Chief Financial Officer (CFO) Cover Letter Examples

May 29, 2025

|

12 min read

Master the art of crafting your CFO cover letter: a balanced budget of skills and experience that speak volumes. Learn to show your financial expertise while adding a touch of personality to stand out from the corporate crowd.

Rated by 348 people

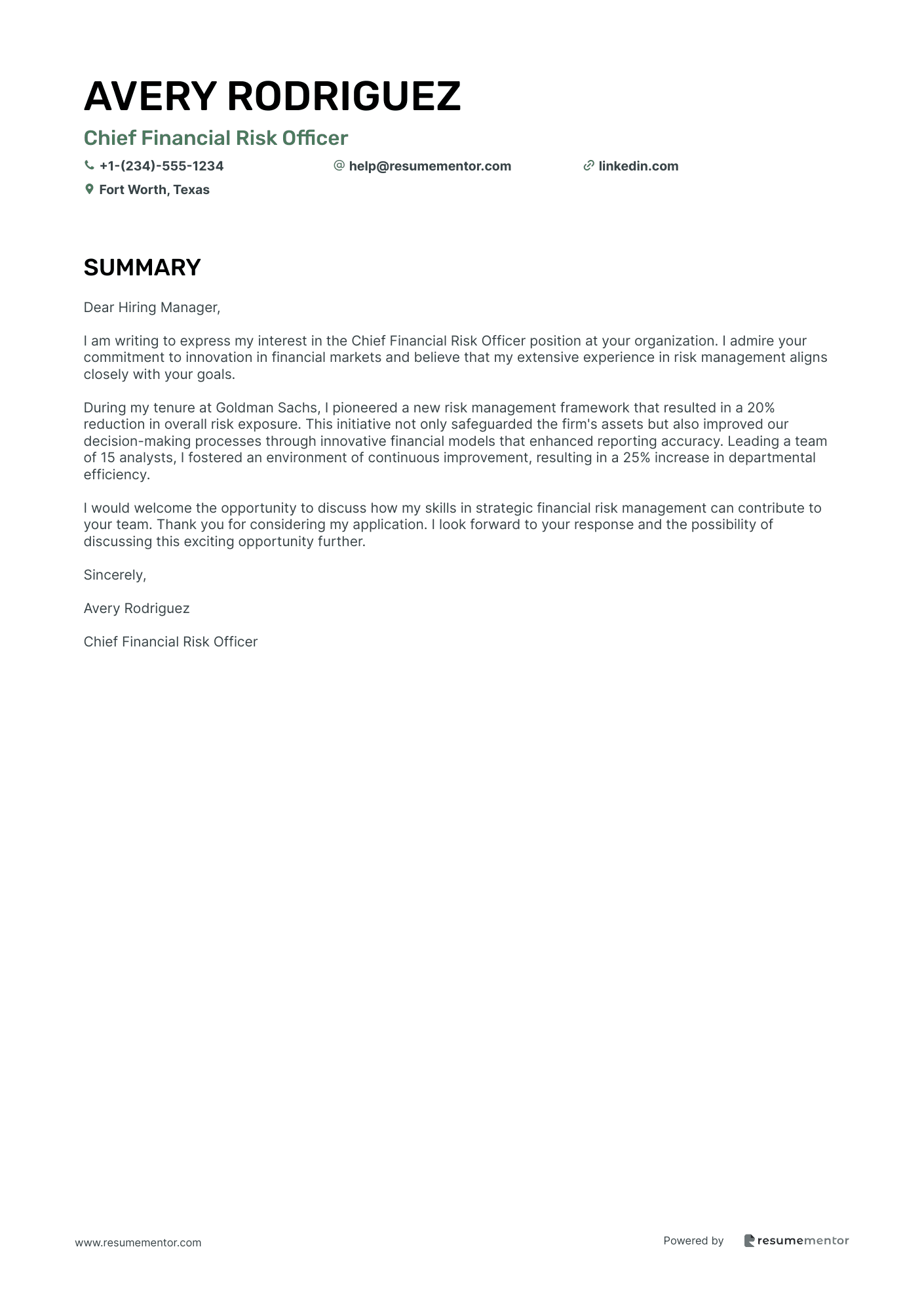

Chief Financial Risk Officer

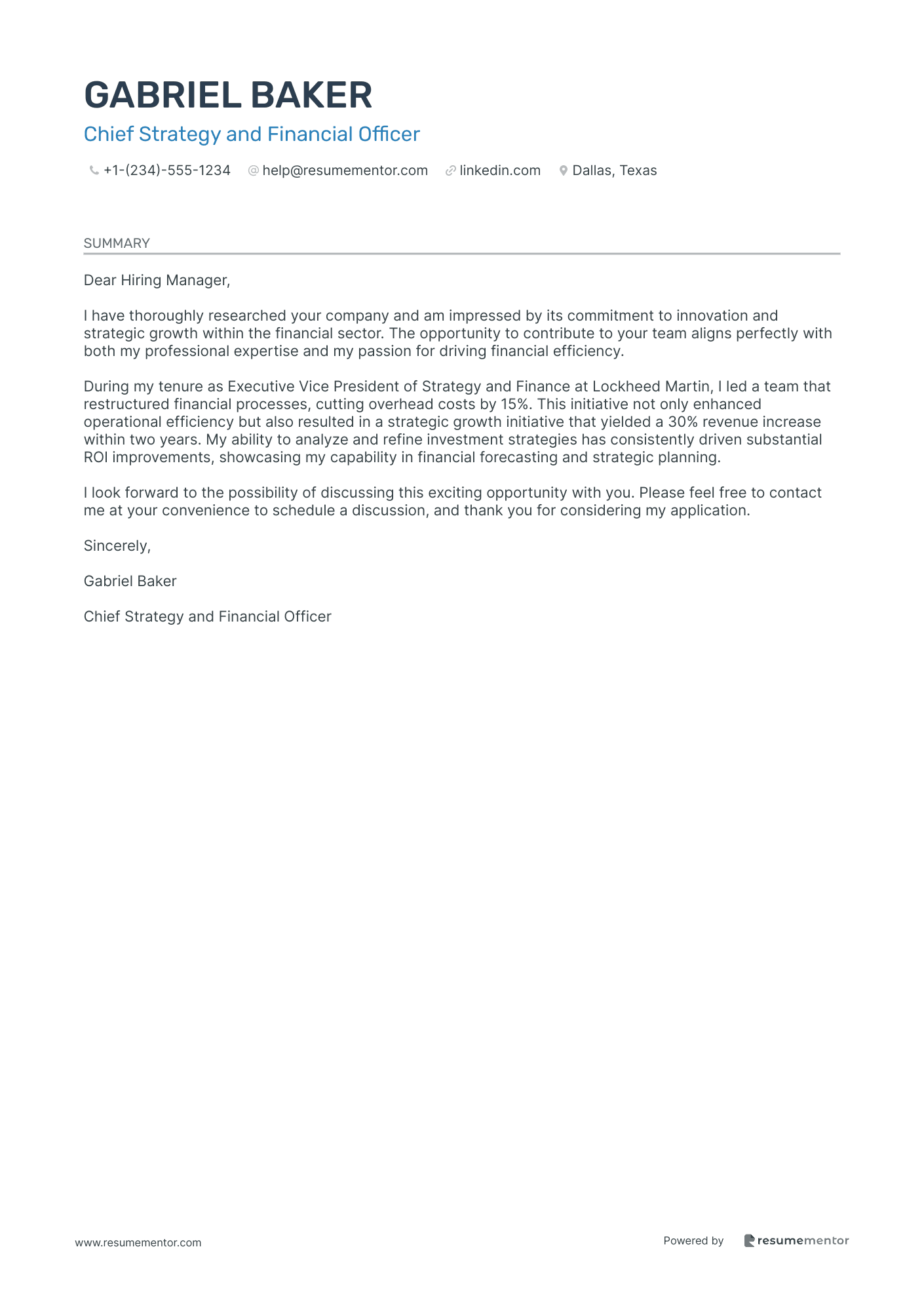

Chief Strategy and Financial Officer

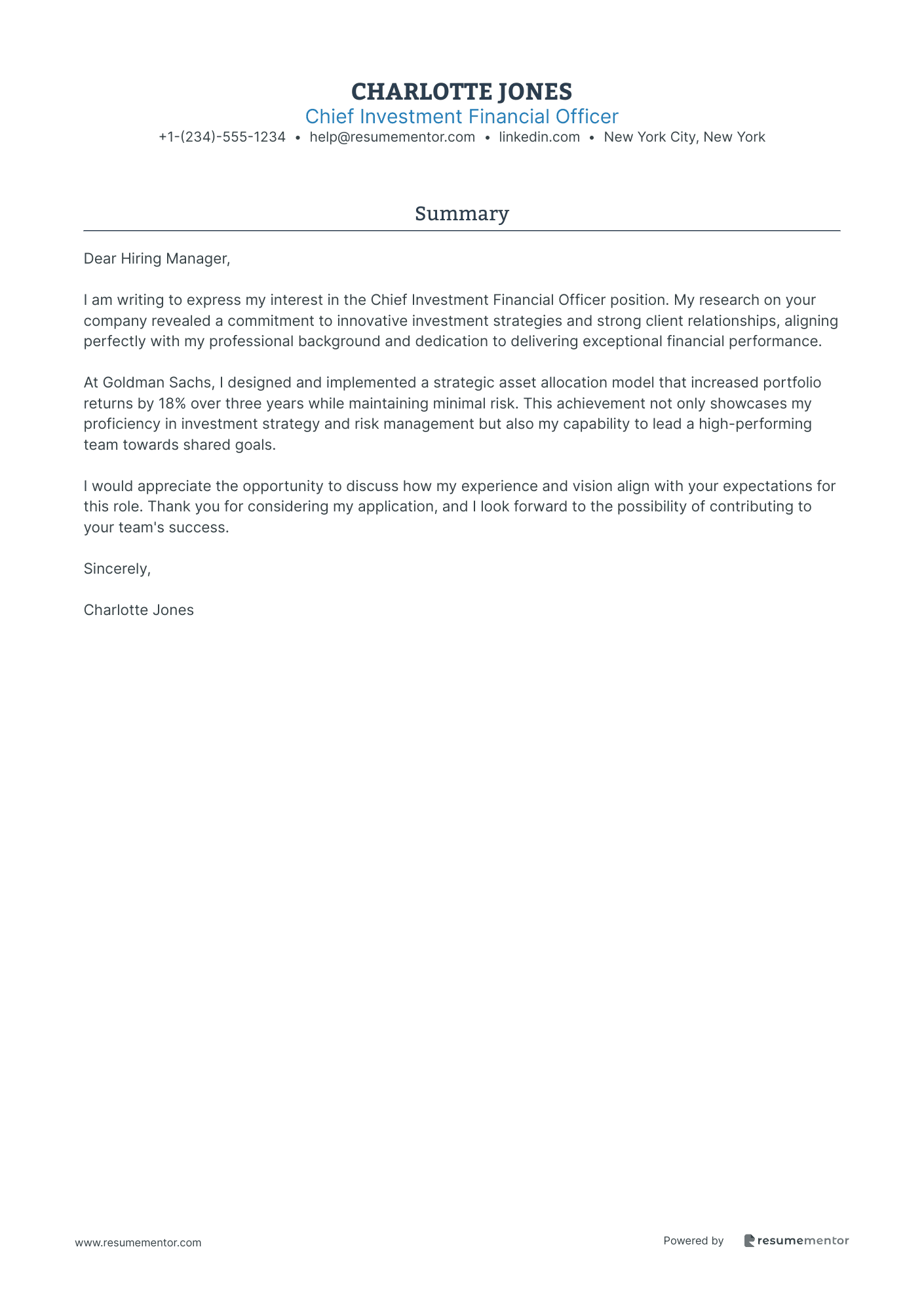

Chief Investment Financial Officer

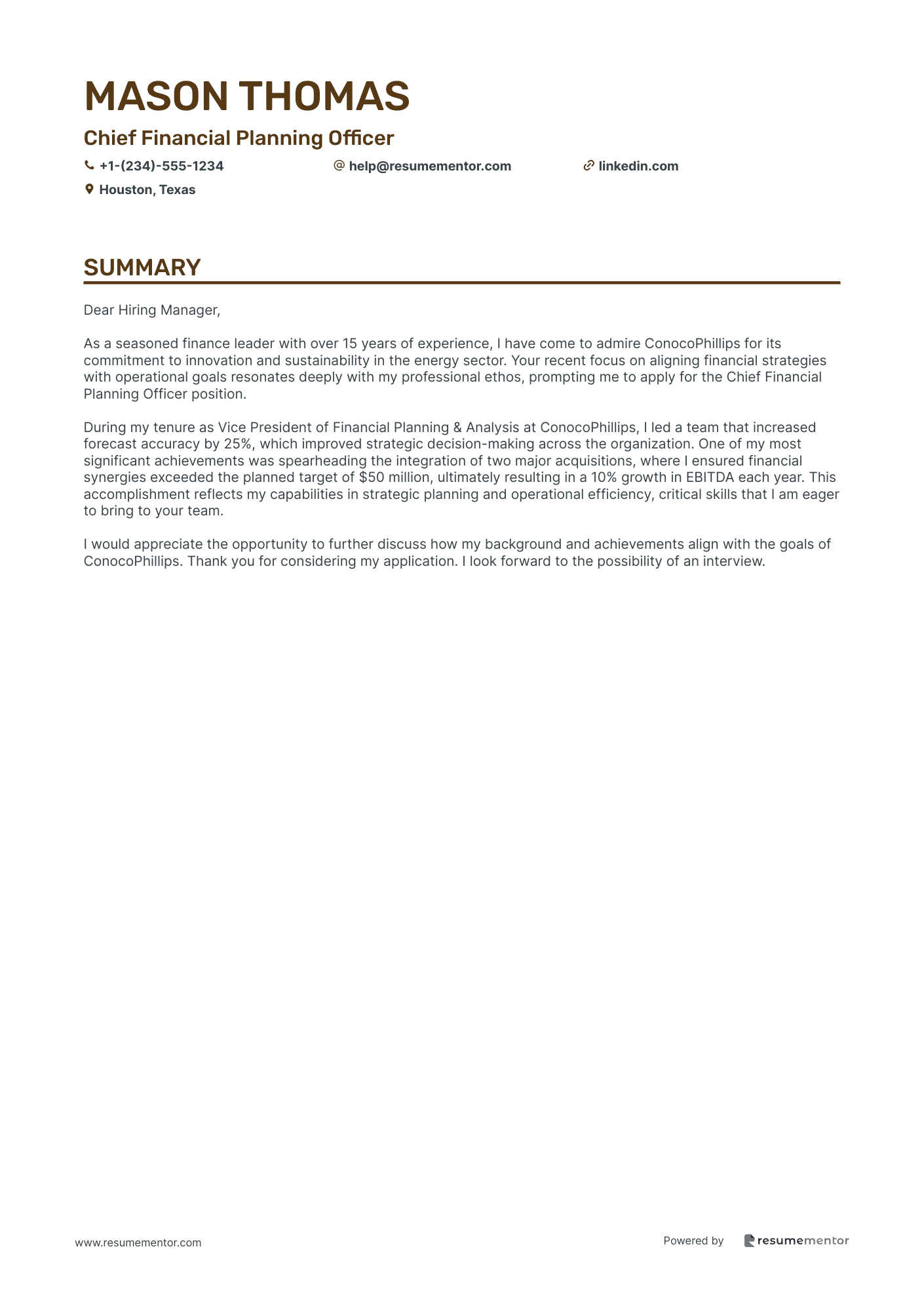

Chief Financial Planning Officer

Chief Financial Transformation Officer

Chief Information and Finance Officer

Chief Revenue and Finance Officer

Chief Financial Analytics Officer

Chief Financial Acquisition Officer

Chief Financial Compliance Officer

Chief Financial Risk Officer cover letter sample

Chief Strategy and Financial Officer cover letter sample

Chief Investment Financial Officer cover letter sample

Chief Financial Planning Officer cover letter sample

Chief Financial Transformation Officer cover letter sample

Chief Information and Finance Officer cover letter sample

Chief Revenue and Finance Officer cover letter sample

Chief Financial Analytics Officer cover letter sample

Chief Financial Acquisition Officer cover letter sample

Chief Financial Compliance Officer cover letter sample

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.