Certified Public Accountant Resume Examples

Mar 24, 2025

|

12 min read

Craft your certified public accountant resume with precision and flair. Balance numbers and narrative to make your skills count. Stand out in a sea of spreadsheets by adding personality to your professional proficiencies.

Rated by 348 people

Certified Tax Accountant

Audit and Assurance Specialist

Forensic Accounting Expert

Certified Management Accountant

Corporate Finance CPA

International Tax Specialist CPA

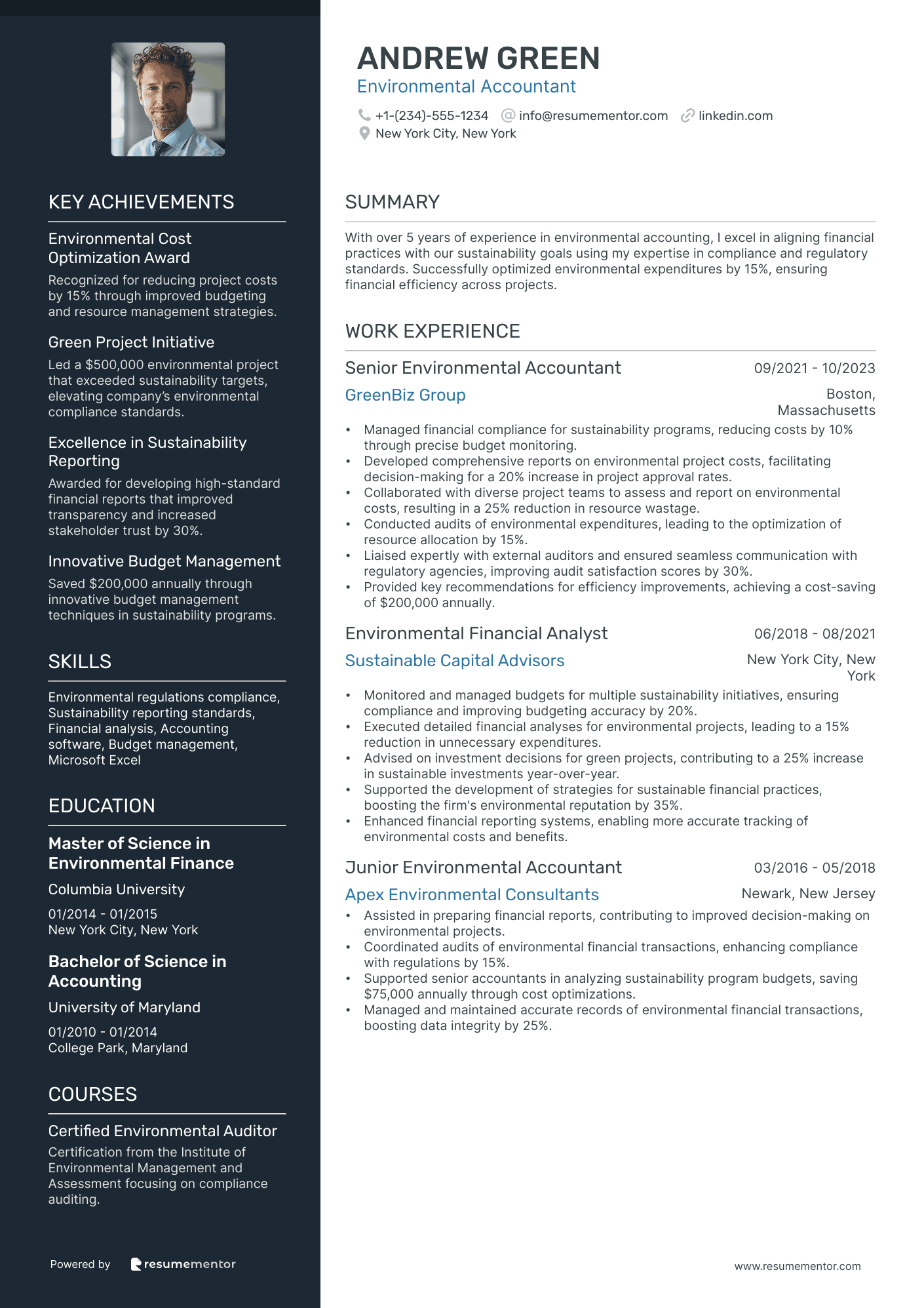

Environmental Accountant

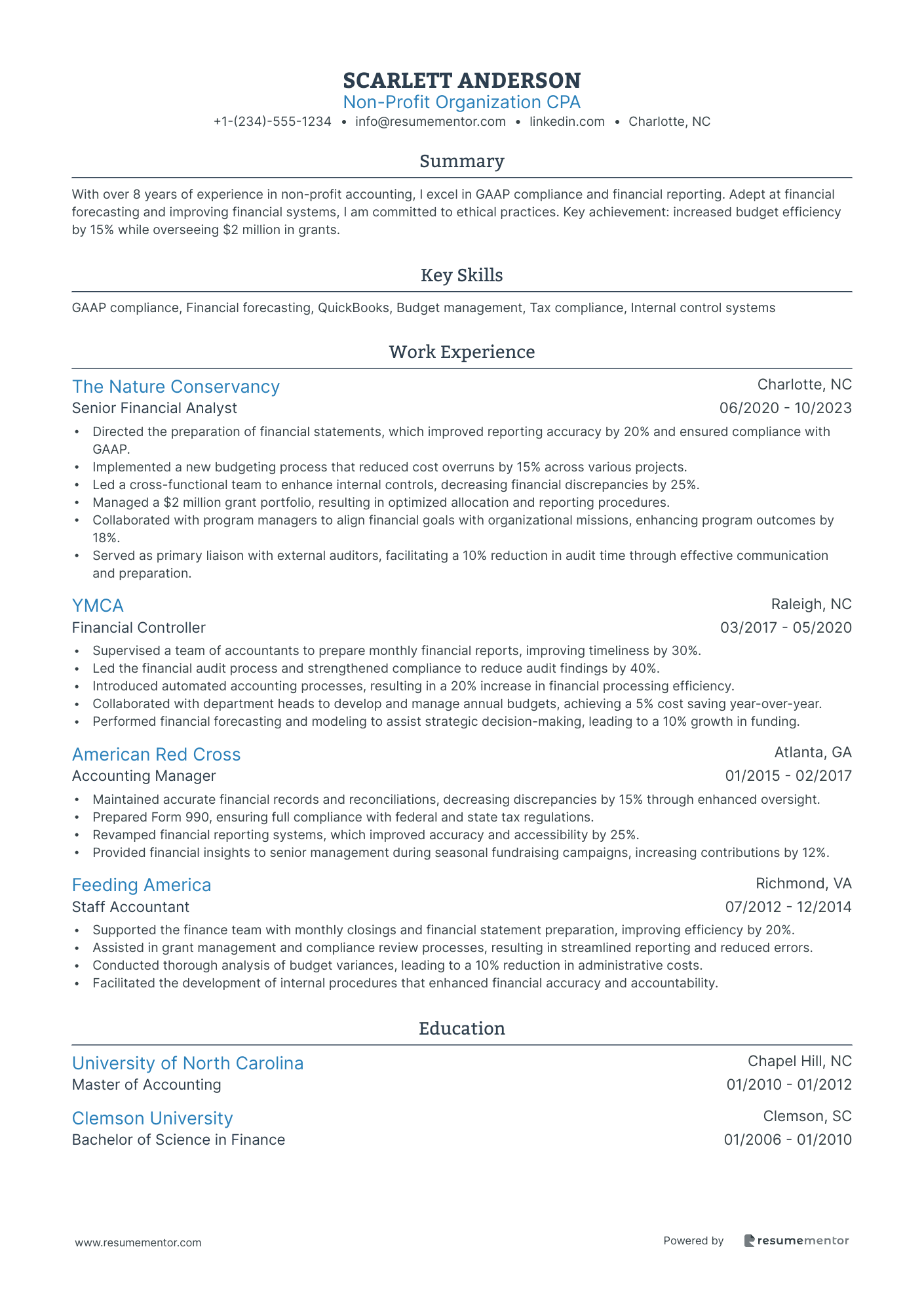

Non-Profit Organization CPA

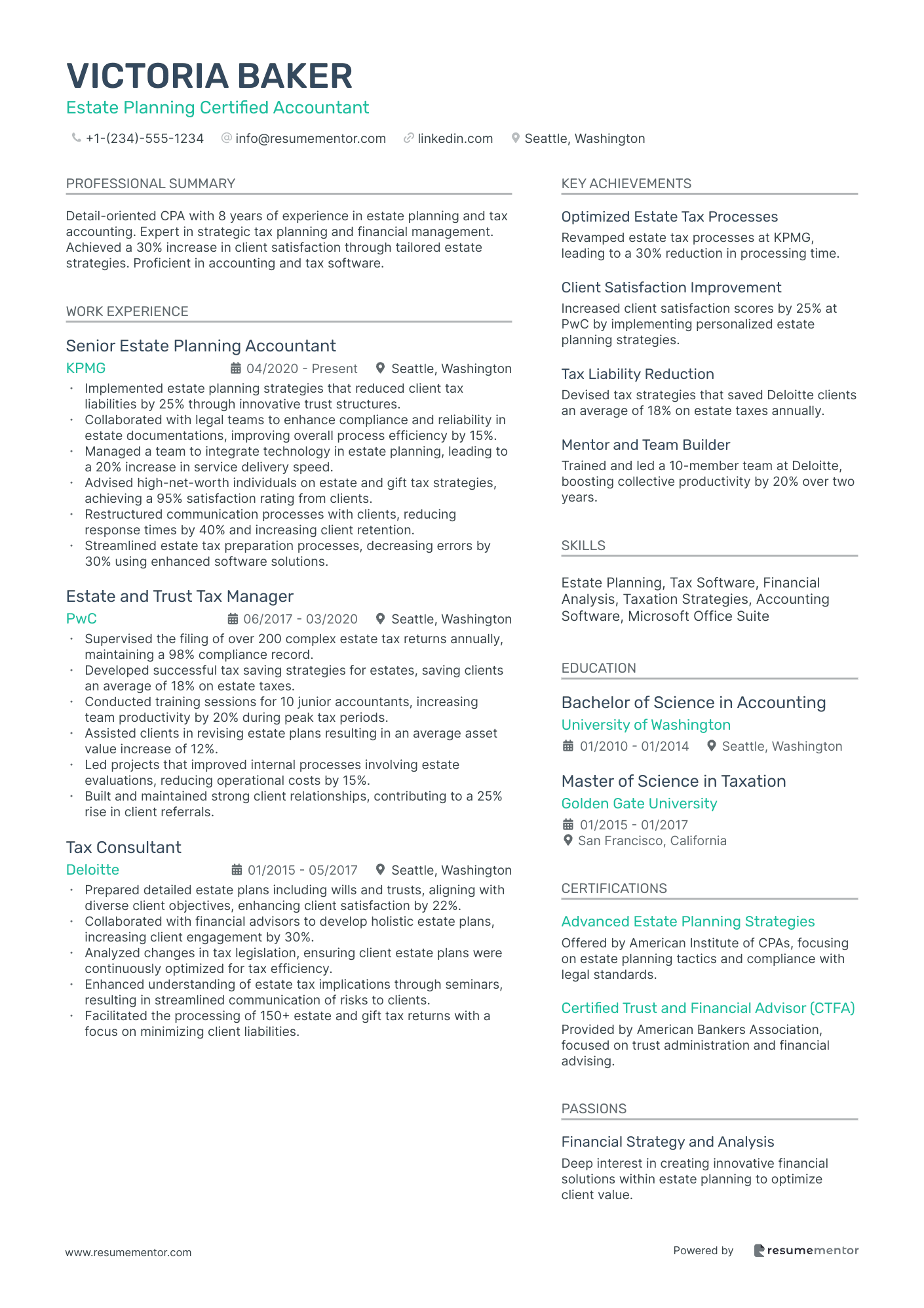

Estate Planning Certified Accountant

Certified Tax Accountant resume sample

- •Led a team to prepare and file over 500 federal and state tax returns annually, ensuring 100% accuracy according to regulations.

- •Developed strategic client tax plans resulting in an average savings of 15% on liabilities during a fiscal year.

- •Conducted detailed tax research to inform decision-making, leading to optimal tax-saving strategies for 100+ clients.

- •Trained and mentored 10 junior staff members, enhancing their skills in tax preparation software and compliance.

- •Maintained up-to-date knowledge of tax laws, leading to a 25% improvement in compliance advisory services.

- •Collaborated closely with audit teams, providing comprehensive documentation, reducing audit discrepancies by 30%.

- •Reviewed and analyzed complex financial statements for 200+ clients, determining the optimal tax implications.

- •Implemented a client database system improving documentation retrieval efficiency by 50% during tax season.

- •Assisted in preparation and filing of diverse corporate tax returns, achieving 99% filing accuracy for two consecutive years.

- •Executed tax-saving strategies, aiding clients to achieve a cumulative reduction of $2 million in annual tax liabilities.

- •Provided exceptional client service by promptly addressing inquiries, enhancing satisfaction rates by 40% in client surveys.

- •Prepared and filed various tax returns, ensuring compliance with federal and state regulations for 50+ small businesses.

- •Conducted in-depth tax research, resulting in a 15% improvement in the accuracy and quality of tax advice provided.

- •Collaborated with financial advisors to evaluate client's tax implications, leading to optimized tax outcomes.

- •Initiated a successful office-wide training program on latest tax software, increasing team proficiency by 30%.

- •Assisted in preparing tax documents for a variety of entities, ensuring 100% compliance with industry standards.

- •Supported auditing processes by compiling and organizing necessary documentation, responding to audit inquiries promptly.

- •Collaborated with senior accountants to develop accurate and effective tax-saving strategies for major corporate accounts.

- •Analyzed financial transactions to identify tax implications, aiding in informed decision-making for 20+ clients.

Audit and Assurance Specialist resume sample

- •Led a team that executed over 50 comprehensive audits annually, resulting in 30% quicker turnaround time for audit completion.

- •Developed detailed audit reports and documentation for high-profile clients, ensuring 98% compliance with industry standards.

- •Analyzed complex financial statements, uncovering significant areas for improvement and saving clients over $500,000 in annual inefficiencies.

- •Implemented effective risk assessment strategies, reducing client's risk exposure by 15% in the first year.

- •Mentored junior staff, improving their performance which lead to a 20% increase in team productivity.

- •Built and maintained strong client relationships, enhancing client satisfaction scores by 25% in a year.

- •Managed audit processes for a portfolio of clients, increasing audit efficiency by 20% through streamlined procedures.

- •Produced comprehensive financial analysis reports, enhancing client decision-making, and resulting in a 15% revenue increase.

- •Identified and suggested process improvements for internal controls, decreasing financial discrepancies by 25%.

- •Facilitated training sessions for audit staff, improving competency levels by over 40% within two quarters.

- •Stayed updated with regulatory changes, ensuring all audit documents were compliant with the latest standards.

- •Supervised audit engagements, increasing audit accuracy by 18% through detailed review processes.

- •Collaborated with cross-functional teams, providing integrated audit solutions that improved efficiencies by 10%.

- •Conducted risk assessments, identifying potential risks and reducing exposure by 12% through targeted recommendations.

- •Prepared in-depth audit reports for clients, resulting in enhanced client understanding and informed decision-making.

- •Performed detailed audit tests on financial statements, achieving 95% accuracy rate and compliance.

- •Assisted in the preparation of audit documentation, helping clients to overcome financial challenges and increasing trust.

- •Engaged in client meetings to discuss audit findings and deliver actionable recommendations, leading to 20% improvement in client processes.

- •Supported implementation of new accounting software, reducing time spent on manual tasks by 30%.

Forensic Accounting Expert resume sample

- •Led a comprehensive financial fraud investigation for a Fortune 500 company, uncovering $3 million in asset misappropriation.

- •Enhanced internal controls of a major client, resulting in a 20% reduction in fraudulent transaction incidents.

- •Conducted forensic data analysis using specialized software to detect patterns indicative of financial misconduct.

- •Collaborated with law enforcement to provide tangible evidence for a high-profile embezzlement case, leading to a conviction.

- •Produced detailed financial reports for various stakeholders, ensuring clarity and actionable insights.

- •Delivered expert testimony in court, successfully articulating complex financial findings to a lay audience.

- •Investigated financial discrepancies within client accounting systems, saving over $1 million in losses.

- •Assisted in developing a fraud detection framework, increasing fraud identification timeliness by 15%.

- •Collaborated with cross-functional teams to streamline investigative processes and enhance reporting efficiency.

- •Utilized forensic accounting tools to trace unauthorized transactions, directly aiding in their rectification.

- •Provided training on fraud prevention methods to colleagues, contributing to a 25% improvement in internal compliance.

- •Analyzed financial statements and identified overstatements in revenue, leading to financial restatements.

- •Developed methodologies for detecting indicators of fraud across various financial documents.

- •Prepared detailed case reports, which facilitated informed decision-making by senior management.

- •Collaborated with legal teams, providing critical input during litigation and arbitration proceedings.

- •Led investigations on complex white-collar crimes, successfully mitigating financial risks and losses.

- •Communicated findings effectively to diverse teams, ensuring precise understanding of financial discrepancies.

- •Detected a significant Ponzi scheme, resulting in legal actions against perpetrators.

- •Assisted in the development of new investigative protocols, enhancing the agency’s capability to address fraud.

Certified Management Accountant resume sample

- •Developed financial strategies resulting in a 12% increase in cost efficiency by collaborating with cross-functional teams.

- •Prepared monthly financial statements with 99% accuracy, ensuring compliance with IFRS and GAAP standards.

- •Conducted variance analysis, leading to a 15% reduction in operational expenses through targeted recommendations.

- •Enhanced KPI reporting systems, improving data-driven decision-making within the organization by 30%.

- •Collaborated with senior management to streamline budget processes, improving completion time by 20%.

- •Led successful internal audit preparation, reducing audit discrepancies by 25%.

- •Executed comprehensive financial forecasts, contributing to 10% growth in financial results over three fiscal years.

- •Provided critical insights to management, reducing project costs by 18% through detailed financial analysis.

- •Implemented budget-tracking initiatives that improved financial transparency and accountability by 22%.

- •Streamlined financial report processes, cutting reporting cycle times by 25% while increasing data accuracy.

- •Coordinated with external auditors, ensuring audit processes were completed efficiently within the deadlines.

- •Supervised payroll accounting processes, enhancing accuracy and efficiency, leading to a 15% reduction in payroll errors.

- •Developed and implemented internal controls, reducing financial discrepancies by 20% within the first year.

- •Analyzed monthly financial statements, aiding in a 10% improvement in budget adherence.

- •Monitored departmental budgets against actuals, providing quarterly reports for management review and action.

- •Conducted detailed cost analysis, achieving a 12% reduction in production costs through refined cost-control measures.

- •Supported annual budget preparation, contributing to a 98% accuracy in forecasting.

- •Collaborated in implementing a new accounting software, reducing processing time by 30%.

- •Prepared detailed cost reports, enhancing managerial insights into operational expenditures.

Corporate Finance CPA resume sample

- •Developed comprehensive financial models for capital projects, improving project evaluation accuracy by 25%, contributing to informed decision-making.

- •Led a cross-functional team to streamline budget processes, reducing processing time by 30% and ensuring alignment with strategic initiatives.

- •Implemented a new forecasting system, enhancing forecast accuracy by 20%, aiding in better resource allocation and performance tracking.

- •Collaborated with departments on variance analysis, providing actionable insights that improved cost control measures by 12%.

- •Managed financial integration during acquisition, harmonizing financial systems and improving synergies, leading to operational efficiency gains.

- •Ensured adherence to GAAP during financial reporting, resulting in a clean audit report and heightened stakeholder trust.

- •Conducted financial performance analysis, identified discrepancies, and recommended solutions, leading to a 10% reduction in costs.

- •Assisted in preparing annual financial reports, ensuring compliance with all regulatory requirements and standards.

- •Supported capital investment planning and analysis, optimizing investment portfolio and achieving a 15% increase in ROI.

- •Monitored compliance with internal financial controls, enhancing governance processes and ensuring data integrity.

- •Collaborated in a team improving ERP system usage, resulting in 20% increased operational efficiency.

- •Advised clients on mergers and acquisitions, providing financial analysis and strategic insights, resulting in successful transactions.

- •Developed financial models for clients, enhancing strategic decision-making processes for long-term growth.

- •Contributed to corporate restructuring projects, improving client financial conditions and delivering optimal restructuring outcomes.

- •Participated in financial audits, providing necessary documentation and ensuring compliance with financial regulations.

- •Assisted in preparing detailed financial reports, supporting senior analysts in strategic financial reviews.

- •Conducted financial due diligence for potential acquisitions, ensuring thorough risk assessments and valuable insights.

- •Engaged in budget preparation and variance analysis, contributing to more accurate financial planning and forecasting.

- •Collaborated on projects to optimize financial reporting systems, improving accuracy and reducing reporting errors by 15%.

International Tax Specialist CPA resume sample

- •Managed international tax compliance projects, achieving a 20% reduction in tax liability through strategic planning and execution.

- •Developed and implemented transfer pricing documentation, aligning with global standards and resulting in minimized audit risks.

- •Conducted thorough tax implications analysis on cross-border transactions, enhancing decision-making for senior management.

- •Regularly liaised with global tax advisors, strengthening information flow and compliance accuracy for international entities.

- •Delivered comprehensive training to finance staff on global tax compliance, significantly improving team competency.

- •Led due diligence for M&A activities involving international entities, contributing to successful integration and tax efficiency.

- •Reviewed and filed over 100 international tax returns annually, maintaining a 98% accuracy rate in compliance with tax regulations.

- •Developed tax strategies that reduced risk exposure by 15% and enhanced tax compliance across multiple jurisdictions.

- •Monitored tax law changes, advising clients on effective strategies to ensure minimal impact on international operations.

- •Conducted research on complex international tax issues, providing actionable recommendations to improve cost-efficiency.

- •Enhanced cash flow by collaborating with finance team on international tax provisions, optimizing business financial management.

- •Assessed foreign tax credit allocations, enabling clients to optimize utilization and minimize financial burdens.

- •Played an integral role in the preparation of transfer pricing documentation, ensuring compliance across various regions.

- •Facilitated communication with global tax entities, improving the accuracy and promptness of information exchange.

- •Provided insights on VAT and GST implications, guiding clients towards cost-effective international tax frameworks.

- •Prepared extensive international tax returns for multinational clients, facilitating compliance with global tax norms.

- •Collaborated on international tax planning initiatives, enhancing strategic advisement and minimizing tax liabilities.

- •Assisted in the development of educational materials on global tax changes, fostering enhanced internal proficiency.

- •Engaged with international colleagues for tax planning discussions, supporting cross-border operations planning.

Environmental Accountant resume sample

- •Managed financial compliance for sustainability programs, reducing costs by 10% through precise budget monitoring.

- •Developed comprehensive reports on environmental project costs, facilitating decision-making for a 20% increase in project approval rates.

- •Collaborated with diverse project teams to assess and report on environmental costs, resulting in a 25% reduction in resource wastage.

- •Conducted audits of environmental expenditures, leading to the optimization of resource allocation by 15%.

- •Liaised expertly with external auditors and ensured seamless communication with regulatory agencies, improving audit satisfaction scores by 30%.

- •Provided key recommendations for efficiency improvements, achieving a cost-saving of $200,000 annually.

- •Monitored and managed budgets for multiple sustainability initiatives, ensuring compliance and improving budgeting accuracy by 20%.

- •Executed detailed financial analyses for environmental projects, leading to a 15% reduction in unnecessary expenditures.

- •Advised on investment decisions for green projects, contributing to a 25% increase in sustainable investments year-over-year.

- •Supported the development of strategies for sustainable financial practices, boosting the firm's environmental reputation by 35%.

- •Enhanced financial reporting systems, enabling more accurate tracking of environmental costs and benefits.

- •Assisted in preparing financial reports, contributing to improved decision-making on environmental projects.

- •Coordinated audits of environmental financial transactions, enhancing compliance with regulations by 15%.

- •Supported senior accountants in analyzing sustainability program budgets, saving $75,000 annually through cost optimizations.

- •Managed and maintained accurate records of environmental financial transactions, boosting data integrity by 25%.

- •Collaborated in the launch of new sustainability initiatives, assisting in securing project funding exceeding $1M.

- •Documented and tracked environmental costs, improving financial transparency for stakeholders by 40%.

- •Contributed to compliance and reporting processes, achieving a 100% audit pass rate.

- •Helped streamline financial documentation processes, reducing administrative overhead by 15%.

Non-Profit Organization CPA resume sample

- •Directed the preparation of financial statements, which improved reporting accuracy by 20% and ensured compliance with GAAP.

- •Implemented a new budgeting process that reduced cost overruns by 15% across various projects.

- •Led a cross-functional team to enhance internal controls, decreasing financial discrepancies by 25%.

- •Managed a $2 million grant portfolio, resulting in optimized allocation and reporting procedures.

- •Collaborated with program managers to align financial goals with organizational missions, enhancing program outcomes by 18%.

- •Served as primary liaison with external auditors, facilitating a 10% reduction in audit time through effective communication and preparation.

- •Supervised a team of accountants to prepare monthly financial reports, improving timeliness by 30%.

- •Led the financial audit process and strengthened compliance to reduce audit findings by 40%.

- •Introduced automated accounting processes, resulting in a 20% increase in financial processing efficiency.

- •Collaborated with department heads to develop and manage annual budgets, achieving a 5% cost saving year-over-year.

- •Performed financial forecasting and modeling to assist strategic decision-making, leading to a 10% growth in funding.

- •Maintained accurate financial records and reconciliations, decreasing discrepancies by 15% through enhanced oversight.

- •Prepared Form 990, ensuring full compliance with federal and state tax regulations.

- •Revamped financial reporting systems, which improved accuracy and accessibility by 25%.

- •Provided financial insights to senior management during seasonal fundraising campaigns, increasing contributions by 12%.

- •Supported the finance team with monthly closings and financial statement preparation, improving efficiency by 20%.

- •Assisted in grant management and compliance review processes, resulting in streamlined reporting and reduced errors.

- •Conducted thorough analysis of budget variances, leading to a 10% reduction in administrative costs.

- •Facilitated the development of internal procedures that enhanced financial accuracy and accountability.

Estate Planning Certified Accountant resume sample

- •Implemented estate planning strategies that reduced client tax liabilities by 25% through innovative trust structures.

- •Collaborated with legal teams to enhance compliance and reliability in estate documentations, improving overall process efficiency by 15%.

- •Managed a team to integrate technology in estate planning, leading to a 20% increase in service delivery speed.

- •Advised high-net-worth individuals on estate and gift tax strategies, achieving a 95% satisfaction rating from clients.

- •Restructured communication processes with clients, reducing response times by 40% and increasing client retention.

- •Streamlined estate tax preparation processes, decreasing errors by 30% using enhanced software solutions.

- •Supervised the filing of over 200 complex estate tax returns annually, maintaining a 98% compliance record.

- •Developed successful tax saving strategies for estates, saving clients an average of 18% on estate taxes.

- •Conducted training sessions for 10 junior accountants, increasing team productivity by 20% during peak tax periods.

- •Assisted clients in revising estate plans resulting in an average asset value increase of 12%.

- •Led projects that improved internal processes involving estate evaluations, reducing operational costs by 15%.

- •Built and maintained strong client relationships, contributing to a 25% rise in client referrals.

- •Prepared detailed estate plans including wills and trusts, aligning with diverse client objectives, enhancing client satisfaction by 22%.

- •Collaborated with financial advisors to develop holistic estate plans, increasing client engagement by 30%.

- •Analyzed changes in tax legislation, ensuring client estate plans were continuously optimized for tax efficiency.

- •Enhanced understanding of estate tax implications through seminars, resulting in streamlined communication of risks to clients.

- •Facilitated the processing of 150+ estate and gift tax returns with a focus on minimizing client liabilities.

- •Coordinated the preparation of tax filings for estates with significant assets, ensuring compliance with applicable tax laws.

- •Supported a 10-person team in executing estate plan evaluations, improving workflow efficiency and reducing bottlenecks by 25%.

- •Provided detailed financial analysis for estate planning sessions, leading to 15% increase in client profitability.

- •Enhanced estate tax estimation models, refining their precision and reducing discrepancies by 20%.

Embarking on a job hunt as a certified public accountant can feel like stepping into a strategic game, with your resume as your key play. This document must clearly showcase your financial expertise and problem-solving skills to impress potential employers. It's often a challenging task, especially when you need to highlight your accounting prowess while also keeping the resume concise and engaging.

Deciding which achievements and certifications to feature prominently can be daunting. Every word matters, and you need your resume to clearly demonstrate your ability to handle complex financial regulations and drive successful outcomes.

To ease this process, consider using a resume template. A clear and professional layout can help you organize your information effectively. Browsing through these resume templates can provide a streamlined approach, helping hiring managers easily see your fit for the role.

Think of your resume as more than just a list of past roles—consider it a map of your professional journey. Taking the time to craft it thoughtfully, with industry standards in mind, can be the key to unlocking your next big opportunity.

Key Takeaways

- A certified public accountant (CPA) resume should effectively highlight your financial expertise, problem-solving skills, and ability to handle complex financial regulations while remaining clear and concise.

- Incorporating a well-structured layout using a resume template can help present your skills and achievements prominently, making it easier for hiring managers to assess your fit for the role.

- Emphasizing quantifiable results and using active verbs in your experience section will showcase your impact, leadership qualities, and problem-solving capabilities, making your resume more compelling.

- Choosing the reverse-chronological format, with a clean design and a professional font, such as Lato or Montserrat, along with PDF file format, maintains clarity and consistency across different devices.

- Adding sections for extra qualifications, such as certifications, languages, and volunteer work, demonstrates diverse skills and dedication, providing a comprehensive view of your abilities and interests to potential employers.

What to focus on when writing your certified public accountant resume

A certified public accountant resume should highlight your accounting expertise while showcasing your ability to handle financial information with precision. Demonstrating your knowledge of accounting laws and your positive impact on an organization is essential.

How to structure your certified public accountant resume

- Contact Information: At the top, include your full name, phone number, email, and LinkedIn profile for easy access. This basic section is crucial as it enables employers to reach you easily and helps set a professional tone for the rest of your resume—correct formatting here paves the way for a polished presentation throughout.

- Professional Summary: Begin with a concise overview of your accounting experience, emphasizing skills crucial in the CPA field such as audit preparation, tax compliance, and financial reporting. Tailor this summary to each job application by focusing on specific experiences and successes that match the job description—this brief section acts as your personal elevator pitch.

- Work Experience: When listing previous accounting roles, focus on achievements and contributions. Highlight areas where you improved financial efficiencies or reduced costs, using numbers to quantify your successes. This section underscores your practical experience and abilities to potential employers—demonstrating concrete results and accomplishments is vital for standing out.

- Education: Follow with your educational background, noting your CPA certification and any relevant coursework in accounting, finance, or business administration that adds depth to your expertise. This underlines your foundational knowledge and commitment to the field—combining your educational achievements with practical experience enhances your candidacy.

- Skills: It’s important to showcase specific accounting skills. Mention your knowledge of GAAP, proficiency in accounting software like QuickBooks or SAP, and your expertise in audit and compliance procedures. Highlighting these competencies sets you apart as a candidate prepared to tackle the demands of the role—your skills section should align closely with the key qualifications outlined in the job description.

- Certifications and Licenses: Clearly state your CPA certification and any additional finance-related credentials that strengthen your profile. This confirms your qualifications and readiness for professional responsibilities—ensuring this section is thorough can persuade employers of your credibility.

Including optional sections like professional affiliations, community involvement, or language skills can further enhance your resume, offering a comprehensive view of your qualifications. In the next section, we’ll dive deeper into each element to ensure your resume is well-crafted and effective.

Which resume format to choose

For a certified public accountant, crafting a strong resume starts with selecting the right format. The reverse-chronological format is ideal since it highlights your most recent roles and achievements, allowing employers to easily see your career growth and expertise in financial analysis and reporting. Keeping the design simple and straightforward helps ensure that your skills and qualifications are the focal point.

Choosing the right font adds another layer of professionalism to your resume. Modern fonts like Lato, Montserrat, and Raleway offer a clean, contemporary look that matches the precision required in accounting. These fonts are easy to read both in print and on digital platforms, ensuring your information is accessible and appealing at first glance.

When choosing a file type, always opt for PDFs. They preserve your layout and font choices across all devices, crucial when your resume is reviewed on various screens by different hiring managers. PDFs safeguard your resume’s integrity, making sure your detailed work history and accomplishments are presented consistently.

Finally, setting your margins to about one inch on each side helps maintain a clean, organized appearance. This spacing ensures your content is easy to read without appearing crowded, allowing the reader to focus on the strengths and value you bring as a certified public accountant.

Bringing these elements together—format, font, file type, and margins—creates a cohesive and professional presentation of your resume. This holistic approach ensures that your qualifications stand out clearly, making you a compelling candidate in the competitive field of accounting.

How to write a quantifiable resume experience section

A strong experience section for a certified public accountant resume can significantly enhance your job prospects. Start by focusing on your achievements, making sure to highlight quantifiable outcomes from each role you held. Use clear, active verbs to effectively convey the impact and value you delivered. When you structure your experience, arrange it in reverse-chronological order, putting your most recent and relevant positions first to capture immediate attention. To keep your resume current, focus on roles within the past 10 to 15 years. Selecting job titles that accurately reflect your roles and accomplishments is key. Tailor your resume by aligning your experience with the requirements and preferences outlined in the job ad, demonstrating that you are the ideal candidate. Use concise bullet points to enhance readability and keep the reader engaged. Words like "implemented," "optimized," and "led" will effectively emphasize your achievements.

- •Boosted company efficiency by 20% with automated ledger systems.

- •Led a finance team of 10, improving departmental accuracy by 15% through thorough audits.

- •Trimmed client tax liabilities by 12% annually with optimized tax strategies.

- •Crafted financial forecasts that improved budget allocation by aligning resources with key business goals.

By focusing on quantifiable results, this experience section stands out, making each point impactful for potential employers. Demonstrating your contributions with specific percentages showcases a knack for effective problem-solving, while clear leadership qualities are evident in the achievements listed. Tailoring the content to skillfully align with key competencies necessary in similar positions ensures you're presenting yourself as a well-suited candidate. Throughout this section, past successes are highlighted, providing insight into future benefits for employers. The use of dynamic action verbs consistently communicates your competence and expertise, ensuring the narrative flows smoothly while remaining both compelling and trustworthy.

Industry-Specific Focus resume experience section

A Certified Public Accountant-focused resume experience section should clearly showcase your unique skills and achievements pertinent to the accounting field. Begin by listing your roles in reverse chronological order, specifying your job title, the company name, and your dates of employment. This sets a clear foundation for highlighting your expertise in accounting, auditing, tax preparation, and financial analysis. Emphasize your accomplishments and duties, using strong action verbs to convey the significant contributions you made to the company, such as improving financial processes or generating cost savings.

To add more depth, provide concrete metrics that quantify your achievements, making them both relatable and impactful. For instance, if you implemented a process that enhanced efficiency or reduced costs, be sure to include those figures. Highlight any specific financial software skills to emphasize your technical proficiency. Moreover, include leadership roles or key projects you spearheaded to impress potential employers and create a standout resume experience section.

Senior Accountant

XYZ Financial Services

June 2018 - Present

- Boosted departmental efficiency by 20% with automated reconciliation processes.

- Managed a team of 5 accountants, enhancing productivity and accuracy in reporting.

- Led a financial audit with a comprehensive report accepted by all stakeholders, ensuring compliance.

- Collaborated with IT to develop new accounting software, reducing task completion time by 30%.

Achievement-Focused resume experience section

A certified public accountant-focused resume experience section should highlight your achievements rather than just listing job responsibilities. It's important to demonstrate how your actions made a significant impact, be it by boosting efficiency or saving money. Each bullet point needs a measurable result, beginning with a strong action verb that showcases what you did, along with the context and outcome. Specify your successes, whether it's cutting costs, improving financial accuracy, or enhancing reporting processes.

When describing initiatives, ensure you quantify the results to illustrate their impact. Use percentages, dollar figures, and other metrics to emphasize your accomplishments, helping potential employers quickly grasp your skills and the difference you can make in their organization. Clear and concise points allow hiring managers to immediately recognize your value. Here's how to effectively structure this information:

Senior Accountant

XYZ International

June 2020 - Present

- Led improvements that boosted financial reporting accuracy and reduced errors by 25%.

- Implemented measures that saved $100,000 annually in operational costs.

- Directed a team of five in transitioning to a paperless office, raising productivity by 30%.

- Created budget plans that optimally allocated resources, leading to a 15% rise in employee satisfaction.

Efficiency-Focused resume experience section

An efficiency-focused certified public accountant resume experience section should clearly highlight how you've effectively managed workloads and improved productivity. Start by selecting experiences that demonstrate your ability to streamline processes, which will showcase the unique talents you bring. Use specific examples and numbers to paint a clear picture of your impact, so potential employers can see the benefits you could bring to their organization.

For each job entry, begin with your job title, workplace, and employment dates. In the bullet points, emphasize your accomplishments rather than just listing tasks, and quantify these achievements wherever possible. Action verbs like "optimized," "reduced," and "enhanced" add energy and clarity to your experience section. Overall, this part of your resume should seamlessly demonstrate how your skills translate into real, tangible improvements in any role you undertake.

Certified Public Accountant

Greenfield Accounting Solutions

March 2018 - Present

- Reduced month-end close process by 30% through streamlined reconciliation procedures and automation.

- Optimized tax preparation workflows, leading to a 20% increase in client capacity without additional resources.

- Implemented a new invoicing system, resulting in a 15% reduction in late payments and improved cash flow.

- Trained and mentored a team of junior accountants, enhancing departmental efficiency and collaboration.

Growth-Focused resume experience section

A growth-focused certified public accountant (CPA) resume experience section should clearly highlight your contributions to driving company success and efficiency. Start by identifying the key accomplishments in each role that demonstrate how you enhanced growth or saved costs. Consider improvements you spearheaded that increased revenue, refined processes, or optimized resource management. Using strong action verbs and quantifiable results can effectively showcase your significant impact and create a compelling narrative.

When describing your responsibilities, connect the challenges you encountered with the skills you used to overcome them, emphasizing alignment with business goals and the resulting positive outcomes. Share specific examples, like percentage increases or savings in dollar amounts, to underscore the value of your contributions. Keeping your descriptions clear and straightforward helps hiring managers quickly see the impact you had on each workplace.

Certified Public Accountant

GreenTech Solutions

June 2018 - Present

- Increased company revenue by 15% within one year by implementing effective budget controls.

- Reduced departmental expenses by 10% through refined auditing processes and cost evaluations.

- Played a pivotal role in securing $2 million in tax credits for the company, enhancing financial stability.

- Developed a streamlined financial reporting system that improved accuracy and reduced reporting time by 25%.

Write your certified public accountant resume summary section

A finance-focused certified public accountant resume should capture your skills and achievements effectively. It’s essential to highlight your strengths in just a few sentences. If you have a lot of experience, zero in on key accomplishments and expertise. For instance, consider this example for a CPA:

This summary works well because it not only showcases your achievements but also how they add value to a company. It underscores technical prowess and the ability to work well with others, both crucial in accounting roles.

When describing yourself, it’s vital to focus on your unique strengths and contributions. Use language that conveys confidence and clarity. Unlike an objective, which outlines your career goals, a summary highlights your value to potential employers. A resume profile offers a broader picture of your career journey, while a summary of qualifications lists notable skills or accomplishments. Understanding these distinct sections helps you tailor your resume to attract the right attention.

Listing your certified public accountant skills on your resume

A skills-focused certified public accountant (CPA) resume should clearly demonstrate your qualifications to potential employers. You can integrate your skills into various sections, such as experience and summary, or list them in a standalone skills section. When you highlight your strengths and soft skills, it shows your ability to communicate effectively and adapt to various circumstances. On the other hand, hard skills represent the specific technical abilities developed through education or experience.

Incorporating your skills and strengths as keywords in your resume can help attract the attention of applicant tracking systems (ATS) and hiring managers who look for job-specific qualifications. Using the right keywords can boost your visibility in a competitive job market.

Consider this example of a standalone skills section in JSON format:

This skills section is effective because it succinctly lists critical CPA-related skills, allowing employers to quickly grasp your qualifications. The focus on simplicity keeps attention on your relevant abilities, each illustrating your expertise in the CPA field.

Best hard skills to feature on your certified public accountant resume

For a CPA, hard skills should highlight your technical accounting and financial expertise. These skills demonstrate your ability to manage financial statements, perform analyses, and ensure compliance with regulatory standards.

Hard Skills

- Financial Analysis

- Tax Preparation

- Auditing

- Regulatory Compliance

- Budgeting

- Forecasting

- Accounting Software Proficiency

- Risk Management

- Internal Controls

- Cost Management

- Financial Reporting

- Data Analysis

- General Ledger Management

- Cash Flow Management

- Knowledge of GAAP (Generally Accepted Accounting Principles)

Best soft skills to feature on your certified public accountant resume

Soft skills indicate your ability to interact effectively, solve problems, and manage time efficiently. These skills show your capability to collaborate and make well-judged decisions under pressure.

Soft Skills

- Communication

- Critical Thinking

- Problem Solving

- Attention to Detail

- Time Management

- Teamwork

- Adaptability

- Ethical Judgment

- Leadership

- Initiative

- Client Management

- Emotional Intelligence

- Negotiation Skills

- Decision Making

- Organizational Skills

How to include your education on your resume

Education sections are vital parts of any resume, including one for a certified public accountant. They show your academic foundation and relevant studies for the role you're targeting. This section should be tailored specifically to the position you're applying for, leaving out irrelevant education that doesn’t align with the job description. When including your GPA, do so only if it is impressive or requested by the employer. For cum laude honors, mention them directly after your degree. When listing your degree, ensure you include the degree name, the institution, and the date you graduated.

Here’s an example of a poorly constructed education section:

And here’s an example of a well-constructed one:

This second example is effective because it highlights relevant education, includes a strong GPA, and mentions honors. By focusing on information pertinent to accounting, it aligns well with the job application. Keep your education section concise and relevant to leave a lasting impression.

How to include certified public accountant certificates on your resume

An important part of a certified public accountant resume is the certificates section. This shows employers your qualifications and commitment to the profession. You can seamlessly feature this section in the body of your resume or even highlight it in the header. For example, you can write: "John Doe, CPA, CIA – Certified Public Accountant with expertise in Auditing and Financial Analysis."

To create this section, start by listing the name of each certificate clearly. Include the date you received the certification to show how current and relevant it is. Add the issuing organization to provide credibility and context. This helps potential employers understand your credentials at a glance.

Here's a good example of what a thorough certificates section looks like:

This example is strong because it includes highly relevant certifications for a CPA role and specifies top organizations as issuers. By providing these details, you offer a clear view of your expertise and dedication to continuous professional development. It presents your qualifications in a concise manner, making it easy for employers to see that you are qualified for the job. Make sure your certificates section stands out for maximum impact!

Extra sections to include on your certified public accountant resume

Crafting a well-rounded resume is key to standing out in the competitive field of accounting. A certified public accountant (CPA) needs more than just impeccable technical skills; showcasing diverse qualities adds depth to your profile. Including certain sections on your resume can highlight your unique skills and experiences.

- Language section — Demonstrate your communication skills by listing any additional languages spoken fluently, increasing your appeal to employers with international clients.

- Hobbies and interests section — Share personal interests like chess or hiking to give employers insight into your personality and problem-solving skills.

- Volunteer work section — Showcase your community involvement and leadership abilities by detailing relevant volunteer experiences, which can enhance your ethical and teamwork credentials.

- Books section — Highlight your commitment to learning by listing industry-related books you've read, showing your dedication to staying informed about accounting trends.

Incorporating these sections subtly showcases your well-rounded nature and commitment to personal and professional growth. They provide glimpses into your character beyond traditional work experience and education. By strategically including these areas, your resume becomes a more compelling narrative of your abilities and interests, capturing the attention of potential employers.

In Conclusion

In conclusion, crafting an impressive resume as a certified public accountant involves strategically highlighting your financial expertise, skills, and accomplishments. To stand out to potential employers, it is crucial to present your professional history in a concise, organized, and engaging manner. Utilizing a professional resume template can aid in structuring your information effectively.

Remember, every section of your resume is an opportunity to demonstrate your unique strengths. From your contact information and professional summary to your work experience, education, skills, certifications, and additional sections, each part should reflect your qualifications and readiness for the role.

Emphasizing quantifiable achievements in your experience section not only showcases your past contributions but also your potential future impact on a company. Incorporating industry-specific keywords subtly throughout your resume enhances its visibility to applicant tracking systems and hiring managers.

Furthermore, including extra sections like volunteer work, languages, or personal interests provides a holistic view of your character. These elements can differentiate you from other candidates, offering a glimpse into your personality and ethical standards.

Ultimately, a well-crafted resume serves as a map of your professional journey, emphasizing your aptitude and capability as a CPA. By highlighting your accomplishments and showcasing your competencies, you position yourself as a compelling candidate. This ensures that your qualifications and the value you bring are clearly communicated, making your resume a powerful tool in your job hunt.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.