Certified Financial Planner Cover Letter Examples

May 29, 2025

|

12 min read

Navigate the world of financial planning with ease as you draft your Certified Financial Planner cover letter using our guide. Equip yourself with tips to balance professionalism and personality, ensuring you seal the "deal" in your job quest.

Rated by 348 people

Certified Retirement Planning Counselor

Estate Planning Certified Financial Planner

Certified Tax Financial Planner

Certified Investment Management Planner

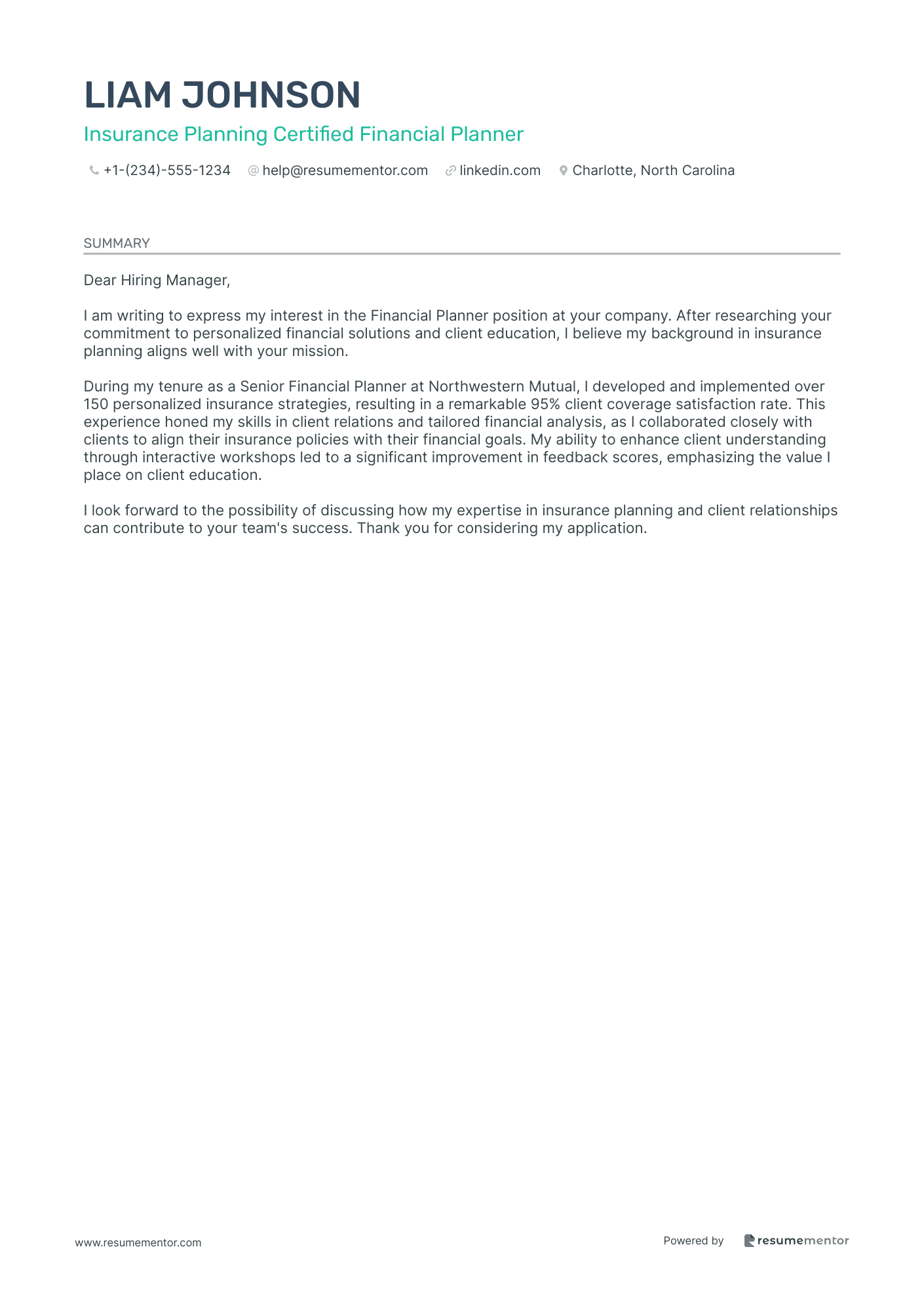

Insurance Planning Certified Financial Planner

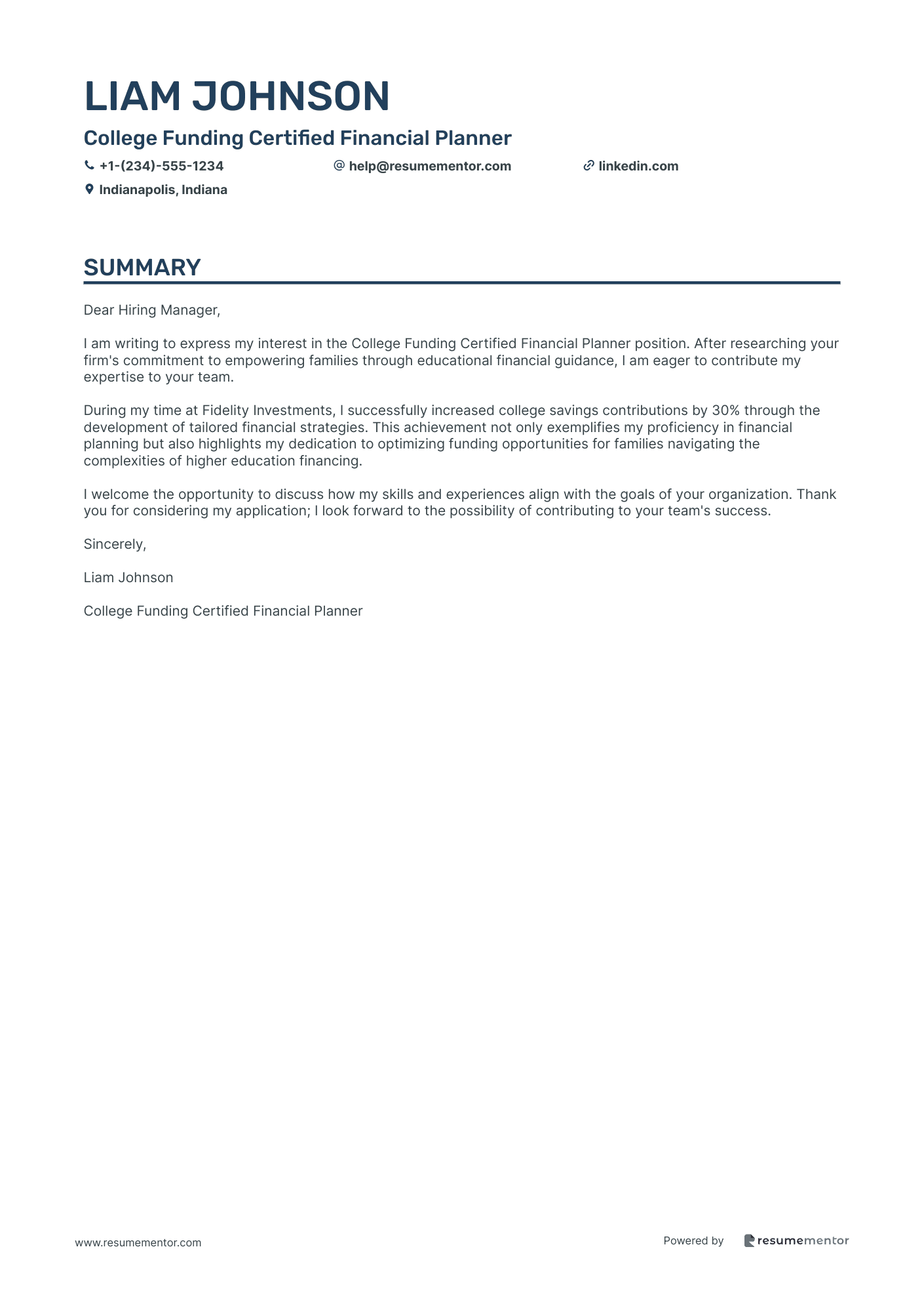

College Funding Certified Financial Planner

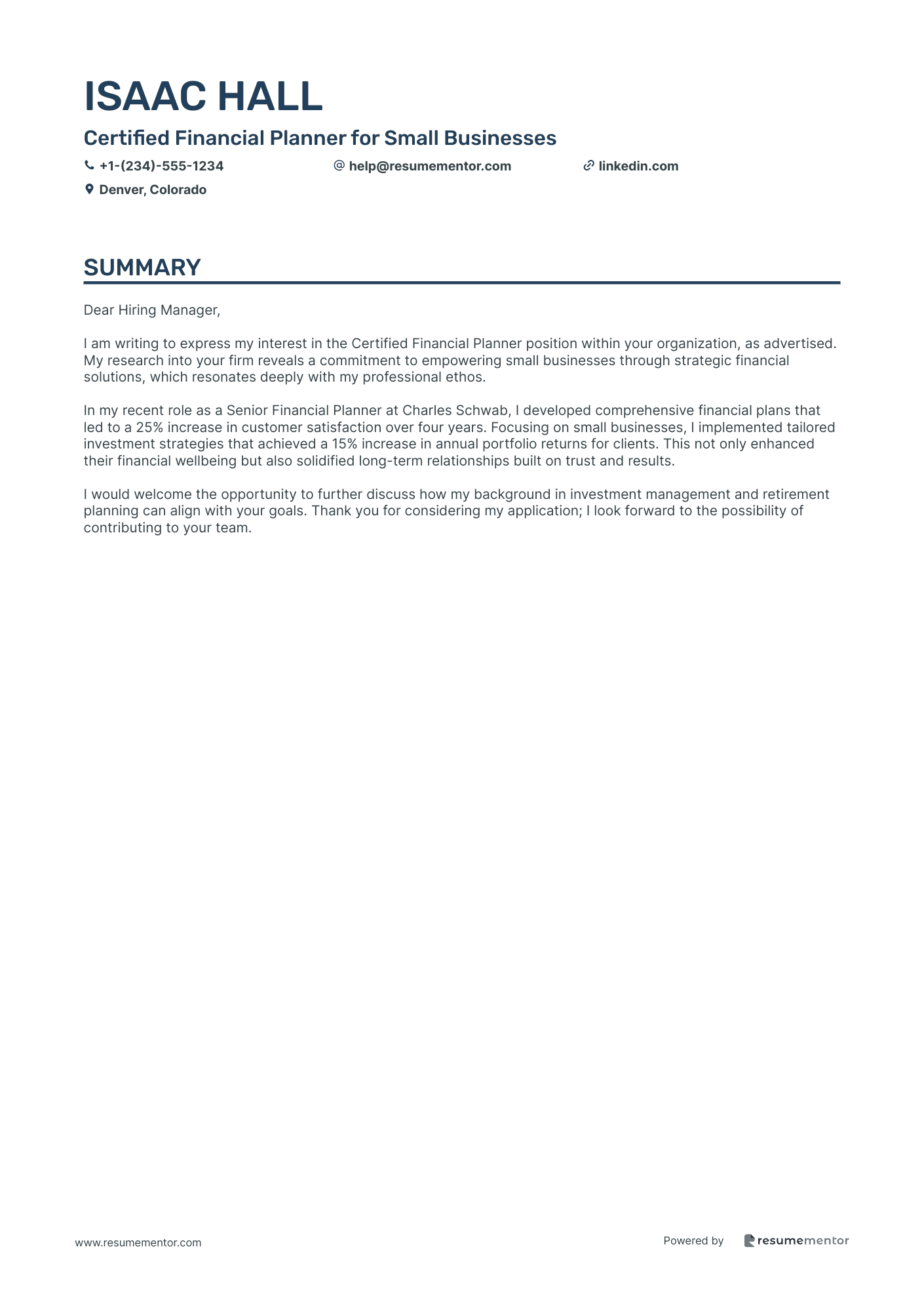

Certified Financial Planner for Small Businesses

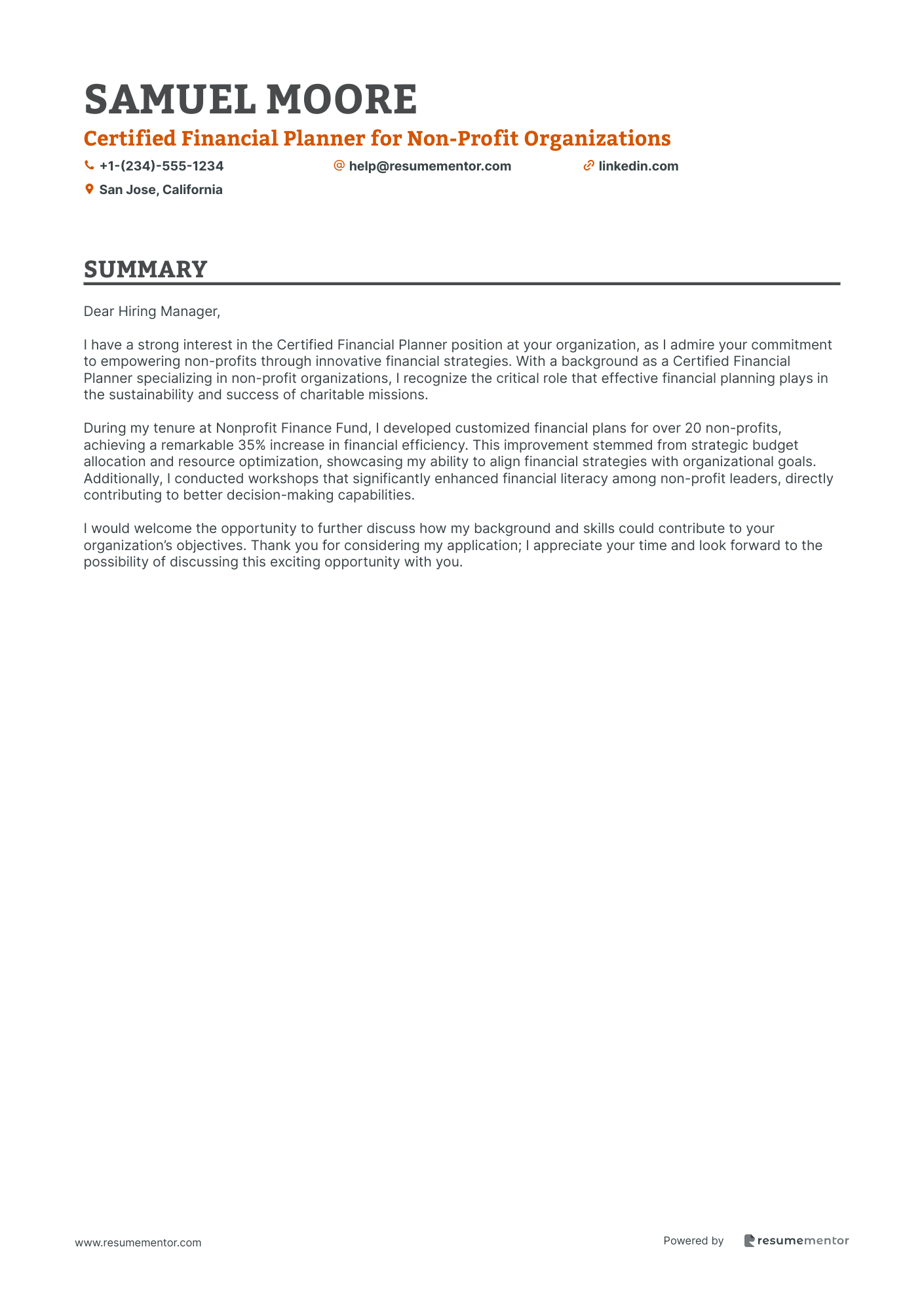

Certified Financial Planner for Non-Profit Organizations

Certified Financial Planner for Corporate Business

Certified Financial Planner for High Net Worth Individuals

Certified Retirement Planning Counselor cover letter sample

Estate Planning Certified Financial Planner cover letter sample

Certified Tax Financial Planner cover letter sample

Certified Investment Management Planner cover letter sample

Insurance Planning Certified Financial Planner cover letter sample

College Funding Certified Financial Planner cover letter sample

Certified Financial Planner for Small Businesses cover letter sample

Certified Financial Planner for Non-Profit Organizations cover letter sample

Certified Financial Planner for Corporate Business cover letter sample

Certified Financial Planner for High Net Worth Individuals cover letter sample

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.