Early Stage Investment Lawyer Resume Examples

Jul 18, 2024

|

12 min read

Crafting the perfect early stage investment lawyer resume: Brush up your legalese and secure that dream job in the venture capital world.

Rated by 348 people

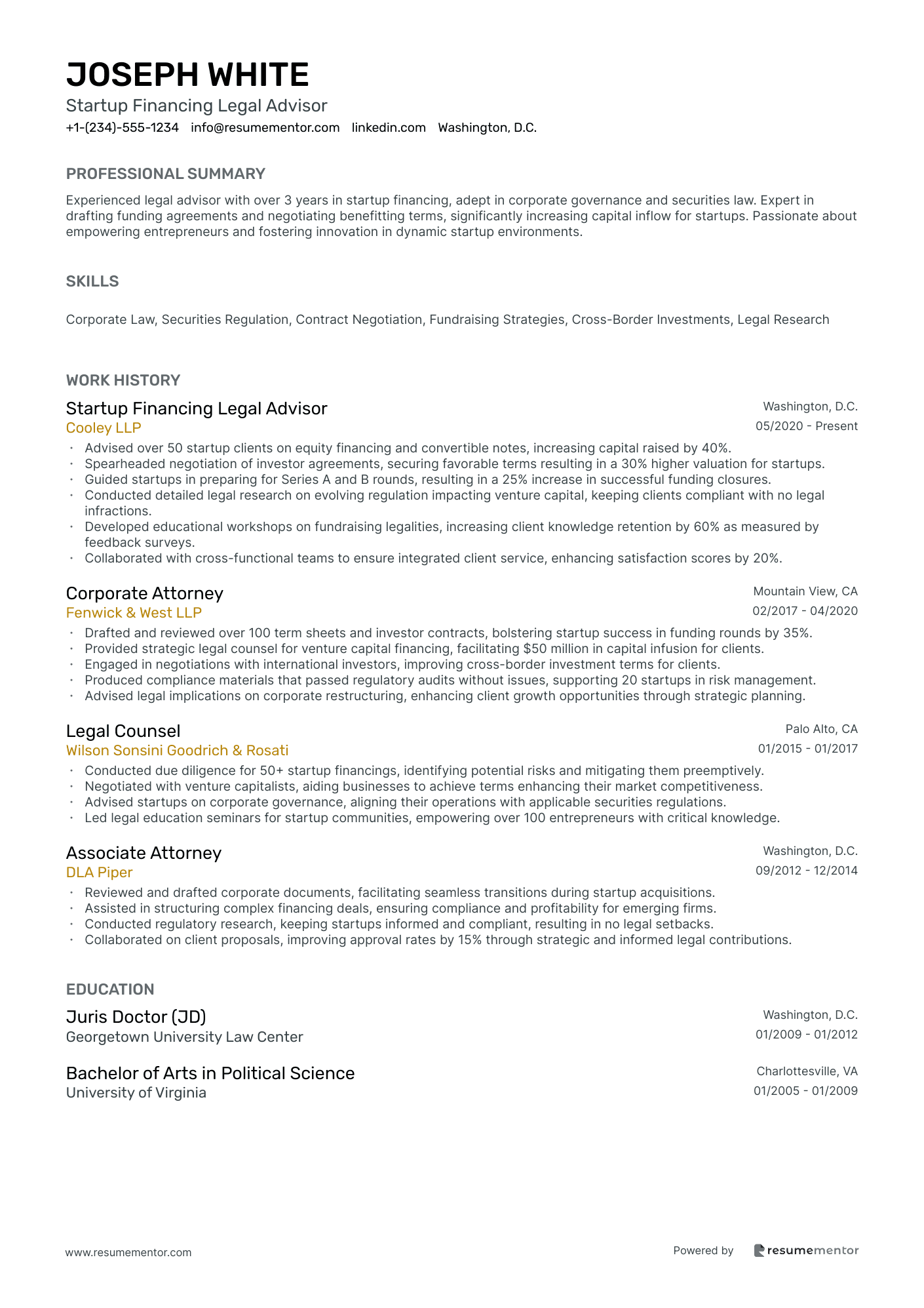

Startup Financing Legal Advisor

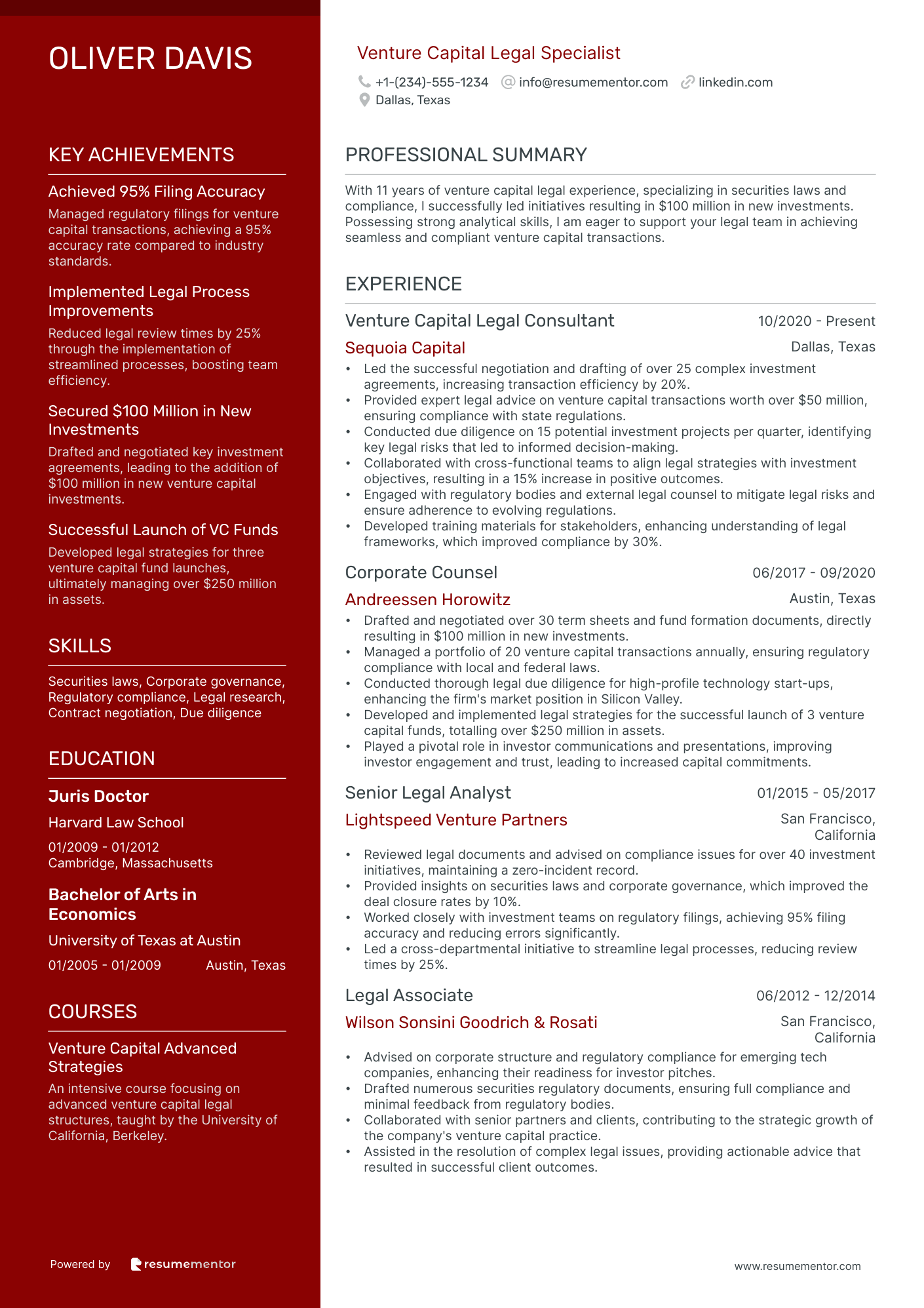

Venture Capital Legal Specialist

Seed Funding Legal Consultant

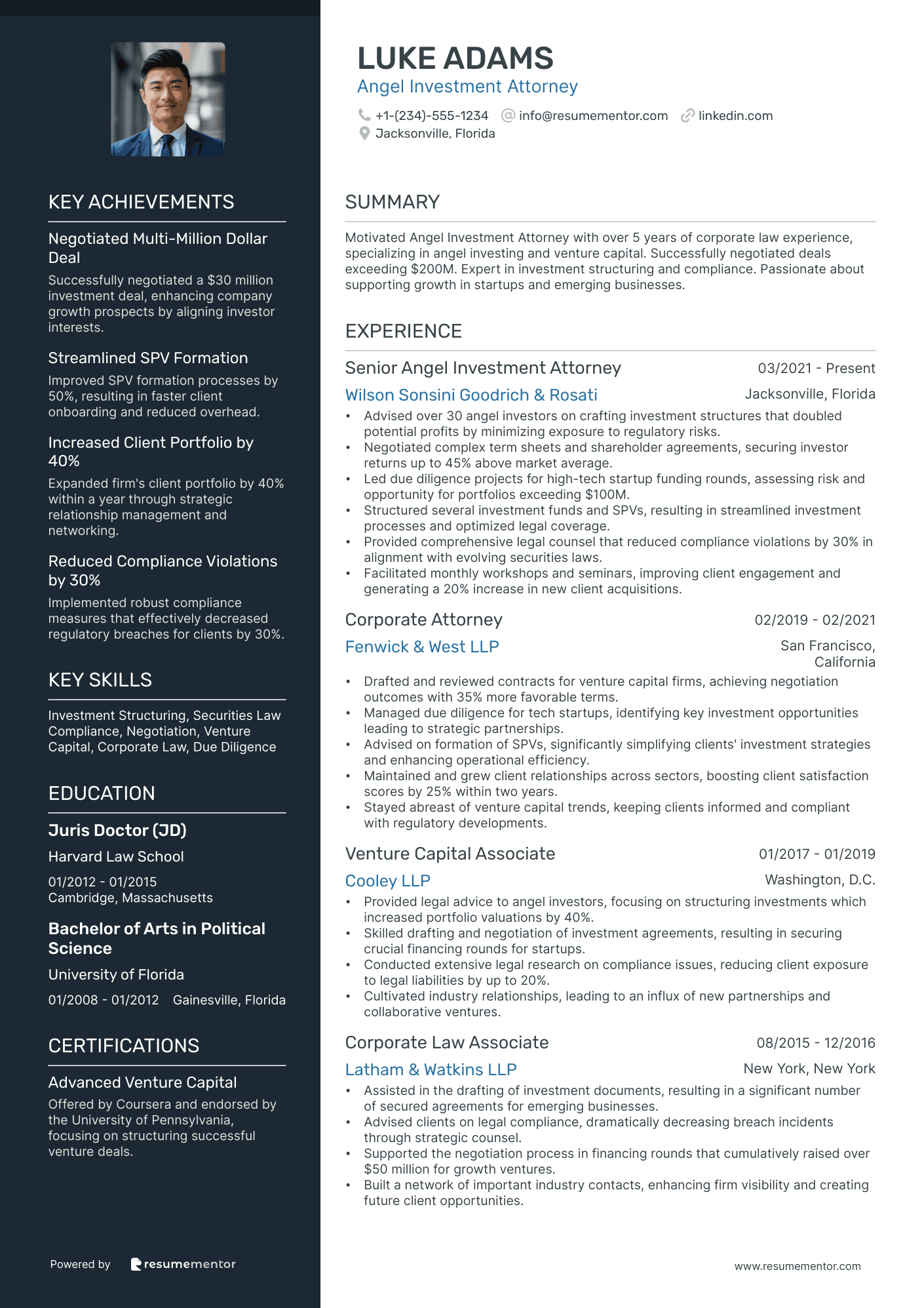

Angel Investment Attorney

Technology Startup Investment Lawyer

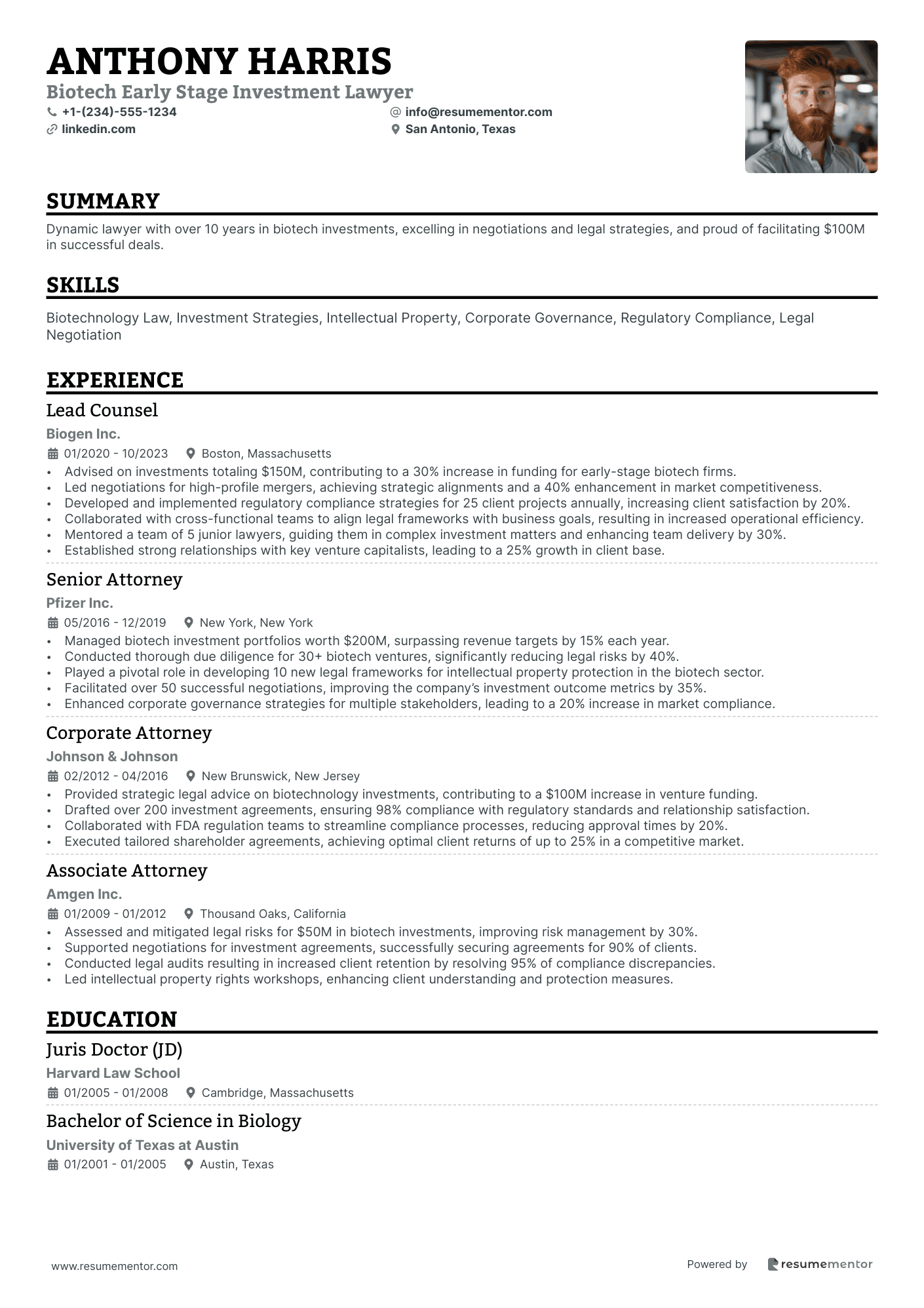

Biotech Early Stage Investment Lawyer

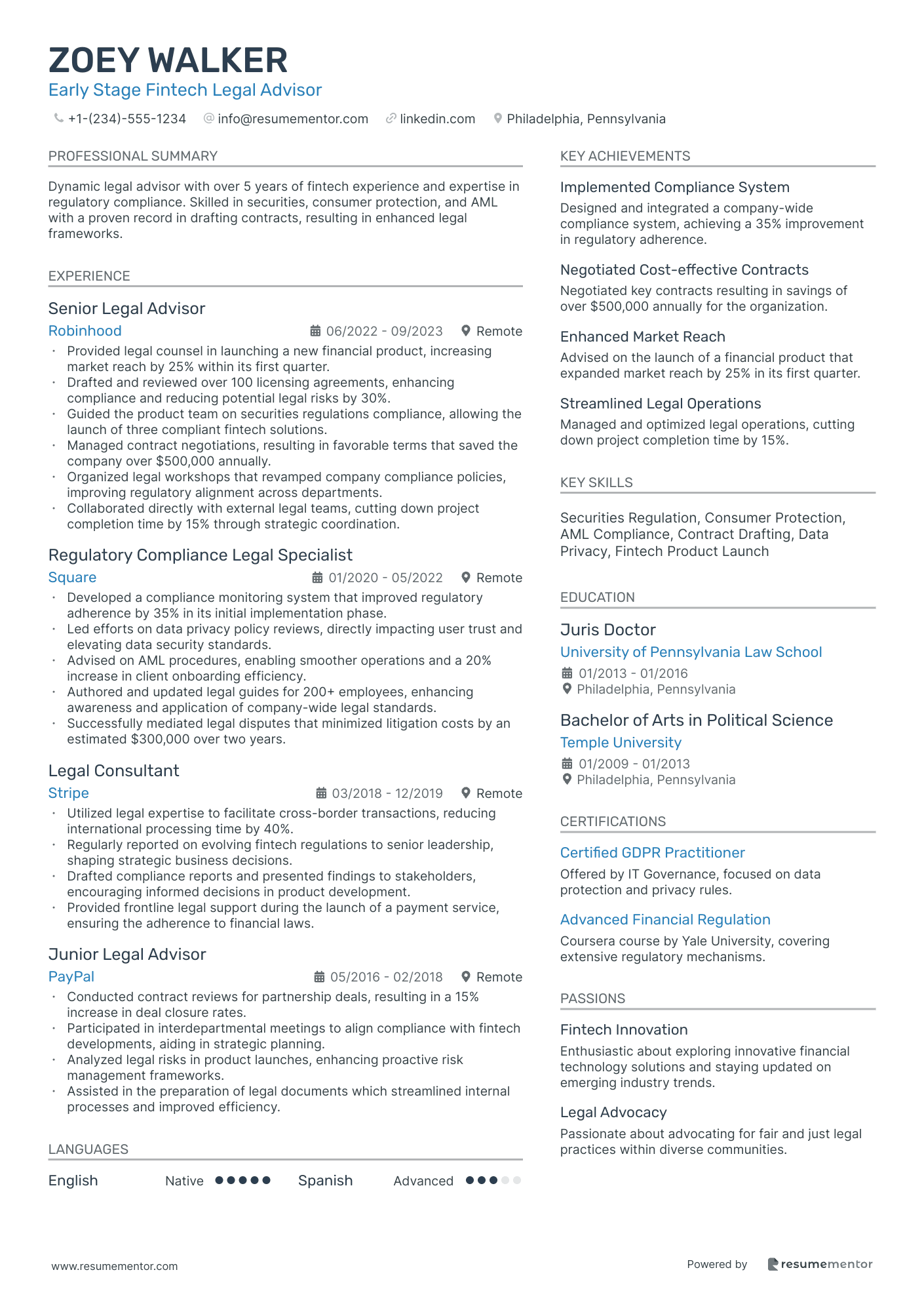

Early Stage Fintech Legal Advisor

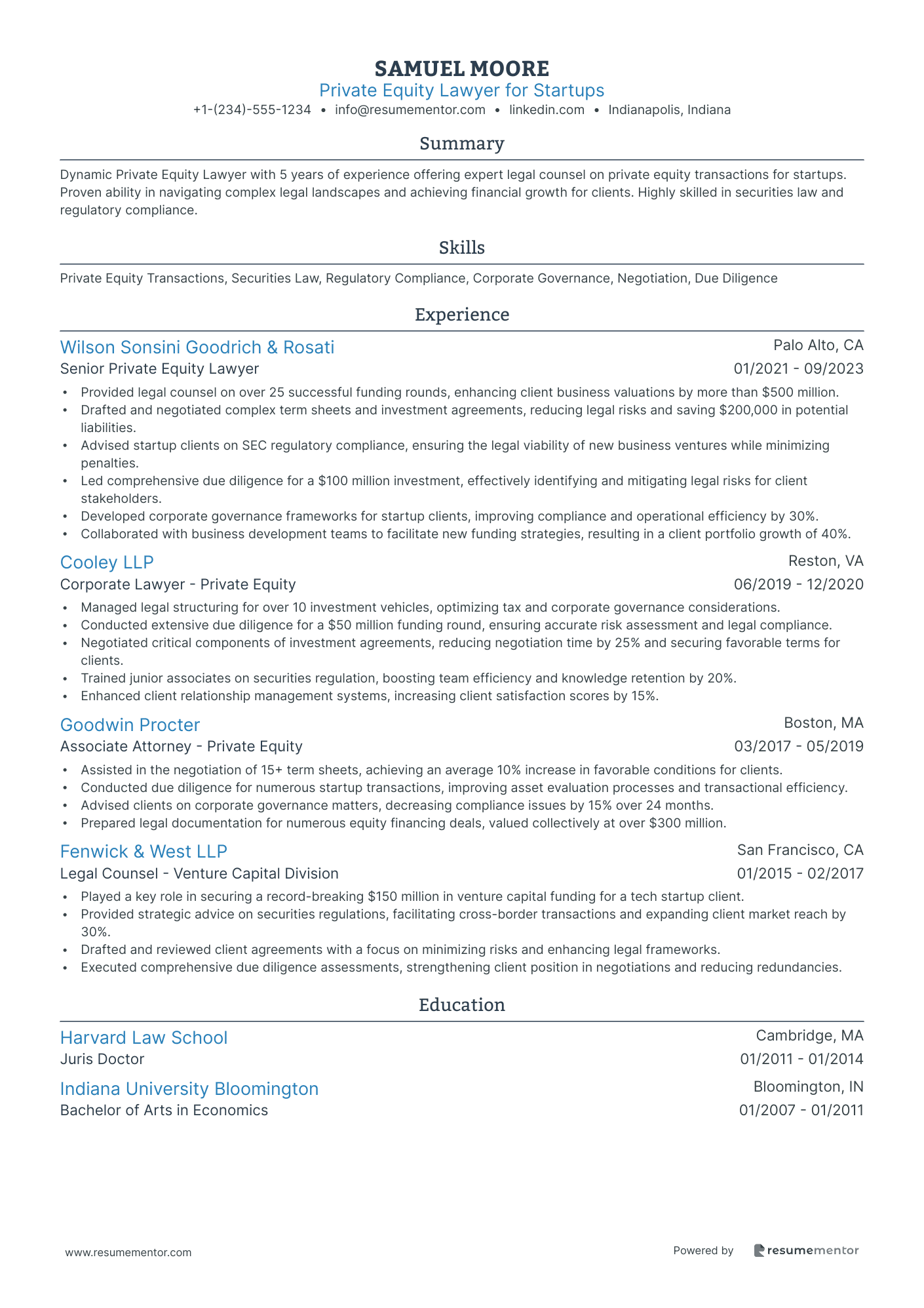

Private Equity Lawyer for Startups

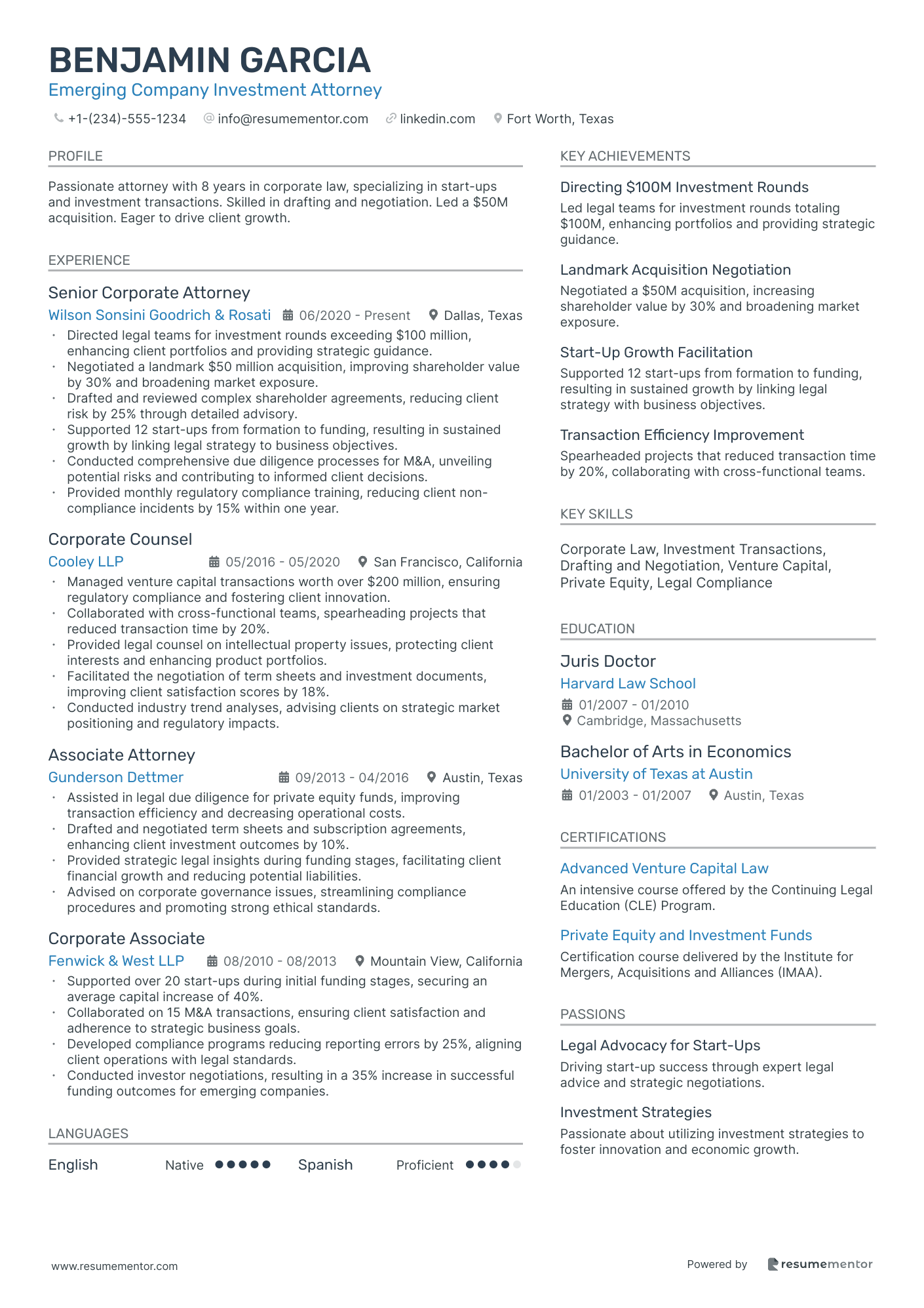

Emerging Company Investment Attorney

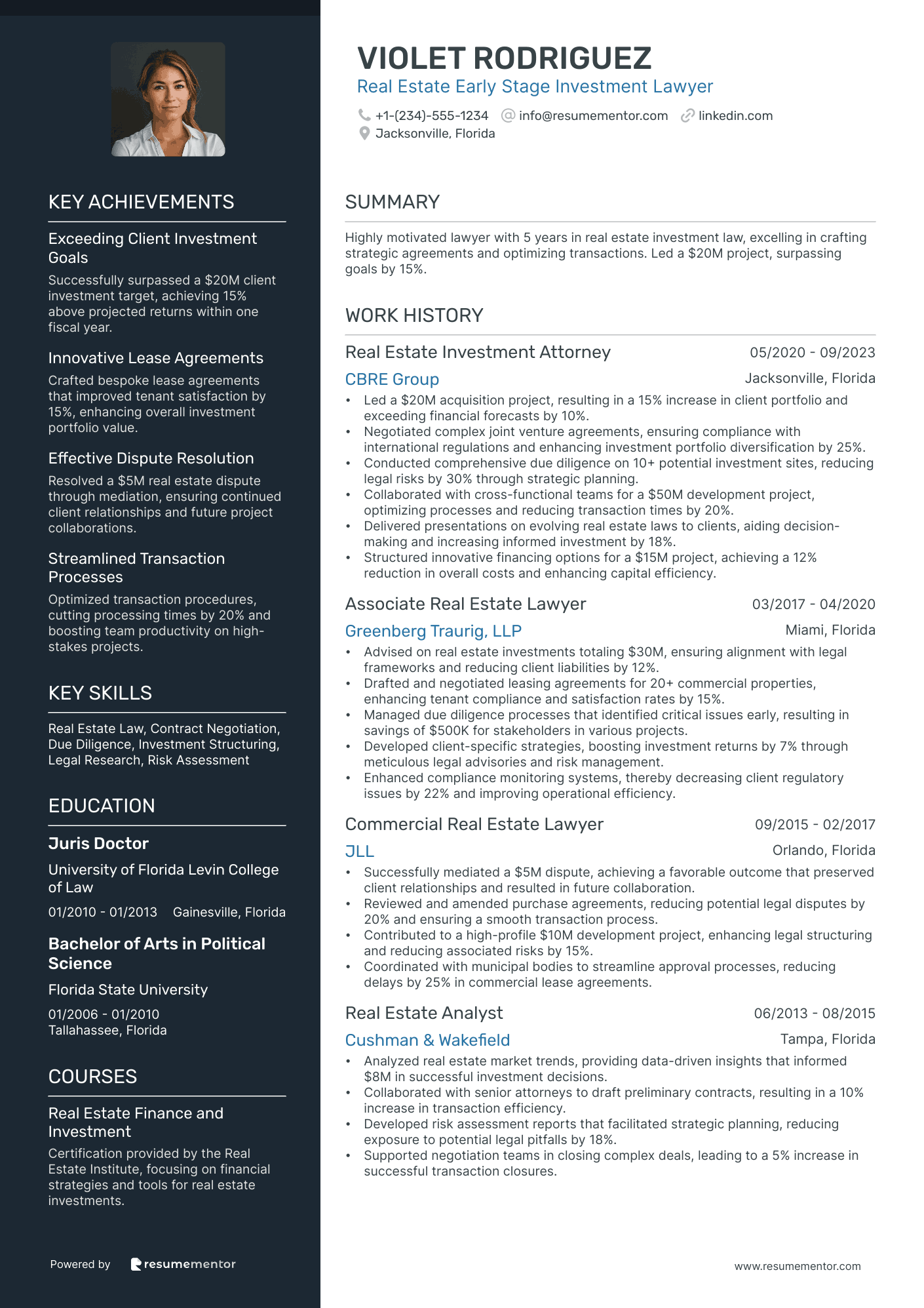

Real Estate Early Stage Investment Lawyer

Startup Financing Legal Advisor resume sample

- •Advised over 50 startup clients on equity financing and convertible notes, increasing capital raised by 40%.

- •Spearheaded negotiation of investor agreements, securing favorable terms resulting in a 30% higher valuation for startups.

- •Guided startups in preparing for Series A and B rounds, resulting in a 25% increase in successful funding closures.

- •Conducted detailed legal research on evolving regulation impacting venture capital, keeping clients compliant with no legal infractions.

- •Developed educational workshops on fundraising legalities, increasing client knowledge retention by 60% as measured by feedback surveys.

- •Collaborated with cross-functional teams to ensure integrated client service, enhancing satisfaction scores by 20%.

- •Drafted and reviewed over 100 term sheets and investor contracts, bolstering startup success in funding rounds by 35%.

- •Provided strategic legal counsel for venture capital financing, facilitating $50 million in capital infusion for clients.

- •Engaged in negotiations with international investors, improving cross-border investment terms for clients.

- •Produced compliance materials that passed regulatory audits without issues, supporting 20 startups in risk management.

- •Advised legal implications on corporate restructuring, enhancing client growth opportunities through strategic planning.

- •Conducted due diligence for 50+ startup financings, identifying potential risks and mitigating them preemptively.

- •Negotiated with venture capitalists, aiding businesses to achieve terms enhancing their market competitiveness.

- •Advised startups on corporate governance, aligning their operations with applicable securities regulations.

- •Led legal education seminars for startup communities, empowering over 100 entrepreneurs with critical knowledge.

- •Reviewed and drafted corporate documents, facilitating seamless transitions during startup acquisitions.

- •Assisted in structuring complex financing deals, ensuring compliance and profitability for emerging firms.

- •Conducted regulatory research, keeping startups informed and compliant, resulting in no legal setbacks.

- •Collaborated on client proposals, improving approval rates by 15% through strategic and informed legal contributions.

Venture Capital Legal Specialist resume sample

- •Led the successful negotiation and drafting of over 25 complex investment agreements, increasing transaction efficiency by 20%.

- •Provided expert legal advice on venture capital transactions worth over $50 million, ensuring compliance with state regulations.

- •Conducted due diligence on 15 potential investment projects per quarter, identifying key legal risks that led to informed decision-making.

- •Collaborated with cross-functional teams to align legal strategies with investment objectives, resulting in a 15% increase in positive outcomes.

- •Engaged with regulatory bodies and external legal counsel to mitigate legal risks and ensure adherence to evolving regulations.

- •Developed training materials for stakeholders, enhancing understanding of legal frameworks, which improved compliance by 30%.

- •Drafted and negotiated over 30 term sheets and fund formation documents, directly resulting in $100 million in new investments.

- •Managed a portfolio of 20 venture capital transactions annually, ensuring regulatory compliance with local and federal laws.

- •Conducted thorough legal due diligence for high-profile technology start-ups, enhancing the firm's market position in Silicon Valley.

- •Developed and implemented legal strategies for the successful launch of 3 venture capital funds, totalling over $250 million in assets.

- •Played a pivotal role in investor communications and presentations, improving investor engagement and trust, leading to increased capital commitments.

- •Reviewed legal documents and advised on compliance issues for over 40 investment initiatives, maintaining a zero-incident record.

- •Provided insights on securities laws and corporate governance, which improved the deal closure rates by 10%.

- •Worked closely with investment teams on regulatory filings, achieving 95% filing accuracy and reducing errors significantly.

- •Led a cross-departmental initiative to streamline legal processes, reducing review times by 25%.

- •Advised on corporate structure and regulatory compliance for emerging tech companies, enhancing their readiness for investor pitches.

- •Drafted numerous securities regulatory documents, ensuring full compliance and minimal feedback from regulatory bodies.

- •Collaborated with senior partners and clients, contributing to the strategic growth of the company's venture capital practice.

- •Assisted in the resolution of complex legal issues, providing actionable advice that resulted in successful client outcomes.

Seed Funding Legal Consultant resume sample

- •Advised over 50 startups on legal and regulatory compliance, resulting in a 90% success rate in securing seed funding.

- •Drafted and reviewed investment agreements and term sheets that led to an average 15% increase in deal closure efficiency.

- •Collaborated with founders on creating tailored funding strategies, which increased client growth by an average of 20% annually.

- •Facilitated due diligence processes by identifying and mitigating risk factors, enhancing investor confidence in 10 startup clients.

- •Educated clients on IP rights, leading to successful patent applications for over 30% of clients' innovative products.

- •Stayed updated on funding market trends, helping clients adjust strategies to current developments effectively.

- •Negotiated and closed 25 seed funding deals valued at over $100 million in total investment.

- •Interpreted complex securities laws for non-legal teams, resulting in improved compliance documentation for 15 startup clients.

- •Developed comprehensive compliance frameworks, leading to a 30% reduction in startup legal disputes.

- •Led workshops on startup equity structuring, attended by over 200 startup founders and investors.

- •Implemented investor relations best practices, boosting client investor retention rates by 20%.

- •Guided startups through the legal intricacies of fundraising, achieving successful funding rounds with a total of $50 million.

- •Conducted risk assessments on investor presentations, reducing potential legal liabilities by 25% for startup clients.

- •Participated in over 100 investment negotiations, improving terms for startups, leading to increased stakeholder satisfaction.

- •Provided strategic advice on equity agreements that led to better protections for founders in 15 startup cases.

- •Advised technology startups on compliance with federal laws, achieving 100% legal compliance in audits for 20 companies.

- •Drafted and negotiated contracts, leading to a significant reduction in legal costs for small businesses by 15%.

- •Conducted legal research on international trade laws, supporting successful market entry strategies for 5 tech startups.

- •Contributed to the development of a legal framework that optimized contract negotiation processes by 25%.

Angel Investment Attorney resume sample

- •Advised over 30 angel investors on crafting investment structures that doubled potential profits by minimizing exposure to regulatory risks.

- •Negotiated complex term sheets and shareholder agreements, securing investor returns up to 45% above market average.

- •Led due diligence projects for high-tech startup funding rounds, assessing risk and opportunity for portfolios exceeding $100M.

- •Structured several investment funds and SPVs, resulting in streamlined investment processes and optimized legal coverage.

- •Provided comprehensive legal counsel that reduced compliance violations by 30% in alignment with evolving securities laws.

- •Facilitated monthly workshops and seminars, improving client engagement and generating a 20% increase in new client acquisitions.

- •Drafted and reviewed contracts for venture capital firms, achieving negotiation outcomes with 35% more favorable terms.

- •Managed due diligence for tech startups, identifying key investment opportunities leading to strategic partnerships.

- •Advised on formation of SPVs, significantly simplifying clients' investment strategies and enhancing operational efficiency.

- •Maintained and grew client relationships across sectors, boosting client satisfaction scores by 25% within two years.

- •Stayed abreast of venture capital trends, keeping clients informed and compliant with regulatory developments.

- •Provided legal advice to angel investors, focusing on structuring investments which increased portfolio valuations by 40%.

- •Skilled drafting and negotiation of investment agreements, resulting in securing crucial financing rounds for startups.

- •Conducted extensive legal research on compliance issues, reducing client exposure to legal liabilities by up to 20%.

- •Cultivated industry relationships, leading to an influx of new partnerships and collaborative ventures.

- •Assisted in the drafting of investment documents, resulting in a significant number of secured agreements for emerging businesses.

- •Advised clients on legal compliance, dramatically decreasing breach incidents through strategic counsel.

- •Supported the negotiation process in financing rounds that cumulatively raised over $50 million for growth ventures.

- •Built a network of important industry contacts, enhancing firm visibility and creating future client opportunities.

Technology Startup Investment Lawyer resume sample

- •Lead counsel for multiple startup clients, facilitating over $100M in venture capital funding, significantly boosting their valuation.

- •Advised startups on formation, compliance, and initial funding, resulting in growth of client base by 30%.

- •Negotiated favorable terms for startups with venture capitalists, improving startup equity by 15% in multiple deals.

- •Collaborated on high-profile intellectual property rights cases, securing patents and trademarks pivotal for tech companies.

- •Supervised corporate governance compliance, reducing regulatory breach risks by 25% through strategic policy implementation.

- •Mentored junior attorneys, increasing team efficiency by 20% while delivering exceptional client services.

- •Advised technology startups in negotiation and execution of $50M Series A and B funding rounds.

- •Provided comprehensive legal reviews, ensuring full compliance with state and federal securities regulations.

- •Drafted investment agreements and term sheets that contributed to successful funding by 40%.

- •Delivered IP counsel on patents, improving tech firm's market position and securing key innovations.

- •Managed cross-departmental legal projects, enhancing client satisfaction scores by 15% through integrated service delivery.

- •Facilitated corporate restructuring, achieving a 10% reduction in operational legal risks for startups.

- •Negotiated key client contracts worth $20M, resulting in secured long-term partnerships.

- •Developed startup investment strategies that improved funding acquisition efficiency by 12%.

- •Guided clients through IP strategy development, enhancing patent portfolio value by 25%.

- •Supported tech startups in drafting and negotiating initial contracts, streamlining early-stage operations.

- •Performed legal due diligence for mergers and acquisitions, optimizing clients' strategic growth objectives.

- •Managed compliance-check procedures to align with emerging industry standards and corporate governance frameworks.

- •Enhanced internal processes leading to a 15% reduction in contract negotiation timeframes.

Biotech Early Stage Investment Lawyer resume sample

- •Advised on investments totaling $150M, contributing to a 30% increase in funding for early-stage biotech firms.

- •Led negotiations for high-profile mergers, achieving strategic alignments and a 40% enhancement in market competitiveness.

- •Developed and implemented regulatory compliance strategies for 25 client projects annually, increasing client satisfaction by 20%.

- •Collaborated with cross-functional teams to align legal frameworks with business goals, resulting in increased operational efficiency.

- •Mentored a team of 5 junior lawyers, guiding them in complex investment matters and enhancing team delivery by 30%.

- •Established strong relationships with key venture capitalists, leading to a 25% growth in client base.

- •Managed biotech investment portfolios worth $200M, surpassing revenue targets by 15% each year.

- •Conducted thorough due diligence for 30+ biotech ventures, significantly reducing legal risks by 40%.

- •Played a pivotal role in developing 10 new legal frameworks for intellectual property protection in the biotech sector.

- •Facilitated over 50 successful negotiations, improving the company’s investment outcome metrics by 35%.

- •Enhanced corporate governance strategies for multiple stakeholders, leading to a 20% increase in market compliance.

- •Provided strategic legal advice on biotechnology investments, contributing to a $100M increase in venture funding.

- •Drafted over 200 investment agreements, ensuring 98% compliance with regulatory standards and relationship satisfaction.

- •Collaborated with FDA regulation teams to streamline compliance processes, reducing approval times by 20%.

- •Executed tailored shareholder agreements, achieving optimal client returns of up to 25% in a competitive market.

- •Assessed and mitigated legal risks for $50M in biotech investments, improving risk management by 30%.

- •Supported negotiations for investment agreements, successfully securing agreements for 90% of clients.

- •Conducted legal audits resulting in increased client retention by resolving 95% of compliance discrepancies.

- •Led intellectual property rights workshops, enhancing client understanding and protection measures.

Early Stage Fintech Legal Advisor resume sample

- •Provided legal counsel in launching a new financial product, increasing market reach by 25% within its first quarter.

- •Drafted and reviewed over 100 licensing agreements, enhancing compliance and reducing potential legal risks by 30%.

- •Guided the product team on securities regulations compliance, allowing the launch of three compliant fintech solutions.

- •Managed contract negotiations, resulting in favorable terms that saved the company over $500,000 annually.

- •Organized legal workshops that revamped company compliance policies, improving regulatory alignment across departments.

- •Collaborated directly with external legal teams, cutting down project completion time by 15% through strategic coordination.

- •Developed a compliance monitoring system that improved regulatory adherence by 35% in its initial implementation phase.

- •Led efforts on data privacy policy reviews, directly impacting user trust and elevating data security standards.

- •Advised on AML procedures, enabling smoother operations and a 20% increase in client onboarding efficiency.

- •Authored and updated legal guides for 200+ employees, enhancing awareness and application of company-wide legal standards.

- •Successfully mediated legal disputes that minimized litigation costs by an estimated $300,000 over two years.

- •Utilized legal expertise to facilitate cross-border transactions, reducing international processing time by 40%.

- •Regularly reported on evolving fintech regulations to senior leadership, shaping strategic business decisions.

- •Drafted compliance reports and presented findings to stakeholders, encouraging informed decisions in product development.

- •Provided frontline legal support during the launch of a payment service, ensuring the adherence to financial laws.

- •Conducted contract reviews for partnership deals, resulting in a 15% increase in deal closure rates.

- •Participated in interdepartmental meetings to align compliance with fintech developments, aiding in strategic planning.

- •Analyzed legal risks in product launches, enhancing proactive risk management frameworks.

- •Assisted in the preparation of legal documents which streamlined internal processes and improved efficiency.

Private Equity Lawyer for Startups resume sample

- •Provided legal counsel on over 25 successful funding rounds, enhancing client business valuations by more than $500 million.

- •Drafted and negotiated complex term sheets and investment agreements, reducing legal risks and saving $200,000 in potential liabilities.

- •Advised startup clients on SEC regulatory compliance, ensuring the legal viability of new business ventures while minimizing penalties.

- •Led comprehensive due diligence for a $100 million investment, effectively identifying and mitigating legal risks for client stakeholders.

- •Developed corporate governance frameworks for startup clients, improving compliance and operational efficiency by 30%.

- •Collaborated with business development teams to facilitate new funding strategies, resulting in a client portfolio growth of 40%.

- •Managed legal structuring for over 10 investment vehicles, optimizing tax and corporate governance considerations.

- •Conducted extensive due diligence for a $50 million funding round, ensuring accurate risk assessment and legal compliance.

- •Negotiated critical components of investment agreements, reducing negotiation time by 25% and securing favorable terms for clients.

- •Trained junior associates on securities regulation, boosting team efficiency and knowledge retention by 20%.

- •Enhanced client relationship management systems, increasing client satisfaction scores by 15%.

- •Assisted in the negotiation of 15+ term sheets, achieving an average 10% increase in favorable conditions for clients.

- •Conducted due diligence for numerous startup transactions, improving asset evaluation processes and transactional efficiency.

- •Advised clients on corporate governance matters, decreasing compliance issues by 15% over 24 months.

- •Prepared legal documentation for numerous equity financing deals, valued collectively at over $300 million.

- •Played a key role in securing a record-breaking $150 million in venture capital funding for a tech startup client.

- •Provided strategic advice on securities regulations, facilitating cross-border transactions and expanding client market reach by 30%.

- •Drafted and reviewed client agreements with a focus on minimizing risks and enhancing legal frameworks.

- •Executed comprehensive due diligence assessments, strengthening client position in negotiations and reducing redundancies.

Emerging Company Investment Attorney resume sample

- •Directed legal teams for investment rounds exceeding $100 million, enhancing client portfolios and providing strategic guidance.

- •Negotiated a landmark $50 million acquisition, improving shareholder value by 30% and broadening market exposure.

- •Drafted and reviewed complex shareholder agreements, reducing client risk by 25% through detailed advisory.

- •Supported 12 start-ups from formation to funding, resulting in sustained growth by linking legal strategy to business objectives.

- •Conducted comprehensive due diligence processes for M&A, unveiling potential risks and contributing to informed client decisions.

- •Provided monthly regulatory compliance training, reducing client non-compliance incidents by 15% within one year.

- •Managed venture capital transactions worth over $200 million, ensuring regulatory compliance and fostering client innovation.

- •Collaborated with cross-functional teams, spearheading projects that reduced transaction time by 20%.

- •Provided legal counsel on intellectual property issues, protecting client interests and enhancing product portfolios.

- •Facilitated the negotiation of term sheets and investment documents, improving client satisfaction scores by 18%.

- •Conducted industry trend analyses, advising clients on strategic market positioning and regulatory impacts.

- •Assisted in legal due diligence for private equity funds, improving transaction efficiency and decreasing operational costs.

- •Drafted and negotiated term sheets and subscription agreements, enhancing client investment outcomes by 10%.

- •Provided strategic legal insights during funding stages, facilitating client financial growth and reducing potential liabilities.

- •Advised on corporate governance issues, streamlining compliance procedures and promoting strong ethical standards.

- •Supported over 20 start-ups during initial funding stages, securing an average capital increase of 40%.

- •Collaborated on 15 M&A transactions, ensuring client satisfaction and adherence to strategic business goals.

- •Developed compliance programs reducing reporting errors by 25%, aligning client operations with legal standards.

- •Conducted investor negotiations, resulting in a 35% increase in successful funding outcomes for emerging companies.

Real Estate Early Stage Investment Lawyer resume sample

- •Led a $20M acquisition project, resulting in a 15% increase in client portfolio and exceeding financial forecasts by 10%.

- •Negotiated complex joint venture agreements, ensuring compliance with international regulations and enhancing investment portfolio diversification by 25%.

- •Conducted comprehensive due diligence on 10+ potential investment sites, reducing legal risks by 30% through strategic planning.

- •Collaborated with cross-functional teams for a $50M development project, optimizing processes and reducing transaction times by 20%.

- •Delivered presentations on evolving real estate laws to clients, aiding decision-making and increasing informed investment by 18%.

- •Structured innovative financing options for a $15M project, achieving a 12% reduction in overall costs and enhancing capital efficiency.

- •Advised on real estate investments totaling $30M, ensuring alignment with legal frameworks and reducing client liabilities by 12%.

- •Drafted and negotiated leasing agreements for 20+ commercial properties, enhancing tenant compliance and satisfaction rates by 15%.

- •Managed due diligence processes that identified critical issues early, resulting in savings of $500K for stakeholders in various projects.

- •Developed client-specific strategies, boosting investment returns by 7% through meticulous legal advisories and risk management.

- •Enhanced compliance monitoring systems, thereby decreasing client regulatory issues by 22% and improving operational efficiency.

- •Successfully mediated a $5M dispute, achieving a favorable outcome that preserved client relationships and resulted in future collaboration.

- •Reviewed and amended purchase agreements, reducing potential legal disputes by 20% and ensuring a smooth transaction process.

- •Contributed to a high-profile $10M development project, enhancing legal structuring and reducing associated risks by 15%.

- •Coordinated with municipal bodies to streamline approval processes, reducing delays by 25% in commercial lease agreements.

- •Analyzed real estate market trends, providing data-driven insights that informed $8M in successful investment decisions.

- •Collaborated with senior attorneys to draft preliminary contracts, resulting in a 10% increase in transaction efficiency.

- •Developed risk assessment reports that facilitated strategic planning, reducing exposure to potential legal pitfalls by 18%.

- •Supported negotiation teams in closing complex deals, leading to a 5% increase in successful transaction closures.

Navigating the world of early stage investment law is like playing a strategic game, where every move counts. Your resume is the key card in this competitive arena, shaping your journey to success. Capturing your expertise in venture capital deals and startup financing within one concise document can be challenging. That’s why presenting your skills and experiences in a way that leaves a strong impression on potential employers is crucial.

Choosing which niche experiences to include can leave you feeling uncertain. Here’s where a reliable resume template comes in handy. It streamlines your experiences, education, and achievements into an organized format, providing a foundation to build upon. For some helpful options, check out these templates.

A disorganized resume might let your key accomplishments slip through the cracks, making it tough for employers to recognize your value. By using a tailored template, you ensure your skills in contract negotiations and investment strategy management are front and center. This approach not only boosts your confidence but also makes you stand out to firms seeking talented investment lawyers.

Key Takeaways

- Writing a strong resume for early stage investment law is crucial as it presents your expertise in venture capital and creates a lasting impression on employers.

- A well-organized template can highlight key experiences and skills, ensuring that important achievements stand out effectively.

- The resume should focus on legal expertise, negotiation skills, and a clear understanding of corporate law and venture capital.

- Including sections such as contact information, professional experience, education, skills, and certifications is vital for showcasing qualifications.

- Choosing a chronological format for the resume with modern fonts and consistent formatting across devices is recommended for a professional presentation.

What to focus on when writing your early stage investment lawyer resume

Your early stage investment lawyer resume should highlight your legal expertise, negotiation skills, and knowledge of venture capital. Recruiters seek professionals who understand corporate law and can navigate startups through complex legal challenges, demonstrating your ability to manage early-stage funding and structuring effectively.

How to structure your early stage investment lawyer resume

- Contact Information — Clearly present your name, phone number, email, and LinkedIn profile to make it easy for recruiters to reach you. Using a professional email address and including a LinkedIn profile further establishes your professional credibility, showing your awareness of maintaining a strong industry presence.

- Summary or Objective — Craft a brief statement showcasing your dedication to supporting emerging companies, emphasizing your expertise in investment law. This section provides a snapshot of your career focus and should resonate with your overall professional narrative. It sets the stage for the reader to understand the depth of your legal experience in early-stage investments.

- Professional Experience — Highlight roles in venture capital and corporate law, stressing experiences like term sheet negotiations. A focus on key achievements, such as successful funding rounds or resolving complex legal obstacles, will illustrate your hands-on skills and underscore your contributions to past employers. Use action words such as "advised" or "structured" to convey your impact effectively.

- Education — Detail your law degree and highlight any notable achievements or coursework, particularly those related to corporate finance or startups, which underline your academic foundation in the field. Your education, especially if supplemented by law courses relevant to venture capital, builds trust in your ability to apply learned principles to real-world situations.

- Skills — Showcase your abilities in contract drafting, negotiation, and a deep understanding of securities law. Mention any involvement with startup accelerators or incubators to highlight your practical experience, reinforcing your readiness to tackle the unique challenges startups face. Your skills section should reflect both your legal know-how and your practical experience in the startup world.

- Certifications/Licenses — List your bar admission(s) and relevant certifications, such as a Certified Investment Management Analyst (CIMA), to reinforce your professional qualifications and commitment to ongoing professional development. These credentials not only validate your expertise but also differentiate you from other candidates.

Consider adding optional sections like Languages, Publications, or Professional Affiliations to further showcase your expertise and commitment to specific areas within the field—up next, we'll cover the best resume format and dive into each section more in-depth.

Which resume format to choose

Creating an impressive resume as an early stage investment lawyer involves highlighting your unique journey and skills in a structured and polished way. Start with a chronological format to effectively map out your career progression. This approach helps illustrate how your experience builds on each role, emphasizing your development and expertise in the investment law sector.

When it comes to choosing fonts, opt for modern styles like Lato, Montserrat, or Raleway. These fonts maintain a clean and professional look while adding a subtle contemporary edge to your resume. This choice reflects both your modern approach to law and your readiness to adapt to the evolving landscape of early stage investments.

Ensuring that your resume's appearance remains consistent across various devices is crucial. That's why saving your document as a PDF is the best choice. PDFs preserve your formatting, making sure that employers see your resume exactly as you designed it, without unexpected shifts in layout.

Margins play an important role in the overall readability and professionalism of your resume. Keep margins around one inch on all sides to provide a structured look with enough white space. This balance ensures that your content doesn’t feel cramped, allowing potential employers to easily focus on your credentials and achievements.

By addressing these aspects, your resume will not only capture attention but also convey the professionalism and expertise essential in the role of an early-stage investment lawyer.

How to write a quantifiable resume experience section

Your experience section is the core of your resume as an early stage investment lawyer, and it should quickly convey your most impactful achievements. Start by listing your job experiences with the most recent first to maintain clarity and focus on roles that highlight your expertise in early stage investments. Including positions from the last 10-15 years gives a comprehensive view without overwhelming the reader. Tailoring your resume to the job ad is crucial; reflect on the skills and qualifications they're seeking, and mirror those with your experiences. Incorporate strong action verbs like "negotiated," "advised," and "facilitated" to provide a vivid picture of your role in each accomplishment.

Consider this example:

- •Negotiated over $100 million in early stage investment deals for emerging tech companies, achieving a 95% success rate.

- •Advised 50+ startups on structuring legal frameworks to secure venture capital, leading to a 20% increase in investor interest.

- •Facilitated a cross-border merger, successfully aligning two top-tier biotech startups under a compliant legal structure.

- •Managed a team of five junior attorneys conducting due diligence, ensuring regulatory compliance across 150+ deals annually.

This example truly stands out, connecting achievements with measurable impact. By using strong verbs like "negotiated," "advised," and "facilitated," it demonstrates your initiative and leadership in a cohesive manner. Placing your experiences in reverse chronological order highlights your evolving skills, making a smooth connection from past roles to future potential. Tailoring is evident in achievements focused on early stage investments, aligning perfectly with what potential employers might seek. Every entry reinforces your ability to drive positive outcomes and support business growth, creating a seamless narrative that positions you as a standout candidate.

Training and Development Focused resume experience section

A training-focused early stage investment lawyer's resume experience section should clearly showcase your role in educating and guiding clients or teams. Start with how you craft and deliver tailored training programs that simplify complex legal concepts. Explain how these programs not only aid startups in understanding regulations but also highlight the positive outcomes, such as improved compliance or enhanced client satisfaction, that result from your efforts.

Highlight your ability to work collaboratively with other departments or professionals, enriching the training sessions you offer. Emphasize your leadership skills by illustrating how you guide teams through interactive seminars and workshops. This approach will demonstrate your problem-solving abilities and your capacity to make a significant impact in early stage investment settings. Below is an example of how to effectively present these contributions on your resume:

Investment Lawyer

Innovative Legal Solutions

June 2020 - Present

- Developed and delivered comprehensive legal training programs for startup founders and investors.

- Collaborated with cross-functional teams to tailor legal education sessions specific to tech industry regulations.

- Led workshops resulting in a 30% increase in regulatory compliance understanding among clients.

- Facilitated interactive seminars improving contract negotiation skills within early-stage startups.

Problem-Solving Focused resume experience section

A problem-solving focused early-stage investment lawyer resume experience section should seamlessly connect your ability to navigate legal complexities with your role in aiding the success of new ventures. Emphasize your analytical skills and negotiation talents, showcasing how these abilities help you thrive under pressure and guide investments within legal boundaries. Highlight both your strategic insights and hands-on contributions, conveying your impact in a clear and straightforward manner.

Begin each experience entry by stating your job title and workplace to provide context. Use bullet points to illustrate specific situations where you effectively solved problems, enhanced processes, or influenced investment decisions. By including measurable outcomes, you paint a vivid picture of your role and achievements in the investment legal field. Here's a formatted example of how to present your experience section in JSON:

Early-Stage Investment Lawyer

Tech Innovations LLC

January 2020 - Present

- Guided a startup acquisition, ensuring compliance with all relevant regulations and achieving a successful deal closure.

- Negotiated and structured critical investment agreements, leading to a 15% boost in funding rounds for new ventures.

- Worked with venture partners to create risk management strategies, greatly reducing potential litigation risks.

- Streamlined due diligence processes, cutting time spent reviewing legal documentation by 30%.

Project-Focused resume experience section

A project-focused early-stage investment lawyer resume experience section should clearly highlight your achievements and contributions in a cohesive manner. Start by showcasing the impact you had in previous roles through specific examples of the deals you navigated and the strategies you crafted. By detailing improvements you implemented in internal processes, you underline your capability to address complex legal challenges within a fast-paced investment setting, which reflects your expertise and the value you bring to prospective employers.

Equally important is illustrating your ability to work collaboratively with others. Highlight your role in team-oriented projects, negotiations, and business decision-making processes. Whenever possible, support your claims with quantifiable results, such as growth percentages, cost savings, or revenue increases that you helped achieve. By weaving these experiences together, you create a compelling narrative that demonstrates your skills and strengths as an effective lawyer in the investment arena.

Investment Lawyer

Innovate Legal Partners

January 2021 - Present

- Led legal negotiations for over 15 successful early-stage investment rounds, securing more than $50 million in startup funding.

- Developed strategic legal frameworks that streamlined due diligence processes by 30%, boosting transaction speed.

- Worked with cross-functional teams to assess risk and ensure compliance, thereby strengthening company governance.

- Advised on intellectual property protection, helping 10 startups enhance their IP portfolios and mitigate legal risks.

Innovation-Focused resume experience section

A resume experience section for an innovation-focused early stage investment lawyer should clearly showcase your role in driving growth for startups and navigating the legal complexities of new ventures. Begin by describing your core responsibilities and achievements in a way that highlights how your actions have directly supported innovation. Use strong, active language to connect your contributions with positive outcomes, and quantify your successes to add credibility and impact.

Highlight specific skills and experiences that align with innovative legal work, emphasizing successful projects or substantial roles in startup environments. Describe how your involvement in pioneering projects and legal strategies has helped burgeoning businesses overcome challenges. This approach will demonstrate your ability to handle intricate legal matters and showcase how your expertise supports the vibrant growth of emerging enterprises.

Early Stage Investment Lawyer

Tech Innovations Inc.

January 2019 - Present

- Advised over 20 tech startups on seed funding agreements, ensuring compliance with legal standards.

- Developed innovative IP protection strategies that increased client portfolio value by 30%.

- Negotiated and secured contracts with venture capital firms, resulting in $10 million in funding.

- Hosted educational workshops to provide legal insights to emerging businesses in the tech sector.

Write your early stage investment lawyer resume summary section

A client-focused early-stage investment lawyer resume summary should effectively showcase your abilities and achievements in a snapshot. Think of it as an elevator pitch that highlights your skills and the value you can bring to a potential employer. Here’s an example crafted for this field:

This example not only highlights your core legal skills but also demonstrates your passion for supporting startups. It gives employers a clear idea of the skills you bring to the table. When crafting your summary, focus on what makes you unique and useful to prospective employers. Strong, active words can help illustrate your impact.

Understanding the differences between types of resume introductions can also enhance your presentation. A summary hones in on your main strengths and professionalism, while a resume objective might outline your career goals. On the other hand, a resume profile provides a broader overview of your experience, and a summary of qualifications lists your specific skills and achievements.

Each serves a unique purpose and can be chosen based on what best suits your career stage. As an early-stage investment lawyer, a well-crafted resume summary is often an effective way to convey your readiness and capability. By tailoring it to the role you’re aiming for, you ensure your message resonates with hiring managers. This approach ties your skills directly to the needs of potential employers, creating a compelling snapshot of your professional identity.

Listing your early stage investment lawyer skills on your resume

A skills-focused early stage investment lawyer resume should highlight the strengths that make you a standout candidate. Start by featuring your skills in their own dedicated section or weaving them into your experience and summary. Incorporating your strengths and soft skills demonstrates your ability to connect with others and solve challenges effectively. Complementing these, hard skills are the specific abilities you've honed through training or experience, showing your capability in handling intricate legal work. When you highlight these skills and strengths, you transform them into powerful keywords that can catch the eye of employers and applicant tracking systems.

Here's an example JSON format for a standalone skills section:

This focused skills section effectively communicates a wide range of relevant expertise, positioning you as an appealing candidate for potential employers.

Best hard skills to feature on your early stage investment lawyer resume

Early stage investment lawyers should emphasize hard skills that reflect expertise in both legal and financial realms. These skills show your ability to manage complex transactions while adhering to legal standards.

Hard Skills

- Legal Research

- Due Diligence

- Contract Negotiation

- Venture Capital

- Corporate Law

- Intellectual Property

- Financial Analysis

- Regulatory Compliance

- Risk Assessment

- Transaction Structuring

- Securities Law

- Mergers and Acquisitions

- Drafting and Reviewing Legal Documents

- Tax Law

- Cross-border Transactions

Best soft skills to feature on your early stage investment lawyer resume

Soft skills provide insight into how you interact and work with others. As an early stage investment lawyer, these skills demonstrate your leadership, collaboration, and problem-solving abilities.

Soft Skills

- Communication

- Analytical Thinking

- Problem Solving

- Negotiation

- Leadership

- Adaptability

- Emotional Intelligence

- Time Management

- Decision Making

- Teamwork

- Integrity

- Creativity

- Conflict Resolution

- Attention to Detail

- Active Listening

How to include your education on your resume

The education section of your resume is crucial, especially when applying for a job as an early stage investment lawyer. Tailoring this section to the job at hand is key, so only include relevant education. Listing irrelevant education can distract from your qualifications. When including your GPA, make sure it adds value and sets you apart. If you graduated with honors such as cum laude, mention it. Clearly state your degree, the institution, and any academic achievements that bolster your fit for the role.

- •Graduated cum laude

The second example is effective because it lists relevant degrees for an early stage investment lawyer. It highlights strong academic performance and mentions honors like cum laude, making the candidate stand out. It includes prestigious institutions that hold weight in the legal field. The inclusion of dates provides a clear timeline of the candidate's educational history. By only listing education related to law and political science, the section remains focused and impressive.

How to include early stage investment lawyer certificates on your resume

Including a certificates section in your resume is crucial, especially in the early stage investment law field. List the name of each certificate clearly. Include the date you received each certificate. Add the issuing organization for validation. Certificates can also be placed in the header for instant visibility. For instance, you can format it like this: “Certified Financial Planner (2021) - CFP Board”.

This example is effective as it lists relevant certifications. Titles like “Certified Financial Planner” and “Financial Risk Manager” align well with investment law. The dates and issuing bodies verify authenticity, boosting your credibility. It's concise and relevant, fitting neatly into a resume for an early stage investment lawyer.

Extra sections to include in your early stage investment lawyer resume

Starting your journey as an early-stage investment lawyer can be both challenging and rewarding. Crafting a strong resume is essential to making a positive impression on potential employers.

- Language section — Highlight your proficiency in multiple languages to show your versatility and ability to communicate with diverse clients.

- Hobbies and interests section — Include activities that demonstrate leadership, teamwork, or analytical skills, like chess or running marathons, which can reflect positively on your character.

- Volunteer work section — Showcase your community involvement to reveal your commitment to giving back and your ability to balance work and personal commitments.

- Books section — Mention relevant books you have read to display your dedication to continuous learning and staying updated with industry trends.

When arranged thoughtfully, these sections not only highlight your professional abilities but also paint a comprehensive picture of who you are. This helps you stand out as a well-rounded candidate ready to tackle the challenges of an early-stage investment lawyer.

In Conclusion

In conclusion, creating a standout resume in the specialized field of early-stage investment law requires careful attention to detail and strategic organization. Your resume acts as a vital tool to bridge the gap between your professional capabilities and the needs of prospective employers. A well-structured resume showcases not just your legal expertise but also your ability to navigate the complex landscape of venture capital and startup investments. Utilizing a chronological format helps map out your career growth, allowing employers to see your development over time. Emphasizing both your hard and soft skills in prominent sections ensures that your resume resonates with potential recruiters, highlighting your analytical, communication, and negotiation abilities.

Incorporating specifics about your education and any relevant certifications strengthens your credentials, demonstrating a committed approach to professional growth. Optional sections, like languages or volunteer work, can further enhance your resume by illustrating your broader experiences and personal attributes. Importantly, a strong resume summary ties all these elements together, making a compelling case for your candidacy in the early-stage investment law field. By implementing these strategies, you present yourself as a well-rounded, capable candidate, ready to make an impactful contribution to any legal team. Whether you’re a seasoned professional or entering the field, paying attention to these aspects can set the stage for a successful career trajectory.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.