Chief Financial Officer (CFO) Resume Examples

Jul 18, 2024

|

12 min read

Crafting a standout CFO resume: your guide to crunching the numbers for your next big role while showing off your financial finesse.

Rated by 348 people

Chief Financial Compliance Officer

Chief Financial Risk Officer

Chief Strategy and Financial Officer

Chief Investment Financial Officer

Chief Financial Planning Officer

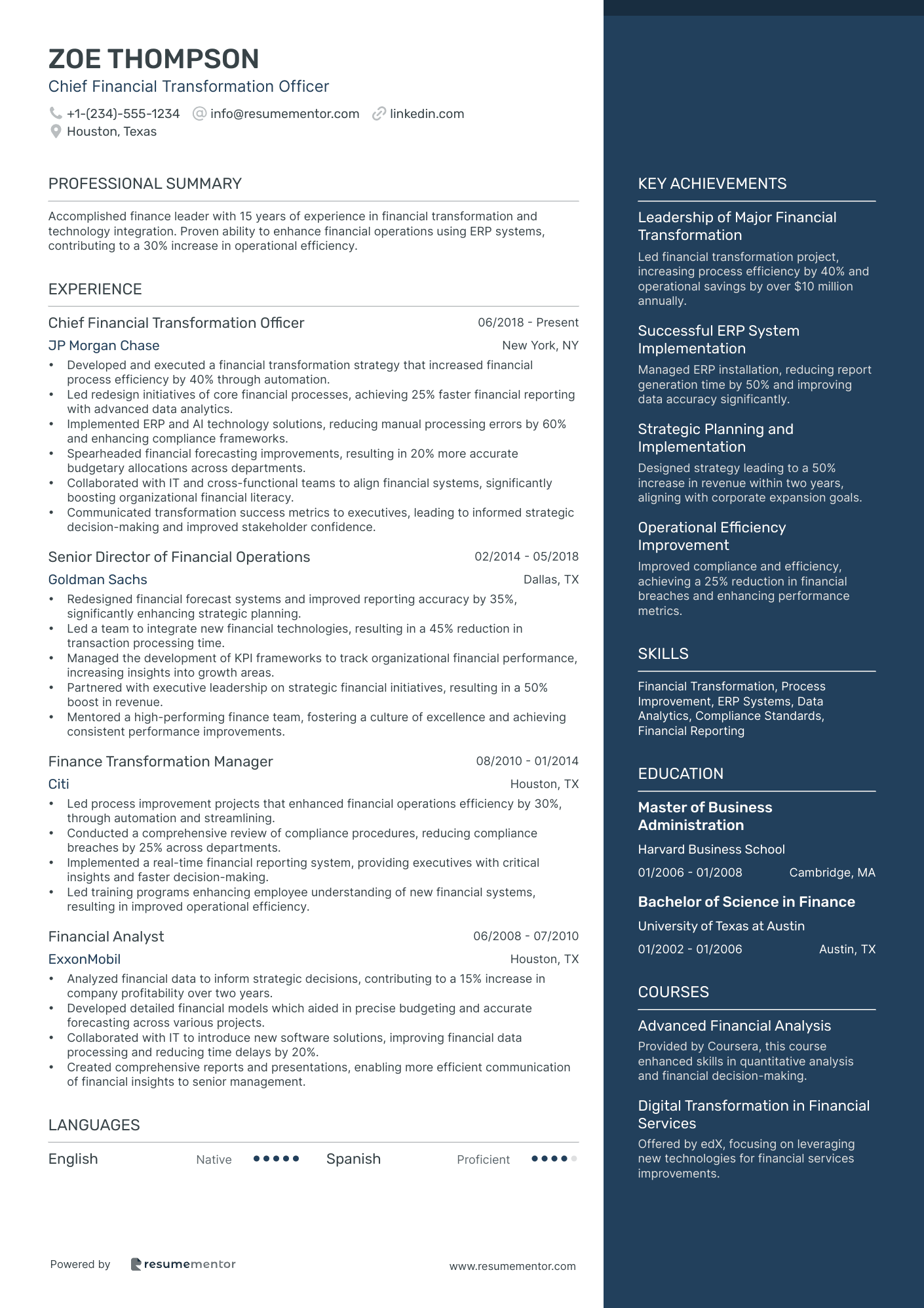

Chief Financial Transformation Officer

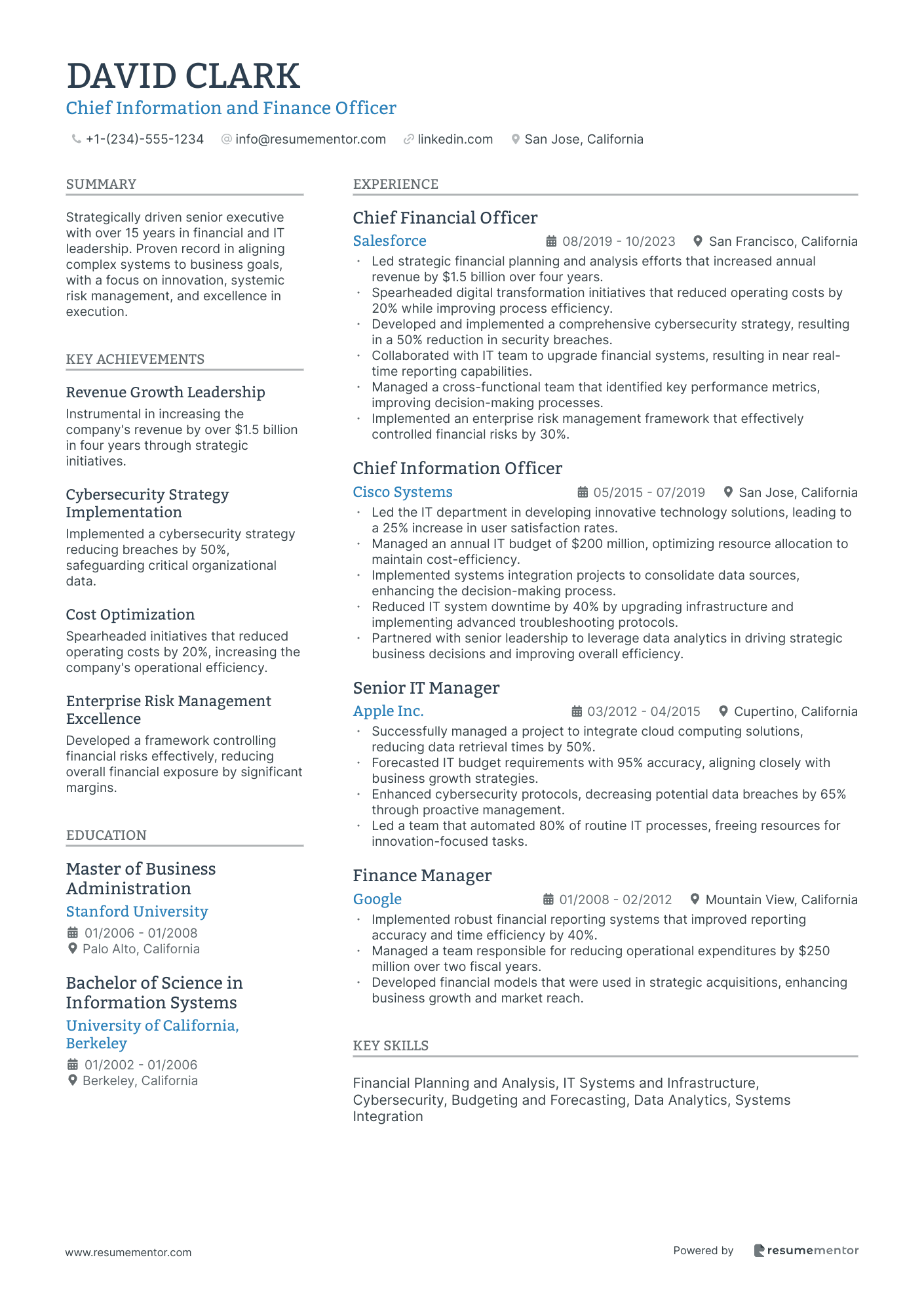

Chief Information and Finance Officer

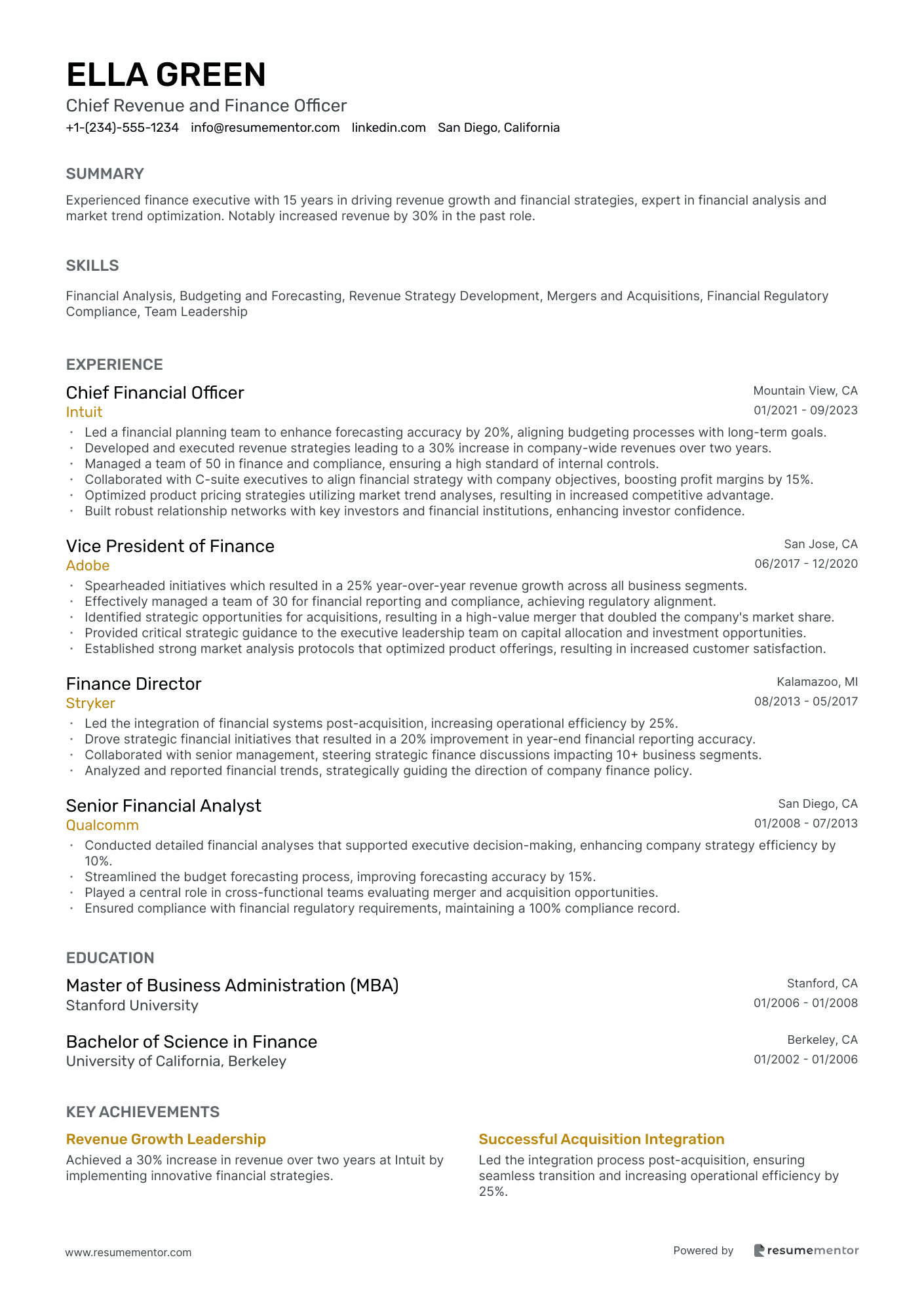

Chief Revenue and Finance Officer

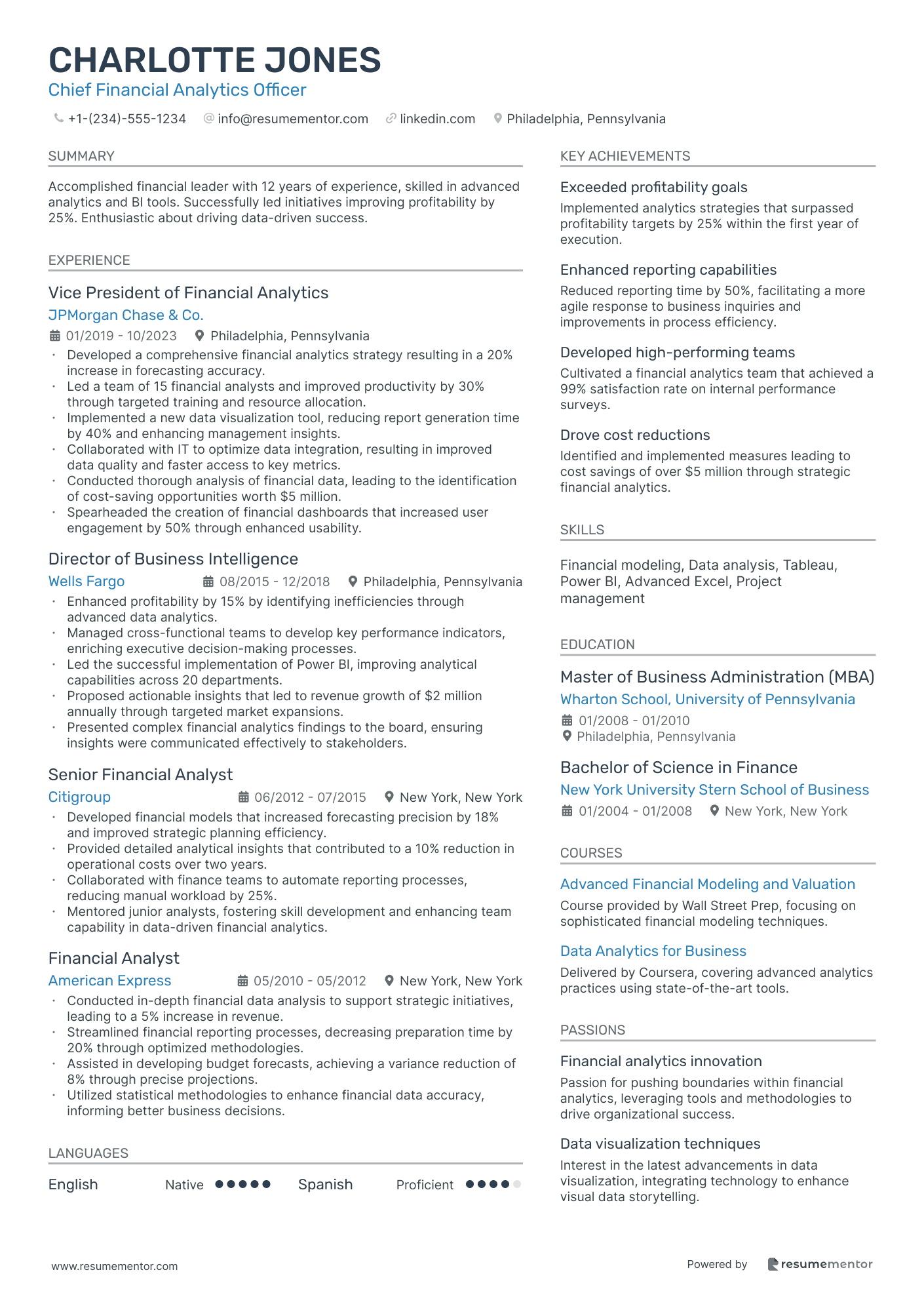

Chief Financial Analytics Officer

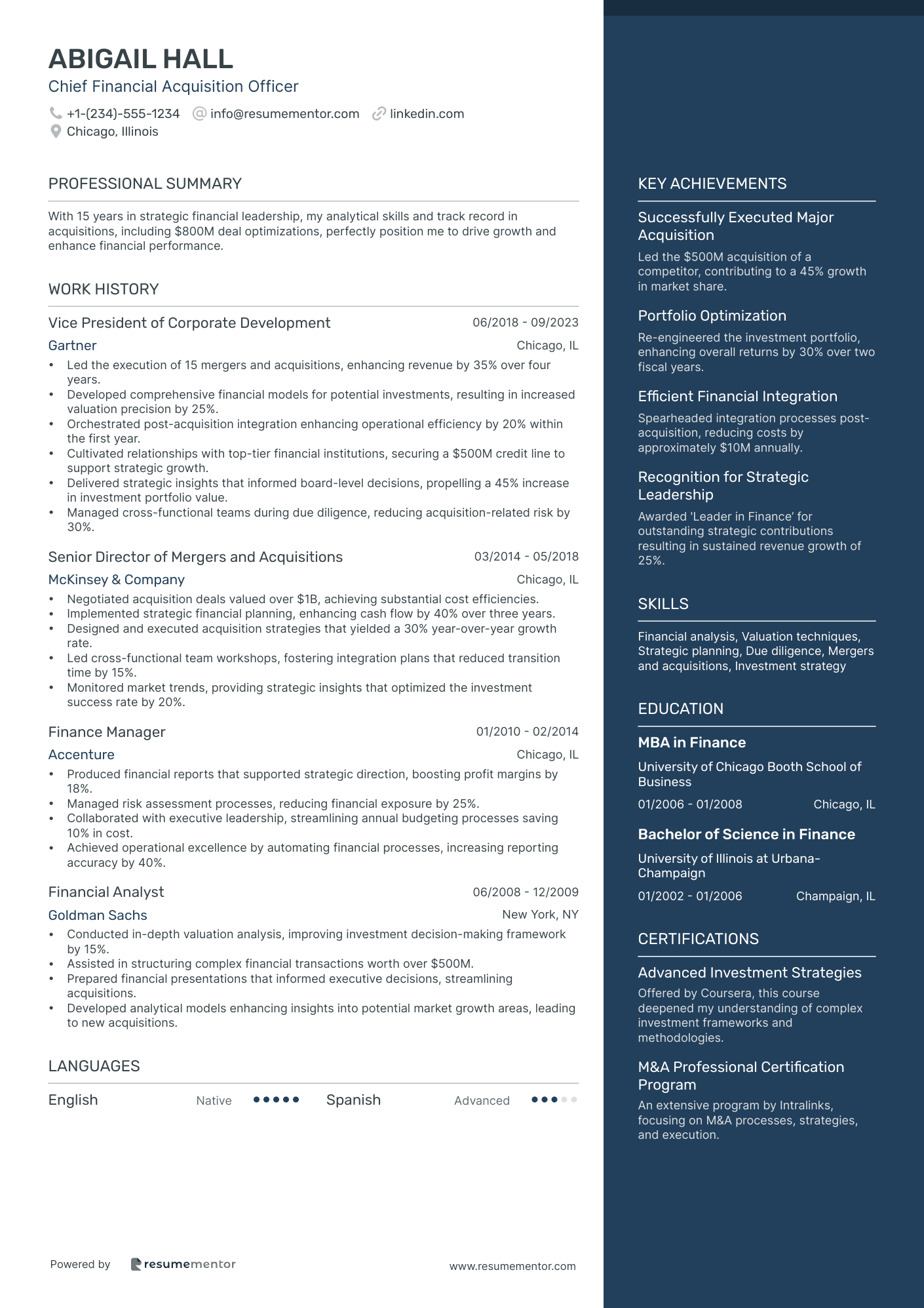

Chief Financial Acquisition Officer

Chief Financial Compliance Officer resume sample

- •Implemented a comprehensive financial compliance program that increased adherence to regulations by 25% in two years.

- •Led a team of 15 compliance professionals, fostering a culture of accountability and continuous improvement.

- •Collaborated with legal and regulatory teams to align organizational practices with global financial regulations, minimizing risk exposure.

- •Conducted thorough audits, reducing compliance violations by 30%, and presented detailed findings to senior executives.

- •Developed training modules, enhancing executive team understanding of compliance protocols by 20%.

- •Streamlined communication with regulatory bodies, resulting in improved response time and 15% faster issue resolution.

- •Authored new compliance policy that reduced risk assessment time by 40% and improved accuracy rates.

- •Led bi-annual compliance audits within the finance department, achieving a 98% accuracy in findings.

- •Managed risk management strategies that led to a 35% decrease in compliance-related financial penalties.

- •Oversaw relationship-building with key regulatory agencies, ensuring consistent policy updates and mitigated risks.

- •Provided comprehensive training on SOX compliance, boosting department adherence and implementation by 15%.

- •Developed risk assessment frameworks that cut non-compliance rates by 20% within the first year.

- •Supervised a team of audit specialists, improving team productivity by 25% through enhanced workflows.

- •Created a compliance tracking system, leading to a 30% reduction in time spent on compliance reporting.

- •Executed regular training workshops, raising awareness and adherence to international financial regulations.

- •Analyzed and reported on financial compliance, resulting in 20% improvement in regulatory report efficiency.

- •Developed financial models for compliance costs, reducing budget overruns by 10% through accurate projections.

- •Assisted in the preparation of financial statements that increased compliance accuracy by 15%.

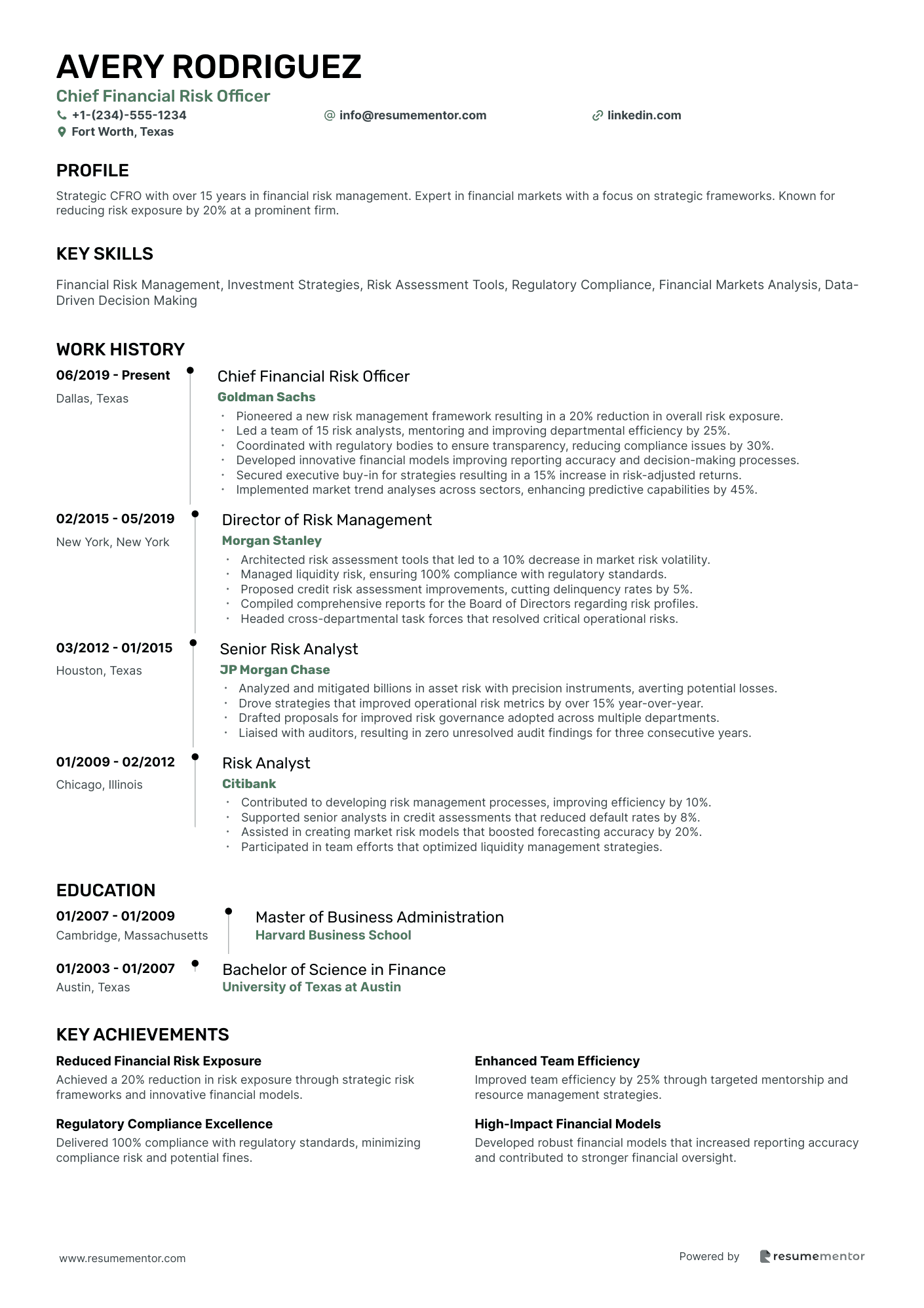

Chief Financial Risk Officer resume sample

- •Pioneered a new risk management framework resulting in a 20% reduction in overall risk exposure.

- •Led a team of 15 risk analysts, mentoring and improving departmental efficiency by 25%.

- •Coordinated with regulatory bodies to ensure transparency, reducing compliance issues by 30%.

- •Developed innovative financial models improving reporting accuracy and decision-making processes.

- •Secured executive buy-in for strategies resulting in a 15% increase in risk-adjusted returns.

- •Implemented market trend analyses across sectors, enhancing predictive capabilities by 45%.

- •Architected risk assessment tools that led to a 10% decrease in market risk volatility.

- •Managed liquidity risk, ensuring 100% compliance with regulatory standards.

- •Proposed credit risk assessment improvements, cutting delinquency rates by 5%.

- •Compiled comprehensive reports for the Board of Directors regarding risk profiles.

- •Headed cross-departmental task forces that resolved critical operational risks.

- •Analyzed and mitigated billions in asset risk with precision instruments, averting potential losses.

- •Drove strategies that improved operational risk metrics by over 15% year-over-year.

- •Drafted proposals for improved risk governance adopted across multiple departments.

- •Liaised with auditors, resulting in zero unresolved audit findings for three consecutive years.

- •Contributed to developing risk management processes, improving efficiency by 10%.

- •Supported senior analysts in credit assessments that reduced default rates by 8%.

- •Assisted in creating market risk models that boosted forecasting accuracy by 20%.

- •Participated in team efforts that optimized liquidity management strategies.

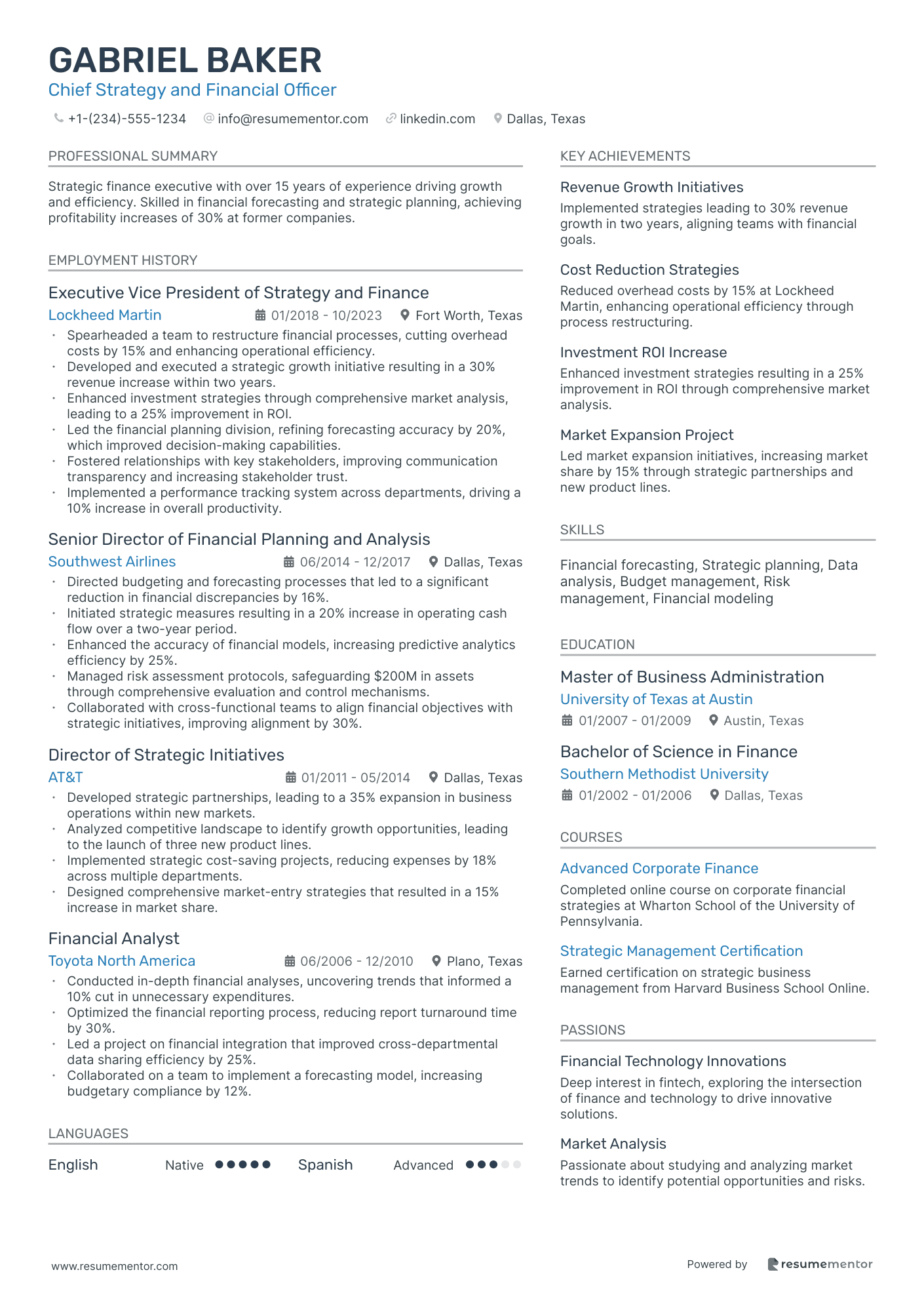

Chief Strategy and Financial Officer resume sample

- •Spearheaded a team to restructure financial processes, cutting overhead costs by 15% and enhancing operational efficiency.

- •Developed and executed a strategic growth initiative resulting in a 30% revenue increase within two years.

- •Enhanced investment strategies through comprehensive market analysis, leading to a 25% improvement in ROI.

- •Led the financial planning division, refining forecasting accuracy by 20%, which improved decision-making capabilities.

- •Fostered relationships with key stakeholders, improving communication transparency and increasing stakeholder trust.

- •Implemented a performance tracking system across departments, driving a 10% increase in overall productivity.

- •Directed budgeting and forecasting processes that led to a significant reduction in financial discrepancies by 16%.

- •Initiated strategic measures resulting in a 20% increase in operating cash flow over a two-year period.

- •Enhanced the accuracy of financial models, increasing predictive analytics efficiency by 25%.

- •Managed risk assessment protocols, safeguarding $200M in assets through comprehensive evaluation and control mechanisms.

- •Collaborated with cross-functional teams to align financial objectives with strategic initiatives, improving alignment by 30%.

- •Developed strategic partnerships, leading to a 35% expansion in business operations within new markets.

- •Analyzed competitive landscape to identify growth opportunities, leading to the launch of three new product lines.

- •Implemented strategic cost-saving projects, reducing expenses by 18% across multiple departments.

- •Designed comprehensive market-entry strategies that resulted in a 15% increase in market share.

- •Conducted in-depth financial analyses, uncovering trends that informed a 10% cut in unnecessary expenditures.

- •Optimized the financial reporting process, reducing report turnaround time by 30%.

- •Led a project on financial integration that improved cross-departmental data sharing efficiency by 25%.

- •Collaborated on a team to implement a forecasting model, increasing budgetary compliance by 12%.

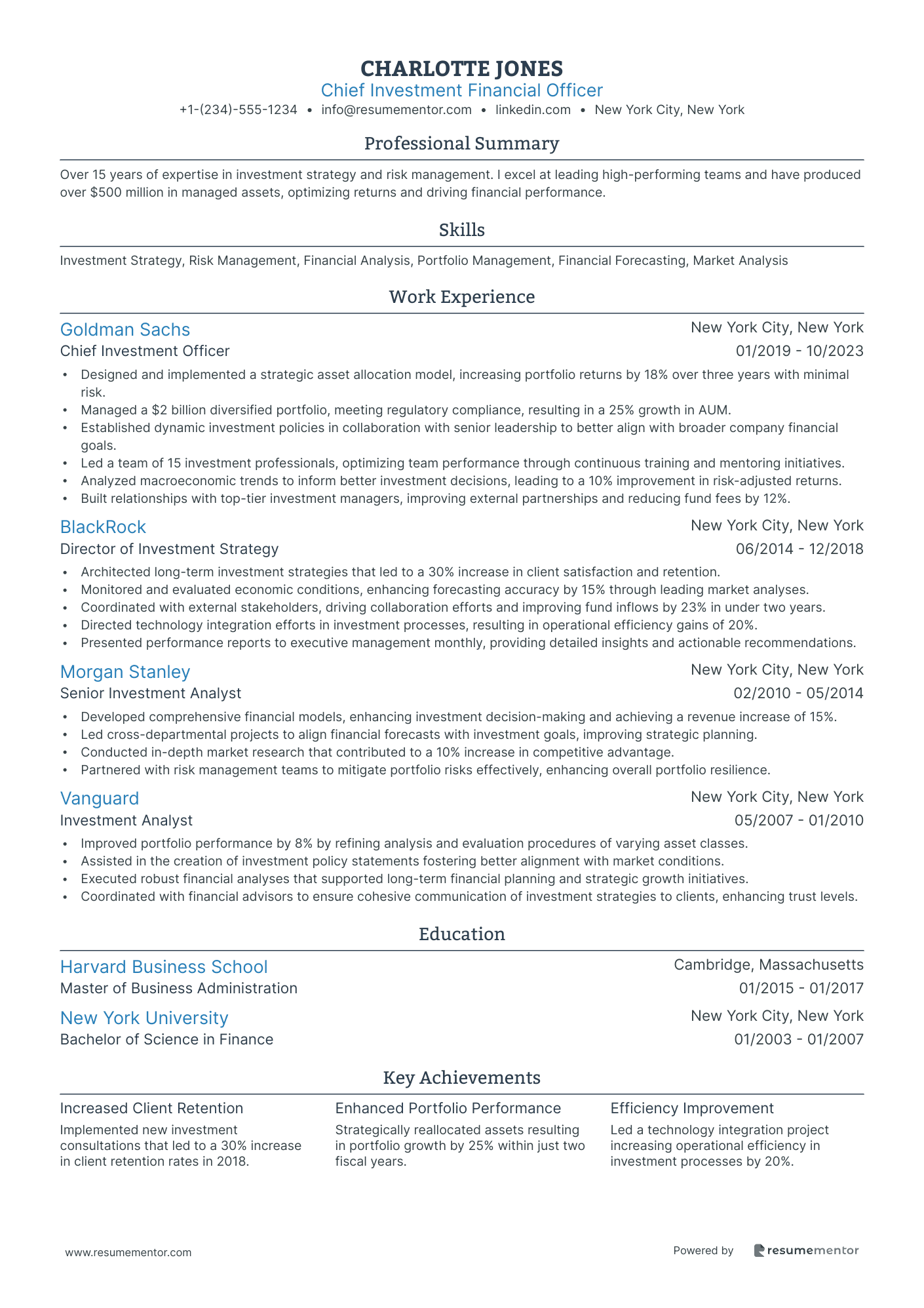

Chief Investment Financial Officer resume sample

- •Designed and implemented a strategic asset allocation model, increasing portfolio returns by 18% over three years with minimal risk.

- •Managed a $2 billion diversified portfolio, meeting regulatory compliance, resulting in a 25% growth in AUM.

- •Established dynamic investment policies in collaboration with senior leadership to better align with broader company financial goals.

- •Led a team of 15 investment professionals, optimizing team performance through continuous training and mentoring initiatives.

- •Analyzed macroeconomic trends to inform better investment decisions, leading to a 10% improvement in risk-adjusted returns.

- •Built relationships with top-tier investment managers, improving external partnerships and reducing fund fees by 12%.

- •Architected long-term investment strategies that led to a 30% increase in client satisfaction and retention.

- •Monitored and evaluated economic conditions, enhancing forecasting accuracy by 15% through leading market analyses.

- •Coordinated with external stakeholders, driving collaboration efforts and improving fund inflows by 23% in under two years.

- •Directed technology integration efforts in investment processes, resulting in operational efficiency gains of 20%.

- •Presented performance reports to executive management monthly, providing detailed insights and actionable recommendations.

- •Developed comprehensive financial models, enhancing investment decision-making and achieving a revenue increase of 15%.

- •Led cross-departmental projects to align financial forecasts with investment goals, improving strategic planning.

- •Conducted in-depth market research that contributed to a 10% increase in competitive advantage.

- •Partnered with risk management teams to mitigate portfolio risks effectively, enhancing overall portfolio resilience.

- •Improved portfolio performance by 8% by refining analysis and evaluation procedures of varying asset classes.

- •Assisted in the creation of investment policy statements fostering better alignment with market conditions.

- •Executed robust financial analyses that supported long-term financial planning and strategic growth initiatives.

- •Coordinated with financial advisors to ensure cohesive communication of investment strategies to clients, enhancing trust levels.

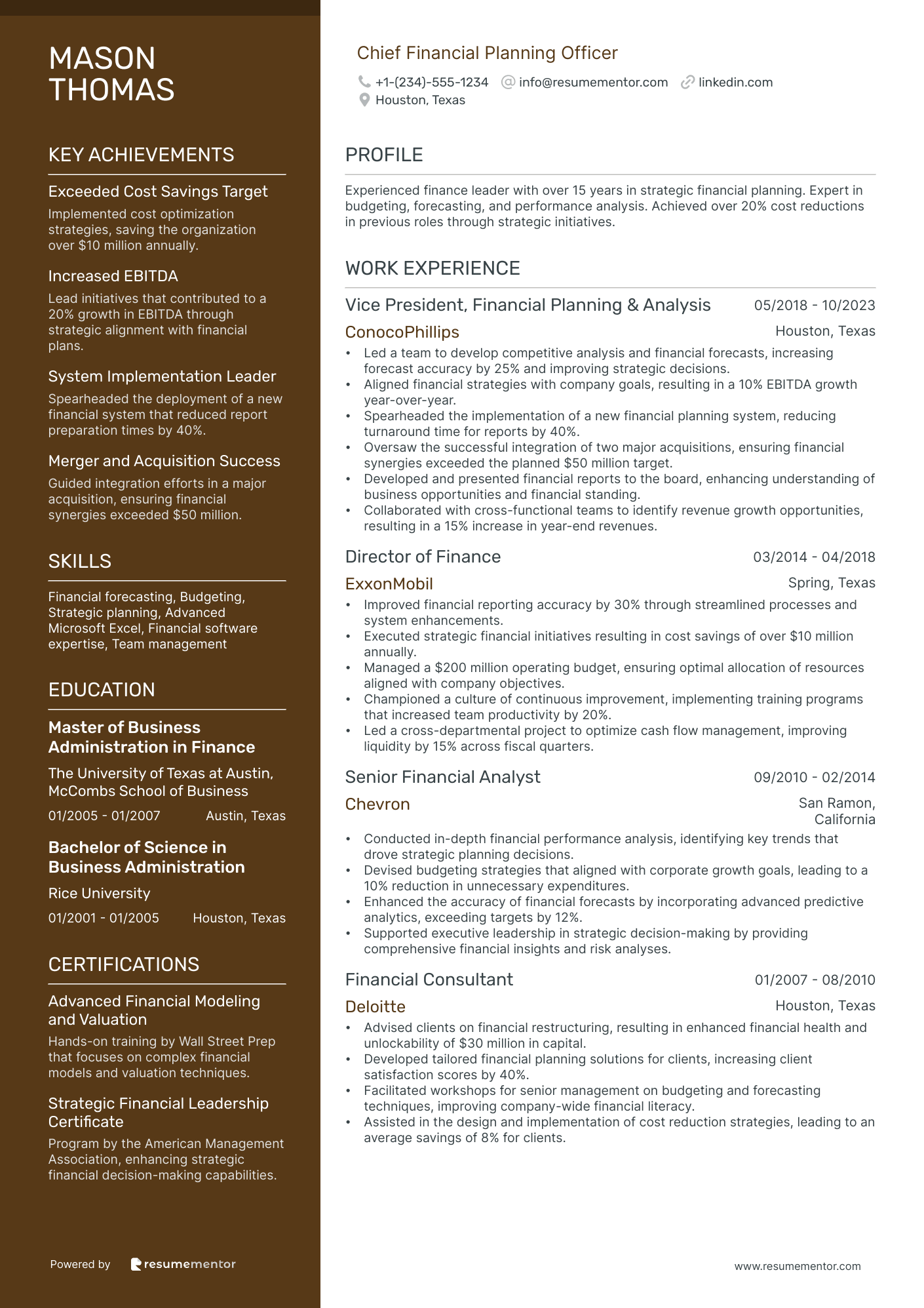

Chief Financial Planning Officer resume sample

- •Led a team to develop competitive analysis and financial forecasts, increasing forecast accuracy by 25% and improving strategic decisions.

- •Aligned financial strategies with company goals, resulting in a 10% EBITDA growth year-over-year.

- •Spearheaded the implementation of a new financial planning system, reducing turnaround time for reports by 40%.

- •Oversaw the successful integration of two major acquisitions, ensuring financial synergies exceeded the planned $50 million target.

- •Developed and presented financial reports to the board, enhancing understanding of business opportunities and financial standing.

- •Collaborated with cross-functional teams to identify revenue growth opportunities, resulting in a 15% increase in year-end revenues.

- •Improved financial reporting accuracy by 30% through streamlined processes and system enhancements.

- •Executed strategic financial initiatives resulting in cost savings of over $10 million annually.

- •Managed a $200 million operating budget, ensuring optimal allocation of resources aligned with company objectives.

- •Championed a culture of continuous improvement, implementing training programs that increased team productivity by 20%.

- •Led a cross-departmental project to optimize cash flow management, improving liquidity by 15% across fiscal quarters.

- •Conducted in-depth financial performance analysis, identifying key trends that drove strategic planning decisions.

- •Devised budgeting strategies that aligned with corporate growth goals, leading to a 10% reduction in unnecessary expenditures.

- •Enhanced the accuracy of financial forecasts by incorporating advanced predictive analytics, exceeding targets by 12%.

- •Supported executive leadership in strategic decision-making by providing comprehensive financial insights and risk analyses.

- •Advised clients on financial restructuring, resulting in enhanced financial health and unlockability of $30 million in capital.

- •Developed tailored financial planning solutions for clients, increasing client satisfaction scores by 40%.

- •Facilitated workshops for senior management on budgeting and forecasting techniques, improving company-wide financial literacy.

- •Assisted in the design and implementation of cost reduction strategies, leading to an average savings of 8% for clients.

Chief Financial Transformation Officer resume sample

- •Developed and executed a financial transformation strategy that increased financial process efficiency by 40% through automation.

- •Led redesign initiatives of core financial processes, achieving 25% faster financial reporting with advanced data analytics.

- •Implemented ERP and AI technology solutions, reducing manual processing errors by 60% and enhancing compliance frameworks.

- •Spearheaded financial forecasting improvements, resulting in 20% more accurate budgetary allocations across departments.

- •Collaborated with IT and cross-functional teams to align financial systems, significantly boosting organizational financial literacy.

- •Communicated transformation success metrics to executives, leading to informed strategic decision-making and improved stakeholder confidence.

- •Redesigned financial forecast systems and improved reporting accuracy by 35%, significantly enhancing strategic planning.

- •Led a team to integrate new financial technologies, resulting in a 45% reduction in transaction processing time.

- •Managed the development of KPI frameworks to track organizational financial performance, increasing insights into growth areas.

- •Partnered with executive leadership on strategic financial initiatives, resulting in a 50% boost in revenue.

- •Mentored a high-performing finance team, fostering a culture of excellence and achieving consistent performance improvements.

- •Led process improvement projects that enhanced financial operations efficiency by 30%, through automation and streamlining.

- •Conducted a comprehensive review of compliance procedures, reducing compliance breaches by 25% across departments.

- •Implemented a real-time financial reporting system, providing executives with critical insights and faster decision-making.

- •Led training programs enhancing employee understanding of new financial systems, resulting in improved operational efficiency.

- •Analyzed financial data to inform strategic decisions, contributing to a 15% increase in company profitability over two years.

- •Developed detailed financial models which aided in precise budgeting and accurate forecasting across various projects.

- •Collaborated with IT to introduce new software solutions, improving financial data processing and reducing time delays by 20%.

- •Created comprehensive reports and presentations, enabling more efficient communication of financial insights to senior management.

Chief Information and Finance Officer resume sample

- •Led strategic financial planning and analysis efforts that increased annual revenue by $1.5 billion over four years.

- •Spearheaded digital transformation initiatives that reduced operating costs by 20% while improving process efficiency.

- •Developed and implemented a comprehensive cybersecurity strategy, resulting in a 50% reduction in security breaches.

- •Collaborated with IT team to upgrade financial systems, resulting in near real-time reporting capabilities.

- •Managed a cross-functional team that identified key performance metrics, improving decision-making processes.

- •Implemented an enterprise risk management framework that effectively controlled financial risks by 30%.

- •Led the IT department in developing innovative technology solutions, leading to a 25% increase in user satisfaction rates.

- •Managed an annual IT budget of $200 million, optimizing resource allocation to maintain cost-efficiency.

- •Implemented systems integration projects to consolidate data sources, enhancing the decision-making process.

- •Reduced IT system downtime by 40% by upgrading infrastructure and implementing advanced troubleshooting protocols.

- •Partnered with senior leadership to leverage data analytics in driving strategic business decisions and improving overall efficiency.

- •Successfully managed a project to integrate cloud computing solutions, reducing data retrieval times by 50%.

- •Forecasted IT budget requirements with 95% accuracy, aligning closely with business growth strategies.

- •Enhanced cybersecurity protocols, decreasing potential data breaches by 65% through proactive management.

- •Led a team that automated 80% of routine IT processes, freeing resources for innovation-focused tasks.

- •Implemented robust financial reporting systems that improved reporting accuracy and time efficiency by 40%.

- •Managed a team responsible for reducing operational expenditures by $250 million over two fiscal years.

- •Developed financial models that were used in strategic acquisitions, enhancing business growth and market reach.

Chief Revenue and Finance Officer resume sample

- •Led a financial planning team to enhance forecasting accuracy by 20%, aligning budgeting processes with long-term goals.

- •Developed and executed revenue strategies leading to a 30% increase in company-wide revenues over two years.

- •Managed a team of 50 in finance and compliance, ensuring a high standard of internal controls.

- •Collaborated with C-suite executives to align financial strategy with company objectives, boosting profit margins by 15%.

- •Optimized product pricing strategies utilizing market trend analyses, resulting in increased competitive advantage.

- •Built robust relationship networks with key investors and financial institutions, enhancing investor confidence.

- •Spearheaded initiatives which resulted in a 25% year-over-year revenue growth across all business segments.

- •Effectively managed a team of 30 for financial reporting and compliance, achieving regulatory alignment.

- •Identified strategic opportunities for acquisitions, resulting in a high-value merger that doubled the company's market share.

- •Provided critical strategic guidance to the executive leadership team on capital allocation and investment opportunities.

- •Established strong market analysis protocols that optimized product offerings, resulting in increased customer satisfaction.

- •Led the integration of financial systems post-acquisition, increasing operational efficiency by 25%.

- •Drove strategic financial initiatives that resulted in a 20% improvement in year-end financial reporting accuracy.

- •Collaborated with senior management, steering strategic finance discussions impacting 10+ business segments.

- •Analyzed and reported financial trends, strategically guiding the direction of company finance policy.

- •Conducted detailed financial analyses that supported executive decision-making, enhancing company strategy efficiency by 10%.

- •Streamlined the budget forecasting process, improving forecasting accuracy by 15%.

- •Played a central role in cross-functional teams evaluating merger and acquisition opportunities.

- •Ensured compliance with financial regulatory requirements, maintaining a 100% compliance record.

Chief Financial Analytics Officer resume sample

- •Developed a comprehensive financial analytics strategy resulting in a 20% increase in forecasting accuracy.

- •Led a team of 15 financial analysts and improved productivity by 30% through targeted training and resource allocation.

- •Implemented a new data visualization tool, reducing report generation time by 40% and enhancing management insights.

- •Collaborated with IT to optimize data integration, resulting in improved data quality and faster access to key metrics.

- •Conducted thorough analysis of financial data, leading to the identification of cost-saving opportunities worth $5 million.

- •Spearheaded the creation of financial dashboards that increased user engagement by 50% through enhanced usability.

- •Enhanced profitability by 15% by identifying inefficiencies through advanced data analytics.

- •Managed cross-functional teams to develop key performance indicators, enriching executive decision-making processes.

- •Led the successful implementation of Power BI, improving analytical capabilities across 20 departments.

- •Proposed actionable insights that led to revenue growth of $2 million annually through targeted market expansions.

- •Presented complex financial analytics findings to the board, ensuring insights were communicated effectively to stakeholders.

- •Developed financial models that increased forecasting precision by 18% and improved strategic planning efficiency.

- •Provided detailed analytical insights that contributed to a 10% reduction in operational costs over two years.

- •Collaborated with finance teams to automate reporting processes, reducing manual workload by 25%.

- •Mentored junior analysts, fostering skill development and enhancing team capability in data-driven financial analytics.

- •Conducted in-depth financial data analysis to support strategic initiatives, leading to a 5% increase in revenue.

- •Streamlined financial reporting processes, decreasing preparation time by 20% through optimized methodologies.

- •Assisted in developing budget forecasts, achieving a variance reduction of 8% through precise projections.

- •Utilized statistical methodologies to enhance financial data accuracy, informing better business decisions.

Chief Financial Acquisition Officer resume sample

- •Led the execution of 15 mergers and acquisitions, enhancing revenue by 35% over four years.

- •Developed comprehensive financial models for potential investments, resulting in increased valuation precision by 25%.

- •Orchestrated post-acquisition integration enhancing operational efficiency by 20% within the first year.

- •Cultivated relationships with top-tier financial institutions, securing a $500M credit line to support strategic growth.

- •Delivered strategic insights that informed board-level decisions, propelling a 45% increase in investment portfolio value.

- •Managed cross-functional teams during due diligence, reducing acquisition-related risk by 30%.

- •Negotiated acquisition deals valued over $1B, achieving substantial cost efficiencies.

- •Implemented strategic financial planning, enhancing cash flow by 40% over three years.

- •Designed and executed acquisition strategies that yielded a 30% year-over-year growth rate.

- •Led cross-functional team workshops, fostering integration plans that reduced transition time by 15%.

- •Monitored market trends, providing strategic insights that optimized the investment success rate by 20%.

- •Produced financial reports that supported strategic direction, boosting profit margins by 18%.

- •Managed risk assessment processes, reducing financial exposure by 25%.

- •Collaborated with executive leadership, streamlining annual budgeting processes saving 10% in cost.

- •Achieved operational excellence by automating financial processes, increasing reporting accuracy by 40%.

- •Conducted in-depth valuation analysis, improving investment decision-making framework by 15%.

- •Assisted in structuring complex financial transactions worth over $500M.

- •Prepared financial presentations that informed executive decisions, streamlining acquisitions.

- •Developed analytical models enhancing insights into potential market growth areas, leading to new acquisitions.

Crafting the perfect chief financial officer (CFO) resume can be as complex as balancing a financial report. You may find yourself struggling to condense years of experience and a multitude of skills into two succinct pages. High-level roles like yours demand a resume that reflects strategic thinking and strong leadership. It's not just about listing qualifications; it's about telling a compelling career story. Getting it wrong can mean missing out on the job of your dreams. You’re not alone in this challenge, and this guide is here to help you avoid pitfalls and stand out.

It's crucial to use the right resume template for a CFO position. A well-designed template ensures that your resume is not only visually appealing but also easy to read. It lets your achievements and skills shine, making it easier for hiring managers to see why you're the best candidate. Make sure to choose a template that highlights your strategic insights and leadership skills effectively.

We offer more than 700 resume examples you can use to craft a stellar resume. Get started today and make your resume a financial asset!

Key Takeaways

- Creating a standout CFO resume requires a strategic approach to highlight leadership, financial expertise, and strategic planning, including sections like Contact Information, Professional Summary, Core Competencies, Work Experience, Education, Certifications, and additional relevant sections.

- Use a well-designed resume template for CFO roles to ensure readability and effective highlighting of achievements and skills, with a preference for chronological format, modern fonts, and PDF file types.

- In your experience section, emphasize specific achievements backed by measurable results to show your impact, rather than just listing responsibilities, focusing on roles relevant to finance and leadership.

- The resume summary should succinctly capture your most relevant skills and accomplishments using active language and avoiding generic statements, aiming to grab the hiring manager's attention.

- Include both hard and soft skills relevant to the CFO role in your resume, alongside detailing your academic background, certifications, and other potentially enriching sections (e.g., volunteer work, hobbies) to present a comprehensive profile.

What to focus on when writing your chief financial officer (CFO) resume

A chief financial officer (CFO) resume should show your ability to manage a company's finances with expertise and precision. Highlight your experience in financial planning, strategic planning, and risk management while showcasing your leadership skills. Emphasize successful projects or transformations you've led, and quantify your achievements where possible.

Boost your accountant resume with:

- Specific metrics from financial reports you've improved.

- Leadership roles in team settings or projects.

- Certifications such as CPA or CMA.

- Technical skills in accounting software or ERP systems.

Must have information on your chief financial officer (CFO) resume

Creating a CFO resume requires a sharp focus on leadership, financial expertise, and strategic planning. Be sure to include the following sections:

- Contact Information

- Professional Summary

- Core Competencies

- Work Experience

- Education

- Certifications and Licenses

Additional sections like "Professional Affiliations" and "Publications" can further enhance your resume by showcasing your involvement in the field and contributions to financial literature. This way, you'll present a comprehensive profile that can stand out in any hiring process.

Which resume format to choose

When crafting a resume for a Chief Financial Officer (CFO), the chronological format is typically the best choice, highlighting your extensive experience and progress over time. Choosing modern fonts like Rubik and Montserrat instead of Arial and Times New Roman can give your resume a fresh, contemporary look. PDFs are the best file type to ensure your formatting stays intact. Aim for 1-inch margins to keep your document clean and readable. Use clear section headings like "Professional Experience" and "Education" to ensure your resume is ATS-friendly.

A CFO resume should include the following sections:

- Contact Information

- Professional Summary

- Core Competencies

- Professional Experience

- Education

- Certifications

- Awards and Honors

- Professional Affiliations

Resume Mentor’s free resume builder takes care of all these details, ensuring a polished and professional document.

How to write a quantifiable resume experience section

Writing the experience section of your Chief Financial Officer (CFO) resume involves a clear and concise summary of your achievements and strengths. Start with the most recent position and work your way back. It's recommended to include around 10-15 years of professional experience, focusing on roles relevant to finance and leadership. Suitable job titles to highlight include CFO, Finance Director, VP of Finance, or any senior-level finance roles. Tailor each entry to show how your skills match the job you're applying for.

Use action-oriented words to describe your duties and achievements. Words like "led," "managed," "enhanced," and "optimized" are examples. Focus on what you accomplished through numbers, like revenue growth percentages, cost savings, or efficiency improvements. Don't just list responsibilities—show how you made a difference.

Here’s your first example for the experience section:

- •Managed team of accountants

- •Supervised financial reporting

- •Oversaw monthly and annual budgeting

This example poorly reflects your impact and achievements. It simply lists responsibilities without quantifying results. Phrases like "managed team of accountants" and "oversaw monthly and annual budgeting" are vague and don't highlight your personal contributions or the positive changes you brought to the company.

Here’s a more outstanding example:

- •Led financial strategy resulting in 15% revenue growth annually

- •Streamlined budget processes, reducing costs by 20%

- •Implemented new accounting system, saving 500 man-hours annually

This example stands out because it highlights specific achievements backed by numbers. It mentions "Led financial strategy resulting in 15% revenue growth annually," which shows a direct impact on the company's success. "Streamlined budget processes, reducing costs by 20%" and "Implemented new accounting system, saving 500 man-hours annually" demonstrate your ability to improve efficiency and cut costs.

Note the difference in how the examples frame the role. Use this format to improve your resume experience section, focusing on measurable successes rather than just listing duties.

Chief financial officer (CFO) resume experience examples

Welcome to this section of showcasing how to tailor your experience as a Chief Financial Officer (CFO). With great power comes great responsibility—especially when it comes to balancing the books and leading the financial strategy of a company!

Achievement-focused

Highlight notable accomplishments that underscore your proficiency and success in financial leadership.

CFO

Tech Innovations Inc.

January 2018 - Present

- Increased annual revenue by 20% through strategic financial planning.

- Secured $50M in funding, enhancing company investments.

- Reduced operating costs by 15% through cost-saving initiatives.

Skills-focused

Emphasize the skills that make you an adept CFO, from financial analysis to risk management.

CFO

Finance Matters Co.

March 2015 - December 2017

- Expertise in financial forecasting and budgeting.

- Proficient in GAAP and IFRS accounting standards.

- Strong analytical skills for data-driven decision making.

Responsibility-focused

Detail the key responsibilities you have taken on as a CFO to demonstrate your leadership.

CFO

Global Enterprises Ltd.

June 2012 - February 2015

- Oversaw financial planning and analysis.

- Managed a team of 20 finance professionals.

- Developed and implemented company-wide financial policies.

Project-focused

Showcase significant projects you led or contributed to, highlighting your ability to handle complex financial tasks.

CFO

Meridian Holdings

August 2009 - May 2012

- Led the financial integration during a $3M merger.

- Implemented a new ERP system to streamline financial reporting.

- Coordinated a project to reduce company's tax liabilities.

Result-focused

Focus on the outcomes of your financial strategies and decisions, showcasing tangible benefits.

CFO

Financially Sound Inc.

February 2006 - July 2009

- Boosted profit margins by 10% within the first year.

- Improved cash flow by restructuring debt.

- Achieved 95% accuracy in financial forecasting.

Industry-Specific Focus

Adapt your experience to illustrate your expertise in a particular industry relevant to potential employers.

CFO

Tech Pioneers Inc.

October 2003 - January 2006

- Specialized in technology sector financial management.

- Navigated industry-specific regulations and compliance.

- Enhanced competitive positioning through financial strategies.

Problem-Solving focused

Describe challenging situations you resolved, emphasizing your problem-solving abilities.

CFO

Smart Solutions Corp.

April 2000 - September 2003

- Resolved a $2M financial discrepancy within three months.

- Instituted stringent audit practices to prevent future issues.

- Improved profitability by addressing unprofitable segments.

Innovation-focused

Showcase your capacity to bring innovative financial solutions and ideas to the table.

CFO

Future Finance Ltd.

July 1997 - March 2000

- Introduced AI-driven financial tracking systems.

- Pioneered online financial reporting, reducing errors by 25%.

- Developed innovative investment strategies increasing ROI.

Leadership-focused

Highlight your experience in leading teams and initiatives, demonstrating your leadership qualities.

CFO

Global Reach Inc.

January 1994 - June 1997

- Directed a team of 30 finance professionals across 3 continents.

- Mentored junior executives, fostering leadership skills.

- Led executive financial strategy meetings with stakeholders.

Customer-focused

Illustrate your commitment to customer satisfaction and how financial strategies can enhance customer experiences.

CFO

Client First Financial

October 1991 - December 1993

- Improved customer payment processes, reducing payment times by 20%.

- Designed financial products aligned with customer needs.

- Established customer-focused financial KPIs.

Growth-focused

Showcase your success in driving company growth through financial acumen and strategy.

CFO

Growth Ventures

January 1988 - September 1991

- Doubled company revenue in three years through strategic investments.

- Expanded market reach by securing key financial partnerships.

- Facilitated international growth with successful financial plans.

Efficiency-focused

Detail your efforts to streamline financial operations and enhance efficiency within your organization.

CFO

Efficient Enterprises

January 1985 - December 1987

- Reduced financial reporting times by 50% with streamlined processes.

- Implemented cost-saving measures, saving $1M annually.

- Optimized cash flow management for operational efficiency.

Technology-focused

Demonstrate your ability to leverage technology to improve financial outcomes.

CFO

Tech Savvy Finance

July 1982 - December 1984

- Implemented new financial software that reduced errors by 35%.

- Leveraged big data analytics for more accurate forecasting.

- Adopted blockchain technology to enhance financial security.

Collaboration-focused

Highlight your experience working closely with other departments to achieve financial goals.

CFO

Unified Enterprises

January 1979 - June 1982

- Collaborated with marketing to align financial and sales goals.

- Worked with IT to enhance financial data security.

- Partnered with HR on compensation and benefits planning.

Training and Development focused

Showcase your efforts in developing the skills and careers of your finance team.

CFO

Learning Finance

March 1976 - December 1978

- Established a finance training program for new hires.

- Developed mentorship initiatives to enhance team skills.

- Conducted workshops on financial best practices and compliance.

Write your chief financial officer (CFO) resume summary section

Writing a great resume summary section as a Chief Financial Officer (CFO) can be key to your job search. It should be a concise, powerful statement that grabs the hiring manager's attention. Make sure it highlights your most relevant skills and accomplishments.

When describing yourself in your resume summary, use active language and focus on your unique qualifications. Avoid generic statements and instead highlight specific achievements that show your expertise. Make sure every word adds value and speaks directly to the hiring manager's needs.

A resume summary is a snapshot of your career, focusing on your experience and strengths. A resume objective, on the other hand, focuses on your career goals and what you aim to achieve. A resume profile is a blend of the two, summarizing key skills and goals. A summary of qualifications is a bullet-point list that highlights your most relevant skills and experiences.

Here is an example of a poorly written summary:

This summary is bad because it is vague and lacks specific achievements. It doesn’t highlight any unique skills or key accomplishments. It uses casual language and doesn’t convey professionalism.

Now, here is an example of an outstanding summary:

This summary is effective because it is specific and detailed. It highlights years of experience, key achievements, and specific skills. It uses strong, professional language and focuses on the value you can bring to a new employer.

Listing your chief financial officer (CFO) skills on your resume

Writing the skills section of a Chief Financial Officer (CFO) resume is crucial for showcasing your strengths effectively. Skills can be presented as a standalone section or seamlessly integrated into other sections like your experience and summary. Including strengths and soft skills emphasizes your interpersonal and management capabilities, while your hard skills demonstrate specific technical competencies.

Hard skills refer to your technical abilities and specialized knowledge, often measurable through qualifications or tests. Including both types of skills and your strengths as resume keywords can help your application stand out to hiring managers and automated applicant tracking systems (ATS).

This example is good because it lists specific, relevant skills without unnecessary words. It demonstrates a breadth of competencies, showing potential employers your range of expertise. Each skill is directly related to the responsibilities of a CFO, ensuring relevance and coherence.

Best hard skills to feature on your chief financial officer (CFO) resume

A CFO should have hard skills that show proficiency in financial management, strategic planning, and regulations. These skills communicate your ability to manage financial aspects of a business, predict financial outcomes, and comply with legal standards.

Hard Skills

- Financial Analysis

- Strategic Planning

- Budgeting and Forecasting

- Risk Management

- Investment Management

- Cost Control

- Financial Reporting

- Mergers and Acquisitions

- Cash Flow Management

- Tax Strategy

- Compliance and Auditing

- Financial Software Proficiency (e.g., SAP, Oracle)

- Capital Markets

- Treasury Management

- Performance Metrics

Best soft skills to feature on your chief financial officer (CFO) resume

A CFO should have soft skills that highlight leadership, communication, and analytical abilities. These skills communicate your ability to lead teams, present complex information clearly, and solve problems efficiently.

Soft Skills

- Leadership

- Communication

- Strategic Thinking

- Problem Solving

- Decision Making

- Interpersonal Skills

- Negotiation

- Attention to Detail

- Time Management

- Team Building

- Adaptability

- Conflict Resolution

- Emotional Intelligence

- Critical Thinking

- Change Management

How to include your education on your resume

The education section is a vital part of any chief financial officer (CFO) resume. It highlights your academic background and can set you apart from other candidates. As a CFO applicant, your education should align with the job you're aiming for. Leave out any irrelevant education to keep it focused and impactful.

If your GPA is above 3.5, consider including it to demonstrate academic excellence. Listing a cum laude or similar honors can also reinforce your credentials. When listing your degree, be precise about the title, institution, and dates of attendance.

Here's an example of a poorly written education section:

This example is bad because it lacks specificity in the degree and dates, and doesn't include any honors or GPA.

Now, here's an outstanding example:

This example is effective because it clearly lists a relevant and prestigious degree, includes the high GPA, and specifies the years of study.

How to include chief financial officer (CFO) certificates on your resume

Including a certificates section in your Chief Financial Officer (CFO) resume is vital. Start by listing the name of your certification. Ensure you include the date when you earned it. Add the issuing organization to lend credibility. You can also include certificates in the header for quick reference. For instance: "John Doe, CPA, CFA".

Here’s how a good standalone certificates section should look:

This example is effective because it lists highly relevant certificates for a CFO role. The certifications are up-to-date and well-recognized in the industry. Including these adds authority and shows a commitment to the field. The clear structure ensures easy reading and quick reference for hiring managers. This approach bolsters your qualifications and highlights your expertise.

Extra sections to include in your chief financial officer (CFO) resume

Crafting a resume for a Chief Financial Officer (CFO) involves more than just listing previous job titles and responsibilities. You need to paint a comprehensive picture of your skills, experiences, and persona, showing both your professional prowess and your personal attributes. Adding a nuanced touch to your resume can set you apart from other candidates.

Language section — List the languages you speak fluently to highlight your ability to navigate international markets and communicate with diverse teams.

Hobbies and interests section — Include activities you enjoy, such as chess or investing, to demonstrate attributes like strategic thinking or a strong financial acumen.

Volunteer work section — Add volunteer experiences to showcase your dedication to the community and your ability to lead and inspire teams outside of work.

Books section — Mention books you've read that relate to financial management or leadership to emphasize your commitment to continuous learning and professional development.

Incorporating these sections can add depth to your resume, making you stand out as a well-rounded candidate. They reveal personal qualities that might not be immediately obvious through your professional experience alone. This approach can present you as a multifaceted leader that any company would want on their team.

Pair your chief financial officer (CFO) resume with a cover letter

A cover letter is a one-page document sent along with a resume when applying for a job. It introduces you to the employer, explains your interest in the position, and highlights your most relevant skills and experiences. A well-crafted cover letter can help you stand out from other applicants, showing your enthusiasm and giving context to your resume.

For a Chief Financial Officer (CFO), the cover letter should focus on your strategic financial leadership, examples of financial success under your management, and your ability to drive company growth. Mention any transformative projects, such as cost-saving initiatives or successful mergers. Highlight your skills in financial forecasting, budgeting, and regulatory compliance, showing that you can safeguard the company's financial health.

Make your cover letter effortlessly with Resume Mentor's cover letter builder. Its user-friendly interface and PDF exporting features protect your content and formatting, ensuring a polished and professional look. Get started today!

Andrew Green

Los Angeles, California

+1-(234)-555-1234

help@resumementor.com

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.