Corporate Accountant Resume Examples

Jul 18, 2024

|

12 min read

Crunch the numbers: Writing your stellar corporate accountant resume for success

Rated by 348 people

Corporate Tax Accountant

Financial Reporting Corporate Accountant

Corporate Budget Accountant

Corporate Audit Accountant

Chief Corporate Accountant

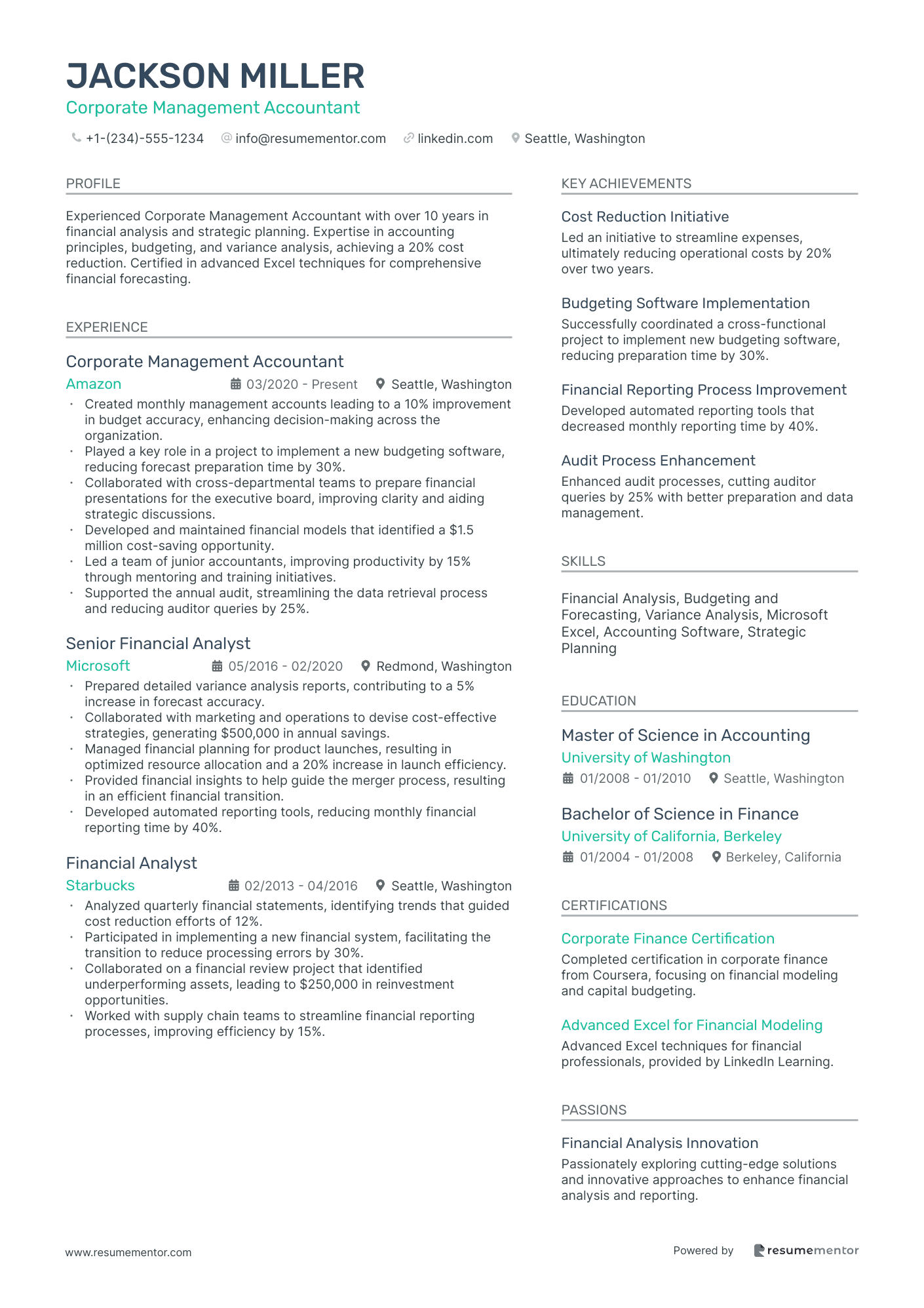

Corporate Management Accountant

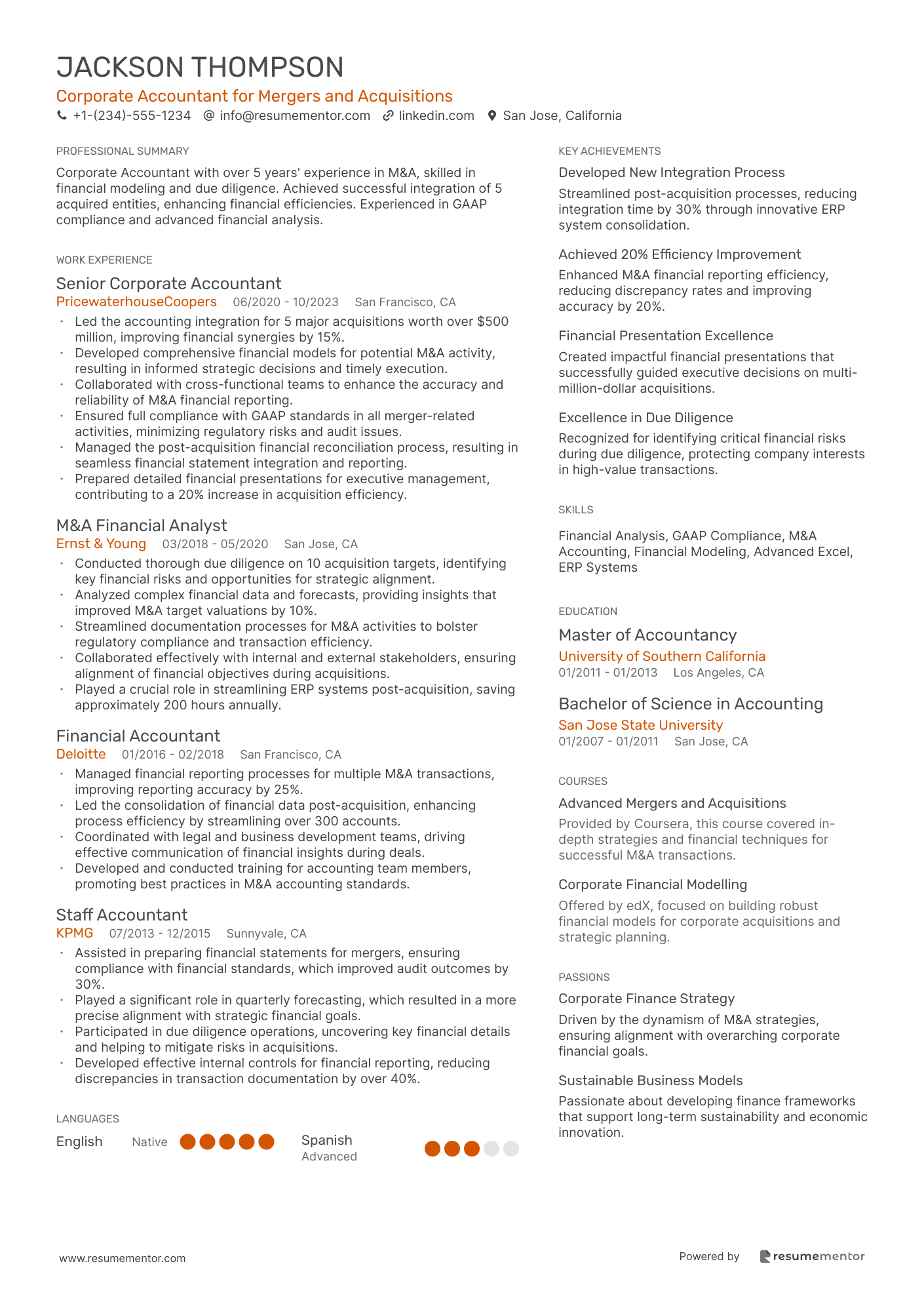

Corporate Accountant for Mergers and Acquisitions

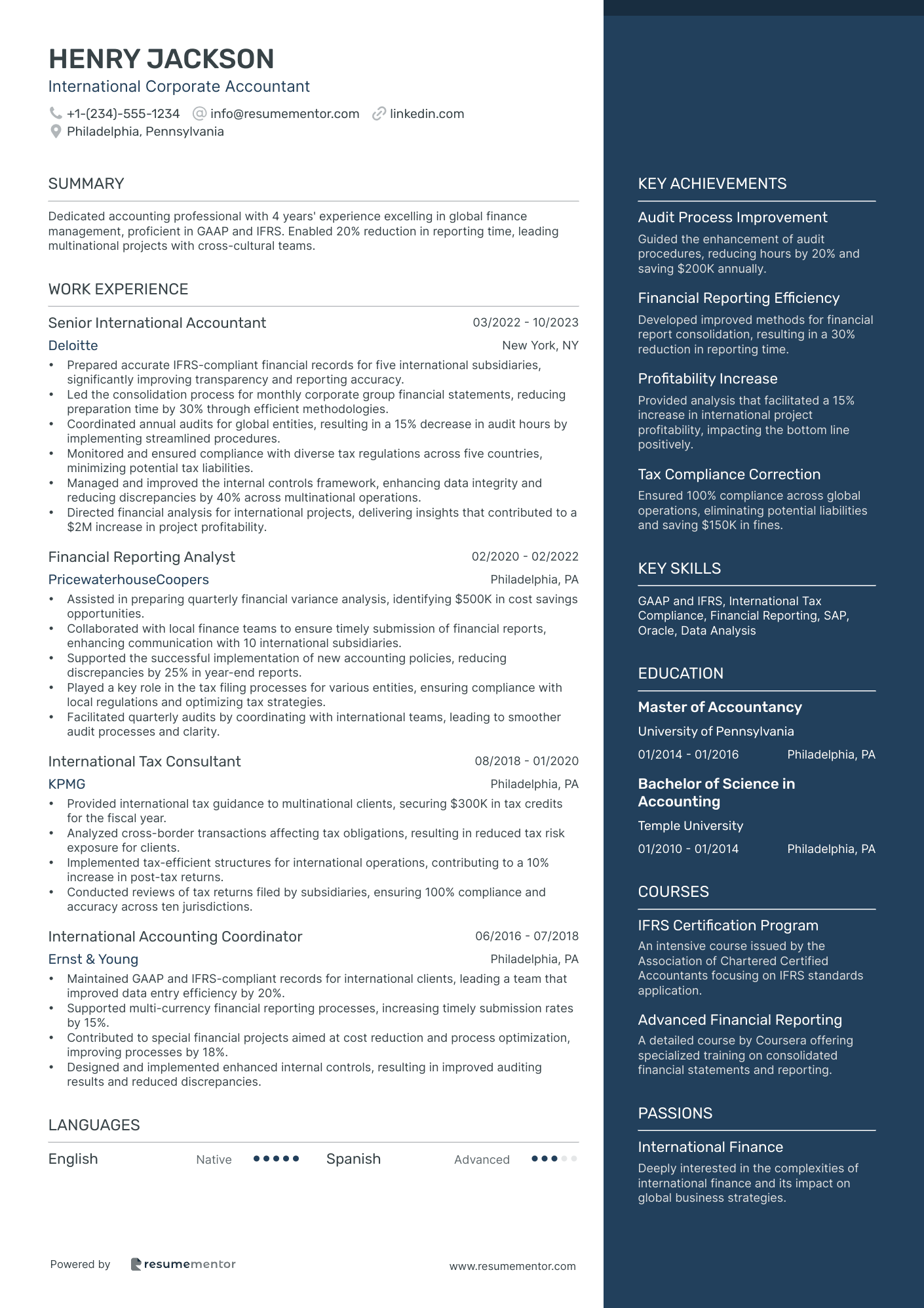

International Corporate Accountant

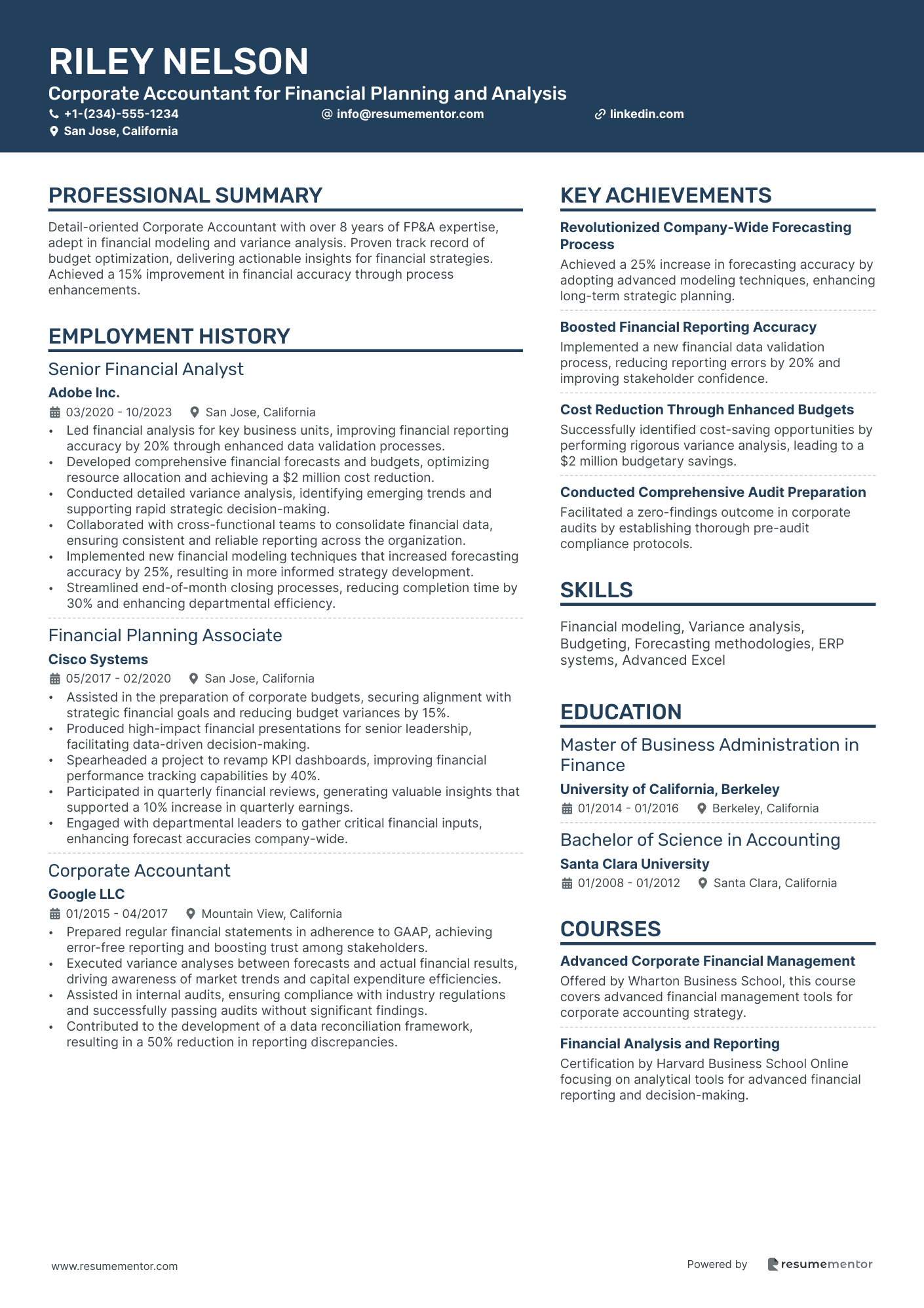

Corporate Accountant for Financial Planning and Analysis

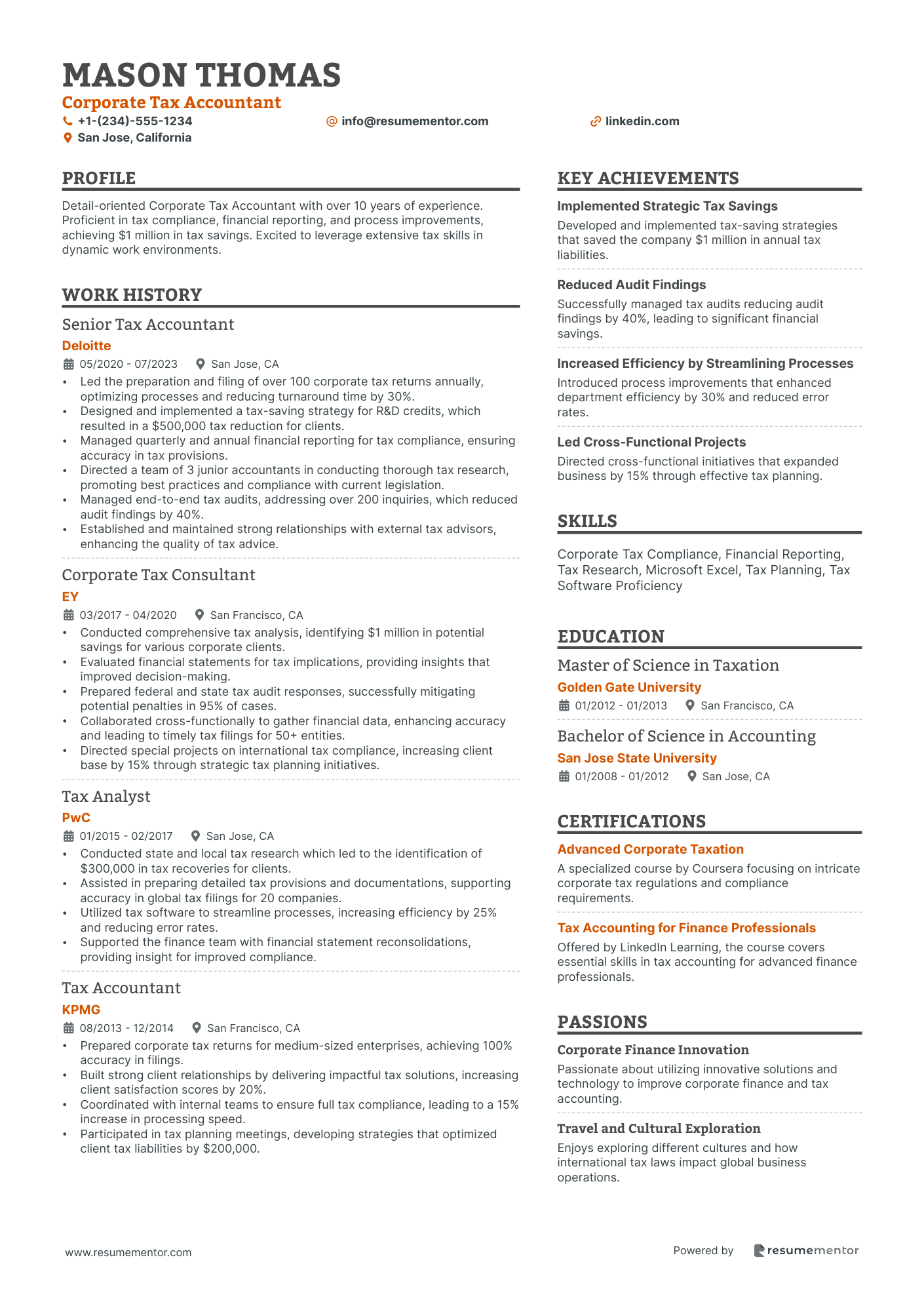

Corporate Tax Accountant resume sample

- •Led the preparation and filing of over 100 corporate tax returns annually, optimizing processes and reducing turnaround time by 30%.

- •Designed and implemented a tax-saving strategy for R&D credits, which resulted in a $500,000 tax reduction for clients.

- •Managed quarterly and annual financial reporting for tax compliance, ensuring accuracy in tax provisions.

- •Directed a team of 3 junior accountants in conducting thorough tax research, promoting best practices and compliance with current legislation.

- •Managed end-to-end tax audits, addressing over 200 inquiries, which reduced audit findings by 40%.

- •Established and maintained strong relationships with external tax advisors, enhancing the quality of tax advice.

- •Conducted comprehensive tax analysis, identifying $1 million in potential savings for various corporate clients.

- •Evaluated financial statements for tax implications, providing insights that improved decision-making.

- •Prepared federal and state tax audit responses, successfully mitigating potential penalties in 95% of cases.

- •Collaborated cross-functionally to gather financial data, enhancing accuracy and leading to timely tax filings for 50+ entities.

- •Directed special projects on international tax compliance, increasing client base by 15% through strategic tax planning initiatives.

- •Conducted state and local tax research which led to the identification of $300,000 in tax recoveries for clients.

- •Assisted in preparing detailed tax provisions and documentations, supporting accuracy in global tax filings for 20 companies.

- •Utilized tax software to streamline processes, increasing efficiency by 25% and reducing error rates.

- •Supported the finance team with financial statement reconsolidations, providing insight for improved compliance.

- •Prepared corporate tax returns for medium-sized enterprises, achieving 100% accuracy in filings.

- •Built strong client relationships by delivering impactful tax solutions, increasing client satisfaction scores by 20%.

- •Coordinated with internal teams to ensure full tax compliance, leading to a 15% increase in processing speed.

- •Participated in tax planning meetings, developing strategies that optimized client tax liabilities by $200,000.

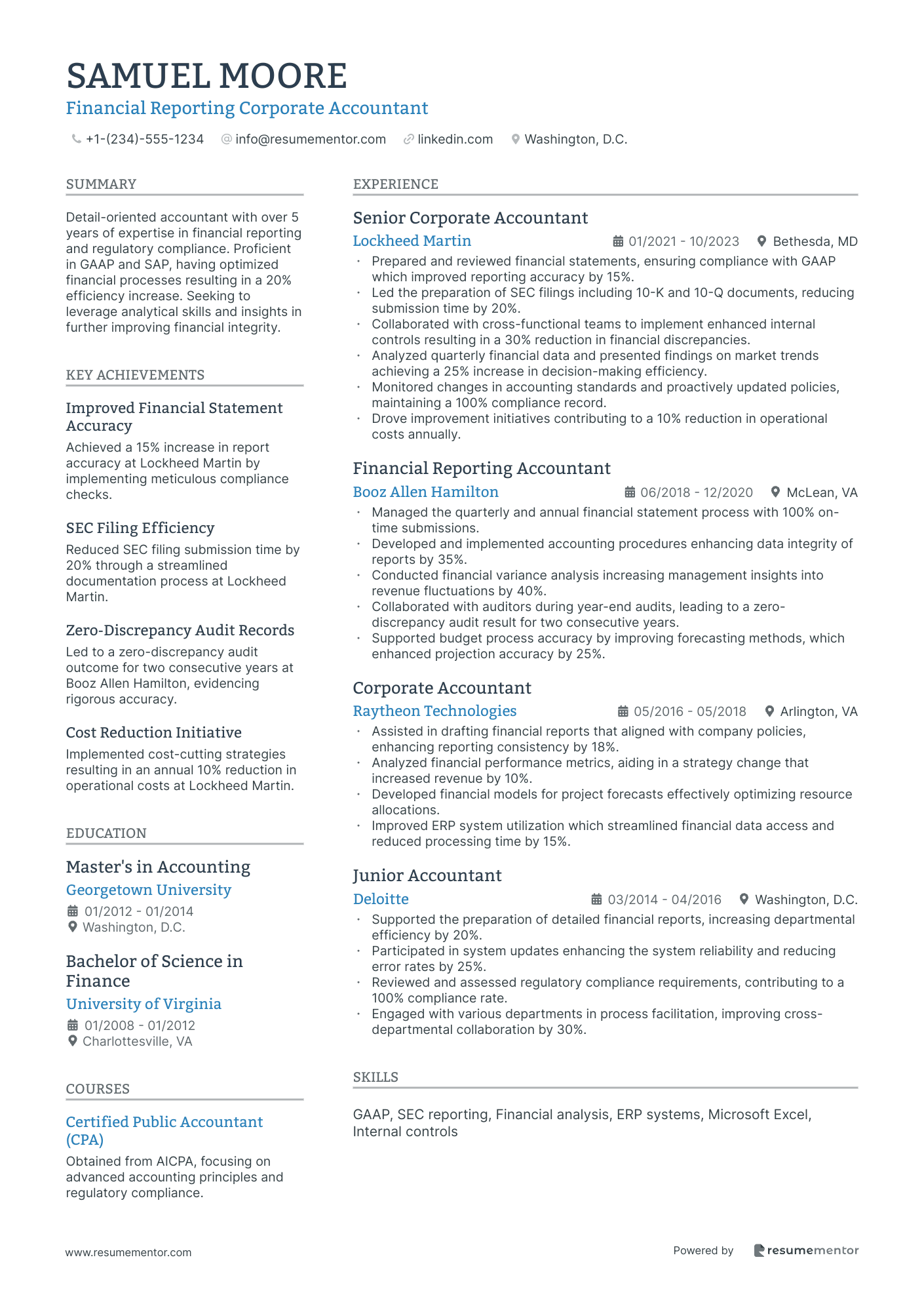

Financial Reporting Corporate Accountant resume sample

- •Prepared and reviewed financial statements, ensuring compliance with GAAP which improved reporting accuracy by 15%.

- •Led the preparation of SEC filings including 10-K and 10-Q documents, reducing submission time by 20%.

- •Collaborated with cross-functional teams to implement enhanced internal controls resulting in a 30% reduction in financial discrepancies.

- •Analyzed quarterly financial data and presented findings on market trends achieving a 25% increase in decision-making efficiency.

- •Monitored changes in accounting standards and proactively updated policies, maintaining a 100% compliance record.

- •Drove improvement initiatives contributing to a 10% reduction in operational costs annually.

- •Managed the quarterly and annual financial statement process with 100% on-time submissions.

- •Developed and implemented accounting procedures enhancing data integrity of reports by 35%.

- •Conducted financial variance analysis increasing management insights into revenue fluctuations by 40%.

- •Collaborated with auditors during year-end audits, leading to a zero-discrepancy audit result for two consecutive years.

- •Supported budget process accuracy by improving forecasting methods, which enhanced projection accuracy by 25%.

- •Assisted in drafting financial reports that aligned with company policies, enhancing reporting consistency by 18%.

- •Analyzed financial performance metrics, aiding in a strategy change that increased revenue by 10%.

- •Developed financial models for project forecasts effectively optimizing resource allocations.

- •Improved ERP system utilization which streamlined financial data access and reduced processing time by 15%.

- •Supported the preparation of detailed financial reports, increasing departmental efficiency by 20%.

- •Participated in system updates enhancing the system reliability and reducing error rates by 25%.

- •Reviewed and assessed regulatory compliance requirements, contributing to a 100% compliance rate.

- •Engaged with various departments in process facilitation, improving cross-departmental collaboration by 30%.

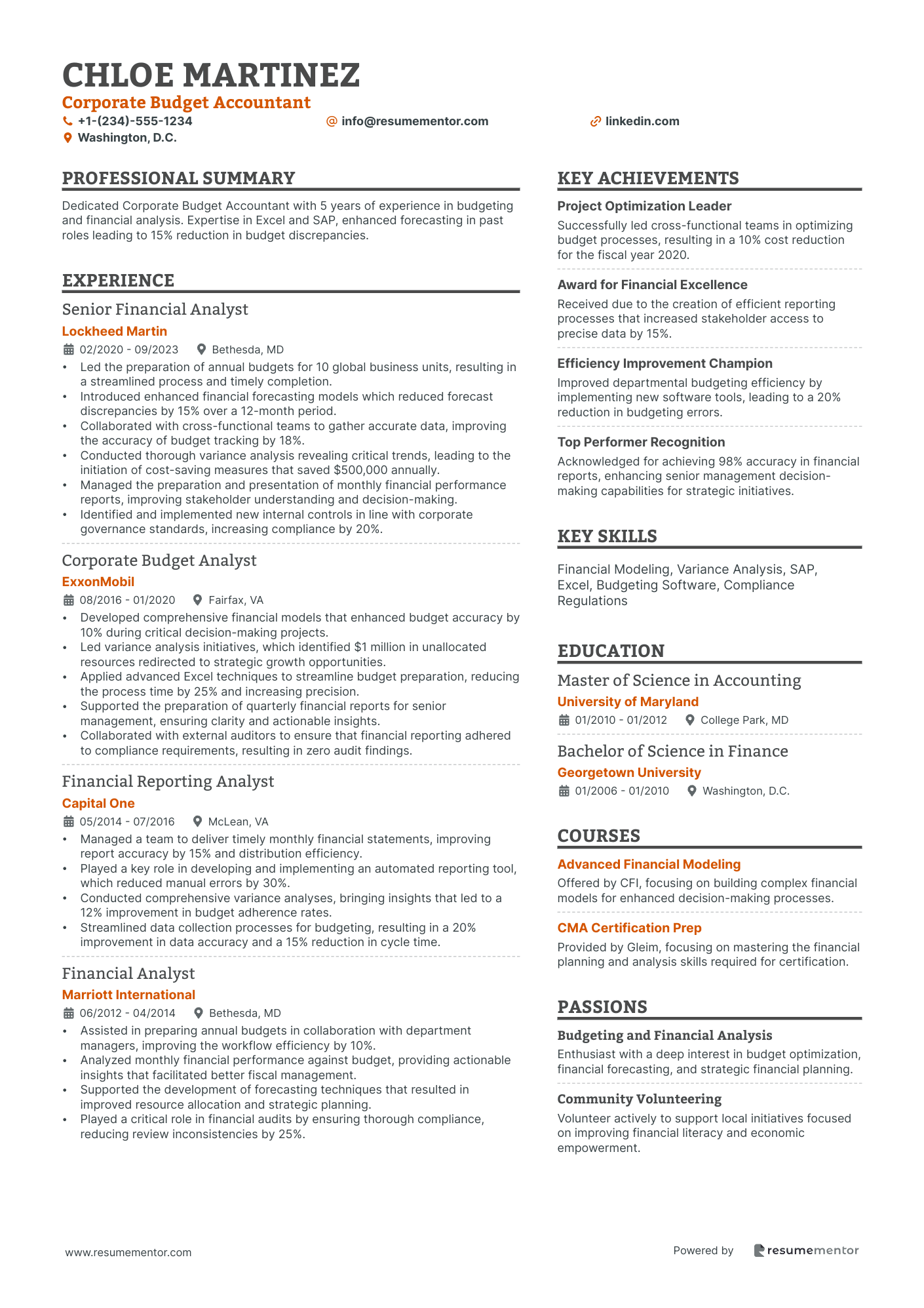

Corporate Budget Accountant resume sample

- •Led the preparation of annual budgets for 10 global business units, resulting in a streamlined process and timely completion.

- •Introduced enhanced financial forecasting models which reduced forecast discrepancies by 15% over a 12-month period.

- •Collaborated with cross-functional teams to gather accurate data, improving the accuracy of budget tracking by 18%.

- •Conducted thorough variance analysis revealing critical trends, leading to the initiation of cost-saving measures that saved $500,000 annually.

- •Managed the preparation and presentation of monthly financial performance reports, improving stakeholder understanding and decision-making.

- •Identified and implemented new internal controls in line with corporate governance standards, increasing compliance by 20%.

- •Developed comprehensive financial models that enhanced budget accuracy by 10% during critical decision-making projects.

- •Led variance analysis initiatives, which identified $1 million in unallocated resources redirected to strategic growth opportunities.

- •Applied advanced Excel techniques to streamline budget preparation, reducing the process time by 25% and increasing precision.

- •Supported the preparation of quarterly financial reports for senior management, ensuring clarity and actionable insights.

- •Collaborated with external auditors to ensure that financial reporting adhered to compliance requirements, resulting in zero audit findings.

- •Managed a team to deliver timely monthly financial statements, improving report accuracy by 15% and distribution efficiency.

- •Played a key role in developing and implementing an automated reporting tool, which reduced manual errors by 30%.

- •Conducted comprehensive variance analyses, bringing insights that led to a 12% improvement in budget adherence rates.

- •Streamlined data collection processes for budgeting, resulting in a 20% improvement in data accuracy and a 15% reduction in cycle time.

- •Assisted in preparing annual budgets in collaboration with department managers, improving the workflow efficiency by 10%.

- •Analyzed monthly financial performance against budget, providing actionable insights that facilitated better fiscal management.

- •Supported the development of forecasting techniques that resulted in improved resource allocation and strategic planning.

- •Played a critical role in financial audits by ensuring thorough compliance, reducing review inconsistencies by 25%.

Corporate Audit Accountant resume sample

- •Led a high-impact audit project that improved compliance processes by 30%, greatly minimizing organizational risk.

- •Conducted financial audits for over 15 departments, resulting in the identification and mitigation of $500k in financial discrepancies.

- •Introduced new audit methodologies that increased efficiency of audit processes by 20%, contributing significantly to time savings.

- •Collaborated with cross-functional teams to enhance training programs, positively influencing compliance adherence across the company.

- •Designed and implemented effective data analysis tools that enabled more accurate financial reporting and compliance checks.

- •Played a pivotal role in an initiative that enhanced risk management strategies, aligning with standardized industry practices.

- •Managed a team of 8 auditors to successfully deliver annual audit plans and ensure financial compliance, achieving a 95% on-time completion rate.

- •Evaluated and revised internal control procedures, resulting in a 25% reduction in compliance gaps.

- •Implemented quarterly compliance training sessions for 200 employees, significantly enhancing awareness and understanding of audit policies.

- •Developed comprehensive audit reporting templates, streamlining the documentation process and improving clarity for management reviews.

- •Participated in special projects that updated financial risk protocols, ensuring alignment with evolving regulatory standards.

- •Executed audits on financial statements and internal controls for multiple high-stake clients, resulting in increased client satisfaction by 40%.

- •Identified control weaknesses and suggested strategic improvements that led to a 15% increase in process efficiency.

- •Facilitated effective communication between audit teams and stakeholders, improving implementation of audit recommendations by 50%.

- •Prepared detailed documentation of audit findings, enhancing management’s ability to resolve complex financial issues.

- •Conducted financial audits and evaluated internal controls, decreasing the error rate of financial reports by 20%.

- •Assisted in ensuring compliance with GAAP standards, contributing to a 30% improvement in financial reporting accuracy at the firm.

- •Provided valuable insights that helped refine company policies, ultimately leading to a 10% increase in compliance efficiency.

- •Contributed to the annual risk assessment process, supporting the formulation of a robust and effective audit plan.

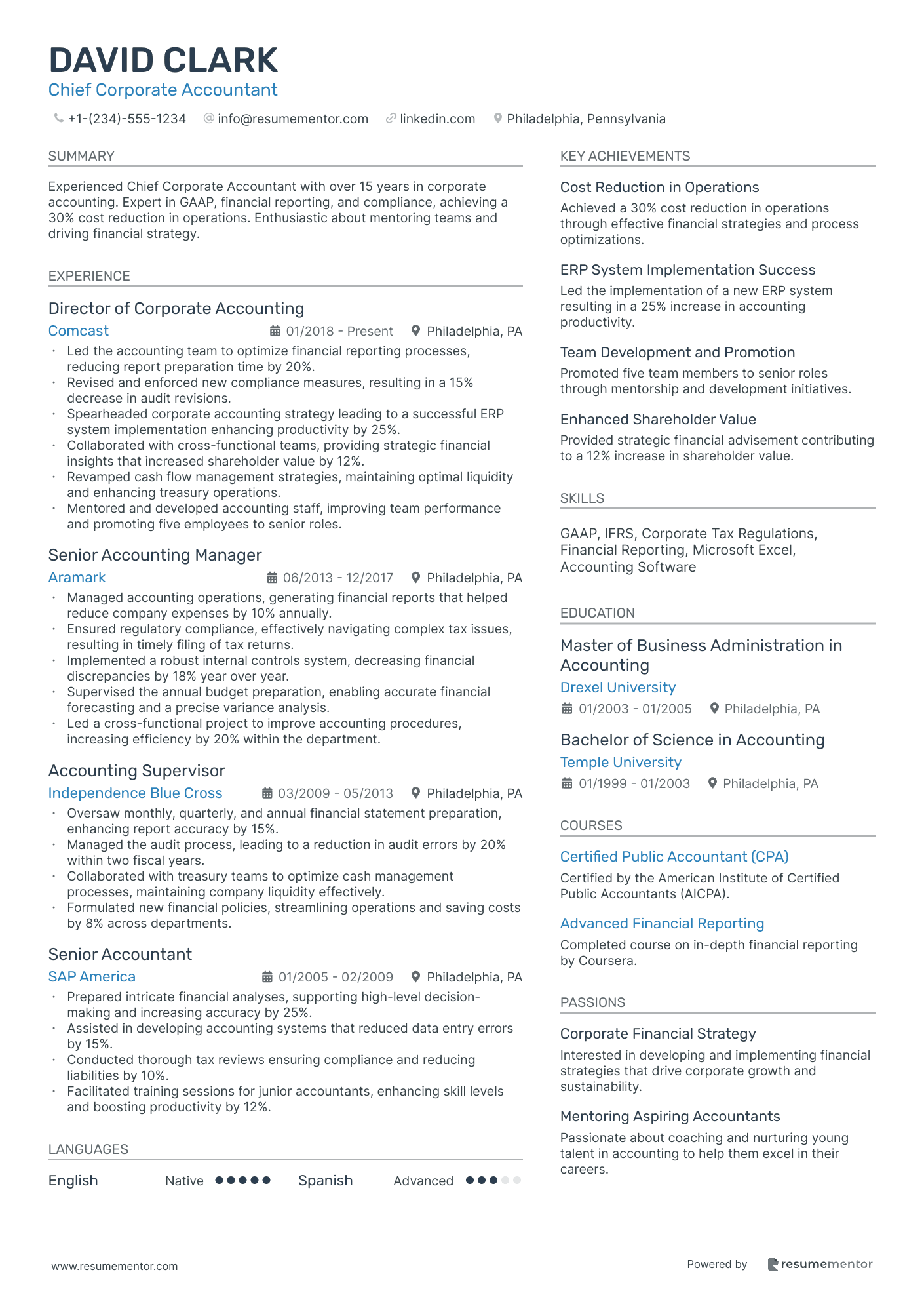

Chief Corporate Accountant resume sample

- •Led the accounting team to optimize financial reporting processes, reducing report preparation time by 20%.

- •Revised and enforced new compliance measures, resulting in a 15% decrease in audit revisions.

- •Spearheaded corporate accounting strategy leading to a successful ERP system implementation enhancing productivity by 25%.

- •Collaborated with cross-functional teams, providing strategic financial insights that increased shareholder value by 12%.

- •Revamped cash flow management strategies, maintaining optimal liquidity and enhancing treasury operations.

- •Mentored and developed accounting staff, improving team performance and promoting five employees to senior roles.

- •Managed accounting operations, generating financial reports that helped reduce company expenses by 10% annually.

- •Ensured regulatory compliance, effectively navigating complex tax issues, resulting in timely filing of tax returns.

- •Implemented a robust internal controls system, decreasing financial discrepancies by 18% year over year.

- •Supervised the annual budget preparation, enabling accurate financial forecasting and a precise variance analysis.

- •Led a cross-functional project to improve accounting procedures, increasing efficiency by 20% within the department.

- •Oversaw monthly, quarterly, and annual financial statement preparation, enhancing report accuracy by 15%.

- •Managed the audit process, leading to a reduction in audit errors by 20% within two fiscal years.

- •Collaborated with treasury teams to optimize cash management processes, maintaining company liquidity effectively.

- •Formulated new financial policies, streamlining operations and saving costs by 8% across departments.

- •Prepared intricate financial analyses, supporting high-level decision-making and increasing accuracy by 25%.

- •Assisted in developing accounting systems that reduced data entry errors by 15%.

- •Conducted thorough tax reviews ensuring compliance and reducing liabilities by 10%.

- •Facilitated training sessions for junior accountants, enhancing skill levels and boosting productivity by 12%.

Corporate Management Accountant resume sample

- •Created monthly management accounts leading to a 10% improvement in budget accuracy, enhancing decision-making across the organization.

- •Played a key role in a project to implement a new budgeting software, reducing forecast preparation time by 30%.

- •Collaborated with cross-departmental teams to prepare financial presentations for the executive board, improving clarity and aiding strategic discussions.

- •Developed and maintained financial models that identified a $1.5 million cost-saving opportunity.

- •Led a team of junior accountants, improving productivity by 15% through mentoring and training initiatives.

- •Supported the annual audit, streamlining the data retrieval process and reducing auditor queries by 25%.

- •Prepared detailed variance analysis reports, contributing to a 5% increase in forecast accuracy.

- •Collaborated with marketing and operations to devise cost-effective strategies, generating $500,000 in annual savings.

- •Managed financial planning for product launches, resulting in optimized resource allocation and a 20% increase in launch efficiency.

- •Provided financial insights to help guide the merger process, resulting in an efficient financial transition.

- •Developed automated reporting tools, reducing monthly financial reporting time by 40%.

- •Analyzed quarterly financial statements, identifying trends that guided cost reduction efforts of 12%.

- •Participated in implementing a new financial system, facilitating the transition to reduce processing errors by 30%.

- •Collaborated on a financial review project that identified underperforming assets, leading to $250,000 in reinvestment opportunities.

- •Worked with supply chain teams to streamline financial reporting processes, improving efficiency by 15%.

- •Assisted in preparing detailed financial statements, meeting tight deadlines with 100% compliance to standards.

- •Implemented process improvements that reduced the time taken for monthly financial closings by 25%.

- •Coordinated with external auditors, ensuring a smooth audit process with minimal corrections.

- •Provided financial analysis support on a team that drove a project, resulting in operational savings of $300,000.

Corporate Accountant for Mergers and Acquisitions resume sample

- •Led the accounting integration for 5 major acquisitions worth over $500 million, improving financial synergies by 15%.

- •Developed comprehensive financial models for potential M&A activity, resulting in informed strategic decisions and timely execution.

- •Collaborated with cross-functional teams to enhance the accuracy and reliability of M&A financial reporting.

- •Ensured full compliance with GAAP standards in all merger-related activities, minimizing regulatory risks and audit issues.

- •Managed the post-acquisition financial reconciliation process, resulting in seamless financial statement integration and reporting.

- •Prepared detailed financial presentations for executive management, contributing to a 20% increase in acquisition efficiency.

- •Conducted thorough due diligence on 10 acquisition targets, identifying key financial risks and opportunities for strategic alignment.

- •Analyzed complex financial data and forecasts, providing insights that improved M&A target valuations by 10%.

- •Streamlined documentation processes for M&A activities to bolster regulatory compliance and transaction efficiency.

- •Collaborated effectively with internal and external stakeholders, ensuring alignment of financial objectives during acquisitions.

- •Played a crucial role in streamlining ERP systems post-acquisition, saving approximately 200 hours annually.

- •Managed financial reporting processes for multiple M&A transactions, improving reporting accuracy by 25%.

- •Led the consolidation of financial data post-acquisition, enhancing process efficiency by streamlining over 300 accounts.

- •Coordinated with legal and business development teams, driving effective communication of financial insights during deals.

- •Developed and conducted training for accounting team members, promoting best practices in M&A accounting standards.

- •Assisted in preparing financial statements for mergers, ensuring compliance with financial standards, which improved audit outcomes by 30%.

- •Played a significant role in quarterly forecasting, which resulted in a more precise alignment with strategic financial goals.

- •Participated in due diligence operations, uncovering key financial details and helping to mitigate risks in acquisitions.

- •Developed effective internal controls for financial reporting, reducing discrepancies in transaction documentation by over 40%.

International Corporate Accountant resume sample

- •Prepared accurate IFRS-compliant financial records for five international subsidiaries, significantly improving transparency and reporting accuracy.

- •Led the consolidation process for monthly corporate group financial statements, reducing preparation time by 30% through efficient methodologies.

- •Coordinated annual audits for global entities, resulting in a 15% decrease in audit hours by implementing streamlined procedures.

- •Monitored and ensured compliance with diverse tax regulations across five countries, minimizing potential tax liabilities.

- •Managed and improved the internal controls framework, enhancing data integrity and reducing discrepancies by 40% across multinational operations.

- •Directed financial analysis for international projects, delivering insights that contributed to a $2M increase in project profitability.

- •Assisted in preparing quarterly financial variance analysis, identifying $500K in cost savings opportunities.

- •Collaborated with local finance teams to ensure timely submission of financial reports, enhancing communication with 10 international subsidiaries.

- •Supported the successful implementation of new accounting policies, reducing discrepancies by 25% in year-end reports.

- •Played a key role in the tax filing processes for various entities, ensuring compliance with local regulations and optimizing tax strategies.

- •Facilitated quarterly audits by coordinating with international teams, leading to smoother audit processes and clarity.

- •Provided international tax guidance to multinational clients, securing $300K in tax credits for the fiscal year.

- •Analyzed cross-border transactions affecting tax obligations, resulting in reduced tax risk exposure for clients.

- •Implemented tax-efficient structures for international operations, contributing to a 10% increase in post-tax returns.

- •Conducted reviews of tax returns filed by subsidiaries, ensuring 100% compliance and accuracy across ten jurisdictions.

- •Maintained GAAP and IFRS-compliant records for international clients, leading a team that improved data entry efficiency by 20%.

- •Supported multi-currency financial reporting processes, increasing timely submission rates by 15%.

- •Contributed to special financial projects aimed at cost reduction and process optimization, improving processes by 18%.

- •Designed and implemented enhanced internal controls, resulting in improved auditing results and reduced discrepancies.

Corporate Accountant for Financial Planning and Analysis resume sample

- •Led financial analysis for key business units, improving financial reporting accuracy by 20% through enhanced data validation processes.

- •Developed comprehensive financial forecasts and budgets, optimizing resource allocation and achieving a $2 million cost reduction.

- •Conducted detailed variance analysis, identifying emerging trends and supporting rapid strategic decision-making.

- •Collaborated with cross-functional teams to consolidate financial data, ensuring consistent and reliable reporting across the organization.

- •Implemented new financial modeling techniques that increased forecasting accuracy by 25%, resulting in more informed strategy development.

- •Streamlined end-of-month closing processes, reducing completion time by 30% and enhancing departmental efficiency.

- •Assisted in the preparation of corporate budgets, securing alignment with strategic financial goals and reducing budget variances by 15%.

- •Produced high-impact financial presentations for senior leadership, facilitating data-driven decision-making.

- •Spearheaded a project to revamp KPI dashboards, improving financial performance tracking capabilities by 40%.

- •Participated in quarterly financial reviews, generating valuable insights that supported a 10% increase in quarterly earnings.

- •Engaged with departmental leaders to gather critical financial inputs, enhancing forecast accuracies company-wide.

- •Prepared regular financial statements in adherence to GAAP, achieving error-free reporting and boosting trust among stakeholders.

- •Executed variance analyses between forecasts and actual financial results, driving awareness of market trends and capital expenditure efficiencies.

- •Assisted in internal audits, ensuring compliance with industry regulations and successfully passing audits without significant findings.

- •Contributed to the development of a data reconciliation framework, resulting in a 50% reduction in reporting discrepancies.

- •Supported monthly and annual financial close processes, enhancing procedural clarity and maintaining adherence to deadlines.

- •Developed initial financial models which served as templates for subsequent fiscal planning and analysis tasks.

- •Coordinated with finance teams to validate general ledger accounts, promoting accuracy and reducing correctional entries by 30%.

- •Compiled diverse sets of financial data into comprehensive reports, contributing to strategic discussions and outcome assessments.

Navigating the job market as a corporate accountant can feel like deciphering a complex spreadsheet, where each detail matters. In such a competitive field, standing out is essential, yet crafting a resume that effectively highlights your unique skills and experiences is often challenging. Your technical expertise and analytical capabilities, though invaluable in your day-to-day work, don't always translate easily onto paper. That's why your resume needs to be more than a list of experiences; it's your opportunity to make a strong first impression within a crowded applicant pool.

Utilizing a resume template can provide the structured foundation needed to convey your qualifications clearly and professionally. This approach allows you to focus on emphasizing your strengths while ensuring your resume includes essential sections like experience, education, and key skills. A resume template enhances visual appeal and helps maintain consistency, making your application stand out to hiring managers.

By aligning your achievements and skills with what prospective employers are seeking, your resume becomes more impactful. It’s about turning your daily tasks into accomplishments that clearly demonstrate your value. With a well-organized and strategically laid-out resume, you convey both your professionalism and your potential as a valuable asset to any company. As you adopt these guidelines, remember that your resume is not just a document; it's a tool that can open doors and propel your career forward.

Key Takeaways

- Crafting a standout resume in a competitive corporate accounting field requires effectively highlighting your unique skills and experiences.

- Using a resume template ensures clarity, professionalism, and consistency while emphasizing your strengths to appeal to hiring managers.

- Aligning your achievements and skills with prospective employers' needs makes your resume impactful and demonstrates your value.

- Choosing a reverse-chronological resume format helps showcase recent achievements effectively; using contemporary fonts and saving as a PDF preserves formatting.

- Quantifying accomplishments in the work experience section with strong action words highlights your impact and aligns with job descriptions.

What to focus on when writing your corporate accountant resume

A corporate accountant's resume should swiftly communicate your financial expertise and your capacity to manage key accounting tasks effectively. Highlighting your strengths in financial reporting, budget management, and compliance will catch a recruiter's attention. Here's how to organize your resume for maximum impact:

How to structure your corporate accountant resume

- Contact Information: Provide your full name, phone number, email, and LinkedIn profile—these details should always be current to ensure you're easy to reach. Highlighting your LinkedIn presence not only makes communication seamless but also provides recruiters with an additional platform to verify and learn more about your professional journey. Ensuring these elements are professional and up-to-date can make the difference in showcasing your readiness for new opportunities.

- Professional Summary: Begin with a concise overview highlighting your years in corporate accounting, emphasizing financial analysis and regulatory compliance. This summary serves as your initial pitch, where you establish the core competencies that define your career and align them with what recruiters are seeking. Tailoring this section to align with job descriptions can further strengthen its relevance and impact.

- Skills: Follow up with a list of specialized skills such as GAAP, financial statement preparation, and proficiency with ERP software like SAP or Oracle. Emphasize your attention to detail and analytical strengths, which are critical in preparing and interpreting complex financial data. Highlighting these abilities communicates your technical capabilities while reassuring recruiters of your precision and analytical expertise.

- Work Experience: Detail your past roles using strong action verbs and focus on achievements in financial reporting, budget forecasting, and audit preparation. You should quantify these accomplishments with numbers and results to underscore your contributions and tangible impacts in previous roles. This section is a narrative of your career's practical applications and real-world successes.

- Education: List your degrees and certifications like CPA or CMA. Including the institution's name and graduation year establishes the educational foundation of your expertise. This lends credibility and context to your experience, ensuring that recruiters understand your background's depth and breadth.

- Certifications: Emphasize certifications like CPA (Certified Public Accountant) prominently to underline your mastery and dedication to the field. This not only highlights your commitment to maintaining industry standards but also differentiates you from candidates who may lack these key qualifications.

Further enhance your resume with optional sections such as "Projects" or "Awards," which reveal leadership and excellence in financial initiatives. Incorporating these elements can provide a fuller picture of your professional abilities, offering recruiters insight into special achievements and recognitions. Transitioning into resume format, the following sections will cover each area more in-depth, ensuring every part of your resume resonates with potential employers.

Which resume format to choose

In corporate accounting, crafting a well-structured resume is key to enhancing your job search efforts. Using a reverse-chronological format puts your most recent achievements in the spotlight, highlighting how your skills and experiences have evolved over time. This format aligns well with the expectation of employers who look for a clear progression in your career path.

When it comes to font selection, opting for Rubik, Lato, or Montserrat gives your resume a contemporary feel. These fonts are not only visually appealing but also ensure that your document remains professional and easy to read at a glance, which is essential when presenting detailed financial expertise.

Saving your resume as a PDF is crucial. This file type preserves your formatting, ensuring that your resume looks the same on any device or operating system. This consistency is vital, as a well-presented resume can make a lasting impression on potential employers.

Finally, setting one-inch margins on all sides of your document contributes to a neat and organized appearance. This layout choice enhances readability, allowing hiring managers to easily digest information without feeling overwhelmed by clutter. A well-organized resume reflects the detail-oriented skills that are vital in the corporate accounting field.

How to write a quantifiable resume experience section

A compelling corporate accountant resume focuses on key experiences and achievements that make a difference. This critical section shows employers that you can handle financial tasks they need, spotlighting your accomplishments through specific examples. Organize your work history from the most recent job to the oldest, including job titles, companies, locations, and dates, and emphasize roles from the last 10 to 15 years that matter most. Tailoring your resume to the job ad is essential, as it aligns your skills with what the employer seeks. Use strong action words like "managed," "optimized," and "reduced" to highlight your impact effectively.

- •Managed a team of 5 accountants, streamlining the month-end closing process and reducing closure time by 30%.

- •Implemented new financial software, which enhanced reporting accuracy and cut operational costs by $100,000 annually.

- •Conducted financial analyses that uncovered new revenue opportunities, resulting in a 15% profit margin increase.

- •Developed a budgeting model that improved forecast accuracy by 20% over the past fiscal year.

The experience section seamlessly connects your achievements with the needs of potential employers, making it highly effective. By focusing on measurable outcomes, each bullet point reinforces the value you brought to the organization and demonstrates your ability to deliver results. Tailoring your resume to the job ad ensures your skills and achievements align perfectly with what the employer is looking for, helping you stand out. Using strong action words enhances your narrative, showcasing your proactive approach and leadership smoothly and cohesively. This structured format efficiently communicates your capabilities, presenting you as the ideal candidate.

Responsibility-Focused resume experience section

A responsibility-focused corporate accountant resume experience section should emphasize your skills and contributions effectively. Begin by summarizing your role and detailing core responsibilities like auditing, budgeting, and financial reporting. Use active language paired with quantifiable achievements to clearly demonstrate your impact. Showcase your ability to take charge of tasks independently or lead a team to success, and mention technologies or software that enhanced your efficiency.

Including specific numbers or percentages will underline your effectiveness. Describe how your efforts positively influenced the company’s bottom line or improved overall efficiency. Employers are looking for results-oriented candidates who can immediately make a difference. Therefore, highlight any innovative solutions you introduced or complex challenges you successfully navigated.

Corporate Accountant

ABC Corporation

June 2018 - August 2022

- Managed monthly financial reporting and closing processes, ensuring accuracy and compliance with regulations.

- Streamlined accounts payable process, reducing invoice processing time by 30%.

- Led a cross-functional team in implementing a new accounting software, enhancing data accuracy and reporting speed.

- Improved cash flow by developing a systematic approach to monitor outstanding invoices and collections.

Industry-Specific Focus resume experience section

A corporate-focused accountant resume experience section should clearly demonstrate your expertise in corporate finance. Begin by identifying the skills and responsibilities relevant to the role, such as financial analysis, budgeting, and ensuring regulatory compliance. Highlight achievements that illustrate your ability to manage complex financial systems effectively. This not only emphasizes your technical capabilities but also shows how your work positively influences the company's financial health.

When detailing your experience, start with clear job titles that accurately reflect your role, and include the dates and company names. Use bullet points to effectively communicate your accomplishments, focusing on measurable outcomes and specific actions taken. Aim to demonstrate how you’ve increased efficiency, reduced costs, or refined processes. By weaving together your technical skills with tangible results, you create a unified narrative that showcases your strengths as a corporate accountant.

Senior Accountant

ABC Corp.

March 2017 - Present

- Managed financial reporting processes, ensuring accuracy and compliance with GAAP.

- Analyzed budget variances and provided detailed financial forecasts to improve planning.

- Streamlined accounts payable and receivable cycles, reducing processing time by 20%.

- Collaborated with external auditors during annual audits and resolved discrepancies.

Growth-Focused resume experience section

A growth-focused corporate accountant resume experience section should highlight how you've driven success and expansion in previous roles. Start by showcasing specific achievements that resulted in measurable impacts, using action-oriented language to convey your contributions. Emphasize your role in projects that streamlined processes or boosted financial performance, and support these claims with solid metrics such as cost savings or revenue increases. This approach not only emphasizes your effectiveness but also demonstrates your potential to replicate this success with future employers.

Reflect on key instances where your strategic decisions, efficiency improvements, or cost-reduction efforts directly contributed to growth. Maintain clarity and simplicity in your language, focusing on the positive outcomes of your actions. Organize your experience section by listing your job title, employment dates, and workplace name at the beginning. Follow this with bullet points that clearly describe your achievements and contributions. This structure effectively conveys the substance of your accomplishments, allowing potential employers to quickly recognize the value you offer.

Corporate Accountant

ABC Corporation

June 2018 - September 2023

- Led a team to streamline financial reporting, reducing errors by 30% and saving 10 hours weekly.

- Implemented cost-efficient budgeting processes that saved the company $200,000 annually.

- Spearheaded a project that improved accounts receivable turnover by 15% within one year.

- Developed a financial forecasting model that increased quarterly profit margins by 5%.

Customer-Focused resume experience section

A customer-focused corporate accountant resume experience section should clearly demonstrate your ability to meet client needs and enhance communication between the company and its customers. Begin by emphasizing your role in nurturing client relationships and improving business processes, fueled by your financial acumen and tailored solutions. Show specific accomplishments that exemplify your commitment to customer satisfaction, whether it’s minimizing errors or boosting efficiency in financial reporting to build trust.

Incorporate examples that illustrate your proactive approach to resolving client issues and offering valuable financial insights that support decision-making. This could involve working with diverse teams to refine operations or implementing new systems that benefit both the company and its clients. Use tangible results to reinforce your achievements, making sure each bullet point highlights your contributions to enriching the customer experience.

Corporate Accountant

FinSolutions Inc

June 2020 - Present

- Streamlined billing process for clients, reducing invoice errors by 25% within first year.

- Collaborated with sales teams to create tailored financial solutions, boosting customer satisfaction scores by 15%.

- Led implementation of new accounting software, cutting client query response time by 40%.

- Designed client-focused workshops, educating partners on financial strategies, resulting in 20% increase in client retention.

Write your corporate accountant resume summary section

A corporate accountant-focused resume summary should effectively showcase your skills and experience in a compelling way. It's important to make an impact right away with a few clear lines. Highlight what sets you apart by mentioning relevant years of experience, successes, and key skills. If you're experienced, emphasize your strengths in financial analysis, budgeting, and compliance. Use straightforward language to convey confidence and professionalism without overwhelming the reader.

This summary adeptly showcases your skills and achievements, offering a clear picture of the value you bring to employers. Its focus remains on rapidly highlighting what matters to hiring managers.

Describing yourself requires using language that is both strong and confident. Words like "skilled," "expert," and "proven" can effectively communicate your capabilities. Honesty is key—present your accomplishments clearly without exaggeration.

Grasping the different sections of a resume can enhance your presentation. A summary provides a quick overview, ideal for those with significant experience. An objective focuses on future goals, suiting newcomers or those switching careers. A resume profile combines elements of both, underscoring achievements and skills with a personal angle. Meanwhile, the summary of qualifications lists key skills and accomplishments in bullet points for easy skimming. Choosing the right section based on your career stage helps you make a strong, tailored impression.

Listing your corporate accountant skills on your resume

A skills-focused corporate accountant resume should effectively highlight the unique abilities you bring to any financial team. The skills section, whether standalone or interwoven within your experience or summary, acts as a crucial showcase of your expertise. By mentioning your strengths and soft skills, you emphasize your ability to collaborate and handle complex responsibilities effectively. Hard skills, meanwhile, underscore your technical prowess in areas like financial analysis or accounting software.

Think of your skills and strengths as the strategic keywords of your resume. These keywords play a vital role in making your resume visible to applicant tracking systems and hiring managers, capturing the essence of what you can offer and aligning with the job’s demands.

Here’s an example of an impactful standalone skills section:

This example effectively communicates your qualifications by clearly listing skills pertinent to a corporate accountant role. It enables hiring managers to quickly ascertain your competencies and see them aligned with the requirements of the position.

Best hard skills to feature on your corporate accountant resume

Hard skills form the backbone of a corporate accountant’s resume by demonstrating your capability to manage financial operations and adhere to industry regulations. They convey your ability to handle financial responsibilities with precision. Consider these essential hard skills:

Hard Skills

- Financial Analysis

- Budget Management

- Tax Preparation and Compliance

- Account Reconciliation

- Auditing

- Knowledge of GAAP (Generally Accepted Accounting Principles)

- Financial Reporting

- Payroll Management

- Proficiency in Accounting Software (like QuickBooks or SAP)

- Spreadsheet Software (like Excel)

- Risk Assessment

- Cost Accounting

- Accounts Payable and Receivable Management

- Internal Controls

- Financial Forecasting

Best soft skills to feature on your corporate accountant resume

Equally important are soft skills, which underscore your interpersonal abilities and adaptability. They reflect your capacity for effective communication and problem-solving within a team setting. Highlight the following soft skills:

Soft Skills

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Problem-Solving

- Time Management

- Team Collaboration

- Adaptability

- Decision Making

- Ethical Judgement

- Organization

- Negotiation Skills

- Leadership

- Critical Thinking

- Strategic Planning

- Conflict Resolution

How to include your education on your resume

The education section of your corporate accountant resume is vital in showcasing your qualifications and academic achievements. As you craft this section, tailor it to the job you're applying for, ensuring that only relevant education is included. Avoid listing unrelated education that doesn't align with the corporate accounting field. Including your GPA can be beneficial, particularly if it's high, but it's not mandatory. If you decide to present it, write it out as "GPA: 3.8/4.0." Honors such as "cum laude" should be mentioned because they highlight your academic excellence. Clearly state your degree by naming the level and field, for example, "Bachelor of Science in Accounting."

Here's an incorrect example of an education section:

Here's a correct example, more aligned with a corporate accountant position:

In the correct example, the degree is directly relevant to the accounting career path. The GPA is included, demonstrating strong academic performance, and the degree completion year indicates recent and likely relevant knowledge. It's concise but provides the necessary information potential employers need to assess your educational background.

How to include corporate accountant certificates on your resume

Including a certificates section in your corporate accountant resume is vital. Certifications highlight your qualifications and show that you have specialized skills. List the name of each certificate, include the date it was issued, and add the name of the issuing organization. This not only provides credibility but also allows hiring managers to verify your qualifications.

You can include certificates in the header of your resume for immediate visibility. For example:

This example is effective because it clearly names the certificates, gives the issuing organizations, and uses recognized credentials relevant to corporate accounting. Each certificate is straightforward and easy to verify. Including both CPA and CMA shows a broad skill set in both public and management accounting, catering to various aspects of the corporate environment.

Extra sections to include in your corporate accountant resume

Creating a standout resume as a corporate accountant means showcasing not only your professional skills but also other elements that illustrate who you are. Including sections like languages, hobbies, volunteer work, and books can add depth to your profile and give hiring managers a broader picture of your capabilities and personality.

Language section — Highlighting your language proficiency can demonstrate your ability to work in diverse environments and communicate effectively with a broader range of clients and colleagues.

Hobbies and interests section — Listing your hobbies and interests can show a more personal side and help create connections with prospective employers; it may also indicate skills such as teamwork, leadership, or dedication.

Volunteer work section — Mentioning volunteer work not only underscores your commitment to social responsibility but also can showcase skills like project management and teamwork that are relevant in a corporate setting.

Books section — Including books you’ve read, especially those related to finance, business, or self-development, can highlight your dedication to ongoing learning and personal growth, demonstrating you are invested in improving your professional knowledge and skills.

In Conclusion

In conclusion, crafting an impactful resume as a corporate accountant involves more than just listing your experiences; it's about strategically presenting your skills and achievements to capture the attention of potential employers. Using a structured template can guide you in highlighting your strengths in financial analysis, budgeting, and compliance, making your application stand out. Whether you're showcasing your work experience, education, or certifications, a clear and organized presentation is essential for reflecting your professionalism and attention to detail—traits highly valued in the accounting field. Tailoring your resume to align with job descriptions not only demonstrates your ability to meet employers' requirements but also communicates your eagerness to contribute to their goals. Remember that your resume is more than a document; it is your personal narrative, illustrating the unique value you bring to the accounting profession. By focusing on quantifiable achievements and organizing content effectively, you enhance your potential to engage hiring managers. Furthermore, supplementing your resume with sections like projects or awards can provide a well-rounded view of your capabilities. The thoughtful inclusion of hard and soft skills ensures a balanced representation of your abilities, ready to meet the demands of a dynamic job market. Ultimately, your resume serves as a gateway to new opportunities, reflecting not just your past, but your potential to impact the future of any organization you join.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.