Finance Controller Resume Examples

Jul 18, 2024

|

12 min read

Ensure your finance controller resume balances the books and bolsters your career prospects with these expert tips. Optimize for keywords while showcasing your key skills and experiences in financial management.

Rated by 348 people

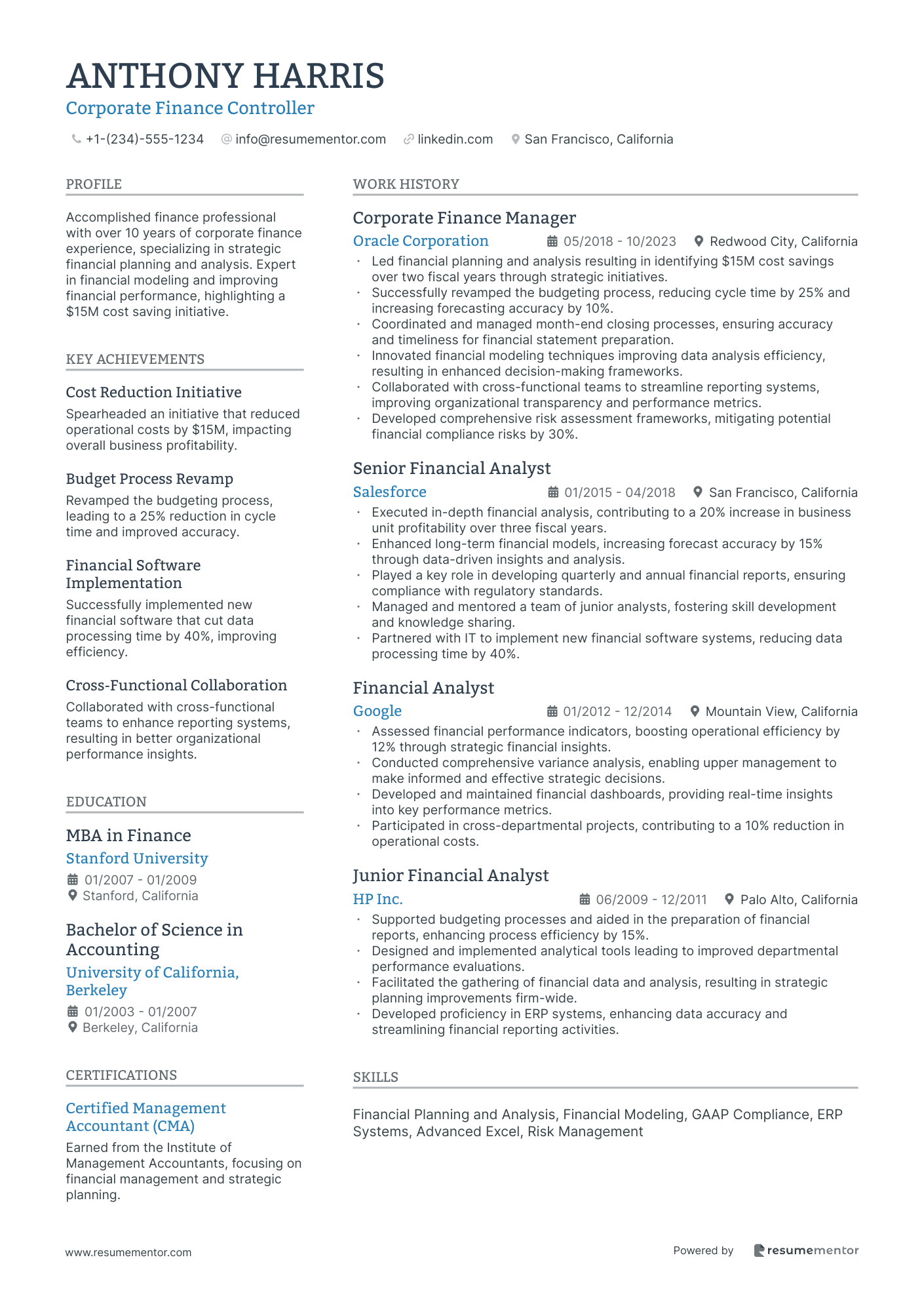

Corporate Finance Controller

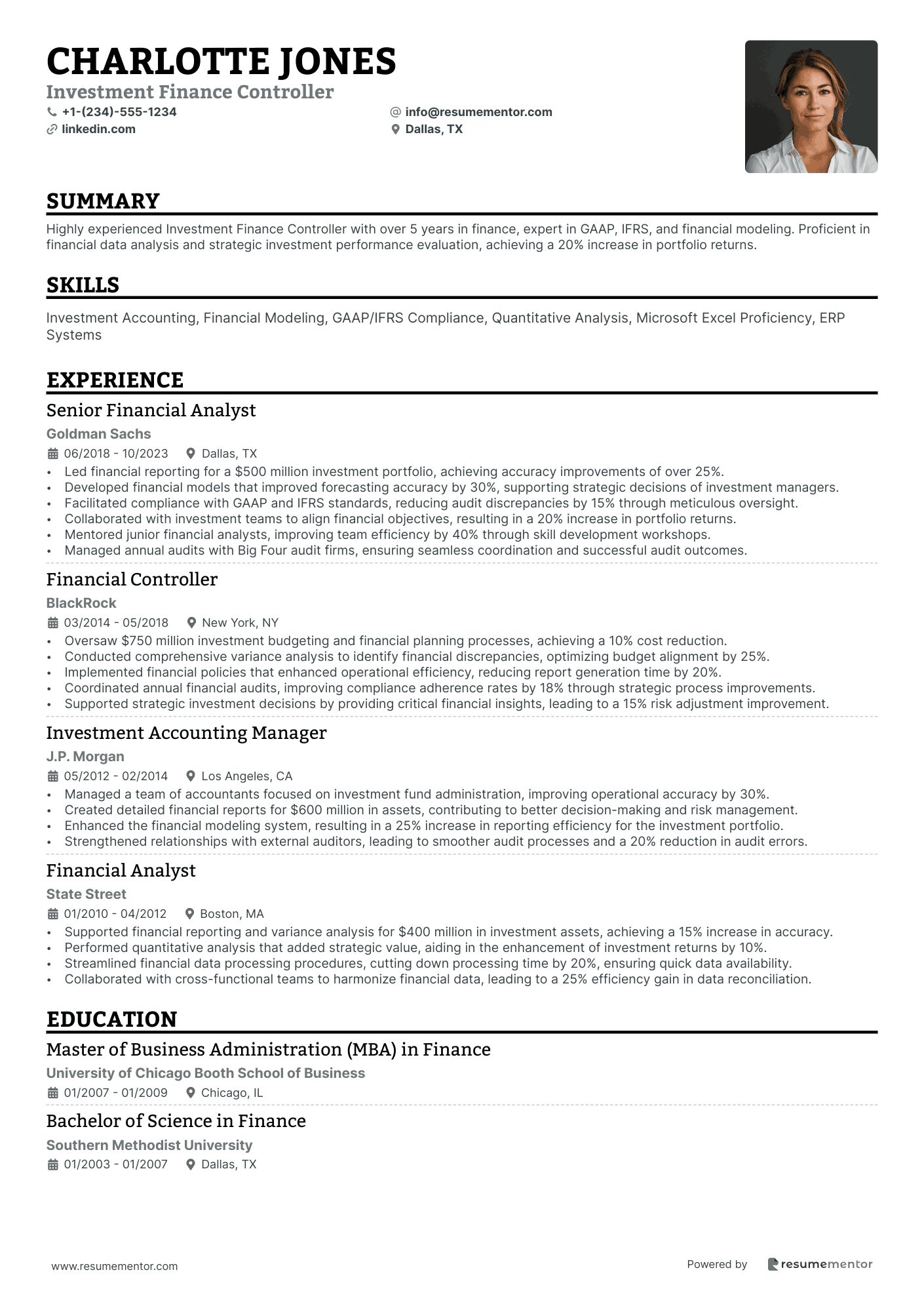

Investment Finance Controller

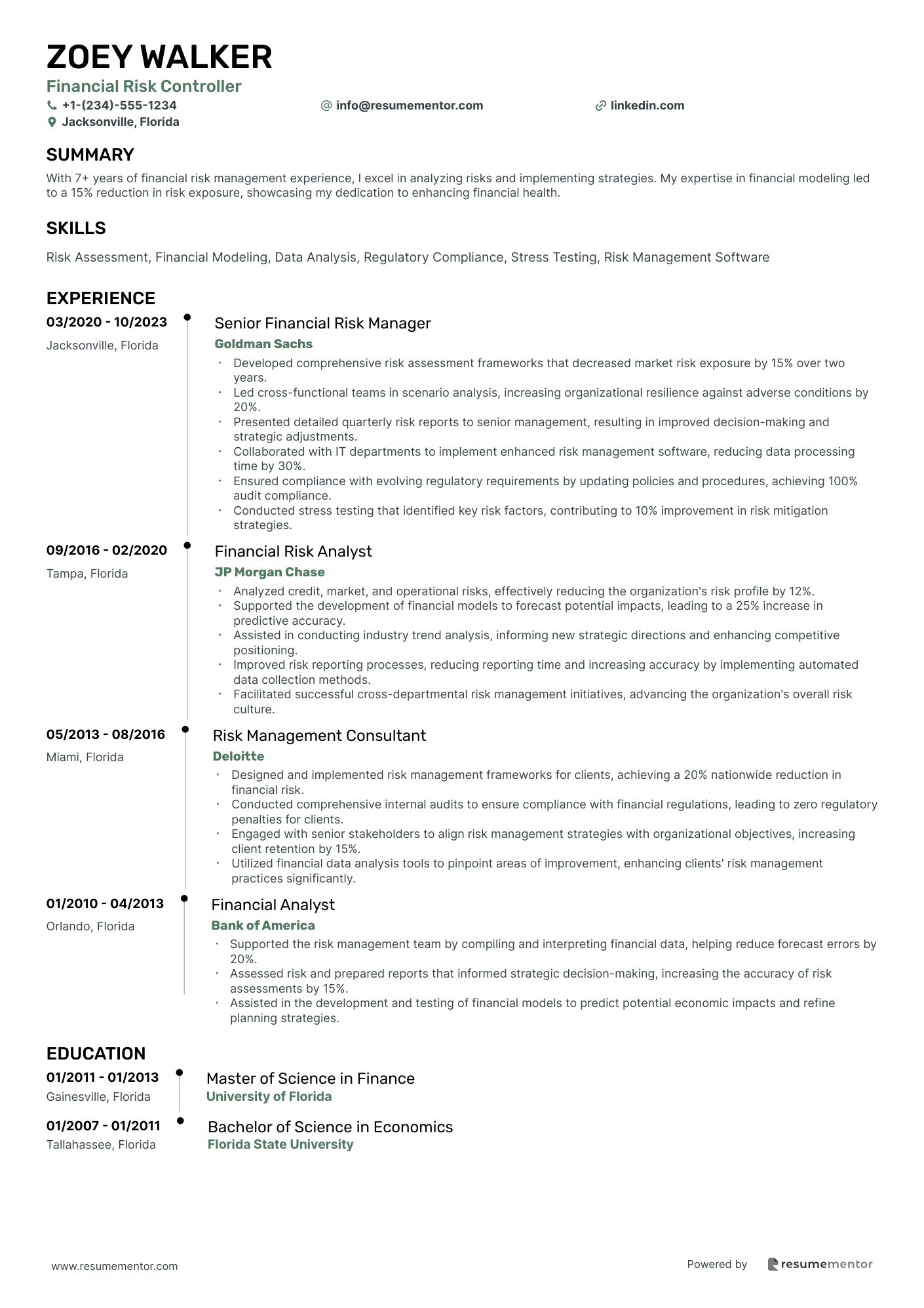

Financial Risk Controller

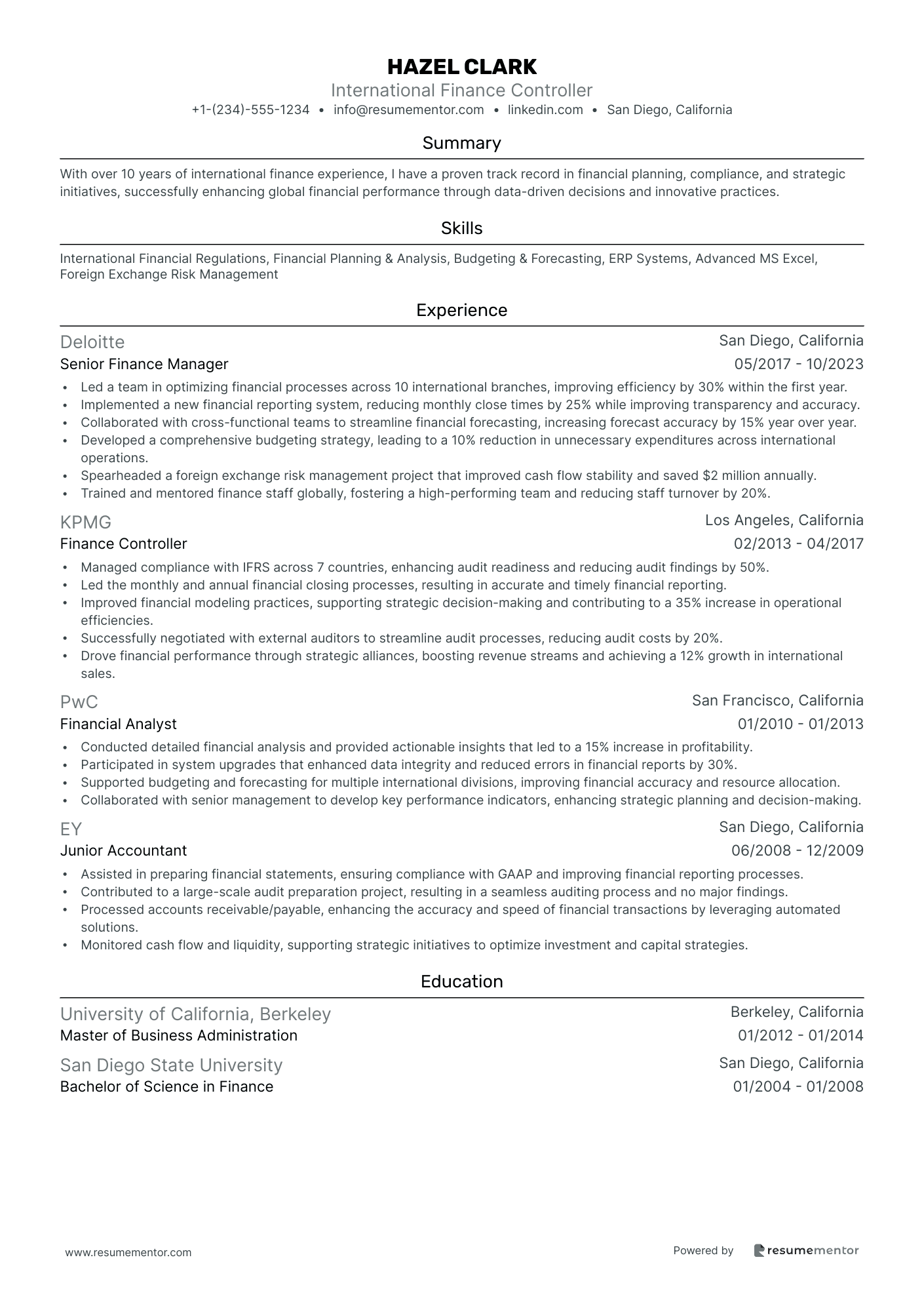

International Finance Controller

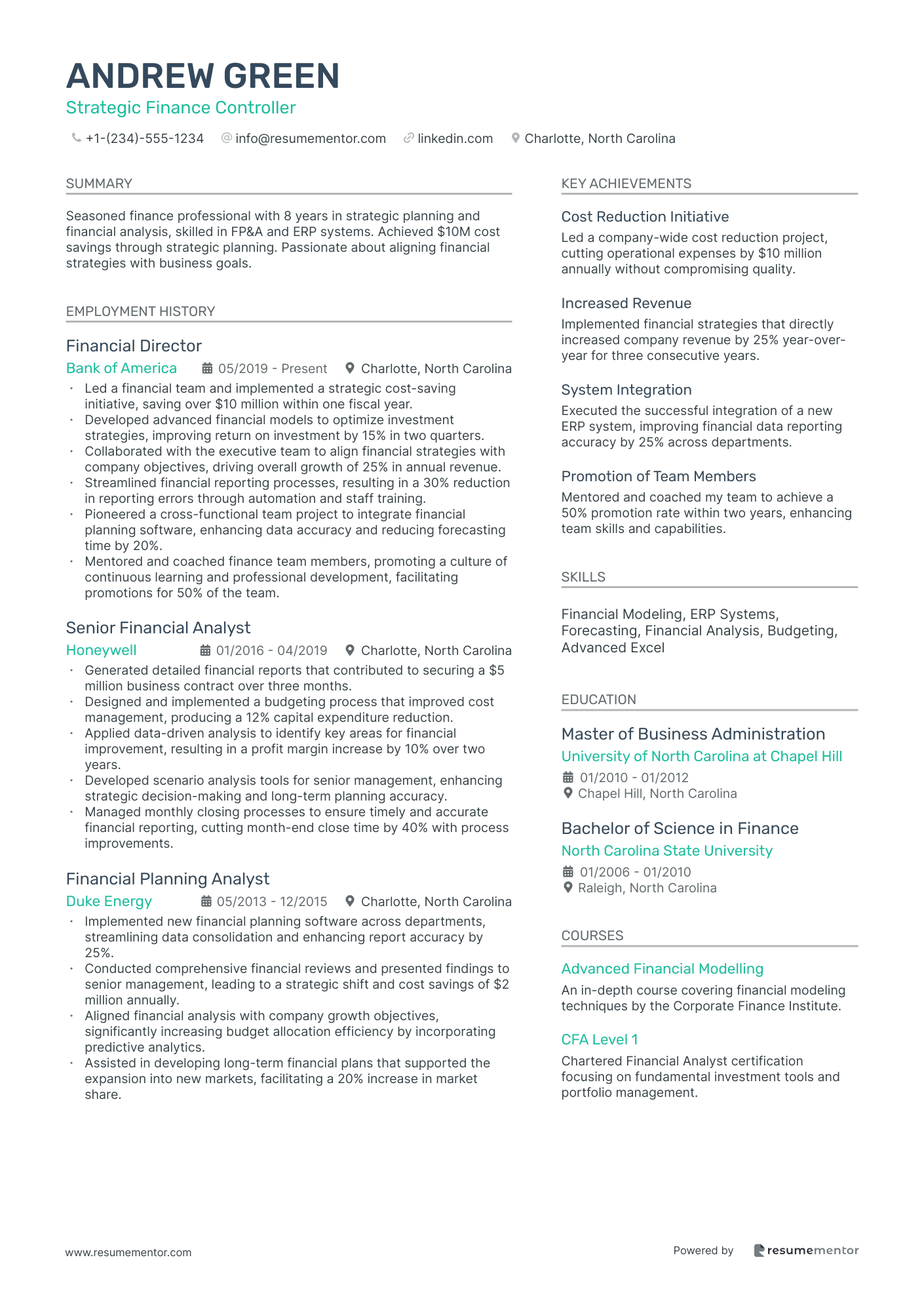

Strategic Finance Controller

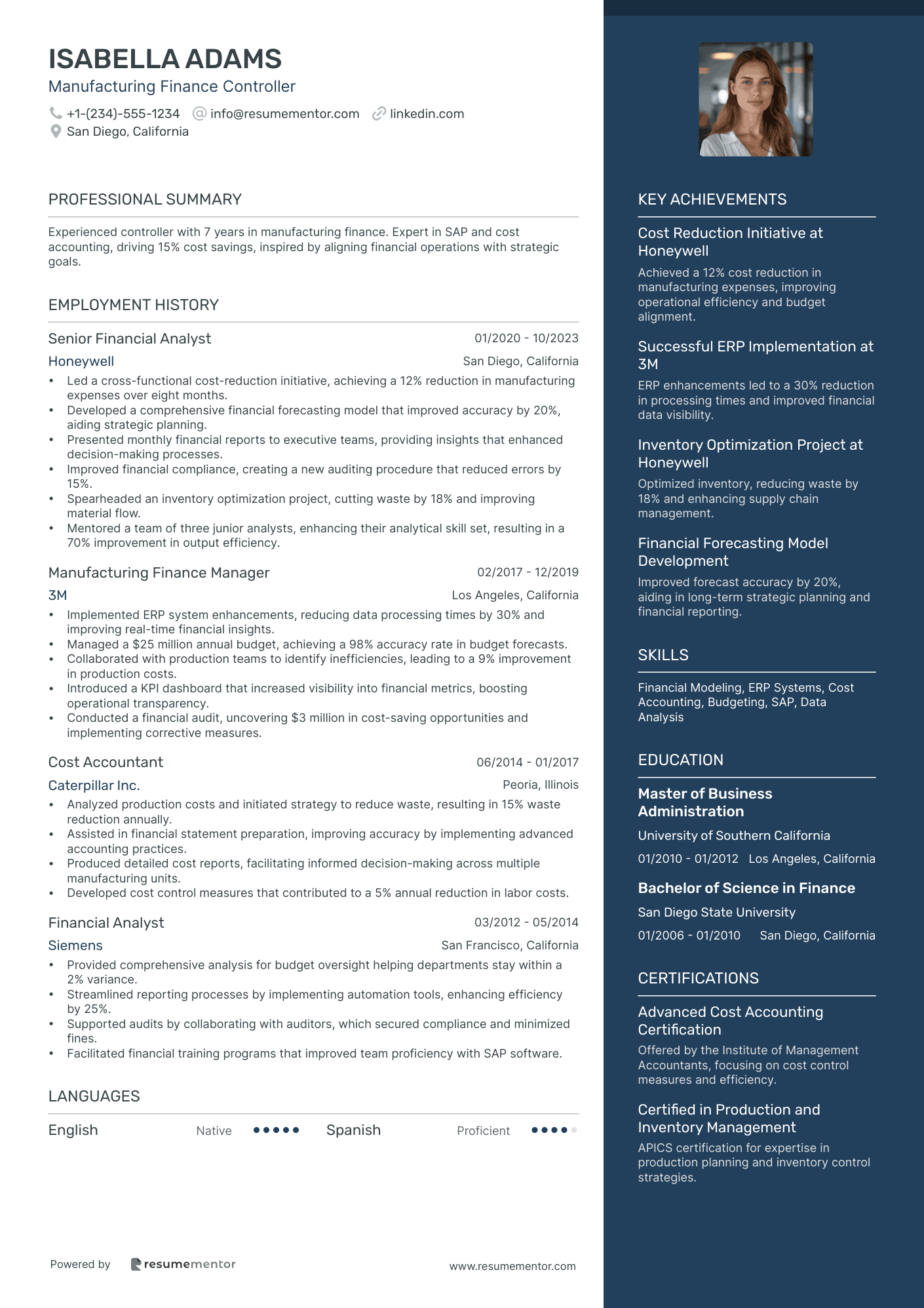

Manufacturing Finance Controller

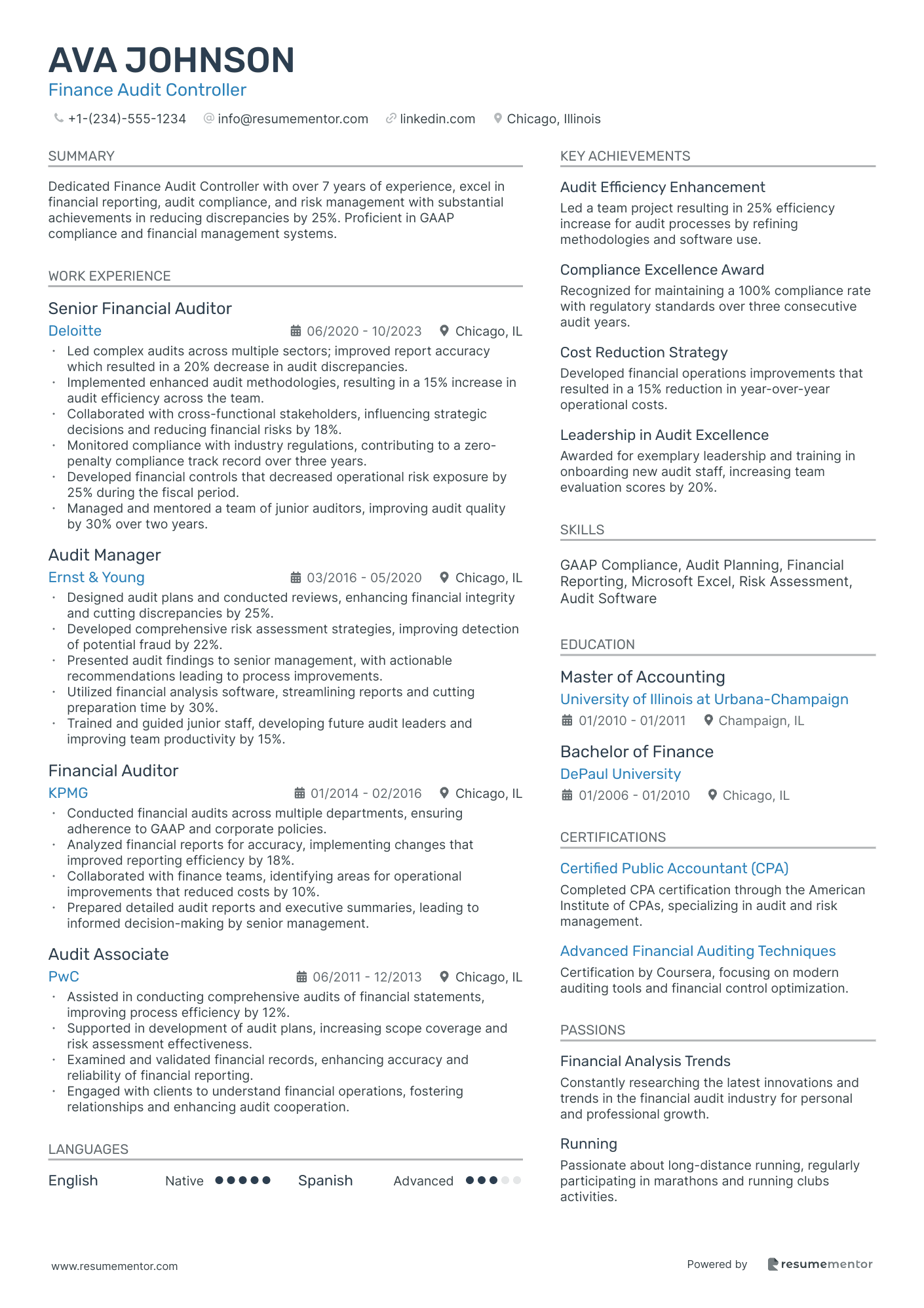

Finance Audit Controller

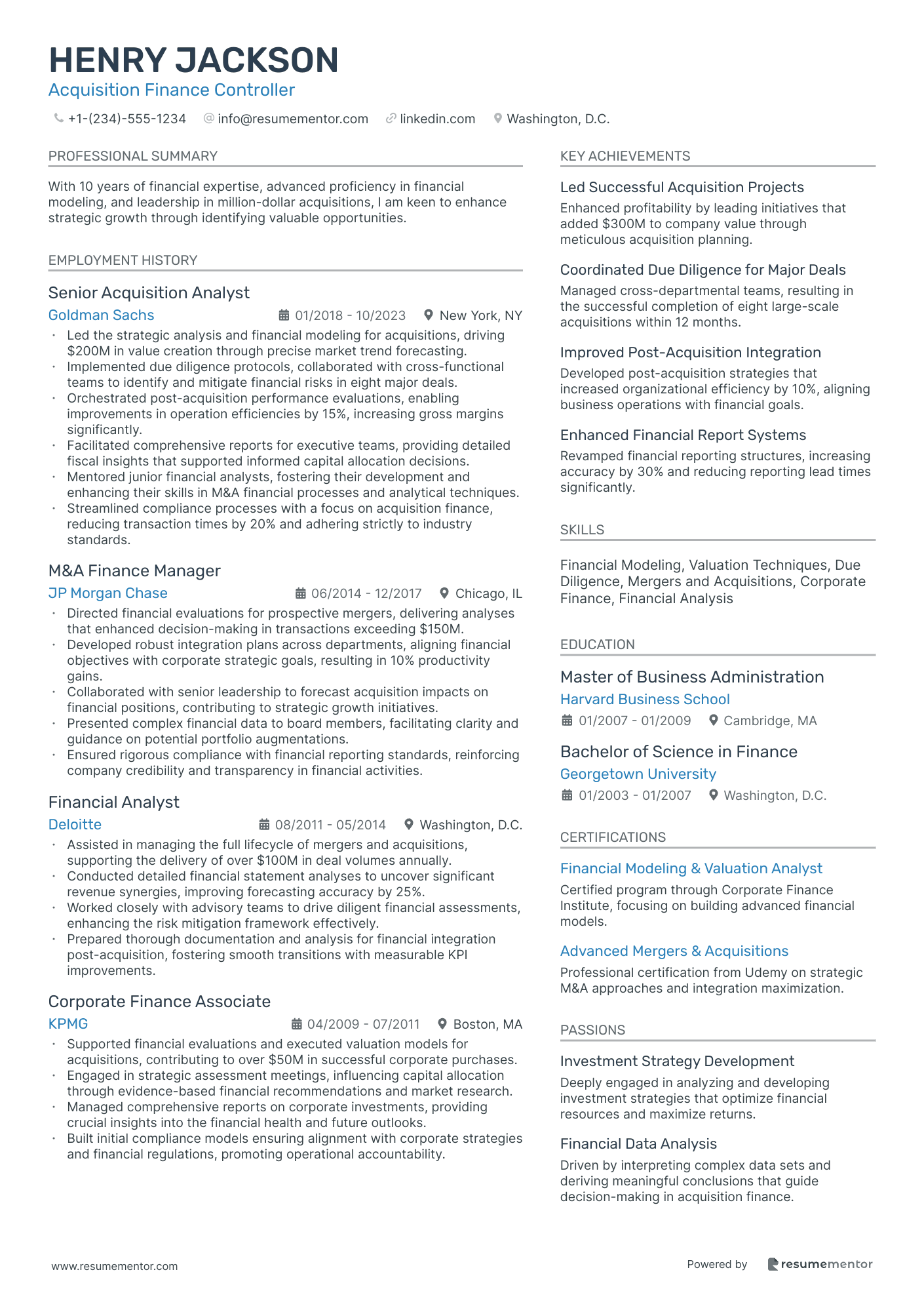

Acquisition Finance Controller

Project Finance Controller

Treasury Finance Controller

Corporate Finance Controller resume sample

- •Led financial planning and analysis resulting in identifying $15M cost savings over two fiscal years through strategic initiatives.

- •Successfully revamped the budgeting process, reducing cycle time by 25% and increasing forecasting accuracy by 10%.

- •Coordinated and managed month-end closing processes, ensuring accuracy and timeliness for financial statement preparation.

- •Innovated financial modeling techniques improving data analysis efficiency, resulting in enhanced decision-making frameworks.

- •Collaborated with cross-functional teams to streamline reporting systems, improving organizational transparency and performance metrics.

- •Developed comprehensive risk assessment frameworks, mitigating potential financial compliance risks by 30%.

- •Executed in-depth financial analysis, contributing to a 20% increase in business unit profitability over three fiscal years.

- •Enhanced long-term financial models, increasing forecast accuracy by 15% through data-driven insights and analysis.

- •Played a key role in developing quarterly and annual financial reports, ensuring compliance with regulatory standards.

- •Managed and mentored a team of junior analysts, fostering skill development and knowledge sharing.

- •Partnered with IT to implement new financial software systems, reducing data processing time by 40%.

- •Assessed financial performance indicators, boosting operational efficiency by 12% through strategic financial insights.

- •Conducted comprehensive variance analysis, enabling upper management to make informed and effective strategic decisions.

- •Developed and maintained financial dashboards, providing real-time insights into key performance metrics.

- •Participated in cross-departmental projects, contributing to a 10% reduction in operational costs.

- •Supported budgeting processes and aided in the preparation of financial reports, enhancing process efficiency by 15%.

- •Designed and implemented analytical tools leading to improved departmental performance evaluations.

- •Facilitated the gathering of financial data and analysis, resulting in strategic planning improvements firm-wide.

- •Developed proficiency in ERP systems, enhancing data accuracy and streamlining financial reporting activities.

Investment Finance Controller resume sample

- •Led financial reporting for a $500 million investment portfolio, achieving accuracy improvements of over 25%.

- •Developed financial models that improved forecasting accuracy by 30%, supporting strategic decisions of investment managers.

- •Facilitated compliance with GAAP and IFRS standards, reducing audit discrepancies by 15% through meticulous oversight.

- •Collaborated with investment teams to align financial objectives, resulting in a 20% increase in portfolio returns.

- •Mentored junior financial analysts, improving team efficiency by 40% through skill development workshops.

- •Managed annual audits with Big Four audit firms, ensuring seamless coordination and successful audit outcomes.

- •Oversaw $750 million investment budgeting and financial planning processes, achieving a 10% cost reduction.

- •Conducted comprehensive variance analysis to identify financial discrepancies, optimizing budget alignment by 25%.

- •Implemented financial policies that enhanced operational efficiency, reducing report generation time by 20%.

- •Coordinated annual financial audits, improving compliance adherence rates by 18% through strategic process improvements.

- •Supported strategic investment decisions by providing critical financial insights, leading to a 15% risk adjustment improvement.

- •Managed a team of accountants focused on investment fund administration, improving operational accuracy by 30%.

- •Created detailed financial reports for $600 million in assets, contributing to better decision-making and risk management.

- •Enhanced the financial modeling system, resulting in a 25% increase in reporting efficiency for the investment portfolio.

- •Strengthened relationships with external auditors, leading to smoother audit processes and a 20% reduction in audit errors.

- •Supported financial reporting and variance analysis for $400 million in investment assets, achieving a 15% increase in accuracy.

- •Performed quantitative analysis that added strategic value, aiding in the enhancement of investment returns by 10%.

- •Streamlined financial data processing procedures, cutting down processing time by 20%, ensuring quick data availability.

- •Collaborated with cross-functional teams to harmonize financial data, leading to a 25% efficiency gain in data reconciliation.

Financial Risk Controller resume sample

- •Developed comprehensive risk assessment frameworks that decreased market risk exposure by 15% over two years.

- •Led cross-functional teams in scenario analysis, increasing organizational resilience against adverse conditions by 20%.

- •Presented detailed quarterly risk reports to senior management, resulting in improved decision-making and strategic adjustments.

- •Collaborated with IT departments to implement enhanced risk management software, reducing data processing time by 30%.

- •Ensured compliance with evolving regulatory requirements by updating policies and procedures, achieving 100% audit compliance.

- •Conducted stress testing that identified key risk factors, contributing to 10% improvement in risk mitigation strategies.

- •Analyzed credit, market, and operational risks, effectively reducing the organization's risk profile by 12%.

- •Supported the development of financial models to forecast potential impacts, leading to a 25% increase in predictive accuracy.

- •Assisted in conducting industry trend analysis, informing new strategic directions and enhancing competitive positioning.

- •Improved risk reporting processes, reducing reporting time and increasing accuracy by implementing automated data collection methods.

- •Facilitated successful cross-departmental risk management initiatives, advancing the organization's overall risk culture.

- •Designed and implemented risk management frameworks for clients, achieving a 20% nationwide reduction in financial risk.

- •Conducted comprehensive internal audits to ensure compliance with financial regulations, leading to zero regulatory penalties for clients.

- •Engaged with senior stakeholders to align risk management strategies with organizational objectives, increasing client retention by 15%.

- •Utilized financial data analysis tools to pinpoint areas of improvement, enhancing clients' risk management practices significantly.

- •Supported the risk management team by compiling and interpreting financial data, helping reduce forecast errors by 20%.

- •Assessed risk and prepared reports that informed strategic decision-making, increasing the accuracy of risk assessments by 15%.

- •Assisted in the development and testing of financial models to predict potential economic impacts and refine planning strategies.

International Finance Controller resume sample

- •Led a team in optimizing financial processes across 10 international branches, improving efficiency by 30% within the first year.

- •Implemented a new financial reporting system, reducing monthly close times by 25% while improving transparency and accuracy.

- •Collaborated with cross-functional teams to streamline financial forecasting, increasing forecast accuracy by 15% year over year.

- •Developed a comprehensive budgeting strategy, leading to a 10% reduction in unnecessary expenditures across international operations.

- •Spearheaded a foreign exchange risk management project that improved cash flow stability and saved $2 million annually.

- •Trained and mentored finance staff globally, fostering a high-performing team and reducing staff turnover by 20%.

- •Managed compliance with IFRS across 7 countries, enhancing audit readiness and reducing audit findings by 50%.

- •Led the monthly and annual financial closing processes, resulting in accurate and timely financial reporting.

- •Improved financial modeling practices, supporting strategic decision-making and contributing to a 35% increase in operational efficiencies.

- •Successfully negotiated with external auditors to streamline audit processes, reducing audit costs by 20%.

- •Drove financial performance through strategic alliances, boosting revenue streams and achieving a 12% growth in international sales.

- •Conducted detailed financial analysis and provided actionable insights that led to a 15% increase in profitability.

- •Participated in system upgrades that enhanced data integrity and reduced errors in financial reports by 30%.

- •Supported budgeting and forecasting for multiple international divisions, improving financial accuracy and resource allocation.

- •Collaborated with senior management to develop key performance indicators, enhancing strategic planning and decision-making.

- •Assisted in preparing financial statements, ensuring compliance with GAAP and improving financial reporting processes.

- •Contributed to a large-scale audit preparation project, resulting in a seamless auditing process and no major findings.

- •Processed accounts receivable/payable, enhancing the accuracy and speed of financial transactions by leveraging automated solutions.

- •Monitored cash flow and liquidity, supporting strategic initiatives to optimize investment and capital strategies.

Strategic Finance Controller resume sample

- •Led a financial team and implemented a strategic cost-saving initiative, saving over $10 million within one fiscal year.

- •Developed advanced financial models to optimize investment strategies, improving return on investment by 15% in two quarters.

- •Collaborated with the executive team to align financial strategies with company objectives, driving overall growth of 25% in annual revenue.

- •Streamlined financial reporting processes, resulting in a 30% reduction in reporting errors through automation and staff training.

- •Pioneered a cross-functional team project to integrate financial planning software, enhancing data accuracy and reducing forecasting time by 20%.

- •Mentored and coached finance team members, promoting a culture of continuous learning and professional development, facilitating promotions for 50% of the team.

- •Generated detailed financial reports that contributed to securing a $5 million business contract over three months.

- •Designed and implemented a budgeting process that improved cost management, producing a 12% capital expenditure reduction.

- •Applied data-driven analysis to identify key areas for financial improvement, resulting in a profit margin increase by 10% over two years.

- •Developed scenario analysis tools for senior management, enhancing strategic decision-making and long-term planning accuracy.

- •Managed monthly closing processes to ensure timely and accurate financial reporting, cutting month-end close time by 40% with process improvements.

- •Implemented new financial planning software across departments, streamlining data consolidation and enhancing report accuracy by 25%.

- •Conducted comprehensive financial reviews and presented findings to senior management, leading to a strategic shift and cost savings of $2 million annually.

- •Aligned financial analysis with company growth objectives, significantly increasing budget allocation efficiency by incorporating predictive analytics.

- •Assisted in developing long-term financial plans that supported the expansion into new markets, facilitating a 20% increase in market share.

- •Compiled and analyzed financial information to prepare entries, maintaining accuracy in the order of operations with a 99% consistency rate.

- •Collaborated with project teams to assess financial impacts of proposed business initiatives, leading to informed budgeting and spending forecasts.

- •Optimized financial reporting by automating data extraction processes, reducing data gathering time by 50%.

Manufacturing Finance Controller resume sample

- •Led a cross-functional cost-reduction initiative, achieving a 12% reduction in manufacturing expenses over eight months.

- •Developed a comprehensive financial forecasting model that improved accuracy by 20%, aiding strategic planning.

- •Presented monthly financial reports to executive teams, providing insights that enhanced decision-making processes.

- •Improved financial compliance, creating a new auditing procedure that reduced errors by 15%.

- •Spearheaded an inventory optimization project, cutting waste by 18% and improving material flow.

- •Mentored a team of three junior analysts, enhancing their analytical skill set, resulting in a 70% improvement in output efficiency.

- •Implemented ERP system enhancements, reducing data processing times by 30% and improving real-time financial insights.

- •Managed a $25 million annual budget, achieving a 98% accuracy rate in budget forecasts.

- •Collaborated with production teams to identify inefficiencies, leading to a 9% improvement in production costs.

- •Introduced a KPI dashboard that increased visibility into financial metrics, boosting operational transparency.

- •Conducted a financial audit, uncovering $3 million in cost-saving opportunities and implementing corrective measures.

- •Analyzed production costs and initiated strategy to reduce waste, resulting in 15% waste reduction annually.

- •Assisted in financial statement preparation, improving accuracy by implementing advanced accounting practices.

- •Produced detailed cost reports, facilitating informed decision-making across multiple manufacturing units.

- •Developed cost control measures that contributed to a 5% annual reduction in labor costs.

- •Provided comprehensive analysis for budget oversight helping departments stay within a 2% variance.

- •Streamlined reporting processes by implementing automation tools, enhancing efficiency by 25%.

- •Supported audits by collaborating with auditors, which secured compliance and minimized fines.

- •Facilitated financial training programs that improved team proficiency with SAP software.

Finance Audit Controller resume sample

- •Led complex audits across multiple sectors; improved report accuracy which resulted in a 20% decrease in audit discrepancies.

- •Implemented enhanced audit methodologies, resulting in a 15% increase in audit efficiency across the team.

- •Collaborated with cross-functional stakeholders, influencing strategic decisions and reducing financial risks by 18%.

- •Monitored compliance with industry regulations, contributing to a zero-penalty compliance track record over three years.

- •Developed financial controls that decreased operational risk exposure by 25% during the fiscal period.

- •Managed and mentored a team of junior auditors, improving audit quality by 30% over two years.

- •Designed audit plans and conducted reviews, enhancing financial integrity and cutting discrepancies by 25%.

- •Developed comprehensive risk assessment strategies, improving detection of potential fraud by 22%.

- •Presented audit findings to senior management, with actionable recommendations leading to process improvements.

- •Utilized financial analysis software, streamlining reports and cutting preparation time by 30%.

- •Trained and guided junior staff, developing future audit leaders and improving team productivity by 15%.

- •Conducted financial audits across multiple departments, ensuring adherence to GAAP and corporate policies.

- •Analyzed financial reports for accuracy, implementing changes that improved reporting efficiency by 18%.

- •Collaborated with finance teams, identifying areas for operational improvements that reduced costs by 10%.

- •Prepared detailed audit reports and executive summaries, leading to informed decision-making by senior management.

- •Assisted in conducting comprehensive audits of financial statements, improving process efficiency by 12%.

- •Supported in development of audit plans, increasing scope coverage and risk assessment effectiveness.

- •Examined and validated financial records, enhancing accuracy and reliability of financial reporting.

- •Engaged with clients to understand financial operations, fostering relationships and enhancing audit cooperation.

Acquisition Finance Controller resume sample

- •Led the strategic analysis and financial modeling for acquisitions, driving $200M in value creation through precise market trend forecasting.

- •Implemented due diligence protocols, collaborated with cross-functional teams to identify and mitigate financial risks in eight major deals.

- •Orchestrated post-acquisition performance evaluations, enabling improvements in operation efficiencies by 15%, increasing gross margins significantly.

- •Facilitated comprehensive reports for executive teams, providing detailed fiscal insights that supported informed capital allocation decisions.

- •Mentored junior financial analysts, fostering their development and enhancing their skills in M&A financial processes and analytical techniques.

- •Streamlined compliance processes with a focus on acquisition finance, reducing transaction times by 20% and adhering strictly to industry standards.

- •Directed financial evaluations for prospective mergers, delivering analyses that enhanced decision-making in transactions exceeding $150M.

- •Developed robust integration plans across departments, aligning financial objectives with corporate strategic goals, resulting in 10% productivity gains.

- •Collaborated with senior leadership to forecast acquisition impacts on financial positions, contributing to strategic growth initiatives.

- •Presented complex financial data to board members, facilitating clarity and guidance on potential portfolio augmentations.

- •Ensured rigorous compliance with financial reporting standards, reinforcing company credibility and transparency in financial activities.

- •Assisted in managing the full lifecycle of mergers and acquisitions, supporting the delivery of over $100M in deal volumes annually.

- •Conducted detailed financial statement analyses to uncover significant revenue synergies, improving forecasting accuracy by 25%.

- •Worked closely with advisory teams to drive diligent financial assessments, enhancing the risk mitigation framework effectively.

- •Prepared thorough documentation and analysis for financial integration post-acquisition, fostering smooth transitions with measurable KPI improvements.

- •Supported financial evaluations and executed valuation models for acquisitions, contributing to over $50M in successful corporate purchases.

- •Engaged in strategic assessment meetings, influencing capital allocation through evidence-based financial recommendations and market research.

- •Managed comprehensive reports on corporate investments, providing crucial insights into the financial health and future outlooks.

- •Built initial compliance models ensuring alignment with corporate strategies and financial regulations, promoting operational accountability.

Project Finance Controller resume sample

- •Led financial projects with budgets over $50M, ensuring compliance and resulting in a 30% reduction in cost overruns.

- •Collaborated with project managers to develop KPIs, enhancing performance tracking with a focus on budget adherence.

- •Prepared detailed financial forecasts and variance reports, contributing to a 25% improvement in project ROI.

- •Managed a team responsible for project accounting, implementing audit trails and improving data accuracy by 15%.

- •Engaged with external auditors and regulatory personnel, ensuring a smooth audit process and full compliance with regulations.

- •Implemented cash flow projections to coordinate funding requests, maintaining a positive cash flow for all managed projects.

- •Conducted regular financial reviews with project leaders, interpreting data effectively to inform strategic decisions.

- •Developed financial statements detailing project finances, enhancing transparency and accuracy of financial reporting by 20%.

- •Implemented and maintained Excel-based financial models for project profitability evaluation, improving forecast accuracy by 10%.

- •Liaised with multiple departments to ensure alignment on project financial objectives, leading to a 15% increase in efficiency.

- •Educated junior finance staff on best practices and financial compliance, resulting in a more competent and reliable finance team.

- •Strengthened financial controls over project expenses, reducing unauthorized spending by 18% through enhanced budget monitoring.

- •Produced monthly financial reports and presentations for executives, facilitating data-driven decision-making processes.

- •Managed end-to-end financial planning for projects valued over $25M, leading to a 10% cost-saving efficiency.

- •Developed financial metrics and benchmarks for project performance evaluations, driving a significant improvement in project delivery timelines.

- •Assisted in preparing comprehensive financial forecasts, contributing to a 5% increase in accuracy across project budgets.

- •Coordinated with project stakeholders to address financial risks, enhancing risk management frameworks by 12%.

- •Performed detailed variance analysis, identifying cost-saving opportunities that led to a 7% budget reallocation.

- •Streamlined financial reporting processes, decreasing report preparation time by 20% through automation initiatives.

Treasury Finance Controller resume sample

- •Led the implementation of a new cash management system that improved transaction speed by 30%, enhancing overall efficiency.

- •Managed liquidity planning strategies during market volatility, resulting in maintaining optimal working capital levels.

- •Developed comprehensive treasury strategies aligning with company goals that reduced cost of borrowing by 15%.

- •Oversaw relationships with multiple banking partners which improved credit facility terms and reduced fees by $200k annually.

- •Facilitated cross-departmental collaboration to ensure compliance with new financial regulations, maintaining a 100% adherence rate.

- •Conducted quarterly analyses on financial instruments, minimizing risk exposure and optimizing asset allocations.

- •Analyzed capital structure and funding strategies, leading to improved liquidity ratios by 20%.

- •Developed complex financial models to forecast cash flow, enabling more accurate corporate budget planning.

- •Devised tax-efficient treasury solutions, resulting in annual savings of $350k in operational costs.

- •Monitored market trends and economic forecasts to advise on investment strategies yielding a 10% ROI increase.

- •Streamlined reporting processes for senior management, decreasing report preparation time by 40%.

- •Enhanced the treasury reporting framework, resulting in a 25% reduction in time-to-deliver financial statuses.

- •Executed cash flow forecasting that improved financial planning and reduced cash shortfalls by 18%.

- •Worked alongside regulatory compliance teams ensuring a 100% compliance rate with treasury regulations.

- •Collaborated with IT department to integrate a treasury management system that enhanced transaction accuracy.

- •Supported treasury operations by analyzing financial data to identify opportunities and mitigate risks.

- •Assisted in negotiating credit terms which reduced annual debt servicing costs by $100k.

- •Drafted financial reports and presented impactful metrics to executive leadership, influencing strategic decisions.

- •Contributed to budgeting processes by creating detailed financial forecasts, improving accuracy by 15%.

Navigating the world of financial control is like steering a ship through a sea of numbers and budgets. Your skill set as a finance controller, with its keen detail and precision, is crucial for keeping an organization steady. However, when it comes to translating these skills onto a resume, it can feel like trying to chart an unclear course. Your resume should serve as that essential compass, guiding potential employers to recognize your true value.

The task of creating a standout resume can be overwhelming, and it's easy to feel unsure about how to effectively communicate your accomplishments and qualifications. Each element plays a critical role, from crafting a compelling summary to listing key achievements that bring your experience to life. This is where a resume template becomes invaluable, giving your resume the structured, professional format it needs to truly shine. Explore these resume templates to find the right structure for highlighting your skills and achievements.

Employers are on the lookout for finance controllers who can adeptly manage financial challenges. Your resume should clearly illustrate your ability to do just that, mapping your skills and achievements to show how your past experiences can lead to future successes. With the right approach, your resume not only opens doors but also charts a clear, promising path in your career journey.

Key Takeaways

- Begin with your contact information, presenting it clearly and accurately to establish professionalism and facilitate easy communication.

- Your professional summary should concisely contextualize your experience, emphasizing analysis and strategic planning achievements to intrigue prospective employers.

- Identify core competencies, highlighting your proficiency in financial reporting and software knowledge, to immediately demonstrate your value.

- Reframe your work experience by spotlighting quantifiable achievements to illustrate your impact effectively and connect past successes to potential future contributions.

- Select a reverse-chronological format for the resume, use modern fonts for a professional look, save the document as a PDF, and maintain 1-inch margins to ensure clarity and consistency.

What to focus on when writing your finance controller resume

Your resume as a finance controller should seamlessly convey your expertise in managing an organization's financial health. Make sure to highlight your skills in budgeting, auditing, and financial forecasting, as these are crucial to the role. It's equally important to emphasize your leadership and analytical abilities, which are integral to effective financial oversight. Transitioning smoothly between sections helps create a compelling narrative that draws recruiters in.

How to structure your finance controller resume

- Contact Information—Begin with your name in a larger, easy-to-read font at the top, followed by your phone number, professional email, and LinkedIn profile. This makes it straightforward for recruiters to find and reach out to you. While it seems basic, ensuring accuracy here establishes professionalism from the outset.

- Professional Summary—Craft a concise statement that encapsulates your experience in financial operations and provides an overview of your career. Focus on how your skills in analysis and strategic planning have driven success. Use this section to set the tone for the rest of the resume, enticing the reader to continue learning about your qualifications.

- Core Competencies—List key skills that align with the role of a finance controller, such as financial reporting, compliance, and risk management. Emphasize proficiency in accounting software like SAP or Oracle to demonstrate technical expertise. This section showcases your ability to bring valuable skills to the potential employer immediately.

- Work Experience—Describe your previous finance roles with an emphasis on achievements. Quantifiable accomplishments like cost savings and efficiency improvements offer recruiters concrete evidence of your impact. This section should clearly connect your competencies to real-world outcomes you’ve delivered in the past.

- Education & Certifications—List degrees in finance or accounting, backing up your work experience with formal education credentials. Include relevant certifications like CPA or CMA, alongside any specialized finance courses or workshops. This not only underscores your commitment to the field but also reinforces your capability and dedication to ongoing learning.

- Technical & Interpersonal Skills—Highlight technical skills such as advanced Excel capabilities and interpersonal skills like leadership and communication. These skills are essential for collaboration and team management, which are crucial in a finance controller role. By showcasing these, you demonstrate a well-rounded ability to not only perform your duties but also lead and connect with your team effectively.

As we delve deeper into the specifics of each resume section below, you'll learn how to effectively format and detail each area to make your resume even more impactful.

Which resume format to choose

Crafting a finance controller resume requires attention to detail in both format and style to make a strong impression. Choosing a reverse-chronological format is particularly effective in the finance industry. This format allows prospective employers to swiftly assess your current and past roles, highlighting your career progression and relevant achievements, which are crucial for demonstrating your capability in handling financial responsibilities.

The choice of font also plays a significant role in how your resume is perceived. Opting for modern fonts like Lato, Raleway, or Montserrat can set your resume apart with a fresh and clean look. These fonts maintain professionalism while being easy on the eyes, which is important when presenting complex financial data and achievements succinctly. A well-chosen font enhances readability and keeps your resume from appearing outdated.

When saving your resume, always choose PDF format. This ensures that your carefully crafted layout remains consistent regardless of the device or platform an employer uses to view it. A PDF preserves your formatting and protects against potential shifts in layout that can occur with word processing files, reflecting your attention to detail and organizational skills—an essential trait for a finance controller.

Setting your resume with 1-inch margins on all sides is another fundamental step. This simple adjustment creates a clean frame around your content, ensuring there’s sufficient white space to separate sections clearly. This organization aids readability, allowing hiring managers to effortlessly navigate through your skills, experience, and certifications, thus supporting the efficient communication of your qualifications.

By refining these components, you create a cohesive and compelling resume that strongly reflects your skills as a finance controller. This attention to detail ensures that your document not only meets professional standards but also effectively communicates your qualifications to potential employers.

How to write a quantifiable resume experience section

A finance controller resume experience section is key to highlighting your skills and the meaningful impact you've made. Start by focusing on achievements that enhance financial processes and boost efficiency. Arrange your entries in reverse chronological order, beginning with your most recent job to provide a clear career progression. Cover the past 10-15 years of experience, ensuring that earlier roles included are relevant to the job you're targeting. By tailoring each entry to the specific job ad, you incorporate relevant keywords and emphasize the accomplishments that matter most. Using strong action verbs like "streamlined," "implemented," and "optimized" effectively communicates your ability to drive results.

Here's an improved finance controller experience example:

- •Boosted budgeting accuracy by 20%, enhancing financial planning and resource allocation.

- •Led the team in implementing a new ERP system, cutting financial closing time by 30%.

- •Streamlined reporting processes, halving preparation time and improving data accuracy.

- •Improved cash flow forecasts, increasing liquidity by 15% to support strategic investments.

This experience section flows seamlessly by focusing on quantifiable achievements, ensuring each point clearly illustrates the impact of your work. Using precise numbers like "20%" and "30%" quickly illustrates your contributions, making it evident how you've added value. Each bullet point connects to a result, offering potential employers a clear picture of your effectiveness. By tailoring these entries to align with job ad keywords, you elevate your resume's appeal, capturing the attention of hiring managers. Including accurate locations and dates adds credibility, while action verbs combined with measurable successes showcase your leadership and technical expertise in a cohesive, compelling narrative.

Result-Focused resume experience section

A results-focused finance controller resume experience section should clearly highlight your ability to enhance financial processes and positively impact a company's financial health. Start by replacing generic job duties with specific achievements, using action verbs and quantifiable results to illustrate your contributions, such as boosting efficiency or cutting costs. Tailoring your descriptions to align with the specific job you’re targeting ensures each experience entry stands out and emphasizes relevant skills.

By portraying yourself not just as someone who manages finances but as a proactive leader driving financial success, you create a compelling narrative. Avoiding generic statements allows you to spotlight unique accomplishments that set you apart from other candidates. Each bullet point should effectively convey the value you provided to past employers, as companies are looking for candidates who actively contribute to growth and stability, not just those who maintain the status quo.

Finance Controller

Tech Innovators Inc.

June 2018 - Present

- Increased operational efficiency by 30% through optimized financial processes.

- Led a team to implement a new budgeting system, reducing costs by $200,000 annually.

- Developed a comprehensive financial model that improved forecasting accuracy by 25%.

- Collaborated with departments to align financial goals with business objectives, boosting profitability by 15%.

Project-Focused resume experience section

A project-focused finance controller resume experience section should effectively demonstrate your ability to manage projects while keeping financial strategies front and center. Begin by clearly stating your role and highlighting the significant projects you managed, emphasizing your leadership and financial oversight. Use action words to illustrate how you successfully drove project outcomes, maintained budgets, and supported organizational goals, ensuring a seamless connection between project management and financial responsibilities.

When describing each project, focus on how your financial expertise positively impacted results. Share measurable achievements, such as cost savings or improved financial reporting, to highlight your contributions. Including the technical tools or software you utilized can further demonstrate your adaptability and tech skills in a project-driven environment, reinforcing the connection between your financial acumen and project management capabilities.

Finance Controller

Tech Innovations Inc.

January 2020 - Present

- Led a team to implement a new financial reporting system, reducing processing time by 30%.

- Managed project budgets, ensuring projects were completed 10% under budget while maintaining quality.

- Collaborated with cross-functional teams to enhance forecasting accuracy, resulting in a 15% improvement.

- Streamlined financial processes using advanced analytical tools, boosting efficiency by 25%.

Customer-Focused resume experience section

A customer-focused finance controller resume experience section should clearly illustrate how your financial acumen directly contributes to customer satisfaction and business growth. Begin by identifying specific achievements where your financial strategies have strengthened customer relationships, such as honing billing accuracy or developing solutions that elevate customer satisfaction. Use clear language to weave a narrative that highlights the ways in which your role has improved customer service and ensured efficient management.

Incorporate examples with quantifiable outcomes to show your impact, like reducing processing times or enhancing service delivery. This approach not only displays your skills as a finance controller but also underscores your role in achieving customer-centric goals. Demonstrate how these accomplishments tie into the company’s broader objectives, reflecting your strategic insight and understanding of the business’s mission and customer focus.

Finance Controller

ABC Corp

June 2020 - Present

- Developed a new billing process that reduced customer complaints by 30%.

- Worked closely with the sales team to improve client communication, boosting retention rates by 15%.

- Implemented a streamlined invoicing system that cut processing time by 40%, improving customer experience.

- Regularly conducted financial audits, ensuring accurate customer accounts and building trust.

Efficiency-Focused resume experience section

An efficiency-focused finance controller resume experience section should clearly showcase your ability to drive impactful results. Begin by highlighting experiences where you successfully streamlined processes, cut costs, or boosted productivity. Specify your accomplishments using numbers, like a 10% reduction in expenses, to make your achievements tangible. This approach is more effective than vague statements about saving money.

Use action words such as "implemented," "reduced," and "improved" to emphasize your direct contributions. It's crucial to show not just what you did, but also how it benefited the company. Include examples of projects where you took the lead or collaborated with others, underscoring your skills in leadership and teamwork, which are essential for a finance controller role.

Finance Controller

Tech Solutions Inc.

2018 - 2022

- Worked with different teams to cut operational costs by 15% over two years.

- Put a new budgeting system in place, boosting forecast accuracy by 20% and cutting down manual tasks.

- Made financial reporting processes more efficient, trimming month-end close time by 25%.

- Negotiated better deals with vendors, resulting in an 8% reduction in supply costs.

Write your finance controller resume summary section

A results-focused finance controller resume summary should quickly convey your strengths and the value you bring. For roles like this, it’s essential to highlight your expertise in financial analysis, budgeting, and leadership skills. Start by stating your experience and expertise clearly. Follow this with key achievements and the positive impact you’ve made in previous roles, providing a clear picture of your contributions. Balance showcasing both your hard and soft skills to demonstrate what makes you an asset. For instance, consider this example:

This example works effectively because it clearly highlights both measurable successes and strong qualitative skills. Concrete achievements add to your credibility, helping potential employers picture your impact. Use positive terms to describe your unique skills and tailor your summary to align with the job’s specific needs. Emphasize your ability to streamline processes and lead initiatives.

Understanding the differences between a resume summary, objective, profile, or qualifications list can refine your message even further. A summary is ideal for those with experience, showcasing past achievements. Meanwhile, an objective suits early career professionals focusing on future goals. A profile weaves together traits and skills, while a qualifications list brings notable accomplishments to the forefront. Recognizing these distinctions ensures your resume effectively communicates why you’re the best fit for the role right away.

Listing your finance controller skills on your resume

A skills-focused finance controller resume should effectively showcase your qualifications. You can choose to list your skills in a dedicated section or integrate them into your career summary and work experience. Highlighting your strengths and soft skills is essential, as these personal qualities, like leadership and communication, demonstrate your ability to work well with others. In contrast, hard skills are technical and teachable abilities, like financial analysis or spreadsheet expertise, which are crucial for the role.

Including these skills and strengths throughout your resume not only presents you as a well-rounded candidate but also acts as powerful keywords, enhancing your visibility to hiring managers and automated systems.

Here's an example of a standalone skills section:

This section is effective because it clearly and succinctly presents your capabilities. Each skill is relevant to the finance controller position, covering the essential technical expertise and strategic skills needed for success.

Best hard skills to feature on your finance controller resume

Hard skills for a finance controller should emphasize your technical proficiency and ability to manage intricate financial operations. These skills highlight your expertise in handling financial data, ensuring compliance, and improving financial performance.

Hard Skills

- Financial Analysis

- Budget Management

- Forecasting

- Financial Reporting

- Internal Auditing

- GAAP/IFRS Knowledge

- Risk Management

- Cost Accounting

- Proficiency in ERP Systems (e.g., SAP, Oracle)

- Advanced Microsoft Excel

- Tax Compliance

- Financial Modeling

- Data Analysis

- Variance Analysis

- Strategic Planning

Best soft skills to feature on your finance controller resume

Your soft skills should reflect your leadership strength, adaptability, and communication effectiveness. These skills highlight your capability to collaborate with teams and lead projects successfully.

Soft Skills

- Leadership

- Communication

- Problem-solving

- Attention to Detail

- Critical Thinking

- Decision-making

- Time Management

- Team Collaboration

- Adaptability

- Ethical Judgment

- Conflict Resolution

- Emotional Intelligence

- Negotiation Skills

- Project Management

- Interpersonal Skills

How to include your education on your resume

The education section of your resume is not just a list of your academic accomplishments; it's a strategic tool that can set you apart as a finance controller. Tailoring this section to the job you're seeking means including only relevant education—which is crucial since employers are interested in what prepares you for the role. Including your GPA on your resume can be beneficial if it is impressive (generally over 3.5), and listing it can be formatted as "GPA: 3.8/4.0." If you graduated with honors, such as cum laude, include that as well to highlight your achievements, like "Bachelor of Science in Accounting, cum laude." Listing your degree is straightforward; specify the degree, major, and institution.

The second example stands out because it directly relates to the finance controller role with a Bachelor’s in Accounting. It includes a high GPA, which is impressive and indicates dedication and expertise in the field. Excluding unnecessary details, like the location, while focusing on accomplishments, ensures it is succinct. Listing the education and accomplishments that matter tells employers that you are prepared and focused, making you a strong candidate for the finance controller position.

How to include finance controller certificates on your resume

A certificates section is an important part of a finance controller resume, showcasing your professional credentials. List the name of each certificate clearly. Include the date when you earned the certificate. Add the issuing organization for authenticity. Certificates can also be included in the header to quickly catch the hiring manager's eye.

Here's an example of including it in the header:

John Doe, CPA, CIMA Certified

In the standalone certificates section, ensure relevance to the finance controller role. Order certificates chronologically with the most recent first. Use a bullet-point list for clarity. Highlight certificates like CPA or CIMA, which are key for this role.

This example is good as it features highly relevant certificates for a finance controller. It lists credible issuers like AICPA and CIMA. The clear and concise format ensures easy readability.

Extra sections to include in your finance controller resume

Creating a compelling finance controller resume involves more than just listing your job experience and skills. Adding unique resume sections like your language abilities, hobbies and interests, volunteer work, and books you've read can help you stand out and show a fuller picture of who you are.

- Language section — Include a language section to show your ability to communicate in multiple languages—this can make you more versatile and valuable to employers with international operations.

- Hobbies and interests section — Share your hobbies and interests to give employers insight into your personality and work-life balance—these can highlight soft skills like teamwork and dedication.

- Volunteer work section — List your volunteer work to demonstrate your commitment to giving back and your ability to manage other responsibilities—this can showcase leadership and community involvement qualities.

- Books section — Mention books you’ve read that are relevant to finance or personal growth—this shows your dedication to continuous learning and staying updated in your field.

By integrating these sections into your resume, you not only flesh out your career story but also portray a well-rounded, engaging candidacy for a finance controller position. Focus on relevance and authenticity to make each section meaningful and impressive to potential employers.

In Conclusion

Creating an impactful finance controller resume is about transforming your detailed financial skills into a narrative that captures potential employers' attention. By carefully crafting each section with your expertise in mind, you increase the likelihood of standing out in a competitive job market. Your resume should serve as a clear map of your abilities, demonstrating not just your experience in managing financial health but also your understanding of strategic planning and leadership. The use of specific achievements and quantifiable results underscores your contributions and effectiveness in past roles.

Selecting the appropriate format, such as the reverse-chronological style, ensures potential employers immediately notice your professional growth and accomplishments. Attending to the small details—choosing a modern font and saving your resume as a PDF—reflects your meticulous attention to detail, a crucial trait for the role of a finance controller. By incorporating a professional summary that highlights both your hard and soft skills, your resume sets the stage for the detailed sections that follow.

Integrating extra sections like certifications, specific skills, and education enhances your profile's credibility. They provide a snapshot of your commitment to the field and ongoing professional development. Additional sections such as language skills, volunteer work, and personal interests can provide a fuller picture of your personality and values, resonating with organizations that share those priorities.

In conclusion, crafting a finance controller resume requires a balance of technical and strategic communication. It’s about showcasing your ability to navigate the financial complexities of an organization while concurrently exhibiting leadership, collaboration, and a willingness for continual improvement. This comprehensive approach positions you optimally for the role, creating a vivid narrative that potential employers cannot ignore.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.