Finance and Accounting Associate Resume Examples

Jul 18, 2024

|

12 min read

Master the art of crafting your finance and accounting associate resume with our pun-filled guide, ensuring you tally up the job offers and balance your career moves effectively.

Rated by 348 people

Financial Reporting Associate

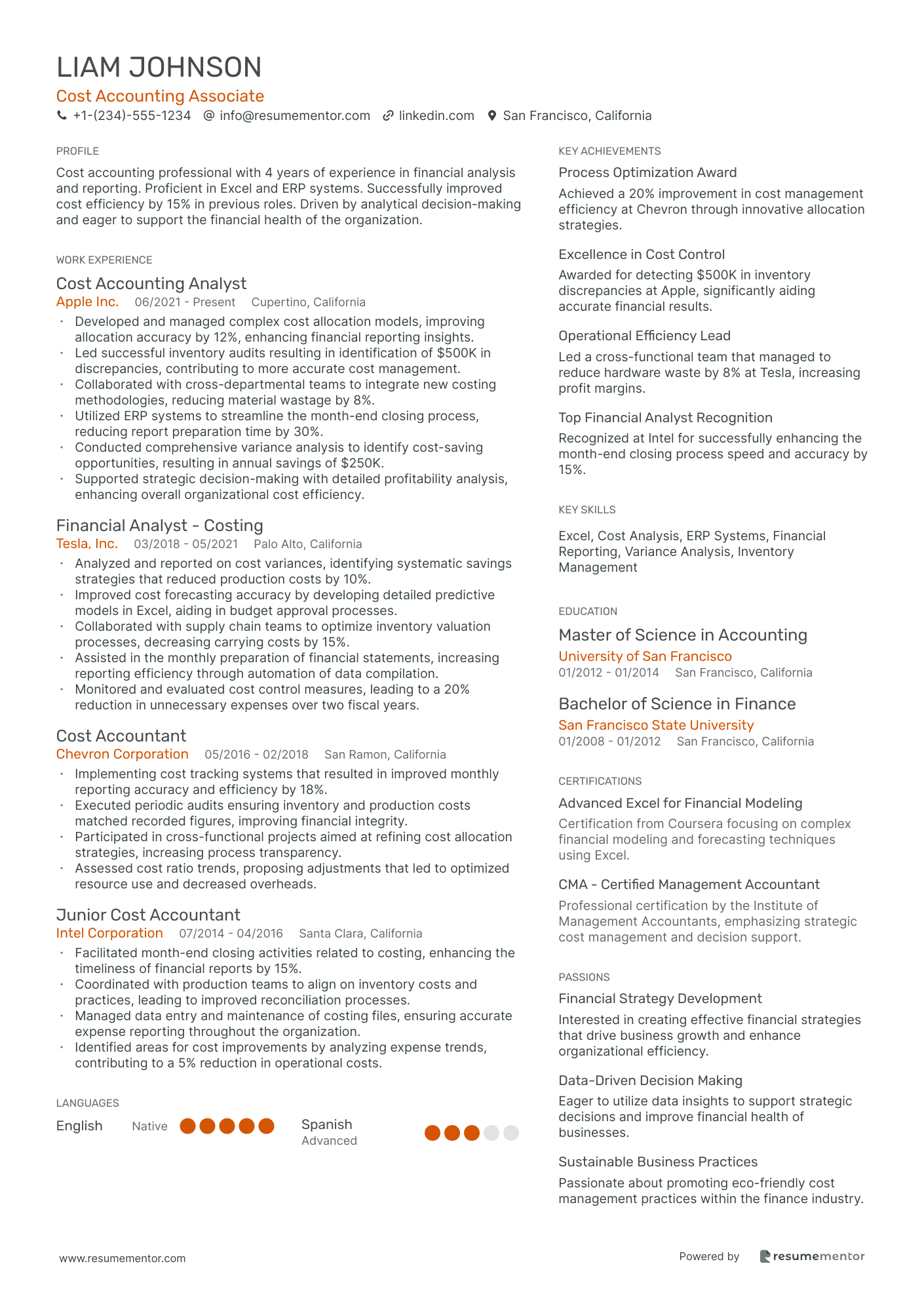

Cost Accounting Associate

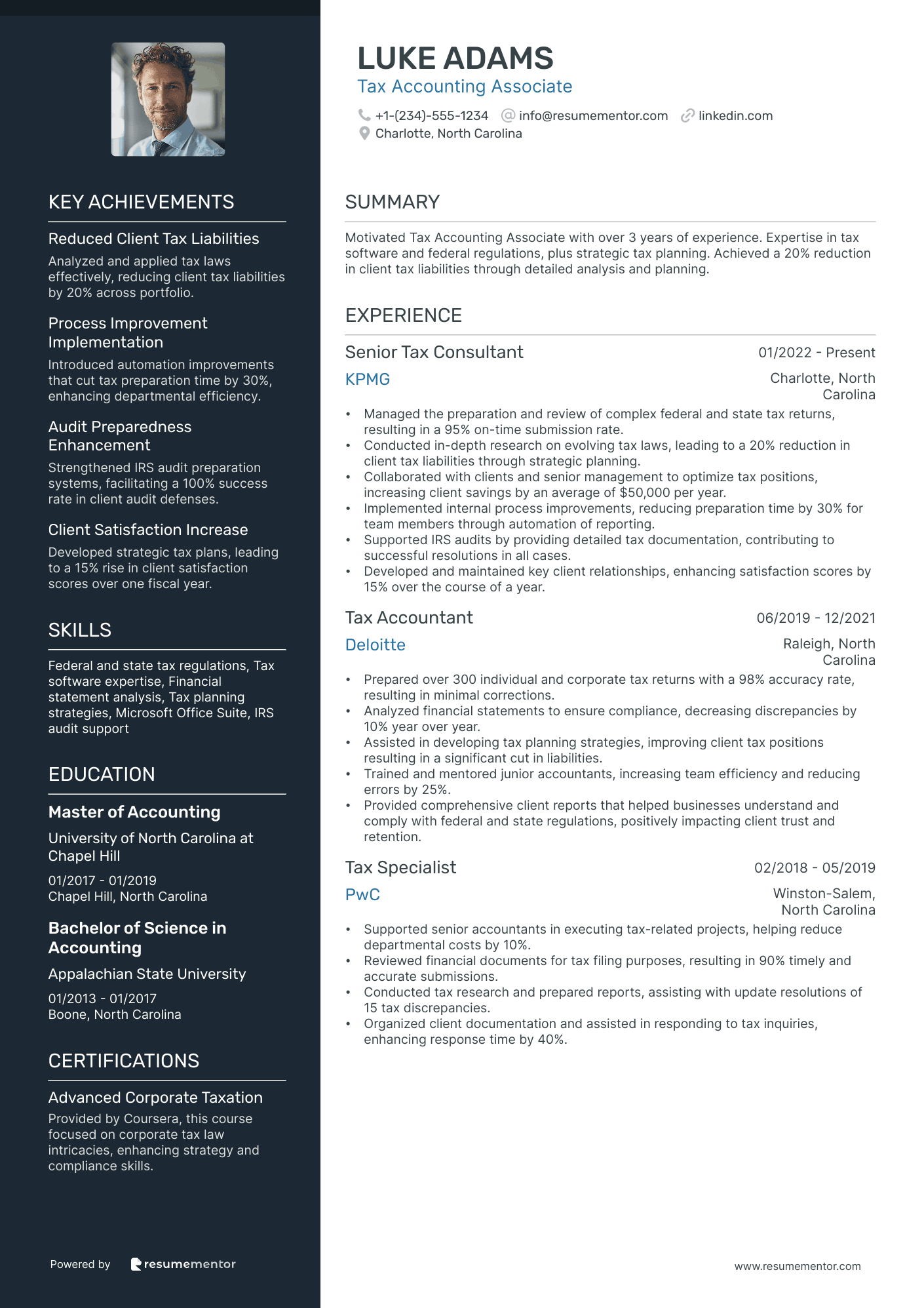

Tax Accounting Associate

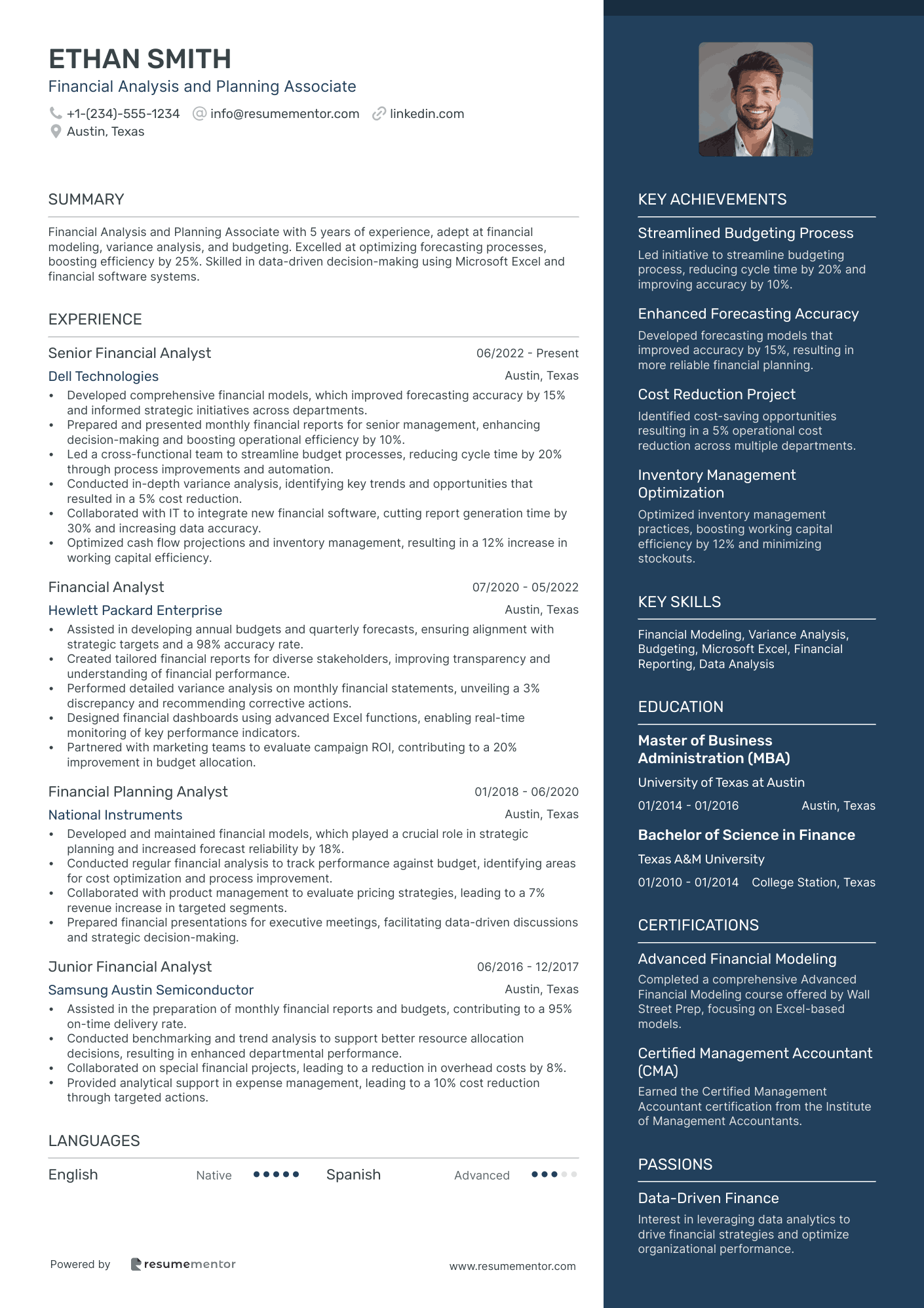

Financial Analysis and Planning Associate

Auditor and Accounting Associate

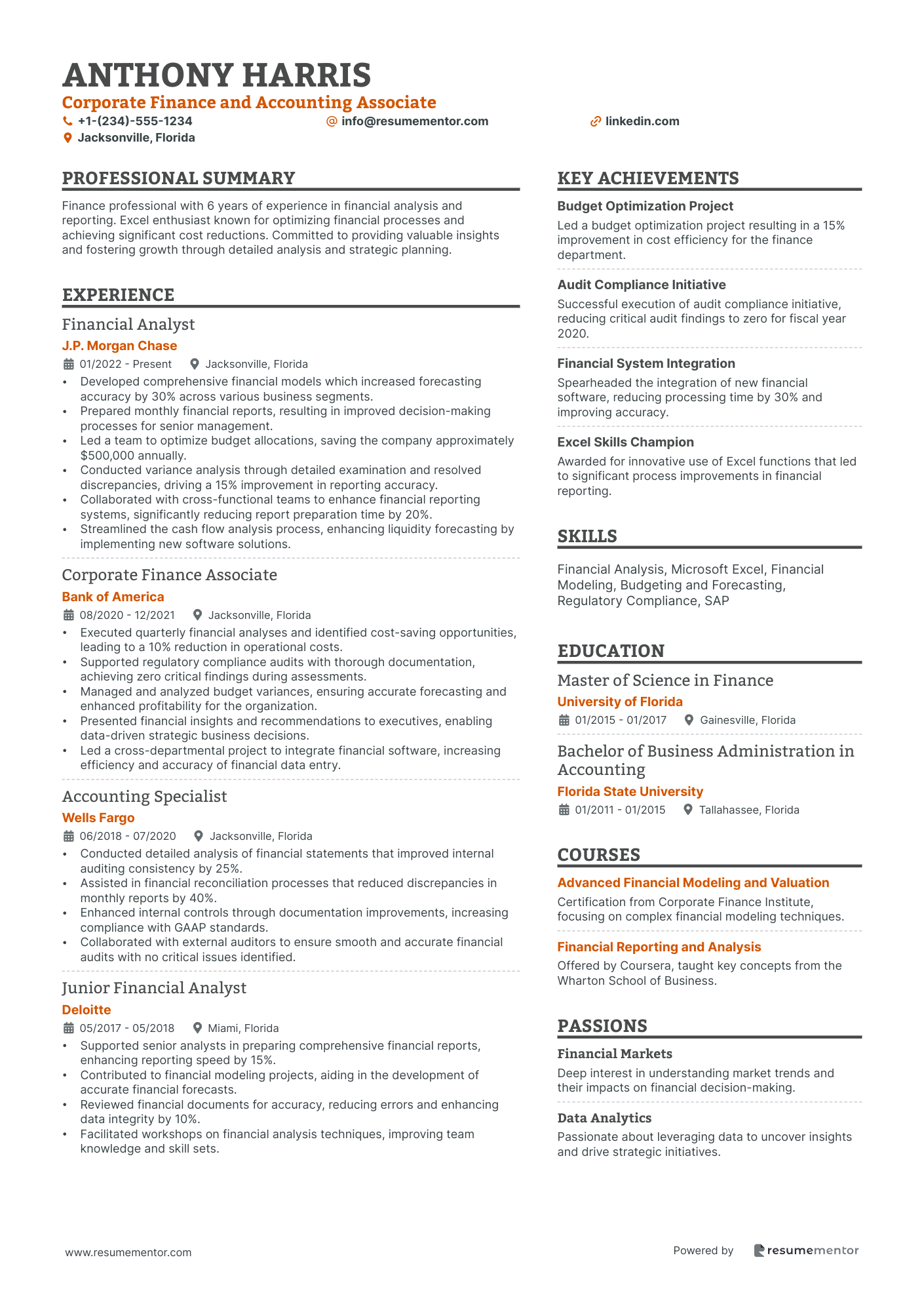

Corporate Finance and Accounting Associate

Risk Management and Finance Associate

Investment Accounting Associate

Payroll Accounting Associate

Treasury and Finance Associate

Financial Reporting Associate resume sample

- •Led the preparation of quarterly financial reports, boosting accuracy by 20% through meticulous data verification and review.

- •Streamlined the financial close process, reducing closing time from 7 to 5 days by implementing new software tools.

- •Analyzed financial statements to identify cost-saving opportunities, resulting in $200,000 annual savings.

- •Collaborated with cross-functional teams to improve budget forecasts, enhancing budgeting accuracy by 15%.

- •Managed external audit queries, providing detailed process explanations to satisfy regulatory compliance standards.

- •Upgraded financial reporting systems, enhancing data entry efficiency by 25% through workflow optimization.

- •Prepared monthly financial statements, achieving a 95% on-time delivery rate by improving data collection methods.

- •Collaborated with the finance team to resolve discrepancies, eliminating reporting errors by 10% within the first year.

- •Supported tax return preparation, contributing to a reduction in filing errors by 5% through detailed audits.

- •Enhanced financial reporting tools, resulting in a 10% increase in analyst team productivity.

- •Participated in financial strategy meetings, providing insights that contributed to a profit margin increase of 8%.

- •Assisted in the preparation of balance sheets, ensuring adherence to GAAP and improving compliance rates by 15%.

- •Conducted variance analysis to identify discrepancies, achieving a reduction in variances by 20%.

- •Supported internal audits by compiling necessary documentation, contributing to an audit pass rate of 98%.

- •Developed new financial tracking tools, enhancing reporting accuracy and decreasing manual entry errors by 25%.

- •Consulted on financial report preparation, resulting in a 30% increase in data submission accuracy.

- •Analyzed financial trends, leading to the identification of new growth opportunities improving revenue by 12%.

- •Advised on compliance with IFRS standards, reducing non-compliance incidents by 50%.

- •Developed custom financial models to project cash flows, enhancing forecasting reliability by 20%.

Cost Accounting Associate resume sample

- •Developed and managed complex cost allocation models, improving allocation accuracy by 12%, enhancing financial reporting insights.

- •Led successful inventory audits resulting in identification of $500K in discrepancies, contributing to more accurate cost management.

- •Collaborated with cross-departmental teams to integrate new costing methodologies, reducing material wastage by 8%.

- •Utilized ERP systems to streamline the month-end closing process, reducing report preparation time by 30%.

- •Conducted comprehensive variance analysis to identify cost-saving opportunities, resulting in annual savings of $250K.

- •Supported strategic decision-making with detailed profitability analysis, enhancing overall organizational cost efficiency.

- •Analyzed and reported on cost variances, identifying systematic savings strategies that reduced production costs by 10%.

- •Improved cost forecasting accuracy by developing detailed predictive models in Excel, aiding in budget approval processes.

- •Collaborated with supply chain teams to optimize inventory valuation processes, decreasing carrying costs by 15%.

- •Assisted in the monthly preparation of financial statements, increasing reporting efficiency through automation of data compilation.

- •Monitored and evaluated cost control measures, leading to a 20% reduction in unnecessary expenses over two fiscal years.

- •Implementing cost tracking systems that resulted in improved monthly reporting accuracy and efficiency by 18%.

- •Executed periodic audits ensuring inventory and production costs matched recorded figures, improving financial integrity.

- •Participated in cross-functional projects aimed at refining cost allocation strategies, increasing process transparency.

- •Assessed cost ratio trends, proposing adjustments that led to optimized resource use and decreased overheads.

- •Facilitated month-end closing activities related to costing, enhancing the timeliness of financial reports by 15%.

- •Coordinated with production teams to align on inventory costs and practices, leading to improved reconciliation processes.

- •Managed data entry and maintenance of costing files, ensuring accurate expense reporting throughout the organization.

- •Identified areas for cost improvements by analyzing expense trends, contributing to a 5% reduction in operational costs.

Tax Accounting Associate resume sample

- •Managed the preparation and review of complex federal and state tax returns, resulting in a 95% on-time submission rate.

- •Conducted in-depth research on evolving tax laws, leading to a 20% reduction in client tax liabilities through strategic planning.

- •Collaborated with clients and senior management to optimize tax positions, increasing client savings by an average of $50,000 per year.

- •Implemented internal process improvements, reducing preparation time by 30% for team members through automation of reporting.

- •Supported IRS audits by providing detailed tax documentation, contributing to successful resolutions in all cases.

- •Developed and maintained key client relationships, enhancing satisfaction scores by 15% over the course of a year.

- •Prepared over 300 individual and corporate tax returns with a 98% accuracy rate, resulting in minimal corrections.

- •Analyzed financial statements to ensure compliance, decreasing discrepancies by 10% year over year.

- •Assisted in developing tax planning strategies, improving client tax positions resulting in a significant cut in liabilities.

- •Trained and mentored junior accountants, increasing team efficiency and reducing errors by 25%.

- •Provided comprehensive client reports that helped businesses understand and comply with federal and state regulations, positively impacting client trust and retention.

- •Supported senior accountants in executing tax-related projects, helping reduce departmental costs by 10%.

- •Reviewed financial documents for tax filing purposes, resulting in 90% timely and accurate submissions.

- •Conducted tax research and prepared reports, assisting with update resolutions of 15 tax discrepancies.

- •Organized client documentation and assisted in responding to tax inquiries, enhancing response time by 40%.

- •Supported tax return preparation for both individual and corporate clients, achieving a 95% on-time completion rate.

- •Collaborated with senior staff to optimize client tax strategies, improving client savings by 10%.

- •Maintained comprehensive knowledge of evolving tax regulations, aiding in accurate and compliant filings.

- •Assisted in administrative functions and organized tax documentation, increasing team productivity by 15%.

Financial Analysis and Planning Associate resume sample

- •Developed comprehensive financial models, which improved forecasting accuracy by 15% and informed strategic initiatives across departments.

- •Prepared and presented monthly financial reports for senior management, enhancing decision-making and boosting operational efficiency by 10%.

- •Led a cross-functional team to streamline budget processes, reducing cycle time by 20% through process improvements and automation.

- •Conducted in-depth variance analysis, identifying key trends and opportunities that resulted in a 5% cost reduction.

- •Collaborated with IT to integrate new financial software, cutting report generation time by 30% and increasing data accuracy.

- •Optimized cash flow projections and inventory management, resulting in a 12% increase in working capital efficiency.

- •Assisted in developing annual budgets and quarterly forecasts, ensuring alignment with strategic targets and a 98% accuracy rate.

- •Created tailored financial reports for diverse stakeholders, improving transparency and understanding of financial performance.

- •Performed detailed variance analysis on monthly financial statements, unveiling a 3% discrepancy and recommending corrective actions.

- •Designed financial dashboards using advanced Excel functions, enabling real-time monitoring of key performance indicators.

- •Partnered with marketing teams to evaluate campaign ROI, contributing to a 20% improvement in budget allocation.

- •Developed and maintained financial models, which played a crucial role in strategic planning and increased forecast reliability by 18%.

- •Conducted regular financial analysis to track performance against budget, identifying areas for cost optimization and process improvement.

- •Collaborated with product management to evaluate pricing strategies, leading to a 7% revenue increase in targeted segments.

- •Prepared financial presentations for executive meetings, facilitating data-driven discussions and strategic decision-making.

- •Assisted in the preparation of monthly financial reports and budgets, contributing to a 95% on-time delivery rate.

- •Conducted benchmarking and trend analysis to support better resource allocation decisions, resulting in enhanced departmental performance.

- •Collaborated on special financial projects, leading to a reduction in overhead costs by 8%.

- •Provided analytical support in expense management, leading to a 10% cost reduction through targeted actions.

Auditor and Accounting Associate resume sample

- •Led a team of auditors in completing 20+ complex financial audits, resulting in a 15% improvement in accuracy for each client.

- •Redesigned audit processes, reducing review times by 30% while maintaining compliance with GAAP standards.

- •Identified financial discrepancies in 5 major audits leading to corrective measures, saving clients $500,000 collectively.

- •Facilitated cross-departmental collaborations to enhance financial reporting which improved stakeholder transparency by 25%.

- •Developed internal control assessment protocols enhancing efficiency, earning team-wide recognition for increased productivity.

- •Trained and mentored four junior auditors, improving team performance by 20% in key audit areas.

- •Analyzed financial reports, identifying discrepancies that increased financial accuracy by 20%.

- •Worked directly with management to implement cost-saving measures that reduced expenses by $250,000 annually.

- •Prepared and presented financial statements to executive teams with a 95% accuracy rate.

- •Collaborated on a team that designed automated accounting systems, decreasing manual data entry errors by 40%.

- •Coordinated with international clients and partners, maximizing global compliance and enhancing service quality by 30%.

- •Conducted detailed financial audits uncovering errors that led to $100,000 cost recoveries for clients.

- •Presented complex audit findings to clients and suggested actionable steps, improving their financial standing by 10%.

- •Revised internal financial policies, which increased operational transparency resulting in greater client trust.

- •Participated in the development of a client satisfaction survey increasing positive feedback by 20%.

- •Assisted in conducting financial audits, supporting senior auditors in completing projects 10% faster than scheduled.

- •Managed data collection processes making cataloging 15% more efficient, enhancing team workflows.

- •Developed detailed spreadsheets optimizing data analysis, greatly improving productivity in audit assessments.

- •Maintained rigorous compliance documentation resulting in a 100% pass rate on external legal audits.

Corporate Finance and Accounting Associate resume sample

- •Developed comprehensive financial models which increased forecasting accuracy by 30% across various business segments.

- •Prepared monthly financial reports, resulting in improved decision-making processes for senior management.

- •Led a team to optimize budget allocations, saving the company approximately $500,000 annually.

- •Conducted variance analysis through detailed examination and resolved discrepancies, driving a 15% improvement in reporting accuracy.

- •Collaborated with cross-functional teams to enhance financial reporting systems, significantly reducing report preparation time by 20%.

- •Streamlined the cash flow analysis process, enhancing liquidity forecasting by implementing new software solutions.

- •Executed quarterly financial analyses and identified cost-saving opportunities, leading to a 10% reduction in operational costs.

- •Supported regulatory compliance audits with thorough documentation, achieving zero critical findings during assessments.

- •Managed and analyzed budget variances, ensuring accurate forecasting and enhanced profitability for the organization.

- •Presented financial insights and recommendations to executives, enabling data-driven strategic business decisions.

- •Led a cross-departmental project to integrate financial software, increasing efficiency and accuracy of financial data entry.

- •Conducted detailed analysis of financial statements that improved internal auditing consistency by 25%.

- •Assisted in financial reconciliation processes that reduced discrepancies in monthly reports by 40%.

- •Enhanced internal controls through documentation improvements, increasing compliance with GAAP standards.

- •Collaborated with external auditors to ensure smooth and accurate financial audits with no critical issues identified.

- •Supported senior analysts in preparing comprehensive financial reports, enhancing reporting speed by 15%.

- •Contributed to financial modeling projects, aiding in the development of accurate financial forecasts.

- •Reviewed financial documents for accuracy, reducing errors and enhancing data integrity by 10%.

- •Facilitated workshops on financial analysis techniques, improving team knowledge and skill sets.

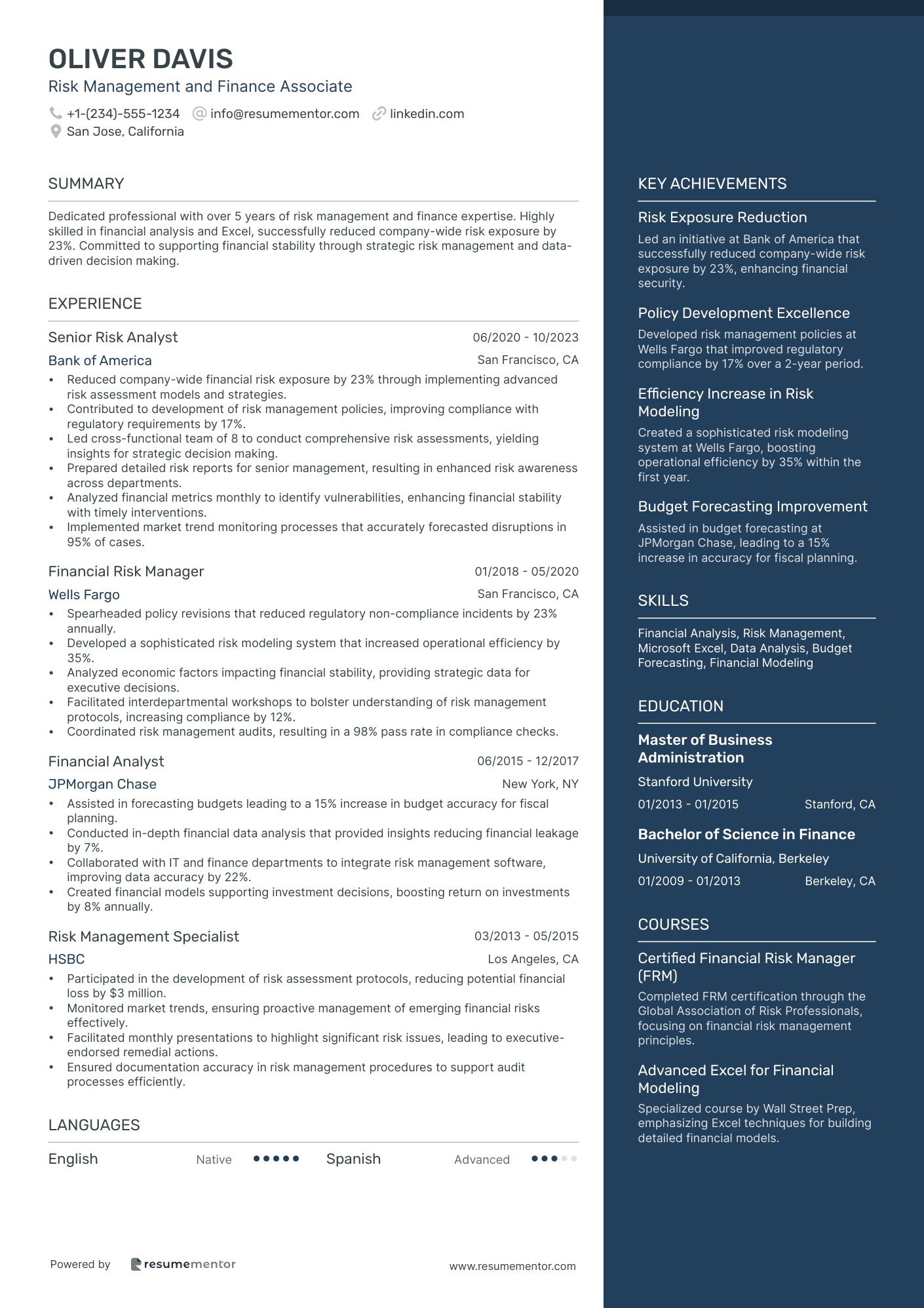

Risk Management and Finance Associate resume sample

- •Reduced company-wide financial risk exposure by 23% through implementing advanced risk assessment models and strategies.

- •Contributed to development of risk management policies, improving compliance with regulatory requirements by 17%.

- •Led cross-functional team of 8 to conduct comprehensive risk assessments, yielding insights for strategic decision making.

- •Prepared detailed risk reports for senior management, resulting in enhanced risk awareness across departments.

- •Analyzed financial metrics monthly to identify vulnerabilities, enhancing financial stability with timely interventions.

- •Implemented market trend monitoring processes that accurately forecasted disruptions in 95% of cases.

- •Spearheaded policy revisions that reduced regulatory non-compliance incidents by 23% annually.

- •Developed a sophisticated risk modeling system that increased operational efficiency by 35%.

- •Analyzed economic factors impacting financial stability, providing strategic data for executive decisions.

- •Facilitated interdepartmental workshops to bolster understanding of risk management protocols, increasing compliance by 12%.

- •Coordinated risk management audits, resulting in a 98% pass rate in compliance checks.

- •Assisted in forecasting budgets leading to a 15% increase in budget accuracy for fiscal planning.

- •Conducted in-depth financial data analysis that provided insights reducing financial leakage by 7%.

- •Collaborated with IT and finance departments to integrate risk management software, improving data accuracy by 22%.

- •Created financial models supporting investment decisions, boosting return on investments by 8% annually.

- •Participated in the development of risk assessment protocols, reducing potential financial loss by $3 million.

- •Monitored market trends, ensuring proactive management of emerging financial risks effectively.

- •Facilitated monthly presentations to highlight significant risk issues, leading to executive-endorsed remedial actions.

- •Ensured documentation accuracy in risk management procedures to support audit processes efficiently.

Investment Accounting Associate resume sample

- •Managed daily reconciliations of over 200 investment accounts, improving accuracy by reducing discrepancies by 30%.

- •Led a team in preparing quarterly financial reports, which enhanced compliance with SEC regulations and improved reporting timelines by 15%.

- •Streamlined the month-end closing process, reducing the closing period by 20% through implementing automation tools.

- •Collaborated with internal audit teams to resolve documentation gaps, ensuring complete compliance during annual audits.

- •Monitored regulatory updates and trained team members on GAAP changes, resulting in a 40% increase in compliance scores.

- •Championed a special project aimed at revamping internal processes, resulting in a 25% increase in efficiency.

- •Executed successful audits with zero compliance issues by improving internal documentation protocols.

- •Implemented automated solutions for daily transaction recording, decreasing manual errors by 50%.

- •Reviewed and adjusted investment entries, reducing discrepancies by enhancing accuracy by 25%.

- •Actively participated in cross-departmental strategy sessions, contributing to a 15% rise in overall portfolio returns.

- •Designed a training module for new hires, accelerating onboarding times by 10%.

- •Prepared accurate monthly financial statements, resulting in a 20% enhancement in board reporting effectiveness.

- •Optimized cash flow reporting procedures, decreasing report preparation time by 35%.

- •Facilitated a seamless transition to new accounting software, maximizing system performance and reducing downtime by 40%.

- •Developed valuation models that achieved 15% more precision, aiding investment strategies.

- •Reevaluated portfolio accounting frameworks, reducing reconciliation times by 25% across 150 investment accounts.

- •Supported month-end closing procedures, achieving timely submission of financial entries by ensuring accuracy.

- •Orchestrated inter-departmental meetings to address investment discrepancies, improving collaboration efficiency by 30%.

- •Spearheaded a project to improve income recognition processes, enhancing investment valuation by 10%.

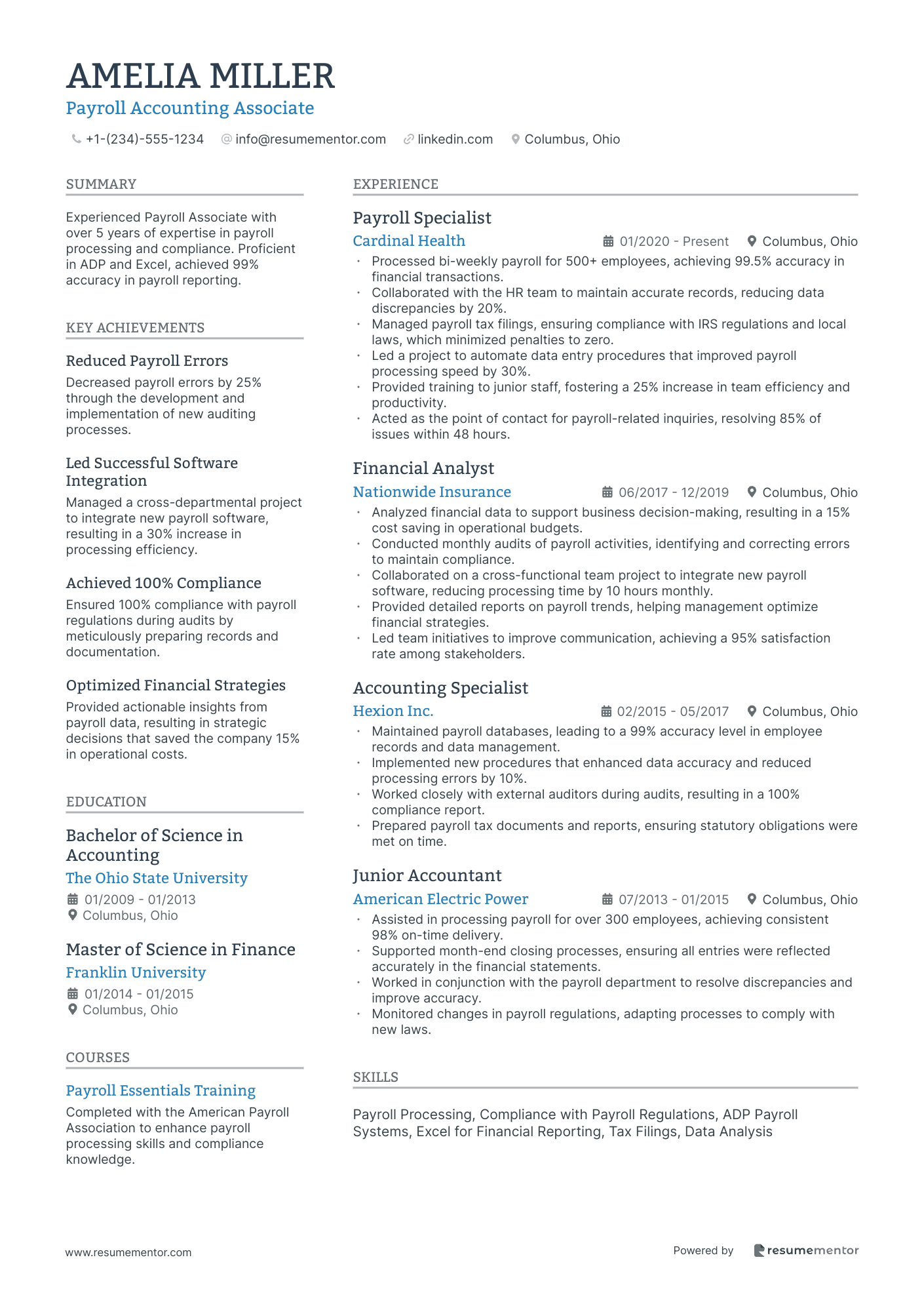

Payroll Accounting Associate resume sample

- •Processed bi-weekly payroll for 500+ employees, achieving 99.5% accuracy in financial transactions.

- •Collaborated with the HR team to maintain accurate records, reducing data discrepancies by 20%.

- •Managed payroll tax filings, ensuring compliance with IRS regulations and local laws, which minimized penalties to zero.

- •Led a project to automate data entry procedures that improved payroll processing speed by 30%.

- •Provided training to junior staff, fostering a 25% increase in team efficiency and productivity.

- •Acted as the point of contact for payroll-related inquiries, resolving 85% of issues within 48 hours.

- •Analyzed financial data to support business decision-making, resulting in a 15% cost saving in operational budgets.

- •Conducted monthly audits of payroll activities, identifying and correcting errors to maintain compliance.

- •Collaborated on a cross-functional team project to integrate new payroll software, reducing processing time by 10 hours monthly.

- •Provided detailed reports on payroll trends, helping management optimize financial strategies.

- •Led team initiatives to improve communication, achieving a 95% satisfaction rate among stakeholders.

- •Maintained payroll databases, leading to a 99% accuracy level in employee records and data management.

- •Implemented new procedures that enhanced data accuracy and reduced processing errors by 10%.

- •Worked closely with external auditors during audits, resulting in a 100% compliance report.

- •Prepared payroll tax documents and reports, ensuring statutory obligations were met on time.

- •Assisted in processing payroll for over 300 employees, achieving consistent 98% on-time delivery.

- •Supported month-end closing processes, ensuring all entries were reflected accurately in the financial statements.

- •Worked in conjunction with the payroll department to resolve discrepancies and improve accuracy.

- •Monitored changes in payroll regulations, adapting processes to comply with new laws.

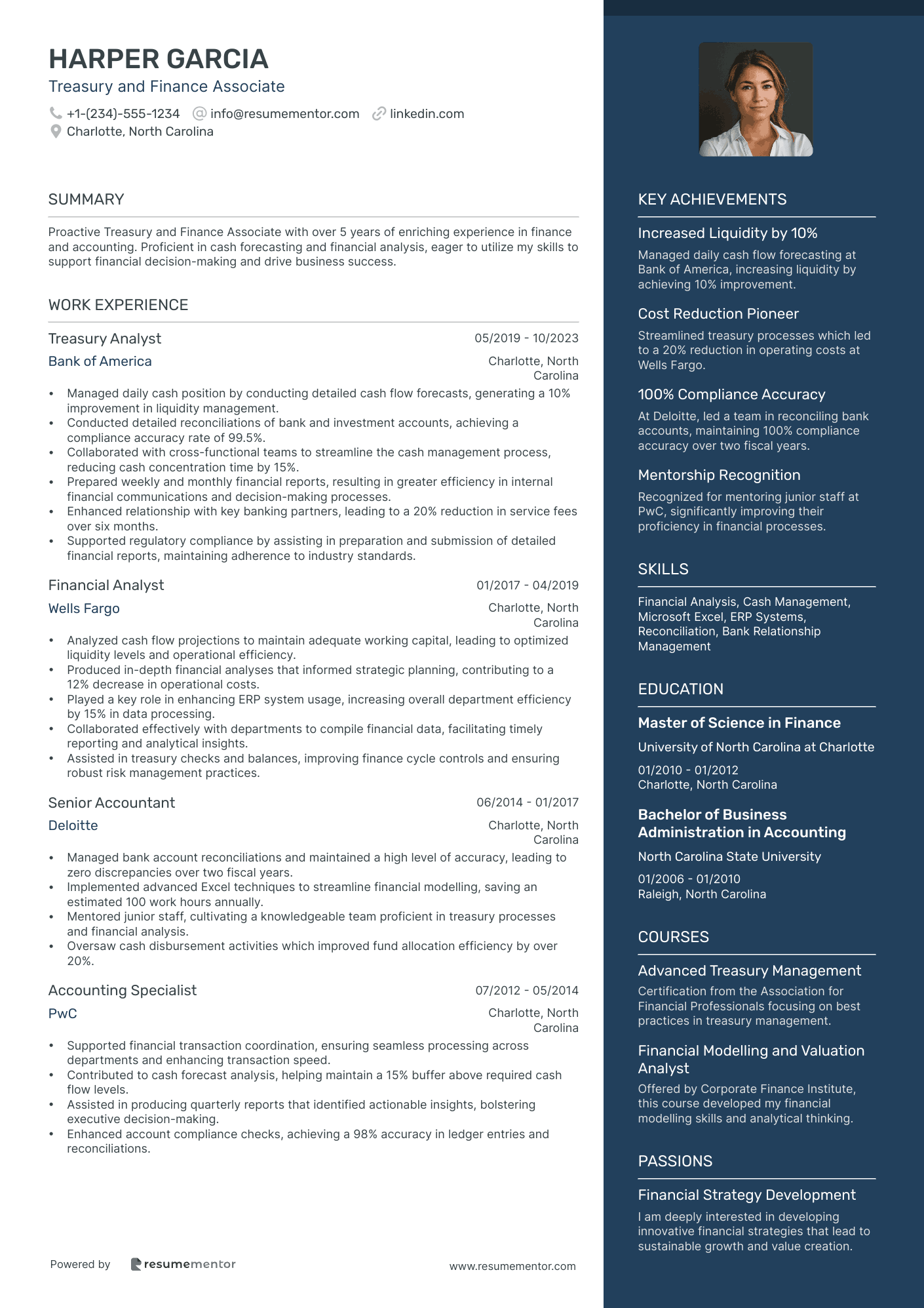

Treasury and Finance Associate resume sample

- •Managed daily cash position by conducting detailed cash flow forecasts, generating a 10% improvement in liquidity management.

- •Conducted detailed reconciliations of bank and investment accounts, achieving a compliance accuracy rate of 99.5%.

- •Collaborated with cross-functional teams to streamline the cash management process, reducing cash concentration time by 15%.

- •Prepared weekly and monthly financial reports, resulting in greater efficiency in internal financial communications and decision-making processes.

- •Enhanced relationship with key banking partners, leading to a 20% reduction in service fees over six months.

- •Supported regulatory compliance by assisting in preparation and submission of detailed financial reports, maintaining adherence to industry standards.

- •Analyzed cash flow projections to maintain adequate working capital, leading to optimized liquidity levels and operational efficiency.

- •Produced in-depth financial analyses that informed strategic planning, contributing to a 12% decrease in operational costs.

- •Played a key role in enhancing ERP system usage, increasing overall department efficiency by 15% in data processing.

- •Collaborated effectively with departments to compile financial data, facilitating timely reporting and analytical insights.

- •Assisted in treasury checks and balances, improving finance cycle controls and ensuring robust risk management practices.

- •Managed bank account reconciliations and maintained a high level of accuracy, leading to zero discrepancies over two fiscal years.

- •Implemented advanced Excel techniques to streamline financial modelling, saving an estimated 100 work hours annually.

- •Mentored junior staff, cultivating a knowledgeable team proficient in treasury processes and financial analysis.

- •Oversaw cash disbursement activities which improved fund allocation efficiency by over 20%.

- •Supported financial transaction coordination, ensuring seamless processing across departments and enhancing transaction speed.

- •Contributed to cash forecast analysis, helping maintain a 15% buffer above required cash flow levels.

- •Assisted in producing quarterly reports that identified actionable insights, bolstering executive decision-making.

- •Enhanced account compliance checks, achieving a 98% accuracy in ledger entries and reconciliations.

Navigating the job market as a finance and accounting associate can feel like steering a ship through unpredictable seas. You excel in analyzing data and managing budgets, yet translating these skills onto your resume can be challenging. Crafting a document that truly reflects your financial expertise, such as forecasting and data analysis, needs precision while avoiding overused industry jargon. It's often tricky to present your experience compellingly.

Think of your resume as a map that guides employers to see both your specialized skills and the unique value you bring. To chart this course effectively, a resume template can serve as your compass. Using a resume template helps you structure your skills and achievements clearly, highlighting them without clutter. This approach ensures your experience resonates powerfully.

Instead of just listing tasks, focus on capturing your accomplishments. Quantifying these gives employers a quick glimpse into the impact you can have. As you assemble your resume, remember that each word should enhance your story. It's about weaving your professional journey in a coherent and engaging way. With a well-organized resume, you'll navigate the job market confidently and make a lasting impression.

Key Takeaways

- Structure your resume with clear sections like contact information, professional summary, work experience, education, and skills to present a coherent professional story.

- Utilize a reverse-chronological format to highlight recent and relevant experience, ensuring both employers and ATS can easily parse your most valuable roles.

- Quantify achievements to demonstrate the impact of your contributions, employing action verbs to describe how you managed, analyzed, or improved financial processes.

- Select relevant hard skills, such as financial reporting and ERP systems, and complement them with soft skills like attention to detail and problem-solving.

- Include education with details like graduation date, honors, and relevant certifications, positioning them to enhance your qualifications for finance roles.

What to focus on when writing your finance and accounting associate resume

Your finance and accounting associate resume should effectively convey your expertise and meticulous attention to detail—essential qualities for making a strong impression on recruiters. Highlighting skills in financial analysis, payroll management, and budgeting not only underscores your value but sets the stage for a compelling application. A clear, precise resume allows ATS systems to easily parse through your qualifications, ensuring they receive the attention they deserve.

How to structure your finance and accounting associate resume

- Contact Information: Begin with your full name, phone number, professional email, and LinkedIn profile—essential elements that recruiters need to reach you quickly. An up-to-date and professional email sets a positive first impression, demonstrating that you have the practical skills to manage communication in a business setting and are actively engaging in professional networking.

- Professional Summary: This section should offer a snapshot of your financial skills, relevant experience, and significant achievements—all elements that bring your work history to life. Focus on showcasing your strong analytical abilities and problem-solving expertise, which are crucial for unraveling complex financial scenarios. Think of this as your "elevator pitch" on paper, offering insight into what you bring to the table.

- Work Experience: Here, list your relevant jobs along with job titles, company names, locations, and dates, and explain your primary responsibilities and achievements. Examples might include managing budgets, preparing financial statements, or improving expense tracking processes. Each bullet point should tell a story of how you contributed to organizational success, emphasizing outcomes or improvements.

- Education: This section provides foundational knowledge and credibility—include your degree(s), school names, and graduation dates. Highlight a strong GPA if relevant, and mention any specialized courses or certifications like CPA or CFA that enhance your profile. This not only establishes you as qualified but also as driven and committed to the field of finance and accounting.

- Skills: Use this section to fortify your application with industry-relevant keywords like financial reporting, budget analysis, and ledger reconciliation. Highlight your proficiency in crucial software like Excel, QuickBooks, or SAP to illustrate your technical capabilities. These skills should connect with experiences noted in your work history, showing a coherent professional narrative.

Each section above will now be examined in greater depth—ensuring your resume is not just a list of qualifications, but a cohesive story of your professional journey.

Which resume format to choose

As a finance and accounting associate, selecting the right resume format is crucial in effectively communicating your skills and experience to potential employers. Opting for a reverse-chronological format is particularly beneficial because it highlights your most recent and relevant roles. This format showcases your career progression and is preferred by both employers and applicant tracking systems, making it a smart choice for the finance industry.

Choosing the right font can further enhance the professional appearance of your resume. Opt for modern fonts like Raleway, Lato, or Montserrat, which offer a clean and contemporary look. These fonts are not only stylish but also improve readability, which is essential when employers review your resume both online and in print.

Always save your resume as a PDF to ensure that the formatting remains intact across devices. This small step helps maintain the professional layout you’ve crafted, so it looks the same whether viewed on a computer or printed out. It shows attention to detail, a quality valued in finance and accounting roles.

Maintaining one-inch margins on all sides of your resume ensures a neat and organized layout. Proper margins create a balanced look, allowing your content to stand out without overwhelming the page. This attention to formatting helps direct employers' focus toward your qualifications and achievements, making your resume not just a document, but a clear and compelling statement of your professional journey.

How to write a quantifiable resume experience section

The experience section of a finance and accounting associate resume is vital as it highlights your career milestones and achievements in a clear, impactful manner. By focusing on results with specific figures, you align your experience with what the finance industry values. Structuring this section in reverse chronological order with your most recent job first ensures clarity. Generally, include your last 10 to 15 years of experience, unless an older role is especially relevant. Use strong action words like "managed," "analyzed," "reduced," and "improved" to convey your contributions clearly. Tailor your resume for each job by ensuring your achievements resonate with the specific requirements of the job ad.

- •Managed accounts payable and receivable, cutting outstanding payments by 20% with better tracking and follow-up.

- •Helped prepare financial reports, trimming report time by 15% while boosting accuracy.

- •Worked on annual budgeting, leading to a 10% rise in budget efficiency.

- •Rolled out new billing software, reducing invoicing mistakes by 30%.

This experience section effectively highlights your professional achievements by clearly linking quantifiable results to industry expectations. Using specific action words and figures, you communicate your ability to make significant contributions to financial operations. The coherence between your achievements and key finance roles ensures that your history aligns with the job requirements. This alignment, combined with detailed points and a clear structure, makes the section highly appealing to hiring managers seeking efficiency and results.

Collaboration-Focused resume experience section

A collaboration-focused finance and accounting associate resume experience section should emphasize your ability to work with others effectively. Start by stating your role and the timeframe of your employment to set the context. Use bullet points to illustrate how your teamwork led to successful outcomes by improving processes and solving problems collaboratively. Clearly convey your impact and accomplishments through straightforward language, painting a vivid picture of your contributions.

Demonstrating your collaborative skills also showcases your communication capabilities, which are vital in teamwork settings. Including quantifiable achievements gives potential employers an exact sense of the value you brought to your previous roles. This focus on collaboration appeals to employers who prioritize teamwork and helps your resume stand out. Highlighting your strengths in working with others can significantly enhance your ability to achieve financial goals effectively.

Finance and Accounting Associate

XYZ Financial Solutions

June 2022 - September 2023

- Collaborated with the accounting team on monthly reconciliation, reducing errors by 20%.

- Worked with cross-functional teams to develop a budgeting tool, improving forecasting accuracy by 15%.

- Partnered with payroll to streamline processes, decreasing processing time by 10 hours monthly.

- Coordinated with auditors during the annual review, ensuring compliance and timely completion.

Problem-Solving Focused resume experience section

A problem-solving-focused finance and accounting associate resume experience section should emphasize your ability to handle challenges and deliver significant results. Start with clear examples of how you've tackled complex issues and include quantifiable outcomes. Using strong action verbs, connect how your efforts led to improved processes or financial results, ensuring that potential employers see the direct impact of your work. This clarity helps them quickly grasp the value you bring to a team.

Recall specific instances where your problem-solving skills made a difference, and detail measurable achievements such as cost reductions or enhanced accuracy. Each bullet should seamlessly flow by connecting the problem you encountered with the actions you implemented and the positive results. This approach not only illustrates your skills but also demonstrates your capacity to contribute meaningfully to any organization.

Finance and Accounting Associate

XYZ Corp

June 2020 - Present

- Reduced monthly closing time by 30% through automation and improved processes, streamlining financial operations.

- Solved discrepancies in financial statements, which boosted accuracy by 15%, ensuring reliable financial reporting.

- Created a new forecasting model that enhanced budget accuracy by 20%, supporting better financial planning.

- Led a team to identify cost-saving opportunities, resulting in $50,000 in annual savings that improved the bottom line.

Growth-Focused resume experience section

A growth-focused finance and accounting resume experience section should emphasize your role in driving financial success and process improvements within an organization. Begin by showcasing how your strategic initiatives have contributed to the company's growth, highlighting achievements that reflect your development and problem-solving abilities. Select experiences that show your efficiency in managing operations and your knack for identifying opportunities for cost-saving.

In each bullet point, illustrate how your actions led to positive organizational change, such as improving processes or effectively managing budgets. Quantify your results whenever possible, as numbers can provide a compelling narrative of your contributions. This approach ensures clarity and allows potential employers to easily understand the impact you've made in your previous roles.

Finance and Accounting Associate

XYZ Corp

Jan 2020 - Present

- Led the launch of new accounting software, boosting efficiency by 30%.

- Managed quarterly budgets, cutting unnecessary expenses by 10%.

- Worked with cross-functional teams to enhance financial report accuracy.

- Started an invoicing automation project, reducing processing time by 25%.

Result-Focused resume experience section

A results-focused finance and accounting associate resume experience section should clearly highlight your career achievements and the value you've brought to past roles. Start with your job title and the company, along with the dates you were employed, to set the stage. Delve into specific accomplishments by focusing on how you made an impact. Highlight instances where your efforts led to improvements or efficiencies, and back these up with numbers like percentages or dollar amounts for added credibility.

Seamlessly detail your contributions by linking improvements in processes to tangible outcomes. Show how your analysis of budget variances provided insights that led to cost reductions, creating a narrative that underscores your analytical strengths. Discuss the ways your detailed financial reports enhanced accuracy and decision-making. By articulating your role in strategic planning, you demonstrate your ability to collaborate and influence business direction, making a compelling case for your value as a prospective team member.

Finance and Accounting Associate

ABC Corp

March 2020 - Present

- Reduced monthly closing time by 20% through streamlined procedures and automation.

- Analyzed budget variances and provided insights to leadership, resulting in a 15% cost reduction.

- Prepared detailed financial reports that increased accuracy by 25%.

- Collaborated with cross-functional teams to support strategic planning initiatives.

Write your finance and accounting associate resume summary section

A finance-focused resume summary for an accounting associate should quickly capture the hiring manager's attention. Concentrate on highlighting your top skills and achievements while also making your career goals clear. This section needs to be brief yet informative, providing a quick glimpse into why you're a strong candidate. If you have experience, focus on past achievements. Consider this example:

This summary ties together your skills and achievements, painting a compelling picture of your capabilities. Aligning your summary with the job description can make your application even more attractive. For those with limited experience, like recent graduates, a resume objective is more appropriate. It leans into your future goals and how the role fits them. A resume profile, on the other hand, expands on your skills, offering a more detailed overview. Meanwhile, a summary of qualifications presents your key achievements in a list, emphasizing what sets you apart. Understanding these formats helps you tailor your resume to highlight your strengths effectively.

Listing your finance and accounting associate skills on your resume

A skill-focused finance and accounting associate résumé should ensure the skills section stands out, but it can also blend seamlessly into experience or summary areas. Highlight your strengths and soft skills across the document. This includes qualities like attention to detail and dependability, while emphasizing hard skills such as software proficiency or data analysis.

By weaving relevant skills and strengths into your résumé, you create natural keywords that catch the eyes of recruiters. These keywords match your abilities with the job description, increasing your likelihood of being noticed. Take a look at this concise skills section example as a guide:

This example effectively lists skills vital for a finance and accounting associate, clearly showing your capability to handle essential tasks. Each skill is targeted and relevant, ensuring you communicate your proficiency.

Best hard skills to feature on your finance and accounting associate resume

Highlighting hard skills relevant to the role demonstrates your technical proficiency and mastery over essential tasks. These skills show you’re equipped to manage critical tools and responsibilities.

Hard Skills

- Financial Analysis

- Budget Management

- QuickBooks

- Microsoft Excel

- Accounts Payable/Receivable

- Data Analysis

- Tax Preparation

- Financial Reporting

- General Ledger Reconciliation

- Cost Accounting

- Auditing

- Payroll Processing

- ERP Systems

- Risk Management

- Financial Modeling

Best soft skills to feature on your finance and accounting associate resume

Include soft skills that underline your interpersonal strengths and adaptability. These traits reveal your ability to collaborate and thrive in various job settings.

Soft Skills

- Attention to Detail

- Problem-Solving

- Time Management

- Strong Communication

- Adaptability

- Teamwork

- Reliability

- Organization

- Critical Thinking

- Ethical Judgment

- Initiative

- Stress Management

- Decision Making

- Accountability

- Customer Service

How to include your education on your resume

The education section of your finance and accounting associate resume is crucial. It showcases your academic background and lays the foundation for your qualifications. Ensure this section is relevant to the job you're applying for. Avoid listing irrelevant education as it clutters your resume.

When it comes to GPA, include it if it's 3.0 or higher. Mention "cum laude" or other honors if applicable. For listing a degree, begin with the degree type, followed by the institution's name and the graduation year.

Consider this incorrect example:

Now, here's a correct illustration:

The second example is standout due to its direct relevance to a finance and accounting career, highlighting the correct degree. Including honors and a solid GPA adds value, demonstrating academic excellence that potential employers will appreciate.

How to include finance and accounting associate certificates on your resume

Having a certificates section is an important part of your finance and accounting associate resume. List the name of each certificate clearly. Include the date when you obtained the certificate. Add the issuing organization to lend credibility. Position this section prominently, or you can also include certificates in the header. For example:

This example is good because it lists highly relevant certifications for a finance and accounting associate role. It includes recognized issuing organizations like AICPA and CFA Institute. Each certification is specifically named, making it clear for employers to see your qualifications. This helps you stand out, showing you have extra skills.

Extra sections to include in your finance and accounting associate resume

Crafting a standout resume for a finance and accounting associate can set you apart in a competitive job market. Including unique and personalized sections can add depth to your profile, showcasing a well-rounded character.

- Language section — List languages you speak fluently to show your global communication skills. This is beneficial as it can demonstrate your ability to work with international clients or teams.

- Hobbies and interests section — Share relevant hobbies like solving puzzles or playing chess to highlight your analytical thinking. This can also reflect your ability to tackle complex problems creatively.

- Volunteer work section — Detail volunteer experiences like assisting with local fundraising events to demonstrate your community involvement. Highlighting volunteer work shows your leadership and initiative outside of work.

- Books section — Mention books related to finance and leadership you’ve read, such as "The Intelligent Investor" by Benjamin Graham. This can reflect your commitment to continual learning and staying updated with industry trends.

Your resume will look more versatile and show a variety of skills and interests, making you a more compelling candidate.

In Conclusion

In conclusion, crafting a finance and accounting associate resume that effectively showcases your skills and achievements is essential for standing out in today's competitive job market. By using a structured template, you can ensure that your expertise in areas such as financial analysis, budget management, and payroll processing is communicated clearly. Integrating quantifiable accomplishments within your professional experience section gives employers tangible evidence of your impact and potential value. Choosing a reverse chronological format, modern fonts, and saving your resume as a PDF ensures a professional appearance that is easy to read and tracks well with applicant systems.

Remember that your resume is not just a document listing your qualifications—it's a story of your professional journey. Highlighting both your hard and soft skills across the resume paints a comprehensive picture of your capabilities, demonstrating your fit for a finance and accounting role. Including relevant certifications and education adds credibility, while sections like language skills or volunteer work can reflect your versatility and commitment to personal and professional growth.

As you polish your resume, ensure that each word enhances your narrative and aligns with the job requirements. Tailor your achievements and skills to resonate with potential employers, providing a clear and compelling statement of what you bring to the table. By doing so, you not only make a strong impression but also increase your chances of securing the role you aspire to.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.