Collections Representative Resume Examples

Mar 24, 2025

|

12 min read

Craft your collections representative resume to perfection. Highlight your skills with precision and make an outstanding impression. Read this guide to sharpen your skills so you can "collect" that dream job offer!

Rated by 348 people

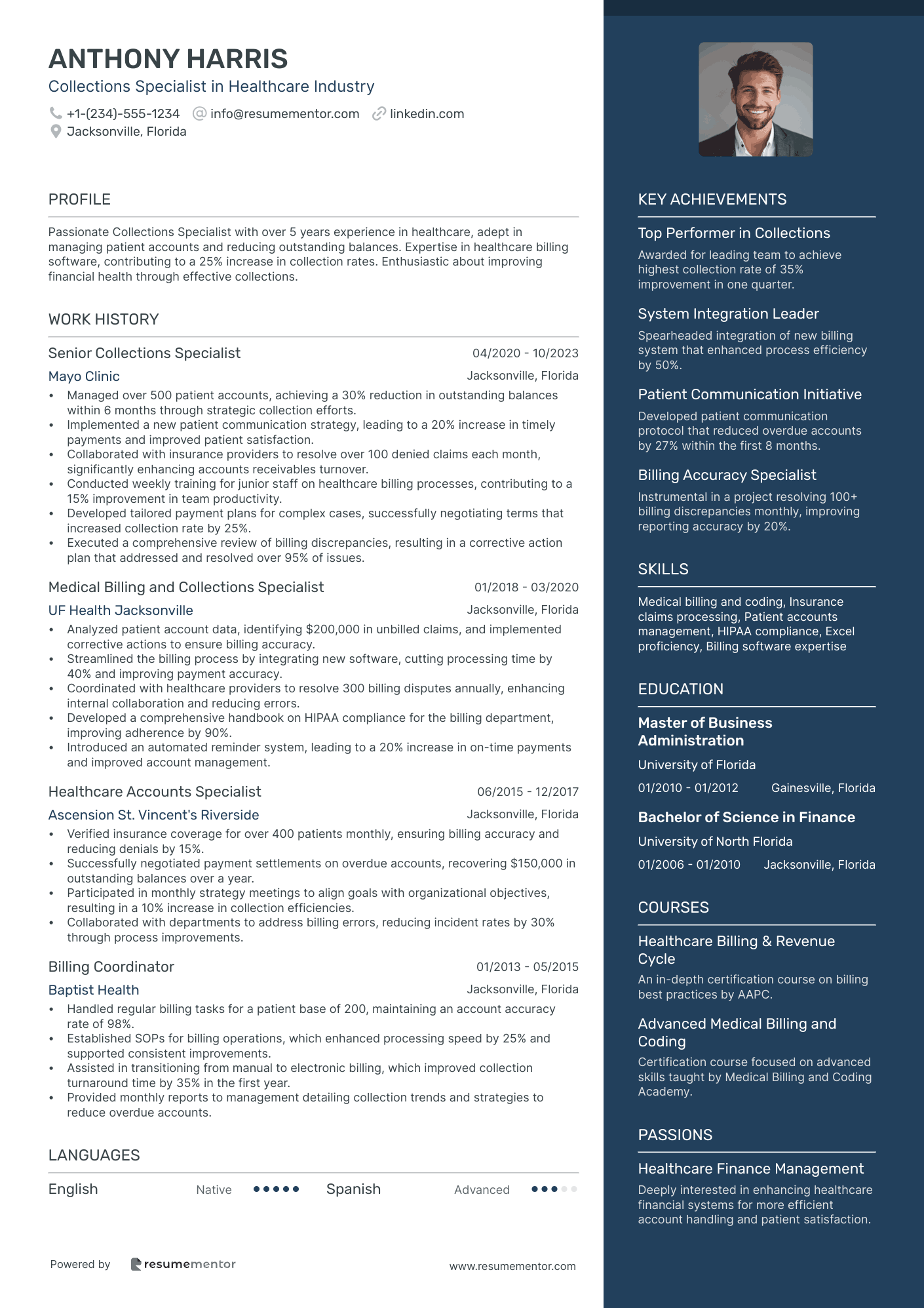

Collections Specialist in Healthcare Industry

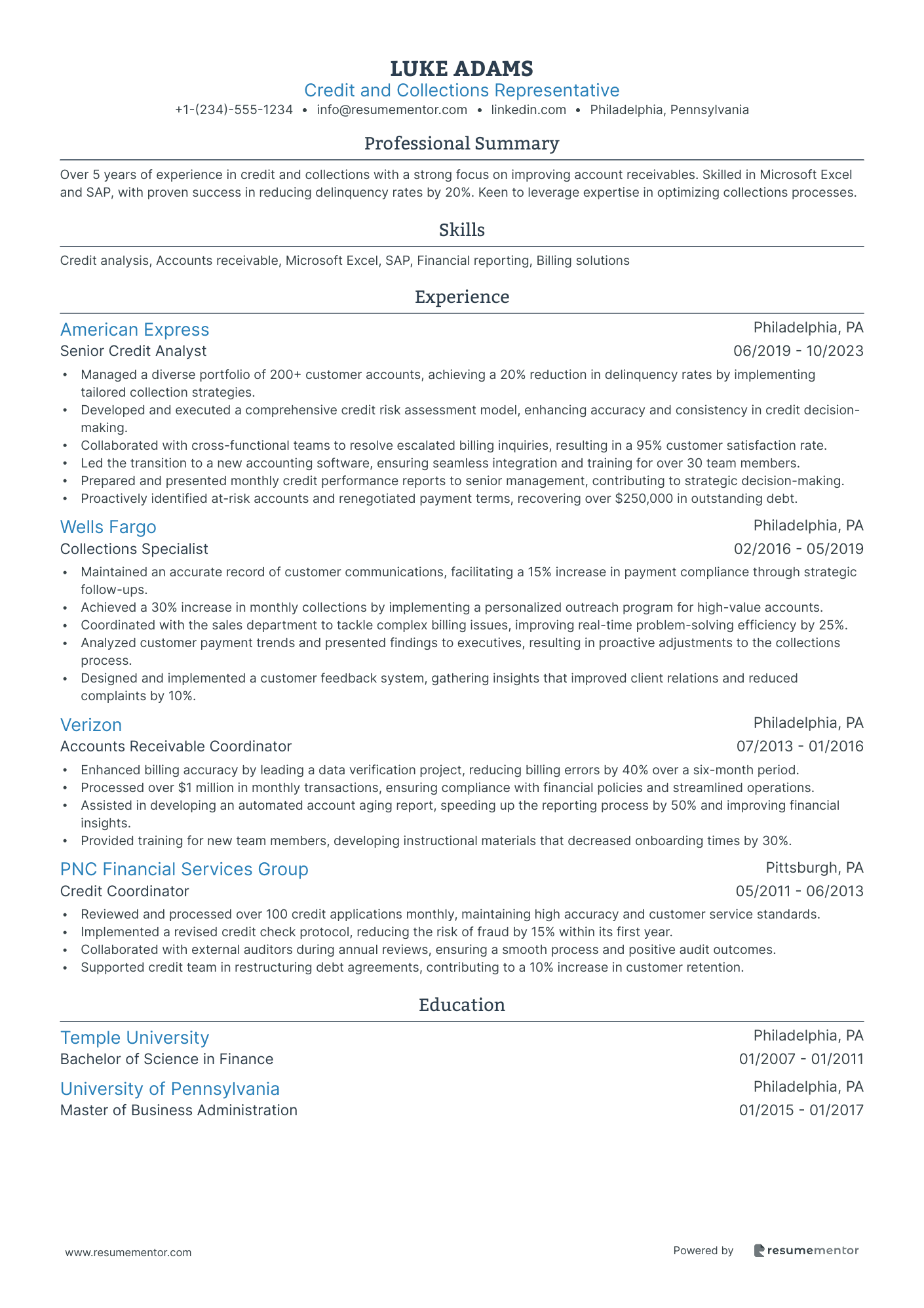

Credit and Collections Representative

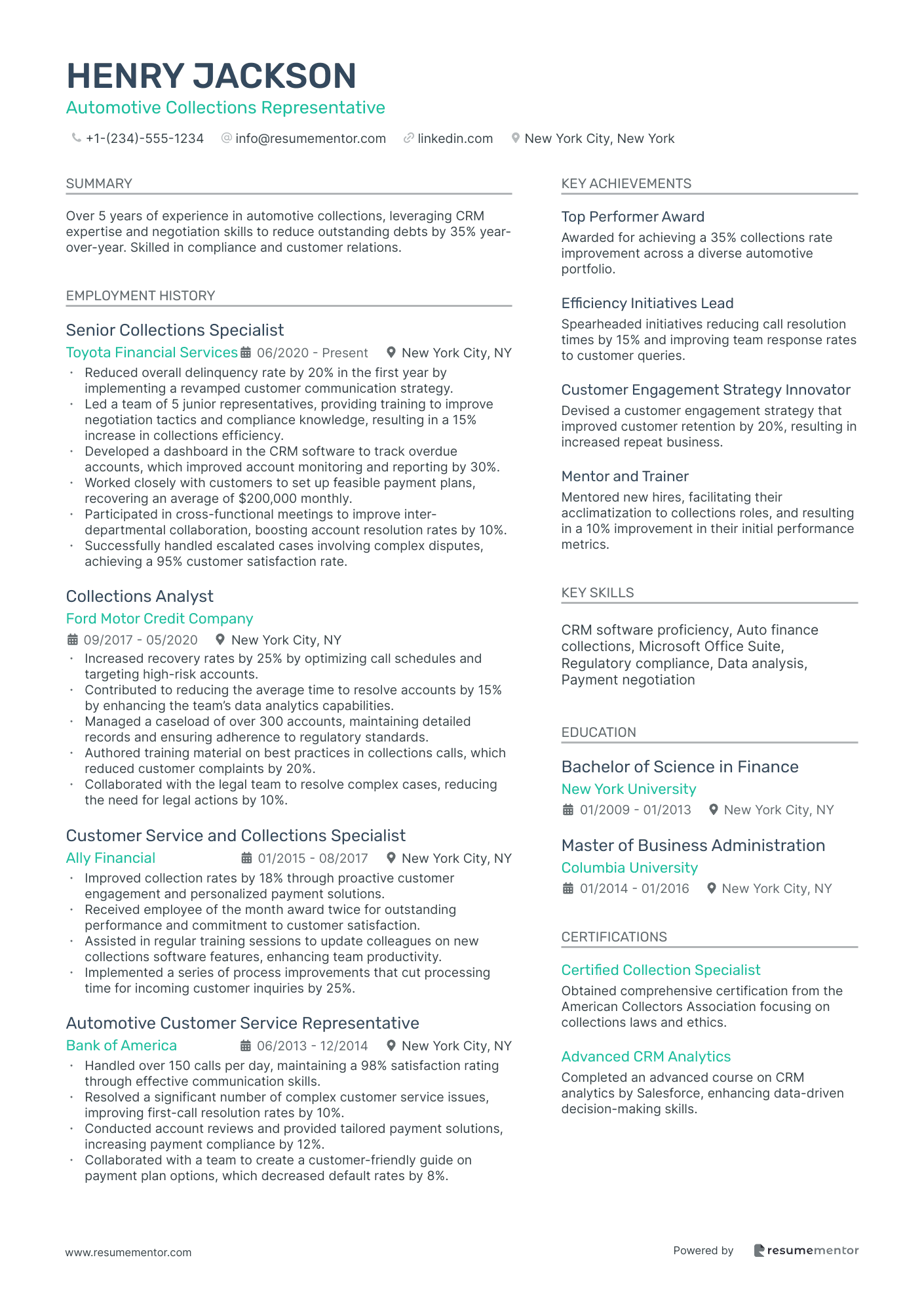

Automotive Collections Representative

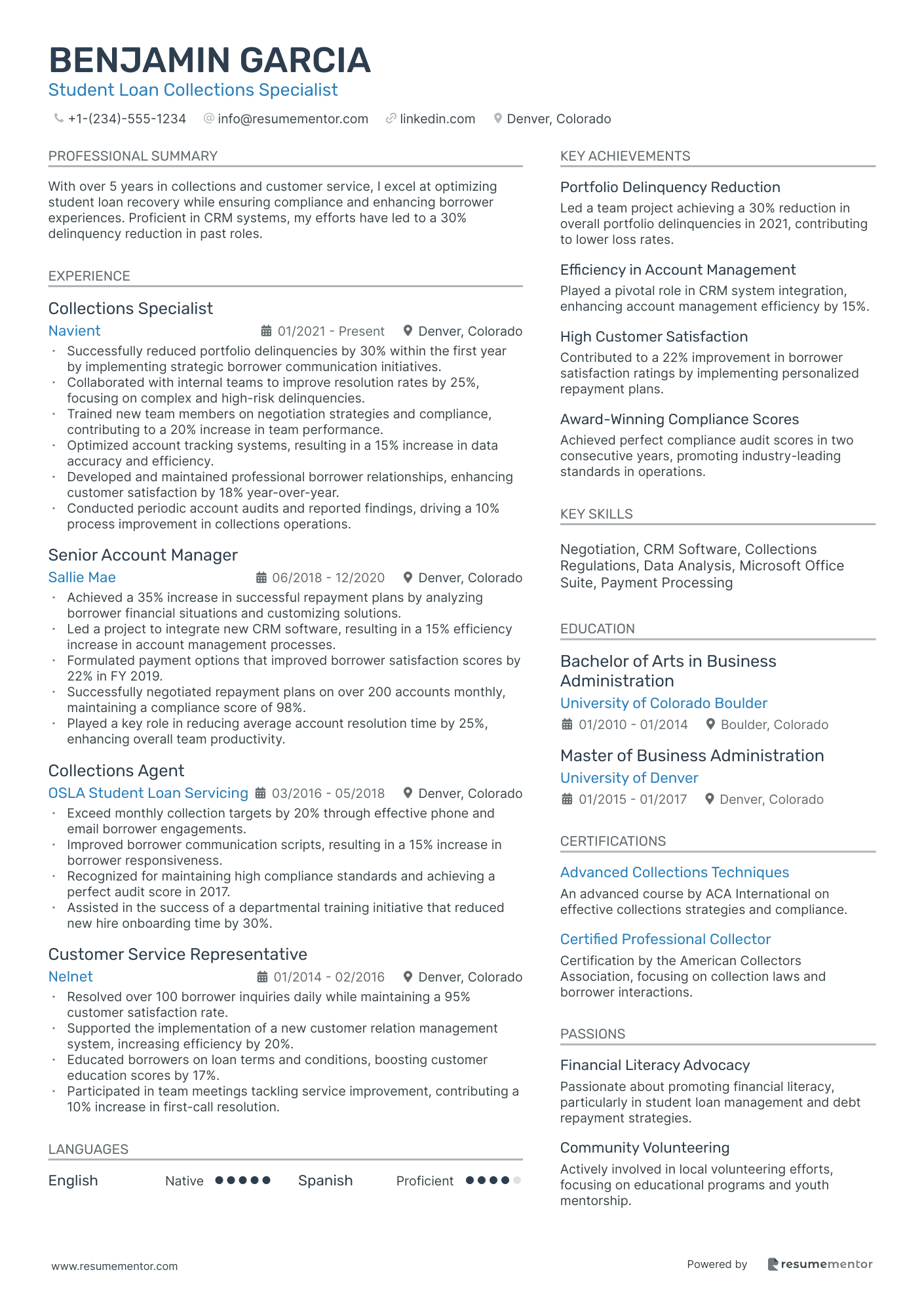

Student Loan Collections Specialist

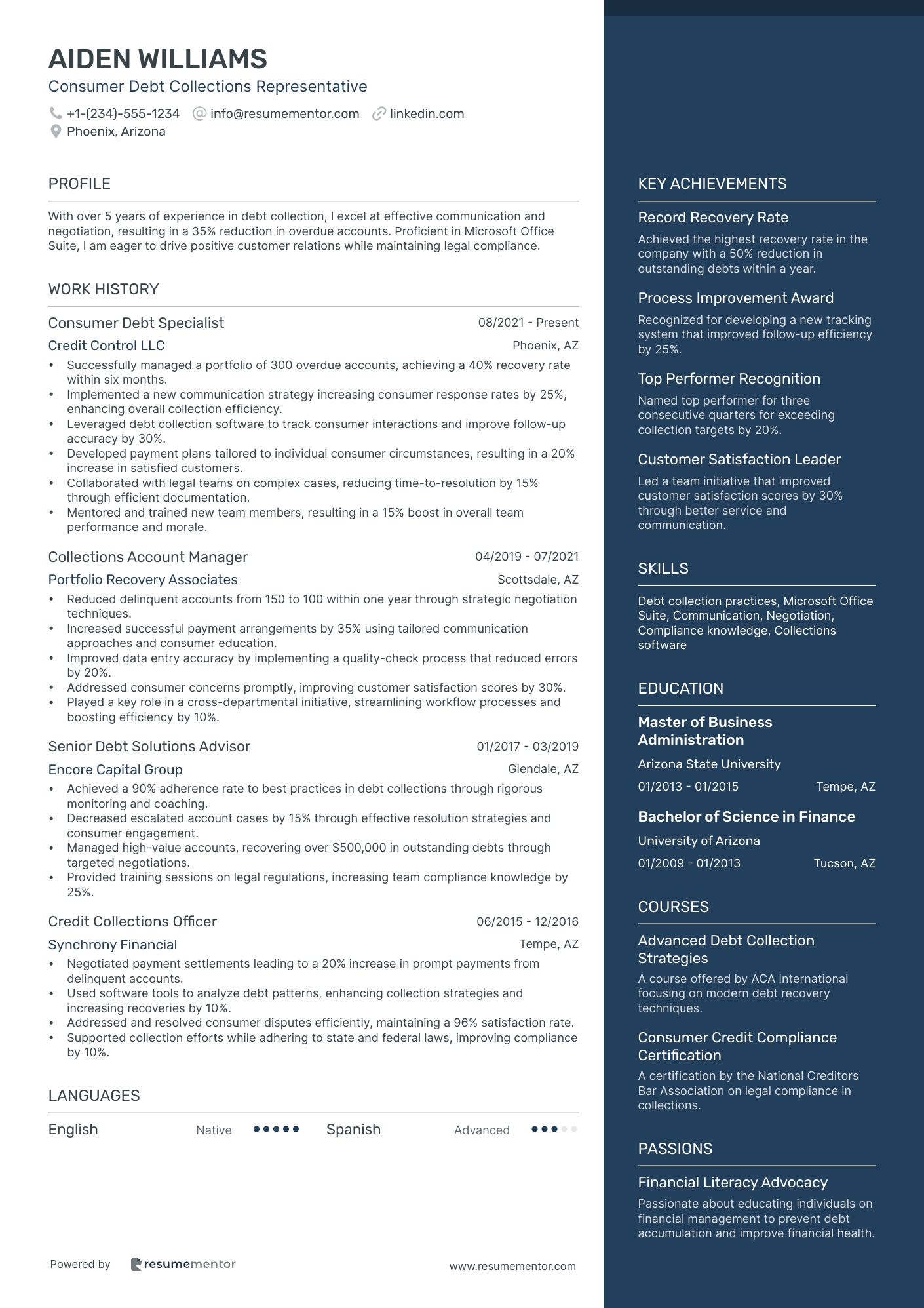

Consumer Debt Collections Representative

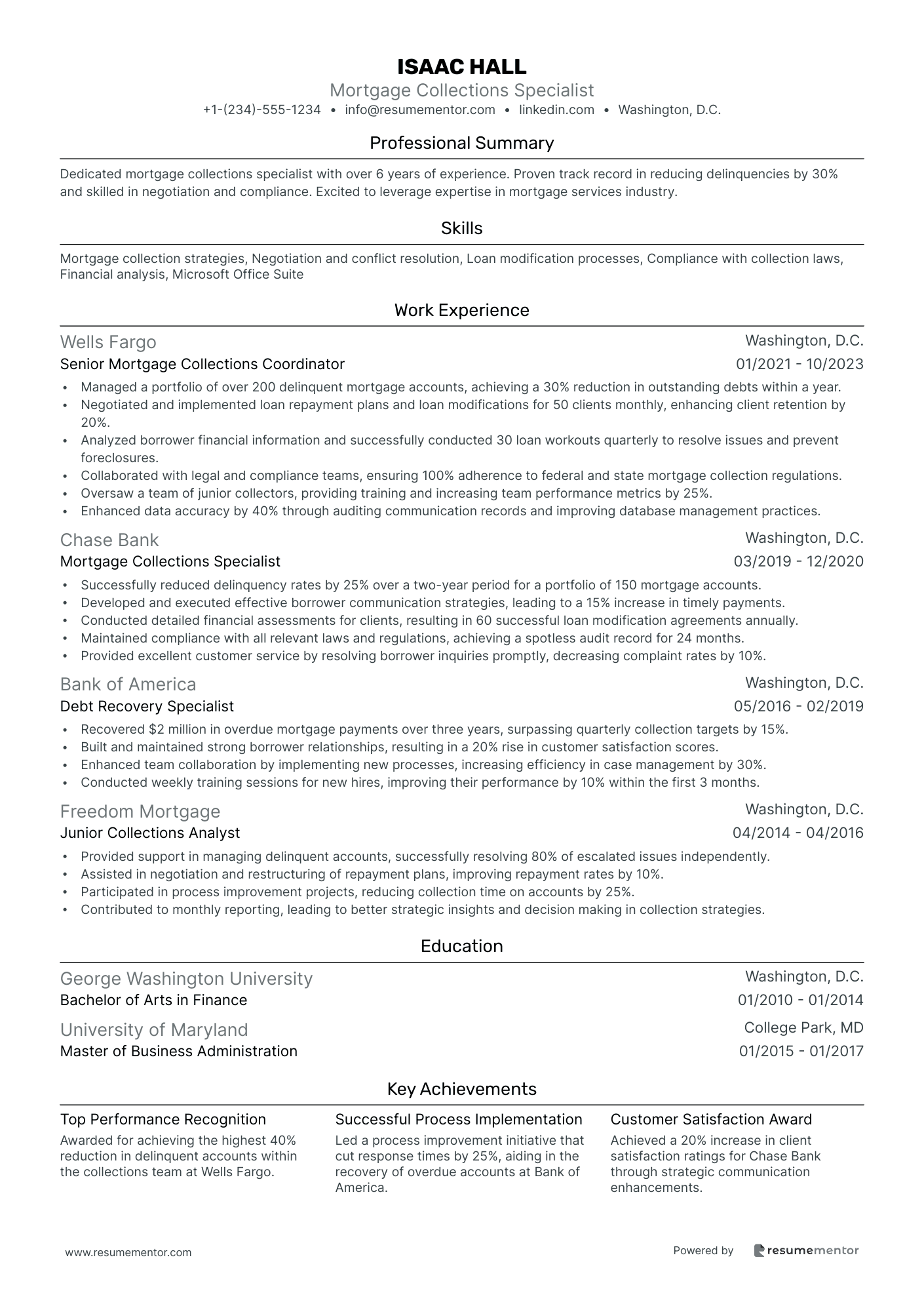

Mortgage Collections Specialist

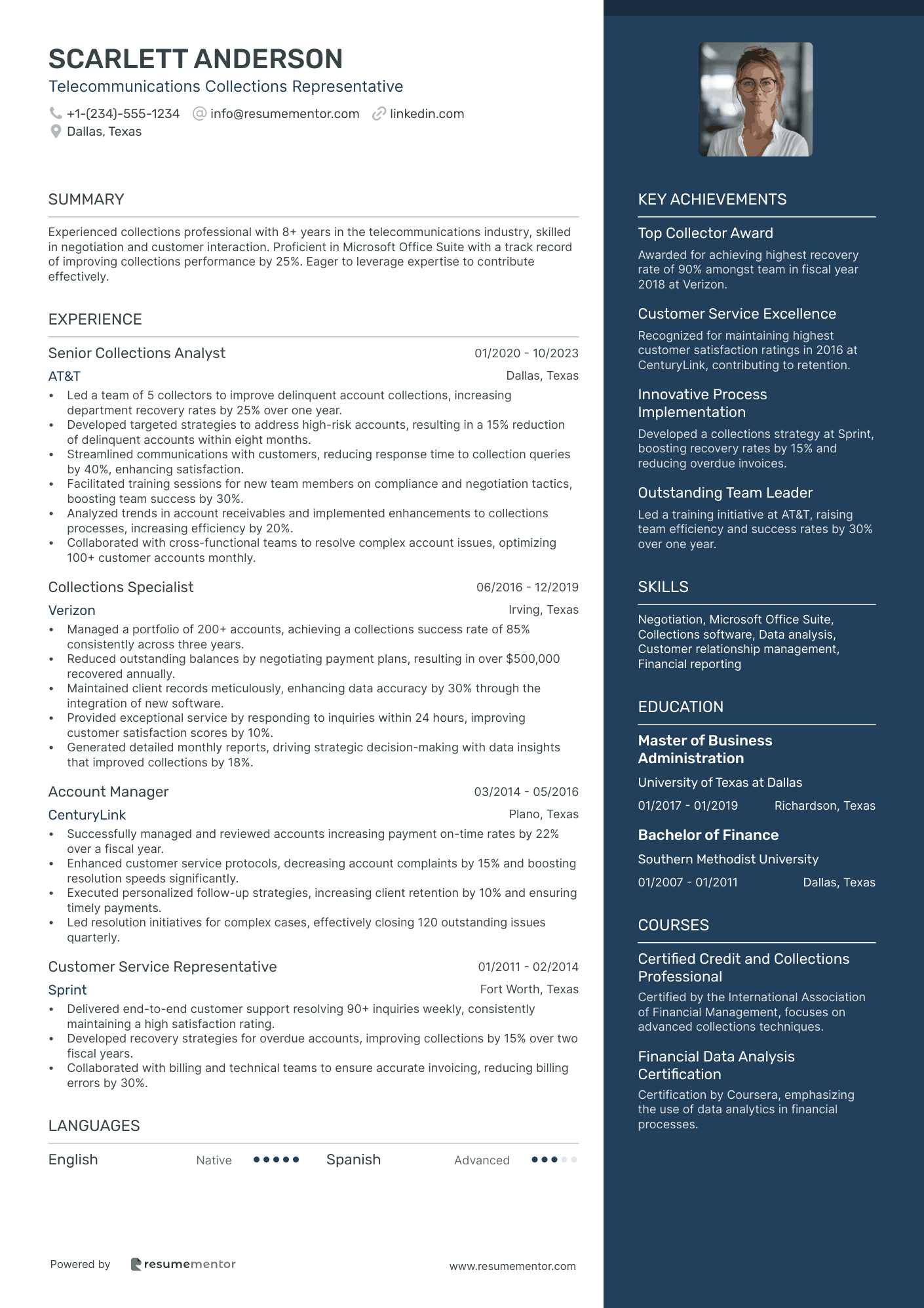

Telecommunications Collections Representative

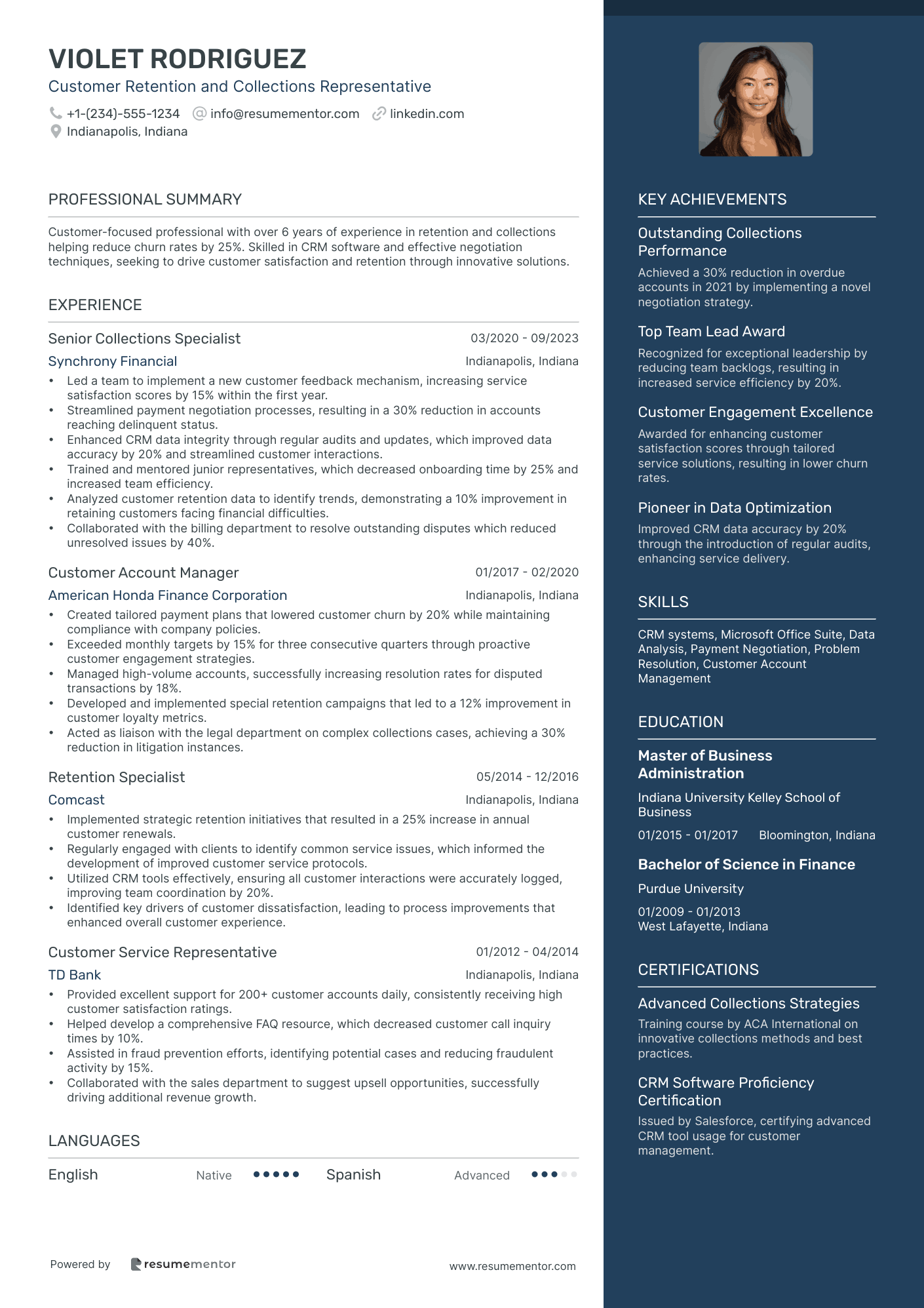

Customer Retention and Collections Representative

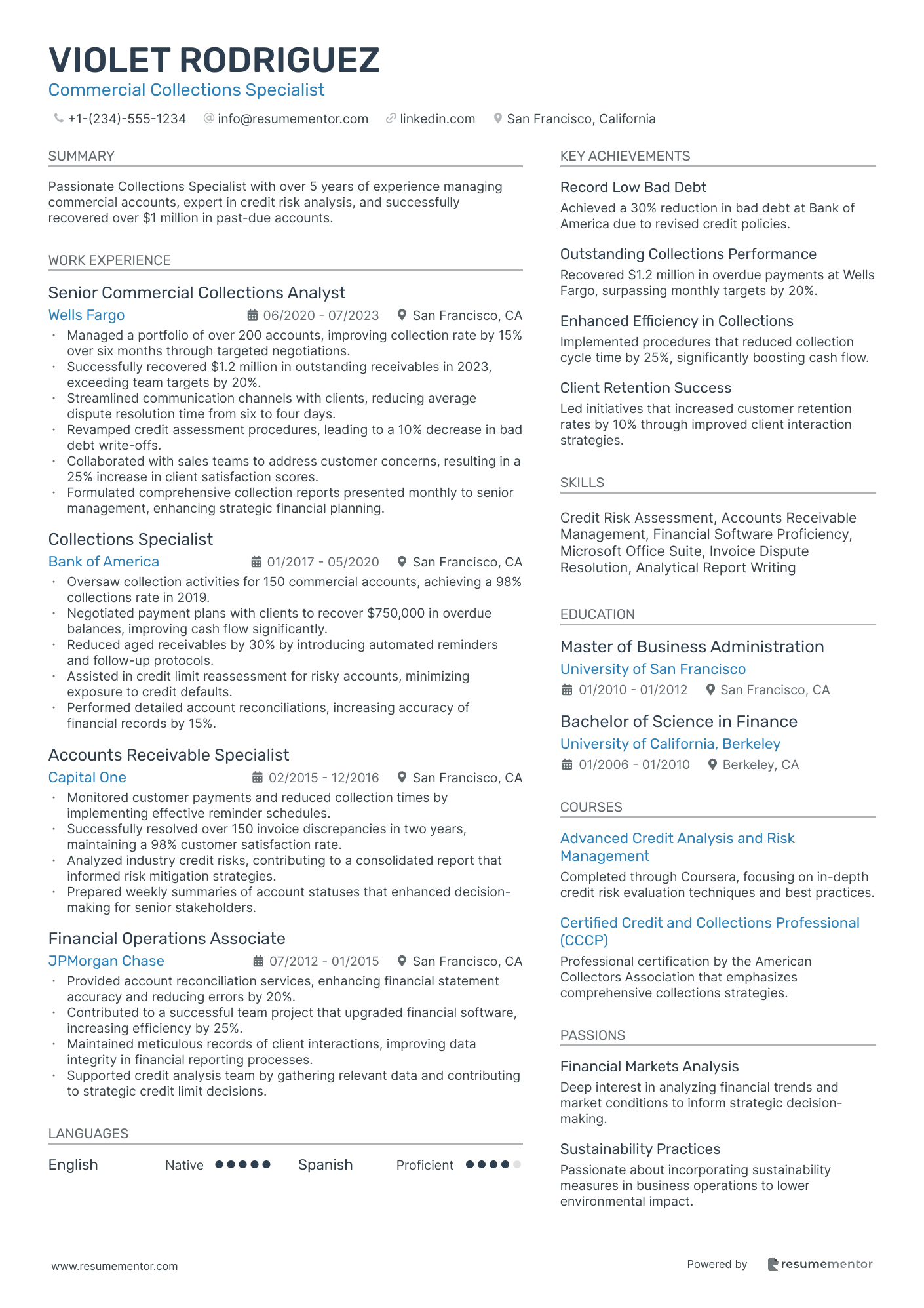

Commercial Collections Specialist

Collections and Recovery Agent in Banking Industry

Collections Specialist in Healthcare Industry resume sample

- •Managed over 500 patient accounts, achieving a 30% reduction in outstanding balances within 6 months through strategic collection efforts.

- •Implemented a new patient communication strategy, leading to a 20% increase in timely payments and improved patient satisfaction.

- •Collaborated with insurance providers to resolve over 100 denied claims each month, significantly enhancing accounts receivables turnover.

- •Conducted weekly training for junior staff on healthcare billing processes, contributing to a 15% improvement in team productivity.

- •Developed tailored payment plans for complex cases, successfully negotiating terms that increased collection rate by 25%.

- •Executed a comprehensive review of billing discrepancies, resulting in a corrective action plan that addressed and resolved over 95% of issues.

- •Analyzed patient account data, identifying $200,000 in unbilled claims, and implemented corrective actions to ensure billing accuracy.

- •Streamlined the billing process by integrating new software, cutting processing time by 40% and improving payment accuracy.

- •Coordinated with healthcare providers to resolve 300 billing disputes annually, enhancing internal collaboration and reducing errors.

- •Developed a comprehensive handbook on HIPAA compliance for the billing department, improving adherence by 90%.

- •Introduced an automated reminder system, leading to a 20% increase in on-time payments and improved account management.

- •Verified insurance coverage for over 400 patients monthly, ensuring billing accuracy and reducing denials by 15%.

- •Successfully negotiated payment settlements on overdue accounts, recovering $150,000 in outstanding balances over a year.

- •Participated in monthly strategy meetings to align goals with organizational objectives, resulting in a 10% increase in collection efficiencies.

- •Collaborated with departments to address billing errors, reducing incident rates by 30% through process improvements.

- •Handled regular billing tasks for a patient base of 200, maintaining an account accuracy rate of 98%.

- •Established SOPs for billing operations, which enhanced processing speed by 25% and supported consistent improvements.

- •Assisted in transitioning from manual to electronic billing, which improved collection turnaround time by 35% in the first year.

- •Provided monthly reports to management detailing collection trends and strategies to reduce overdue accounts.

Credit and Collections Representative resume sample

- •Managed a diverse portfolio of 200+ customer accounts, achieving a 20% reduction in delinquency rates by implementing tailored collection strategies.

- •Developed and executed a comprehensive credit risk assessment model, enhancing accuracy and consistency in credit decision-making.

- •Collaborated with cross-functional teams to resolve escalated billing inquiries, resulting in a 95% customer satisfaction rate.

- •Led the transition to a new accounting software, ensuring seamless integration and training for over 30 team members.

- •Prepared and presented monthly credit performance reports to senior management, contributing to strategic decision-making.

- •Proactively identified at-risk accounts and renegotiated payment terms, recovering over $250,000 in outstanding debt.

- •Maintained an accurate record of customer communications, facilitating a 15% increase in payment compliance through strategic follow-ups.

- •Achieved a 30% increase in monthly collections by implementing a personalized outreach program for high-value accounts.

- •Coordinated with the sales department to tackle complex billing issues, improving real-time problem-solving efficiency by 25%.

- •Analyzed customer payment trends and presented findings to executives, resulting in proactive adjustments to the collections process.

- •Designed and implemented a customer feedback system, gathering insights that improved client relations and reduced complaints by 10%.

- •Enhanced billing accuracy by leading a data verification project, reducing billing errors by 40% over a six-month period.

- •Processed over $1 million in monthly transactions, ensuring compliance with financial policies and streamlined operations.

- •Assisted in developing an automated account aging report, speeding up the reporting process by 50% and improving financial insights.

- •Provided training for new team members, developing instructional materials that decreased onboarding times by 30%.

- •Reviewed and processed over 100 credit applications monthly, maintaining high accuracy and customer service standards.

- •Implemented a revised credit check protocol, reducing the risk of fraud by 15% within its first year.

- •Collaborated with external auditors during annual reviews, ensuring a smooth process and positive audit outcomes.

- •Supported credit team in restructuring debt agreements, contributing to a 10% increase in customer retention.

Automotive Collections Representative resume sample

- •Reduced overall delinquency rate by 20% in the first year by implementing a revamped customer communication strategy.

- •Led a team of 5 junior representatives, providing training to improve negotiation tactics and compliance knowledge, resulting in a 15% increase in collections efficiency.

- •Developed a dashboard in the CRM software to track overdue accounts, which improved account monitoring and reporting by 30%.

- •Worked closely with customers to set up feasible payment plans, recovering an average of $200,000 monthly.

- •Participated in cross-functional meetings to improve inter-departmental collaboration, boosting account resolution rates by 10%.

- •Successfully handled escalated cases involving complex disputes, achieving a 95% customer satisfaction rate.

- •Increased recovery rates by 25% by optimizing call schedules and targeting high-risk accounts.

- •Contributed to reducing the average time to resolve accounts by 15% by enhancing the team’s data analytics capabilities.

- •Managed a caseload of over 300 accounts, maintaining detailed records and ensuring adherence to regulatory standards.

- •Authored training material on best practices in collections calls, which reduced customer complaints by 20%.

- •Collaborated with the legal team to resolve complex cases, reducing the need for legal actions by 10%.

- •Improved collection rates by 18% through proactive customer engagement and personalized payment solutions.

- •Received employee of the month award twice for outstanding performance and commitment to customer satisfaction.

- •Assisted in regular training sessions to update colleagues on new collections software features, enhancing team productivity.

- •Implemented a series of process improvements that cut processing time for incoming customer inquiries by 25%.

- •Handled over 150 calls per day, maintaining a 98% satisfaction rating through effective communication skills.

- •Resolved a significant number of complex customer service issues, improving first-call resolution rates by 10%.

- •Conducted account reviews and provided tailored payment solutions, increasing payment compliance by 12%.

- •Collaborated with a team to create a customer-friendly guide on payment plan options, which decreased default rates by 8%.

Student Loan Collections Specialist resume sample

- •Successfully reduced portfolio delinquencies by 30% within the first year by implementing strategic borrower communication initiatives.

- •Collaborated with internal teams to improve resolution rates by 25%, focusing on complex and high-risk delinquencies.

- •Trained new team members on negotiation strategies and compliance, contributing to a 20% increase in team performance.

- •Optimized account tracking systems, resulting in a 15% increase in data accuracy and efficiency.

- •Developed and maintained professional borrower relationships, enhancing customer satisfaction by 18% year-over-year.

- •Conducted periodic account audits and reported findings, driving a 10% process improvement in collections operations.

- •Achieved a 35% increase in successful repayment plans by analyzing borrower financial situations and customizing solutions.

- •Led a project to integrate new CRM software, resulting in a 15% efficiency increase in account management processes.

- •Formulated payment options that improved borrower satisfaction scores by 22% in FY 2019.

- •Successfully negotiated repayment plans on over 200 accounts monthly, maintaining a compliance score of 98%.

- •Played a key role in reducing average account resolution time by 25%, enhancing overall team productivity.

- •Exceed monthly collection targets by 20% through effective phone and email borrower engagements.

- •Improved borrower communication scripts, resulting in a 15% increase in borrower responsiveness.

- •Recognized for maintaining high compliance standards and achieving a perfect audit score in 2017.

- •Assisted in the success of a departmental training initiative that reduced new hire onboarding time by 30%.

- •Resolved over 100 borrower inquiries daily while maintaining a 95% customer satisfaction rate.

- •Supported the implementation of a new customer relation management system, increasing efficiency by 20%.

- •Educated borrowers on loan terms and conditions, boosting customer education scores by 17%.

- •Participated in team meetings tackling service improvement, contributing a 10% increase in first-call resolution.

Consumer Debt Collections Representative resume sample

- •Successfully managed a portfolio of 300 overdue accounts, achieving a 40% recovery rate within six months.

- •Implemented a new communication strategy increasing consumer response rates by 25%, enhancing overall collection efficiency.

- •Leveraged debt collection software to track consumer interactions and improve follow-up accuracy by 30%.

- •Developed payment plans tailored to individual consumer circumstances, resulting in a 20% increase in satisfied customers.

- •Collaborated with legal teams on complex cases, reducing time-to-resolution by 15% through efficient documentation.

- •Mentored and trained new team members, resulting in a 15% boost in overall team performance and morale.

- •Reduced delinquent accounts from 150 to 100 within one year through strategic negotiation techniques.

- •Increased successful payment arrangements by 35% using tailored communication approaches and consumer education.

- •Improved data entry accuracy by implementing a quality-check process that reduced errors by 20%.

- •Addressed consumer concerns promptly, improving customer satisfaction scores by 30%.

- •Played a key role in a cross-departmental initiative, streamlining workflow processes and boosting efficiency by 10%.

- •Achieved a 90% adherence rate to best practices in debt collections through rigorous monitoring and coaching.

- •Decreased escalated account cases by 15% through effective resolution strategies and consumer engagement.

- •Managed high-value accounts, recovering over $500,000 in outstanding debts through targeted negotiations.

- •Provided training sessions on legal regulations, increasing team compliance knowledge by 25%.

- •Negotiated payment settlements leading to a 20% increase in prompt payments from delinquent accounts.

- •Used software tools to analyze debt patterns, enhancing collection strategies and increasing recoveries by 10%.

- •Addressed and resolved consumer disputes efficiently, maintaining a 96% satisfaction rate.

- •Supported collection efforts while adhering to state and federal laws, improving compliance by 10%.

Mortgage Collections Specialist resume sample

- •Managed a portfolio of over 200 delinquent mortgage accounts, achieving a 30% reduction in outstanding debts within a year.

- •Negotiated and implemented loan repayment plans and loan modifications for 50 clients monthly, enhancing client retention by 20%.

- •Analyzed borrower financial information and successfully conducted 30 loan workouts quarterly to resolve issues and prevent foreclosures.

- •Collaborated with legal and compliance teams, ensuring 100% adherence to federal and state mortgage collection regulations.

- •Oversaw a team of junior collectors, providing training and increasing team performance metrics by 25%.

- •Enhanced data accuracy by 40% through auditing communication records and improving database management practices.

- •Successfully reduced delinquency rates by 25% over a two-year period for a portfolio of 150 mortgage accounts.

- •Developed and executed effective borrower communication strategies, leading to a 15% increase in timely payments.

- •Conducted detailed financial assessments for clients, resulting in 60 successful loan modification agreements annually.

- •Maintained compliance with all relevant laws and regulations, achieving a spotless audit record for 24 months.

- •Provided excellent customer service by resolving borrower inquiries promptly, decreasing complaint rates by 10%.

- •Recovered $2 million in overdue mortgage payments over three years, surpassing quarterly collection targets by 15%.

- •Built and maintained strong borrower relationships, resulting in a 20% rise in customer satisfaction scores.

- •Enhanced team collaboration by implementing new processes, increasing efficiency in case management by 30%.

- •Conducted weekly training sessions for new hires, improving their performance by 10% within the first 3 months.

- •Provided support in managing delinquent accounts, successfully resolving 80% of escalated issues independently.

- •Assisted in negotiation and restructuring of repayment plans, improving repayment rates by 10%.

- •Participated in process improvement projects, reducing collection time on accounts by 25%.

- •Contributed to monthly reporting, leading to better strategic insights and decision making in collection strategies.

Telecommunications Collections Representative resume sample

- •Led a team of 5 collectors to improve delinquent account collections, increasing department recovery rates by 25% over one year.

- •Developed targeted strategies to address high-risk accounts, resulting in a 15% reduction of delinquent accounts within eight months.

- •Streamlined communications with customers, reducing response time to collection queries by 40%, enhancing satisfaction.

- •Facilitated training sessions for new team members on compliance and negotiation tactics, boosting team success by 30%.

- •Analyzed trends in account receivables and implemented enhancements to collections processes, increasing efficiency by 20%.

- •Collaborated with cross-functional teams to resolve complex account issues, optimizing 100+ customer accounts monthly.

- •Managed a portfolio of 200+ accounts, achieving a collections success rate of 85% consistently across three years.

- •Reduced outstanding balances by negotiating payment plans, resulting in over $500,000 recovered annually.

- •Maintained client records meticulously, enhancing data accuracy by 30% through the integration of new software.

- •Provided exceptional service by responding to inquiries within 24 hours, improving customer satisfaction scores by 10%.

- •Generated detailed monthly reports, driving strategic decision-making with data insights that improved collections by 18%.

- •Successfully managed and reviewed accounts increasing payment on-time rates by 22% over a fiscal year.

- •Enhanced customer service protocols, decreasing account complaints by 15% and boosting resolution speeds significantly.

- •Executed personalized follow-up strategies, increasing client retention by 10% and ensuring timely payments.

- •Led resolution initiatives for complex cases, effectively closing 120 outstanding issues quarterly.

- •Delivered end-to-end customer support resolving 90+ inquiries weekly, consistently maintaining a high satisfaction rating.

- •Developed recovery strategies for overdue accounts, improving collections by 15% over two fiscal years.

- •Collaborated with billing and technical teams to ensure accurate invoicing, reducing billing errors by 30%.

Customer Retention and Collections Representative resume sample

- •Led a team to implement a new customer feedback mechanism, increasing service satisfaction scores by 15% within the first year.

- •Streamlined payment negotiation processes, resulting in a 30% reduction in accounts reaching delinquent status.

- •Enhanced CRM data integrity through regular audits and updates, which improved data accuracy by 20% and streamlined customer interactions.

- •Trained and mentored junior representatives, which decreased onboarding time by 25% and increased team efficiency.

- •Analyzed customer retention data to identify trends, demonstrating a 10% improvement in retaining customers facing financial difficulties.

- •Collaborated with the billing department to resolve outstanding disputes which reduced unresolved issues by 40%.

- •Created tailored payment plans that lowered customer churn by 20% while maintaining compliance with company policies.

- •Exceeded monthly targets by 15% for three consecutive quarters through proactive customer engagement strategies.

- •Managed high-volume accounts, successfully increasing resolution rates for disputed transactions by 18%.

- •Developed and implemented special retention campaigns that led to a 12% improvement in customer loyalty metrics.

- •Acted as liaison with the legal department on complex collections cases, achieving a 30% reduction in litigation instances.

- •Implemented strategic retention initiatives that resulted in a 25% increase in annual customer renewals.

- •Regularly engaged with clients to identify common service issues, which informed the development of improved customer service protocols.

- •Utilized CRM tools effectively, ensuring all customer interactions were accurately logged, improving team coordination by 20%.

- •Identified key drivers of customer dissatisfaction, leading to process improvements that enhanced overall customer experience.

- •Provided excellent support for 200+ customer accounts daily, consistently receiving high customer satisfaction ratings.

- •Helped develop a comprehensive FAQ resource, which decreased customer call inquiry times by 10%.

- •Assisted in fraud prevention efforts, identifying potential cases and reducing fraudulent activity by 15%.

- •Collaborated with the sales department to suggest upsell opportunities, successfully driving additional revenue growth.

Commercial Collections Specialist resume sample

- •Managed a portfolio of over 200 accounts, improving collection rate by 15% over six months through targeted negotiations.

- •Successfully recovered $1.2 million in outstanding receivables in 2023, exceeding team targets by 20%.

- •Streamlined communication channels with clients, reducing average dispute resolution time from six to four days.

- •Revamped credit assessment procedures, leading to a 10% decrease in bad debt write-offs.

- •Collaborated with sales teams to address customer concerns, resulting in a 25% increase in client satisfaction scores.

- •Formulated comprehensive collection reports presented monthly to senior management, enhancing strategic financial planning.

- •Oversaw collection activities for 150 commercial accounts, achieving a 98% collections rate in 2019.

- •Negotiated payment plans with clients to recover $750,000 in overdue balances, improving cash flow significantly.

- •Reduced aged receivables by 30% by introducing automated reminders and follow-up protocols.

- •Assisted in credit limit reassessment for risky accounts, minimizing exposure to credit defaults.

- •Performed detailed account reconciliations, increasing accuracy of financial records by 15%.

- •Monitored customer payments and reduced collection times by implementing effective reminder schedules.

- •Successfully resolved over 150 invoice discrepancies in two years, maintaining a 98% customer satisfaction rate.

- •Analyzed industry credit risks, contributing to a consolidated report that informed risk mitigation strategies.

- •Prepared weekly summaries of account statuses that enhanced decision-making for senior stakeholders.

- •Provided account reconciliation services, enhancing financial statement accuracy and reducing errors by 20%.

- •Contributed to a successful team project that upgraded financial software, increasing efficiency by 25%.

- •Maintained meticulous records of client interactions, improving data integrity in financial reporting processes.

- •Supported credit analysis team by gathering relevant data and contributing to strategic credit limit decisions.

Collections and Recovery Agent in Banking Industry resume sample

- •Led a team of 5 agents in recovering outstanding debts, achieving a 30% reduction in delinquency rate over 12 months.

- •Implemented a revised negotiation strategy that increased successful payment arrangements by 20% quarter over quarter.

- •Maintained detailed and precise records in the collections system, resulting in improved compliance and audit scores.

- •Analyzed customer accounts and developed tailored payment plans, increasing client satisfaction by 15% in six months.

- •Trained and mentored new employees in best practices, reducing onboarding time by 25% through comprehensive training modules.

- •Collaborated with cross-functional teams to enhance recovery processes, contributing to a 10% rise in recovery rates.

- •Negotiated and secured payment arrangements with clients, enhancing recovery performance by 15% year over year.

- •Developed automated communication procedures improving customer outreach by 30% and decreasing average collectability time by 10 days.

- •Coordinated with the legal department to enforce compliance standards, minimizing regulatory disputes to less than 1% annually.

- •Evaluated and improved collections software use, increasing efficiency of daily operations by streamlining data entry processes.

- •Communicated effectively with customers regarding their accounts, boosting positive client feedback and reducing complaints by 20%.

- •Provided expert advice on debt management and recovery, achieving a reduction in client debt levels across 80% of portfolios.

- •Supported a diverse client base with problem-solving strategies, improving customer loan repayment rates by 18% within a year.

- •Configured client account setups to enhance financial stability, increasing satisfaction levels and promoting long-term banking relationships.

- •Prepared accurate financial reports analyzing team performance metrics, leading to strategic enhancements in service offerings.

- •Conducted in-depth analysis of delinquent accounts, creating a recovery strategy that decreased bad debt by over 25%.

- •Assisted in software implementation for collections tracking, enhancing traceability and improving departmental accountability.

- •Worked closely with senior management to develop collections targets, meeting or exceeding goals consistently over a 2-year period.

Crafting a collections representative resume can feel like untangling a web where every detail must align perfectly, guiding you through the job search maze. In this journey, effectively highlighting your skills is crucial, especially in areas like debt recovery and negotiation. Yet, how do you weave in the finer details of your professional story, ensuring it captivates potential employers? A well-structured resume serves as your map, leading you confidently through the market.

Listing critical skills like communication and problem-solving is a start, but including technical expertise specific to collections work sets you apart. Mentioning knowledge of credit scoring software and customer relationship management systems can strengthen your application, highlighting your capability in handling industry-specific tools. To ensure each detail carries weight, structuring your resume becomes essential—and that's where using a resume template can truly make a difference.

With a resume template, you can concentrate on what truly matters in your writing, like having the right tools to construct a solid narrative. This approach ensures each part of your professional journey shines, helping you stand out to employers without worrying about format. Check out these resume templates for a clear path forward.

Ultimately, your resume should do more than list duties; it should tell your story as a collections representative determined to make an impact. Let your experiences illuminate the path to your next opportunity.

Key Takeaways

- Emphasize critical skills such as debt recovery, negotiation, communication, and technical abilities, making your resume stand out by incorporating specific industry-related software knowledge like credit scoring and CRM systems.

- Utilize resume templates to ensure a clear structure and format, allowing you to focus on effectively conveying each aspect of your professional journey to potential employers.

- Adopt a chronological resume format to map your professional growth, utilizing modern fonts and ensuring the document is saved as a PDF for consistent viewing across devices.

- Quantify achievements in your experience section with action verbs, revealing your potential fit through detailed success stories in debt recovery and account management.

- Highlight soft and hard skills relevant to collection work, including communication, negotiation, billing systems expertise, and add sections on language fluency and volunteer experience to present a well-rounded professional image.

What to focus on when writing your collections representative resume

Your collections representative resume should clearly communicate your skills in debt recovery and customer communication to the recruiter. Begin by highlighting how you effectively negotiate while maintaining positive relationships with customers, showing that you understand complex financial regulations and have a strong record in managing accounts.

How to structure your collections representative resume

- Contact Information — Make sure all your details, like full name, phone number, email address, and LinkedIn profile, are current and professional. This forms the basis of your introduction to potential employers, so ensure your contact information stands out for its clarity and precision. Remove any outdated or informal elements to present yourself as a responsible and approachable candidate.

- Professional Summary — Provide a succinct but powerful overview of your experience and strengths in collections. Emphasize skills that are pivotal in this sector, such as adept negotiation techniques, robust customer relationship management, and a solid grasp of financial regulations. This summary should quickly convey to the recruiter that you have the core competencies needed for success.

- Work Experience — As you detail your past roles, focus on showcasing achievements that demonstrate your capabilities. Highlight the ways you exceeded collection targets, handled a high volume of accounts, and improved recovery rates by using strong action verbs. This section is essential for providing tangible evidence of your skills and the direct value you bring to potential employers.

- Skills — Reinforce your strengths by listing abilities like debt collection, effective communication, negotiation skills, and knowledge of collection software and legal rules. These skills are critical for overcoming the everyday challenges you will face in collections, making them a core part of your resume's appeal.

- Education — List any relevant degrees or certifications. A high school diploma serves as a foundation, but a degree in finance, business, or similar fields can elevate your profile, illustrating your dedication to the discipline and enhancing your credibility in the eyes of recruiters.

- Certifications — Mention specialized certifications, such as ACA International's Professional Collection Specialist designation, to underscore your expertise and dedication to professional growth. Certifications add weight to your resume by showing you're committed to ongoing education and improvement.

Consider adding optional sections like languages spoken or volunteer experience to provide a fuller picture of your abilities and personality. These extras can enhance the overall impact of your resume. Now, let's explore the resume format in more depth and cover each section in detail below.

Which resume format to choose

Choosing the right resume format is key to highlighting your experience as a collections representative. A chronological format is ideal because it clearly maps out your professional journey, showcasing your skills and growth in handling collections over time. This format helps potential employers easily assess your qualifications and experience.

Selecting the right font can also significantly impact how your resume is perceived. Fonts like Rubic, Lato, or Montserrat provide a modern and polished look that aligns with today’s design trends. They ensure that your resume is easy to read and gives off a professional vibe, which is crucial when trying to make a strong first impression.

When it comes to saving your resume, always choose the PDF format. PDFs preserve your layout and chosen fonts, ensuring that your resume looks consistent on any device or printer. This reliability is critical when applying for jobs, as it ensures your resume is viewed exactly how you intended.

Finally, consider your margins carefully. Between 0.5 to 1 inch on each side is ideal. This space not only makes your document look cleaner but also ensures your information is well-organized and easy to navigate. A tidy layout can make a positive impact by showing your attention to detail, an important trait for a collections representative.

By thoughtfully considering format, fonts, file type, and margins, you craft a resume that effectively communicates your professionalism, experience, and suitability for a role in collections.

How to write a quantifiable resume experience section

A standout collections representative resume experience section effectively highlights your successes and skills, demonstrating how you've benefited past employers. With a focus on quantifiable achievements and action verbs, it paints a clear picture of your abilities in recovering debts, negotiating payment terms, and resolving disputes. This part of your resume serves as a bridge for hiring managers to understand your background in collections, illustrating your potential fit for their company. Organizing your experiences chronologically, starting with the most recent, and including relevant roles from the past 10-15 years ensures clarity and relevance. By using job titles that align with the collections field, even if your role wasn’t strictly labeled as "Collections Representative," you keep the focus sharp. This tailoring allows you to mirror the language and requirements from the job ad, using action words like "achieved," "managed," and "improved" to highlight your contributions effectively.

- •Boosted collection rates by 25% in the first year through strategic negotiation and building relationships.

- •Resolved over 50 customer disputes monthly, hitting a 90% satisfaction rate.

- •Cut outstanding debts by $250,000 in just 12 months with efficient follow-up schedules.

- •Trained and mentored a team of 10 junior collectors, improving overall performance by 30%.

This experience section excels by cohesively showcasing measurable achievements and employing clear action verbs, thus making your contributions tangible and impressive. Each bullet point seamlessly flows into the next, detailing specific accomplishments like boosting collection rates and reducing debts, which are crucial skills for collections representatives. The use of metrics throughout solidifies the impact of your work, underscoring it in a way that resonates with hiring managers. This language not only matches industry expectations but aligns your past successes with the skills and qualities potential employers are actively seeking, making it a powerful component of your resume.

Efficiency-Focused resume experience section

An efficiency-focused collections representative resume experience section should clearly showcase your ability to handle account volumes, reduce outstanding debts, and streamline communication processes. It’s important to use straightforward language to describe how you successfully reduced overdue accounts and improved customer relationships. By quantifying your achievements with specific numbers and percentages, you provide potential employers with a tangible sense of your impact. Demonstrating your skills in negotiating repayment terms, analyzing customer data for better outcomes, and leveraging technology can further highlight your efficiency.

Start each bullet with a strong action verb that directly relates to improving efficiency. Share instances where you exceeded targets, embraced innovative practices, or trained others to enhance their performance. These examples showcase not only your personal successes but also how you contributed to your team's overall efficiency. Maintaining simple and clear language will ensure your experience section effectively communicates your value as a candidate.

Collections Representative

ABC Financial Services

June 2018 - Present

- Reduced overdue accounts by 30% through strategic negotiation and improved customer communication.

- Streamlined account tracking system, resulting in a 20% time savings in daily operations.

- Implemented a new debtor prioritization strategy that increased recovery rate by 15%.

- Trained team members on software tools that improved their efficiency and accuracy.

Innovation-Focused resume experience section

An innovation-focused collections representative resume experience section should highlight your knack for solving problems creatively and enhancing processes. Begin by showing how you've successfully streamlined collections operations, saved costs, or boosted customer satisfaction through innovative methods. Use bullet points to clearly present your accomplishments, demonstrating not just the actions you took but how these led to improved outcomes. Focus on specific initiatives, like implementing a new software system or developing a creative communication strategy that increased efficiency.

To effectively showcase your impact, detail your contributions that drove positive change within your organization. Use simple language to describe what you did and why it worked, providing context such as team size or specific improvements in collections rates. This adds weight to your achievements. Use action-oriented verbs like "developed," "implemented," or "designed" to keep the narrative lively and forward-moving. The aim is to demonstrate how your innovative approach made a meaningful difference in your role.

Senior Collections Representative

ABC Financial Services

March 2021 - Present

- Implemented a new automated calling system, which reduced overdue account calls by 35%.

- Developed a customer feedback loop that increased repayment engagement by 40%.

- Streamlined the collections process, cutting response times by 50% and improving customer satisfaction ratings.

- Designed training workshops for team members to enhance negotiation skills, resulting in a 25% increase in successful payment arrangements.

Achievement-Focused resume experience section

An achievement-focused collections representative resume experience section should emphasize your ability to deliver results and add value to your previous roles. Start by listing your job title and workplace to establish the context of your responsibilities. From there, concentrate on highlighting your top achievements using bullet points for clear presentation.

Connect each achievement to illustrate how your skills translated into success. Use strong action verbs to describe what you accomplished, like improving collection rates and customer satisfaction. Whenever possible, back these accomplishments with numbers or percentages to show their impact. By maintaining clear and simple language, you'll make it easy for employers to see how your contributions made a difference in your past roles.

Collections Representative

XYZ Financial Corp.

June 2020 - August 2023

- Increased collection rate by 35% within one year through refined negotiation strategies.

- Resolved 90% of delinquent accounts quickly, boosting customer satisfaction by 20%.

- Managed over 500 accounts, consistently hitting or exceeding monthly collection goals.

- Trained and guided a team of three junior reps, elevating team performance by 15%.

Leadership-Focused resume experience section

A leadership-focused collections representative resume experience section should emphasize how you inspire and guide your team to consistently achieve impressive results. Begin by specifying your role and briefly describe the workplace to set the scene for your accomplishments. Highlight achievements and responsibilities that showcase your ability to lead, such as training and mentoring team members, implementing new strategies, and driving improvements in collections outcomes. Use bullet points to clearly convey how your leadership contributed to a strong track record in both collections and team management.

Focus on tangible achievements like resolving disputes efficiently or consistently meeting targets, adding depth with awards or recognition that highlight your leadership qualities. Each bullet point should start with an action verb and maintain a consistent tense for smooth readability. Furthermore, quantifying your results with numbers, whenever possible, can enhance the credibility of your leadership accomplishments.

Collections Team Leader

ABC Financial Services

Jan 2020 - Present

- Led a team of 10 representatives, boosting monthly collections by 15% with effective training and support.

- Developed a new dispute resolution strategy, cutting down average resolution time by 30%.

- Mentored junior team members, resulting in a 25% improvement in their performance within six months.

- Earned Employee of the Month three times for exceptional leadership and team success.

Write your collections representative resume summary section

A well-focused collections representative resume summary should immediately capture attention by emphasizing your relevant skills and experience. If you're applying for this role, ensure your summary showcases your ability to excel in debt recovery. Here's how you might present it:

This summary is effective because it succinctly encapsulates your professional journey and achievements, highlighting both your technical expertise and interpersonal skills. Such a balance is crucial in collections roles, where managing relationships and meeting targets go hand in hand.

To describe yourself in your resume summary, focus on attributes that align with the job requirements. Use proactive language, emphasizing achievements that help you stand out. It's important to understand how a resume summary differs from similar sections like a resume objective or profile. While a summary offers a snapshot of your career highlights, a resume objective concentrates on your future aspirations within the role. Meanwhile, a resume profile provides a broader career overview, and a summary of qualifications lists key skills without delving into specific achievements. Your choice of format should reflect your career stage: opt for a solid resume summary if you're experienced, or a resume objective if you're just starting out, ensuring you effectively spotlight your strengths.

Listing your collections representative skills on your resume

A skills-focused collections representative resume should highlight your unique abilities, seamlessly blending them into your experience and summary. By showcasing your strengths and soft skills, like communication and empathy, you can illustrate your capacity to navigate various situations effectively. Meanwhile, hard skills, such as expertise in billing software and data analysis, demonstrate the technical abilities you've honed through learning and experience.

Including skills and strengths on your resume acts as strategic keywords that can capture the attention of potential employers and applicant tracking systems. These keywords significantly enhance your chances of securing an interview by aligning your abilities with the role's demands.

Consider structuring your skills section like this:

This structure is effective because it clearly lists eight critical skills for a collections representative. Each skill is presented concisely, ensuring clarity and readability. Together, these skills reflect a balanced mix of technical and interpersonal strengths crucial for the role.

Best hard skills to feature on your collections representative resume

In the dynamic world of collections, hard skills highlight your technical competence, vital for managing accounts, processing payments, and using tools effectively. Here are some key hard skills to feature:

Hard Skills

- CRM Software

- Billing Systems

- Data Analysis

- Credit Scoring

- Payment Processing

- Debt Collection Tools

- Financial Reporting

- Risk Management

- Legal Compliance

- Microsoft Excel

- Account Reconciliation

- Database Management

- Multilingual Communication

- Negotiation Techniques

- Dispute Resolution

Best soft skills to feature on your collections representative resume

Equally important, soft skills reveal your capability to interact positively with customers and manage stress while upholding company standards. Revealing qualities like empathy and patience, these skills are vital:

Soft Skills

- Communication

- Negotiation

- Problem Solving

- Patience

- Empathy

- Resilience

- Time Management

- Active Listening

- Conflict Resolution

- Flexibility

- Stress Management

- Teamwork

- Adaptability

- Customer Service

- Persuasion

How to include your education on your resume

Your education section is an important piece of your resume. It helps employers understand your background and qualifications. Tailor this section to the collections representative role you’re applying for by omitting irrelevant education. If it’s pertinent, include your GPA to showcase your academic achievement. Write it like this: "GPA: 3.8/4.0." Awards like "cum laude" should be listed to highlight your honors, for example, "Graduated cum laude." Clearly define your degree, such as "Bachelor of Business Administration."

Consider an example that does not work well.

The above example isn't fitting because the degree is not relevant. Notice this better sample:

The second example works well because it includes a relevant degree to a collections representative role. A business administration degree supports skills necessary for finance-related tasks. Furthermore, the inclusion of a solid GPA boosts credibility. This example reflects how your education can align with the job you want.

How to include collections representative certificates on your resume

Adding a certificates section to your resume is an important way to show your professional skills and qualifications. It's vital to your job application, especially for a collections representative. You can even include certificates in the resume header to immediately catch the hiring manager's eye. Start by listing the name of the certificate. Include the date it was earned to show your continuous development in the field. After that, add the issuing organization to verify the certificate's authenticity. Here's an example: "Certified Credit and Collections Professional, January 2022, National Association of Credit Management."

A well-structured certificates section could look like this:

This example is effective because it contains certifications relevant to collections work. The "Certified Credit and Collections Professional" confirms specialized expertise and could impress potential employers. Listing the "Debt Management Certification" shows a well-rounded skill set. Both include clear titles and recognized issuing bodies, which adds credibility. Such details can help your resume stand out in a crowded job market.

Extra sections to include on your collections representative resume

Securing a role as a collections representative requires attention to detail, patience, and excellent communication skills. To make your resume shine, it is important to include key sections that highlight your strengths and experiences.

Language skills — List any languages you speak fluently. Showing proficiency in multiple languages can set you apart and demonstrate your ability to communicate with diverse clients.

Hobbies and interests — Mention hobbies that highlight your soft skills, like problem-solving or teamwork. This can provide insights into your personality beyond professional credentials.

Volunteer work — Include volunteering experiences that relate to your field or highlight relevant skills. This can showcase your commitment to helping others and your ability to take initiative.

Books section — Share titles of books that have influenced your professional development. This can illustrate your commitment to self-improvement and lifelong learning in your career.

Crafting a resume with these sections not only highlights your unique skills but also shows a well-rounded professional image. Each part adds value and makes your application more compelling to potential employers.

In Conclusion

In conclusion, crafting a standout collections representative resume involves more than just listing past job roles. Your resume should be a strategic tool that highlights your unique skills and experience in the field. Focusing on effective communication, negotiation, and proficiency with industry-specific tools will set you apart from others in the field. Utilize resume templates to maintain a neat, professional look, allowing you to focus on content rather than format. Remember, the right resume format helps potential employers easily see your qualifications and career growth. Whether it's showcasing your hard skills like CRM software or soft skills like patience, each element of your resume should align with the job's demands. Quantifiable achievements and specific examples provide tangible evidence of your capabilities and are crucial for making a positive impression. By including relevant education and certifications, you underscore your commitment to professional growth. Additional sections, such as language skills and volunteer work, offer a fuller picture of your abilities. Through thoughtful organization and attention to detail, your resume will effectively communicate your readiness for a collections role.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.