Estate Planning Lawyer Resume Examples

Jul 18, 2024

|

12 min read

Turn your legal expertise into your legacy: A step-by-step guide for crafting your estate planning lawyer resume that stands out in a competitive field. Get tips on highlighting your skills and experiences effectively.

Rated by 348 people

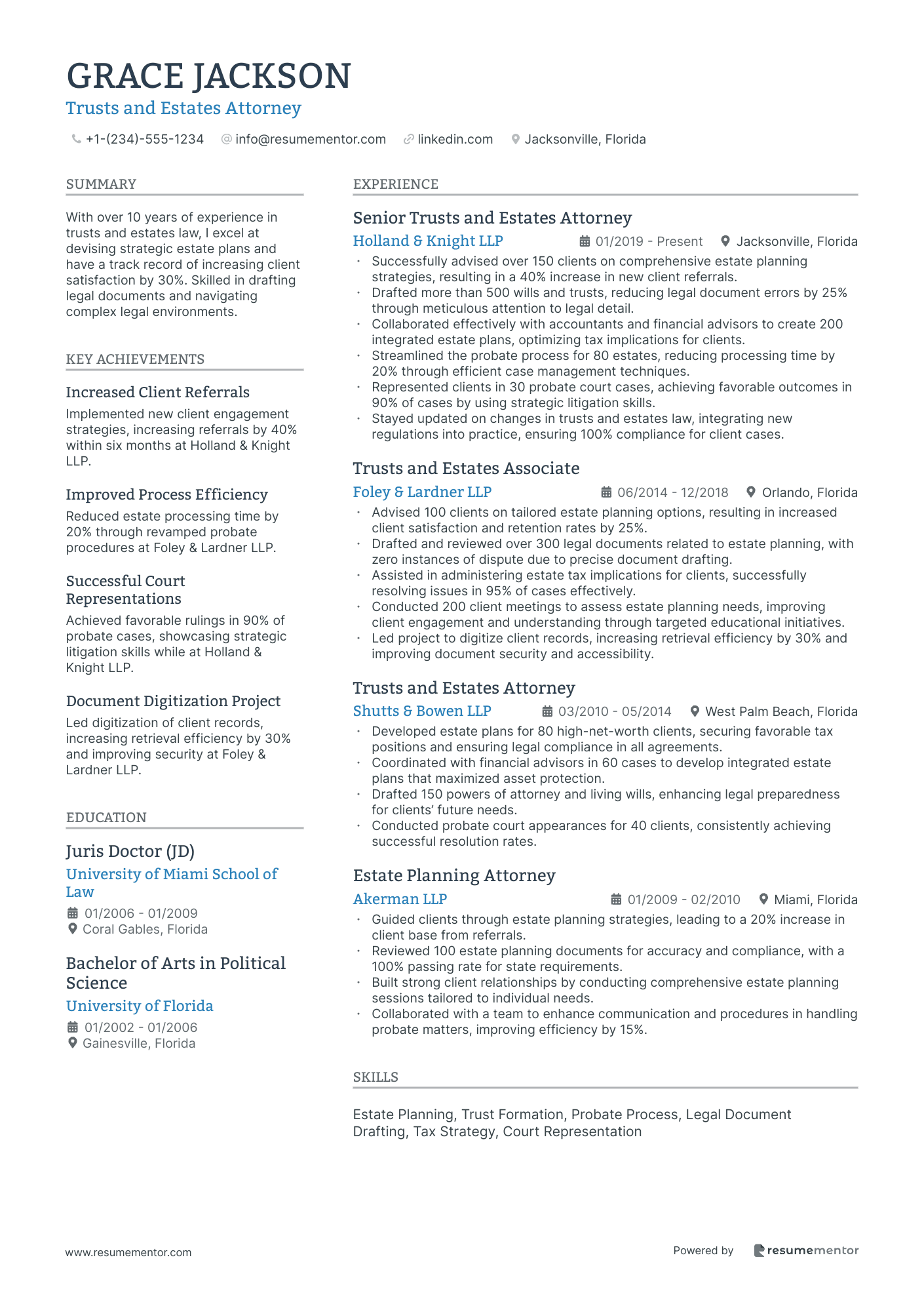

Trusts and Estates Attorney

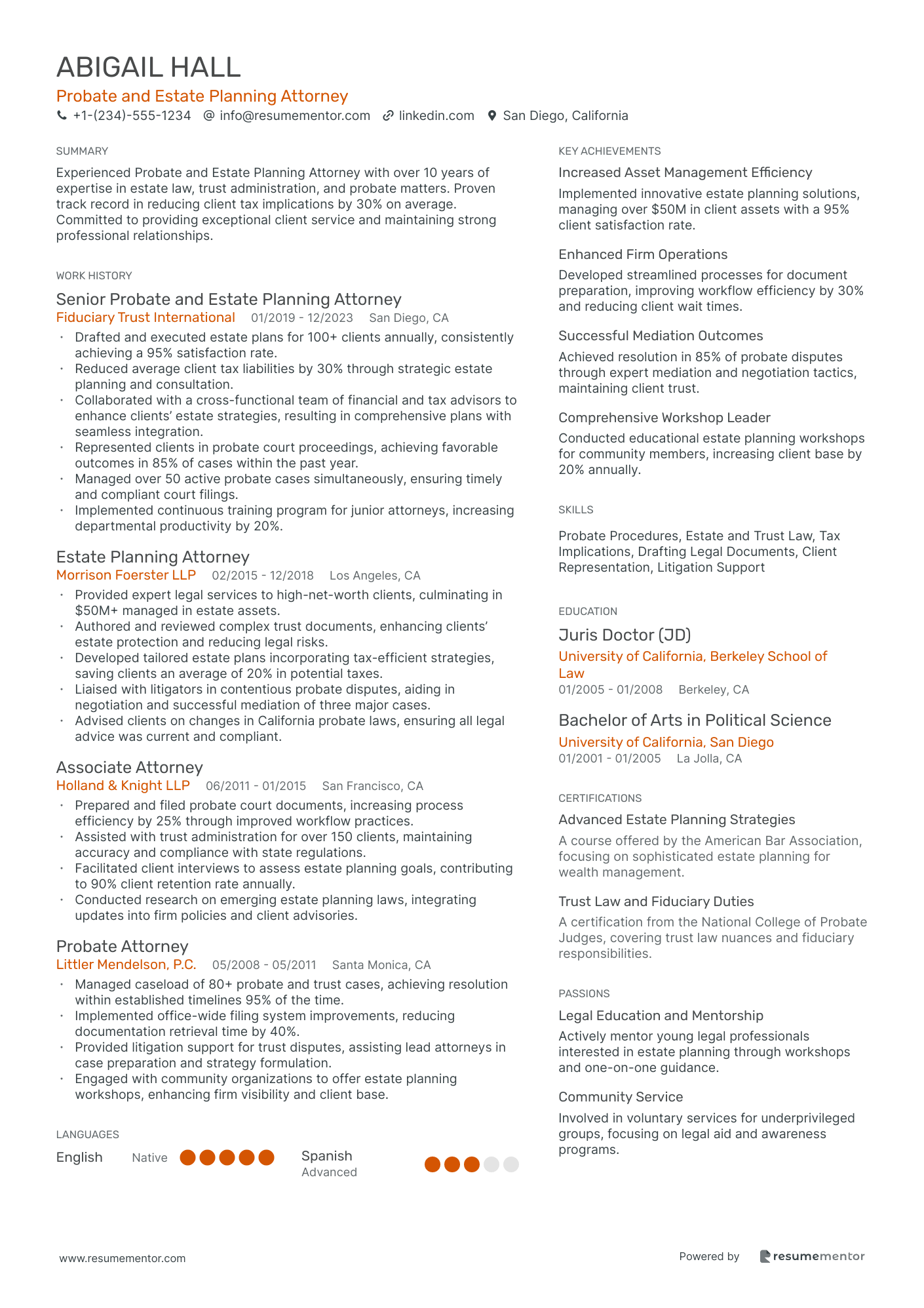

Probate and Estate Planning Attorney

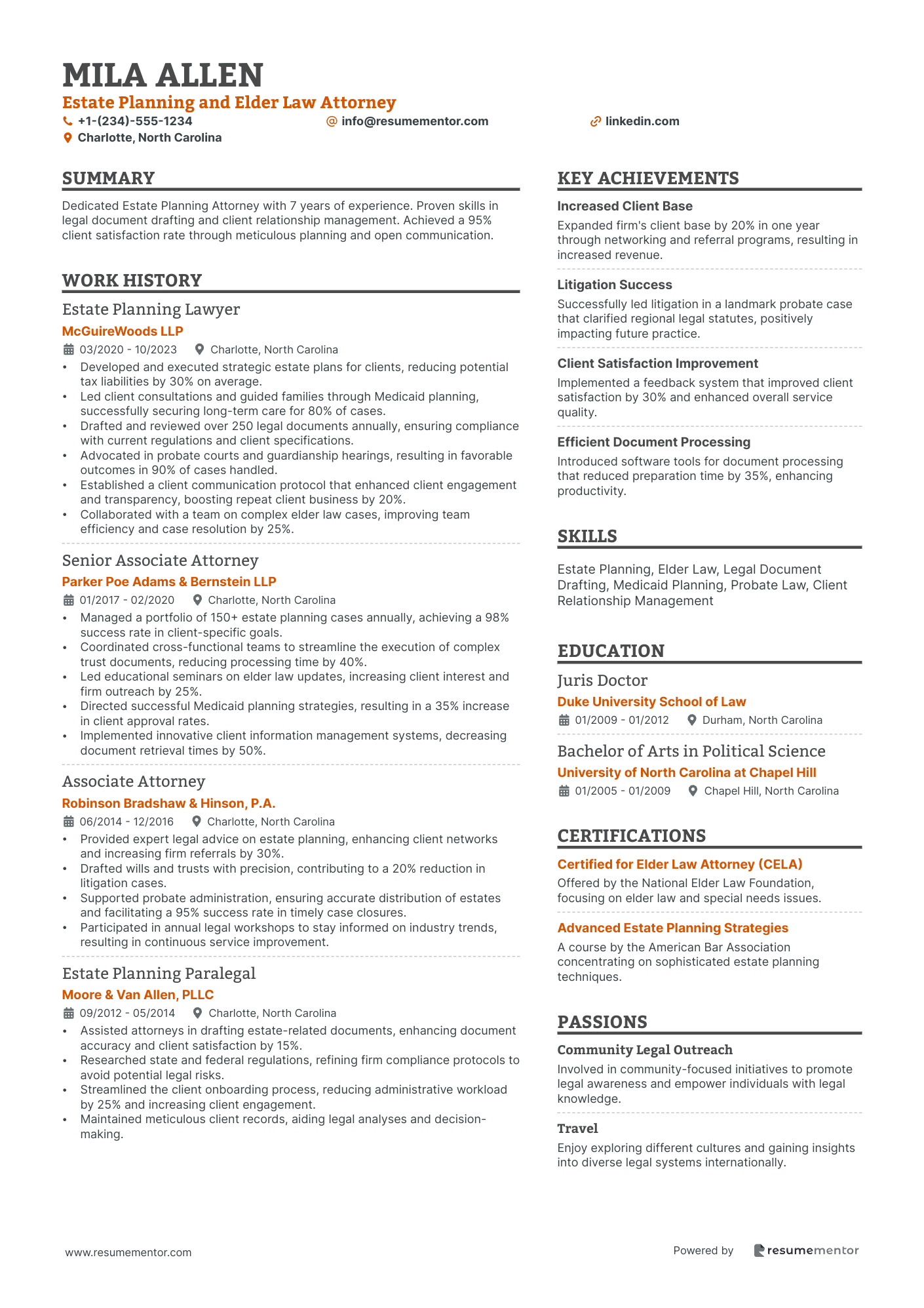

Estate Planning and Elder Law Attorney

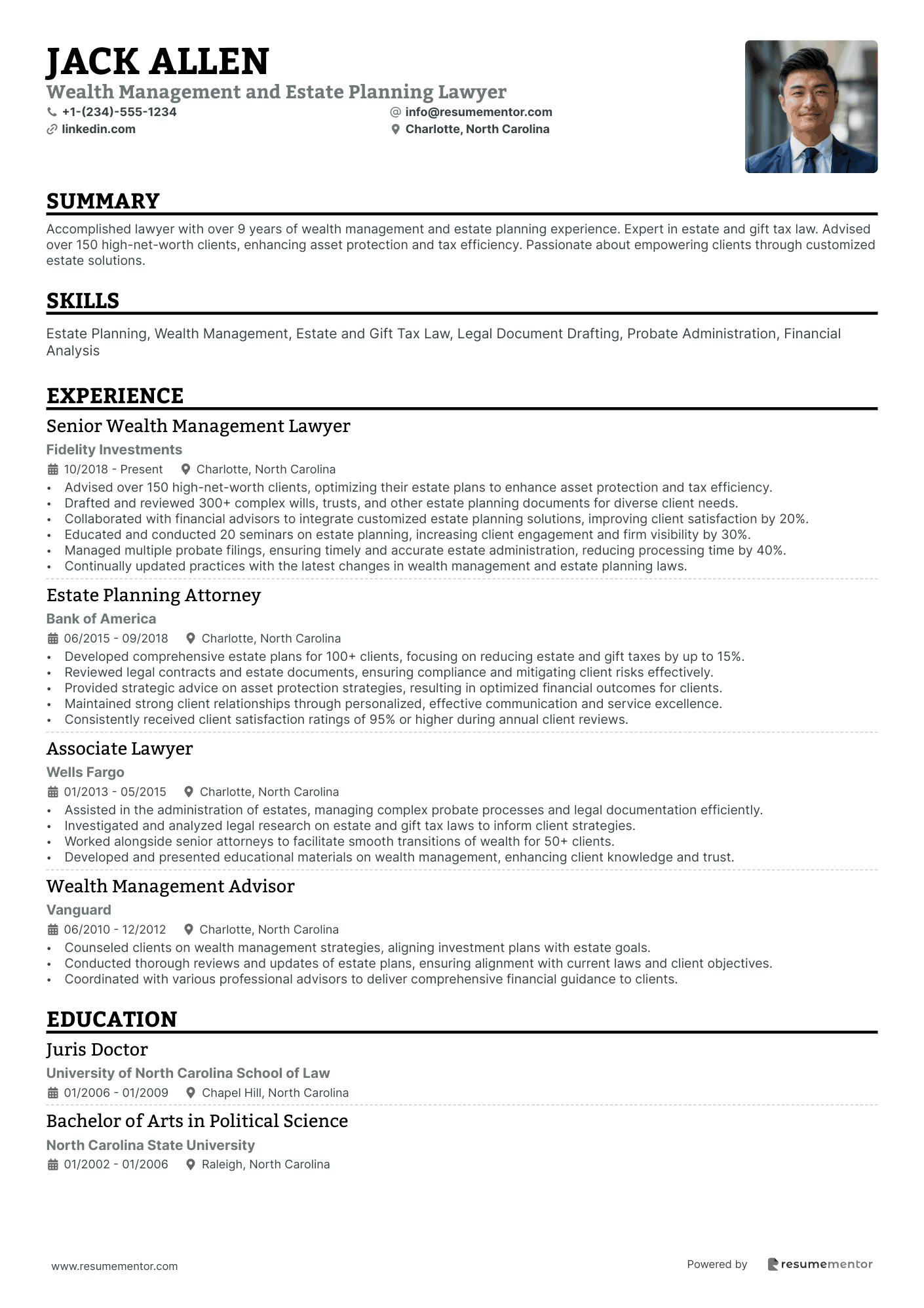

Wealth Management and Estate Planning Lawyer

High Net Worth Estate Planning Lawyer

Charitable Giving Estate Planning Lawyer

Estate Tax Planning Attorney

Business Succession Planning Lawyer

Special Needs Trust Attorney

International Estate Planning Lawyer

Trusts and Estates Attorney resume sample

- •Successfully advised over 150 clients on comprehensive estate planning strategies, resulting in a 40% increase in new client referrals.

- •Drafted more than 500 wills and trusts, reducing legal document errors by 25% through meticulous attention to legal detail.

- •Collaborated effectively with accountants and financial advisors to create 200 integrated estate plans, optimizing tax implications for clients.

- •Streamlined the probate process for 80 estates, reducing processing time by 20% through efficient case management techniques.

- •Represented clients in 30 probate court cases, achieving favorable outcomes in 90% of cases by using strategic litigation skills.

- •Stayed updated on changes in trusts and estates law, integrating new regulations into practice, ensuring 100% compliance for client cases.

- •Advised 100 clients on tailored estate planning options, resulting in increased client satisfaction and retention rates by 25%.

- •Drafted and reviewed over 300 legal documents related to estate planning, with zero instances of dispute due to precise document drafting.

- •Assisted in administering estate tax implications for clients, successfully resolving issues in 95% of cases effectively.

- •Conducted 200 client meetings to assess estate planning needs, improving client engagement and understanding through targeted educational initiatives.

- •Led project to digitize client records, increasing retrieval efficiency by 30% and improving document security and accessibility.

- •Developed estate plans for 80 high-net-worth clients, securing favorable tax positions and ensuring legal compliance in all agreements.

- •Coordinated with financial advisors in 60 cases to develop integrated estate plans that maximized asset protection.

- •Drafted 150 powers of attorney and living wills, enhancing legal preparedness for clients’ future needs.

- •Conducted probate court appearances for 40 clients, consistently achieving successful resolution rates.

- •Guided clients through estate planning strategies, leading to a 20% increase in client base from referrals.

- •Reviewed 100 estate planning documents for accuracy and compliance, with a 100% passing rate for state requirements.

- •Built strong client relationships by conducting comprehensive estate planning sessions tailored to individual needs.

- •Collaborated with a team to enhance communication and procedures in handling probate matters, improving efficiency by 15%.

Probate and Estate Planning Attorney resume sample

- •Drafted and executed estate plans for 100+ clients annually, consistently achieving a 95% satisfaction rate.

- •Reduced average client tax liabilities by 30% through strategic estate planning and consultation.

- •Collaborated with a cross-functional team of financial and tax advisors to enhance clients’ estate strategies, resulting in comprehensive plans with seamless integration.

- •Represented clients in probate court proceedings, achieving favorable outcomes in 85% of cases within the past year.

- •Managed over 50 active probate cases simultaneously, ensuring timely and compliant court filings.

- •Implemented continuous training program for junior attorneys, increasing departmental productivity by 20%.

- •Provided expert legal services to high-net-worth clients, culminating in $50M+ managed in estate assets.

- •Authored and reviewed complex trust documents, enhancing clients’ estate protection and reducing legal risks.

- •Developed tailored estate plans incorporating tax-efficient strategies, saving clients an average of 20% in potential taxes.

- •Liaised with litigators in contentious probate disputes, aiding in negotiation and successful mediation of three major cases.

- •Advised clients on changes in California probate laws, ensuring all legal advice was current and compliant.

- •Prepared and filed probate court documents, increasing process efficiency by 25% through improved workflow practices.

- •Assisted with trust administration for over 150 clients, maintaining accuracy and compliance with state regulations.

- •Facilitated client interviews to assess estate planning goals, contributing to 90% client retention rate annually.

- •Conducted research on emerging estate planning laws, integrating updates into firm policies and client advisories.

- •Managed caseload of 80+ probate and trust cases, achieving resolution within established timelines 95% of the time.

- •Implemented office-wide filing system improvements, reducing documentation retrieval time by 40%.

- •Provided litigation support for trust disputes, assisting lead attorneys in case preparation and strategy formulation.

- •Engaged with community organizations to offer estate planning workshops, enhancing firm visibility and client base.

Estate Planning and Elder Law Attorney resume sample

- •Developed and executed strategic estate plans for clients, reducing potential tax liabilities by 30% on average.

- •Led client consultations and guided families through Medicaid planning, successfully securing long-term care for 80% of cases.

- •Drafted and reviewed over 250 legal documents annually, ensuring compliance with current regulations and client specifications.

- •Advocated in probate courts and guardianship hearings, resulting in favorable outcomes in 90% of cases handled.

- •Established a client communication protocol that enhanced client engagement and transparency, boosting repeat client business by 20%.

- •Collaborated with a team on complex elder law cases, improving team efficiency and case resolution by 25%.

- •Managed a portfolio of 150+ estate planning cases annually, achieving a 98% success rate in client-specific goals.

- •Coordinated cross-functional teams to streamline the execution of complex trust documents, reducing processing time by 40%.

- •Led educational seminars on elder law updates, increasing client interest and firm outreach by 25%.

- •Directed successful Medicaid planning strategies, resulting in a 35% increase in client approval rates.

- •Implemented innovative client information management systems, decreasing document retrieval times by 50%.

- •Provided expert legal advice on estate planning, enhancing client networks and increasing firm referrals by 30%.

- •Drafted wills and trusts with precision, contributing to a 20% reduction in litigation cases.

- •Supported probate administration, ensuring accurate distribution of estates and facilitating a 95% success rate in timely case closures.

- •Participated in annual legal workshops to stay informed on industry trends, resulting in continuous service improvement.

- •Assisted attorneys in drafting estate-related documents, enhancing document accuracy and client satisfaction by 15%.

- •Researched state and federal regulations, refining firm compliance protocols to avoid potential legal risks.

- •Streamlined the client onboarding process, reducing administrative workload by 25% and increasing client engagement.

- •Maintained meticulous client records, aiding legal analyses and decision-making.

Wealth Management and Estate Planning Lawyer resume sample

- •Advised over 150 high-net-worth clients, optimizing their estate plans to enhance asset protection and tax efficiency.

- •Drafted and reviewed 300+ complex wills, trusts, and other estate planning documents for diverse client needs.

- •Collaborated with financial advisors to integrate customized estate planning solutions, improving client satisfaction by 20%.

- •Educated and conducted 20 seminars on estate planning, increasing client engagement and firm visibility by 30%.

- •Managed multiple probate filings, ensuring timely and accurate estate administration, reducing processing time by 40%.

- •Continually updated practices with the latest changes in wealth management and estate planning laws.

- •Developed comprehensive estate plans for 100+ clients, focusing on reducing estate and gift taxes by up to 15%.

- •Reviewed legal contracts and estate documents, ensuring compliance and mitigating client risks effectively.

- •Provided strategic advice on asset protection strategies, resulting in optimized financial outcomes for clients.

- •Maintained strong client relationships through personalized, effective communication and service excellence.

- •Consistently received client satisfaction ratings of 95% or higher during annual client reviews.

- •Assisted in the administration of estates, managing complex probate processes and legal documentation efficiently.

- •Investigated and analyzed legal research on estate and gift tax laws to inform client strategies.

- •Worked alongside senior attorneys to facilitate smooth transitions of wealth for 50+ clients.

- •Developed and presented educational materials on wealth management, enhancing client knowledge and trust.

- •Counseled clients on wealth management strategies, aligning investment plans with estate goals.

- •Conducted thorough reviews and updates of estate plans, ensuring alignment with current laws and client objectives.

- •Coordinated with various professional advisors to deliver comprehensive financial guidance to clients.

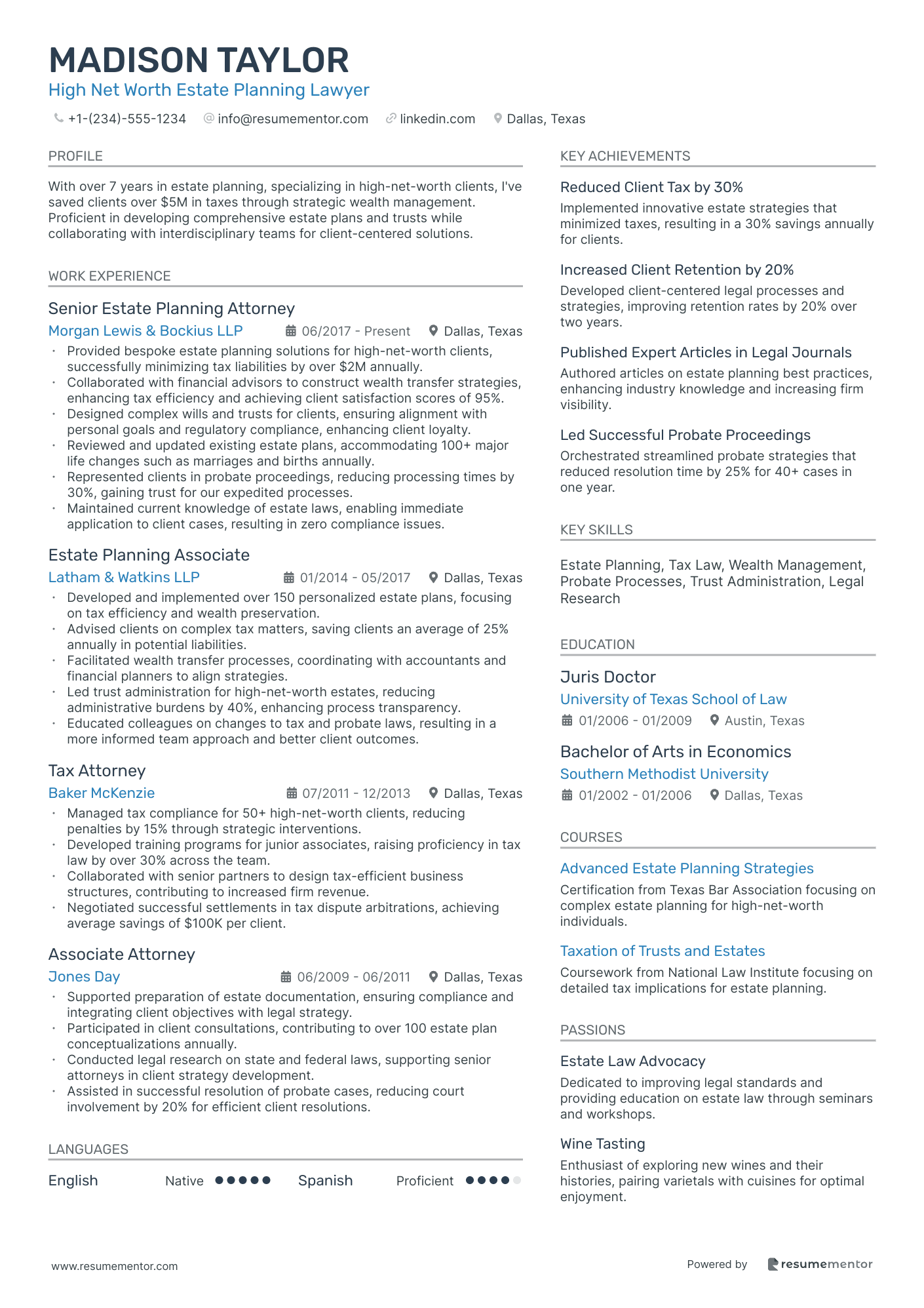

High Net Worth Estate Planning Lawyer resume sample

- •Provided bespoke estate planning solutions for high-net-worth clients, successfully minimizing tax liabilities by over $2M annually.

- •Collaborated with financial advisors to construct wealth transfer strategies, enhancing tax efficiency and achieving client satisfaction scores of 95%.

- •Designed complex wills and trusts for clients, ensuring alignment with personal goals and regulatory compliance, enhancing client loyalty.

- •Reviewed and updated existing estate plans, accommodating 100+ major life changes such as marriages and births annually.

- •Represented clients in probate proceedings, reducing processing times by 30%, gaining trust for our expedited processes.

- •Maintained current knowledge of estate laws, enabling immediate application to client cases, resulting in zero compliance issues.

- •Developed and implemented over 150 personalized estate plans, focusing on tax efficiency and wealth preservation.

- •Advised clients on complex tax matters, saving clients an average of 25% annually in potential liabilities.

- •Facilitated wealth transfer processes, coordinating with accountants and financial planners to align strategies.

- •Led trust administration for high-net-worth estates, reducing administrative burdens by 40%, enhancing process transparency.

- •Educated colleagues on changes to tax and probate laws, resulting in a more informed team approach and better client outcomes.

- •Managed tax compliance for 50+ high-net-worth clients, reducing penalties by 15% through strategic interventions.

- •Developed training programs for junior associates, raising proficiency in tax law by over 30% across the team.

- •Collaborated with senior partners to design tax-efficient business structures, contributing to increased firm revenue.

- •Negotiated successful settlements in tax dispute arbitrations, achieving average savings of $100K per client.

- •Supported preparation of estate documentation, ensuring compliance and integrating client objectives with legal strategy.

- •Participated in client consultations, contributing to over 100 estate plan conceptualizations annually.

- •Conducted legal research on state and federal laws, supporting senior attorneys in client strategy development.

- •Assisted in successful resolution of probate cases, reducing court involvement by 20% for efficient client resolutions.

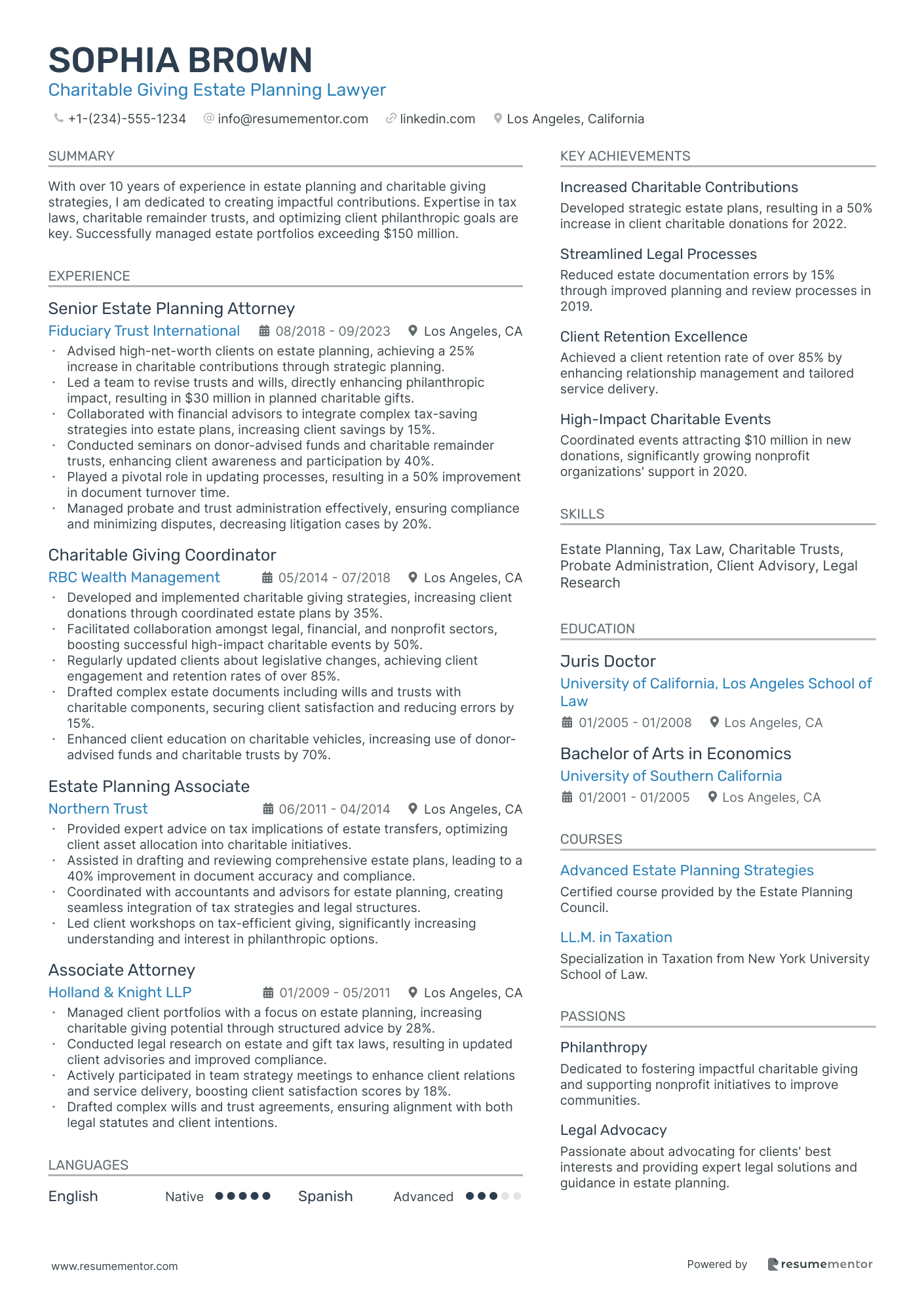

Charitable Giving Estate Planning Lawyer resume sample

- •Advised high-net-worth clients on estate planning, achieving a 25% increase in charitable contributions through strategic planning.

- •Led a team to revise trusts and wills, directly enhancing philanthropic impact, resulting in $30 million in planned charitable gifts.

- •Collaborated with financial advisors to integrate complex tax-saving strategies into estate plans, increasing client savings by 15%.

- •Conducted seminars on donor-advised funds and charitable remainder trusts, enhancing client awareness and participation by 40%.

- •Played a pivotal role in updating processes, resulting in a 50% improvement in document turnover time.

- •Managed probate and trust administration effectively, ensuring compliance and minimizing disputes, decreasing litigation cases by 20%.

- •Developed and implemented charitable giving strategies, increasing client donations through coordinated estate plans by 35%.

- •Facilitated collaboration amongst legal, financial, and nonprofit sectors, boosting successful high-impact charitable events by 50%.

- •Regularly updated clients about legislative changes, achieving client engagement and retention rates of over 85%.

- •Drafted complex estate documents including wills and trusts with charitable components, securing client satisfaction and reducing errors by 15%.

- •Enhanced client education on charitable vehicles, increasing use of donor-advised funds and charitable trusts by 70%.

- •Provided expert advice on tax implications of estate transfers, optimizing client asset allocation into charitable initiatives.

- •Assisted in drafting and reviewing comprehensive estate plans, leading to a 40% improvement in document accuracy and compliance.

- •Coordinated with accountants and advisors for estate planning, creating seamless integration of tax strategies and legal structures.

- •Led client workshops on tax-efficient giving, significantly increasing understanding and interest in philanthropic options.

- •Managed client portfolios with a focus on estate planning, increasing charitable giving potential through structured advice by 28%.

- •Conducted legal research on estate and gift tax laws, resulting in updated client advisories and improved compliance.

- •Actively participated in team strategy meetings to enhance client relations and service delivery, boosting client satisfaction scores by 18%.

- •Drafted complex wills and trust agreements, ensuring alignment with both legal statutes and client intentions.

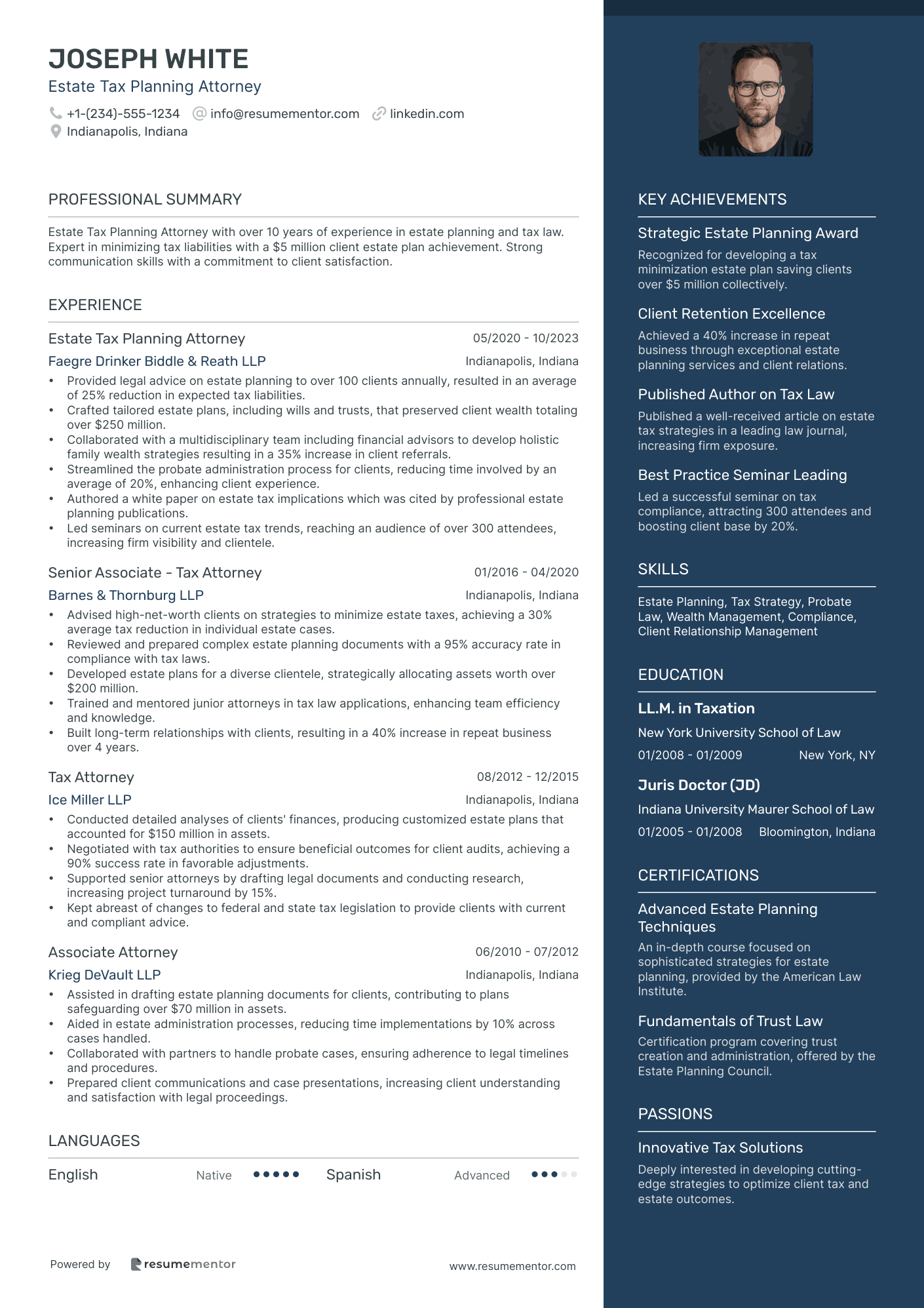

Estate Tax Planning Attorney resume sample

- •Provided legal advice on estate planning to over 100 clients annually, resulted in an average of 25% reduction in expected tax liabilities.

- •Crafted tailored estate plans, including wills and trusts, that preserved client wealth totaling over $250 million.

- •Collaborated with a multidisciplinary team including financial advisors to develop holistic family wealth strategies resulting in a 35% increase in client referrals.

- •Streamlined the probate administration process for clients, reducing time involved by an average of 20%, enhancing client experience.

- •Authored a white paper on estate tax implications which was cited by professional estate planning publications.

- •Led seminars on current estate tax trends, reaching an audience of over 300 attendees, increasing firm visibility and clientele.

- •Advised high-net-worth clients on strategies to minimize estate taxes, achieving a 30% average tax reduction in individual estate cases.

- •Reviewed and prepared complex estate planning documents with a 95% accuracy rate in compliance with tax laws.

- •Developed estate plans for a diverse clientele, strategically allocating assets worth over $200 million.

- •Trained and mentored junior attorneys in tax law applications, enhancing team efficiency and knowledge.

- •Built long-term relationships with clients, resulting in a 40% increase in repeat business over 4 years.

- •Conducted detailed analyses of clients' finances, producing customized estate plans that accounted for $150 million in assets.

- •Negotiated with tax authorities to ensure beneficial outcomes for client audits, achieving a 90% success rate in favorable adjustments.

- •Supported senior attorneys by drafting legal documents and conducting research, increasing project turnaround by 15%.

- •Kept abreast of changes to federal and state tax legislation to provide clients with current and compliant advice.

- •Assisted in drafting estate planning documents for clients, contributing to plans safeguarding over $70 million in assets.

- •Aided in estate administration processes, reducing time implementations by 10% across cases handled.

- •Collaborated with partners to handle probate cases, ensuring adherence to legal timelines and procedures.

- •Prepared client communications and case presentations, increasing client understanding and satisfaction with legal proceedings.

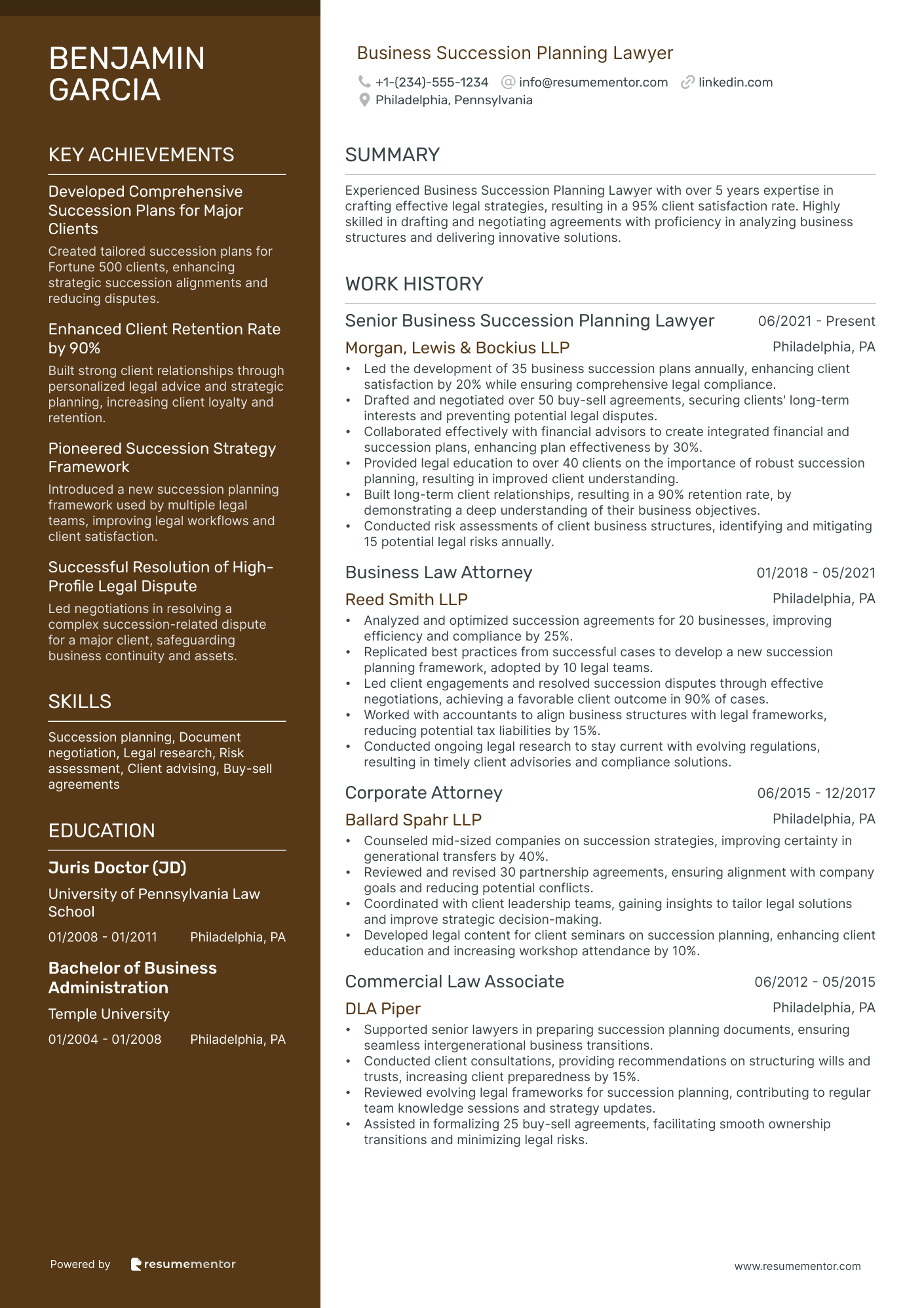

Business Succession Planning Lawyer resume sample

- •Led the development of 35 business succession plans annually, enhancing client satisfaction by 20% while ensuring comprehensive legal compliance.

- •Drafted and negotiated over 50 buy-sell agreements, securing clients' long-term interests and preventing potential legal disputes.

- •Collaborated effectively with financial advisors to create integrated financial and succession plans, enhancing plan effectiveness by 30%.

- •Provided legal education to over 40 clients on the importance of robust succession planning, resulting in improved client understanding.

- •Built long-term client relationships, resulting in a 90% retention rate, by demonstrating a deep understanding of their business objectives.

- •Conducted risk assessments of client business structures, identifying and mitigating 15 potential legal risks annually.

- •Analyzed and optimized succession agreements for 20 businesses, improving efficiency and compliance by 25%.

- •Replicated best practices from successful cases to develop a new succession planning framework, adopted by 10 legal teams.

- •Led client engagements and resolved succession disputes through effective negotiations, achieving a favorable client outcome in 90% of cases.

- •Worked with accountants to align business structures with legal frameworks, reducing potential tax liabilities by 15%.

- •Conducted ongoing legal research to stay current with evolving regulations, resulting in timely client advisories and compliance solutions.

- •Counseled mid-sized companies on succession strategies, improving certainty in generational transfers by 40%.

- •Reviewed and revised 30 partnership agreements, ensuring alignment with company goals and reducing potential conflicts.

- •Coordinated with client leadership teams, gaining insights to tailor legal solutions and improve strategic decision-making.

- •Developed legal content for client seminars on succession planning, enhancing client education and increasing workshop attendance by 10%.

- •Supported senior lawyers in preparing succession planning documents, ensuring seamless intergenerational business transitions.

- •Conducted client consultations, providing recommendations on structuring wills and trusts, increasing client preparedness by 15%.

- •Reviewed evolving legal frameworks for succession planning, contributing to regular team knowledge sessions and strategy updates.

- •Assisted in formalizing 25 buy-sell agreements, facilitating smooth ownership transitions and minimizing legal risks.

Special Needs Trust Attorney resume sample

- •Provided expert legal counsel to 150+ clients on special needs trust creation, improving estate planning outcomes by 40%.

- •Drafted over 200 legal documents annually, ensuring 100% compliance with state regulations and increasing client retention.

- •Collaborated with multidisciplinary teams, leading to a 25% improvement in case management and client success.

- •Successfully represented clients in 50+ legal proceedings, maintaining a success rate of 90% in favorable resolutions.

- •Regularly updated clients and staff on new laws, resulting in a 15% increase in trust plan accuracy.

- •Implemented client education initiatives, reaching over 1,000 community members and raising awareness on special needs planning.

- •Advised 75+ families annually on elder law issues, enhancing their understanding of Medicaid and SSI benefits.

- •Created a comprehensive trust administration system, resulting in a 30% increase in process efficiency.

- •Delivered engaging client workshops, increasing community knowledge by 50% on special needs and elder laws.

- •Collaborated with financial analysts to optimize trust structures, yielding a 20% increase in client asset protection.

- •Improved client satisfaction scores by 35% through personalized service and clear communication.

- •Drafted and reviewed 100+ wills annually, enhancing the estate planning for clients across diverse demographics.

- •Managed complex trust setups, increasing client trust portfolios by an average of 20%.

- •Spearheaded a project focused on reducing legal documentation errors, decreasing mistakes by 15% within a year.

- •Worked with financial planners to create holistic solutions for clients, achieving a 40% satisfaction rate improvement.

- •Assisted in trust litigation cases, contributing to a 90% success rate in court outcomes.

- •Provided legal advice to clients on estate management, achieving a 30% improvement in estate value protection.

- •Enhanced client outreach strategies, increasing the firm's client base by 25%.

- •Performed over 200 client consultations annually, optimizing estate planning and legal strategies.

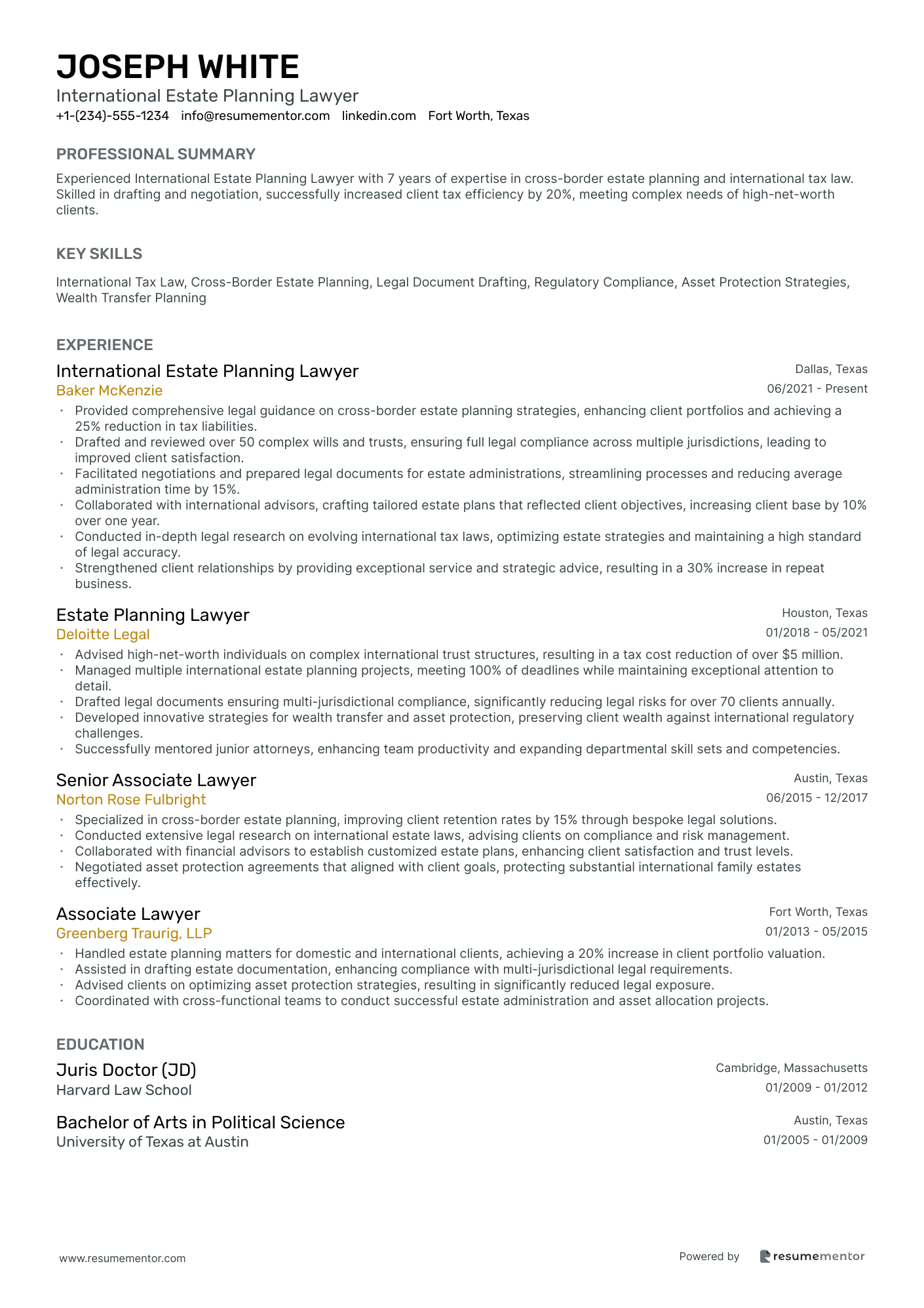

International Estate Planning Lawyer resume sample

- •Provided comprehensive legal guidance on cross-border estate planning strategies, enhancing client portfolios and achieving a 25% reduction in tax liabilities.

- •Drafted and reviewed over 50 complex wills and trusts, ensuring full legal compliance across multiple jurisdictions, leading to improved client satisfaction.

- •Facilitated negotiations and prepared legal documents for estate administrations, streamlining processes and reducing average administration time by 15%.

- •Collaborated with international advisors, crafting tailored estate plans that reflected client objectives, increasing client base by 10% over one year.

- •Conducted in-depth legal research on evolving international tax laws, optimizing estate strategies and maintaining a high standard of legal accuracy.

- •Strengthened client relationships by providing exceptional service and strategic advice, resulting in a 30% increase in repeat business.

- •Advised high-net-worth individuals on complex international trust structures, resulting in a tax cost reduction of over $5 million.

- •Managed multiple international estate planning projects, meeting 100% of deadlines while maintaining exceptional attention to detail.

- •Drafted legal documents ensuring multi-jurisdictional compliance, significantly reducing legal risks for over 70 clients annually.

- •Developed innovative strategies for wealth transfer and asset protection, preserving client wealth against international regulatory challenges.

- •Successfully mentored junior attorneys, enhancing team productivity and expanding departmental skill sets and competencies.

- •Specialized in cross-border estate planning, improving client retention rates by 15% through bespoke legal solutions.

- •Conducted extensive legal research on international estate laws, advising clients on compliance and risk management.

- •Collaborated with financial advisors to establish customized estate plans, enhancing client satisfaction and trust levels.

- •Negotiated asset protection agreements that aligned with client goals, protecting substantial international family estates effectively.

- •Handled estate planning matters for domestic and international clients, achieving a 20% increase in client portfolio valuation.

- •Assisted in drafting estate documentation, enhancing compliance with multi-jurisdictional legal requirements.

- •Advised clients on optimizing asset protection strategies, resulting in significantly reduced legal exposure.

- •Coordinated with cross-functional teams to conduct successful estate administration and asset allocation projects.

As an estate planning attorney, crafting a compelling resume is like drafting an air-tight will; it demands precision and foresight. You work at the intersection of law and human experience, which makes integrating your skills in trust creation, tax law, and asset protection into a single page challenging. Translating these complex abilities into clear, concise language is crucial for capturing an employer’s attention.

The job market is competitive, and a polished resume is your key to standing out. Without a strategic approach, even the most experienced attorney might struggle to make an impact. This is where a well-designed resume template can make all the difference. It provides a clear framework to organize your achievements, skills, and career progression, ensuring that your expertise doesn’t get lost in clutter.

A good template illuminates your strengths, making it easier for potential employers to understand your qualifications. By avoiding the pitfalls of a cluttered or generic document, you ensure your career journey takes center stage. Whether you're aspiring to join a prestigious law firm or start your own practice, a well-crafted resume will significantly boost your job search efforts.

Key Takeaways

- Your estate planning lawyer resume should clearly communicate expertise in navigating legal matters related to wills, trusts, and estate management, emphasizing analytical skills and attention to detail.

- Contact information should be professional and complete, while the resume should effectively highlight work experience, education, and licenses to validate your qualifications.

- Choosing a reverse-chronological format can effectively showcase recent experiences, while strategic use of impactful action words in the experience section underscores your influence.

- Skills highlighted should include both hard skills like legal document drafting and soft skills such as empathy and communication, serving as keywords for applicant tracking systems.

- Certificates and education should focus on relevant legal qualifications, ensuring your resume remains succinct and tailored to demonstrate expertise and commitment to the field.

What to focus on when writing your estate planning lawyer resume

Your estate planning lawyer resume should clearly communicate your expertise in navigating legal matters related to wills, trusts, and estate management. This involves emphasizing your analytical skills, keen attention to detail, and your ability to guide clients through complex processes. Demonstrating how you balance empathy with legal precision can further strengthen your application.

How to structure your estate planning lawyer resume

- Contact Information—having your full name, phone number, professional email address, and LinkedIn profile is essential. This section establishes the first point of connection with the recruiter, so ensure it's current and professional. Providing a complete and streamlined way for recruiters to reach you is the foundation of your resume.

- Professional Summary—this brief section should encapsulate your professional identity and highlight key achievements and skills specific to estate planning. It allows you to convey passion and expertise in the field, acting as your personal marketing statement. Think of it as setting the stage for everything else in your resume.

- Work Experience—focus on relevant positions that truly showcase your ability to draft wills, manage trusts, and provide tax advice. This area allows you to tell the story of your professional journey through achievements and responsibilities. Articulate how these roles contributed to your growth and expertise in estate planning.

- Education—list your law degree and pertinent certifications, mentioning coursework or honors related to estate planning or tax law here demonstrates your specialized knowledge. This section reinforces the academic foundation that underpins your professional capabilities, highlighting your preparation for the challenges of the field.

- Skills—the section should underline estate planning abilities such as trust and estate tax planning, probate processes, and client relationship management. Including skills with legal software can give you an edge by showing your capability to integrate technology into your practice. This section provides a quick scan of your core competencies.

- Licenses and Certifications—detail your Bar admission(s) and any certifications related to estate planning or other legal areas, as these validate your credentials and legal ability to practice. This concrete evidence of your qualifications supports the expertise claimed in previous sections.

To add further depth, consider optional sections like "Awards and Honors" or "Professional Affiliations" that highlight your accomplishments and connections in the field of estate planning law. With a solid understanding of these key resume sections, this guide will now delve deeper into each part, ensuring you’re equipped to create a standout estate planning lawyer resume.

Which resume format to choose

As an estate planning lawyer, selecting the right resume format is crucial for showcasing your expertise effectively. The reverse-chronological layout works best in highlighting your most recent and relevant experiences, which is vital in a field where up-to-date knowledge and practice matter. Make your resume visually appealing and professional with fonts like Raleway, Montserrat, or Lato. These modern fonts ensure that your information remains clear and inviting without distracting from the content. It’s also important to save your resume as a PDF. This file type keeps your layout and formatting consistent, so your resume looks just as you intended on any device. Proper formatting extends to margins, too. Setting them to one inch on all sides gives your document a neat structure, making it easy for a hiring manager to read through your credentials. By attending to these nuances, your resume will effectively communicate your skills and professionalism in the legal industry.

How to write a quantifiable resume experience section

A well-crafted experience section is essential for an estate planning lawyer's resume, as it seamlessly highlights your career journey and notable achievements. Focus on providing specific and relevant details that paint a clear picture of your skills. Organize your jobs in reverse chronological order, starting with your most recent position, and keep your history to the last 10-15 years unless earlier roles are particularly relevant. Choose job titles that clearly convey your responsibilities, like Partner or Associate, and tailor each resume to the specific job by using impactful action words. Words like "developed," "negotiated," and "implemented" not only describe your actions but also showcase your influence and expertise.

- •Increased client satisfaction scores by 30% with personalized estate planning solutions.

- •Negotiated complex will and trust agreements, cutting clients’ tax liabilities by 20%.

- •Led a team of 5 attorneys, boosting workflow efficiency by 15% through better processes.

- •Launched an estate planning seminar series, attracting over 100 new clients and increasing firm revenue by 25%.

The experience section effectively highlights your expertise with clear, measurable achievements, aligning each point with the employer's needs. Each bullet point builds upon the last, demonstrating not only improved client satisfaction and tax savings but also showcasing leadership and innovation. The use of action-oriented language makes your contributions stand out, creating a cohesive narrative that flows naturally. This structured approach enables hiring managers to easily follow your career progression while appreciating the value you bring. By integrating specific percentages and results, you communicate your unique strengths and further distinguish yourself in a competitive market.

Skills-Focused resume experience section

A skills-focused estate planning lawyer resume experience section should emphasize your legal expertise while showcasing accomplishments that highlight your capabilities in estate planning. Begin by listing past positions along with their dates, titles, and the names of the workplaces. This sets the stage for highlighting specific skills like client counseling, drafting legal documents, and navigating probate processes. Use bullet points to clearly outline each achievement, ensuring they reflect the most relevant skills for estate planning.

When crafting bullet points, aim to demonstrate your ability to effectively manage estate planning tasks. Highlight complex cases you've successfully handled or innovative solutions you've implemented, illustrating your problem-solving skills. Emphasize leadership roles and teamwork experiences to showcase your collaboration abilities. Use straightforward language to present your achievements and the impactful results you've achieved, making it evident that you possess the expertise and skill needed in estate planning law.

Estate Planning Lawyer

Smith & Associates Law Firm

June 2015 - Present

- Counseled over 100 clients on estate planning strategies, achieving a 95% satisfaction rate.

- Drafted more than 250 wills, trusts, and power of attorney documents, ensuring they met state laws.

- Led a team to streamline the probate process, cutting case resolution time by 30%.

- Launched a client education program that boosted referrals by 20% each year.

Achievement-Focused resume experience section

An achievement-focused estate planning lawyer resume experience section should clearly highlight your accomplishments and relevant skills. Begin by showcasing the significant achievements and responsibilities from each role. Use straightforward language and an active voice to emphasize the impact of your contributions. Where possible, quantify your success by noting details like the number of cases handled or the percentage of successful outcomes, which adds depth to your expertise. Tailor these examples to stress your proficiency in estate planning and your ability to deliver value to your clients and the firm.

Start each job entry with your title and employment dates, followed by bullet points that outline your roles and achievements. Focus on accomplishments demonstrating your technical knowledge in estate law, your problem-solving abilities, and innovative legal strategies. Highlight key skills such as analytical reasoning, client communication, attention to detail, and negotiation, which are crucial in estate planning. These elements together illustrate a comprehensive picture of your strengths and capabilities in the legal field.

Senior Estate Planning Lawyer

Stone & Taylor Law Group

January 2018 - Present

- Developed and implemented over 200 estate plans, leading to a 30% increase in client satisfaction.

- Led probate proceedings for more than 50 high-net-worth estates, ensuring smooth asset transfers.

- Negotiated and settled 90% of contested estate plans with outcomes favorable to clients.

- Authored articles on estate planning, earning recognition from the state bar association.

Efficiency-Focused resume experience section

An efficiency-focused estate planning lawyer resume experience section should effectively highlight your prowess in managing resources and time. Begin by demonstrating how you've simplified complex processes, consistently delivering quality legal services to your clients. Use clear, interconnected examples of your skills in prioritizing tasks, which lead to meeting deadlines without compromising client satisfaction. This approach should not only reflect your dedication but also showcase your capability to streamline operations and improve client outcomes seamlessly.

Further, incorporate specific achievements, ensuring each bullet point naturally flows from one to the next. Your language should be straightforward and impactful, with each entry demonstrating a significant role or achievement. This cohesion and clarity will give prospective employers a comprehensive insight into your abilities and accomplishments, highlighting your contribution to a more efficient legal practice.

Senior Estate Planning Attorney

Smith & Associates Law Firm

January 2018 - Present

- Streamlined document preparation and cut completion time by 30%.

- Rolled out a client intake system boosting satisfaction by 25%.

- Led a shift to digital filing, slashing paper use by 20%.

- Handled 100+ client caseload with a 95% success rate.

Result-Focused resume experience section

A result-focused estate planning lawyer resume experience section should effectively demonstrate your accomplishments and the impact you've made. Begin by highlighting areas where you've truly made a difference, whether through crafting effective estate plans, managing clients efficiently, or implementing successful legal strategies. Use clear action verbs and quantify your achievements to illustrate not just what you've done, but how it made a positive impact. This approach skillfully communicates your expertise and showcases the unique value you bring to clients and potential employers.

In detailing your experience, concentrate on how your actions benefited clients or your firm, especially where you exceeded standard responsibilities. This portion of your resume is your chance to spotlight how your skills led to tangible improvements. Make sure to connect your experience directly to the skills that are most relevant to the job you’re applying for, and use straightforward language for clarity. This will help keep your narrative cohesive and engaging.

Senior Estate Planning Lawyer

Prestige Law Firm

2020 - 2023

- Developed over 150 comprehensive estate plans that minimized tax liabilities by up to 25%, ensuring clients preserved more of their wealth.

- Led a team in executing trust agreements for high-net-worth individuals, improving asset protection and client satisfaction scores by 30%.

- Advised clients on strategic charitable donations, resulting in $2 million directed to community organizations and significant tax benefits.

- Negotiated complex family trusts in contentious circumstances, maintaining family harmony and achieving 100% dispute resolution success.

Write your estate planning lawyer resume summary section

A resume summary for an estate planning lawyer should zero in on the strengths and achievements that make you stand out. This section offers a snapshot of your career, clearly showing why you're the perfect fit for the role. By using strong, direct language tailored to the specific job you're targeting, you highlight your qualifications. Instead of vague statements, focus on concrete results and the value you've added in previous positions. This approach helps keep the reader’s attention. Here's an example:

In this example, the lawyer emphasizes extensive experience and key skills like attention to detail and handling complex cases. Strengths in collaboration and client satisfaction are highlighted, underscoring why these traits matter in the legal field. Understanding the differences in resume components helps too: a summary provides an overview of your professional background, while an objective outlines career goals. A resume profile offers a broader view of your skills and experiences, whereas a summary of qualifications lists your top skills and achievements. Knowing these distinctions guides you in choosing the right format based on your experience and the job's requirements.

Listing your estate planning lawyer skills on your resume

A skills-focused estate planning lawyer resume should thoughtfully integrate your abilities throughout the document. Your skills can be highlighted in a standalone section or woven into other parts like your experience or summary. Start by emphasizing your strengths and soft skills, such as communication and empathy, which are crucial for building strong client relationships. These are complemented by hard skills, including drafting legal documents or mastering tax laws, which demonstrate your technical proficiency.

Incorporating these skills and strengths strategically throughout your resume serves as a way to use them as keywords. This approach not only captures the attention of potential employers but also enhances your visibility in applicant tracking systems, making you a more attractive candidate.

Here's an example of an effective standalone skills section:

This skills section effectively highlights essential abilities for estate planning lawyers. Each skill is clearly articulated, emphasizing the competencies that employers seek. The blend of hard and soft skills needed for legal practice presents you as a well-rounded professional.

Best hard skills to feature on your estate planning lawyer resume

For an estate planning lawyer, hard skills are vital in demonstrating your ability to handle the job's technical demands. These skills show your expertise in managing client cases and crafting estate plans:

Hard Skills

- Drafting legal documents

- Estate planning strategies

- Tax law knowledge

- Legal research

- Trust administration

- Probate proceedings

- Wealth management

- Asset protection

- Courtroom experience

- Retirement planning

- Property law

- Business succession planning

- Digital estate planning

- Financial analysis

- Risk assessment

Best soft skills to feature on your estate planning lawyer resume

In your role, soft skills play a crucial part, highlighting your interpersonal abilities. These skills show your capacity to engage with clients and collaborate effectively with colleagues:

Soft Skills

- Empathy

- Communication skills

- Attention to detail

- Problem solving

- Negotiation

- Conflict resolution

- Organization

- Time management

- Critical thinking

- Active listening

- Adaptability

- Client relations

- Teamwork

- Creative thinking

- Discretion

How to include your education on your resume

The education section of your resume is crucial in showcasing your qualifications and expertise, especially for specialized fields like estate planning law. This part of your resume should highlight relevant education that aligns with the job you are applying for. Avoid including unrelated coursework or degrees, as this may dilute your focus. If your GPA is impressive, consider including it; you can list it as "GPA: X.XX/4.00" to provide context. Academic honors such as cum laude should be highlighted next to your degree to demonstrate your academic excellence. When listing a degree, clearly state the name of the degree, followed by the institution, and any pertinent dates.

Here's a poorly formatted education section:

And here's a well-crafted example:

The second example is effective because it includes pertinent information that aligns with a career in estate planning law. The degree, listed with honors, adds credibility and impresses potential employers. Including the GPA of 3.8/4.0 further underscores academic achievement. The section is succinct, relevant, and tailored to appeal to those seeking legal expertise. Emphasizing critical legal education while leaving out unrelated degrees keeps your resume focused and professional.

How to include estate planning lawyer certificates on your resume

Adding a certificates section to your estate planning lawyer resume is crucial. Certificates validate your skills and expertise. List the name of the certificate, include the date you earned it, and add the issuing organization. If you prefer to emphasize these credentials, you can also include them in your resume header.

For example, you can write in the header: "John Doe, Estate Planning Lawyer, J.D., LL.M., Certified Specialist in Estate Planning from the State Bar of California."

Here is a good standalone certificates section example:

This example works well because it focuses on certifications relevant to estate planning. The certificates highlight advanced knowledge and specialization. They demonstrate not only competence but also commitment to the field, making you a strong candidate.

Extra sections to include in your estate planning lawyer resume

Navigating the intricate world of estate planning can be challenging, which is why it's crucial for an estate planning lawyer to present a well-rounded resume. A resume showcasing diverse skills and experiences can distinguish you in the competitive legal field.

Language section — Demonstrate fluency in multiple languages like Spanish, French, or Mandarin, as it broadens your client base and shows cultural competence.

Hobbies and interests section — Include activities like chess or reading legal literature, which highlight your analytical skills and passion for the field.

Volunteer work section — Discuss involvement in community legal aid programs, emphasizing your commitment to pro bono work and community service.

Books section — Mention relevant books you've read, such as "A Trustee's Handbook" or "The Complete Estate Planning Guide," showcasing your dedication to continuous learning.

In Conclusion

In conclusion, writing an effective estate planning lawyer resume calls for precision and careful organization, much like the legal documents you handle in your profession. By focusing on your unique blend of hard and soft skills, you can create a resume that stands out in a competitive market. Highlighting your technical abilities in drafting legal documents and navigating tax laws is essential, as well as showcasing your client relations skills and ability to manage complicated cases. Remember to include measurable achievements, such as increasing client satisfaction or streamlining probate processes, to demonstrate your capabilities. Properly structuring your resume with a clean format and modern fonts can ensure it captures the attention of potential employers. Additionally, integrating sections like education and certifications further validates your expertise and commitment to the field of estate planning. Extra sections such as language skills or volunteer work can add depth and illustrate your well-rounded professional profile. Ultimately, your resume should convey both your competency and your passion for estate planning, making it clear that you are the ideal candidate for any position in the legal industry. With careful attention to detail and strategic content placement, you can present yourself as a valuable asset to any legal team looking to excel in estate planning.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.