Entry Level Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Master your entry-level accountant resume with our guide, ensuring your skills and experience count in your favor for your next job hunt. Learn key tips to excel and put your best foot forward."

Rated by 348 people

Entry Level Audit Accountant

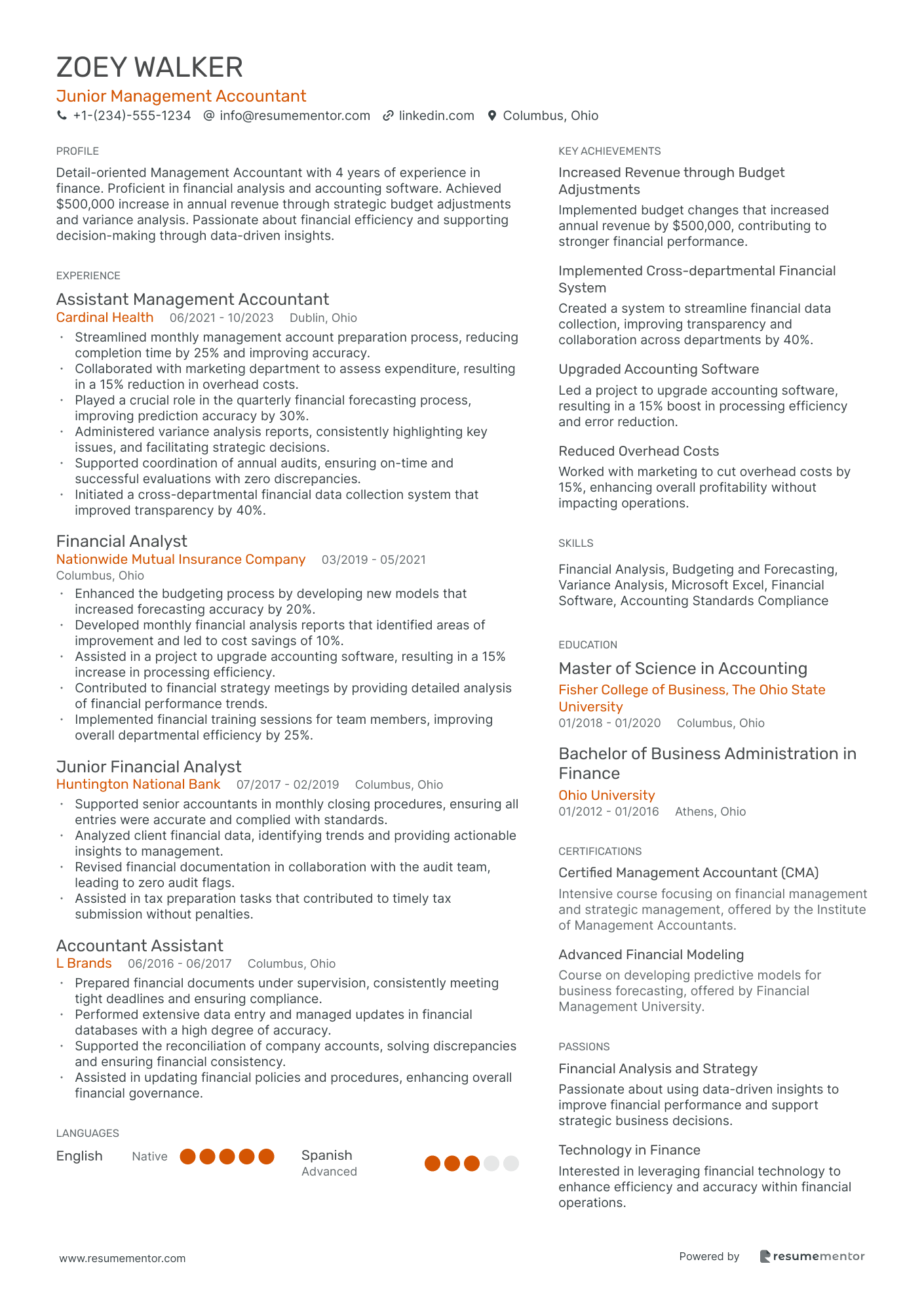

Junior Management Accountant

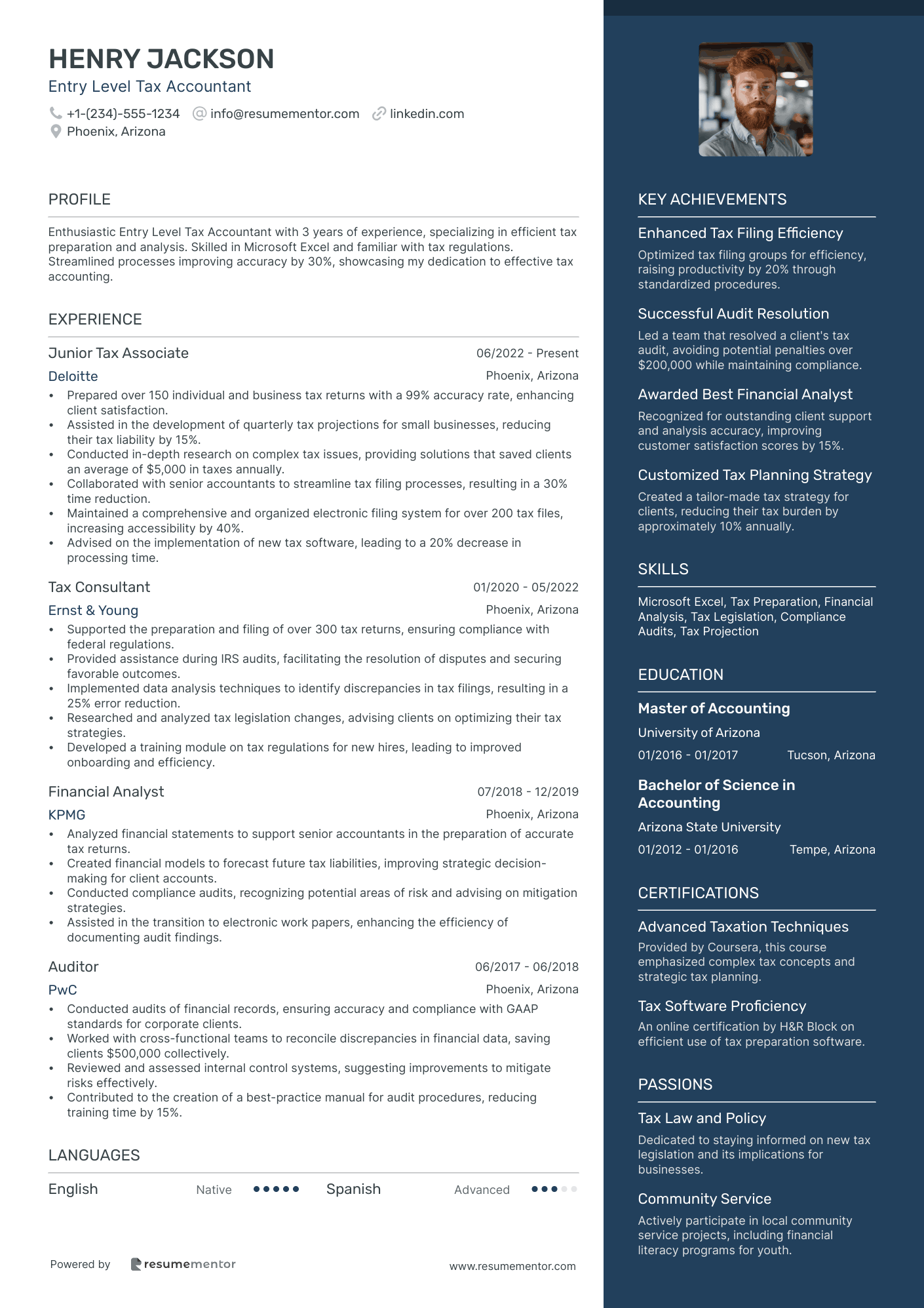

Entry Level Tax Accountant

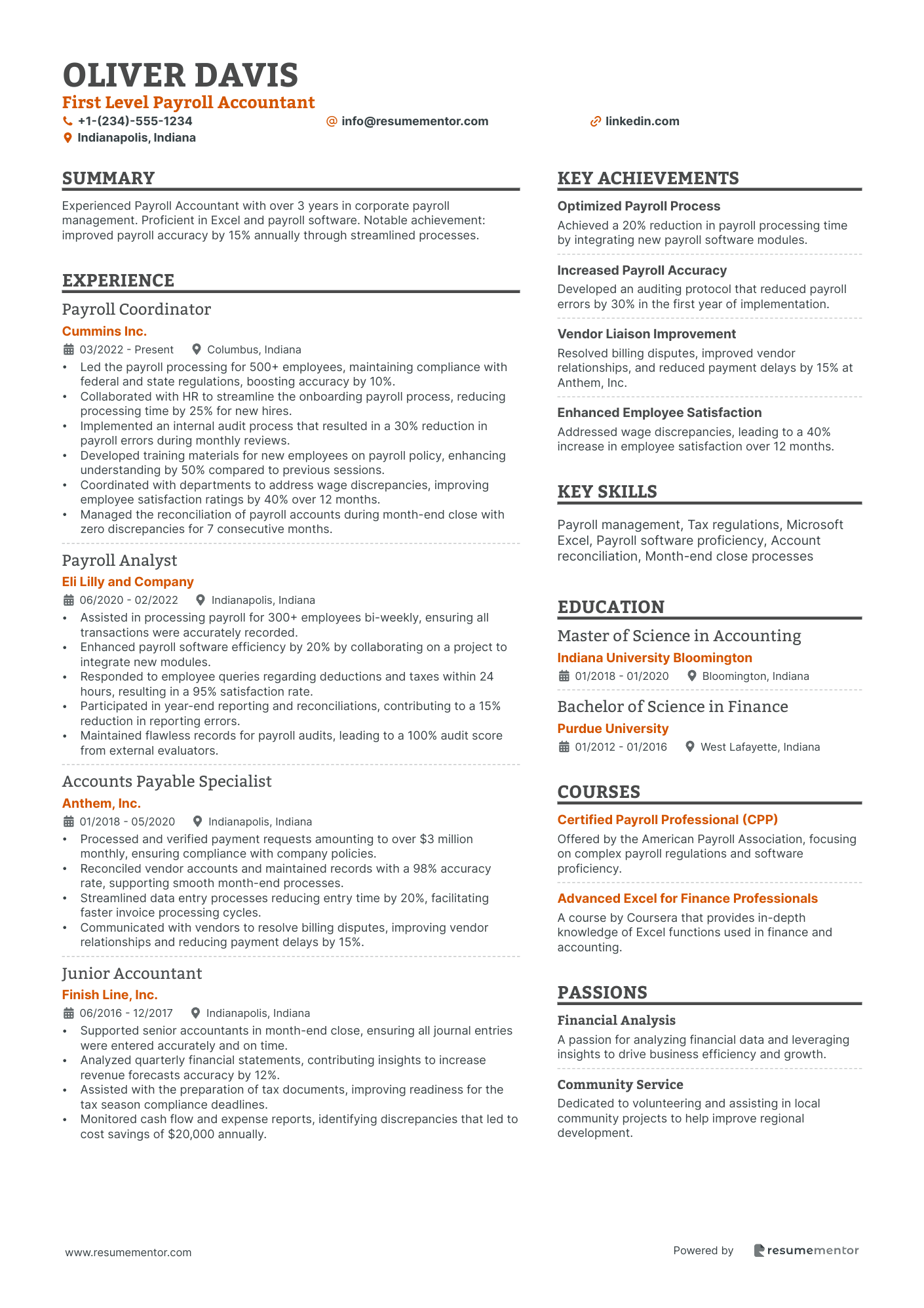

First Level Payroll Accountant

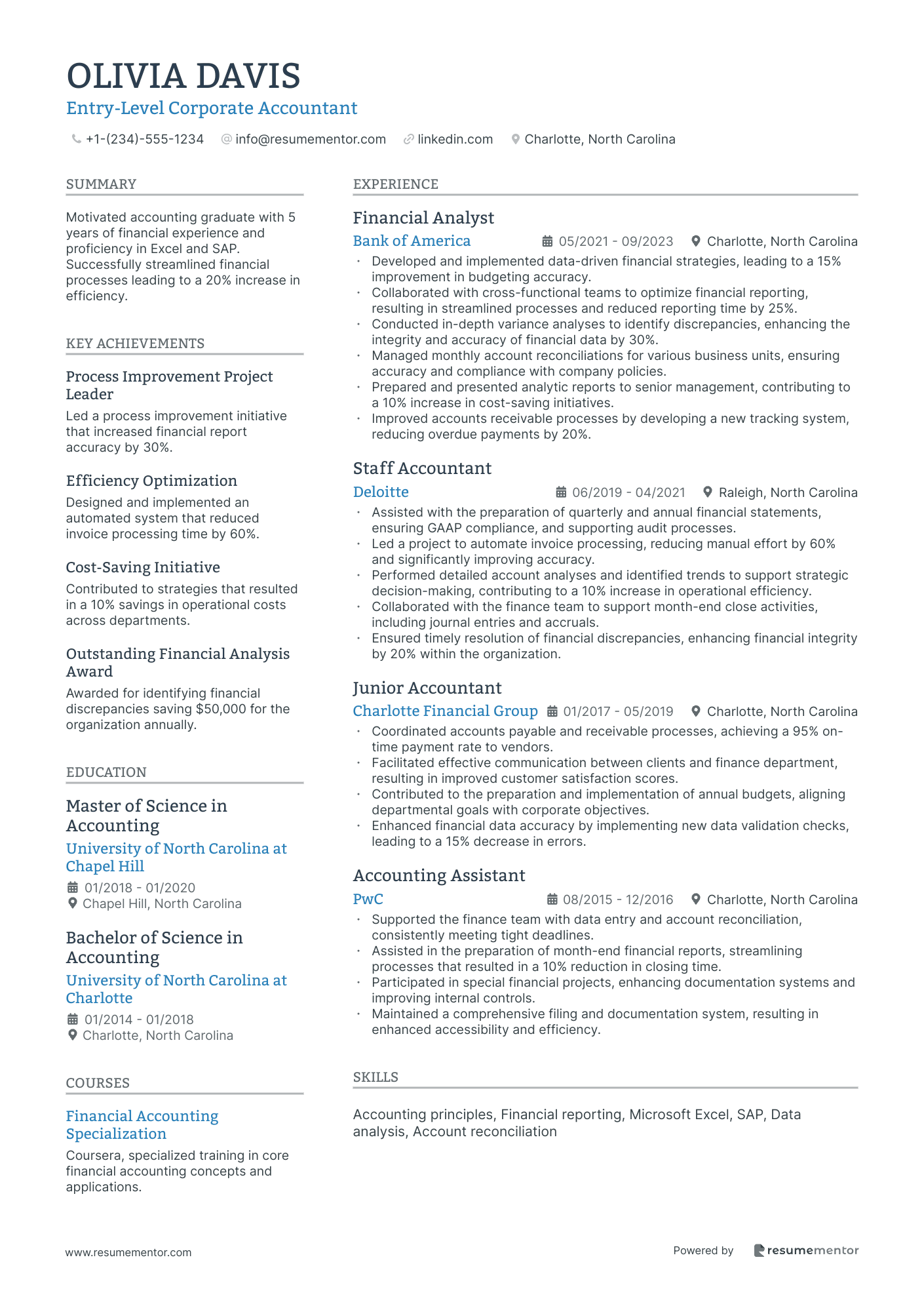

Entry-Level Corporate Accountant

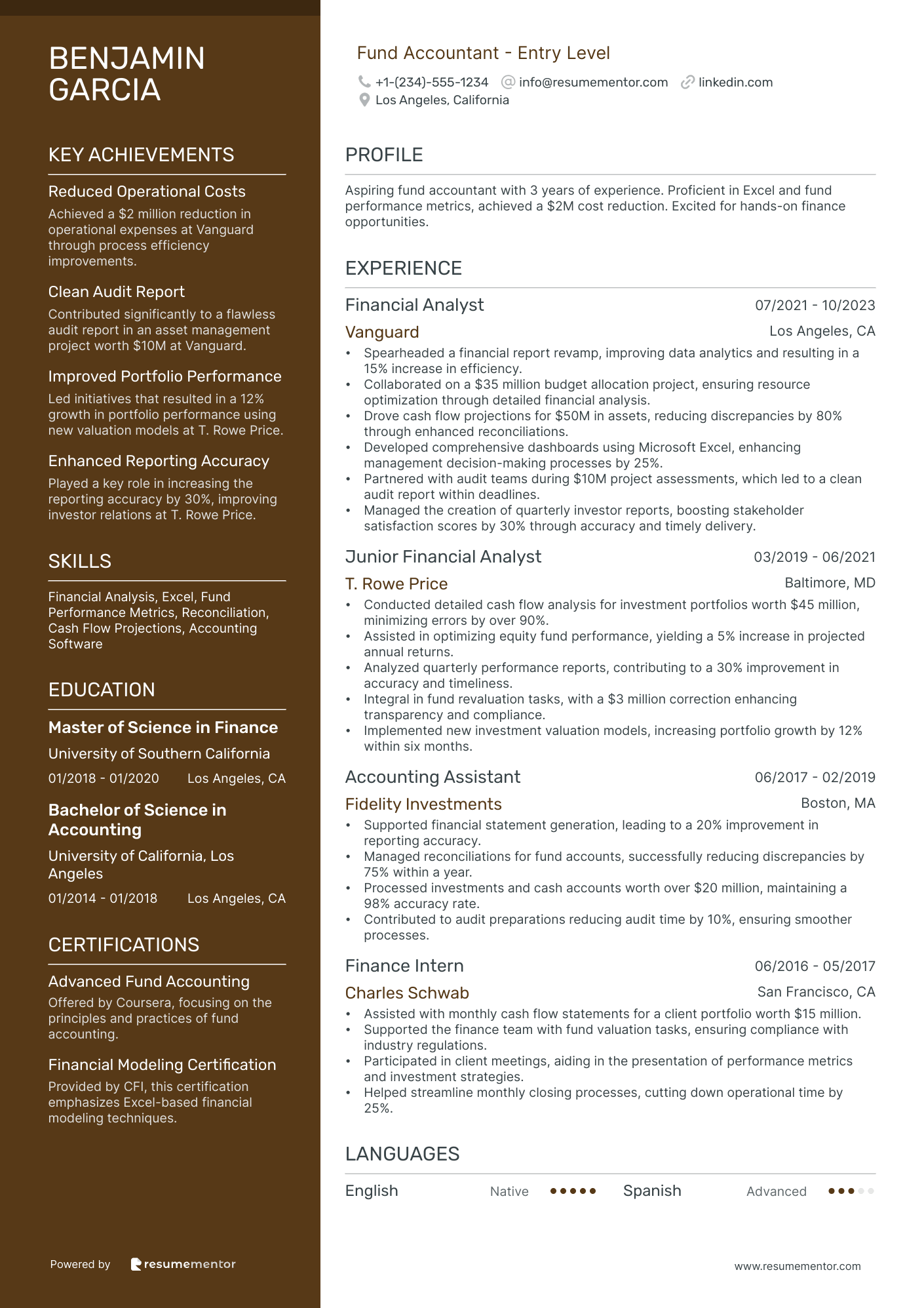

Fund Accountant - Entry Level

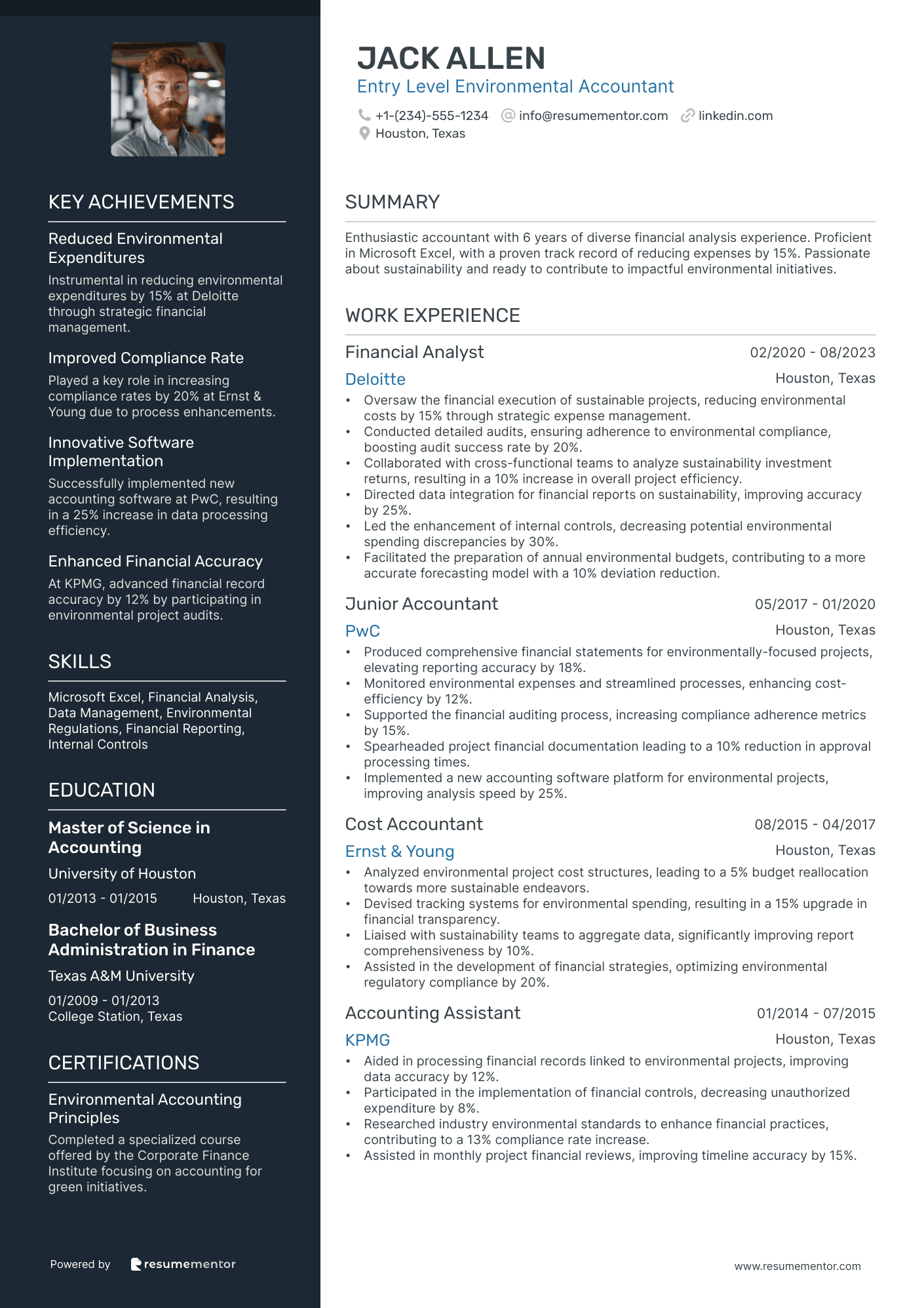

Entry Level Environmental Accountant

Entry Level Audit Accountant resume sample

- •Led comprehensive audits for a diverse portfolio, improving client compliance by 20% through detailed risk assessment processes.

- •Managed a team of 4 junior auditors, ensuring efficient workflow and timely submission of over 15 audit reports annually.

- •Implemented advanced data analytics techniques, streamlining audit procedures and reducing completion time by 35%.

- •Developed and conducted workshops on best auditing practices, attended by over 50 professionals, enhancing skillsets across the department.

- •Collaborated with regulatory bodies, ensuring full adherence to evolving industry standards and minimizing client penalties by 15%.

- •Devised a new documentation strategy, increasing the accuracy of client records by 30% and reducing revision needs.

- •Conducted audits for large-scale manufacturing clients, leading to a 25% improvement in operational efficiencies.

- •Detect decision errors through analytical procedures, leading to a 30% reduction in financial inaccuracies.

- •Assisted in unveiling discrepancies in client financial records, resulting in client savings of $1 million annually.

- •Guided clients through the audit process, enhancing client satisfaction scores by 40% through effective communication.

- •Co-authored audit plans tailored to specific client needs, improving audit precision and client alignment by 20%.

- •Assisted senior auditors in achieving 100% on-time audit deliveries by refining task management methodologies.

- •Applied detailed analytical skills to identify compliance issues, effectively reducing non-compliance penalties by 10%.

- •Prepared preliminary financial reports, facilitating senior-management decision-making processes with 95% accuracy.

- •Optimized data collection methods, resulting in a 20% decrease in audit prep time across projects.

- •Supported finance team in budget preparation, contributing to a 15% cost reduction by optimizing resource allocation.

- •Developed organizational systems that increased reporting efficiency by 25%, benefiting overall project workflows.

- •Collaborated with teams to ensure financial documents were accurately maintained, resulting in zero discrepancies over 5 audits.

- •Enhanced client relations by providing clear, concise financial analysis, increasing repeat business by 30%.

Junior Management Accountant resume sample

- •Streamlined monthly management account preparation process, reducing completion time by 25% and improving accuracy.

- •Collaborated with marketing department to assess expenditure, resulting in a 15% reduction in overhead costs.

- •Played a crucial role in the quarterly financial forecasting process, improving prediction accuracy by 30%.

- •Administered variance analysis reports, consistently highlighting key issues, and facilitating strategic decisions.

- •Supported coordination of annual audits, ensuring on-time and successful evaluations with zero discrepancies.

- •Initiated a cross-departmental financial data collection system that improved transparency by 40%.

- •Enhanced the budgeting process by developing new models that increased forecasting accuracy by 20%.

- •Developed monthly financial analysis reports that identified areas of improvement and led to cost savings of 10%.

- •Assisted in a project to upgrade accounting software, resulting in a 15% increase in processing efficiency.

- •Contributed to financial strategy meetings by providing detailed analysis of financial performance trends.

- •Implemented financial training sessions for team members, improving overall departmental efficiency by 25%.

- •Supported senior accountants in monthly closing procedures, ensuring all entries were accurate and complied with standards.

- •Analyzed client financial data, identifying trends and providing actionable insights to management.

- •Revised financial documentation in collaboration with the audit team, leading to zero audit flags.

- •Assisted in tax preparation tasks that contributed to timely tax submission without penalties.

- •Prepared financial documents under supervision, consistently meeting tight deadlines and ensuring compliance.

- •Performed extensive data entry and managed updates in financial databases with a high degree of accuracy.

- •Supported the reconciliation of company accounts, solving discrepancies and ensuring financial consistency.

- •Assisted in updating financial policies and procedures, enhancing overall financial governance.

Entry Level Tax Accountant resume sample

- •Prepared over 150 individual and business tax returns with a 99% accuracy rate, enhancing client satisfaction.

- •Assisted in the development of quarterly tax projections for small businesses, reducing their tax liability by 15%.

- •Conducted in-depth research on complex tax issues, providing solutions that saved clients an average of $5,000 in taxes annually.

- •Collaborated with senior accountants to streamline tax filing processes, resulting in a 30% time reduction.

- •Maintained a comprehensive and organized electronic filing system for over 200 tax files, increasing accessibility by 40%.

- •Advised on the implementation of new tax software, leading to a 20% decrease in processing time.

- •Supported the preparation and filing of over 300 tax returns, ensuring compliance with federal regulations.

- •Provided assistance during IRS audits, facilitating the resolution of disputes and securing favorable outcomes.

- •Implemented data analysis techniques to identify discrepancies in tax filings, resulting in a 25% error reduction.

- •Researched and analyzed tax legislation changes, advising clients on optimizing their tax strategies.

- •Developed a training module on tax regulations for new hires, leading to improved onboarding and efficiency.

- •Analyzed financial statements to support senior accountants in the preparation of accurate tax returns.

- •Created financial models to forecast future tax liabilities, improving strategic decision-making for client accounts.

- •Conducted compliance audits, recognizing potential areas of risk and advising on mitigation strategies.

- •Assisted in the transition to electronic work papers, enhancing the efficiency of documenting audit findings.

- •Conducted audits of financial records, ensuring accuracy and compliance with GAAP standards for corporate clients.

- •Worked with cross-functional teams to reconcile discrepancies in financial data, saving clients $500,000 collectively.

- •Reviewed and assessed internal control systems, suggesting improvements to mitigate risks effectively.

- •Contributed to the creation of a best-practice manual for audit procedures, reducing training time by 15%.

First Level Payroll Accountant resume sample

- •Led the payroll processing for 500+ employees, maintaining compliance with federal and state regulations, boosting accuracy by 10%.

- •Collaborated with HR to streamline the onboarding payroll process, reducing processing time by 25% for new hires.

- •Implemented an internal audit process that resulted in a 30% reduction in payroll errors during monthly reviews.

- •Developed training materials for new employees on payroll policy, enhancing understanding by 50% compared to previous sessions.

- •Coordinated with departments to address wage discrepancies, improving employee satisfaction ratings by 40% over 12 months.

- •Managed the reconciliation of payroll accounts during month-end close with zero discrepancies for 7 consecutive months.

- •Assisted in processing payroll for 300+ employees bi-weekly, ensuring all transactions were accurately recorded.

- •Enhanced payroll software efficiency by 20% by collaborating on a project to integrate new modules.

- •Responded to employee queries regarding deductions and taxes within 24 hours, resulting in a 95% satisfaction rate.

- •Participated in year-end reporting and reconciliations, contributing to a 15% reduction in reporting errors.

- •Maintained flawless records for payroll audits, leading to a 100% audit score from external evaluators.

- •Processed and verified payment requests amounting to over $3 million monthly, ensuring compliance with company policies.

- •Reconciled vendor accounts and maintained records with a 98% accuracy rate, supporting smooth month-end processes.

- •Streamlined data entry processes reducing entry time by 20%, facilitating faster invoice processing cycles.

- •Communicated with vendors to resolve billing disputes, improving vendor relationships and reducing payment delays by 15%.

- •Supported senior accountants in month-end close, ensuring all journal entries were entered accurately and on time.

- •Analyzed quarterly financial statements, contributing insights to increase revenue forecasts accuracy by 12%.

- •Assisted with the preparation of tax documents, improving readiness for the tax season compliance deadlines.

- •Monitored cash flow and expense reports, identifying discrepancies that led to cost savings of $20,000 annually.

Entry-Level Corporate Accountant resume sample

- •Developed and implemented data-driven financial strategies, leading to a 15% improvement in budgeting accuracy.

- •Collaborated with cross-functional teams to optimize financial reporting, resulting in streamlined processes and reduced reporting time by 25%.

- •Conducted in-depth variance analyses to identify discrepancies, enhancing the integrity and accuracy of financial data by 30%.

- •Managed monthly account reconciliations for various business units, ensuring accuracy and compliance with company policies.

- •Prepared and presented analytic reports to senior management, contributing to a 10% increase in cost-saving initiatives.

- •Improved accounts receivable processes by developing a new tracking system, reducing overdue payments by 20%.

- •Assisted with the preparation of quarterly and annual financial statements, ensuring GAAP compliance, and supporting audit processes.

- •Led a project to automate invoice processing, reducing manual effort by 60% and significantly improving accuracy.

- •Performed detailed account analyses and identified trends to support strategic decision-making, contributing to a 10% increase in operational efficiency.

- •Collaborated with the finance team to support month-end close activities, including journal entries and accruals.

- •Ensured timely resolution of financial discrepancies, enhancing financial integrity by 20% within the organization.

- •Coordinated accounts payable and receivable processes, achieving a 95% on-time payment rate to vendors.

- •Facilitated effective communication between clients and finance department, resulting in improved customer satisfaction scores.

- •Contributed to the preparation and implementation of annual budgets, aligning departmental goals with corporate objectives.

- •Enhanced financial data accuracy by implementing new data validation checks, leading to a 15% decrease in errors.

- •Supported the finance team with data entry and account reconciliation, consistently meeting tight deadlines.

- •Assisted in the preparation of month-end financial reports, streamlining processes that resulted in a 10% reduction in closing time.

- •Participated in special financial projects, enhancing documentation systems and improving internal controls.

- •Maintained a comprehensive filing and documentation system, resulting in enhanced accessibility and efficiency.

Fund Accountant - Entry Level resume sample

- •Spearheaded a financial report revamp, improving data analytics and resulting in a 15% increase in efficiency.

- •Collaborated on a $35 million budget allocation project, ensuring resource optimization through detailed financial analysis.

- •Drove cash flow projections for $50M in assets, reducing discrepancies by 80% through enhanced reconciliations.

- •Developed comprehensive dashboards using Microsoft Excel, enhancing management decision-making processes by 25%.

- •Partnered with audit teams during $10M project assessments, which led to a clean audit report within deadlines.

- •Managed the creation of quarterly investor reports, boosting stakeholder satisfaction scores by 30% through accuracy and timely delivery.

- •Conducted detailed cash flow analysis for investment portfolios worth $45 million, minimizing errors by over 90%.

- •Assisted in optimizing equity fund performance, yielding a 5% increase in projected annual returns.

- •Analyzed quarterly performance reports, contributing to a 30% improvement in accuracy and timeliness.

- •Integral in fund revaluation tasks, with a $3 million correction enhancing transparency and compliance.

- •Implemented new investment valuation models, increasing portfolio growth by 12% within six months.

- •Supported financial statement generation, leading to a 20% improvement in reporting accuracy.

- •Managed reconciliations for fund accounts, successfully reducing discrepancies by 75% within a year.

- •Processed investments and cash accounts worth over $20 million, maintaining a 98% accuracy rate.

- •Contributed to audit preparations reducing audit time by 10%, ensuring smoother processes.

- •Assisted with monthly cash flow statements for a client portfolio worth $15 million.

- •Supported the finance team with fund valuation tasks, ensuring compliance with industry regulations.

- •Participated in client meetings, aiding in the presentation of performance metrics and investment strategies.

- •Helped streamline monthly closing processes, cutting down operational time by 25%.

Entry Level Environmental Accountant resume sample

- •Oversaw the financial execution of sustainable projects, reducing environmental costs by 15% through strategic expense management.

- •Conducted detailed audits, ensuring adherence to environmental compliance, boosting audit success rate by 20%.

- •Collaborated with cross-functional teams to analyze sustainability investment returns, resulting in a 10% increase in overall project efficiency.

- •Directed data integration for financial reports on sustainability, improving accuracy by 25%.

- •Led the enhancement of internal controls, decreasing potential environmental spending discrepancies by 30%.

- •Facilitated the preparation of annual environmental budgets, contributing to a more accurate forecasting model with a 10% deviation reduction.

- •Produced comprehensive financial statements for environmentally-focused projects, elevating reporting accuracy by 18%.

- •Monitored environmental expenses and streamlined processes, enhancing cost-efficiency by 12%.

- •Supported the financial auditing process, increasing compliance adherence metrics by 15%.

- •Spearheaded project financial documentation leading to a 10% reduction in approval processing times.

- •Implemented a new accounting software platform for environmental projects, improving analysis speed by 25%.

- •Analyzed environmental project cost structures, leading to a 5% budget reallocation towards more sustainable endeavors.

- •Devised tracking systems for environmental spending, resulting in a 15% upgrade in financial transparency.

- •Liaised with sustainability teams to aggregate data, significantly improving report comprehensiveness by 10%.

- •Assisted in the development of financial strategies, optimizing environmental regulatory compliance by 20%.

- •Aided in processing financial records linked to environmental projects, improving data accuracy by 12%.

- •Participated in the implementation of financial controls, decreasing unauthorized expenditure by 8%.

- •Researched industry environmental standards to enhance financial practices, contributing to a 13% compliance rate increase.

- •Assisted in monthly project financial reviews, improving timeline accuracy by 15%.

Creating a resume for an entry-level accounting job can feel like walking a tightrope, as balancing fresh accounting skills with limited experience is crucial. Highlighting your academic achievements and relevant projects is important, but making those details really shine requires careful thought.

Since employers spend less than a minute reviewing each resume, crafting a strong first impression is vital. A resume template can help by providing a structured format, ensuring your resume looks neat and professional. With a variety of resume templates available, you can find one that suits your style, streamlining the process.

Your ability to present your accounting expertise—no matter how new—can be a game-changer. Your resume should serve as a marketing tool that tells potential employers why you’re the right fit, showcasing your knack for simplifying complex financial data. With focused attention on formatting and tailoring your resume to match the job you desire, you'll be set on the path to securing interviews and advancing your accounting career.

Key Takeaways

- Crafting a strong first impression in a teacher resume is crucial, given the limited time employers spend reviewing each resume.

- Highlight your educational achievements and relevant skills, using a structured format to present your academic and certification backgrounds.

- Emphasize practical teaching experiences, even if they involve internships or volunteer work, by illustrating specific teaching tasks and outcomes.

- Include both hard skills, such as lesson planning and classroom management, and soft skills like communication and adaptability.

- Consider adding optional sections like volunteer experience, languages, or relevant hobbies to provide a well-rounded view of your capabilities.

What to focus on when writing your entry level accountant resume

Your entry level accountant resume should clearly convey that you're equipped to contribute effectively within an accounting team. It should emphasize your understanding of foundational accounting principles and reflect your eagerness to grow and learn in the field. Demonstrating your skills in number management and data handling, along with your reliability and attention to detail, is essential.

How to structure your entry level accountant resume

- Contact Information: Start by including your full name, phone number, professional email address, and LinkedIn profile—this ensures that hiring managers have multiple ways to reach you easily. Ensure your email and LinkedIn profile maintain a professional tone to create a strong first impression. Doubling down on accurate contact information also shows your attention to detail, a key trait in accounting.

- Objective Statement: A concise summary of your career goals helps to present a clear picture of what you aim to achieve in an accounting role. It should align with the job description and company values, indicating your genuine interest in the position. Tailoring this section for each job application can greatly enhance its impact, as recruiters often look for candidates whose ambitions align with organizational goals.

- Education: List your degree, university, and graduation date to reflect your academic background in accounting—also include relevant coursework or certifications, such as CPA preparation, to illustrate your technical readiness. This section confirms your accounting knowledge base and ability to apply learned concepts in a professional setting. Highlighting academic achievements can bolster your credentials and differentiate you from other candidates.

- Relevant Experience: Include details of internships, volunteer work, or part-time positions related to accounting, accentuating experiences with bookkeeping, accounts receivable, or financial record management. This section is crucial to showing practical applications of your theoretical knowledge and your ability to contribute in real workplace scenarios. It can be a strong indicator of how you'll perform in future roles.

- Skills: Highlight key accounting skills such as proficiency in Microsoft Excel, understanding of GAAP, or familiarity with accounting software like QuickBooks—these reflect your ability to handle the technical demands of the role. Soft skills like communication and analytical thinking are equally important, demonstrating that you can explain complex information clearly and solve problems effectively.

- Certifications or Training: Underscore any certifications or training in accounting software or tax preparation to enhance your profile—this shows a commitment to professional growth and staying updated with industry standards. Acquiring fresh skills and certifications can help bridge any experience gaps and make you a more attractive candidate.

To round out your resume, adding optional sections like "Volunteer Experience" or "Languages" can highlight additional skills or interests that relate to your accounting career. Below, we'll cover each of these sections more in-depth to ensure your resume is comprehensive and impactful.

Which resume format to choose

Creating your first resume as an entry level accountant involves critical choices, starting with the right format. For accounting roles, the reverse-chronological format is ideal as it presents your most recent education and any practical experience upfront, which is what employers are eager to see. This format is straightforward and makes it easy for recruiters to spot key qualifications quickly.

Choosing the right font is also important in making your resume visually appealing. Fonts like Raleway, Lato, and Montserrat offer a modern touch while maintaining readability. A clean and professional appearance reinforces your attention to detail, an essential skill for any accountant.

When you save your resume, opt for a PDF file format. This ensures that your resume’s formatting remains consistent, no matter how it’s viewed. A PDF presents your information clearly and professionally, showing employers that you're thorough and precise—qualities they value in a candidate.

Setting your resume margins to about one inch on each side is a small detail with a big impact. Proper margins provide enough white space to keep your resume from looking cluttered, making it easy to read. This attention to layout and organization reflects the meticulous nature required in accounting positions.

By carefully considering each of these elements—format, font, file type, and margins—you craft a resume that not only highlights your qualifications but also demonstrates the organizational skills and professionalism needed in the accounting field.

How to write a quantifiable resume experience section

The experience section of your entry-level accountant resume plays a crucial role in showcasing your relevant skills and professionalism, even if your background includes internships or part-time roles. Focusing on these experiences allows you to demonstrate your ability to handle accounting tasks effectively. To catch the recruiter’s eye, structure this section to emphasize quantifiable achievements, listing your experience in reverse chronological order. This strategy ensures your most recent and relevant roles are immediately visible, especially those from the past five to ten years that show a connection to accounting or related areas.

Tailoring your resume is key to making a strong impression. By aligning your entries with the job ad, using industry-specific keywords, and highlighting relevant experiences, you show a clear fit for the role. Action words like "analyzed," "prepared," "reconciled," and "enhanced" at the start of each bullet point inject energy and demonstrate decisiveness. When you quantify achievements—demonstrating improvements like increased accuracy or reduced costs—you effectively convey the value you can bring to a potential employer. It’s crucial to make each entry concise yet impactful, adding to your narrative of competence and readiness.

Here’s an improved JSON example of an experience section for an entry-level accountant:

- •Analyzed over 300 financial documents to spot discrepancies, improving data accuracy by 15%.

- •Prepared detailed monthly financial reports, boosting efficiency by 20%.

- •Reconciled accounts with a 98% accuracy rate, ensuring financial compliance.

- •Helped optimize budgeting practices, reducing overall costs by 10%.

In this example, each bullet point highlights how you utilized specific skills to achieve significant results, creating a cohesive narrative of your capability and impact. Numbers and percentages give the recruiter a clear picture of your contributions, underlining your initiative and precision. This experience section naturally aligns with common responsibilities in entry-level accounting, such as data analysis, report preparation, account reconciliation, and cost management. With its clear structure and focused content, each part of your resume effortlessly builds a compelling case for your candidacy.

Leadership-Focused resume experience section

A leadership-focused entry-level accountant resume experience section should emphasize your initiative and contribution within team settings. Reflect on your experiences where you've actively participated in the success and improvement of processes. Begin each job entry with a brief role description followed by bullet points that clearly outline your specific actions and their outcomes. Highlighting even smaller leadership roles, with measurable results or improvements, can significantly enhance your resume.

This method allows potential employers to recognize your leadership potential from the start of your accounting career. Each bullet point should serve as evidence of how effectively you've organized, led, or collaborated in your roles. Using concrete examples that yield results is especially compelling, as it not only showcases your past contributions but also demonstrates the skills you can bring to future opportunities.

Accounting Intern

Financial Consulting Co.

June 2021 - August 2021

- Organized and led weekly meetings to streamline inventory audits, cutting review time by 20%

- Collaborated with team members to develop a new spreadsheet format, increasing data entry efficiency

- Assisted in training new interns, improving onboarding timeliness by 15%

- Coordinated with the accounting team to implement a new invoicing system, reducing errors by 30%

Customer-Focused resume experience section

A customer-focused entry-level accountant resume experience section should effectively demonstrate your ability to merge customer service with accounting skills. Begin by listing your employment dates, job title, and company name, followed by a concise description. In the bullet points, focus on how your interactions with customers naturally integrated with your accounting tasks, showcasing your knack for resolving issues and enhancing satisfaction. Utilize strong verbs and specifics to paint a clear picture of your role. These detailed examples will present you as well-prepared for an entry-level accounting position, emphasizing your ability to manage customer relationships alongside financial responsibilities.

In your writing, ensure a seamless flow by linking different aspects of your experience. Describe how collaborating with a team helped refine reports, or how streamlining processes improved customer account management. Your aim is to highlight not just your accounting knowledge but also your skill in making clients feel valued. By connecting your experiences, you'll illustrate a cohesive story of how customer service has been an integral part of your professional journey.

Customer Service Assistant

ABC Financial Services

June 2022 - August 2023

- Assisted over 100 clients monthly by handling billing inquiries and resolving discrepancies quickly.

- Worked closely with the accounting team to improve monthly financial reports, making them easier for clients to understand.

- Facilitated clear communication between clients and the finance department, boosting satisfaction by 20%.

- Streamlined data entry for customer accounts, which reduced errors and improved efficiency.

Result-Focused resume experience section

A result-focused entry-level accountant resume experience section should clearly showcase your achievements and highlight your accounting skills and ability to deliver measurable results. Start by stating your role or project, giving context to your work. Use bullet points to detail these accomplishments, choosing action verbs to convey energy and success. Quantifying your achievements whenever possible is also key, as numbers effectively illustrate your impact.

For a seamless reading experience, arrange this section to allow potential employers to quickly grasp your key skills and strengths. Ensure your bullet points balance your technical accounting competencies with your demonstrated ability to improve efficiency and add value to past workplaces. Tailor this part of your resume to align with the job description, making sure your accomplishments resonate with the listed responsibilities.

Accounting Intern

XYZ Financial Services

June 2022 - August 2022

- Prepared and analyzed monthly financial statements, reducing discrepancies by 10%.

- Assisted in the preparation of budgets and forecasts for various departments, ensuring accurate financial planning.

- Streamlined daily reporting by implementing a new software tool, boosting efficiency by 15%.

- Collaborated with senior accountants on tax preparation and audits, enhancing understanding of key processes.

Skills-Focused resume experience section

A skills-focused entry-level accountant resume experience section should clearly demonstrate the unique strengths you bring to the position. Instead of just listing duties, emphasize achievements and skills gained from internships or volunteer experiences. This approach allows you to show how you've applied problem-solving and analytical skills in practical situations. Highlight your understanding of financial principles and your proficiency with accounting software, as these are crucial in any accounting role. Share how you've contributed to projects or developed a deeper knowledge of the field, making sure each point adds value to your profile.

List your experience with bullet points that are clear and direct, each focusing on a different skill or achievement. Strong action verbs make your accomplishments stand out and help convey your strengths more convincingly. Don’t forget to emphasize traits like attention to detail or strategic thinking, and mention any specific tools you’ve mastered along the way. Connecting your skills to real-world examples will effectively demonstrate your potential value to future employers.

Accounting Intern

XYZ Financial Solutions

June 2022 - August 2022

- Analyzed company financial statements and identified areas for cost savings.

- Assisted in preparing monthly financial reports and forecasts, supporting strategic decisions.

- Utilized Excel to create detailed spreadsheets that improved data accuracy for quarterly budgeting.

- Collaborated with team members to streamline processes, increasing efficiency by 15%.

Write your entry level accountant resume summary section

A skills-focused entry-level accountant resume summary should make a great first impression. It’s your chance to highlight the skills, education, and qualities that make you a strong candidate. Here's an example of a well-crafted resume summary:

This summary skillfully connects your qualifications with the job. By mentioning your analytical skills and software knowledge, you showcase key attributes for an accountant. Highlighting your educational background alongside specific tools like QuickBooks and Excel adds credibility. Including the company name personalizes the message, demonstrating genuine interest. It’s important to describe yourself effectively, using clear and concise language. Specific achievements and brief narratives about experiences amplify your impact. Focusing on what you offer to the employer makes your summary compelling. Understanding the nuances between a resume summary and objective is crucial. A summary outlines your qualifications and experiences, whereas an objective states your career goals. For entry-level roles, a summary highlights your readiness and enthusiasm. A resume profile is another term for a summary, while a summary of qualifications may list skills and achievements in bullet points. Knowing these distinctions aids in crafting an effective summary. Always tailor it to the job, as a personalized approach resonates with employers.

Listing your entry level accountant skills on your resume

A skills-focused entry-level accountant resume should emphasize both your technical abilities and interpersonal qualities. When constructing your resume, consider whether your skills section should stand alone or be integrated with your experience and summary sections. Highlighting your strengths and soft skills demonstrates your interpersonal abilities, while hard skills showcase specific, learned competencies. Including both types of skills as keywords can significantly improve your visibility to potential employers who search for candidates using automated systems.

Ensure your skills section not only lists your abilities but aligns them with the job you are targeting. This can make your resume more appealing and searchable, capturing the attention of hiring managers. Here’s an example of how a standalone skills section might look:

This comprehensive list effectively highlights key competencies essential for accounting roles. By showcasing technical skills like Microsoft Excel and QuickBooks, you demonstrate proficiency with crucial industry-standard tools. Each skill is carefully chosen to reflect readiness for entry-level roles in accounting.

Best hard skills to feature on your entry-level accountant resume

Hard skills cover the specific knowledge and techniques required for accounting tasks. They communicate your ability to perform core functions within the field:

Hard Skills

- Microsoft Excel

- QuickBooks

- Data Analysis

- Financial Reporting

- Account Reconciliation

- Tax Preparation

- Budgeting

- Payroll Processing

- Financial Modeling

- Audit Support

- Asset Management

- Financial Forecasting

- Cost Accounting

- Inventory Management

- Compliance and Regulations

Best soft skills to feature on your entry-level accountant resume

Soft skills illustrate how you work with others and fit within a company’s culture. They highlight your personal attributes, such as:

Together, proficiently listed hard and soft skills provide a well-rounded view of your potential contributions, showcasing how you can be an asset to any team.

Soft Skills

- Communication

- Attention to Detail

- Problem-solving

- Time Management

- Adaptability

- Critical Thinking

- Teamwork

- Initiative

- Organizational Skills

- Dependability

- Interpersonal Skills

- Stress Management

- Analytical Thinking

- Leadership Potential

- Customer Service

How to include your education on your resume

An education section is an important part of your resume, especially for an entry-level accountant position. It showcases your academic background and highlights relevant skills that align with the job requirements. Tailor this section to match the job you’re applying for, and leave out any unrelated education. If you’re proud of your GPA, and it’s strong, including it can make you stand out. It's also okay to mention honors like cum laude to showcase your academic achievements. List your degree clearly, including the type of degree, the institution, and the graduation date.

Here's an example that needs improvement:

While an accurate representation, this example includes irrelevant education for an accounting role. Here’s a better, tailored version:

The second example is outstanding because it directly relates to the accounting field, uses a strong GPA, and clearly lists the degree and dates. This makes the candidate more attractive for an accounting role by highlighting relevant expertise and academic success.

How to include entry level accountant certificates on your resume

Your resume's certificates section is crucial for showcasing your qualifications as an entry-level accountant. It's essential to highlight your relevant certifications to stand out to employers. List the name of the certificate prominently. Include the date when you received it. Add the issuing organization to give legitimacy to your certification. You can also place these certifications in the header for higher visibility.

Here's an effective way to format it:

This example works well because it features certifications relevant to accounting. It clearly states the certification title, making it easy for recruiters to identify your qualifications. Including the issuing organization adds credibility. This concise format ensures your certificates stand out, making a strong impression.

Extra sections to include in your entry level accountant resume

Starting your career as an entry-level accountant can be both exciting and challenging. Crafting a well-rounded resume can help you stand out and showcase your various skills and experiences effectively. Here are some key sections you might consider including in your entry-level accountant resume to add depth and personality.

- Language section— List any languages you speak fluently to show your ability to handle diverse clients. Knowing another language can also set you apart in multinational firms.

- Hobbies and interests section— Mention activities that align with accounting, such as playing strategic games or participating in financial clubs. This can give a glimpse into your analytical and problem-solving skills.

- Volunteer work section— Include volunteer experiences, especially if they involve financial tasks. Highlighting volunteer work demonstrates your commitment to the community and gaining practical experience.

- Books section— Share books you've read about accounting, finance, or personal development. Reading relevant books can showcase your dedication to learning and staying updated in your field.

Adding these sections to your resume not only enriches it but also helps potential employers understand you better. It can make you a stronger candidate by highlighting your multifaceted skills and interests.

In Conclusion

In conclusion, crafting an effective entry-level accountant resume is a balance of highlighting your academic achievements and emerging accounting skills, while addressing the common challenge of limited professional experience. By strategically structuring your resume, including key sections like contact information, education, relevant experience, skills, and certifications, you present a compelling case to potential employers. Providing quantifiable achievements in your experience section and selecting a reverse-chronological format can significantly bolster your appeal. Paying attention to details like resume layout, font choice, and format further demonstrates the meticulous nature vital in accounting roles. Additionally, a well-written resume summary can succinctly convey your readiness and enthusiasm for the role, making you stand out. Including optional sections, such as volunteer experience or language skills, helps demonstrate your well-rounded capabilities. Remember that tailoring your resume to each specific job is essential, emphasizing alignment with the job advertisement. With careful construction and thoughtful customization, your resume becomes a powerful tool in launching your career and opening doors to new opportunities in the accounting field.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.