Entry-Level Financial Analyst Resume Examples

Mar 25, 2025

|

12 min read

Craft a winning entry-level financial analyst resume: balance your skills and experience to unlock your career potential. Navigate the numbers game with ease and present yourself as the best asset for any team.

Rated by 348 people

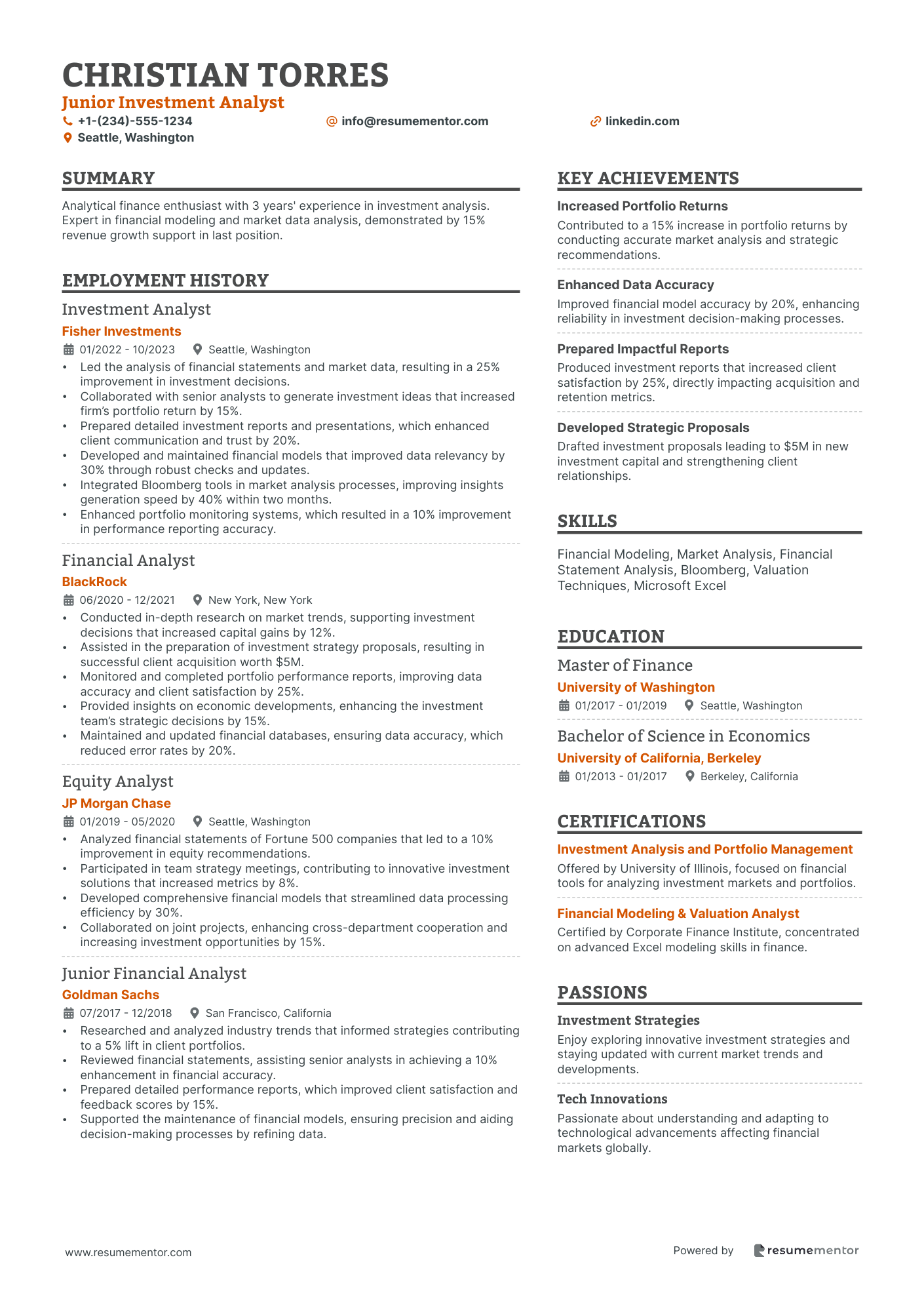

Junior Investment Analyst

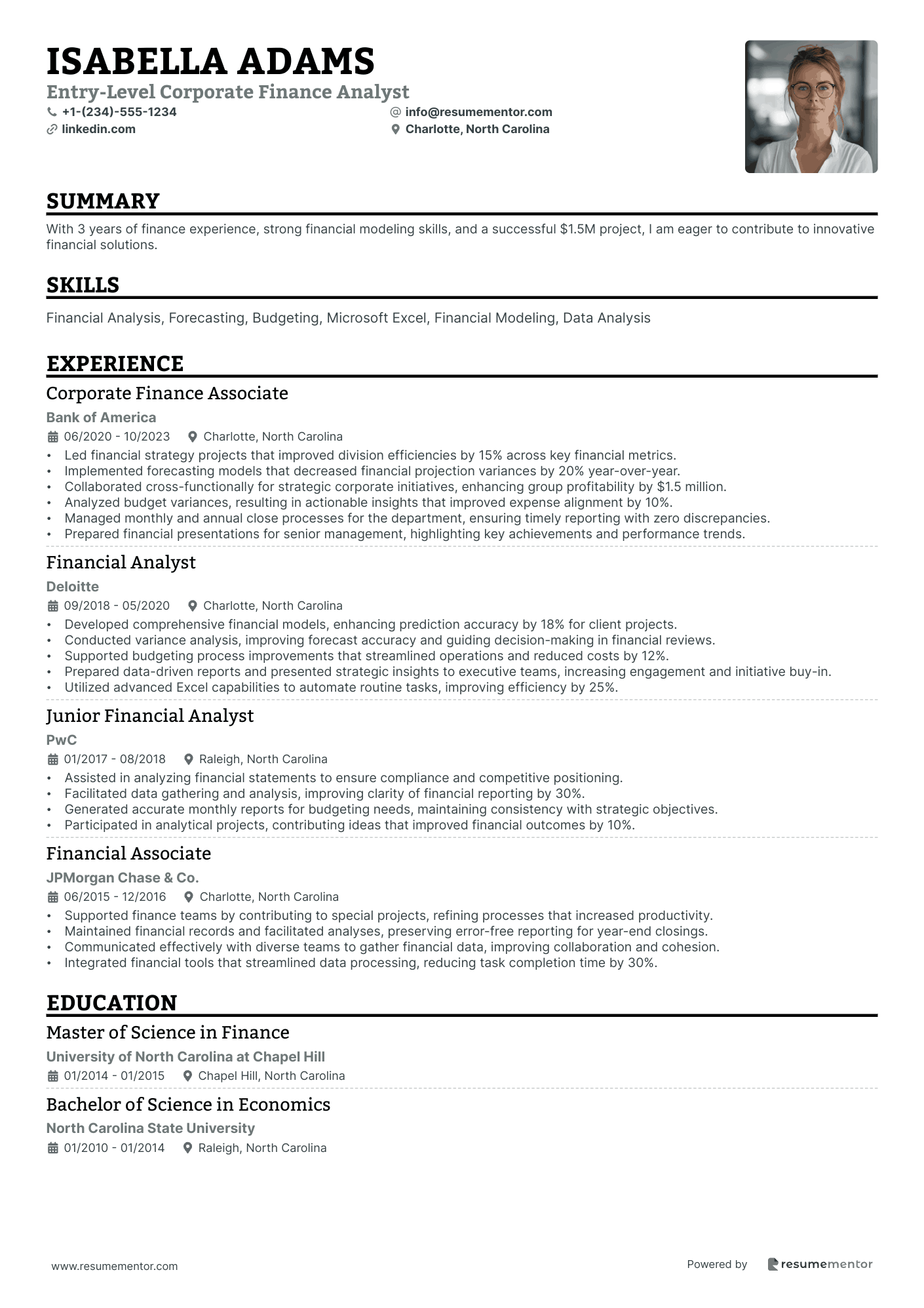

Entry-Level Corporate Finance Analyst

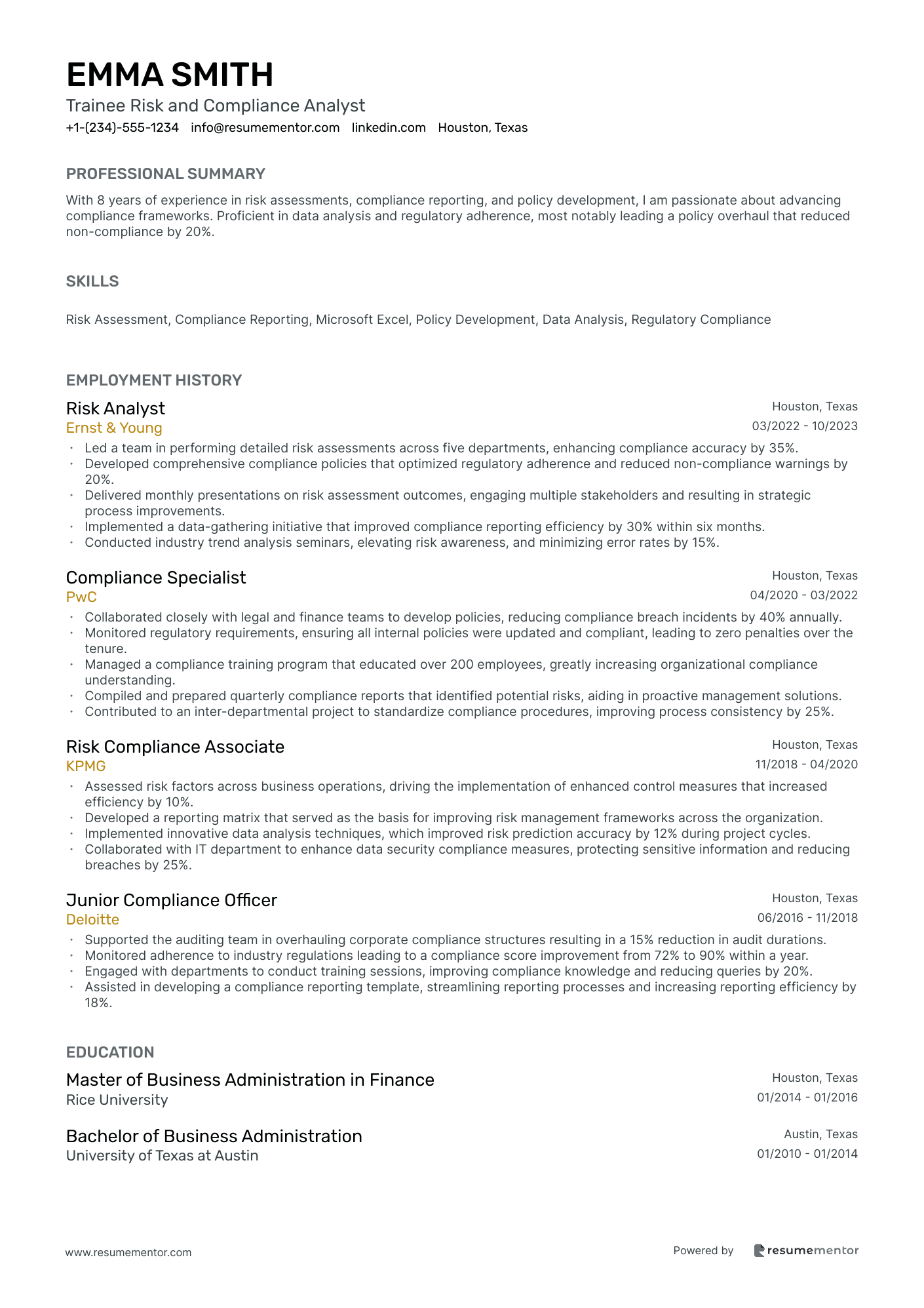

Trainee Risk and Compliance Analyst

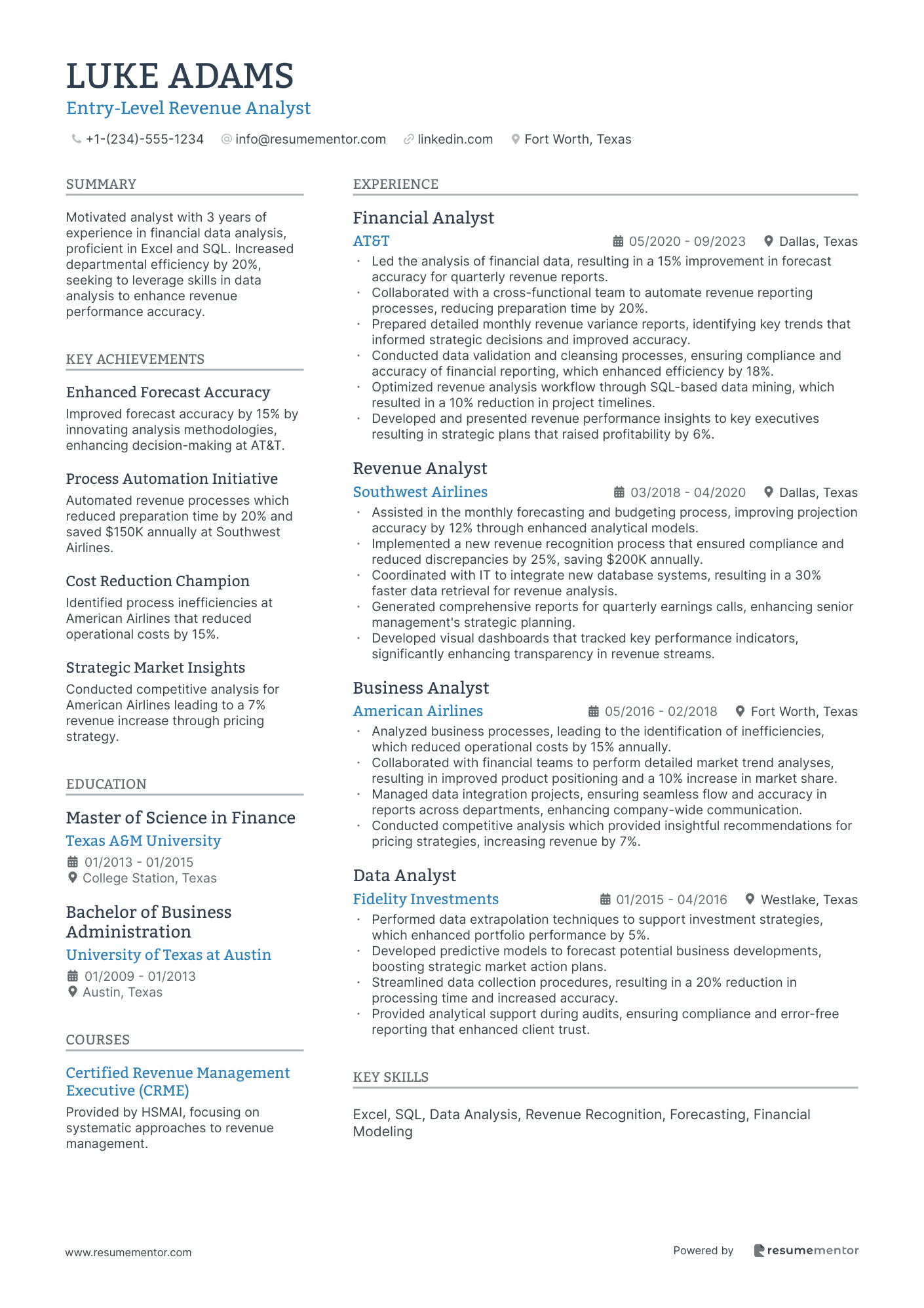

Entry-Level Revenue Analyst

Junior Financial Strategy Analyst

Entry-Level Financial Data Analyst

Entry-Level Budget Analyst

Junior Equity Research Analyst

Trainee Portfolio Analyst

Junior Investment Analyst resume sample

- •Led the analysis of financial statements and market data, resulting in a 25% improvement in investment decisions.

- •Collaborated with senior analysts to generate investment ideas that increased firm’s portfolio return by 15%.

- •Prepared detailed investment reports and presentations, which enhanced client communication and trust by 20%.

- •Developed and maintained financial models that improved data relevancy by 30% through robust checks and updates.

- •Integrated Bloomberg tools in market analysis processes, improving insights generation speed by 40% within two months.

- •Enhanced portfolio monitoring systems, which resulted in a 10% improvement in performance reporting accuracy.

- •Conducted in-depth research on market trends, supporting investment decisions that increased capital gains by 12%.

- •Assisted in the preparation of investment strategy proposals, resulting in successful client acquisition worth $5M.

- •Monitored and completed portfolio performance reports, improving data accuracy and client satisfaction by 25%.

- •Provided insights on economic developments, enhancing the investment team’s strategic decisions by 15%.

- •Maintained and updated financial databases, ensuring data accuracy, which reduced error rates by 20%.

- •Analyzed financial statements of Fortune 500 companies that led to a 10% improvement in equity recommendations.

- •Participated in team strategy meetings, contributing to innovative investment solutions that increased metrics by 8%.

- •Developed comprehensive financial models that streamlined data processing efficiency by 30%.

- •Collaborated on joint projects, enhancing cross-department cooperation and increasing investment opportunities by 15%.

- •Researched and analyzed industry trends that informed strategies contributing to a 5% lift in client portfolios.

- •Reviewed financial statements, assisting senior analysts in achieving a 10% enhancement in financial accuracy.

- •Prepared detailed performance reports, which improved client satisfaction and feedback scores by 15%.

- •Supported the maintenance of financial models, ensuring precision and aiding decision-making processes by refining data.

Entry-Level Corporate Finance Analyst resume sample

- •Led financial strategy projects that improved division efficiencies by 15% across key financial metrics.

- •Implemented forecasting models that decreased financial projection variances by 20% year-over-year.

- •Collaborated cross-functionally for strategic corporate initiatives, enhancing group profitability by $1.5 million.

- •Analyzed budget variances, resulting in actionable insights that improved expense alignment by 10%.

- •Managed monthly and annual close processes for the department, ensuring timely reporting with zero discrepancies.

- •Prepared financial presentations for senior management, highlighting key achievements and performance trends.

- •Developed comprehensive financial models, enhancing prediction accuracy by 18% for client projects.

- •Conducted variance analysis, improving forecast accuracy and guiding decision-making in financial reviews.

- •Supported budgeting process improvements that streamlined operations and reduced costs by 12%.

- •Prepared data-driven reports and presented strategic insights to executive teams, increasing engagement and initiative buy-in.

- •Utilized advanced Excel capabilities to automate routine tasks, improving efficiency by 25%.

- •Assisted in analyzing financial statements to ensure compliance and competitive positioning.

- •Facilitated data gathering and analysis, improving clarity of financial reporting by 30%.

- •Generated accurate monthly reports for budgeting needs, maintaining consistency with strategic objectives.

- •Participated in analytical projects, contributing ideas that improved financial outcomes by 10%.

- •Supported finance teams by contributing to special projects, refining processes that increased productivity.

- •Maintained financial records and facilitated analyses, preserving error-free reporting for year-end closings.

- •Communicated effectively with diverse teams to gather financial data, improving collaboration and cohesion.

- •Integrated financial tools that streamlined data processing, reducing task completion time by 30%.

Trainee Risk and Compliance Analyst resume sample

- •Led a team in performing detailed risk assessments across five departments, enhancing compliance accuracy by 35%.

- •Developed comprehensive compliance policies that optimized regulatory adherence and reduced non-compliance warnings by 20%.

- •Delivered monthly presentations on risk assessment outcomes, engaging multiple stakeholders and resulting in strategic process improvements.

- •Implemented a data-gathering initiative that improved compliance reporting efficiency by 30% within six months.

- •Conducted industry trend analysis seminars, elevating risk awareness, and minimizing error rates by 15%.

- •Collaborated closely with legal and finance teams to develop policies, reducing compliance breach incidents by 40% annually.

- •Monitored regulatory requirements, ensuring all internal policies were updated and compliant, leading to zero penalties over the tenure.

- •Managed a compliance training program that educated over 200 employees, greatly increasing organizational compliance understanding.

- •Compiled and prepared quarterly compliance reports that identified potential risks, aiding in proactive management solutions.

- •Contributed to an inter-departmental project to standardize compliance procedures, improving process consistency by 25%.

- •Assessed risk factors across business operations, driving the implementation of enhanced control measures that increased efficiency by 10%.

- •Developed a reporting matrix that served as the basis for improving risk management frameworks across the organization.

- •Implemented innovative data analysis techniques, which improved risk prediction accuracy by 12% during project cycles.

- •Collaborated with IT department to enhance data security compliance measures, protecting sensitive information and reducing breaches by 25%.

- •Supported the auditing team in overhauling corporate compliance structures resulting in a 15% reduction in audit durations.

- •Monitored adherence to industry regulations leading to a compliance score improvement from 72% to 90% within a year.

- •Engaged with departments to conduct training sessions, improving compliance knowledge and reducing queries by 20%.

- •Assisted in developing a compliance reporting template, streamlining reporting processes and increasing reporting efficiency by 18%.

Entry-Level Revenue Analyst resume sample

- •Led the analysis of financial data, resulting in a 15% improvement in forecast accuracy for quarterly revenue reports.

- •Collaborated with a cross-functional team to automate revenue reporting processes, reducing preparation time by 20%.

- •Prepared detailed monthly revenue variance reports, identifying key trends that informed strategic decisions and improved accuracy.

- •Conducted data validation and cleansing processes, ensuring compliance and accuracy of financial reporting, which enhanced efficiency by 18%.

- •Optimized revenue analysis workflow through SQL-based data mining, which resulted in a 10% reduction in project timelines.

- •Developed and presented revenue performance insights to key executives resulting in strategic plans that raised profitability by 6%.

- •Assisted in the monthly forecasting and budgeting process, improving projection accuracy by 12% through enhanced analytical models.

- •Implemented a new revenue recognition process that ensured compliance and reduced discrepancies by 25%, saving $200K annually.

- •Coordinated with IT to integrate new database systems, resulting in a 30% faster data retrieval for revenue analysis.

- •Generated comprehensive reports for quarterly earnings calls, enhancing senior management's strategic planning.

- •Developed visual dashboards that tracked key performance indicators, significantly enhancing transparency in revenue streams.

- •Analyzed business processes, leading to the identification of inefficiencies, which reduced operational costs by 15% annually.

- •Collaborated with financial teams to perform detailed market trend analyses, resulting in improved product positioning and a 10% increase in market share.

- •Managed data integration projects, ensuring seamless flow and accuracy in reports across departments, enhancing company-wide communication.

- •Conducted competitive analysis which provided insightful recommendations for pricing strategies, increasing revenue by 7%.

- •Performed data extrapolation techniques to support investment strategies, which enhanced portfolio performance by 5%.

- •Developed predictive models to forecast potential business developments, boosting strategic market action plans.

- •Streamlined data collection procedures, resulting in a 20% reduction in processing time and increased accuracy.

- •Provided analytical support during audits, ensuring compliance and error-free reporting that enhanced client trust.

Junior Financial Strategy Analyst resume sample

- •Developed financial models that optimized decision-making processes, leading to a 15% improvement in financial accuracy.

- •Collaborated with cross-functional teams, enhancing data collection processes and improving analysis speed by 25%.

- •Generated monthly financial reports and presentations, providing actionable insights and increasing executive decision efficiency by 30%.

- •Monitored performance metrics across departments, resulting in more agile management responses to market changes.

- •Led budget preparation sessions, streamlining processes, and reducing completion time by 20%.

- •Identified critical trends in financial data, recommending process improvements which increased revenue by 10%.

- •Conducted comprehensive financial analysis for clients, improving financial visibility and supporting strategic decisions with enhanced data.

- •Assisted in forecast preparation, achieving a 95% accuracy rate and boosting client confidence.

- •Streamlined variance analysis, enabling quicker financial adjustments and saving clients approximately $500,000 annually.

- •Delivered financial insights to stakeholders, facilitating informed strategic planning and increasing project success rates by 15%.

- •Enhanced financial documentation practices, ensuring accurate records and compliance with industry standards.

- •Supported senior analysts in financial modeling, contributing to a 25% increase in model accuracy and reliability.

- •Participated in budgeting sessions, reducing deviations between projected and actual budgets by 10%.

- •Collaborated with marketing team to align financial goals, enhancing cross-departmental synergy by 20%.

- •Assessed financial performance of various branches, offering insights that led to a 15% improvement in branch profitability.

- •Managed financial records, integrating new software that improved record-keeping efficiency by 30%.

- •Conducted initial audits for small projects, identifying cost-saving opportunities and increasing audit team efficiency.

- •Analyzed financial transactions, improving data accuracy and supporting successful compliance checks.

- •Assisted in creating financial manuals, standardizing procedures and reducing errors by 15%.

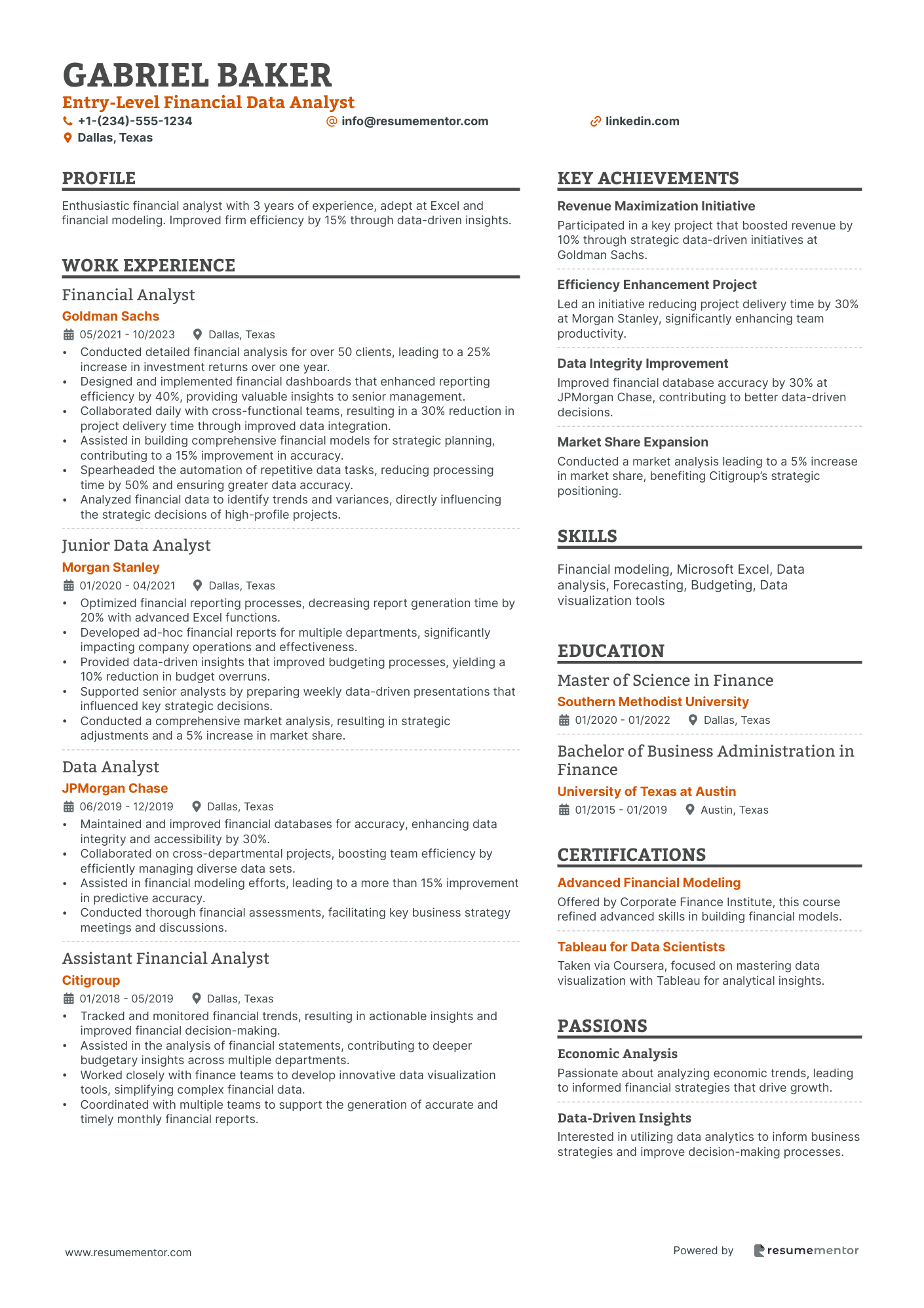

Entry-Level Financial Data Analyst resume sample

- •Conducted detailed financial analysis for over 50 clients, leading to a 25% increase in investment returns over one year.

- •Designed and implemented financial dashboards that enhanced reporting efficiency by 40%, providing valuable insights to senior management.

- •Collaborated daily with cross-functional teams, resulting in a 30% reduction in project delivery time through improved data integration.

- •Assisted in building comprehensive financial models for strategic planning, contributing to a 15% improvement in accuracy.

- •Spearheaded the automation of repetitive data tasks, reducing processing time by 50% and ensuring greater data accuracy.

- •Analyzed financial data to identify trends and variances, directly influencing the strategic decisions of high-profile projects.

- •Optimized financial reporting processes, decreasing report generation time by 20% with advanced Excel functions.

- •Developed ad-hoc financial reports for multiple departments, significantly impacting company operations and effectiveness.

- •Provided data-driven insights that improved budgeting processes, yielding a 10% reduction in budget overruns.

- •Supported senior analysts by preparing weekly data-driven presentations that influenced key strategic decisions.

- •Conducted a comprehensive market analysis, resulting in strategic adjustments and a 5% increase in market share.

- •Maintained and improved financial databases for accuracy, enhancing data integrity and accessibility by 30%.

- •Collaborated on cross-departmental projects, boosting team efficiency by efficiently managing diverse data sets.

- •Assisted in financial modeling efforts, leading to a more than 15% improvement in predictive accuracy.

- •Conducted thorough financial assessments, facilitating key business strategy meetings and discussions.

- •Tracked and monitored financial trends, resulting in actionable insights and improved financial decision-making.

- •Assisted in the analysis of financial statements, contributing to deeper budgetary insights across multiple departments.

- •Worked closely with finance teams to develop innovative data visualization tools, simplifying complex financial data.

- •Coordinated with multiple teams to support the generation of accurate and timely monthly financial reports.

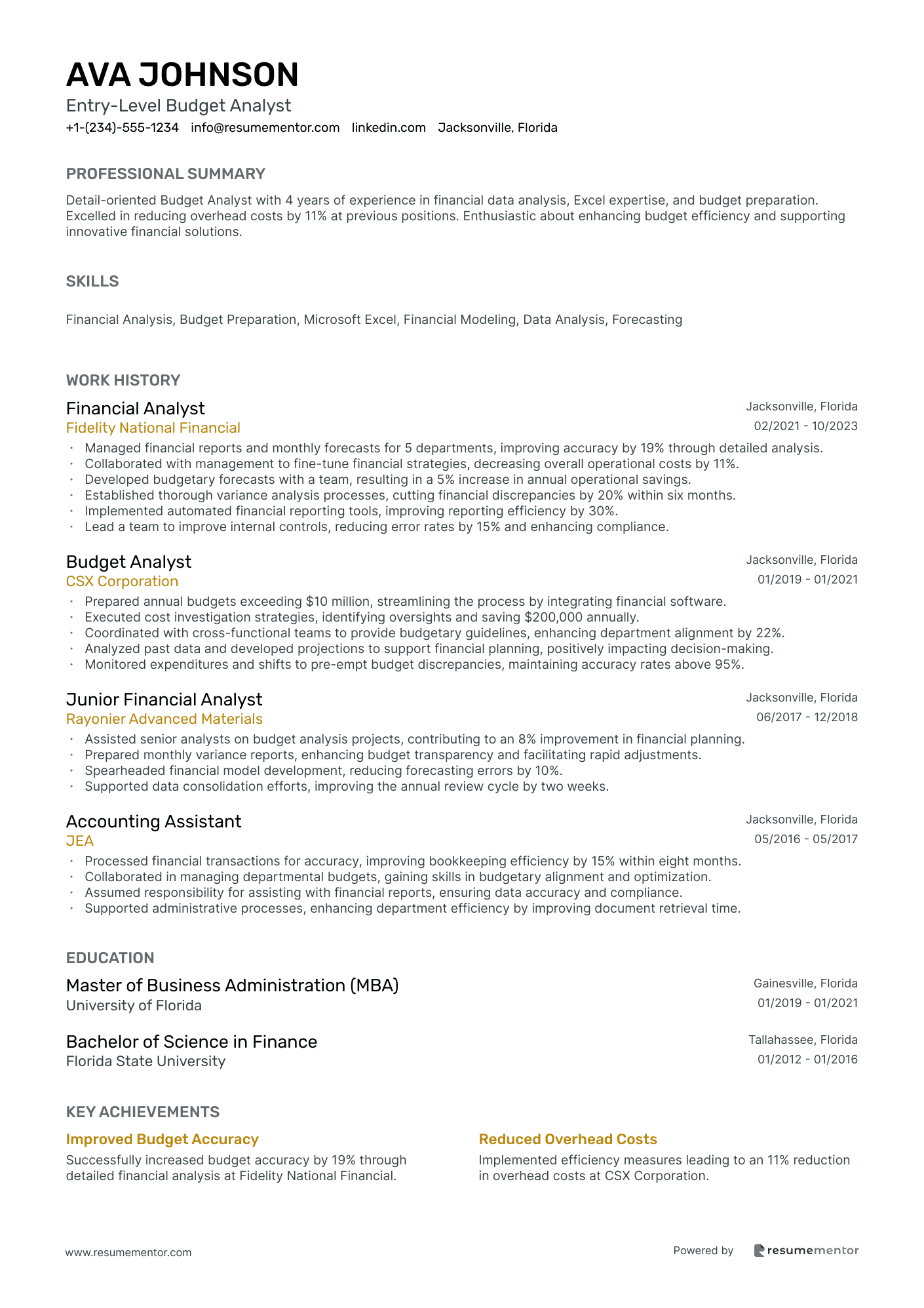

Entry-Level Budget Analyst resume sample

- •Managed financial reports and monthly forecasts for 5 departments, improving accuracy by 19% through detailed analysis.

- •Collaborated with management to fine-tune financial strategies, decreasing overall operational costs by 11%.

- •Developed budgetary forecasts with a team, resulting in a 5% increase in annual operational savings.

- •Established thorough variance analysis processes, cutting financial discrepancies by 20% within six months.

- •Implemented automated financial reporting tools, improving reporting efficiency by 30%.

- •Lead a team to improve internal controls, reducing error rates by 15% and enhancing compliance.

- •Prepared annual budgets exceeding $10 million, streamlining the process by integrating financial software.

- •Executed cost investigation strategies, identifying oversights and saving $200,000 annually.

- •Coordinated with cross-functional teams to provide budgetary guidelines, enhancing department alignment by 22%.

- •Analyzed past data and developed projections to support financial planning, positively impacting decision-making.

- •Monitored expenditures and shifts to pre-empt budget discrepancies, maintaining accuracy rates above 95%.

- •Assisted senior analysts on budget analysis projects, contributing to an 8% improvement in financial planning.

- •Prepared monthly variance reports, enhancing budget transparency and facilitating rapid adjustments.

- •Spearheaded financial model development, reducing forecasting errors by 10%.

- •Supported data consolidation efforts, improving the annual review cycle by two weeks.

- •Processed financial transactions for accuracy, improving bookkeeping efficiency by 15% within eight months.

- •Collaborated in managing departmental budgets, gaining skills in budgetary alignment and optimization.

- •Assumed responsibility for assisting with financial reports, ensuring data accuracy and compliance.

- •Supported administrative processes, enhancing department efficiency by improving document retrieval time.

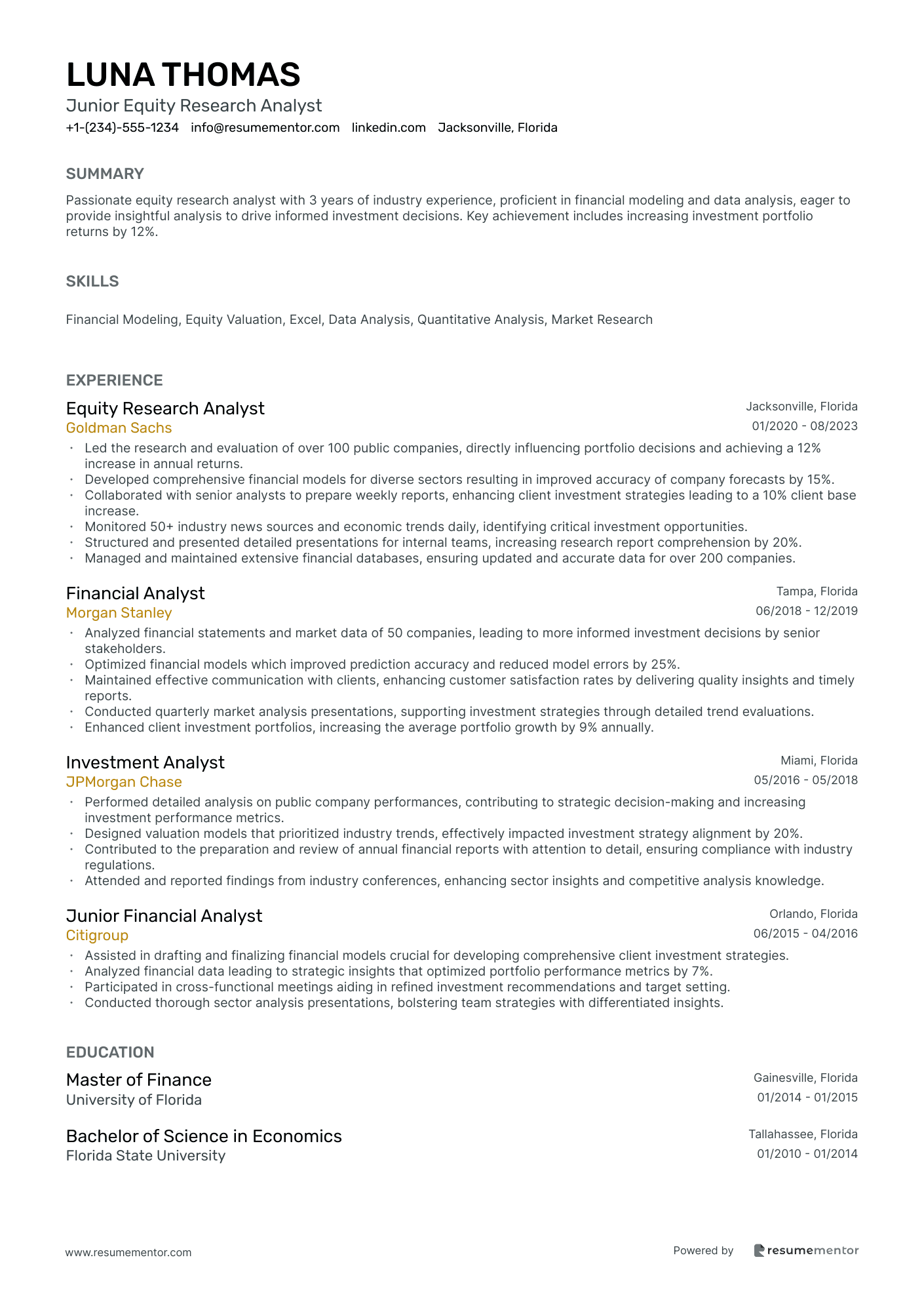

Junior Equity Research Analyst resume sample

- •Led the research and evaluation of over 100 public companies, directly influencing portfolio decisions and achieving a 12% increase in annual returns.

- •Developed comprehensive financial models for diverse sectors resulting in improved accuracy of company forecasts by 15%.

- •Collaborated with senior analysts to prepare weekly reports, enhancing client investment strategies leading to a 10% client base increase.

- •Monitored 50+ industry news sources and economic trends daily, identifying critical investment opportunities.

- •Structured and presented detailed presentations for internal teams, increasing research report comprehension by 20%.

- •Managed and maintained extensive financial databases, ensuring updated and accurate data for over 200 companies.

- •Analyzed financial statements and market data of 50 companies, leading to more informed investment decisions by senior stakeholders.

- •Optimized financial models which improved prediction accuracy and reduced model errors by 25%.

- •Maintained effective communication with clients, enhancing customer satisfaction rates by delivering quality insights and timely reports.

- •Conducted quarterly market analysis presentations, supporting investment strategies through detailed trend evaluations.

- •Enhanced client investment portfolios, increasing the average portfolio growth by 9% annually.

- •Performed detailed analysis on public company performances, contributing to strategic decision-making and increasing investment performance metrics.

- •Designed valuation models that prioritized industry trends, effectively impacted investment strategy alignment by 20%.

- •Contributed to the preparation and review of annual financial reports with attention to detail, ensuring compliance with industry regulations.

- •Attended and reported findings from industry conferences, enhancing sector insights and competitive analysis knowledge.

- •Assisted in drafting and finalizing financial models crucial for developing comprehensive client investment strategies.

- •Analyzed financial data leading to strategic insights that optimized portfolio performance metrics by 7%.

- •Participated in cross-functional meetings aiding in refined investment recommendations and target setting.

- •Conducted thorough sector analysis presentations, bolstering team strategies with differentiated insights.

Trainee Portfolio Analyst resume sample

- •Conducted in-depth portfolio analyses leading to a 15% reduction in risk exposure and boosted client confidence.

- •Supported senior analysts by implementing data collection processes that increased research efficiency by 30%.

- •Prepared investment proposals that contributed to client acquisition worth over $10 million, significantly enhancing portfolio growth.

- •Assessed macroeconomic trends in collaboration with a 5-member team, improving strategic planning by 20%.

- •Developed customizable financial modeling tools, increasing the accuracy of predictive analyses by 50%.

- •Monitored compliance with investment guidelines, resulting in a 95% adherence rate and improved audit outcomes.

- •Collected and analyzed market data, informing investment recommendations that increased annual portfolio returns by 18%.

- •Participated in client presentation development, which helped in retaining clients worth $15 million in assets.

- •Introduced a weekly market trends report which enhanced investment strategy adjustments, positively impacting decision-making by 12%.

- •Collaborated with a cross-functional team to launch a new investment product, boosting customer engagement by 22%.

- •Implemented a data-driven approach to evaluate risk factors, improving forecasting accuracy by 40%.

- •Assisted in the preparation of annual financial reports, leading to a 10% improvement in data integrity.

- •Monitored financial performance of 50+ clients, ensuring a 90% compliance rate with regulatory standards.

- •Contributed to the development of investment strategies, resulting in a portfolio diversification boost of 15%.

- •Facilitated monthly meetings with investment teams, improving collaborative market analysis efficiency by 25%.

- •Analyzed client data to optimize investment portfolio performance, delivering a significant 20% increase in ROI.

- •Prepared detailed market analysis reports supporting senior management decisions and enhancing accuracy by 15%.

- •Created financial models leading to a 17% increase in forecasting precision for high-value investment decisions.

- •Worked on a project that improved client reporting efficiency by 35%, resulting in a higher client satisfaction score.

Embarking on a career as an entry-level financial analyst is like setting sail on a vast ocean of opportunities where your resume serves as the crucial compass. Crafting this compass can be challenging as many budding analysts struggle to distill their education, emerging skills, and potential into a compelling one-page document. With limited experience, standing out among seasoned professionals may feel like navigating stormy seas.

Yet, even the largest ships start with careful planning. That's where using a resume template comes in to offer a guiding framework. A well-designed template aligns your education, analytical passion, and eagerness to learn into a cohesive story, making your resume more than just a list. It becomes a strategic tool for showcasing your readiness for the finance world and steering your career in the right direction.

As you set about crafting your resume, embrace the enthusiasm that fuels your journey. Steer clear of cluttered layouts or underplaying your analytical skills, as these can anchor you down. Instead, refine your resume to tell the story of your financial understanding and your desire to make an impact. With a well-crafted resume, you’ll be on course to land the job you’ve been aiming for, charting a successful start to your career voyage.

Key Takeaways

- Choose a resume format that combines chronological and skill-based elements to effectively highlight both your educational background and relevant skills such as financial modeling and data analysis.

- Make effective use of sections like objective statements, contact information, education, and technical skills to showcase your readiness and capabilities as an entry-level financial analyst.

- Structure your experience section to focus on quantifiable achievements, using action verbs and specific results to demonstrate your impact in previous roles, including internships and volunteer work.

- Include additional sections like certifications to highlight specialized knowledge, and extra areas like language skills or hobbies to present yourself as a well-rounded candidate.

- Ensure your resume is professional and modern in appearance, with clean margins, easy-to-read fonts, and a PDF format to maintain consistent presentation.

What to focus on when writing your entry-level financial analyst resume

Your entry-level financial analyst resume should effectively convey your readiness to enter the financial world by emphasizing your analytical skills. Make sure it highlights your ability to gather and interpret data, solve problems, and support effective decision-making, which are all crucial in this field.

How to structure your entry-level financial analyst resume

- Contact Information — Start your resume with your full name, phone number, email address, and LinkedIn profile. It is crucial that these details are up-to-date and free from errors, as they form your first point of contact with potential employers. A clear and professional format will set the stage for the rest of your resume, making it easy for recruiters to reach out to you. This section signals the beginning of your journey into building a connection with hiring managers.

- Objective Statement — Craft a brief yet impactful statement about your career goals as an entry-level financial analyst. This is your chance to express your enthusiasm for the role and the unique skills you bring to the table. Align your objectives with the company's goals to show potential employers that you're a good fit for their team. A well-tailored objective statement sets the tone for the experience and skills sections that follow, serving as a snapshot of what you hope to achieve in your new role.

- Education — Your academic background in finance, accounting, or a related field is a pivotal section. Mention your degree, the name of your school, and your graduation date. If applicable, highlight honors or relevant coursework in areas like investment analysis, corporate finance, or financial modeling. This section reinforces your foundational knowledge and prepares the recruiter to see the practical skills you have gained through experience.

- Technical Skills — Listing your proficiency with financial software such as Excel, Bloomberg Terminal, or SAP is critical. Mentioning skills in statistical analysis, data mining, or financial modeling demonstrates your technical prowess and readiness to tackle the challenges of a financial analyst role. This section supports your educational background by showing how you can apply learned concepts in practical scenarios.

- Relevant Experience — Detailing internships, part-time jobs, or volunteer work provides valuable insights into your practical experience. Use bullet points to detail your responsibilities and achievements, like assisting in financial reporting or conducting market research, to clearly demonstrate your impact and contributions. This section validates the skills you've listed and builds on the academic and technical foundations provided earlier on your resume.

- Certifications — Adding certifications like CFA Level 1 or similar credentials enhances your credibility and supports your professional growth in the finance sector. This shows potential employers that you are committed to continuous learning and development, rounding out your resume by adding an extra layer of qualification. Now that we have outlined how to frame each section, we'll dive deeper into the formatting and content to include for each part to maximize impact.

Which resume format to choose

Creating your entry-level financial analyst resume involves bringing together various elements to present yourself effectively. Start with a combination format. This structure blends a chronological listing of your education and any previous experience with a focus on relevant skills. It showcases how your abilities align with the financial analyst role, even if you're just starting out.

Choosing the right font enhances the professionalism of your resume. Opt for Rubik, Montserrat, or Raleway. These fonts give your resume a contemporary look, and their clarity ensures that your information is easily readable. This modern touch can subtly reflect your awareness of current industry trends without overshadowing the content.

Saving your resume as a PDF is crucial for maintaining its layout and formatting, no matter where or how it’s viewed. Employers will see your resume exactly the way you intended, whether they open it on a computer, tablet, or phone, ensuring consistency.

One-inch margins on all sides of your resume provide a clean and organized appearance. This spacing allows your information to breathe, making it more accessible and easier to read. In a field like finance, where attention to detail is key, these seemingly small choices reflect your professionalism and readiness for the role.

By carefully considering these elements, you ensure your resume effectively communicates your strengths and readiness for an entry-level financial analyst position.

How to write a quantifiable resume experience section

The experience section is crucial for your entry-level financial analyst resume because it allows you to spotlight your skills and achievements in a compelling way. By focusing on quantifiable results, you're able to demonstrate your impact on an organization’s financial success. Begin with your most recent job and include relevant roles, even internships, to show your career progression. Tailoring your resume to match the job ad ensures your qualifications align with what employers are seeking. Use strong action words like “analyzed” and “developed” to vividly illustrate your contributions.

Here's an improved experience section example:

- •Analyzed financial statements, pinpointing cost-saving opportunities that cut monthly expenses by 10%.

- •Created an Excel model to track performance metrics, which boosted reporting efficiency by 15%.

- •Collaborated on a team project that successfully grew client investment portfolios by 20% in three months.

- •Conducted research and data analysis for a market study, helping to increase new client acquisitions by 5%.

This experience section effectively intertwines your skills and achievements, highlighting specific, quantifiable outcomes. Each bullet point connects your contributions directly to positive results, making it clear how you added value. Starting with the most recent role, the section reflects your relevant experience and career growth. Strong action words tie the points together, painting a cohesive picture of your potential as a financial analyst. Tailoring the content to financial contexts ensures you're positioned as ready to handle key responsibilities.

Responsibility-Focused resume experience section

A responsibility-focused financial analyst resume experience section should clearly highlight your key duties and the impact of your work. Begin by listing your job title, workplace, and the dates you worked there. Break down your responsibilities and accomplishments into bullet points that are easy for hiring managers to read quickly. Using strong action verbs and quantifying achievements can effectively demonstrate your value. For example, rather than just stating you "did financial reports," explain that you "prepared monthly financial reports that identified trends, helping senior analysts make informed decisions."

Think about the specific tasks you handled and their overall significance. If you assisted with developing financial models or took part in budget planning, make sure to include those responsibilities. Focus on detailing how you contributed to your team and the skills you employed. Even in an entry-level position, each bullet point should underscore your specific accomplishments and how you added value to your team’s objectives.

Financial Analyst Intern

Smith & Co.

June 2022 - August 2023

- Assisted in preparing monthly financial reports, identifying trends that supported strategic planning for senior management.

- Conducted market research and analysis, contributing to competitive analysis reports used by senior analysts.

- Supported in developing Excel-based financial models, improving the accuracy of financial projections by 10%.

- Collaborated with finance team members on budget preparation, ensuring alignment with company objectives.

Skills-Focused resume experience section

A skills-focused entry-level financial analyst resume experience section should clearly demonstrate how your past roles have equipped you with the necessary abilities for the position. Begin by identifying key skills and detailing how they have been developed through internships, part-time jobs, or relevant projects. This approach ensures you effectively convey the practical application of your skills, using simple language and highlighting tangible outcomes.

Describe your experience chronologically, specifying your role and the organization where you worked. In the bullet points, focus on responsibilities and achievements that highlight the financial skills you possess. Be precise in detailing how you improved processes or contributed to successes. Tailor each experience to relate directly to the skills most relevant for a financial analyst role.

Financial Analyst Intern

XYZ Financial Services

June 2021 - August 2021

- Worked with a team on quarterly financial reports, uncovering insights that improved budget forecasts by 15%.

- Helped prepare financial models and managed a financial database, keeping all entries accurate and current.

- Researched market trends and compiled data for presentations, aiding senior management in making informed decisions.

- Contributed to the development of client investment portfolios by assessing risks, leading to a 20% boost in customer satisfaction.

Customer-Focused resume experience section

A customer-focused financial analyst resume experience section should demonstrate your ability to bridge financial goals with customer needs. Start by highlighting roles you've held that involved client interaction, focusing on how you combined financial insight with excellent customer service. Use clear language to describe how your actions not only supported clients but also aligned with the company's broader objectives.

Detailing your soft skills, such as communication and problem-solving, can show how effectively you understood and met customer needs. This might include customizing financial products or leveraging data analysis to enhance client relationships. Sharing specific achievements or tasks can illustrate your value, especially if you can highlight improvements in service delivery. Quantifying these results will help underline your impact and make your experience stand out to potential employers.

Finance Intern

ABC Financial Solutions

June 2021 - Present

- Collaborated with the client relations team to deliver personalized financial reports, boosting client satisfaction by 20%.

- Analyzed client feedback to improve financial processes, cutting report generation time by 15%.

- Helped resolve client inquiries by effectively using analytical tools, speeding up response times.

- Joined team meetings to suggest new strategies for client-focused financial solutions.

Result-Focused resume experience section

A result-focused entry-level financial analyst resume experience section should effectively showcase your potential to employers. Begin by highlighting any internships, part-time jobs, or volunteer activities where you've honed your financial skills. It's important to articulate your role using dynamic action verbs like "analyzed," "developed," or "created," which vividly describe your contributions. By emphasizing outcomes and aligning your experiences with the target role, you make your accomplishments shine through quantifiable achievements.

Link each bullet point to the skills and results achieved, moving beyond a simple description of daily tasks. Highlight how your specific contributions have led to significant improvements or successes. Incorporating numbers or statistics into your statements gives weight to your achievements, providing concrete evidence of your impact. For instance, instead of listing a vague "project involvement," describe how you enhanced efficiency by 15% using a new data analysis method. This narrative not only shows that you understand the job requirements but also clearly demonstrates your ability to deliver valuable results.

Financial Analyst Intern

ABC Financial Solutions

June 2022 - August 2022

- Analyzed monthly sales reports to uncover trends, boosting forecasting accuracy by 10%.

- Worked with senior analysts to design a new cost-tracking system, which cut accounting errors by 8%.

- Crafted detailed presentations summarizing financial insights, helping to secure an additional $50K in funding.

- Led a team project that streamlined internal reporting processes, reducing report preparation time by 25%.

Write your entry-level financial analyst resume summary section

A finance-focused entry-level financial analyst resume summary should clearly communicate your potential to employers. Highlighting your skills, education, and any practical experience helps set you apart from others. Use this section to demonstrate the value you can bring to a company, focusing on your understanding of financial concepts and your eagerness to grow. An example of this could be:

This example is effective because it succinctly summarizes your education, skills, and relevant experience, painting a complete picture for employers. A resume summary typically offers a quick snapshot of your professional achievements and goals which appeals to those hiring for positions requiring some experience. For entry-level roles, you might consider a resume objective, focusing on your career aspirations and how they align with the company’s goals. Alternatively, a resume profile can provide a more detailed personal statement, while a summary of qualifications offers a concise list of your skills and experiences. Selecting the right approach lets you craft a resume that leaves a strong impression.

Listing your entry-level financial analyst skills on your resume

A skills-focused entry-level financial analyst resume should clearly highlight your abilities in both technical and personal aspects. Start by creating a separate skills section or integrate your skills into your summary and experience sections. Strengths and soft skills are the personal qualities that enhance both your work style and your interactions with others, such as communication and problem-solving abilities. In contrast, hard skills are your technical capabilities, including data analysis and financial modeling, that are crucial to your role.

When employed effectively, your skills and strengths also act as essential resume keywords. These keywords not only capture the attention of potential employers but also optimize your resume for Applicant Tracking Systems (ATS). Utilizing them strategically can spotlight your qualifications, boosting the appeal of your application.

To craft a standalone skills section, using the JSON format can be a clear and organized approach. Here's a straightforward example to guide you:

This example excels because it centralizes crucial information, keeping it concise and relevant. Employers can easily pinpoint your key abilities without wading through unnecessary details.

Best hard skills to feature on your entry-level financial analyst resume

Hard skills are essential in demonstrating your technical prowess and capacity to contribute effectively. They signal your ability to analyze data, provide financial forecasts, and facilitate informed decision-making. Consider showcasing these 15 in-demand hard skills:

Hard Skills

- Financial Modeling

- Data Analysis

- Excel Proficiency

- Market Research

- Risk Assessment

- Financial Reporting

- Quantitative Analysis

- Investment Strategies

- Accounting Principles

- Budgeting Forecasts

- Economic Analysis

- Microsoft Office Suite

- SQL Proficiency

- PowerPoint Presentation Skills

- Business Intelligence Tools

Best soft skills to feature on your entry-level financial analyst resume

The role of soft skills in your professional toolkit is equally critical. As an entry-level financial analyst, these skills reflect your adaptability, reliability, and effective communication prowess. Highlight these 15 soft skills to show that you’re ready to work well in any environment:

Soft Skills

- Analytical Thinking

- Problem Solving

- Communication

- Teamwork

- Attention to Detail

- Time Management

- Adaptability

- Critical Thinking

- Organizational Skills

- Initiative

- Multitasking

- Interpersonal Skills

- Decision-Making

- Work Ethic

- Emotional Intelligence

How to include your education on your resume

When crafting an entry-level financial analyst resume, the education section plays a vital role. It's essential to ensure this section aligns with the specific job you're targeting, leaving out any irrelevant education. Consider including your GPA if it's impressive, often a 3.5 or higher on a 4.0 scale. Additionally, if you graduated with honors such as cum laude, mention it as it adds value to your credentials. When listing your degree, start with the most recent and include the degree type, major, institution name, and graduation date.

The second example is well-suited for a financial analyst role. It clearly highlights a relevant finance degree and cumulative GPA that showcases academic excellence. Including the cum laude distinction further strengthens the candidate's qualifications. The entry includes completion dates, providing a clear timeline of education. This education section is concise, professionally formatted, and tailored to the job application, making it highly effective.

How to include entry-level financial analyst certificates on your resume

When creating your entry-level financial analyst resume, including a certificates section is crucial. Certificates demonstrate your commitment to learning and can set you apart from other candidates. List the name of each certificate clearly. Include the date when you obtained the certificate to show your timeline of professional development. Add the issuing organization to establish the credibility of your credentials.

Certificates can also be included in the resume header for immediate visibility. For example: "Jane Doe, Financial Analyst | CFA Level I Passed | Excel Specialist Certified." A standalone certificates section should be concise and relevant to the financial analyst role. For example, having certificates such as CFA Level I or Bloomberg Market Concepts shows specialized knowledge that employers value.

A strong example of a certificates section includes certificates that relate directly to the skills required for a financial analyst. This demonstrates both your qualification and enthusiasm for the field. Each certificate should clearly state the title, the issuing organization, and whether you want to show the issuer. This simple format ensures that your qualifications are easy to understand and impactful.

This example is effective because it showcases certificates that directly enhance your financial analyst profile, reinforcing your suitability for the role.

Extra sections to include on your entry-level financial analyst resume

Crafting a resume for an entry-level financial analyst position involves presenting your skills and experiences in a way that stands out. It’s not just about listing your education and work experience, but also about showcasing the other facets of your personality and capabilities.

Language section — Highlight your language skills to show you can work with diverse teams and international clients. Speaking another language like Spanish or Mandarin can often give you an advantage in the financial industry.

Hobbies and interests section — Share your hobbies to give employers a glimpse of your personality and potential team fit. Mentioning interests like chess or investment clubs can also demonstrate your commitment to analytical thinking.

Volunteer work section — Include volunteer work to show your commitment to community and teamwork. Details like organizing financial literacy workshops can highlight transferable skills valuable for a financial analyst.

Books section — List books to reflect a commitment to learning and staying informed about industry trends. Books about financial markets or economics illustrate your proactive approach to professional development.

Including these sections not only enriches your resume but also makes you a more well-rounded candidate. It personalizes your application and can often spark interesting discussions in an interview setting.

In Conclusion

In conclusion, creating an impactful resume as an entry-level financial analyst requires careful planning and thoughtful presentation of your skills, education, and experiences. Your resume is more than just a document; it is your personal marketing tool that can open doors to exciting opportunities in the world of finance. Start by selecting a clean and professional format that highlights your most relevant achievements and skills. Remember to include a strong objective or summary to grab the attention of hiring managers. Don't underestimate the power of strong action verbs and quantifiable achievements in showcasing your potential impact. Including certifications, special projects, and additional sections like languages or volunteer work can further demonstrate your commitment and readiness. Tailor each application to fit the position you’re applying for, ensuring that your resume reflects what employers are seeking. This approach ensures your qualifications resonate and helps you stand out in a competitive candidate pool. With a well-structured and carefully crafted resume, you set the course for a successful entry into the financial industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.