Chartered Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Master the art of writing your chartered accountant resume: Ace your next job with these finance-tastic tips and tricks"

Rated by 348 people

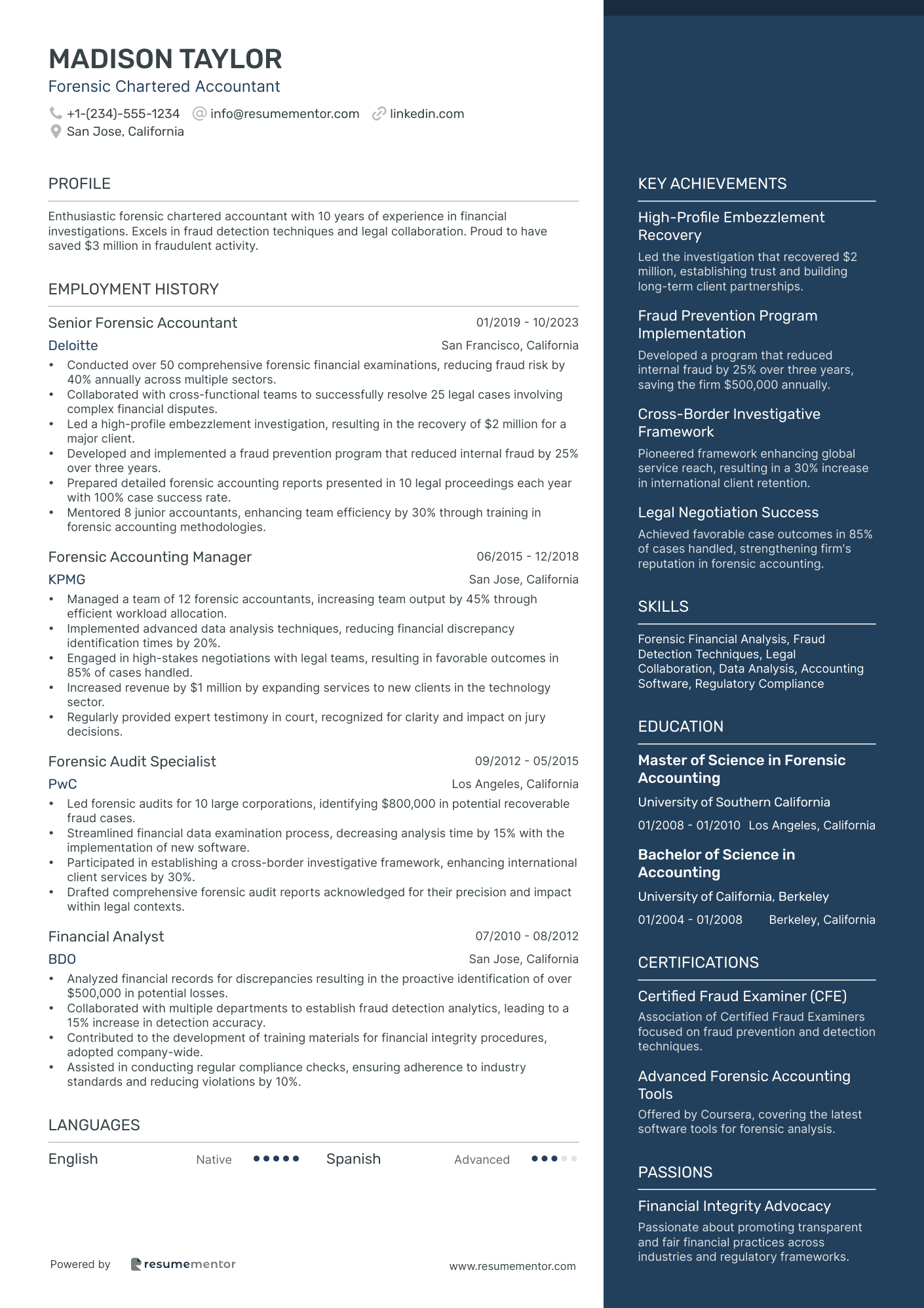

Forensic Chartered Accountant

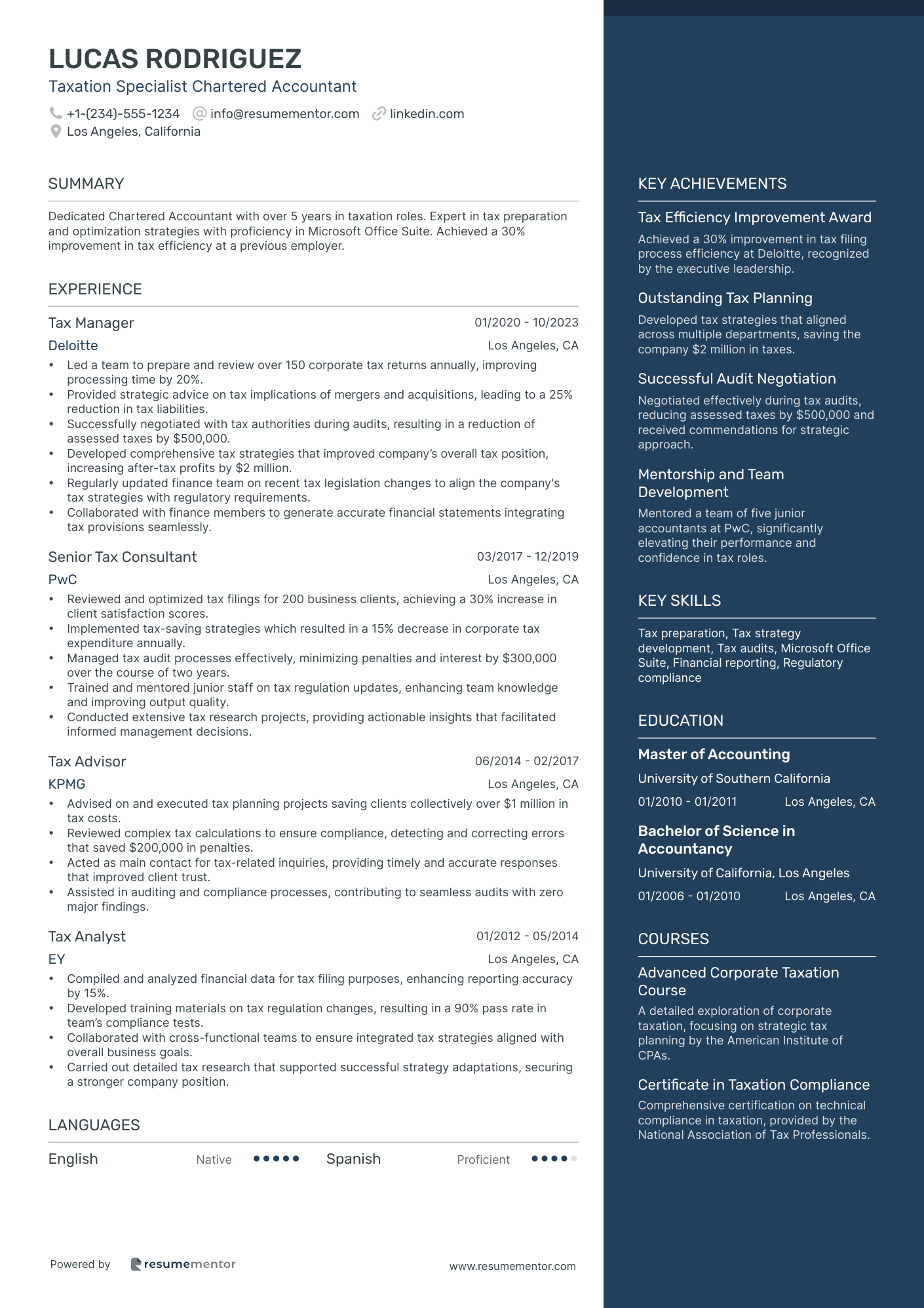

Taxation Specialist Chartered Accountant

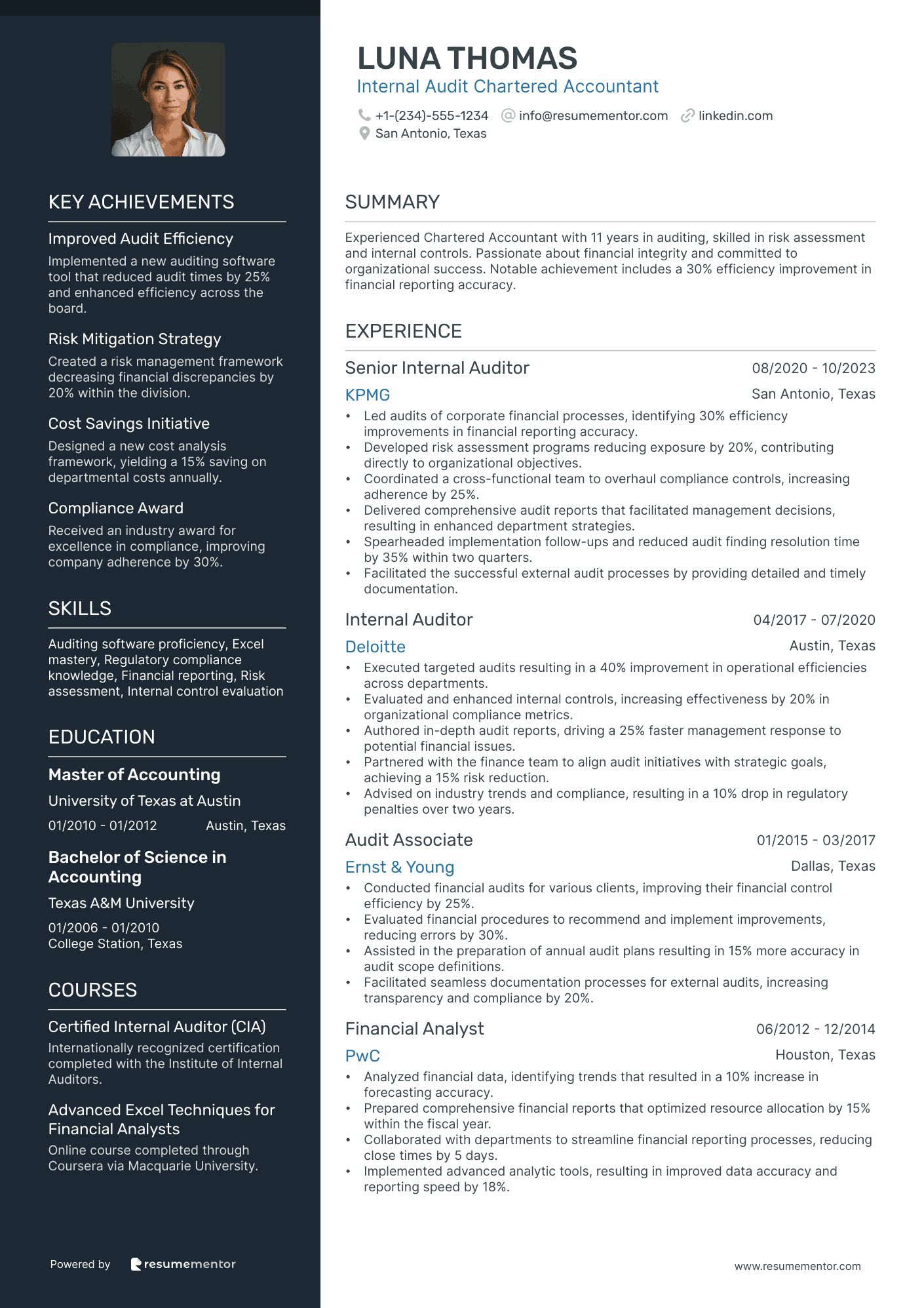

Internal Audit Chartered Accountant

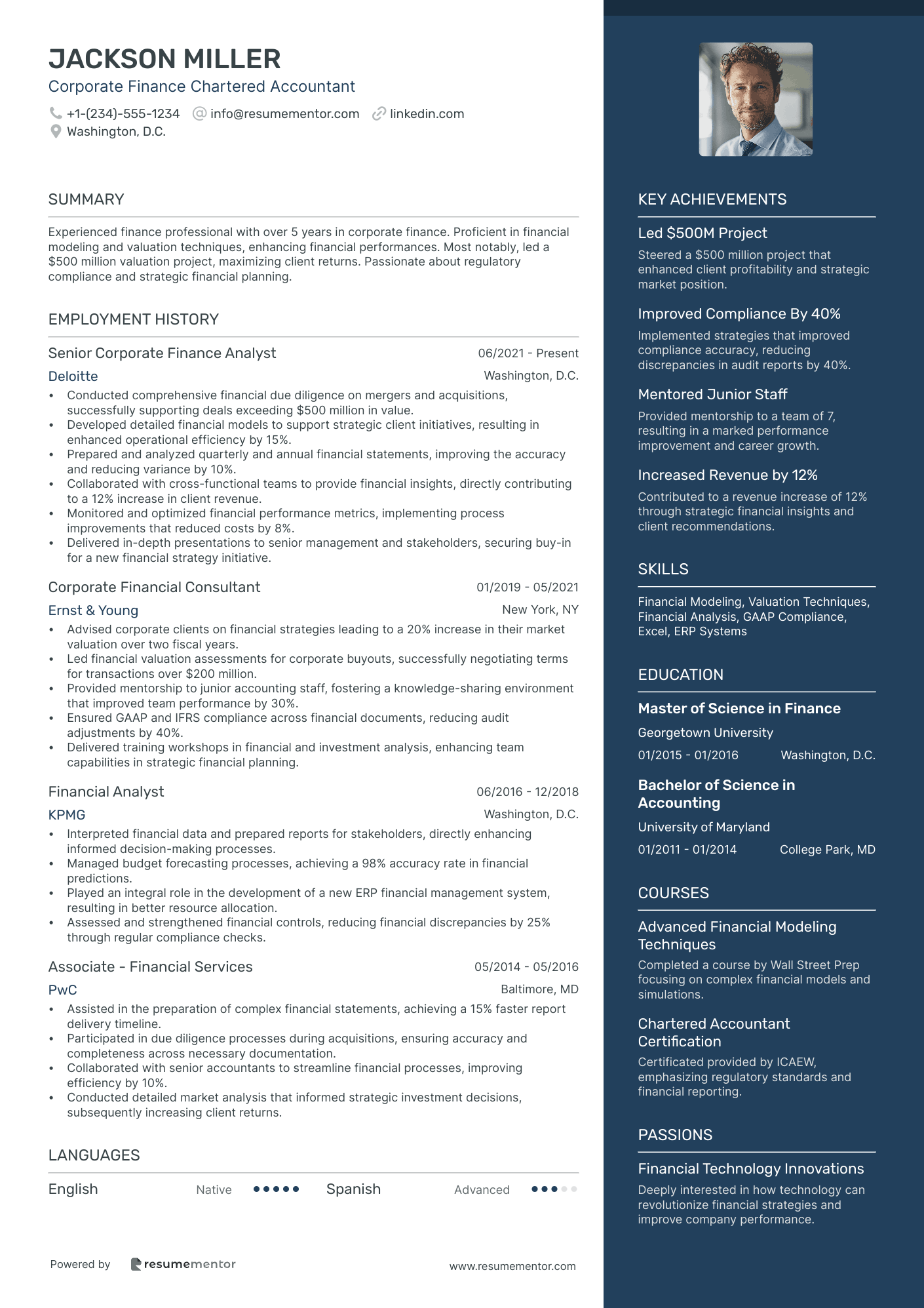

Corporate Finance Chartered Accountant

Nonprofit Organization Chartered Accountant

Management Consulting Chartered Accountant

Risk Assessment Chartered Accountant

Insolvency and Recovery Chartered Accountant

Mergers and Acquisitions Chartered Accountant

Investment Banking Chartered Accountant

Forensic Chartered Accountant resume sample

- •Conducted over 50 comprehensive forensic financial examinations, reducing fraud risk by 40% annually across multiple sectors.

- •Collaborated with cross-functional teams to successfully resolve 25 legal cases involving complex financial disputes.

- •Led a high-profile embezzlement investigation, resulting in the recovery of $2 million for a major client.

- •Developed and implemented a fraud prevention program that reduced internal fraud by 25% over three years.

- •Prepared detailed forensic accounting reports presented in 10 legal proceedings each year with 100% case success rate.

- •Mentored 8 junior accountants, enhancing team efficiency by 30% through training in forensic accounting methodologies.

- •Managed a team of 12 forensic accountants, increasing team output by 45% through efficient workload allocation.

- •Implemented advanced data analysis techniques, reducing financial discrepancy identification times by 20%.

- •Engaged in high-stakes negotiations with legal teams, resulting in favorable outcomes in 85% of cases handled.

- •Increased revenue by $1 million by expanding services to new clients in the technology sector.

- •Regularly provided expert testimony in court, recognized for clarity and impact on jury decisions.

- •Led forensic audits for 10 large corporations, identifying $800,000 in potential recoverable fraud cases.

- •Streamlined financial data examination process, decreasing analysis time by 15% with the implementation of new software.

- •Participated in establishing a cross-border investigative framework, enhancing international client services by 30%.

- •Drafted comprehensive forensic audit reports acknowledged for their precision and impact within legal contexts.

- •Analyzed financial records for discrepancies resulting in the proactive identification of over $500,000 in potential losses.

- •Collaborated with multiple departments to establish fraud detection analytics, leading to a 15% increase in detection accuracy.

- •Contributed to the development of training materials for financial integrity procedures, adopted company-wide.

- •Assisted in conducting regular compliance checks, ensuring adherence to industry standards and reducing violations by 10%.

Taxation Specialist Chartered Accountant resume sample

- •Led a team to prepare and review over 150 corporate tax returns annually, improving processing time by 20%.

- •Provided strategic advice on tax implications of mergers and acquisitions, leading to a 25% reduction in tax liabilities.

- •Successfully negotiated with tax authorities during audits, resulting in a reduction of assessed taxes by $500,000.

- •Developed comprehensive tax strategies that improved company’s overall tax position, increasing after-tax profits by $2 million.

- •Regularly updated finance team on recent tax legislation changes to align the company's tax strategies with regulatory requirements.

- •Collaborated with finance members to generate accurate financial statements integrating tax provisions seamlessly.

- •Reviewed and optimized tax filings for 200 business clients, achieving a 30% increase in client satisfaction scores.

- •Implemented tax-saving strategies which resulted in a 15% decrease in corporate tax expenditure annually.

- •Managed tax audit processes effectively, minimizing penalties and interest by $300,000 over the course of two years.

- •Trained and mentored junior staff on tax regulation updates, enhancing team knowledge and improving output quality.

- •Conducted extensive tax research projects, providing actionable insights that facilitated informed management decisions.

- •Advised on and executed tax planning projects saving clients collectively over $1 million in tax costs.

- •Reviewed complex tax calculations to ensure compliance, detecting and correcting errors that saved $200,000 in penalties.

- •Acted as main contact for tax-related inquiries, providing timely and accurate responses that improved client trust.

- •Assisted in auditing and compliance processes, contributing to seamless audits with zero major findings.

- •Compiled and analyzed financial data for tax filing purposes, enhancing reporting accuracy by 15%.

- •Developed training materials on tax regulation changes, resulting in a 90% pass rate in team’s compliance tests.

- •Collaborated with cross-functional teams to ensure integrated tax strategies aligned with overall business goals.

- •Carried out detailed tax research that supported successful strategy adaptations, securing a stronger company position.

Internal Audit Chartered Accountant resume sample

- •Led audits of corporate financial processes, identifying 30% efficiency improvements in financial reporting accuracy.

- •Developed risk assessment programs reducing exposure by 20%, contributing directly to organizational objectives.

- •Coordinated a cross-functional team to overhaul compliance controls, increasing adherence by 25%.

- •Delivered comprehensive audit reports that facilitated management decisions, resulting in enhanced department strategies.

- •Spearheaded implementation follow-ups and reduced audit finding resolution time by 35% within two quarters.

- •Facilitated the successful external audit processes by providing detailed and timely documentation.

- •Executed targeted audits resulting in a 40% improvement in operational efficiencies across departments.

- •Evaluated and enhanced internal controls, increasing effectiveness by 20% in organizational compliance metrics.

- •Authored in-depth audit reports, driving a 25% faster management response to potential financial issues.

- •Partnered with the finance team to align audit initiatives with strategic goals, achieving a 15% risk reduction.

- •Advised on industry trends and compliance, resulting in a 10% drop in regulatory penalties over two years.

- •Conducted financial audits for various clients, improving their financial control efficiency by 25%.

- •Evaluated financial procedures to recommend and implement improvements, reducing errors by 30%.

- •Assisted in the preparation of annual audit plans resulting in 15% more accuracy in audit scope definitions.

- •Facilitated seamless documentation processes for external audits, increasing transparency and compliance by 20%.

- •Analyzed financial data, identifying trends that resulted in a 10% increase in forecasting accuracy.

- •Prepared comprehensive financial reports that optimized resource allocation by 15% within the fiscal year.

- •Collaborated with departments to streamline financial reporting processes, reducing close times by 5 days.

- •Implemented advanced analytic tools, resulting in improved data accuracy and reporting speed by 18%.

Corporate Finance Chartered Accountant resume sample

- •Conducted comprehensive financial due diligence on mergers and acquisitions, successfully supporting deals exceeding $500 million in value.

- •Developed detailed financial models to support strategic client initiatives, resulting in enhanced operational efficiency by 15%.

- •Prepared and analyzed quarterly and annual financial statements, improving the accuracy and reducing variance by 10%.

- •Collaborated with cross-functional teams to provide financial insights, directly contributing to a 12% increase in client revenue.

- •Monitored and optimized financial performance metrics, implementing process improvements that reduced costs by 8%.

- •Delivered in-depth presentations to senior management and stakeholders, securing buy-in for a new financial strategy initiative.

- •Advised corporate clients on financial strategies leading to a 20% increase in their market valuation over two fiscal years.

- •Led financial valuation assessments for corporate buyouts, successfully negotiating terms for transactions over $200 million.

- •Provided mentorship to junior accounting staff, fostering a knowledge-sharing environment that improved team performance by 30%.

- •Ensured GAAP and IFRS compliance across financial documents, reducing audit adjustments by 40%.

- •Delivered training workshops in financial and investment analysis, enhancing team capabilities in strategic financial planning.

- •Interpreted financial data and prepared reports for stakeholders, directly enhancing informed decision-making processes.

- •Managed budget forecasting processes, achieving a 98% accuracy rate in financial predictions.

- •Played an integral role in the development of a new ERP financial management system, resulting in better resource allocation.

- •Assessed and strengthened financial controls, reducing financial discrepancies by 25% through regular compliance checks.

- •Assisted in the preparation of complex financial statements, achieving a 15% faster report delivery timeline.

- •Participated in due diligence processes during acquisitions, ensuring accuracy and completeness across necessary documentation.

- •Collaborated with senior accountants to streamline financial processes, improving efficiency by 10%.

- •Conducted detailed market analysis that informed strategic investment decisions, subsequently increasing client returns.

Nonprofit Organization Chartered Accountant resume sample

- •Led financial statement preparation and budgeting with compliance to nonprofit accounting standards, boosting budget accuracy by 20%.

- •Streamlined the tax filing process, decreasing preparation time by 30%, thereby improving operational efficiency.

- •Conducted comprehensive audits leading to a 15% reduction in financial discrepancies.

- •Developed robust financial policies improving asset safeguarding and resource allocation, which resulted in 25% cost savings.

- •Successfully managed cash flow exceeding $10 million, ensuring adequate funding levels for core activities.

- •Executed key financial analysis, providing insights that increased program funding by 18%.

- •Managed the preparation of financial reports and budgets, improving departmental financial planning accuracy by 15%.

- •Reduced external audit fees by 10% through strong audit preparation and efficient liaison with auditors.

- •Enhanced grant reporting processes for major donors, resulting in a 10% increase in donor satisfaction.

- •Spearheaded the implementation of a new accounting software, leading to improved reporting speed by 25%.

- •Ensured regulatory compliance, reducing tax filing errors by 40% over three years.

- •Performed detailed financial analyses supporting strategic decision-making, contributing to a 10% revenue growth.

- •Implemented financial tracking systems improving accuracy in financial reporting by 20%.

- •Facilitated financial reviews leading to process improvements and cost savings of 15%.

- •Assisted in the preparation of financial audits resulting in regulatory compliance and enhanced external reputation.

- •Prepared financial statements that enhanced transparency and trust with stakeholders, leading to increased funding by 12%.

- •Developed and maintained accurate financial records, improving audit readiness and reducing discrepancies by 30%.

- •Collaborated with cross-functional teams to ensure alignment of financial practices, supporting operational efficiency.

- •Monitored cash flows effectively, ensuring project continuity and financial stability.

Management Consulting Chartered Accountant resume sample

- •Led a project to streamline financial operations resulting in a 20% cost saving across client divisions.

- •Designed and implemented strategic plans, aligning them with client objectives, enhancing operational efficiency by 30%.

- •Provided detailed financial analyses, identifying key areas for improvement, boosting client revenue streams by 15%.

- •Developed comprehensive financial reports for C-suite executives, improving decision-making processes and operational transparency.

- •Guided clients through complex regulatory compliance tasks, increasing adherence by 25% within partner organizations.

- •Mentored junior staff, fostering a learning environment, and facilitating their professional growth through structured training sessions.

- •Conducted financial modeling and forecasting that improved client cash flow optimization by 18%.

- •Collaborated with cross-functional teams to execute financing strategies, accelerating project delivery times by 25%.

- •Cultivated strong client relationships, achieving a 97% satisfaction rate, while boosting business repeat rates.

- •Formulated performance measurement tools guiding clients in exceeding industry benchmarks by 10%.

- •Spearheaded regulatory compliance projects, ensuring 100% client adherence to changes within fiscal policies.

- •Streamlined budgeting processes, enhancing accuracy and efficiency while reducing turnaround time by 40%.

- •Played a key role in a major client’s financial restructuring project, resulting in a 35% increase in profit margins.

- •Crafted detailed fiscal reports instrumental in client strategic decision-making, increasing forecast accuracy by 28%.

- •Analyzed market trends to provide actionable insights to clients, contributing to their sustained development initiatives.

- •Managed multiple concurrent financial projects, consistently meeting 100% of stringent deadlines.

- •Conducted comprehensive audits, leading to identifying cost-saving measures that reduced waste by 22%.

- •Provided strategic recommendations through insightful data analysis, aiding client decision-making processes significantly.

- •Acted as the primary liaison with clients, facilitating smooth communication and ensuring robust project engagement quality.

Risk Assessment Chartered Accountant resume sample

- •Led a major project to revamp risk management frameworks, boosting overall organizational compliance by 20% within a year.

- •Conducted 50+ risk assessments annually, identifying crucial operational risks and implementing mitigation strategies.

- •Collaborated with cross-departmental teams to enhance risk awareness, resulting in a 15% improvement in compliance scores.

- •Developed a comprehensive risk reporting system which increased risk visibility to senior management by 35%.

- •Facilitated training programs for over 100 employees, enhancing understanding of risk management principles.

- •Implemented real-time financial anomaly detection tools, decreasing potential risk occurrences by 25%.

- •Advised on risk management strategies resulting in a 10% increase in strategic risk mitigation effectiveness.

- •Played a central role in compliance audits, achieving a 98% compliance rate across financial operations.

- •Generated detailed risk assessment reports that were instrumental in shaping executive-level decision-making processes.

- •Engaged with internal stakeholders regularly to review and update risk management procedures, enhancing collaboration.

- •Introduced innovative financial modeling practices, improving overall risk detection accuracy by 18%.

- •Monitored financial activities, identifying trends and anomalies, reducing high-risk transactions by 20% over two years.

- •Developed risk mitigation strategies, significantly strengthening the organization’s adherence to financial regulations.

- •Coordinated company-wide risk awareness programs, fostering a proactive approach to risk management.

- •Contributed to the formulation of risk management policies and frameworks, enhancing compliance standards.

- •Worked on formulating high-impact risk mitigation strategies, cutting potential financial losses by 15%.

- •Participated actively in regulatory audits, improving regulatory compliance rates by 12%.

- •Assisted in developing a company-wide risk management framework that standardized risk assessment practices.

- •Conducted detailed risk assessments across multiple departments, ensuring comprehensive financial coverage.

Insolvency and Recovery Chartered Accountant resume sample

- •Managed a portfolio of 30+ corporate insolvency cases, enhancing recovery rates by 25% through strategic planning.

- •Developed recovery plans that ensured regulatory compliance, resulting in successful resolutions for distressed clients.

- •Conducted detailed financial analyses and reports, boosting creditor confidence and aiding in seamless negotiations.

- •Chaired creditor meetings to facilitate settlements, achieving a 95% consensus in complex cases.

- •Collaborated with stakeholders to refine financial management strategies, optimizing cash flow for struggling businesses.

- •Pioneered a new documentation process that improved case file accuracy, reducing discrepancies by 40%.

- •Oversaw personal insolvency cases, increasing recovery outcomes by 20% with innovative debt restructuring solutions.

- •Liaised closely with debtors and creditors, successfully negotiating settlements that exceeded initial projections.

- •Created comprehensive statements of affairs and forecasts, aiding clients in making informed financial decisions.

- •Provided expert advice on insolvency legislation and best practices, securing client trust and long-term relationships.

- •Introduced a proprietary financial analysis tool that enhanced accuracy in forecasting, resulting in improved client reporting.

- •Executed detailed evaluations of insolvency cases, improving recovery processes and shortening case durations by 15%.

- •Guided clients through restructuring options, improving financial health and reducing debt by 10%.

- •Produced high-quality financial reports that exceeded creditor standards, strengthening stakeholder relations.

- •Acted as a representative in insolvency proceedings, successfully defending client interests in all hearings.

- •Conducted robust financial analyses for diverse client portfolios, contributing to strategic decision-making processes.

- •Assisted in developing cash flow forecasts, aiding in enhanced financial planning for clients.

- •Supported senior management in preparing documentation for insolvency proceedings, ensuring high accuracy and compliance.

- •Leveraged Microsoft Office Suite to streamline report generation, reducing preparation time by 30%.

Mergers and Acquisitions Chartered Accountant resume sample

- •Led due diligence for over 10 successful M&A transactions in the tech sector, identifying potential financial risks and opportunities.

- •Collaborated with cross-functional teams to assess strategic fit of acquisitions and assisted in increasing portfolio value by 35%.

- •Developed comprehensive financial models and projections which enhanced decision-making speed, resulting in a 20% reduction of transaction time.

- •Reviewed negotiation terms for multiple deals, leading to favorable purchase price allocations and optimal funding structures.

- •Prepared detailed M&A documentation, including financial reports and presentations, influencing stakeholder decisions and capital allocation.

- •Streamlined post-merger integration processes, managing $50M in projected synergies with a 95% success alignment rate.

- •Advised on the valuation and financial strategy for 15+ high-profile acquisition targets within the manufacturing and consumer goods sector.

- •Executed financial analysis and scenario modeling that supported the closure of M&A deals worth $500M, enhancing profitability by 15%.

- •Built lasting relationships with key external advisors, ensuring a seamless transaction process and strengthening market presence.

- •Implemented industry best practices for financial compliance, reducing regulatory scrutiny occurrences by 40%.

- •Initiated post-transaction evaluations, contributing to a 10% increase in integration efficiency and synergy realization.

- •Conducted in-depth financial due diligence for potential acquisition targets, identifying risks that averted a potential $15M loss.

- •Supported financial audits and prepared vital reports that ensured accurate forecasting and budgeting during corporate mergers.

- •Part of a team that successfully executed a large-scale merger, resulting in an improved consolidated revenue by 25%.

- •Evaluated tax implications and structured the financial aspects of M&A transactions, enhancing tax efficiency by 30%.

- •Managed complex financial statements for multiple clients, proactively identifying ways to optimize their financial reporting and compliance.

- •Provided strategic insights for investment decisions, resulting in a 12% increase in client revenue over a fiscal year.

- •Expertly navigated tax considerations, contributing to a 20% reduction in tax liabilities for large-scale M&A undertakings.

- •Assessed market trends to provide clients forward-thinking financial advice, directly influencing a 30% growth in customer base.

Investment Banking Chartered Accountant resume sample

- •Led a team to prepare quarterly financial statements and forecasts, achieving a 30% increase in accuracy over two years.

- •Collaborated with cross-functional teams on a $500M acquisition project, increasing annual revenue by 10%.

- •Conducted in-depth financial analysis and valuations for mergers, leading to successful client buy-in and increased market share.

- •Streamlined the financial reporting process, resulting in a 20% reduction in time-to-report and improved compliance.

- •Developed pitch books and marketing materials contributing to winning multi-million dollar clients.

- •Provided strategic financial advice to senior clients, enhancing their capital structure, which resulted in improved financial health.

- •Reviewed and improved financial forecasts, increasing forecast accuracy by 25% over three years.

- •Facilitated due diligence in strategic transactions worth over $1B, enhancing client satisfaction and business continuity.

- •Implemented a new valuation modeling system, resulting in a streamlined process that increased productivity by 15%.

- •Engaged with a diverse range of clients, tailoring investment solutions that improved their agendas aligning with financial goals.

- •Led a cross-departmental audit which reduced accounting discrepancies by 40%, ensuring compliance with best practices.

- •Conducted financial analysis for corporate clients to determine optimal capital structures, improving investment opportunities.

- •Played a key role in the preparation of financial reports for an international IPO, increasing credibility by 15%.

- •Worked with auditors and tax advisors, resulting in improved audit ratings and reduced regulatory issues.

- •Supported client engagements by producing industry research that improved decision-making and strategic planning.

- •Analyzed market trends to inform investment decisions and enhance client portfolio performance, increasing returns by 20%.

- •Assisted in financial modeling and evaluation for a major M&A transaction worth $200M, leading to successful deals.

- •Managed financial data and reporting, improving accuracy and efficiency, reducing errors by 50%.

- •Liaised with external clients and stakeholders to maintain compliance and ensure seamless financial operations.

In today's competitive job market, crafting the ideal chartered accountant resume is like assembling a precise financial report. It's not just about numbers; you also need to present your skills and experiences effectively to capture attention. The challenge often lies in showcasing achievements without appearing boastful or missing key contributions.

Navigating this balance, your resume must translate financial expertise into a format that engages both recruiters and their systems. This first impression is crucial, and knowing how to start can make all the difference in standing out.

A well-structured resume template becomes your guiding light, ensuring each essential detail is covered in an appealing format. These templates are designed to streamline your information for recruiters and automated systems, saving you time and effort. You can explore various resume templates to find the one that suits your needs.

Through this guide, you'll discover how to merge all critical elements—your qualifications, accomplishments, and unique skills—into a cohesive and compelling narrative. Together, we'll make sure your resume not only gets noticed but also opens doors to exciting career opportunities.

Key Takeaways

- In today's competitive job market, an effective chartered accountant resume must balance showcasing achievements without appearing boastful while engaging recruiters and automated systems.

- Choosing the right resume format, such as reverse chronological, and maintaining a professional look with suitable fonts and consistent formatting is vital for standing out.

- A strong experience section should present achievements with quantifiable results, demonstrating tangible value and impact with action words and job-specific keywords.

- Highlighting both hard skills like financial analysis and compliance and soft skills like communication and teamwork is crucial for portraying comprehensive competence.

- Incorporating sections like certifications and optional extras such as language skills, hobbies, or volunteer work can provide a more rounded picture of your capabilities and personality.

What to focus on when writing your chartered accountant resume

Your chartered accountant resume should clearly tell the recruiter about your financial expertise while emphasizing your keen attention to detail. This means highlighting your skills with financial regulations and accounting software, which are crucial to a chartered accountant’s role.

How to structure your chartered accountant resume

- Contact Information — Start your resume with your full name, phone number, and a professional email, ensuring they are easy to locate. Adding your LinkedIn profile can offer insights into your career, providing a comprehensive view of your professional activities and achievements, which helps establish credibility right from the start. Tailoring your LinkedIn URL to your name is an extra touch of professionalism.

- Professional Summary — Use this section to highlight your main accounting skills and achievements. This brief, impactful snapshot of your career emphasizes your experience with financial analysis and your ability to adhere to accounting standards like GAAP or IFRS. Craft this section to quickly build trust and interest, encouraging the recruiter to read further.

- Work Experience — Detail your relevant job positions, emphasizing responsibilities and accomplishments with concrete examples. Demonstrating your impact using numbers, such as managing budgets or streamlining financial processes, can translate your skills into tangible added value for potential employers. This section serves as the backbone of your resume by showcasing your real-world application of skills.

- Education — Mention your degree in accounting or a related field, including significant coursework that underlines your expertise. Highlighting any advanced courses in finance or economics reinforces your educational foundation and signals commitment to ongoing learning, a valuable trait in the dynamic financial sector.

- Certifications — Clearly listing your CPA certification and any other relevant credentials like CMA or CISA assures recruiters of your professional qualifications and commitment to the field. Certifications not only validate your skills but also distinguish you from other candidates, demonstrating dedication and competence.

- Technical Skills — Highlight your proficiency with accounting software like QuickBooks, SAP, or Oracle, and include your familiarity with financial modeling and analysis tools. This section marks you as technically adept and ready to tackle complex accounting tasks, showing you have the practical skills needed in today’s tech-driven environment.

To dive deeper into how to craft each of these essential sections in a resume format that’s both engaging and effective, we will explore each area more thoroughly below.

Which resume format to choose

Selecting the right resume format is essential for a chartered accountant. The reverse chronological format is particularly effective because it showcases your career progression, making your most recent and relevant roles stand out—a vital factor in the finance sector, where experience is key. Highlighting these roles helps potential employers quickly see how your experience aligns with their needs.

Choosing the right fonts can elevate the professional appearance of your resume. Opt for fonts like Raleway, Lato, or Montserrat. These fonts offer a modern yet straightforward design, providing a clean and polished aesthetic that suits the meticulous nature of accounting work. While font choice might seem minor, a professional look sets a strong first impression.

When it comes to presentation, the file type is crucial. Save your resume as a PDF to ensure it retains its formatting across all devices and platforms. This consistency is necessary for maintaining a professional appearance, as any discrepancies in layout could distract from your qualifications.

Margins play a subtle but important role in readability. Setting one-inch margins on all sides creates a balanced layout that offers plenty of white space. This spacing makes your resume easier to read, guiding hiring managers smoothly through your skills and experiences, which is important when they’re reviewing multiple applications.

By focusing on these elements, you'll create a resume that effectively communicates your qualifications while maintaining a professional and polished look.

How to write a quantifiable resume experience section

A strong chartered accountant resume experience section is crucial for capturing employers' attention because it highlights your ability to add tangible value. You should present your achievements with clear, quantifiable results, showing how you've positively impacted organizations. Organize your experience in reverse chronological order, starting with your most recent role. Typically, you should go back about 10–15 years or include 3–5 positions if you've held shorter assignments. Selecting job titles that illustrate your growth and progression in accountancy helps convey your professional journey effectively.

Tailoring your resume by incorporating keywords from the job description is essential to stand out. It's important to use action words like "led," "managed," "analyzed," or "optimized" to demonstrate your impact. Each bullet point should reflect a specific, quantifiable accomplishment, such as saving costs, increasing efficiency, or improving processes.

- •Led a team of 10 accountants to decrease the financial audit time by 25%, enhancing reporting efficiency.

- •Managed client portfolios with an average growth of 15% year-over-year in investments.

- •Analyzed costing strategies that resulted in a 30% reduction in overhead expenses.

- •Optimized tax planning processes, saving clients a collective total of $500,000 annually.

This experience section effectively connects each element by focusing on achievements that directly relate to business goals. By illustrating your professional journey as a progression of impact and leadership, it paints a coherent picture of your career. The use of numbers in every point strengthens your case by providing concrete evidence of your skills. Tailoring each entry to match the desired job skills conveys to employers that you meet their needs. With its clear formatting, the section allows hiring managers to easily understand your contributions. By emphasizing your role in financial management, it assures employers of your potential to bring dedication and success to their team.

Achievement-Focused resume experience section

A chartered accountant's achievement-focused resume experience section should emphasize the impact you've had in your roles, making it clear how you've contributed to success. Instead of simply listing duties, focus on highlighting your accomplishments and the value you added. Share examples where you saved money, improved efficiency, or helped the company thrive, using action verbs to link these achievements to your proactive role. Make sure each bullet point tells a story of a specific achievement, ideally supported by quantifiable results.

To put this into practice, organize your experience in reverse chronological order, starting with your most recent role. Include the job title, company name, and dates for each position. Keep your bullet points concise, highlighting the evidence of your contributions and their impact. This approach will present you as a results-driven professional, distinguishing you from those who only list tasks and responsibilities.

Chartered Accountant

XYZ Accounting Firm

June 2018 - Present

- Led a team to complete over 50 financial audits, achieving a 20% improvement in efficiency.

- Identified cost-saving opportunities that reduced client expenses by $200,000 annually.

- Developed and implemented financial procedures, resulting in a 15% increase in department accuracy.

- Mentored junior staff, resulting in a 30% improvement in performance reviews.

Project-Focused resume experience section

A project-focused chartered accountant resume experience section should showcase how your skills and achievements have driven success in past projects. Begin by clearly stating the main focus, like "audit projects" or "financial analysis," and then describe how your actions contributed to the company’s accomplishments. Use concrete action verbs and numbers to highlight your impact, making each point meaningful and clear.

In the provided example, keep the details such as dates, job titles, and workplace information precise. Each bullet should flow naturally to the next, offering a snapshot of specific achievements or responsibilities. Detail your role, the steps you took, and the outcomes, demonstrating your expertise and adaptability in managing different projects. This approach emphasizes your ability to deliver exceptional financial services, illustrating your skill in handling varied challenges.

Senior Chartered Accountant

Smith & Co Financial Services

June 2020 - March 2023

- Led a five-member team in auditing a $500 million company, identifying $5 million in cost savings.

- Implemented a new financial reporting system, reducing processing time by 30% and enhancing accuracy.

- Conducted detailed analysis of client portfolios, resulting in a 15% increase in profitability.

- Assisted in the preparation of annual budgets and forecasts, contributing to a 10% growth in revenue.

Industry-Specific Focus resume experience section

A chartered accountant-focused resume experience section should emphasize your industry-specific successes and illustrate how you've added value in your previous positions. Start by highlighting the job experiences that best showcase your proficiency in financial analysis, budgeting, and compliance. This approach demonstrates how your contributions have led to tangible outcomes, such as saving money, enhancing processes, or improving the accuracy of forecasts, making your value to potential employers clear.

Connecting these ideas, each bullet point should start with an action verb, maintaining clarity and directness in your descriptions. This ensures that every point underscores a relevant achievement or duty that aligns with the role you're applying for. By incorporating numbers and percentages, you can clearly convey the impact of your work, weaving a cohesive narrative that draws the reader in. This storytelling approach helps to articulate the story of your career effectively. Here’s a structured example:

Senior Chartered Accountant

XYZ Corp

June 2020 - Present

- Conducted detailed financial analyses that led to a 15% reduction in company costs over two years.

- Developed a budgeting system which improved accuracy by 20% and streamlined financial reporting.

- Implemented a compliance program that ensured 100% regulatory adherence and avoided fines.

- Collaborated with cross-functional teams to enhance financial forecasting processes by 25%.

Innovation-Focused resume experience section

An innovation-focused chartered accountant resume experience section should effectively highlight your ability to drive transformative change in your roles. Begin each entry with your job title and include the employment dates to provide context. Enhancing understanding by briefly describing the workplace's size or industry can add valuable insight. Utilizing bullet points helps present your achievements clearly and concisely. Emphasize how your implementation of new strategies or technologies has improved efficiency or provided added value, demonstrating tangible results like cost reductions, increased accuracy, or time savings. It's important to focus on the significant impact your innovations have had on the company or clients.

To create a cohesive narrative, align your innovative accomplishments with the organization's objectives or vision. Discuss any challenges you faced and illuminate how you overcame them to succeed. Start each bullet point with active verbs such as "developed," "streamlined," or "transformed" to emphasize action and initiative. Include any collaborative efforts with a team, as teamwork is often pivotal to successful innovation. This approach not only highlights your technical expertise but also underscores key skills like communication and leadership.

Senior Chartered Accountant

ABC Financial Services

June 2018 - Present

- Pioneered a new accounting software that decreased data processing time by 30%.

- Led a team to integrate AI tools into financial reports, enhancing accuracy by 20%.

- Successfully implemented a cost-saving initiative that reduced annual expenses by $50,000.

- Transformed client onboarding workflow, cutting the setup time by half.

Write your chartered accountant resume summary section

A career-focused chartered accountant resume summary should effectively capture the hiring manager's attention, providing a quick yet impactful glimpse of your career. This summary is your chance to showcase the skills and experiences that make you a standout candidate. Think of it as a movie trailer that draws the reader into the full story of your resume, enticing them to want to know more. Highlight not just your years of experience, but also your areas of expertise and impressive achievements that demonstrate your contributions to previous employers.

To express your professional identity effectively, use clear and powerful language that highlights your unique strengths. Focus on specific achievements and include quantifiable results to convey your value to potential employers. Tailor your summary to each job application, targeting the skills and experiences that are most relevant to the role you're seeking.

Understanding the nuances between a resume summary and other sections like a resume objective, resume profile, and a summary of qualifications is crucial. A resume summary is ideal for seasoned professionals, offering a snapshot of your career achievements and expertise. Meanwhile, a resume objective often serves those with less experience, outlining the skills you want to develop and the value you aim to contribute. A resume profile combines elements of both, providing an overview of your career path and aspirations. On the other hand, a summary of qualifications highlights key skills and experiences, typically in bullet points. Knowing these distinctions ensures you choose the approach that aligns best with your career stage and the job you're pursuing.

Listing your chartered accountant skills on your resume

A skill-focused chartered accountant resume should thoughtfully highlight your key abilities. You can dedicate a separate section to skills or skillfully blend them into your experience and summary sections. A standalone skills section offers a quick glance at your strengths, while incorporating skills into your experiences adds depth and context.

Your strengths and soft skills, like effective communication and teamwork, are vital for demonstrating how well you collaborate with others. Hard skills, on the other hand, are concrete abilities such as financial analysis and tax preparation, which are indispensable in your role as a chartered accountant. These technical skills underscore your capability in performing essential tasks.

Incorporating your skills and strengths as keywords throughout your resume is crucial, as employers and digital screening tools rely on these keywords to evaluate your fit for the role—ensuring your resume meets job requirements.

An example of an effective skills section is straightforward and focused. Listing essential skills like financial analysis and auditing directly links to the core tasks you'll tackle as a chartered accountant. By focusing on relevant skills, you highlight your competence and readiness for the position.

Best hard skills to feature on your chartered accountant resume

Your hard skills are the backbone of your technical expertise. In a chartered accountant role, these skills confirm your proficiency and reliability in handling complex tasks.

Hard Skills

- Financial Analysis

- Tax Planning

- Auditing

- Regulatory Compliance

- Budgeting

- Spreadsheet Proficiency

- Risk Management

- Data Interpretation

- Financial Reporting

- Cost Accounting

- Software Proficiency (e.g., QuickBooks, SAP)

- Financial Forecasting

- Mergers and Acquisitions

- Investment Analysis

- Forensic Accounting

Best soft skills to feature on your chartered accountant resume

Soft skills illustrate your ability to effectively interact and collaborate. For chartered accountants, these skills ensure productive teamwork and adept problem-solving, crucial qualities for engaging with clients and colleagues.

Soft Skills

- Communication

- Teamwork

- Attention to Detail

- Problem Solving

- Time Management

- Adaptability

- Leadership

- Critical Thinking

- Negotiation

- Stress Management

- Ethical Judgment

- Multitasking

- Client Relations

- Decision Making

- Conflict Resolution

How to include your education on your resume

The education section of your chartered accountant resume is crucial. It shows your qualifications and can set you apart. Tailor this section to the job by including only relevant education. If a degree or course isn't related, leave it out. When listing your degree, be clear. State the degree type, the institution, and the date range. If your GPA is good, it's okay to include it, along with the scale (e.g., 3.8/4.0). If you graduated with honors, such as cum laude, add this detail to stand out.

Here’s an ineffective education section example:

And a strong example for a chartered accountant:

This second example is effective because it includes a relevant degree in accounting. The GPA and honors are mentioned, showcasing academic excellence. It provides a complete picture of qualifications related to the accounting field, making you a more appealing candidate.

How to include chartered accountant certificates on your resume

Including a certificates section in your chartered accountant resume is crucial. Ensure you list the name of each certification, include the date you received it, and add the issuing organization. You can also choose to display your certifications in the header for maximum visibility. For instance, "John Doe, CPA, ACCA" immediately informs employers of your qualifications.

An effective certificates section provides the employer with a quick snapshot of your professional qualifications and ongoing education. It shows your commitment to staying updated with industry standards. Let's take a look at a good example:

This example is effective because it highlights certifications that are directly relevant to the chartered accountant role. The titles are clearly stated, and the issuing organizations are well-known, which adds credibility. Such a section helps make your resume stand out to potential employers.

Extra sections to include in your chartered accountant resume

Are you aiming to make your resume stand out in the competitive field of chartered accountancy? Not only should your resume clearly outline your technical qualifications and experience, but including sections such as languages, hobbies, volunteer work, and books can also set you apart and reveal more about who you are as a person.

Language section—Highlight any additional languages you know to showcase your ability to communicate with a diverse client base. State your proficiency level to add credibility.

Hobbies and interests section—Mention hobbies to show your well-rounded personality and to make you more memorable. Choose interests that demonstrate positive traits such as teamwork or leadership.

Volunteer work section—Include volunteer work to illustrate your commitment to giving back and your ability to manage time effectively. Highlight roles where you've taken on responsibilities or leadership.

Books section—List relevant books you've read to show your commitment to continuous learning. This can demonstrate your proactive attitude toward staying current in your field.

In Conclusion

In conclusion, your chartered accountant resume serves as your personal brand ambassador in a competitive job market. It’s not merely a document of past jobs and education but a narrative that articulately showcases your financial expertise, achievements, and potential value to employers. By highlighting your skills with financial regulations and accounting software, you ensure that recruiters quickly grasp your competence. Structuring your resume effectively with well-designed templates elevates its readability and appeal, directing focus to your accomplishments and qualifications. Incorporating quantifiable achievements within the experience section reinforces your impact in previous roles and convinces employers of your capacity to replicate that success in their organization. Including a well-crafted professional summary offers a succinct glimpse into your career trajectory and strengths, sparking interest from potential employers. Moreover, taking care to present your credentials, like certifications, with clarity emphasizes your commitment to the field. Beyond the essentials, adding sections on languages, volunteer work, or hobbies provides a fuller picture of your character, reflecting interests and skills that may resonate with organizational needs. As you tailor each resume component to align with the job you're targeting, remember that even subtle details, like a consistent format and judicious font choice, work to leave a strong first impression. By strategically showcasing your experience and abilities, you position yourself as the ideal candidate, opening pathways to exciting career opportunities in the financial world.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.