Club Accountant Resume Examples

Jul 18, 2024

|

12 min read

Get the balance right: Tips for creating a standout club accountant resume. Learn how to showcase your skills and experience effectively to land your next role. Maximize your potential and get the job you want.

Rated by 348 people

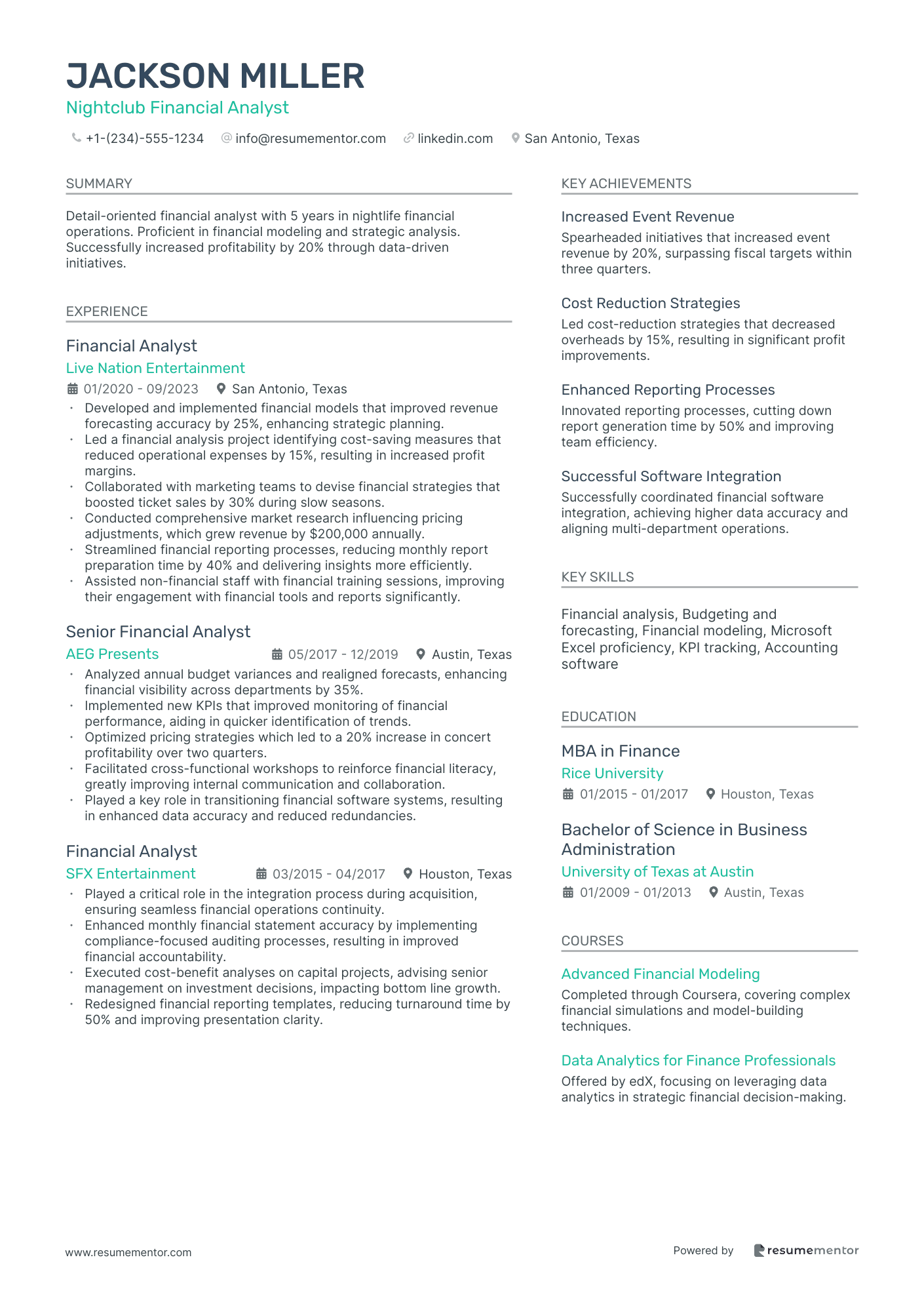

Nightclub Financial Analyst

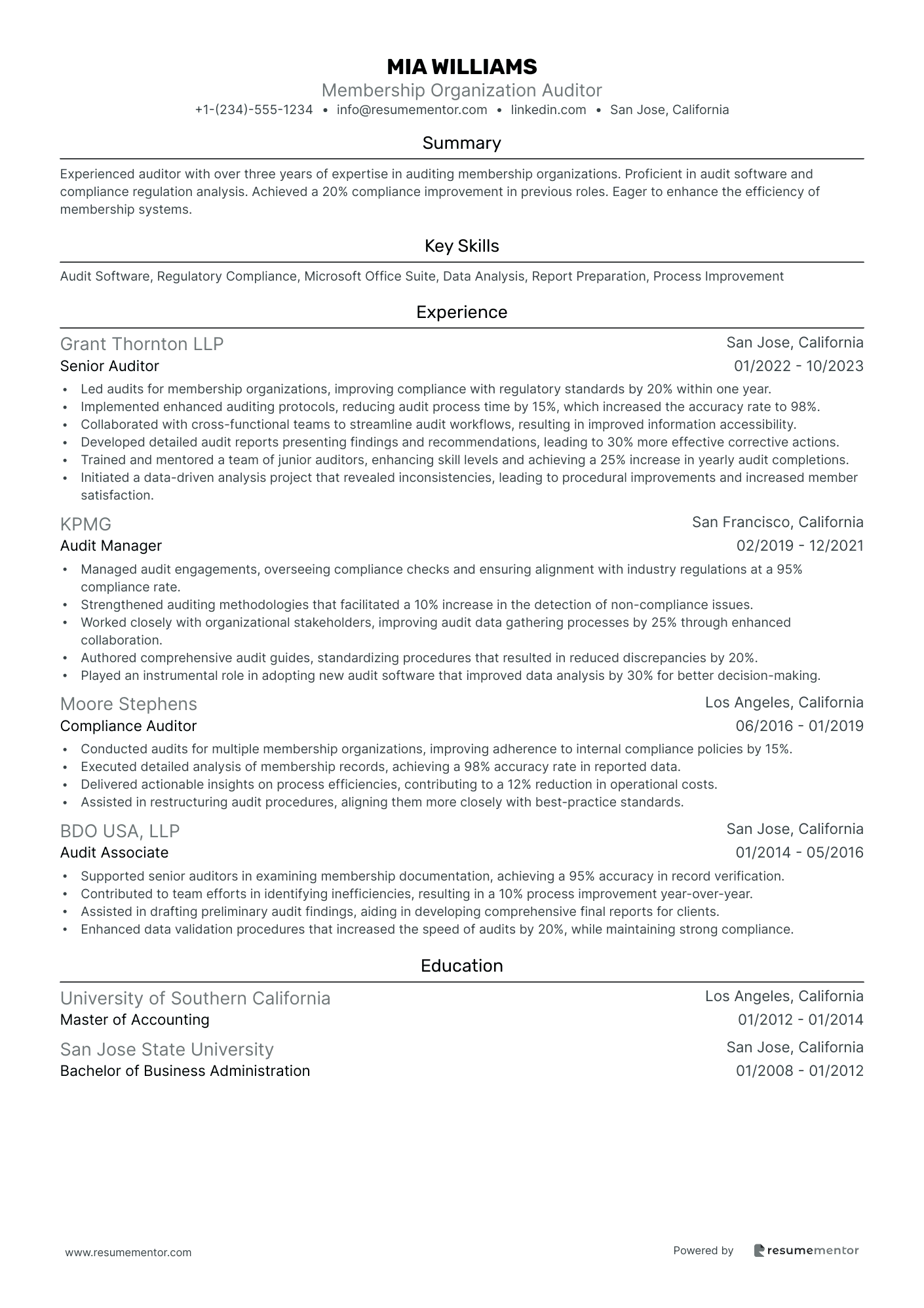

Membership Organization Auditor

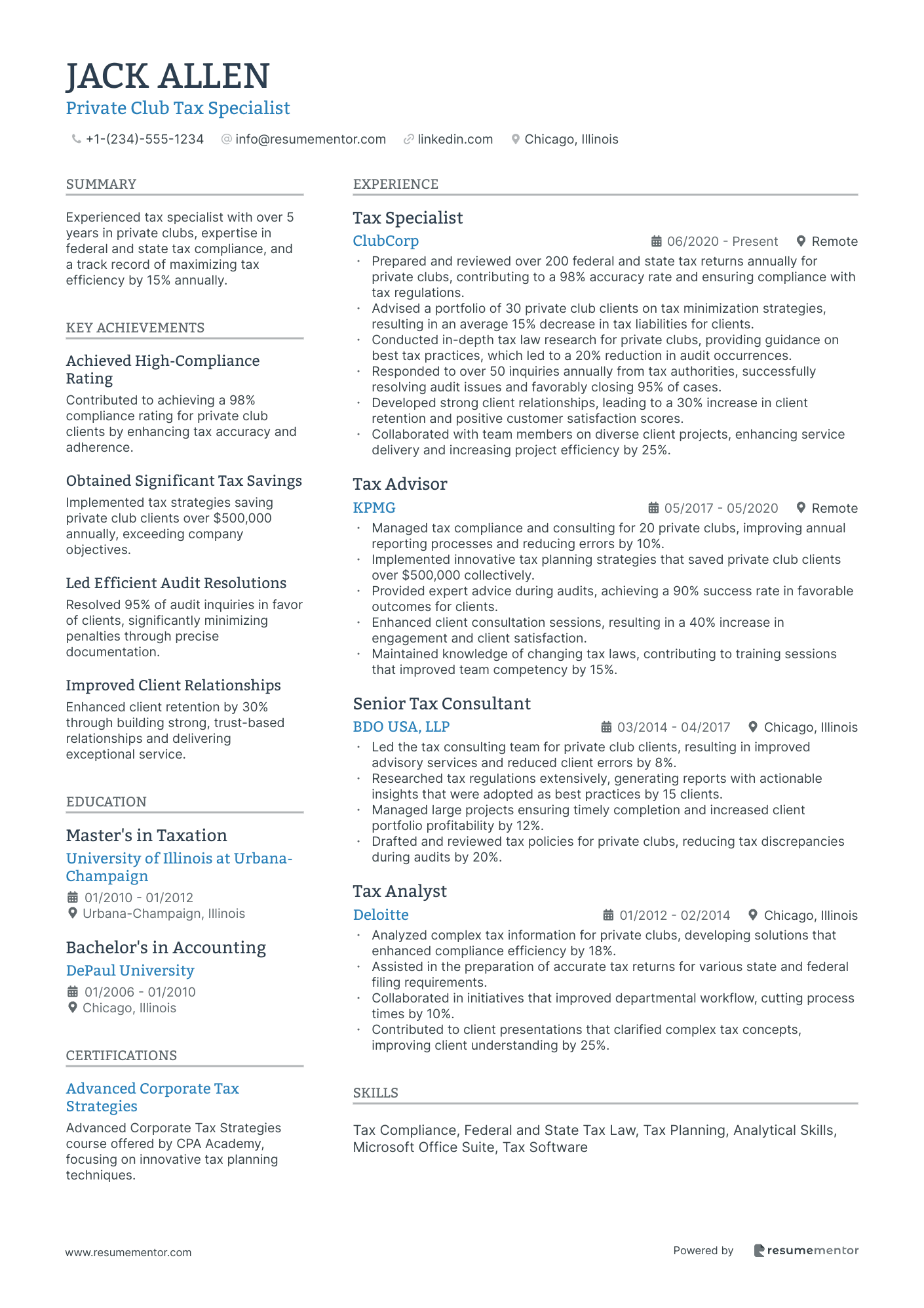

Private Club Tax Specialist

Sports Club Financial Coordinator

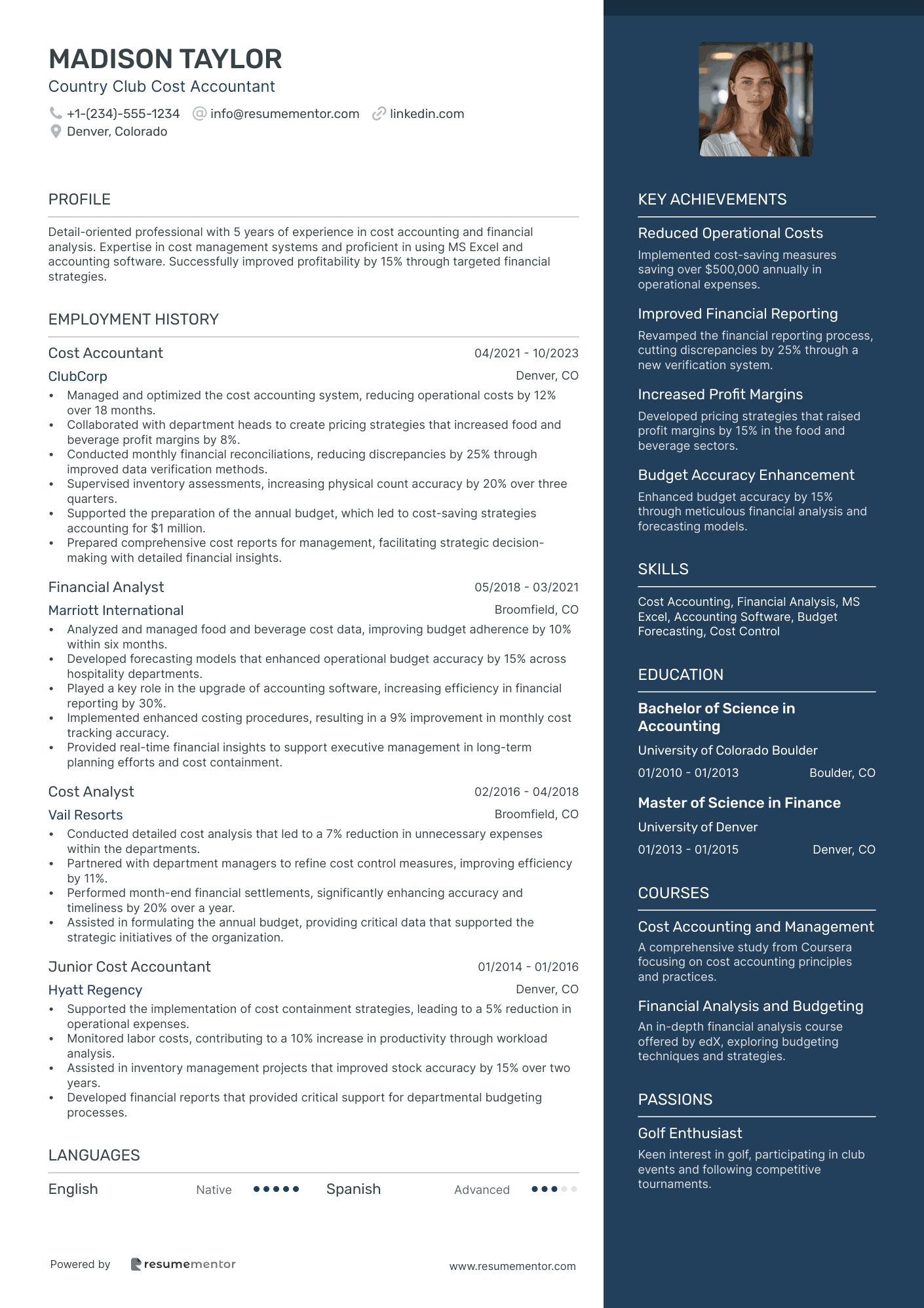

Country Club Cost Accountant

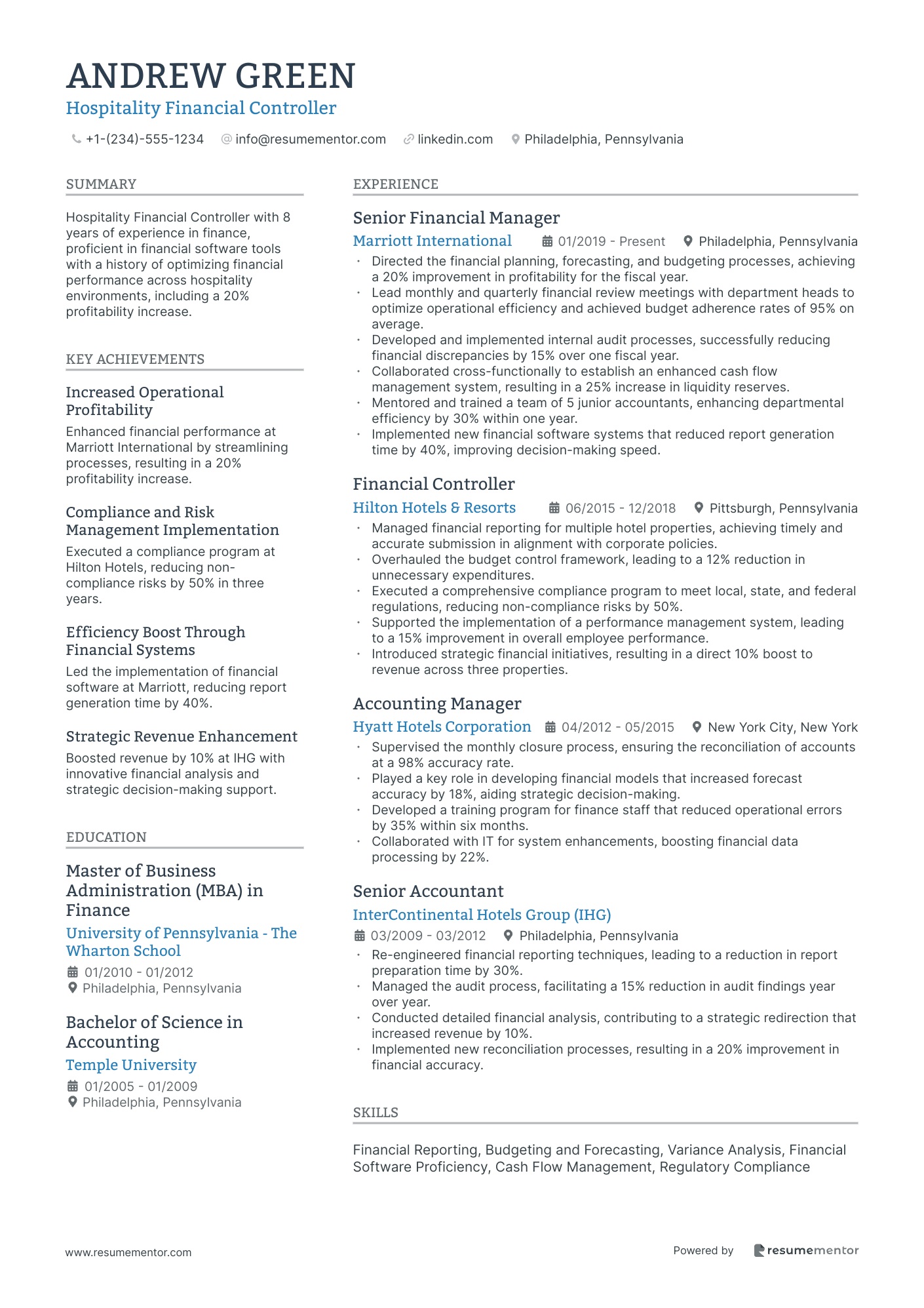

Hospitality Financial Controller

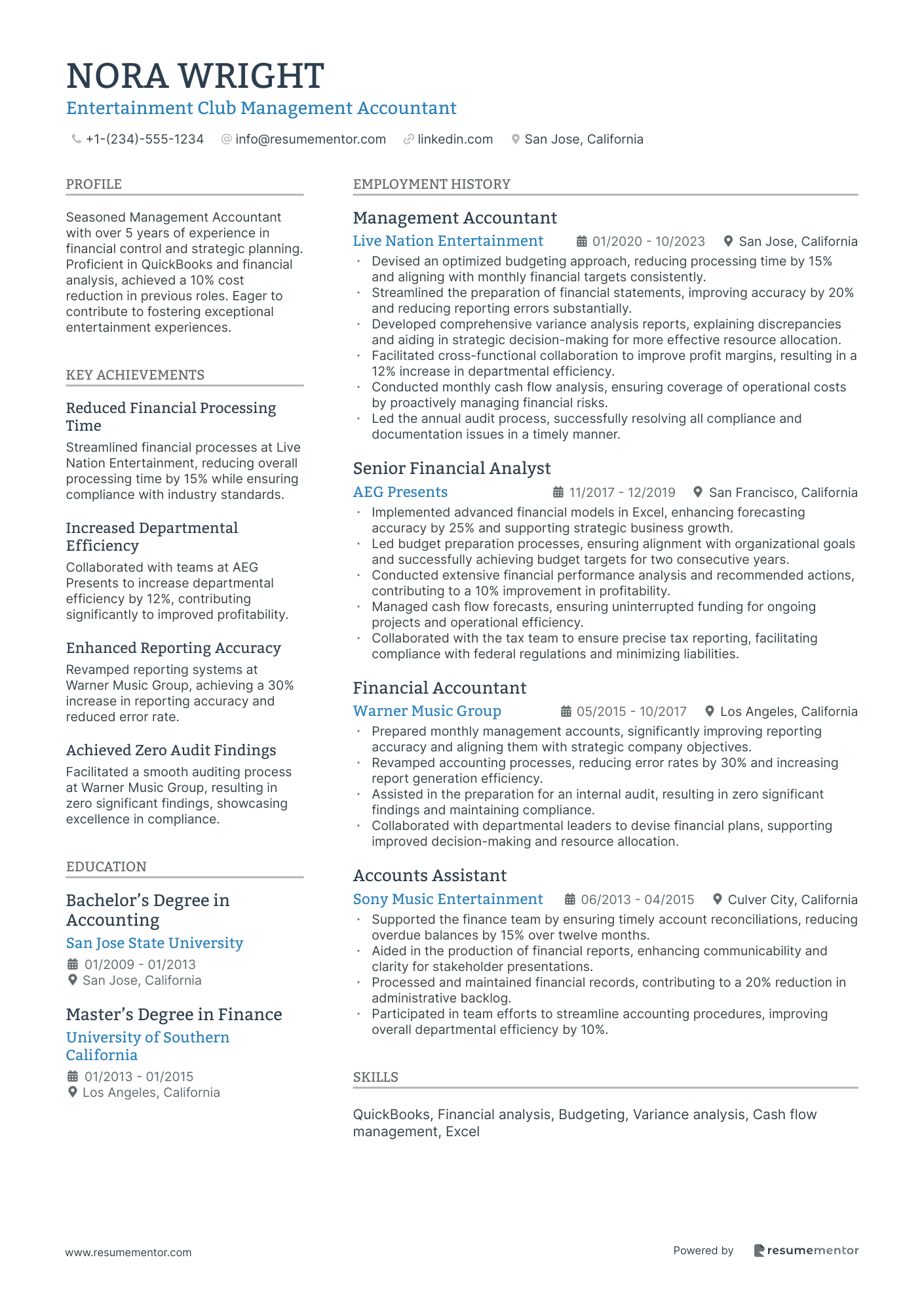

Entertainment Club Management Accountant

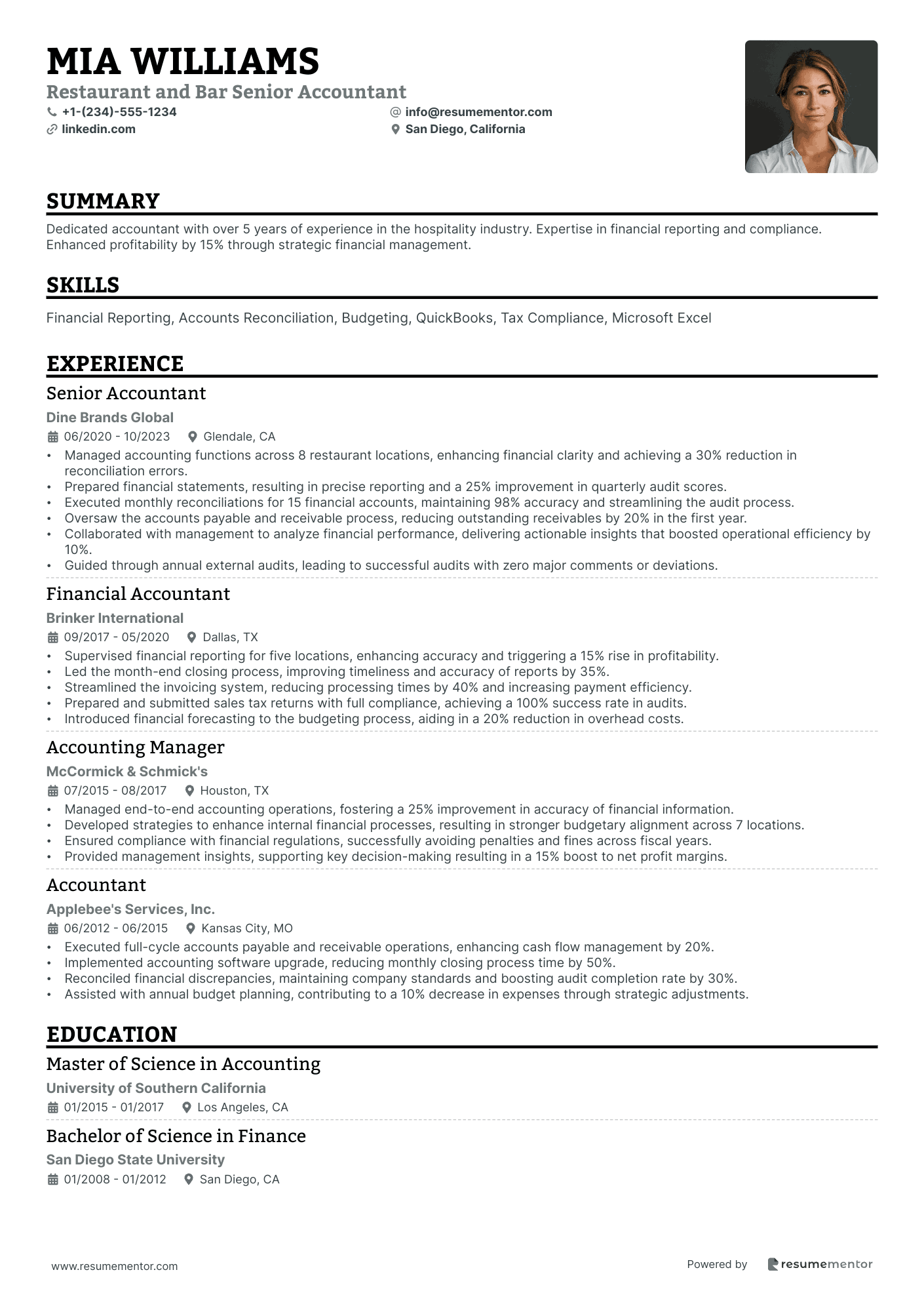

Restaurant and Bar Senior Accountant

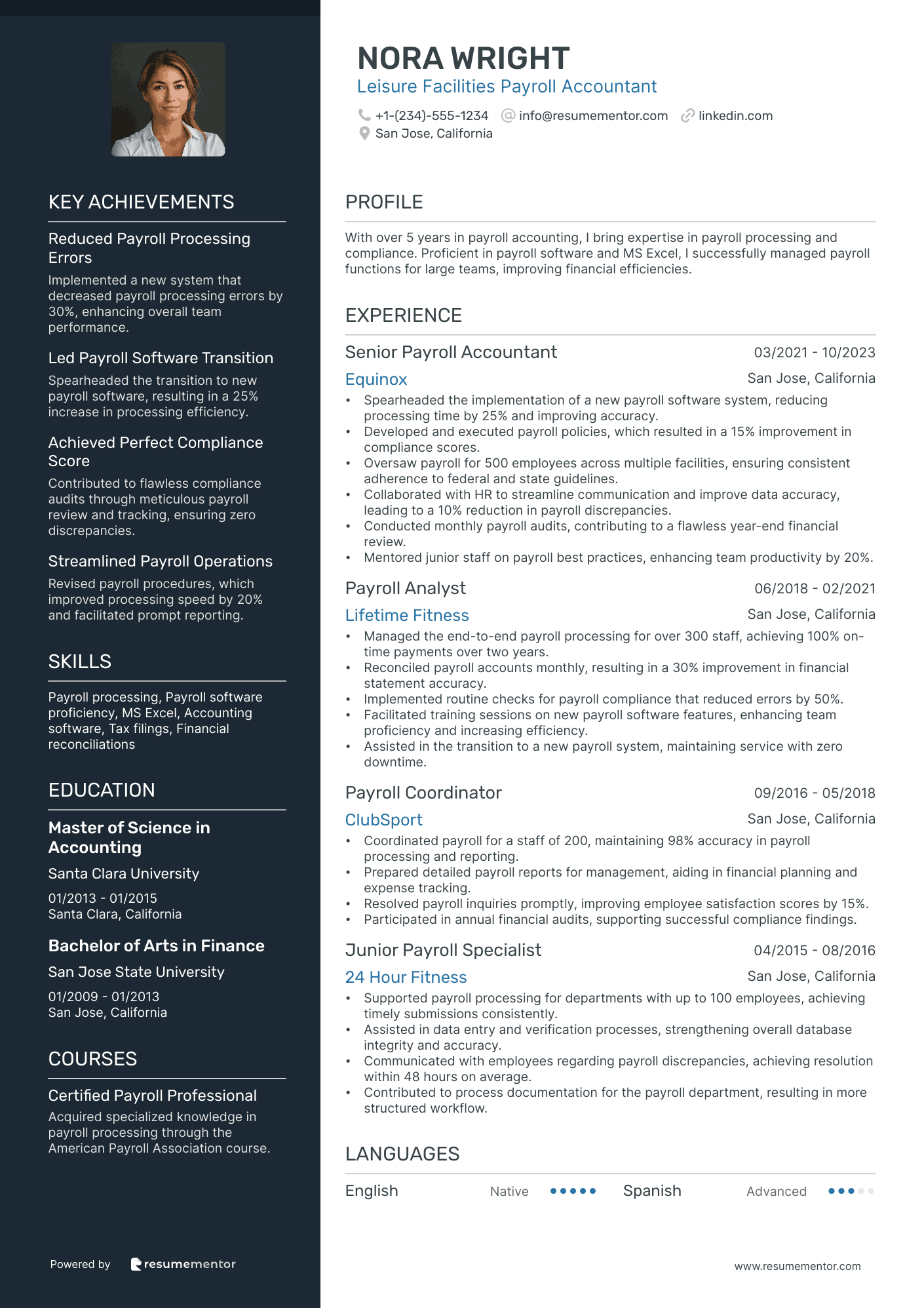

Leisure Facilities Payroll Accountant

Nightlife Venue Financial Planner

Nightclub Financial Analyst resume sample

- •Developed and implemented financial models that improved revenue forecasting accuracy by 25%, enhancing strategic planning.

- •Led a financial analysis project identifying cost-saving measures that reduced operational expenses by 15%, resulting in increased profit margins.

- •Collaborated with marketing teams to devise financial strategies that boosted ticket sales by 30% during slow seasons.

- •Conducted comprehensive market research influencing pricing adjustments, which grew revenue by $200,000 annually.

- •Streamlined financial reporting processes, reducing monthly report preparation time by 40% and delivering insights more efficiently.

- •Assisted non-financial staff with financial training sessions, improving their engagement with financial tools and reports significantly.

- •Analyzed annual budget variances and realigned forecasts, enhancing financial visibility across departments by 35%.

- •Implemented new KPIs that improved monitoring of financial performance, aiding in quicker identification of trends.

- •Optimized pricing strategies which led to a 20% increase in concert profitability over two quarters.

- •Facilitated cross-functional workshops to reinforce financial literacy, greatly improving internal communication and collaboration.

- •Played a key role in transitioning financial software systems, resulting in enhanced data accuracy and reduced redundancies.

- •Played a critical role in the integration process during acquisition, ensuring seamless financial operations continuity.

- •Enhanced monthly financial statement accuracy by implementing compliance-focused auditing processes, resulting in improved financial accountability.

- •Executed cost-benefit analyses on capital projects, advising senior management on investment decisions, impacting bottom line growth.

- •Redesigned financial reporting templates, reducing turnaround time by 50% and improving presentation clarity.

- •Conducted financial variance analyses, resulting in corrective actions that improved annual budget accuracy by 10%.

- •Collaborated with marketing teams to align event pricing strategies with market demands, enhancing revenue streams.

- •Managed quarterly financial reviews, ensuring compliance and identifying improvement opportunities across departments.

- •Developed detailed financial reports that provided executives with actionable insights to inform strategic decisions.

Membership Organization Auditor resume sample

- •Led audits for membership organizations, improving compliance with regulatory standards by 20% within one year.

- •Implemented enhanced auditing protocols, reducing audit process time by 15%, which increased the accuracy rate to 98%.

- •Collaborated with cross-functional teams to streamline audit workflows, resulting in improved information accessibility.

- •Developed detailed audit reports presenting findings and recommendations, leading to 30% more effective corrective actions.

- •Trained and mentored a team of junior auditors, enhancing skill levels and achieving a 25% increase in yearly audit completions.

- •Initiated a data-driven analysis project that revealed inconsistencies, leading to procedural improvements and increased member satisfaction.

- •Managed audit engagements, overseeing compliance checks and ensuring alignment with industry regulations at a 95% compliance rate.

- •Strengthened auditing methodologies that facilitated a 10% increase in the detection of non-compliance issues.

- •Worked closely with organizational stakeholders, improving audit data gathering processes by 25% through enhanced collaboration.

- •Authored comprehensive audit guides, standardizing procedures that resulted in reduced discrepancies by 20%.

- •Played an instrumental role in adopting new audit software that improved data analysis by 30% for better decision-making.

- •Conducted audits for multiple membership organizations, improving adherence to internal compliance policies by 15%.

- •Executed detailed analysis of membership records, achieving a 98% accuracy rate in reported data.

- •Delivered actionable insights on process efficiencies, contributing to a 12% reduction in operational costs.

- •Assisted in restructuring audit procedures, aligning them more closely with best-practice standards.

- •Supported senior auditors in examining membership documentation, achieving a 95% accuracy in record verification.

- •Contributed to team efforts in identifying inefficiencies, resulting in a 10% process improvement year-over-year.

- •Assisted in drafting preliminary audit findings, aiding in developing comprehensive final reports for clients.

- •Enhanced data validation procedures that increased the speed of audits by 20%, while maintaining strong compliance.

Private Club Tax Specialist resume sample

- •Prepared and reviewed over 200 federal and state tax returns annually for private clubs, contributing to a 98% accuracy rate and ensuring compliance with tax regulations.

- •Advised a portfolio of 30 private club clients on tax minimization strategies, resulting in an average 15% decrease in tax liabilities for clients.

- •Conducted in-depth tax law research for private clubs, providing guidance on best tax practices, which led to a 20% reduction in audit occurrences.

- •Responded to over 50 inquiries annually from tax authorities, successfully resolving audit issues and favorably closing 95% of cases.

- •Developed strong client relationships, leading to a 30% increase in client retention and positive customer satisfaction scores.

- •Collaborated with team members on diverse client projects, enhancing service delivery and increasing project efficiency by 25%.

- •Managed tax compliance and consulting for 20 private clubs, improving annual reporting processes and reducing errors by 10%.

- •Implemented innovative tax planning strategies that saved private club clients over $500,000 collectively.

- •Provided expert advice during audits, achieving a 90% success rate in favorable outcomes for clients.

- •Enhanced client consultation sessions, resulting in a 40% increase in engagement and client satisfaction.

- •Maintained knowledge of changing tax laws, contributing to training sessions that improved team competency by 15%.

- •Led the tax consulting team for private club clients, resulting in improved advisory services and reduced client errors by 8%.

- •Researched tax regulations extensively, generating reports with actionable insights that were adopted as best practices by 15 clients.

- •Managed large projects ensuring timely completion and increased client portfolio profitability by 12%.

- •Drafted and reviewed tax policies for private clubs, reducing tax discrepancies during audits by 20%.

- •Analyzed complex tax information for private clubs, developing solutions that enhanced compliance efficiency by 18%.

- •Assisted in the preparation of accurate tax returns for various state and federal filing requirements.

- •Collaborated in initiatives that improved departmental workflow, cutting process times by 10%.

- •Contributed to client presentations that clarified complex tax concepts, improving client understanding by 25%.

Sports Club Financial Coordinator resume sample

- •Implemented new budgeting processes that improved forecast accuracy by 30% and reduced discrepancies significantly.

- •Collaborated with department heads to strategically align budgets, increasing financial transparency and board approval rates by 20%.

- •Enhanced quarterly financial reports, shortening review time by 25% through streamlined reporting methods.

- •Led successful external audits with zero compliance issues, maintaining regulatory adherence efficiently.

- •Managed accounts payable processes, reducing outstanding receivables by 15% through optimized collection strategies.

- •Oversaw financial policy development that resulted in cost savings and refined operational efficiencies organization-wide.

- •Devised detailed financial models that enhanced strategic planning efforts by 20% across multiple sports teams.

- •Generated comprehensive monthly reports that resulted in more informed decision-making for senior management.

- •Strengthened compliance measures with new policies that decreased audit preparation time by 15%.

- •Optimized revenue tracking systems, improving accuracy of financial data analysis which led to better forecasting.

- •Spearheaded financial training sessions for new staff, which uplifted department proficiency by 40% within a year.

- •Assisted in the revision of annual budgets, achieving a more accurate budget plan by employing advanced forecasting techniques.

- •Conducted variance analysis that helped reduce overspending by 10% through strategic reallocation of resources.

- •Implemented expense monitoring protocols which increased budget adherence, ensuring financial controls were strengthened.

- •Facilitated cross-departmental workshops to foster financial literacy, bolstering overall organizational financial awareness.

- •Monitored financials for community sports programs, implementing strategic funding allocations that supported long-term sustainability.

- •Managed accounts receivable, reducing delinquent accounts by 18% with an enhanced collection strategy.

- •Prepared fiscal reports for stakeholders, increasing transparency and trust by providing detailed financial insights.

- •Streamlined invoicing processes that resulted in a 20% reduction in processing time, enhancing operational efficiency.

Country Club Cost Accountant resume sample

- •Managed and optimized the cost accounting system, reducing operational costs by 12% over 18 months.

- •Collaborated with department heads to create pricing strategies that increased food and beverage profit margins by 8%.

- •Conducted monthly financial reconciliations, reducing discrepancies by 25% through improved data verification methods.

- •Supervised inventory assessments, increasing physical count accuracy by 20% over three quarters.

- •Supported the preparation of the annual budget, which led to cost-saving strategies accounting for $1 million.

- •Prepared comprehensive cost reports for management, facilitating strategic decision-making with detailed financial insights.

- •Analyzed and managed food and beverage cost data, improving budget adherence by 10% within six months.

- •Developed forecasting models that enhanced operational budget accuracy by 15% across hospitality departments.

- •Played a key role in the upgrade of accounting software, increasing efficiency in financial reporting by 30%.

- •Implemented enhanced costing procedures, resulting in a 9% improvement in monthly cost tracking accuracy.

- •Provided real-time financial insights to support executive management in long-term planning efforts and cost containment.

- •Conducted detailed cost analysis that led to a 7% reduction in unnecessary expenses within the departments.

- •Partnered with department managers to refine cost control measures, improving efficiency by 11%.

- •Performed month-end financial settlements, significantly enhancing accuracy and timeliness by 20% over a year.

- •Assisted in formulating the annual budget, providing critical data that supported the strategic initiatives of the organization.

- •Supported the implementation of cost containment strategies, leading to a 5% reduction in operational expenses.

- •Monitored labor costs, contributing to a 10% increase in productivity through workload analysis.

- •Assisted in inventory management projects that improved stock accuracy by 15% over two years.

- •Developed financial reports that provided critical support for departmental budgeting processes.

Hospitality Financial Controller resume sample

- •Directed the financial planning, forecasting, and budgeting processes, achieving a 20% improvement in profitability for the fiscal year.

- •Lead monthly and quarterly financial review meetings with department heads to optimize operational efficiency and achieved budget adherence rates of 95% on average.

- •Developed and implemented internal audit processes, successfully reducing financial discrepancies by 15% over one fiscal year.

- •Collaborated cross-functionally to establish an enhanced cash flow management system, resulting in a 25% increase in liquidity reserves.

- •Mentored and trained a team of 5 junior accountants, enhancing departmental efficiency by 30% within one year.

- •Implemented new financial software systems that reduced report generation time by 40%, improving decision-making speed.

- •Managed financial reporting for multiple hotel properties, achieving timely and accurate submission in alignment with corporate policies.

- •Overhauled the budget control framework, leading to a 12% reduction in unnecessary expenditures.

- •Executed a comprehensive compliance program to meet local, state, and federal regulations, reducing non-compliance risks by 50%.

- •Supported the implementation of a performance management system, leading to a 15% improvement in overall employee performance.

- •Introduced strategic financial initiatives, resulting in a direct 10% boost to revenue across three properties.

- •Supervised the monthly closure process, ensuring the reconciliation of accounts at a 98% accuracy rate.

- •Played a key role in developing financial models that increased forecast accuracy by 18%, aiding strategic decision-making.

- •Developed a training program for finance staff that reduced operational errors by 35% within six months.

- •Collaborated with IT for system enhancements, boosting financial data processing by 22%.

- •Re-engineered financial reporting techniques, leading to a reduction in report preparation time by 30%.

- •Managed the audit process, facilitating a 15% reduction in audit findings year over year.

- •Conducted detailed financial analysis, contributing to a strategic redirection that increased revenue by 10%.

- •Implemented new reconciliation processes, resulting in a 20% improvement in financial accuracy.

Entertainment Club Management Accountant resume sample

- •Devised an optimized budgeting approach, reducing processing time by 15% and aligning with monthly financial targets consistently.

- •Streamlined the preparation of financial statements, improving accuracy by 20% and reducing reporting errors substantially.

- •Developed comprehensive variance analysis reports, explaining discrepancies and aiding in strategic decision-making for more effective resource allocation.

- •Facilitated cross-functional collaboration to improve profit margins, resulting in a 12% increase in departmental efficiency.

- •Conducted monthly cash flow analysis, ensuring coverage of operational costs by proactively managing financial risks.

- •Led the annual audit process, successfully resolving all compliance and documentation issues in a timely manner.

- •Implemented advanced financial models in Excel, enhancing forecasting accuracy by 25% and supporting strategic business growth.

- •Led budget preparation processes, ensuring alignment with organizational goals and successfully achieving budget targets for two consecutive years.

- •Conducted extensive financial performance analysis and recommended actions, contributing to a 10% improvement in profitability.

- •Managed cash flow forecasts, ensuring uninterrupted funding for ongoing projects and operational efficiency.

- •Collaborated with the tax team to ensure precise tax reporting, facilitating compliance with federal regulations and minimizing liabilities.

- •Prepared monthly management accounts, significantly improving reporting accuracy and aligning them with strategic company objectives.

- •Revamped accounting processes, reducing error rates by 30% and increasing report generation efficiency.

- •Assisted in the preparation for an internal audit, resulting in zero significant findings and maintaining compliance.

- •Collaborated with departmental leaders to devise financial plans, supporting improved decision-making and resource allocation.

- •Supported the finance team by ensuring timely account reconciliations, reducing overdue balances by 15% over twelve months.

- •Aided in the production of financial reports, enhancing communicability and clarity for stakeholder presentations.

- •Processed and maintained financial records, contributing to a 20% reduction in administrative backlog.

- •Participated in team efforts to streamline accounting procedures, improving overall departmental efficiency by 10%.

Restaurant and Bar Senior Accountant resume sample

- •Managed accounting functions across 8 restaurant locations, enhancing financial clarity and achieving a 30% reduction in reconciliation errors.

- •Prepared financial statements, resulting in precise reporting and a 25% improvement in quarterly audit scores.

- •Executed monthly reconciliations for 15 financial accounts, maintaining 98% accuracy and streamlining the audit process.

- •Oversaw the accounts payable and receivable process, reducing outstanding receivables by 20% in the first year.

- •Collaborated with management to analyze financial performance, delivering actionable insights that boosted operational efficiency by 10%.

- •Guided through annual external audits, leading to successful audits with zero major comments or deviations.

- •Supervised financial reporting for five locations, enhancing accuracy and triggering a 15% rise in profitability.

- •Led the month-end closing process, improving timeliness and accuracy of reports by 35%.

- •Streamlined the invoicing system, reducing processing times by 40% and increasing payment efficiency.

- •Prepared and submitted sales tax returns with full compliance, achieving a 100% success rate in audits.

- •Introduced financial forecasting to the budgeting process, aiding in a 20% reduction in overhead costs.

- •Managed end-to-end accounting operations, fostering a 25% improvement in accuracy of financial information.

- •Developed strategies to enhance internal financial processes, resulting in stronger budgetary alignment across 7 locations.

- •Ensured compliance with financial regulations, successfully avoiding penalties and fines across fiscal years.

- •Provided management insights, supporting key decision-making resulting in a 15% boost to net profit margins.

- •Executed full-cycle accounts payable and receivable operations, enhancing cash flow management by 20%.

- •Implemented accounting software upgrade, reducing monthly closing process time by 50%.

- •Reconciled financial discrepancies, maintaining company standards and boosting audit completion rate by 30%.

- •Assisted with annual budget planning, contributing to a 10% decrease in expenses through strategic adjustments.

Leisure Facilities Payroll Accountant resume sample

- •Spearheaded the implementation of a new payroll software system, reducing processing time by 25% and improving accuracy.

- •Developed and executed payroll policies, which resulted in a 15% improvement in compliance scores.

- •Oversaw payroll for 500 employees across multiple facilities, ensuring consistent adherence to federal and state guidelines.

- •Collaborated with HR to streamline communication and improve data accuracy, leading to a 10% reduction in payroll discrepancies.

- •Conducted monthly payroll audits, contributing to a flawless year-end financial review.

- •Mentored junior staff on payroll best practices, enhancing team productivity by 20%.

- •Managed the end-to-end payroll processing for over 300 staff, achieving 100% on-time payments over two years.

- •Reconciled payroll accounts monthly, resulting in a 30% improvement in financial statement accuracy.

- •Implemented routine checks for payroll compliance that reduced errors by 50%.

- •Facilitated training sessions on new payroll software features, enhancing team proficiency and increasing efficiency.

- •Assisted in the transition to a new payroll system, maintaining service with zero downtime.

- •Coordinated payroll for a staff of 200, maintaining 98% accuracy in payroll processing and reporting.

- •Prepared detailed payroll reports for management, aiding in financial planning and expense tracking.

- •Resolved payroll inquiries promptly, improving employee satisfaction scores by 15%.

- •Participated in annual financial audits, supporting successful compliance findings.

- •Supported payroll processing for departments with up to 100 employees, achieving timely submissions consistently.

- •Assisted in data entry and verification processes, strengthening overall database integrity and accuracy.

- •Communicated with employees regarding payroll discrepancies, achieving resolution within 48 hours on average.

- •Contributed to process documentation for the payroll department, resulting in more structured workflow.

Nightlife Venue Financial Planner resume sample

- •Managed and optimized financial reports and budgets, reducing unnecessary expenses by 15%, enhancing financial efficiency.

- •Conducted comprehensive profitability analysis for over 50 events, enhancing revenue-generating promotions by 30%.

- •Collaborated directly with departmental heads to align financial strategies with corporate goals, resulting in a 20% profitability increase.

- •Developed financial models to assess viability of new venues, contributing to a 25% increase in successful venue launches.

- •Trained and mentored junior financial analysts, leading to a 50% improvement in team productivity.

- •Stay updated on nightlife trends to inform data-driven strategic financial decisions, driving competitive advantage.

- •Analyzed operational costs and implemented cost-control strategies, reducing expenditures by 10% annually.

- •Developed and implemented financial forecasting techniques, achieving a 95% accuracy rate in predictions.

- •Provided detailed financial presentations that influenced the strategic decisions of senior management.

- •Identified key areas for financial improvement, resulting in overall cost savings of $100,000 annually.

- •Led cross-departmental spending audits that optimized budget allocation and resource management by 20%.

- •Prepared and analyzed monthly financial statements, contributing to a 15% improvement in cost efficiency.

- •Collaborated with marketing to assess financial viability of promotions, boosting monthly sales by 10%.

- •Monitored venue inventory and staffing budgets, optimizing resource allocation effectively.

- •Recommended financial adjustments based on market trend analysis, aligning with strategic initiatives.

- •Assisted in budgeting processes, contributing to 10% savings through accurate financial analysis.

- •Participated in financial reviews to support compliance, ensuring adherence to regulatory standards.

- •Utilized Excel for complex modeling, improving forecasting accuracy by 20%.

- •Facilitated cross-functional teams in adapting to financial software tools, increasing efficiency by 25%.

Creating a standout club accountant resume is like putting together a well-balanced financial portfolio—it requires structure, clarity, and precision. Your extensive skills in managing funds, balancing budgets, and ensuring compliance are invaluable. Yet, transforming this expertise into a compelling resume can feel overwhelming. The challenge lies in highlighting your unique contributions within the intricate world of numbers and regulations, all while showcasing your specialized accounting practices tailored to club environments.

Here’s where a resume template becomes indispensable, offering a structured path to clearly present your experiences and achievements. You can explore a range of helpful resume templates to guide your efforts.

In a competitive job market, where candidates with similar skill sets abound, your resume becomes your first impression. It is a reflection of the vital role you play in a club’s financial success. When you approach resume writing like financial planning, you ensure that every achievement and skill is optimally placed, making a compelling case for your candidacy.

Key Takeaways

- Emphasize your financial expertise, attention to detail, and unique ability to manage club finances effectively on your club accountant resume.

- Incorporate sections such as contact information, summary statement, professional experience, education, and skills to create a structured and comprehensive resume.

- Choose a chronological format for your resume to clearly present work history and education, ensuring employers can easily understand your career progression.

- Quantify achievements in the experience section, using strong action words to demonstrate how your accomplishments had a tangible impact.

- Include additional sections like certifications, languages, volunteer work, and relevant hobbies to offer a well-rounded view of your skills and interests.

What to focus on when writing your club accountant resume

A club accountant resume should clearly highlight your financial expertise and attention to detail, showcasing your ability to manage club finances effectively. It's important to convey your experience and skills in a club or similar setting, demonstrating to the recruiter that you can handle financial records, budgeting, and reports with precision.

How to structure your club accountant resume

- Contact Information: Make sure to include your full name, phone number, email address, and LinkedIn profile so employers can easily reach you—ensuring that this section is clear and complete establishes a strong professional first impression.

- Summary Statement: Offer a brief overview that captures your accounting experience, emphasizing your financial management skills and familiarity with club operations to set the stage for your qualifications—this section helps express how your background aligns with the role.

- Professional Experience: Highlight your previous roles with a focus on financial management responsibilities, detailing accomplishments like process streamlining or accuracy improvements to illustrate your impact—sharing specific achievements gives insight into your real-world contributions.

- Education: Showcase your academic background by listing your degree(s) in accounting or finance, alongside any relevant certifications or coursework that affirm your knowledge—this demonstrates your formal training and dedication to the field.

- Skills: Underscore your expertise with skills such as financial reporting, budgeting, and accounts reconciliation, and mention your proficiency with accounting software like QuickBooks to demonstrate your technical ability—competency in these areas signals your readiness to manage club finances.

- Certifications: If applicable, highlight relevant certifications, such as CPA or CMA, which can further validate your professional competencies—certifications add credibility and may set you apart from other candidates.

Enhance your resume with optional sections that can distinguish your application. Consider examples like Professional Affiliations, Volunteer Experience, or Awards, which can provide further insight into your professional journey and contributions. Below, we'll cover each section more in-depth as we discuss the ideal resume format.

Which resume format to choose

As a club accountant, crafting a standout resume begins with selecting the right format, and the chronological format often serves best in this regard. It highlights your work history and educational achievements in a coherent and straightforward manner. This approach aligns with what most employers value, offering a clear view of your career progression, which is crucial for roles emphasizing experience and stability.

When choosing fonts, modern alternatives to the traditional Arial and Times New Roman can subtly enhance your resume's appearance. Using Rubik provides a clean and professional look, which resonates well in financial environments. Lato’s friendly and approachable style can soften your resume’s tone without compromising professionalism, fitting well within creative club settings. Montserrat, with its contemporary flair, brings a polished and stylish touch, ensuring your resume remains distinct yet appropriately formal.

Always save your resume as a PDF. This file type preserves your formatting and design elements, ensuring your resume looks the same across all devices. Such consistency is key when presenting professional documents, as it maintains the structure and aesthetic you intend, which is particularly important for roles requiring precision and attention to detail.

Finally, setting your margins to about one inch on all sides gives your resume a clean, uncluttered appearance. This spacing enables employers to easily focus on your skills and achievements. A well-structured layout not only enhances readability but also reflects the meticulous attention to detail necessary for a successful club accountant. By carefully integrating these elements, your resume will effectively convey your professionalism and readiness for the role.

How to write a quantifiable resume experience section

In the experience section of your club accountant resume, your focus should be on highlighting achievements that made a tangible impact. Emphasize results that are quantifiable, clearly showing how your actions led to improvements. Begin with your most recent or current job and organize your entries in reverse chronological order. Select job titles that resonate with the role you're targeting and tailor each entry to align with the job ad, using relevant keywords and phrases. Utilizing strong action words like "managed," "reduced," "increased," or "optimized" ensures your accomplishments are impactful and noticeable. Keep your entries concise, concentrating on outcomes that are directly relevant to the position.

Your job history should cover the last 10-15 years or your last three roles to provide a comprehensive view of your experience. The objective here is to demonstrate your expertise through concrete benefits you’ve delivered.

- •Boosted club revenue by 15% through strategic budget management and cost-cutting.

- •Cut financial discrepancies by 20% by implementing a new accounting system that improved accuracy.

- •Streamlined monthly financial reports, cutting preparation time by 30% and enhancing transparency.

- •Improved member satisfaction scores by 25% by working with management on finance-driven upgrades.

This version excels because it seamlessly links your achievements with quantifiable outcomes, providing a narrative of your impact. By integrating specific numbers like a 15% revenue increase, you're painting a clear picture of your contributions. The language naturally connects to the skills emphasized in the job ad, ensuring relevance. This connection creates a smooth flow as your structure highlights the benefits brought to the organization. Overall, each point builds upon the last, presenting a cohesive story of your professional value.

Industry-Specific Focus resume experience section

A club-focused accountant resume experience section should emphasize your expertise in financial management within a club setting. Start by showcasing experiences that highlight your skills in managing budgets and preparing accurate financial reports, as well as your ability to ensure compliance with financial regulations. Use bullet points to clearly outline your accomplishments, and quantify your successes to provide a tangible sense of your impact.

Each bullet point should use active language to demonstrate how you've effectively initiated, organized, or improved processes. This cohesive approach will clearly convey your qualifications to potential employers, emphasizing your expertise in club accounting tasks and showcasing your specialized industry knowledge.

Club Accountant

Sunset Valley Country Club

March 2018 - Present

- Managed a $2 million annual budget, optimizing spending and achieving a 15% cost reduction.

- Prepared detailed quarterly financial reports for board review, ensuring accuracy and clarity.

- Implemented a new accounting software system, reducing data entry errors by 30%.

- Oversaw monthly reconciliations, maintaining compliance with local regulatory standards.

Problem-Solving Focused resume experience section

A problem-solving-focused club accountant resume experience section should effectively highlight your expertise in addressing financial challenges. Start by showcasing how you've used your analytical skills alongside financial tools to enhance accounting procedures and boost the club's financial health. It's important to emphasize your role in improving financial reports and resolving discrepancies, illustrating how these actions positively impacted the club's finances. Connect these experiences to demonstrate your ability to spot inefficiencies and implement solutions that result in tangible benefits.

Ensure your bullet points begin with strong action verbs to clearly convey your achievements. By including specific accomplishments and quantifying them, you create a vivid picture of your impact and effectiveness. Tailor these points to mirror the essential skills needed for a club accountant, such as financial planning and risk management. Your aim is to present yourself as a proactive and resourceful individual, adept at navigating and resolving financial challenges with ease.

Club Accountant

Sunrise Community Club

January 2020 - Present

- Implemented a new budgeting system, reducing annual overspending by 15%.

- Identified discrepancies in monthly reports, leading to a recovery of $10,000 in lost funds.

- Streamlined financial processes, decreasing report preparation time by two days.

- Led a team to conduct a financial audit, uncovering $5,000 in redundant expenses.

Growth-Focused resume experience section

A growth-focused club accountant resume experience section should spotlight your key achievements that contributed to revenue increases. Begin by showcasing measurable outcomes you directly influenced, like boosting revenue or cutting costs. Use active verbs to describe your accomplishments, emphasizing how you enhanced the club's financial growth. Skills in budget management, financial reporting, and strategic planning are crucial, as they underline your capacity to drive revenue. This approach allows employers to quickly grasp your positive impact on a club's financial health.

When crafting bullet points, maintain clarity and brevity to effectively illustrate your direct involvement in achieving these results. Quantifying your accomplishments, such as stating revenue growth percentages or specific savings, bolsters your resume with solid evidence of success. Tailor each point to spotlight your achievements in the club accountant role by detailing specific projects or initiatives you led. By weaving facts and figures throughout, your resume will leave a lasting impression on hiring managers, demonstrating your ability to deliver financial gains.

Club Accountant

City Sports Club

March 2019 - Present

- Increased club revenue by 15% in a year through improved budget forecasting and expense monitoring.

- Implemented a new financial reporting system leading to a 30% reduction in errors.

- Negotiated vendor contracts saving the club $10,000 annually.

- Collaborated with department heads to create strategic financial plans, enhancing budget adherence by 20%.

Result-Focused resume experience section

A result-focused club accountant resume experience section should emphasize how your financial expertise has positively impacted the club. Start by showcasing specific achievements, like how your budget management skills have driven measurable outcomes, such as boosting revenue by a certain percentage. Using clear metrics helps employers quickly see the tangible benefits of your work.

Link your examples to improvements in financial processes or systems, highlighting your problem-solving skills and your commitment to enhancing the club's financial health. By keeping your language clear and centered on results, you make it easier for readers to understand your contributions and recognize their significance to the club's success.

Club Accountant

Sunset Valley Sports Club

June 2020 - Present

- Increased club revenue by 15% through careful budget management and uncovering new income sources.

- Streamlined the financial reporting process, which reduced monthly closing time by 25%.

- Implemented an automated transaction tracking system, improving accuracy by 30%.

- Conducted regular audits that resulted in a 20% reduction in unauthorized expenses.

Write your club accountant resume summary section

A well-crafted, experience-focused resume summary for a Club Accountant can set you apart by showcasing your unique mix of skills and achievements. It should succinctly convey who you are as a professional and emphasize your standout qualities. In the example provided, notice how the summary highlights years of focused experience and relevant skills. This gives employers a rapid understanding of your career highlights. It's vital to steer clear of vague statements, opting instead to spotlight measurable achievements. By tailoring your summary to fit the job description, you're making the most of the opportunity to highlight key attributes. It's important to avoid filler and rely instead on emphasizing expertise in critical tools or software. Focusing on outcomes such as efficiency boosts or cost reductions can add significant impact to your narrative. Recognize that while a resume summary suits those with ample experience, newcomers might opt for an objective to express future aspirations. In contrast, a summary of qualifications can efficiently list key skills, presenting them in a clear format. A resume profile serves as a blend of traits and achievements, offering depth. Choosing the right format ultimately defines your strengths, aligning them with your current career stage.

Listing your club accountant skills on your resume

A skills-focused club accountant resume should effectively showcase your abilities in financial management and bookkeeping, while clearly integrating these into your experience and summary sections. Highlighting your strengths and soft skills in the resume shows that you not only excel at collaborating with others but also possess the ability to manage financial details with precision. Pair this with well-defined hard skills acquired through training or experience, and you create a powerful set of resume keywords. These keywords ensure that your resume stands out to hiring managers seeking the perfect fit for their team.

A targeted skills section using these keywords can emphasize why you're an ideal candidate for the role. Here's an example:

Incorporating these vital skills into your resume serves as a spotlight on your core competencies, making sure they are clearly and effectively communicated.

Best hard skills to feature on your club accountant resume

For club accountants, hard skills are central to managing financial operations effectively. These skills ensure that you're capable of handling complex financial tasks with accuracy and expertise.

Hard Skills

- Financial software proficiency

- Financial reporting

- Budget management

- Accounts payable and receivable

- Tax preparation

- Financial analysis

- Payroll management

- Reconciliation

- Audit processes

- General ledger familiarity

- Financial forecasting

- Data analysis

- Cost accounting

- Risk management

- Compliance knowledge

Best soft skills to feature on your club accountant resume

Equally important, soft skills communicate your ability to thrive in collaborative environments and adapt to varying situations. They express how you will approach tasks and contribute positively within teams.

Soft Skills

- Communication

- Team collaboration

- Attention to detail

- Problem-solving

- Adaptability

- Time management

- Organizational skills

- Critical thinking

- Patience

- Leadership

- Negotiation

- Conflict resolution

- Dependability

- Initiative

- Decision-making

How to include your education on your resume

Crafting the education section of your club accountant resume is crucial. It's not just a formality; it highlights your foundation in relevant skills and knowledge. Tailoring this section to the job you're applying for ensures you showcase pertinent educational experiences. Leave out any unrelated education to keep your resume focused and compelling. Listing your GPA can be helpful if it's above 3.0, and you can write it as "GPA: 3.5/4.0". If you graduated with honors, such as cum laude, include this to demonstrate your academic excellence. To list a degree correctly, write the degree name, institution, and graduation date.

Here's an incorrect example of an education section:

Here's a strong example:

The second example is effective as it highlights a relevant degree in accounting, which is directly applicable to a club accountant role. This example also includes a strong GPA, showcasing academic achievement. Tailoring your education section in this way helps convey your qualifications clearly and efficiently, making it more attractive to hiring managers.

How to include club accountant certificates on your resume

Including a certificates section in a club accountant resume is essential to highlight your professional qualifications. Make sure to list the name of each certificate clearly. Include the date you earned each certificate to show your career timeline. Add the issuing organization for credibility. Ensure this section is easy to read and properly formatted. Certificates can also be included in the header for quick visibility. For example, you can write "CPA, Excel Specialist" next to your name.

A good certificates section should showcase relevant qualifications. For a club accountant, relevant certificates might include a CPA or certifications in financial software. Here is an ideal example of how to list your certificates:

This example is good because it includes critical and relevant credentials for a club accountant. Each entry lists the certificate's name, the issuing organization, and keeps everything organized, making it easy for hiring managers to verify your qualifications.

Extra sections to include in your club accountant resume

Creating a resume that truly stands out is essential for any job seeker, especially for a position like a club accountant. Your resume should showcase your skills, experience, and unique qualifications in a clear and organized manner. Certain sections can help you stand out from other candidates and show a more complete picture of who you are.

Language section — List any languages you speak fluently, as this can highlight your ability to work with diverse clientele and international aspects of the club. It also provides added value to your role because communication in multiple languages is often an asset in a global business environment.

Hobbies and interests section — Include activities that show you possess qualities beneficial to your role, such as analytical thinking, teamwork, or leadership. This helps to give employers a sense of your personality and reveals soft skills that may not be evident from your professional experience alone.

Volunteer work section — Detail your volunteer activities, emphasizing any tasks related to finance or management, as these underscore your commitment to community and practical experience in accounting. Volunteer work also indicates strong character and a willingness to go above and beyond your job responsibilities.

Books section — Mention relevant books on accounting, finance, or leadership that you have read recently, demonstrating your continuous learning and passion for the field. This shows that you stay updated with industry trends and are motivated to enhance your skill set independently.

Including these sections not only enriches your resume but also sets you apart in a competitive job market. By providing a well-rounded view of your abilities and interests, you make a strong case for why you are the ideal candidate for the club accountant position.

In Conclusion

In conclusion, crafting an exceptional club accountant resume is all about precision, clarity, and showcasing your unique skills and achievements in financial management. Your resume serves as your first impression to potential employers and should reflect your ability to manage club finances effectively. By utilizing structured resume templates, you can ensure that your experiences and accomplishments are presented in a clear and cohesive manner. Choosing the right resume format and meticulously organizing each section according to industry standards can significantly enhance your professional presentation.

Focusing on quantifiable achievements, such as budget management successes and financial reporting improvements, will strongly communicate your impact on financial health. Including both hard skills like financial software proficiency and soft skills such as team collaboration further highlights your ability to excel in multifaceted club environments. Tailoring your education section to emphasize relevant qualifications, such as a degree in accounting, reinforces your capability in handling the responsibilities of a club accountant role.

Moreover, showcasing relevant certificates, while including optional sections like volunteer work and language proficiency, can significantly bolster your resume. In doing so, you present yourself as a well-rounded, proactive professional committed to continuous learning and community involvement. These elements come together to ensure that your resume not only reflects your technical expertise but also your personal attributes that contribute to a club's financial success. By effectively integrating these strategies, you position yourself as a standout candidate in the competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.