Deputy Finance Manager Resume Examples

Jul 18, 2024

|

12 min read

Ace your deputy finance manager resume: Tips to make you a worthy investment and steal the spotlight.

Rated by 348 people

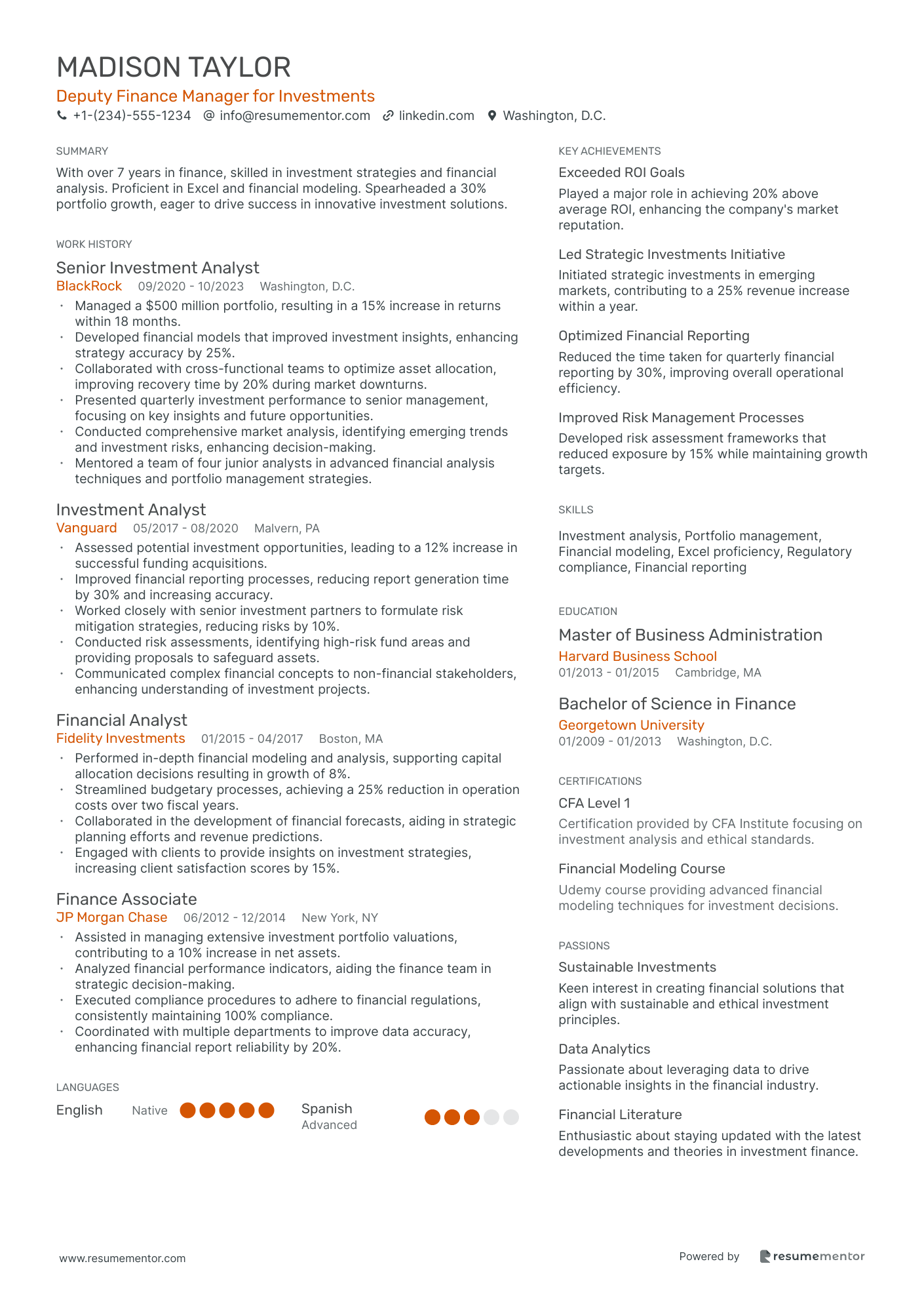

Deputy Finance Manager for Investments

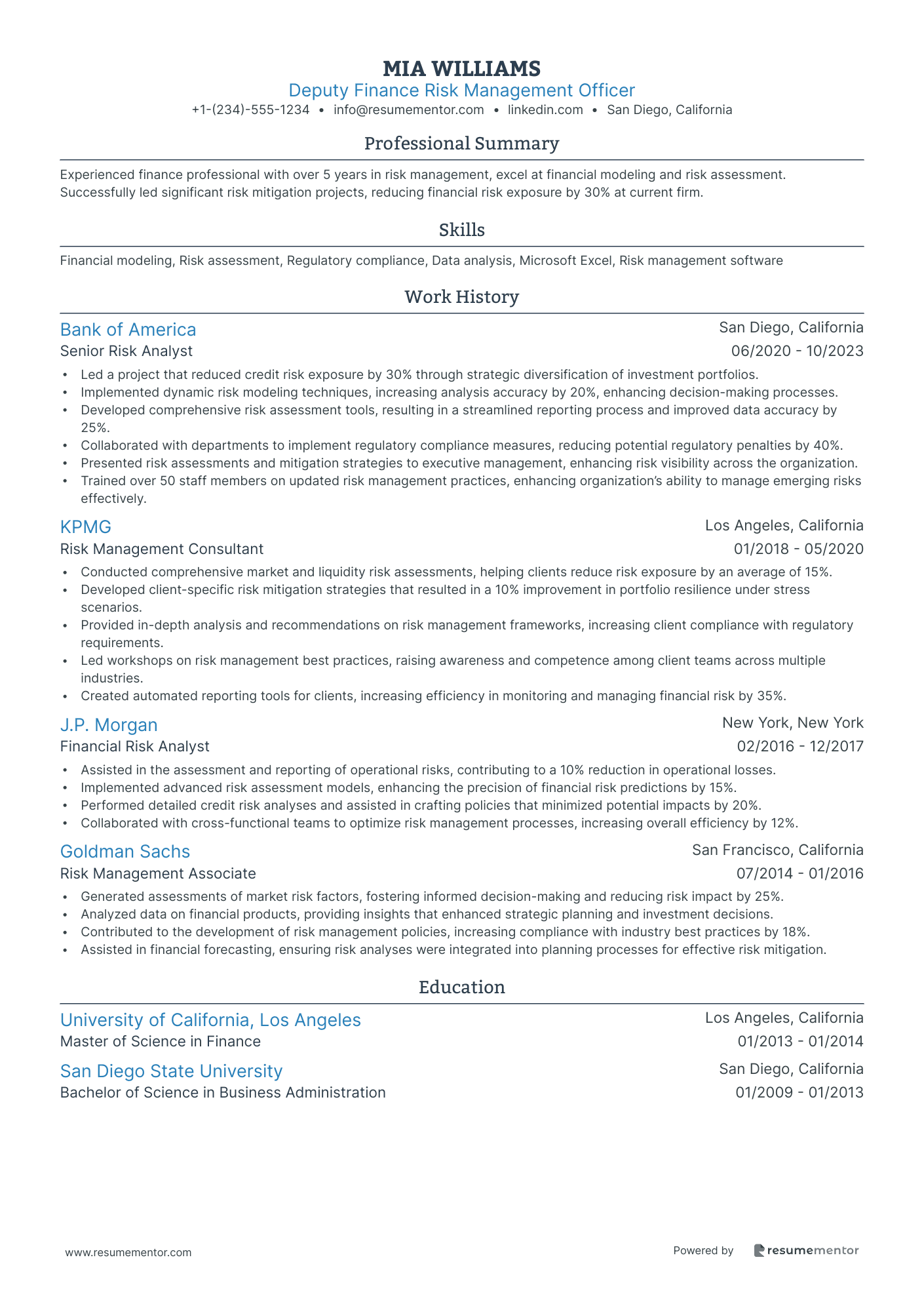

Deputy Finance Risk Management Officer

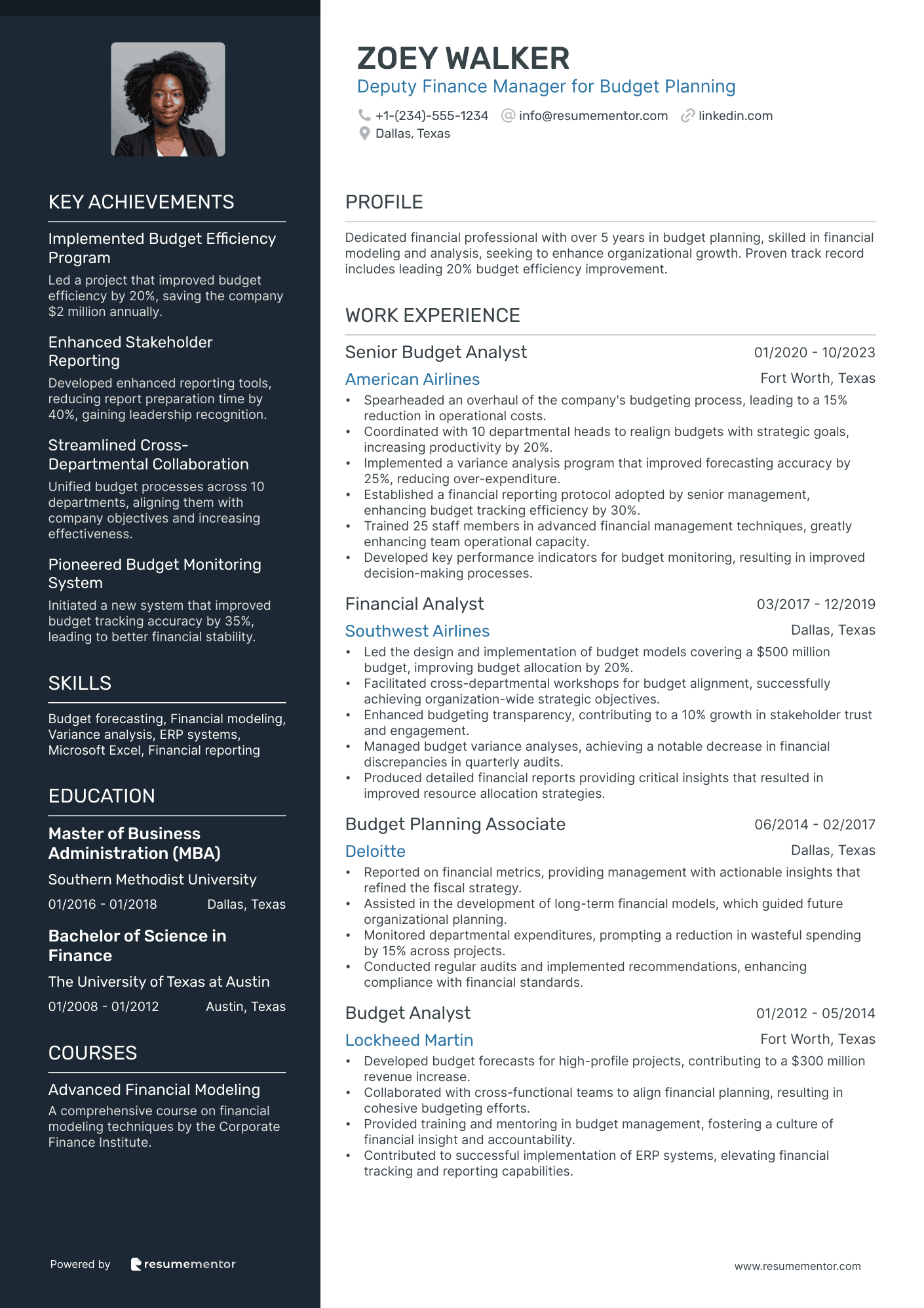

Deputy Finance Manager for Budget Planning

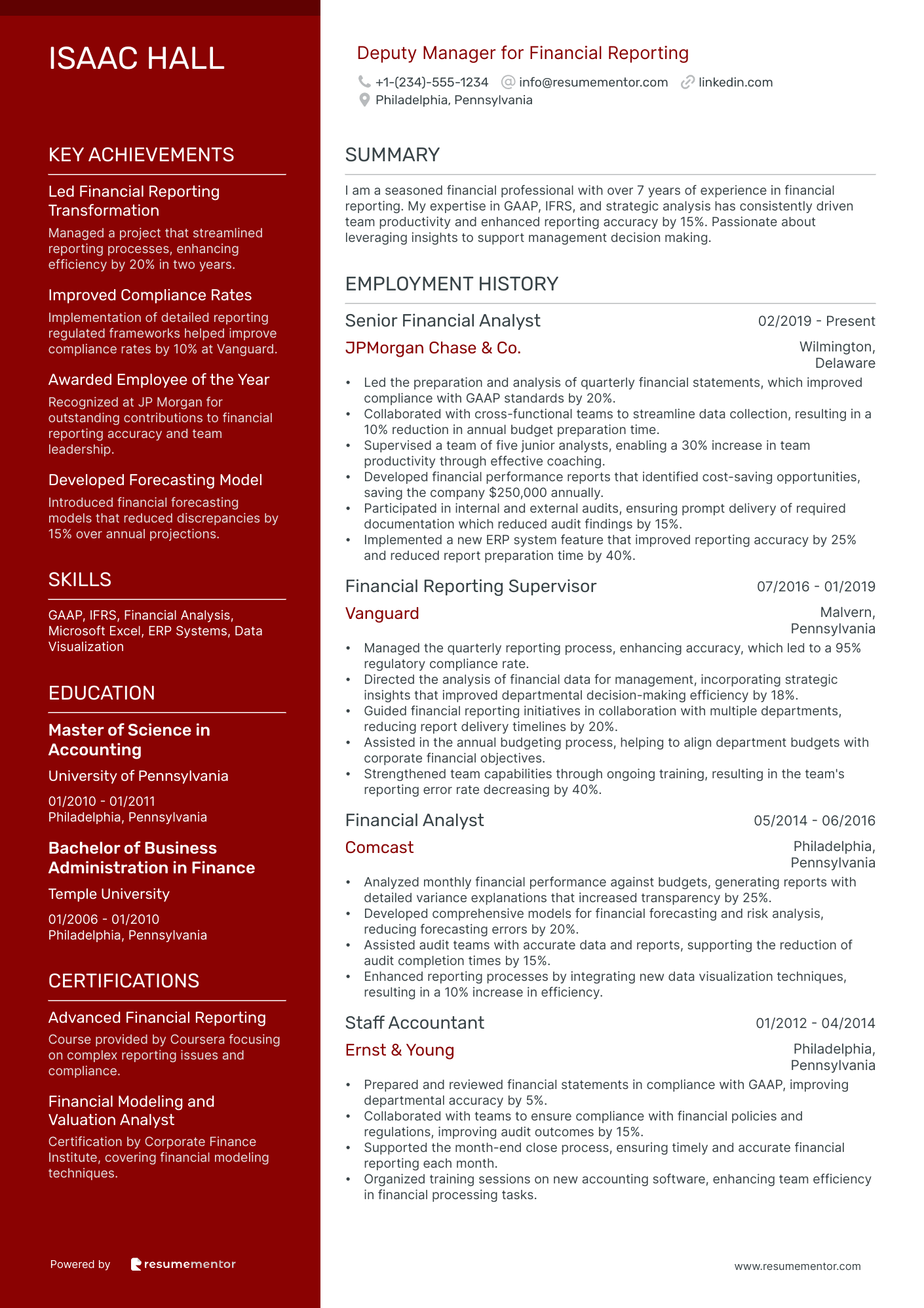

Deputy Manager for Financial Reporting

Deputy Financial Audit Manager

Deputy Corporate Finance Manager

Deputy Manager for Fiscal Policy

Deputy Finance Manager for Strategic Planning

Deputy Treasury and Finance Manager

Deputy Finance Manager for Tax Compliance

Deputy Finance Manager for Investments resume sample

- •Managed a $500 million portfolio, resulting in a 15% increase in returns within 18 months.

- •Developed financial models that improved investment insights, enhancing strategy accuracy by 25%.

- •Collaborated with cross-functional teams to optimize asset allocation, improving recovery time by 20% during market downturns.

- •Presented quarterly investment performance to senior management, focusing on key insights and future opportunities.

- •Conducted comprehensive market analysis, identifying emerging trends and investment risks, enhancing decision-making.

- •Mentored a team of four junior analysts in advanced financial analysis techniques and portfolio management strategies.

- •Assessed potential investment opportunities, leading to a 12% increase in successful funding acquisitions.

- •Improved financial reporting processes, reducing report generation time by 30% and increasing accuracy.

- •Worked closely with senior investment partners to formulate risk mitigation strategies, reducing risks by 10%.

- •Conducted risk assessments, identifying high-risk fund areas and providing proposals to safeguard assets.

- •Communicated complex financial concepts to non-financial stakeholders, enhancing understanding of investment projects.

- •Performed in-depth financial modeling and analysis, supporting capital allocation decisions resulting in growth of 8%.

- •Streamlined budgetary processes, achieving a 25% reduction in operation costs over two fiscal years.

- •Collaborated in the development of financial forecasts, aiding in strategic planning efforts and revenue predictions.

- •Engaged with clients to provide insights on investment strategies, increasing client satisfaction scores by 15%.

- •Assisted in managing extensive investment portfolio valuations, contributing to a 10% increase in net assets.

- •Analyzed financial performance indicators, aiding the finance team in strategic decision-making.

- •Executed compliance procedures to adhere to financial regulations, consistently maintaining 100% compliance.

- •Coordinated with multiple departments to improve data accuracy, enhancing financial report reliability by 20%.

Deputy Finance Risk Management Officer resume sample

- •Led a project that reduced credit risk exposure by 30% through strategic diversification of investment portfolios.

- •Implemented dynamic risk modeling techniques, increasing analysis accuracy by 20%, enhancing decision-making processes.

- •Developed comprehensive risk assessment tools, resulting in a streamlined reporting process and improved data accuracy by 25%.

- •Collaborated with departments to implement regulatory compliance measures, reducing potential regulatory penalties by 40%.

- •Presented risk assessments and mitigation strategies to executive management, enhancing risk visibility across the organization.

- •Trained over 50 staff members on updated risk management practices, enhancing organization’s ability to manage emerging risks effectively.

- •Conducted comprehensive market and liquidity risk assessments, helping clients reduce risk exposure by an average of 15%.

- •Developed client-specific risk mitigation strategies that resulted in a 10% improvement in portfolio resilience under stress scenarios.

- •Provided in-depth analysis and recommendations on risk management frameworks, increasing client compliance with regulatory requirements.

- •Led workshops on risk management best practices, raising awareness and competence among client teams across multiple industries.

- •Created automated reporting tools for clients, increasing efficiency in monitoring and managing financial risk by 35%.

- •Assisted in the assessment and reporting of operational risks, contributing to a 10% reduction in operational losses.

- •Implemented advanced risk assessment models, enhancing the precision of financial risk predictions by 15%.

- •Performed detailed credit risk analyses and assisted in crafting policies that minimized potential impacts by 20%.

- •Collaborated with cross-functional teams to optimize risk management processes, increasing overall efficiency by 12%.

- •Generated assessments of market risk factors, fostering informed decision-making and reducing risk impact by 25%.

- •Analyzed data on financial products, providing insights that enhanced strategic planning and investment decisions.

- •Contributed to the development of risk management policies, increasing compliance with industry best practices by 18%.

- •Assisted in financial forecasting, ensuring risk analyses were integrated into planning processes for effective risk mitigation.

Deputy Finance Manager for Budget Planning resume sample

- •Spearheaded an overhaul of the company's budgeting process, leading to a 15% reduction in operational costs.

- •Coordinated with 10 departmental heads to realign budgets with strategic goals, increasing productivity by 20%.

- •Implemented a variance analysis program that improved forecasting accuracy by 25%, reducing over-expenditure.

- •Established a financial reporting protocol adopted by senior management, enhancing budget tracking efficiency by 30%.

- •Trained 25 staff members in advanced financial management techniques, greatly enhancing team operational capacity.

- •Developed key performance indicators for budget monitoring, resulting in improved decision-making processes.

- •Led the design and implementation of budget models covering a $500 million budget, improving budget allocation by 20%.

- •Facilitated cross-departmental workshops for budget alignment, successfully achieving organization-wide strategic objectives.

- •Enhanced budgeting transparency, contributing to a 10% growth in stakeholder trust and engagement.

- •Managed budget variance analyses, achieving a notable decrease in financial discrepancies in quarterly audits.

- •Produced detailed financial reports providing critical insights that resulted in improved resource allocation strategies.

- •Reported on financial metrics, providing management with actionable insights that refined the fiscal strategy.

- •Assisted in the development of long-term financial models, which guided future organizational planning.

- •Monitored departmental expenditures, prompting a reduction in wasteful spending by 15% across projects.

- •Conducted regular audits and implemented recommendations, enhancing compliance with financial standards.

- •Developed budget forecasts for high-profile projects, contributing to a $300 million revenue increase.

- •Collaborated with cross-functional teams to align financial planning, resulting in cohesive budgeting efforts.

- •Provided training and mentoring in budget management, fostering a culture of financial insight and accountability.

- •Contributed to successful implementation of ERP systems, elevating financial tracking and reporting capabilities.

Deputy Manager for Financial Reporting resume sample

- •Led the preparation and analysis of quarterly financial statements, which improved compliance with GAAP standards by 20%.

- •Collaborated with cross-functional teams to streamline data collection, resulting in a 10% reduction in annual budget preparation time.

- •Supervised a team of five junior analysts, enabling a 30% increase in team productivity through effective coaching.

- •Developed financial performance reports that identified cost-saving opportunities, saving the company $250,000 annually.

- •Participated in internal and external audits, ensuring prompt delivery of required documentation which reduced audit findings by 15%.

- •Implemented a new ERP system feature that improved reporting accuracy by 25% and reduced report preparation time by 40%.

- •Managed the quarterly reporting process, enhancing accuracy, which led to a 95% regulatory compliance rate.

- •Directed the analysis of financial data for management, incorporating strategic insights that improved departmental decision-making efficiency by 18%.

- •Guided financial reporting initiatives in collaboration with multiple departments, reducing report delivery timelines by 20%.

- •Assisted in the annual budgeting process, helping to align department budgets with corporate financial objectives.

- •Strengthened team capabilities through ongoing training, resulting in the team's reporting error rate decreasing by 40%.

- •Analyzed monthly financial performance against budgets, generating reports with detailed variance explanations that increased transparency by 25%.

- •Developed comprehensive models for financial forecasting and risk analysis, reducing forecasting errors by 20%.

- •Assisted audit teams with accurate data and reports, supporting the reduction of audit completion times by 15%.

- •Enhanced reporting processes by integrating new data visualization techniques, resulting in a 10% increase in efficiency.

- •Prepared and reviewed financial statements in compliance with GAAP, improving departmental accuracy by 5%.

- •Collaborated with teams to ensure compliance with financial policies and regulations, improving audit outcomes by 15%.

- •Supported the month-end close process, ensuring timely and accurate financial reporting each month.

- •Organized training sessions on new accounting software, enhancing team efficiency in financial processing tasks.

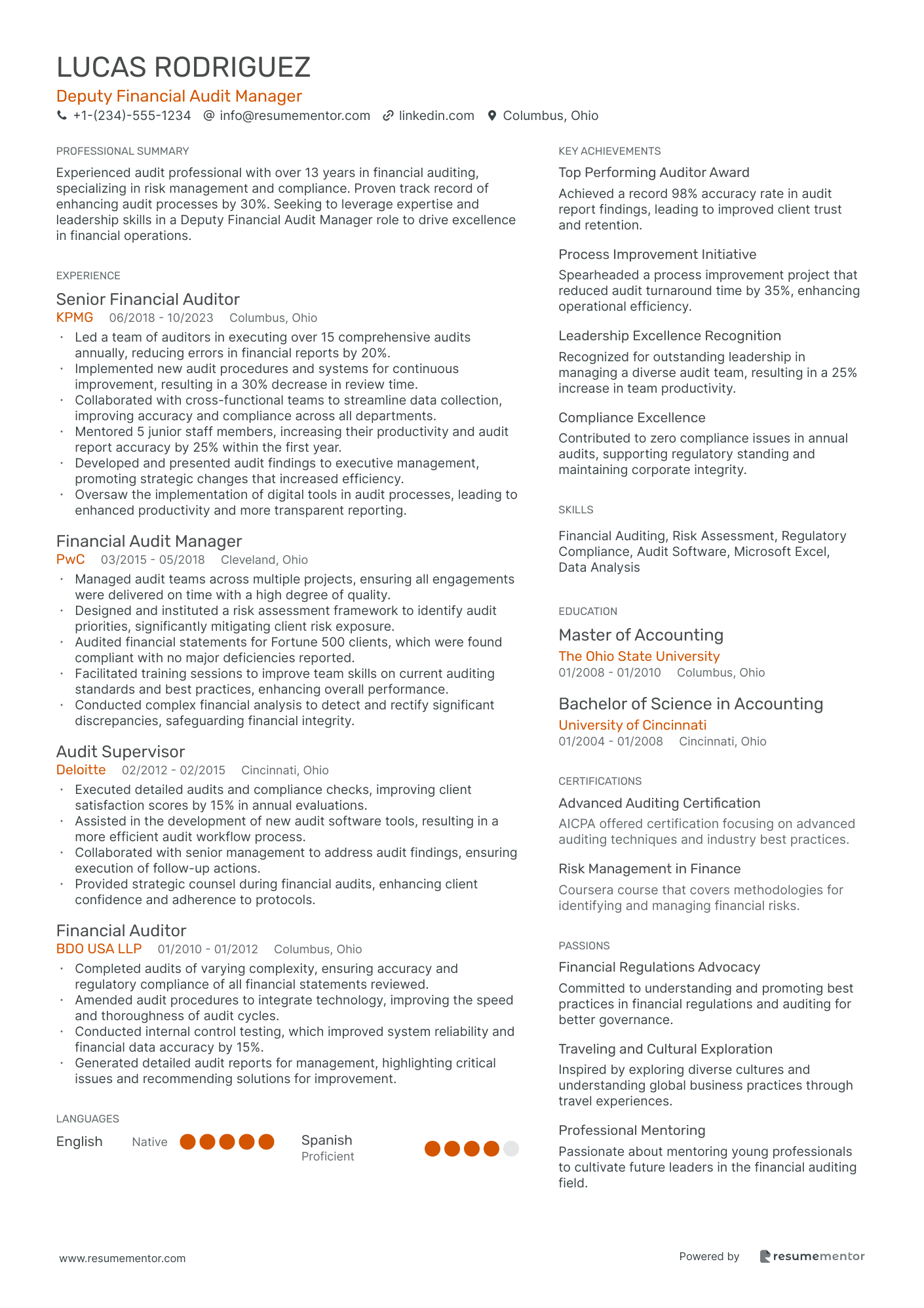

Deputy Financial Audit Manager resume sample

- •Led a team of auditors in executing over 15 comprehensive audits annually, reducing errors in financial reports by 20%.

- •Implemented new audit procedures and systems for continuous improvement, resulting in a 30% decrease in review time.

- •Collaborated with cross-functional teams to streamline data collection, improving accuracy and compliance across all departments.

- •Mentored 5 junior staff members, increasing their productivity and audit report accuracy by 25% within the first year.

- •Developed and presented audit findings to executive management, promoting strategic changes that increased efficiency.

- •Oversaw the implementation of digital tools in audit processes, leading to enhanced productivity and more transparent reporting.

- •Managed audit teams across multiple projects, ensuring all engagements were delivered on time with a high degree of quality.

- •Designed and instituted a risk assessment framework to identify audit priorities, significantly mitigating client risk exposure.

- •Audited financial statements for Fortune 500 clients, which were found compliant with no major deficiencies reported.

- •Facilitated training sessions to improve team skills on current auditing standards and best practices, enhancing overall performance.

- •Conducted complex financial analysis to detect and rectify significant discrepancies, safeguarding financial integrity.

- •Executed detailed audits and compliance checks, improving client satisfaction scores by 15% in annual evaluations.

- •Assisted in the development of new audit software tools, resulting in a more efficient audit workflow process.

- •Collaborated with senior management to address audit findings, ensuring execution of follow-up actions.

- •Provided strategic counsel during financial audits, enhancing client confidence and adherence to protocols.

- •Completed audits of varying complexity, ensuring accuracy and regulatory compliance of all financial statements reviewed.

- •Amended audit procedures to integrate technology, improving the speed and thoroughness of audit cycles.

- •Conducted internal control testing, which improved system reliability and financial data accuracy by 15%.

- •Generated detailed audit reports for management, highlighting critical issues and recommending solutions for improvement.

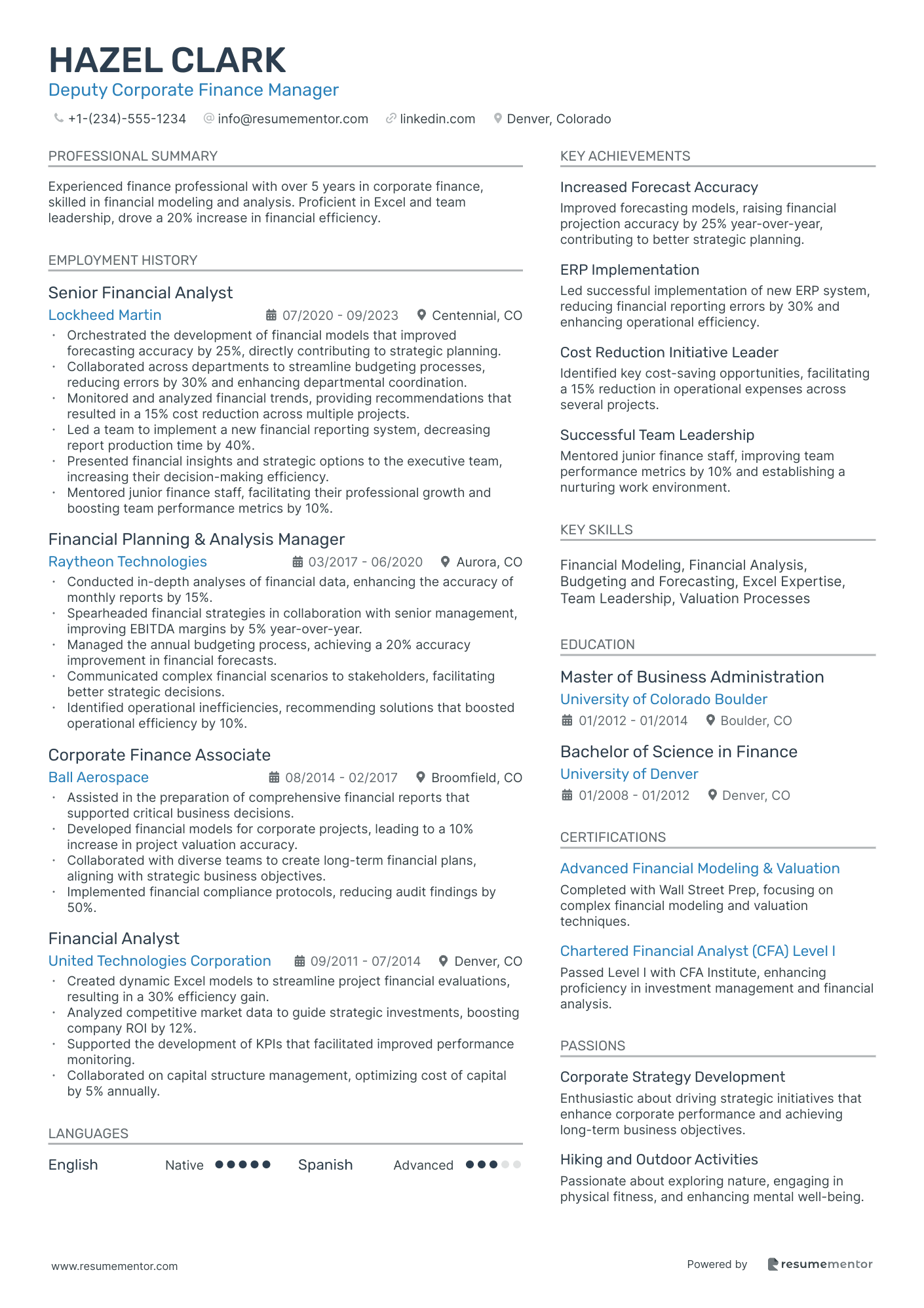

Deputy Corporate Finance Manager resume sample

- •Orchestrated the development of financial models that improved forecasting accuracy by 25%, directly contributing to strategic planning.

- •Collaborated across departments to streamline budgeting processes, reducing errors by 30% and enhancing departmental coordination.

- •Monitored and analyzed financial trends, providing recommendations that resulted in a 15% cost reduction across multiple projects.

- •Led a team to implement a new financial reporting system, decreasing report production time by 40%.

- •Presented financial insights and strategic options to the executive team, increasing their decision-making efficiency.

- •Mentored junior finance staff, facilitating their professional growth and boosting team performance metrics by 10%.

- •Conducted in-depth analyses of financial data, enhancing the accuracy of monthly reports by 15%.

- •Spearheaded financial strategies in collaboration with senior management, improving EBITDA margins by 5% year-over-year.

- •Managed the annual budgeting process, achieving a 20% accuracy improvement in financial forecasts.

- •Communicated complex financial scenarios to stakeholders, facilitating better strategic decisions.

- •Identified operational inefficiencies, recommending solutions that boosted operational efficiency by 10%.

- •Assisted in the preparation of comprehensive financial reports that supported critical business decisions.

- •Developed financial models for corporate projects, leading to a 10% increase in project valuation accuracy.

- •Collaborated with diverse teams to create long-term financial plans, aligning with strategic business objectives.

- •Implemented financial compliance protocols, reducing audit findings by 50%.

- •Created dynamic Excel models to streamline project financial evaluations, resulting in a 30% efficiency gain.

- •Analyzed competitive market data to guide strategic investments, boosting company ROI by 12%.

- •Supported the development of KPIs that facilitated improved performance monitoring.

- •Collaborated on capital structure management, optimizing cost of capital by 5% annually.

Deputy Manager for Fiscal Policy resume sample

- •Led a comprehensive budgetary overhaul resulting in a 15% cost-efficiency increase across various departments.

- •Compiled and presented detailed economic trend analyses to senior management, influencing strategic fiscal direction.

- •Collaborated with state agencies to implement a fiscal modernization project, improving transparency and accountability.

- •Contributed to the development of fiscal policy guidelines leading to enhanced compliance with state regulations.

- •Mentored a team of junior analysts, increasing their productivity by 30% through structured training programs.

- •Facilitated interdepartmental workshops to align fiscal policies with broader organizational objectives, enhancing cross-functional relationships.

- •Analyzed state fiscal structures and provided actionable insights that reduced client expenses by 12%.

- •Developed forecasting models that accurately predicted budget surpluses, aiding in strategic financial planning.

- •Prepared comprehensive fiscal reports, effectively communicating key findings to stakeholders and increasing client retention.

- •Facilitated cross-functional team meetings to integrate fiscal strategies, ensuring cohesive policy implementation.

- •Liaised with municipal agencies to advocate for fiscal policies, contributing to successful legislative changes.

- •Assisted in strategic budget planning, resulting in a 10% increase in allocated resources efficiency.

- •Monitored economic indicators to evaluate fiscal health, supporting decision-making with precise data interpretation.

- •Developed detailed financial presentations for management, which improved their understanding of fiscal challenges.

- •Coordinated with external auditors to ensure compliance with fiscal standards, achieving exemplary audit outcomes.

- •Optimized state budget allocation procedures, resulting in a 9% increase in efficiency.

- •Conducted research on fiscal policies at the federal level, facilitating informed policy development at the state level.

- •Created monthly fiscal policy reports, enhancing transparency and accountability across departments.

- •Engaged with community stakeholders to promote understanding and support for new fiscal initiatives.

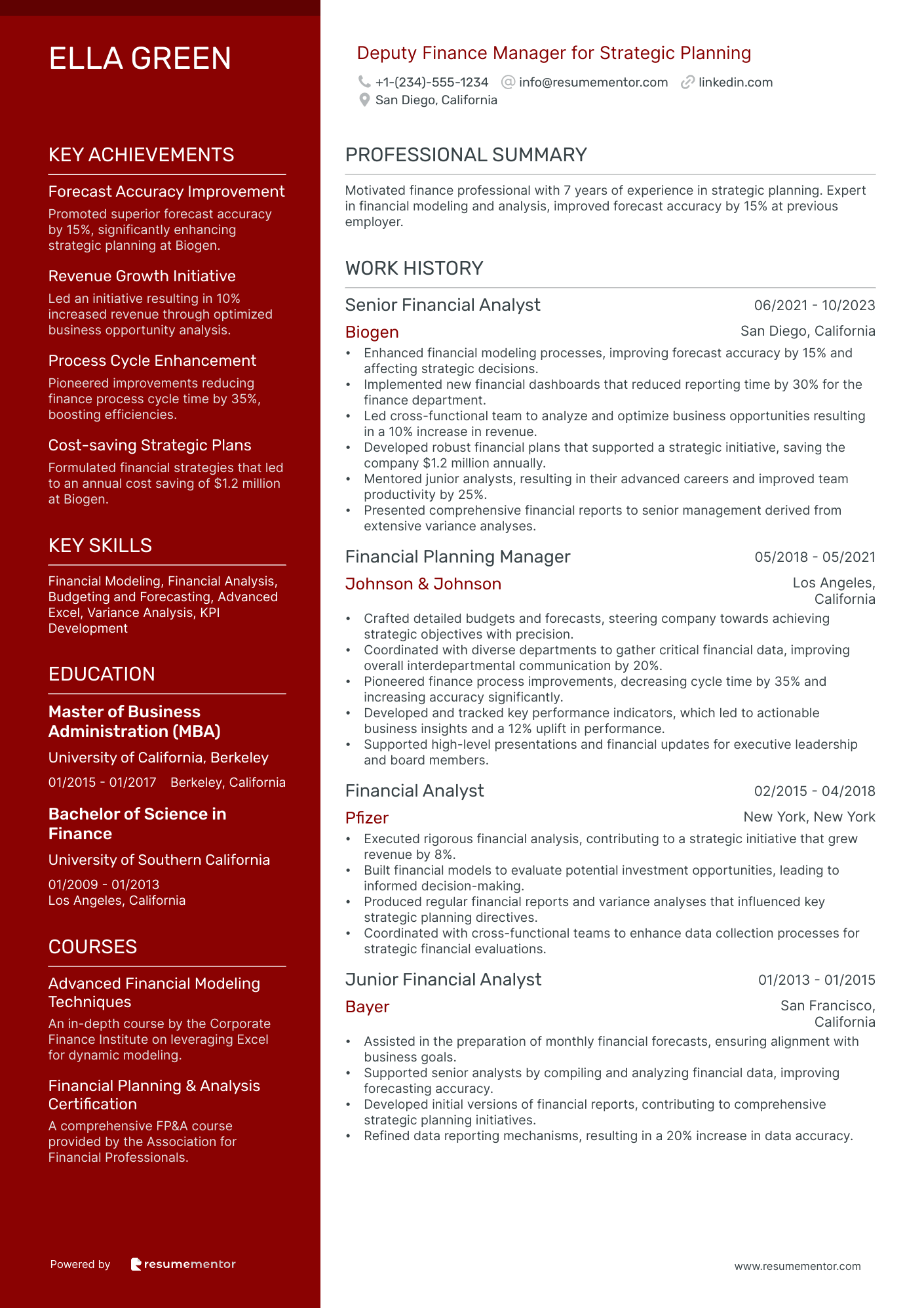

Deputy Finance Manager for Strategic Planning resume sample

- •Enhanced financial modeling processes, improving forecast accuracy by 15% and affecting strategic decisions.

- •Implemented new financial dashboards that reduced reporting time by 30% for the finance department.

- •Led cross-functional team to analyze and optimize business opportunities resulting in a 10% increase in revenue.

- •Developed robust financial plans that supported a strategic initiative, saving the company $1.2 million annually.

- •Mentored junior analysts, resulting in their advanced careers and improved team productivity by 25%.

- •Presented comprehensive financial reports to senior management derived from extensive variance analyses.

- •Crafted detailed budgets and forecasts, steering company towards achieving strategic objectives with precision.

- •Coordinated with diverse departments to gather critical financial data, improving overall interdepartmental communication by 20%.

- •Pioneered finance process improvements, decreasing cycle time by 35% and increasing accuracy significantly.

- •Developed and tracked key performance indicators, which led to actionable business insights and a 12% uplift in performance.

- •Supported high-level presentations and financial updates for executive leadership and board members.

- •Executed rigorous financial analysis, contributing to a strategic initiative that grew revenue by 8%.

- •Built financial models to evaluate potential investment opportunities, leading to informed decision-making.

- •Produced regular financial reports and variance analyses that influenced key strategic planning directives.

- •Coordinated with cross-functional teams to enhance data collection processes for strategic financial evaluations.

- •Assisted in the preparation of monthly financial forecasts, ensuring alignment with business goals.

- •Supported senior analysts by compiling and analyzing financial data, improving forecasting accuracy.

- •Developed initial versions of financial reports, contributing to comprehensive strategic planning initiatives.

- •Refined data reporting mechanisms, resulting in a 20% increase in data accuracy.

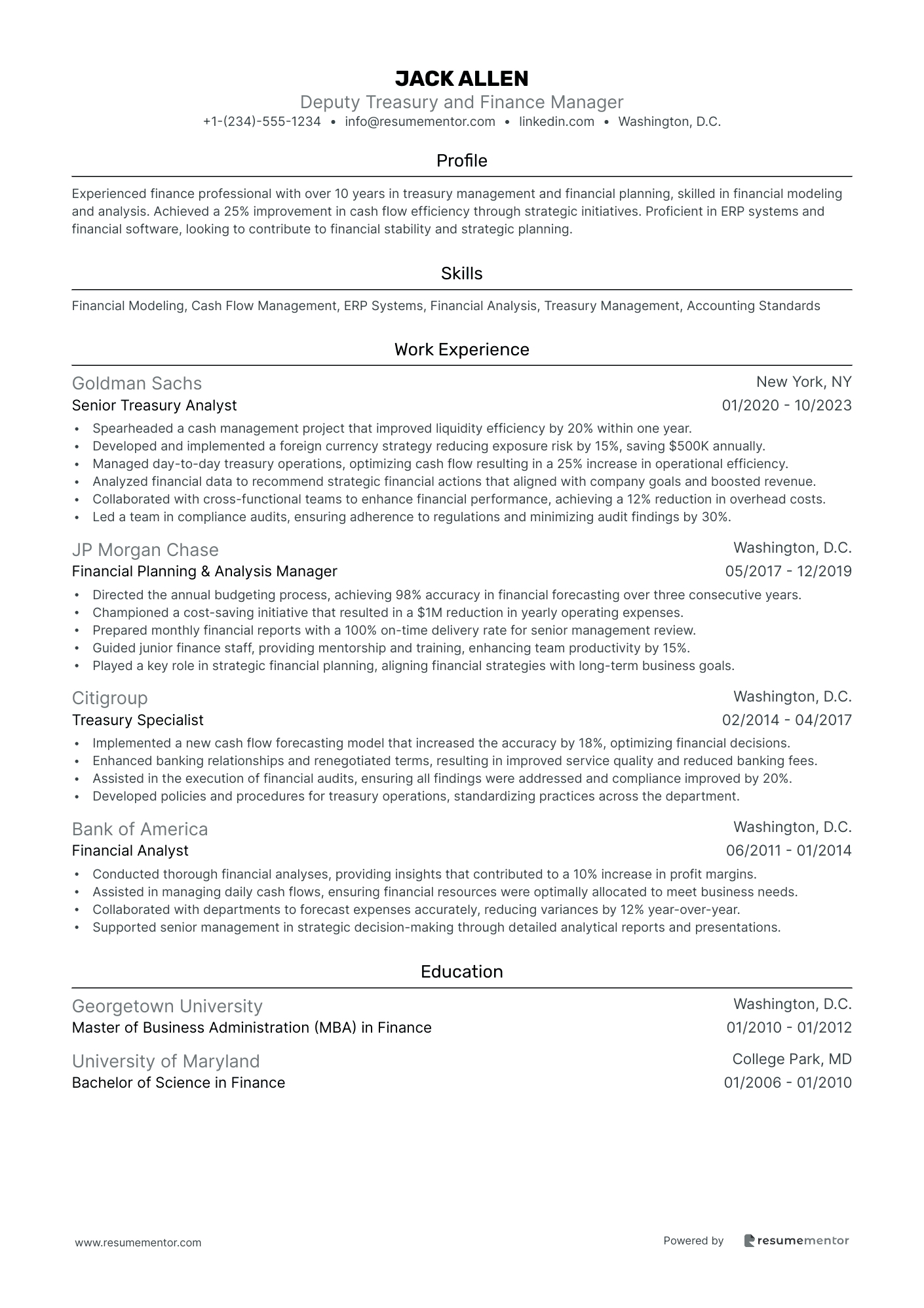

Deputy Treasury and Finance Manager resume sample

- •Spearheaded a cash management project that improved liquidity efficiency by 20% within one year.

- •Developed and implemented a foreign currency strategy reducing exposure risk by 15%, saving $500K annually.

- •Managed day-to-day treasury operations, optimizing cash flow resulting in a 25% increase in operational efficiency.

- •Analyzed financial data to recommend strategic financial actions that aligned with company goals and boosted revenue.

- •Collaborated with cross-functional teams to enhance financial performance, achieving a 12% reduction in overhead costs.

- •Led a team in compliance audits, ensuring adherence to regulations and minimizing audit findings by 30%.

- •Directed the annual budgeting process, achieving 98% accuracy in financial forecasting over three consecutive years.

- •Championed a cost-saving initiative that resulted in a $1M reduction in yearly operating expenses.

- •Prepared monthly financial reports with a 100% on-time delivery rate for senior management review.

- •Guided junior finance staff, providing mentorship and training, enhancing team productivity by 15%.

- •Played a key role in strategic financial planning, aligning financial strategies with long-term business goals.

- •Implemented a new cash flow forecasting model that increased the accuracy by 18%, optimizing financial decisions.

- •Enhanced banking relationships and renegotiated terms, resulting in improved service quality and reduced banking fees.

- •Assisted in the execution of financial audits, ensuring all findings were addressed and compliance improved by 20%.

- •Developed policies and procedures for treasury operations, standardizing practices across the department.

- •Conducted thorough financial analyses, providing insights that contributed to a 10% increase in profit margins.

- •Assisted in managing daily cash flows, ensuring financial resources were optimally allocated to meet business needs.

- •Collaborated with departments to forecast expenses accurately, reducing variances by 12% year-over-year.

- •Supported senior management in strategic decision-making through detailed analytical reports and presentations.

Deputy Finance Manager for Tax Compliance resume sample

- •Spearheaded the enhancement of tax compliance procedures, leading a team of 5 to streamline processes, decreasing reporting time by 30%.

- •Initiated and developed strategic tax planning solutions, resulting in a 25% reduction in corporate tax liabilities over the past 12 months.

- •Managed the preparation and submission of federal and state tax returns for multiple entities, enhancing accuracy and compliance by over 95%.

- •Assessed the impact of new tax legislation promptly, advising senior management on operational adjustments, mitigating potential risks efficiently.

- •Led a primary role in key financial audits, liaising with external auditors and ensuring seamless data provision, enhancing audit readiness by 40%.

- •Collaborated with IT to integrate advanced tax software, improving tax calculation accuracy and reducing manual intervention by 50%.

- •Led tax compliance reviews across Southeast U.S. region, ensuring 100% compliance with local tax regulations through comprehensive audits.

- •Designed and implemented a database system for managing tax documentation, streamlining access, and reducing retrieval time by 40%.

- •Examined tax returns for over 30 clients annually, achieving a 98% on-time filing rate and enhancing client satisfaction through precision.

- •Monitored and communicated evolving tax laws to cross-functional teams, mitigating compliance issues and maintaining regulatory adherence.

- •Directed complex corporate tax planning initiatives, successfully reducing client tax obligations by $500,000 within two fiscal years.

- •Advised clients on strategic tax planning, increasing savings and reducing tax liabilities by an average of 15% annually.

- •Conducted detailed tax research and analysis, generating insightful reports that informed senior management decisions.

- •Coordinated with auditors during tax evaluations, providing thorough documentation and achieving a 100% compliance track record.

- •Facilitated training workshops for junior analysts on tax laws and compliance, enhancing team efficiency by 20%.

- •Prepared individual and corporate tax returns, increasing accuracy and on-time submissions by 25% through meticulous review processes.

- •Developed tax-saving strategies for clients, optimizing returns and increasing client retention by 10%.

- •Assisted in maintaining compliance with international tax laws, enhancing the company's global operations efficiency by supporting cross-border solutions.

- •Improved tax software database by implementing updates and resolving user issues, increasing system performance by 30%.

As a deputy finance manager, you're skilled at making numbers sing for your organization, yet expressing that expertise on a resume can feel daunting. Serving as the co-pilot of your company's financial journey, it's crucial that your influence is clear right from the beginning. With a competitive job market, crafting a resume that truly reflects your capabilities is essential for making a strong impression.

This challenge often lies in blending your technical expertise with your leadership accomplishments seamlessly. You need to clearly communicate how you add value to potential employers, though it can be tough to integrate these elements into a cohesive story. The varied responsibilities you handle can make organizing your achievements into an engaging resume difficult.

A resume template can act as a helpful guide, providing the structure needed to focus on the story you want to tell. This approach lets you highlight your strengths, like improving an organization’s financial health or successfully leading audits, in a way that's both clear and professional. You can explore some solid resume templates to get started.

Starting your job search with a polished, thoughtfully crafted resume sets the stage for success. An effective resume paints a vivid picture for potential employers, illustrating your knack for leading financial strategies with precision and skill. Being prepared with a standout resume ensures you're ready to seize your next opportunity when it arises.

Key Takeaways

- Creating a compelling deputy finance manager resume requires effectively conveying your financial expertise and leadership abilities to potential employers.

- Organizing your resume with a clear structure using resume templates helps highlight your strengths and achievements, such as improving financial health and leading audits.

- Choosing the right resume format, professional fonts, and saving it as a PDF are crucial steps to maintain a polished and consistent presentation of your qualifications.

- Incorporating quantifiable experiences, skills, and relevant education enhances the resume's impact by showcasing your contributions and readiness for the role.

- Including additional sections like languages, hobbies, volunteer work, or industry-relevant books can present you as a well-rounded and dynamic candidate.

What to focus on when writing your deputy finance manager resume

A deputy finance manager resume should clearly convey your financial expertise and leadership abilities to the recruiter. It should demonstrate how your skills in managing financial operations and analyzing data support strategic decision-making, presenting you as a reliable and skilled professional capable of driving financial success.

How to structure your deputy finance manager resume

- Contact Information: Start with your full name, phone number, email, and LinkedIn profile to ensure recruiters can easily contact you—this basic information sets the foundation for your resume, ensuring all other details are anchored to you as an individual.

- Professional Summary: Follow up with a brief statement about your finance experience and accomplishments, focusing on strengths like financial analysis, budgeting, and leadership to set the tone for your qualifications—this section is a snapshot that captures your professional essence and piques the recruiter's interest.

- Work Experience: Next, list your job roles in reverse chronological order. Use this section to highlight achievements related to financial reporting, cost management, and operational efficiency, showing how your experience supports the skills mentioned in your summary—this part of the resume demonstrates how your past roles align with the responsibilities of a deputy finance manager.

- Education: Include your degrees in finance or related fields, along with school names and graduation dates. Adding relevant certifications like CPA or CFA will reinforce your professional credibility—this shows that you have the foundational knowledge and credentials needed for the role.

- Skills: Detail key finance skills such as financial planning, forecasting, and software proficiency, highlighting how these abilities enable you to excel in your roles—this section gives insight into what you can bring to the team in practical terms.

- Achievements: Round out your resume by emphasizing accomplishments like reducing financial discrepancies, leading successful audits, or improving investment returns, illustrating the impact of your skills and experience—this helps demonstrate the tangible results of your contributions in previous positions.

Which resume format to choose

Creating a standout resume as a deputy finance manager is crucial in the finance industry, and choosing the right format can significantly impact how hiring managers perceive your application. A reverse chronological format is highly effective because it showcases your most recent experiences and accomplishments upfront, demonstrating your growth and relevance in the finance sector.

In addition to the format, selecting the right font can contribute to a professional appearance. Fonts like Lato, Montserrat, and Raleway offer a modern, clean look that maintains readability, which is key when presenting detailed financial information. These fonts help your resume look current and can subtly convey your attention to detail and style.

Moreover, always save your resume as a PDF file. This is crucial because it ensures that your careful formatting remains intact and your document appears exactly as intended on any device. This reliability is important in conveying your professionalism and ensuring that nothing gets lost in translation.

Lastly, maintain a standard 1-inch margin on all sides of your resume. Adequate white space helps guide the reader's eye and makes your content more digestible, which is especially important when presenting complex financial details or achievements. When all these elements are combined thoughtfully, your resume not only looks polished but effectively communicates your qualifications in the competitive finance industry.

How to write a quantifiable resume experience section

The experience section of a deputy finance manager resume should clearly present your expertise and achievements. By highlighting your impact with tangible results, you effectively show your contributions in past roles. Incorporate action words like "led," "developed," and "streamlined" to emphasize your role and effectiveness. Organize your experience, beginning with your most recent job to reflect your career growth. Tailor your resume to the job you're targeting, focusing on relevant experiences. Include roles from the last 10-15 years unless older positions add unique value. Keeping it clear and focused ensures it grabs an employer's attention.

- •Boosted efficiency by 20% with automated financial reporting processes.

- •Led a team to cut costs by $2 million/year by streamlining budgeting.

- •Created a forecasting model that reduced budget variances by 15%.

- •Introduced a financial tool enhancing decision-making for senior management.

This experience section is strong because it cohesively ties your past contributions and concrete achievements. By focusing on measurable impacts, like efficiency improvements and cost reductions, it demonstrates your capacity to enhance financial operations effectively. Using action words tied to these outcomes illustrates your proactive role in value addition. This approach smoothly conveys your strengths as a finance professional, ensuring your resume attracts the attention of hiring managers.

Project-Focused resume experience section

A project-focused Deputy Finance Manager resume experience section should effectively showcase your leadership in coordinating and managing financial projects. Begin with your job title, the company name, and the duration of your employment. Clearly articulate the projects you've been involved in, highlighting your role and the positive impacts. Use bullet points to present your accomplishments, showcasing your skills in a clear and concise manner.

When detailing your experience, weave together the scope of each project with your key contributions. Demonstrate measurable outcomes, such as cost reductions or improvements in processes, to highlight your impact. Emphasize your leadership and problem-solving abilities by illustrating how you navigated challenges and ensured successful project completion on time and within budget. Make sure each entry reflects responsibilities and achievements that are aligned with the job you are pursuing, ensuring your resume captures attention and underscores your value as a candidate.

Deputy Finance Manager

ABC Corporation

Jan 2020 - Present

- Led a cross-functional team to implement a new financial software, cutting reporting time by 30%.

- Coordinated budget planning for three major projects, achieving a 15% cost saving.

- Streamlined project financial processes, boosting data accuracy by 20%.

- Assisted in developing financial training for project managers, enhancing their financial skills.

Problem-Solving Focused resume experience section

A Problem-Solving Focused Deputy Finance Manager resume experience section should effectively showcase how you tackle financial challenges and develop practical solutions. Begin by clearly stating your job title, the company you worked for, and your employment period, setting the stage for the accomplishments that follow. In the bullet points, highlight specific issues you encountered in the finance department and describe the direct actions you took to address them. Make sure to emphasize the results of your initiatives, whether they delivered cost savings, streamlined processes, or enhanced financial accuracy, using numbers or percentages to reinforce the impact of your achievements.

To ensure a natural flow, tie your problem-solving approach to tangible benefits for the organization. Describe how your initiative in developing strategies or improvements led to positive outcomes in financial performance. Include examples of teamwork, especially if your solutions required cross-departmental collaboration, and highlight your capability to lead projects to success, even when faced with challenges. By varying the structure of the bullet points, you keep the content engaging while fully conveying your expertise and accomplishments.

Deputy Finance Manager

ABC Corp

June 2020 - August 2023

- Created an expense tracking system that cut costs by 15% in the first year, demonstrating your ability to identify cost-saving opportunities.

- Led a team to resolve a budgeting issue, saving the company $200,000, showcasing your leadership skills and attention to detail.

- Implemented new financial software that sped up invoice processing by 30%, highlighting your technical proficiency and process improvement skills.

- Teamed up with IT to upgrade cybersecurity, keeping all financial data safe and emphasizing your commitment to data security and cross-functional collaboration.

Innovation-Focused resume experience section

A deputy finance manager resume experience section should effectively showcase how you've driven innovation within financial systems and strategic decision-making. Begin by listing your employment dates, job title, and the company's name, adding a brief description for context if it enhances understanding. Use bullet points to outline specific responsibilities and achievements, emphasizing the innovative approaches you've taken.

As you describe your work, connect your initiatives to their outcomes, using numbers and percentages to quantify success. For instance, mention how a new budgeting software you implemented reduced processing time, leading to notable efficiency gains. Highlight how you led cost-saving measures and transitioned to digital invoicing, which not only cut costs but also minimized errors. Finally, illustrate how collaboration with teams enhanced financial transparency and accuracy, underscoring a proactive stance in adapting to industry changes.

Deputy Finance Manager

Tech Innovations Inc.

June 2020 - Present

- Led the implementation of a new budgeting software, reducing processing time by 30%.

- Developed and executed a strategic cost-cutting plan, saving the company 15% in overhead expenses.

- Spearheaded the transition to digital invoicing, enhancing efficiency and reducing errors by 25%.

- Collaborated with cross-functional teams to innovate financial reporting systems, improving transparency and accuracy.

Customer-Focused resume experience section

A customer-focused deputy finance manager resume experience section should highlight how your financial skills directly improve customer satisfaction. Start by listing your job title and workplace, adding a brief description if necessary, but concentrate on detailing your achievements. Use active verbs to illustrate your contribution to the company's success, emphasizing roles and achievements that show your impact. Each bullet point should encapsulate a notable accomplishment, providing potential employers a clear view of your expertise.

Connect each point to demonstrate a seamless narrative of your career journey. If you have improved billing procedures that resulted in faster payment processing and happier customers, explain how this change impacted the company's overall performance. Quantifying these achievements adds credibility and depth, helping employers see the tangible results of your work.

Deputy Finance Manager

ABC Financial Solutions

June 2018 - Present

- Enhanced customer satisfaction by streamlining financial service processes, cutting service time by 20%.

- Led a team to improve collection rates by 15% through optimized billing procedures, which strengthened client trust.

- Created insightful financial reports that boosted decision-making, contributing to a 10% revenue increase and overall business growth.

- Collaborated with sales and support teams to solve billing issues, which improved customer retention by 12% and reinforced long-term relationships.

Write your deputy finance manager resume summary section

A finance-focused Deputy Finance Manager resume should start with a strong summary that clearly showcases your skills and achievements. This section is crucial for catching the employer's attention and should concisely highlight your expertise. For example:

This example effectively highlights specific experiences, accomplishments, and leadership skills that are essential for the role, demonstrating how you've successfully led teams and driven financial success. Describing yourself well in a resume summary not only helps you stand out but also shows what makes you unique and how your strengths align with the job. By spotlighting past impacts using specific achievements and even metrics, you avoid vague descriptions and instead emphasize your value.

Understanding the differences between a resume summary, objective, and profile can guide your choice. A summary focuses on your career background and achievements, making it particularly suited for experienced professionals. In contrast, an objective is more about stating career goals, and a resume profile combines skills with ambitions. Meanwhile, a summary of qualifications zooms in on particular achievements. Each serves a different purpose, so choose based on your career stage and experience.

For roles like Deputy Finance Manager, those with experience often benefit from a summary because it allows you to showcase past results that align perfectly with the new role. Tailoring your summary to the specific job can make a strong impact on potential employers and ensure that your resume clearly reflects your professional journey and aspirations.

Listing your deputy finance manager skills on your resume

A skills-focused deputy finance manager resume should effectively showcase your abilities and strengths. You can choose to highlight these skills in a standalone section or integrate them into your professional summary and experience areas. Your strengths, especially your soft skills, demonstrate your ability to collaborate and communicate effectively, while your hard skills are specific technical abilities essential for the role.

By including your skills and strengths, you also introduce powerful keywords into your resume. These keywords help you navigate automated systems and capture the attention of hiring managers. Here’s an effective example of a skills section that focuses on what's most relevant for a deputy finance manager:

This skills section is focused and relevant because each skill is crucial for success as a deputy finance manager. It emphasizes your readiness for technical demands and incorporates important keywords to boost your resume's visibility.

Best hard skills to feature on your deputy finance manager resume

Your hard skills should underscore your capacity to manage complex financial tasks efficiently. Essential skills such as managing reports, handling budgets, and conducting financial analysis are vital. Consider these 15 hard skills as central to your resume:

Hard Skills

- Project Management

- Financial Analysis

- Budgeting and Forecasting

- Risk Management

- Financial Reporting

- Tax Compliance

- Cost Control

- Excel Proficiency

- Financial Software (e.g., SAP, Oracle)

- Accounting Principles

- Regulatory Knowledge

- Strategic Planning

- Data Analysis

- Cash Flow Management

- Auditing

Best soft skills to feature on your deputy finance manager resume

While your hard skills convey technical proficiency, your soft skills reveal your ability to work well with others and adapt to changes. These skills highlight how you interact effectively in the workplace. Here are 15 valuable soft skills to feature:

Soft Skills

- Communication

- Leadership

- Time Management

- Problem-Solving

- Adaptability

- Team Collaboration

- Critical Thinking

- Detail Orientation

- Decision-Making

- Organization

- Interpersonal Skills

- Negotiation

- Conflict Resolution

- Emotional Intelligence

- Initiative

How to include your education on your resume

Your education section is a critical part of your deputy finance manager resume. Tailoring this section to align with the job you're aiming for is key. Leave out any irrelevant education that doesn't support your role as a deputy finance manager. When adding your GPA, decide if it enhances your application; include it if it's impressive, typically above 3.5 out of 4. Highlight honors like cum laude alongside your degree, as it distinguishes your academic excellence. Clearly list your degree, such as "Bachelor of Science in Finance," along with the institution's name, location, and relevant dates.

Let's look at two examples:

The second example is exemplary because it lists a relevant degree, "Bachelor of Science in Finance," ideal for a deputy finance manager. It highlights "Magna Cum Laude", underscoring academic achievement. Additionally, a solid GPA of 3.8/4.0 is included, enhancing credibility. Providing the location of the institution isn't necessary here, but the strong structure and relevant degree shine.

How to include deputy finance manager certificates on your resume

Including a certificates section in your deputy finance manager resume is a great way to showcase your qualifications. Listing these details can make you stand out.

To create this section, start with listing the name of each certificate you have earned. Follow this by including the date when you received each certificate. Adding the issuing organization will give credibility to your achievements. Ensure that you include certificates relevant to finance.

Certificates can also be featured in the header for quick visibility. For example, "CPA - Certified Public Accountant, CFA - Chartered Financial Analyst".

This example is effective because it clearly states each certificate, the issuer, and is directly related to a finance role. The certificates listed, such as CPA and CFA, are well-known and respected in the finance industry. This makes it clear that you have the necessary qualifications for the deputy finance manager position.

Extra sections to include in your deputy finance manager resume

In today's competitive job market, crafting a resume that highlights diverse skills and experiences can make a difference. For a deputy finance manager position, a well-rounded resume can help you stand out and showcase your suitability for the role.

Language section—Showcase any additional languages you speak to highlight your communication skills and cultural awareness. Mentioning proficiency in languages such as Spanish or Mandarin can be particularly beneficial for international finance roles.

Hobbies and interests section—List hobbies that demonstrate skills relevant to finance, such as chess for analytical thinking, or running for discipline. This can help the recruiter see you as a well-rounded individual who can bring additional skills to the team.

Volunteer work section—Include volunteer work to show your commitment to social responsibility and community engagement. This highlights your ability to manage diverse tasks and contribute positively to the work environment.

Books section—Mention finance-related books or industry journals you’ve read to underline your commitment to ongoing education. This section shows that you're dedicated to staying informed about the latest trends and theories in the field.

Incorporating these sections can give potential employers a more comprehensive view of your qualifications and interests, making your resume memorable. Presenting yourself as a multifaceted candidate with varied skills and knowledge can set you apart from others in the pool. Adding these details supports your professional story and showcases your enthusiasm for both personal and professional growth.

In Conclusion

In conclusion, crafting a standout resume as a deputy finance manager requires a thoughtful blend of technical expertise and demonstrated leadership success. It is essential to present a cohesive story that captures the value you bring to potential employers, addressing the varied responsibilities of your role. Using a well-structured resume template can guide you in showcasing your strengths, like improving financial health or leading successful audits, clearly and professionally. Remember, each section of your resume should communicate your contributions, especially with quantifiable outcomes, to make a solid impression in the competitive job market. Highlighting both hard and soft skills, as well as relevant certifications, will boost your resume's appeal. Adding extra sections, such as language proficiencies or volunteer work, can provide a more comprehensive view of who you are as a candidate. Always tailor your resume to the job you are applying for, emphasizing experiences and skills that are relevant to that role. By using a clear, modern format and ensuring your achievements are prominent, you're set up to capture the attention of hiring managers. This approach not only demonstrates your qualifications but also reflects the strategic mindset crucial for success in finance roles. With a polished, well-organized resume, you're well-prepared to seize the next opportunity in your career journey.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.