Corporate Finance Manager Resume Examples

Jul 18, 2024

|

12 min read

Master corporate finance manager resume writing: Sell your financial finesse and win that job! Make your experience and skills shine to stand out in the finance field and gain the CFO's approval.

Rated by 348 people

Corporate Finance Restructuring Manager

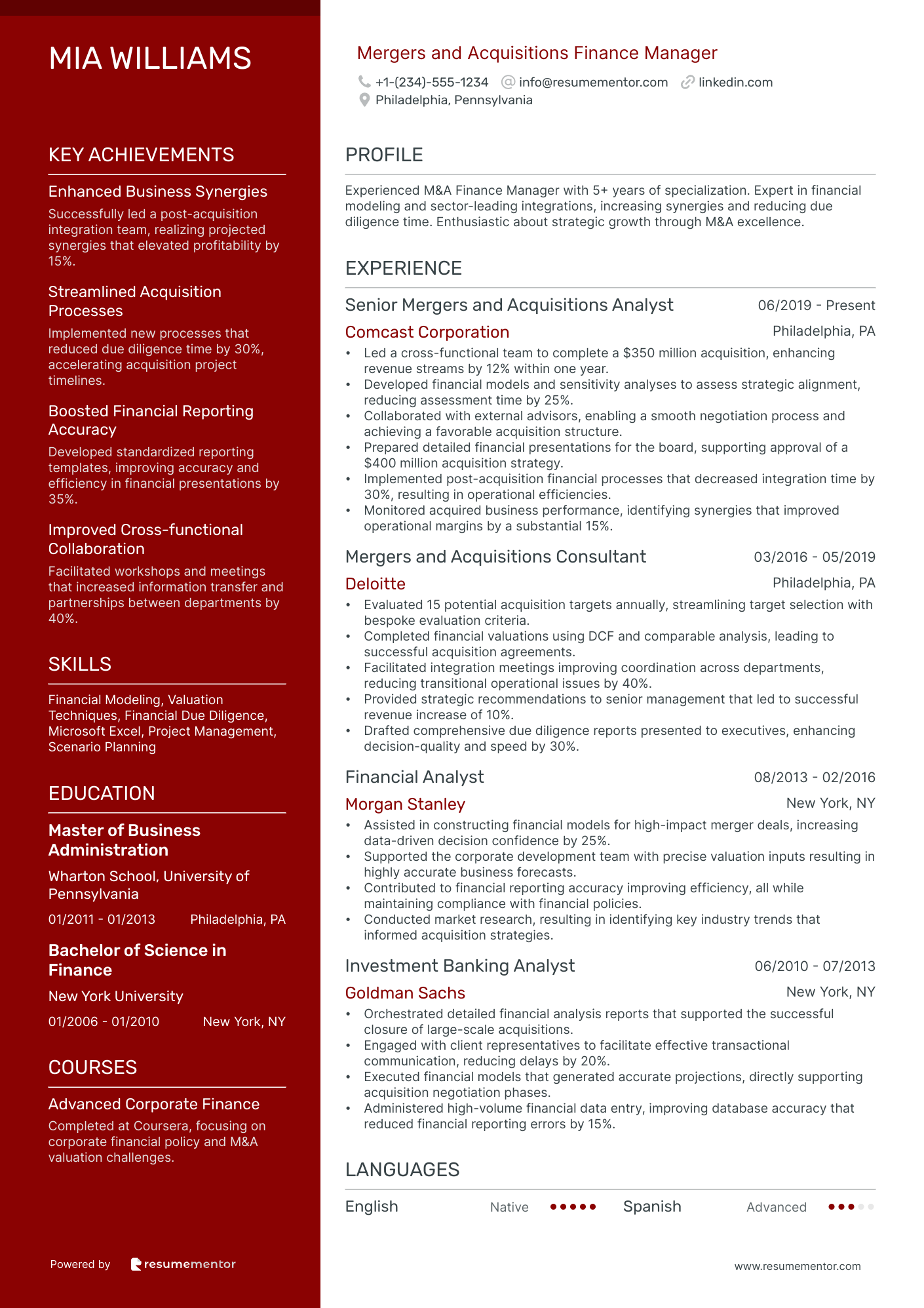

Mergers and Acquisitions Finance Manager

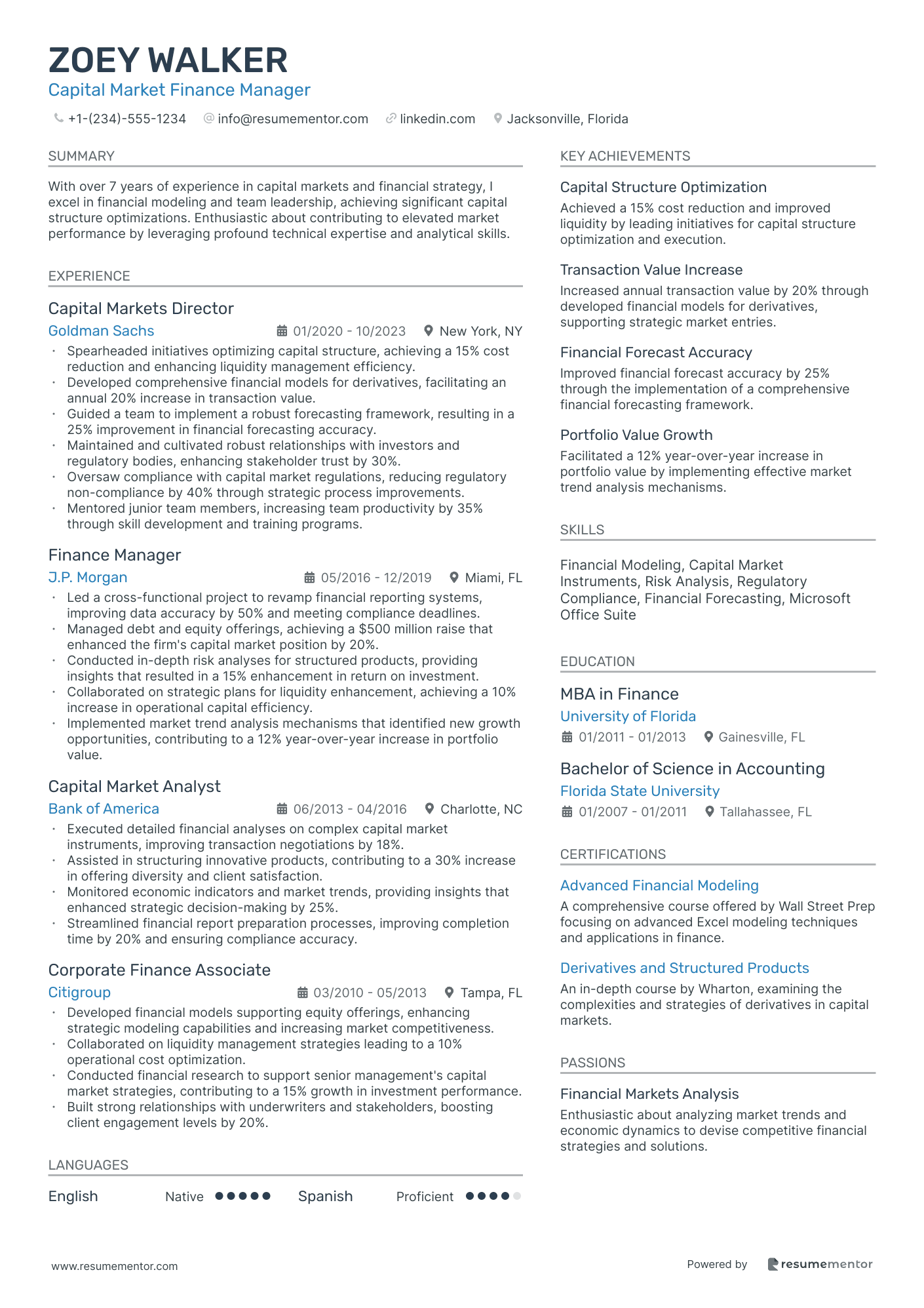

Capital Market Finance Manager

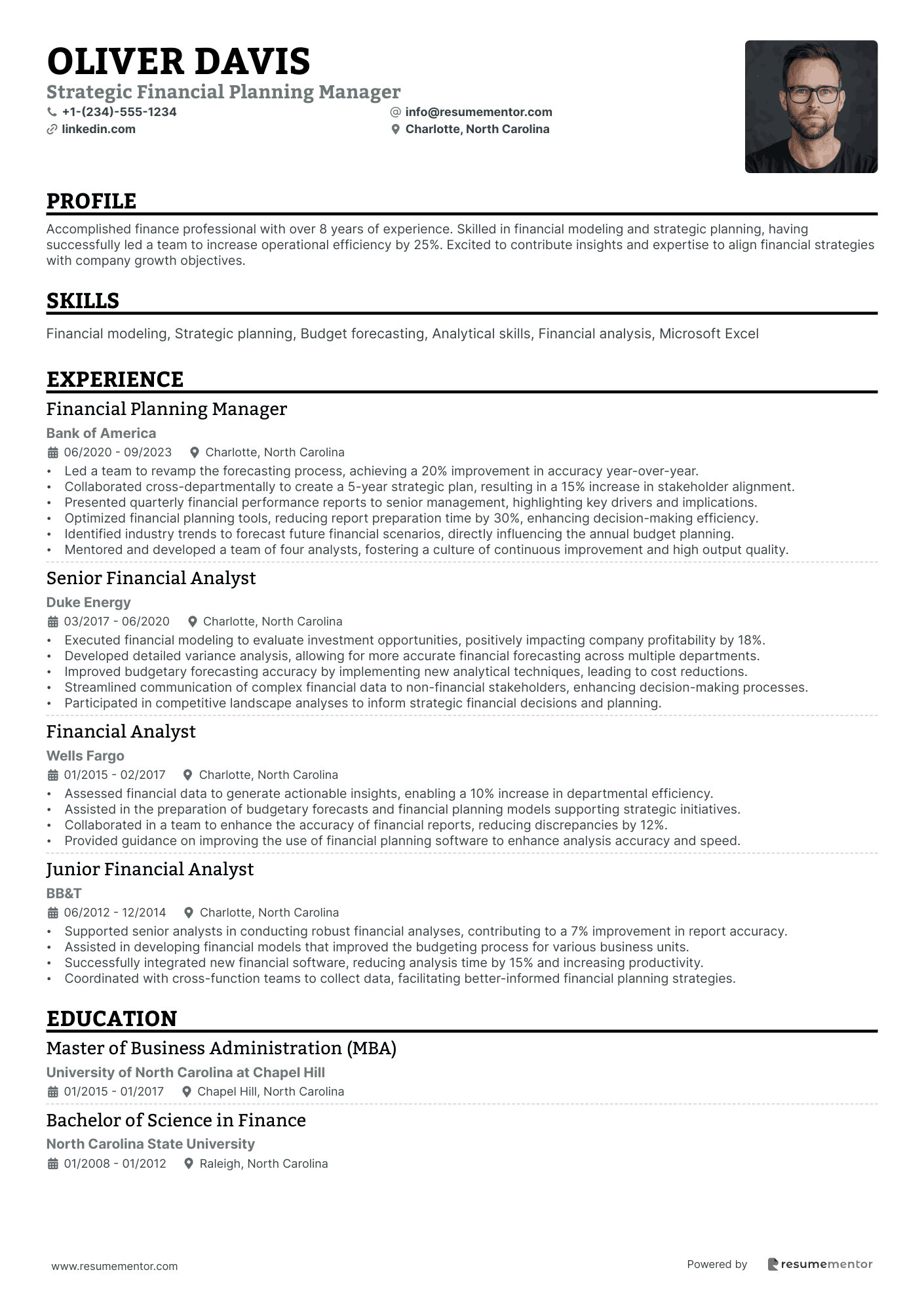

Strategic Financial Planning Manager

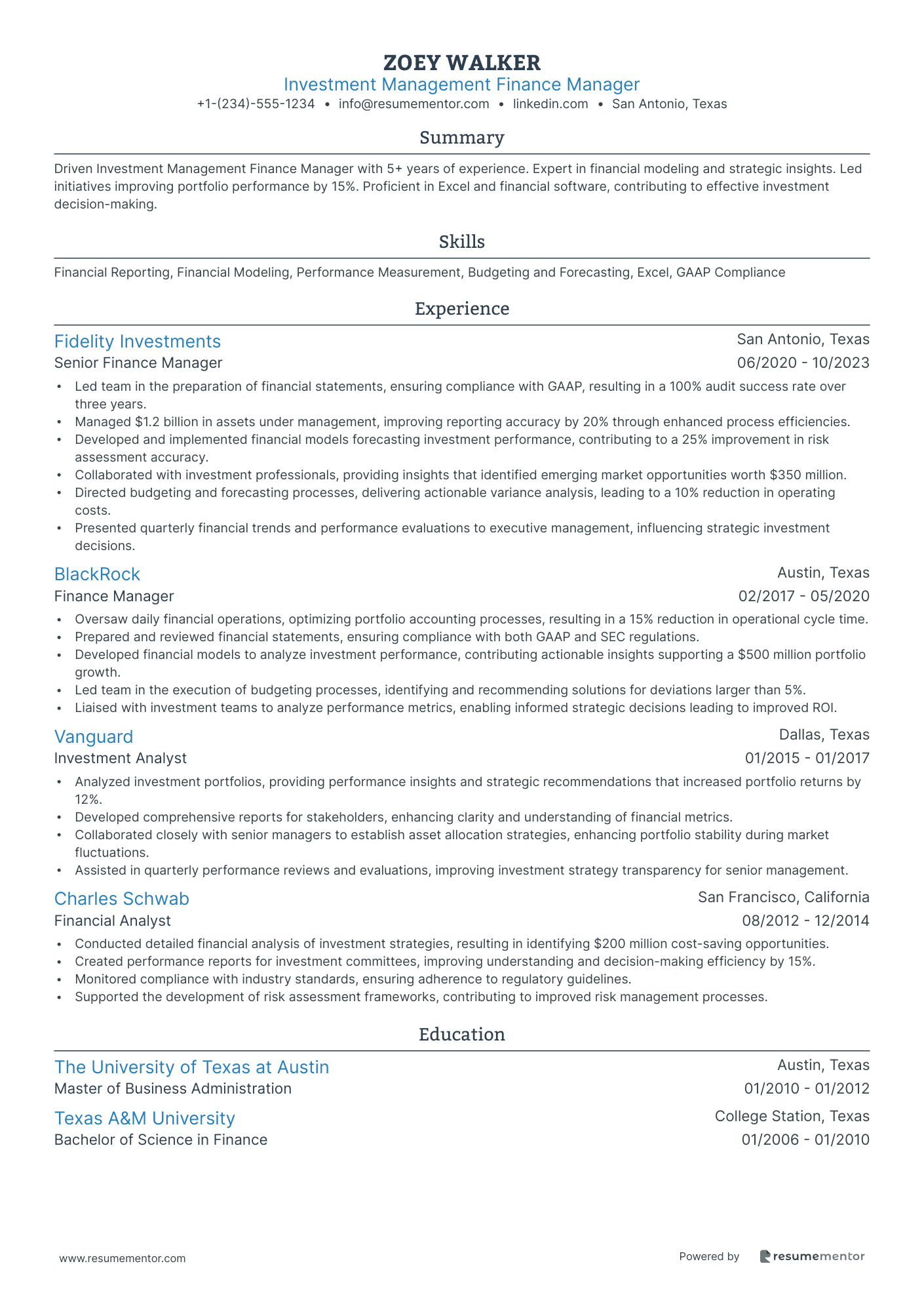

Investment Management Finance Manager

International Corporate Finance Manager

Corporate Finance Risk Manager

Corporate Finance Operations Manager

Enterprise Performance Corporate Finance Manager

Corporate Finance Compliance Manager

Corporate Finance Restructuring Manager resume sample

- •Led a major restructuring initiative for a tech firm, enhancing liquidity that improved cash flow by 35% over six months.

- •Conducted complex financial modeling and scenario analysis for distressed companies to pinpoint funding gaps, leading to strategic refinancing solutions.

- •Developed and executed comprehensive restructuring plans for multiple industries, ensuring alignment between operational strategies and financial objectives.

- •Collaborated with cross-functional teams including legal and tax specialists, resulting in a turnaround plan that doubled EBITA within one fiscal year.

- •Prepared and delivered detailed financial reports to stakeholders, enhancing understanding of financial forecasts and driving buy-in for strategy execution.

- •Mentored junior financial analysts, fostering their professional growth and contributing to a cohesive and high-performing finance team.

- •Managed complex financial restructuring projects, identifying cost-saving initiatives that reduced overhead expenses by $7 million annually.

- •Designed dynamic financial models critical for strategic decision-making in distressed asset acquisitions, facilitating two successful buyouts.

- •Implemented cash flow management strategies in restructuring cases, enhancing liquidity management and stabilizing operations during critical phases.

- •Coordinated with cross-functional teams to develop strategic reports, significantly improving stakeholder engagement and understanding of financial objectives.

- •Increased client retention rates by 20% through effective communication and tailored restructuring strategies that met their evolving economic needs.

- •Developed innovative restructuring strategies for distressed organizations, contributing to a 50% reduction in debt for a major retail client.

- •Performed in-depth financial statement analysis, accurately predicting cash flow issues and facilitating preemptive turnaround measures.

- •Collaborated with stakeholders to implement restructuring plans, ensuring alignment with the overall organizational goals and improving EBITDA by 30%.

- •Mentored new analysts, providing guidance on financial analysis techniques and fostering a learning-oriented team environment.

- •Conducted rigorous financial analysis and due diligence for restructurings, supporting actions that resulted in increased financial stability.

- •Contributed to the preparation of detailed client presentations, highlighting key insights and strategic recommendations for financial improvement.

- •Supported project managers in restructuring projects, facilitating timely delivery and optimization of client resources.

- •Assisted with financial forecasting and budgeting, achieving a strategic cost reduction of 15% in operational budgets through analytical insight.

Mergers and Acquisitions Finance Manager resume sample

- •Led a cross-functional team to complete a $350 million acquisition, enhancing revenue streams by 12% within one year.

- •Developed financial models and sensitivity analyses to assess strategic alignment, reducing assessment time by 25%.

- •Collaborated with external advisors, enabling a smooth negotiation process and achieving a favorable acquisition structure.

- •Prepared detailed financial presentations for the board, supporting approval of a $400 million acquisition strategy.

- •Implemented post-acquisition financial processes that decreased integration time by 30%, resulting in operational efficiencies.

- •Monitored acquired business performance, identifying synergies that improved operational margins by a substantial 15%.

- •Evaluated 15 potential acquisition targets annually, streamlining target selection with bespoke evaluation criteria.

- •Completed financial valuations using DCF and comparable analysis, leading to successful acquisition agreements.

- •Facilitated integration meetings improving coordination across departments, reducing transitional operational issues by 40%.

- •Provided strategic recommendations to senior management that led to successful revenue increase of 10%.

- •Drafted comprehensive due diligence reports presented to executives, enhancing decision-quality and speed by 30%.

- •Assisted in constructing financial models for high-impact merger deals, increasing data-driven decision confidence by 25%.

- •Supported the corporate development team with precise valuation inputs resulting in highly accurate business forecasts.

- •Contributed to financial reporting accuracy improving efficiency, all while maintaining compliance with financial policies.

- •Conducted market research, resulting in identifying key industry trends that informed acquisition strategies.

- •Orchestrated detailed financial analysis reports that supported the successful closure of large-scale acquisitions.

- •Engaged with client representatives to facilitate effective transactional communication, reducing delays by 20%.

- •Executed financial models that generated accurate projections, directly supporting acquisition negotiation phases.

- •Administered high-volume financial data entry, improving database accuracy that reduced financial reporting errors by 15%.

Capital Market Finance Manager resume sample

- •Spearheaded initiatives optimizing capital structure, achieving a 15% cost reduction and enhancing liquidity management efficiency.

- •Developed comprehensive financial models for derivatives, facilitating an annual 20% increase in transaction value.

- •Guided a team to implement a robust forecasting framework, resulting in a 25% improvement in financial forecasting accuracy.

- •Maintained and cultivated robust relationships with investors and regulatory bodies, enhancing stakeholder trust by 30%.

- •Oversaw compliance with capital market regulations, reducing regulatory non-compliance by 40% through strategic process improvements.

- •Mentored junior team members, increasing team productivity by 35% through skill development and training programs.

- •Led a cross-functional project to revamp financial reporting systems, improving data accuracy by 50% and meeting compliance deadlines.

- •Managed debt and equity offerings, achieving a $500 million raise that enhanced the firm's capital market position by 20%.

- •Conducted in-depth risk analyses for structured products, providing insights that resulted in a 15% enhancement in return on investment.

- •Collaborated on strategic plans for liquidity enhancement, achieving a 10% increase in operational capital efficiency.

- •Implemented market trend analysis mechanisms that identified new growth opportunities, contributing to a 12% year-over-year increase in portfolio value.

- •Executed detailed financial analyses on complex capital market instruments, improving transaction negotiations by 18%.

- •Assisted in structuring innovative products, contributing to a 30% increase in offering diversity and client satisfaction.

- •Monitored economic indicators and market trends, providing insights that enhanced strategic decision-making by 25%.

- •Streamlined financial report preparation processes, improving completion time by 20% and ensuring compliance accuracy.

- •Developed financial models supporting equity offerings, enhancing strategic modeling capabilities and increasing market competitiveness.

- •Collaborated on liquidity management strategies leading to a 10% operational cost optimization.

- •Conducted financial research to support senior management's capital market strategies, contributing to a 15% growth in investment performance.

- •Built strong relationships with underwriters and stakeholders, boosting client engagement levels by 20%.

Strategic Financial Planning Manager resume sample

- •Led a team to revamp the forecasting process, achieving a 20% improvement in accuracy year-over-year.

- •Collaborated cross-departmentally to create a 5-year strategic plan, resulting in a 15% increase in stakeholder alignment.

- •Presented quarterly financial performance reports to senior management, highlighting key drivers and implications.

- •Optimized financial planning tools, reducing report preparation time by 30%, enhancing decision-making efficiency.

- •Identified industry trends to forecast future financial scenarios, directly influencing the annual budget planning.

- •Mentored and developed a team of four analysts, fostering a culture of continuous improvement and high output quality.

- •Executed financial modeling to evaluate investment opportunities, positively impacting company profitability by 18%.

- •Developed detailed variance analysis, allowing for more accurate financial forecasting across multiple departments.

- •Improved budgetary forecasting accuracy by implementing new analytical techniques, leading to cost reductions.

- •Streamlined communication of complex financial data to non-financial stakeholders, enhancing decision-making processes.

- •Participated in competitive landscape analyses to inform strategic financial decisions and planning.

- •Assessed financial data to generate actionable insights, enabling a 10% increase in departmental efficiency.

- •Assisted in the preparation of budgetary forecasts and financial planning models supporting strategic initiatives.

- •Collaborated in a team to enhance the accuracy of financial reports, reducing discrepancies by 12%.

- •Provided guidance on improving the use of financial planning software to enhance analysis accuracy and speed.

- •Supported senior analysts in conducting robust financial analyses, contributing to a 7% improvement in report accuracy.

- •Assisted in developing financial models that improved the budgeting process for various business units.

- •Successfully integrated new financial software, reducing analysis time by 15% and increasing productivity.

- •Coordinated with cross-function teams to collect data, facilitating better-informed financial planning strategies.

Investment Management Finance Manager resume sample

- •Led team in the preparation of financial statements, ensuring compliance with GAAP, resulting in a 100% audit success rate over three years.

- •Managed $1.2 billion in assets under management, improving reporting accuracy by 20% through enhanced process efficiencies.

- •Developed and implemented financial models forecasting investment performance, contributing to a 25% improvement in risk assessment accuracy.

- •Collaborated with investment professionals, providing insights that identified emerging market opportunities worth $350 million.

- •Directed budgeting and forecasting processes, delivering actionable variance analysis, leading to a 10% reduction in operating costs.

- •Presented quarterly financial trends and performance evaluations to executive management, influencing strategic investment decisions.

- •Oversaw daily financial operations, optimizing portfolio accounting processes, resulting in a 15% reduction in operational cycle time.

- •Prepared and reviewed financial statements, ensuring compliance with both GAAP and SEC regulations.

- •Developed financial models to analyze investment performance, contributing actionable insights supporting a $500 million portfolio growth.

- •Led team in the execution of budgeting processes, identifying and recommending solutions for deviations larger than 5%.

- •Liaised with investment teams to analyze performance metrics, enabling informed strategic decisions leading to improved ROI.

- •Analyzed investment portfolios, providing performance insights and strategic recommendations that increased portfolio returns by 12%.

- •Developed comprehensive reports for stakeholders, enhancing clarity and understanding of financial metrics.

- •Collaborated closely with senior managers to establish asset allocation strategies, enhancing portfolio stability during market fluctuations.

- •Assisted in quarterly performance reviews and evaluations, improving investment strategy transparency for senior management.

- •Conducted detailed financial analysis of investment strategies, resulting in identifying $200 million cost-saving opportunities.

- •Created performance reports for investment committees, improving understanding and decision-making efficiency by 15%.

- •Monitored compliance with industry standards, ensuring adherence to regulatory guidelines.

- •Supported the development of risk assessment frameworks, contributing to improved risk management processes.

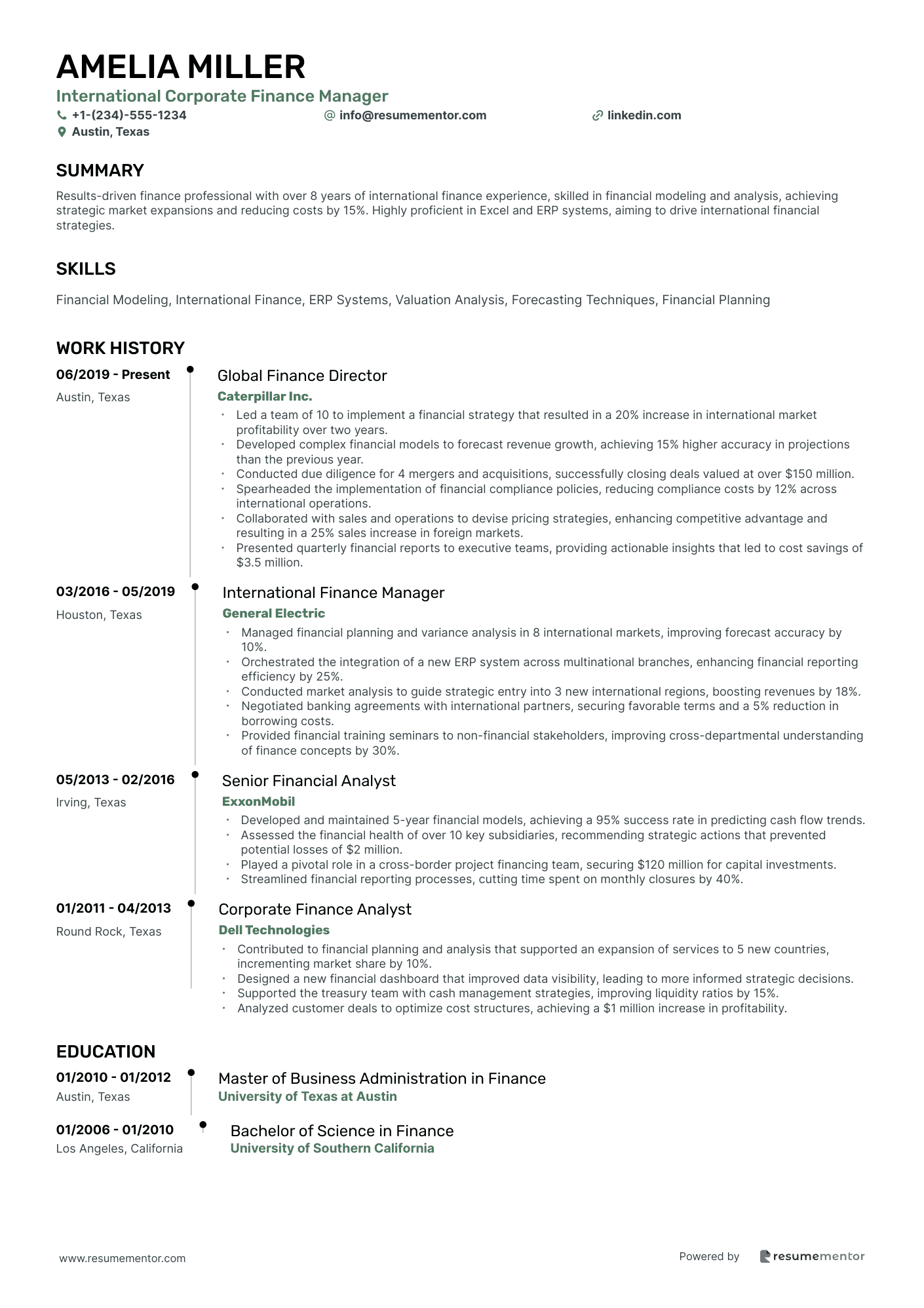

International Corporate Finance Manager resume sample

- •Led a team of 10 to implement a financial strategy that resulted in a 20% increase in international market profitability over two years.

- •Developed complex financial models to forecast revenue growth, achieving 15% higher accuracy in projections than the previous year.

- •Conducted due diligence for 4 mergers and acquisitions, successfully closing deals valued at over $150 million.

- •Spearheaded the implementation of financial compliance policies, reducing compliance costs by 12% across international operations.

- •Collaborated with sales and operations to devise pricing strategies, enhancing competitive advantage and resulting in a 25% sales increase in foreign markets.

- •Presented quarterly financial reports to executive teams, providing actionable insights that led to cost savings of $3.5 million.

- •Managed financial planning and variance analysis in 8 international markets, improving forecast accuracy by 10%.

- •Orchestrated the integration of a new ERP system across multinational branches, enhancing financial reporting efficiency by 25%.

- •Conducted market analysis to guide strategic entry into 3 new international regions, boosting revenues by 18%.

- •Negotiated banking agreements with international partners, securing favorable terms and a 5% reduction in borrowing costs.

- •Provided financial training seminars to non-financial stakeholders, improving cross-departmental understanding of finance concepts by 30%.

- •Developed and maintained 5-year financial models, achieving a 95% success rate in predicting cash flow trends.

- •Assessed the financial health of over 10 key subsidiaries, recommending strategic actions that prevented potential losses of $2 million.

- •Played a pivotal role in a cross-border project financing team, securing $120 million for capital investments.

- •Streamlined financial reporting processes, cutting time spent on monthly closures by 40%.

- •Contributed to financial planning and analysis that supported an expansion of services to 5 new countries, incrementing market share by 10%.

- •Designed a new financial dashboard that improved data visibility, leading to more informed strategic decisions.

- •Supported the treasury team with cash management strategies, improving liquidity ratios by 15%.

- •Analyzed customer deals to optimize cost structures, achieving a $1 million increase in profitability.

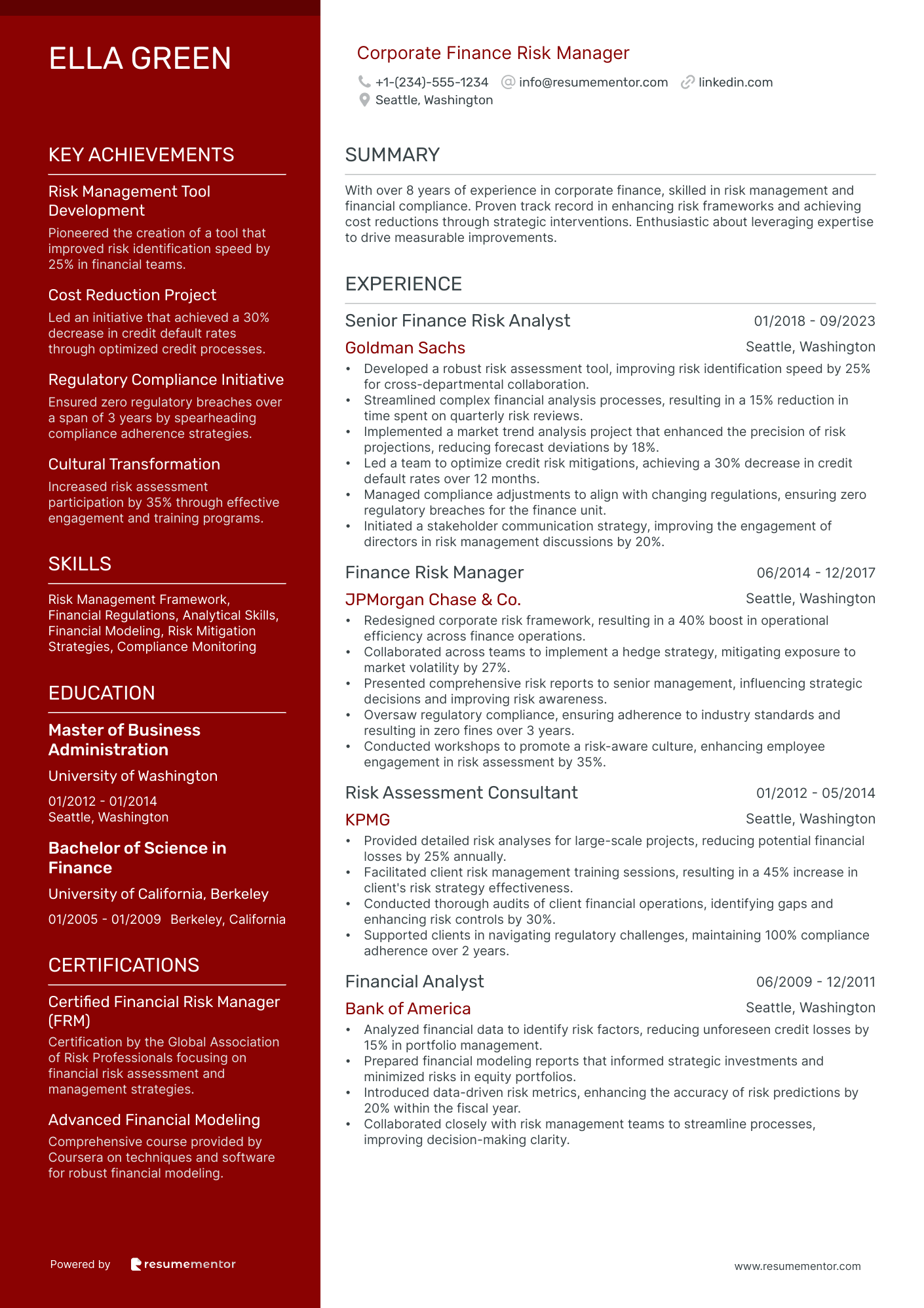

Corporate Finance Risk Manager resume sample

- •Developed a robust risk assessment tool, improving risk identification speed by 25% for cross-departmental collaboration.

- •Streamlined complex financial analysis processes, resulting in a 15% reduction in time spent on quarterly risk reviews.

- •Implemented a market trend analysis project that enhanced the precision of risk projections, reducing forecast deviations by 18%.

- •Led a team to optimize credit risk mitigations, achieving a 30% decrease in credit default rates over 12 months.

- •Managed compliance adjustments to align with changing regulations, ensuring zero regulatory breaches for the finance unit.

- •Initiated a stakeholder communication strategy, improving the engagement of directors in risk management discussions by 20%.

- •Redesigned corporate risk framework, resulting in a 40% boost in operational efficiency across finance operations.

- •Collaborated across teams to implement a hedge strategy, mitigating exposure to market volatility by 27%.

- •Presented comprehensive risk reports to senior management, influencing strategic decisions and improving risk awareness.

- •Oversaw regulatory compliance, ensuring adherence to industry standards and resulting in zero fines over 3 years.

- •Conducted workshops to promote a risk-aware culture, enhancing employee engagement in risk assessment by 35%.

- •Provided detailed risk analyses for large-scale projects, reducing potential financial losses by 25% annually.

- •Facilitated client risk management training sessions, resulting in a 45% increase in client's risk strategy effectiveness.

- •Conducted thorough audits of client financial operations, identifying gaps and enhancing risk controls by 30%.

- •Supported clients in navigating regulatory challenges, maintaining 100% compliance adherence over 2 years.

- •Analyzed financial data to identify risk factors, reducing unforeseen credit losses by 15% in portfolio management.

- •Prepared financial modeling reports that informed strategic investments and minimized risks in equity portfolios.

- •Introduced data-driven risk metrics, enhancing the accuracy of risk predictions by 20% within the fiscal year.

- •Collaborated closely with risk management teams to streamline processes, improving decision-making clarity.

Corporate Finance Operations Manager resume sample

- •Led a team to update the financial forecasting process, resulting in a 20% improvement in accuracy.

- •Implemented a new budgeting system, reducing operational inefficiencies by 15% over two quarters.

- •Collaborated with IT to streamline ERP system enhancements, cutting processing time by 25%.

- •Developed robust financial reports for senior management, increasing visibility into financial metrics by 35%.

- •Coordinated financial audits, ensuring compliance and reducing audit findings by 40%.

- •Managed an initiative to enhance cross-departmental financial goals alignment, leading to a 10% increase in collaborative projects.

- •Spearheaded initiatives that improved financial reporting timelines by 30% through process streamlining.

- •Managed financial data consolidation, facilitating accurate and timely strategic decision-making by top executives.

- •Developed procedures that enhanced regulatory compliance across finance operations, reducing compliance risk by 25%.

- •Implemented financial modeling techniques that improved cash flow forecasting accuracy by 50%.

- •Conducted detailed financial analyses to support key investment decisions, influencing a $50 million project approval.

- •Enhanced financial analysis procedures that supported strategic decisions, leading to a 15% reduction in operational costs.

- •Collaborated with finance and business units to align budgetary goals, improving departmental synergy by 20%.

- •Conducted in-depth cost-benefit analyses, saving $2 million annually through optimized spending.

- •Utilized SAP software to improve real-time financial data access, increasing management's data-driven decision capacity by 40%.

- •Assisted in the preparation and monitoring of budgets, leading to a 10% improvement in accuracy.

- •Conducted financial data analysis that identified potential savings of $1 million in operational efficiencies.

- •Supported the finance department in maintaining compliance with financial regulations, reducing audit discrepancies.

- •Improved usage of financial software tools, enhancing departmental productivity by 15%.

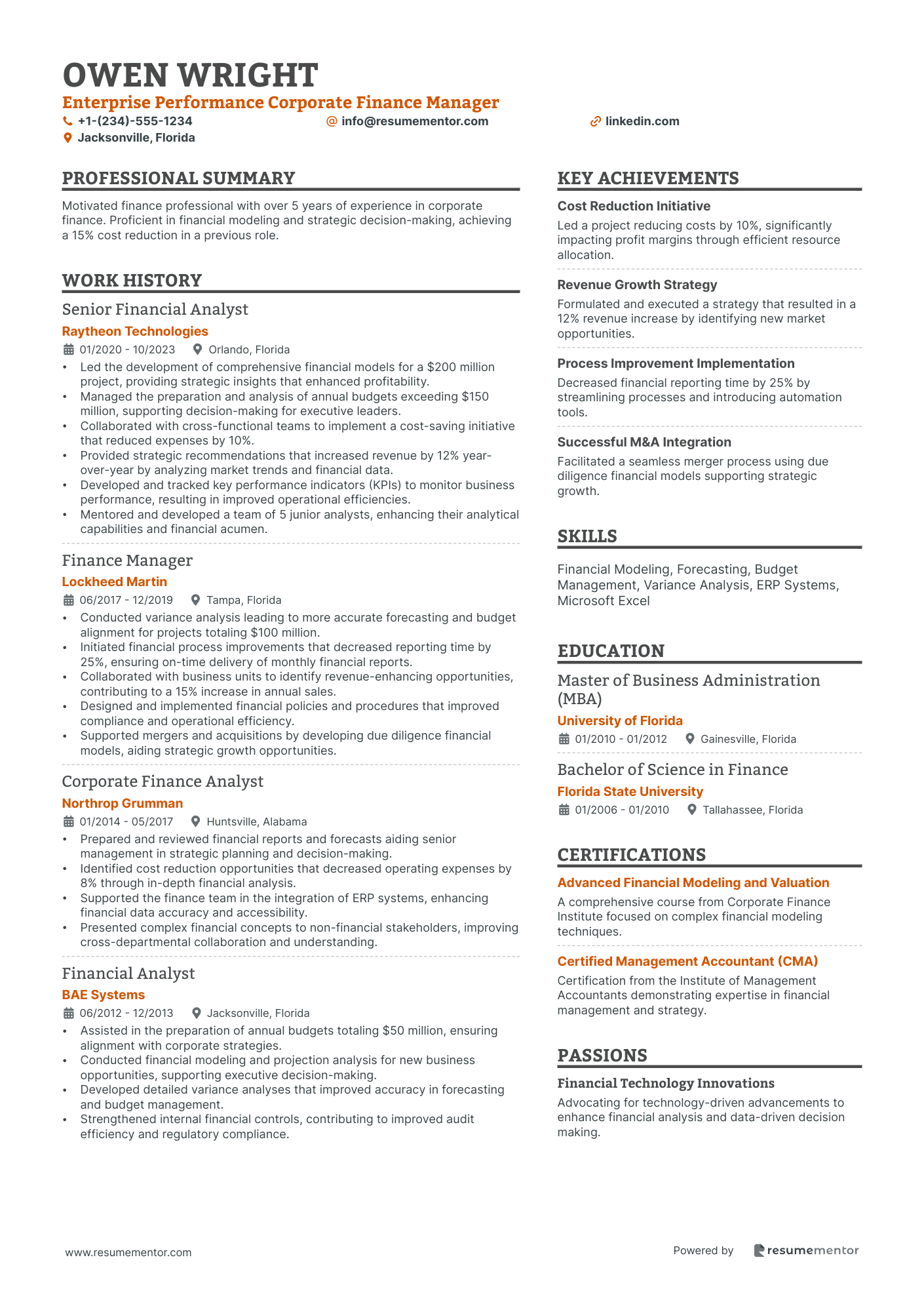

Enterprise Performance Corporate Finance Manager resume sample

- •Led the development of comprehensive financial models for a $200 million project, providing strategic insights that enhanced profitability.

- •Managed the preparation and analysis of annual budgets exceeding $150 million, supporting decision-making for executive leaders.

- •Collaborated with cross-functional teams to implement a cost-saving initiative that reduced expenses by 10%.

- •Provided strategic recommendations that increased revenue by 12% year-over-year by analyzing market trends and financial data.

- •Developed and tracked key performance indicators (KPIs) to monitor business performance, resulting in improved operational efficiencies.

- •Mentored and developed a team of 5 junior analysts, enhancing their analytical capabilities and financial acumen.

- •Conducted variance analysis leading to more accurate forecasting and budget alignment for projects totaling $100 million.

- •Initiated financial process improvements that decreased reporting time by 25%, ensuring on-time delivery of monthly financial reports.

- •Collaborated with business units to identify revenue-enhancing opportunities, contributing to a 15% increase in annual sales.

- •Designed and implemented financial policies and procedures that improved compliance and operational efficiency.

- •Supported mergers and acquisitions by developing due diligence financial models, aiding strategic growth opportunities.

- •Prepared and reviewed financial reports and forecasts aiding senior management in strategic planning and decision-making.

- •Identified cost reduction opportunities that decreased operating expenses by 8% through in-depth financial analysis.

- •Supported the finance team in the integration of ERP systems, enhancing financial data accuracy and accessibility.

- •Presented complex financial concepts to non-financial stakeholders, improving cross-departmental collaboration and understanding.

- •Assisted in the preparation of annual budgets totaling $50 million, ensuring alignment with corporate strategies.

- •Conducted financial modeling and projection analysis for new business opportunities, supporting executive decision-making.

- •Developed detailed variance analyses that improved accuracy in forecasting and budget management.

- •Strengthened internal financial controls, contributing to improved audit efficiency and regulatory compliance.

Corporate Finance Compliance Manager resume sample

- •Led a team to develop a compliance framework that reduced regulatory risks by 20% annually and increased audit efficiency.

- •Conducted comprehensive compliance audits which identified and addressed previously undetected compliance gaps, improving adherence by 30%.

- •Collaborated with multi-disciplinary teams to align departmental procedures across compliance and finance, achieving 25% process efficiency gains.

- •Streamlined reporting processes for SEC filings, reducing preparation time by 15% while maintaining accuracy and compliance.

- •Integrated new compliance software tools that enhanced real-time monitoring capabilities and automated compliance checks, improving response times by 40%.

- •Managed the resolution of complex compliance inquiries resulting in strengthened relationships with regulatory bodies and improved company regulations.

- •Implemented new compliance procedures which reduced regulatory breaches by 18% resulting in a more robust system.

- •Designed and delivered compliance training sessions to over 300 employees, enhancing compliance understanding by 45%.

- •Developed risk assessment models informing decisions on compliance priorities, reducing potential risks by 25%.

- •Monitored regulatory changes and advised leadership, leading to timely adaptation and maintaining 100% compliance.

- •Established strong compliance reporting policies that improved transparency with senior management and identified improvement areas.

- •Assessed corporate financial practices, resulting in 20% fewer compliance incidents year-on-year.

- •Collaborated with the legal team to ensure compliance with updated regulations, supporting strategic business decisions.

- •Conducted compliance checks for financial operations, improving risk management protocols by 30%.

- •Facilitated cross-departmental compliance workshops, resulting in increased awareness and understanding of financial regulation changes.

- •Analyzed financial data ensuring compliance with GAAP, contributing to a 10% increase in audit success rate.

- •Prepared reports for senior managers detailing compliance adherence, boosting informed strategic planning by 15%.

- •Streamlined financial reporting tools, enhancing report accuracy and ensuring compliance, resulting in 12% reduction in errors.

- •Supported compliance audits by providing necessary financial data, aiding in a 20% improvement in audit completions.

As a corporate finance manager, your resume is your blueprint to new opportunities. Capturing your extensive financial expertise, strategic thinking, and leadership skills in one concise document can feel as daunting as piecing together a complex financial model. Nevertheless, standing out in a competitive job market requires this effort.

Employers are keen to see your ability to manage financial operations, maximize resources, and lead teams effectively. This means your resume must convey these strengths clearly and quickly. While technical financial skills are undoubtedly vital, highlighting your decision-making and problem-solving abilities brings depth to your profile.

To achieve this clarity, using a proven resume template is crucial. A well-structured template helps organize your content, guiding you to emphasize essential elements without excessive detail. If you're seeking tools to enhance your professional presentation, explore resources like resume templates.

With a well-crafted resume, you'll unlock doors to opportunities in the corporate finance sector. Acting as your personal marketing tool, it weaves your professional story with clarity and purpose. By using the right structure, you can demonstrate your readiness to tackle new challenges in the field.

Key Takeaways

- Crafting a corporate finance manager resume involves clearly highlighting your expertise in financial strategies, leadership, and the impact on financial growth and improvements.

- Using a reverse-chronological format is highly recommended, emphasizing recent roles and relevant experiences with quantifiable achievements.

- The resume should include a concise professional summary, detailed work experience, relevant education, and impactful skills aligned with the job description.

- Incorporating certifications, additional language skills, and sections on hobbies, volunteering, or relevant books can enhance the overall profile.

- Ensure a tidy appearance with modern font choices, adequate margins, and save the resume as a PDF to preserve its format across different devices.

What to focus on when writing your corporate finance manager resume

Your resume as a corporate finance manager should clearly highlight your expertise in managing complex financial strategies while showcasing your leadership skills—it's crucial to communicate your impact on financial growth and process improvements.

How to structure your corporate finance manager resume

- Contact Information: Easily findable and up-to-date contact details, including your full name, phone number, email address, and LinkedIn profile, help set a professional tone from the start—ensure these are consistent across all job application materials to maintain a cohesive professional brand.

- Professional Summary: This is your first chance to make a strong impression, so provide an overview that captures your extensive experience, core financial skills, and notable accomplishments—use this section to hook the recruiter’s attention and invite them to explore your work experience in detail.

- Work Experience: Highlight roles that demonstrate your proficiency in financial planning, budgeting, and strategic analysis—articulate your career progression and the tangible value you’ve contributed through improved profitability or management of large financial portfolios.

- Education: List relevant degrees, institutions, and graduation years to strengthen your profile—certifications like CPA or CFA emphasize not only your expertise but also your commitment to maintaining high professional standards.

- Skills: Emphasize essential competencies like financial modeling, forecasting, and strategic planning—align this section with the specific skills listed in the job description to ensure your resume resonates with the recruiter’s needs.

- Achievements: Provide concrete examples of your successes, such as cost reductions or revenue growth, and support them with specific figures to highlight the real-world impact of your efforts—transitions smoothly into an exploration of each section in greater depth, allowing for a tailored resume format.

Which resume format to choose

Creating a resume as a corporate finance manager requires a well-thought-out approach to highlight your expertise effectively. Start with the reverse-chronological format. This is particularly effective for finance roles as it emphasizes your most recent and relevant experiences, allowing potential employers to quickly understand your career trajectory and the depth of your expertise.

Choosing the right fonts is also important to the appearance of your resume. Opt for modern options like Lato, Montserrat, or Raleway. These fonts are not only professional but also ensure that your information is presented in a clear and organized manner. A clean font choice complements the detailed information typically found in a finance manager's resume, such as figures and analytics, making it easier for hiring managers to digest.

Saving your resume as a PDF is essential. This format preserves your carefully structured layout and design across all devices and operating systems. In a competitive field like corporate finance, a PDF ensures that the first impression—your resume—is just as you intended it, without any unexpected formatting issues.

Lastly, setting your margins to about 1 inch on each side creates a balanced look. This ample white space makes your resume easy to read and prevents it from appearing cluttered. A tidy presentation is crucial in finance, where attention to detail and clarity of information are highly valued.

By focusing on these elements, you ensure that your resume stands out in the corporate finance industry. This approach helps communicate your skills and accomplishments effectively while maintaining a professional and coherent presentation.

How to write a quantifiable resume experience section

A powerful experience section in your corporate finance manager resume is crucial for highlighting your skills and impact. It should showcase achievements using quantifiable data to convey your contributions effectively. Starting with your most recent position, structure your experience in reverse chronological order to highlight your career progression and relevancy. Tailor your descriptions to align with the specific job you're targeting, focusing on the necessary skills and accomplishments. Include roles that demonstrate career growth or directly relate to the role, typically covering the last 10-15 years unless an older position adds significant value. Choosing strong action words like “managed,” “optimized,” “increased,” and “led” can effectively illustrate your contributions. This tailored approach ensures your experience resonates with the job description and captures a potential employer’s attention.

- •Led the financial analysis team to achieve a 25% revenue increase over three years through strategic forecasting and budgeting.

- •Optimized capital expenditure, reducing waste by 15% annually and boosting return on investment.

- •Developed a new financial model that decreased forecasting errors by 20%.

- •Implemented a cost-saving initiative, resulting in $500,000 in annual savings.

The experience section above excels by beginning with a solid position at a reputable company, instantly establishing credibility. Strategic insights and capital management responsibilities are highlighted to connect directly with a corporate finance manager's core role. Each bullet point emphasizes quantifiable achievements, linking your actions to tangible results. For instance, phrases like “25% revenue increase” and “$500,000 in annual savings” provide clear, measurable evidence of your contributions. Using active language such as “led” and “optimized” further highlights your leadership and initiative. This cohesive narrative effectively illustrates your impact on organizational goals, positioning you as an ideal candidate for a corporate finance role.

Technology-Focused resume experience section

A technology-focused corporate finance manager resume experience section should seamlessly blend your finance skills with your expertise in technology. Begin by choosing job titles that clearly convey your influence and include dates to outline your employment timeline. It's crucial to demonstrate how you've successfully led financial strategies using technology to drive business improvements. This involves highlighting your leadership role in implementing financial software and integrating systems that enhance both process efficiency and financial decision-making.

Dive into specific achievements in your bullet points, particularly those that intertwine technology and finance. Talk about your involvement in cross-functional teams and collaboration with IT to transform financial operations. Share examples of how you've made data-driven decisions and used innovative financial technologies, as well as deployed forecasting tools that strengthened the company's financial health. Strive for straightforward and factual language, ensuring the information flows clearly and logically.

Corporate Finance Manager

Innovatech Solutions

2019 - 2023

- Led the implementation of an enterprise-wide financial software that increased reporting accuracy by 20%.

- Collaborated with IT and operations teams to streamline financial processes, reducing closing time from 10 to 5 days.

- Championed the integration of AI tools for predictive analytics, enhancing forecasting accuracy by 15%.

- Developed a new financial dashboard, improving data visibility and aiding strategic decision-making.

Problem-Solving Focused resume experience section

A problem-solving-focused corporate finance manager resume experience section should vividly illustrate your capacity to tackle financial challenges. Begin by selecting examples from past roles where you've effectively resolved financial issues. Use clear descriptions to demonstrate how your contributions positively impacted your organization. This approach shifts the focus away from mere responsibilities to tangible results, such as achieving cost savings, enhancing financial reporting accuracy, or streamlining processes.

To create a cohesive narrative, start each bullet point with a strong action verb that highlights your proactive approach. Emphasize the skills and experiences that underscore your problem-solving capabilities, linking each bullet point to a broader strategic context. This seamless connection between your experiences showcases not just your problem-solving skills but also your strategic thinking and decision-making prowess, painting a comprehensive picture of your ability to tackle financial challenges efficiently.

Corporate Finance Manager

ABC Corporation

June 2018 - Present

- Implemented a new budgeting process that resulted in a 15% reduction in project overruns.

- Revamped financial reporting systems, improving accuracy and efficiency by 20%.

- Led a cross-functional team to identify cost-saving opportunities, achieving a $500K annual savings.

- Developed a risk management strategy that decreased financial risks by 30%.

Achievement-Focused resume experience section

A results-focused corporate finance manager resume experience section should highlight your significant achievements to effectively demonstrate your impact within previous roles. Begin by using strong action verbs that clearly portray your responsibilities and contributions. This approach not only emphasizes your accomplishments but also highlights your capability to deliver impactful results. Quantifying achievements wherever possible can further illustrate the tangible value you brought to your company and should be a focal point when detailing your most impressive accomplishments, especially those relevant to the position you seek.

To better capture the value you add, focus on achievements rather than listing job duties. This might include leading major projects, driving improvements, or developing innovative strategies. Clarity can be enhanced through bullet points, which provide a concise view of your successes, such as reducing costs, driving revenue growth, or optimizing processes. This method allows potential employers to quickly understand your contributions and see how well you could fit into their organization.

Corporate Finance Manager

Global Solutions Inc.

Jan 2020 - Present

- Reduced operational costs by 15% through strategic vendor negotiations.

- Implemented a new financial reporting system that improved data accuracy by 25%.

- Created detailed financial models that led to a 10% increase in annual revenue projections.

- Led a team of five in optimizing the budget process, cutting unnecessary expenditures by 20%.

Innovation-Focused resume experience section

An innovation-focused corporate finance manager resume experience section should seamlessly showcase your creativity and adaptability in dynamic environments. Begin by highlighting instances where you introduced innovative financial strategies that led to measurable improvements in performance or efficiency. Strengthen your narrative by providing numbers that reflect your achievements, such as revenue growth or cost savings, to give potential employers a clear sense of your contributions.

Next, underscore your leadership in managing cross-functional teams to execute financial projects. Illustrate how you've leveraged technology or data analytics to modernize processes and keep your company competitive in a fast-paced market. Ensure each bullet point tells a cohesive story about your role in driving innovation and leadership, making it evident how you can bring unique value to prospective employers.

Corporate Finance Manager

ABC Corporation

June 2019 - Present

- Led team to develop a new budgeting model that increased efficiency by 25%.

- Implemented data-driven financial analysis tool, cutting reporting time by 30%.

- Drove adoption of digital financial solutions that improved revenue tracking accuracy by 15%.

- Collaborated with marketing and operations to launch cost-saving initiatives, resulting in 10% annual savings.

Write your corporate finance manager resume summary section

A results-focused corporate finance manager resume summary should clearly define your skills, achievements, and professional experience to demonstrate your value to employers. A well-crafted summary draws attention to your expertise in financial analysis, strategic planning, and budgeting while highlighting significant accomplishments like improving efficiency or profit margins. Providing a concise snapshot of your career encourages hiring managers to delve deeper into your resume. Clear, direct language is your ally in conveying these strengths effectively.

This summary stands out by instantly spotlighting your most relevant skills and tangible accomplishments. Emphasizing quantifiable results, like a 15% profit increase and a 20% reduction in reporting time, transforms abstract achievements into compelling evidence of your effectiveness. Using action verbs like "crafting" and "leading" further conveys your confidence and competence.

Effectively describing yourself in a resume summary involves aligning your skills and achievements with the job requirements. Including keywords from the job listing strengthens the link between your qualifications and the employer's needs. The resume summary, unlike an objective, focuses on showcasing career accomplishments and skills, making it ideal for experienced professionals. While a resume objective outlines career goals appropriate for newcomers, a resume profile offers a broad overview, similar to a summary but less detailed. A summary of qualifications lists key highlights without storytelling. For seasoned corporate finance managers, a well-crafted summary provides the ideal showcase for your professional journey.

Listing your corporate finance manager skills on your resume

A skills-focused corporate finance manager resume should effectively highlight your abilities to handle both technical tasks and interpersonal interactions. Present your skills either in their standalone section or interwoven into the experience and summary parts of your resume. Your strengths and soft skills reflect how you relate to others and navigate challenges, while hard skills showcase your specific technical expertise.

Incorporating skills as keywords into your resume is essential for attracting recruiter attention. These keywords help your resume pass through automated systems and reach the right audience. Here's an example of a well-crafted standalone skills section:

This section succeeds because it is straightforward and closely aligned with the key roles expected of a corporate finance manager. The clarity of language underscores core skills without unnecessary embellishments.

Best hard skills to feature on your corporate finance manager resume

Highlighting the right hard skills is critical to showcasing your capacity for financial responsibility and oversight. These specialized competencies are essential for efficiently managing financial operations. Consider focusing on these 15 hard skills:

Hard Skills

- Financial Analysis

- Budget Management

- Risk Management

- Financial Modeling

- Performance Metrics

- Strategic Planning

- Project Management

- Cost Reduction Strategies

- Financial Reporting

- Cash Flow Management

- Capital Budgeting

- Investment Analysis

- Forecasting Techniques

- Data Interpretation

- Treasury Management

Best soft skills to feature on your corporate finance manager resume

Equally important are the soft skills that indicate your ability to lead and collaborate effectively. These skills highlight your potential to guide teams and solve problems creatively. Here are 15 soft skills to feature:

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Decision-Making

- Team Collaboration

- Adaptability

- Conflict Resolution

- Time Management

- Negotiation

- Emotional Intelligence

- Attention to Detail

- Resourcefulness

- Critical Thinking

- Flexibility

- Stress Management

How to include your education on your resume

The education section of your resume is crucial for showcasing your qualifications as a corporate finance manager. It should be tailored to each job application to make sure the most relevant educational experiences are highlighted. Avoid including irrelevant education details that don't pertain to the position. When listing your GPA, provide it if it's 3.5 or above, paired with the scale (e.g., "3.7/4.0"). If you graduated with honors like cum laude, including it can highlight your academic achievements. List your degree by writing the type of degree (e.g., Bachelor of Science) followed by the field of study (e.g., Finance) and the educational institution's name.

An ineffective education section can hinder your chances of being noticed. For example:

This example is ineffective as it cites an irrelevant degree for the corporate finance field.

A well-crafted education section could look like this:

- •Graduated cum laude.

This example is effective due to a relevant degree and high GPA, elements that are crucial for jobs in finance. Including cum laude demonstrates academic excellence, which is essential for forming a strong impression in the competitive field.

How to include corporate finance manager certificates on your resume

Including a certificates section on your corporate finance manager resume is crucial. It showcases your continuous learning and dedication to professional growth. You can feature this section in the header as it grabs immediate attention from employers.

List the name of the certification clearly. Include the date you obtained the certificate. Add the issuing organization to lend credibility. Ensure the certification is relevant to the corporate finance field to make your resume stand out.

For example:

This example demonstrates a focus on highly-regarded and industry-specific certifications. The CFA demonstrates financial analysis expertise, vital for managing corporate finances. The CTP shows specialized knowledge in treasury and liquidity management. These certificates are from respected organizations, making your profile more appealing to prospective employers. Keep your certifications updated to reflect your current qualifications and readiness for the role.

Extra sections to include in your corporate finance manager resume

In today's competitive job market, creating a standout resume requires strategically including various sections that highlight more than just your professional experience. As a corporate finance manager, these seemingly auxiliary sections can significantly enhance your profile.

- Language section — List additional languages you speak, such as Spanish or Mandarin; this shows your ability to communicate in diverse business settings and expands your career opportunities.

- Hobbies and interests section — Outline hobbies that demonstrate your leadership qualities, like captaining a local sports team; this provides a glimpse into your personality and stress management skills.

- Volunteer work section — Include volunteer experiences, such as financial advisory roles in nonprofits; this showcases your commitment to community service and enhances your overall profile.

- Books section — Mention books you have read that are relevant to your field, like "Principles of Corporate Finance" by Brealey and Myers; this displays your continuous learning mindset and passion for finance.

Incorporating these sections into your resume provides a holistic picture of your abilities, interests, and values. It helps recruiters see you as a well-rounded candidate, potentially giving you an edge over others.

In Conclusion

In conclusion, creating an effective corporate finance manager resume requires more than just listing your past roles and responsibilities. It's about strategically showcasing your skills, achievements, and qualifications in a clear and organized manner. By emphasizing quantifiable accomplishments and aligning your experience with job requirements, you present yourself as an ideal candidate. Remember to use strong action verbs and maintain a clean layout with modern font choices to enhance readability. Including a professional summary can efficiently capture the attention of hiring managers, while a thoughtfully structured skills section further emphasizes your strengths. Don't overlook the importance of detailing your education and any relevant certifications, as these elements bolster your credibility. Extra sections like languages, hobbies, and volunteer work can provide additional depth, painting a well-rounded picture of your character and capabilities. By following these guidelines, your resume will stand out in the competitive field of corporate finance, setting you on a path toward new and exciting career opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.