Chief Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Make your chief accountant resume count: easy tips for highlighting your financial skills and leadership experience"

Rated by 348 people

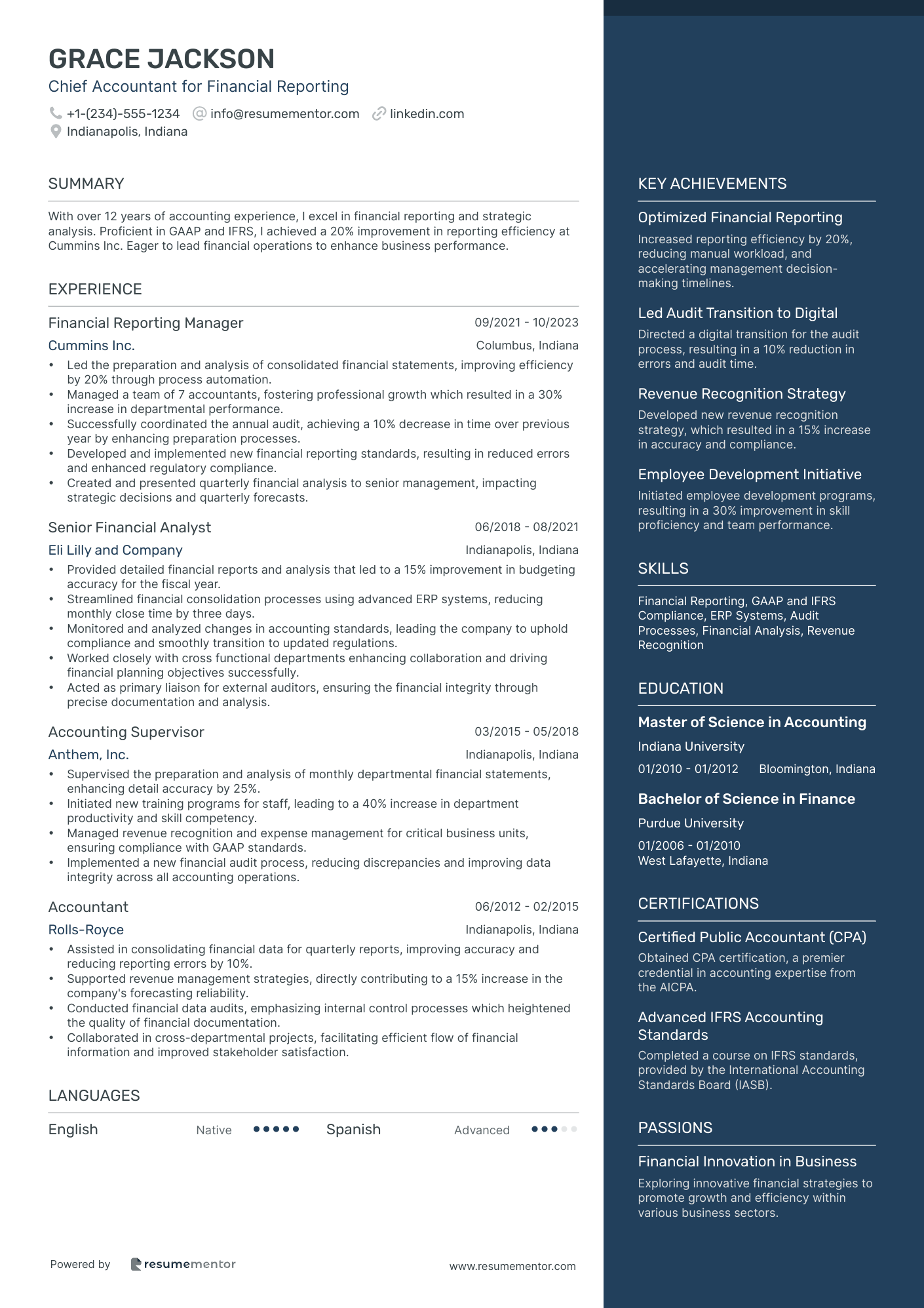

Chief Accountant for Financial Reporting

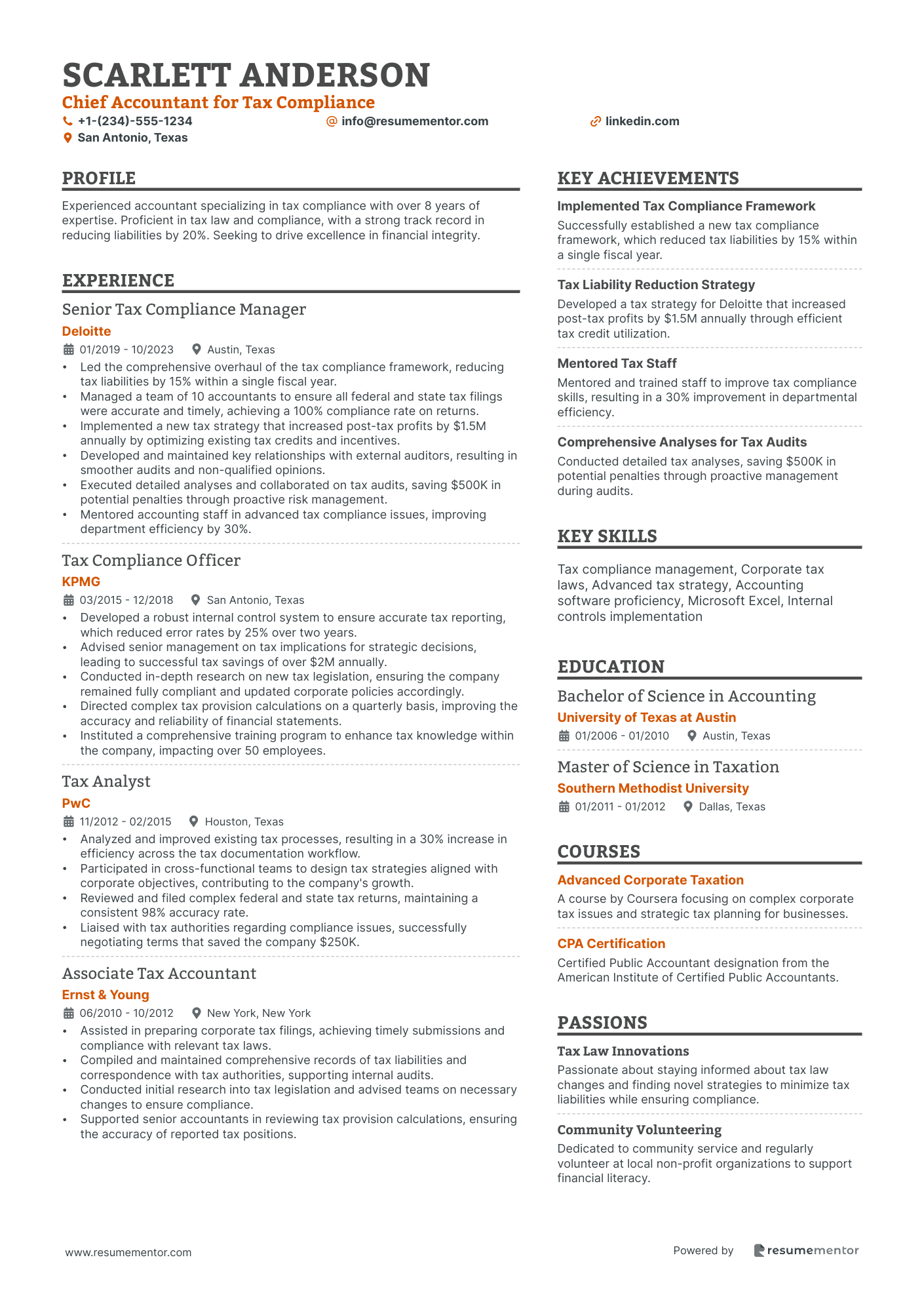

Chief Accountant for Tax Compliance

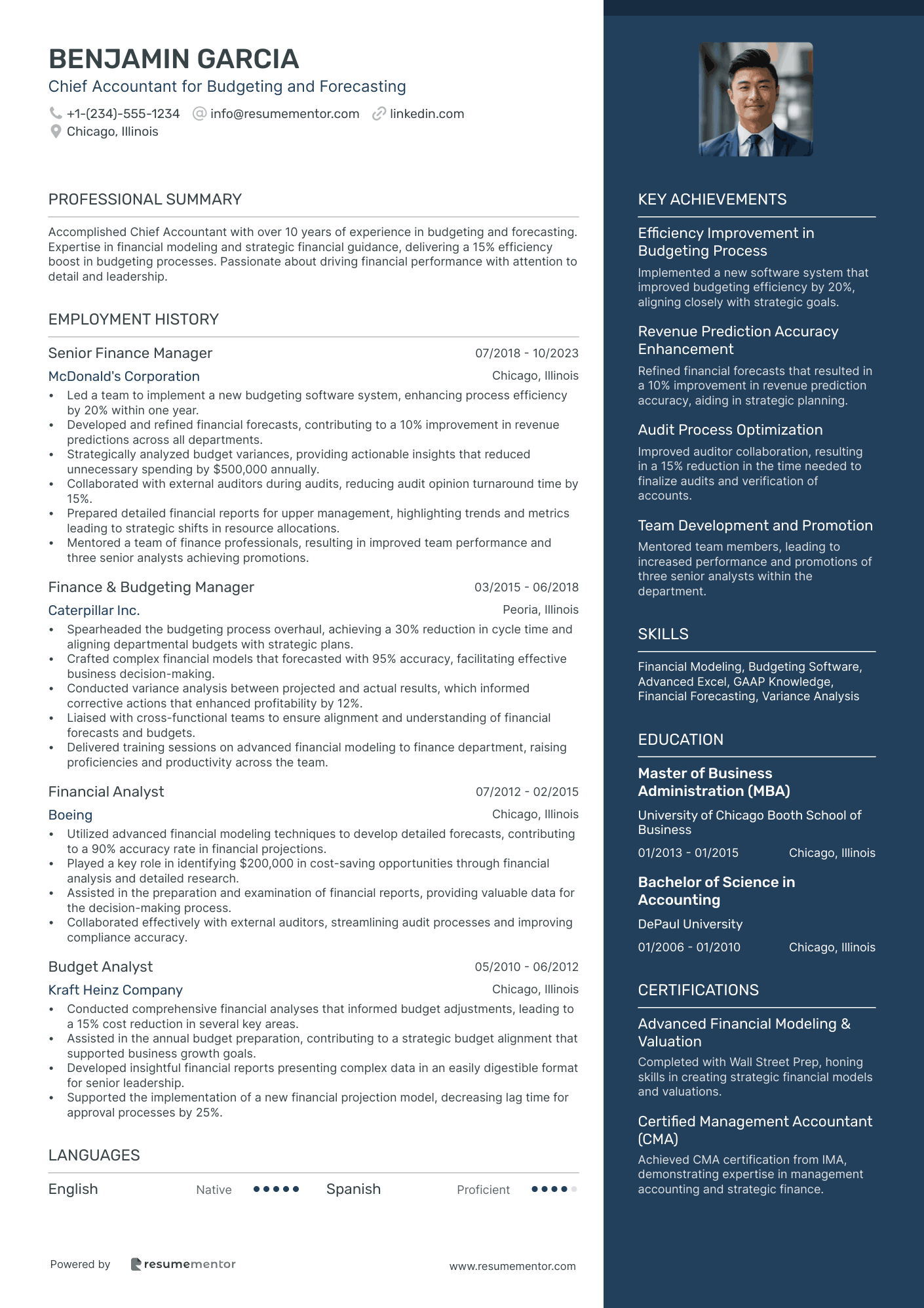

Chief Accountant for Budgeting and Forecasting

Chief Accountant for Cash Management

Chief Accountant for Payroll Administration

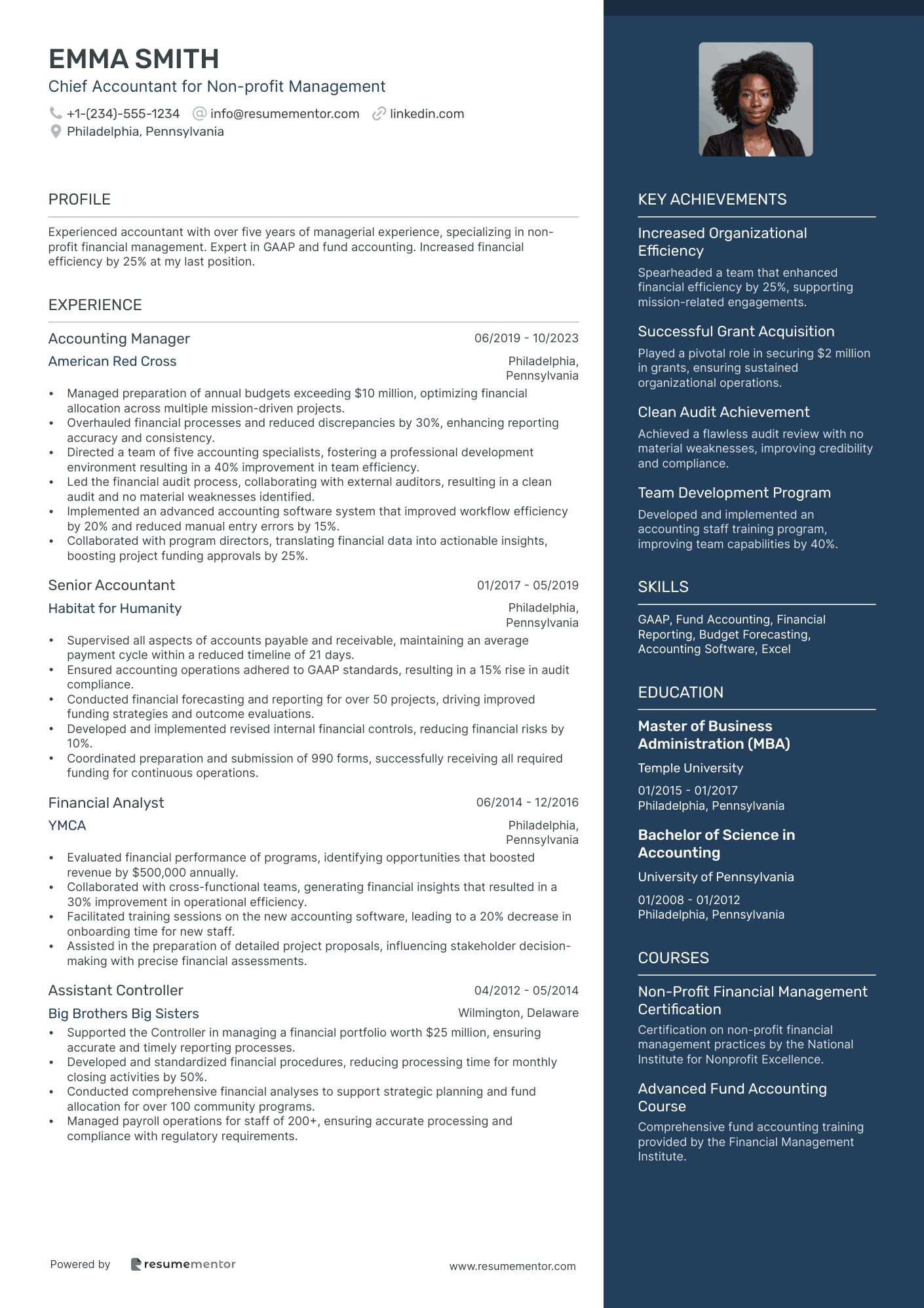

Chief Accountant for Non-profit Management

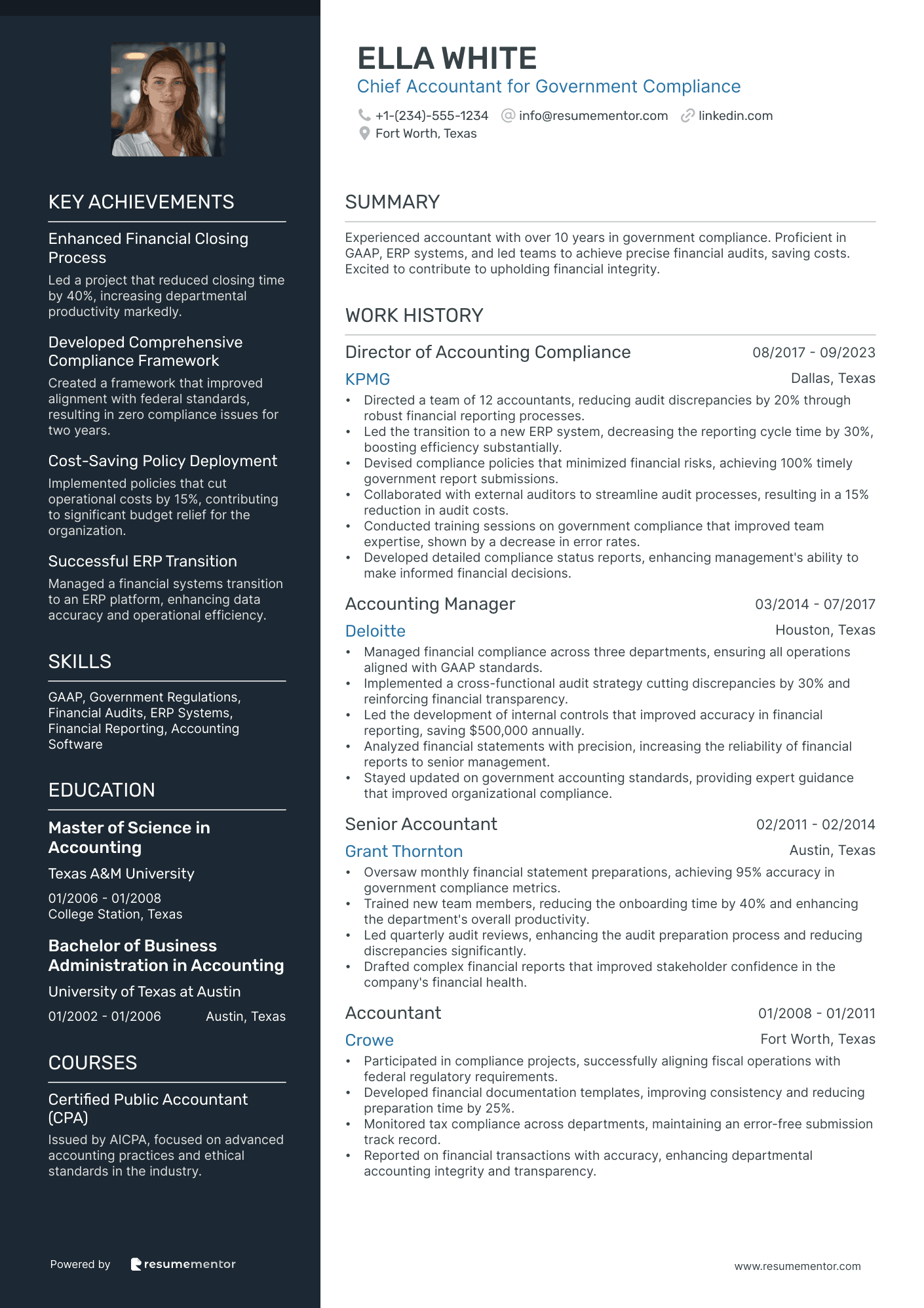

Chief Accountant for Government Compliance

Chief Accountant for Costing and Inventory

Chief Accountant for Capital Investments

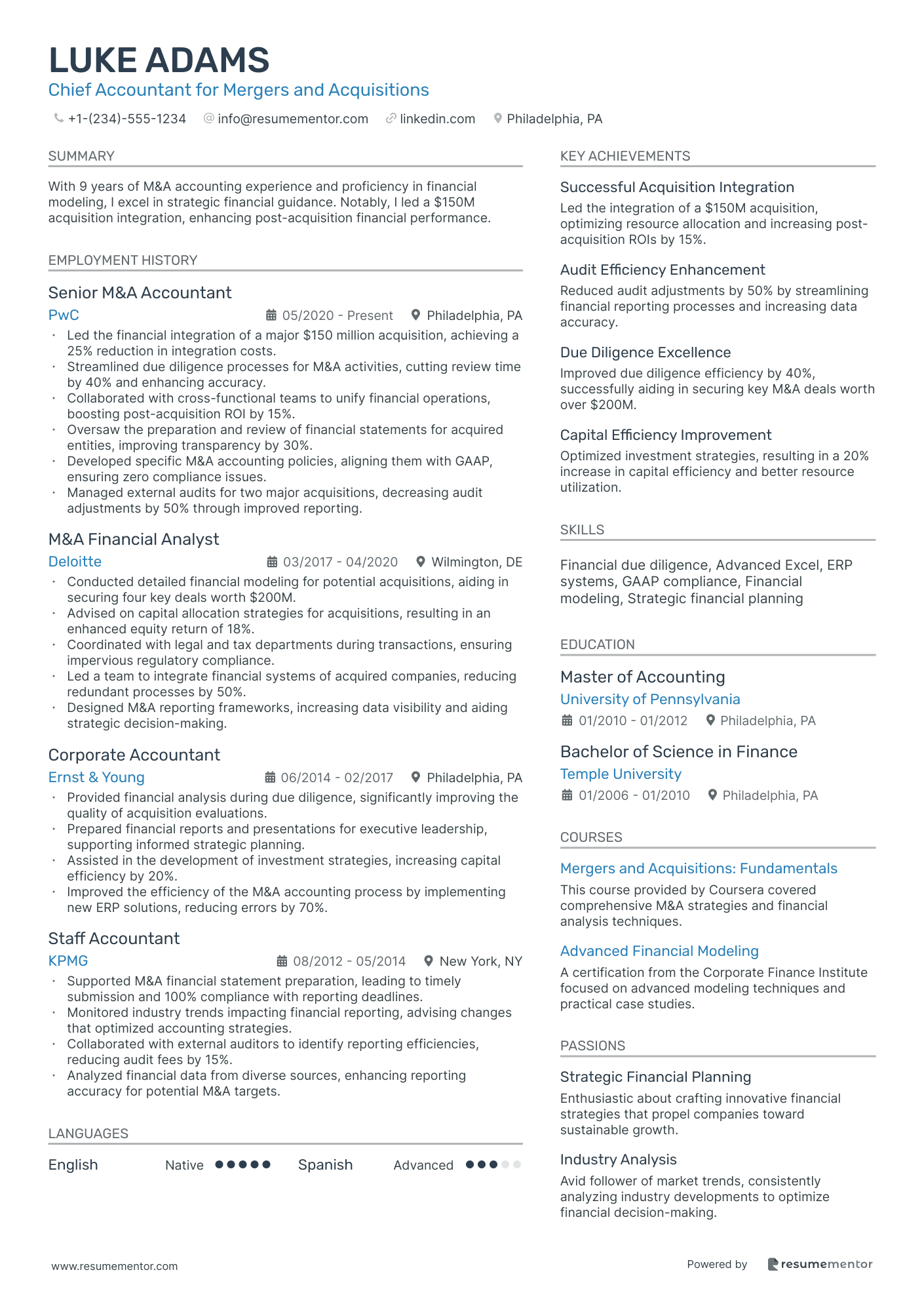

Chief Accountant for Mergers and Acquisitions

Chief Accountant for Financial Reporting resume sample

- •Led the preparation and analysis of consolidated financial statements, improving efficiency by 20% through process automation.

- •Managed a team of 7 accountants, fostering professional growth which resulted in a 30% increase in departmental performance.

- •Successfully coordinated the annual audit, achieving a 10% decrease in time over previous year by enhancing preparation processes.

- •Developed and implemented new financial reporting standards, resulting in reduced errors and enhanced regulatory compliance.

- •Created and presented quarterly financial analysis to senior management, impacting strategic decisions and quarterly forecasts.

- •Provided detailed financial reports and analysis that led to a 15% improvement in budgeting accuracy for the fiscal year.

- •Streamlined financial consolidation processes using advanced ERP systems, reducing monthly close time by three days.

- •Monitored and analyzed changes in accounting standards, leading the company to uphold compliance and smoothly transition to updated regulations.

- •Worked closely with cross functional departments enhancing collaboration and driving financial planning objectives successfully.

- •Acted as primary liaison for external auditors, ensuring the financial integrity through precise documentation and analysis.

- •Supervised the preparation and analysis of monthly departmental financial statements, enhancing detail accuracy by 25%.

- •Initiated new training programs for staff, leading to a 40% increase in department productivity and skill competency.

- •Managed revenue recognition and expense management for critical business units, ensuring compliance with GAAP standards.

- •Implemented a new financial audit process, reducing discrepancies and improving data integrity across all accounting operations.

- •Assisted in consolidating financial data for quarterly reports, improving accuracy and reducing reporting errors by 10%.

- •Supported revenue management strategies, directly contributing to a 15% increase in the company's forecasting reliability.

- •Conducted financial data audits, emphasizing internal control processes which heightened the quality of financial documentation.

- •Collaborated in cross-departmental projects, facilitating efficient flow of financial information and improved stakeholder satisfaction.

Chief Accountant for Tax Compliance resume sample

- •Led the comprehensive overhaul of the tax compliance framework, reducing tax liabilities by 15% within a single fiscal year.

- •Managed a team of 10 accountants to ensure all federal and state tax filings were accurate and timely, achieving a 100% compliance rate on returns.

- •Implemented a new tax strategy that increased post-tax profits by $1.5M annually by optimizing existing tax credits and incentives.

- •Developed and maintained key relationships with external auditors, resulting in smoother audits and non-qualified opinions.

- •Executed detailed analyses and collaborated on tax audits, saving $500K in potential penalties through proactive risk management.

- •Mentored accounting staff in advanced tax compliance issues, improving department efficiency by 30%.

- •Developed a robust internal control system to ensure accurate tax reporting, which reduced error rates by 25% over two years.

- •Advised senior management on tax implications for strategic decisions, leading to successful tax savings of over $2M annually.

- •Conducted in-depth research on new tax legislation, ensuring the company remained fully compliant and updated corporate policies accordingly.

- •Directed complex tax provision calculations on a quarterly basis, improving the accuracy and reliability of financial statements.

- •Instituted a comprehensive training program to enhance tax knowledge within the company, impacting over 50 employees.

- •Analyzed and improved existing tax processes, resulting in a 30% increase in efficiency across the tax documentation workflow.

- •Participated in cross-functional teams to design tax strategies aligned with corporate objectives, contributing to the company's growth.

- •Reviewed and filed complex federal and state tax returns, maintaining a consistent 98% accuracy rate.

- •Liaised with tax authorities regarding compliance issues, successfully negotiating terms that saved the company $250K.

- •Assisted in preparing corporate tax filings, achieving timely submissions and compliance with relevant tax laws.

- •Compiled and maintained comprehensive records of tax liabilities and correspondence with tax authorities, supporting internal audits.

- •Conducted initial research into tax legislation and advised teams on necessary changes to ensure compliance.

- •Supported senior accountants in reviewing tax provision calculations, ensuring the accuracy of reported tax positions.

Chief Accountant for Budgeting and Forecasting resume sample

- •Led a team to implement a new budgeting software system, enhancing process efficiency by 20% within one year.

- •Developed and refined financial forecasts, contributing to a 10% improvement in revenue predictions across all departments.

- •Strategically analyzed budget variances, providing actionable insights that reduced unnecessary spending by $500,000 annually.

- •Collaborated with external auditors during audits, reducing audit opinion turnaround time by 15%.

- •Prepared detailed financial reports for upper management, highlighting trends and metrics leading to strategic shifts in resource allocations.

- •Mentored a team of finance professionals, resulting in improved team performance and three senior analysts achieving promotions.

- •Spearheaded the budgeting process overhaul, achieving a 30% reduction in cycle time and aligning departmental budgets with strategic plans.

- •Crafted complex financial models that forecasted with 95% accuracy, facilitating effective business decision-making.

- •Conducted variance analysis between projected and actual results, which informed corrective actions that enhanced profitability by 12%.

- •Liaised with cross-functional teams to ensure alignment and understanding of financial forecasts and budgets.

- •Delivered training sessions on advanced financial modeling to finance department, raising proficiencies and productivity across the team.

- •Utilized advanced financial modeling techniques to develop detailed forecasts, contributing to a 90% accuracy rate in financial projections.

- •Played a key role in identifying $200,000 in cost-saving opportunities through financial analysis and detailed research.

- •Assisted in the preparation and examination of financial reports, providing valuable data for the decision-making process.

- •Collaborated effectively with external auditors, streamlining audit processes and improving compliance accuracy.

- •Conducted comprehensive financial analyses that informed budget adjustments, leading to a 15% cost reduction in several key areas.

- •Assisted in the annual budget preparation, contributing to a strategic budget alignment that supported business growth goals.

- •Developed insightful financial reports presenting complex data in an easily digestible format for senior leadership.

- •Supported the implementation of a new financial projection model, decreasing lag time for approval processes by 25%.

Chief Accountant for Cash Management resume sample

- •Directed cash flow forecasting, improving accuracy by 30% and ensuring optimal liquidity management.

- •Implemented cash management software, reducing processing times by 20% and enhancing efficiency.

- •Negotiated banking fees, saving the company $200,000 annually through strategic partnerships.

- •Prepared comprehensive cash flow reports, supporting senior management in pivotal financial decisions.

- •Led risk management initiatives, mitigating cash exposure and aligning with regulatory standards.

- •Coordinated internal teams, fostering efficient communication and streamlined financial operations.

- •Oversaw daily cash management operations, reinforcing the integrity of financial transactions.

- •Enhanced cash flow models, driving a 15% increase in forecasting accuracy and financial planning.

- •Mentored and developed accounting teams, resulting in a 40% improvement in staff performance.

- •Collaborated with Treasury and Accounts Payable, cutting processing times by 25%.

- •Presented cash management reports to senior leadership, facilitating informed strategic decisions.

- •Managed bank account reconciliations, achieving a 98% accuracy rate in cash transaction recordings.

- •Developed cash management policies, optimizing liquidity and control over cash exposure.

- •Analyzed cash flow and banking fees, leading to a 10% cost reduction.

- •Supported budget preparation, focusing on cash flow needs and resource allocation.

- •Assisted in the analysis of financial data, supporting decision-making processes for senior management.

- •Conducted detailed market analyses, identifying potential cost savings opportunities.

- •Collaborated with various teams to streamline financial operations and reporting.

- •Optimized use of ERP systems, improving data accuracy and reporting efficiency.

Chief Accountant for Payroll Administration resume sample

- •Led a team of 12 to ensure timely and accurate processing of payroll for over 5,000 employees, significantly reducing errors by 20%.

- •Developed and implemented streamlined payroll processes that resulted in a 15% reduction in processing time.

- •Collaborated with HR and IT departments to integrate advanced ERP solutions, enhancing data accuracy and reporting capabilities.

- •Delivered comprehensive financial reporting and analysis, supporting budgeting and forecasting efforts across departments.

- •Ensured compliance with federal and state payroll regulations, resulting in zero compliance violations in 3 years.

- •Implemented training programs for payroll staff, increasing team efficiency and knowledge of updated systems.

- •Supervised payroll operations for a team of 7, ensuring accuracy and delivering payroll for 3,000 professionals.

- •Resolved complex payroll discrepancies and reconciliations effectively, improving resolution time by 30%.

- •Prepared and reviewed payroll reports, achieving a 98% accuracy rate consistently.

- •Collaborated with external auditors, providing accurate documentation and reports for successful audits.

- •Facilitated communication between payroll and department heads to maintain consistent data accuracy and streamline reporting.

- •Managed payroll data entry and reconciliations, reducing data errors by 25% through meticulous attention to detail.

- •Worked closely with HR to ensure smooth processing of employee records, enhancing data harmony and reliability.

- •Assisted in the development of payroll systems enhancements, resulting in improved processing speed and accuracy.

- •Prepared monthly payroll summaries and financial reports, ensuring alignment with corporate financial targets.

- •Supported payroll processing for a major financial institution, maintaining an error rate of less than 2%.

- •Compiled and analyzed financial data to provide insights for process improvement and cost savings.

- •Assisted in the preparation of annual payroll budgets, contributing to cost-effective financial planning.

- •Facilitated training sessions for new accounting staff, enhancing team capabilities and payroll accuracy.

Chief Accountant for Non-profit Management resume sample

- •Managed preparation of annual budgets exceeding $10 million, optimizing financial allocation across multiple mission-driven projects.

- •Overhauled financial processes and reduced discrepancies by 30%, enhancing reporting accuracy and consistency.

- •Directed a team of five accounting specialists, fostering a professional development environment resulting in a 40% improvement in team efficiency.

- •Led the financial audit process, collaborating with external auditors, resulting in a clean audit and no material weaknesses identified.

- •Implemented an advanced accounting software system that improved workflow efficiency by 20% and reduced manual entry errors by 15%.

- •Collaborated with program directors, translating financial data into actionable insights, boosting project funding approvals by 25%.

- •Supervised all aspects of accounts payable and receivable, maintaining an average payment cycle within a reduced timeline of 21 days.

- •Ensured accounting operations adhered to GAAP standards, resulting in a 15% rise in audit compliance.

- •Conducted financial forecasting and reporting for over 50 projects, driving improved funding strategies and outcome evaluations.

- •Developed and implemented revised internal financial controls, reducing financial risks by 10%.

- •Coordinated preparation and submission of 990 forms, successfully receiving all required funding for continuous operations.

- •Evaluated financial performance of programs, identifying opportunities that boosted revenue by $500,000 annually.

- •Collaborated with cross-functional teams, generating financial insights that resulted in a 30% improvement in operational efficiency.

- •Facilitated training sessions on the new accounting software, leading to a 20% decrease in onboarding time for new staff.

- •Assisted in the preparation of detailed project proposals, influencing stakeholder decision-making with precise financial assessments.

- •Supported the Controller in managing a financial portfolio worth $25 million, ensuring accurate and timely reporting processes.

- •Developed and standardized financial procedures, reducing processing time for monthly closing activities by 50%.

- •Conducted comprehensive financial analyses to support strategic planning and fund allocation for over 100 community programs.

- •Managed payroll operations for staff of 200+, ensuring accurate processing and compliance with regulatory requirements.

Chief Accountant for Government Compliance resume sample

- •Directed a team of 12 accountants, reducing audit discrepancies by 20% through robust financial reporting processes.

- •Led the transition to a new ERP system, decreasing the reporting cycle time by 30%, boosting efficiency substantially.

- •Devised compliance policies that minimized financial risks, achieving 100% timely government report submissions.

- •Collaborated with external auditors to streamline audit processes, resulting in a 15% reduction in audit costs.

- •Conducted training sessions on government compliance that improved team expertise, shown by a decrease in error rates.

- •Developed detailed compliance status reports, enhancing management's ability to make informed financial decisions.

- •Managed financial compliance across three departments, ensuring all operations aligned with GAAP standards.

- •Implemented a cross-functional audit strategy cutting discrepancies by 30% and reinforcing financial transparency.

- •Led the development of internal controls that improved accuracy in financial reporting, saving $500,000 annually.

- •Analyzed financial statements with precision, increasing the reliability of financial reports to senior management.

- •Stayed updated on government accounting standards, providing expert guidance that improved organizational compliance.

- •Oversaw monthly financial statement preparations, achieving 95% accuracy in government compliance metrics.

- •Trained new team members, reducing the onboarding time by 40% and enhancing the department's overall productivity.

- •Led quarterly audit reviews, enhancing the audit preparation process and reducing discrepancies significantly.

- •Drafted complex financial reports that improved stakeholder confidence in the company's financial health.

- •Participated in compliance projects, successfully aligning fiscal operations with federal regulatory requirements.

- •Developed financial documentation templates, improving consistency and reducing preparation time by 25%.

- •Monitored tax compliance across departments, maintaining an error-free submission track record.

- •Reported on financial transactions with accuracy, enhancing departmental accounting integrity and transparency.

Chief Accountant for Costing and Inventory resume sample

- •Led month-end closing for inventory and costing, improving reporting accuracy by 15% through detailed analysis and verification.

- •Collaborated with supply chain to streamline inventory processes, reducing excess stock by 20% and leading to cost savings.

- •Developed advanced costing models, improving pricing strategy alignment and increasing profitability by 10% for multiple product lines.

- •Presented comprehensive financial reports to senior management, identifying trends that resulted in 5% growth in key business areas.

- •Implemented stringent internal controls, reducing financial discrepancies by 30% and improving compliance with regulatory standards.

- •Oversaw the development of a new costing system, reducing unnecessary expenses by 15% and enhancing financial projections.

- •Conducted thorough inventory valuations, ensuring compliance with all relevant accounting standards and company regulations.

- •Enhanced collaboration with operations teams, resulting in optimized inventory levels and improved cash flow by $1 million.

- •Analyzed variances between actual and budgeted costs, successfully identifying opportunities for cost reduction, resulting in savings.

- •Provided mentorship to junior accounting staff, improving team efficiency and accuracy in financial reporting and analysis.

- •Conducted cost analysis projects that led to a 10% reduction in operational costs through improved costing models.

- •Collaborated with finance team to develop detailed financial models, enhancing accuracy of forecasts and financial health assessments.

- •Implemented ERP solutions, resulting in improved inventory management and $500,000 reduction in carrying costs.

- •Regularly reviewed compliance with internal controls policies, reducing risk of financial inaccuracies by 25%.

- •Managed daily inventory accounting activities, maintaining a 98% accuracy rate in financial records and reports.

- •Participated in cross-functional projects improving inventory processes, saving $200,000 annually through efficiency gains.

- •Assisted in the development of inventory policies, enhancing compliance and achieving a 30% reduction in audit discrepancies.

- •Monitored and reported on inventory variances, providing actionable insights that improved stock accuracy and reduced write-offs.

Chief Accountant for Capital Investments resume sample

- •Oversaw a $500 million investment portfolio, increasing returns by 15% over two years through strategic capital reallocation.

- •Directed month-end financial reporting to align with GAAP, improving reporting accuracy by 20%.

- •Led a team of four in developing progressive investment accounting policies, improving process efficiency by 25%.

- •Orchestrated annual audits with external partners, reducing audit adjustments by 60% over three years.

- •Developed and presented key metric dashboards, enabling essential insights for stakeholders, leading to strategic decisions that enhanced profitability.

- •Played a pivotal role in system integration projects resulting in a seamless transition to a new ERP system.

- •Managed a $350 million investment portfolio with a 98% compliance rating in regulatory audits over three years.

- •Pioneered new budgeting techniques, decreasing operational costs by 18% while maximizing investment income.

- •Performed detailed analyses of capital gains for quarterly reviews, enhancing the decision-making process for investment managers.

- •Facilitated cross-departmental collaborations, resulting in a 30% decrease in data discrepancies.

- •Trained and mentored three junior accountants leading to a 40% improvement in team productivity.

- •Coordinated detailed capital investment financial reports, maintaining a 96% accuracy rate in all assessments.

- •Implemented innovative financial data management systems, enhancing reporting efficiency by 33%.

- •Led a fiscal project review that streamlined capital investment strategies, increasing client satisfaction scores by 25%.

- •Provided crucial financial guidance which accelerated the annual capital investment return rate by an average of 12%.

- •Assessed investment data resulting in a 10% improvement in the accuracy of financial forecasts.

- •Collaborated with senior accountants to develop new investment tracking systems reducing errors by 35%.

- •Developed detailed fiscal reports to support stakeholder engagement, contributing to strategic investment planning.

- •Utilized ERP systems to streamline financial processes, optimizing productivity and ensuring compliance with GAAP.

Chief Accountant for Mergers and Acquisitions resume sample

- •Led the financial integration of a major $150 million acquisition, achieving a 25% reduction in integration costs.

- •Streamlined due diligence processes for M&A activities, cutting review time by 40% and enhancing accuracy.

- •Collaborated with cross-functional teams to unify financial operations, boosting post-acquisition ROI by 15%.

- •Oversaw the preparation and review of financial statements for acquired entities, improving transparency by 30%.

- •Developed specific M&A accounting policies, aligning them with GAAP, ensuring zero compliance issues.

- •Managed external audits for two major acquisitions, decreasing audit adjustments by 50% through improved reporting.

- •Conducted detailed financial modeling for potential acquisitions, aiding in securing four key deals worth $200M.

- •Advised on capital allocation strategies for acquisitions, resulting in an enhanced equity return of 18%.

- •Coordinated with legal and tax departments during transactions, ensuring impervious regulatory compliance.

- •Led a team to integrate financial systems of acquired companies, reducing redundant processes by 50%.

- •Designed M&A reporting frameworks, increasing data visibility and aiding strategic decision-making.

- •Provided financial analysis during due diligence, significantly improving the quality of acquisition evaluations.

- •Prepared financial reports and presentations for executive leadership, supporting informed strategic planning.

- •Assisted in the development of investment strategies, increasing capital efficiency by 20%.

- •Improved the efficiency of the M&A accounting process by implementing new ERP solutions, reducing errors by 70%.

- •Supported M&A financial statement preparation, leading to timely submission and 100% compliance with reporting deadlines.

- •Monitored industry trends impacting financial reporting, advising changes that optimized accounting strategies.

- •Collaborated with external auditors to identify reporting efficiencies, reducing audit fees by 15%.

- •Analyzed financial data from diverse sources, enhancing reporting accuracy for potential M&A targets.

Creating a standout chief accountant resume is like building a robust financial foundation for a company. Your financial expertise is invaluable, but turning it into a compelling document can feel like balancing a complex budget sheet. The challenge is to present your achievements clearly, making every detail matter without overwhelming the reader.

In a competitive job market, capturing a recruiter's attention with a well-structured resume is essential. It must quickly showcase your abilities as a seasoned chief accountant, where skills like managing financial records and overseeing audits are vital. Effectively highlighting your strategic and financial expertise can be the key to securing an interview.

This is where a resume template comes in handy, providing a clear framework to organize your experiences. By using a professional resume template, you can ensure that your strengths in accounting are presented in a structured and professional manner.

In doing so, you maintain consistency and professionalism, allowing you to focus on crafting the content. The goal is to communicate your value effectively, and a well-formatted resume can help achieve that. It’s not merely about listing your duties; it’s about aligning your achievements with the needs of the employer. This guide will help transform your accounting skills into a resume that speaks with clarity and precision, making your professional journey compelling and coherent.

Key Takeaways

- Crafting a standout chief accountant resume requires effectively highlighting your financial expertise and leadership skills to capture recruiters' attention in a competitive job market.

- Using a professional resume template ensures your strengths are presented in a structured manner, allowing you to communicate your value with clarity and precision.

- A functional resume format that focuses on skills and achievements can set you apart by effectively demonstrating your impact in the accounting field.

- Quantifiable and tailored experience sections featuring strong action verbs are essential for demonstrating leadership and results that align with job requirements.

- Including additional sections such as certifications, language skills, and volunteer work can further enhance your resume by showcasing a well-rounded professional profile.

What to focus on when writing your chief accountant resume

A chief accountant resume should effectively convey your financial expertise and leadership skills, offering a comprehensive view to the recruiter. This includes not only your experience in managing financial operations but also your ability to refine and enhance financial processes within a company. Recruiters seek candidates who demonstrate strategic thinking and have a proven capability to lead finance teams with impact.

How to structure your chief accountant resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile to create a professional connection. Including a LinkedIn profile provides recruiters with a broader view of your professional network and recent achievements, which helps establish trust. Make sure this section is clear and easy to find at the top of your resume as it sets the foundation for the first impression—below, we'll continue by highlighting how an impactful professional summary can shape your narrative.

- Professional Summary: Then, provide a snapshot of your accounting experience along with your skills in financial analysis and leadership success in guiding accounting teams. This section is your elevator pitch—craft it to reflect your track record of financial management success and highlight your strategic approach to problem-solving and team leadership. It's important to blend your career goals with your accomplishments to engage the recruiter immediately—after setting the stage here, we delve into detailing your work experience.

- Work Experience: Follow with a detailed list of relevant roles where you highlight achievements in budgeting, audits, and financial reporting, painting a picture of your capabilities. Use quantifiable results to demonstrate your impact, such as percentage increases in financial efficiency or cost reductions you spearheaded. This section should provide context for your leadership and decision-making skills within the accounting frameworks you've worked in—next, we'll see how your education supports all this expertise.

- Education: Your educational background, including degrees related to accounting or finance and certifications like CPA or CMA, should be clearly outlined to establish your qualified expertise. Certifications signal your commitment to ongoing professional development and can be crucial differentiators in the eyes of recruiters. Pairing this with your work experience showcases a solid foundation in both practical and theoretical knowledge—following this, we'll explore how key skills further enhance your profile.

- Skills: Showcase critical skills such as financial forecasting, tax compliance, and proficiency with accounting software like QuickBooks or SAP to underscore your technical know-how. Employ action verbs and specific terminology relevant to the accounting field to demonstrate your proficiency and breadth of experience. Skills should be tailored to align with the job description you're applying for, giving recruiters confidence in your ability to meet their needs—up next, we discuss how leadership and management roles can complement these skills.

- Leadership and Management: Finally, discuss your experience in leading teams and improving accounting processes, showcasing your ability to mentor and guide others effectively. Highlight instances where your leadership led to improved team performance or process innovations, demonstrating your value beyond technical acumen. These stories make your resume stand out and resonate with recruiters seeking leadership potential—this transitions into understanding optional sections that capture additional dimensions of your professional journey.

Which resume format to choose

As a chief accountant, crafting a resume that blends professionalism with a modern edge is crucial. A functional format is a strategic choice, focusing on your skills and achievements, which are vital for demonstrating your expertise and impact in the accounting field. This format allows you to organize your resume in a way that highlights your unique qualifications, setting you apart in a competitive job market.

Selecting the right font plays a significant role in the readability and overall aesthetic of your resume. Opt for Rubik, Lato, or Montserrat, as they offer a fresh and contemporary look. These fonts help maintain a professional appearance while ensuring your resume doesn't blend in with more traditional ones. The key is to choose a font that complements your content and makes your document accessible to readers.

Ensuring the file type is consistent across devices is important for maintaining the integrity of your resume’s design. Saving your document as a PDF guarantees that your carefully crafted layout remains intact, providing a polished presentation to potential employers. It’s a small step that yields a big payoff, as it reflects attention to detail.

Margin settings might seem minor, but they contribute significantly to your resume’s overall appearance and readability. A one-inch margin all around keeps your content organized and ensures there’s enough white space, which makes it easier for recruiters to scan through your accomplishments and skills quickly.

Integrating these components into your resume helps showcase your qualifications effectively while creating a memorable impression with a design that's both modern and highly professional. This approach aligns perfectly with the goal of writing a standout chief accountant resume.

How to write a quantifiable resume experience section

A chief accountant resume experience section is essential for capturing interest. You want to highlight achievements that are quantifiable and align with the job you're pursuing. Start your experience with the most recent role and work backward, focusing on the last 10-15 years to spotlight impactful positions. Tailor your resume by incorporating keywords from the job ad, directly showing you're the right fit. Use strong action words like "managed," "optimized," and "led" to effectively convey leadership and results.

Here's how you can apply this to your chief accountant experience:

- •Led a team of 10 accountants, improving reporting accuracy by 30% through process optimization.

- •Implemented new accounting software, reducing month-end closing time by 40%.

- •Managed a $15M budget and achieved 10% cost savings through strategic planning.

- •Developed internal controls that decreased audit findings by 50% year-over-year.

This experience section is cohesive and highlights significant achievements, such as improved processes and cost savings. Each bullet point seamlessly connects to the next by demonstrating the progression of skills and results. By aligning these accomplishments with job requirements using relevant keywords, you ensure your experience section is both compelling and directly tied to the role you want, enhancing your suitability for the job.

Customer-Focused resume experience section

A customer-focused chief accountant resume experience section should spotlight your ability to enhance client satisfaction and build strong financial partnerships. Emphasize how you've boosted client satisfaction by solving financial problems and improving processes that directly affect customers. Highlight specific, measurable results like reducing error rates or increasing customer retention. The language should remain concise and professional, utilizing strong action verbs to make your points clear and compelling.

Include detailed examples that showcase your direct interactions with customers, such as leading financial consultations or developing tailored financial plans. Each bullet point should reflect your dedication to understanding and meeting client needs. Demonstrate your proactive approach to exceeding expectations within a financial setting. These specifics will assure future employers of your commitment to excellence and your skill in cultivating trust and loyalty in client relationships.

Chief Accountant

XYZ Financial Services

Jan 2015 - Jun 2020

- Improved customer retention rate by 25% through personalized financial analysis services.

- Led meetings with clients to identify financial goals, resulting in a 30% increase in revenue from customized plans.

- Developed a new reporting tool that reduced client inquiries about financial status by 40%.

- Successfully resolved a 15% drop in client satisfaction by implementing a feedback-driven improvement program.

Innovation-Focused resume experience section

An innovation-focused chief accountant resume experience section should showcase your ability to drive change and improve processes seamlessly. Highlighting your role in leading transformation initiatives demonstrates how you have streamlined operations, reduced costs, and improved reporting accuracy. Make sure to include the tools or technologies you implemented, and back up your claims with specific metrics or examples that illustrate the impact of your efforts. This approach will clearly show how your innovative solutions have positively influenced the organizations you've been with.

To make your experience section truly stand out, use clear and straightforward language to effectively communicate your accomplishments. Begin by stating your role and the organization, then transition smoothly into how you introduced new ideas and improvements. Avoid relying on buzzwords; instead, opt for a direct approach that conveys your value to potential employers. Utilize bullet points to neatly list specific contributions, ensuring you cover a range of achievements like cost management, process improvement, and team leadership for maximum impact.

Chief Accountant

ABC Corp

June 2020 - Present

- Led a team in implementing a new ERP system that reduced monthly closing time by 20%.

- Developed automated financial reporting tools, increasing report accuracy by 30%.

- Introduced a cost analysis framework that identified savings of over $200,000 annually.

- Collaborated with the IT department to enhance data security, avoiding revenue losses.

Achievement-Focused resume experience section

A results-focused chief accountant resume experience section should highlight your accomplishments in a way that captures attention. Start by pinpointing the skills and responsibilities that are pivotal to your role, then back them up with real examples of your achievements. Using numbers to convey your successes can make them more tangible and understandable to potential employers. For instance, explain how you introduced a new accounting software that significantly boosted efficiency, or how you led a team to reduce financial reporting errors by a substantial percentage.

Furthermore, it's essential to emphasize your leadership and problem-solving skills. Think about instances where you proactively tackled challenges or enhanced processes. Include details about your ability to manage complex tasks simultaneously, which showcases your organizational skills. Keep your content clear and concise, always with an eye on how your contributions have brought positive changes to your previous workplaces. The goal is to illustrate your impact rather than merely listing responsibilities.

Chief Accountant

XYZ Corporation

2018-2022

- Developed a new accounting system that cut report generation time by 40%.

- Led a team of 5 accountants, improving financial accuracy by 15%.

- Implemented cost-saving measures, reducing expenses by 20% over two years.

- Trained staff on updated compliance regulations, enhancing team's efficiency.

Growth-Focused resume experience section

A growth-focused chief accountant resume experience section should effectively highlight how you have driven financial success and supported business expansion. Begin by detailing your significant contributions in previous roles, concentrating on the ways you have enhanced financial systems. Emphasize your leadership in managing teams, optimizing processes, or introducing new systems, all of which lead to increased efficiency and profitability. To give your achievements weight, back them up with concrete data that illustrates your impact.

As you craft this section, weave in specific examples of how you've influenced growth within past organizations. Share stories of managing complex financial projects or strategic financial planning efforts, demonstrating how these led to improved financial outcomes. By organizing your accomplishments into bullet points, you ensure clarity and draw attention to your most significant achievements. Keep your descriptions straightforward but compelling, consistently tying your actions to the positive results they generated, and highlighting the skills you deployed.

Chief Accountant

ABC Corp

June 2018 - Present

- Led a team of 10 accountants and analysts to improve financial reporting processes, cutting report delivery times by 30%.

- Introduced a new budgeting system, boosting forecasting accuracy by 20% and enabling strategic decision-making for top management.

- Collaborated with department heads to pinpoint cost-saving opportunities, achieving $500k in annual overhead reductions.

- Facilitated the integration of new financial software that enhanced data analytics and strengthened reporting capabilities.

Write your chief accountant resume summary section

A chief accountant-focused resume summary should emphasize your qualifications and demonstrate how you can benefit the company. Think of it as your elevator pitch—concise and focused on your standout achievements and skills. Here's an example to consider:

This summary is effective because it highlights your most relevant experiences and skills. Introducing your years of experience sets the stage for your expertise. Words like "seasoned" and "eager to leverage expertise" not only capture your proficiency but also convey enthusiasm. Highlighting specific strengths such as "budget analysis" and "accounting system improvements" illustrates what you excel at. Tailoring the last part to reference a specific company, like "XYZ Corp," personalizes it, showing a keen interest in the organization.

Describing yourself effectively means using words that truly reflect your professional identity. Descriptive adjectives like "dedicated" or "innovative" can encapsulate who you are. Focus on skills that are vital for the job you’re pursuing, showing your readiness to contribute positively to the company.

Understanding the nuances between resume components helps you choose the right section for your needs. While a resume summary is suited for those with extensive experience, a resume objective is more forward-looking, ideal for newcomers. A resume profile merges both elements, offering a broad overview. A summary of qualifications, on the other hand, is a bullet-point list of specific abilities and accomplishments.

Grasping these differences ensures you use the correct section for your career stage, enhancing your chances of catching an employer’s eye.

Listing your chief accountant skills on your resume

A skills-focused chief accountant resume should clearly highlight the key areas that make you an ideal candidate for the role. The skills section is a powerful part of your resume, whether it stands alone or is integrated into your experience and summary sections. By emphasizing your strengths and soft skills, you demonstrate your ability to collaborate and adapt in various settings. Hard skills serve as your technical foundation, vital for performing accounting tasks like financial analysis and budgeting.

Presenting your skills as keywords is strategic, ensuring that hiring managers easily identify your qualifications. Here's a streamlined example of an effective standalone skills section using JSON format:

This section is efficient yet comprehensive, listing essential competencies crucial for a chief accountant. Each skill is carefully chosen to reflect the technical expertise and relevance to the job.

Best hard skills to feature on your chief accountant resume

Hard skills are crucial because they underscore your technical abilities and proficiency necessary for the chief accountant role, from managing finances to ensuring regulatory compliance.

Hard Skills

- Financial Analysis

- Budgeting and Forecasting

- Risk Management

- Tax Compliance

- Financial Reporting

- Auditing Procedures

- General Ledger Management

- Accounting Software Proficiency

- Regulatory Knowledge

- Cost Accounting

- Internal Controls

- Cash Flow Management

- Profit and Loss Analysis

- Payroll Accounting

- Inventory Management

Best soft skills to feature on your chief accountant resume

Soft skills are equally important in illustrating how you interact effectively with teams and communicate as a chief accountant, enhancing your overall impact in the workplace.

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Time Management

- Adaptability

- Team Collaboration

- Leadership

- Critical Thinking

- Decision-Making

- Ethical Judgment

- Organizational Skills

- Conflict Resolution

- Emotional Intelligence

- Client Relationship Management

How to include your education on your resume

An education section is crucial for your chief accountant resume as it showcases your academic background, giving potential employers insight into your qualifications. This section should be tailored to the job you're applying for, so leave out any irrelevant education details. When listing degrees, always include the full title of your degree and the name of the institution. If your GPA is impressive (generally 3.5 or above), include it to highlight your academic performance. Listing honors such as cum laude is important as it emphasizes your achievements.

Here's a wrong example of an education section:

Now, here is a right example:

This second example is excellent because it highlights a degree directly related to accounting, which is highly relevant for a chief accountant position. The inclusion of a strong GPA of 3.8 demonstrates academic excellence, while omitting unnecessary details keeps it concise and focused.

How to include chief accountant certificates on your resume

Including a certificates section in your chief accountant resume is essential. Certificates demonstrate your expertise and dedication to your field. List the name of the certificate first. Include the date when you earned it next. Add the issuing organization to provide credibility. Certificates can also go in the header for quick visibility. For example, "CPA, American Institute of CPAs, 2015".

Putting your certificates in a dedicated section keeps your resume organized. It also makes it easy for employers to locate your qualifications. Tailor your certificates to the job you're applying for.

This example is effective because it lists relevant certificates for a chief accountant role. The certificates are from reputable organizations, which adds value. The dates are omitted here, but you should include them in your actual resume. This keeps the section neat and gives a clear picture of your qualifications.

Extra sections to include in your chief accountant resume

Crafting a resume for a chief accountant involves more than just listing your job titles and responsibilities. To truly stand out, it's essential to include sections that paint a well-rounded picture of you as a professional and person. Adding diverse information such as languages, hobbies, volunteer work, and books can give potential employers deeper insights.

- Language section — Highlight your proficiency in financial and business languages. This demonstrates your ability to communicate in diverse environments.

- Hobbies and interests section — Mention interests that show analytical skills or attention to detail, such as chess or sudoku. This gives employers a glimpse into your personality and cognitive skills.

- Volunteer work section — Include volunteer experience related to finance or community service. This showcases your commitment to societal betterment and teamwork.

- Books section — List relevant books that have influenced your financial knowledge or leadership style. This shows a dedication to ongoing learning and growth in your field.

In Conclusion

In conclusion, crafting a standout chief accountant resume is essential in the competitive job market. Your resume serves as a vital tool in showcasing your financial expertise and leadership qualities. By strategically organizing your experiences and skills, you can greatly increase your chances of landing an interview. Choosing the right format and font ensures your resume is both professional and modern, making an excellent first impression. Highlighting quantifiable achievements demonstrates your impact and aptitude for financial management. Your summary should effectively encapsulate your career goals and accomplishments, capturing the attention of potential employers. A well-structured skills section further emphasizes your technical and soft skills, showcasing your comprehensive capabilities as a chief accountant. Education and certifications lend credibility to your qualifications, strengthening your application. Additional sections, such as languages and volunteer work, help present a holistic view of you as a candidate. By implementing these strategies, your resume will not only stand out but also clearly communicate your value to future employers, making it an integral step in advancing your career as a chief accountant.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.