Corporate Banking Resume Examples

Jul 18, 2024

|

12 min read

Craft an impressive corporate banking resume: boost your career with these tips to stand out to employers and get the role you want in finance.

Rated by 348 people

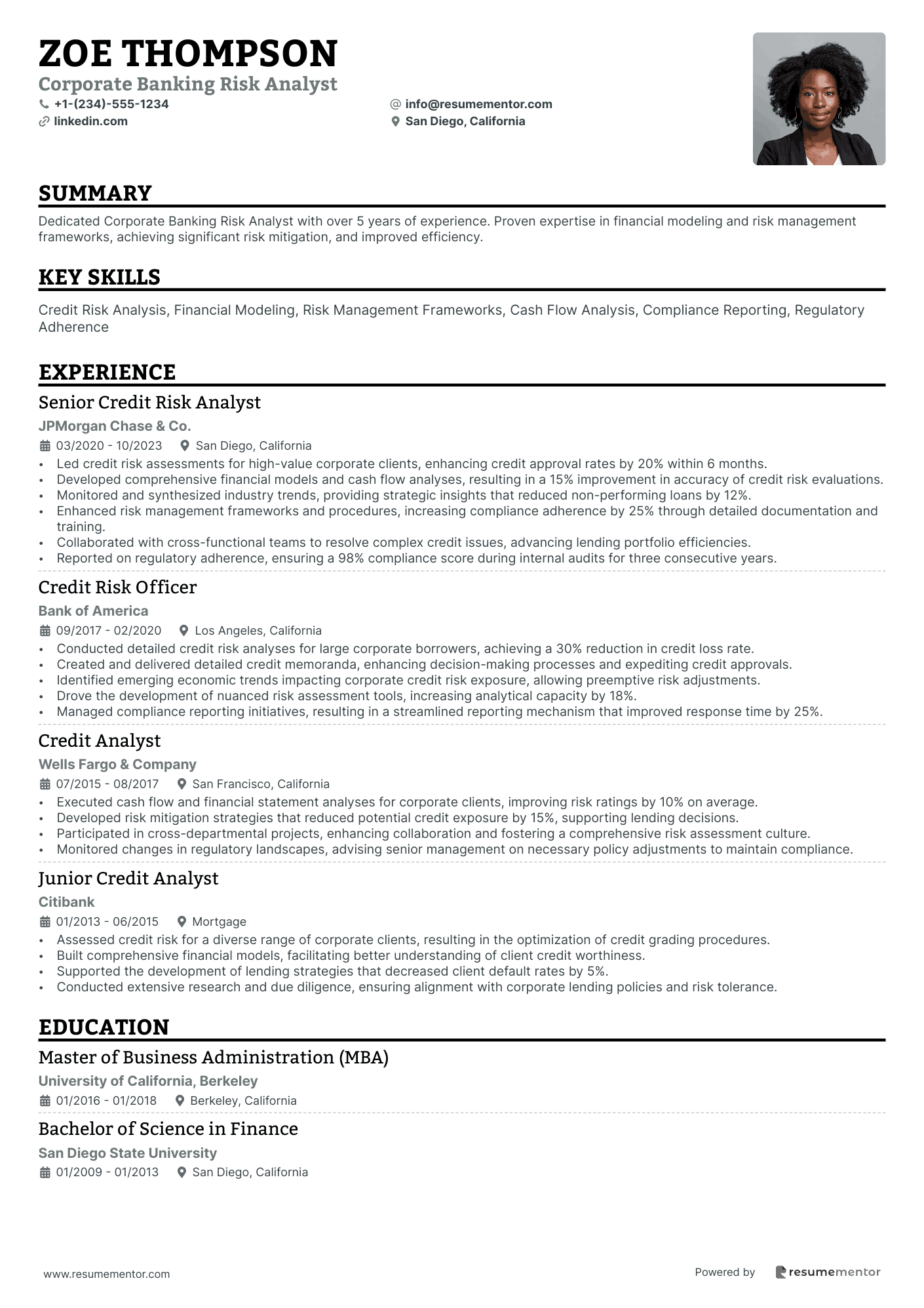

Corporate Banking Risk Analyst

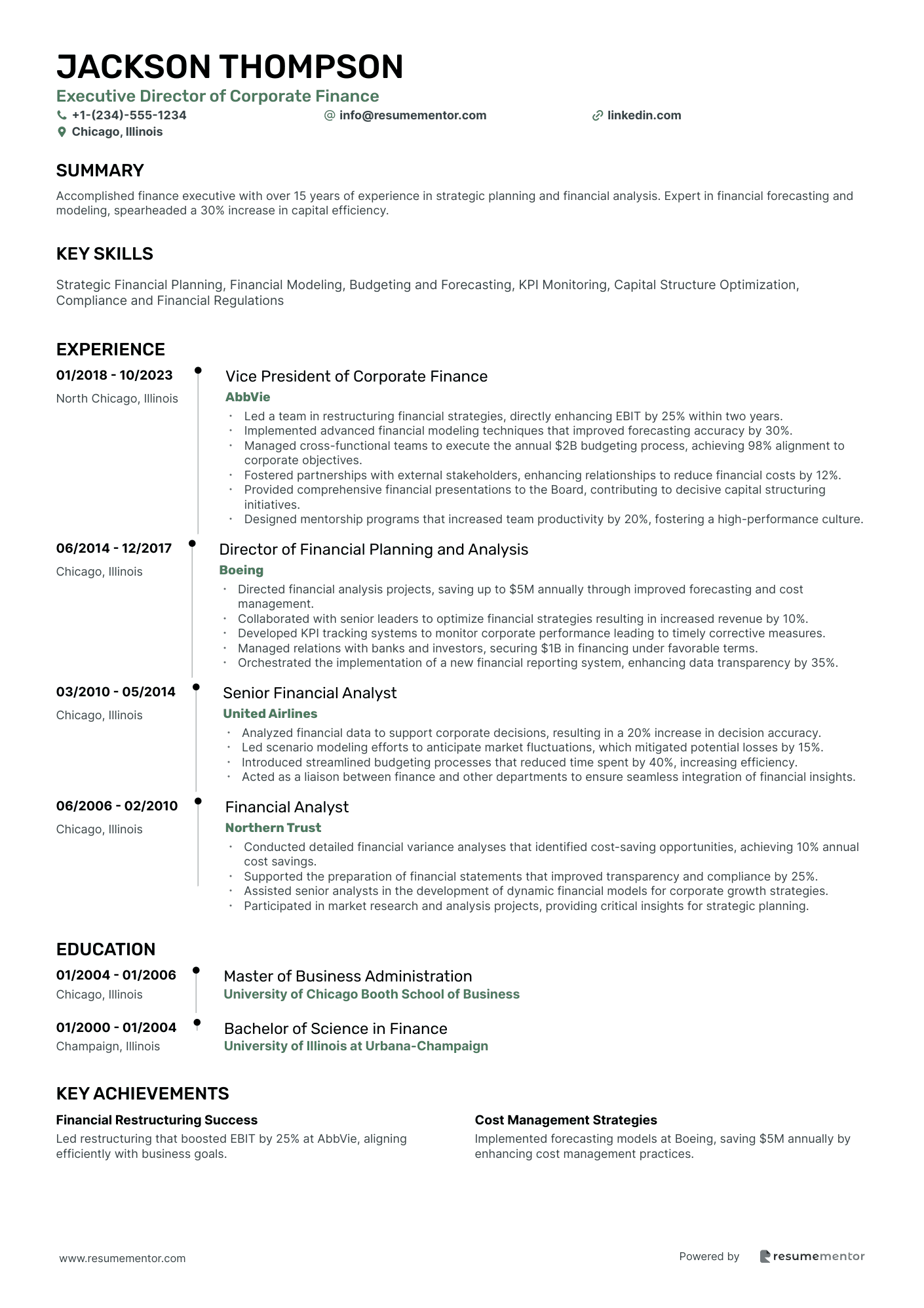

Executive Director of Corporate Finance

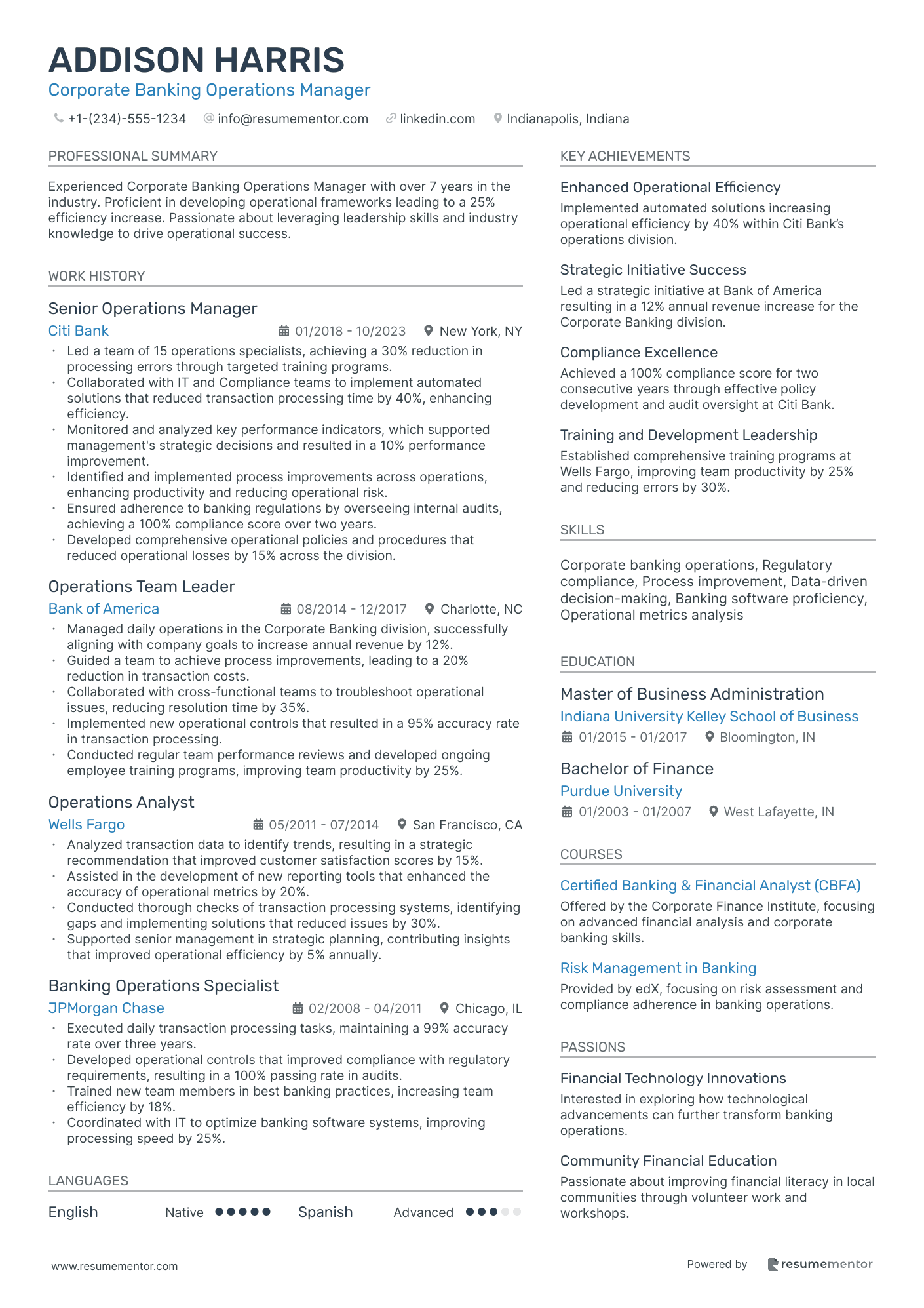

Corporate Banking Operations Manager

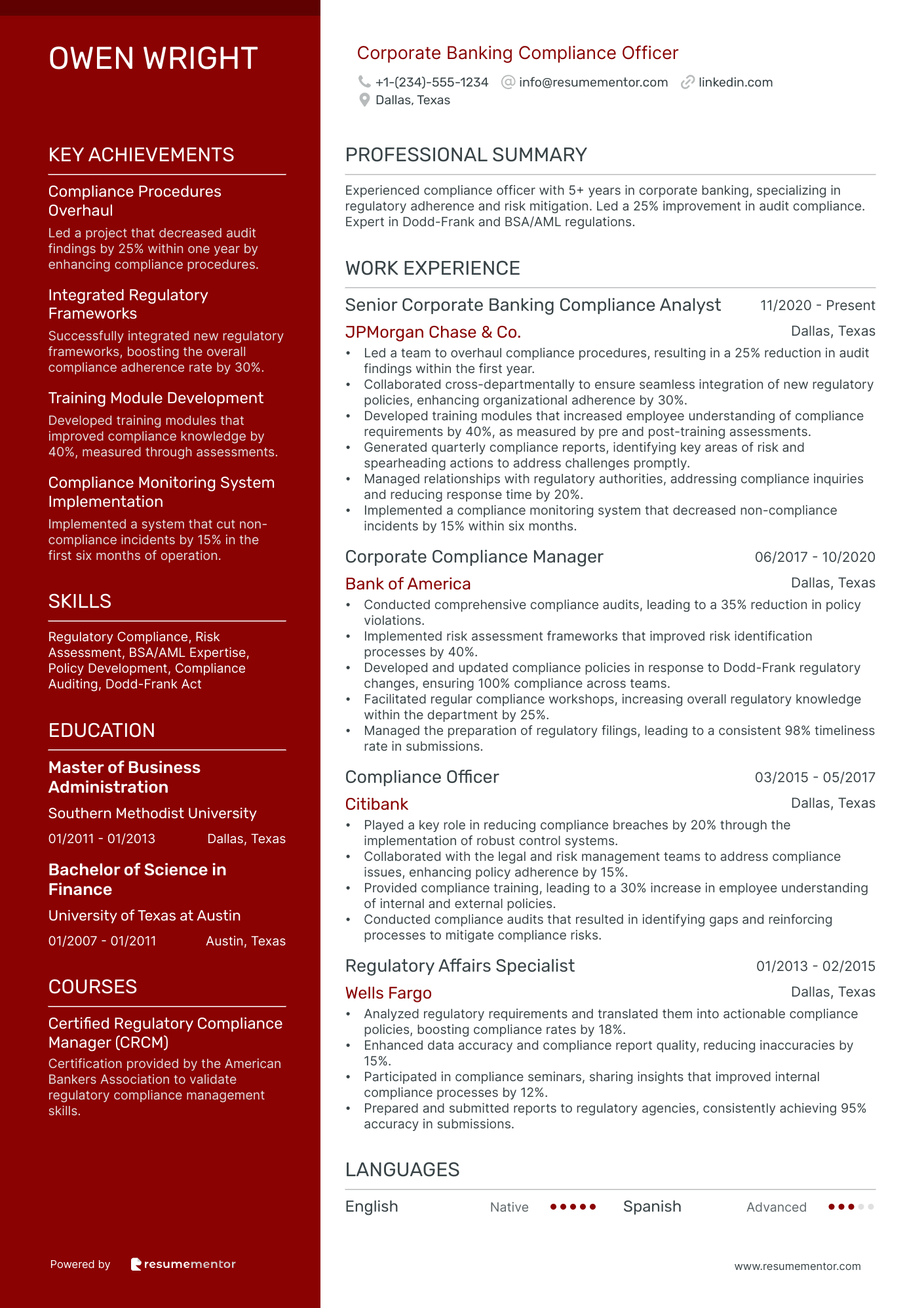

Corporate Banking Compliance Officer

Project Finance Corporate Banker

Mergers & Acquisitions Corporate Banker

Corporate Banking Relationship Manager

Foreign Exchange Trading, Corporate Banking

Corporate Banking Treasury Analyst

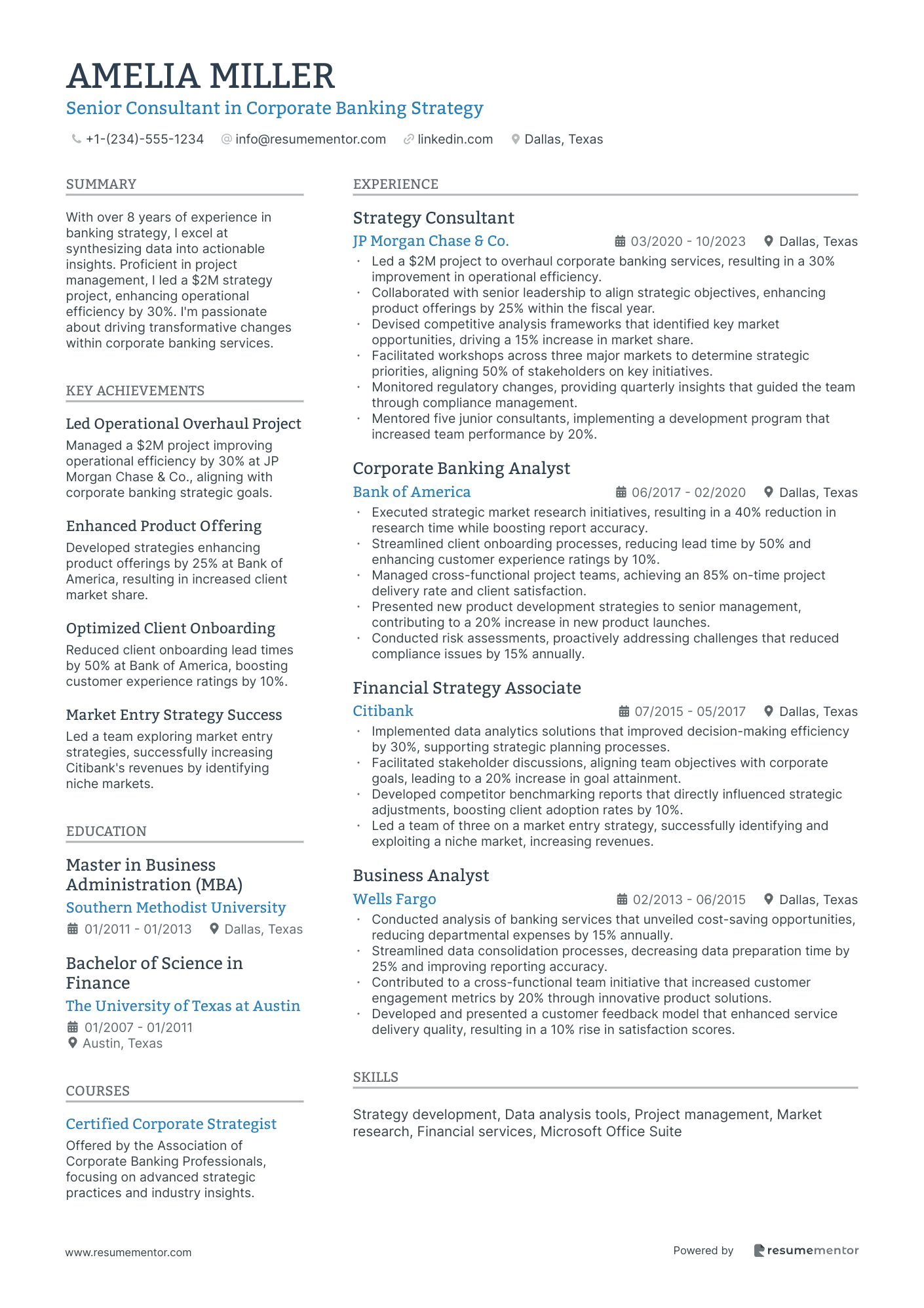

Senior Consultant in Corporate Banking Strategy

Corporate Banking Risk Analyst resume sample

- •Led credit risk assessments for high-value corporate clients, enhancing credit approval rates by 20% within 6 months.

- •Developed comprehensive financial models and cash flow analyses, resulting in a 15% improvement in accuracy of credit risk evaluations.

- •Monitored and synthesized industry trends, providing strategic insights that reduced non-performing loans by 12%.

- •Enhanced risk management frameworks and procedures, increasing compliance adherence by 25% through detailed documentation and training.

- •Collaborated with cross-functional teams to resolve complex credit issues, advancing lending portfolio efficiencies.

- •Reported on regulatory adherence, ensuring a 98% compliance score during internal audits for three consecutive years.

- •Conducted detailed credit risk analyses for large corporate borrowers, achieving a 30% reduction in credit loss rate.

- •Created and delivered detailed credit memoranda, enhancing decision-making processes and expediting credit approvals.

- •Identified emerging economic trends impacting corporate credit risk exposure, allowing preemptive risk adjustments.

- •Drove the development of nuanced risk assessment tools, increasing analytical capacity by 18%.

- •Managed compliance reporting initiatives, resulting in a streamlined reporting mechanism that improved response time by 25%.

- •Executed cash flow and financial statement analyses for corporate clients, improving risk ratings by 10% on average.

- •Developed risk mitigation strategies that reduced potential credit exposure by 15%, supporting lending decisions.

- •Participated in cross-departmental projects, enhancing collaboration and fostering a comprehensive risk assessment culture.

- •Monitored changes in regulatory landscapes, advising senior management on necessary policy adjustments to maintain compliance.

- •Assessed credit risk for a diverse range of corporate clients, resulting in the optimization of credit grading procedures.

- •Built comprehensive financial models, facilitating better understanding of client credit worthiness.

- •Supported the development of lending strategies that decreased client default rates by 5%.

- •Conducted extensive research and due diligence, ensuring alignment with corporate lending policies and risk tolerance.

Executive Director of Corporate Finance resume sample

- •Led a team in restructuring financial strategies, directly enhancing EBIT by 25% within two years.

- •Implemented advanced financial modeling techniques that improved forecasting accuracy by 30%.

- •Managed cross-functional teams to execute the annual $2B budgeting process, achieving 98% alignment to corporate objectives.

- •Fostered partnerships with external stakeholders, enhancing relationships to reduce financial costs by 12%.

- •Provided comprehensive financial presentations to the Board, contributing to decisive capital structuring initiatives.

- •Designed mentorship programs that increased team productivity by 20%, fostering a high-performance culture.

- •Directed financial analysis projects, saving up to $5M annually through improved forecasting and cost management.

- •Collaborated with senior leaders to optimize financial strategies resulting in increased revenue by 10%.

- •Developed KPI tracking systems to monitor corporate performance leading to timely corrective measures.

- •Managed relations with banks and investors, securing $1B in financing under favorable terms.

- •Orchestrated the implementation of a new financial reporting system, enhancing data transparency by 35%.

- •Analyzed financial data to support corporate decisions, resulting in a 20% increase in decision accuracy.

- •Led scenario modeling efforts to anticipate market fluctuations, which mitigated potential losses by 15%.

- •Introduced streamlined budgeting processes that reduced time spent by 40%, increasing efficiency.

- •Acted as a liaison between finance and other departments to ensure seamless integration of financial insights.

- •Conducted detailed financial variance analyses that identified cost-saving opportunities, achieving 10% annual cost savings.

- •Supported the preparation of financial statements that improved transparency and compliance by 25%.

- •Assisted senior analysts in the development of dynamic financial models for corporate growth strategies.

- •Participated in market research and analysis projects, providing critical insights for strategic planning.

Corporate Banking Operations Manager resume sample

- •Led a team of 15 operations specialists, achieving a 30% reduction in processing errors through targeted training programs.

- •Collaborated with IT and Compliance teams to implement automated solutions that reduced transaction processing time by 40%, enhancing efficiency.

- •Monitored and analyzed key performance indicators, which supported management's strategic decisions and resulted in a 10% performance improvement.

- •Identified and implemented process improvements across operations, enhancing productivity and reducing operational risk.

- •Ensured adherence to banking regulations by overseeing internal audits, achieving a 100% compliance score over two years.

- •Developed comprehensive operational policies and procedures that reduced operational losses by 15% across the division.

- •Managed daily operations in the Corporate Banking division, successfully aligning with company goals to increase annual revenue by 12%.

- •Guided a team to achieve process improvements, leading to a 20% reduction in transaction costs.

- •Collaborated with cross-functional teams to troubleshoot operational issues, reducing resolution time by 35%.

- •Implemented new operational controls that resulted in a 95% accuracy rate in transaction processing.

- •Conducted regular team performance reviews and developed ongoing employee training programs, improving team productivity by 25%.

- •Analyzed transaction data to identify trends, resulting in a strategic recommendation that improved customer satisfaction scores by 15%.

- •Assisted in the development of new reporting tools that enhanced the accuracy of operational metrics by 20%.

- •Conducted thorough checks of transaction processing systems, identifying gaps and implementing solutions that reduced issues by 30%.

- •Supported senior management in strategic planning, contributing insights that improved operational efficiency by 5% annually.

- •Executed daily transaction processing tasks, maintaining a 99% accuracy rate over three years.

- •Developed operational controls that improved compliance with regulatory requirements, resulting in a 100% passing rate in audits.

- •Trained new team members in best banking practices, increasing team efficiency by 18%.

- •Coordinated with IT to optimize banking software systems, improving processing speed by 25%.

Corporate Banking Compliance Officer resume sample

- •Led a team to overhaul compliance procedures, resulting in a 25% reduction in audit findings within the first year.

- •Collaborated cross-departmentally to ensure seamless integration of new regulatory policies, enhancing organizational adherence by 30%.

- •Developed training modules that increased employee understanding of compliance requirements by 40%, as measured by pre and post-training assessments.

- •Generated quarterly compliance reports, identifying key areas of risk and spearheading actions to address challenges promptly.

- •Managed relationships with regulatory authorities, addressing compliance inquiries and reducing response time by 20%.

- •Implemented a compliance monitoring system that decreased non-compliance incidents by 15% within six months.

- •Conducted comprehensive compliance audits, leading to a 35% reduction in policy violations.

- •Implemented risk assessment frameworks that improved risk identification processes by 40%.

- •Developed and updated compliance policies in response to Dodd-Frank regulatory changes, ensuring 100% compliance across teams.

- •Facilitated regular compliance workshops, increasing overall regulatory knowledge within the department by 25%.

- •Managed the preparation of regulatory filings, leading to a consistent 98% timeliness rate in submissions.

- •Played a key role in reducing compliance breaches by 20% through the implementation of robust control systems.

- •Collaborated with the legal and risk management teams to address compliance issues, enhancing policy adherence by 15%.

- •Provided compliance training, leading to a 30% increase in employee understanding of internal and external policies.

- •Conducted compliance audits that resulted in identifying gaps and reinforcing processes to mitigate compliance risks.

- •Analyzed regulatory requirements and translated them into actionable compliance policies, boosting compliance rates by 18%.

- •Enhanced data accuracy and compliance report quality, reducing inaccuracies by 15%.

- •Participated in compliance seminars, sharing insights that improved internal compliance processes by 12%.

- •Prepared and submitted reports to regulatory agencies, consistently achieving 95% accuracy in submissions.

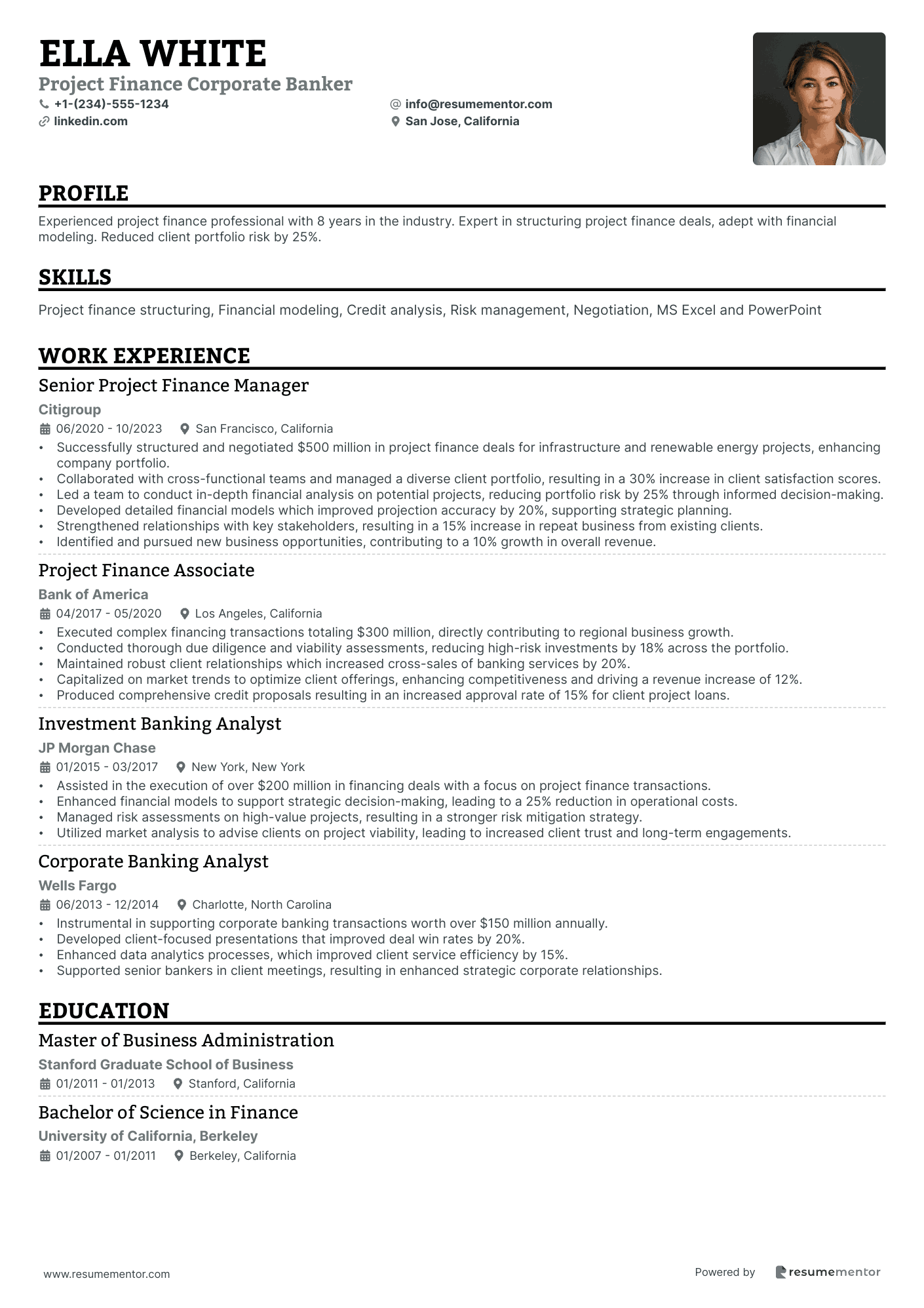

Project Finance Corporate Banker resume sample

- •Successfully structured and negotiated $500 million in project finance deals for infrastructure and renewable energy projects, enhancing company portfolio.

- •Collaborated with cross-functional teams and managed a diverse client portfolio, resulting in a 30% increase in client satisfaction scores.

- •Led a team to conduct in-depth financial analysis on potential projects, reducing portfolio risk by 25% through informed decision-making.

- •Developed detailed financial models which improved projection accuracy by 20%, supporting strategic planning.

- •Strengthened relationships with key stakeholders, resulting in a 15% increase in repeat business from existing clients.

- •Identified and pursued new business opportunities, contributing to a 10% growth in overall revenue.

- •Executed complex financing transactions totaling $300 million, directly contributing to regional business growth.

- •Conducted thorough due diligence and viability assessments, reducing high-risk investments by 18% across the portfolio.

- •Maintained robust client relationships which increased cross-sales of banking services by 20%.

- •Capitalized on market trends to optimize client offerings, enhancing competitiveness and driving a revenue increase of 12%.

- •Produced comprehensive credit proposals resulting in an increased approval rate of 15% for client project loans.

- •Assisted in the execution of over $200 million in financing deals with a focus on project finance transactions.

- •Enhanced financial models to support strategic decision-making, leading to a 25% reduction in operational costs.

- •Managed risk assessments on high-value projects, resulting in a stronger risk mitigation strategy.

- •Utilized market analysis to advise clients on project viability, leading to increased client trust and long-term engagements.

- •Instrumental in supporting corporate banking transactions worth over $150 million annually.

- •Developed client-focused presentations that improved deal win rates by 20%.

- •Enhanced data analytics processes, which improved client service efficiency by 15%.

- •Supported senior bankers in client meetings, resulting in enhanced strategic corporate relationships.

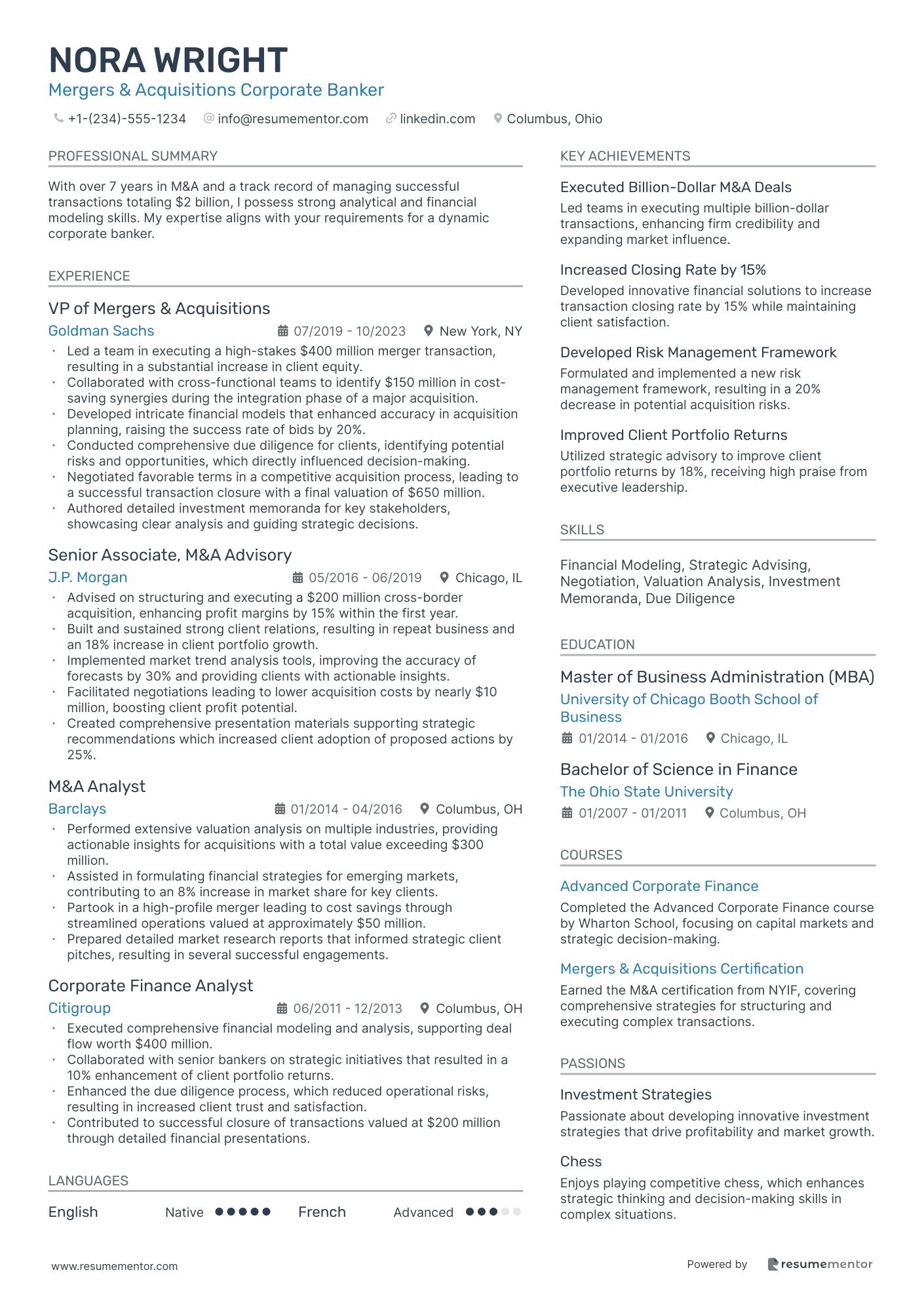

Mergers & Acquisitions Corporate Banker resume sample

- •Led a team in executing a high-stakes $400 million merger transaction, resulting in a substantial increase in client equity.

- •Collaborated with cross-functional teams to identify $150 million in cost-saving synergies during the integration phase of a major acquisition.

- •Developed intricate financial models that enhanced accuracy in acquisition planning, raising the success rate of bids by 20%.

- •Conducted comprehensive due diligence for clients, identifying potential risks and opportunities, which directly influenced decision-making.

- •Negotiated favorable terms in a competitive acquisition process, leading to a successful transaction closure with a final valuation of $650 million.

- •Authored detailed investment memoranda for key stakeholders, showcasing clear analysis and guiding strategic decisions.

- •Advised on structuring and executing a $200 million cross-border acquisition, enhancing profit margins by 15% within the first year.

- •Built and sustained strong client relations, resulting in repeat business and an 18% increase in client portfolio growth.

- •Implemented market trend analysis tools, improving the accuracy of forecasts by 30% and providing clients with actionable insights.

- •Facilitated negotiations leading to lower acquisition costs by nearly $10 million, boosting client profit potential.

- •Created comprehensive presentation materials supporting strategic recommendations which increased client adoption of proposed actions by 25%.

- •Performed extensive valuation analysis on multiple industries, providing actionable insights for acquisitions with a total value exceeding $300 million.

- •Assisted in formulating financial strategies for emerging markets, contributing to an 8% increase in market share for key clients.

- •Partook in a high-profile merger leading to cost savings through streamlined operations valued at approximately $50 million.

- •Prepared detailed market research reports that informed strategic client pitches, resulting in several successful engagements.

- •Executed comprehensive financial modeling and analysis, supporting deal flow worth $400 million.

- •Collaborated with senior bankers on strategic initiatives that resulted in a 10% enhancement of client portfolio returns.

- •Enhanced the due diligence process, which reduced operational risks, resulting in increased client trust and satisfaction.

- •Contributed to successful closure of transactions valued at $200 million through detailed financial presentations.

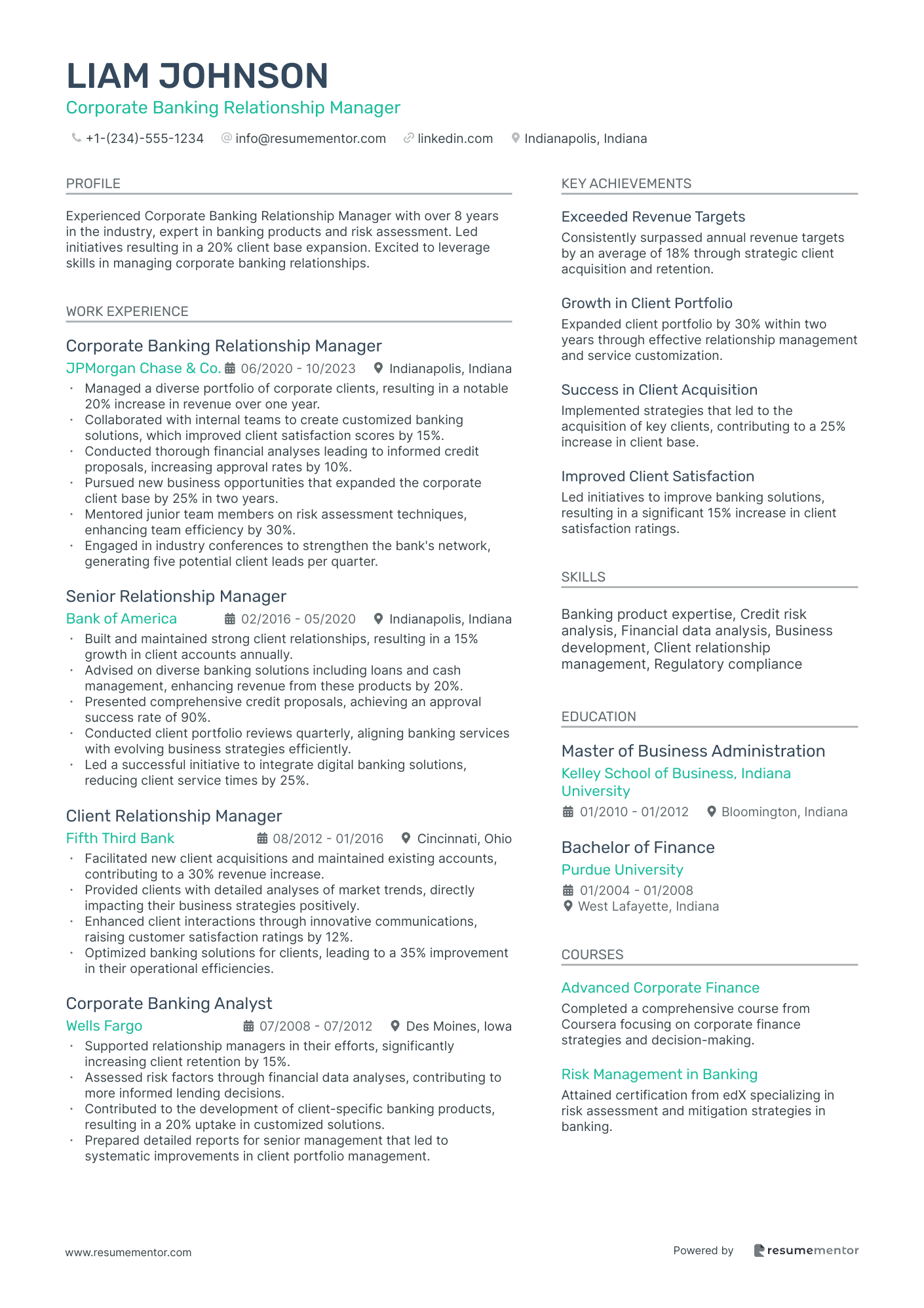

Corporate Banking Relationship Manager resume sample

- •Managed a diverse portfolio of corporate clients, resulting in a notable 20% increase in revenue over one year.

- •Collaborated with internal teams to create customized banking solutions, which improved client satisfaction scores by 15%.

- •Conducted thorough financial analyses leading to informed credit proposals, increasing approval rates by 10%.

- •Pursued new business opportunities that expanded the corporate client base by 25% in two years.

- •Mentored junior team members on risk assessment techniques, enhancing team efficiency by 30%.

- •Engaged in industry conferences to strengthen the bank's network, generating five potential client leads per quarter.

- •Built and maintained strong client relationships, resulting in a 15% growth in client accounts annually.

- •Advised on diverse banking solutions including loans and cash management, enhancing revenue from these products by 20%.

- •Presented comprehensive credit proposals, achieving an approval success rate of 90%.

- •Conducted client portfolio reviews quarterly, aligning banking services with evolving business strategies efficiently.

- •Led a successful initiative to integrate digital banking solutions, reducing client service times by 25%.

- •Facilitated new client acquisitions and maintained existing accounts, contributing to a 30% revenue increase.

- •Provided clients with detailed analyses of market trends, directly impacting their business strategies positively.

- •Enhanced client interactions through innovative communications, raising customer satisfaction ratings by 12%.

- •Optimized banking solutions for clients, leading to a 35% improvement in their operational efficiencies.

- •Supported relationship managers in their efforts, significantly increasing client retention by 15%.

- •Assessed risk factors through financial data analyses, contributing to more informed lending decisions.

- •Contributed to the development of client-specific banking products, resulting in a 20% uptake in customized solutions.

- •Prepared detailed reports for senior management that led to systematic improvements in client portfolio management.

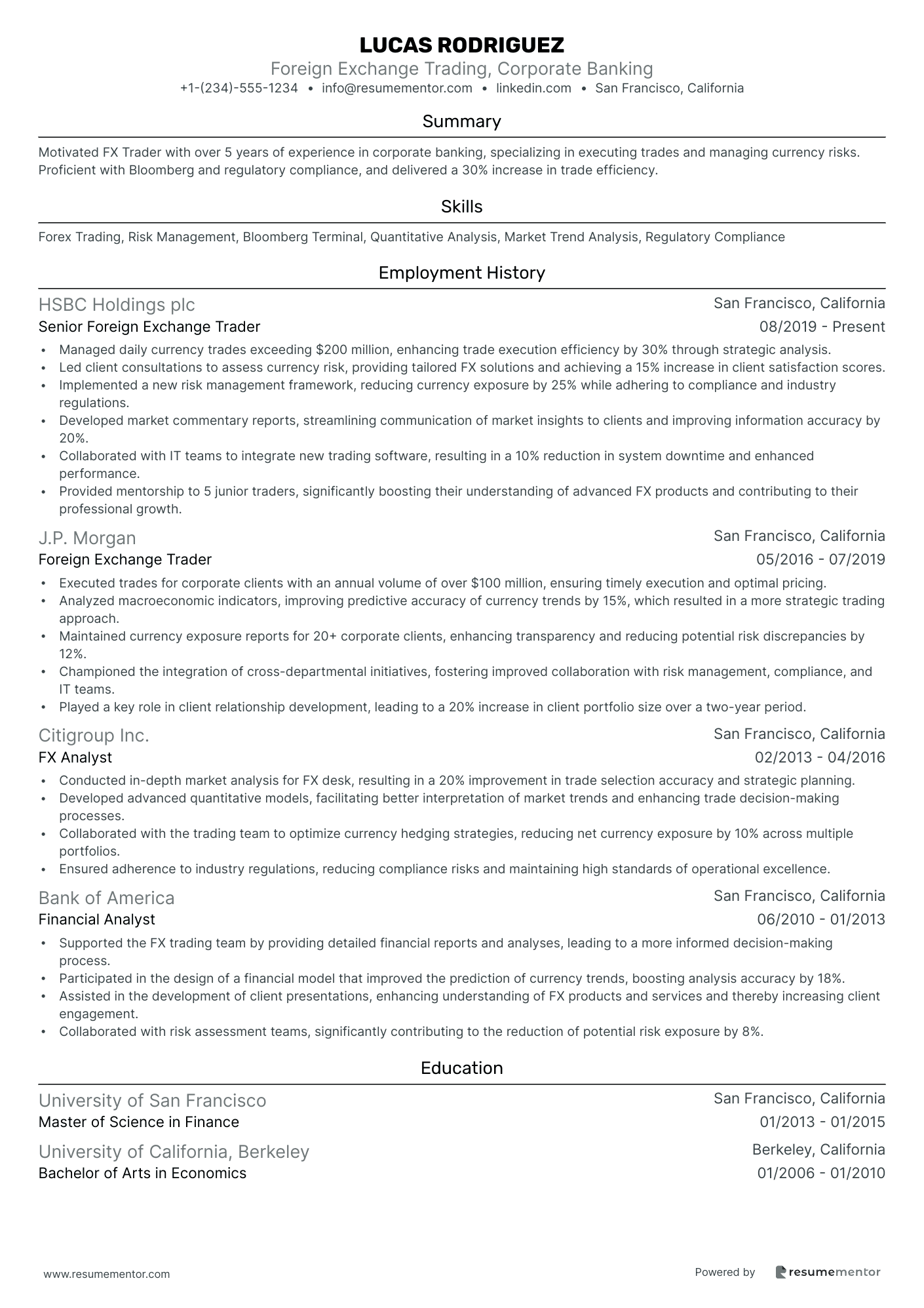

Foreign Exchange Trading, Corporate Banking resume sample

- •Managed daily currency trades exceeding $200 million, enhancing trade execution efficiency by 30% through strategic analysis.

- •Led client consultations to assess currency risk, providing tailored FX solutions and achieving a 15% increase in client satisfaction scores.

- •Implemented a new risk management framework, reducing currency exposure by 25% while adhering to compliance and industry regulations.

- •Developed market commentary reports, streamlining communication of market insights to clients and improving information accuracy by 20%.

- •Collaborated with IT teams to integrate new trading software, resulting in a 10% reduction in system downtime and enhanced performance.

- •Provided mentorship to 5 junior traders, significantly boosting their understanding of advanced FX products and contributing to their professional growth.

- •Executed trades for corporate clients with an annual volume of over $100 million, ensuring timely execution and optimal pricing.

- •Analyzed macroeconomic indicators, improving predictive accuracy of currency trends by 15%, which resulted in a more strategic trading approach.

- •Maintained currency exposure reports for 20+ corporate clients, enhancing transparency and reducing potential risk discrepancies by 12%.

- •Championed the integration of cross-departmental initiatives, fostering improved collaboration with risk management, compliance, and IT teams.

- •Played a key role in client relationship development, leading to a 20% increase in client portfolio size over a two-year period.

- •Conducted in-depth market analysis for FX desk, resulting in a 20% improvement in trade selection accuracy and strategic planning.

- •Developed advanced quantitative models, facilitating better interpretation of market trends and enhancing trade decision-making processes.

- •Collaborated with the trading team to optimize currency hedging strategies, reducing net currency exposure by 10% across multiple portfolios.

- •Ensured adherence to industry regulations, reducing compliance risks and maintaining high standards of operational excellence.

- •Supported the FX trading team by providing detailed financial reports and analyses, leading to a more informed decision-making process.

- •Participated in the design of a financial model that improved the prediction of currency trends, boosting analysis accuracy by 18%.

- •Assisted in the development of client presentations, enhancing understanding of FX products and services and thereby increasing client engagement.

- •Collaborated with risk assessment teams, significantly contributing to the reduction of potential risk exposure by 8%.

Corporate Banking Treasury Analyst resume sample

- •Led a cross-functional team to enhance cash flow forecasting accuracy, achieving a 20% reduction in variance errors.

- •Implemented advanced financial modeling techniques for liquidity analysis, improving efficiency by 15%.

- •Collaborated with the IT department to integrate a new treasury management system, reducing processing time by 25%.

- •Developed a robust internal reporting framework for management, aiding strategic decision-making through timely insights.

- •Re-engineered payment processing workflows, resulting in a 10% cost saving in transaction fees annually.

- •Presented quarterly analysis reports to senior management, influencing decisions on fund allocations and investments.

- •Monitored daily liquidity metrics and managed cash flow operations with a turnover of over $500 million monthly.

- •Optimized short-term borrowing strategies, reducing interest costs by $500,000 annually through strategic negotiations.

- •Assisted in maintaining strong banking relationships, resulting in a 5% improvement in service delivery ratings.

- •Created and maintained comprehensive cash management reports, improving transparency, and control for executive review.

- •Initiated a special project that benchmarked cash management practices against industry standards, identifying key improvement areas.

- •Conducted financial market analyses, supporting treasury operations in maintaining an optimal liquidity position.

- •Played a key role in cash flow analysis for $200 million in assets, enhancing asset-liability management.

- •Implemented data analytics for cash forecasting, resulting in a 15% increase in forecast accuracy.

- •Collaborated closely with cross-functional teams to identify and address potential cash management challenges proactively.

- •Assessed and managed financial risks associated with corporate banking services, enhancing the bank's risk mitigation protocols.

- •Provided strategic input on cash flow management to minimize liquidity risks during volatile market conditions.

- •Developed a risk assessment framework for treasury operations, streamlining processes and reducing potential financial exposure.

- •Liaised with other departments to ensure comprehensive understanding and management of financial risks within the organization.

Senior Consultant in Corporate Banking Strategy resume sample

- •Led a $2M project to overhaul corporate banking services, resulting in a 30% improvement in operational efficiency.

- •Collaborated with senior leadership to align strategic objectives, enhancing product offerings by 25% within the fiscal year.

- •Devised competitive analysis frameworks that identified key market opportunities, driving a 15% increase in market share.

- •Facilitated workshops across three major markets to determine strategic priorities, aligning 50% of stakeholders on key initiatives.

- •Monitored regulatory changes, providing quarterly insights that guided the team through compliance management.

- •Mentored five junior consultants, implementing a development program that increased team performance by 20%.

- •Executed strategic market research initiatives, resulting in a 40% reduction in research time while boosting report accuracy.

- •Streamlined client onboarding processes, reducing lead time by 50% and enhancing customer experience ratings by 10%.

- •Managed cross-functional project teams, achieving an 85% on-time project delivery rate and client satisfaction.

- •Presented new product development strategies to senior management, contributing to a 20% increase in new product launches.

- •Conducted risk assessments, proactively addressing challenges that reduced compliance issues by 15% annually.

- •Implemented data analytics solutions that improved decision-making efficiency by 30%, supporting strategic planning processes.

- •Facilitated stakeholder discussions, aligning team objectives with corporate goals, leading to a 20% increase in goal attainment.

- •Developed competitor benchmarking reports that directly influenced strategic adjustments, boosting client adoption rates by 10%.

- •Led a team of three on a market entry strategy, successfully identifying and exploiting a niche market, increasing revenues.

- •Conducted analysis of banking services that unveiled cost-saving opportunities, reducing departmental expenses by 15% annually.

- •Streamlined data consolidation processes, decreasing data preparation time by 25% and improving reporting accuracy.

- •Contributed to a cross-functional team initiative that increased customer engagement metrics by 20% through innovative product solutions.

- •Developed and presented a customer feedback model that enhanced service delivery quality, resulting in a 10% rise in satisfaction scores.

Creating a resume for corporate banking is like assembling a strategic investment portfolio. It should highlight your analytical skills and financial foresight, opening the door to exciting career opportunities. However, balancing technical expertise with clear communication on paper can be tricky.

Effectively presenting your financial experiences in a simple yet impactful way is essential. Turning your proficiency with numbers into compelling words that convey your impact is often challenging. This is where a reliable resume template becomes invaluable.

Using a resume template ensures your skills are organized clearly and professionally. It provides structure, making it easier for hiring managers to grasp your strengths. In the competitive world of corporate banking, focusing on results is crucial.

Highlight accomplishments like increasing profits, reducing risks, or managing budgets effectively. These achievements set you apart and make a strong impression. Each detail in your resume should add value, much like how each asset in a financial portfolio plays a key role.

By following these tips and using a well-crafted resume template, you position yourself to stand out and capture the attention of recruiters.

Key Takeaways

- Corporate banking resumes should clearly demonstrate financial expertise and results-driven accomplishments.

- Use a structured resume template to effectively organize your skills and background.

- Highlight achievements in profit growth, risk reduction, and budget management to stand out.

- Include quantifiable experience details to convey your impact in past roles effectively.

- Choose a professional format and style, including modern fonts and PDF format to ensure readability and consistency.

What to focus on when writing your corporate banking resume

A corporate banking resume should present a clear picture of your financial expertise and strategic abilities to the recruiter. It's important to underscore your achievements, demonstrating your grasp of corporate finance alongside expertise in managing client relationships. This shows your potential to significantly contribute to a banking institution's success.

How to structure your corporate banking resume

- Contact Information: Start with your full name, phone number, email, and LinkedIn profile, ensuring that reaching out is simple for recruiters. Make sure your email address is professional, and your LinkedIn profile is up-to-date with your latest achievements and roles, as these will be the first things a recruiter looks at. Including all essential contact details ensures you are easily reachable and demonstrates your professionalism—next, let's look into how to create a compelling introduction with your professional summary.

- Professional Summary: Here’s where you provide a snapshot of your corporate banking journey. Highlight your key achievements, years of experience, and your proficiency in areas like financial analysis and client relationship management. Tailor this section to show that you understand the bank’s specific needs and how your background fits into their objectives. Using strong, active language and being concise yet informative will draw the recruiter in—moving forward, we will explore how to effectively catalog your work history to support this summary.

- Work Experience: Move on to detailing your past roles, beginning with the latest. Focus on milestones such as successful deals, impressive client retention rates, or innovative strategies that have driven revenue growth. Quantify your achievements with figures and percentages to provide context. Clearly presenting your impact in past roles helps the recruiter visualize your potential contributions to their team—next, we explore how to reinforce this narrative with the right educational credentials.

- Education: Your educational background is next, where you mention your degrees in finance or business. Adding certifications like CFA or CPA will emphasize your specialized knowledge. This section isn't just about listing your degrees but showcasing how your academic background has equipped you with the theoretical expertise necessary for the role. Highlight any honors or relevant coursework that sets you apart—let's now dive into the skillset that complements your education and work experience.

- Skills: Now, highlight the specific skills essential for corporate banking, such as financial modeling, credit analysis, and risk management, along with your proficiency in relevant financial software. Tailoring your skills list to match the job description can make you stand out as a strong candidate. Demonstrating proficiency in specialized software or analytical tools can also give you an edge—finally, let's discuss how your achievements can paint a picture of your potential success in their organization.

- Achievements: Finally, shine a light on your accomplishments by quantifying your successes. Whether it's awards or noteworthy projects, reflect on instances where you’ve significantly met or exceeded sales targets. This section is an opportunity to showcase the outcomes of your efforts and provide tangible evidence of your abilities. Highlighting your accomplishments can be a compelling final argument for your candidacy. With a strong base, we’ll now delve into each resume section in more depth.

Which resume format to choose

Crafting a corporate banking resume that truly shines involves a strategic approach to format and style, ensuring each element underscores your expertise and professionalism. Begin with a reverse-chronological format, which is especially effective for illustrating your career progression and recent roles. This format naturally draws attention to the most current and relevant experiences that hiring managers in corporate banking are keen to see.

Font choice might seem like a small detail, but it significantly impacts readability and first impressions. Selecting modern fonts like Rubik, Lato, or Montserrat can subtly convey a sense of innovation and clarity, traits valued in the corporate world. These fonts keep your resume looking clean and professional, avoiding the outdated feel of traditional fonts like Arial or Times New Roman.

Saving your resume as a PDF is crucial. This format locks in your carefully chosen design and layout, ensuring consistency no matter who views it or on what device. In an industry that values detail and precision, a PDF protects against any unintentional changes that can occur when files are opened in different programs.

Margins, though often overlooked, are key to your resume's overall readability and aesthetic. Maintaining 1-inch margins provides ample whitespace, allowing your achievements and skills to stand out without overwhelming the reader. Proper spacing is a small but mighty tool in making a resume inviting and easy to digest.

These thoughtful choices, from format to font to layout, collectively elevate your corporate banking resume, presenting you as a polished and capable professional ready to excel in the industry.

How to write a quantifiable resume experience section

A standout corporate banking resume experience section is crucial in the competitive banking field, as it highlights your skills and achievements that catch a recruiter's attention. To make an impact, start with your most recent job, ensuring your relevant experience is easy to find. Ideally, you'll want to include the past 10–15 years, focusing on positions that align with the employer's needs. To make this connection clear, tailor each job entry to the role you're applying for, using keywords from the job ad to show you have the right skills. Choosing action words like "led," "improved," "generated," or "spearheaded" helps your contributions stand out.

Typically, your resume should begin with contact details, followed by a summary and then your experience, which serves as the core. Including significant job titles relevant to corporate banking is vital because it helps tailor your resume to align your experiences with what employers are actively seeking. This strategy enhances your visibility to hiring managers and ATS software, increasing your chances of standing out.

Here's a top-notch example of a corporate banking experience section in JSON format:

- •Increased portfolio revenues by 30% through strategic cross-selling initiatives.

- •Led a team of 8 in streamlining processes, cutting costs by 20% annually.

- •Developed and delivered client-centric financial solutions, improving satisfaction scores by 45%.

- •Executed complex financial models that enhanced decision-making across departments.

This experience section is effective because it quantifies achievements clearly, with metrics that tell your story in the corporate banking sphere. Each bullet highlights specific, significant results, proving your capability to make a financial impact. Using strong action verbs ensures clarity, making your role in each success unmistakable. By tailoring the language to fit industry needs, you communicate your value to future employers with precision and effectiveness.

Responsibility-Focused resume experience section

A responsibility-focused corporate banking resume experience section should effectively highlight your core duties and the successful outcomes of your actions. Begin by clearly stating the section's focus and ensure each bullet point is concise and impactful, showing how your responsibilities have driven the bank’s success. Use clear and specific language that naturally connects your successful relationship management strategies to an improvement in client retention, for example, or link the effectiveness of your team leadership to the resulting increase in efficiency. By using action verbs, you can artfully demonstrate your contributions, and evidence will strengthen the narrative of your success.

Strive for a seamless and consistent style while avoiding jargon that may hinder understanding. Emphasize the most significant responsibilities and their outcomes by maintaining tense consistency—past tense for previous roles and present for current positions. Such a cohesive approach will present a clear and compelling account of your professional journey.

Senior Corporate Banking Manager

ABC National Bank

January 2020 - Present

- Managed a portfolio of corporate clients, boosting client retention by 15% with effective relationship strategies that strengthened trust and collaboration.

- Led a team of banking specialists, enhancing team performance and achieving a 20% increase in efficiency through targeted training and support.

- Developed risk assessment processes that directly contributed to a 10% reduction in loan default rates by identifying potential challenges early.

- Ensured compliance with banking regulations, leading to a successful audit that underscored the department's dedication to maintaining the highest standards.

Industry-Specific Focus resume experience section

A corporate banking-focused resume experience section should effectively showcase your expertise and accomplishments by highlighting your unique contributions and achievements. Start by using specific examples that align with what potential employers need, supporting your claims with numbers and data. This approach clearly demonstrates your success in managing corporate banking clients or projects and illustrates how you have contributed to business growth through improved client satisfaction or enhanced efficiency.

Selecting precise, action-oriented words helps you make a strong impression, while naturally incorporating industry-specific terms keeps your resume relevant without overloading it. By doing so, you present an authentic application that catches the attention of hiring managers. Demonstrating your critical thinking and problem-solving skills through your experiences is also crucial for standing out. Throughout your writing, maintain a professional yet approachable tone that is easy to connect with.

Senior Corporate Banking Analyst

ABC Bank

January 2020 - Present

- Led a team that increased the corporate client base by 30% over two years.

- Implemented a new loan underwriting process, reducing turnaround time by 15%.

- Developed and executed strategies that improved cross-selling of financial products by 25%.

- Strengthened relationships with key accounts, resulting in a 20% increase in client retention.

Skills-Focused resume experience section

A skills-focused corporate banking resume experience section should effectively highlight your expertise while seamlessly connecting each achievement. Start by identifying essential skills for the role, such as financial analysis, risk management, and client relationship building, and ensure they are reflected in your bullet points. Each point should showcase these skills with measurable successes, using active verbs and relevant industry language to keep the narrative cohesive.

By illustrating how your skills lead to tangible results, you not only demonstrate your proficiency but also paint a clear picture of your impact. Incorporate metrics or outcomes to enhance the credibility of your claims. For instance, if you improved client relations, specify how your efforts resulted in higher retention rates or satisfaction scores. This narrative strategy not only emphasizes your expertise but also ties together your achievements into a compelling story of contribution and success.

Senior Corporate Banking Analyst

ABC Bank

June 2020 - Present

- Developed a comprehensive financial analysis framework that boosted efficiency by 20%, showcasing analytical skills.

- Implemented a new risk assessment protocol, cutting loan default rates by 15% and enhancing risk management expertise.

- Enhanced client portfolio performance through strategic investment advice, raising returns by 12% and strengthening client relations.

- Optimized client onboarding processes, leading to a 25% increase in customer satisfaction, thereby improving customer engagement.

Technology-Focused resume experience section

A technology-focused corporate banking resume experience section should effectively highlight your achievements by connecting technology use to the banking sector's specific needs. Begin by showcasing the key technologies and projects you’ve led, emphasizing innovation and problem-solving within your past roles. Use dynamic action verbs to capture your contributions and impact, moving beyond task lists to demonstrate specific efficiencies and improvements you've implemented. Tailor your descriptions to resonate with the employer’s needs, showing how your work produced tangible results, such as increased transaction speeds or reduced operational costs.

To ensure clarity while providing depth, balance technical explanations with straightforward language. Make job titles and employment dates precise yet concise, prioritizing recent or particularly impactful roles. Structure your points logically to convey a cohesive professional narrative. Use bullet points to simplify complex achievements and responsibilities, enabling potential employers to easily grasp the value you could bring to their organization. This approach allows your resume to tell a compelling story about your skills and contributions in the banking technology space.

Senior Banking Technology Specialist

Future Banking Corp

June 2019 - Present

- Led a team of 12 in implementing a new digital payment system, increasing transaction speed by 30%.

- Developed and streamlined banking software, enhancing user experience and reducing glitches by 40%.

- Collaborated with cross-functional teams to ensure data security measures were up-to-date, reducing data breaches by 20%.

- Managed IT budgets efficiently, resulting in a 15% reduction in operational costs.

Write your corporate banking resume summary section

A corporate banking-focused resume summary should highlight your key skills and achievements in a clear and concise way. This section is crucial for setting the right tone for your entire application. By using straightforward language, you can emphasize what makes you unique. For example:

In this example, the summary immediately grabs attention by showcasing your experience and quantifying your achievements, all while highlighting your expertise. Describing yourself with words like adaptable, proactive, or results-oriented further paints you as an ideal candidate. If you are new to corporate banking, consider using a resume objective instead. This will convey your career goals and aspirations within the company. While a resume objective focuses on where you want to go, a summary showcases what you have already accomplished.

To balance both past achievements and future goals, you might opt for a resume profile. Alternatively, a summary of qualifications succinctly lists your top skills and experiences. Understanding the differences among these options helps you tailor your resume to fit your experience and aspirations. Selecting the right format ensures that your resume starts strong, helping you stand out immediately.

Listing your corporate banking skills on your resume

A skills-focused corporate banking resume should highlight your strengths in both hard and soft skills, setting you apart as an accomplished professional. In crafting the skills section, consider presenting it as a standalone feature or integrating it into sections like experience and summary. This strategic approach allows you to clearly showcase both your technical expertise and interpersonal abilities.

Soft skills, such as effective communication and teamwork, are personal traits that help you connect with others. They complement hard skills, which are specific technical abilities essential to your job in corporate banking. This combination significantly enhances your value as a candidate.

Skills and strengths also serve as vital resume keywords that can capture the attention of hiring managers and automated systems. These keywords help ensure your resume shines in searches focused on specific skills and qualifications. By incorporating these elements, your skills section highlights what makes you a compelling candidate.

Example of a standalone skills section in JSON format:

This skills section directly lists relevant abilities without overloading the reader, highlighting key strengths essential for corporate banking. Each skill draws attention to your expertise and gives a straightforward view of your capabilities.

Best hard skills to feature on your corporate banking resume

Hard skills in corporate banking showcase your command over necessary tools and processes. They demonstrate your aptitude for managing complex financial tasks, adhering to regulations, and handling client portfolios. Consider these essential hard skills:

Hard Skills

- Financial Analysis

- Risk Assessment

- Credit Analysis

- Regulatory Compliance

- Quantitative Modelling

- Cash Flow Management

- Portfolio Management

- Financial Reporting

- Asset Management

- Loan Structuring

- Data Analysis

- Derivatives Pricing

- Treasury Management

- Investment Banking

- Mergers and Acquisitions

Best soft skills to feature on your corporate banking resume

Soft skills highlight your ability to interact effectively within dynamic environments. They signal your readiness to collaborate, communicate effectively, and resolve conflicts. Here are some important soft skills to showcase:

Soft Skills

- Communication

- Negotiation

- Leadership

- Teamwork

- Adaptability

- Problem Solving

- Critical Thinking

- Time Management

- Customer Service Orientation

- Attention to Detail

- Emotional Intelligence

- Decision Making

- Interpersonal Skills

- Stress Management

- Active Listening

How to include your education on your resume

The education section of your resume is essential. It highlights the foundation of your skills and knowledge. This section should be customized to align with the specifics of the corporate banking job you're applying for. Exclude any education that doesn’t support your qualifications for the role. When listing your education, ensure that your degree, institution, and dates are clear. If your GPA is strong, reflect it accurately by including it as "3.8/4.0" and mention honors like "cum laude" to underscore academic excellence. Present your education chronologically to show your educational journey effectively. Here's an example of a poorly crafted education section and a well-written one that enhances your application.

The above example lacks relevance for a corporate banking position. Now, here's how an ideal education section should look:

The second example is effective because it directly aligns with the skills needed in corporate banking, highlighting a finance degree and academic honors. Listing a strong GPA further demonstrates your competence and dedication, which are crucial in this field.

How to include corporate banking certificates on your resume

Including a certificates section in your corporate banking resume is crucial for highlighting your qualifications. This section showcases your commitment to professional development and industry standards. List the name of your certificates prominently. Include the date you received them and add the issuing organization. Certificates can also be included in the header for more visibility. For example, you could write "John Doe, CFA, CFMP" right under your name.

Consider this JSON format example:

This example is effective because it clearly states the certificates' titles and the issuing organizations. It boosts credibility by including well-known certifications relevant to corporate banking. Make sure your certificates section is easy to read and straightforward.

Extra sections to include in your corporate banking resume

In the competitive world of corporate banking, crafting a compelling resume can be the key to unlocking career opportunities. Understanding which sections can enhance your resume is crucial to presenting a holistic view of your qualifications, abilities, and personality.

• Language section — Demonstrate your communication skills and global readiness by listing the languages you speak, indicating proficiency levels. Highlighting multilingual abilities in a corporate banking resume shows your capability to communicate with diverse clients.

• Hobbies and interests section — Add an interesting, human touch to your resume by including hobbies and interests. Connecting with hiring managers through shared interests can make you a memorable candidate.

• Volunteer work section — Present your commitment to giving back and showcase your leadership and teamwork skills. Detailing volunteer work on your resume can resonate deeply with employers looking for well-rounded candidates.

• Books section — Show that you keep yourself informed and continuously learn by mentioning relevant books you've read. Including a few professional or industry-related books demonstrates your dedication to your career growth.

Remember, every section of your resume can serve a purpose and offer unique benefits. Be thoughtful and strategic in what you choose to include to maximize your chances of landing that desired role in corporate banking.

In Conclusion

In conclusion, crafting a resume for the corporate banking sector involves a strategic blend of showcasing both your technical and interpersonal skills. It's akin to constructing a well-rounded investment portfolio, where each component plays a crucial role in creating an appealing overall picture. Using a resume template can offer a reliable structure, ensuring that your skills, achievements, and experiences are communicated professionally. By focusing on results and quantitative achievements, you set yourself apart in this competitive field, providing recruiters with clear evidence of your potential contributions to their organizations.

Complementing your work experience and education, choosing the right format and font ensures that your resume is not only comprehensive but also reader-friendly. Highlighting hard skills like financial analysis and risk management, alongside soft skills such as communication and adaptability, adds to your candidacy's appeal. Don't forget to include professional certifications, as these can greatly enhance your credibility and demonstrate a commitment to your professional growth.

Consider incorporating additional sections like language proficiency, volunteer work, and personal interests to provide a well-rounded view of who you are beyond your professional identity. These extra sections can humanize your application and make you a relatable and memorable candidate.

Ultimately, your resume is a reflection of your professional journey and aspirations in the corporate banking landscape. By meticulously crafting each section with precision and relevance, you maximize your chances of standing out and securing an attractive position in the industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.