Commercial Banking Resume Examples

Jul 18, 2024

|

12 min read

Craft your standout commercial banking resume to vault ahead. Learn tips to highlight your financial acumen and clinch that bank-tastic job.

Rated by 348 people

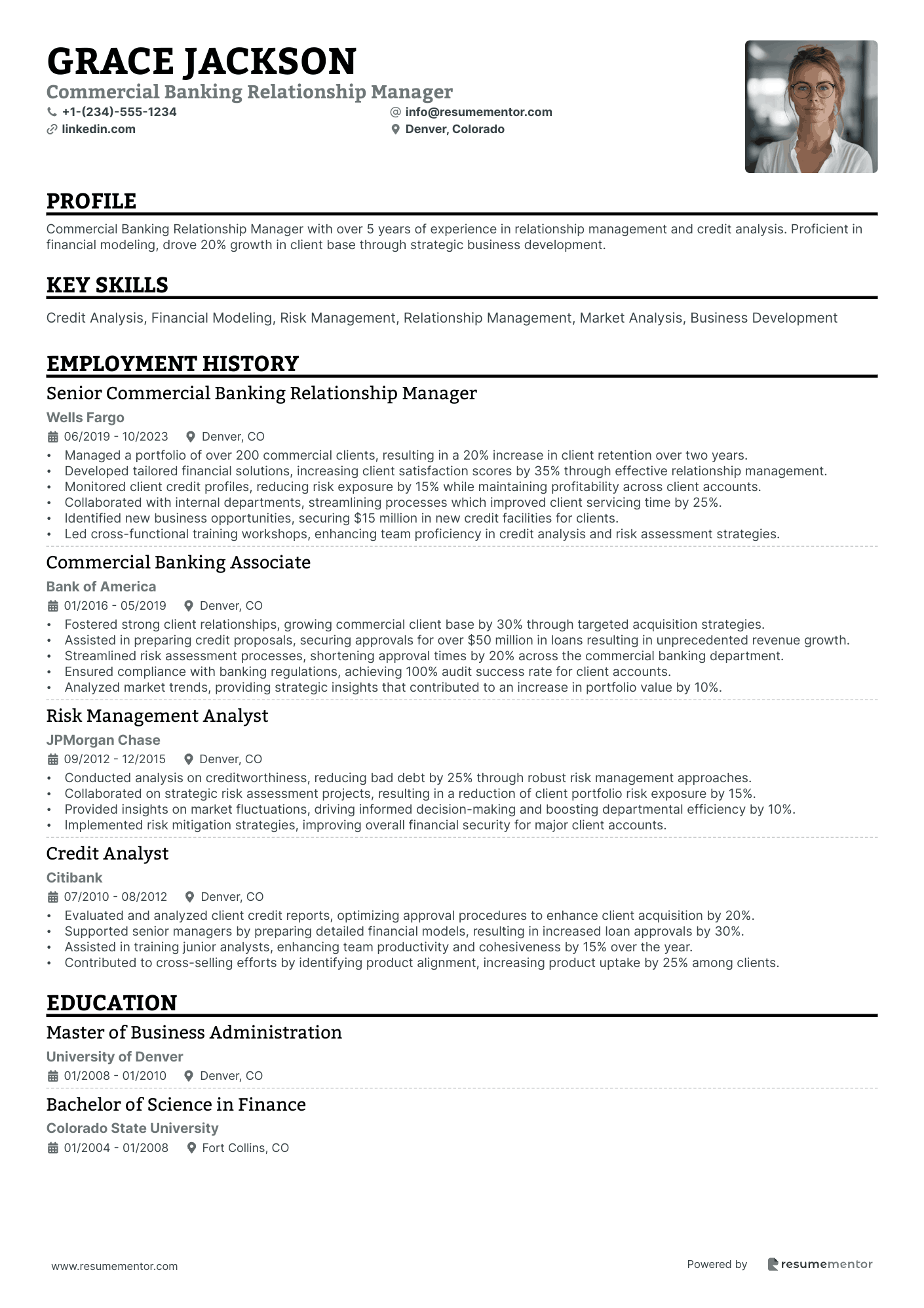

Commercial Banking Relationship Manager

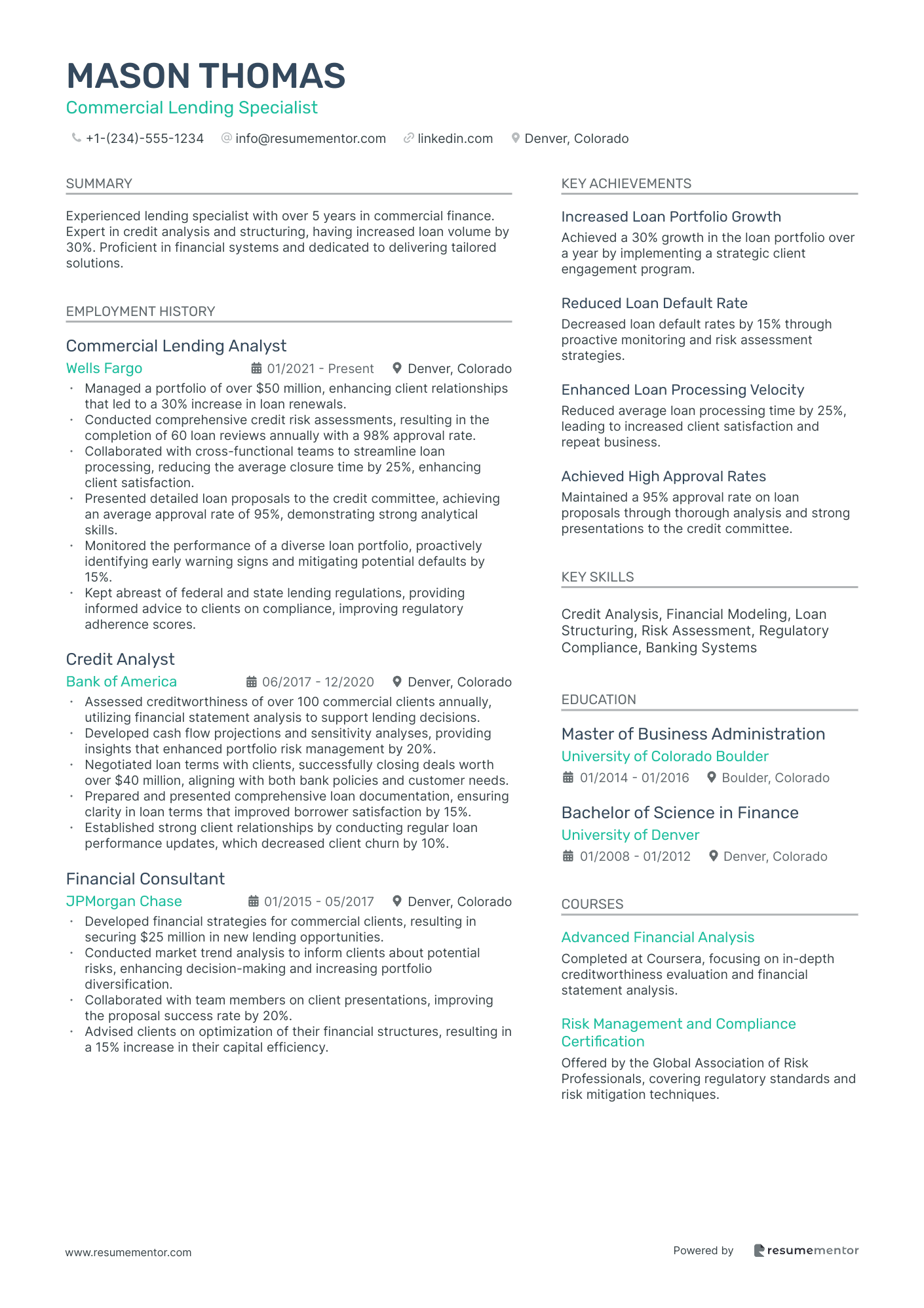

Commercial Lending Specialist

Corporate Treasury Solutions Officer

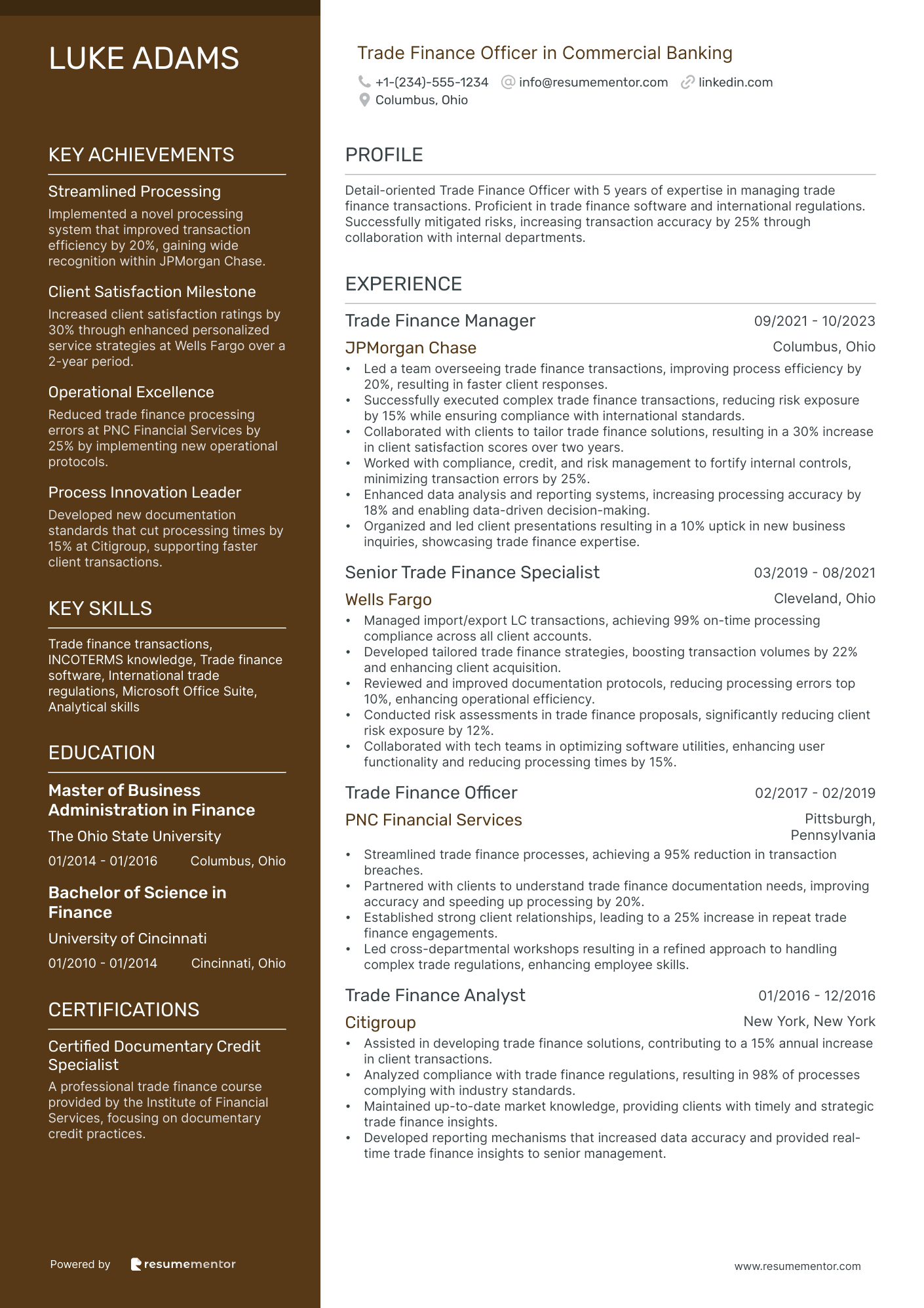

Trade Finance Officer in Commercial Banking

Commercial Banking Risk Analyst

Business Banking Relationship Manager

Commercial Real Estate Banking Officer

Commercial Banking Operations Analyst

Middle Market Commercial Banker

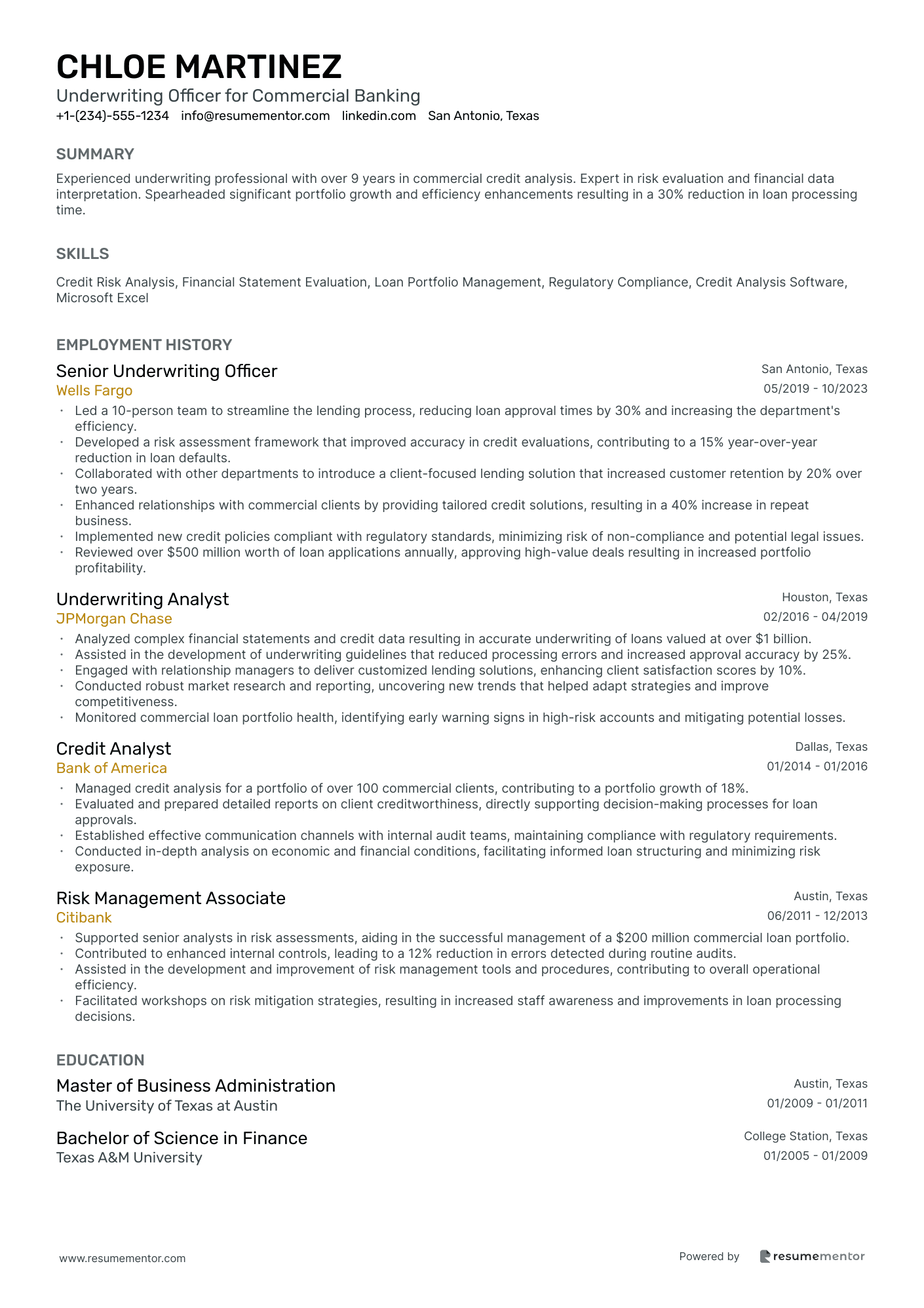

Underwriting Officer for Commercial Banking

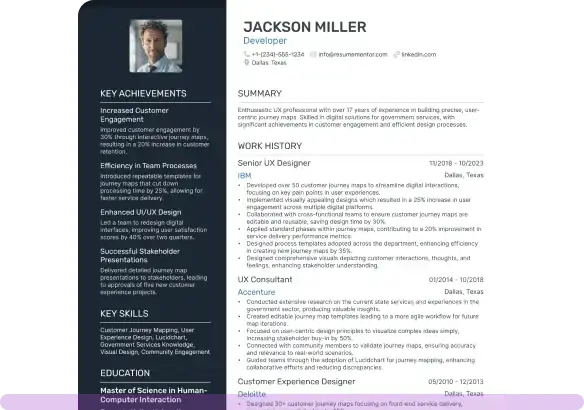

Commercial Banking Relationship Manager resume sample

- •Managed a portfolio of over 200 commercial clients, resulting in a 20% increase in client retention over two years.

- •Developed tailored financial solutions, increasing client satisfaction scores by 35% through effective relationship management.

- •Monitored client credit profiles, reducing risk exposure by 15% while maintaining profitability across client accounts.

- •Collaborated with internal departments, streamlining processes which improved client servicing time by 25%.

- •Identified new business opportunities, securing $15 million in new credit facilities for clients.

- •Led cross-functional training workshops, enhancing team proficiency in credit analysis and risk assessment strategies.

- •Fostered strong client relationships, growing commercial client base by 30% through targeted acquisition strategies.

- •Assisted in preparing credit proposals, securing approvals for over $50 million in loans resulting in unprecedented revenue growth.

- •Streamlined risk assessment processes, shortening approval times by 20% across the commercial banking department.

- •Ensured compliance with banking regulations, achieving 100% audit success rate for client accounts.

- •Analyzed market trends, providing strategic insights that contributed to an increase in portfolio value by 10%.

- •Conducted analysis on creditworthiness, reducing bad debt by 25% through robust risk management approaches.

- •Collaborated on strategic risk assessment projects, resulting in a reduction of client portfolio risk exposure by 15%.

- •Provided insights on market fluctuations, driving informed decision-making and boosting departmental efficiency by 10%.

- •Implemented risk mitigation strategies, improving overall financial security for major client accounts.

- •Evaluated and analyzed client credit reports, optimizing approval procedures to enhance client acquisition by 20%.

- •Supported senior managers by preparing detailed financial models, resulting in increased loan approvals by 30%.

- •Assisted in training junior analysts, enhancing team productivity and cohesiveness by 15% over the year.

- •Contributed to cross-selling efforts by identifying product alignment, increasing product uptake by 25% among clients.

Commercial Lending Specialist resume sample

- •Managed a portfolio of over $50 million, enhancing client relationships that led to a 30% increase in loan renewals.

- •Conducted comprehensive credit risk assessments, resulting in the completion of 60 loan reviews annually with a 98% approval rate.

- •Collaborated with cross-functional teams to streamline loan processing, reducing the average closure time by 25%, enhancing client satisfaction.

- •Presented detailed loan proposals to the credit committee, achieving an average approval rate of 95%, demonstrating strong analytical skills.

- •Monitored the performance of a diverse loan portfolio, proactively identifying early warning signs and mitigating potential defaults by 15%.

- •Kept abreast of federal and state lending regulations, providing informed advice to clients on compliance, improving regulatory adherence scores.

- •Assessed creditworthiness of over 100 commercial clients annually, utilizing financial statement analysis to support lending decisions.

- •Developed cash flow projections and sensitivity analyses, providing insights that enhanced portfolio risk management by 20%.

- •Negotiated loan terms with clients, successfully closing deals worth over $40 million, aligning with both bank policies and customer needs.

- •Prepared and presented comprehensive loan documentation, ensuring clarity in loan terms that improved borrower satisfaction by 15%.

- •Established strong client relationships by conducting regular loan performance updates, which decreased client churn by 10%.

- •Developed financial strategies for commercial clients, resulting in securing $25 million in new lending opportunities.

- •Conducted market trend analysis to inform clients about potential risks, enhancing decision-making and increasing portfolio diversification.

- •Collaborated with team members on client presentations, improving the proposal success rate by 20%.

- •Advised clients on optimization of their financial structures, resulting in a 15% increase in their capital efficiency.

- •Evaluated loan applications, supervising the processing of over $15 million in commercial loans annually.

- •Utilized financial analysis software to assess the credit ratings of businesses, improving departmental efficiency by 15%.

- •Coordinated with compliance teams to ensure all lending activities adhered to federal and state regulations.

- •Conducted client onboarding sessions, which improved client engagement and service uptake by 20%.

Corporate Treasury Solutions Officer resume sample

- •Developed customized treasury solutions for 20+ corporate clients, improving cash flow efficiency by 22% collectively.

- •Coordinated with cross-functional teams including Risk and Operations, enhancing service delivery efficiency by 30%.

- •Analyzed client data and market trends to propose strategy improvements, resulting in a 15% reduction in liquidity risks.

- •Trained client finance teams on treasury management tools, leading to a 40% increase in tool usage.

- •Managed multiple projects to optimize cash and liquidity for clients, consistently achieving project deadlines and KPIs.

- •Compiled quarterly performance reports for clients, improving client satisfaction scores by 20% as a result.

- •Executed seamless onboarding of treasury systems for new clients, accelerating the integration process by 15%.

- •Generated market trend analysis reports, providing insights that improved strategic decisions in treasury management.

- •Lead initiatives to enhance client experiences, which increased average client retention rates by 12%.

- •Worked closely with Sales team to ensure client needs were met, achieving a 95% satisfaction rating in client feedback.

- •Collaborated on compliance projects aligning with regulatory requirements, reducing audit findings by 25%.

- •Supported deployment of treasury products, enhancing cash management for 15 mid-sized corporate clients.

- •Participated in risk assessment initiatives, resulting in improved management strategies for liquidity risks.

- •Captured and analyzed quarterly financial data, providing actionable insights to improve operations by 18%.

- •Advised clients on optimizing cash flow strategies, leading to a 20% increase in cash efficiency.

- •Analyzed financial statements to identify areas for improvement in treasury operations, increasing net savings by 10%.

- •Assisted in the development of cash forecasting models, improving accuracy by 25% for client accounts.

- •Supported implementation of new financial software, which cut process times by 30%.

- •Maintained accurate financial records for clients, enhancing data integrity and compliance.

Trade Finance Officer in Commercial Banking resume sample

- •Led a team overseeing trade finance transactions, improving process efficiency by 20%, resulting in faster client responses.

- •Successfully executed complex trade finance transactions, reducing risk exposure by 15% while ensuring compliance with international standards.

- •Collaborated with clients to tailor trade finance solutions, resulting in a 30% increase in client satisfaction scores over two years.

- •Worked with compliance, credit, and risk management to fortify internal controls, minimizing transaction errors by 25%.

- •Enhanced data analysis and reporting systems, increasing processing accuracy by 18% and enabling data-driven decision-making.

- •Organized and led client presentations resulting in a 10% uptick in new business inquiries, showcasing trade finance expertise.

- •Managed import/export LC transactions, achieving 99% on-time processing compliance across all client accounts.

- •Developed tailored trade finance strategies, boosting transaction volumes by 22% and enhancing client acquisition.

- •Reviewed and improved documentation protocols, reducing processing errors top 10%, enhancing operational efficiency.

- •Conducted risk assessments in trade finance proposals, significantly reducing client risk exposure by 12%.

- •Collaborated with tech teams in optimizing software utilities, enhancing user functionality and reducing processing times by 15%.

- •Streamlined trade finance processes, achieving a 95% reduction in transaction breaches.

- •Partnered with clients to understand trade finance documentation needs, improving accuracy and speeding up processing by 20%.

- •Established strong client relationships, leading to a 25% increase in repeat trade finance engagements.

- •Led cross-departmental workshops resulting in a refined approach to handling complex trade regulations, enhancing employee skills.

- •Assisted in developing trade finance solutions, contributing to a 15% annual increase in client transactions.

- •Analyzed compliance with trade finance regulations, resulting in 98% of processes complying with industry standards.

- •Maintained up-to-date market knowledge, providing clients with timely and strategic trade finance insights.

- •Developed reporting mechanisms that increased data accuracy and provided real-time trade finance insights to senior management.

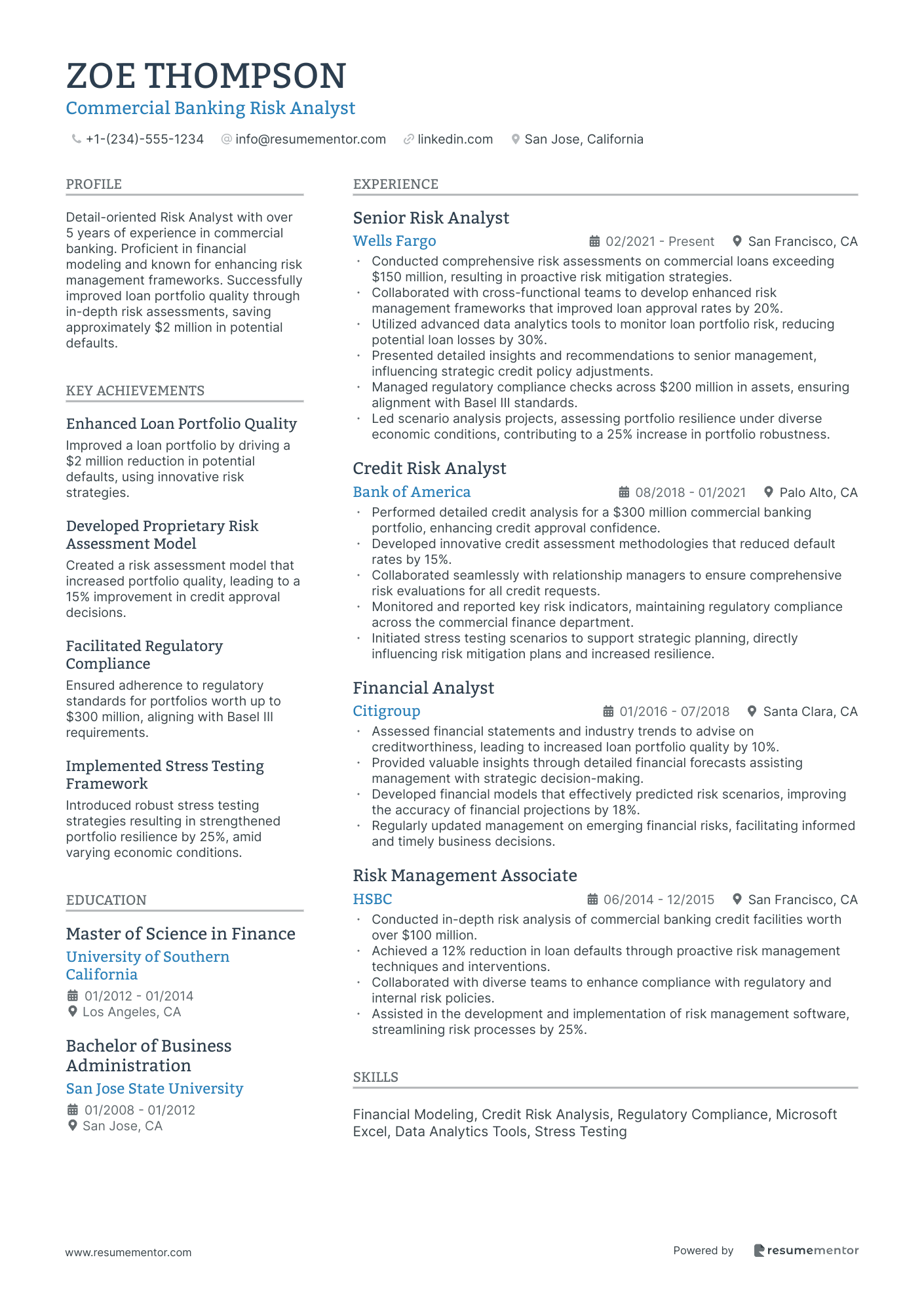

Commercial Banking Risk Analyst resume sample

- •Conducted comprehensive risk assessments on commercial loans exceeding $150 million, resulting in proactive risk mitigation strategies.

- •Collaborated with cross-functional teams to develop enhanced risk management frameworks that improved loan approval rates by 20%.

- •Utilized advanced data analytics tools to monitor loan portfolio risk, reducing potential loan losses by 30%.

- •Presented detailed insights and recommendations to senior management, influencing strategic credit policy adjustments.

- •Managed regulatory compliance checks across $200 million in assets, ensuring alignment with Basel III standards.

- •Led scenario analysis projects, assessing portfolio resilience under diverse economic conditions, contributing to a 25% increase in portfolio robustness.

- •Performed detailed credit analysis for a $300 million commercial banking portfolio, enhancing credit approval confidence.

- •Developed innovative credit assessment methodologies that reduced default rates by 15%.

- •Collaborated seamlessly with relationship managers to ensure comprehensive risk evaluations for all credit requests.

- •Monitored and reported key risk indicators, maintaining regulatory compliance across the commercial finance department.

- •Initiated stress testing scenarios to support strategic planning, directly influencing risk mitigation plans and increased resilience.

- •Assessed financial statements and industry trends to advise on creditworthiness, leading to increased loan portfolio quality by 10%.

- •Provided valuable insights through detailed financial forecasts assisting management with strategic decision-making.

- •Developed financial models that effectively predicted risk scenarios, improving the accuracy of financial projections by 18%.

- •Regularly updated management on emerging financial risks, facilitating informed and timely business decisions.

- •Conducted in-depth risk analysis of commercial banking credit facilities worth over $100 million.

- •Achieved a 12% reduction in loan defaults through proactive risk management techniques and interventions.

- •Collaborated with diverse teams to enhance compliance with regulatory and internal risk policies.

- •Assisted in the development and implementation of risk management software, streamlining risk processes by 25%.

Business Banking Relationship Manager resume sample

- •Managed a business client portfolio increasing asset base by 40% in two years through strategic partnerships.

- •Developed customized financial solutions resulting in a 30% increase in cross-sell opportunities.

- •Led team to achieve an 85% customer satisfaction rate by implementing streamlined processes.

- •Coordinated with the commercial lending department, securing loans for 70% of eligible clients.

- •Generated an annual revenue increase of 25% by leveraging market insights and customer needs.

- •Conducted detailed financial analyses, bolstering client retention by delivering strategic insights.

- •Exceeded sales targets by 20% annually, positioning commercial banking solutions to small businesses.

- •Enhanced client retention by 15% through proactive account management and tailored financial advice.

- •Increased new client acquisition by 25% with strategic networking and community engagement.

- •Collaborated with internal teams, reducing client onboarding time by 30%, enhancing service efficiency.

- •Educated clients on credit options, leading to a 40% increase in credit product utilization rates.

- •Supported the senior manager in managing a $150 million portfolio, enhancing client satisfaction.

- •Implemented CRM strategies increasing client interactions by 35%, resulting in higher engagement.

- •Coordinated cross-functional efforts to resolve client issues swiftly, improving resolution time by 40%.

- •Led a successful campaign to boost small business loan production by 30% within one fiscal year.

- •Analyzed financial statements of SME clients, aiding a loan approval rate increase by 20%.

- •Facilitated training sessions for new hires, improving the department productivity by 15%.

- •Executed targeted networking strategies, expanding the client base by 10% annually.

- •Monitored regulatory compliance, ensuring a spotless audit record across three consecutive years.

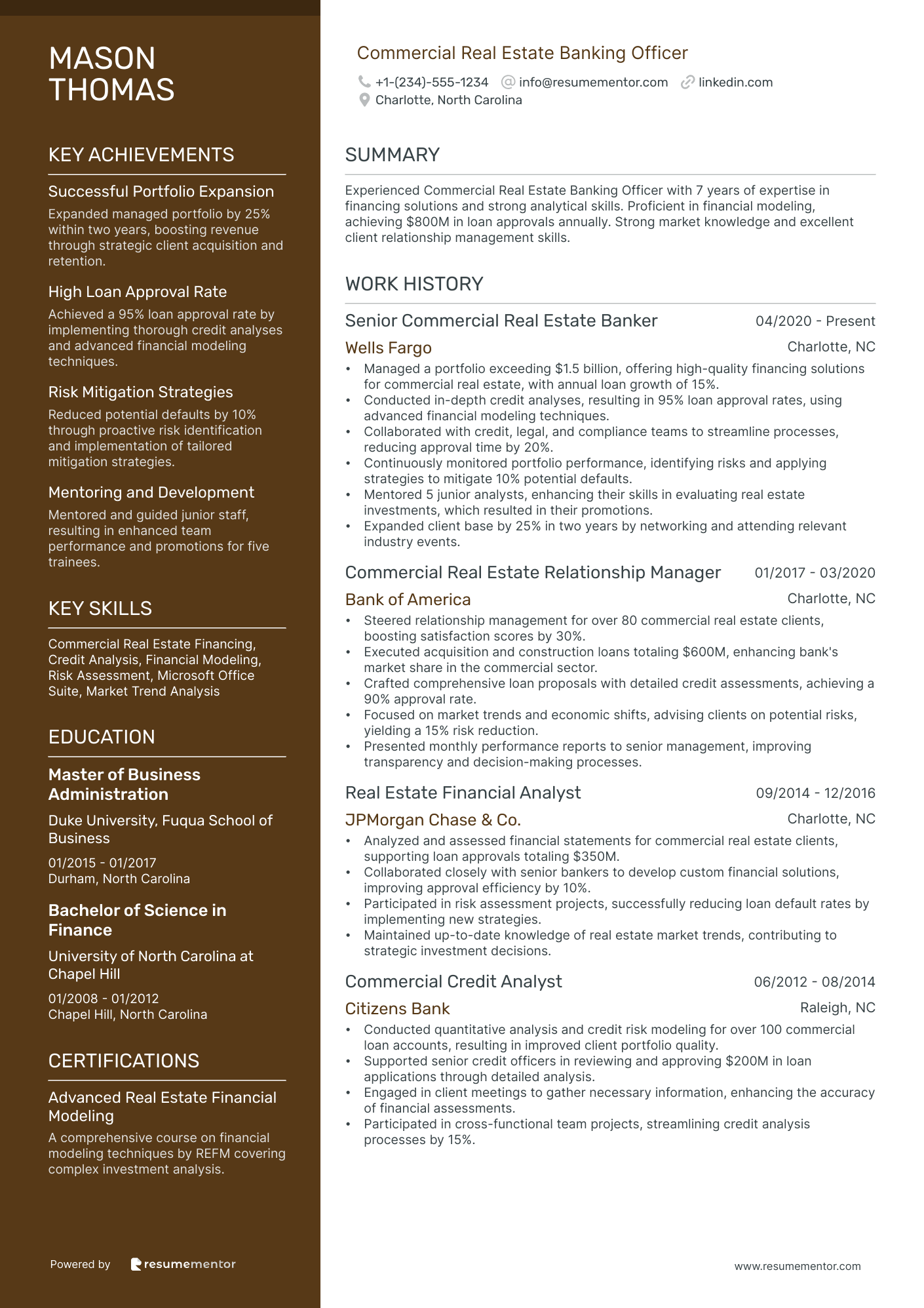

Commercial Real Estate Banking Officer resume sample

- •Managed a portfolio exceeding $1.5 billion, offering high-quality financing solutions for commercial real estate, with annual loan growth of 15%.

- •Conducted in-depth credit analyses, resulting in 95% loan approval rates, using advanced financial modeling techniques.

- •Collaborated with credit, legal, and compliance teams to streamline processes, reducing approval time by 20%.

- •Continuously monitored portfolio performance, identifying risks and applying strategies to mitigate 10% potential defaults.

- •Mentored 5 junior analysts, enhancing their skills in evaluating real estate investments, which resulted in their promotions.

- •Expanded client base by 25% in two years by networking and attending relevant industry events.

- •Steered relationship management for over 80 commercial real estate clients, boosting satisfaction scores by 30%.

- •Executed acquisition and construction loans totaling $600M, enhancing bank's market share in the commercial sector.

- •Crafted comprehensive loan proposals with detailed credit assessments, achieving a 90% approval rate.

- •Focused on market trends and economic shifts, advising clients on potential risks, yielding a 15% risk reduction.

- •Presented monthly performance reports to senior management, improving transparency and decision-making processes.

- •Analyzed and assessed financial statements for commercial real estate clients, supporting loan approvals totaling $350M.

- •Collaborated closely with senior bankers to develop custom financial solutions, improving approval efficiency by 10%.

- •Participated in risk assessment projects, successfully reducing loan default rates by implementing new strategies.

- •Maintained up-to-date knowledge of real estate market trends, contributing to strategic investment decisions.

- •Conducted quantitative analysis and credit risk modeling for over 100 commercial loan accounts, resulting in improved client portfolio quality.

- •Supported senior credit officers in reviewing and approving $200M in loan applications through detailed analysis.

- •Engaged in client meetings to gather necessary information, enhancing the accuracy of financial assessments.

- •Participated in cross-functional team projects, streamlining credit analysis processes by 15%.

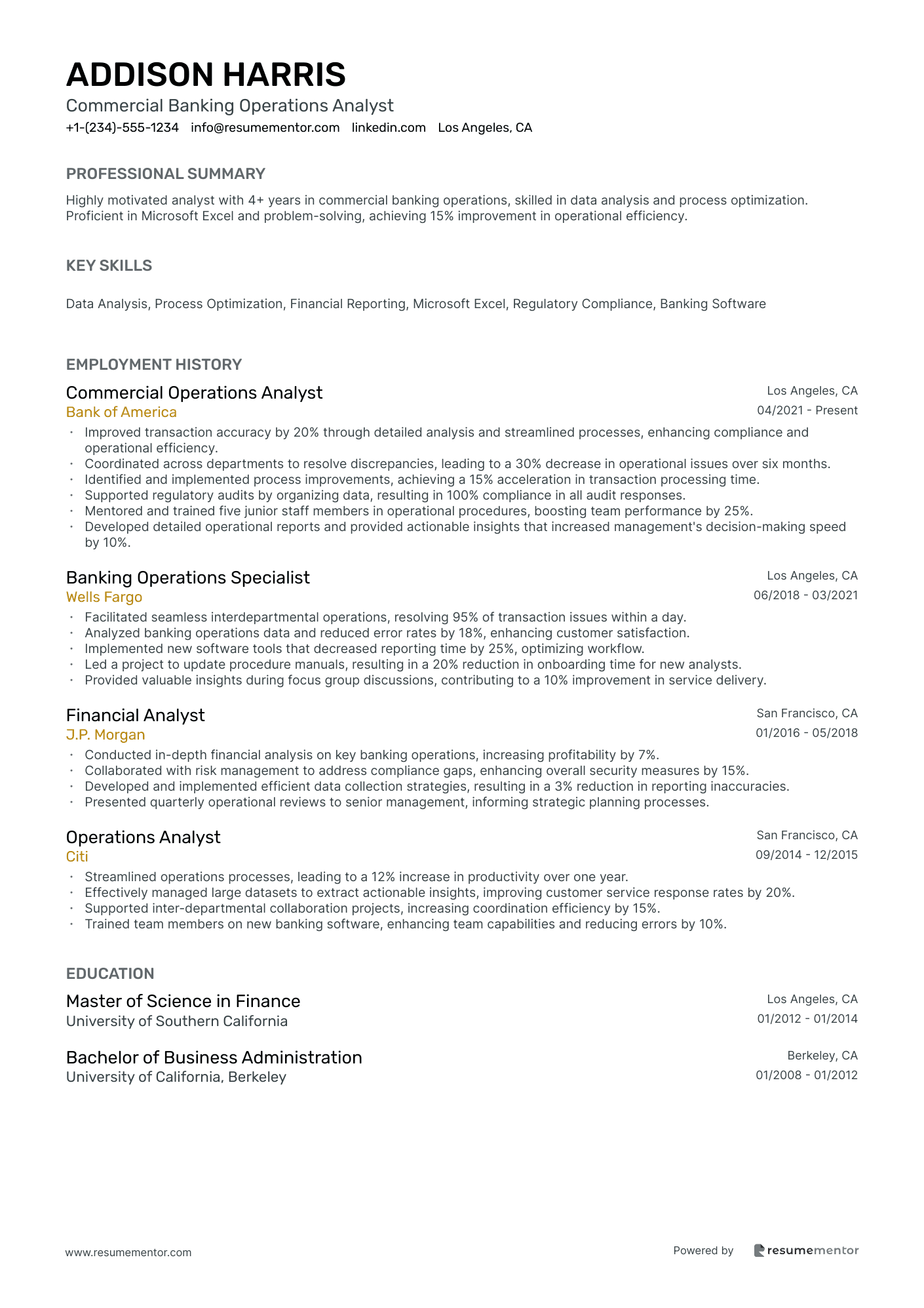

Commercial Banking Operations Analyst resume sample

- •Improved transaction accuracy by 20% through detailed analysis and streamlined processes, enhancing compliance and operational efficiency.

- •Coordinated across departments to resolve discrepancies, leading to a 30% decrease in operational issues over six months.

- •Identified and implemented process improvements, achieving a 15% acceleration in transaction processing time.

- •Supported regulatory audits by organizing data, resulting in 100% compliance in all audit responses.

- •Mentored and trained five junior staff members in operational procedures, boosting team performance by 25%.

- •Developed detailed operational reports and provided actionable insights that increased management's decision-making speed by 10%.

- •Facilitated seamless interdepartmental operations, resolving 95% of transaction issues within a day.

- •Analyzed banking operations data and reduced error rates by 18%, enhancing customer satisfaction.

- •Implemented new software tools that decreased reporting time by 25%, optimizing workflow.

- •Led a project to update procedure manuals, resulting in a 20% reduction in onboarding time for new analysts.

- •Provided valuable insights during focus group discussions, contributing to a 10% improvement in service delivery.

- •Conducted in-depth financial analysis on key banking operations, increasing profitability by 7%.

- •Collaborated with risk management to address compliance gaps, enhancing overall security measures by 15%.

- •Developed and implemented efficient data collection strategies, resulting in a 3% reduction in reporting inaccuracies.

- •Presented quarterly operational reviews to senior management, informing strategic planning processes.

- •Streamlined operations processes, leading to a 12% increase in productivity over one year.

- •Effectively managed large datasets to extract actionable insights, improving customer service response rates by 20%.

- •Supported inter-departmental collaboration projects, increasing coordination efficiency by 15%.

- •Trained team members on new banking software, enhancing team capabilities and reducing errors by 10%.

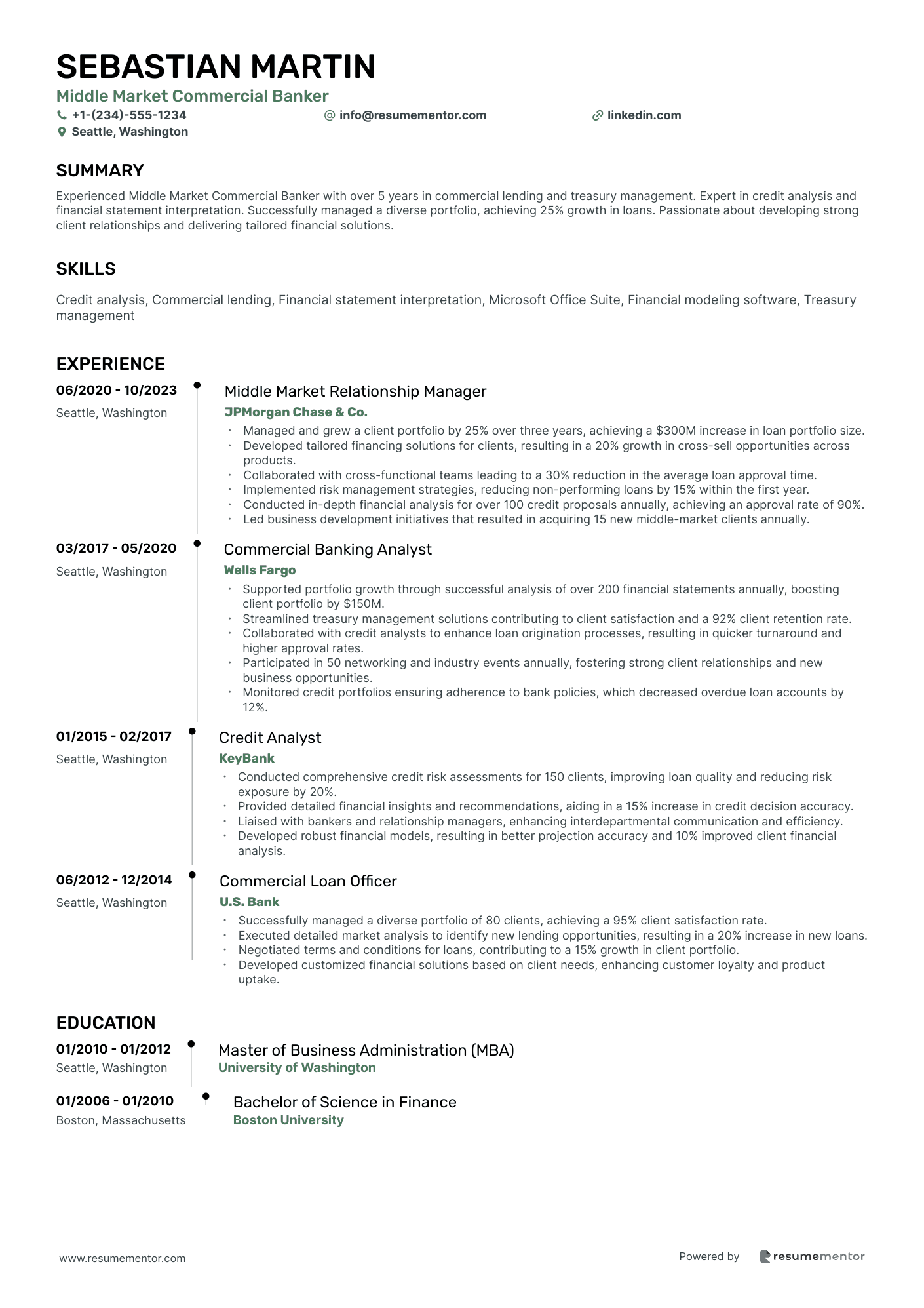

Middle Market Commercial Banker resume sample

- •Managed and grew a client portfolio by 25% over three years, achieving a $300M increase in loan portfolio size.

- •Developed tailored financing solutions for clients, resulting in a 20% growth in cross-sell opportunities across products.

- •Collaborated with cross-functional teams leading to a 30% reduction in the average loan approval time.

- •Implemented risk management strategies, reducing non-performing loans by 15% within the first year.

- •Conducted in-depth financial analysis for over 100 credit proposals annually, achieving an approval rate of 90%.

- •Led business development initiatives that resulted in acquiring 15 new middle-market clients annually.

- •Supported portfolio growth through successful analysis of over 200 financial statements annually, boosting client portfolio by $150M.

- •Streamlined treasury management solutions contributing to client satisfaction and a 92% client retention rate.

- •Collaborated with credit analysts to enhance loan origination processes, resulting in quicker turnaround and higher approval rates.

- •Participated in 50 networking and industry events annually, fostering strong client relationships and new business opportunities.

- •Monitored credit portfolios ensuring adherence to bank policies, which decreased overdue loan accounts by 12%.

- •Conducted comprehensive credit risk assessments for 150 clients, improving loan quality and reducing risk exposure by 20%.

- •Provided detailed financial insights and recommendations, aiding in a 15% increase in credit decision accuracy.

- •Liaised with bankers and relationship managers, enhancing interdepartmental communication and efficiency.

- •Developed robust financial models, resulting in better projection accuracy and 10% improved client financial analysis.

- •Successfully managed a diverse portfolio of 80 clients, achieving a 95% client satisfaction rate.

- •Executed detailed market analysis to identify new lending opportunities, resulting in a 20% increase in new loans.

- •Negotiated terms and conditions for loans, contributing to a 15% growth in client portfolio.

- •Developed customized financial solutions based on client needs, enhancing customer loyalty and product uptake.

Underwriting Officer for Commercial Banking resume sample

- •Led a 10-person team to streamline the lending process, reducing loan approval times by 30% and increasing the department's efficiency.

- •Developed a risk assessment framework that improved accuracy in credit evaluations, contributing to a 15% year-over-year reduction in loan defaults.

- •Collaborated with other departments to introduce a client-focused lending solution that increased customer retention by 20% over two years.

- •Enhanced relationships with commercial clients by providing tailored credit solutions, resulting in a 40% increase in repeat business.

- •Implemented new credit policies compliant with regulatory standards, minimizing risk of non-compliance and potential legal issues.

- •Reviewed over $500 million worth of loan applications annually, approving high-value deals resulting in increased portfolio profitability.

- •Analyzed complex financial statements and credit data resulting in accurate underwriting of loans valued at over $1 billion.

- •Assisted in the development of underwriting guidelines that reduced processing errors and increased approval accuracy by 25%.

- •Engaged with relationship managers to deliver customized lending solutions, enhancing client satisfaction scores by 10%.

- •Conducted robust market research and reporting, uncovering new trends that helped adapt strategies and improve competitiveness.

- •Monitored commercial loan portfolio health, identifying early warning signs in high-risk accounts and mitigating potential losses.

- •Managed credit analysis for a portfolio of over 100 commercial clients, contributing to a portfolio growth of 18%.

- •Evaluated and prepared detailed reports on client creditworthiness, directly supporting decision-making processes for loan approvals.

- •Established effective communication channels with internal audit teams, maintaining compliance with regulatory requirements.

- •Conducted in-depth analysis on economic and financial conditions, facilitating informed loan structuring and minimizing risk exposure.

- •Supported senior analysts in risk assessments, aiding in the successful management of a $200 million commercial loan portfolio.

- •Contributed to enhanced internal controls, leading to a 12% reduction in errors detected during routine audits.

- •Assisted in the development and improvement of risk management tools and procedures, contributing to overall operational efficiency.

- •Facilitated workshops on risk mitigation strategies, resulting in increased staff awareness and improvements in loan processing decisions.

In the world of commercial banking, your resume isn't just a document—it's the key to unlocking new career opportunities. Think of it like solving a complex financial puzzle; each piece, from your financial analysis expertise to your client management skills, must seamlessly fit into a cohesive narrative.

This task can feel overwhelming as you try to capture your skills on paper. It's common in commercial banking to struggle with translating diverse experiences into a clear and compelling story. Yet, standing out in this competitive field hinges on crafting a resume that effectively communicates your value.

To achieve this, a structured approach is essential. Utilizing a resume template simplifies this process, allowing you to focus on highlighting key details. Consider using these resume templates as a guide.

Finding the right format can showcase your skills clearly, making it easier for employers to recognize your potential. As you progress through this guide, you'll uncover strategies that clarify your career journey, helping your successes in commercial banking truly stand out. Embrace this opportunity to craft a resume that opens doors and advances your career.

Key Takeaways

- Your resume is critical for showcasing your expertise in commercial banking, emphasizing skills like financial analysis and client management which must be effectively communicated through a well-structured and cohesive format.

- A clear and organized resume structure involves key sections such as contact information, professional summary, work experience, education, skills, and certifications, each tailored to highlight your contributions and expertise in the banking industry.

- Utilizing a reverse-chronological format proves beneficial by spotlighting recent, relevant experiences and using a readable font while saving the document as a PDF ensures consistent presentation across devices, crucial for maintaining professionalism.

- Your experience section should be quantifiable, featuring achievements with clear metrics, action verbs, and specific examples to delineate your impact and align your strengths with job requirements.

- Supplementary sections like language skills, hobbies, volunteer work, and industry-relevant books can offer a comprehensive view of your personal and professional attributes, making you a well-rounded and appealing candidate.

What to focus on when writing your commercial banking resume

A commercial banking resume should clearly present your ability to navigate financial complexities and deliver outstanding customer service. Recruiters seek proof of your skill in analyzing financial statements, offering strategic insights, and nurturing client relationships. Your resume needs to emphasize your problem-solving capabilities, attention to detail, and proficiency in managing risk.

How to structure your commercial banking resume

- Contact Information: Start with your full name, phone number, email, and LinkedIn profile—placing it at the top makes it easy for recruiters to reach you quickly. Ensuring this section is well-organized gives an impression of professionalism and reliability, necessary traits in commercial banking.

- Professional Summary: Offer a concise overview that captures your experience in commercial banking, highlighting key accomplishments such as expertise in credit analysis and portfolio management. This section is your chance to make a strong first impression by summarizing your career highlights and areas of specialization tailored to the job you're targeting.

- Work Experience: Use bullet points to spotlight your achievements in past roles, focusing on solid results like boosting loan volumes or enhancing risk management strategies. Describing your past roles by emphasizing measurable outcomes gives recruiters confidence in your ability to contribute effectively.

- Education: List your degrees in finance or business administration, highlighting any honors or coursework that strengthen your alignment with commercial banking. Clearly documenting your educational background helps illustrate your foundational knowledge in finance, crucial for anyone in the banking sector.

- Skills: Emphasize abilities critical to the field, such as financial analysis, client relationship management, and risk assessment. Include any specific banking software and regulatory knowledge you possess to demonstrate your readiness for the demands of commercial banking roles.

- Certifications: Mention certifications like CFA or CPA if applicable, as these are highly respected credentials in the industry. Highlighting certifications provides evidence of your commitment to professional growth and staying current with industry standards.

Consider adding optional sections like awards, volunteer work, or professional affiliations, which can further underscore your leadership skills and commitment to the banking sector. By considering the resume format discussed below, each section can be crafted to maximize impact and align with industry expectations, ensuring you capture the attention of recruiters.

Which resume format to choose

Crafting a resume for a commercial banking role involves careful attention to format, font, and layout to effectively convey your professional journey. The reverse-chronological format is particularly suited to this sector because it allows you to highlight your most recent and relevant experiences first. This approach makes it easier for recruiters to track your career progression and see how your skills have evolved, which is critical in a field where experience speaks volumes.

Selecting the right font is more than just a design choice; it's about readability and professionalism. Fonts like Lato, Montserrat, and Raleway are not only modern, but they also offer a clean look that enhances readability. They subtly enhance the document's professionalism without distracting from the content itself.

Saving your resume as a PDF is an essential step that underscores your attention to detail. PDFs ensure that your resume appears exactly as you've designed it, maintaining the integrity of your neat formatting and ensuring consistency across different devices and operating systems. This reliability is vital in the banking industry, where precision and organization are highly valued.

Setting your margins to about an inch creates a balanced appearance that improves readability. The white space helps guide the reader's eye, making it easier to digest information efficiently. In a competitive field like commercial banking, a neatly organized resume can make a strong first impression, indicating that you possess the attention to detail and clarity of thought that are essential in the finance sector. All these elements combined create a powerful tool that effectively communicates your qualifications and readiness for the role.

How to write a quantifiable resume experience section

In commercial banking, your resume's experience section plays a key role in setting you apart from the competition. By highlighting your accomplishments with clear metrics, you can effectively showcase how you've grown business, managed client relationships, and driven financial success. Organizing your experience in reverse chronological order allows the most relevant and recent roles to shine, ideally including the last 10–15 years of your career. Tailoring your resume to echo the job description enhances its impact by weaving in the language and keywords that are most relevant, aligning your strengths with the job’s specific requirements. Using strong action verbs like “spearheaded,” “improved,” “negotiated,” or “achieved” gives depth and vividness to your roles, helping employers envision your contributions.

Include job titles that directly relate to commercial banking or demonstrate transferable skills crucial to the industry. This customization makes your resume align seamlessly with the employer’s expectations, ensuring you stand out as a candidate. Quantifying your achievements not only highlights your individual contributions but also provides an impactful narrative of the benefits you brought to your previous organizations.

- •Increased portfolio size by 40% over three years, achieving an annual revenue growth of $12 million.

- •Negotiated and structured $50 million in business loans tailored to client needs, enhancing customer satisfaction.

- •Implemented a client risk assessment strategy that reduced portfolio risk by 20% in six months.

- •Spearheaded cross-functional teams to develop a digital banking platform, boosting client engagement by 25%.

This experience section exemplifies your expertise in commercial banking by linking your skills in portfolio growth and client-focused solutions with tangible, quantifiable outcomes. The metrics used to describe your achievements provide a clear picture of your impact, illustrating how increased revenue and improved customer satisfaction were achieved. By tailoring the content with specific industry keywords and responsibilities, you create a cohesive narrative that aligns your value directly with the expectations of potential employers, making you a compelling candidate.

Growth-Focused resume experience section

A growth-focused commercial banking resume experience section should effectively demonstrate your contributions to the bank's expansion. Highlight achievements that showcase your role in driving outcomes, using metrics to emphasize your impact on both revenue and customer growth. Strong action verbs and positive language can clearly communicate how your skills facilitated these advancements. Whether through upselling services, refining processes, or enhancing client relationships, your involvement in fostering growth should be apparent.

Start each entry by providing your job title, workplace, and employment dates to establish context. Use bullet points to detail key accomplishments centered on client acquisition or revenue enhancement. Each bullet should seamlessly convey tangible results, reflecting not just your responsibilities but the significant successes you’ve achieved. Think about how your initiatives have directly supported the bank's growth goals, making it clear that your efforts have directly contributed to achieving those objectives.

Growth Specialist

ABC National Bank

January 2020 – Present

- Expanded client portfolio by 25% within one year, bringing in $10 million in new deposits.

- Created a client retention strategy that lifted repeat business rates by 15%.

- Developed a cross-sell strategy boosting loan product uptake by 30%.

- Worked with marketing to launch a campaign increasing new client leads by 40%.

Skills-Focused resume experience section

A skills-focused commercial banking resume experience section should spotlight the abilities that distinguish you in the field. Begin by showcasing crucial skills such as financial analysis, customer relationship management, and risk assessment. Demonstrate how these skills have been put into practice in your previous roles, emphasizing your impact and achievements. Utilize clear language to link your responsibilities to the positive outcomes gained from your efforts.

Start with your most recent job and include details like your job title, company name, and employment dates. Use bullet points to effectively outline your key responsibilities and accomplishments. Each bullet should kick off with an action verb and include specific examples and measurable results. This approach ensures that hiring managers instantly understand the considerable value you brought to your previous positions, tying together your expertise and the tangible outcomes you've achieved.

Commercial Banking Analyst

Financial Group Inc.

January 2020 - Present

- Created financial models that boosted loan approval rates by 20% through improved risk assessment.

- Managed a portfolio of over 50 business clients, enhancing customer retention with better relationship management.

- Led a team to streamline loan processing, cutting approval time by 30% and boosting customer satisfaction.

- Performed market analysis to spot growth opportunities, contributing to a 15% revenue increase.

Project-Focused resume experience section

A project-focused resume experience section should showcase your role in key projects and how you made a difference. Begin by identifying projects where you played a significant part and think about the specific actions you took that led to concrete outcomes. Highlight these achievements using numbers to paint a clear picture of your impact. Use simple, active language to clearly communicate your accomplishments and ensure each bullet point demonstrates your ability to lead, innovate, or solve complex problems.

When organizing your experience, it's important to keep it structured and easy to read. Start by listing your job title, the company’s name, and the timeframe in which you worked there. Use bullet points to detail your responsibilities and achievements, ensuring each one is specific and highlights your accomplishments rather than just duties performed. Showing how your efforts contributed to the company’s goals can make your resume truly stand out to potential employers.

Senior Risk Analyst

XYZ National Bank

March 2020 - July 2023

- Led a team of 5 to develop a new risk assessment tool, cutting assessment time by 30%.

- Implemented a fraud detection system that saved $1.2 million in potential losses.

- Trained 10 junior analysts on risk evaluation techniques, boosting team productivity by 25%.

- Worked with cross-functional teams to improve risk reporting processes.

Result-Focused resume experience section

A result-focused commercial banking resume experience section should highlight your achievements and the positive impact you've made in your roles, rather than just listing duties. Start by showcasing specific accomplishments where your expertise led to successful outcomes, such as boosting revenue, cutting costs, or enhancing customer satisfaction. Use numbers or percentages to quantify these achievements, as this paints a clearer picture of your contributions and draws attention to your capabilities.

Your aim is to directly appeal to potential employers by demonstrating the tangible value you can bring to their organization. Emphasize transferable skills and proven results that align with the job you're aiming for. Arrange your bullet points so the most impressive results stand out, and begin each point with an action verb that conveys a proactive approach and ownership of your tasks. This cohesive strategy ensures each entry is both clear and impactful, effectively tying together your achievements into a compelling narrative.

Senior Commercial Banking Officer

Avalon Financial Group

Jan 2020 - Sep 2023

- Boosted loan portfolio by 30% over two years by spotting key market opportunities and speeding up approval processes.

- Led a team that cut operating costs by 15% through the implementation of efficient financial software and workflow optimization.

- Created customer loyalty programs that led to a 20% rise in long-term deposits.

- Partnered with cross-functional teams to design new product offerings, driving a 25% increase in new client acquisition.

Write your commercial banking resume summary section

A customer-focused commercial banking resume summary should immediately capture the attention of hiring managers with its clarity and conciseness. Start by highlighting your skills, experience, and achievements to give potential employers a clear picture of what you bring to the table. If you have substantial experience, emphasizing your successes and expertise in commercial banking can showcase your value. For example, consider this summary:

This summary seamlessly reflects your background, linking your years of experience with specific skills like account management and revenue growth. It also underscores your talent for building strong client relationships, an essential quality in the banking industry. Presenting yourself as a professional who delivers tangible results can quickly draw in the reader and differentiate you from the competition.

It's important to understand how a resume summary differs from other sections. While a resume summary provides a snapshot of your experience and achievements, a resume objective focuses on your career goals and why you're a good fit for the role, especially if you're new to the industry. A resume profile, on the other hand, often combines skills and goals for a more rounded picture. In contrast, a summary of qualifications lists the skills and accomplishments relevant to the job. Each serves a distinct purpose based on your career stage and experience level, ensuring you convey the right message to potential employers.

Listing your commercial banking skills on your resume

A skills-focused commercial banking resume should clearly and effectively present your abilities. Skills can stand alone in their own section or be woven into other areas like your experience or summary. Highlighting strengths and soft skills showcases personal traits, such as communication and leadership, which are crucial in banking. Hard skills, on the other hand, refer to the specific, teachable abilities like financial analysis or regulatory compliance that you learn through education or training. Integrating your skills and strengths throughout your resume can act as powerful keywords, helping it capture attention from hiring managers and automatic systems scanning for specific terms.

Here's an example of how you might format a standalone skills section using JSON:

A well-crafted skills section is both clear and concise, enabling employers to quickly assess your strengths. Including relevant keywords that align with job descriptions adds to its effectiveness, presenting a comprehensive set of capabilities crucial in the banking industry.

Best hard skills to feature on your commercial banking resume

Hard skills demonstrate your technical expertise and ability to manage financial information, understand regulatory requirements, and effectively assist clients, all of which are essential in commercial banking.

Hard Skills

- Financial Analysis

- Commercial Lending

- Risk Management

- Regulatory Compliance

- Cash Flow Forecasting

- Credit Analysis

- Portfolio Management

- Financial Reporting

- Loan Structuring

- Asset Management

- Data Analysis

- Credit Risk Assessment

- Investment Banking

- Derivatives Knowledge

- Budget Management

Best soft skills to feature on your commercial banking resume

Soft skills illustrate how you interact with others and solve problems. In commercial banking, they demonstrate your ability to communicate effectively, lead teams, and drive positive changes in various scenarios.

Soft Skills

- Communication

- Teamwork

- Problem-Solving

- Client Relationship Management

- Attention to Detail

- Negotiation

- Adaptability

- Leadership

- Time Management

- Conflict Resolution

- Decision Making

- Emotional Intelligence

- Networking

- Patience

- Initiative

How to include your education on your resume

The education section is a crucial part of your commercial banking resume. This section showcases your academic qualifications and underscores why you’re fit for the job. Tailor your education section to the position by including only relevant details. If your GPA is impressive, list it using a format like "3.8/4.0". When achieving honors like cum laude, ensure they stand out by including them alongside your degree. Clearly list your degree by stating what it is, where you earned it, and when.

Here is a wrong example:

Now, a strong example:

The improved example fits the commercial banking role perfectly. It highlights a finance degree from a reputable institution, making it relevant to the job. Including the cum laude distinction and an impressive GPA further strengthens your candidacy, showing dedication and expertise. The education section effectively communicates relevant qualifications concisely and clearly.

How to include commercial banking certificates on your resume

Including a certificates section on your commercial banking resume is crucial. Certificates showcase your expertise and dedication to professional growth. You can also feature key certificates in the header to maximize their visibility.

List the name of each certificate clearly. Include the date you obtained the certification. Add the issuing organization to lend credibility. Ensure the certificates are relevant to commercial banking roles, such as financial analysis or compliance-related certifications.

Here’s how you can format it:

The example above is effective because it lists industry-recognized certificates that align with commercial banking. Including the CFA shows advanced financial skills, while the Chartered Banker MBA highlights leadership in banking. Both add substantial value to your resume, demonstrating expertise and commitment.

Extra sections to include in your commercial banking resume

A well-crafted resume for a commercial banking role not only highlights your professional expertise but also showcases your personal qualities and unique strengths. Including sections such as language skills, hobbies, volunteer work, and books can make you stand out and provide a more comprehensive view of who you are.

- Language skills — List languages you speak fluently to show communication abilities with diverse clients. Demonstrating multilingual capabilities can enhance your marketability and improve client relationships.

- Hobbies and interests — Briefly mention hobbies that reflect discipline or teamwork, such as marathon running or playing chess. Showing well-rounded interests can make you more relatable and highlight soft skills like strategic thinking.

- Volunteer work — Include volunteer roles and impact, like organizing fundraisers with a local nonprofit. Highlighting volunteer work can illustrate your commitment to community and social responsibility.

- Books — List industry-relevant books you have read, such as "The Intelligent Investor" by Benjamin Graham. Mentioning books can demonstrate your ongoing pursuit of industry knowledge and personal growth.

Incorporating these sections can enrich your resume and present you as a balanced, thoughtful candidate.

In Conclusion

In conclusion, creating a successful commercial banking resume involves more than just listing your previous job titles and responsibilities. It requires a strategic approach that highlights your unique skills, achievements, and the value you bring to potential employers. Your resume serves as your professional narrative, showcasing your ability to solve financial puzzles through complex financial analysis, client management, and strategic decision-making. Using a consistent and clean format, such as reverse chronological order, can help present your career trajectory effectively. Incorporating specific metrics and quantifiable results alongside strong action verbs can vividly portray your competence and accomplishments. Don't underestimate the importance of showcasing both hard and soft skills, as they collectively define your professional capabilities in the banking sector. Furthermore, ensure your education and certifications are well-documented, reflecting your commitment to staying current in the industry. Finally, consider adding extra sections like volunteer work, languages, or relevant books to demonstrate your well-rounded personality and dedication to personal growth. By carefully crafting each section, you can create a compelling resume that stands out in a competitive market, opening doors to new career opportunities in commercial banking.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.