Finance Internship Resume Examples

Jul 18, 2024

|

12 min read

Craft the perfect finance internship resume: your guide to counting successes and landing your dream role in the financial world.

Rated by 348 people

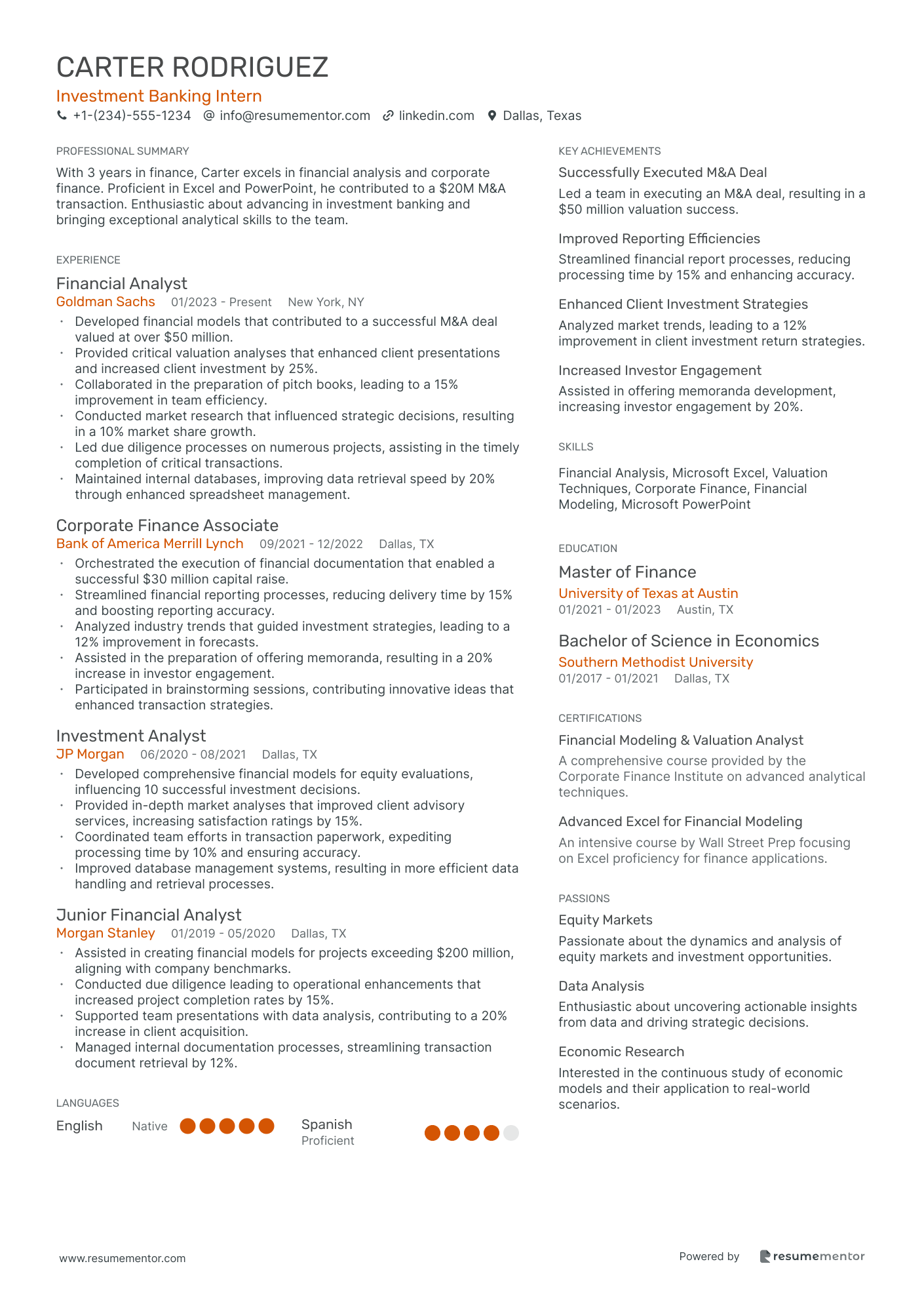

Investment Banking Intern

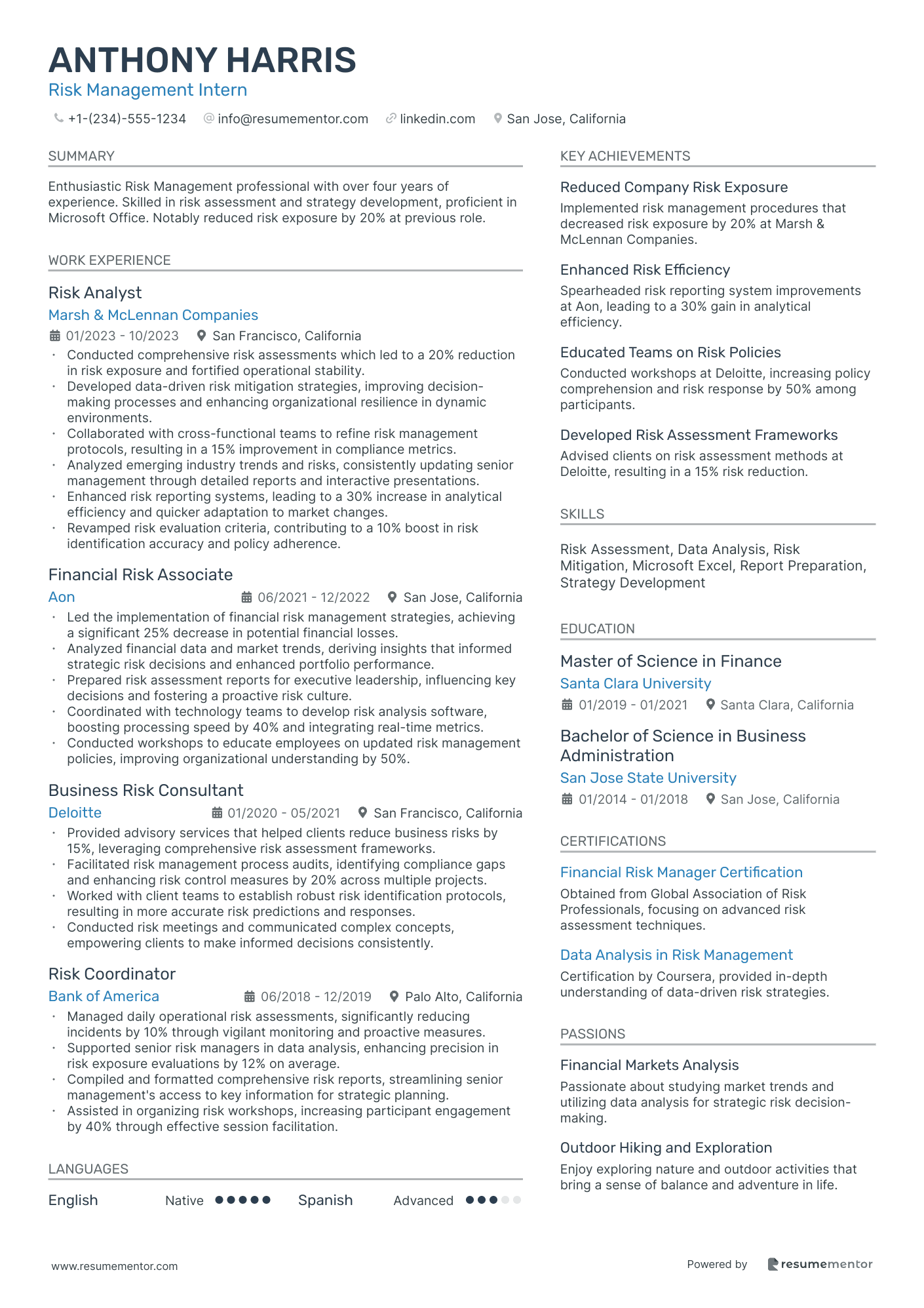

Risk Management Intern

Financial Modeling Internship

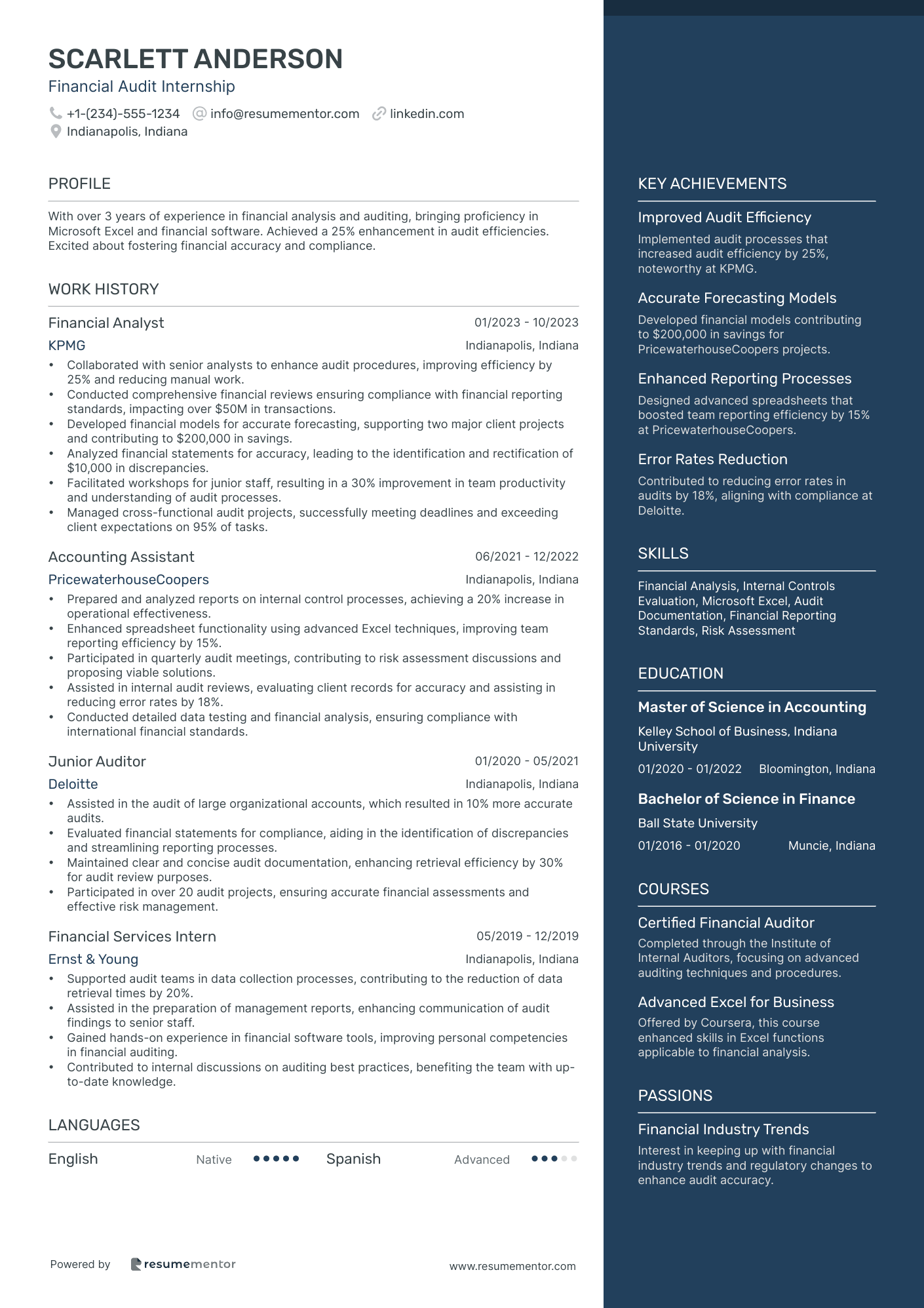

Financial Audit Internship

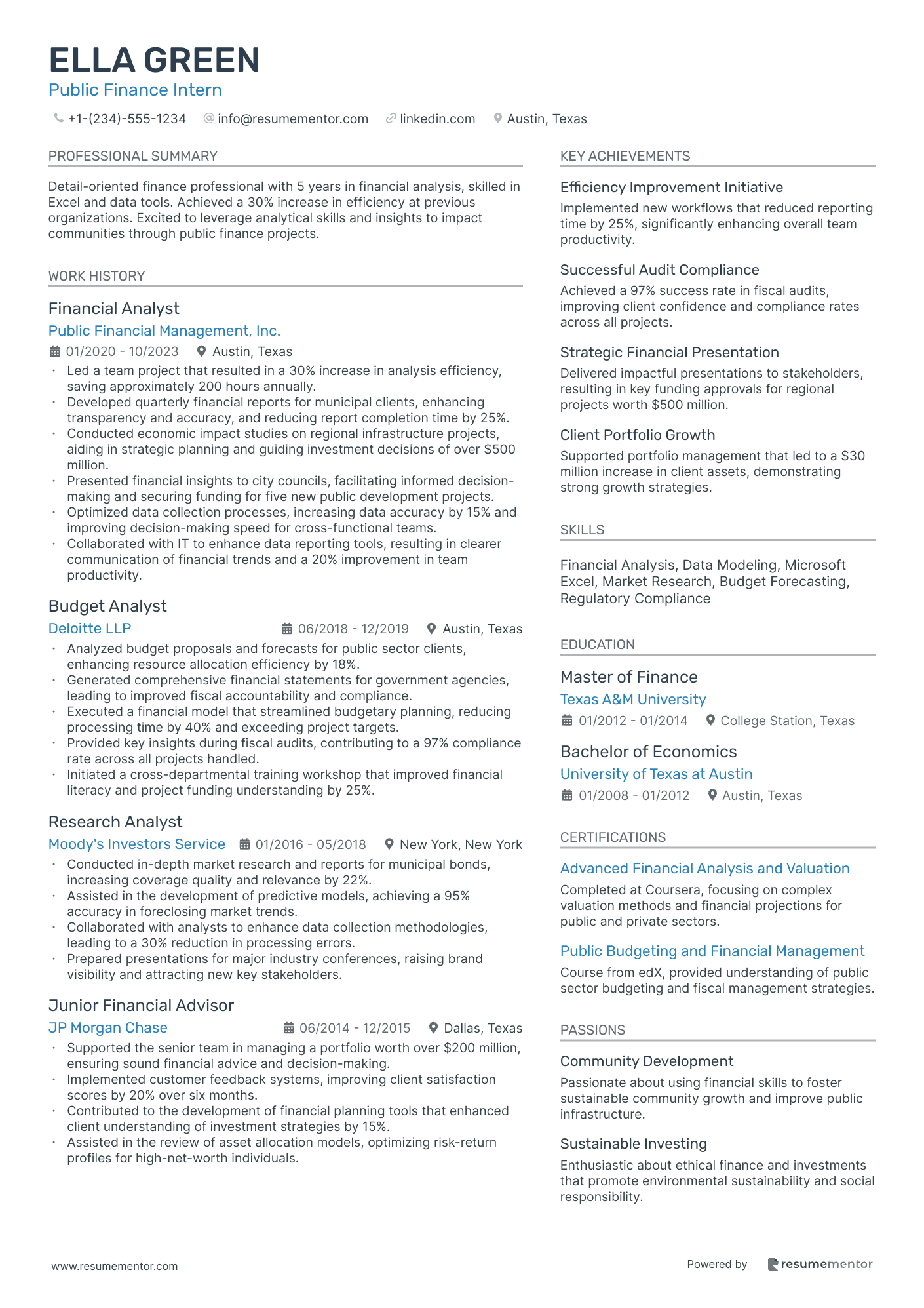

Public Finance Intern

Private Equity Intern

Mergers & Acquisitions Intern

Asset Management Intern

Financial Planning Internship

Investment Banking Intern resume sample

- •Developed financial models that contributed to a successful M&A deal valued at over $50 million.

- •Provided critical valuation analyses that enhanced client presentations and increased client investment by 25%.

- •Collaborated in the preparation of pitch books, leading to a 15% improvement in team efficiency.

- •Conducted market research that influenced strategic decisions, resulting in a 10% market share growth.

- •Led due diligence processes on numerous projects, assisting in the timely completion of critical transactions.

- •Maintained internal databases, improving data retrieval speed by 20% through enhanced spreadsheet management.

- •Orchestrated the execution of financial documentation that enabled a successful $30 million capital raise.

- •Streamlined financial reporting processes, reducing delivery time by 15% and boosting reporting accuracy.

- •Analyzed industry trends that guided investment strategies, leading to a 12% improvement in forecasts.

- •Assisted in the preparation of offering memoranda, resulting in a 20% increase in investor engagement.

- •Participated in brainstorming sessions, contributing innovative ideas that enhanced transaction strategies.

- •Developed comprehensive financial models for equity evaluations, influencing 10 successful investment decisions.

- •Provided in-depth market analyses that improved client advisory services, increasing satisfaction ratings by 15%.

- •Coordinated team efforts in transaction paperwork, expediting processing time by 10% and ensuring accuracy.

- •Improved database management systems, resulting in more efficient data handling and retrieval processes.

- •Assisted in creating financial models for projects exceeding $200 million, aligning with company benchmarks.

- •Conducted due diligence leading to operational enhancements that increased project completion rates by 15%.

- •Supported team presentations with data analysis, contributing to a 20% increase in client acquisition.

- •Managed internal documentation processes, streamlining transaction document retrieval by 12%.

Risk Management Intern resume sample

- •Conducted comprehensive risk assessments which led to a 20% reduction in risk exposure and fortified operational stability.

- •Developed data-driven risk mitigation strategies, improving decision-making processes and enhancing organizational resilience in dynamic environments.

- •Collaborated with cross-functional teams to refine risk management protocols, resulting in a 15% improvement in compliance metrics.

- •Analyzed emerging industry trends and risks, consistently updating senior management through detailed reports and interactive presentations.

- •Enhanced risk reporting systems, leading to a 30% increase in analytical efficiency and quicker adaptation to market changes.

- •Revamped risk evaluation criteria, contributing to a 10% boost in risk identification accuracy and policy adherence.

- •Led the implementation of financial risk management strategies, achieving a significant 25% decrease in potential financial losses.

- •Analyzed financial data and market trends, deriving insights that informed strategic risk decisions and enhanced portfolio performance.

- •Prepared risk assessment reports for executive leadership, influencing key decisions and fostering a proactive risk culture.

- •Coordinated with technology teams to develop risk analysis software, boosting processing speed by 40% and integrating real-time metrics.

- •Conducted workshops to educate employees on updated risk management policies, improving organizational understanding by 50%.

- •Provided advisory services that helped clients reduce business risks by 15%, leveraging comprehensive risk assessment frameworks.

- •Facilitated risk management process audits, identifying compliance gaps and enhancing risk control measures by 20% across multiple projects.

- •Worked with client teams to establish robust risk identification protocols, resulting in more accurate risk predictions and responses.

- •Conducted risk meetings and communicated complex concepts, empowering clients to make informed decisions consistently.

- •Managed daily operational risk assessments, significantly reducing incidents by 10% through vigilant monitoring and proactive measures.

- •Supported senior risk managers in data analysis, enhancing precision in risk exposure evaluations by 12% on average.

- •Compiled and formatted comprehensive risk reports, streamlining senior management's access to key information for strategic planning.

- •Assisted in organizing risk workshops, increasing participant engagement by 40% through effective session facilitation.

Financial Modeling Internship resume sample

- •Enhanced financial reporting processes, decreasing processing time by 30%, leading to more timely business insights.

- •Developed complex financial models improving forecasting accuracy by 20% and supporting strategic financial planning decisions.

- •Led a team project to analyze cost trends, reducing operational costs by $200,000 annually.

- •Collaborated with cross-departmental teams to optimize budget allocation, improving overall financial performance by 15%.

- •Presented quarterly variance analysis and financial forecasts to senior management, fostering more efficient business strategies.

- •Implemented a new dashboard for real-time financial data tracking, increasing reporting efficiency by 25%.

- •Conducted comprehensive financial analysis enabling data-driven decision-making, increasing operating profit margins by 10%.

- •Assisted in the development of a financial model used for new product viability study, impacting company revenue projections.

- •Streamlined budgeting processes, enhancing accuracy and reducing preparation time by 40%, resulting in improved budget adherence.

- •Facilitated stakeholder meetings with detailed presentations on financial status, influencing strategic business development.

- •Played a key role in the acquisition of a local firm by providing crucial financial evaluation, valuing the firm at $1.2 million.

- •Supported the finance team with monthly revenue and expense reporting, increasing clarity and accountability across departments.

- •Utilized Excel to conduct detailed financial analysis, leading to corrective action that boosted cash flow by 18%.

- •Assisted in yearly budgeting activities, optimizing budget allocations and maximizing financial resource utilization.

- •Participated in special projects, delivering comprehensive reports that enhanced management's understanding of market trends.

- •Analyzed client financial status and created custom financial models, resulting in a 15% increase in client profitability.

- •Prepared detailed market analysis reports, providing insights that informed product development strategies.

- •Collaborated with multi-disciplinary teams to develop tailored financial solutions, directly impacting client satisfaction.

- •Delivered impactful presentations to clients, clarifying complex financial concepts and fostering informed decision-making.

Financial Audit Internship resume sample

- •Collaborated with senior analysts to enhance audit procedures, improving efficiency by 25% and reducing manual work.

- •Conducted comprehensive financial reviews ensuring compliance with financial reporting standards, impacting over $50M in transactions.

- •Developed financial models for accurate forecasting, supporting two major client projects and contributing to $200,000 in savings.

- •Analyzed financial statements for accuracy, leading to the identification and rectification of $10,000 in discrepancies.

- •Facilitated workshops for junior staff, resulting in a 30% improvement in team productivity and understanding of audit processes.

- •Managed cross-functional audit projects, successfully meeting deadlines and exceeding client expectations on 95% of tasks.

- •Prepared and analyzed reports on internal control processes, achieving a 20% increase in operational effectiveness.

- •Enhanced spreadsheet functionality using advanced Excel techniques, improving team reporting efficiency by 15%.

- •Participated in quarterly audit meetings, contributing to risk assessment discussions and proposing viable solutions.

- •Assisted in internal audit reviews, evaluating client records for accuracy and assisting in reducing error rates by 18%.

- •Conducted detailed data testing and financial analysis, ensuring compliance with international financial standards.

- •Assisted in the audit of large organizational accounts, which resulted in 10% more accurate audits.

- •Evaluated financial statements for compliance, aiding in the identification of discrepancies and streamlining reporting processes.

- •Maintained clear and concise audit documentation, enhancing retrieval efficiency by 30% for audit review purposes.

- •Participated in over 20 audit projects, ensuring accurate financial assessments and effective risk management.

- •Supported audit teams in data collection processes, contributing to the reduction of data retrieval times by 20%.

- •Assisted in the preparation of management reports, enhancing communication of audit findings to senior staff.

- •Gained hands-on experience in financial software tools, improving personal competencies in financial auditing.

- •Contributed to internal discussions on auditing best practices, benefiting the team with up-to-date knowledge.

Public Finance Intern resume sample

- •Led a team project that resulted in a 30% increase in analysis efficiency, saving approximately 200 hours annually.

- •Developed quarterly financial reports for municipal clients, enhancing transparency and accuracy, and reducing report completion time by 25%.

- •Conducted economic impact studies on regional infrastructure projects, aiding in strategic planning and guiding investment decisions of over $500 million.

- •Presented financial insights to city councils, facilitating informed decision-making and securing funding for five new public development projects.

- •Optimized data collection processes, increasing data accuracy by 15% and improving decision-making speed for cross-functional teams.

- •Collaborated with IT to enhance data reporting tools, resulting in clearer communication of financial trends and a 20% improvement in team productivity.

- •Analyzed budget proposals and forecasts for public sector clients, enhancing resource allocation efficiency by 18%.

- •Generated comprehensive financial statements for government agencies, leading to improved fiscal accountability and compliance.

- •Executed a financial model that streamlined budgetary planning, reducing processing time by 40% and exceeding project targets.

- •Provided key insights during fiscal audits, contributing to a 97% compliance rate across all projects handled.

- •Initiated a cross-departmental training workshop that improved financial literacy and project funding understanding by 25%.

- •Conducted in-depth market research and reports for municipal bonds, increasing coverage quality and relevance by 22%.

- •Assisted in the development of predictive models, achieving a 95% accuracy in foreclosing market trends.

- •Collaborated with analysts to enhance data collection methodologies, leading to a 30% reduction in processing errors.

- •Prepared presentations for major industry conferences, raising brand visibility and attracting new key stakeholders.

- •Supported the senior team in managing a portfolio worth over $200 million, ensuring sound financial advice and decision-making.

- •Implemented customer feedback systems, improving client satisfaction scores by 20% over six months.

- •Contributed to the development of financial planning tools that enhanced client understanding of investment strategies by 15%.

- •Assisted in the review of asset allocation models, optimizing risk-return profiles for high-net-worth individuals.

Private Equity Intern resume sample

- •Developed financial models that identified cost-saving opportunities, reducing operational expenses by 15% annually.

- •Led a team audit project that streamlined financial reporting processes, resulting in a 30% increase in efficiency.

- •Conducted in-depth market analysis to support strategic acquisitions, supporting the review of over 20 potential investments.

- •Collaborated on portfolio management tasks, ensuring a 25% increase in portfolio return on investment through strategic initiatives.

- •Prepared comprehensive investment presentations for senior management, aiding in securing approvals for multi-million dollar investments.

- •Facilitated cross-functional team meetings to review company performance, contributing to improved communication and decision-making.

- •Assessed industry trends and competitive landscape for potential investments, leading to a 20% success rate in executed deals.

- •Supported the preparation of detailed investment memos, contributing to a more informed decision-making process.

- •Participated in due diligence processes for acquisitions, which enhanced evaluation procedures by 25%.

- •Monitored the financial health of portfolio companies, generating insights that helped improve financial performance by 10%.

- •Collaborated on a CRM system implementation project, resulting in greater data accuracy and a 20% reduction in reporting time.

- •Facilitated workshops that boosted client knowledge in financial planning, enhancing client satisfaction ratings by 15%.

- •Conducted quantitative analyses that supported client engagement strategies, leading to a 10% increase in market share.

- •Assisted in creating strategic financial plans, aiding clients to achieve a 20% growth in revenue.

- •Managed project timelines ensuring delivery within deadlines, improving client relations and repeat engagements by 30%.

- •Analyzed market data that informed new business initiatives, contributing to entering new markets.

- •Developed reports and recommendations that improved operational processes, enhancing productivity by 20%.

- •Liaised with stakeholders to define project requirements, leading to clearer project scopes and deliverables.

- •Coordinated internal meetings to share insights, promoting knowledge sharing and continuous improvement across teams.

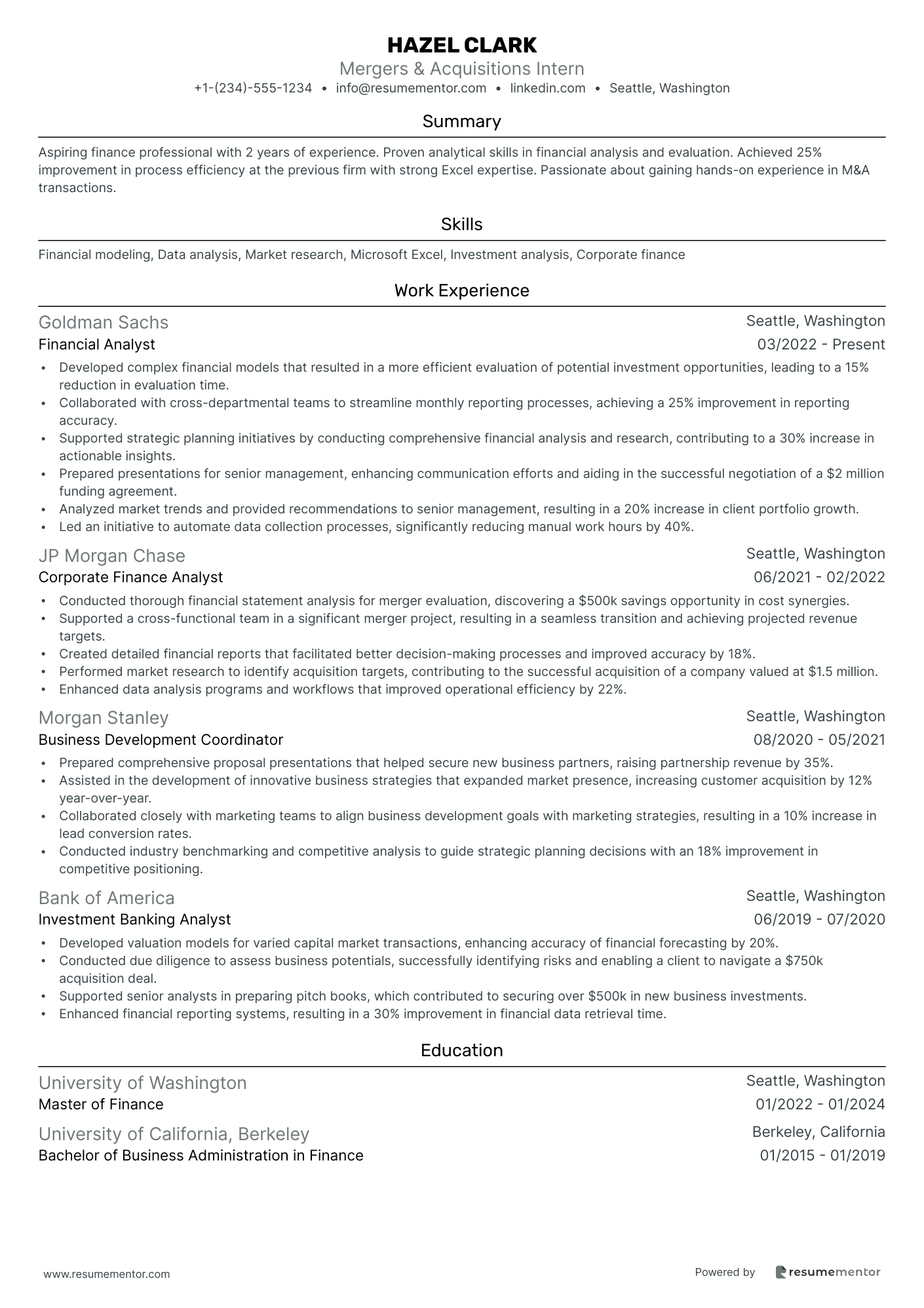

Mergers & Acquisitions Intern resume sample

- •Developed complex financial models that resulted in a more efficient evaluation of potential investment opportunities, leading to a 15% reduction in evaluation time.

- •Collaborated with cross-departmental teams to streamline monthly reporting processes, achieving a 25% improvement in reporting accuracy.

- •Supported strategic planning initiatives by conducting comprehensive financial analysis and research, contributing to a 30% increase in actionable insights.

- •Prepared presentations for senior management, enhancing communication efforts and aiding in the successful negotiation of a $2 million funding agreement.

- •Analyzed market trends and provided recommendations to senior management, resulting in a 20% increase in client portfolio growth.

- •Led an initiative to automate data collection processes, significantly reducing manual work hours by 40%.

- •Conducted thorough financial statement analysis for merger evaluation, discovering a $500k savings opportunity in cost synergies.

- •Supported a cross-functional team in a significant merger project, resulting in a seamless transition and achieving projected revenue targets.

- •Created detailed financial reports that facilitated better decision-making processes and improved accuracy by 18%.

- •Performed market research to identify acquisition targets, contributing to the successful acquisition of a company valued at $1.5 million.

- •Enhanced data analysis programs and workflows that improved operational efficiency by 22%.

- •Prepared comprehensive proposal presentations that helped secure new business partners, raising partnership revenue by 35%.

- •Assisted in the development of innovative business strategies that expanded market presence, increasing customer acquisition by 12% year-over-year.

- •Collaborated closely with marketing teams to align business development goals with marketing strategies, resulting in a 10% increase in lead conversion rates.

- •Conducted industry benchmarking and competitive analysis to guide strategic planning decisions with an 18% improvement in competitive positioning.

- •Developed valuation models for varied capital market transactions, enhancing accuracy of financial forecasting by 20%.

- •Conducted due diligence to assess business potentials, successfully identifying risks and enabling a client to navigate a $750k acquisition deal.

- •Supported senior analysts in preparing pitch books, which contributed to securing over $500k in new business investments.

- •Enhanced financial reporting systems, resulting in a 30% improvement in financial data retrieval time.

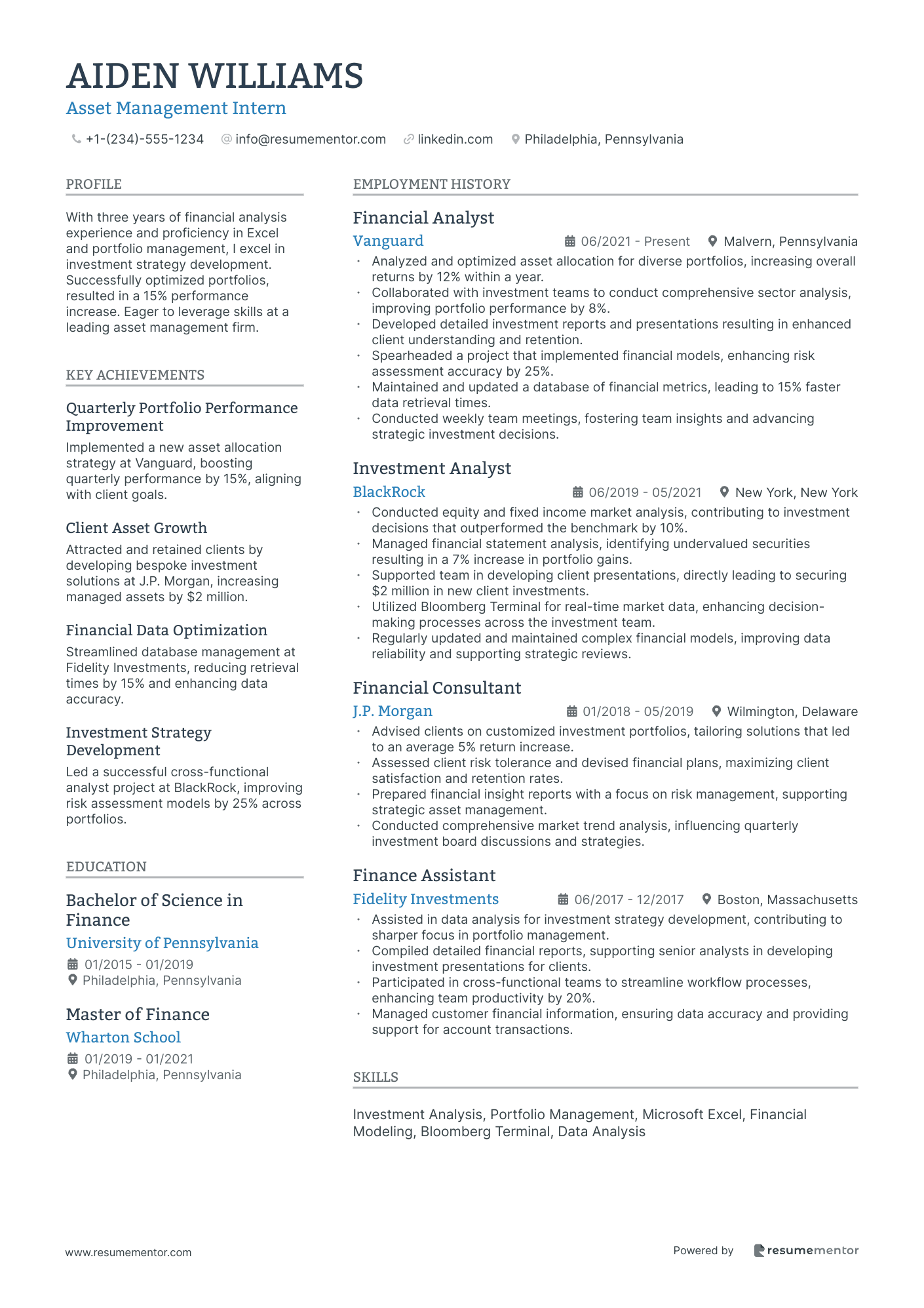

Asset Management Intern resume sample

- •Analyzed and optimized asset allocation for diverse portfolios, increasing overall returns by 12% within a year.

- •Collaborated with investment teams to conduct comprehensive sector analysis, improving portfolio performance by 8%.

- •Developed detailed investment reports and presentations resulting in enhanced client understanding and retention.

- •Spearheaded a project that implemented financial models, enhancing risk assessment accuracy by 25%.

- •Maintained and updated a database of financial metrics, leading to 15% faster data retrieval times.

- •Conducted weekly team meetings, fostering team insights and advancing strategic investment decisions.

- •Conducted equity and fixed income market analysis, contributing to investment decisions that outperformed the benchmark by 10%.

- •Managed financial statement analysis, identifying undervalued securities resulting in a 7% increase in portfolio gains.

- •Supported team in developing client presentations, directly leading to securing $2 million in new client investments.

- •Utilized Bloomberg Terminal for real-time market data, enhancing decision-making processes across the investment team.

- •Regularly updated and maintained complex financial models, improving data reliability and supporting strategic reviews.

- •Advised clients on customized investment portfolios, tailoring solutions that led to an average 5% return increase.

- •Assessed client risk tolerance and devised financial plans, maximizing client satisfaction and retention rates.

- •Prepared financial insight reports with a focus on risk management, supporting strategic asset management.

- •Conducted comprehensive market trend analysis, influencing quarterly investment board discussions and strategies.

- •Assisted in data analysis for investment strategy development, contributing to sharper focus in portfolio management.

- •Compiled detailed financial reports, supporting senior analysts in developing investment presentations for clients.

- •Participated in cross-functional teams to streamline workflow processes, enhancing team productivity by 20%.

- •Managed customer financial information, ensuring data accuracy and providing support for account transactions.

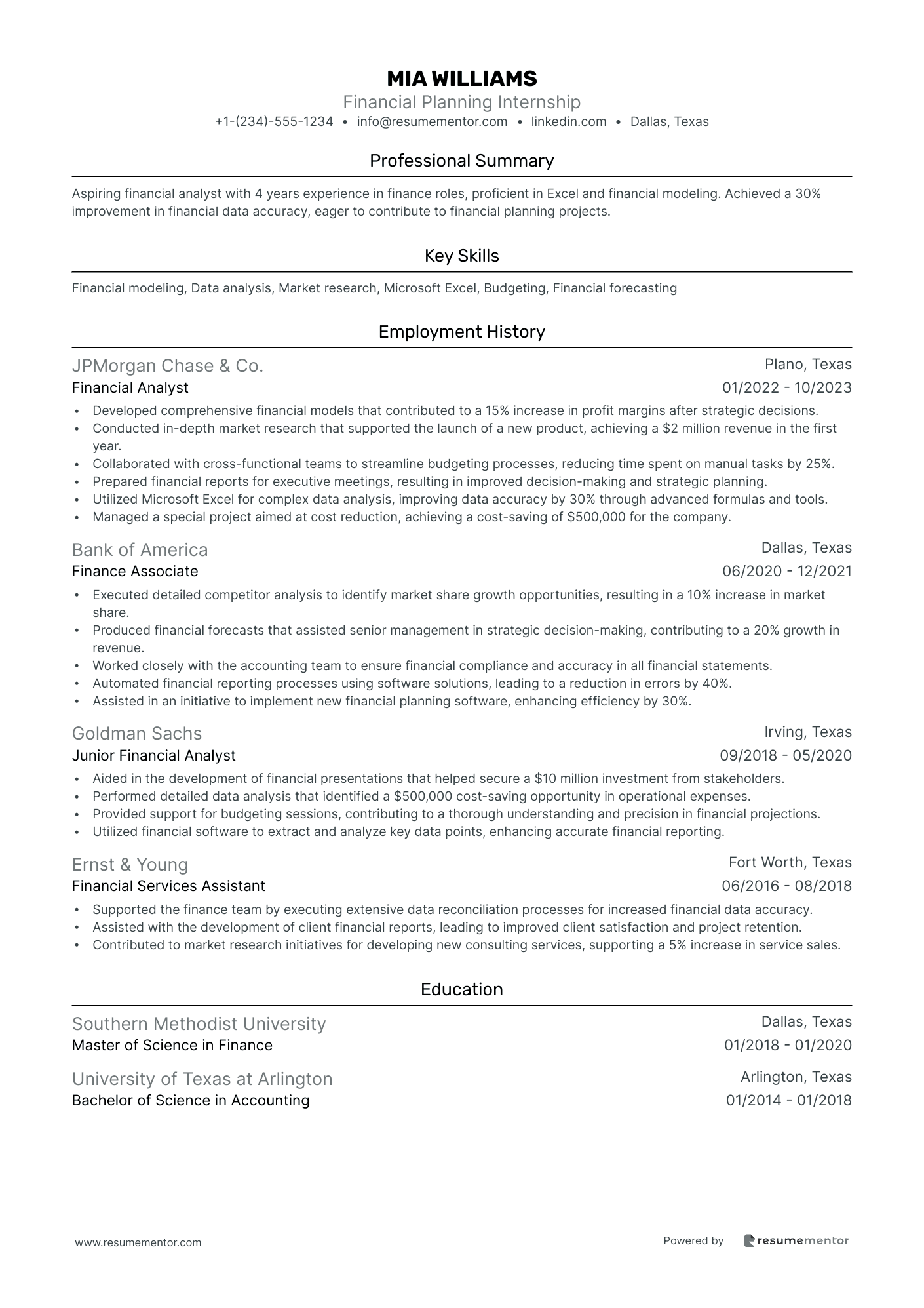

Financial Planning Internship resume sample

- •Developed comprehensive financial models that contributed to a 15% increase in profit margins after strategic decisions.

- •Conducted in-depth market research that supported the launch of a new product, achieving a $2 million revenue in the first year.

- •Collaborated with cross-functional teams to streamline budgeting processes, reducing time spent on manual tasks by 25%.

- •Prepared financial reports for executive meetings, resulting in improved decision-making and strategic planning.

- •Utilized Microsoft Excel for complex data analysis, improving data accuracy by 30% through advanced formulas and tools.

- •Managed a special project aimed at cost reduction, achieving a cost-saving of $500,000 for the company.

- •Executed detailed competitor analysis to identify market share growth opportunities, resulting in a 10% increase in market share.

- •Produced financial forecasts that assisted senior management in strategic decision-making, contributing to a 20% growth in revenue.

- •Worked closely with the accounting team to ensure financial compliance and accuracy in all financial statements.

- •Automated financial reporting processes using software solutions, leading to a reduction in errors by 40%.

- •Assisted in an initiative to implement new financial planning software, enhancing efficiency by 30%.

- •Aided in the development of financial presentations that helped secure a $10 million investment from stakeholders.

- •Performed detailed data analysis that identified a $500,000 cost-saving opportunity in operational expenses.

- •Provided support for budgeting sessions, contributing to a thorough understanding and precision in financial projections.

- •Utilized financial software to extract and analyze key data points, enhancing accurate financial reporting.

- •Supported the finance team by executing extensive data reconciliation processes for increased financial data accuracy.

- •Assisted with the development of client financial reports, leading to improved client satisfaction and project retention.

- •Contributed to market research initiatives for developing new consulting services, supporting a 5% increase in service sales.

As a finance intern, your resume is like a stock portfolio—your opportunity to highlight the strong points that make you an attractive candidate to future employers. Landing a finance internship is highly competitive, and effectively presenting your financial skills and achievements is essential. It’s easy to feel overwhelmed when deciding what to include and how to organize each section for maximum impact.

Think of your resume as more than a simple list of experiences; it’s a first impression that can unlock potential opportunities. This means organizing your information clearly and professionally is crucial. Utilizing a resume template can streamline this process and bring structure to your document, allowing employers to quickly grasp your accomplishments. A well-chosen template not only saves you time but also helps emphasize critical skills like financial analysis and relevant coursework.

In a field where attention to detail is key, your resume should reflect precision. Using bullet points can help clearly outline your contributions and skills, steering clear of jargon that might obscure your abilities. Tailoring your resume to each job application makes it more impactful, especially when you incorporate keywords from the job description.

Remember, your resume should be easy to read and leave a lasting impression. Thorough proofreading is necessary to eliminate errors that could detract from your professionalism. A polished, organized resume communicates that you have the potential to be a valuable asset, showcasing your readiness to meet the challenges of the finance world.

Key Takeaways

- Organize your resume clearly and professionally using templates to quickly highlight your financial skills and achievements to employers.

- Use bullet points to clearly outline your experiences and skills, and tailor your resume for each application by incorporating job-specific keywords.

- Avoid jargon and proofread thoroughly to eliminate errors that could detract from your professionalism and potential job opportunities.

- Choose a reverse-chronological resume format with modern fonts to emphasize your most recent achievements and ensure easy readability.

- Highlight both hard and soft skills, such as financial analysis and teamwork, to illustrate your readiness and capability for a finance role.

What to focus on when writing your finance internship resume

Your finance internship resume should clearly communicate your analytical skills and understanding of financial principles, helping recruiters see your potential as part of their team. Highlighting your educational background in finance, alongside any relevant experience and unique skills, is key. A well-organized resume format ensures that your strengths stand out to recruiters, making them eager to learn more about you.

How to structure your finance internship resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile if applicable—ensuring recruiters can easily reach out to you if they are interested in your application. Including a LinkedIn profile adds a professional touch and provides a platform where they can learn more about your accomplishments.

- Objective Statement: Follow with a short sentence explaining your career goals and enthusiasm for the finance internship, mentioning specific interests like investment analysis or financial modeling to clarify your focus. This statement sets the stage for the rest of your resume, showing your direction and what you aim to achieve during the internship.

- Education: Next, provide details of your current or most recent academic journey, including your degree, major, university, and expected graduation date. Emphasize finance courses you've completed that directly relate to the internship—showing you have a solid theoretical foundation and are prepared to apply this knowledge practically.

- Relevant Experience: Whether from internships, part-time jobs, or projects, showcase experiences that demonstrate your finance-related skills or industry exposure, even if they're informal, such as managing a student organization’s budget or participating in a business club—highlighting your ability to apply finance concepts in real situations.

- Skills: Highlight specific skills like proficiency in Excel, understanding of financial statements, or experience with data analysis, focusing on those relevant to finance roles. These skills illustrate your capability to handle tasks and projects efficiently, assuring recruiters of your readiness to contribute effectively.

- Projects or Certifications: Conclude with any finance-related school projects or certifications like Bloomberg Market Concepts that enhance your resume and demonstrate your commitment to the field—reinforcing your dedication to advancing your finance knowledge.

Understanding the importance of each section is crucial for creating a standout resume—below we'll cover each section more in-depth to ensure your finance internship application is compelling.

Which resume format to choose

Crafting a finance internship resume requires careful attention to detail, starting with the format. Opt for a reverse-chronological layout, as it emphasizes your most recent experiences and achievements. This is particularly important in finance, where up-to-date skills and knowledge are highly valued. Choosing the right font can also make a big difference; Rubik, Lato, or Montserrat offer a modern and professional appearance, ensuring your resume is easy to read and visually appealing.

When it comes to preserving your resume's integrity, saving it as a PDF is crucial. PDFs maintain your formatting, ensuring that your document appears consistently across various devices and platforms, which can be critical during the finance recruitment process. Lastly, consider your margins. A one-inch margin on all sides not only adds to the document's polished appearance but also provides ample white space. This makes your resume more readable and helps hiring managers focus on your qualifications without unnecessary clutter. By carefully considering each of these elements, you create a resume that stands out in the competitive finance industry.

How to write a quantifiable resume experience section

The experience section is crucial for landing a finance internship because it highlights your relevant skills and accomplishments. You should focus on quantifiable achievements while customizing your experience to match the job description. To make it effective, organize your entries with clear bullet points under each role. Start with your most recent position and work backwards, generally covering up to the past 10 years if applicable. It's important to include roles related to finance or those where you developed transferrable skills. Use strong action words like "analyzed," "contributed," and "enhanced" to convey impact. Tailoring your experience by aligning your achievements with the internship’s needs can make a significant difference.

- •Analyzed financial data for 10 key clients, improving portfolio performance by 15%.

- •Created a financial modeling tool that cut forecast calculation time by 20%.

- •Worked with a team to prepare end-of-quarter reports, enhancing accuracy by 10% through data checks.

- •Researched market trends, supporting senior analysts with strategic insights.

This experience section stands out by tying together achievements that are directly relevant to a finance internship. By providing clear and measurable results, each bullet point underscores the candidate's impact. In finance roles, where data-driven outcomes are critical, these specifics help convey value effectively. Using strong action words complemented by targeted accomplishments aligns well with what the industry expects. This tailored approach ensures that the experience resonates with hiring managers by directly reflecting the job description. Its professional layout and clear structure capture attention and demonstrate the candidate’s capability to excel in a financial setting.

Collaboration-Focused resume experience section

A collaboration-focused finance internship resume experience section should clearly demonstrate how effectively you worked with others to achieve financial goals. Start by identifying situations where you teamed up with colleagues, stakeholders, or different departments to tackle finance-related tasks. Highlight the positive outcomes of these collaborations, like how your teamwork improved processes or enhanced financial analysis. Clearly describe your role, ensuring to use straightforward language that shows how your efforts made a difference.

It's important to avoid vague statements and instead be specific about your contributions and the results. Employers are keen to see concrete examples of your capability to work well in a team within a finance setting. Connect your communication, adaptability, and problem-solving skills to the context of teamwork. These examples will effectively illustrate how you can contribute strong collaborative skills to their organization.

Finance Intern

XYZ Corporation

June 2021 - August 2021

- Worked with a team of 5 interns to create a financial report that improved decision-making processes.

- Collaborated with cross-departmental teams to gather data, resulting in a 20% increase in report accuracy.

- Developed a budget tracking tool in partnership with IT, enhancing budget monitoring efficiency by 30%.

- Participated in weekly strategy meetings, contributing ideas that were implemented in a new financial strategy.

Training and Development Focused resume experience section

A training-focused finance internship resume experience section should highlight how you contributed to learning and development within the organization. Focus on your involvement in facilitating training sessions, onboarding new team members, and creating easy-to-understand materials. Demonstrating your ability to translate complex financial concepts into simple, actionable guidance can showcase your skill in aiding others' growth. When you describe your achievements, use active verbs to bring energy to your experience and make it more relatable.

In your bullet points, aim to illustrate the results of your work, not just the tasks. For instance, detailing how you "created training materials that improved new hire understanding of financial software by 40%" not only highlights your role but also the impact it had. Linking your actions to measurable outcomes provides evidence of your effectiveness. Whenever possible, quantify these results to strengthen your profile in a training and development context.

Finance Intern

XYZ Financial Services

June 2022 - August 2022

- Developed comprehensive training guides for new financial software, improving early adoption rates.

- Conducted workshops for interns and new employees, enhancing their understanding of budgeting tools.

- Collaborated with senior analysts to create a mentorship program, increasing intern retention by 30%.

- Prepared and delivered presentations simplifying complex investment strategies, boosting team confidence.

Achievement-Focused resume experience section

A finance-focused internship resume experience section should showcase your specific achievements and the impact you made during your internship. Begin by identifying key instances where your efforts led to noteworthy outcomes. Use dynamic action verbs that highlight your contributions, such as "increased," "crafted," or "enhanced," to clearly convey your role. Wherever possible, back up your achievements with numbers or percentages to highlight the significance of your work. Connect these contributions to larger business objectives, demonstrating how you advanced processes, increased profitability, or elevated customer satisfaction.

The goal is to leave a strong impression by highlighting the value you added. Craft bullet points that are clear and specific, allowing readers to fully grasp the breadth of your experience. Ensure each bullet focuses on a distinct aspect of your work, illustrating your varied skills. Tailor this section to emphasize traits that finance employers seek, like analytical abilities, attention to detail, and teamwork skills.

Finance Intern

ABC Financial Services

June 2023 - August 2023

- Analyzed financial data to support investment decisions, boosting portfolio performance by 15%.

- Developed comprehensive financial reports, streamlining reporting and reducing preparation time by 20%.

- Collaborated with a team of 5 to refine budgeting strategies, resulting in a 10% reduction in operational costs.

- Offered insights and recommendations on risk management, which enhanced the financial risk profiles of clients.

Innovation-Focused resume experience section

An innovation-focused finance internship resume experience section should clearly demonstrate how you've creatively improved financial processes. Begin by highlighting specific projects where your innovative approaches made a real impact. You should describe your role and the context of each task, emphasizing action verbs and using straightforward language. By focusing on the positive effects of your innovations, such as improved efficiency or cost savings, you can help hiring managers easily recognize your value.

Within your bullet points, it's important to emphasize achievements with quantifiable outcomes, showcasing the specific skills you applied. For instance, if you enhanced a financial process, mention how much time you saved or how you reduced errors. Each bullet should illustrate not just what you did, but how it benefitted the organization, thereby demonstrating your initiative and results-driven mindset. This well-rounded approach will make your resume stand out by conveying how you can proactively contribute in a finance setting.

Finance Intern

Innovative Financial Solutions

Summer 2022

- Designed a new budgeting tool using Excel, reducing data entry time by 20%.

- Led a project to automate financial reports, which decreased operational errors by 15%.

- Collaborated with a team to implement AI solutions, improving forecast accuracy by 30%.

- Streamlined the process for financial audits, resulting in faster turnaround times by two weeks.

Write your finance internship resume summary section

A finance-focused internship resume summary should clearly communicate what makes you an ideal candidate. In just a few sentences, introduce yourself, highlight your skills, and make a connection to the role. Begin by mentioning your academic background or any financial skills you possess that are crucial for the internship. Aim for a concise and relevant message. Consider this example:

This summary effectively frames your ambition while underlining the skills you've honed, demonstrating your readiness to contribute meaningfully. Your academic and practical experiences are showcased without adding unnecessary detail, making your case as a strong contender for the role.

Recognizing the distinctions between summaries and objectives can sharpen your resume's impact. While a summary highlights your current skills and readiness, a resume objective focuses more on your career aspirations. A resume profile, by comparison, may span personality traits and professional qualities. A 'summary of qualifications' zeroes in on key skills and notable achievements. Despite their unique focuses, each section aims to solidify your status as a capable candidate. Always tailor these sections to align your abilities with the company's needs, ensuring you spotlight how you meet their expectations.

Listing your finance internship skills on your resume

A finance-focused internship resume should emphasize your skills and strengths, whether in a standalone section or integrated into your experience and summary. Start by understanding the importance of both soft and hard skills. Soft skills encompass qualities like teamwork, communication, and adaptability, which complement your technical abilities. Hard skills, on the other hand, are your concrete abilities in areas like financial analysis and data management.

Integrating these skills and strengths across your resume can make them serve as powerful keywords. This strategic placement increases your visibility to employers, helping you stand out.

Example skills section:

This skills section effectively showcases the key abilities for a finance internship. Each skill is a keyword that catches the eye of employers, revealing your strengths in vital technical areas. The organized format also makes it easy for recruiters to quickly assess your competencies.

Best hard skills to feature on your finance internship resume

For a finance internship, focusing on hard skills is crucial as they demonstrate your technical aptitude. They reflect your ability to manage financial data and use industry tools, which are essential for these roles. Here are some paramount hard skills:

Hard Skills

- Financial Analysis

- Data Management

- Excel Proficiency

- Budgeting

- Risk Assessment

- Financial Modeling

- Microsoft Office Suite

- Investment Strategies

- QuickBooks

- Forecasting

- Valuation Techniques

- Statistical Analysis

- Cost Accounting

- Auditing

- ERP Systems

Best soft skills to feature on your finance internship resume

Equally important are the soft skills, which enhance your ability to work effectively in teams and communicate well in a finance environment. These skills show your capability to adapt and collaborate. Here are some vital soft skills:

Highlighting these skills throughout your resume not only strengthens your application but also demonstrates your readiness to excel in a finance internship.

Soft Skills

- Team Collaboration

- Communication Skills

- Attention to Detail

- Problem-Solving

- Adaptability

- Time Management

- Leadership

- Critical Thinking

- Interpersonal Skills

- Organizational Skills

- Emotional Intelligence

- Decision-Making

- Initiative

- Conflict Resolution

- Multitasking

How to include your education on your resume

The education section is a crucial part of your finance internship resume. It should be carefully tailored to the position you're applying for, showcasing only relevant educational experiences. Unrelated degrees or courses should be left out, keeping the focus on experiences that relate directly to the finance field. When including your GPA, only list it if it enhances your credentials — typically, a 3.0 or higher is desirable. If you graduated with honors like cum laude, indicate this next to your degree. List your degree in a clear and concise manner, including the full name of your degree, institution, and dates of attendance.

Here's an example of a poorly formatted education section:

And a well-formatted example:

The second example is strong because it directly links to the finance field. It highlights a solid GPA and honors that will attract potential employers. It includes clear details about the degree and school without unnecessary information. This sets a professional tone and showcases qualifications that are relevant for a finance internship.

How to include finance internship certificates on your resume

Including a certificates section in your finance internship resume is essential as it showcases your relevant qualifications. Certificates prove your specialized skills and knowledge, making you stand out to potential employers. You can also mention your certificates in the header for greater visibility.

List the name of the certificate. Include the date you received it. Add the issuing organization. If applicable, specify if you have any ongoing or upcoming certifications.

Here's an example of a header with a certificates section:

John Doe, Finance Intern Email: johndoe@example.com | Phone: (123) 456-7890 Certifications: CFA Level 1, Bloomberg Market Concepts

Here is a good example of a standalone certificates section:

This example is good because it includes widely recognized certifications relevant to finance. It lists the certification title, the issuing organization, and shows the issuer, giving a comprehensive view of your qualifications. This way, employers can quickly see your competence in essential areas.

Extra sections to include in your finance internship resume

In today's competitive job market, landing a finance internship requires more than just a stellar GPA and relevant coursework. To stand out, your resume should showcase a diverse set of skills, experiences, and personal qualities that make you a well-rounded candidate. While technical skills and professional experience are crucial, unique sections like languages, hobbies, volunteer work, and books can give you an edge.

- Language section — Include any languages you speak fluently along with your proficiency level. Highlighting language skills can show your ability to communicate with a diverse client base or work in international markets.

- Hobbies and interests section — Briefly mention hobbies and interests that reflect your personal qualities, like analytical skills or teamwork. This can make you more relatable and show that you have a well-balanced life outside work.

- Volunteer work section — Include relevant volunteer experiences, focusing on roles that required strong financial skills or leadership. Demonstrating volunteer work can show your commitment to community and showcase transferable skills.

- Books section — List finance-related books you have read to show your commitment to continuous learning in your field. This can demonstrate your passion for finance and indicate that you are proactive in staying updated with industry knowledge.

A well-crafted resume that includes these sections can offer a comprehensive view of your capabilities and interests. It's a smart way to make your application stand out from the crowd. By showcasing a variety of experiences, you demonstrate your versatility and potential value to potential employers.

In Conclusion

In conclusion, crafting a finance internship resume effectively marries your educational background and skills with the demands of a competitive industry. This resume is not just a history of your academic and work experiences; it’s a bridge to your next opportunity, showcasing your unique blend of hard and soft skills. Tailor each section to emphasize your ability to meet specific job requirements. Be meticulous, ensuring every detail from formatting to content aligns with industry expectations. Remember, your resume is a reflection of your attention to detail, a critical attribute in finance. Use impactful action verbs when detailing experiences to convey your capability. Focus on quantifiable achievements that paint a clear picture of your contributions. Templates can aid in maintaining a professional appearance, keeping your layout clean and accessible. Proofreading is essential; even minor errors can detract from an otherwise polished document. Leverage certifications to reinforce your credentials, backing them up with evidence of proficiency. Supplementing your resume with extra sections like languages or volunteer work can set you apart, highlighting your all-around capabilities. In presenting a well-rounded profile, your resume will resonate with potential employers, opening doors to further opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.