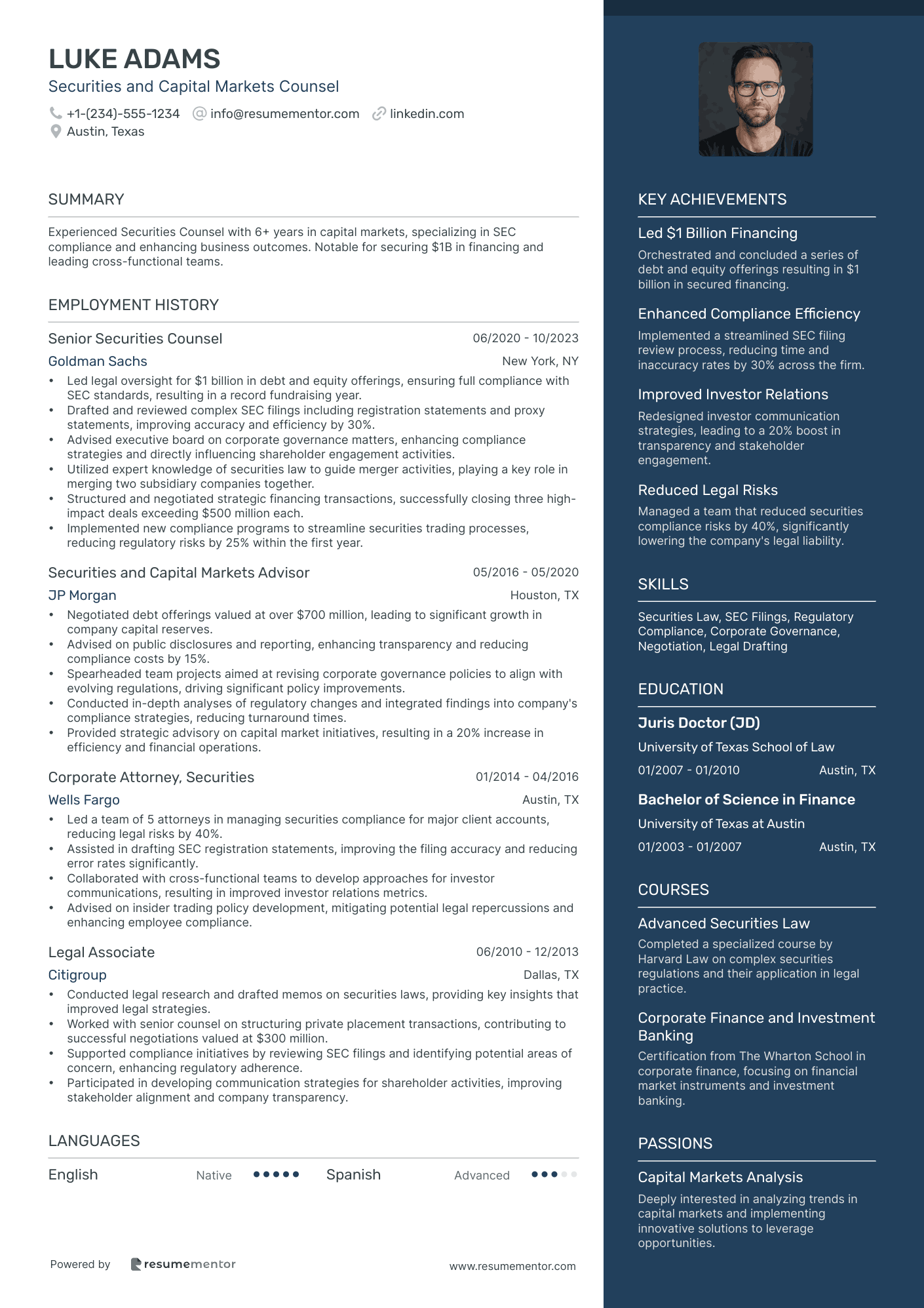

Securities and Capital Markets Counsel resume sample

When applying for a role in this field, focus on your legal expertise in securities regulations and compliance. Highlight your experience with drafting and reviewing complex financial documents, as well as your understanding of market trends. Experience in advising clients on investment strategies is important. Include any relevant certifications, such as 'SEC Compliance' or 'Financial Markets Law'. Provide specific examples of how your legal advice has mitigated risks or improved client outcomes, using a 'challenge-solution-impact' structure to demonstrate the value you bring.

- •Led legal oversight for $1 billion in debt and equity offerings, ensuring full compliance with SEC standards, resulting in a record fundraising year.

- •Drafted and reviewed complex SEC filings including registration statements and proxy statements, improving accuracy and efficiency by 30%.

- •Advised executive board on corporate governance matters, enhancing compliance strategies and directly influencing shareholder engagement activities.

- •Utilized expert knowledge of securities law to guide merger activities, playing a key role in merging two subsidiary companies together.

- •Structured and negotiated strategic financing transactions, successfully closing three high-impact deals exceeding $500 million each.

- •Implemented new compliance programs to streamline securities trading processes, reducing regulatory risks by 25% within the first year.

- •Negotiated debt offerings valued at over $700 million, leading to significant growth in company capital reserves.

- •Advised on public disclosures and reporting, enhancing transparency and reducing compliance costs by 15%.

- •Spearheaded team projects aimed at revising corporate governance policies to align with evolving regulations, driving significant policy improvements.

- •Conducted in-depth analyses of regulatory changes and integrated findings into company's compliance strategies, reducing turnaround times.

- •Provided strategic advisory on capital market initiatives, resulting in a 20% increase in efficiency and financial operations.

- •Led a team of 5 attorneys in managing securities compliance for major client accounts, reducing legal risks by 40%.

- •Assisted in drafting SEC registration statements, improving the filing accuracy and reducing error rates significantly.

- •Collaborated with cross-functional teams to develop approaches for investor communications, resulting in improved investor relations metrics.

- •Advised on insider trading policy development, mitigating potential legal repercussions and enhancing employee compliance.

- •Conducted legal research and drafted memos on securities laws, providing key insights that improved legal strategies.

- •Worked with senior counsel on structuring private placement transactions, contributing to successful negotiations valued at $300 million.

- •Supported compliance initiatives by reviewing SEC filings and identifying potential areas of concern, enhancing regulatory adherence.

- •Participated in developing communication strategies for shareholder activities, improving stakeholder alignment and company transparency.

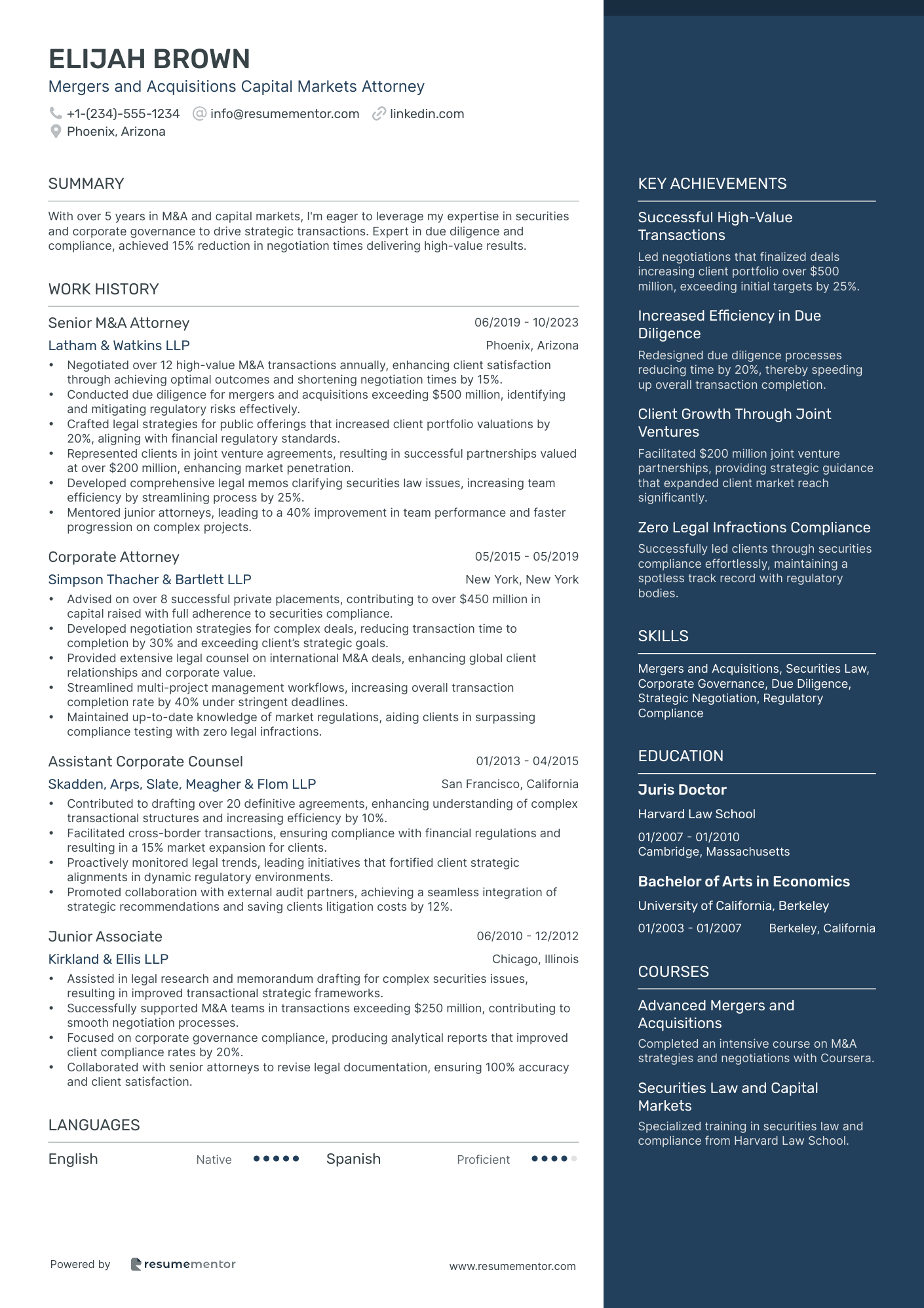

Mergers and Acquisitions Capital Markets Attorney resume sample

When applying for a position, it’s essential to highlight any experience in corporate finance or transactional law. Showcase abilities in due diligence, negotiation, and drafting complex agreements. If you have completed courses or certifications in corporate law or financial structuring, include these details to reflect your knowledge base. Provide concrete examples of how your legal expertise led to successful deal closures or minimized risks, following a 'challenge-action-result' format. This approach can demonstrate your value and commitment to potential employers effectively.

- •Negotiated over 12 high-value M&A transactions annually, enhancing client satisfaction through achieving optimal outcomes and shortening negotiation times by 15%.

- •Conducted due diligence for mergers and acquisitions exceeding $500 million, identifying and mitigating regulatory risks effectively.

- •Crafted legal strategies for public offerings that increased client portfolio valuations by 20%, aligning with financial regulatory standards.

- •Represented clients in joint venture agreements, resulting in successful partnerships valued at over $200 million, enhancing market penetration.

- •Developed comprehensive legal memos clarifying securities law issues, increasing team efficiency by streamlining process by 25%.

- •Mentored junior attorneys, leading to a 40% improvement in team performance and faster progression on complex projects.

- •Advised on over 8 successful private placements, contributing to over $450 million in capital raised with full adherence to securities compliance.

- •Developed negotiation strategies for complex deals, reducing transaction time to completion by 30% and exceeding client’s strategic goals.

- •Provided extensive legal counsel on international M&A deals, enhancing global client relationships and corporate value.

- •Streamlined multi-project management workflows, increasing overall transaction completion rate by 40% under stringent deadlines.

- •Maintained up-to-date knowledge of market regulations, aiding clients in surpassing compliance testing with zero legal infractions.

- •Contributed to drafting over 20 definitive agreements, enhancing understanding of complex transactional structures and increasing efficiency by 10%.

- •Facilitated cross-border transactions, ensuring compliance with financial regulations and resulting in a 15% market expansion for clients.

- •Proactively monitored legal trends, leading initiatives that fortified client strategic alignments in dynamic regulatory environments.

- •Promoted collaboration with external audit partners, achieving a seamless integration of strategic recommendations and saving clients litigation costs by 12%.

- •Assisted in legal research and memorandum drafting for complex securities issues, resulting in improved transactional strategic frameworks.

- •Successfully supported M&A teams in transactions exceeding $250 million, contributing to smooth negotiation processes.

- •Focused on corporate governance compliance, producing analytical reports that improved client compliance rates by 20%.

- •Collaborated with senior attorneys to revise legal documentation, ensuring 100% accuracy and client satisfaction.

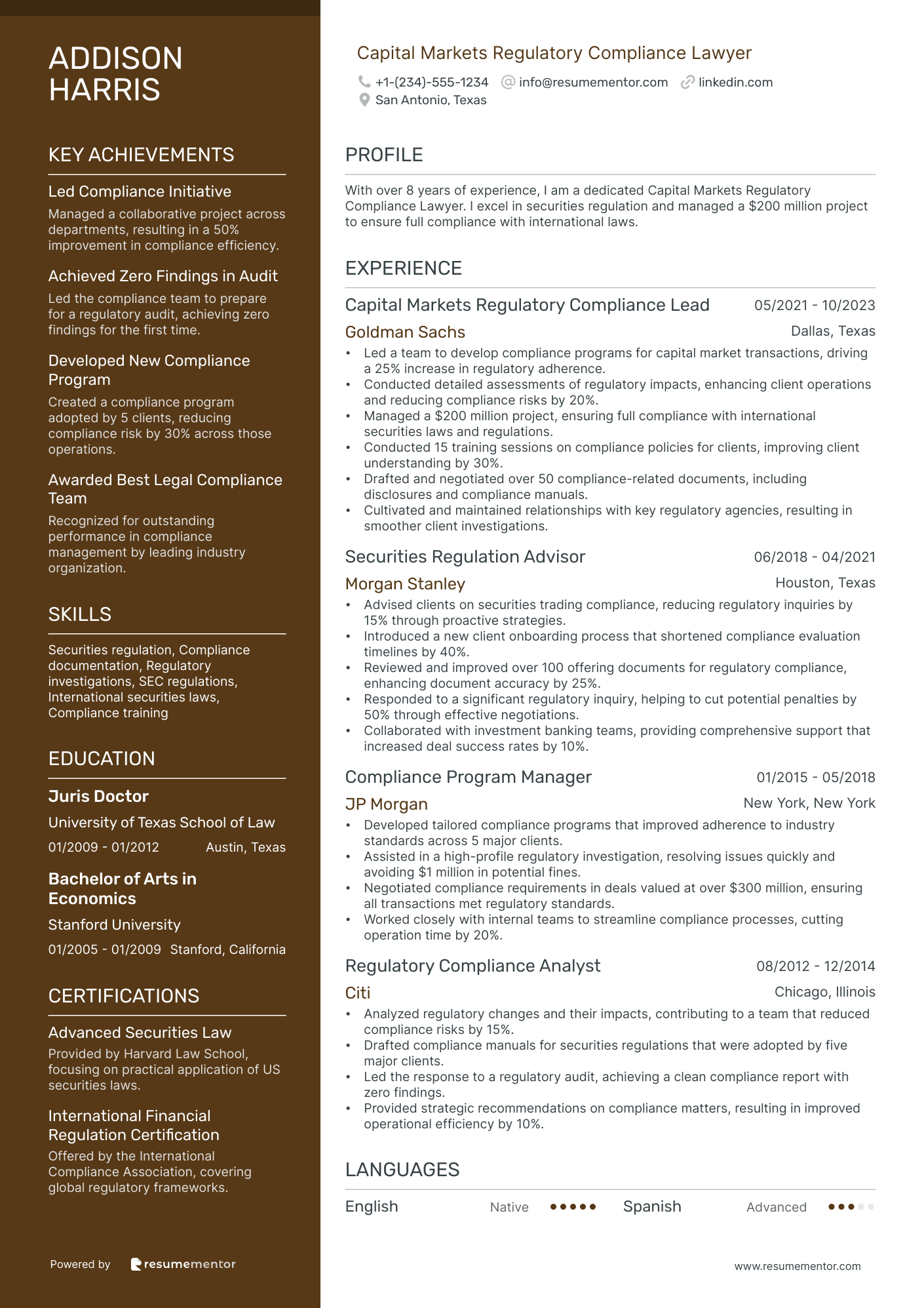

Capital Markets Regulatory Compliance Lawyer resume sample

When crafting a cover letter for this role, highlight your understanding of relevant regulations and compliance frameworks. Emphasize experience with risk assessment and regulatory reporting. If you've participated in compliance audits or developed compliance training programs, be sure to mention these specific contributions. Show how your analytical skills have helped identify potential issues before they became problems, utilizing a 'skill-action-result' framework. It's essential to detail how your insights have improved compliance outcomes or reduced risks for your previous employers.

- •Led a team to develop compliance programs for capital market transactions, driving a 25% increase in regulatory adherence.

- •Conducted detailed assessments of regulatory impacts, enhancing client operations and reducing compliance risks by 20%.

- •Managed a $200 million project, ensuring full compliance with international securities laws and regulations.

- •Conducted 15 training sessions on compliance policies for clients, improving client understanding by 30%.

- •Drafted and negotiated over 50 compliance-related documents, including disclosures and compliance manuals.

- •Cultivated and maintained relationships with key regulatory agencies, resulting in smoother client investigations.

- •Advised clients on securities trading compliance, reducing regulatory inquiries by 15% through proactive strategies.

- •Introduced a new client onboarding process that shortened compliance evaluation timelines by 40%.

- •Reviewed and improved over 100 offering documents for regulatory compliance, enhancing document accuracy by 25%.

- •Responded to a significant regulatory inquiry, helping to cut potential penalties by 50% through effective negotiations.

- •Collaborated with investment banking teams, providing comprehensive support that increased deal success rates by 10%.

- •Developed tailored compliance programs that improved adherence to industry standards across 5 major clients.

- •Assisted in a high-profile regulatory investigation, resolving issues quickly and avoiding $1 million in potential fines.

- •Negotiated compliance requirements in deals valued at over $300 million, ensuring all transactions met regulatory standards.

- •Worked closely with internal teams to streamline compliance processes, cutting operation time by 20%.

- •Analyzed regulatory changes and their impacts, contributing to a team that reduced compliance risks by 15%.

- •Drafted compliance manuals for securities regulations that were adopted by five major clients.

- •Led the response to a regulatory audit, achieving a clean compliance report with zero findings.

- •Provided strategic recommendations on compliance matters, resulting in improved operational efficiency by 10%.

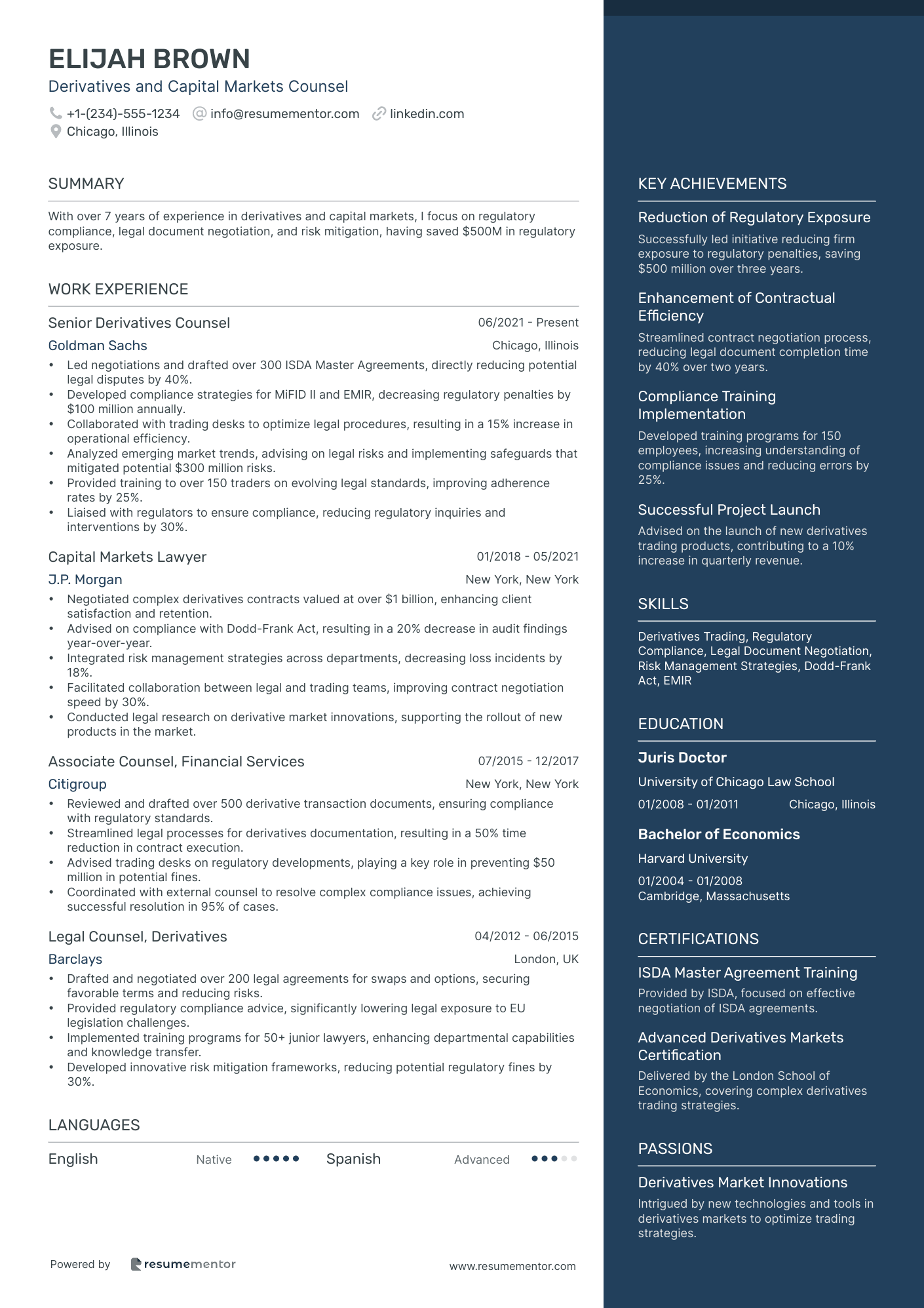

Derivatives and Capital Markets Counsel resume sample

When applying for this position, it's important to showcase your knowledge of derivatives, regulatory compliance, and risk assessment. Highlight any prior experience working with financial products or asset management teams. Include specific achievements, such as successful negotiation of complex contracts or your contribution to risk mitigation strategies. Certifications like 'Financial Risk Manager' or relevant legal courses add credibility. Use concrete examples that illustrate your ability to navigate intricate legal frameworks and how your contributions resulted in positive outcomes for clients or projects.

- •Led negotiations and drafted over 300 ISDA Master Agreements, directly reducing potential legal disputes by 40%.

- •Developed compliance strategies for MiFID II and EMIR, decreasing regulatory penalties by $100 million annually.

- •Collaborated with trading desks to optimize legal procedures, resulting in a 15% increase in operational efficiency.

- •Analyzed emerging market trends, advising on legal risks and implementing safeguards that mitigated potential $300 million risks.

- •Provided training to over 150 traders on evolving legal standards, improving adherence rates by 25%.

- •Liaised with regulators to ensure compliance, reducing regulatory inquiries and interventions by 30%.

- •Negotiated complex derivatives contracts valued at over $1 billion, enhancing client satisfaction and retention.

- •Advised on compliance with Dodd-Frank Act, resulting in a 20% decrease in audit findings year-over-year.

- •Integrated risk management strategies across departments, decreasing loss incidents by 18%.

- •Facilitated collaboration between legal and trading teams, improving contract negotiation speed by 30%.

- •Conducted legal research on derivative market innovations, supporting the rollout of new products in the market.

- •Reviewed and drafted over 500 derivative transaction documents, ensuring compliance with regulatory standards.

- •Streamlined legal processes for derivatives documentation, resulting in a 50% time reduction in contract execution.

- •Advised trading desks on regulatory developments, playing a key role in preventing $50 million in potential fines.

- •Coordinated with external counsel to resolve complex compliance issues, achieving successful resolution in 95% of cases.

- •Drafted and negotiated over 200 legal agreements for swaps and options, securing favorable terms and reducing risks.

- •Provided regulatory compliance advice, significantly lowering legal exposure to EU legislation challenges.

- •Implemented training programs for 50+ junior lawyers, enhancing departmental capabilities and knowledge transfer.

- •Developed innovative risk mitigation frameworks, reducing potential regulatory fines by 30%.

Capital Markets and Financial Services Attorney resume sample

When applying for this position, it's essential to highlight your experience with regulatory compliance and transaction structuring. Emphasize any knowledge of securities law and regulations, as well as your ability to manage complex agreements. Include relevant courses or certifications, such as 'Securities Regulation' or 'Corporate Finance.' Use real examples of how you've navigated legal challenges or improved compliance processes, employing the 'skill-action-result' format. Demonstrating your ability to analyze market trends and advise clients can significantly impact your application.

- •Led the legal team on a merger transaction valued at $200M, providing strategic legal advice and ensuring regulatory compliance throughout.

- •Successfully negotiated and drafted over 50 securities-related documents, enhancing client portfolio performance by 25%.

- •Conducted in-depth regulatory analysis for clients, reducing compliance risks by 30% through tailored legal strategies.

- •Provided expert guidance on international capital markets projects, resulting in 15% increased cross-border client engagements.

- •Developed and delivered 10 compliance training sessions for investment teams, significantly increasing regulatory adherence.

- •Advised on regulatory changes and securities law developments, enabling clients to adapt strategies efficiently and prevent potential legal liabilities.

- •Advised on and structured public offerings and private placements totaling $300M, navigating complex legal frameworks.

- •Collaborated with business development to increase capital market transactions by 20%, through strategic legal input and analysis.

- •Drafted and reviewed a wide range of financial agreements, ensuring adherence to SEC regulations and improving document efficiency by 15%.

- •Reduced turnaround time for client legal requests by 35%, improving overall client satisfaction and service delivery.

- •Participated in cross-functional teams to integrate innovative risk management practices, enhancing legal service offerings.

- •Conducted legal research on securities laws, contributing to successful client defenses in major regulatory investigations.

- •Improved client contract negotiation outcomes by 40% through precise legal analysis and strategic guidance.

- •Assisted in restructuring corporate finance agreements, enhancing compliance and financial transparency across transactions.

- •Participated in drafting and negotiating M&A contracts, facilitating seamless integration of acquired assets worth $100M.

- •Analyzed complex SEC regulations for multiple clients, resulting in a 50% reduction in potential legal breaches.

- •Drafted legal briefs on securities regulation cases, improving firm's success rate in handling regulatory inquiries by 20%.

- •Monitored changes in financial laws, ensuring proactive client advisory and minimizing regulatory risk.

- •Supported capital markets teams by compiling comprehensive regulatory reports and due diligence documentation.

Structured Finance and Capital Markets Lawyer resume sample

When applying for this role, it's important to highlight any experience with complex financial transactions and asset-backed securities. Detail your understanding of regulatory frameworks and financial modeling tools, showcasing certifications such as 'Financial Analysis' or 'Securities Law'. Include specific instances where your analytical skills led to successful deal structuring or risk assessment. Use the 'skill-action-result' format to illustrate how your contributions helped previous clients navigate challenging financial landscapes or improved transaction efficiencies, thereby encouraging confidence in your expertise.

- •Successfully led a team of junior lawyers in negotiating and closing a $500 million securitization deal, resulting in a 20% increase in revenue for the client.

- •Advised on compliance issues and implemented a new compliance program for asset-backed securities, which is expected to reduce audit times by 40%.

- •Drafted complex financial documents including indentures and purchase agreements with a 98% client satisfaction rate based on post-transaction surveys.

- •Managed multiple high-stake projects with a focus on asset-backed financing, achieving a 15% efficiency increase in document preparation processes.

- •Collaborated with internal stakeholders across three international offices to streamline cross-border transaction processes, leading to a 30% reduction in closing time.

- •Conducted comprehensive legal research on emerging trends in structured finance, directly contributing to policy updates and improving regulatory compliance by 25%.

- •Guided a Fortune 500 client through a complex derivative transaction, increasing its market capitalization by 10% over 12 months.

- •Contributed to the development of a fintech solution for capital markets, enhancing transaction speed by 25% and reducing errors by 15%.

- •Negotiated international financial transactions worth over $1 billion, ensuring full regulatory compliance and satisfying all stakeholder requirements.

- •Improved internal contract review processes by 20% through the implementation of advanced contract lifecycle management software.

- •Trained and mentored two junior associates, resulting in a 30% increase in their billable hours and productivity over 18 months.

- •Successfully managed a portfolio of high-value client accounts, securing an additional $100 million in asset-backed loans.

- •Worked closely with external clients to draft and negotiate transaction agreements, achieving 100% deal closure within projected timelines.

- •Conducted due diligence and legal analysis for an IPO, contributing to a 50% over-subscription rate on launch day.

- •Reduced document preparation time by 30% through the introduction of efficient drafting protocols across the department.

- •Assisted in drafting offering memoranda for a range of financial instruments, contributing to a 25% increase in client acquisition.

- •Supported senior legal team in the execution of large-scale transactions exceeding $1 billion, ensuring seamless regulatory approvals.

- •Compiled comprehensive market analysis reports on securities laws, leading to strategic client advisory services that enhanced market positioning by 15%.

- •Initiated client education workshops on securities compliance, resulting in heightened client engagement and a 95% satisfaction rating.

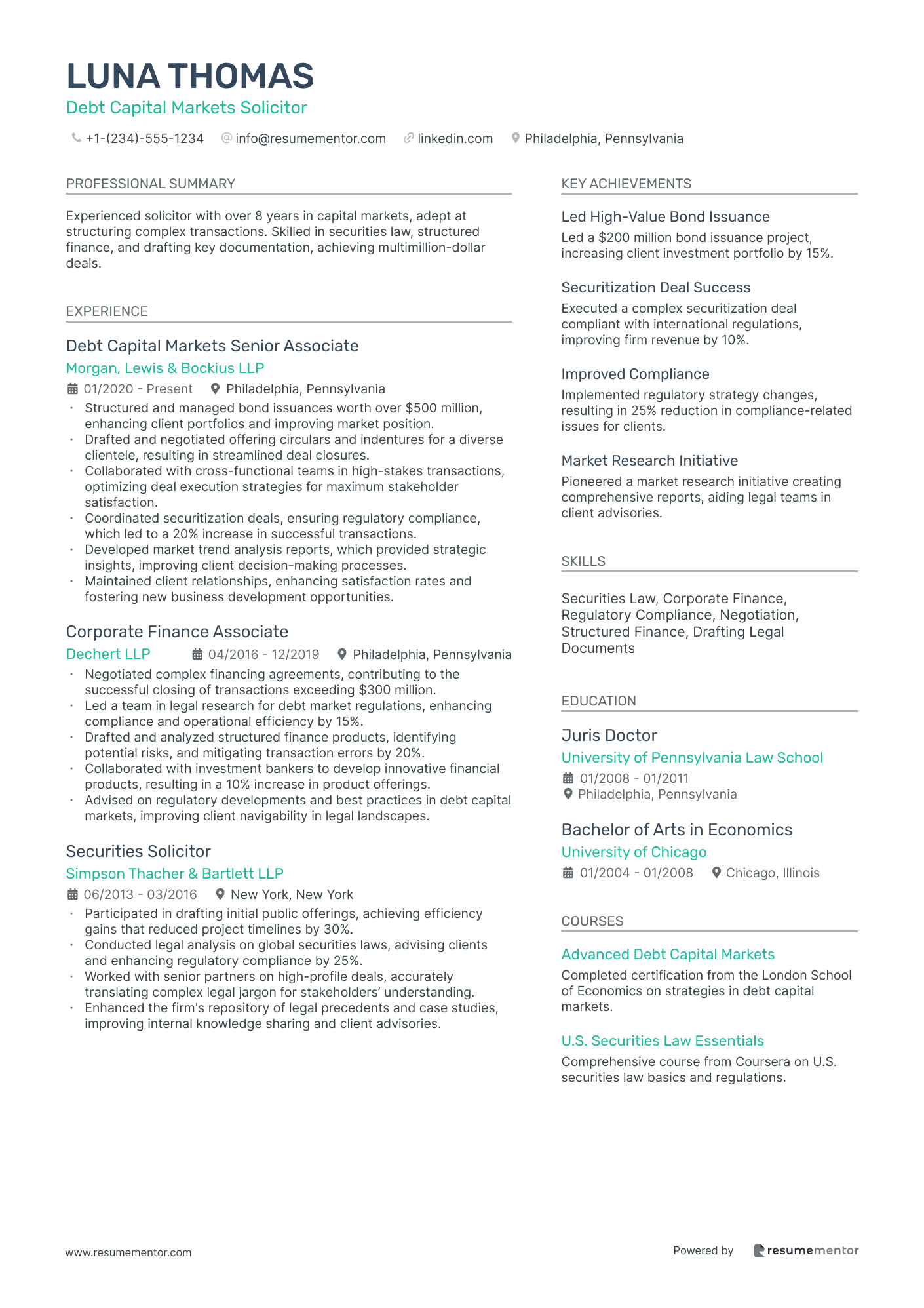

Debt Capital Markets Solicitor resume sample

When applying for this role, it’s essential to highlight any experience in financial markets and understanding of debt instruments. Showcase your analytical skills, especially in credit risk assessment and valuation methods. If you've completed coursework in corporate finance or securities regulation, mention these to demonstrate your qualifications. Include examples of projects where your research significantly influenced decision-making, using the 'skill-action-result' format to illustrate your impact. Don’t forget to mention teamwork experiences that reflect your ability to collaborate under pressure in fast-paced environments.

- •Structured and managed bond issuances worth over $500 million, enhancing client portfolios and improving market position.

- •Drafted and negotiated offering circulars and indentures for a diverse clientele, resulting in streamlined deal closures.

- •Collaborated with cross-functional teams in high-stakes transactions, optimizing deal execution strategies for maximum stakeholder satisfaction.

- •Coordinated securitization deals, ensuring regulatory compliance, which led to a 20% increase in successful transactions.

- •Developed market trend analysis reports, which provided strategic insights, improving client decision-making processes.

- •Maintained client relationships, enhancing satisfaction rates and fostering new business development opportunities.

- •Negotiated complex financing agreements, contributing to the successful closing of transactions exceeding $300 million.

- •Led a team in legal research for debt market regulations, enhancing compliance and operational efficiency by 15%.

- •Drafted and analyzed structured finance products, identifying potential risks, and mitigating transaction errors by 20%.

- •Collaborated with investment bankers to develop innovative financial products, resulting in a 10% increase in product offerings.

- •Advised on regulatory developments and best practices in debt capital markets, improving client navigability in legal landscapes.

- •Participated in drafting initial public offerings, achieving efficiency gains that reduced project timelines by 30%.

- •Conducted legal analysis on global securities laws, advising clients and enhancing regulatory compliance by 25%.

- •Worked with senior partners on high-profile deals, accurately translating complex legal jargon for stakeholders’ understanding.

- •Enhanced the firm's repository of legal precedents and case studies, improving internal knowledge sharing and client advisories.

- •Assisted in managing a portfolio of $200 million in capital market securities, optimizing service delivery.

- •Conducted industry research, providing insights that contributed to the development of new legal services areas.

- •Liaised with international clients, resulting in enhanced cross-border transaction efficiencies and reduced regulatory barriers.

- •Provided detailed financial analysis to support senior solicitors in executing major transactions.

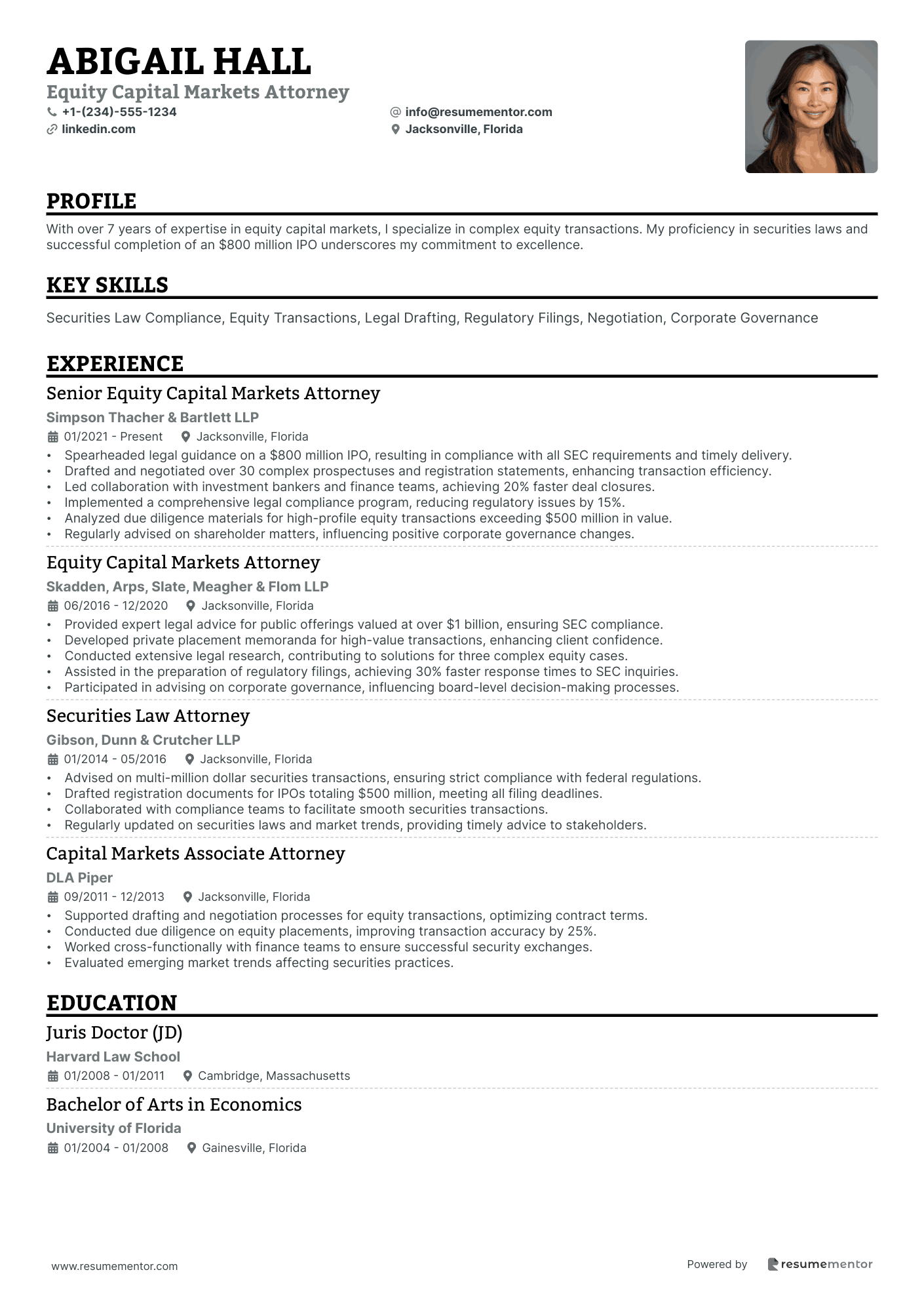

Equity Capital Markets Attorney resume sample

When applying for this role, it’s important to highlight any experience in public offerings or private placements. Emphasize your knowledge of securities laws and regulations. Provide specific examples of how you have successfully navigated complex transactions or resolved legal challenges. Mention any relevant certifications, such as specialized courses in corporate finance or investment banking. Focus on instances where your analytical skills led to favorable outcomes for clients. Use a 'challenge-solution-result' approach to outline your contributions in previous positions.

- •Spearheaded legal guidance on a $800 million IPO, resulting in compliance with all SEC requirements and timely delivery.

- •Drafted and negotiated over 30 complex prospectuses and registration statements, enhancing transaction efficiency.

- •Led collaboration with investment bankers and finance teams, achieving 20% faster deal closures.

- •Implemented a comprehensive legal compliance program, reducing regulatory issues by 15%.

- •Analyzed due diligence materials for high-profile equity transactions exceeding $500 million in value.

- •Regularly advised on shareholder matters, influencing positive corporate governance changes.

- •Provided expert legal advice for public offerings valued at over $1 billion, ensuring SEC compliance.

- •Developed private placement memoranda for high-value transactions, enhancing client confidence.

- •Conducted extensive legal research, contributing to solutions for three complex equity cases.

- •Assisted in the preparation of regulatory filings, achieving 30% faster response times to SEC inquiries.

- •Participated in advising on corporate governance, influencing board-level decision-making processes.

- •Advised on multi-million dollar securities transactions, ensuring strict compliance with federal regulations.

- •Drafted registration documents for IPOs totaling $500 million, meeting all filing deadlines.

- •Collaborated with compliance teams to facilitate smooth securities transactions.

- •Regularly updated on securities laws and market trends, providing timely advice to stakeholders.

- •Supported drafting and negotiation processes for equity transactions, optimizing contract terms.

- •Conducted due diligence on equity placements, improving transaction accuracy by 25%.

- •Worked cross-functionally with finance teams to ensure successful security exchanges.

- •Evaluated emerging market trends affecting securities practices.

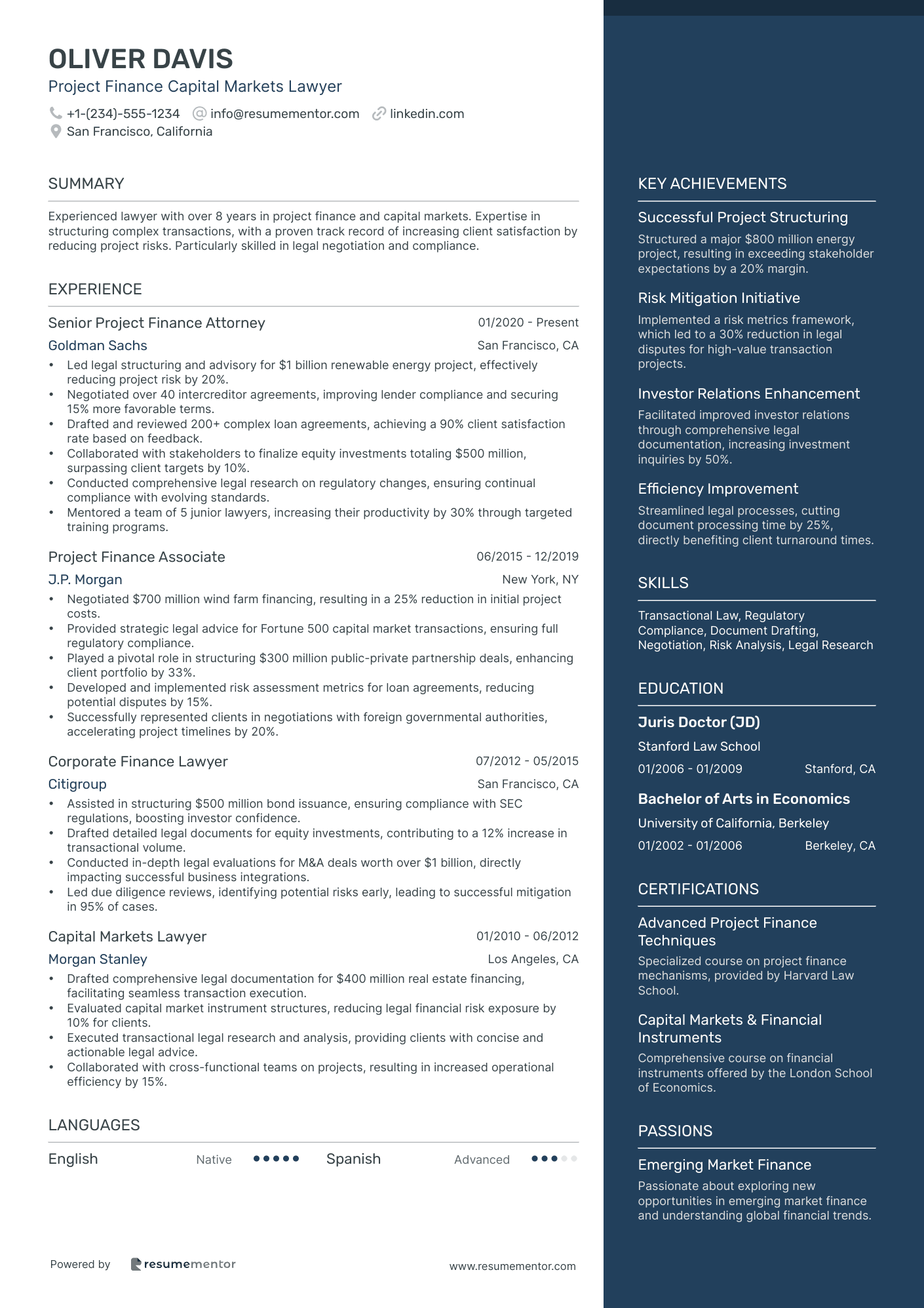

Project Finance Capital Markets Lawyer resume sample

When applying for this role, it’s important to showcase any previous experience in financial modeling or project management. Highlight your expertise in analyzing financial risks and structuring deals. Mention any relevant coursework or certifications, such as 'Project Finance Fundamentals' or 'Risk Assessment Techniques', to demonstrate your knowledge. Use specific examples to illustrate how your analytical skills led to successful project outcomes, focusing on measurable impacts. Employ a 'skill-action-result' approach to clearly articulate how your contributions have driven value in past positions.

- •Led legal structuring and advisory for $1 billion renewable energy project, effectively reducing project risk by 20%.

- •Negotiated over 40 intercreditor agreements, improving lender compliance and securing 15% more favorable terms.

- •Drafted and reviewed 200+ complex loan agreements, achieving a 90% client satisfaction rate based on feedback.

- •Collaborated with stakeholders to finalize equity investments totaling $500 million, surpassing client targets by 10%.

- •Conducted comprehensive legal research on regulatory changes, ensuring continual compliance with evolving standards.

- •Mentored a team of 5 junior lawyers, increasing their productivity by 30% through targeted training programs.

- •Negotiated $700 million wind farm financing, resulting in a 25% reduction in initial project costs.

- •Provided strategic legal advice for Fortune 500 capital market transactions, ensuring full regulatory compliance.

- •Played a pivotal role in structuring $300 million public-private partnership deals, enhancing client portfolio by 33%.

- •Developed and implemented risk assessment metrics for loan agreements, reducing potential disputes by 15%.

- •Successfully represented clients in negotiations with foreign governmental authorities, accelerating project timelines by 20%.

- •Assisted in structuring $500 million bond issuance, ensuring compliance with SEC regulations, boosting investor confidence.

- •Drafted detailed legal documents for equity investments, contributing to a 12% increase in transactional volume.

- •Conducted in-depth legal evaluations for M&A deals worth over $1 billion, directly impacting successful business integrations.

- •Led due diligence reviews, identifying potential risks early, leading to successful mitigation in 95% of cases.

- •Drafted comprehensive legal documentation for $400 million real estate financing, facilitating seamless transaction execution.

- •Evaluated capital market instrument structures, reducing legal financial risk exposure by 10% for clients.

- •Executed transactional legal research and analysis, providing clients with concise and actionable legal advice.

- •Collaborated with cross-functional teams on projects, resulting in increased operational efficiency by 15%.

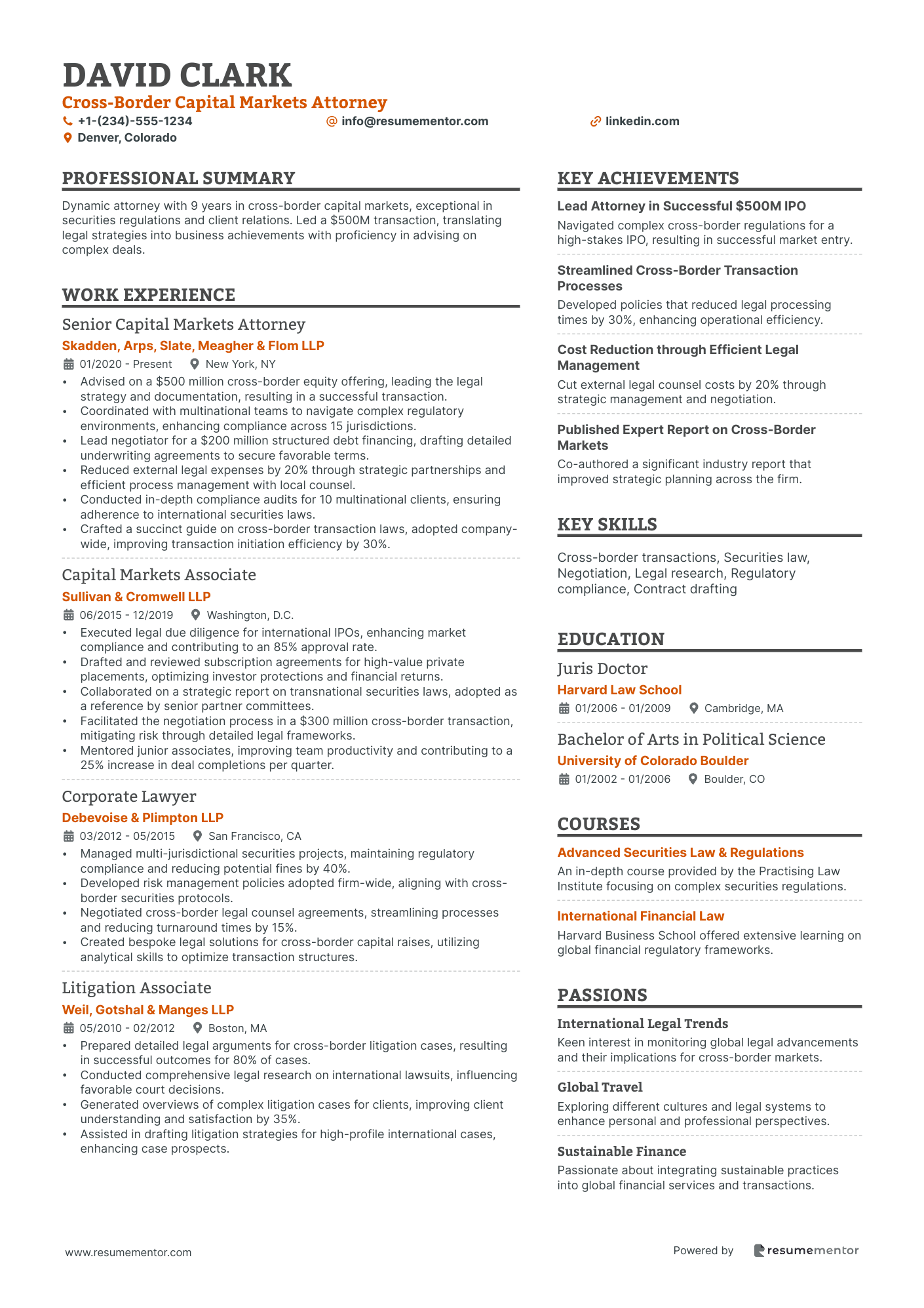

Cross-Border Capital Markets Attorney resume sample

When applying for this role, it’s important to highlight any experience with international transactions or cross-border regulations. Proficiency in foreign regulatory frameworks or the ability to conduct due diligence on non-domestic legal aspects should be emphasized. Additionally, showcase your familiarity with drafting and negotiating complex agreements that involve parties from different jurisdictions. Share specific examples where your analytical skills led to successful outcomes. Illustrate how your work contributed to minimizing risks and enhancing compliance, focusing on measurable impacts to strengthen your application.

- •Advised on a $500 million cross-border equity offering, leading the legal strategy and documentation, resulting in a successful transaction.

- •Coordinated with multinational teams to navigate complex regulatory environments, enhancing compliance across 15 jurisdictions.

- •Lead negotiator for a $200 million structured debt financing, drafting detailed underwriting agreements to secure favorable terms.

- •Reduced external legal expenses by 20% through strategic partnerships and efficient process management with local counsel.

- •Conducted in-depth compliance audits for 10 multinational clients, ensuring adherence to international securities laws.

- •Crafted a succinct guide on cross-border transaction laws, adopted company-wide, improving transaction initiation efficiency by 30%.

- •Executed legal due diligence for international IPOs, enhancing market compliance and contributing to an 85% approval rate.

- •Drafted and reviewed subscription agreements for high-value private placements, optimizing investor protections and financial returns.

- •Collaborated on a strategic report on transnational securities laws, adopted as a reference by senior partner committees.

- •Facilitated the negotiation process in a $300 million cross-border transaction, mitigating risk through detailed legal frameworks.

- •Mentored junior associates, improving team productivity and contributing to a 25% increase in deal completions per quarter.

- •Managed multi-jurisdictional securities projects, maintaining regulatory compliance and reducing potential fines by 40%.

- •Developed risk management policies adopted firm-wide, aligning with cross-border securities protocols.

- •Negotiated cross-border legal counsel agreements, streamlining processes and reducing turnaround times by 15%.

- •Created bespoke legal solutions for cross-border capital raises, utilizing analytical skills to optimize transaction structures.

- •Prepared detailed legal arguments for cross-border litigation cases, resulting in successful outcomes for 80% of cases.

- •Conducted comprehensive legal research on international lawsuits, influencing favorable court decisions.

- •Generated overviews of complex litigation cases for clients, improving client understanding and satisfaction by 35%.

- •Assisted in drafting litigation strategies for high-profile international cases, enhancing case prospects.

As a capital markets lawyer, navigating the world of resume writing can feel like steering a ship through choppy waters. While your expertise in securities regulations and market trends is impressive, translating this into an engaging document requires finesse. The challenge lies in turning your technical skills into language that captures the attention of hiring managers.

Balancing detailed legal experience with clarity can be tricky. You need to highlight your accomplishments and unique contributions while keeping everything easy to read. In such a competitive field, it’s crucial to present your skills and achievements in ways that quickly make an impact.

This is where a well-structured resume template comes into play, offering a solid foundation for organizing your information. A clear format guides each section of your resume, ensuring that your expertise is easily digestible. By using a thoughtfully designed resume template, you can focus on showcasing your strengths without overwhelming potential employers. These are just resume templates, not specifically made for capital markets lawyers.

Crafting each section with care gives you a better chance to stand out from the competition. Your resume is more than a simple list of duties; it’s your most powerful tool for securing interviews in the legal field. With thoughtful preparation, you can turn your diverse skills into a compelling narrative that leaves employers eager to know more about you.

Key Takeaways

- Writing a teacher resume requires turning technical skills into language that captures the attention of hiring managers while keeping it easy to read and impactful.

- A well-structured resume template can help organize information clearly, illustrating legal expertise in digestible ways without overwhelming potential employers.

- Focusing on achievements with clear examples and quantifying results adds credibility, making a resume memorable to recruiters in the competitive capital markets legal field.

- Choosing the right resume format, such as reverse chronological, and ensuring modern font choice, clarity, and PDF saving are vital in maintaining a professional impression.

- The resume should include sections on contact information, professional summary, experience, education, skills, and certifications, tailored to showcase relevant expertise and achievements.

What to focus on when writing your capital markets lawyer resume

A capital markets lawyer resume should convey your expertise in financial law and your ability to manage complex transactions effectively. Recruiters look for strong skills in compliance, negotiation, and financial analysis, as these are essential in the capital markets sector. By highlighting your experience with securities regulations, you can demonstrate your capacity to advise on legal aspects of financial instruments.

How to structure your capital markets lawyer resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile to ensure you're easy to reach—this section is crucial because it provides recruiters with the means to contact you and verify your professional image online.

- Professional Summary: Provide a brief overview of your experience, emphasizing your strengths in capital markets and financial law—this is your chance to catch the recruiter's attention with your most relevant accomplishments and objectives right at the start.

- Experience: Go into detail about your previous roles, focusing on tasks related to securities laws, IPOs, and M&A transactions. Mention any notable deals to showcase your impact—linking your experience to actual results can demonstrate your effectiveness in real-world scenarios, making you more memorable to recruiters.

- Education: List your law degree along with relevant coursework, such as securities law or corporate finance, to show your academic background—providing details on your education reflects your foundational knowledge and commitment to the field of law.

- Skills: Highlight your abilities in legal research, contract negotiation, and knowledge of SEC regulations, which are crucial for a capital markets lawyer—detailing these skills helps to frame your expertise in a way that mirrors the demands of the job.

- Certifications: Include important certifications like bar admission or FINRA licenses that are pertinent to the legal and financial sectors—these credentials can differentiate you from other candidates by verifying your qualifications and specializations.

We can transition to the resume format next, where we'll cover each section more in-depth to ensure your resume stands out.

Which resume format to choose

Creating your resume as a capital markets lawyer requires thoughtful choices to effectively showcase your expertise. Begin with a reverse chronological format, the gold standard for professional resumes. This format highlights your latest work experiences first, which is crucial in the fast-paced finance sector where recent achievements often carry the most weight. It helps potential employers quickly grasp the trajectory of your career and your current standing in the industry.

Font selection, though subtle, can significantly influence the perception of your resume. Opt for modern fonts like Lato, Montserrat, or Raleway. These fonts exude a contemporary and professional look, enhancing readability. Their clean lines and balanced spacing ensure your resume is easy to scan, keeping the focus on your content rather than any distractions caused by outdated or overly decorative fonts.

Always save your resume as a PDF. This ensures the meticulous formatting and design choices you've made remain consistent across all devices and software used by hiring managers. It’s a professional standard that eliminates the risk of your resume appearing jumbled or unprofessional, which can occur with other file types like Word documents.

Maintain one-inch margins on all sides to promote clarity and structure. These margins create the right amount of white space, preventing the page from appearing cluttered. This not only aids readability but also suggests a methodical, detail-oriented approach—an essential trait for professionals in capital markets who often deal with complex information and data.

By giving attention to these details, your resume will reflect professionalism and competence, key qualities that convey your ability to excel in the demanding environment of capital markets.

How to write a quantifiable resume experience section

As a capital markets lawyer, making your experience section compelling is crucial for attracting potential employers. Start by crafting a clear and structured overview of your professional journey. Begin with your most recent position in reverse chronological order, highlighting the most relevant experiences to the job you're applying for. This approach not only showcases your growth over the last 10-15 years but also aligns your skills with what the employer is seeking.

Use dynamic action verbs like "advised," "negotiated," "executed," and "led" to demonstrate your impact. Focus on quantifiable achievements to provide a clear picture of your contributions. Tailor your resume by linking your experiences to the specific requirements of the job advertisement. Highlight roles and titles connected to capital markets, investment banking, or securities law, emphasizing skills and achievements that meet the employer’s needs.

- •Led a $500M IPO for a leading tech company, ensuring SEC compliance and timely execution.

- •Negotiated and executed 20+ cross-border debt and equity offerings, successfully raising over $2B.

- •Advised Fortune 500 clients on regulatory changes, reducing compliance risks by 30%.

- •Developed a new client intake process, boosting department efficiency by 25%.

This refined experience section flows naturally, emphasizing the connection between your leadership and results. By leading a $500M IPO and negotiating over $2B in capital through cross-border offerings, you've demonstrated your capacity to handle significant transactions. Your advice to Fortune 500 clients showcases your strategic depth, reducing compliance risks by 30%. These achievements culminate in developing a client intake process that enhanced department efficiency by 25%, seamlessly linking your specific contributions to broader organizational success. This cohesive narrative presents a compelling case for your abilities and future potential.

Innovation-Focused resume experience section

A capital markets lawyer resume experience section should seamlessly weave together stories of innovation and achievement. Begin by identifying key moments where your creative legal solutions led to measurable success. Use powerful action verbs to describe your contributions and their impact. It's essential to integrate how your innovative thinking resolved challenging issues and created new opportunities, making sure each point flows smoothly from one to the next and highlights your ability to navigate the complex financial landscape.

Illustrate your work with detailed examples, showcasing projects where your unique approach made a difference. Each story should vividly depict how your efforts led to notable successes, using quantifiable achievements to emphasize the impact. Ensure clarity and cohesion, with each sentence naturally advancing to the next, conveying your innovative mindset and its benefits. This approach solidifies the reader’s understanding of your valuable contributions while maintaining alignment with legal standards.

Senior Capital Markets Lawyer

Global Financial Solutions Inc.

January 2018 - Present

- Led a team to develop a new regulatory strategy, boosting client compliance efficiency by 15%.

- Pioneered next-gen technology solutions for contract management, cutting processing time by 30%.

- Advised on a groundbreaking cross-border securities offering, using innovative legal frameworks for smooth execution.

- Mentored junior lawyers, instilling a culture of creativity and innovation in legal problem-solving.

Result-Focused resume experience section

A results-focused capital markets lawyer resume experience section should clearly showcase your ability to drive successful legal outcomes. Start by highlighting how your expertise led to significant achievements, demonstrating your value across various projects. Use action verbs that connect your role in negotiating deals, managing transactions, and ensuring compliance, weaving a story of how your work impacts overall success. Keep your descriptions concise yet impactful, emphasizing how measurable achievements and skills consistently contributed to your team's objectives.

When crafting your bullet points, aim for seamless clarity and consistency. Each bullet should seamlessly connect one noteworthy responsibility or achievement with the next, beginning with a decisive action verb. Don't forget to quantify your accomplishments where possible, like specifying the size of a deal or a notable increase in client satisfaction. Use straightforward language to make sure anyone can easily grasp the importance of your contributions to your previous roles and the firm as a whole.

Senior Capital Markets Lawyer

International Legal Solutions

June 2018 - Present

- Led legal team to negotiate and close $500 million bond issuance for a major client.

- Drafted and reviewed complex contracts ensuring compliance with national and international regulations.

- Represented clients in 30+ high-stake transactions, boosting firm reputation and client trust.

- Created training programs for junior associates, increasing team efficiency by 40%.

Skills-Focused resume experience section

A skills-focused capital markets lawyer resume experience section should emphasize your expertise in finance-related activities, such as transactions, negotiations, and regulatory compliance. Start by pinpointing the essential skills for your desired role, like effective communication, attention to detail, and a deep understanding of financial regulations. Display your work experience in a manner that highlights how you've applied these skills, using clear and concise bullet points to ensure easy readability for potential employers.

In each job entry, describe tasks or achievements that showcase your ability to manage complex capital market projects, giving context to make your experience feel tangible and relevant. Highlight successful negotiations or transactions, including details like their size and type, to add weight to your experience. If you've worked collaboratively with other professionals or led a team, underline this involvement since teamwork and leadership are vital in capital markets. By providing a well-rounded view of your contributions, you help create a comprehensive picture of your skills and accomplishments, making your resume stand out.

Senior Capital Markets Lawyer

Global Finance Law Firm

January 2019 - Present

- Managed transactions worth over $500 million, ensuring compliance with all regulatory requirements.

- Led a team of 5 lawyers in negotiating cross-border stock exchanges.

- Drafted and reviewed complex securities documents with zero error incidence.

- Collaborated with financial analysts to assess market trends and risks.

Technology-Focused resume experience section

A technology-focused capital markets lawyer resume experience section should clearly convey your role and showcase achievements that blend expertise in both financial and technological areas. Start by using active language to describe your contributions, keeping descriptions concise but impactful, which demonstrates your ability to influence legal frameworks and market dynamics through technology. By doing so, you provide a clear picture of how you make a difference in the field, underscoring your suitability for roles requiring tech-savvy legal skills and financial acumen.

Each bullet point should highlight specific initiatives where you've driven or influenced outcomes, especially where technology was used to solve legal challenges or enhance transaction efficiency. For instance, integrating digital tools in documentation processes can shorten procedures, while implementing blockchain can boost security and transparency in cross-border transactions. Similarly, collaborating with tech teams to develop AI compliance tools can result in higher accuracy and faster review times. These examples connect your capability in leveraging technology with strategic thinking and leadership in capital markets.

Capital Markets Lawyer

Global Finance LLC

January 2020 - Present

- Streamlined financial transaction documentation using digital tools, cutting processing time by 30%.

- Enhanced cross-border transaction security and transparency by implementing blockchain solutions.

- Worked with tech teams to build AI compliance tools, improving accuracy and cutting review times by 25%.

- Advised on legal issues around new fintech innovations, ensuring they met regulatory standards.

Write your capital markets lawyer resume summary section

A capital markets lawyer-focused resume summary should effectively capture the attention of potential employers by offering a concise yet impactful overview of your career highlights. This section acts as your elevator pitch, quickly giving the reader insight into your expertise in contract negotiation, IPOs, and SEC regulatory compliance. For instance, a well-crafted summary for a capital markets lawyer could be:

This summary is effective because it immediately communicates your extensive experience and key areas of expertise. The use of strong action words vividly illustrates your achievements and skills, making your core message clear. While a resume summary is ideal for those with significant experience, those new to the field might opt for a resume objective instead. Objectives focus on your career aspirations and what you hope to accomplish in a new role. Meanwhile, a resume profile combines elements of both a summary and an objective, offering a wider view of your skills and goals. A summary of qualifications, on the other hand, presents your most relevant skills or achievements in bullet points for easier reading. Understanding these formats helps you choose the right tone and focus for your resume, making sure it aligns with your career level and objectives.

Listing your capital markets lawyer skills on your resume

A skills-focused capital markets lawyer resume should effectively convey your strengths and expertise. Your skills can either stand alone or be integrated into sections like experience and summary. Highlighting both strengths and soft skills emphasizes your ability to collaborate and solve complex issues. Hard skills demonstrate your technical prowess in legal and financial domains. By embedding these skills and strengths as keywords, you align closely with job descriptions and increase your visibility to potential employers.

Here's an example of how a standalone skills section might look:

This skill section captures the essential competencies required in capital markets law, blending legal precision with financial insight to ensure your resume directly addresses employer needs.

Best hard skills to feature on your capital markets lawyer resume

A strong capital markets lawyer requires hard skills that reflect a deep understanding of legal frameworks and financial market operations. These skills communicate your expertise in navigating complex and varied financial landscapes.

Hard Skills

- Securities Regulation

- Financial Compliance

- Due Diligence

- Corporate Finance

- Legal Writing

- Drafting and Negotiating Contracts

- Initial Public Offerings (IPOs)

- Investment Funds

- Risk Management

- Equity and Debt Offerings

- Cross-border Transactions

- Financial Instruments

- Anti-Money Laundering

- Tax Law

- Banking Law

Best soft skills to feature on your capital markets lawyer resume

Your soft skills should highlight your interpersonal and adaptive abilities, which are critical in a dynamic work environment. These skills show employers your readiness to collaborate and solve problems effectively.

Soft Skills

- Communication

- Analytical Thinking

- Attention to Detail

- Problem Solving

- Time Management

- Teamwork

- Leadership

- Adaptability

- Client Management

- Strategic Planning

- Emotional Intelligence

- Negotiation Skills

- Decision Making

- Conflict Resolution

- Cultural Awareness

How to include your education on your resume

An education section is a crucial part of your resume and showcases your academic background to potential employers. Tailoring this section to match the job opening is important, focusing on education relevant to the position. A capital markets lawyer should highlight law-related education, while excluding unrelated degrees. When including your GPA, ensure it’s above 3.0. Otherwise, you may decide to omit it. If you graduated with honors, such as cum laude, include this distinction after your degree title. When listing a degree, include the degree type, institution name, and graduation date.

Here’s an example of an education section that might not fit well for a capital markets lawyer role:

In contrast, here’s a fitting example for a capital markets lawyer:

This version highlights relevant law education with an esteemed institution, adds credibility with cum laude honors, and includes clear dates. This effectively aligns qualifications with the responsibilities of a capital markets lawyer. Showcasing prestigious education and honors demonstrates your diligence and excellence in the field.

How to include capital markets lawyer certificates on your resume

Including a certificates section in your resume is essential as it showcases your additional qualifications. Certificates can also be displayed in your header to immediately highlight your expertise.

List the name of the certificate clearly. Include the date you received it. Add the issuing organization to provide credibility. For example, you could place it in your header like this:

Jane Smith, Capital Markets Lawyer | CFA Charterholder | Harvard Law School, J.D. 2015

Placing it in the header allows recruiters to quickly see your key credentials. Alternatively, a standalone section towards the end of your resume is also effective.

Here's an example:

This example is good because it lists certificates relevant to a capital markets lawyer, such as CFA, which indicates financial expertise. The Advanced Corporate Finance Certification from NYU adds further credibility. Each entry shows both the title and issuer, making it easy for recruiters to verify your qualifications.

Extra sections to include in your capital markets lawyer resume

Navigating the elaborate realm of capital markets requires a unique blend of legal acumen, financial expertise, and interpersonal flair. As a capital markets lawyer, your resume should reflect these competencies while showcasing your diverse experiences and personal interests to offer a more complete picture of who you are.

• Language section — Add any languages you speak fluently to demonstrate your ability to work in diverse markets.

• Hobbies and interests section — Include activities that show your dedication and ability to handle stress, like running marathons or chess.

• Volunteer work section — Highlight volunteer activities to demonstrate your commitment to community service and strong ethical grounding.

• Books section — List influential books you've read to reveal your intellectual curiosity and continuous desire to learn.

While highlighting the critical sections of your resume, remember to inject some creativity to set yourself apart. This comprehensive approach can significantly enhance your attractiveness to potential employers.

In Conclusion

In conclusion, crafting a resume as a capital markets lawyer is both an art and a science. You need to clearly convey your expertise and accomplishments while ensuring your resume is easy to read and visually appealing. Use a reverse chronological format to highlight your recent achievements and a modern font to keep your document professional. Remember, your resume should not just be a list of duties but a powerful narrative that captures your career journey and potential. Focus on quantifying your achievements and linking them to the demands of the job you’re applying for. Choose strong action verbs to demonstrate your impact in your roles, and ensure that your skills, both hard and soft, align with the expectations of the industry. Highlight relevant education and certifications to underscore your qualifications. Lastly, consider adding extra sections that reflect your personality and interests, as they can provide a more holistic view of who you are as a candidate. By paying attention to these details, you ensure that your resume stands out in a competitive marketplace, ultimately increasing your chances of securing exciting opportunities in capital markets law.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.