Entry-level Finance Resume Examples

Jul 18, 2024

|

12 min read

Crafting the perfect entry-level finance resume: polish your skills and balance your experience like an accountant.

Rated by 348 people

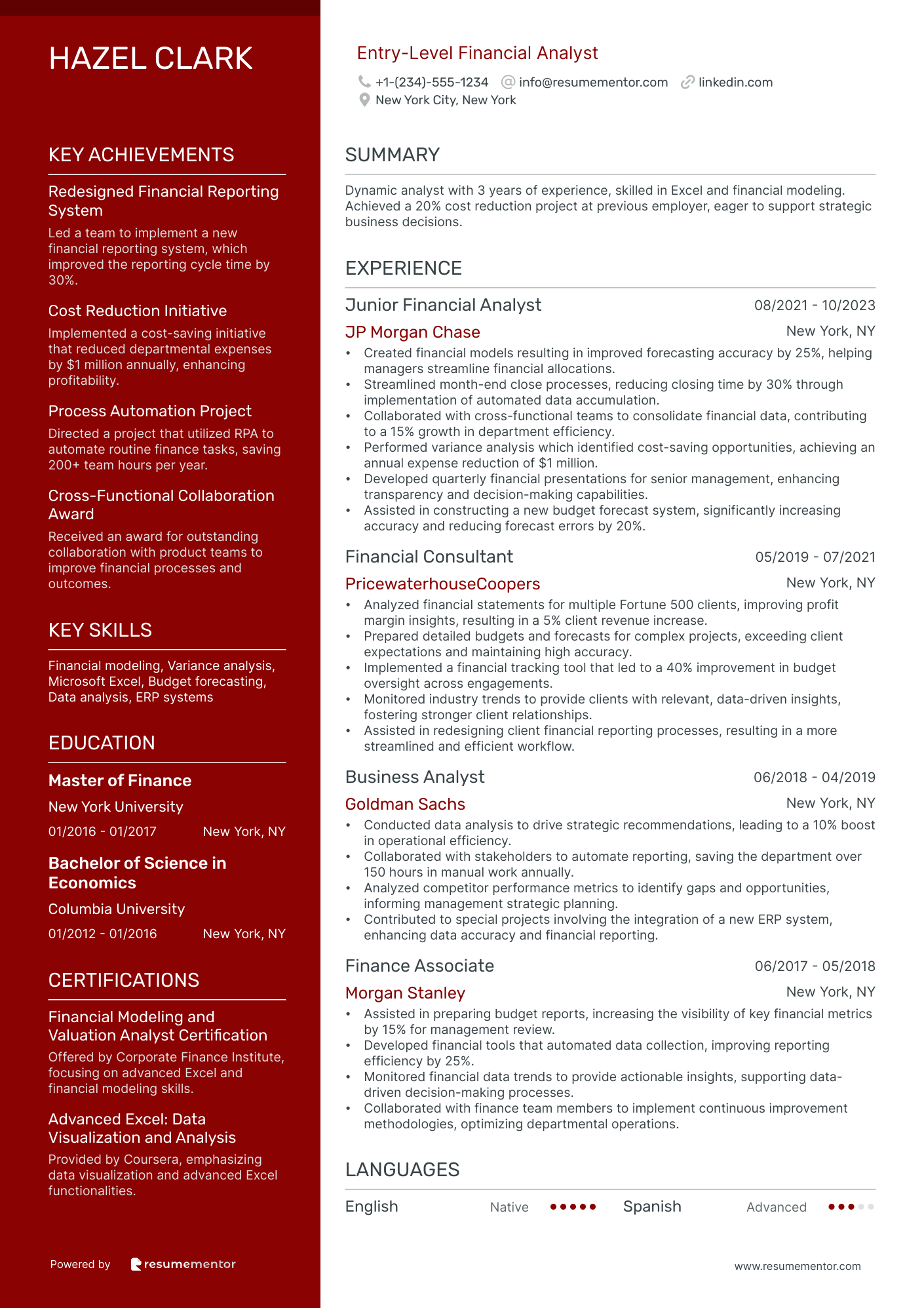

Entry-Level Financial Analyst

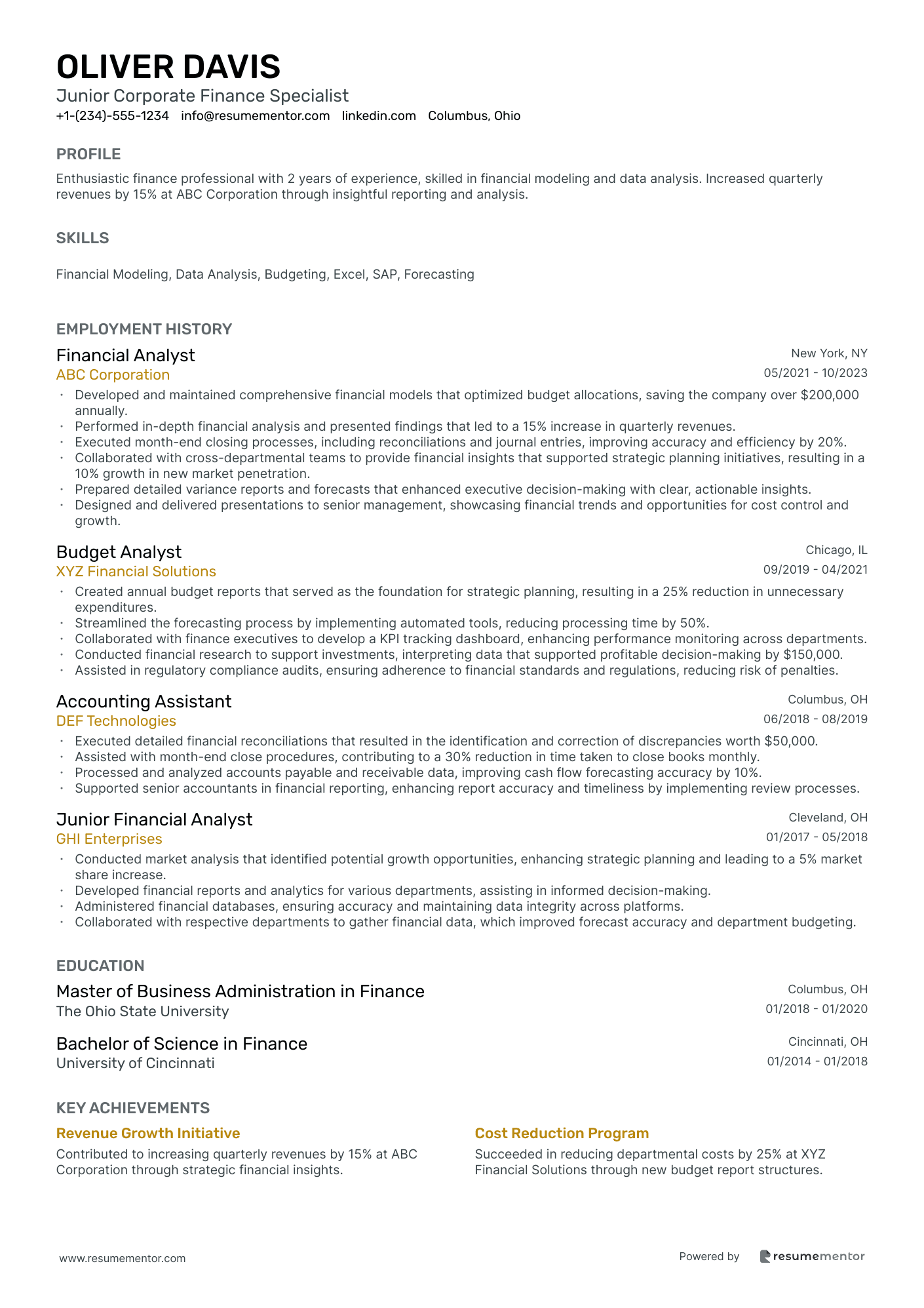

Junior Corporate Finance Specialist

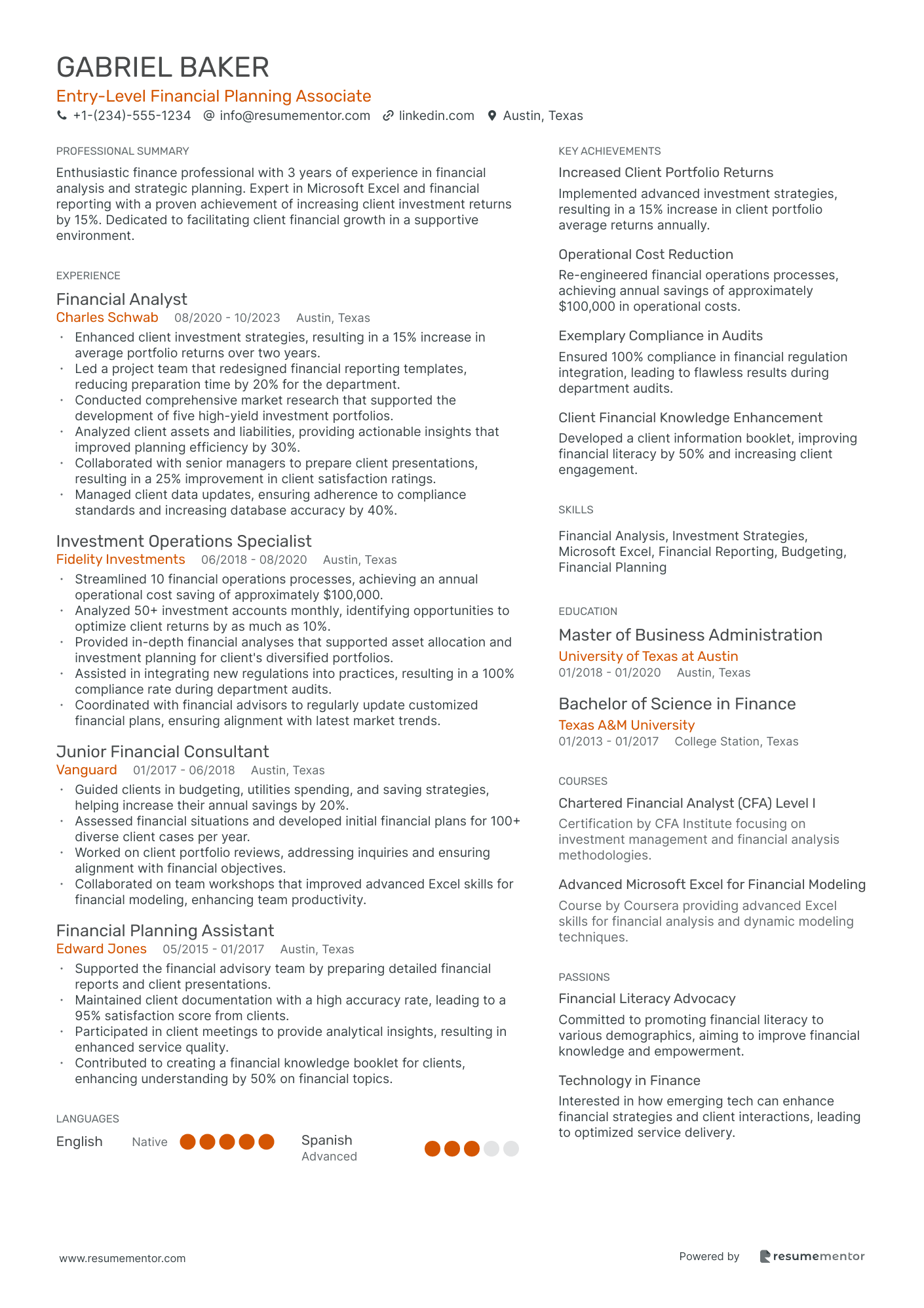

Entry-Level Financial Planning Associate

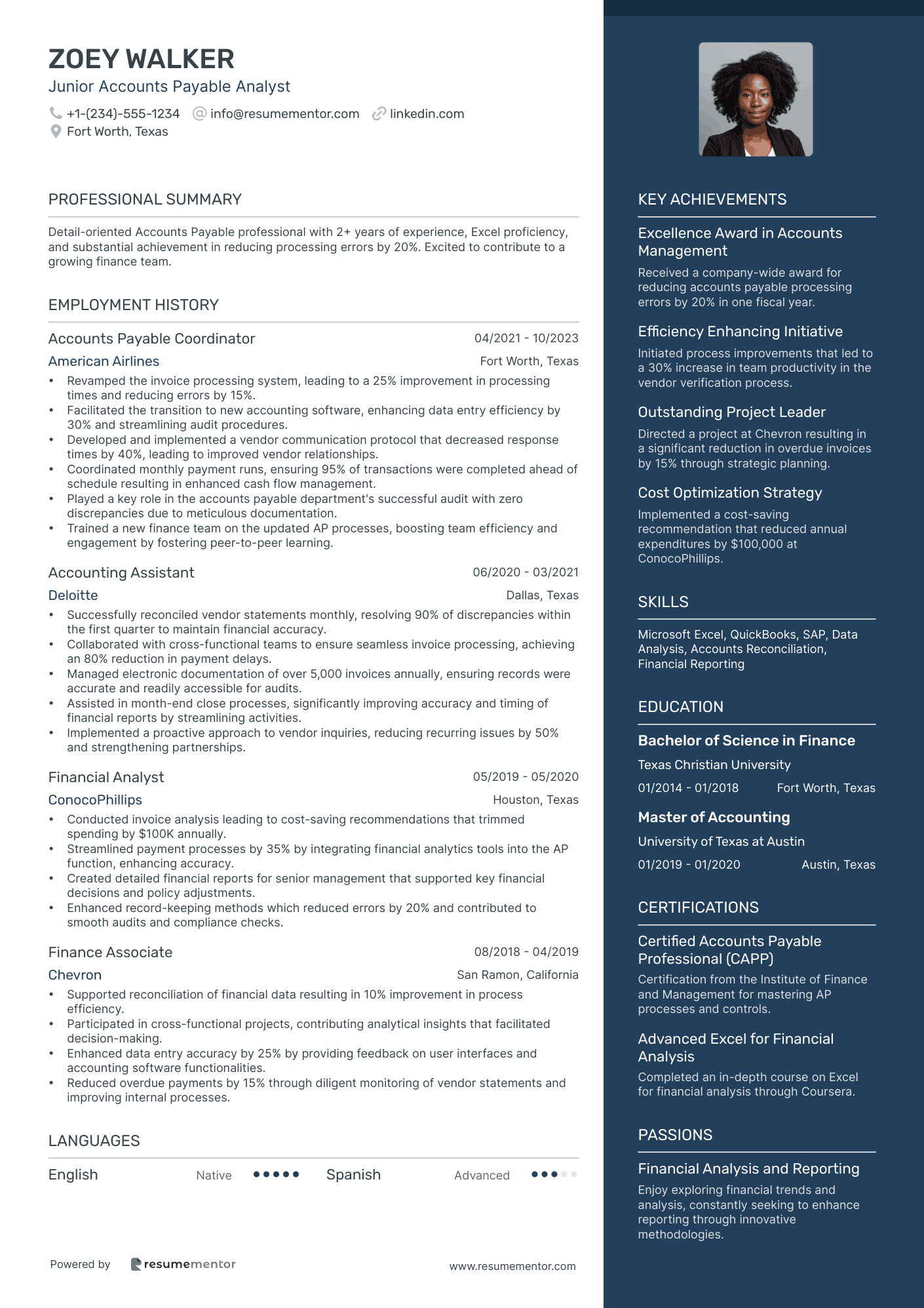

Junior Accounts Payable Analyst

Entry-Level Finance Operations Specialist

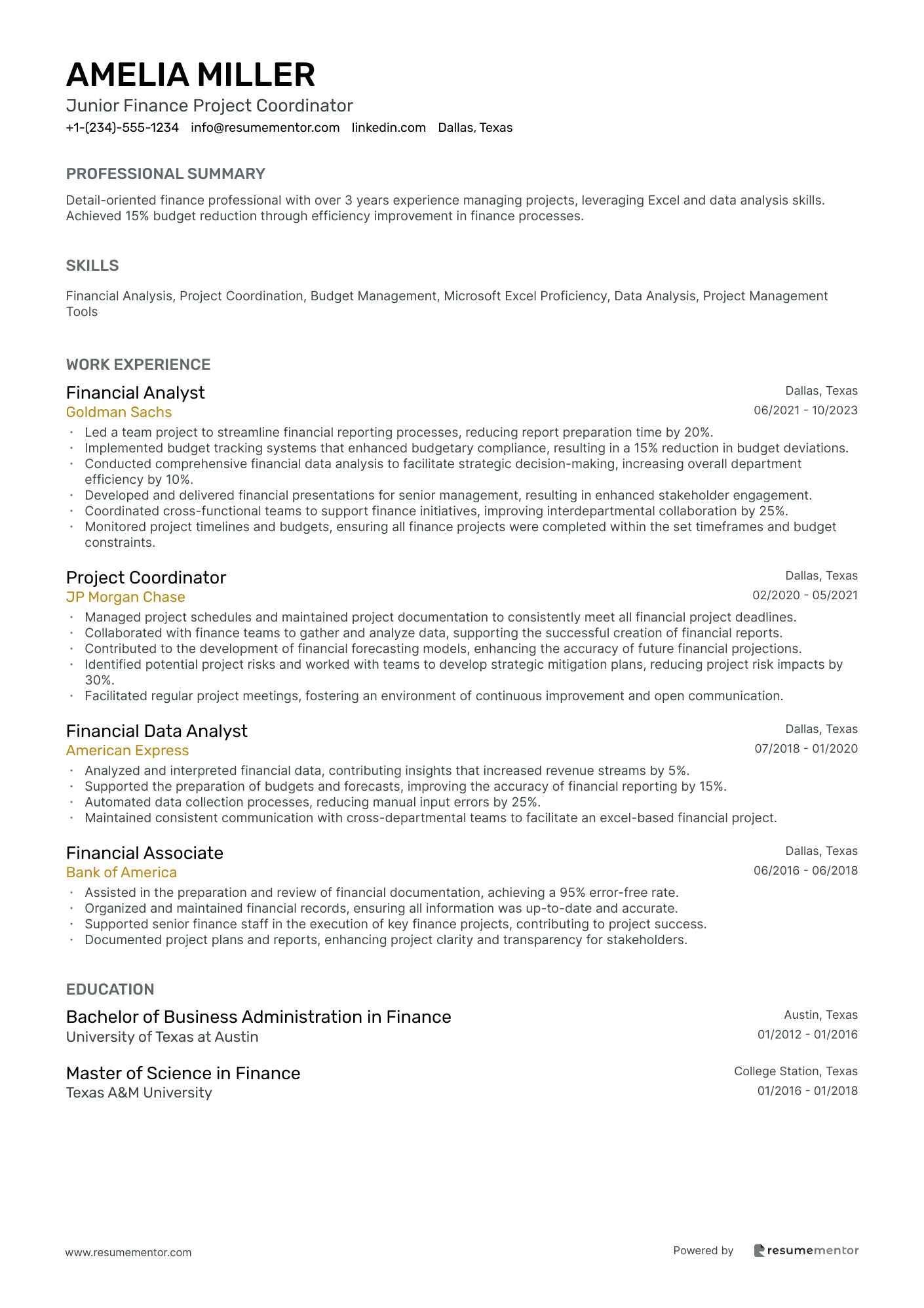

Junior Finance Project Coordinator

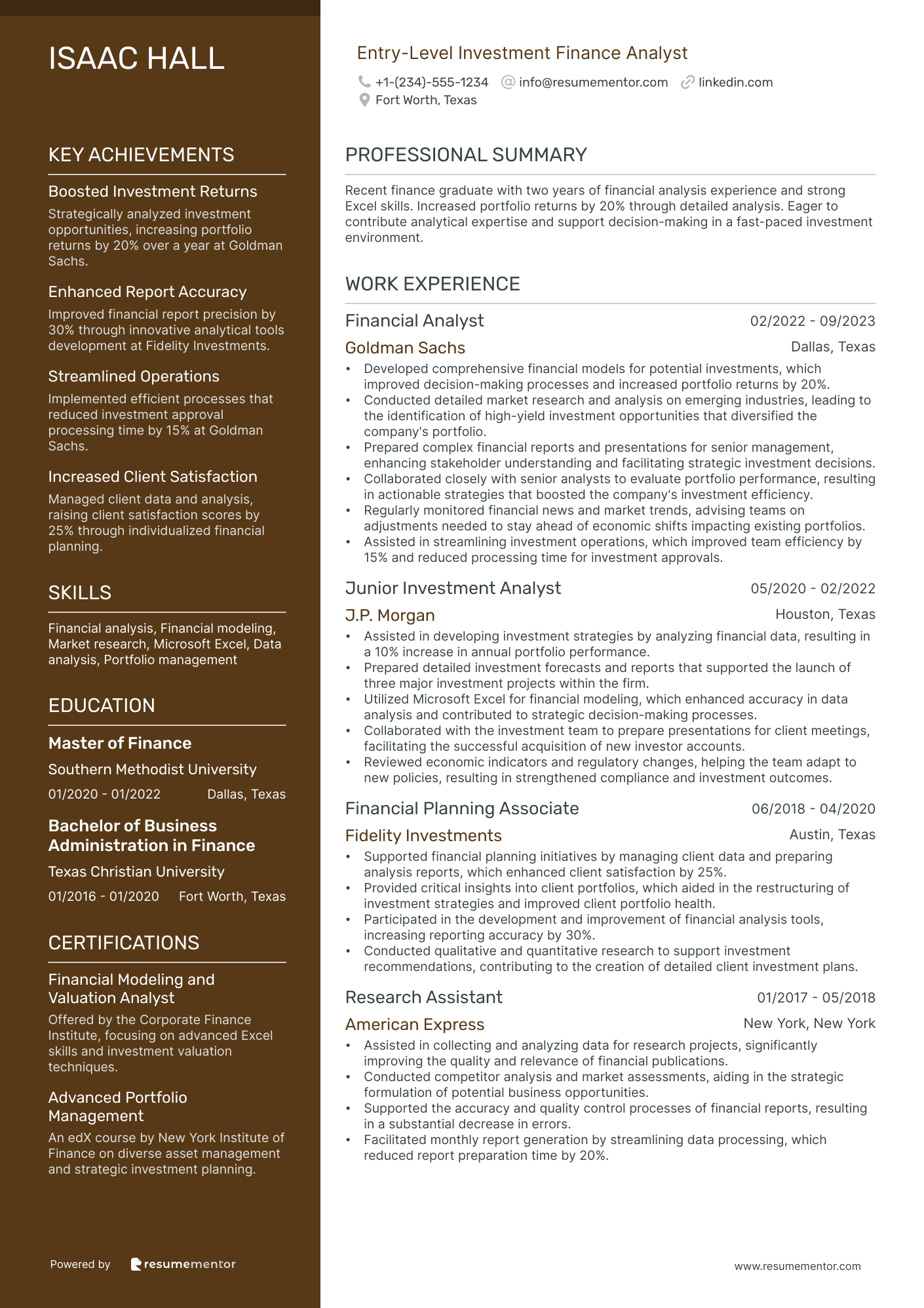

Entry-Level Investment Finance Analyst

Junior Financial Reporting Specialist

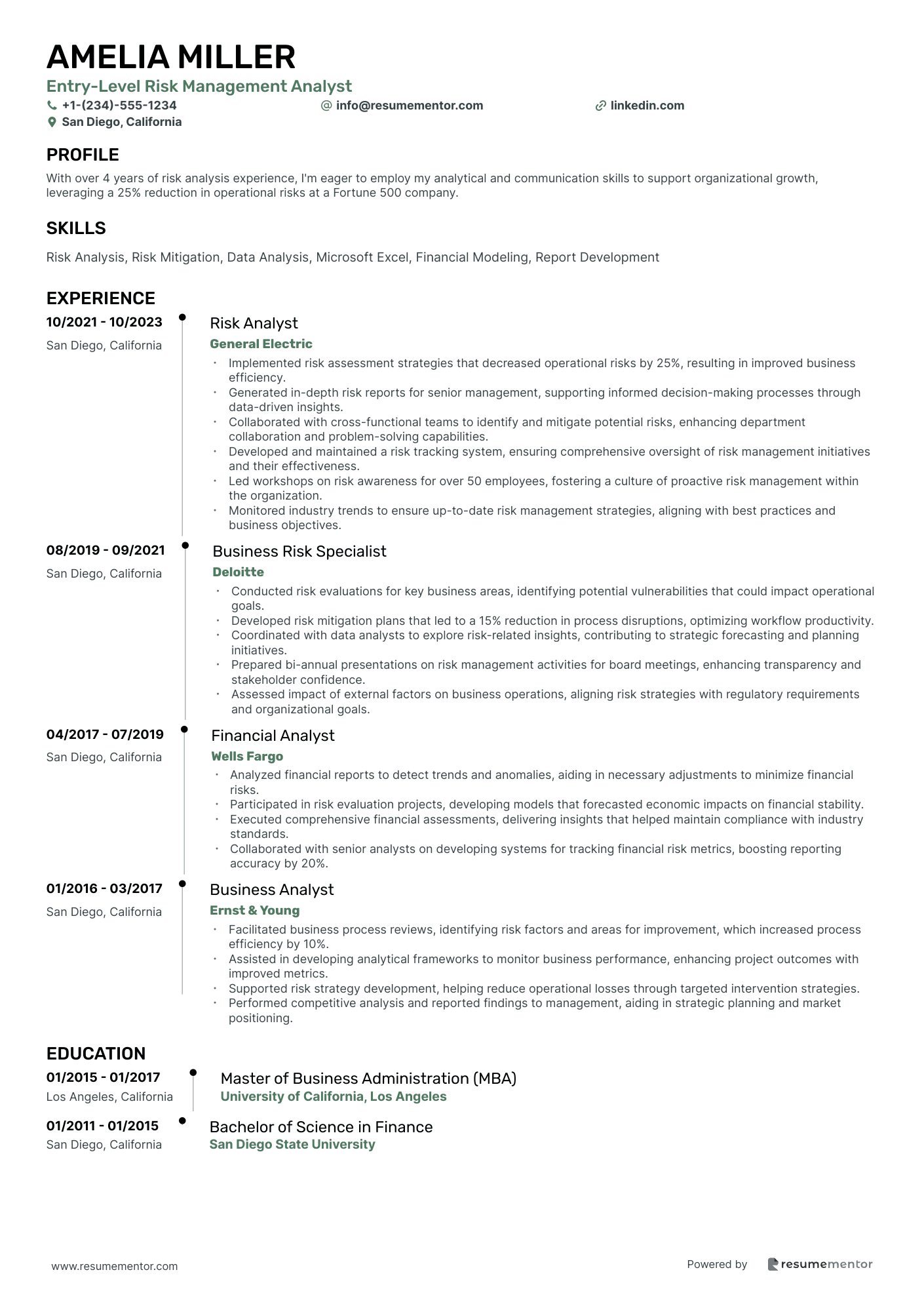

Entry-Level Risk Management Analyst

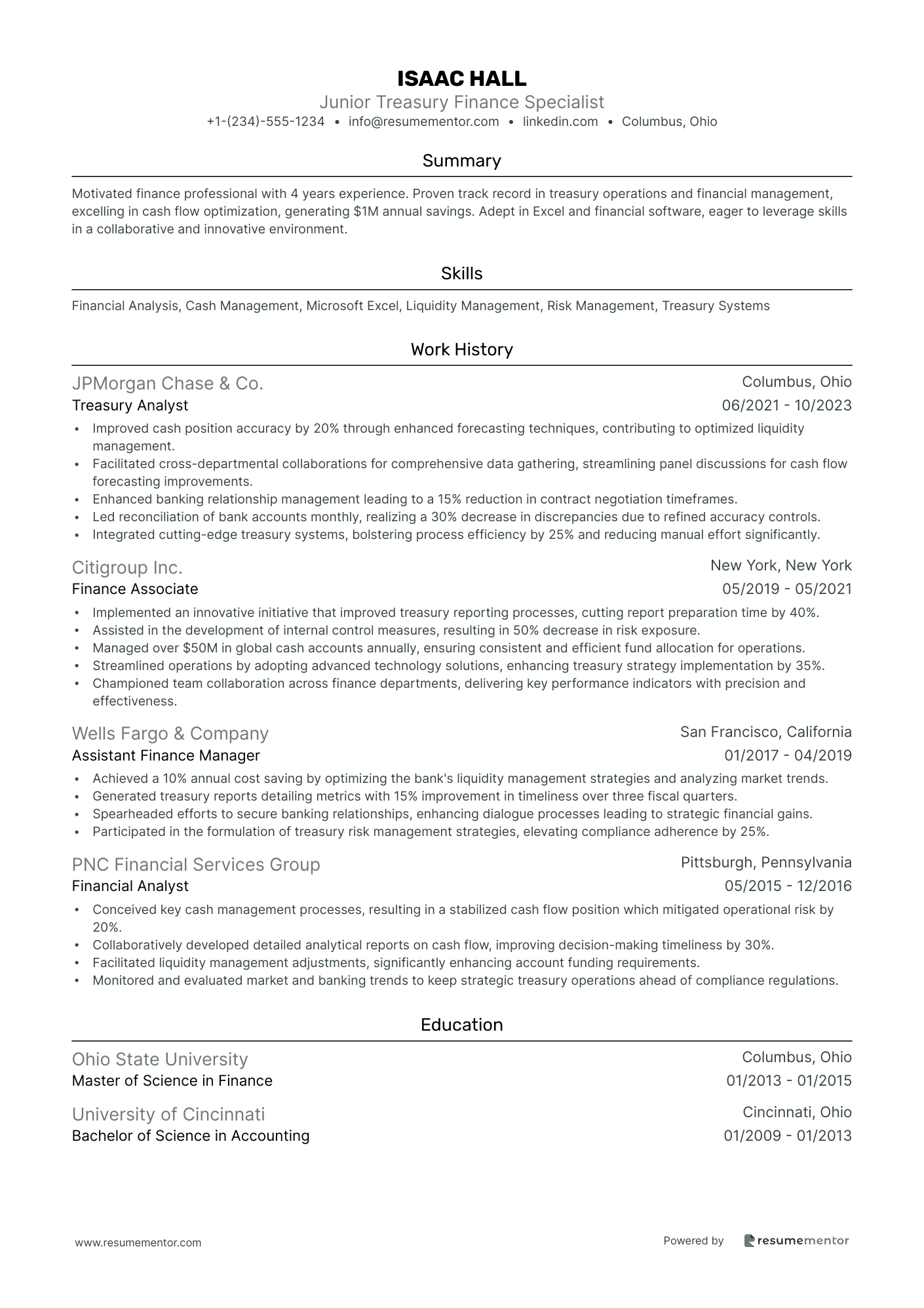

Junior Treasury Finance Specialist

Entry-Level Financial Analyst resume sample

- •Created financial models resulting in improved forecasting accuracy by 25%, helping managers streamline financial allocations.

- •Streamlined month-end close processes, reducing closing time by 30% through implementation of automated data accumulation.

- •Collaborated with cross-functional teams to consolidate financial data, contributing to a 15% growth in department efficiency.

- •Performed variance analysis which identified cost-saving opportunities, achieving an annual expense reduction of $1 million.

- •Developed quarterly financial presentations for senior management, enhancing transparency and decision-making capabilities.

- •Assisted in constructing a new budget forecast system, significantly increasing accuracy and reducing forecast errors by 20%.

- •Analyzed financial statements for multiple Fortune 500 clients, improving profit margin insights, resulting in a 5% client revenue increase.

- •Prepared detailed budgets and forecasts for complex projects, exceeding client expectations and maintaining high accuracy.

- •Implemented a financial tracking tool that led to a 40% improvement in budget oversight across engagements.

- •Monitored industry trends to provide clients with relevant, data-driven insights, fostering stronger client relationships.

- •Assisted in redesigning client financial reporting processes, resulting in a more streamlined and efficient workflow.

- •Conducted data analysis to drive strategic recommendations, leading to a 10% boost in operational efficiency.

- •Collaborated with stakeholders to automate reporting, saving the department over 150 hours in manual work annually.

- •Analyzed competitor performance metrics to identify gaps and opportunities, informing management strategic planning.

- •Contributed to special projects involving the integration of a new ERP system, enhancing data accuracy and financial reporting.

- •Assisted in preparing budget reports, increasing the visibility of key financial metrics by 15% for management review.

- •Developed financial tools that automated data collection, improving reporting efficiency by 25%.

- •Monitored financial data trends to provide actionable insights, supporting data-driven decision-making processes.

- •Collaborated with finance team members to implement continuous improvement methodologies, optimizing departmental operations.

Junior Corporate Finance Specialist resume sample

- •Developed and maintained comprehensive financial models that optimized budget allocations, saving the company over $200,000 annually.

- •Performed in-depth financial analysis and presented findings that led to a 15% increase in quarterly revenues.

- •Executed month-end closing processes, including reconciliations and journal entries, improving accuracy and efficiency by 20%.

- •Collaborated with cross-departmental teams to provide financial insights that supported strategic planning initiatives, resulting in a 10% growth in new market penetration.

- •Prepared detailed variance reports and forecasts that enhanced executive decision-making with clear, actionable insights.

- •Designed and delivered presentations to senior management, showcasing financial trends and opportunities for cost control and growth.

- •Created annual budget reports that served as the foundation for strategic planning, resulting in a 25% reduction in unnecessary expenditures.

- •Streamlined the forecasting process by implementing automated tools, reducing processing time by 50%.

- •Collaborated with finance executives to develop a KPI tracking dashboard, enhancing performance monitoring across departments.

- •Conducted financial research to support investments, interpreting data that supported profitable decision-making by $150,000.

- •Assisted in regulatory compliance audits, ensuring adherence to financial standards and regulations, reducing risk of penalties.

- •Executed detailed financial reconciliations that resulted in the identification and correction of discrepancies worth $50,000.

- •Assisted with month-end close procedures, contributing to a 30% reduction in time taken to close books monthly.

- •Processed and analyzed accounts payable and receivable data, improving cash flow forecasting accuracy by 10%.

- •Supported senior accountants in financial reporting, enhancing report accuracy and timeliness by implementing review processes.

- •Conducted market analysis that identified potential growth opportunities, enhancing strategic planning and leading to a 5% market share increase.

- •Developed financial reports and analytics for various departments, assisting in informed decision-making.

- •Administered financial databases, ensuring accuracy and maintaining data integrity across platforms.

- •Collaborated with respective departments to gather financial data, which improved forecast accuracy and department budgeting.

Entry-Level Financial Planning Associate resume sample

- •Enhanced client investment strategies, resulting in a 15% increase in average portfolio returns over two years.

- •Led a project team that redesigned financial reporting templates, reducing preparation time by 20% for the department.

- •Conducted comprehensive market research that supported the development of five high-yield investment portfolios.

- •Analyzed client assets and liabilities, providing actionable insights that improved planning efficiency by 30%.

- •Collaborated with senior managers to prepare client presentations, resulting in a 25% improvement in client satisfaction ratings.

- •Managed client data updates, ensuring adherence to compliance standards and increasing database accuracy by 40%.

- •Streamlined 10 financial operations processes, achieving an annual operational cost saving of approximately $100,000.

- •Analyzed 50+ investment accounts monthly, identifying opportunities to optimize client returns by as much as 10%.

- •Provided in-depth financial analyses that supported asset allocation and investment planning for client's diversified portfolios.

- •Assisted in integrating new regulations into practices, resulting in a 100% compliance rate during department audits.

- •Coordinated with financial advisors to regularly update customized financial plans, ensuring alignment with latest market trends.

- •Guided clients in budgeting, utilities spending, and saving strategies, helping increase their annual savings by 20%.

- •Assessed financial situations and developed initial financial plans for 100+ diverse client cases per year.

- •Worked on client portfolio reviews, addressing inquiries and ensuring alignment with financial objectives.

- •Collaborated on team workshops that improved advanced Excel skills for financial modeling, enhancing team productivity.

- •Supported the financial advisory team by preparing detailed financial reports and client presentations.

- •Maintained client documentation with a high accuracy rate, leading to a 95% satisfaction score from clients.

- •Participated in client meetings to provide analytical insights, resulting in enhanced service quality.

- •Contributed to creating a financial knowledge booklet for clients, enhancing understanding by 50% on financial topics.

Junior Accounts Payable Analyst resume sample

- •Revamped the invoice processing system, leading to a 25% improvement in processing times and reducing errors by 15%.

- •Facilitated the transition to new accounting software, enhancing data entry efficiency by 30% and streamlining audit procedures.

- •Developed and implemented a vendor communication protocol that decreased response times by 40%, leading to improved vendor relationships.

- •Coordinated monthly payment runs, ensuring 95% of transactions were completed ahead of schedule resulting in enhanced cash flow management.

- •Played a key role in the accounts payable department's successful audit with zero discrepancies due to meticulous documentation.

- •Trained a new finance team on the updated AP processes, boosting team efficiency and engagement by fostering peer-to-peer learning.

- •Successfully reconciled vendor statements monthly, resolving 90% of discrepancies within the first quarter to maintain financial accuracy.

- •Collaborated with cross-functional teams to ensure seamless invoice processing, achieving an 80% reduction in payment delays.

- •Managed electronic documentation of over 5,000 invoices annually, ensuring records were accurate and readily accessible for audits.

- •Assisted in month-end close processes, significantly improving accuracy and timing of financial reports by streamlining activities.

- •Implemented a proactive approach to vendor inquiries, reducing recurring issues by 50% and strengthening partnerships.

- •Conducted invoice analysis leading to cost-saving recommendations that trimmed spending by $100K annually.

- •Streamlined payment processes by 35% by integrating financial analytics tools into the AP function, enhancing accuracy.

- •Created detailed financial reports for senior management that supported key financial decisions and policy adjustments.

- •Enhanced record-keeping methods which reduced errors by 20% and contributed to smooth audits and compliance checks.

- •Supported reconciliation of financial data resulting in 10% improvement in process efficiency.

- •Participated in cross-functional projects, contributing analytical insights that facilitated decision-making.

- •Enhanced data entry accuracy by 25% by providing feedback on user interfaces and accounting software functionalities.

- •Reduced overdue payments by 15% through diligent monitoring of vendor statements and improving internal processes.

Entry-Level Finance Operations Specialist resume sample

- •Led a project to streamline the financial reconciliation process, improving accuracy and reducing time spent on reconciliation by 30%.

- •Implemented a new financial records management system, resulting in a 25% increase in compliance efficiency.

- •Developed detailed financial reports that enhanced the decision-making process, resulting in a 15% increase in departmental performance.

- •Collaborated with cross-functional teams to identify and resolve financial discrepancies, reducing errors by 20%.

- •Managed monthly financial closes, ensuring accurate and timely reporting for stakeholders.

- •Provided administrative support to the finance department, improving departmental efficiency by standardizing procedures.

- •Executed accurate and efficient processing of over 400 vendor invoices monthly, achieving a 99% accuracy rate.

- •Streamlined accounts payable workflow, resulting in a 40% reduction in processing time.

- •Collaborated with vendors to resolve payment discrepancies within 24 hours, improving vendor satisfaction rates.

- •Maintained up-to-date financial records, resulting in timely audit completion with zero discrepancies.

- •Monitored and analyzed expense reports to ensure compliance with company policies, reducing expenditure by 10%.

- •Contributed to the preparation and management of annual budget plans, ensuring alignment with financial goals.

- •Analyzed budget variances and provided detailed reports that improved management's budget accuracy by 18%.

- •Assisted in the implementation of new budgeting software, resulting in a 30% increase in processing efficiency.

- •Worked closely with departments to develop cost-saving initiatives, reducing operational costs by 5%.

- •Facilitated training sessions for 15+ staff members to improve understanding of budget management principles.

- •Processed payroll for over 500 employees with a 99% accuracy rate, ensuring timely and error-free payments.

- •Conducted audits of payroll data to identify discrepancies, resolving issues within 48 hours.

- •Created user guides for payroll software, resulting in improved user efficiency and a decrease in support inquiries.

- •Assisted in the implementation of a new payroll system, streamlining operations and reducing manual errors.

Junior Finance Project Coordinator resume sample

- •Led a team project to streamline financial reporting processes, reducing report preparation time by 20%.

- •Implemented budget tracking systems that enhanced budgetary compliance, resulting in a 15% reduction in budget deviations.

- •Conducted comprehensive financial data analysis to facilitate strategic decision-making, increasing overall department efficiency by 10%.

- •Developed and delivered financial presentations for senior management, resulting in enhanced stakeholder engagement.

- •Coordinated cross-functional teams to support finance initiatives, improving interdepartmental collaboration by 25%.

- •Monitored project timelines and budgets, ensuring all finance projects were completed within the set timeframes and budget constraints.

- •Managed project schedules and maintained project documentation to consistently meet all financial project deadlines.

- •Collaborated with finance teams to gather and analyze data, supporting the successful creation of financial reports.

- •Contributed to the development of financial forecasting models, enhancing the accuracy of future financial projections.

- •Identified potential project risks and worked with teams to develop strategic mitigation plans, reducing project risk impacts by 30%.

- •Facilitated regular project meetings, fostering an environment of continuous improvement and open communication.

- •Analyzed and interpreted financial data, contributing insights that increased revenue streams by 5%.

- •Supported the preparation of budgets and forecasts, improving the accuracy of financial reporting by 15%.

- •Automated data collection processes, reducing manual input errors by 25%.

- •Maintained consistent communication with cross-departmental teams to facilitate an excel-based financial project.

- •Assisted in the preparation and review of financial documentation, achieving a 95% error-free rate.

- •Organized and maintained financial records, ensuring all information was up-to-date and accurate.

- •Supported senior finance staff in the execution of key finance projects, contributing to project success.

- •Documented project plans and reports, enhancing project clarity and transparency for stakeholders.

Entry-Level Investment Finance Analyst resume sample

- •Developed comprehensive financial models for potential investments, which improved decision-making processes and increased portfolio returns by 20%.

- •Conducted detailed market research and analysis on emerging industries, leading to the identification of high-yield investment opportunities that diversified the company's portfolio.

- •Prepared complex financial reports and presentations for senior management, enhancing stakeholder understanding and facilitating strategic investment decisions.

- •Collaborated closely with senior analysts to evaluate portfolio performance, resulting in actionable strategies that boosted the company's investment efficiency.

- •Regularly monitored financial news and market trends, advising teams on adjustments needed to stay ahead of economic shifts impacting existing portfolios.

- •Assisted in streamlining investment operations, which improved team efficiency by 15% and reduced processing time for investment approvals.

- •Assisted in developing investment strategies by analyzing financial data, resulting in a 10% increase in annual portfolio performance.

- •Prepared detailed investment forecasts and reports that supported the launch of three major investment projects within the firm.

- •Utilized Microsoft Excel for financial modeling, which enhanced accuracy in data analysis and contributed to strategic decision-making processes.

- •Collaborated with the investment team to prepare presentations for client meetings, facilitating the successful acquisition of new investor accounts.

- •Reviewed economic indicators and regulatory changes, helping the team adapt to new policies, resulting in strengthened compliance and investment outcomes.

- •Supported financial planning initiatives by managing client data and preparing analysis reports, which enhanced client satisfaction by 25%.

- •Provided critical insights into client portfolios, which aided in the restructuring of investment strategies and improved client portfolio health.

- •Participated in the development and improvement of financial analysis tools, increasing reporting accuracy by 30%.

- •Conducted qualitative and quantitative research to support investment recommendations, contributing to the creation of detailed client investment plans.

- •Assisted in collecting and analyzing data for research projects, significantly improving the quality and relevance of financial publications.

- •Conducted competitor analysis and market assessments, aiding in the strategic formulation of potential business opportunities.

- •Supported the accuracy and quality control processes of financial reports, resulting in a substantial decrease in errors.

- •Facilitated monthly report generation by streamlining data processing, which reduced report preparation time by 20%.

Junior Financial Reporting Specialist resume sample

- •Assisted in monthly financial statement preparation, ensuring compliance with GAAP, leading to error reduction by 20%.

- •Collaborated with IT to automate account reconciliation processes, saving the team 15 hours per month.

- •Led cross-departmental data collection efforts, enhancing report accuracy and supporting informed strategic planning.

- •Played a pivotal role in a project that improved budget forecasting accuracy by 10% through detailed analysis.

- •Managed documentation and support during annual audit, contributing to a 30% faster audit completion time.

- •Identified areas of process improvement, implementing changes that increased financial report efficiency by 15%.

- •Prepared quarterly financial statements, resulting in accurate and prompt regulatory filings.

- •Contributed to collaborative budgeting processes, creating reports that improved departmental budget compliance by 12%.

- •Updated financial templates, streamlining processes resulting in a 10% reduction in reporting time.

- •Actively participated in internal audits, ensuring all financial data was accurately compiled and accessible.

- •Coordinated with various teams to gather accurate financial performance data, ensuring clarity and compliance.

- •Conducted detailed account reconciliations, reducing discrepancies by 5% over three quarters.

- •Supported the financial team in managing annual budget reports, enhancing resource allocation accuracy.

- •Provided analytical insight for future forecasts, contributing positively to strategic decision-making.

- •Maintained accurate financial records, essential for compliance with regulatory standards.

- •Managed monthly closing activities and ensured financial reports reflected true business performance.

- •Optimized financial data collection methods, achieving a reduction of report preparation time by 20%.

- •Supported senior accountants during financial audits, actively ensuring the accuracy of all documentation.

- •Assisted in improving the efficiency of internal communication related to financial reporting.

Entry-Level Risk Management Analyst resume sample

- •Implemented risk assessment strategies that decreased operational risks by 25%, resulting in improved business efficiency.

- •Generated in-depth risk reports for senior management, supporting informed decision-making processes through data-driven insights.

- •Collaborated with cross-functional teams to identify and mitigate potential risks, enhancing department collaboration and problem-solving capabilities.

- •Developed and maintained a risk tracking system, ensuring comprehensive oversight of risk management initiatives and their effectiveness.

- •Led workshops on risk awareness for over 50 employees, fostering a culture of proactive risk management within the organization.

- •Monitored industry trends to ensure up-to-date risk management strategies, aligning with best practices and business objectives.

- •Conducted risk evaluations for key business areas, identifying potential vulnerabilities that could impact operational goals.

- •Developed risk mitigation plans that led to a 15% reduction in process disruptions, optimizing workflow productivity.

- •Coordinated with data analysts to explore risk-related insights, contributing to strategic forecasting and planning initiatives.

- •Prepared bi-annual presentations on risk management activities for board meetings, enhancing transparency and stakeholder confidence.

- •Assessed impact of external factors on business operations, aligning risk strategies with regulatory requirements and organizational goals.

- •Analyzed financial reports to detect trends and anomalies, aiding in necessary adjustments to minimize financial risks.

- •Participated in risk evaluation projects, developing models that forecasted economic impacts on financial stability.

- •Executed comprehensive financial assessments, delivering insights that helped maintain compliance with industry standards.

- •Collaborated with senior analysts on developing systems for tracking financial risk metrics, boosting reporting accuracy by 20%.

- •Facilitated business process reviews, identifying risk factors and areas for improvement, which increased process efficiency by 10%.

- •Assisted in developing analytical frameworks to monitor business performance, enhancing project outcomes with improved metrics.

- •Supported risk strategy development, helping reduce operational losses through targeted intervention strategies.

- •Performed competitive analysis and reported findings to management, aiding in strategic planning and market positioning.

Junior Treasury Finance Specialist resume sample

- •Improved cash position accuracy by 20% through enhanced forecasting techniques, contributing to optimized liquidity management.

- •Facilitated cross-departmental collaborations for comprehensive data gathering, streamlining panel discussions for cash flow forecasting improvements.

- •Enhanced banking relationship management leading to a 15% reduction in contract negotiation timeframes.

- •Led reconciliation of bank accounts monthly, realizing a 30% decrease in discrepancies due to refined accuracy controls.

- •Integrated cutting-edge treasury systems, bolstering process efficiency by 25% and reducing manual effort significantly.

- •Implemented an innovative initiative that improved treasury reporting processes, cutting report preparation time by 40%.

- •Assisted in the development of internal control measures, resulting in 50% decrease in risk exposure.

- •Managed over $50M in global cash accounts annually, ensuring consistent and efficient fund allocation for operations.

- •Streamlined operations by adopting advanced technology solutions, enhancing treasury strategy implementation by 35%.

- •Championed team collaboration across finance departments, delivering key performance indicators with precision and effectiveness.

- •Achieved a 10% annual cost saving by optimizing the bank's liquidity management strategies and analyzing market trends.

- •Generated treasury reports detailing metrics with 15% improvement in timeliness over three fiscal quarters.

- •Spearheaded efforts to secure banking relationships, enhancing dialogue processes leading to strategic financial gains.

- •Participated in the formulation of treasury risk management strategies, elevating compliance adherence by 25%.

- •Conceived key cash management processes, resulting in a stabilized cash flow position which mitigated operational risk by 20%.

- •Collaboratively developed detailed analytical reports on cash flow, improving decision-making timeliness by 30%.

- •Facilitated liquidity management adjustments, significantly enhancing account funding requirements.

- •Monitored and evaluated market and banking trends to keep strategic treasury operations ahead of compliance regulations.

Entering the world of entry-level finance is like stepping onto a bustling trading floor for the first time, with your resume as your entry pass. Crafting this key document can feel as intricate as managing a portfolio. Amid the numbers and jargon, it's crucial to highlight your unique skills and potential to stand out, even when your experience is just beginning.

In building your finance career, you'll want to strategically highlight the skills and experiences that make you a strong candidate. Emphasizing your educational background, relevant coursework, and any internships can showcase your analytical and financial strengths. This isn’t just about listing past roles; it’s about communicating why you belong in the finance industry.

To simplify the resume-building process, consider using a resume template that provides structure and ensures no critical section is overlooked. A well-organized resume helps hiring managers quickly grasp your potential and sets the stage for engaging conversations about your future.

As you showcase your talents, don't forget to balance technical finance skills with soft skills like communication and problem-solving. Numbers may drive the finance world, but soft skills are what keep operations running smoothly and effectively. Highlighting this unique blend of abilities will help create a comprehensive picture of what you bring to the table.

As you set off on this career journey, remember that clarity and precision in your resume can open doors. Let it reflect your financial promise and ambition, guiding you toward success in the industry.

Key Takeaways

- An entry-level finance resume should highlight analytical skills, attention to detail, and an understanding of financial principles, showcasing educational background, relevant coursework, and internships.

- Utilizing a structured resume template can simplify the process, ensuring all critical sections are covered, and allows you to present both technical and soft skills effectively.

- The reverse chronological resume format is recommended to emphasize recent accomplishments and internships, with modern fonts improving professionalism and readability.

- Skills sections should include both hard skills like financial analysis and financial software, and soft skills such as communication and analytical thinking to enhance suitability.

- Certificates like the CFA Level 1 add credibility, and additional sections like language skills, volunteer work, and interests provide a well-rounded view of the candidate.

What to focus on when writing your entry-level finance resume

An entry-level finance resume should clearly convey your competence and potential to a recruiter by highlighting your analytical skills, attention to detail, and eagerness to learn in the finance field. To do this, make sure your resume reflects your understanding of financial principles and your ambition to contribute meaningfully to a finance team.

How to structure your entry-level finance resume

- Contact Information: Start with your full name, phone number, and professional email address, ensuring easy access for potential follow-ups. Including a LinkedIn profile link can also add value, offering more insight into your professional background.

- Professional Summary: Follow up with a brief statement sharing your enthusiasm for finance, underscoring your educational background, and touching on any relevant internships or projects that highlight your skills—this sets the tone by giving recruiters a quick glimpse of your qualifications.

- Education: Include your degree, major, university name, and graduation date—this is essential for showcasing your academic foundation. Mention specific coursework like "Financial Analytics" or "Investment Principles," which signals to employers your preparedness for finance roles.

- Work Experience: Connect your education with real-world experience by detailing internships, part-time jobs, or volunteer work where you used finance-related skills. Include achievements and describe your impact with specific numbers when possible to demonstrate your contribution—this helps recruiters see how your skills will translate to their organization.

- Skills: Reinforce your experience by listing finance-specific skills such as "Data Analysis," "Financial Modeling," or "Excel Proficiency"—showing further evidence of your capability helps employers understand your technical proficiency.

- Certifications: If you possess certifications like "Bloomberg Terminal" or "Financial Risk Management," mention them to add weight to your qualifications and show your commitment to the field—these can set you apart, indicating specialized knowledge and dedication.

To enhance your resume further, consider adding optional sections like "Projects," "Volunteer Experience," or "Awards" which demonstrate your unique qualifications, particularly if they relate back to finance, reinforcing your readiness for an entry-level role. Below, we'll cover each of these sections more in-depth in terms of resume format.

Which resume format to choose

Creating an entry-level finance resume that stands out is key in the competitive finance industry. Begin by choosing a reverse chronological format, which prioritizes your recent accomplishments and is perfect for highlighting your education and any internships. This format helps employers see your most relevant experiences first, aligning with what they value in a candidate.

The font you choose impacts how professional your resume appears. Modern fonts like Lato, Montserrat, and Raleway provide a clean and contemporary look that enhances readability and keeps the focus on your content. These fonts subtly suggest you are up-to-date with current design trends, an attribute that can be appealing even in finance, where attention to detail matters.

When it comes to sharing your resume, always save it as a PDF. This ensures the document maintains its formatting across all devices, making it easy for hiring managers to read without any technical issues. PDFs also prevent any accidental alterations that might happen with other file types, ensuring your carefully crafted presentation remains intact.

Your resume layout is also important. Keep your margins between 0.5 to 1 inch on all sides. This creates a well-balanced appearance with enough white space to make the document easy to navigate. Proper margins highlight your organizational skills and attention to detail, which are critical in finance roles. By focusing on these aspects, you ensure your resume is polished, professional, and ready to capture the attention of potential employers in the finance sector.

How to write a quantifiable resume experience section

The experience section of your entry-level finance resume is essential because it demonstrates your achievements and readiness for the field. Begin by focusing on experiences that align with the specific job you're targeting. List these in reverse chronological order, starting with your most recent roles, which could include internships or volunteer work if they highlight your progression in finance. Tailor each entry to the job ad by emphasizing skills and accomplishments that meet the employer's requirements. Use powerful action words such as "analyzed," "managed," "increased," and "developed" to effectively communicate your contributions.

Move beyond merely listing duties and highlight quantifiable achievements with concrete results. Starting each bullet point with a strong action verb, incorporate numbers to clearly illustrate the scale and impact of your actions. Here’s an example following the requested format:

- •Analyzed monthly spending reports and helped reduce unnecessary costs by 15%, contributing to a more efficient budget management.

- •Collaborated with the senior finance team to optimize cash flow models, resulting in a 10% increase in cash reserves over six months.

- •Developed spreadsheets to track financial trends, aiding in quarterly performance reviews that boosted project funding by 20%.

- •Managed a database of over 500 client records, improving data accuracy and enhancing reporting capabilities by 30%.

This approach is effective because it strategically links your past roles to your current job pursuit, using relevant skills and result-oriented language to convey your readiness for increased responsibilities. Each bullet focuses on clear, measurable outcomes, creating a cohesive narrative that portrays your past work as dynamic and impactful to potential employers.

Project-Focused resume experience section

A project-focused entry-level finance resume experience section should effectively showcase your ability to contribute to specific financial projects. It's important to highlight the skills you applied and the impact of your contributions to demonstrate your value to potential employers. Start with active verbs to vividly convey your actions and include numbers or percentages whenever possible to quantify your achievements. By keeping your bullet points clear and concise, you can provide just enough detail to outline your role without overwhelming the reader.

Start by listing each project with the dates, your job title, and the organization. This structure helps employers understand the context in which you applied your skills. In your bullet points, focus on the actions you took, the skills you employed, and the outcomes you achieved. For example, emphasize finance-relevant skills such as data analysis or budgeting, which are critical in the industry.

Intern

XYZ Financial Services

June 2021 - August 2021

- Conducted a detailed analysis of departmental budgets, leading to a 10% reduction in expenses.

- Collaborated with a team of 5 to create a more efficient reporting process, improving data accuracy by 15%.

- Presented insights to senior management, enhancing their decision-making with clear financial information.

- Utilized Excel and financial tools to forecast budget trends, providing valuable support for strategic planning.

Responsibility-Focused resume experience section

A responsibility-focused entry-level finance resume experience section should clearly showcase the tasks and duties you've managed. It's crucial for potential employers to recognize your capability to effectively handle responsibilities. Begin by listing your previous roles, including the dates, job titles, and company names, to provide context. Use bullet points to emphasize your specific responsibilities, and start each point with an action verb like "managed," "organized," or "analyzed," which highlights your proactive involvement.

To maintain clarity, keep your bullet points simple and direct. Mention any tools or software you used, and highlight any significant achievements that stemmed from your efforts. This approach ensures employers understand your competence in meeting job demands. Furthermore, if you've handled specific financial tasks such as budgeting, forecasting, or data analysis, include these as they are pivotal in finance roles. By emphasizing these tasks, you demonstrate your readiness to tackle similar responsibilities in future positions.

Finance Intern

Smith & Associates

June 2021 - August 2022

- Managed monthly budgeting reports for a small company, improving accuracy by 15%.

- Organized and maintained financial records using Excel and QuickBooks.

- Assisted in preparing financial presentations for quarterly meetings.

- Analyzed financial data to identify cost-saving opportunities.

Efficiency-Focused resume experience section

An efficiency-focused finance resume experience section should effectively highlight your ability to streamline operations and improve processes. Begin by reflecting on any relevant internships, part-time roles, or academic projects where you enhanced workflows or saved time. Use action verbs to illustrate your involvement and specify the results of your efforts, aligning each bullet point with the skills that employers are looking for. Ensuring your entries are both personalized and impactful strengthens their appeal.

When crafting your content, keep your language clear and concise, emphasizing quantifiable outcomes like percentage improvements or time saved to demonstrate your impact. Use parallel structure to organize your points for greater readability. Each bullet should weave a narrative of how you actively contributed to efficiency, showcasing the tangible benefits of your work. Highlight the value you brought to your team and the real improvements your actions achieved.

Finance Intern

ABC Financial Services

June 2022 - August 2022

- Enhanced the accuracy of financial reports by designing a streamlined data-entry process, cutting errors by 15%.

- Collaborated with team members to adopt a new budgeting tool, saving 20% of the time typically spent on budget prep.

- Developed an automated system for tracking invoice approvals, slashing processing time by 30%.

- Supported account reconciliation, swiftly resolving discrepancies for a smoother month-end close.

Skills-Focused resume experience section

A skills-focused entry-level finance resume experience section should effectively showcase your relevant skills and experiences in the finance field. Begin by identifying your key skills, such as financial analysis, budgeting, or reporting, which are crucial for the roles you are targeting. When detailing your experience, clearly describe each role, emphasizing the achievements or lessons gained. Use bullet points to outline your responsibilities and accomplishments concisely, ensuring your resume is easy to read and communicates your skills effectively to potential employers.

By providing specific examples of your skills in action, even from internships or part-time jobs, you'll make your experience more compelling. Tailor your descriptions to highlight results and impact, like streamlining processes or achieving financial targets. Active language can emphasize your contributions, and adding quantifiable achievements lends credibility and context. Here’s an example structure to guide you in crafting your resume’s experience section:

Finance Intern

Bright Finance Corp

June 2021 - August 2021

- Assisted in preparing monthly financial reports for 5 major clients, ensuring accuracy and timeliness.

- Conducted in-depth market analysis to identify growth opportunities, resulting in a 15% increase in company outreach.

- Collaborated with cross-functional teams to streamline budgeting processes, improving efficiency by 10%.

- Led a team of interns to develop a cost-saving initiative, which reduced operational costs by 5%.

Write your entry-level finance resume summary section

A finance-focused entry-level resume summary should clearly highlight your skills, education, and any relevant experience. Your goal is to give potential employers a quick snapshot of why you're a strong candidate. For example:

This kind of summary effectively combines your education, skills, and hands-on experience. It’s concise yet informative, offering employers a snapshot of your qualifications. By describing yourself with a focus on your strengths, you can clearly show what you bring to the table. Action verbs and specific achievements help convey your confidence and competence.

It's important to understand how a summary differs from other sections like a resume objective, profile, or a summary of qualifications. While a resume summary highlights your overall skills and what you offer, a resume objective focuses on your career goals. A resume profile may include broader personal attributes, and a summary of qualifications is a straightforward list of key skills and experiences.

By showcasing your readiness to contribute in your summary, you can stand out as an entry-level applicant. Tailoring your summary to each job application by highlighting the role's key requirements shows employers that you've done your research and truly understand what they value.

Listing your entry-level finance skills on your resume

A finance-focused, entry-level resume should effectively highlight your skills and experiences to impress potential employers. You have the flexibility to display your skills either as a standalone section or embed them into other areas like your experience or summary. Consider your strengths and soft skills as essential traits that facilitate better collaboration and performance in any work environment. In contrast, hard skills consist of specific technical abilities and knowledge acquired through education and practice. Viewing skills and strengths as keywords on your resume can help capture attention during initial screenings by clearly showcasing your competencies.

A well-structured skills section, as seen above, can effectively communicate your finance-related skills to recruiters. Important technical abilities such as Financial Analysis demonstrate your capacity to evaluate economic conditions. Excel Proficiency highlights your adeptness with indispensable financial tools. Each skill directly pertains to industry demands, thereby emphasizing your preparedness for job-specific tasks. By including popular skills like Financial Reporting, you signal your potential to positively impact business operations.

Best hard skills to feature on your entry-level finance resume

In the finance field, showcasing hard skills indicates your proficiency with essential financial concepts and tools. These skills should convey your capability to manage industry-specific responsibilities effectively.

Hard Skills

- Financial Analysis

- Accounting Principles

- Excel Proficiency

- Data Analysis

- Budgeting

- Financial Reporting

- Risk Assessment

- Statistical Modeling

- Portfolio Management

- Financial Software

- Auditing

- Financial Regulations

- Bookkeeping

- Cost Analysis

- Tax Preparation

Best soft skills to feature on your entry-level finance resume

Soft skills are equally important as they highlight your ability to engage with colleagues and clients, solve challenges, and adapt in a dynamic workplace.

Soft Skills

- Communication

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Time Management

- Adaptability

- Team Collaboration

- Decision-Making

- Organizational Skills

- Critical Thinking

- Negotiation Skills

- Initiative

- Patience

- Customer Service

- Stress Management

How to include your education on your resume

The education section of your resume is a crucial part, especially for entry-level finance positions. It's your chance to highlight academic achievements that make you a strong candidate. Tailor it to the specific job by including only relevant educational experiences. Listing irrelevant education could distract from the qualifications that best suit the role you're applying for. When mentioning your GPA, include it if it's impressive and relevant, typically if it's above a 3.0. If you graduated with honors like cum laude, make sure to note that visible on your resume. Your degree should be clearly listed, complete with the institution's name and your graduation date.

Creating a clear and concise education section can emphasize the skills and knowledge that's pertinent to finance. Here is a poorly organized example that doesn't fit the requirements of a finance position:

Here is a well-structured example that highlights relevant education:

This example is effective because it presents necessary details related to the finance field accurately and concisely. The degree is directly relevant, the GPA spotlights consistent academic performance, and the absence of unnecessary information keeps it focused. This targeted approach helps potential employers quickly see how your education aligns with their job requirements.

How to include entry-level finance certificates on your resume

Adding a certificates section to an entry-level finance resume is essential. Certificates show your dedication and specialized knowledge, which can set you apart from other candidates. You can place this section either in the main body of the resume or in the header for quick visibility.

List the name of the certificate first. Include the date of when you earned it. Add the issuing organization that provided the certificate. Organizing information in this way makes it easy for employers to evaluate your qualifications quickly.

The example above is excellent because it focuses on certificates relevant to finance. The "Chartered Financial Analyst (CFA) Level 1" is highly respected in the finance industry. "CFA Institute" is clearly mentioned, letting employers know the credibility of the certification. This simple yet effective information layout allows for quick readability and clarity.

Extra sections to include in your entry-level finance resume

Breaking into the finance world can be challenging, especially for entry-level candidates. Building a well-rounded resume that showcases more than just your academic and professional experiences is crucial. Including diverse sections like language skills, hobbies, volunteer work, and books can help your resume stand out.

- Language section — List additional languages you know as this can highlight your communication skills and cultural awareness.

- Hobbies and interests section — Share your personal interests to show that you have a balanced life and can bring unique perspectives to the team.

- Volunteer work section — Include volunteer activities to demonstrate your commitment to community and willingness to go the extra mile.

- Books section — Mention books you've read that are relevant to finance to show your passion for continuous learning and staying updated in your field.

These sections can provide a fuller picture of who you are beyond your academic and work achievements. They can help you stand out as a well-rounded candidate, making you more appealing to employers.

In Conclusion

In conclusion, your entry-level finance resume serves as a powerful tool in launching your career in the finance industry. By thoughtfully highlighting your academic achievements, internships, and unique skills, you are positioning yourself as a strong candidate. Using clear, concise language and focusing on quantifiable achievements can greatly enhance the impact of your resume. It's crucial to not only emphasize your technical skills but also your soft skills, as these demonstrate your ability to communicate and solve problems effectively within a team. Adopting a reverse chronological format helps emphasize your most relevant experiences first. Additionally, always consider the presentation aspects, such as choosing contemporary fonts and saving your resume as a PDF, to ensure clarity and professionalism. Including optional sections like volunteer work or books read can provide a fuller picture of your character and interests. Remember, a polished resume reflects your attention to detail and dedication to the finance field. By crafting your resume with intention, you can effectively convey your potential to employers and open the door to exciting opportunities in the finance world.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.