Entry-Level Staff Accountant Resume Examples

Jul 18, 2024

|

12 min read

Polish your entry-level staff accountant resume to spark interest with these tips. Learn how to balance your skills and experience to stand out from the ledger.

Rated by 348 people

Entry-Level Tax Staff Accountant

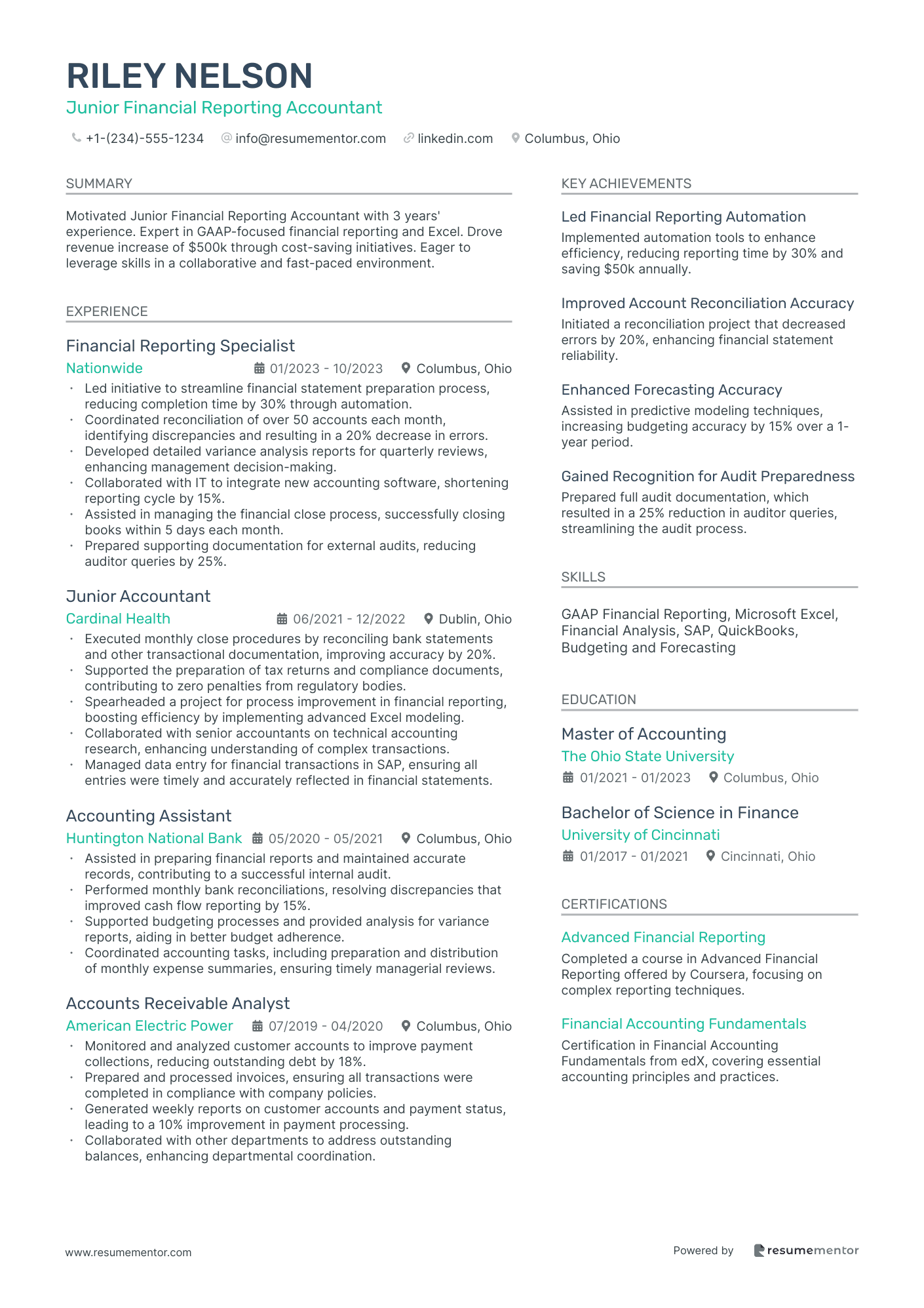

Junior Financial Reporting Accountant

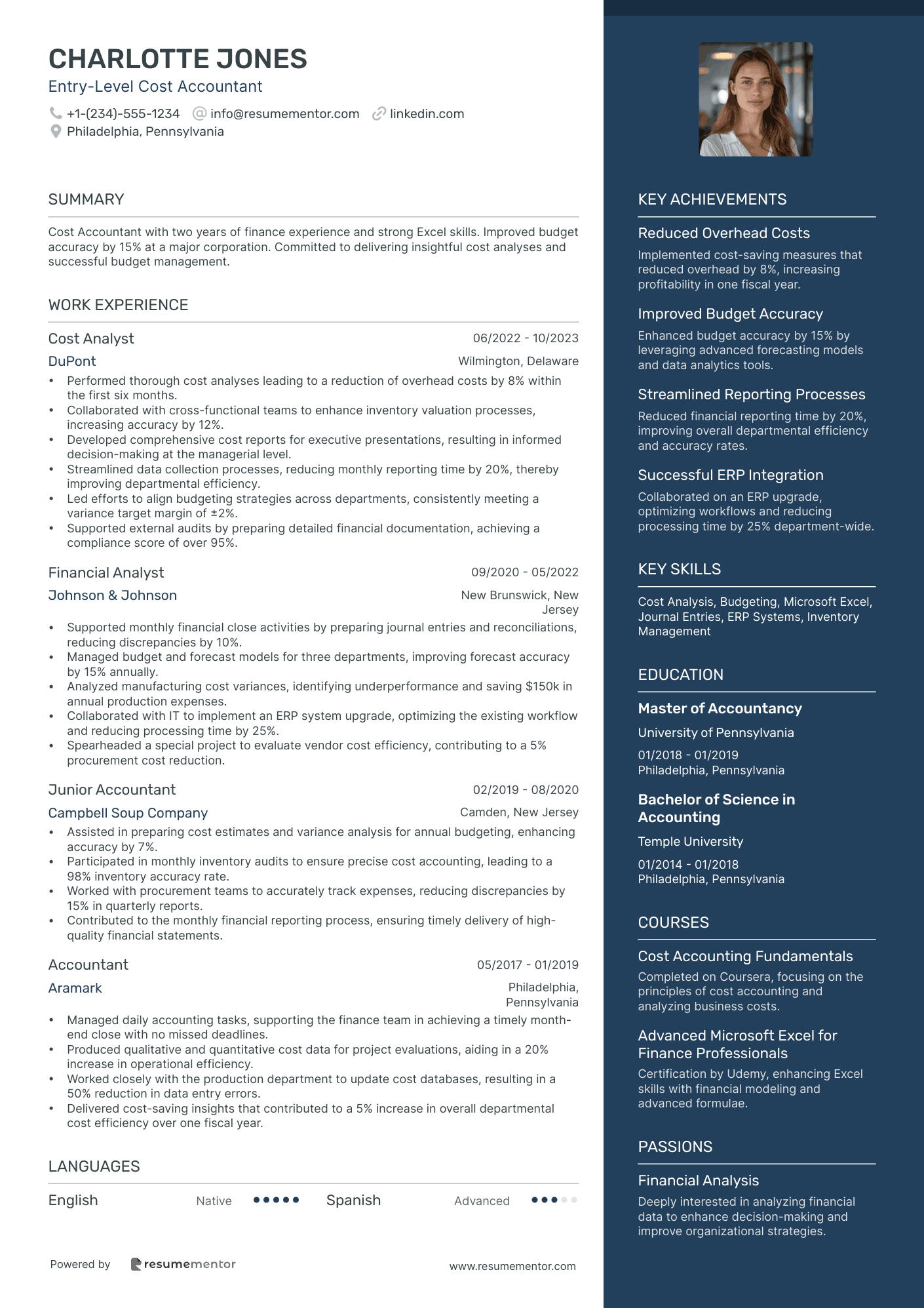

Entry-Level Cost Accountant

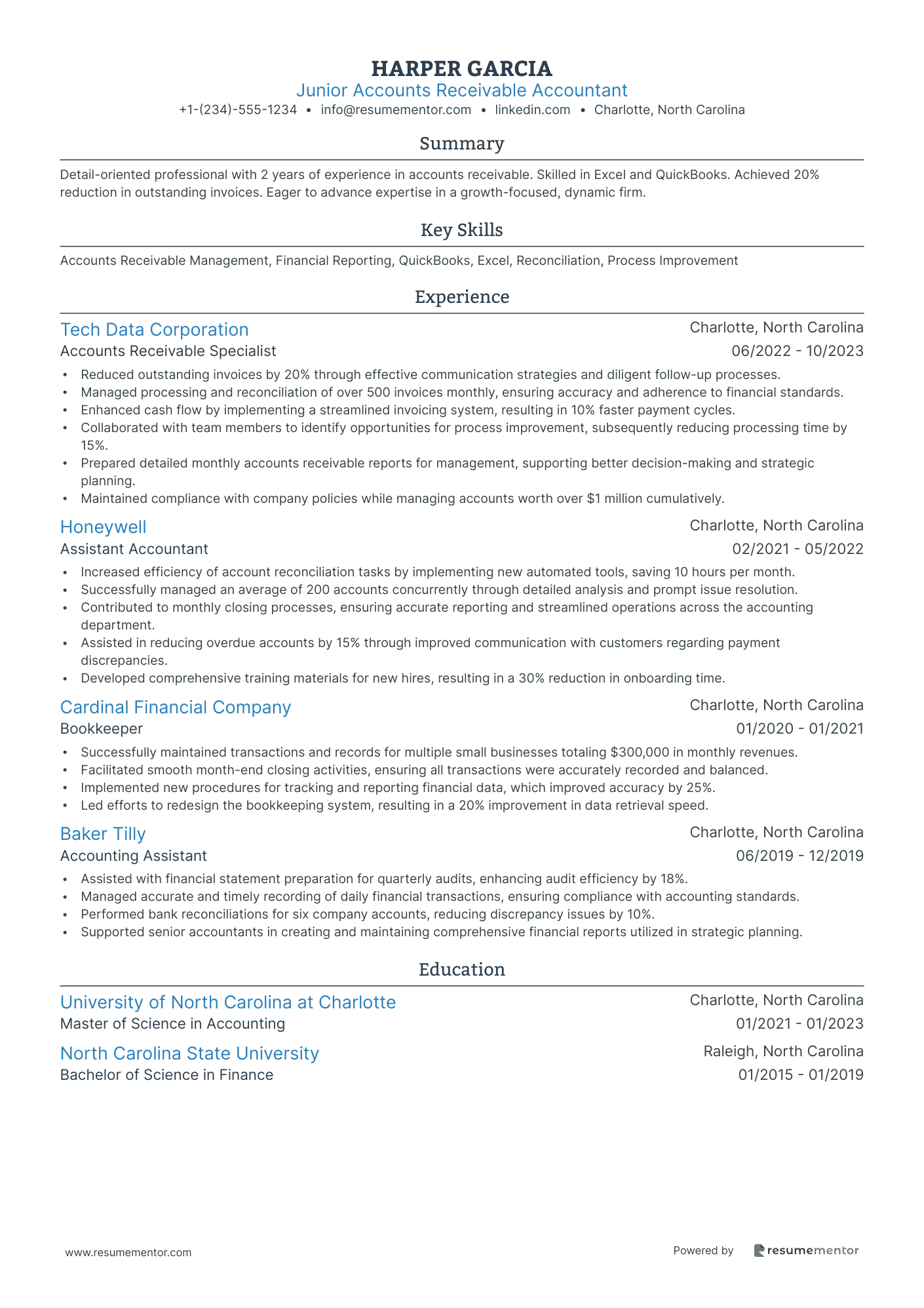

Junior Accounts Receivable Accountant

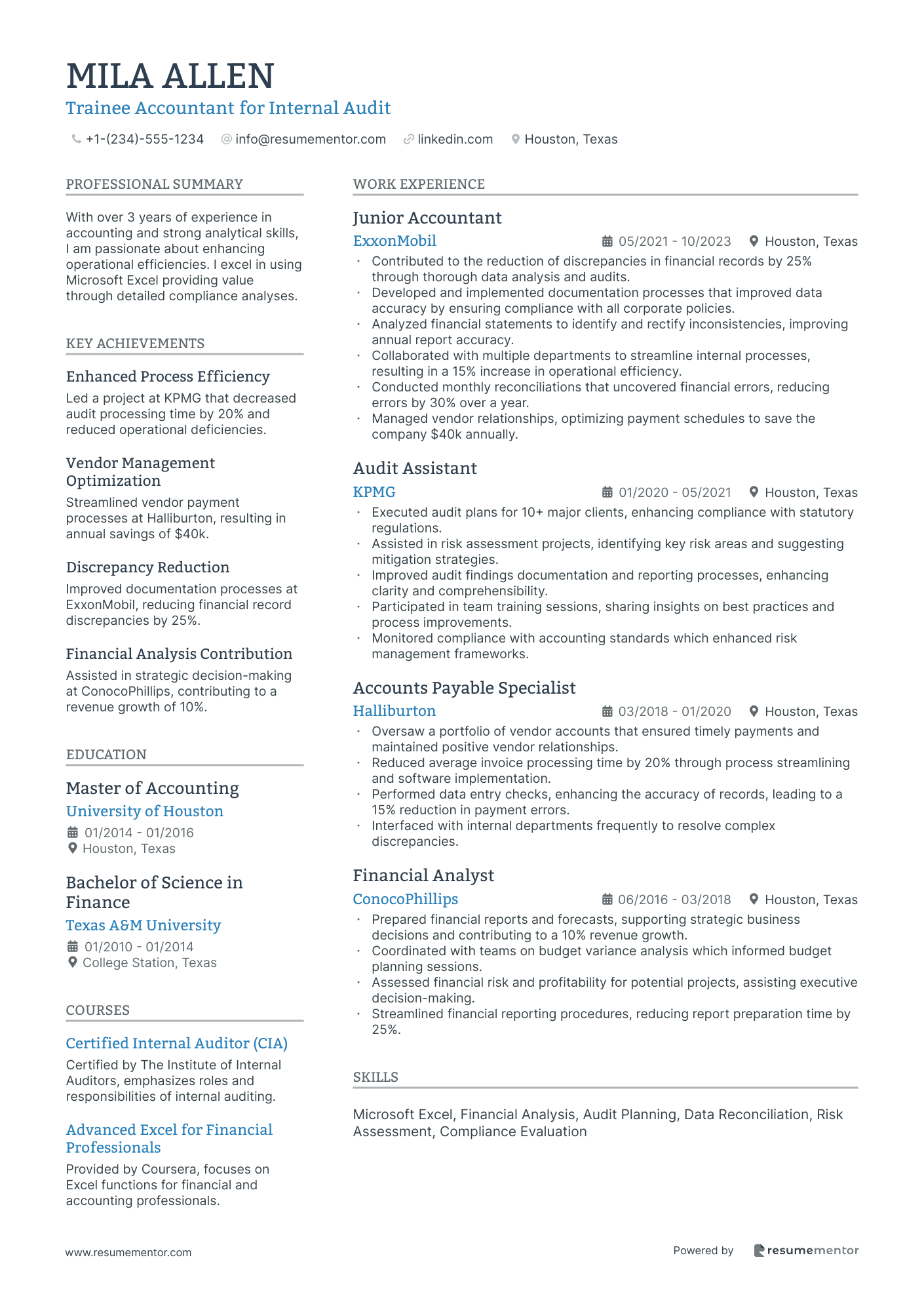

Trainee Accountant for Internal Audit

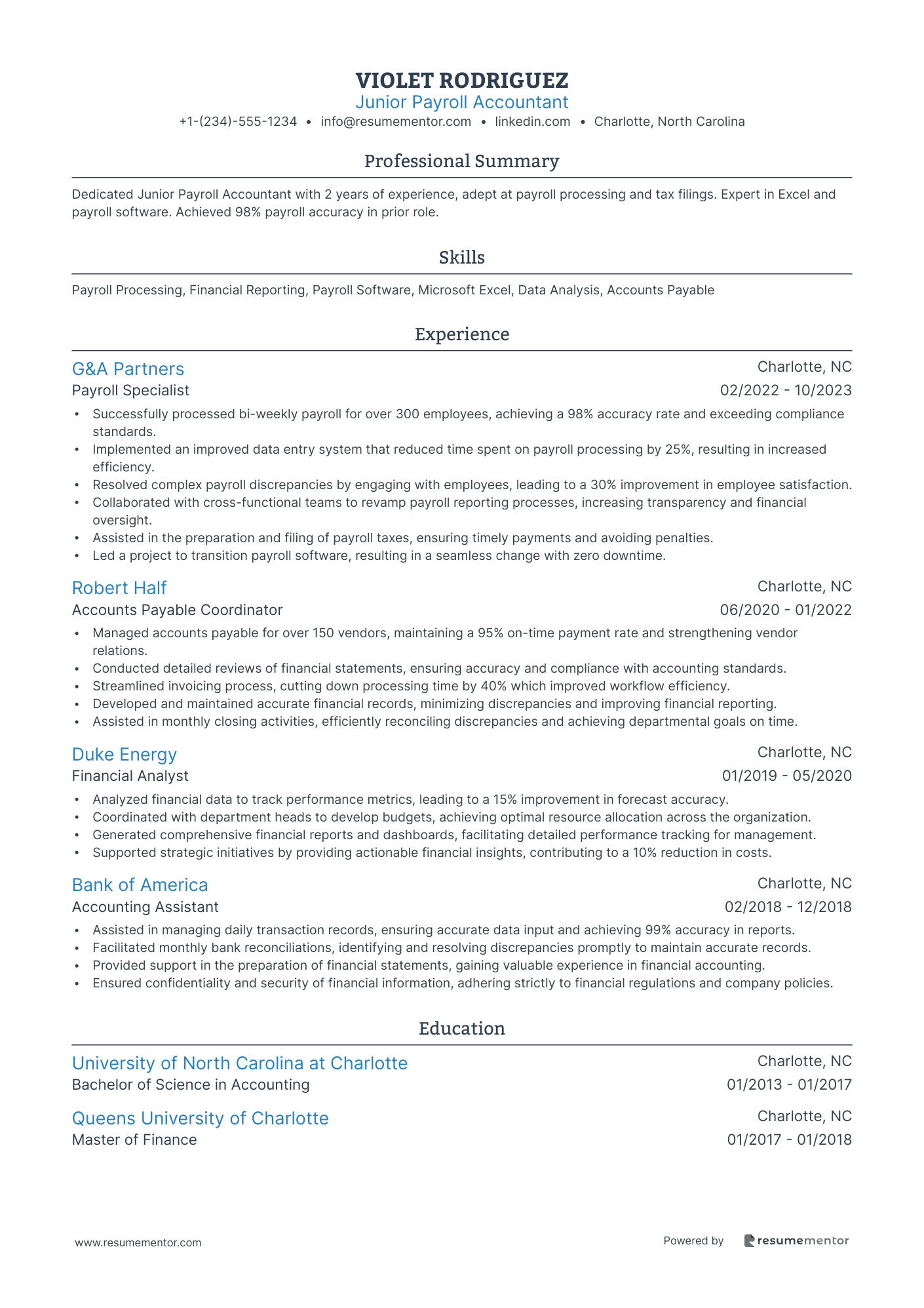

Junior Payroll Accountant

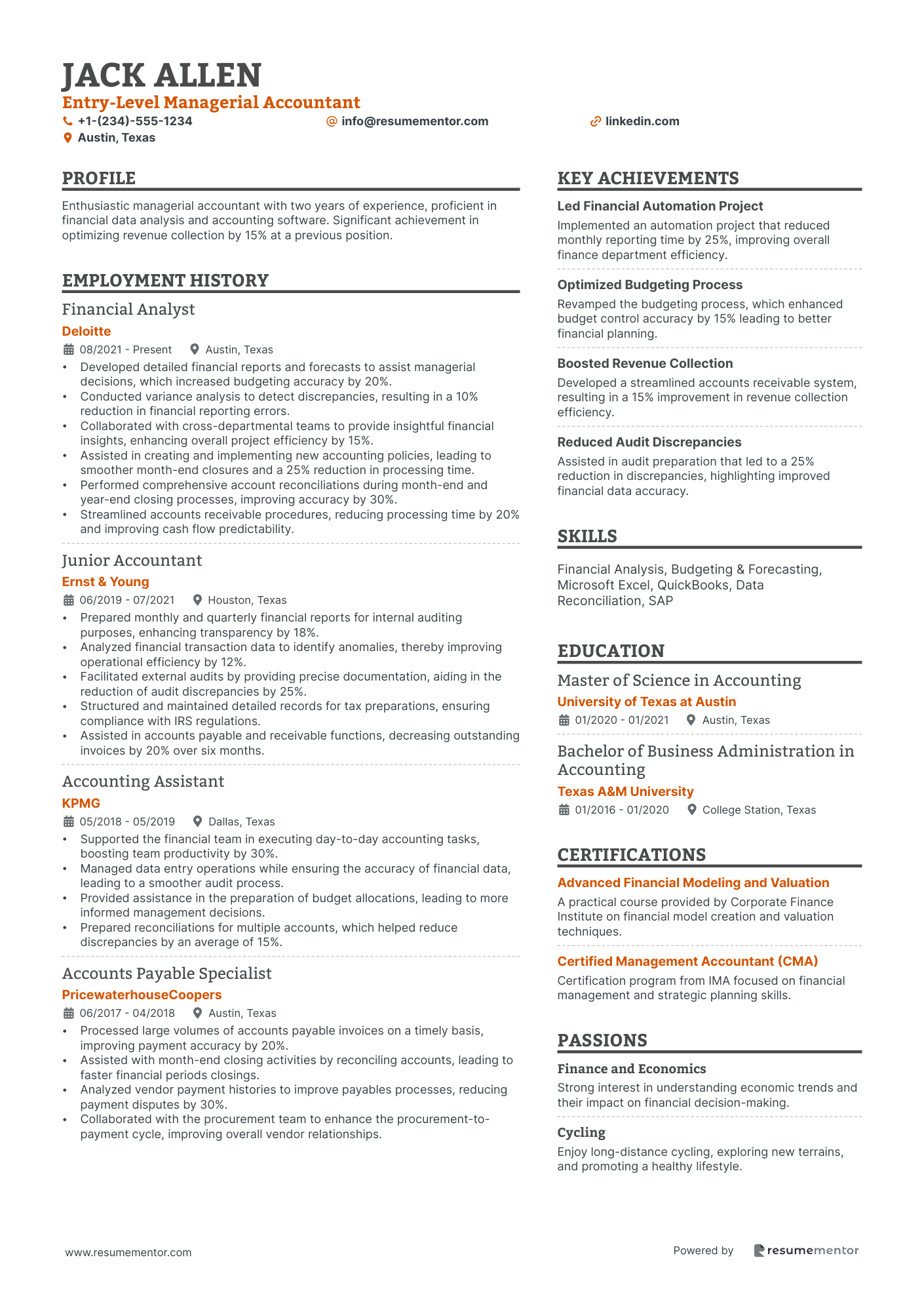

Entry-Level Managerial Accountant

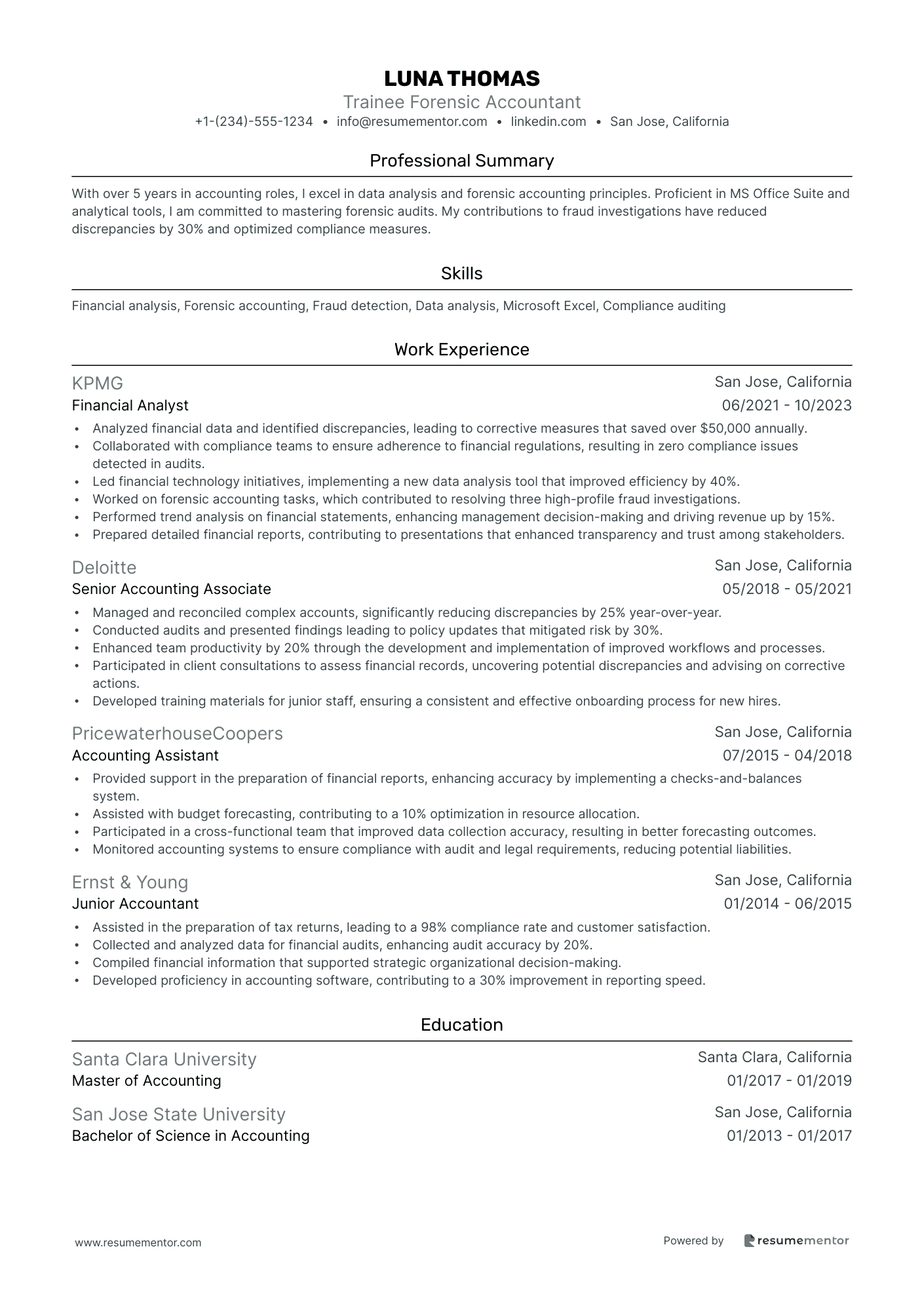

Trainee Forensic Accountant

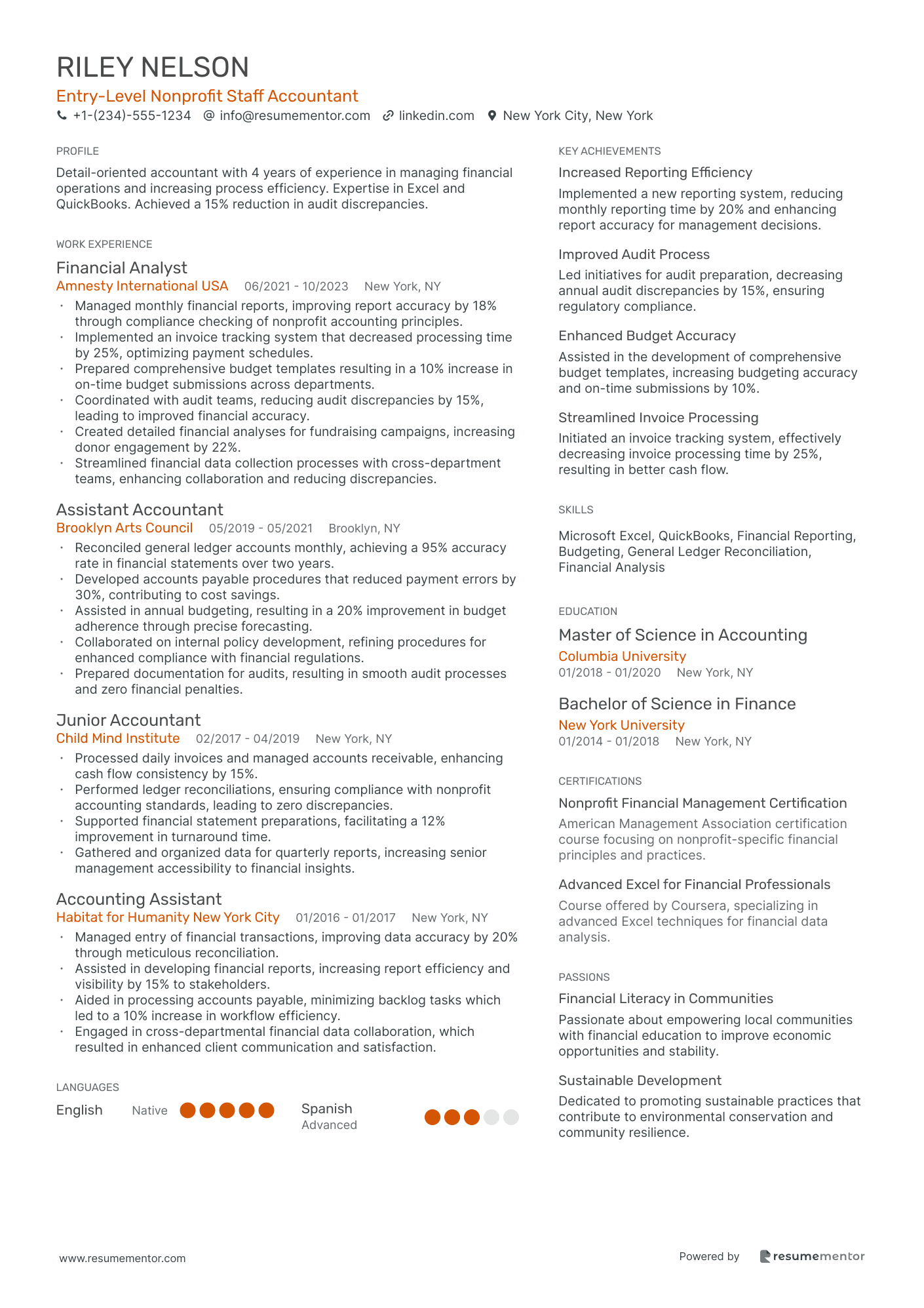

Entry-Level Nonprofit Staff Accountant

Junior Accounts Payable Accountant

Entry-Level Tax Staff Accountant resume sample

- •Worked with a team to streamline the tax preparation process, improving efficiency by 25% through workflow enhancements.

- •Managed the preparation of individual tax returns, resulting in an increase in client satisfaction by 15%.

- •Collaborated with auditors to resolve discrepancies in tax filings, which reduced errors by 30%, increasing compliance.

- •Assisted in research and identification of tax benefits for 10 small business clients, generating $100,000 in tax savings.

- •Developed and documented processes for incorporation into departmental guidelines, leading to a more efficient training program.

- •Participated in a special project addressing international tax matters, positively impacting cross-border clients’ compliance.

- •Analyzed financial statements and documents to ensure conformity with tax laws, improving client tax compliance by 15%.

- •Assisted with federal and state tax returns for 30 corporation clients, increasing return accuracy by 20%.

- •Provided research insights on tax regulations impacting corporate clients, contributing to informed strategic planning.

- •Co-facilitated a workshop on efficient tax planning, enhancing team skills and reducing report preparation time by 10%.

- •Oversaw tax filing procedures and documented improvement points, resulting in enhanced compliance and organization.

- •Assisted senior accountants with tax preparation tasks, improving efficiency by 18% through better use of accounting software.

- •Contributed to financial report preparation, enhancing accuracy by 25% by implementing software-based checks.

- •Collaborated with a team on tax research projects, discovering new tax-saving strategies resulting in $80,000 saved for clients.

- •Managed client documentation for audits, resulting in streamlined processes and improved client relations.

- •Prepared working papers and documentation for audit tasks, improving the accuracy of submissions by 20%.

- •Assisted in client file maintenance, enhancing the organization of records, resulting in a 10% efficiency gain.

- •Contributed to tax preparation for corporate clients, providing valuable support that increased department productivity by 15%.

- •Communicated suggestions for tax document organization, resulting in more efficient inter-departmental collaboration.

Junior Financial Reporting Accountant resume sample

- •Led initiative to streamline financial statement preparation process, reducing completion time by 30% through automation.

- •Coordinated reconciliation of over 50 accounts each month, identifying discrepancies and resulting in a 20% decrease in errors.

- •Developed detailed variance analysis reports for quarterly reviews, enhancing management decision-making.

- •Collaborated with IT to integrate new accounting software, shortening reporting cycle by 15%.

- •Assisted in managing the financial close process, successfully closing books within 5 days each month.

- •Prepared supporting documentation for external audits, reducing auditor queries by 25%.

- •Executed monthly close procedures by reconciling bank statements and other transactional documentation, improving accuracy by 20%.

- •Supported the preparation of tax returns and compliance documents, contributing to zero penalties from regulatory bodies.

- •Spearheaded a project for process improvement in financial reporting, boosting efficiency by implementing advanced Excel modeling.

- •Collaborated with senior accountants on technical accounting research, enhancing understanding of complex transactions.

- •Managed data entry for financial transactions in SAP, ensuring all entries were timely and accurately reflected in financial statements.

- •Assisted in preparing financial reports and maintained accurate records, contributing to a successful internal audit.

- •Performed monthly bank reconciliations, resolving discrepancies that improved cash flow reporting by 15%.

- •Supported budgeting processes and provided analysis for variance reports, aiding in better budget adherence.

- •Coordinated accounting tasks, including preparation and distribution of monthly expense summaries, ensuring timely managerial reviews.

- •Monitored and analyzed customer accounts to improve payment collections, reducing outstanding debt by 18%.

- •Prepared and processed invoices, ensuring all transactions were completed in compliance with company policies.

- •Generated weekly reports on customer accounts and payment status, leading to a 10% improvement in payment processing.

- •Collaborated with other departments to address outstanding balances, enhancing departmental coordination.

Entry-Level Cost Accountant resume sample

- •Performed thorough cost analyses leading to a reduction of overhead costs by 8% within the first six months.

- •Collaborated with cross-functional teams to enhance inventory valuation processes, increasing accuracy by 12%.

- •Developed comprehensive cost reports for executive presentations, resulting in informed decision-making at the managerial level.

- •Streamlined data collection processes, reducing monthly reporting time by 20%, thereby improving departmental efficiency.

- •Led efforts to align budgeting strategies across departments, consistently meeting a variance target margin of ±2%.

- •Supported external audits by preparing detailed financial documentation, achieving a compliance score of over 95%.

- •Supported monthly financial close activities by preparing journal entries and reconciliations, reducing discrepancies by 10%.

- •Managed budget and forecast models for three departments, improving forecast accuracy by 15% annually.

- •Analyzed manufacturing cost variances, identifying underperformance and saving $150k in annual production expenses.

- •Collaborated with IT to implement an ERP system upgrade, optimizing the existing workflow and reducing processing time by 25%.

- •Spearheaded a special project to evaluate vendor cost efficiency, contributing to a 5% procurement cost reduction.

- •Assisted in preparing cost estimates and variance analysis for annual budgeting, enhancing accuracy by 7%.

- •Participated in monthly inventory audits to ensure precise cost accounting, leading to a 98% inventory accuracy rate.

- •Worked with procurement teams to accurately track expenses, reducing discrepancies by 15% in quarterly reports.

- •Contributed to the monthly financial reporting process, ensuring timely delivery of high-quality financial statements.

- •Managed daily accounting tasks, supporting the finance team in achieving a timely month-end close with no missed deadlines.

- •Produced qualitative and quantitative cost data for project evaluations, aiding in a 20% increase in operational efficiency.

- •Worked closely with the production department to update cost databases, resulting in a 50% reduction in data entry errors.

- •Delivered cost-saving insights that contributed to a 5% increase in overall departmental cost efficiency over one fiscal year.

Junior Accounts Receivable Accountant resume sample

- •Reduced outstanding invoices by 20% through effective communication strategies and diligent follow-up processes.

- •Managed processing and reconciliation of over 500 invoices monthly, ensuring accuracy and adherence to financial standards.

- •Enhanced cash flow by implementing a streamlined invoicing system, resulting in 10% faster payment cycles.

- •Collaborated with team members to identify opportunities for process improvement, subsequently reducing processing time by 15%.

- •Prepared detailed monthly accounts receivable reports for management, supporting better decision-making and strategic planning.

- •Maintained compliance with company policies while managing accounts worth over $1 million cumulatively.

- •Increased efficiency of account reconciliation tasks by implementing new automated tools, saving 10 hours per month.

- •Successfully managed an average of 200 accounts concurrently through detailed analysis and prompt issue resolution.

- •Contributed to monthly closing processes, ensuring accurate reporting and streamlined operations across the accounting department.

- •Assisted in reducing overdue accounts by 15% through improved communication with customers regarding payment discrepancies.

- •Developed comprehensive training materials for new hires, resulting in a 30% reduction in onboarding time.

- •Successfully maintained transactions and records for multiple small businesses totaling $300,000 in monthly revenues.

- •Facilitated smooth month-end closing activities, ensuring all transactions were accurately recorded and balanced.

- •Implemented new procedures for tracking and reporting financial data, which improved accuracy by 25%.

- •Led efforts to redesign the bookkeeping system, resulting in a 20% improvement in data retrieval speed.

- •Assisted with financial statement preparation for quarterly audits, enhancing audit efficiency by 18%.

- •Managed accurate and timely recording of daily financial transactions, ensuring compliance with accounting standards.

- •Performed bank reconciliations for six company accounts, reducing discrepancy issues by 10%.

- •Supported senior accountants in creating and maintaining comprehensive financial reports utilized in strategic planning.

Trainee Accountant for Internal Audit resume sample

- •Contributed to the reduction of discrepancies in financial records by 25% through thorough data analysis and audits.

- •Developed and implemented documentation processes that improved data accuracy by ensuring compliance with all corporate policies.

- •Analyzed financial statements to identify and rectify inconsistencies, improving annual report accuracy.

- •Collaborated with multiple departments to streamline internal processes, resulting in a 15% increase in operational efficiency.

- •Conducted monthly reconciliations that uncovered financial errors, reducing errors by 30% over a year.

- •Managed vendor relationships, optimizing payment schedules to save the company $40k annually.

- •Executed audit plans for 10+ major clients, enhancing compliance with statutory regulations.

- •Assisted in risk assessment projects, identifying key risk areas and suggesting mitigation strategies.

- •Improved audit findings documentation and reporting processes, enhancing clarity and comprehensibility.

- •Participated in team training sessions, sharing insights on best practices and process improvements.

- •Monitored compliance with accounting standards which enhanced risk management frameworks.

- •Oversaw a portfolio of vendor accounts that ensured timely payments and maintained positive vendor relationships.

- •Reduced average invoice processing time by 20% through process streamlining and software implementation.

- •Performed data entry checks, enhancing the accuracy of records, leading to a 15% reduction in payment errors.

- •Interfaced with internal departments frequently to resolve complex discrepancies.

- •Prepared financial reports and forecasts, supporting strategic business decisions and contributing to a 10% revenue growth.

- •Coordinated with teams on budget variance analysis which informed budget planning sessions.

- •Assessed financial risk and profitability for potential projects, assisting executive decision-making.

- •Streamlined financial reporting procedures, reducing report preparation time by 25%.

Junior Payroll Accountant resume sample

- •Successfully processed bi-weekly payroll for over 300 employees, achieving a 98% accuracy rate and exceeding compliance standards.

- •Implemented an improved data entry system that reduced time spent on payroll processing by 25%, resulting in increased efficiency.

- •Resolved complex payroll discrepancies by engaging with employees, leading to a 30% improvement in employee satisfaction.

- •Collaborated with cross-functional teams to revamp payroll reporting processes, increasing transparency and financial oversight.

- •Assisted in the preparation and filing of payroll taxes, ensuring timely payments and avoiding penalties.

- •Led a project to transition payroll software, resulting in a seamless change with zero downtime.

- •Managed accounts payable for over 150 vendors, maintaining a 95% on-time payment rate and strengthening vendor relations.

- •Conducted detailed reviews of financial statements, ensuring accuracy and compliance with accounting standards.

- •Streamlined invoicing process, cutting down processing time by 40% which improved workflow efficiency.

- •Developed and maintained accurate financial records, minimizing discrepancies and improving financial reporting.

- •Assisted in monthly closing activities, efficiently reconciling discrepancies and achieving departmental goals on time.

- •Analyzed financial data to track performance metrics, leading to a 15% improvement in forecast accuracy.

- •Coordinated with department heads to develop budgets, achieving optimal resource allocation across the organization.

- •Generated comprehensive financial reports and dashboards, facilitating detailed performance tracking for management.

- •Supported strategic initiatives by providing actionable financial insights, contributing to a 10% reduction in costs.

- •Assisted in managing daily transaction records, ensuring accurate data input and achieving 99% accuracy in reports.

- •Facilitated monthly bank reconciliations, identifying and resolving discrepancies promptly to maintain accurate records.

- •Provided support in the preparation of financial statements, gaining valuable experience in financial accounting.

- •Ensured confidentiality and security of financial information, adhering strictly to financial regulations and company policies.

Entry-Level Managerial Accountant resume sample

- •Developed detailed financial reports and forecasts to assist managerial decisions, which increased budgeting accuracy by 20%.

- •Conducted variance analysis to detect discrepancies, resulting in a 10% reduction in financial reporting errors.

- •Collaborated with cross-departmental teams to provide insightful financial insights, enhancing overall project efficiency by 15%.

- •Assisted in creating and implementing new accounting policies, leading to smoother month-end closures and a 25% reduction in processing time.

- •Performed comprehensive account reconciliations during month-end and year-end closing processes, improving accuracy by 30%.

- •Streamlined accounts receivable procedures, reducing processing time by 20% and improving cash flow predictability.

- •Prepared monthly and quarterly financial reports for internal auditing purposes, enhancing transparency by 18%.

- •Analyzed financial transaction data to identify anomalies, thereby improving operational efficiency by 12%.

- •Facilitated external audits by providing precise documentation, aiding in the reduction of audit discrepancies by 25%.

- •Structured and maintained detailed records for tax preparations, ensuring compliance with IRS regulations.

- •Assisted in accounts payable and receivable functions, decreasing outstanding invoices by 20% over six months.

- •Supported the financial team in executing day-to-day accounting tasks, boosting team productivity by 30%.

- •Managed data entry operations while ensuring the accuracy of financial data, leading to a smoother audit process.

- •Provided assistance in the preparation of budget allocations, leading to more informed management decisions.

- •Prepared reconciliations for multiple accounts, which helped reduce discrepancies by an average of 15%.

- •Processed large volumes of accounts payable invoices on a timely basis, improving payment accuracy by 20%.

- •Assisted with month-end closing activities by reconciling accounts, leading to faster financial periods closings.

- •Analyzed vendor payment histories to improve payables processes, reducing payment disputes by 30%.

- •Collaborated with the procurement team to enhance the procurement-to-payment cycle, improving overall vendor relationships.

Trainee Forensic Accountant resume sample

- •Analyzed financial data and identified discrepancies, leading to corrective measures that saved over $50,000 annually.

- •Collaborated with compliance teams to ensure adherence to financial regulations, resulting in zero compliance issues detected in audits.

- •Led financial technology initiatives, implementing a new data analysis tool that improved efficiency by 40%.

- •Worked on forensic accounting tasks, which contributed to resolving three high-profile fraud investigations.

- •Performed trend analysis on financial statements, enhancing management decision-making and driving revenue up by 15%.

- •Prepared detailed financial reports, contributing to presentations that enhanced transparency and trust among stakeholders.

- •Managed and reconciled complex accounts, significantly reducing discrepancies by 25% year-over-year.

- •Conducted audits and presented findings leading to policy updates that mitigated risk by 30%.

- •Enhanced team productivity by 20% through the development and implementation of improved workflows and processes.

- •Participated in client consultations to assess financial records, uncovering potential discrepancies and advising on corrective actions.

- •Developed training materials for junior staff, ensuring a consistent and effective onboarding process for new hires.

- •Provided support in the preparation of financial reports, enhancing accuracy by implementing a checks-and-balances system.

- •Assisted with budget forecasting, contributing to a 10% optimization in resource allocation.

- •Participated in a cross-functional team that improved data collection accuracy, resulting in better forecasting outcomes.

- •Monitored accounting systems to ensure compliance with audit and legal requirements, reducing potential liabilities.

- •Assisted in the preparation of tax returns, leading to a 98% compliance rate and customer satisfaction.

- •Collected and analyzed data for financial audits, enhancing audit accuracy by 20%.

- •Compiled financial information that supported strategic organizational decision-making.

- •Developed proficiency in accounting software, contributing to a 30% improvement in reporting speed.

Entry-Level Nonprofit Staff Accountant resume sample

- •Managed monthly financial reports, improving report accuracy by 18% through compliance checking of nonprofit accounting principles.

- •Implemented an invoice tracking system that decreased processing time by 25%, optimizing payment schedules.

- •Prepared comprehensive budget templates resulting in a 10% increase in on-time budget submissions across departments.

- •Coordinated with audit teams, reducing audit discrepancies by 15%, leading to improved financial accuracy.

- •Created detailed financial analyses for fundraising campaigns, increasing donor engagement by 22%.

- •Streamlined financial data collection processes with cross-department teams, enhancing collaboration and reducing discrepancies.

- •Reconciled general ledger accounts monthly, achieving a 95% accuracy rate in financial statements over two years.

- •Developed accounts payable procedures that reduced payment errors by 30%, contributing to cost savings.

- •Assisted in annual budgeting, resulting in a 20% improvement in budget adherence through precise forecasting.

- •Collaborated on internal policy development, refining procedures for enhanced compliance with financial regulations.

- •Prepared documentation for audits, resulting in smooth audit processes and zero financial penalties.

- •Processed daily invoices and managed accounts receivable, enhancing cash flow consistency by 15%.

- •Performed ledger reconciliations, ensuring compliance with nonprofit accounting standards, leading to zero discrepancies.

- •Supported financial statement preparations, facilitating a 12% improvement in turnaround time.

- •Gathered and organized data for quarterly reports, increasing senior management accessibility to financial insights.

- •Managed entry of financial transactions, improving data accuracy by 20% through meticulous reconciliation.

- •Assisted in developing financial reports, increasing report efficiency and visibility by 15% to stakeholders.

- •Aided in processing accounts payable, minimizing backlog tasks which led to a 10% increase in workflow efficiency.

- •Engaged in cross-departmental financial data collaboration, which resulted in enhanced client communication and satisfaction.

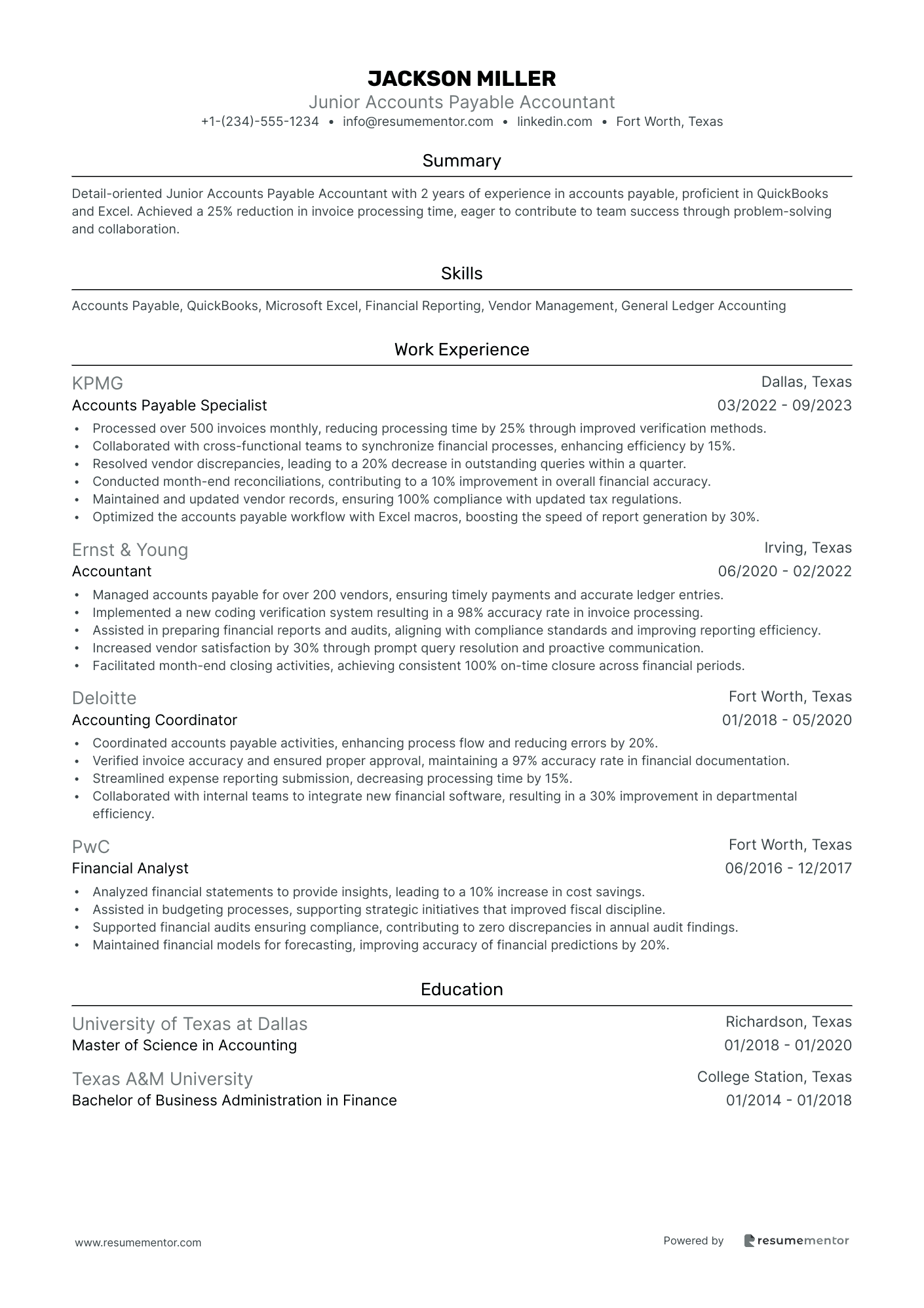

Junior Accounts Payable Accountant resume sample

- •Processed over 500 invoices monthly, reducing processing time by 25% through improved verification methods.

- •Collaborated with cross-functional teams to synchronize financial processes, enhancing efficiency by 15%.

- •Resolved vendor discrepancies, leading to a 20% decrease in outstanding queries within a quarter.

- •Conducted month-end reconciliations, contributing to a 10% improvement in overall financial accuracy.

- •Maintained and updated vendor records, ensuring 100% compliance with updated tax regulations.

- •Optimized the accounts payable workflow with Excel macros, boosting the speed of report generation by 30%.

- •Managed accounts payable for over 200 vendors, ensuring timely payments and accurate ledger entries.

- •Implemented a new coding verification system resulting in a 98% accuracy rate in invoice processing.

- •Assisted in preparing financial reports and audits, aligning with compliance standards and improving reporting efficiency.

- •Increased vendor satisfaction by 30% through prompt query resolution and proactive communication.

- •Facilitated month-end closing activities, achieving consistent 100% on-time closure across financial periods.

- •Coordinated accounts payable activities, enhancing process flow and reducing errors by 20%.

- •Verified invoice accuracy and ensured proper approval, maintaining a 97% accuracy rate in financial documentation.

- •Streamlined expense reporting submission, decreasing processing time by 15%.

- •Collaborated with internal teams to integrate new financial software, resulting in a 30% improvement in departmental efficiency.

- •Analyzed financial statements to provide insights, leading to a 10% increase in cost savings.

- •Assisted in budgeting processes, supporting strategic initiatives that improved fiscal discipline.

- •Supported financial audits ensuring compliance, contributing to zero discrepancies in annual audit findings.

- •Maintained financial models for forecasting, improving accuracy of financial predictions by 20%.

Creating a strong resume as a staff accountant is much like organizing a complex spreadsheet. The document you craft can open career doors by clearly highlighting your strengths in the accounting field. This means you'll need to effectively convey your talent for financial analysis and your understanding of essential accounting principles. Your resume should make your abilities in balancing numbers and preparing financial statements crystal clear.

To help you tackle this task, using a structured resume template can be incredibly beneficial. Explore these resume templates to find one that allows your skills to shine. A well-chosen template lets you concentrate on writing your content, making sure that your accounting qualifications are front and center.

Feeling overwhelmed when trying to put your financial expertise into words is common among new accountants. Mastering how to present your skills, like proficiency in accounting software and tax regulation knowledge, is crucial. This guide will support you in creating a resume that successfully highlights your technical expertise and aligns with industry standards.

By leveraging the right structure and approach, you can build a resume that boosts your confidence as you step into the accounting world. As you navigate through this guide, you'll pick up valuable tips and insights, ensuring your resume serves as a powerful introduction to potential employers.

Key Takeaways

- Creating a powerful resume as a staff accountant involves highlighting financial analysis skills and understanding accounting principles, making one's abilities clear in balancing numbers and preparing financial statements.

- Using a structured resume template can enhance focus on content, ensuring accounting qualifications are prominently displayed.

- Mastering the presentation of skills like proficiency in accounting software and tax regulation knowledge is crucial.

- Choosing a chronological resume format is ideal for showcasing an academic background and any internships or part-time roles.

- Integrating hard and soft skills, along with relevant projects, education, and certifications, increases the resume's appeal to potential employers.

What to focus on when writing your entry-level staff accountant resume

Your entry-level staff accountant resume needs to present your skills, experiences, and aspirations clearly and effectively. It's a crucial tool for making the right impression on potential employers.

How to structure your entry-level staff accountant resume

- Contact Information: This section is the gateway to your resume. Ensure your name, phone number, email, and LinkedIn profile are clearly stated so that recruiters have no trouble reaching out to you. They should immediately sense your professionalism from these details, setting a positive tone for the rest of the resume.

- Objective Statement: This brief introduction to your resume should succinctly capture your career goals and key skills. It’s your chance to make a strong first impression, highlighting specific software proficiencies such as QuickBooks or Excel, which are vital in accounting roles. Crafting this section well can pave the way for a more detailed exploration of your capabilities.

- Education: Listing your educational background is more than just stating where you studied. It involves emphasizing specific courses like Financial and Managerial Accounting that directly relate to the skills you'll use in your accounting role. Your education section sets the stage for your technical knowledge and how it applies to real-world tasks.

- Work Experience: Detail your past roles by emphasizing internships, part-time jobs, or volunteer work where accounting skills were key. Clearly outline your job title, the company, location, and your accomplishments, such as improving financial report accuracy. This section demonstrates your proactive approach and practical application of accounting knowledge, preparing the reader to understand the depth of your skills.

- Skills: This area should highlight your proficiency in areas like GAAP and ERP systems. These specific skills not only validate your technical competencies but also prepare you to meet the demands of a staff accountant role. It’s crucial to present this information in a way that speaks directly to potential employer needs.

- Certifications or Training: Mentioning any certifications like CPA-eligibility or specialized training gives your resume additional authority. These qualifications show your commitment to the field and readiness to engage with the more complex aspects of accounting tasks.

Your resume should provide a comprehensive picture of your abilities and potential as an entry-level staff accountant—now let's dive deeper into each section to ensure it's crafted to perfection with a focus on format and detail.

Which resume format to choose

In the accounting field, having a well-structured resume is key to standing out as an entry-level staff accountant. The chronological format is especially effective because it lets you spotlight your academic background along with any internships or part-time roles. This format makes it easy for employers to see your career path and how your experiences build towards your new role.

Choosing the right font can enhance this clarity by making your resume look modern and professional at first glance. Opt for fonts like Rubik, Montserrat, or Lato. These choices are clean and easy to read, helping to keep your resume looking fresh without distracting from the content.

When it comes to saving and sharing your resume, always go with a PDF. This choice is crucial in ensuring that your formatting remains intact and your document appears the same on any recruiter’s screen, eliminating the risk of disruptions in layout or design that can occur with other file types.

Finally, don’t overlook your resume’s margins. By setting them to one inch on all sides, you create a balanced look that provides enough white space. This not only makes your resume easier to read but also avoids the cluttered appearance that can sometimes deter recruiters.

Focusing on these interconnected elements will help you craft a resume that effectively reflects your dedication and professionalism as you pursue an entry-level staff accountant position.

How to write a quantifiable resume experience section

Crafting a standout experience section for your entry-level staff accountant resume can truly set you apart from other candidates. Start by focusing on relevant skills and achievements, even if they come from internships or volunteer work. Begin with your most recent role and use reverse chronological order to guide potential employers through your journey. Prioritize experience that aligns closely with the accounting field, covering the past five to seven years. If your work history is shorter, include academic projects or extracurriculars that demonstrate your abilities. Tailor your resume to the job ad by highlighting skills and experiences that match the description, and use action words like "analyzed," "managed," and "prepared" to show initiative. Here's how these elements can come together smoothly:

- •Analyzed and reconciled over 200 financial transactions monthly, improving accuracy by 15%.

- •Collaborated with accounting team to prepare quarterly financial reports, directly contributing to securing a $500,000 investment.

- •Implemented a new filing system that reduced document retrieval time by 25%.

- •Managed accounts payable and receivable, reducing outstanding balances by 20% within three months.

This example connects each part seamlessly. The experience section clearly illustrates your capabilities by showcasing achievements with measurable data, crucial for demonstrating your value. Each bullet starts with a strong action verb, emphasizing your initiative and the impact you've made. These achievements resonate with typical accounting responsibilities, painting a picture of your contributions and potential. The tailored approach reflects your proactive nature, making a compelling case for your readiness to advance in your accounting career.

Technology-Focused resume experience section

A technology-focused entry-level staff accountant resume experience section should clearly demonstrate how your technical skills contribute to your work. Begin by listing your job title, the company name, and the dates of employment to establish your background. Then, highlight responsibilities and achievements that showcase your proficiency in using technology for accounting tasks. Each bullet point should tell a story of how specific software tools, financial analysis, or data management skills improved the company's operations or efficiency.

With action verbs, your experiences will come to life and catch the reader's attention. Specify the accounting software you’ve mastered and illustrate how you've used it to meet challenges or optimize processes. Incorporating metrics or achievements provides concrete evidence of your contributions. Whether it’s reducing reporting time with advanced tools or assisting in more accurate financial reporting, these elements will make your resume resonate with potential employers.

Staff Accountant

Tech Financial Solutions

June 2022 - Present

- Utilized QuickBooks to manage accounts payable and receivable, keeping all transactions precise and up-to-date.

- Created an Excel-based system that reduced monthly financial reporting time by 30%, boosting departmental efficiency.

- Collaborated with IT to integrate new accounting software, enhancing data processing and accuracy.

- Organized digital financial data for audits, speeding up and improving the accuracy of the audit process.

Problem-Solving Focused resume experience section

A problem-solving focused staff accountant resume experience section should emphasize your ability to tackle challenges and deliver effective solutions. Start by showcasing situations where you identified and addressed issues, detailing your role in achieving successful outcomes. Use numbers and clear results to highlight your impact, and ensure each example aligns with the skills required for the job.

For your bullet points, aim for clarity and detail while maintaining brevity. Begin each point with a powerful action verb and include measurable results to illustrate your effectiveness. Provide specific examples of your contributions to avoid vagueness, demonstrating your initiative and the value you bring to the team.

Staff Accountant

XYZ Financial Services

June 2021 - Present

- Resolved discrepancies in monthly financial reports, leading to a 15% improvement in reporting accuracy.

- Implemented a new expense tracking system that reduced overhead costs by $20,000 annually.

- Collaborated with IT to address system errors, reducing downtime by 30%.

- Developed a training program for team members, which improved efficiency in report generation by 25%.

Skills-Focused resume experience section

A skills-focused entry-level staff accountant resume experience section should effectively highlight your capabilities, even with limited job history. Begin by selecting tasks or projects that align with the skills desired by the employer. Quantifying your achievements can offer potential employers a clearer picture of your contributions, making your resume more impactful. Tailor your wording to echo the job description, emphasizing how your skills can positively impact the team or project. Choosing strong action verbs for your bullet points helps express your responsibilities and achievements clearly, ensuring your resume captures the attention of hiring managers.

Incorporate experiences from internships or volunteer work where you applied skills like financial analysis, data entry, or accounting software. Focus on illustrating your ability to maintain records, prepare documents, or assist in audits, demonstrating the practical application of your theoretical knowledge. Keep your descriptions concise yet detailed enough to convey the significance of your role and achievements, linking all elements into a cohesive narrative.

Accounting Intern

Smith & Co Accountants

June 2021 - August 2021

- Assisted in analyzing financial statements, identifying cost-saving opportunities worth $10,000.

- Aided in data entry for financial reports, ensuring 99% accuracy.

- Worked with senior accountants to prepare quarterly tax filings, reducing errors by 15%.

- Organized and maintained accurate digital records, improving the retrieval process by 40% for audits.

Project-Focused resume experience section

A project-focused entry-level staff accountant resume experience section should showcase specific projects where you made a meaningful contribution, effectively demonstrating your problem-solving skills, attention to detail, and teamwork abilities. Choose projects that truly highlight your strengths and clearly state your role in each one. Use bullet points to describe your responsibilities, achievements, and the impact your efforts had on the project’s success.

In each entry, clearly list your role, the workplace, and the duration of your involvement. Start each bullet point with a strong action verb to effectively convey your contributions and what you learned. This approach not only underscores your capability in handling accounting tasks but also your ability to set and achieve specific goals. Keep your writing crisp and focused, ensuring each entry underscores the skills and accomplishments that are most relevant in the accounting field.

Staff Accountant Intern

XYZ Consulting Group

June 2022 - August 2022

- Helped prepare financial reports and budgets, boosting accuracy by 10%

- Created a new filing system that cut document retrieval time by 30%

- Worked with a team of four to speed up the monthly closing process

- Examined historical data for trends and anomalies, offering insights for better decisions

Write your entry-level staff accountant resume summary section

A well-crafted, focused entry-level staff accountant resume should highlight your strengths and potential impact. Here's an example of a strong summary:

This example effectively communicates your enthusiasm and relevant skills, making you stand out as a valuable candidate. By beginning with your educational background and familiarity with essential accounting software, you quickly establish credibility. This foundation allows you to express your confidence and desire to positively impact a prospective employer. Emphasize your commitment to learning and supporting your colleagues, which are traits employers appreciate.

In the context of an entry-level role, the resume summary can overlap with a resume objective. A summary provides a snapshot of your skills and experience, serving as a concise personal story. In contrast, an objective outlines your career goals and what you aim to achieve. Understanding these nuances allows you to tailor your resume effectively. A resume profile, which offers insight into your personality and work style, differs by being more personal. Meanwhile, a summary of qualifications lists your top skills and achievements. Focusing on crafting an engaging resume section that emphasizes your willingness to grow can strongly position you for opportunities.

Listing your entry-level staff accountant skills on your resume

A skills-focused entry-level staff accountant resume should effectively highlight the abilities that make you a strong candidate. These skills can stand alone in a dedicated section or be seamlessly incorporated into your experience and summary. Your strengths and soft skills show how well you collaborate and solve problems. In contrast, hard skills are specific abilities, like using accounting software or navigating financial regulations. By integrating your skills and strengths into your resume, you enhance its keyword richness, making it more attractive to potential employers.

Here's how you might structure a standalone skills section:

This section is effective because it lists skills relevant to accounting, arranged in an organized and clear manner so hiring managers can quickly see your capabilities. Including a mix of technical and analytical skills demonstrates your ability to handle diverse accounting tasks.

Best hard skills to feature on your entry-level staff accountant resume

For an entry-level staff accountant, hard skills are essential. They prove you can manage financial tasks and use accounting tools effectively, showing you're ready to contribute to a financial team. Here are 15 sought-after hard skills:

Hard Skills

- Accounting Software (e.g., QuickBooks, SAP)

- Financial Reporting

- General Ledger Accounting

- Microsoft Excel

- Data Analysis

- Budgeting and Forecasting

- Accounts Payable/Receivable

- Compliance with Financial Regulations

- Tax Preparation

- Auditing

- Cost Accounting

- Payroll Processing

- Reconciliation

- Financial Planning

- Financial Statement Preparation

Best soft skills to feature on your entry-level staff accountant resume

Soft skills are critical for working successfully with colleagues and managing challenges at work. They reflect your approach and attitude towards tasks, which can positively impact team dynamics. Here are 15 essential soft skills:

Soft Skills

- Communication

- Teamwork

- Time Management

- Adaptability

- Problem-Solving

- Attention to Detail

- Critical Thinking

- Organization

- Customer Service

- Conflict Resolution

- Active Listening

- Decision-Making

- Reliability

- Initiative

- Emotional Intelligence

How to include your education on your resume

An education section is an important part of your entry-level staff accountant resume because it shows your academic background and qualifications. Tailor this section to the job you are applying for and exclude any irrelevant education details. When listing your degree, include the name of the degree, the institution, and the date of completion. Including your GPA on your resume is optional; do it if it's 3.0 or higher to highlight academic success. If you graduated with honors, such as cum laude, make sure to note it to show your achievements. Present your education in reverse chronological order, starting with the most recent degree.

Here’s a wrong example:

- •Member of the book club

And here's a right example:

The second example is good because it presents relevant education that aligns with the staff accountant role. It highlights the degree with a focus on accounting, mentions honors (cum laude), and showcases a strong GPA, all of which are attractive to potential employers. It also smartly omits the high school information, focusing directly on the degree relevant to the job you're pursuing. This professionalism in the education section signals to recruiters that you have the qualifications and achievements they are seeking in a candidate.

How to include entry-level staff accountant certificates on your resume

Including a Certificates section in your entry-level staff accountant resume can significantly enhance its impact. Certificates demonstrate additional skills and expertise relevant to the job. Placing certificates in the header is another effective way to highlight important credentials at a quick glance.

List the name of the certification clearly. Include the date it was obtained to show its recency. Add the issuing organization to establish the certificate’s credibility. This method ensures your qualifications stand out to hiring managers.

This example works well because it showcases certifications that are directly relevant to accounting roles. It includes well-known and respected credentials such as the CPA and CMA, which tells employers you have advanced accounting skills. Listing a Microsoft Excel certification also highlights your technical proficiency, which is essential for any accounting position.

Extra sections to include in your entry-level staff accountant resume

As an entry-level staff accountant, crafting a strong resume is crucial to showcase your skills and experience effectively. Adding specific sections to your resume can highlight your unique qualifications and personal attributes, setting you apart from other candidates.

Language section — Include your proficiency in multiple languages to show your ability to communicate with diverse clients or team members, such as "Fluent in Spanish and proficient in French." This can be especially beneficial in multinational firms or regions with diverse populations.

Hobbies and interests section — Share activities that show relevant skills or traits, like "Enjoys playing chess, which enhances strategic thinking and problem-solving abilities." This provides a glimpse into your personality and can make your resume more memorable.

Volunteer work section — Mention volunteer experiences that demonstrate skills relevant to accounting. For example, "Volunteered as a financial coordinator for a local nonprofit, managing budgets and financial reports."

Books section — Cite books you’ve read that are related to accounting or business. You could write, "Recently read 'Rich Dad Poor Dad,' which provided insights into financial management and investment strategies."

These sections can make your resume more well-rounded and show that you bring more to the table than just academic qualifications. Tailoring your resume this way can better position you for an entry-level staff accountant role.

In Conclusion

In conclusion, crafting a standout entry-level staff accountant resume involves more than just listing your previous jobs and academic achievements. It's about creating a strategic document that effectively highlights your technical skills, such as proficiency in accounting software and financial analysis, alongside your ability to tackle problems and work well within a team. Emphasizing tangible achievements, particularly those with measurable outcomes, can significantly set you apart from other applicants. Leveraging a chronological format helps narrate a clear career path to potential employers, showcasing how your education and past experiences build towards your accounting ambitions. Your resume should not just be a list of duties but a reflection of how you identify and solve problems, apply technical knowledge, and contribute to team goals, demonstrating your readiness for a staff accountant role. By maintaining clarity with a professional font and secure layout, your resume will look polished and be easy for employers to review. Finally, integrating sections on languages, hobbies, volunteer work, or books read related to the role can provide a fuller picture of your personality and professional interests, making you an even more attractive candidate.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.