Finance Director Resume Examples

Jul 18, 2024

|

12 min read

Master your finance director resume: tips for crafting a numbers game-winning CV. Learn to highlight your skills, experience, and leadership qualities for a standout application. Your future in finance could be just a page away!

Rated by 348 people

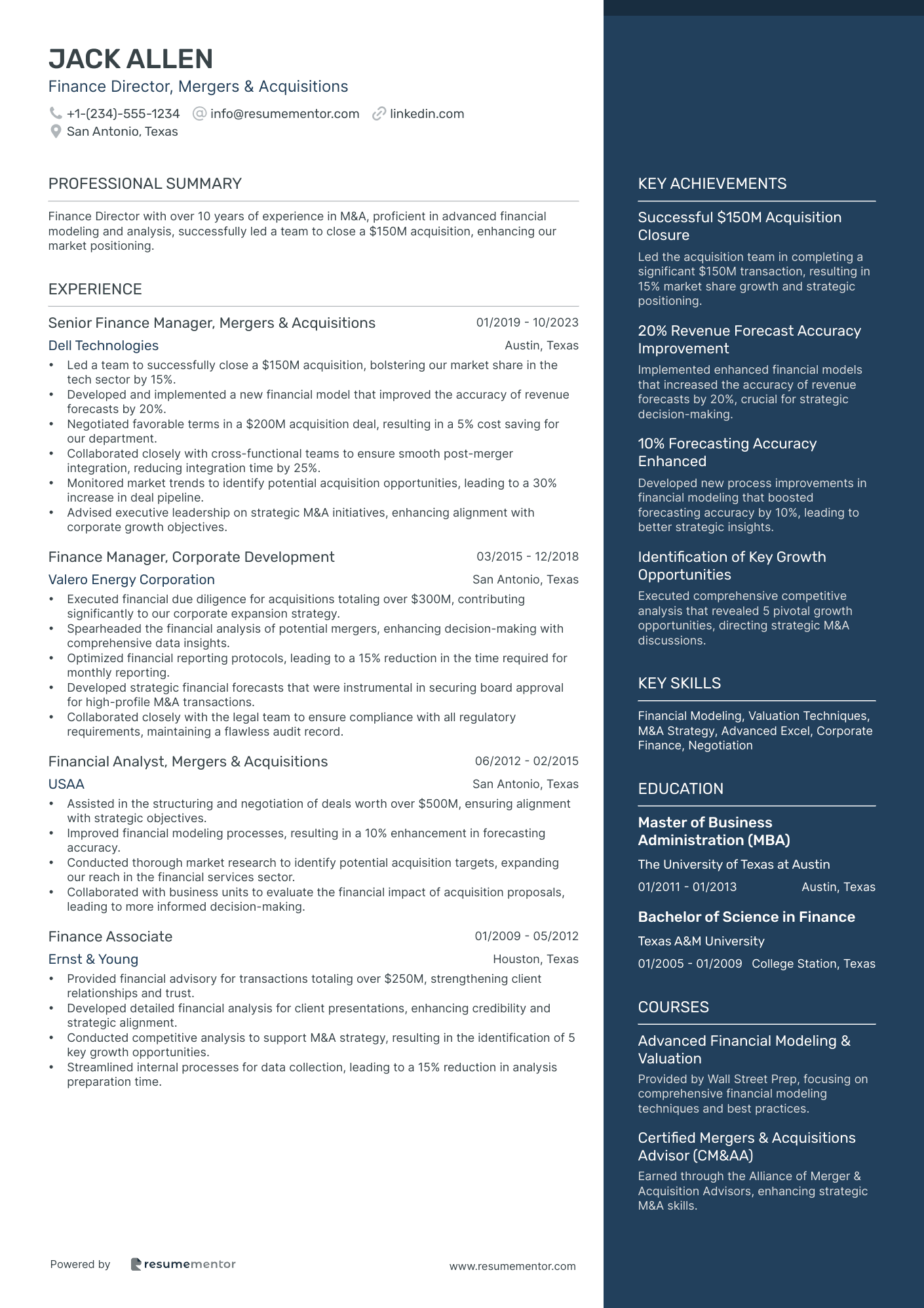

Finance Director, Mergers & Acquisitions

Director of Corporate Finance

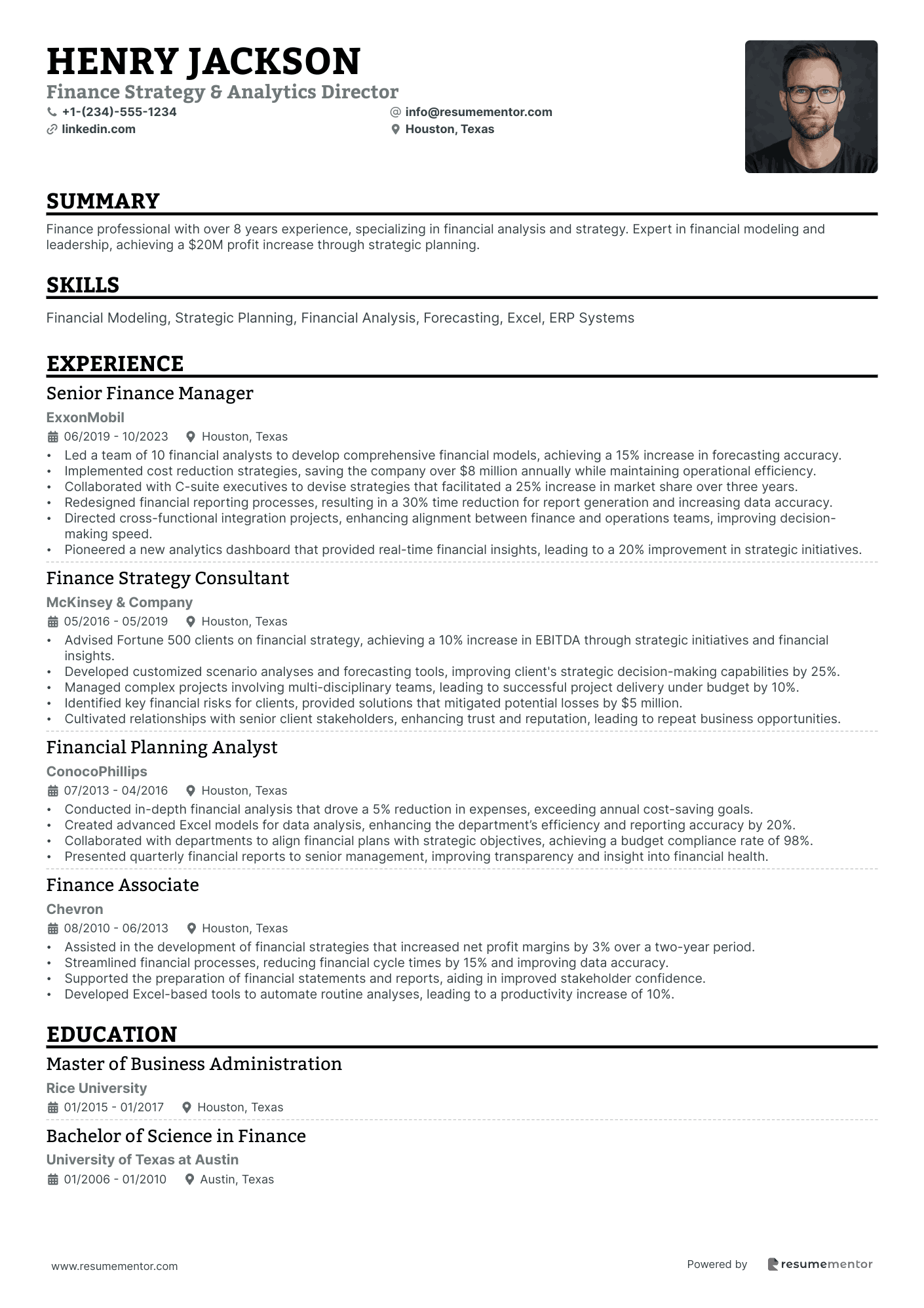

Finance Strategy & Analytics Director

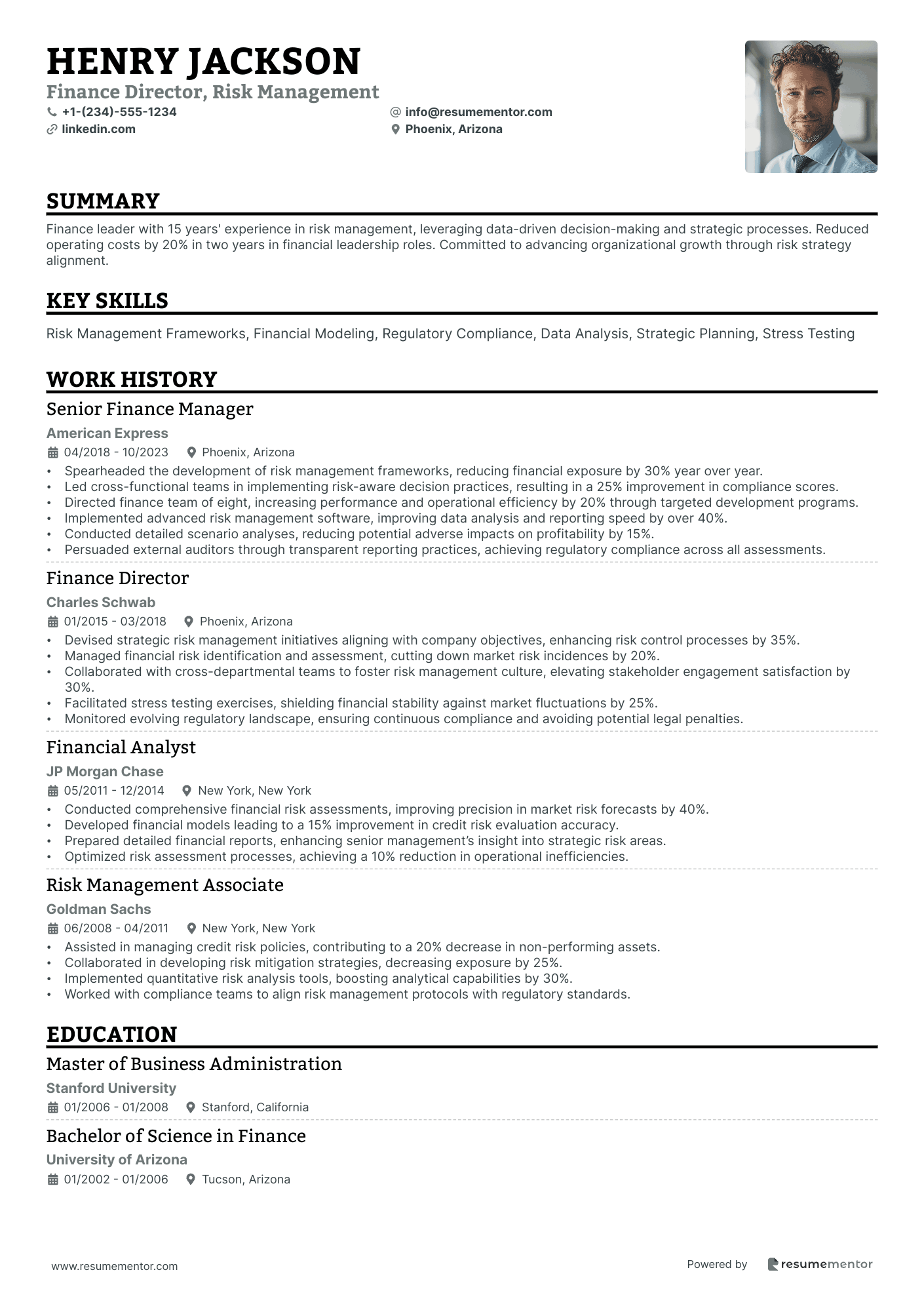

Finance Director, Risk Management

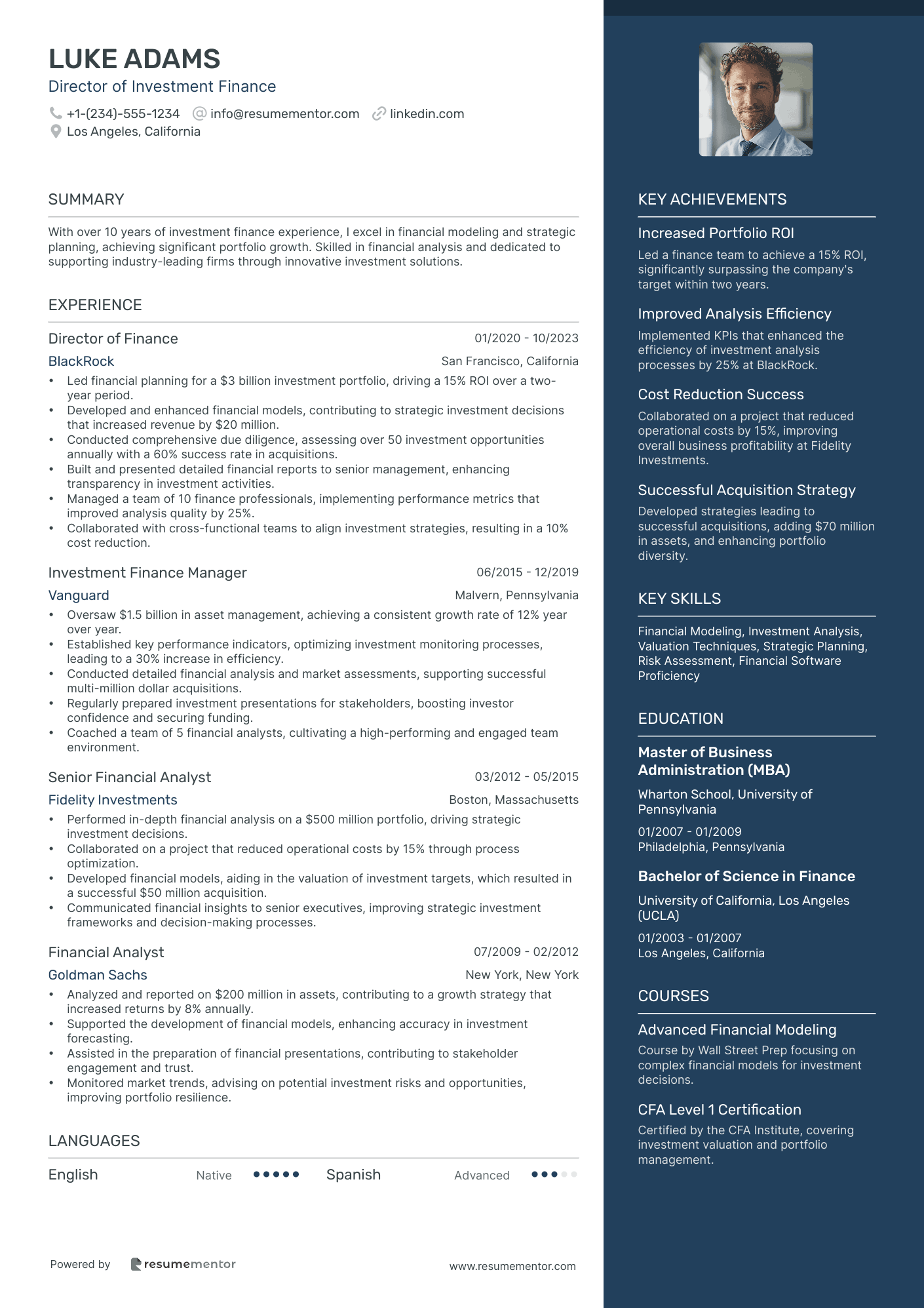

Director of Investment Finance

Capital Markets Finance Director

Finance Director, Business Planning

Director, Financial Auditing

Employee Benefits Finance Director

Director of Global Finance Operations

Finance Director, Mergers & Acquisitions resume sample

- •Led a team to successfully close a $150M acquisition, bolstering our market share in the tech sector by 15%.

- •Developed and implemented a new financial model that improved the accuracy of revenue forecasts by 20%.

- •Negotiated favorable terms in a $200M acquisition deal, resulting in a 5% cost saving for our department.

- •Collaborated closely with cross-functional teams to ensure smooth post-merger integration, reducing integration time by 25%.

- •Monitored market trends to identify potential acquisition opportunities, leading to a 30% increase in deal pipeline.

- •Advised executive leadership on strategic M&A initiatives, enhancing alignment with corporate growth objectives.

- •Executed financial due diligence for acquisitions totaling over $300M, contributing significantly to our corporate expansion strategy.

- •Spearheaded the financial analysis of potential mergers, enhancing decision-making with comprehensive data insights.

- •Optimized financial reporting protocols, leading to a 15% reduction in the time required for monthly reporting.

- •Developed strategic financial forecasts that were instrumental in securing board approval for high-profile M&A transactions.

- •Collaborated closely with the legal team to ensure compliance with all regulatory requirements, maintaining a flawless audit record.

- •Assisted in the structuring and negotiation of deals worth over $500M, ensuring alignment with strategic objectives.

- •Improved financial modeling processes, resulting in a 10% enhancement in forecasting accuracy.

- •Conducted thorough market research to identify potential acquisition targets, expanding our reach in the financial services sector.

- •Collaborated with business units to evaluate the financial impact of acquisition proposals, leading to more informed decision-making.

- •Provided financial advisory for transactions totaling over $250M, strengthening client relationships and trust.

- •Developed detailed financial analysis for client presentations, enhancing credibility and strategic alignment.

- •Conducted competitive analysis to support M&A strategy, resulting in the identification of 5 key growth opportunities.

- •Streamlined internal processes for data collection, leading to a 15% reduction in analysis preparation time.

Director of Corporate Finance resume sample

- •Led the optimization of capital allocation strategies, improving shareholder value by 20% over two fiscal years.

- •Developed and implemented financial strategies aligned with corporate growth objectives, resulting in a 15% increase in profitability.

- •Spearheaded the preparation and revision of annual budgets totaling over $3 billion, enhancing the accuracy of long-term financial planning.

- •Managed valuation and risk assessment projects that supported investment decisions, contributing to a 10% reduction in financial risk exposure.

- •Collaborated with IT and operations to streamline financial reporting processes, reducing turnaround time by 25%.

- •Mentored a team of 15 finance professionals, fostering a culture of accountability and continuous improvement.

- •Executed comprehensive forecasting processes that increased forecasting accuracy by 18% and supported strategic investment decisions.

- •Led financial modeling for over $500 million in capital projects, improving investment outcomes by 12%.

- •Implemented a new ERP system that streamlined finance operations, reducing manual work by 30%.

- •Provided strategic financial insights to senior executives and the board, aiding in complex business decisions.

- •Developed financial performance metrics that improved decision-making processes and enhanced financial transparency.

- •Managed financial planning and analysis initiatives for a $1.2 billion business unit, delivering a 10% cost reduction.

- •Facilitated cross-functional team collaborations to optimize revenue channels, resulting in a 20% revenue growth.

- •Oversaw the preparation of financial reports ensuring compliance with regulatory standards and high-quality governance.

- •Led risk assessment projects, mitigating potential financial risks by 15%.

- •Performed detailed financial analysis and modeling that contributed to improving the cost structure by 15%.

- •Supported the financial planning process with accurate data analysis, enhancing budgetary control measures.

- •Collaborated on valuation projects for potential acquisitions, aiding in strategic decision-making processes.

- •Developed financial insights that helped streamline decision-making and improve overall financial performance.

Finance Strategy & Analytics Director resume sample

- •Led a team of 10 financial analysts to develop comprehensive financial models, achieving a 15% increase in forecasting accuracy.

- •Implemented cost reduction strategies, saving the company over $8 million annually while maintaining operational efficiency.

- •Collaborated with C-suite executives to devise strategies that facilitated a 25% increase in market share over three years.

- •Redesigned financial reporting processes, resulting in a 30% time reduction for report generation and increasing data accuracy.

- •Directed cross-functional integration projects, enhancing alignment between finance and operations teams, improving decision-making speed.

- •Pioneered a new analytics dashboard that provided real-time financial insights, leading to a 20% improvement in strategic initiatives.

- •Advised Fortune 500 clients on financial strategy, achieving a 10% increase in EBITDA through strategic initiatives and financial insights.

- •Developed customized scenario analyses and forecasting tools, improving client's strategic decision-making capabilities by 25%.

- •Managed complex projects involving multi-disciplinary teams, leading to successful project delivery under budget by 10%.

- •Identified key financial risks for clients, provided solutions that mitigated potential losses by $5 million.

- •Cultivated relationships with senior client stakeholders, enhancing trust and reputation, leading to repeat business opportunities.

- •Conducted in-depth financial analysis that drove a 5% reduction in expenses, exceeding annual cost-saving goals.

- •Created advanced Excel models for data analysis, enhancing the department’s efficiency and reporting accuracy by 20%.

- •Collaborated with departments to align financial plans with strategic objectives, achieving a budget compliance rate of 98%.

- •Presented quarterly financial reports to senior management, improving transparency and insight into financial health.

- •Assisted in the development of financial strategies that increased net profit margins by 3% over a two-year period.

- •Streamlined financial processes, reducing financial cycle times by 15% and improving data accuracy.

- •Supported the preparation of financial statements and reports, aiding in improved stakeholder confidence.

- •Developed Excel-based tools to automate routine analyses, leading to a productivity increase of 10%.

Finance Director, Risk Management resume sample

- •Spearheaded the development of risk management frameworks, reducing financial exposure by 30% year over year.

- •Led cross-functional teams in implementing risk-aware decision practices, resulting in a 25% improvement in compliance scores.

- •Directed finance team of eight, increasing performance and operational efficiency by 20% through targeted development programs.

- •Implemented advanced risk management software, improving data analysis and reporting speed by over 40%.

- •Conducted detailed scenario analyses, reducing potential adverse impacts on profitability by 15%.

- •Persuaded external auditors through transparent reporting practices, achieving regulatory compliance across all assessments.

- •Devised strategic risk management initiatives aligning with company objectives, enhancing risk control processes by 35%.

- •Managed financial risk identification and assessment, cutting down market risk incidences by 20%.

- •Collaborated with cross-departmental teams to foster risk management culture, elevating stakeholder engagement satisfaction by 30%.

- •Facilitated stress testing exercises, shielding financial stability against market fluctuations by 25%.

- •Monitored evolving regulatory landscape, ensuring continuous compliance and avoiding potential legal penalties.

- •Conducted comprehensive financial risk assessments, improving precision in market risk forecasts by 40%.

- •Developed financial models leading to a 15% improvement in credit risk evaluation accuracy.

- •Prepared detailed financial reports, enhancing senior management’s insight into strategic risk areas.

- •Optimized risk assessment processes, achieving a 10% reduction in operational inefficiencies.

- •Assisted in managing credit risk policies, contributing to a 20% decrease in non-performing assets.

- •Collaborated in developing risk mitigation strategies, decreasing exposure by 25%.

- •Implemented quantitative risk analysis tools, boosting analytical capabilities by 30%.

- •Worked with compliance teams to align risk management protocols with regulatory standards.

Director of Investment Finance resume sample

- •Led financial planning for a $3 billion investment portfolio, driving a 15% ROI over a two-year period.

- •Developed and enhanced financial models, contributing to strategic investment decisions that increased revenue by $20 million.

- •Conducted comprehensive due diligence, assessing over 50 investment opportunities annually with a 60% success rate in acquisitions.

- •Built and presented detailed financial reports to senior management, enhancing transparency in investment activities.

- •Managed a team of 10 finance professionals, implementing performance metrics that improved analysis quality by 25%.

- •Collaborated with cross-functional teams to align investment strategies, resulting in a 10% cost reduction.

- •Oversaw $1.5 billion in asset management, achieving a consistent growth rate of 12% year over year.

- •Established key performance indicators, optimizing investment monitoring processes, leading to a 30% increase in efficiency.

- •Conducted detailed financial analysis and market assessments, supporting successful multi-million dollar acquisitions.

- •Regularly prepared investment presentations for stakeholders, boosting investor confidence and securing funding.

- •Coached a team of 5 financial analysts, cultivating a high-performing and engaged team environment.

- •Performed in-depth financial analysis on a $500 million portfolio, driving strategic investment decisions.

- •Collaborated on a project that reduced operational costs by 15% through process optimization.

- •Developed financial models, aiding in the valuation of investment targets, which resulted in a successful $50 million acquisition.

- •Communicated financial insights to senior executives, improving strategic investment frameworks and decision-making processes.

- •Analyzed and reported on $200 million in assets, contributing to a growth strategy that increased returns by 8% annually.

- •Supported the development of financial models, enhancing accuracy in investment forecasting.

- •Assisted in the preparation of financial presentations, contributing to stakeholder engagement and trust.

- •Monitored market trends, advising on potential investment risks and opportunities, improving portfolio resilience.

Capital Markets Finance Director resume sample

- •Led a team of 12 in executing capital raising efforts totaling over $3 billion, directly impacting our strategic growth.

- •Analyzed complex market data, providing actionable insights that improved investment decision-making processes by 25%.

- •Crafted financial models that increased forecasting accuracy by 18%, enhancing resource allocation efficiency.

- •Fostered strategic partnerships with key investment banks, resulting in a 20% reduction in transaction costs.

- •Presented comprehensive financial reports to the board, achieving approval for critical investments worth $1 billion.

- •Collaborated with cross-functional teams to integrate capital strategies with broader business initiatives, optimizing overall performance.

- •Instrumental in raising $500 million for strategic acquisitions, increasing company market share by 10%.

- •Improved capital structure by analyzing economic trends, leading to a 15% cost of capital reduction.

- •Developed financial modeling tools that enhanced decision making for mergers and acquisitions.

- •Established and maintained relationships with over 30 private equity firms and institutional investors.

- •Led team of analysts in identifying profitable investment opportunities, increasing portfolio returns by 12%.

- •Executed financial analyses for capital raising projects totaling over $300 million with 100% compliance.

- •Facilitated stakeholder meetings for project finance strategies, enhancing engagement by improving communication processes.

- •Restructured detailed financial models, resulting in a 10% increase in efficiency in reporting procedures.

- •Introduced risk management techniques that improved investment portfolio resilience against economic downturns.

- •Assisted in preparing financial documentation supporting capital raising and investment strategies amounting to $200 million.

- •Collaborated in multi-departmental teams to design efficient budgeting processes, reducing budget deviations by 8%.

- •Developed early financial projection models that improved forecast accuracy and guided executive decisions.

- •Supported senior analysts in market trend analysis for strategic planning and resource allocation.

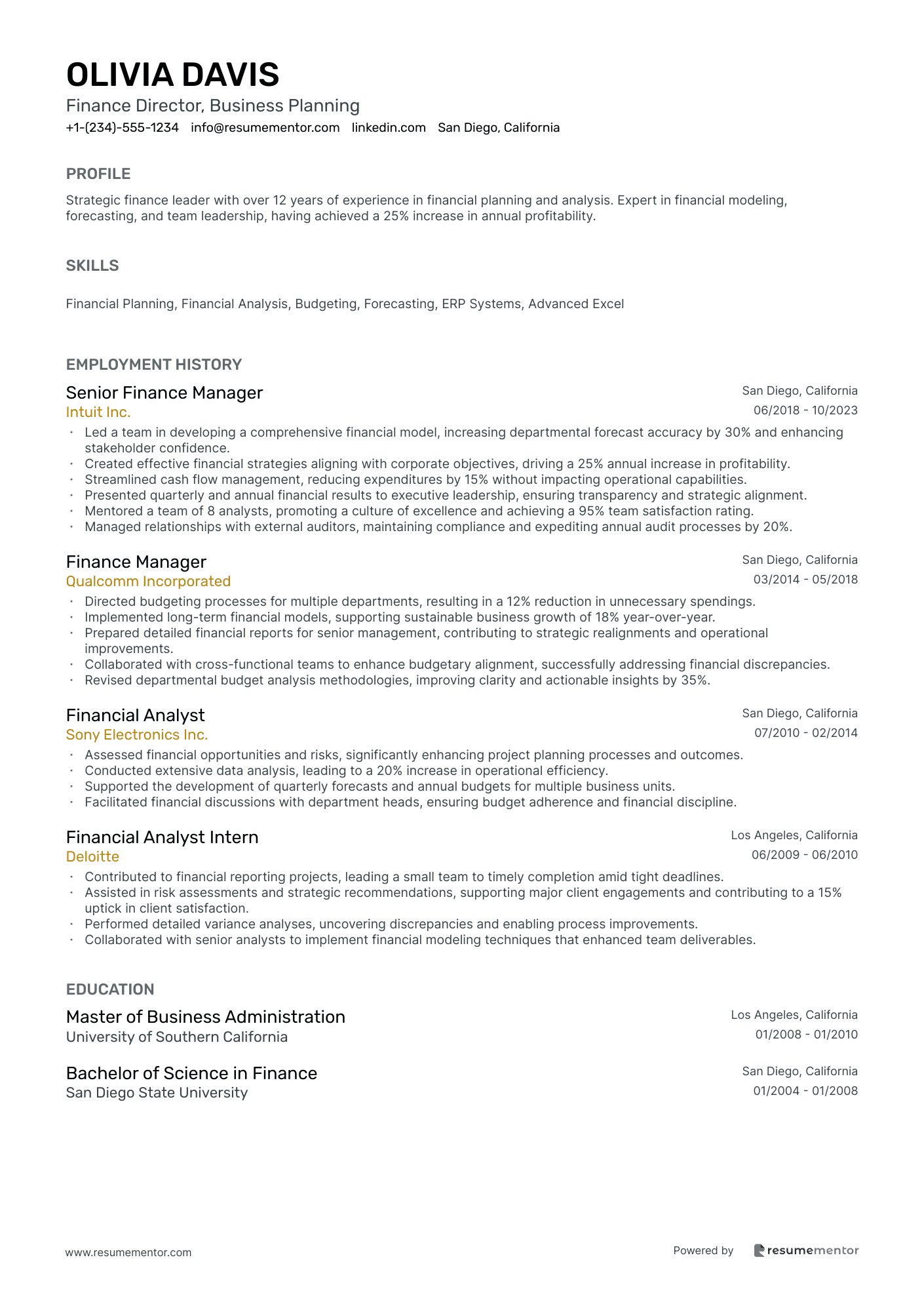

Finance Director, Business Planning resume sample

- •Led a team in developing a comprehensive financial model, increasing departmental forecast accuracy by 30% and enhancing stakeholder confidence.

- •Created effective financial strategies aligning with corporate objectives, driving a 25% annual increase in profitability.

- •Streamlined cash flow management, reducing expenditures by 15% without impacting operational capabilities.

- •Presented quarterly and annual financial results to executive leadership, ensuring transparency and strategic alignment.

- •Mentored a team of 8 analysts, promoting a culture of excellence and achieving a 95% team satisfaction rating.

- •Managed relationships with external auditors, maintaining compliance and expediting annual audit processes by 20%.

- •Directed budgeting processes for multiple departments, resulting in a 12% reduction in unnecessary spendings.

- •Implemented long-term financial models, supporting sustainable business growth of 18% year-over-year.

- •Prepared detailed financial reports for senior management, contributing to strategic realignments and operational improvements.

- •Collaborated with cross-functional teams to enhance budgetary alignment, successfully addressing financial discrepancies.

- •Revised departmental budget analysis methodologies, improving clarity and actionable insights by 35%.

- •Assessed financial opportunities and risks, significantly enhancing project planning processes and outcomes.

- •Conducted extensive data analysis, leading to a 20% increase in operational efficiency.

- •Supported the development of quarterly forecasts and annual budgets for multiple business units.

- •Facilitated financial discussions with department heads, ensuring budget adherence and financial discipline.

- •Contributed to financial reporting projects, leading a small team to timely completion amid tight deadlines.

- •Assisted in risk assessments and strategic recommendations, supporting major client engagements and contributing to a 15% uptick in client satisfaction.

- •Performed detailed variance analyses, uncovering discrepancies and enabling process improvements.

- •Collaborated with senior analysts to implement financial modeling techniques that enhanced team deliverables.

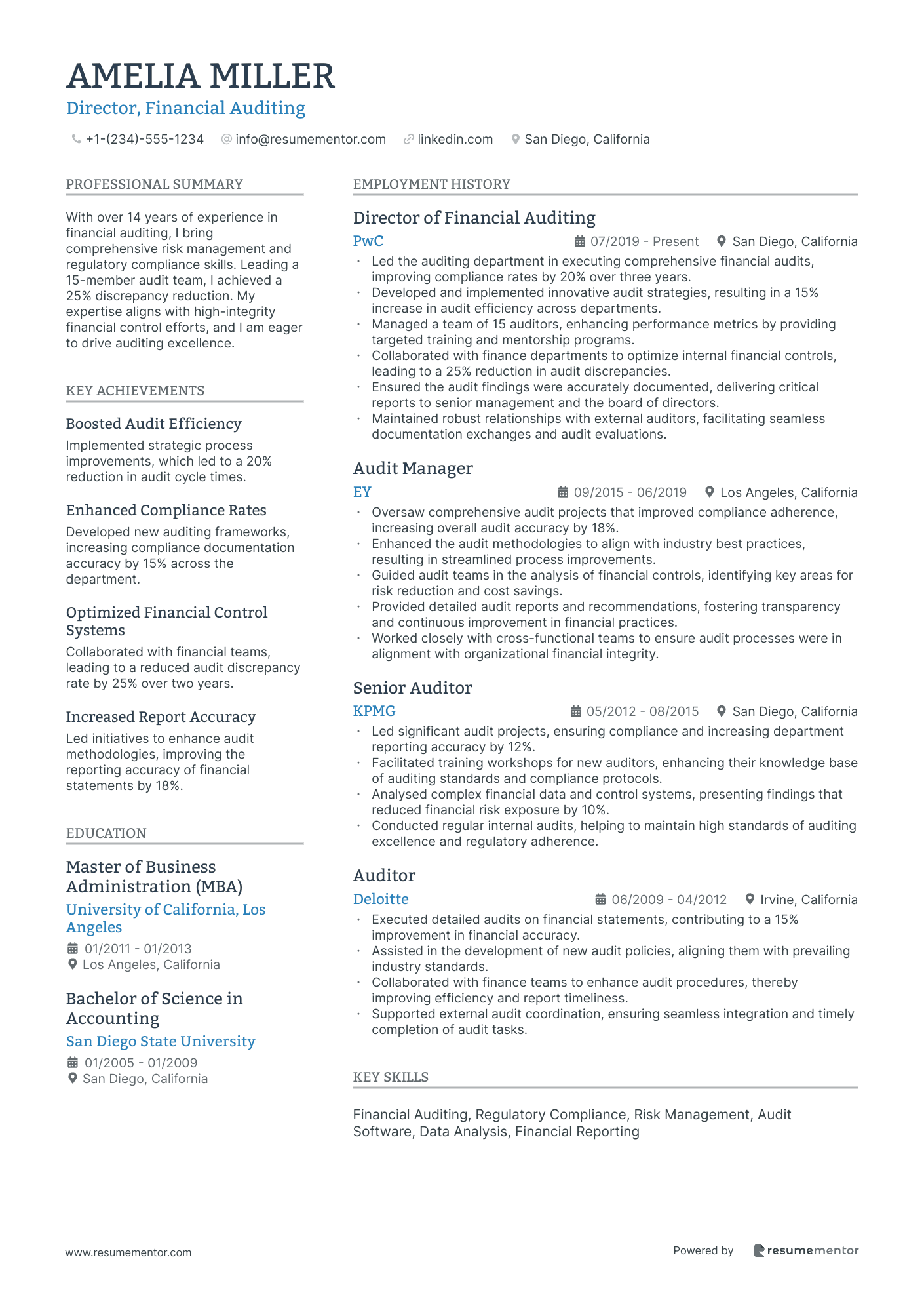

Director, Financial Auditing resume sample

- •Led the auditing department in executing comprehensive financial audits, improving compliance rates by 20% over three years.

- •Developed and implemented innovative audit strategies, resulting in a 15% increase in audit efficiency across departments.

- •Managed a team of 15 auditors, enhancing performance metrics by providing targeted training and mentorship programs.

- •Collaborated with finance departments to optimize internal financial controls, leading to a 25% reduction in audit discrepancies.

- •Ensured the audit findings were accurately documented, delivering critical reports to senior management and the board of directors.

- •Maintained robust relationships with external auditors, facilitating seamless documentation exchanges and audit evaluations.

- •Oversaw comprehensive audit projects that improved compliance adherence, increasing overall audit accuracy by 18%.

- •Enhanced the audit methodologies to align with industry best practices, resulting in streamlined process improvements.

- •Guided audit teams in the analysis of financial controls, identifying key areas for risk reduction and cost savings.

- •Provided detailed audit reports and recommendations, fostering transparency and continuous improvement in financial practices.

- •Worked closely with cross-functional teams to ensure audit processes were in alignment with organizational financial integrity.

- •Led significant audit projects, ensuring compliance and increasing department reporting accuracy by 12%.

- •Facilitated training workshops for new auditors, enhancing their knowledge base of auditing standards and compliance protocols.

- •Analysed complex financial data and control systems, presenting findings that reduced financial risk exposure by 10%.

- •Conducted regular internal audits, helping to maintain high standards of auditing excellence and regulatory adherence.

- •Executed detailed audits on financial statements, contributing to a 15% improvement in financial accuracy.

- •Assisted in the development of new audit policies, aligning them with prevailing industry standards.

- •Collaborated with finance teams to enhance audit procedures, thereby improving efficiency and report timeliness.

- •Supported external audit coordination, ensuring seamless integration and timely completion of audit tasks.

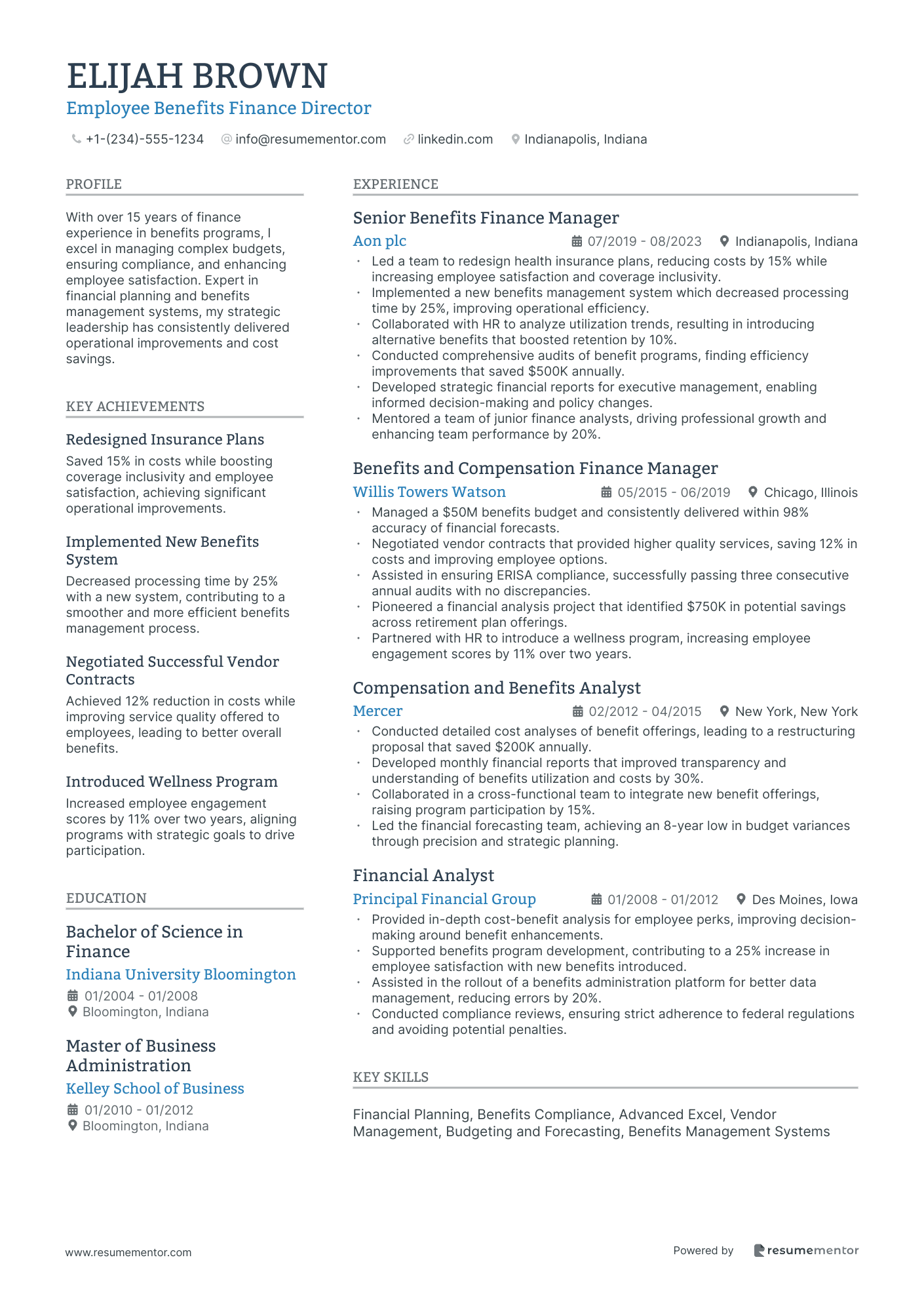

Employee Benefits Finance Director resume sample

- •Led a team to redesign health insurance plans, reducing costs by 15% while increasing employee satisfaction and coverage inclusivity.

- •Implemented a new benefits management system which decreased processing time by 25%, improving operational efficiency.

- •Collaborated with HR to analyze utilization trends, resulting in introducing alternative benefits that boosted retention by 10%.

- •Conducted comprehensive audits of benefit programs, finding efficiency improvements that saved $500K annually.

- •Developed strategic financial reports for executive management, enabling informed decision-making and policy changes.

- •Mentored a team of junior finance analysts, driving professional growth and enhancing team performance by 20%.

- •Managed a $50M benefits budget and consistently delivered within 98% accuracy of financial forecasts.

- •Negotiated vendor contracts that provided higher quality services, saving 12% in costs and improving employee options.

- •Assisted in ensuring ERISA compliance, successfully passing three consecutive annual audits with no discrepancies.

- •Pioneered a financial analysis project that identified $750K in potential savings across retirement plan offerings.

- •Partnered with HR to introduce a wellness program, increasing employee engagement scores by 11% over two years.

- •Conducted detailed cost analyses of benefit offerings, leading to a restructuring proposal that saved $200K annually.

- •Developed monthly financial reports that improved transparency and understanding of benefits utilization and costs by 30%.

- •Collaborated in a cross-functional team to integrate new benefit offerings, raising program participation by 15%.

- •Led the financial forecasting team, achieving an 8-year low in budget variances through precision and strategic planning.

- •Provided in-depth cost-benefit analysis for employee perks, improving decision-making around benefit enhancements.

- •Supported benefits program development, contributing to a 25% increase in employee satisfaction with new benefits introduced.

- •Assisted in the rollout of a benefits administration platform for better data management, reducing errors by 20%.

- •Conducted compliance reviews, ensuring strict adherence to federal regulations and avoiding potential penalties.

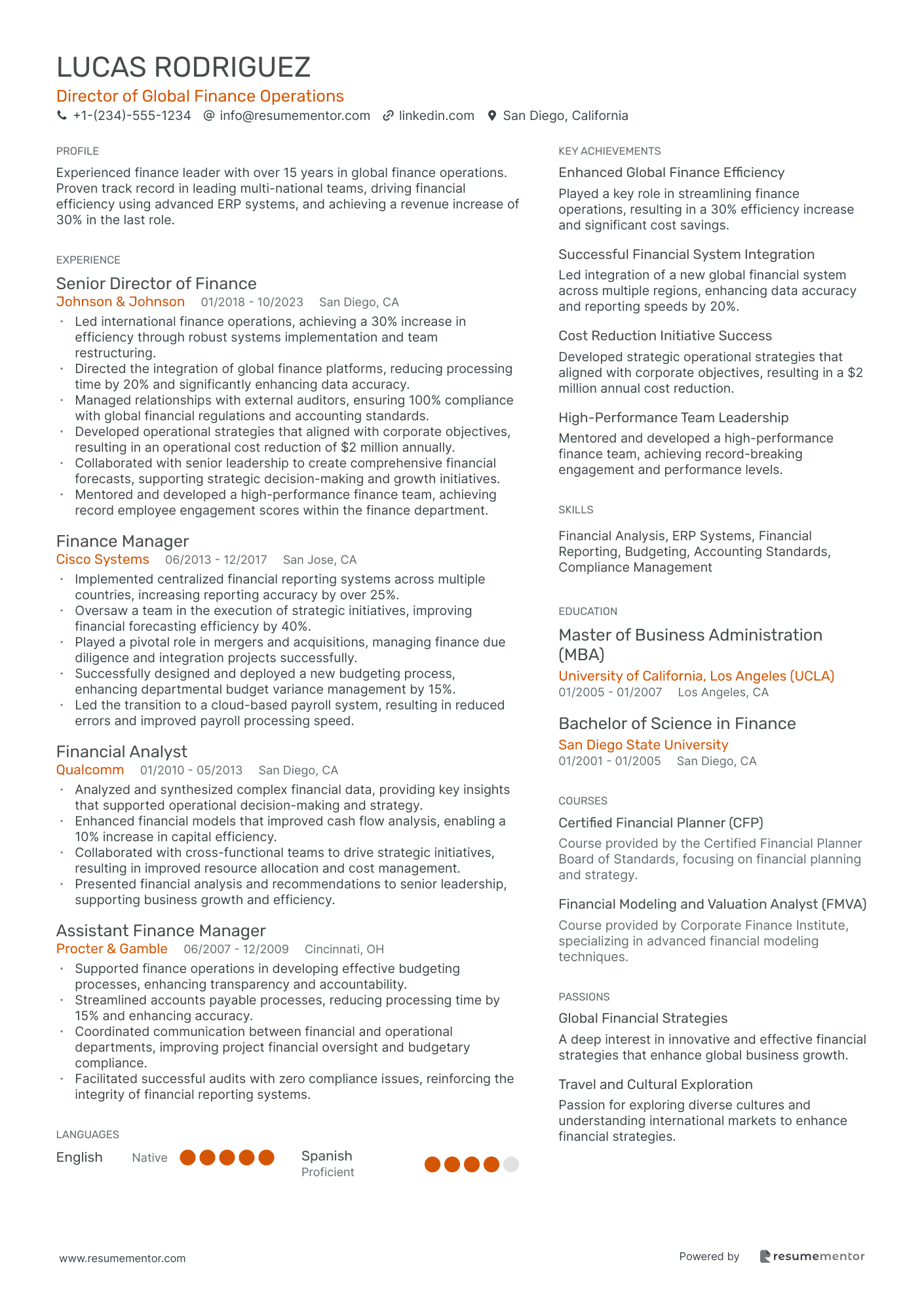

Director of Global Finance Operations resume sample

- •Led international finance operations, achieving a 30% increase in efficiency through robust systems implementation and team restructuring.

- •Directed the integration of global finance platforms, reducing processing time by 20% and significantly enhancing data accuracy.

- •Managed relationships with external auditors, ensuring 100% compliance with global financial regulations and accounting standards.

- •Developed operational strategies that aligned with corporate objectives, resulting in an operational cost reduction of $2 million annually.

- •Collaborated with senior leadership to create comprehensive financial forecasts, supporting strategic decision-making and growth initiatives.

- •Mentored and developed a high-performance finance team, achieving record employee engagement scores within the finance department.

- •Implemented centralized financial reporting systems across multiple countries, increasing reporting accuracy by over 25%.

- •Oversaw a team in the execution of strategic initiatives, improving financial forecasting efficiency by 40%.

- •Played a pivotal role in mergers and acquisitions, managing finance due diligence and integration projects successfully.

- •Successfully designed and deployed a new budgeting process, enhancing departmental budget variance management by 15%.

- •Led the transition to a cloud-based payroll system, resulting in reduced errors and improved payroll processing speed.

- •Analyzed and synthesized complex financial data, providing key insights that supported operational decision-making and strategy.

- •Enhanced financial models that improved cash flow analysis, enabling a 10% increase in capital efficiency.

- •Collaborated with cross-functional teams to drive strategic initiatives, resulting in improved resource allocation and cost management.

- •Presented financial analysis and recommendations to senior leadership, supporting business growth and efficiency.

- •Supported finance operations in developing effective budgeting processes, enhancing transparency and accountability.

- •Streamlined accounts payable processes, reducing processing time by 15% and enhancing accuracy.

- •Coordinated communication between financial and operational departments, improving project financial oversight and budgetary compliance.

- •Facilitated successful audits with zero compliance issues, reinforcing the integrity of financial reporting systems.

Steering the financial ship of an organization is no easy task, and as a finance director, you bring exceptional skills to the table. Yet, translating this technical expertise into a compelling resume can often feel like navigating uncharted waters. To stand out, it’s crucial to showcase your ability to manage budgets, forecasts, and strategic planning in a way that resonates with hiring managers.

Simply listing previous roles isn’t enough to convey your value. Highlighting your achievements effectively captures attention, and this is where a strong resume template can make all the difference. A well-structured template provides a clear framework, ensuring your resume is professional and easy to read.

Beyond the numbers, a strong resume should reflect your leadership abilities. By tailoring your accomplishments to align with a company’s needs, you present yourself as more than just a numbers person. You become a strategic partner in the eyes of potential employers.

Every choice you make, from format to wording, shapes the impression you leave. In a competitive field, a well-crafted resume is your ticket to standing out. It’s your chance to highlight your role as a key player in an organization’s financial health. Let’s explore how to create a resume that opens doors to new opportunities.

Key Takeaways

- A finance director's resume should highlight leadership in financial strategy, demonstrating expertise in budgeting, forecasting, and the ability to drive organizational success.

- A strong professional summary with specific metrics catches attention, showcasing contributions to financial health and alignment with business goals.

- Use industry-specific keywords and organize work experience in reverse chronological order, focusing on quantifiable achievements to illustrate your impact.

- Balance showcasing hard skills like "financial analysis" and "budget management" with essential soft skills such as "leadership" and "communication" in your skills section.

- Ensure your education and certifications support your practical experience, displaying them prominently to underline credibility and expertise.

What to focus on when writing your finance director resume

A finance director's resume should clearly demonstrate your leadership in financial strategy and your ability to drive organizational success. Your credentials need to show off your expertise in budgeting, forecasting, and financial planning—demonstrating how you deftly manage financial operations and improve overall performance. Exhibiting your strong analytical skills and showcasing the impact you've made in previous roles will make your resume stand out from other applicants. It is essential that your resume not only details your ability to lead but also reflects the strategic influence you've had on the financial health of past organizations.

How to structure your finance director resume

- Professional Summary: This is your chance to provide a snapshot of your career, showcasing your experience in leading financial initiatives. Include specific metrics that highlight your role in improving financial health or achieving cost reductions. Highlighting these achievements with percentages or figures will make them credible and impressive. Your summary should convey a strong sense of accountability and emphasize your ability to align financial strategy with business goals.

- Work Experience: Highlight your career trajectory by detailing your prior roles in reverse chronological order. Focus on delineating your accomplishments, such as implementing processes that doubled revenue or improved budgeting efficiency. Use industry-specific keywords, like "financial oversight," "strategic planning," or "risk management," to demonstrate your comprehensive expertise in guiding financial operations.

- Education: Your educational background is a key component in establishing your credibility. List your degree in finance, accounting, or a related field, and include notable advanced courses or certifications, such as CPA or CFA, that reinforce your proficiency. This section supports your practical experience and underlines your foundational knowledge in financial management.

- Key Skills: Skill selection is critical for illustrating your core competencies. Emphasize skills like "financial analysis," "regulatory compliance," and "leadership"—abilities that are indispensable in financial management. When listed alongside your work experience, these skills will reflect your well-rounded capability to address the complex challenges faced by finance directors.

- Technical Proficiencies: Given the importance of technology in financial management, this section should highlight your expertise with relevant software tools. Proficiencies in platforms like SAP, Oracle, QuickBooks, or advanced Excel demonstrate your technical adeptness, allowing you to implement effective financial solutions and optimizations.

Considering optional sections like "Professional Affiliations" or "Volunteer Experience" can further enrich your resume, adding depth and showcasing additional leadership abilities or industry connections. Below, we will cover each section more in-depth to help you craft a polished and effective finance director resume.

Which resume format to choose

A well-crafted finance director resume benefits significantly from choosing the right format. For this role, the chronological style is ideal, as it effectively highlights your career progression, showcasing your growth and increasing responsibility over time. This format allows potential employers to trace your steps and assess the experience that backs your qualifications.

Selecting modern fonts like Rubic, Montserrat, or Lato offers a clean and professional appearance, subtly setting your resume apart from those using more traditional fonts like Arial or Times New Roman. These fonts contribute to a contemporary feel, aligning with the innovative thinking expected in finance leadership roles.

Saving your resume as a PDF is important, ensuring that your formatting remains intact across all devices. This consistency helps maintain a polished and professional presentation, crucial for making a strong impression.

Margins should be set at one inch on all sides. This creates a balanced layout, offering plenty of white space, which enhances readability and keeps the document from feeling cramped. Together, these elements not only make your resume easy to read but also make sure it communicates your expertise and readiness for the finance director role effectively.

How to write a quantifiable resume experience section

The experience section of your finance director resume is crucial because it shows potential employers how your past achievements align with their needs. By focusing on quantifiable results, you illustrate your ability to drive success. Organize this section in reverse-chronological order to highlight your most recent and relevant roles. Consider detailing your experience from the last ten to fifteen years, depending on what best showcases your skills. Tailoring your resume to the job ad ensures your expertise stands out. Use active language like "spearheaded," "optimized," and "increased" to describe your accomplishments in roles such as Finance Director or CFO. Highlight specific metrics to emphasize your impact.

Here's a strong resume experience example:

- •Increased annual revenue by 20% through implementation of cost-saving strategies and process improvements.

- •Reduced operating expenses by 15% by renegotiating supplier contracts and streamlining operations.

- •Led a team of 15 finance professionals, enhancing team performance by 30% through development programs.

- •Implemented a new financial tracking system that improved financial reporting accuracy by 25%.

This example is effective due to its clear use of precise language and measurable achievements, which convey substantial impact. By organizing the information in a structured and easily readable way, it provides valuable insights into your past roles. Tailoring the content to match the job description keeps everything relevant and directly ties your accomplishments to the needs of potential employers. The active verbs and specific data points demonstrate your initiative and measurable contributions.

Problem-Solving Focused resume experience section

A problem-solving-focused finance director resume experience section should showcase your ability to tackle challenges head-on and drive positive change. Begin by highlighting the main focus of your experience and explain how you addressed financial challenges in a way that improved operations. Use active verbs to illustrate how you identified issues and crafted solutions that led to measurable improvements. Integrate metrics and tangible outcomes to demonstrate your success and innovative thinking, showing how you contributed to significant enhancements.

Draw from specific instances where you optimized processes, reduced costs, or facilitated growth. Connect these achievements back to your leadership skills, emphasizing the impact you had in each situation. Clearly and concisely present these examples to paint a vivid picture of your contributions. Here is a structured example to guide you:

Finance Director

XYZ Corporation

Jan 2018 - Present

- Led a cross-functional team that reduced budget variance by 15% within one fiscal quarter.

- Streamlined financial reporting process, reducing cycle time by 50% and improving accuracy.

- Developed and implemented a risk management strategy that lowered organizational risk exposure by 20%.

- Spearheaded automation of billing systems, enhancing efficiency and reducing processing errors by 30%.

Collaboration-Focused resume experience section

A collaboration-focused finance director resume experience section should highlight your ability to work effectively with others to achieve financial objectives. Begin by describing how you actively engaged with various departments to enhance strategies and streamline processes. Use clear, action-oriented language such as "partnered with," "collaborated on," or "led a team" to emphasize your collaborative efforts. Illustrate your capacity to manage or contribute to cross-functional projects, showcasing your skill in unifying team efforts toward common goals.

Weave specific examples or metrics throughout your descriptions to underscore your achievements. If you've improved a budgeting process through teamwork or successfully led a task force to cut costs, these details will make your resume memorable. By mentioning the tools or methods you used, like communication platforms or organizing workshops, you paint a complete picture of your collaborative approach. Ultimately, your experience section should not only showcase your financial acumen but also your proficiency in leveraging collective expertise to drive results.

Finance Director

Acme Corporation

2018 - 2022

- Collaborated with the IT department to develop a new financial reporting tool, cutting report preparation time by 30%.

- Led a cross-functional team to streamline the annual budgeting process, boosting forecasting accuracy by 20%.

- Partnered with sales and marketing teams to align strategies, driving a 15% increase in revenue over two years.

- Organized monthly interdepartmental workshops to enhance communication and problem-solving skills among teams.

Responsibility-Focused resume experience section

A responsibility-focused finance director resume experience section should clearly illustrate your accomplishments and demonstrate your ability to manage financial tasks, lead teams, and drive improvements. Start by showcasing experiences that highlight your skills in managing financial functions. Emphasize tangible results, such as cost savings and increased efficiency, to show the impact of your work. Maintain a clear and straightforward language using active verbs to effectively communicate your contributions.

Specific examples can help connect your experiences to real outcomes. Instead of saying you managed budgets, you might explain how you improved budget processes to achieve cost savings. Numbers and data can further highlight the impact of your responsibilities, making it easier for potential employers to see the real-world results of your efforts. This strategy paints a cohesive and impressive picture of your capabilities.

Finance Director

ABC Corporation

March 2018 - Present

- Optimized annual budget processes, reducing expenses by 15%

- Led a finance team in streamlining reporting procedures, improving efficiency by 25%

- Implemented a new financial system that enhanced accuracy in forecasting by 35%

- Directed investment strategies that resulted in a 20% increase in returns

Leadership-Focused resume experience section

A leadership-focused finance director resume experience section should clearly emphasize the impact of your leadership and financial management skills. Highlight your ability to guide teams, control budgets, and drive better financial outcomes. Begin with your job titles and workplaces, then use bullet points to convey your achievements. Describe your responsibilities and the results you achieved using strong action verbs. Illustrate how your leadership led to success stories, such as cost savings, revenue increases, or process improvements.

Throughout the bullet points, aim to be both concise and informative, showcasing your talent for spearheading initiatives and developing strategic financial plans. Each point should naturally highlight your leadership capabilities, as well as your managerial and decision-making skills. Enhance your accomplishments with metrics or examples, such as "cut expenses by 15%" or "guided a team of 10 professionals." The ultimate goal is to demonstrate your leadership strengths and the concrete results you've delivered, rather than just listing duties.

Finance Director

ABC Corporation

2018 - Present

- Led a finance team of 15 to enhance budget efficiency, reducing overhead by 20%

- Developed strategic plans that boosted company profits by $2 million in 2020

- Streamlined reporting processes, decreasing monthly close times by 30 hours

- Implemented a new financial forecasting system, increasing accuracy by 25%

Write your finance director resume summary section

A finance-focused resume summary for a director-level position should effectively showcase your expertise and leadership impact. This initial section serves to highlight your achievements and skills, setting the tone for the entire resume. Consider using a format like this JSON example:

This summary makes an immediate impact by underscoring extensive industry experience and notable achievements. Reference to skills like "strategic planning" and "risk mitigation" reinforces your expertise in critical areas of the role. When describing yourself, focus on articulating your skills and accomplishments with specificity. Terms like "proven leader" not only highlight your capabilities but also demonstrate your ability to inspire teams.

Grasping the distinction between a summary and other similar statements is crucial for a nuanced resume. While a summary zeroes in on your experience and value concisely, a resume objective speaks to your career ambitions, making it more suitable for those at the beginning of their career. A resume profile combines elements of both summary and objective to give a broader overview of your skills and goals. Meanwhile, a summary of qualifications provides a quick snapshot of your skills and achievements. Opting for a summary is ideal if you have extensive experience, as it effectively showcases your past performance and illustrates your suitability for the finance director role.

Listing your finance director skills on your resume

A finance-focused director resume should feature a skills section that can either stand alone or be seamlessly blended into your experience and summary areas. This section should start by showcasing your strengths and essential soft skills, like leadership and communication, which are crucial for any finance director. Hard skills, on the other hand, represent your technical abilities specific to finance. These include areas like financial analysis or budget management. Including both types of skills effectively turns them into powerful keywords that increase your chances of standing out.

To illustrate, here's an example of a standalone skills section in JSON format:

This skills section provides a clear display of the vital abilities you need as a finance director. It is compact yet comprehensive, ensuring your resume gets through screening systems effectively. Each skill is chosen to reflect a thorough understanding of crucial finance areas.

Best hard skills to feature on your finance director resume

Your hard skills should demonstrate a solid grasp of financial management tasks. They should convey your expertise in organizing finances and implementing strategies efficiently.

Hard Skills

- Financial Analysis

- Budget Management

- Strategic Planning

- Risk Management

- Financial Reporting

- Mergers and Acquisitions

- Compliance and Regulations

- Cash Flow Management

- Cost Reduction Strategies

- Forecasting

- Audit and Taxation

- Investment Analysis

- Performance Metrics

- Financial Modeling

- Profitability Analysis

Best soft skills to feature on your finance director resume

Soft skills should reflect your ability to lead teams and communicate effectively. They highlight your capacity to manage teams and guide organizations toward success.

Soft Skills

- Leadership

- Communication

- Decision-making

- Problem-solving

- Interpersonal Skills

- Adaptability

- Negotiation

- Teamwork

- Time Management

- Critical Thinking

- Emotional Intelligence

- Project Management

- Conflict Resolution

- Integrity

- Change Management

How to include your education on your resume

An education section is an important part of your resume, especially for a Finance Director position. This section serves to highlight your academic background and any relevant coursework that aligns with the job. When crafting the education section, putting only relevant education on your resume is key. Avoid listing any irrelevant degrees or certifications. Remember that tailoring your resume to the specific job is necessary, focusing only on what would appeal to the hiring manager.

If you're including your GPA on the resume, only do so if it is above 3.5 or distinctly impressive. Mention it in parentheses next to your degree or separately, depending on the format you choose. To list cum laude honors, include it immediately after your degree, for instance: "Bachelor of Science, Finance, cum laude." When listing a degree, format it as 'Bachelor's Degree in

' or 'Master's Degree in

' with the institution's name and date of completion.

Here's an example of what not to do compared to a well-crafted education section:

[here was the JSON object 3]

In contrast, here is an impressive example suitable for a Finance Director:

[here was the JSON object 4]

This example highlights a strong educational background in finance, specifying an impressive GPA and graduation from a prestigious business school. It makes your qualifications immediately evident to recruiters, showing the credibility and specificity needed for a Finance Director role. Such an education section not only meets but exceeds the relevance needed, increasing your chances of getting noticed.

How to include finance director certificates on your resume

Including a certificates section is an important part of your resume as a finance director. List the name of each certificate you hold, as well as the date you received it. Add the issuing organization to provide credibility. You can also include certificates in the header of your resume to ensure they are prominently displayed.

For example, in your header, you could write something like "Certified Public Accountant (CPA), Chartered Financial Analyst (CFA)."

Here's how to create a standalone certificates section. First, list the name of each certificate clearly. Include the date when you earned the certificate. Add the issuing organization to establish credibility.

This example is good because it showcases relevant certificates for the finance director role. It clearly lists the name, date, and issuing organization, verifying your expertise. These certifications are highly respected in the finance field, making your resume stand out to potential employers.

Extra sections to include in your finance director resume

As a finance director, creating a well-rounded resume can open doors to new job opportunities, showcase your skills, and highlight your diverse qualifications. Including various sections in your resume can help you stand out from other applicants and show hiring managers the depth of your expertise and personal qualities.

Language section—Demonstrate your ability to communicate globally by listing your language skills. Highlight proficiency in multiple languages to show your adaptability and global business acumen.

Hobbies and interests section—Include hobbies that reflect both your personal interests and skills relevant to a finance position. Showcase activities such as reading financial journals or participating in economic forums to establish your commitment to staying informed.

Volunteer work section—Showcase your philanthropy and leadership by detailing volunteer experiences that align with your professional skills. Illustrate how your volunteer work has honed your financial expertise and decision-making abilities.

Books section—Highlight books that have influenced your career in finance and management. Mentioning relevant books you have read shows you are committed to lifelong learning and staying informed about industry trends.

In Conclusion

In conclusion, crafting a finance director resume requires thoughtful presentation of your skills, achievements, and experiences. It's vital to focus on showcasing your leadership in financial strategy and your ability to enhance an organization's success. Highlight your expertise in budgeting, strategic planning, and financial management through specific, quantifiable achievements. This not only displays your capabilities but also sets you apart in a competitive job market. Using a structure that prioritizes clarity and professionalism will further help in making a lasting impression on potential employers. Optimizing your resume's format with modern fonts and saving it as a PDF ensures that it is easy to read and maintains its appearance across devices. Remember, each element from your experience to your education and certifications paints a comprehensive picture of your qualifications. By tailoring your resume to the needs of each role you apply for, you demonstrate your suitability for the position. Lastly, enriching your resume with additional sections like languages or volunteer work can add depth and reflect your versatility. Each section, thoughtfully crafted, works together to illustrate your readiness to take on the challenges and responsibilities of a finance director role, enhancing your chances of landing an interview.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.