Credit Analyst Resume Examples

Jul 18, 2024

|

12 min read

Boost your credit analyst resume: Craft a compelling resume that holds up against scrutiny, just like a thorough credit check. Here’s your guide to showcasing your financial skills and analytical expertise.

Rated by 348 people

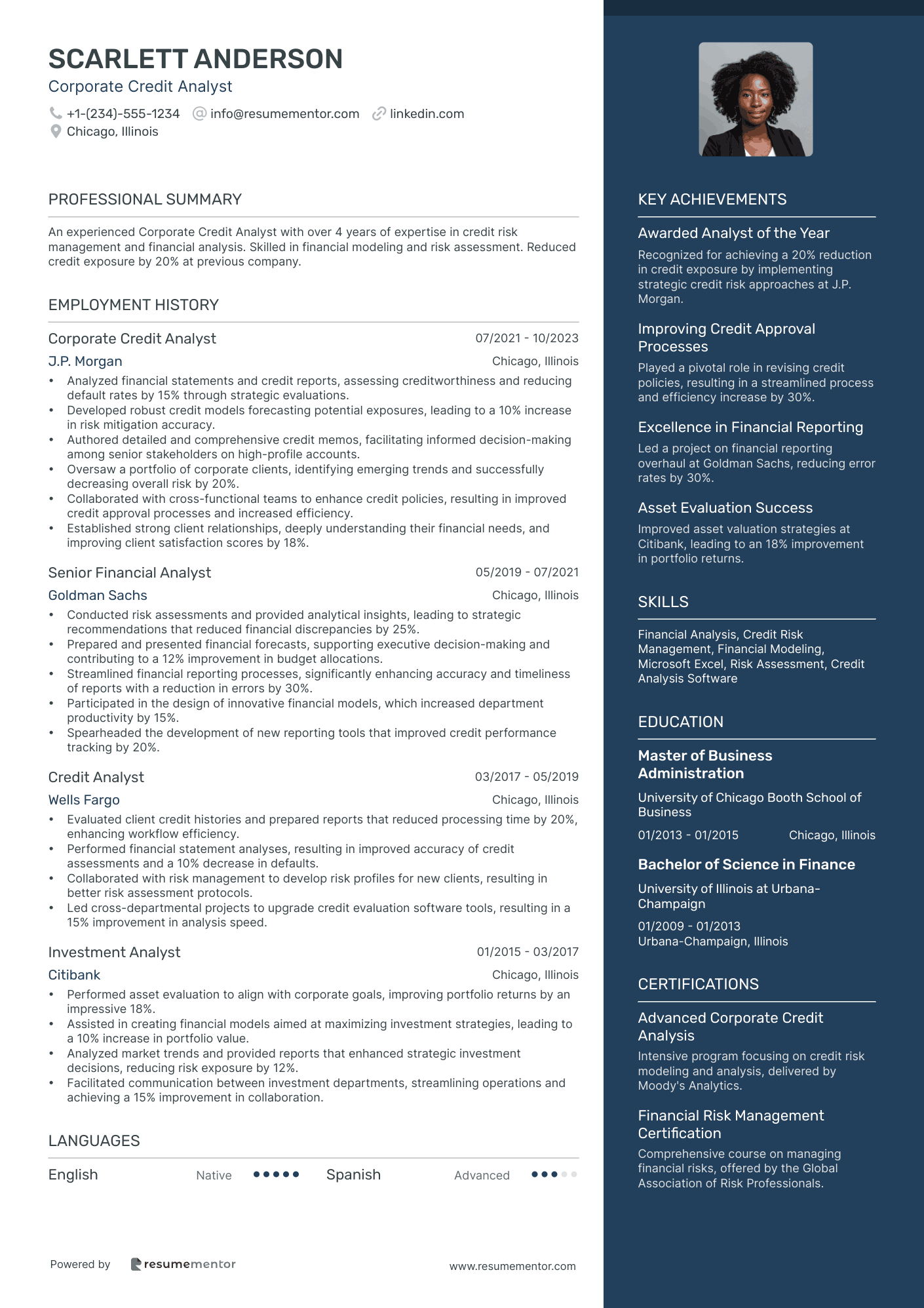

Corporate Credit Analyst

Consumer Credit Risk Analyst

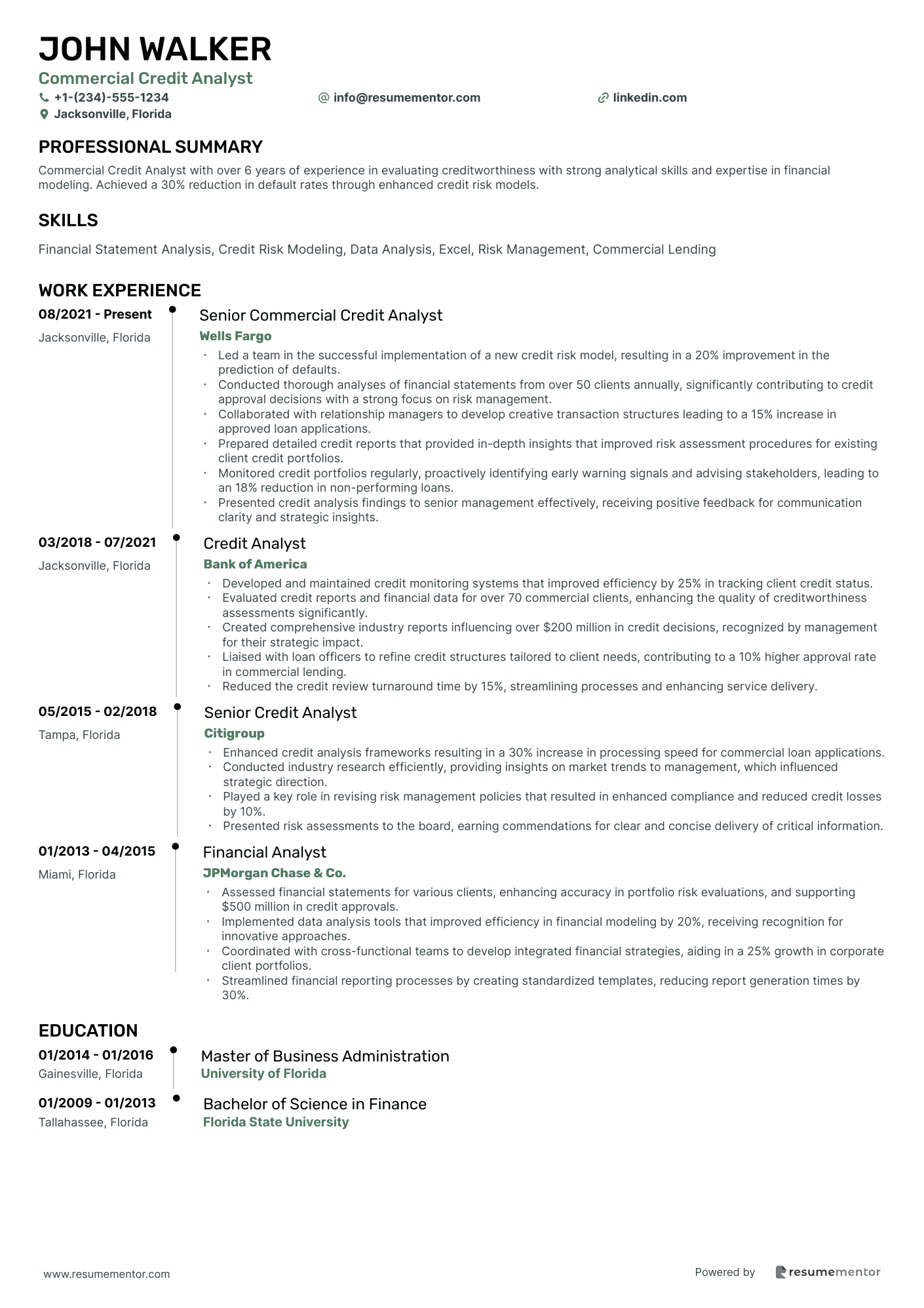

Commercial Credit Analyst

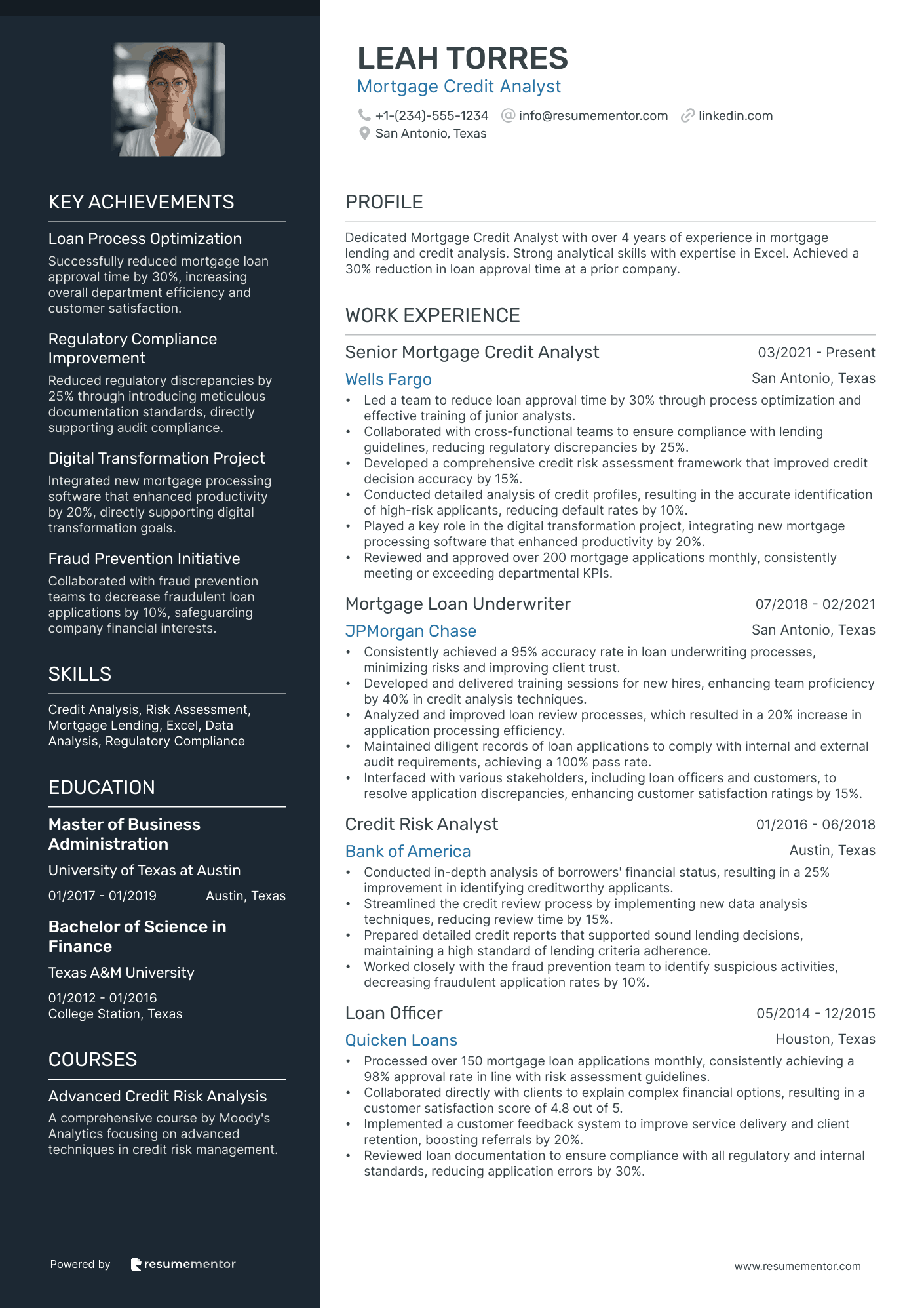

Mortgage Credit Analyst

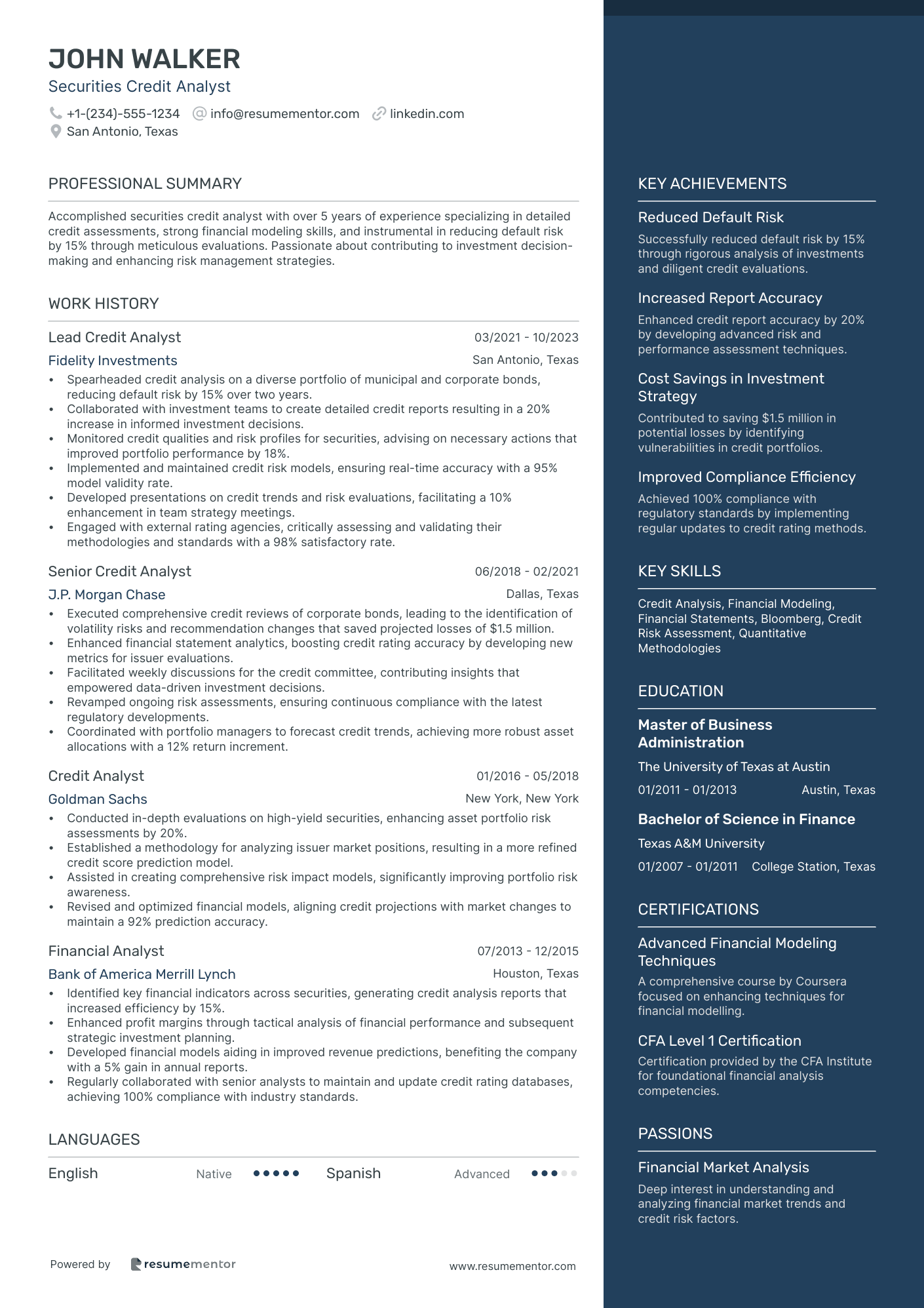

Securities Credit Analyst

Investment Credit Analyst

Real Estate Credit Analyst

Small Business Credit Analyst

International Credit Analyst

Automotive Credit Analyst

Corporate Credit Analyst resume sample

- •Analyzed financial statements and credit reports, assessing creditworthiness and reducing default rates by 15% through strategic evaluations.

- •Developed robust credit models forecasting potential exposures, leading to a 10% increase in risk mitigation accuracy.

- •Authored detailed and comprehensive credit memos, facilitating informed decision-making among senior stakeholders on high-profile accounts.

- •Oversaw a portfolio of corporate clients, identifying emerging trends and successfully decreasing overall risk by 20%.

- •Collaborated with cross-functional teams to enhance credit policies, resulting in improved credit approval processes and increased efficiency.

- •Established strong client relationships, deeply understanding their financial needs, and improving client satisfaction scores by 18%.

- •Conducted risk assessments and provided analytical insights, leading to strategic recommendations that reduced financial discrepancies by 25%.

- •Prepared and presented financial forecasts, supporting executive decision-making and contributing to a 12% improvement in budget allocations.

- •Streamlined financial reporting processes, significantly enhancing accuracy and timeliness of reports with a reduction in errors by 30%.

- •Participated in the design of innovative financial models, which increased department productivity by 15%.

- •Spearheaded the development of new reporting tools that improved credit performance tracking by 20%.

- •Evaluated client credit histories and prepared reports that reduced processing time by 20%, enhancing workflow efficiency.

- •Performed financial statement analyses, resulting in improved accuracy of credit assessments and a 10% decrease in defaults.

- •Collaborated with risk management to develop risk profiles for new clients, resulting in better risk assessment protocols.

- •Led cross-departmental projects to upgrade credit evaluation software tools, resulting in a 15% improvement in analysis speed.

- •Performed asset evaluation to align with corporate goals, improving portfolio returns by an impressive 18%.

- •Assisted in creating financial models aimed at maximizing investment strategies, leading to a 10% increase in portfolio value.

- •Analyzed market trends and provided reports that enhanced strategic investment decisions, reducing risk exposure by 12%.

- •Facilitated communication between investment departments, streamlining operations and achieving a 15% improvement in collaboration.

Consumer Credit Risk Analyst resume sample

- •Developed and maintained advanced credit scoring models which improved portfolio risk assessment accuracy by 15%.

- •Conducted deep-dive analysis into consumer credit portfolios, identifying trends that led to a 25% reduction in delinquency rates.

- •Collaborated with underwriting and marketing teams to implement risk segmentation strategies, fostering a 10% rise in customer engagement.

- •Monitored key risk performance indicators, providing insights to senior management, resulting in enhanced decision-making processes.

- •Assisted in the design and execution of new credit policies, leading to a streamlined approval process and reduced processing times by 20%.

- •Stayed updated on industry trends by attending industry workshops, ensuring compliance with latest credit risk regulations.

- •Analyzed data using SQL, improving risk assessment speed and efficiency by over 30%.

- •Led a project to overhaul reporting systems, cutting data processing time by half and increasing reporting accuracy.

- •Presented detailed credit risk reports to stakeholders, facilitating informed decision-making on credit products.

- •Developed comprehensive risk exposure analyses, reducing potential losses by 18% through proactive risk management.

- •Collaborated closely with cross-functional teams, promoting best practices in risk management and enhancing collaboration.

- •Contributed to the development of risk assessment tools which advanced risk accuracy, enhancing portfolio performance by 12%.

- •Assisted in implementing risk management policies, streamlining compliance processes and improving regulatory adherence.

- •Performed extensive data analysis using Excel, providing insights that boosted predictive accuracy by 10%.

- •Engaged in regular cross-functional meetings to ensure risk strategies were aligned with corporate objectives.

- •Conducted economic impact studies that informed credit risk strategies, directly contributing to a 5% decrease in exposure.

- •Used SAS for statistical modeling which led to insights improving credit product offerings.

- •Prepared presentations for senior management, educating them on macroeconomic trends affecting credit risk.

- •Collaborated on a team that implemented cost-saving measures, resulting in a 7% operational efficiency improvement.

Commercial Credit Analyst resume sample

- •Led a team in the successful implementation of a new credit risk model, resulting in a 20% improvement in the prediction of defaults.

- •Conducted thorough analyses of financial statements from over 50 clients annually, significantly contributing to credit approval decisions with a strong focus on risk management.

- •Collaborated with relationship managers to develop creative transaction structures leading to a 15% increase in approved loan applications.

- •Prepared detailed credit reports that provided in-depth insights that improved risk assessment procedures for existing client credit portfolios.

- •Monitored credit portfolios regularly, proactively identifying early warning signals and advising stakeholders, leading to an 18% reduction in non-performing loans.

- •Presented credit analysis findings to senior management effectively, receiving positive feedback for communication clarity and strategic insights.

- •Developed and maintained credit monitoring systems that improved efficiency by 25% in tracking client credit status.

- •Evaluated credit reports and financial data for over 70 commercial clients, enhancing the quality of creditworthiness assessments significantly.

- •Created comprehensive industry reports influencing over $200 million in credit decisions, recognized by management for their strategic impact.

- •Liaised with loan officers to refine credit structures tailored to client needs, contributing to a 10% higher approval rate in commercial lending.

- •Reduced the credit review turnaround time by 15%, streamlining processes and enhancing service delivery.

- •Enhanced credit analysis frameworks resulting in a 30% increase in processing speed for commercial loan applications.

- •Conducted industry research efficiently, providing insights on market trends to management, which influenced strategic direction.

- •Played a key role in revising risk management policies that resulted in enhanced compliance and reduced credit losses by 10%.

- •Presented risk assessments to the board, earning commendations for clear and concise delivery of critical information.

- •Assessed financial statements for various clients, enhancing accuracy in portfolio risk evaluations, and supporting $500 million in credit approvals.

- •Implemented data analysis tools that improved efficiency in financial modeling by 20%, receiving recognition for innovative approaches.

- •Coordinated with cross-functional teams to develop integrated financial strategies, aiding in a 25% growth in corporate client portfolios.

- •Streamlined financial reporting processes by creating standardized templates, reducing report generation times by 30%.

Mortgage Credit Analyst resume sample

- •Led a team to reduce loan approval time by 30% through process optimization and effective training of junior analysts.

- •Collaborated with cross-functional teams to ensure compliance with lending guidelines, reducing regulatory discrepancies by 25%.

- •Developed a comprehensive credit risk assessment framework that improved credit decision accuracy by 15%.

- •Conducted detailed analysis of credit profiles, resulting in the accurate identification of high-risk applicants, reducing default rates by 10%.

- •Played a key role in the digital transformation project, integrating new mortgage processing software that enhanced productivity by 20%.

- •Reviewed and approved over 200 mortgage applications monthly, consistently meeting or exceeding departmental KPIs.

- •Consistently achieved a 95% accuracy rate in loan underwriting processes, minimizing risks and improving client trust.

- •Developed and delivered training sessions for new hires, enhancing team proficiency by 40% in credit analysis techniques.

- •Analyzed and improved loan review processes, which resulted in a 20% increase in application processing efficiency.

- •Maintained diligent records of loan applications to comply with internal and external audit requirements, achieving a 100% pass rate.

- •Interfaced with various stakeholders, including loan officers and customers, to resolve application discrepancies, enhancing customer satisfaction ratings by 15%.

- •Conducted in-depth analysis of borrowers' financial status, resulting in a 25% improvement in identifying creditworthy applicants.

- •Streamlined the credit review process by implementing new data analysis techniques, reducing review time by 15%.

- •Prepared detailed credit reports that supported sound lending decisions, maintaining a high standard of lending criteria adherence.

- •Worked closely with the fraud prevention team to identify suspicious activities, decreasing fraudulent application rates by 10%.

- •Processed over 150 mortgage loan applications monthly, consistently achieving a 98% approval rate in line with risk assessment guidelines.

- •Collaborated directly with clients to explain complex financial options, resulting in a customer satisfaction score of 4.8 out of 5.

- •Implemented a customer feedback system to improve service delivery and client retention, boosting referrals by 20%.

- •Reviewed loan documentation to ensure compliance with all regulatory and internal standards, reducing application errors by 30%.

Securities Credit Analyst resume sample

- •Spearheaded credit analysis on a diverse portfolio of municipal and corporate bonds, reducing default risk by 15% over two years.

- •Collaborated with investment teams to create detailed credit reports resulting in a 20% increase in informed investment decisions.

- •Monitored credit qualities and risk profiles for securities, advising on necessary actions that improved portfolio performance by 18%.

- •Implemented and maintained credit risk models, ensuring real-time accuracy with a 95% model validity rate.

- •Developed presentations on credit trends and risk evaluations, facilitating a 10% enhancement in team strategy meetings.

- •Engaged with external rating agencies, critically assessing and validating their methodologies and standards with a 98% satisfactory rate.

- •Executed comprehensive credit reviews of corporate bonds, leading to the identification of volatility risks and recommendation changes that saved projected losses of $1.5 million.

- •Enhanced financial statement analytics, boosting credit rating accuracy by developing new metrics for issuer evaluations.

- •Facilitated weekly discussions for the credit committee, contributing insights that empowered data-driven investment decisions.

- •Revamped ongoing risk assessments, ensuring continuous compliance with the latest regulatory developments.

- •Coordinated with portfolio managers to forecast credit trends, achieving more robust asset allocations with a 12% return increment.

- •Conducted in-depth evaluations on high-yield securities, enhancing asset portfolio risk assessments by 20%.

- •Established a methodology for analyzing issuer market positions, resulting in a more refined credit score prediction model.

- •Assisted in creating comprehensive risk impact models, significantly improving portfolio risk awareness.

- •Revised and optimized financial models, aligning credit projections with market changes to maintain a 92% prediction accuracy.

- •Identified key financial indicators across securities, generating credit analysis reports that increased efficiency by 15%.

- •Enhanced profit margins through tactical analysis of financial performance and subsequent strategic investment planning.

- •Developed financial models aiding in improved revenue predictions, benefiting the company with a 5% gain in annual reports.

- •Regularly collaborated with senior analysts to maintain and update credit rating databases, achieving 100% compliance with industry standards.

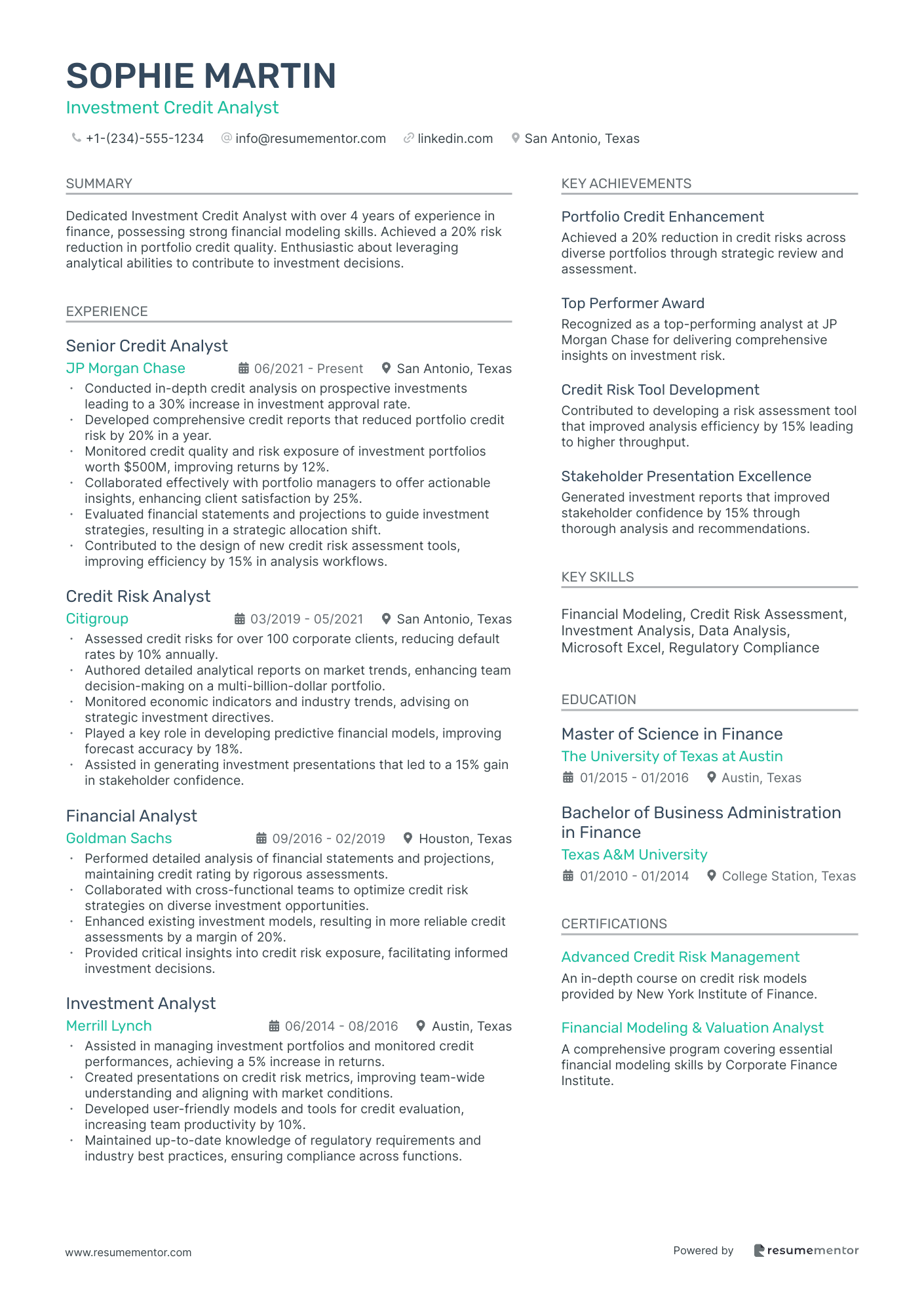

Investment Credit Analyst resume sample

- •Conducted in-depth credit analysis on prospective investments leading to a 30% increase in investment approval rate.

- •Developed comprehensive credit reports that reduced portfolio credit risk by 20% in a year.

- •Monitored credit quality and risk exposure of investment portfolios worth $500M, improving returns by 12%.

- •Collaborated effectively with portfolio managers to offer actionable insights, enhancing client satisfaction by 25%.

- •Evaluated financial statements and projections to guide investment strategies, resulting in a strategic allocation shift.

- •Contributed to the design of new credit risk assessment tools, improving efficiency by 15% in analysis workflows.

- •Assessed credit risks for over 100 corporate clients, reducing default rates by 10% annually.

- •Authored detailed analytical reports on market trends, enhancing team decision-making on a multi-billion-dollar portfolio.

- •Monitored economic indicators and industry trends, advising on strategic investment directives.

- •Played a key role in developing predictive financial models, improving forecast accuracy by 18%.

- •Assisted in generating investment presentations that led to a 15% gain in stakeholder confidence.

- •Performed detailed analysis of financial statements and projections, maintaining credit rating by rigorous assessments.

- •Collaborated with cross-functional teams to optimize credit risk strategies on diverse investment opportunities.

- •Enhanced existing investment models, resulting in more reliable credit assessments by a margin of 20%.

- •Provided critical insights into credit risk exposure, facilitating informed investment decisions.

- •Assisted in managing investment portfolios and monitored credit performances, achieving a 5% increase in returns.

- •Created presentations on credit risk metrics, improving team-wide understanding and aligning with market conditions.

- •Developed user-friendly models and tools for credit evaluation, increasing team productivity by 10%.

- •Maintained up-to-date knowledge of regulatory requirements and industry best practices, ensuring compliance across functions.

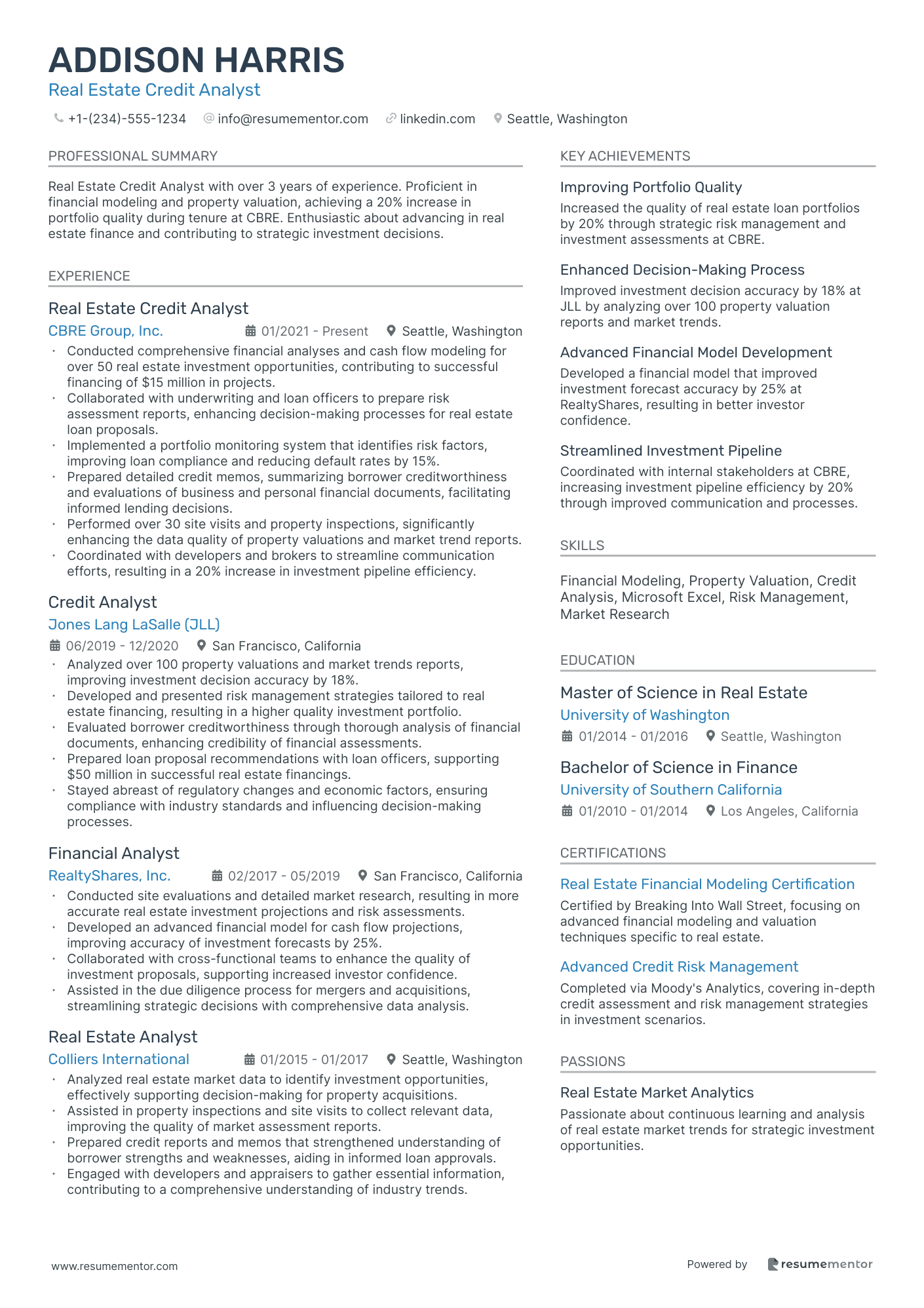

Real Estate Credit Analyst resume sample

- •Conducted comprehensive financial analyses and cash flow modeling for over 50 real estate investment opportunities, contributing to successful financing of $15 million in projects.

- •Collaborated with underwriting and loan officers to prepare risk assessment reports, enhancing decision-making processes for real estate loan proposals.

- •Implemented a portfolio monitoring system that identifies risk factors, improving loan compliance and reducing default rates by 15%.

- •Prepared detailed credit memos, summarizing borrower creditworthiness and evaluations of business and personal financial documents, facilitating informed lending decisions.

- •Performed over 30 site visits and property inspections, significantly enhancing the data quality of property valuations and market trend reports.

- •Coordinated with developers and brokers to streamline communication efforts, resulting in a 20% increase in investment pipeline efficiency.

- •Analyzed over 100 property valuations and market trends reports, improving investment decision accuracy by 18%.

- •Developed and presented risk management strategies tailored to real estate financing, resulting in a higher quality investment portfolio.

- •Evaluated borrower creditworthiness through thorough analysis of financial documents, enhancing credibility of financial assessments.

- •Prepared loan proposal recommendations with loan officers, supporting $50 million in successful real estate financings.

- •Stayed abreast of regulatory changes and economic factors, ensuring compliance with industry standards and influencing decision-making processes.

- •Conducted site evaluations and detailed market research, resulting in more accurate real estate investment projections and risk assessments.

- •Developed an advanced financial model for cash flow projections, improving accuracy of investment forecasts by 25%.

- •Collaborated with cross-functional teams to enhance the quality of investment proposals, supporting increased investor confidence.

- •Assisted in the due diligence process for mergers and acquisitions, streamlining strategic decisions with comprehensive data analysis.

- •Analyzed real estate market data to identify investment opportunities, effectively supporting decision-making for property acquisitions.

- •Assisted in property inspections and site visits to collect relevant data, improving the quality of market assessment reports.

- •Prepared credit reports and memos that strengthened understanding of borrower strengths and weaknesses, aiding in informed loan approvals.

- •Engaged with developers and appraisers to gather essential information, contributing to a comprehensive understanding of industry trends.

Small Business Credit Analyst resume sample

- •Developed comprehensive credit analysis reports for over 100 small businesses, leading to a 30% increase in loan approvals.

- •Collaborated with loan officers to mitigate high-risk loans, maintaining a loan portfolio with less than 1% default rate.

- •Spearheaded a team project to refine risk assessment models, resulting in a 20% improvement in credit evaluation accuracy.

- •Reviewed comprehensive financial statements and credit reports, reducing processing time by 25%.

- •Trained junior analysts, enhancing team efficiency by 40% in application turnaround.

- •Implemented a new financial data analysis tool, increasing processing speeds by 15%.

- •Managed credit analysis for a diverse portfolio, maintaining a client satisfaction rate of over 90%.

- •Conducted in-depth assessments and uncovered high-risk prospects, reducing bad debt by $200K annually.

- •Engaged with small business clients to address application ambiguities, increasing clarity and approval rates by 18%.

- •Stayed informed on market trends, advising teams on regulatory impacts and saving $100K in potential compliance fees.

- •Facilitated process improvements meetings that optimized workflows, enhancing lending efficiency by 35%.

- •Assisted in the development of lending protocols for small businesses, streamlining risk assessment processes, and achieving a 15% approval rate increase.

- •Collaborated with cross-function teams to design analytical tools that reduced loan processing times by 20%.

- •Provided insights into small business client behavior, unraveling trends that enhanced product offerings by 10%.

- •Monitored existing loan portfolios, identifying potential risks proactively, and reducing debtor days by 12%.

- •Conducted analysis of financial statements for potential loan applicants, contributing to a 25% rise in application approvals.

- •Engaged with clients to clarify financial queries, enhancing customer service satisfaction score by 15%.

- •Led training sessions on financial software tools, increasing team capability by 32%.

- •Managed a workload of 50-60 credit evaluations monthly, ensuring accuracy and timeliness of reports.

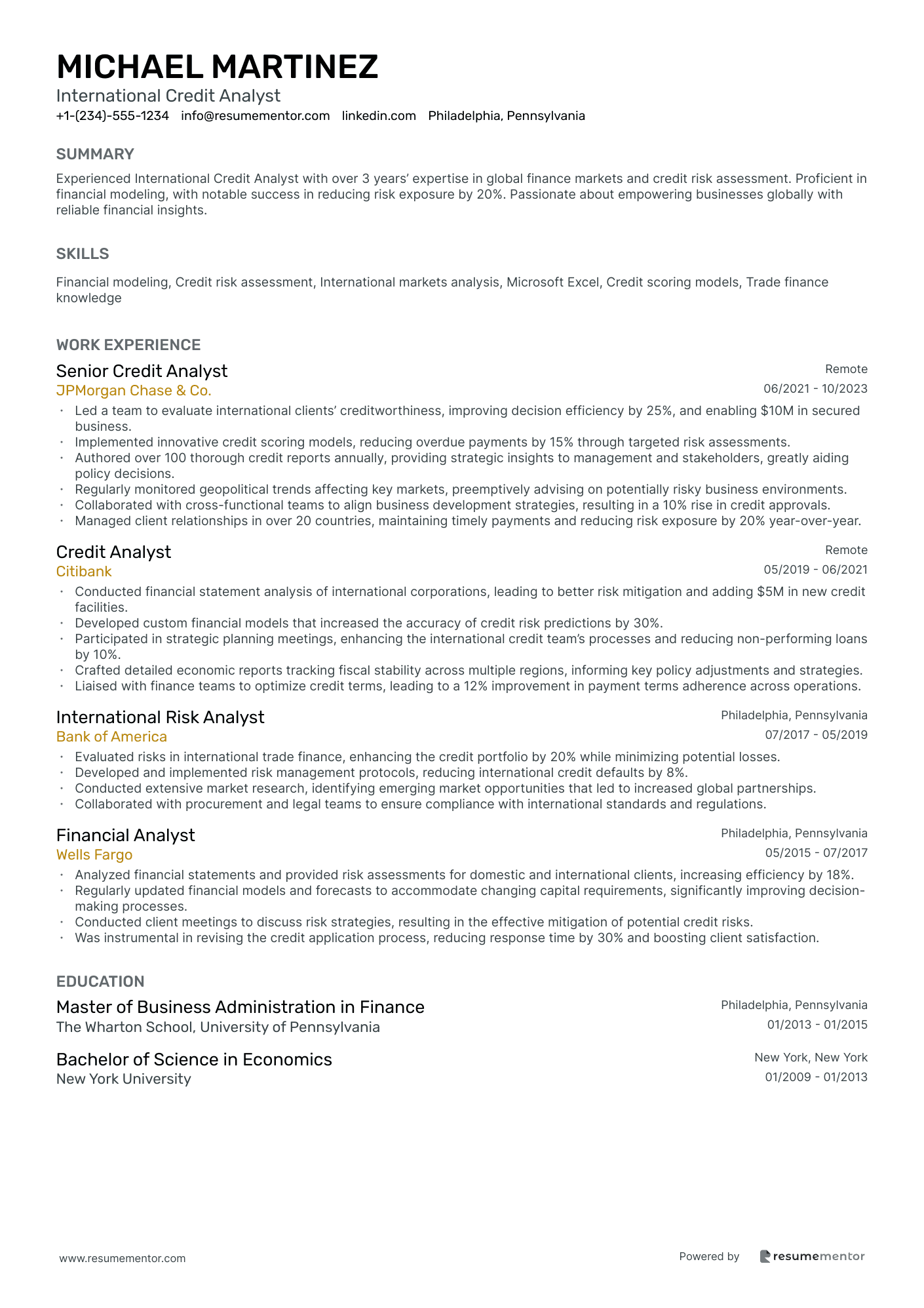

International Credit Analyst resume sample

- •Led a team to evaluate international clients’ creditworthiness, improving decision efficiency by 25%, and enabling $10M in secured business.

- •Implemented innovative credit scoring models, reducing overdue payments by 15% through targeted risk assessments.

- •Authored over 100 thorough credit reports annually, providing strategic insights to management and stakeholders, greatly aiding policy decisions.

- •Regularly monitored geopolitical trends affecting key markets, preemptively advising on potentially risky business environments.

- •Collaborated with cross-functional teams to align business development strategies, resulting in a 10% rise in credit approvals.

- •Managed client relationships in over 20 countries, maintaining timely payments and reducing risk exposure by 20% year-over-year.

- •Conducted financial statement analysis of international corporations, leading to better risk mitigation and adding $5M in new credit facilities.

- •Developed custom financial models that increased the accuracy of credit risk predictions by 30%.

- •Participated in strategic planning meetings, enhancing the international credit team’s processes and reducing non-performing loans by 10%.

- •Crafted detailed economic reports tracking fiscal stability across multiple regions, informing key policy adjustments and strategies.

- •Liaised with finance teams to optimize credit terms, leading to a 12% improvement in payment terms adherence across operations.

- •Evaluated risks in international trade finance, enhancing the credit portfolio by 20% while minimizing potential losses.

- •Developed and implemented risk management protocols, reducing international credit defaults by 8%.

- •Conducted extensive market research, identifying emerging market opportunities that led to increased global partnerships.

- •Collaborated with procurement and legal teams to ensure compliance with international standards and regulations.

- •Analyzed financial statements and provided risk assessments for domestic and international clients, increasing efficiency by 18%.

- •Regularly updated financial models and forecasts to accommodate changing capital requirements, significantly improving decision-making processes.

- •Conducted client meetings to discuss risk strategies, resulting in the effective mitigation of potential credit risks.

- •Was instrumental in revising the credit application process, reducing response time by 30% and boosting client satisfaction.

Automotive Credit Analyst resume sample

- •Spearheaded the implementation of a new credit risk assessment system, improving decision accuracy by 18% over one year.

- •Developed relationships with over 50 dealerships, increasing credit approval rates by 30% through effective negotiation and collaboration.

- •Analyzed credit applications valued at over $100 million, ensuring rigorous compliance with regulatory standards at all times.

- •Trained dealership personnel on credit processes, reducing application errors by 40% within six months, resulting in faster processing times.

- •Reduced the overall bad debt ratio by 25% through focused creditworthiness assessments and mitigation strategies.

- •Collaborated with cross-functional teams to align risk evaluation procedures, successfully shortening approval cycles by 20%.

- •Reviewed and assessed over 1,000 credit applications monthly, maintaining a 95% accuracy rate in creditworthiness evaluation.

- •Implemented automated systems for recording credit decisions, leading to a 50% decrease in administrative workload.

- •Participated in cross-departmental workshops to enhance credit policies, resulting in a streamlined process and improved compliance.

- •Partnered with sales teams to facilitate the approval process, boosting customer satisfaction ratings by 15%.

- •Conducted regular market trend analyses to adapt credit strategies, increasing loan approval conversions by 12%.

- •Assessed financial data from diverse sources, enhancing the credit report evaluation process with improvements of 20% in efficiency.

- •Collaborated on credit policy revisions, contributing to a 10% reduction in loan default rates over two years.

- •Developed and maintained comprehensive customer credit profiles, improving data accuracy and access by 30%.

- •Analyzed annual economic trends to provide insights, supporting strategic adjustments to credit policies.

- •Reviewed and approved customer credit applications with a focus on reducing risk exposure by 15%.

- •Monitored and reported on customer payment behavior, resulting in a 10% improvement in collection rates.

- •Conducted periodic training sessions for team members on updated credit risk assessment methodologies.

- •Aided in the development of risk management strategies, enhancing team decision-making capabilities by 25%.

Creating a standout credit analyst resume involves more than simply listing your work history. As a credit analyst, you’re like a detective in the financial world, uncovering the stories behind numbers, and your resume should capture this analytical prowess. However, translating your skills and insights into a polished document can be challenging.

Many credit analysts find it tough to make their resumes rise above the rest. Whether you’re a seasoned expert or just starting out, expressing your financial expertise clearly is crucial to grabbing an employer's attention. This is where using the right resume template can be beneficial, providing a clean structure that highlights your skills and achievements in a clear way.

Effectively presenting your ability to analyze financial data and assess credit risks is key. Employers look for candidates with a sharp eye for detail and the ability to make informed decisions, and you want these strengths to shine rather than get overshadowed by poor formatting.

This guide will walk you through the process of building a compelling resume. From structuring your achievements to emphasizing your technical expertise, you’ll learn how to portray yourself as a top candidate in the financial field. Let’s dive in and transform your resume into a powerful showcase of your skills as a credit analyst!

Key Takeaways

- When creating a credit analyst resume, focus on effectively presenting your financial skills and ability to evaluate credit risk through a clear format.

- Use specific resume sections such as contact information, professional summary, skills, work experience, education, and technical skills to highlight your qualifications.

- Choose a reverse chronological resume format to emphasize recent achievements, and ensure your resume uses modern fonts and is saved as a PDF for consistency across devices.

- Your resume's experience section should focus on quantifiable achievements, using strong action words and specific numbers to convey your impact.

- Additional sections like languages, hobbies, volunteer work, and books can enrich your resume, showcasing your broader competencies and alignment with the role.

What to focus on when writing your credit analyst resume

A credit analyst resume should clearly convey your financial skills and ability to evaluate credit risk to the recruiter. These qualities are essential to highlight your strengths in assessing creditworthiness and managing potential risks effectively. To make a strong impression, it's vital to emphasize your analytical skills and financial expertise throughout the resume.

How to structure your credit analyst resume

- Contact Information —Ensure this section includes your full name, phone number, email address, and LinkedIn profile. It’s key to present your contact details in a professional manner, making it simple for recruiters to reach you without hassle. Establishing this point of contact is crucial as it lays the groundwork for future communication and interest.

- Professional Summary —Use this section to provide a concise overview of your professional journey in credit analysis, underscoring pivotal skills and notable accomplishments. Craft this summary to engage recruiters immediately, offering them a glimpse into your capabilities and setting the tone for the rest of the resume.

- Skills —Here, list your data analysis abilities, attention to detail, and expertise in credit risk assessment. Including familiarity with software like Moody’s, S&P, or Bloomberg connects your skills directly to industry tools, enhancing your credibility. It's about presenting yourself as someone who can seamlessly fit into the role using these technical proficiencies.

- Work Experience —Detail your previous positions in reverse order, focusing on tangible achievements like improving credit scoring systems or reducing bad debt. This section is where you can illustrate the impact of your skills in the real world, reinforcing the narrative established in your professional summary.

- Education —Mention your degrees and relevant coursework in finance, economics, or accounting and any certifications like CFA or CPA. This background reinforces your qualifications and demonstrates your commitment to the field of credit analysis, adding depth to your story.

- Technical Skills —Highlight your expertise in financial modeling, data analysis tools, and programming languages like SQL. Such skills are foundational to performing detailed credit analysis and help you stand out as a technically proficient candidate ready to handle the challenges of the role.

Now that we've highlighted what each section should include, we'll delve deeper into each element to ensure your resume format effectively communicates your strengths and readiness as a credit analyst.

Which resume format to choose

In the competitive field of credit analysis, picking the right resume format is crucial. A reverse chronological format is often your best bet because it effectively showcases your most recent and relevant experience. This format helps highlight the career progression and achievements that potential employers in finance are eager to see. In crafting a strong credit analyst resume, your work history should tell a story of growth and impact.

The choice of font also plays a vital role in the overall professionalism of your resume. Modern fonts like Montserrat, Raleway, or Lato offer a clean and polished look. These fonts not only provide a fresh alternative to standard choices but also align with the precision and clarity expected in financial documentation. Ensuring the font size is readable means hiring managers can easily scan through your key achievements and skills without strain.

Pairing these elements with the right file type is equally important. Saving your resume as a PDF preserves your layout and design, which is crucial when submitting applications through various online portals. PDFs ensure that your resume appears the same on different devices and operating systems, maintaining the integrity of your carefully crafted presentation.

Finally, attention to detail, such as setting your margins to about one inch on all sides, creates a neat and organized layout. Adequate white space can make a significant difference in readability, preventing your resume from feeling cluttered and allowing your content to stand out effectively. With these elements in harmony, your skills and experiences will be clearly and compellingly presented to potential employers.

How to write a quantifiable resume experience section

Crafting a standout credit analyst resume experience section involves highlighting your impact with clear, quantifiable achievements. This part of the resume must vividly illustrate your professional journey, making it simple for employers to recognize your value. Start with your most recent role, sticking to jobs from the last 10-15 years to maintain relevance. Job titles should reflect positions directly tied to credit analysis or highlight transferable skills that can seamlessly apply to the field. By tailoring your resume to mirror the job ad, you increase the chances of passing ATS checks and capturing a recruiter’s attention. Strong action words like "evaluated," "assessed," and "optimized" enhance your contributions and help make them stand out.

Consider this example of a credit analyst resume experience section that effectively brings these elements together:

- •Improved credit portfolio risk rating by 15% through targeted risk assessment strategies.

- •Conducted 300+ credit reviews annually, leading to a 10% increase in timely loan repayments.

- •Integrated a new credit risk assessment tool that lowered default rates by 8%.

- •Optimized credit approval processes, reducing turnaround time by 20%.

This experience section excels by linking quantifiable achievements with overall expertise. The specific numbers provide solid proof of your success in areas like improving risk ratings and reducing default rates, showing how your actions positively impact a company’s bottom line. Each bullet point not only highlights a specific accomplishment but also paints a picture of continuous improvement and strategic innovation. As you tailor your resume details to reflect optimized processes and the integration of new tools, you effectively connect your skills with the needs of potential employers, making your application more compelling.

Result-Focused resume experience section

A Result-Focused credit analyst resume experience section should clearly demonstrate how you have made a positive impact on your previous companies. Start each bullet point with a strong action verb to highlight your contributions, focusing on results that improved efficiency or helped the company grow. This approach enables employers to quickly see the value you bring and how you could benefit their team.

To strengthen your claims, incorporate specific examples and numbers, as these elements make your achievements tangible and impressive. Keep each point concise yet detailed, making sure to cover varied successes such as project completions or financial improvements. This variety paints a complete picture of your skills and experience, offering potential employers a well-rounded view of your capabilities.

Credit Analyst

ABC Financial Services

June 2021 - Present

- Evaluated creditworthiness for over 50 small and medium-sized businesses, boosting loan approval rates by 30%.

- Developed a new credit risk model, cutting default rates by 15% within the first year.

- Worked with different teams to refine the underwriting process, increasing efficiency by 20%.

- Created detailed reports and presentations for senior management, enhancing their decision-making with data.

Innovation-Focused resume experience section

An innovation-focused credit analyst resume experience section should clearly convey your ability to creatively interpret data and introduce fresh techniques in financial analysis. Begin by highlighting unique data models or analytical tools you've developed or improved. Discuss specific situations where you have identified potential risks and crafted innovative solutions to address them. Use concrete examples and numbers to demonstrate the impact of your insights, such as driving major changes in credit strategies or significantly contributing to business growth. It's essential that your descriptions illustrate how your innovative mindset directly benefited the companies you worked for.

To further enhance your experience section, integrate how you foster teamwork and communication to propel innovative projects forward. Consider sharing stories of collaboration with cross-functional teams to introduce new credit policies or analytical methods, even when initial resistance was present. This connection will not only showcase your skill under pressure but also emphasize your commitment to delivering inventive solutions. By weaving these elements together, your resume will effectively highlight your expertise as an analyst and showcase you as a forward-thinking leader.

Senior Credit Analyst

Financial Solutions Inc.

June 2019 - June 2023

- Developed a predictive analytics model that reduced credit processing time by 30%.

- Introduced a novel risk assessment tool that improved the accuracy of credit scoring by 20%.

- Collaborated with a cross-functional team to implement an AI-based analytical method, increasing loan approval efficiency.

- Led a project to revamp the credit analysis framework, resulting in a 15% reduction in default rates.

Growth-Focused resume experience section

A growth-focused credit analyst resume experience section should spotlight your successes in driving financial improvements while minimizing risk. Start by arranging your experiences chronologically, but ensure each one highlights a key achievement that underscores your growth-oriented skills. Use straightforward language with measurable outcomes, like percentages or dollar amounts, to make your results clear and impressive. This structured approach helps potential employers quickly see how your abilities translate into tangible benefits for their organization.

To really impress, weave in details about your expertise in analyzing data and assessing creditworthiness, and how these skills lead to company growth. Give specific examples that show how you've boosted business performance or secured financial stability through your work. It’s crucial to highlight your ability to evaluate financial statements and nurture client relationships smoothly. Don't forget to mention any initiatives you've been a part of or led that improved credit processes or resulted in expanding business opportunities, as these add depth to your profile.

Senior Credit Analyst

FinPro Financial Services

June 2020 - Present

- Evaluated credit data and financial statements for 100+ clients, resulting in a 15% increase in loan retention.

- Implemented a new credit review process that reduced approval times by 20%, boosting client satisfaction.

- Led a team of analysts in identifying high-growth markets, contributing to a 10% rise in new business acquisitions.

- Developed and launched a risk assessment model that decreased loan defaults by 12%.

Responsibility-Focused resume experience section

A responsibility-focused credit analyst resume experience section should clearly communicate your role and achievements in a way that feels cohesive and compelling. Start by listing your job title, workplace, and the timeframe of your employment to set the context. You might opt to include a brief company description if it significantly enhances understanding. The heart of this section lies in the bullet points, where you emphasize your key responsibilities and achievements, highlighting your proactive actions and their impact. This approach naturally ties your past roles to your effectiveness.

Think back to instances where your analysis or financial insights drove positive change. With this in mind, use strong action words like "analyzed," "developed," or "increased" to clearly show your contributions and accomplishments. Ensure each bullet is concise yet informative, making every word earn its place. Tailor these details to resonate with each job application, spotlighting the skills and experiences your prospective employer desires most. This way, your resume reads not just as a list of jobs, but as a story of your professional growth and impact.

Credit Analyst

ABC Financial Services

June 2019 - July 2023

- Reviewed and evaluated over 200 loan applications each month, ensuring they met financial regulations and internal standards.

- Created an automated scoring model that cut application processing time by 25%, improving overall efficiency.

- Worked with cross-functional teams to identify and mitigate credit risk, achieving a 15% reduction in default rates over two years.

- Prepared detailed reports and presentations for senior management, aiding in informed decision-making.

Write your credit analyst resume summary section

A credit analyst-focused resume summary should clearly communicate your ability to add value in assessing financial risks and making informed lending decisions. This section is your chance to highlight not just your skills and experience but also your specific accomplishments. Emphasizing your role in evaluating creditworthiness demonstrates your valuable contribution to financial decisions. A powerful example captures these elements:

This example works because it combines experience and skills with specific, measurable achievements, capturing the reader’s interest. Mentioning the reduction in delinquency rates illustrates your ability to make impactful contributions, which is what potential employers are keen to see.

Linking your achievements to real-world outcomes can make your summary more compelling. It's also important to distinguish between related resume sections: while a summary provides a snapshot of your past successes, a resume objective highlights your future goals and what you aim to bring to a new role. Meanwhile, a resume profile offers an overview of your career experience, and a summary of qualifications lists key credentials. Tailor your approach depending on your career stage and the specific job you’re targeting to ensure a seamless, engaging introduction.

Listing your credit analyst skills on your resume

A skills-focused credit analyst resume section should seamlessly highlight your expertise to boost your chances of landing an interview. You can feature your skills in a dedicated section, weave them into your experience, or include them in a summary to emphasize what you excel at. By presenting your strengths and soft skills, you showcase your ability to work collaboratively and adapt to different situations. Meanwhile, hard skills, such as your proficiency with financial analysis tools or software, serve as concrete evidence of your capabilities.

These skills and strengths often double as crucial keywords in your resume, which employers search for when reviewing applications. Incorporating the right keywords ensures that your resume stands out to both automated systems and hiring managers, increasing your visibility and likelihood of being shortlisted.

Example of a skills section in JSON format:

Listing skills in this manner ensures that they are directly related to credit analysis tasks, such as financial analysis, risk assessment, and data interpretation, which are crucial for the role. Highlighting these relevant skills draws the attention of both automated systems and hiring managers who are seeking specific competencies.

Best hard skills to feature on your credit analyst resume

For credit analysts, showcasing essential hard skills is crucial. These demonstrate your technical expertise and ability to handle job-specific tasks effectively. Here are 15 hard skills that are important for a credit analyst:

Hard Skills

- Financial statement analysis

- Risk assessment

- Credit scoring models

- Use of financial software tools

- Data analysis

- Loan underwriting

- Knowledge of regulatory compliance

- Accounting skills

- Banking process understanding

- Portfolio management

- Industry-specific knowledge

- Financial modeling

- Statistical analysis

- Investment analysis

- Contract review

Best soft skills to feature on your credit analyst resume

Equally, featuring key soft skills is vital for a credit analyst, reflecting your ability to collaborate and adjust to various scenarios. Here are 15 important soft skills:

Soft Skills

- Communication skills

- Attention to detail

- Problem-solving

- Negotiation

- Time management

- Analytical thinking

- Teamwork

- Adaptability

- Decision-making

- Leadership

- Empathy

- Collaboration

- Stress management

- Creativity

- Listening skills

How to include your education on your resume

The education section is a critical part of your credit analyst resume. Emphasize only relevant education, omitting any that doesn’t pertain to the credit analyst role. Clearly listing your degrees, honors, and GPA can provide a snapshot of your academic achievements. If your GPA is strong, include it to demonstrate academic excellence. When mentioning cum laude, it's important to state this distinction alongside your degree to show your high level of achievement. Properly listing your degree, such as Bachelor of Science in Finance, is essential for clarity. A well-crafted education section reflects your qualifications and suitability for the job.

Here's an example of how not to write an education section:

A better example for a credit analyst role:

- •Graduated cum laude

The second example is outstanding due to its relevance and focus. It includes a finance degree, pertinent to credit analysis, and highlights cum laude standing, indicating high academic performance. The GPA is impressive and relevant, showcasing the candidate's hard work and commitment. Such details convey readiness and alignment with the desired credit analyst position.

How to include credit analyst certificates on your resume

Including a certificates section is an important part of your credit analyst resume. List the name of each certificate clearly. Include the date when you earned the certificate. Add the issuing organization to make it authoritative. Certificates can also be included in the header; for example, "John Doe, CFA Charterholder."

A good certificates section could look like this:

This example is good because it lists certificates that are directly relevant to the credit analyst role. It clearly mentions the certificate titles, making it easy for hiring managers to see your qualifications. The issuing organizations are well-known and respected in the field, adding credibility. This approach makes it clear that you have the specialized skills needed for the job.

Extra sections to include in your credit analyst resume

Crafting a top-notch resume as a credit analyst involves more than just listing your jobs and accomplishments. Including additional sections such as languages, hobbies and interests, volunteer work, and books can significantly enhance your profile and set you apart from other candidates.

- Include a language section — Demonstrate multilingual abilities, which can be especially attractive to employers with diverse or international clientele.

- Feature hobbies and interests — Show your well-rounded personality and potential team fit by mentioning relevant activities that reflect valuable skills or personal traits.

- Highlight volunteer work — Reflect your community involvement and soft skills such as leadership, empathy, and teamwork, which are vital for a credit analyst.

- Add a books section — Exhibit your commitment to continuous learning and staying informed about industry-related topics.

This approach can help you create a more dynamic and appealing resume.

In Conclusion

In conclusion, creating an effective credit analyst resume requires careful attention to detail and a strategic approach to presenting your skills and experiences. By focusing on clear and organized sections such as your contact information, professional summary, skills, work experience, and education, you can create a resume that is not only informative but also engaging. The choice of an appropriate resume format, such as the reverse chronological format, ensures that your most relevant experiences are highlighted. Moreover, using modern fonts and saving your resume in a PDF format will help maintain its professional appearance across different platforms. Adding quantifiable achievements within your experience section provides solid proof of your impact and expertise. Including additional sections, like certifications or languages, can further enhance your profile, offering a holistic view of your qualifications. By weaving in your hard and soft skills throughout the resume, you can impress both automated systems and hiring managers. Remember, a well-crafted resume serves as a personal marketing tool, showcasing your unique strengths as a credit analyst. Tailoring each application meticulously increases your chances of capturing an employer’s attention and sets the foundation for a successful job search.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.