Division Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Master the art of crafting your division accountant resume: A step-by-step guide to balancing qualifications and achievements for your dream job title."

Rated by 348 people

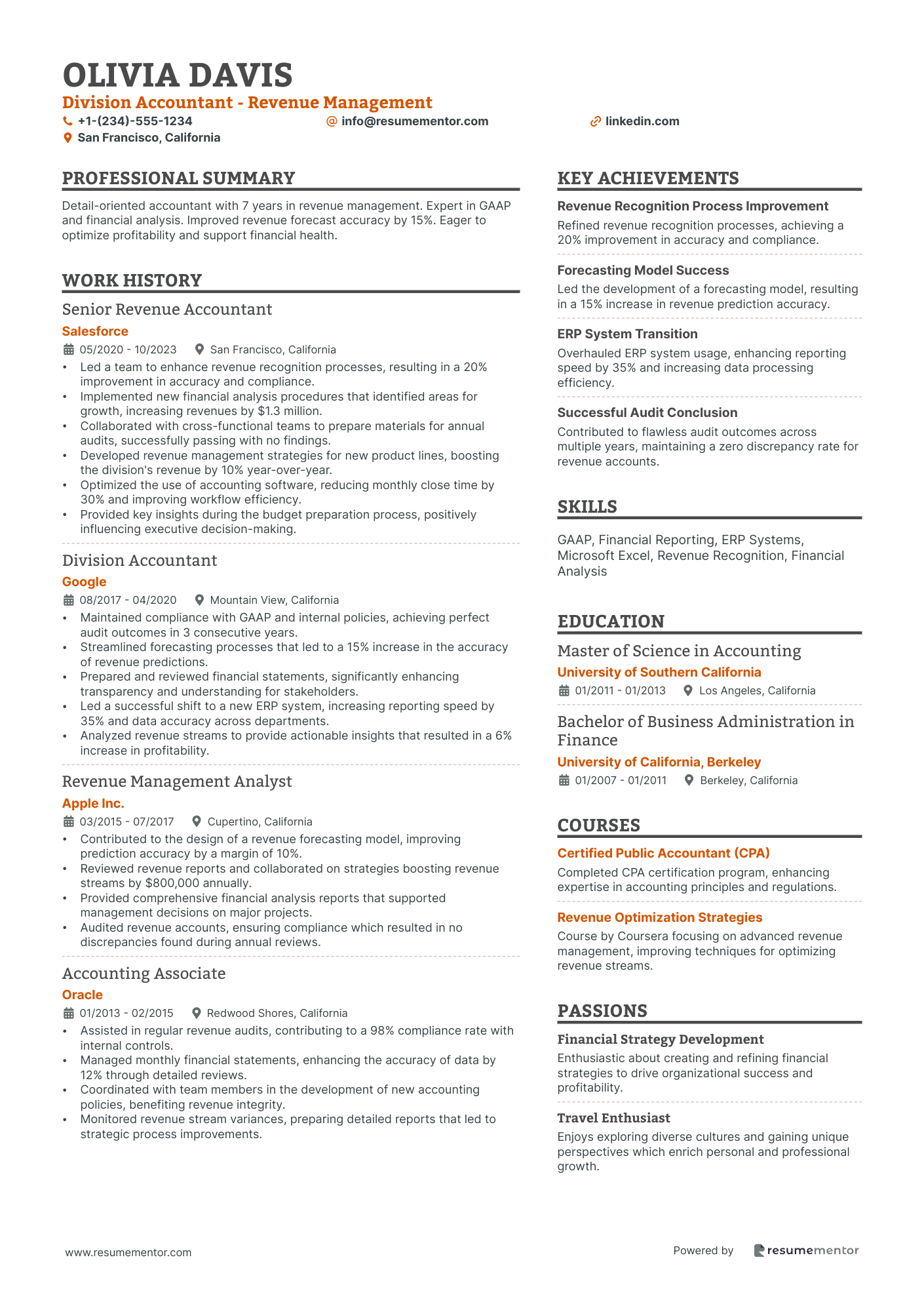

Division Accountant - Revenue Management

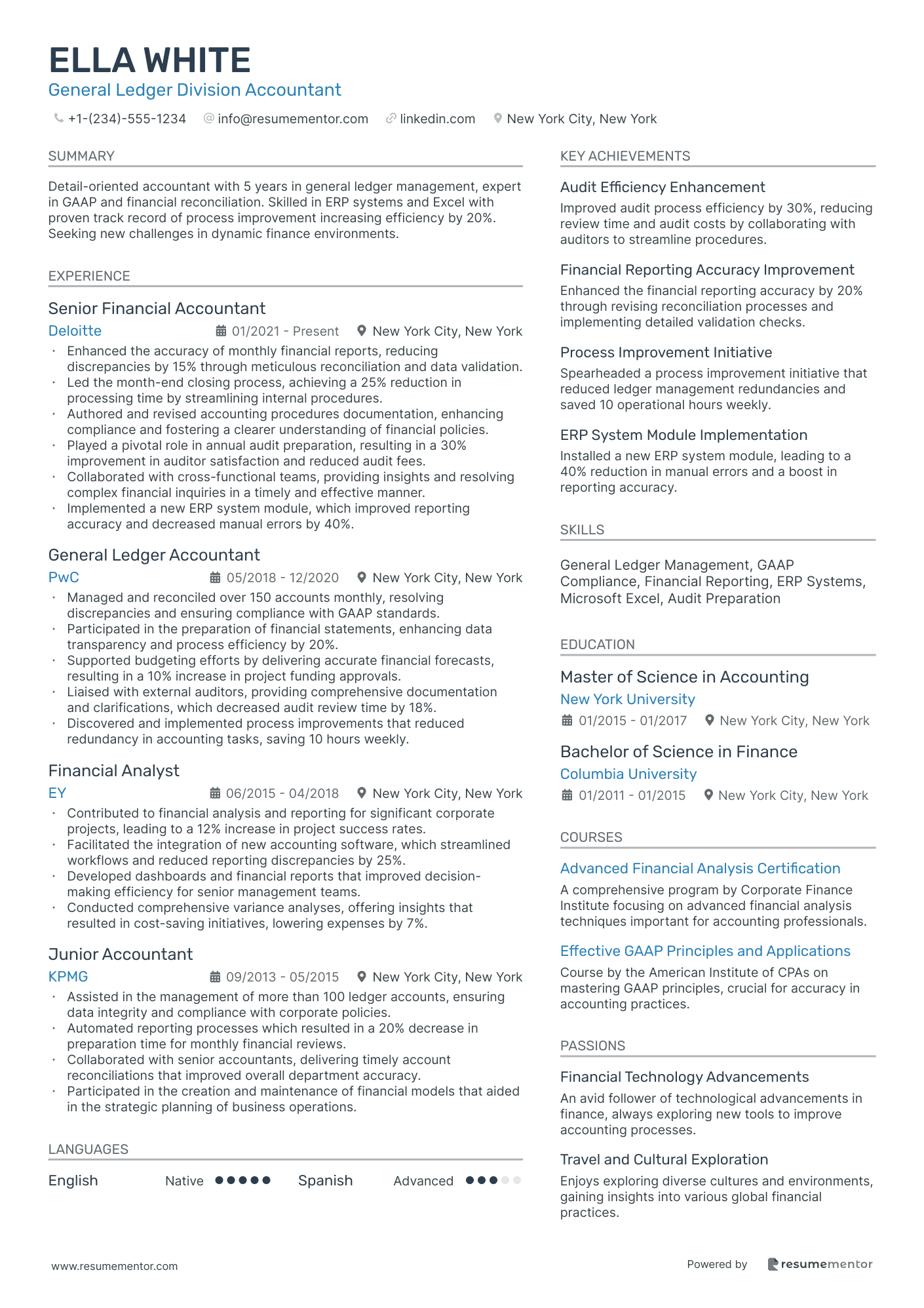

General Ledger Division Accountant

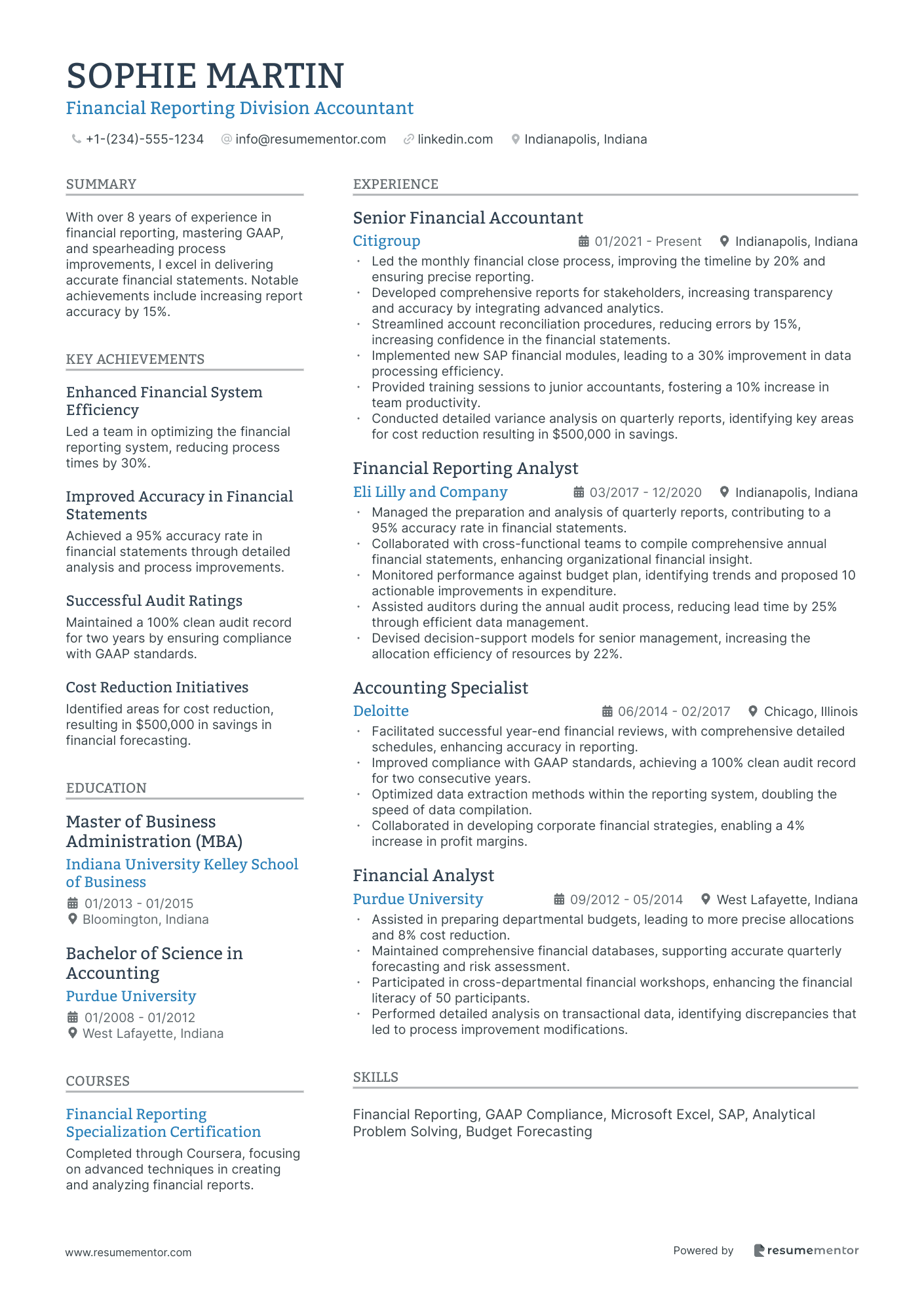

Financial Reporting Division Accountant

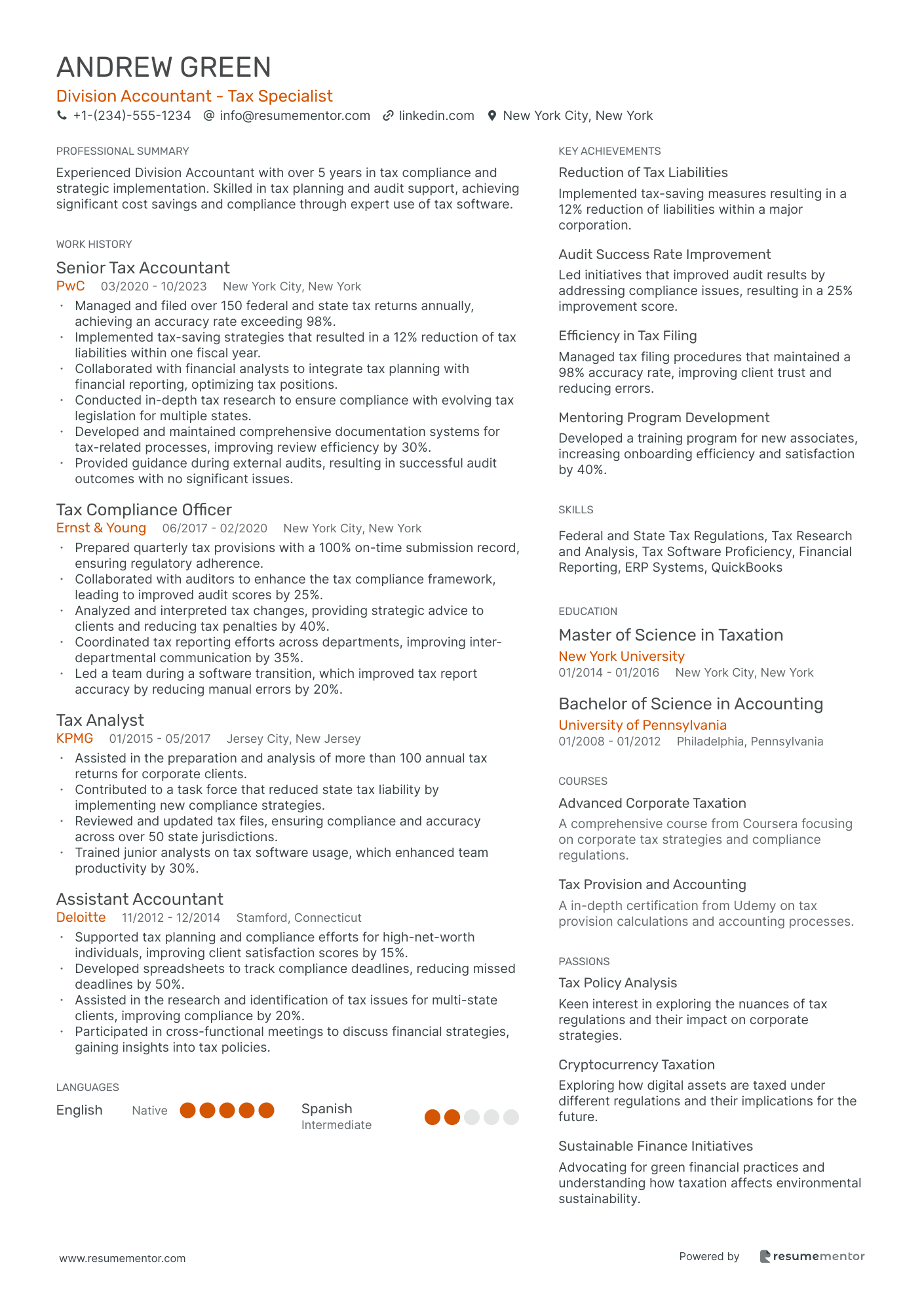

Division Accountant - Tax Specialist

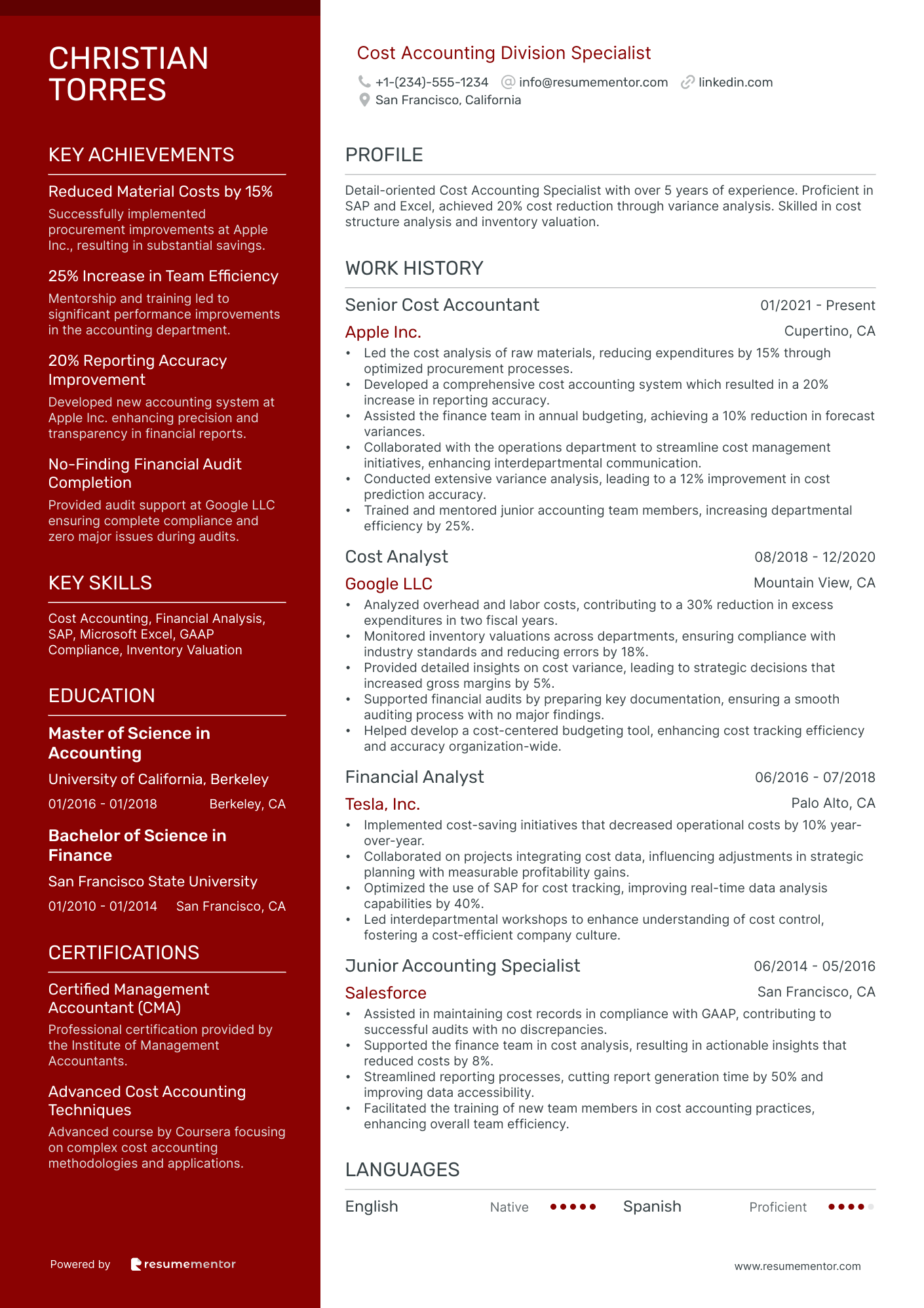

Cost Accounting Division Specialist

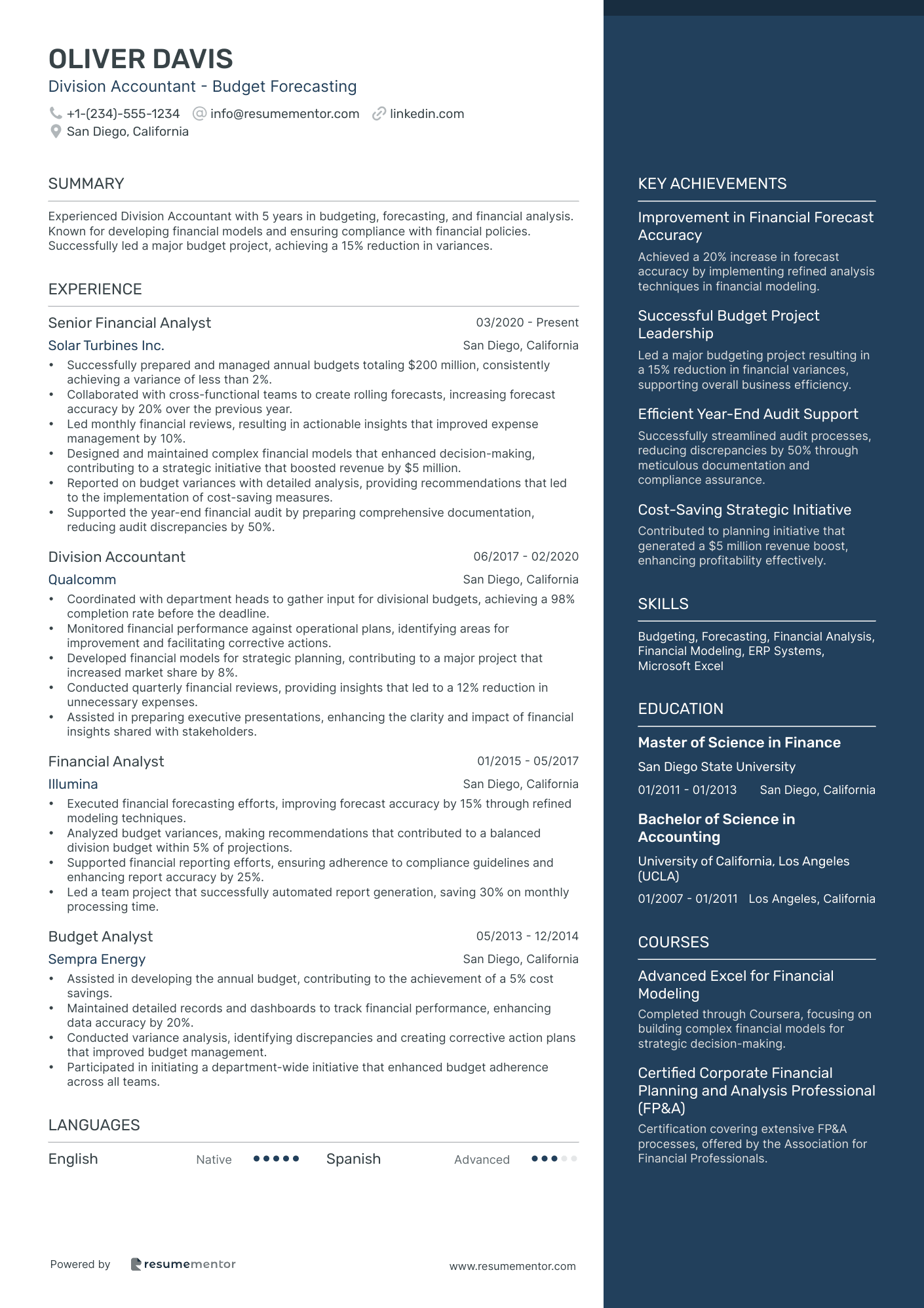

Division Accountant - Budget Forecasting

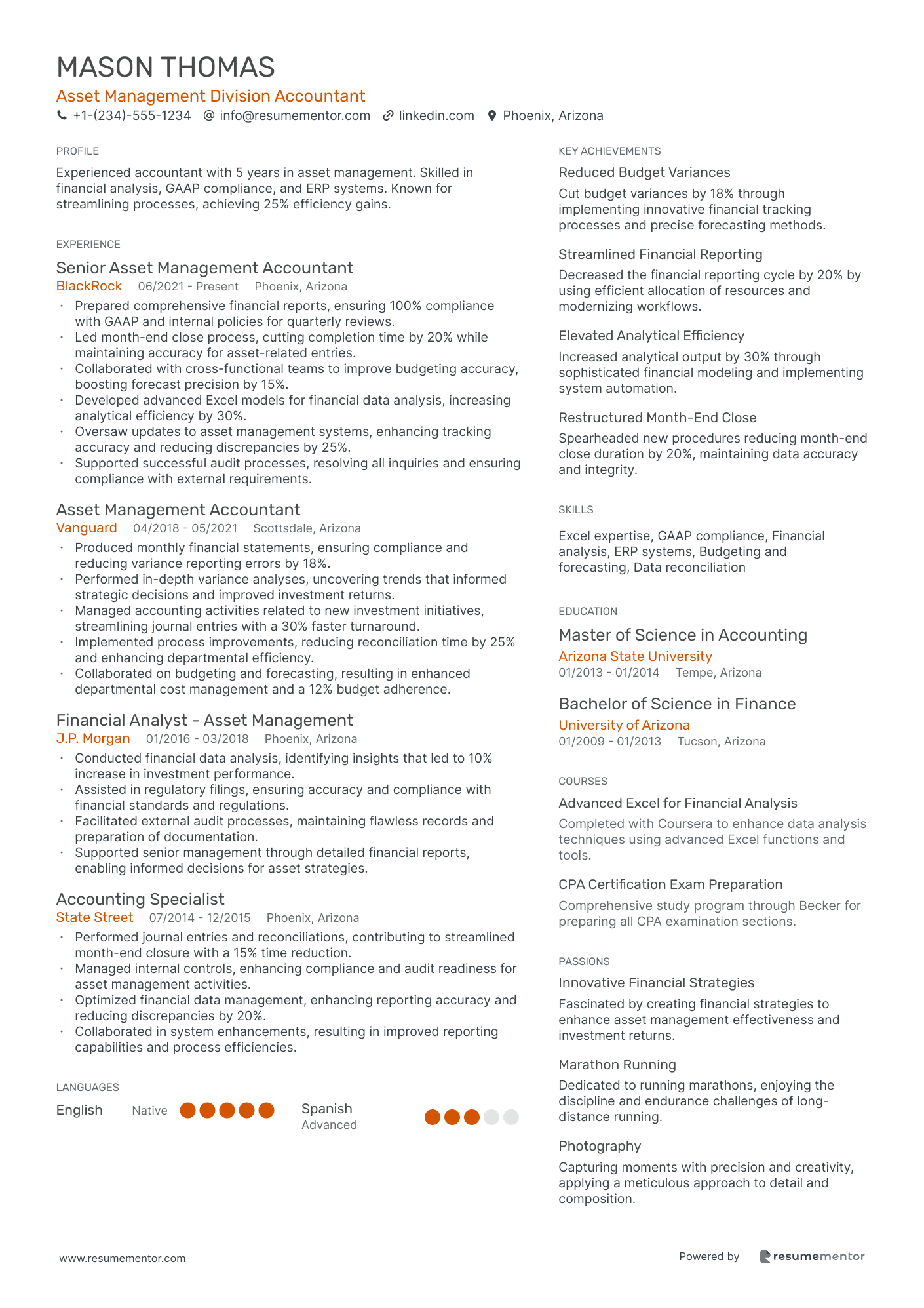

Asset Management Division Accountant

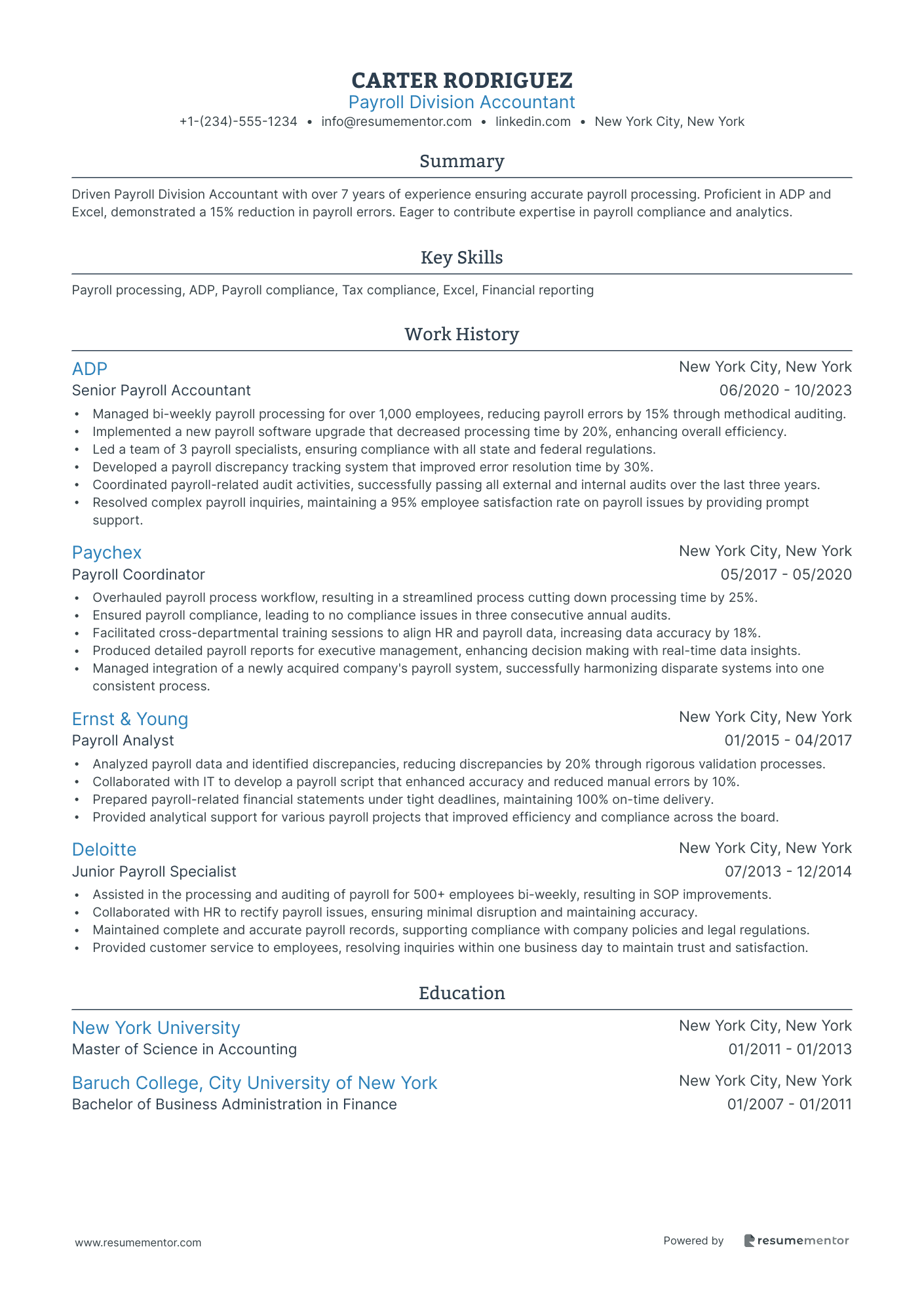

Payroll Division Accountant

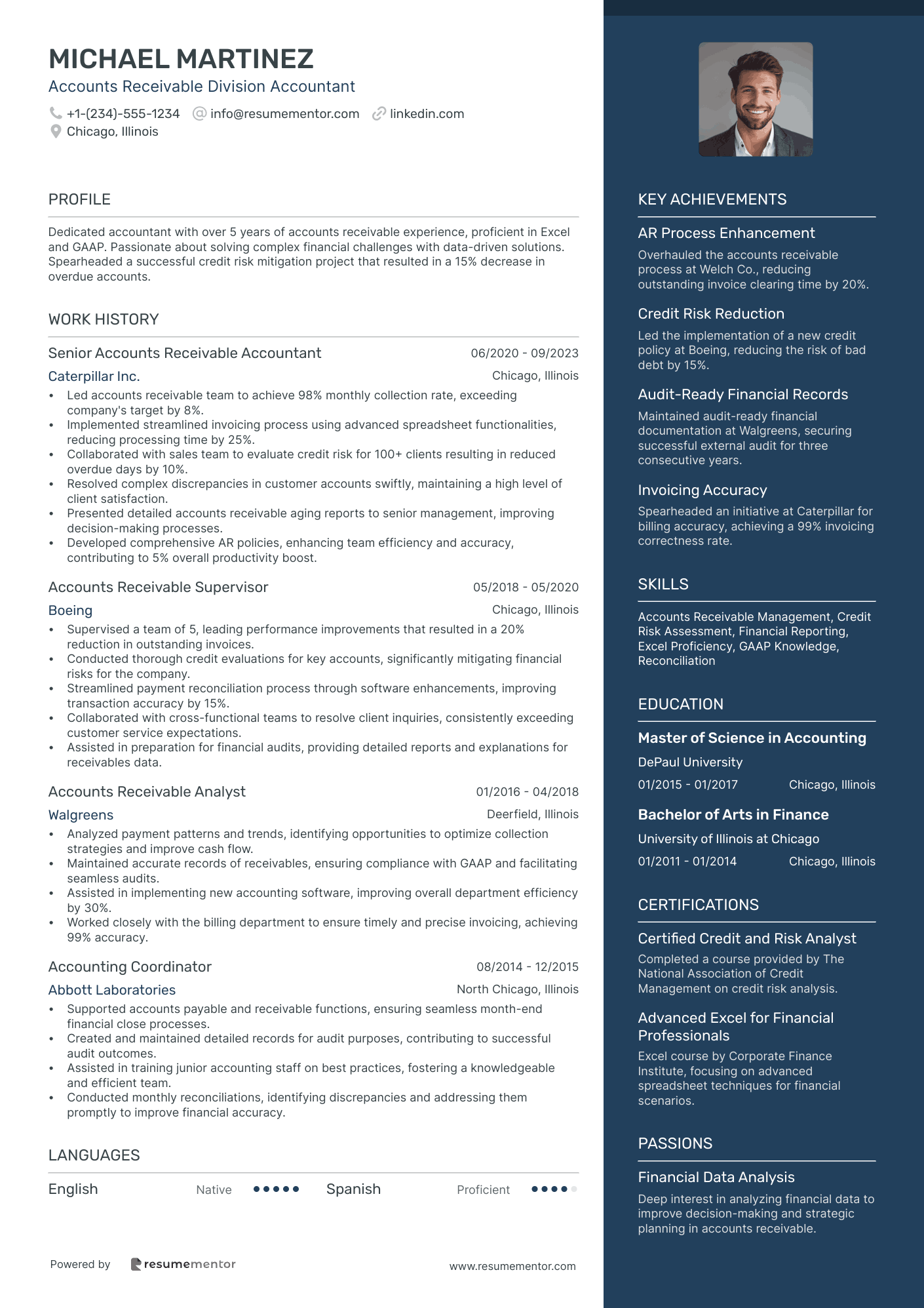

Accounts Receivable Division Accountant

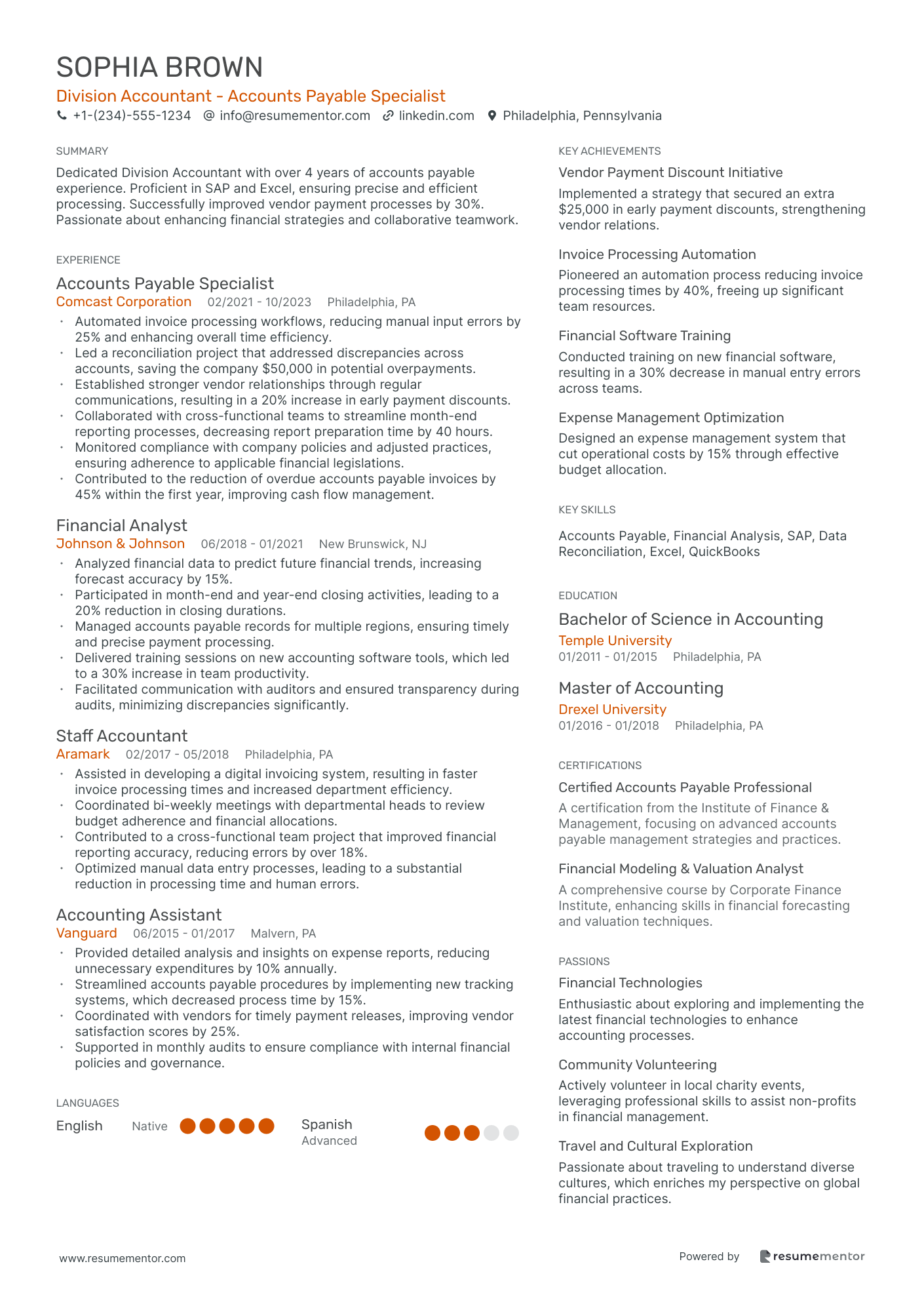

Division Accountant - Accounts payable Specialist

Division Accountant - Revenue Management resume sample

- •Led a team to enhance revenue recognition processes, resulting in a 20% improvement in accuracy and compliance.

- •Implemented new financial analysis procedures that identified areas for growth, increasing revenues by $1.3 million.

- •Collaborated with cross-functional teams to prepare materials for annual audits, successfully passing with no findings.

- •Developed revenue management strategies for new product lines, boosting the division's revenue by 10% year-over-year.

- •Optimized the use of accounting software, reducing monthly close time by 30% and improving workflow efficiency.

- •Provided key insights during the budget preparation process, positively influencing executive decision-making.

- •Maintained compliance with GAAP and internal policies, achieving perfect audit outcomes in 3 consecutive years.

- •Streamlined forecasting processes that led to a 15% increase in the accuracy of revenue predictions.

- •Prepared and reviewed financial statements, significantly enhancing transparency and understanding for stakeholders.

- •Led a successful shift to a new ERP system, increasing reporting speed by 35% and data accuracy across departments.

- •Analyzed revenue streams to provide actionable insights that resulted in a 6% increase in profitability.

- •Contributed to the design of a revenue forecasting model, improving prediction accuracy by a margin of 10%.

- •Reviewed revenue reports and collaborated on strategies boosting revenue streams by $800,000 annually.

- •Provided comprehensive financial analysis reports that supported management decisions on major projects.

- •Audited revenue accounts, ensuring compliance which resulted in no discrepancies found during annual reviews.

- •Assisted in regular revenue audits, contributing to a 98% compliance rate with internal controls.

- •Managed monthly financial statements, enhancing the accuracy of data by 12% through detailed reviews.

- •Coordinated with team members in the development of new accounting policies, benefiting revenue integrity.

- •Monitored revenue stream variances, preparing detailed reports that led to strategic process improvements.

General Ledger Division Accountant resume sample

- •Enhanced the accuracy of monthly financial reports, reducing discrepancies by 15% through meticulous reconciliation and data validation.

- •Led the month-end closing process, achieving a 25% reduction in processing time by streamlining internal procedures.

- •Authored and revised accounting procedures documentation, enhancing compliance and fostering a clearer understanding of financial policies.

- •Played a pivotal role in annual audit preparation, resulting in a 30% improvement in auditor satisfaction and reduced audit fees.

- •Collaborated with cross-functional teams, providing insights and resolving complex financial inquiries in a timely and effective manner.

- •Implemented a new ERP system module, which improved reporting accuracy and decreased manual errors by 40%.

- •Managed and reconciled over 150 accounts monthly, resolving discrepancies and ensuring compliance with GAAP standards.

- •Participated in the preparation of financial statements, enhancing data transparency and process efficiency by 20%.

- •Supported budgeting efforts by delivering accurate financial forecasts, resulting in a 10% increase in project funding approvals.

- •Liaised with external auditors, providing comprehensive documentation and clarifications, which decreased audit review time by 18%.

- •Discovered and implemented process improvements that reduced redundancy in accounting tasks, saving 10 hours weekly.

- •Contributed to financial analysis and reporting for significant corporate projects, leading to a 12% increase in project success rates.

- •Facilitated the integration of new accounting software, which streamlined workflows and reduced reporting discrepancies by 25%.

- •Developed dashboards and financial reports that improved decision-making efficiency for senior management teams.

- •Conducted comprehensive variance analyses, offering insights that resulted in cost-saving initiatives, lowering expenses by 7%.

- •Assisted in the management of more than 100 ledger accounts, ensuring data integrity and compliance with corporate policies.

- •Automated reporting processes which resulted in a 20% decrease in preparation time for monthly financial reviews.

- •Collaborated with senior accountants, delivering timely account reconciliations that improved overall department accuracy.

- •Participated in the creation and maintenance of financial models that aided in the strategic planning of business operations.

Financial Reporting Division Accountant resume sample

- •Led the monthly financial close process, improving the timeline by 20% and ensuring precise reporting.

- •Developed comprehensive reports for stakeholders, increasing transparency and accuracy by integrating advanced analytics.

- •Streamlined account reconciliation procedures, reducing errors by 15%, increasing confidence in the financial statements.

- •Implemented new SAP financial modules, leading to a 30% improvement in data processing efficiency.

- •Provided training sessions to junior accountants, fostering a 10% increase in team productivity.

- •Conducted detailed variance analysis on quarterly reports, identifying key areas for cost reduction resulting in $500,000 in savings.

- •Managed the preparation and analysis of quarterly reports, contributing to a 95% accuracy rate in financial statements.

- •Collaborated with cross-functional teams to compile comprehensive annual financial statements, enhancing organizational financial insight.

- •Monitored performance against budget plan, identifying trends and proposed 10 actionable improvements in expenditure.

- •Assisted auditors during the annual audit process, reducing lead time by 25% through efficient data management.

- •Devised decision-support models for senior management, increasing the allocation efficiency of resources by 22%.

- •Facilitated successful year-end financial reviews, with comprehensive detailed schedules, enhancing accuracy in reporting.

- •Improved compliance with GAAP standards, achieving a 100% clean audit record for two consecutive years.

- •Optimized data extraction methods within the reporting system, doubling the speed of data compilation.

- •Collaborated in developing corporate financial strategies, enabling a 4% increase in profit margins.

- •Assisted in preparing departmental budgets, leading to more precise allocations and 8% cost reduction.

- •Maintained comprehensive financial databases, supporting accurate quarterly forecasting and risk assessment.

- •Participated in cross-departmental financial workshops, enhancing the financial literacy of 50 participants.

- •Performed detailed analysis on transactional data, identifying discrepancies that led to process improvement modifications.

Division Accountant - Tax Specialist resume sample

- •Managed and filed over 150 federal and state tax returns annually, achieving an accuracy rate exceeding 98%.

- •Implemented tax-saving strategies that resulted in a 12% reduction of tax liabilities within one fiscal year.

- •Collaborated with financial analysts to integrate tax planning with financial reporting, optimizing tax positions.

- •Conducted in-depth tax research to ensure compliance with evolving tax legislation for multiple states.

- •Developed and maintained comprehensive documentation systems for tax-related processes, improving review efficiency by 30%.

- •Provided guidance during external audits, resulting in successful audit outcomes with no significant issues.

- •Prepared quarterly tax provisions with a 100% on-time submission record, ensuring regulatory adherence.

- •Collaborated with auditors to enhance the tax compliance framework, leading to improved audit scores by 25%.

- •Analyzed and interpreted tax changes, providing strategic advice to clients and reducing tax penalties by 40%.

- •Coordinated tax reporting efforts across departments, improving inter-departmental communication by 35%.

- •Led a team during a software transition, which improved tax report accuracy by reducing manual errors by 20%.

- •Assisted in the preparation and analysis of more than 100 annual tax returns for corporate clients.

- •Contributed to a task force that reduced state tax liability by implementing new compliance strategies.

- •Reviewed and updated tax files, ensuring compliance and accuracy across over 50 state jurisdictions.

- •Trained junior analysts on tax software usage, which enhanced team productivity by 30%.

- •Supported tax planning and compliance efforts for high-net-worth individuals, improving client satisfaction scores by 15%.

- •Developed spreadsheets to track compliance deadlines, reducing missed deadlines by 50%.

- •Assisted in the research and identification of tax issues for multi-state clients, improving compliance by 20%.

- •Participated in cross-functional meetings to discuss financial strategies, gaining insights into tax policies.

Cost Accounting Division Specialist resume sample

- •Led the cost analysis of raw materials, reducing expenditures by 15% through optimized procurement processes.

- •Developed a comprehensive cost accounting system which resulted in a 20% increase in reporting accuracy.

- •Assisted the finance team in annual budgeting, achieving a 10% reduction in forecast variances.

- •Collaborated with the operations department to streamline cost management initiatives, enhancing interdepartmental communication.

- •Conducted extensive variance analysis, leading to a 12% improvement in cost prediction accuracy.

- •Trained and mentored junior accounting team members, increasing departmental efficiency by 25%.

- •Analyzed overhead and labor costs, contributing to a 30% reduction in excess expenditures in two fiscal years.

- •Monitored inventory valuations across departments, ensuring compliance with industry standards and reducing errors by 18%.

- •Provided detailed insights on cost variance, leading to strategic decisions that increased gross margins by 5%.

- •Supported financial audits by preparing key documentation, ensuring a smooth auditing process with no major findings.

- •Helped develop a cost-centered budgeting tool, enhancing cost tracking efficiency and accuracy organization-wide.

- •Implemented cost-saving initiatives that decreased operational costs by 10% year-over-year.

- •Collaborated on projects integrating cost data, influencing adjustments in strategic planning with measurable profitability gains.

- •Optimized the use of SAP for cost tracking, improving real-time data analysis capabilities by 40%.

- •Led interdepartmental workshops to enhance understanding of cost control, fostering a cost-efficient company culture.

- •Assisted in maintaining cost records in compliance with GAAP, contributing to successful audits with no discrepancies.

- •Supported the finance team in cost analysis, resulting in actionable insights that reduced costs by 8%.

- •Streamlined reporting processes, cutting report generation time by 50% and improving data accessibility.

- •Facilitated the training of new team members in cost accounting practices, enhancing overall team efficiency.

Division Accountant - Budget Forecasting resume sample

- •Successfully prepared and managed annual budgets totaling $200 million, consistently achieving a variance of less than 2%.

- •Collaborated with cross-functional teams to create rolling forecasts, increasing forecast accuracy by 20% over the previous year.

- •Led monthly financial reviews, resulting in actionable insights that improved expense management by 10%.

- •Designed and maintained complex financial models that enhanced decision-making, contributing to a strategic initiative that boosted revenue by $5 million.

- •Reported on budget variances with detailed analysis, providing recommendations that led to the implementation of cost-saving measures.

- •Supported the year-end financial audit by preparing comprehensive documentation, reducing audit discrepancies by 50%.

- •Coordinated with department heads to gather input for divisional budgets, achieving a 98% completion rate before the deadline.

- •Monitored financial performance against operational plans, identifying areas for improvement and facilitating corrective actions.

- •Developed financial models for strategic planning, contributing to a major project that increased market share by 8%.

- •Conducted quarterly financial reviews, providing insights that led to a 12% reduction in unnecessary expenses.

- •Assisted in preparing executive presentations, enhancing the clarity and impact of financial insights shared with stakeholders.

- •Executed financial forecasting efforts, improving forecast accuracy by 15% through refined modeling techniques.

- •Analyzed budget variances, making recommendations that contributed to a balanced division budget within 5% of projections.

- •Supported financial reporting efforts, ensuring adherence to compliance guidelines and enhancing report accuracy by 25%.

- •Led a team project that successfully automated report generation, saving 30% on monthly processing time.

- •Assisted in developing the annual budget, contributing to the achievement of a 5% cost savings.

- •Maintained detailed records and dashboards to track financial performance, enhancing data accuracy by 20%.

- •Conducted variance analysis, identifying discrepancies and creating corrective action plans that improved budget management.

- •Participated in initiating a department-wide initiative that enhanced budget adherence across all teams.

Asset Management Division Accountant resume sample

- •Prepared comprehensive financial reports, ensuring 100% compliance with GAAP and internal policies for quarterly reviews.

- •Led month-end close process, cutting completion time by 20% while maintaining accuracy for asset-related entries.

- •Collaborated with cross-functional teams to improve budgeting accuracy, boosting forecast precision by 15%.

- •Developed advanced Excel models for financial data analysis, increasing analytical efficiency by 30%.

- •Oversaw updates to asset management systems, enhancing tracking accuracy and reducing discrepancies by 25%.

- •Supported successful audit processes, resolving all inquiries and ensuring compliance with external requirements.

- •Produced monthly financial statements, ensuring compliance and reducing variance reporting errors by 18%.

- •Performed in-depth variance analyses, uncovering trends that informed strategic decisions and improved investment returns.

- •Managed accounting activities related to new investment initiatives, streamlining journal entries with a 30% faster turnaround.

- •Implemented process improvements, reducing reconciliation time by 25% and enhancing departmental efficiency.

- •Collaborated on budgeting and forecasting, resulting in enhanced departmental cost management and a 12% budget adherence.

- •Conducted financial data analysis, identifying insights that led to 10% increase in investment performance.

- •Assisted in regulatory filings, ensuring accuracy and compliance with financial standards and regulations.

- •Facilitated external audit processes, maintaining flawless records and preparation of documentation.

- •Supported senior management through detailed financial reports, enabling informed decisions for asset strategies.

- •Performed journal entries and reconciliations, contributing to streamlined month-end closure with a 15% time reduction.

- •Managed internal controls, enhancing compliance and audit readiness for asset management activities.

- •Optimized financial data management, enhancing reporting accuracy and reducing discrepancies by 20%.

- •Collaborated in system enhancements, resulting in improved reporting capabilities and process efficiencies.

Payroll Division Accountant resume sample

- •Managed bi-weekly payroll processing for over 1,000 employees, reducing payroll errors by 15% through methodical auditing.

- •Implemented a new payroll software upgrade that decreased processing time by 20%, enhancing overall efficiency.

- •Led a team of 3 payroll specialists, ensuring compliance with all state and federal regulations.

- •Developed a payroll discrepancy tracking system that improved error resolution time by 30%.

- •Coordinated payroll-related audit activities, successfully passing all external and internal audits over the last three years.

- •Resolved complex payroll inquiries, maintaining a 95% employee satisfaction rate on payroll issues by providing prompt support.

- •Overhauled payroll process workflow, resulting in a streamlined process cutting down processing time by 25%.

- •Ensured payroll compliance, leading to no compliance issues in three consecutive annual audits.

- •Facilitated cross-departmental training sessions to align HR and payroll data, increasing data accuracy by 18%.

- •Produced detailed payroll reports for executive management, enhancing decision making with real-time data insights.

- •Managed integration of a newly acquired company's payroll system, successfully harmonizing disparate systems into one consistent process.

- •Analyzed payroll data and identified discrepancies, reducing discrepancies by 20% through rigorous validation processes.

- •Collaborated with IT to develop a payroll script that enhanced accuracy and reduced manual errors by 10%.

- •Prepared payroll-related financial statements under tight deadlines, maintaining 100% on-time delivery.

- •Provided analytical support for various payroll projects that improved efficiency and compliance across the board.

- •Assisted in the processing and auditing of payroll for 500+ employees bi-weekly, resulting in SOP improvements.

- •Collaborated with HR to rectify payroll issues, ensuring minimal disruption and maintaining accuracy.

- •Maintained complete and accurate payroll records, supporting compliance with company policies and legal regulations.

- •Provided customer service to employees, resolving inquiries within one business day to maintain trust and satisfaction.

Accounts Receivable Division Accountant resume sample

- •Led accounts receivable team to achieve 98% monthly collection rate, exceeding company's target by 8%.

- •Implemented streamlined invoicing process using advanced spreadsheet functionalities, reducing processing time by 25%.

- •Collaborated with sales team to evaluate credit risk for 100+ clients resulting in reduced overdue days by 10%.

- •Resolved complex discrepancies in customer accounts swiftly, maintaining a high level of client satisfaction.

- •Presented detailed accounts receivable aging reports to senior management, improving decision-making processes.

- •Developed comprehensive AR policies, enhancing team efficiency and accuracy, contributing to 5% overall productivity boost.

- •Supervised a team of 5, leading performance improvements that resulted in a 20% reduction in outstanding invoices.

- •Conducted thorough credit evaluations for key accounts, significantly mitigating financial risks for the company.

- •Streamlined payment reconciliation process through software enhancements, improving transaction accuracy by 15%.

- •Collaborated with cross-functional teams to resolve client inquiries, consistently exceeding customer service expectations.

- •Assisted in preparation for financial audits, providing detailed reports and explanations for receivables data.

- •Analyzed payment patterns and trends, identifying opportunities to optimize collection strategies and improve cash flow.

- •Maintained accurate records of receivables, ensuring compliance with GAAP and facilitating seamless audits.

- •Assisted in implementing new accounting software, improving overall department efficiency by 30%.

- •Worked closely with the billing department to ensure timely and precise invoicing, achieving 99% accuracy.

- •Supported accounts payable and receivable functions, ensuring seamless month-end financial close processes.

- •Created and maintained detailed records for audit purposes, contributing to successful audit outcomes.

- •Assisted in training junior accounting staff on best practices, fostering a knowledgeable and efficient team.

- •Conducted monthly reconciliations, identifying discrepancies and addressing them promptly to improve financial accuracy.

Division Accountant - Accounts payable Specialist resume sample

- •Automated invoice processing workflows, reducing manual input errors by 25% and enhancing overall time efficiency.

- •Led a reconciliation project that addressed discrepancies across accounts, saving the company $50,000 in potential overpayments.

- •Established stronger vendor relationships through regular communications, resulting in a 20% increase in early payment discounts.

- •Collaborated with cross-functional teams to streamline month-end reporting processes, decreasing report preparation time by 40 hours.

- •Monitored compliance with company policies and adjusted practices, ensuring adherence to applicable financial legislations.

- •Contributed to the reduction of overdue accounts payable invoices by 45% within the first year, improving cash flow management.

- •Analyzed financial data to predict future financial trends, increasing forecast accuracy by 15%.

- •Participated in month-end and year-end closing activities, leading to a 20% reduction in closing durations.

- •Managed accounts payable records for multiple regions, ensuring timely and precise payment processing.

- •Delivered training sessions on new accounting software tools, which led to a 30% increase in team productivity.

- •Facilitated communication with auditors and ensured transparency during audits, minimizing discrepancies significantly.

- •Assisted in developing a digital invoicing system, resulting in faster invoice processing times and increased department efficiency.

- •Coordinated bi-weekly meetings with departmental heads to review budget adherence and financial allocations.

- •Contributed to a cross-functional team project that improved financial reporting accuracy, reducing errors by over 18%.

- •Optimized manual data entry processes, leading to a substantial reduction in processing time and human errors.

- •Provided detailed analysis and insights on expense reports, reducing unnecessary expenditures by 10% annually.

- •Streamlined accounts payable procedures by implementing new tracking systems, which decreased process time by 15%.

- •Coordinated with vendors for timely payment releases, improving vendor satisfaction scores by 25%.

- •Supported in monthly audits to ensure compliance with internal financial policies and governance.

Crafting a division accountant resume can feel like piecing together a complex puzzle, where each section must fit just right. Your expertise in financial analysis, reporting, and management is impressive, but conveying it effectively on paper can be challenging. This is where a well-structured approach becomes essential, ensuring your skills not only stand out but also resonate with potential employers.

You might find yourself worrying if your technical expertise is being communicated clearly and if your strategic thinking is evident. A helpful tool in this process is using a resume template, which can effortlessly organize your information and draw attention to relevant details. Choosing a professional resume template allows your resume to remain clear and visually appealing, making it easier for hiring managers to see your strengths.

With an abundance of accomplishments, it’s easy for your resume to become cluttered. Focus on distilling these into concise, impactful statements that balance depth and brevity. This approach ensures that your resume captures your skills comprehensively but remains easy to digest.

Your knack for numbers is undeniable, yet translating those abilities into a job-winning resume requires additional finesse. Customizing each resume to align with the job you’re applying for highlights the value you offer to a division’s financial strategy. By tailoring your resume to meet industry needs, you’re more likely to capture the attention of hiring managers and secure that sought-after interview.

Key Takeaways

- Employing a well-structured resume approach is crucial for emphasizing your financial analysis, reporting, and management skills effectively.

- Utilizing a professional resume template helps present your information clearly and makes key details more noticeable, aiding hiring managers in recognizing your strengths.

- Focusing on concise, impactful statements and tailoring your resume to the job application enriches its readability and relevance.

- Incorporating quantifiable achievements and action verbs in your experience section illustrates your value and aligns your expertise with job requirements.

- Additional sections like certifications, skills, and even volunteer work can highlight your breadth of capabilities and commitment to professional growth.

What to focus on when writing your division accountant resume

A division accountant resume should effectively communicate your skills in financial analysis, budgeting, and cost control, crucial for maintaining financial integrity in a corporate setting—these abilities showcase your expertise and readiness for the role. Through your resume, recruiters should see your ability to manage audits and deliver insightful financial reporting, ensuring fiscal responsibility and contributing to strategic financial decisions. This lets them know you’re not just experienced, but also actively engaged in enhancing financial performance.

How to structure your division accountant resume

- Contact Information: Make sure to include your full name, phone number, professional email, and LinkedIn profile for easy connection—these details set the foundation for your professional identity and make it easy for recruiters to reach you.

- Professional Summary: Share a brief overview of your experience in financial reporting and budgeting within division accounting roles, setting the stage for your detailed work history—this section should succinctly present your career highlights and core competencies to grab the recruiter’s attention.

- Work Experience: Provide a detailed look at your past positions, focusing on specific responsibilities and achievements like cost savings or successful audits, which underscore your professional value—descriptions here should tell a story of growth and contributions, demonstrating how you made a difference in previous roles.

- Education: List your degree(s) in accounting, finance, or related areas, along with the name of the institution and your graduation date, showing your foundational knowledge—this background solidifies your qualifications and readiness for complex financial tasks.

- Technical Skills: Highlight your proficiency with industry-standard accounting software like SAP or QuickBooks, as well as financial modeling tools in Excel, demonstrating your technical capabilities—these skills reflect your adaptability and efficiency, key traits in managing division accounts.

- Certifications: Include relevant credentials such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), cementing your expertise in the field—certifications not only validate your knowledge but also signal commitment to professional development.

Consider adding optional sections like volunteer work or awards to further illustrate your dedication and success beyond your primary job responsibilities. As we move forward, we'll cover each section of the resume more in-depth, highlighting resume formats that can best showcase your skills.

Which resume format to choose

Getting the format right is crucial when writing a division accountant resume. A reverse-chronological format helps you present your work history in a way that highlights your most recent experience and achievements. This structure is particularly effective in accounting roles, where a clear progression of responsibility and expertise is often expected by employers. By laying this out clearly, you make it easier for hiring managers to see your career path and how you've built your skills over time.

The choice of font contributes significantly to how your resume is perceived. Opt for modern fonts like Raleway, Lato, or Montserrat to ensure readability while giving your resume a contemporary feel. These fonts help your document stand out, portraying a sense of innovation and professionalism that is important in the evolving field of accounting. They balance style and readability, reflecting the precise and meticulous nature of accounting work.

When you save your resume, always choose PDF as the file type. This choice ensures that your carefully crafted format and font selections are preserved exactly as you intended, no matter what device or software the recipient uses. Given the importance of detail in accounting, presenting a resume that looks polished and professional underscores your attention to detail and organizational skills.

Finally, consistent margins are key to maintaining the visual accessibility of your resume. Margins of around 1 inch on all sides create ample white space, which is inviting and easy on the eyes. This consideration helps your content stand out without overwhelming the reader, reflecting the orderliness and precision that are trademarks of successful accountants.

By combining these elements—format, font, file type, and margins—you ensure your division accountant resume not only captures your credentials but also showcases them in the best possible light.

How to write a quantifiable resume experience section

In your division accountant resume experience section, focus on showcasing your accounting expertise and contributions to your organization's financial success. Begin with your most recent role and work backward through key positions from the last 10-15 years, ensuring that each position highlights your impact. Tailor your experience to align with the job ad by incorporating specific language and skills mentioned, which demonstrates that you're the right fit for the job. Highlight roles that clearly convey your expertise and use strong action verbs like "managed," "optimized," and "achieved" to illustrate your influence.

Concentrate on crafting bullet points that emphasize measurable achievements. For instance:

- •Implemented a new budgeting system that cut overhead costs by 10% each year.

- •Streamlined financial reporting, reducing preparation time by 25%.

- •Supervised a team of 5 accountants, boosting audit accuracy by 30%.

- •Improved cash flow management, enhancing liquidity by 15% year-over-year.

This section seamlessly combines strong verbs and quantifiable results, demonstrating your significant impact. By tailoring the content to fit the job ad, you create a relevant and engaging experience for hiring managers. Every bullet point connects your skills to real-world improvements, crafting a persuasive narrative. Consistent flow and formatting build a clear story of professional growth and accounting expertise. This focus on results and alignment with job needs ensures your experience section grabs attention.

Project-Focused resume experience section

A project-focused division accountant resume experience section should effectively highlight how you have contributed to key financial projects that led to organizational success. Start by selecting examples that showcase where your financial expertise and project management skills brought quantifiable results, ensuring you align each with the company's objectives. Your narrative should paint a clear picture of your role in these projects and the impact you had.

Each bullet point needs to be dynamic and illustrate different aspects of your position. Clearly convey how you led projects, tackled challenges, and achieved results, emphasizing skills like financial analysis, budgeting, and strategic planning. The goal is to illustrate how your contributions can significantly benefit potential employers, making your skillset and experience stand out distinctively.

Division Accountant

XYZ Corporation

June 2018 - May 2022

- Led a cross-functional team to implement a new accounting software, cutting report generation time by 40%.

- Created budget forecasts that improved financial planning accuracy by 30%.

- Collaborated with senior management to enhance financial reporting processes, increasing efficiency by 20%.

- Managed quarterly and annual closing processes, ensuring compliance with GAAP standards.

Technology-Focused resume experience section

A technology-focused division accountant resume experience section should highlight your ability to integrate technology within your accounting roles effectively. Begin by listing your job title, the name of your workplace, and the relevant dates of employment. Use strong action verbs in your bullet points to demonstrate how you've utilized technology to make a significant impact. Focus on the software applications, systems, or tools you have mastered, ensuring that each point illustrates your accomplishments and the results of your tech-driven efforts.

Tailor your descriptions to match the job you're applying for, making your experience section truly shine. When discussing your technical skills, show how they saved time, improved efficiency, or enhanced data accuracy in previous roles. Quantifying these impacts with specific numbers or percentages makes your resume stand out to employers. These illustrative examples highlight your expertise not only in accounting but also in leveraging technology to solve problems and drive success.

Division Accountant

Tech Solutions Inc.

January 2020 - Present

- Led a team in streamlining accounting processes, cutting report generation time by 40% through advanced software solutions.

- Implemented a new ERP system, enhancing data accuracy and eliminating 30% of redundancies.

- Conducted training sessions to boost staff proficiency in accounting software, increasing team productivity by 25%.

- Utilized cutting-edge BI tools to analyze financial data, providing strategic insights for executive decision-making.

Leadership-Focused resume experience section

A leadership-focused Division Accountant resume experience section should highlight your skills and achievements in guiding teams and driving financial success. Start with a clear header such as "Leadership Experience" to set the tone. In the first paragraph, delve into your roles by describing the leadership skills that played a crucial part in your accomplishments. Connect this by discussing how you led specific projects or initiatives, showcasing the impact of your mentoring and guidance on the team. Emphasizing the positive outcomes reflects your ability to inspire and influence effectively.

The narrative should then flow into the tangible results and challenges you tackled, using measurable achievements and statistics to anchor your story. This approach not only gives depth to your experiences but also demonstrates how your leadership directly contributed to overcoming obstacles and achieving objectives. By illustrating specific goals met by your team, you build a cohesive picture of your leadership prowess. Make sure each point underlines your distinctive qualities, weaving a story of growth and success throughout your career.

Division Accountant

ABC Corporation

June 2018 - Present

- Led a team of 10 accountants to streamline financial reporting processes, cutting report delivery time by 20%.

- Implemented a new budget strategy, resulting in a 15% cost reduction for the finance department.

- Mentored junior accountants, which led to a 50% improvement in their performance reviews.

- Spearheaded a project to enhance financial transparency across departments, increasing stakeholder trust by 30%.

Customer-Focused resume experience section

A customer-focused division accountant resume experience section should highlight your commitment to customer satisfaction and your expertise in division accounting. Start by using action words to show how you've made a difference in previous roles. For example, detail how you resolved customer issues and engaged with other departments to boost client satisfaction, making the connection between customer service and accounting clear. Include measurable outcomes like cost savings, increased efficiency, or revenue growth to emphasize the real impact of your work. Tailor these descriptions to reflect the values and priorities of the potential employer.

Next, seamlessly connect your accounting skills with the positive outcomes for customers. Describe how your efforts led to satisfied clients and more efficient financial operations, making sure to highlight any tools or systems you introduced that improved customer interactions or streamlined processes. This approach paints a comprehensive picture of how you can add value to a new team. The goal is to weave your skills and achievements into a narrative that resonates with what the employer is seeking.

Division Accountant

Prime Finance Group

2019-2023

- Improved customer satisfaction scores by 25% by implementing a streamlined billing process.

- Collaborated with cross-functional teams to reduce error rates in financial reporting by 15%.

- Led training sessions for team members, resulting in increased efficiency in customer communication.

- Introduced a new system that reduced invoice processing time by 30%.

Write your division accountant resume summary section

A division accountant-focused resume summary should clearly highlight your financial expertise and your ability to drive results in an organization. This section needs to be concise yet impactful, allowing your strengths to shine. For those with significant experience in this field, it's crucial to emphasize your skills in managing budgets, ensuring compliance, and handling complex financial tasks. Consider this example:

Here, the summary effectively connects your extensive experience with the core competencies expected in the role, linking your past successes to potential future contributions. If you're just starting your career, shifting to an objective can be an effective strategy. This approach focuses on your goals and what you aim to accomplish in your new role. For a junior division accountant, you might say:

[here was the JSON object 2]

This example smoothly transitions from your educational background to your professional aspirations, showing how you're prepared to add value even at an early stage of your career. Understanding the difference between a summary and an objective is vital. A summary focuses on past achievements and is better suited for experienced professionals. In contrast, an objective highlights future goals and is tailored for those new to the field. Distinguishing between these and other formats like a resume profile or a summary of qualifications, which have their own unique styles, is essential for presenting your potential in the best light.

Listing your division accountant skills on your resume

A skills-focused division accountant resume should thoughtfully integrate your capabilities within a dedicated section or weave them throughout your experience and summary. Highlighting your strengths, including key soft skills, is crucial because they reflect how you work with others and approach problems. Hard skills, in contrast, are specific abilities gained through education and training, essential for executing accounting tasks effectively.

Your skills and strengths function as important resume keywords, catching the attention of automated systems and hiring managers alike. When you smartly incorporate relevant skills, you enhance the impact and appeal of your resume.

Here's an example of a standalone skills section using JSON format:

This skills section is effective because it emphasizes specific and relevant abilities that encapsulate the responsibilities of a division accountant. It showcases both depth and breadth of expertise.

Best hard skills to feature on your division accountant resume

A division accountant's hard skills are crucial for proving your technical ability to perform job-specific tasks. These skills demonstrate your proficiency with industry tools and practices. Consider these top 15 in-demand hard skills:

Hard Skills

- Financial Analysis

- Advanced Excel Proficiency

- Budgeting and Forecasting

- ERP Systems (like SAP, Oracle)

- Financial Reporting

- Tax Compliance and Preparation

- Accounts Reconciliation

- Regulatory Knowledge

- Auditing Procedures

- Cost Accounting

- Payroll Management

- Risk Management

- Financial Modeling

- Data Analysis and Management

- Accounting Software (QuickBooks, Netsuite)

Best soft skills to feature on your division accountant resume

Division accountants should also highlight soft skills, which show how well you communicate and collaborate within the workplace. These skills reinforce your professionalism and ability to work effectively with others. Consider emphasizing these 15 key soft skills:

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem Solving

- Communication

- Time Management

- Adaptability

- Teamwork

- Critical Thinking

- Leadership

- Conflict Resolution

- Accountability

- Decision Making

- Stress Management

- Integrity

- Self-motivation

How to include your education on your resume

When crafting your resume, the education section is a crucial part that can significantly impact your application for a division accountant position. It's important to tailor this section to suit the job you're applying for, omitting any unrelated educational experiences. Mentioning GPA can add to your credibility, particularly if it's strong. If you graduated with honors, such as cum laude, make sure to highlight that beside your degree. When listing your degree, be precise and clear about your qualification and institution.

Here’s a poor example of an education section:

This example is ineffective because it lists an irrelevant degree for an accounting role and omits any achievement like cum laude.

Now, consider this example for a division accountant's education section:

- •Graduated magna cum laude

This example works well because it highlights a relevant accounting degree. Featuring a high GPA and the achievement of graduating magna cum laude emphasizes academic success and dedication, vital attributes for a division accountant. The addition of a major achievement conveys a commitment to excellence. Each element chosen aligns strongly with the role you are aiming for, making your application more compelling.

How to include division accountant certificates on your resume

Including a certificates section in your division accountant resume is crucial to showcase your qualifications and professional development. Start by listing the name of each certificate you have earned. Include the date when you received it to demonstrate the relevance and recency of your skills. Add the issuing organization to validate the credibility of your certification. This section can greatly enhance your resume by highlighting your continuous education and specialization.

You can also embed key certificates in the resume header. For example, under your name, contact information, and professional title, you might include "CPA | Certified Management Accountant." This approach ensures recruiters can quickly see your qualifications.

This example is good because it lists relevant and respected certifications for a division accountant. Including the issuing organizations easily verifies the authenticity and value of the credentials. The order in which these certificates are listed shows a clear career progression and commitment to professional growth. This layout makes it easy for hiring managers to see your qualifications at a glance.

Extra sections to include in your division accountant resume

Landing a job as a division accountant requires showcasing various skills and experiences that make you stand out. Once you've highlighted your education and professional background, including additional information can be critical.

- Language section — Include foreign languages you know to show you can work in diverse environments or with international clients. Speaking multiple languages is a strong asset in global companies.

- Hobbies and interests section — Add your hobbies to give a complete picture of who you are outside of work. This helps hiring managers see your personality and potential culture fit.

- Volunteer work section — Detail any volunteer activities to illustrate your commitment to community and social responsibility. Voluntary roles also highlight your ability to manage various tasks and your teamwork skills.

- Books section — List relevant books you've read to demonstrate your continuous learning mindset. Sharing favorite books can also serve as a unique conversation starter in an interview.

In Conclusion

In conclusion, crafting an effective division accountant resume involves combining detailed information with strategic structure to highlight your professional strengths. Your resume is your personal marketing tool, showcasing your analytical abilities, financial expertise, and accomplishments in a way that aligns with employers' expectations. Utilizing a professional template aids in organizing this information clearly and concisely.

Remember, each section of your resume must harmonize to create a comprehensive narrative about your career. Tailoring your resume to the specific job description enhances its relevance, increasing your chances of catching recruiters' attention. Thoughtful formatting, such as using modern fonts and maintaining consistent margins, contributes to a professional appearance.

In your experience sections, focus on quantifiable achievements to effectively communicate the real-world impact of your contributions. Whether you're emphasizing leadership, technology, or customer service skills, ensure each point is backed by specific results. Incorporating sections for skills, education, and certifications fortifies your credentials, providing a fuller view of your qualifications.

Additionally, including extra sections like volunteer work or language skills can offer a broader perspective on your abilities, emphasizing cultural fit and continuous learning. Presenting a resume that balances depth with clarity demonstrates not only your expertise but also your commitment to excellence in accounting. By following these guidelines, you effectively position yourself as a strong candidate in the competitive job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.