Contract Accountant Resume Examples

Jul 18, 2024

|

12 min read

Ace your financial future: a simple guide to crafting an accountant contract resume that counts.

Rated by 348 people

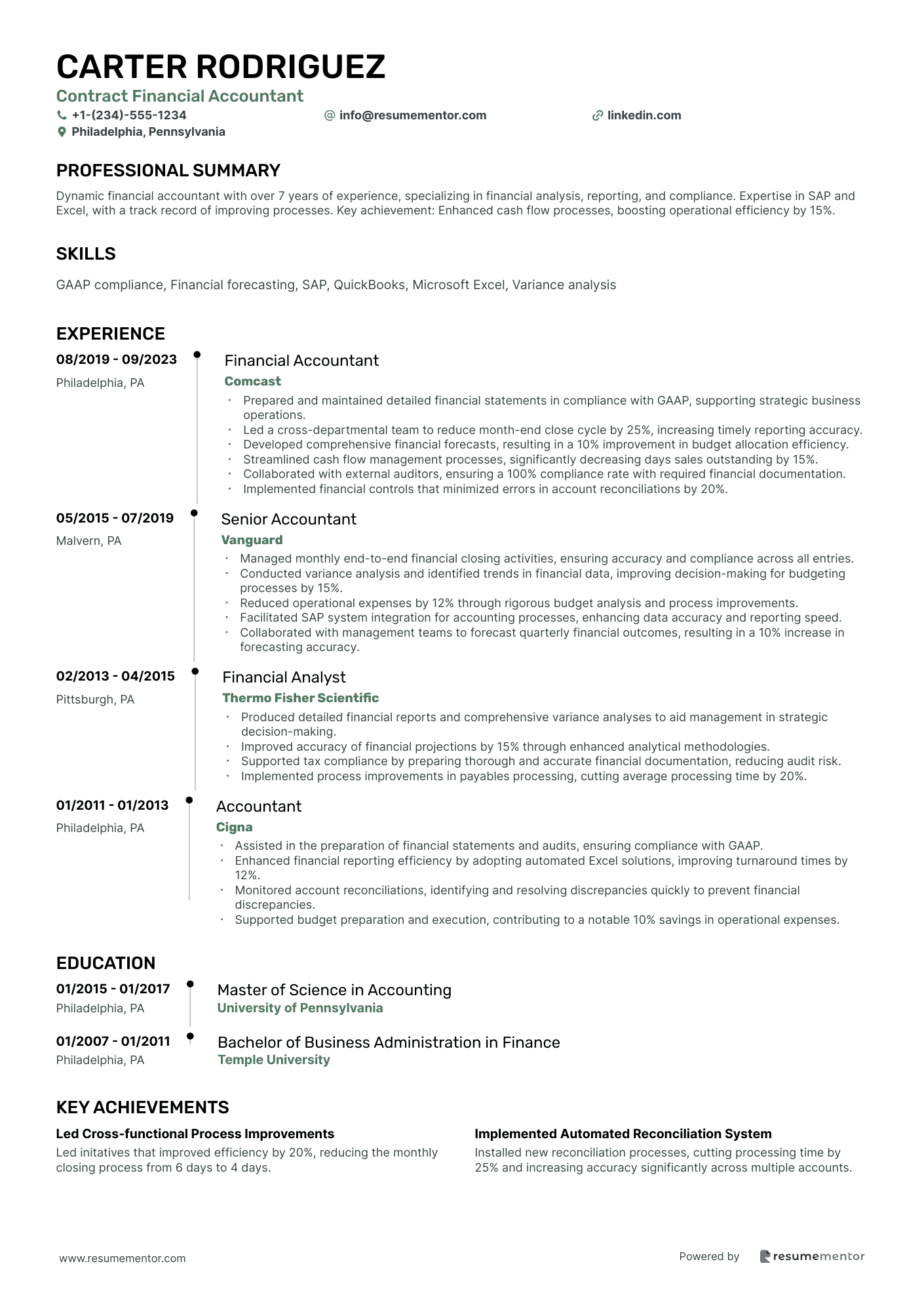

Contract Financial Accountant

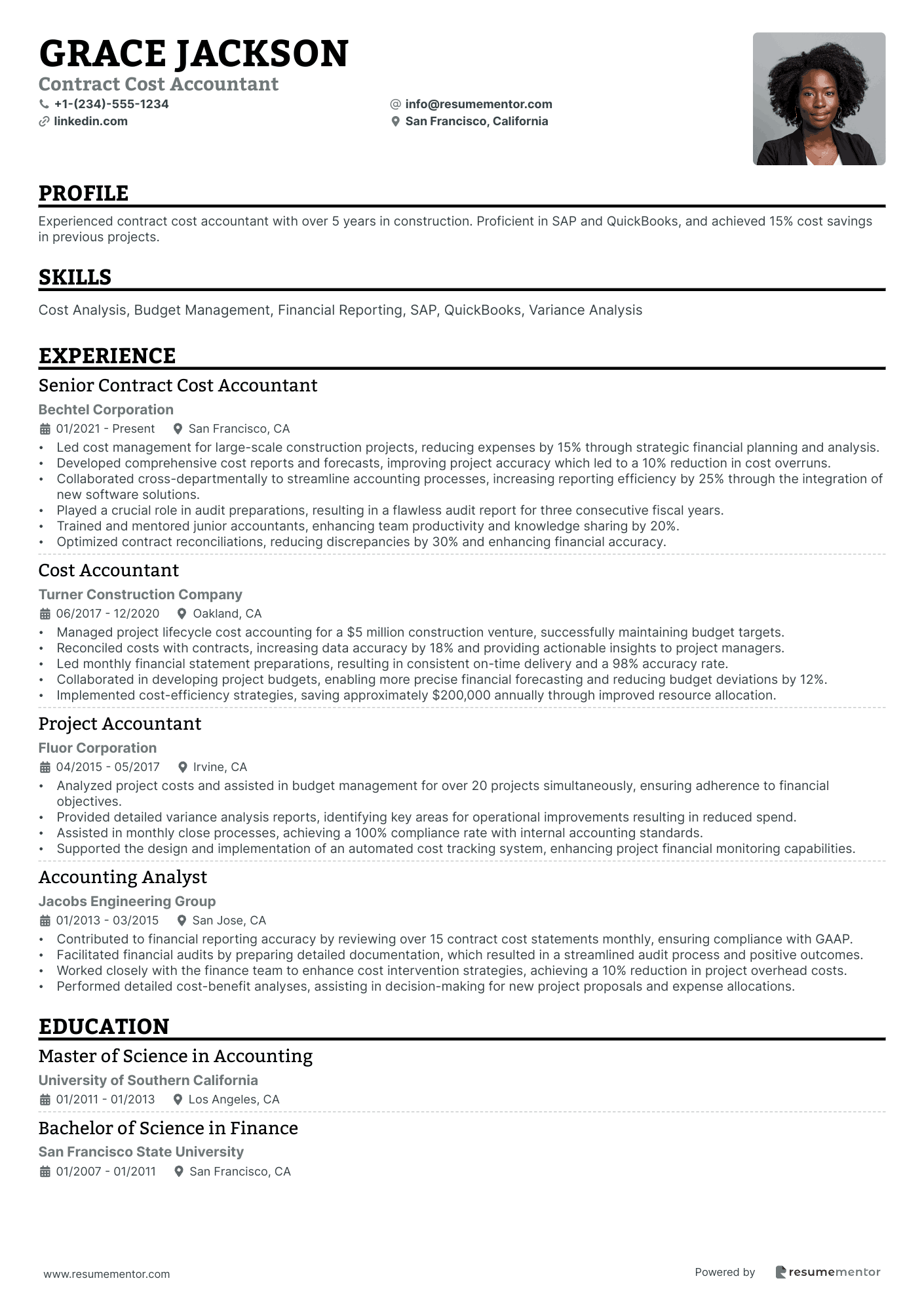

Contract Cost Accountant

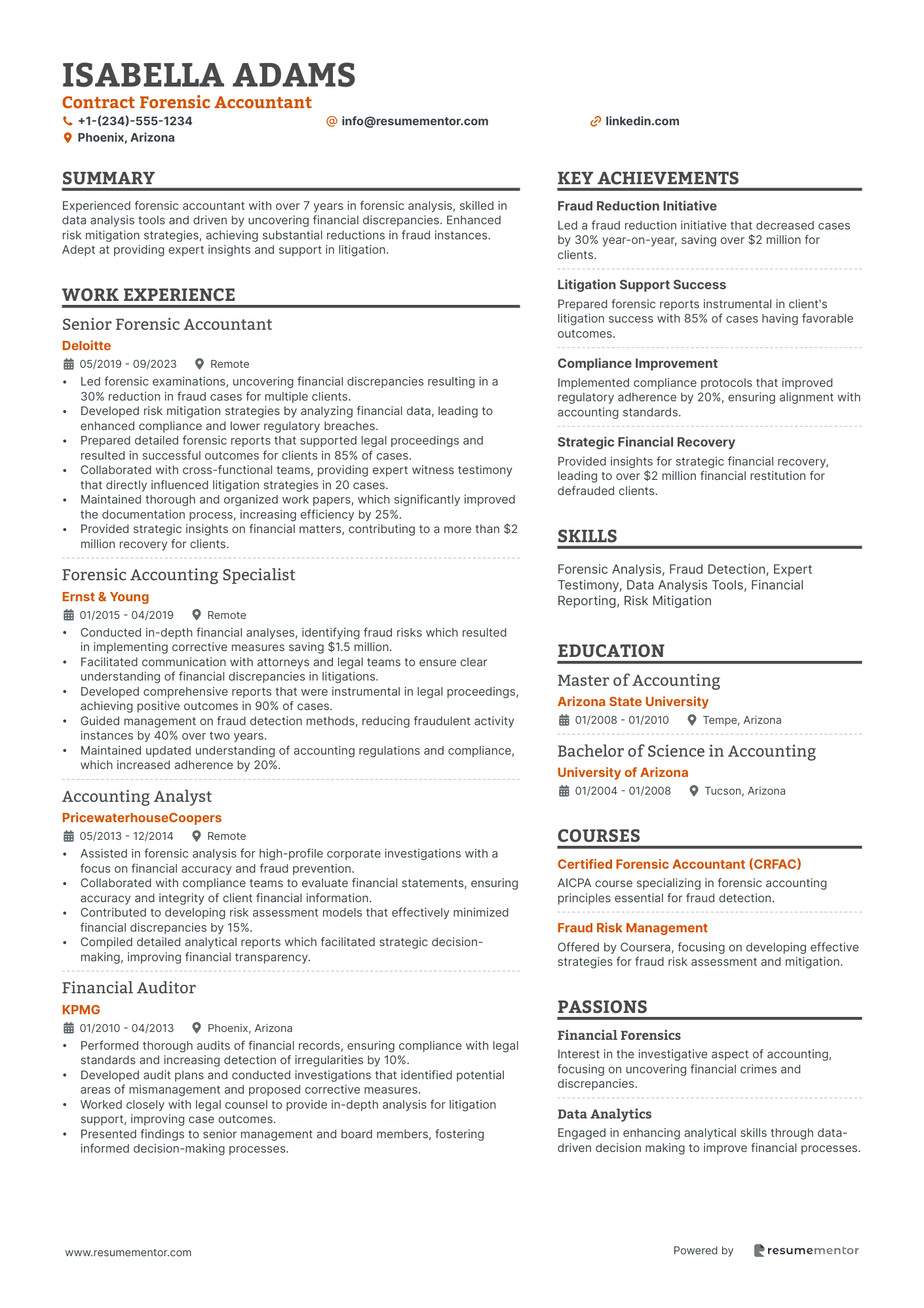

Contract Forensic Accountant

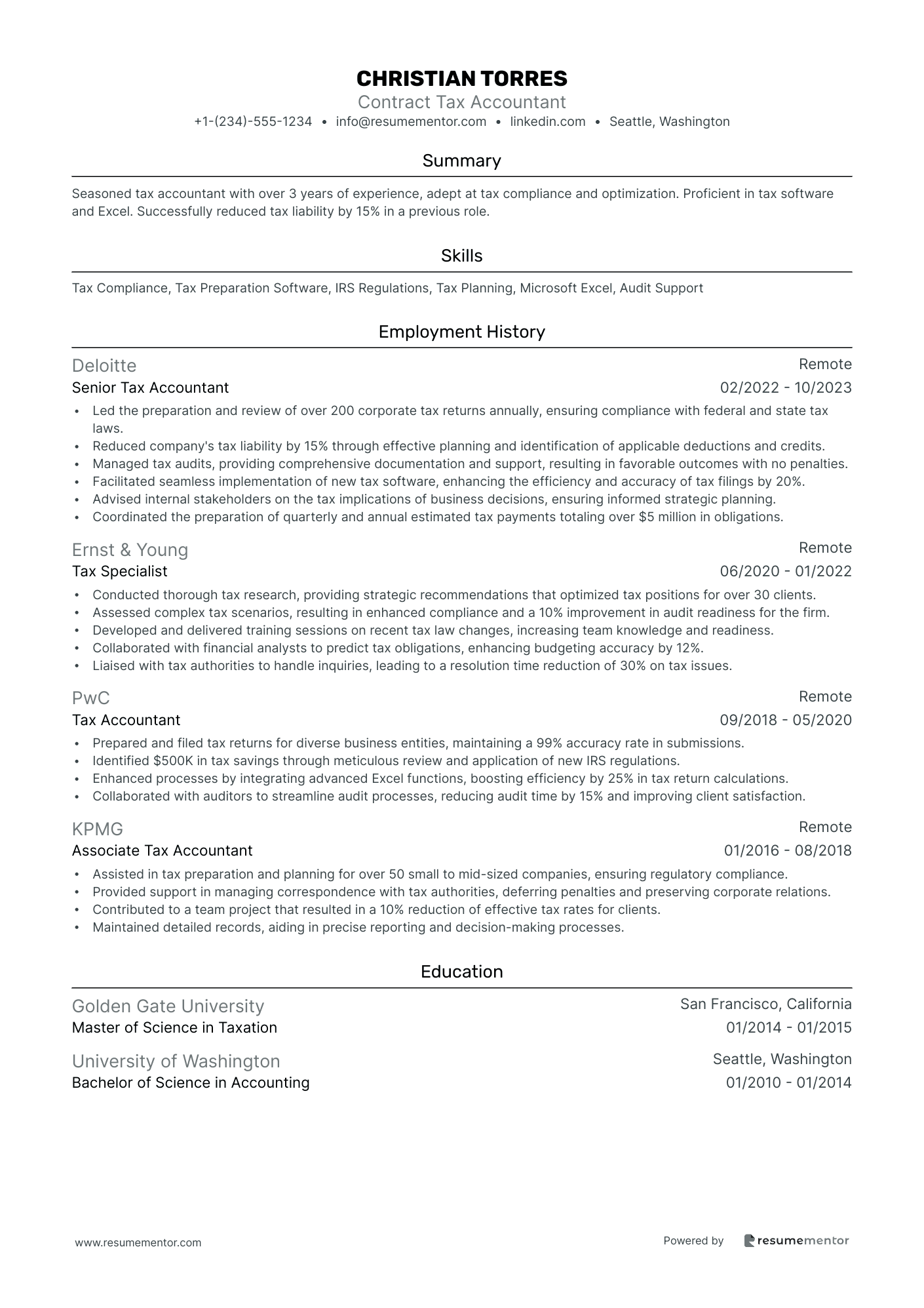

Contract Tax Accountant

Project-Based Payroll Accountant

Contract Asset Management Accountant

Temporary Contract Accounting Specialist

Freelance Government Contract Accountant

Contract Accounting Systems Analyst

Contract Budget Accountant

Contract Financial Accountant resume sample

- •Prepared and maintained detailed financial statements in compliance with GAAP, supporting strategic business operations.

- •Led a cross-departmental team to reduce month-end close cycle by 25%, increasing timely reporting accuracy.

- •Developed comprehensive financial forecasts, resulting in a 10% improvement in budget allocation efficiency.

- •Streamlined cash flow management processes, significantly decreasing days sales outstanding by 15%.

- •Collaborated with external auditors, ensuring a 100% compliance rate with required financial documentation.

- •Implemented financial controls that minimized errors in account reconciliations by 20%.

- •Managed monthly end-to-end financial closing activities, ensuring accuracy and compliance across all entries.

- •Conducted variance analysis and identified trends in financial data, improving decision-making for budgeting processes by 15%.

- •Reduced operational expenses by 12% through rigorous budget analysis and process improvements.

- •Facilitated SAP system integration for accounting processes, enhancing data accuracy and reporting speed.

- •Collaborated with management teams to forecast quarterly financial outcomes, resulting in a 10% increase in forecasting accuracy.

- •Produced detailed financial reports and comprehensive variance analyses to aid management in strategic decision-making.

- •Improved accuracy of financial projections by 15% through enhanced analytical methodologies.

- •Supported tax compliance by preparing thorough and accurate financial documentation, reducing audit risk.

- •Implemented process improvements in payables processing, cutting average processing time by 20%.

- •Assisted in the preparation of financial statements and audits, ensuring compliance with GAAP.

- •Enhanced financial reporting efficiency by adopting automated Excel solutions, improving turnaround times by 12%.

- •Monitored account reconciliations, identifying and resolving discrepancies quickly to prevent financial discrepancies.

- •Supported budget preparation and execution, contributing to a notable 10% savings in operational expenses.

Contract Cost Accountant resume sample

- •Led cost management for large-scale construction projects, reducing expenses by 15% through strategic financial planning and analysis.

- •Developed comprehensive cost reports and forecasts, improving project accuracy which led to a 10% reduction in cost overruns.

- •Collaborated cross-departmentally to streamline accounting processes, increasing reporting efficiency by 25% through the integration of new software solutions.

- •Played a crucial role in audit preparations, resulting in a flawless audit report for three consecutive fiscal years.

- •Trained and mentored junior accountants, enhancing team productivity and knowledge sharing by 20%.

- •Optimized contract reconciliations, reducing discrepancies by 30% and enhancing financial accuracy.

- •Managed project lifecycle cost accounting for a $5 million construction venture, successfully maintaining budget targets.

- •Reconciled costs with contracts, increasing data accuracy by 18% and providing actionable insights to project managers.

- •Led monthly financial statement preparations, resulting in consistent on-time delivery and a 98% accuracy rate.

- •Collaborated in developing project budgets, enabling more precise financial forecasting and reducing budget deviations by 12%.

- •Implemented cost-efficiency strategies, saving approximately $200,000 annually through improved resource allocation.

- •Analyzed project costs and assisted in budget management for over 20 projects simultaneously, ensuring adherence to financial objectives.

- •Provided detailed variance analysis reports, identifying key areas for operational improvements resulting in reduced spend.

- •Assisted in monthly close processes, achieving a 100% compliance rate with internal accounting standards.

- •Supported the design and implementation of an automated cost tracking system, enhancing project financial monitoring capabilities.

- •Contributed to financial reporting accuracy by reviewing over 15 contract cost statements monthly, ensuring compliance with GAAP.

- •Facilitated financial audits by preparing detailed documentation, which resulted in a streamlined audit process and positive outcomes.

- •Worked closely with the finance team to enhance cost intervention strategies, achieving a 10% reduction in project overhead costs.

- •Performed detailed cost-benefit analyses, assisting in decision-making for new project proposals and expense allocations.

Contract Forensic Accountant resume sample

- •Led forensic examinations, uncovering financial discrepancies resulting in a 30% reduction in fraud cases for multiple clients.

- •Developed risk mitigation strategies by analyzing financial data, leading to enhanced compliance and lower regulatory breaches.

- •Prepared detailed forensic reports that supported legal proceedings and resulted in successful outcomes for clients in 85% of cases.

- •Collaborated with cross-functional teams, providing expert witness testimony that directly influenced litigation strategies in 20 cases.

- •Maintained thorough and organized work papers, which significantly improved the documentation process, increasing efficiency by 25%.

- •Provided strategic insights on financial matters, contributing to a more than $2 million recovery for clients.

- •Conducted in-depth financial analyses, identifying fraud risks which resulted in implementing corrective measures saving $1.5 million.

- •Facilitated communication with attorneys and legal teams to ensure clear understanding of financial discrepancies in litigations.

- •Developed comprehensive reports that were instrumental in legal proceedings, achieving positive outcomes in 90% of cases.

- •Guided management on fraud detection methods, reducing fraudulent activity instances by 40% over two years.

- •Maintained updated understanding of accounting regulations and compliance, which increased adherence by 20%.

- •Assisted in forensic analysis for high-profile corporate investigations with a focus on financial accuracy and fraud prevention.

- •Collaborated with compliance teams to evaluate financial statements, ensuring accuracy and integrity of client financial information.

- •Contributed to developing risk assessment models that effectively minimized financial discrepancies by 15%.

- •Compiled detailed analytical reports which facilitated strategic decision-making, improving financial transparency.

- •Performed thorough audits of financial records, ensuring compliance with legal standards and increasing detection of irregularities by 10%.

- •Developed audit plans and conducted investigations that identified potential areas of mismanagement and proposed corrective measures.

- •Worked closely with legal counsel to provide in-depth analysis for litigation support, improving case outcomes.

- •Presented findings to senior management and board members, fostering informed decision-making processes.

Contract Tax Accountant resume sample

- •Led the preparation and review of over 200 corporate tax returns annually, ensuring compliance with federal and state tax laws.

- •Reduced company's tax liability by 15% through effective planning and identification of applicable deductions and credits.

- •Managed tax audits, providing comprehensive documentation and support, resulting in favorable outcomes with no penalties.

- •Facilitated seamless implementation of new tax software, enhancing the efficiency and accuracy of tax filings by 20%.

- •Advised internal stakeholders on the tax implications of business decisions, ensuring informed strategic planning.

- •Coordinated the preparation of quarterly and annual estimated tax payments totaling over $5 million in obligations.

- •Conducted thorough tax research, providing strategic recommendations that optimized tax positions for over 30 clients.

- •Assessed complex tax scenarios, resulting in enhanced compliance and a 10% improvement in audit readiness for the firm.

- •Developed and delivered training sessions on recent tax law changes, increasing team knowledge and readiness.

- •Collaborated with financial analysts to predict tax obligations, enhancing budgeting accuracy by 12%.

- •Liaised with tax authorities to handle inquiries, leading to a resolution time reduction of 30% on tax issues.

- •Prepared and filed tax returns for diverse business entities, maintaining a 99% accuracy rate in submissions.

- •Identified $500K in tax savings through meticulous review and application of new IRS regulations.

- •Enhanced processes by integrating advanced Excel functions, boosting efficiency by 25% in tax return calculations.

- •Collaborated with auditors to streamline audit processes, reducing audit time by 15% and improving client satisfaction.

- •Assisted in tax preparation and planning for over 50 small to mid-sized companies, ensuring regulatory compliance.

- •Provided support in managing correspondence with tax authorities, deferring penalties and preserving corporate relations.

- •Contributed to a team project that resulted in a 10% reduction of effective tax rates for clients.

- •Maintained detailed records, aiding in precise reporting and decision-making processes.

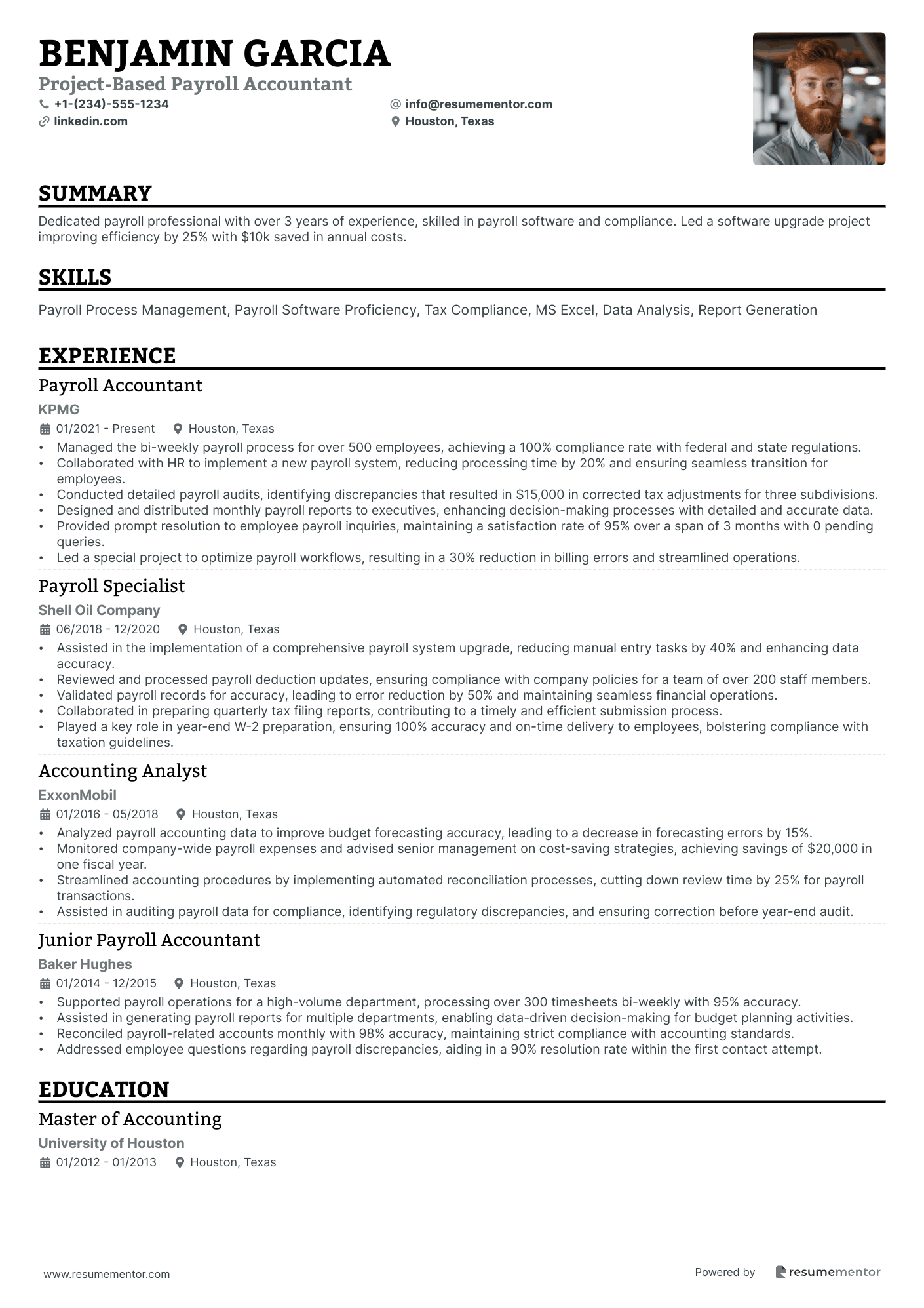

Project-Based Payroll Accountant resume sample

- •Managed the bi-weekly payroll process for over 500 employees, achieving a 100% compliance rate with federal and state regulations.

- •Collaborated with HR to implement a new payroll system, reducing processing time by 20% and ensuring seamless transition for employees.

- •Conducted detailed payroll audits, identifying discrepancies that resulted in $15,000 in corrected tax adjustments for three subdivisions.

- •Designed and distributed monthly payroll reports to executives, enhancing decision-making processes with detailed and accurate data.

- •Provided prompt resolution to employee payroll inquiries, maintaining a satisfaction rate of 95% over a span of 3 months with 0 pending queries.

- •Led a special project to optimize payroll workflows, resulting in a 30% reduction in billing errors and streamlined operations.

- •Assisted in the implementation of a comprehensive payroll system upgrade, reducing manual entry tasks by 40% and enhancing data accuracy.

- •Reviewed and processed payroll deduction updates, ensuring compliance with company policies for a team of over 200 staff members.

- •Validated payroll records for accuracy, leading to error reduction by 50% and maintaining seamless financial operations.

- •Collaborated in preparing quarterly tax filing reports, contributing to a timely and efficient submission process.

- •Played a key role in year-end W-2 preparation, ensuring 100% accuracy and on-time delivery to employees, bolstering compliance with taxation guidelines.

- •Analyzed payroll accounting data to improve budget forecasting accuracy, leading to a decrease in forecasting errors by 15%.

- •Monitored company-wide payroll expenses and advised senior management on cost-saving strategies, achieving savings of $20,000 in one fiscal year.

- •Streamlined accounting procedures by implementing automated reconciliation processes, cutting down review time by 25% for payroll transactions.

- •Assisted in auditing payroll data for compliance, identifying regulatory discrepancies, and ensuring correction before year-end audit.

- •Supported payroll operations for a high-volume department, processing over 300 timesheets bi-weekly with 95% accuracy.

- •Assisted in generating payroll reports for multiple departments, enabling data-driven decision-making for budget planning activities.

- •Reconciled payroll-related accounts monthly with 98% accuracy, maintaining strict compliance with accounting standards.

- •Addressed employee questions regarding payroll discrepancies, aiding in a 90% resolution rate within the first contact attempt.

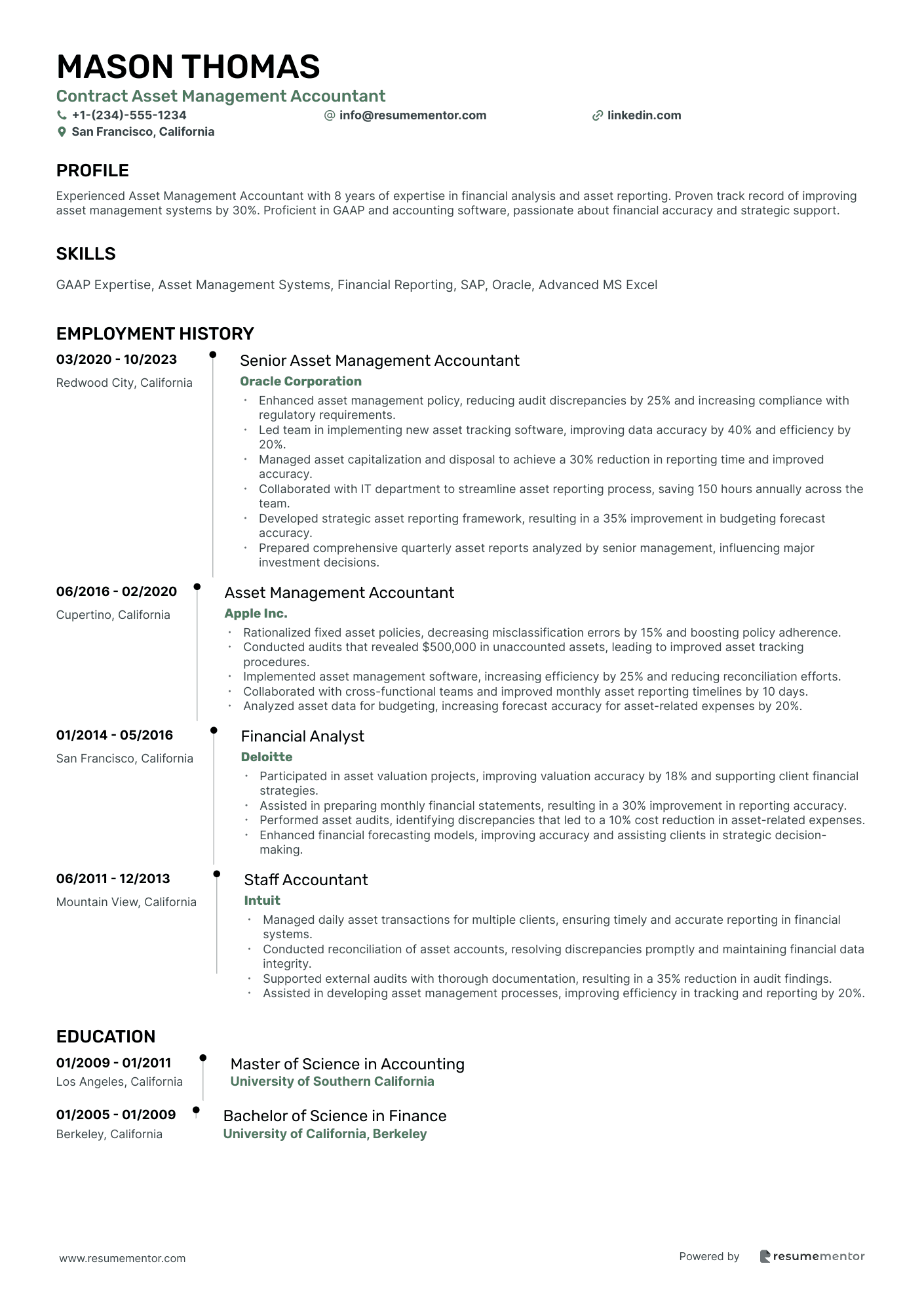

Contract Asset Management Accountant resume sample

- •Enhanced asset management policy, reducing audit discrepancies by 25% and increasing compliance with regulatory requirements.

- •Led team in implementing new asset tracking software, improving data accuracy by 40% and efficiency by 20%.

- •Managed asset capitalization and disposal to achieve a 30% reduction in reporting time and improved accuracy.

- •Collaborated with IT department to streamline asset reporting process, saving 150 hours annually across the team.

- •Developed strategic asset reporting framework, resulting in a 35% improvement in budgeting forecast accuracy.

- •Prepared comprehensive quarterly asset reports analyzed by senior management, influencing major investment decisions.

- •Rationalized fixed asset policies, decreasing misclassification errors by 15% and boosting policy adherence.

- •Conducted audits that revealed $500,000 in unaccounted assets, leading to improved asset tracking procedures.

- •Implemented asset management software, increasing efficiency by 25% and reducing reconciliation efforts.

- •Collaborated with cross-functional teams and improved monthly asset reporting timelines by 10 days.

- •Analyzed asset data for budgeting, increasing forecast accuracy for asset-related expenses by 20%.

- •Participated in asset valuation projects, improving valuation accuracy by 18% and supporting client financial strategies.

- •Assisted in preparing monthly financial statements, resulting in a 30% improvement in reporting accuracy.

- •Performed asset audits, identifying discrepancies that led to a 10% cost reduction in asset-related expenses.

- •Enhanced financial forecasting models, improving accuracy and assisting clients in strategic decision-making.

- •Managed daily asset transactions for multiple clients, ensuring timely and accurate reporting in financial systems.

- •Conducted reconciliation of asset accounts, resolving discrepancies promptly and maintaining financial data integrity.

- •Supported external audits with thorough documentation, resulting in a 35% reduction in audit findings.

- •Assisted in developing asset management processes, improving efficiency in tracking and reporting by 20%.

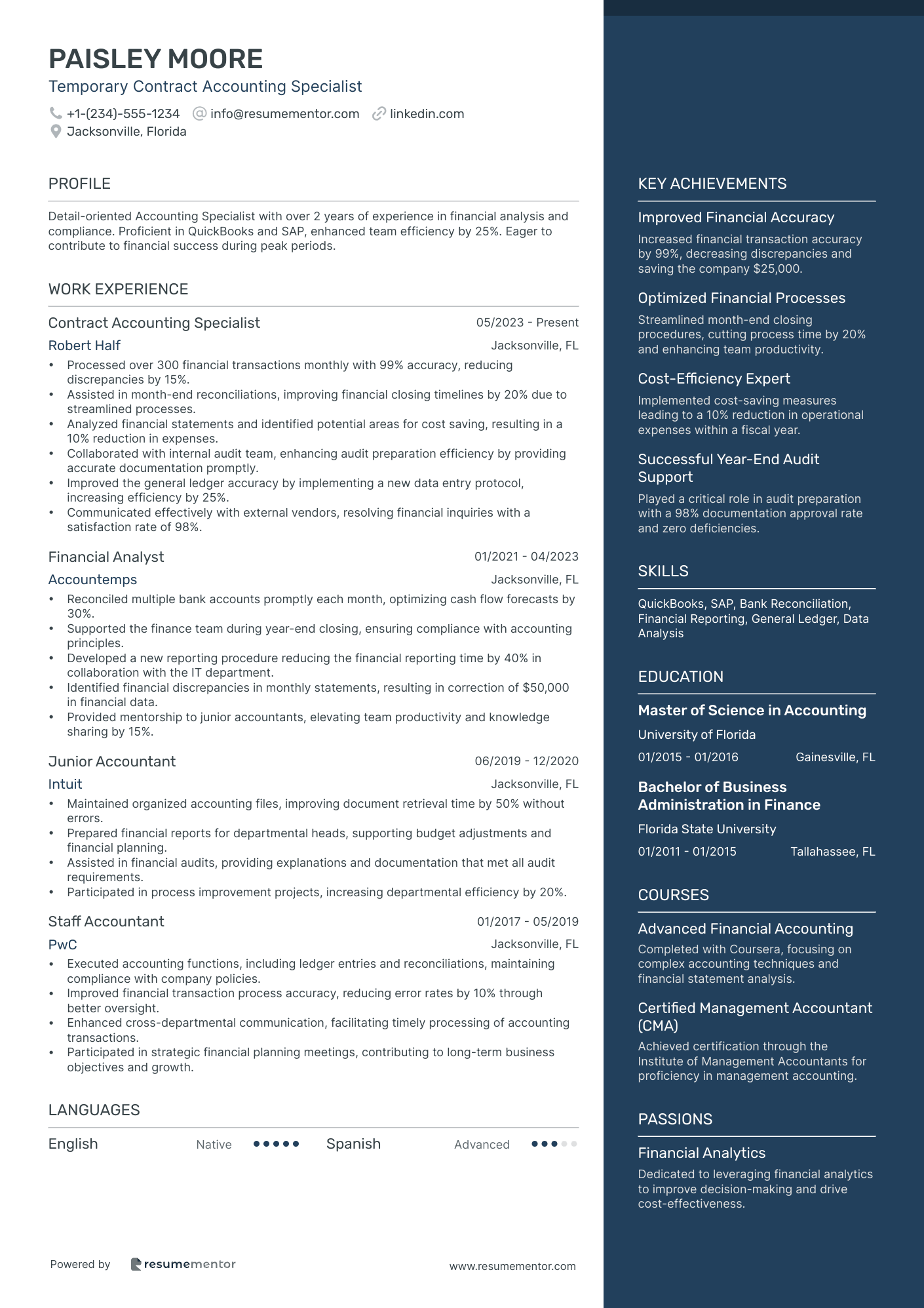

Temporary Contract Accounting Specialist resume sample

- •Processed over 300 financial transactions monthly with 99% accuracy, reducing discrepancies by 15%.

- •Assisted in month-end reconciliations, improving financial closing timelines by 20% due to streamlined processes.

- •Analyzed financial statements and identified potential areas for cost saving, resulting in a 10% reduction in expenses.

- •Collaborated with internal audit team, enhancing audit preparation efficiency by providing accurate documentation promptly.

- •Improved the general ledger accuracy by implementing a new data entry protocol, increasing efficiency by 25%.

- •Communicated effectively with external vendors, resolving financial inquiries with a satisfaction rate of 98%.

- •Reconciled multiple bank accounts promptly each month, optimizing cash flow forecasts by 30%.

- •Supported the finance team during year-end closing, ensuring compliance with accounting principles.

- •Developed a new reporting procedure reducing the financial reporting time by 40% in collaboration with the IT department.

- •Identified financial discrepancies in monthly statements, resulting in correction of $50,000 in financial data.

- •Provided mentorship to junior accountants, elevating team productivity and knowledge sharing by 15%.

- •Maintained organized accounting files, improving document retrieval time by 50% without errors.

- •Prepared financial reports for departmental heads, supporting budget adjustments and financial planning.

- •Assisted in financial audits, providing explanations and documentation that met all audit requirements.

- •Participated in process improvement projects, increasing departmental efficiency by 20%.

- •Executed accounting functions, including ledger entries and reconciliations, maintaining compliance with company policies.

- •Improved financial transaction process accuracy, reducing error rates by 10% through better oversight.

- •Enhanced cross-departmental communication, facilitating timely processing of accounting transactions.

- •Participated in strategic financial planning meetings, contributing to long-term business objectives and growth.

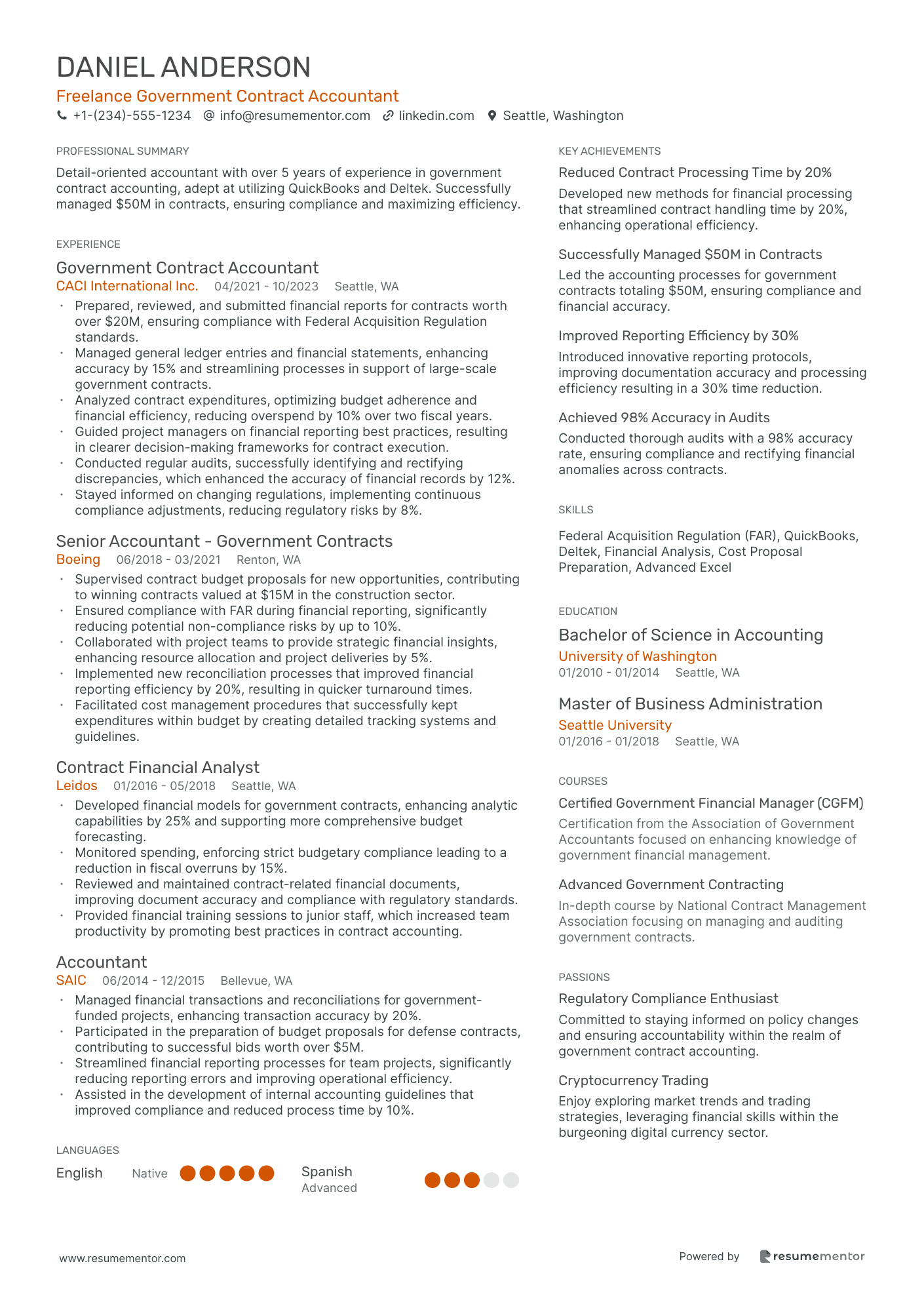

Freelance Government Contract Accountant resume sample

- •Prepared, reviewed, and submitted financial reports for contracts worth over $20M, ensuring compliance with Federal Acquisition Regulation standards.

- •Managed general ledger entries and financial statements, enhancing accuracy by 15% and streamlining processes in support of large-scale government contracts.

- •Analyzed contract expenditures, optimizing budget adherence and financial efficiency, reducing overspend by 10% over two fiscal years.

- •Guided project managers on financial reporting best practices, resulting in clearer decision-making frameworks for contract execution.

- •Conducted regular audits, successfully identifying and rectifying discrepancies, which enhanced the accuracy of financial records by 12%.

- •Stayed informed on changing regulations, implementing continuous compliance adjustments, reducing regulatory risks by 8%.

- •Supervised contract budget proposals for new opportunities, contributing to winning contracts valued at $15M in the construction sector.

- •Ensured compliance with FAR during financial reporting, significantly reducing potential non-compliance risks by up to 10%.

- •Collaborated with project teams to provide strategic financial insights, enhancing resource allocation and project deliveries by 5%.

- •Implemented new reconciliation processes that improved financial reporting efficiency by 20%, resulting in quicker turnaround times.

- •Facilitated cost management procedures that successfully kept expenditures within budget by creating detailed tracking systems and guidelines.

- •Developed financial models for government contracts, enhancing analytic capabilities by 25% and supporting more comprehensive budget forecasting.

- •Monitored spending, enforcing strict budgetary compliance leading to a reduction in fiscal overruns by 15%.

- •Reviewed and maintained contract-related financial documents, improving document accuracy and compliance with regulatory standards.

- •Provided financial training sessions to junior staff, which increased team productivity by promoting best practices in contract accounting.

- •Managed financial transactions and reconciliations for government-funded projects, enhancing transaction accuracy by 20%.

- •Participated in the preparation of budget proposals for defense contracts, contributing to successful bids worth over $5M.

- •Streamlined financial reporting processes for team projects, significantly reducing reporting errors and improving operational efficiency.

- •Assisted in the development of internal accounting guidelines that improved compliance and reduced process time by 10%.

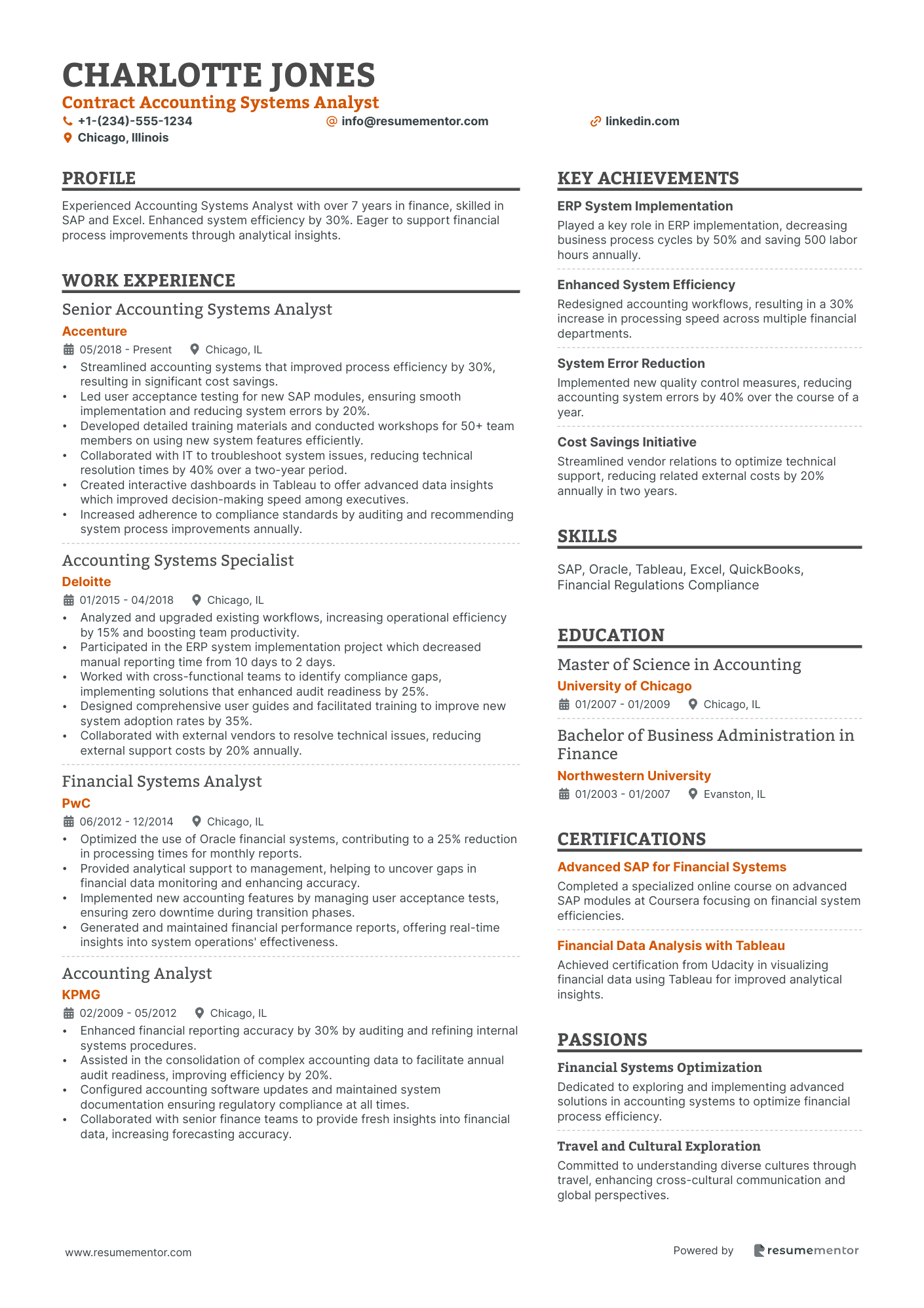

Contract Accounting Systems Analyst resume sample

- •Streamlined accounting systems that improved process efficiency by 30%, resulting in significant cost savings.

- •Led user acceptance testing for new SAP modules, ensuring smooth implementation and reducing system errors by 20%.

- •Developed detailed training materials and conducted workshops for 50+ team members on using new system features efficiently.

- •Collaborated with IT to troubleshoot system issues, reducing technical resolution times by 40% over a two-year period.

- •Created interactive dashboards in Tableau to offer advanced data insights which improved decision-making speed among executives.

- •Increased adherence to compliance standards by auditing and recommending system process improvements annually.

- •Analyzed and upgraded existing workflows, increasing operational efficiency by 15% and boosting team productivity.

- •Participated in the ERP system implementation project which decreased manual reporting time from 10 days to 2 days.

- •Worked with cross-functional teams to identify compliance gaps, implementing solutions that enhanced audit readiness by 25%.

- •Designed comprehensive user guides and facilitated training to improve new system adoption rates by 35%.

- •Collaborated with external vendors to resolve technical issues, reducing external support costs by 20% annually.

- •Optimized the use of Oracle financial systems, contributing to a 25% reduction in processing times for monthly reports.

- •Provided analytical support to management, helping to uncover gaps in financial data monitoring and enhancing accuracy.

- •Implemented new accounting features by managing user acceptance tests, ensuring zero downtime during transition phases.

- •Generated and maintained financial performance reports, offering real-time insights into system operations' effectiveness.

- •Enhanced financial reporting accuracy by 30% by auditing and refining internal systems procedures.

- •Assisted in the consolidation of complex accounting data to facilitate annual audit readiness, improving efficiency by 20%.

- •Configured accounting software updates and maintained system documentation ensuring regulatory compliance at all times.

- •Collaborated with senior finance teams to provide fresh insights into financial data, increasing forecasting accuracy.

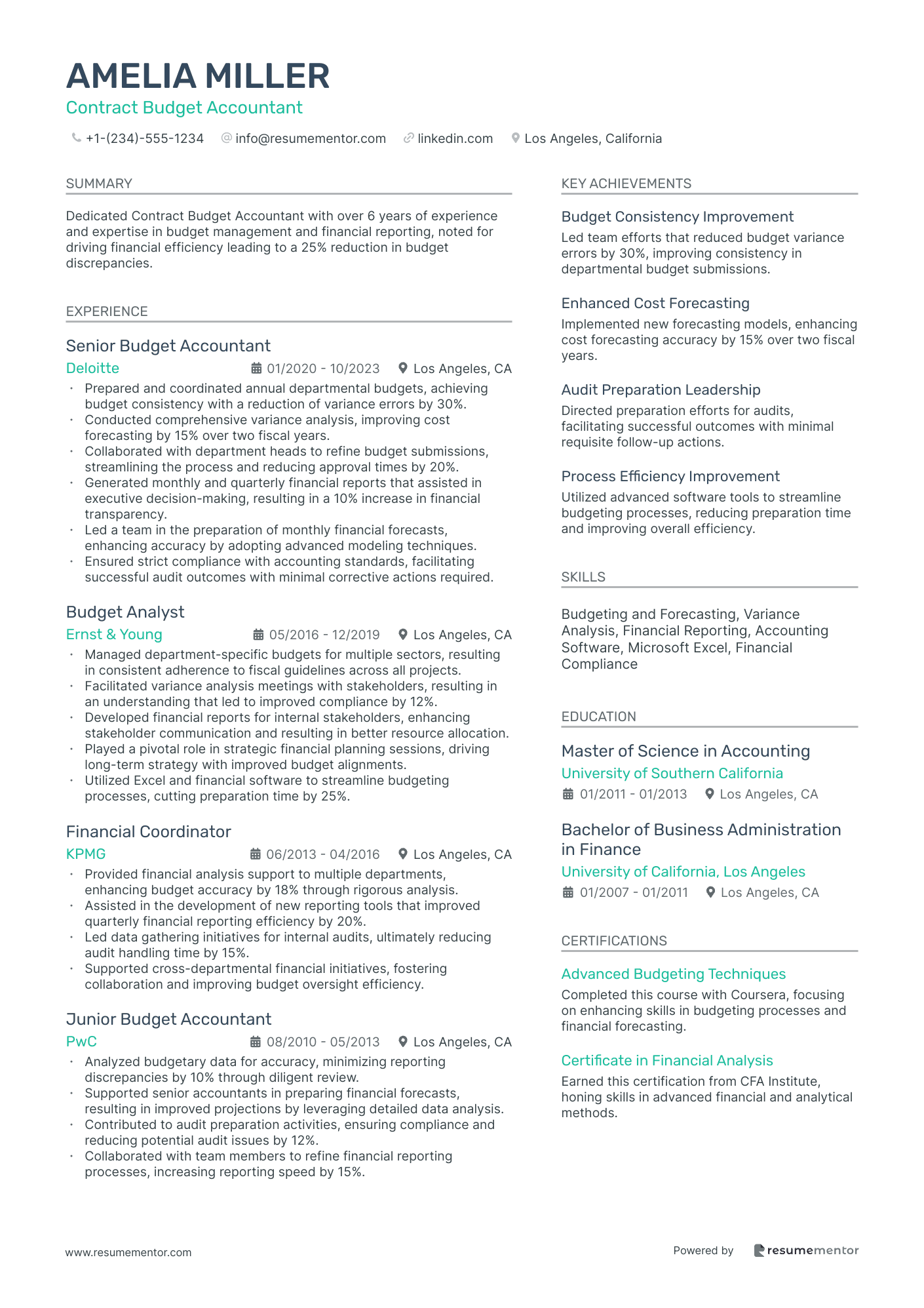

Contract Budget Accountant resume sample

- •Prepared and coordinated annual departmental budgets, achieving budget consistency with a reduction of variance errors by 30%.

- •Conducted comprehensive variance analysis, improving cost forecasting by 15% over two fiscal years.

- •Collaborated with department heads to refine budget submissions, streamlining the process and reducing approval times by 20%.

- •Generated monthly and quarterly financial reports that assisted in executive decision-making, resulting in a 10% increase in financial transparency.

- •Led a team in the preparation of monthly financial forecasts, enhancing accuracy by adopting advanced modeling techniques.

- •Ensured strict compliance with accounting standards, facilitating successful audit outcomes with minimal corrective actions required.

- •Managed department-specific budgets for multiple sectors, resulting in consistent adherence to fiscal guidelines across all projects.

- •Facilitated variance analysis meetings with stakeholders, resulting in an understanding that led to improved compliance by 12%.

- •Developed financial reports for internal stakeholders, enhancing stakeholder communication and resulting in better resource allocation.

- •Played a pivotal role in strategic financial planning sessions, driving long-term strategy with improved budget alignments.

- •Utilized Excel and financial software to streamline budgeting processes, cutting preparation time by 25%.

- •Provided financial analysis support to multiple departments, enhancing budget accuracy by 18% through rigorous analysis.

- •Assisted in the development of new reporting tools that improved quarterly financial reporting efficiency by 20%.

- •Led data gathering initiatives for internal audits, ultimately reducing audit handling time by 15%.

- •Supported cross-departmental financial initiatives, fostering collaboration and improving budget oversight efficiency.

- •Analyzed budgetary data for accuracy, minimizing reporting discrepancies by 10% through diligent review.

- •Supported senior accountants in preparing financial forecasts, resulting in improved projections by leveraging detailed data analysis.

- •Contributed to audit preparation activities, ensuring compliance and reducing potential audit issues by 12%.

- •Collaborated with team members to refine financial reporting processes, increasing reporting speed by 15%.

Navigating the world of contract accounting is much like managing a complex balancing act, where each project demands different skills and expertise. In such a dynamic field, crafting a compelling resume is your key to effectively presenting these varied abilities to potential employers. It's crucial that your resume communicates your adaptability and highlights your financial expertise across industries.

Choosing the right words to articulate your skills can make the difference between landing an interview and being overlooked. Because you've worked across different assignments, you need to ensure your resume paints a consistent and clear picture of your achievements and competencies tailored to your desired roles.

A great way to achieve this is by using a resume template, which helps you organize information in a way that makes your credentials shine. Take a look at these resume templates to give your resume that professional polish it needs.

By presenting your experience concisely and comprehensively, you can capture the attention of decision-makers effectively. Your resume should be a dynamic reflection of your career journey as a contract accountant, more than just a list of jobs. Think of it as your marketing tool, your first point of contact with employers. With the right tools and guidance, transforming your resume into a vibrant showcase of your career successes is within reach. Ready to refine your job search skills and attract the opportunities you deserve? Let’s dive into crafting a resume that opens doors for you.

Key Takeaways

- Craft a resume that highlights your adaptability and financial expertise through clear articulation of skills and a consistent portrayal of achievements across various assignments.

- A template can help you organize your resume effectively, ensuring that your credentials stand out and make a strong first impression on potential employers.

- Select the reverse-chronological format to emphasize recent experience and choose clean, modern fonts for readability and professionalism, saving your resume as a PDF to preserve the layout.

- In the experience section, focus on quantifiable achievements and use action verbs to demonstrate your impact, aligning your roles with job requirements and showcasing your journey as a contract accountant.

- Incorporate both hard skills like financial analysis and soft skills such as communication, ensuring that these are tailored to the job description and can be easily identified by tracking systems.

What to focus on when writing your contract accountant resume

Your contract accountant resume should effectively convey your financial expertise and adaptability to recruiters. Emphasizing your skill in handling various accounting tasks naturally demonstrates how well you perform in different settings, which is essential for contract roles.

How to structure your contract accountant resume

- Contact Information: Provide your full name, phone number, and professional email. Including your LinkedIn profile can further enhance your professional image and connectivity—this essential information serves as the foundation of your resume, ensuring recruiters can easily reach you for potential opportunities. Below, we'll delve deeper into crafting each section for maximum impact.

- Professional Summary: This section allows you to quickly outline your key accounting skills and years of experience. Highlight major achievements, such as managing budgets or handling financial reports, which paint a picture of your proficiency in diverse company settings—this is your opportunity to make a strong first impression, setting the stage for the detailed sections that follow.

- Work Experience: In this section, list your contract roles and focus on important responsibilities like tax preparation, audit assistance, or financial analysis. Mentioning the industries you've worked in showcases your adaptability and breadth of experience—think of this as the backbone of your resume, providing concrete examples of your past successes.

- Skills: Highlight crucial capabilities such as GAAP compliance and financial forecasting. Adding expertise with accounting software like QuickBooks or SAP ties directly into your ability to create detailed financial reports, which is a significant asset—this section underscores the specific tools and knowledge that make you a standout candidate.

- Education: Include your degree in Accounting or a related field. Certifications like CPA or CMA add credibility and relevance to your career profile, emphasizing your commitment to the profession—laying out your educational foundation reinforces your qualifications and dedication, leading smoothly into the tech skills you'll describe next.

- Technical Skills: Discuss software skills or tools you're proficient in, like Excel macros, as they enhance your ability to increase efficiency in financial operations—this final core section demonstrates your practical, hands-on capabilities, rounding out the key elements of your resume before we explore each aspect more in-depth.

Which resume format to choose

Crafting a standout resume for a contract accountant role begins with selecting the right format. The reverse-chronological format serves you well because it effectively highlights your most recent and relevant experience, which is key in demonstrating your up-to-date accounting skills and accomplishments.

When choosing fonts, it's not just about style; it's about readability and professionalism too. Consider Raleway, Montserrat, or Lato for their clean and modern appearance. These fonts ensure your text is not only easy on the eyes but also conveys a polished image, both important when capturing the attention of hiring managers.

The file type you choose for your resume is crucial for preserving your layout. Always save and share your document as a PDF. This choice keeps your formatting intact, ensuring your resume looks consistent and professional across different devices and platforms, which reflects your attention to detail.

Lastly, paying attention to your margins is more important than it might seem. One-inch margins all around your resume create a balanced and open appearance. This makes your content more approachable and ensures nothing feels cluttered, helping hiring managers focus on what really matters—your qualifications and experience.

By focusing on these key areas, you can create a resume that effectively showcases your unique strengths as a contract accountant, setting you apart in the job market.

How to write a quantifiable resume experience section

Your contract accountant resume needs to seamlessly highlight your skills and achievements while focusing on delivering financial insights and maintaining compliance. Start by listing your most recent roles to show your evolution in the field, focusing on positions from the last 10-15 years unless older roles are highly relevant. Tailor this section to match the job ad's requirements, ensuring your job titles and duties align with what the employer seeks. Use powerful action verbs like "managed," "developed," "analyzed," and "reduced." Including quantifiable achievements shows your impact on previous organizations, adding credibility and depth to your experience.

- •Reduced financial discrepancies by 30% through detailed analysis and reconciliation processes.

- •Developed an automated financial reporting system that improved efficiency by 50%.

- •Analyzed client budgets and financial statements, leading to a 20% increase in client profitability.

- •Collaborated with client teams to ensure compliance with GAAP standards, achieving 100% compliance.

This experience section connects your role and achievements by clearly defining responsibilities and showing real outcomes. As you use strong action verbs and specify results, each line builds on the previous one, illustrating how effectively you've enhanced business performance. By tailoring your resume to fit the job requirements, you help employers immediately see how your skills align with their needs. Each point emphasizes your ability to deliver value, which is crucial for a contract accountant. This cohesive presentation ensures your resume not only catches attention but also communicates the significant impact you've made.

Project-Focused resume experience section

A project-focused contract accountant resume experience section should clearly showcase the specific initiatives you've tackled and the impact you've had. Start by listing each project or role name along with the dates to provide clear context. By highlighting your achievements with quantifiable results, you can effectively showcase your contributions to the project's success. Action verbs help convey what you've accomplished and emphasize your role in the overall success of the organization.

Your bullet points should outline the tasks you managed and initiatives you led to show your skills in action. Describing how you handled budgets, addressed challenges, or collaborated with diverse teams will illustrate your ability to deliver results. This section should make your readiness to take on responsibility in a contract setting evident. Tailor your content to highlight your strengths, such as managing accounts or improving processes, and underscore the unique skills you bring to the table.

Contract Accountant

XYZ Financial Services

January 2022 - June 2022

- Led a team of three accountants to analyze and audit company financial statements, enhancing accuracy by 20%.

- Developed a new budgeting process that reduced discrepancies by 15%, ensuring better financial planning.

- Coordinated with external auditors during the annual audit process, resulting in a successful compliance report.

- Implemented a cloud-based accounting software, increasing efficiency and reducing manual entry tasks by 30%.

Responsibility-Focused resume experience section

A responsibility-focused contract accountant resume experience section should emphasize the key tasks central to the role. Begin by identifying these core responsibilities, then reflect on your experiences that align well with them. Showcase the skills and achievements that demonstrate how you've effectively handled these responsibilities, detailing the tasks you managed and their outcomes. Consider the projects you've led, the challenges you've tackled, and the expertise you've developed, highlighting them as evidence of your proficiency.

To present your experience clearly, use bullet points that communicate your actions and the results achieved. Make each point concise but comprehensive, connecting your tasks with their positive impacts. Enhance these details with numbers or percentages where possible, offering concrete evidence of your contributions. This approach paints a vivid picture for potential employers of your ability to manage complex projects and improve processes, showing how you've added value to past employers.

Contract Accountant

XYZ Financial Solutions

June 2020 - August 2023

- Managed financial records and ensured compliance with accounting standards, reducing errors by 20%.

- Collaborated with cross-functional teams to implement a new accounting software, enhancing efficiency by 30%.

- Conducted thorough audits that uncovered unnecessary expenses, saving the company $50,000 annually.

- Streamlined month-end closing processes, decreasing completion time by three days.

Skills-Focused resume experience section

A skills-focused contract accountant resume experience section should begin by emphasizing the most relevant abilities that align with your targeted job. Highlight achievements and tasks that clearly demonstrate these skills to make your experience memorable. By including measurable results, you illustrate your impact effectively, helping potential employers see your value. Organizing your section with bullet points helps maintain clarity and keeps the format consistent.

Align your experience with the specific job description by focusing on skills such as analytical thinking, financial reporting, or system implementation that the employer is seeking. Ensure that your statements are concise and straightforward, using simple language to avoid any confusion. This approach helps connect your achievements to the job, making it easier for potential employers to quickly recognize why you would be an excellent fit for their organization.

Contract Accountant

XYZ Financial Solutions

June 2018 - August 2020

- Managed monthly financial statements and reports for a portfolio of clients, improving reporting accuracy by 15%.

- Developed and streamlined accounting processes, reducing monthly closing time by 20%.

- Collaborated with cross-functional teams to implement a new accounting software, enhancing data tracking and reporting.

- Provided detailed budget analysis for clients, resulting in a cost savings of $50,000 annually.

Problem-Solving Focused resume experience section

A problem-solving-focused contract accountant resume experience section should effectively demonstrate your skills in identifying and resolving financial challenges. Begin by listing the dates and job title, then provide insights into how you addressed specific issues in your role. Use strong action words to describe your achievements, emphasizing the significant impact of your efforts. As you describe your work, integrate mentions of the tools or software you utilized to streamline accounting processes and enhance efficiency. This gives context and depth, ensuring that anyone reading can easily grasp the value of your contributions.

In the bullet points, center on the outcomes of your problem-solving skills, tying them back to your initial statements. Show how processes were improved, errors corrected, or efficiencies introduced, saving valuable time and resources. Highlight your ability to independently analyze situations and effectively collaborate with others to implement changes. This approach not only presents your skills comprehensively but also illustrates your real-world experience in tackling accounting challenges, helping your resume make a strong impression on potential employers.

Contract Accountant

XYZ Corp

January 2020 - December 2021

- Cut down the monthly financial closing time by 20% with better data analysis techniques.

- Introduced a new reconciliation process that slashed discrepancies by 30%, boosting accuracy.

- Formulated a cost-saving plan that trimmed $50,000 annually in overhead expenses.

- Worked with a cross-functional team to roll out an automated reporting tool, raising productivity by 25%.

Write your contract accountant resume summary section

A contract-focused accountant resume summary should make a strong first impression, showing your top skills and experiences clearly and concisely. Your goal is to quickly capture the interest of potential clients. Here’s an example of how you might write such a summary:

This example starts by quantifying your experience, which helps establish credibility. It goes on to highlight not just what you do, but how well you do it, focusing on accuracy and deadlines—key aspects of contract work. By showing your ability to collaborate and optimize processes, you present yourself as a valuable asset. When writing about yourself on a resume, focus on your unique strengths and achievements. Use strong action verbs to convey your points and avoid vague language. By giving examples of your successes, you create a convincing narrative.

Understanding the purpose of different resume sections can help in crafting your summary effectively. A resume summary captures your key skills and accomplishments succinctly, making it ideal for someone with experience. In contrast, a resume objective outlines what you hope to achieve, suitable for entry-level candidates. A resume profile blends your career goals with your skills, while a summary of qualifications lists standout skills and achievements in bullet points. These sections help highlight your strengths, tailored to your career path and aspirations.

Listing your contract accountant skills on your resume

A skills-focused contract accountant resume should make it clear what you bring to the table. When creating your skills section, you can opt for a standalone format or integrate your skills into other sections like experience and summary. A standalone section makes your expertise easy to spot right away, while weaving your skills into your experience section can illustrate how you've applied them in real-world scenarios.

Highlighting your strengths and soft skills, such as communication and teamwork, can show potential employers how well you collaborate with others. On the other hand, hard skills are more concrete abilities like financial analysis and forecasting, gained through education or hands-on experience.

Including both skills and strengths as keywords in your resume can enhance your visibility in applicant tracking systems, making it more likely for your resume to catch employers' attention during the review process.

Here's an example of an effective standalone skills section:

This skills section is effective because it highlights the critical competencies you need for contract accounting roles. By clearly listing each skill, it makes it easier for hiring managers to determine if you're the right fit for the job. This section balances technical skills and job-specific abilities that are crucial for an accountant position.

Best hard skills to feature on your contract accountant resume

As a contract accountant, showcasing hard skills is vital to demonstrate your technical expertise and practical abilities. These skills indicate your capacity to handle complex accounting tasks and specialized tools, making you a strong candidate. The most sought-after hard skills include:

Hard Skills

- Financial Analysis

- Budgeting

- Tax Compliance

- Accounts Reconciliation

- Financial Reporting

- Contract Review

- Software Proficiency (e.g., Excel, QuickBooks)

- Risk Management

- Cost Accounting

- Ledger Management

- Payroll Processing

- Accounts Payable/Receivable

- Regulatory Compliance

- Auditing

- Cash Flow Management

Best soft skills to feature on your contract accountant resume

In addition to hard skills, soft skills are essential in conveying how you interact with others and manage workplace environments. These skills highlight your potential to seamlessly integrate into a company's culture and work effectively as part of a team. The most in-demand soft skills include:

Soft Skills

- Communication

- Attention to Detail

- Time Management

- Problem-Solving

- Adaptability

- Leadership

- Teamwork

- Critical Thinking

- Organization

- Multitasking

- Analytical Thinking

- Ethical Judgment

- Dependability

- Stress Management

- Customer Service

How to include your education on your resume

The education section is a critical part of your contract accountant resume as it highlights your academic background related to the job. Tailor this section by including only relevant education, leaving out any irrelevant details that don’t pertain to accounting. Details like GPA and honors such as cum laude can enhance your resume if applicable.

When listing a degree, include the name of the degree, the institution, and dates of attendance. Mention your GPA if it’s impressive (generally 3.5 or higher) and use the format GPA: X.XX/4.0 to clearly present it. Include honors like cum laude after your degree name for added value.

Here’s a poor example of a standalone education section:

A well-tailored example for a contract accountant might look like this:

This example is effective because it showcases a relevant degree, includes a solid GPA, and highlights the honor of cum laude. It’s precise and professional, displaying education relevant to the field of accounting without unnecessary information.

How to include contract accountant certificates on your resume

The certificates section is an important part of your resume as a contract accountant. List the name of each certificate you’ve earned. Include the date you received it. Add the issuing organization to give it credibility. You can also place certificates in the header for greater visibility. For example, "CPA - Licensed by AICPA (2018)" immediately showcases your credentials.

A well-organized standalone certificates section can greatly boost your resume’s impact. For example:

This example effectively presents relevant certifications. It shows your expertise with recognized credentials like CPA, CFA, and CMA. The certifying organizations are highly respected in the industry. These details make your qualifications clear and credible. This structured approach can make your resume stand out to potential employers.

Extra sections to include in your contract accountant resume

Looking to stand out in the competitive field of contract accounting? Your resume can be more impactful by including specific sections that highlight your skills, interests, and overall character. Including these will help you look more rounded and capable.

Language section—Showcase your communication skills by noting any languages you speak fluently. This can set you apart from other candidates and indicate you can work with a diverse client base.

Hobbies and interests section—Include personal interests to give employers a more complete picture of who you are. This can make you memorable and add a personal touch to your resume.

Volunteer work section—Mention any volunteer activities to demonstrate your commitment to community and leadership skills. This shows you are proactive and capable of balancing multiple responsibilities.

Books section—List any accounting or business books that have influenced your professional approach. This shows you are serious about your career and continuously developing your knowledge.

In Conclusion

In conclusion, crafting a strong resume as a contract accountant is essential to showcasing your diverse skills and adaptability in a dynamic field. It's crucial to present your financial expertise and accomplishments clearly and professionally, using action verbs and quantifiable achievements to demonstrate your impact. A well-structured resume, incorporating key sections such as work experience, skills, education, and certifications, provides a comprehensive view of your professional journey.

Selecting the appropriate resume format—like reverse-chronological—helps highlight recent achievements and ensures your resume stands out. Attention to details such as readability, font choice, and layout consistency, including using a PDF for distribution, further enhances your document's professionalism. Including extra sections, such as languages, hobbies, or volunteer work, can provide a fuller picture of you as a candidate and help you connect with potential employers on a personal level.

Remember, your resume is a marketing tool, your first point of contact with prospective employers. By tailoring its content to align with job descriptions and capturing your skills in action, you increase your chances of attracting the right opportunities. With a well-crafted resume, you'll be well-prepared to make a strong impression and secure exciting roles in contract accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.