Finance Manager Resume Examples

Jul 19, 2024

|

12 min read

Craft your finance manager resume with these tips to make it outstanding: you'll learn to balance skills, experiences, and achievements to catch employers' eyes. It's time to bank on your talents the right way.

Rated by 348 people

Risk Management Finance Manager

Corporate Finance Strategy Manager

Financial Planning and Analysis Manager

Investment Finance Manager

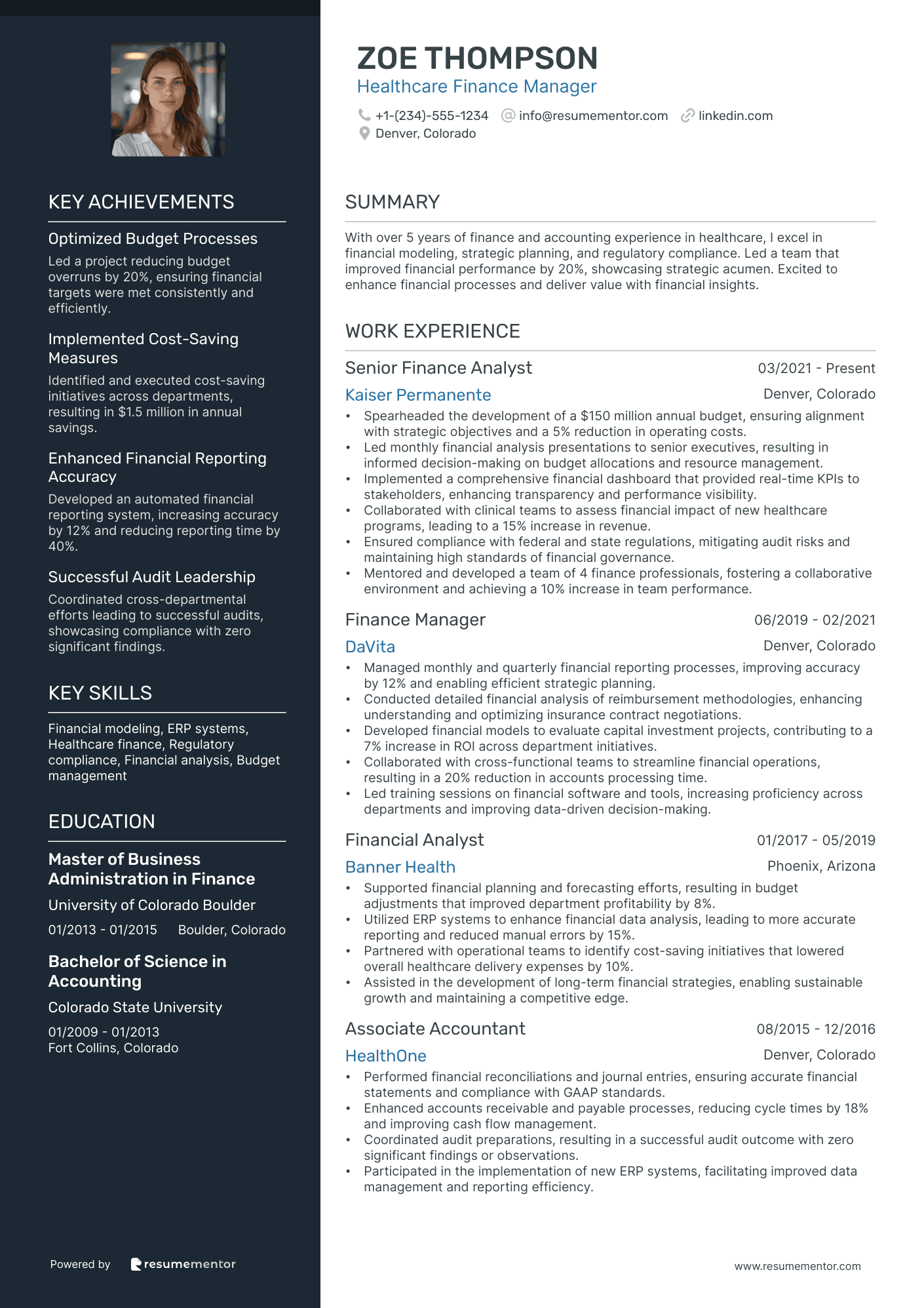

Healthcare Finance Manager

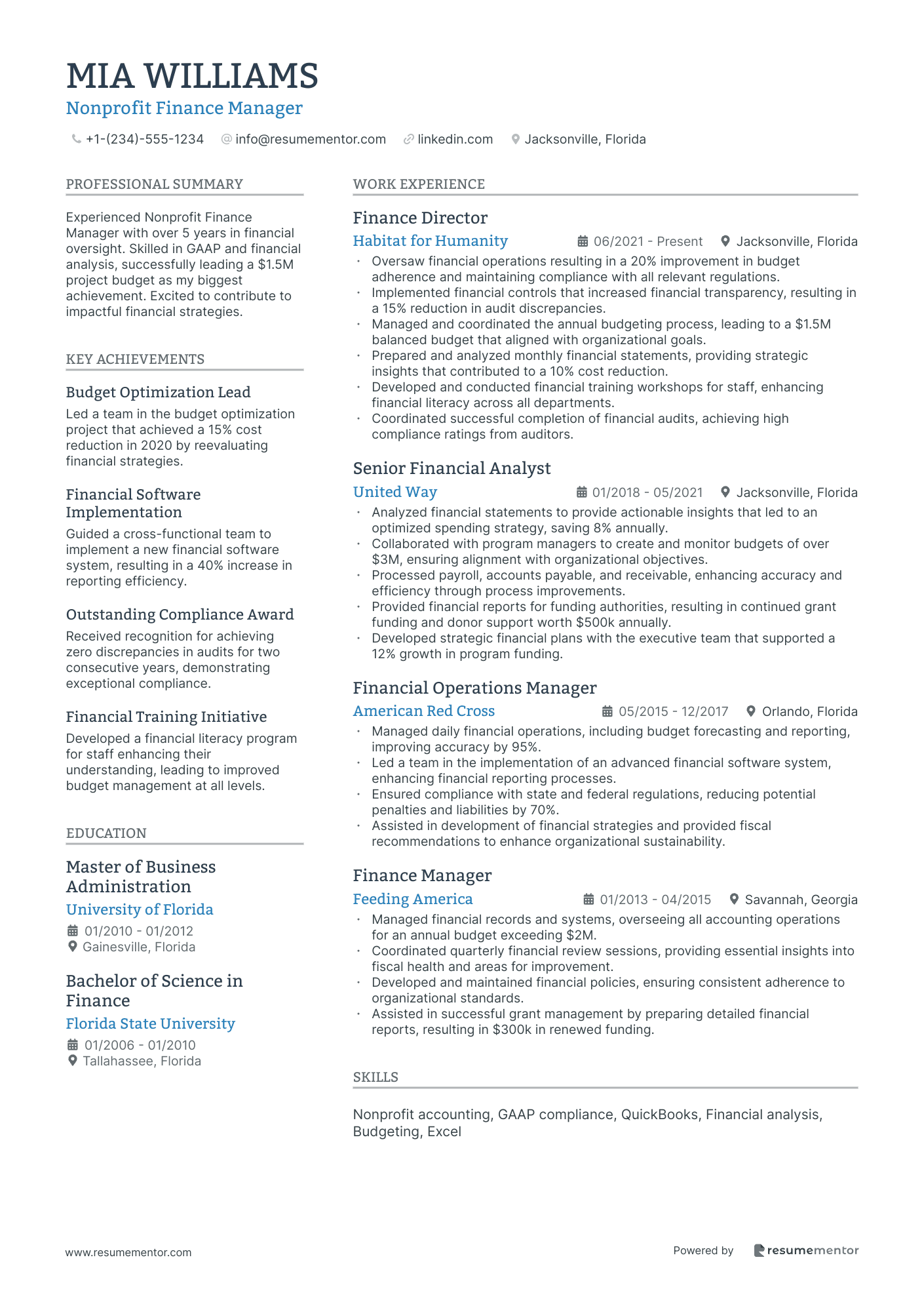

Nonprofit Finance Manager

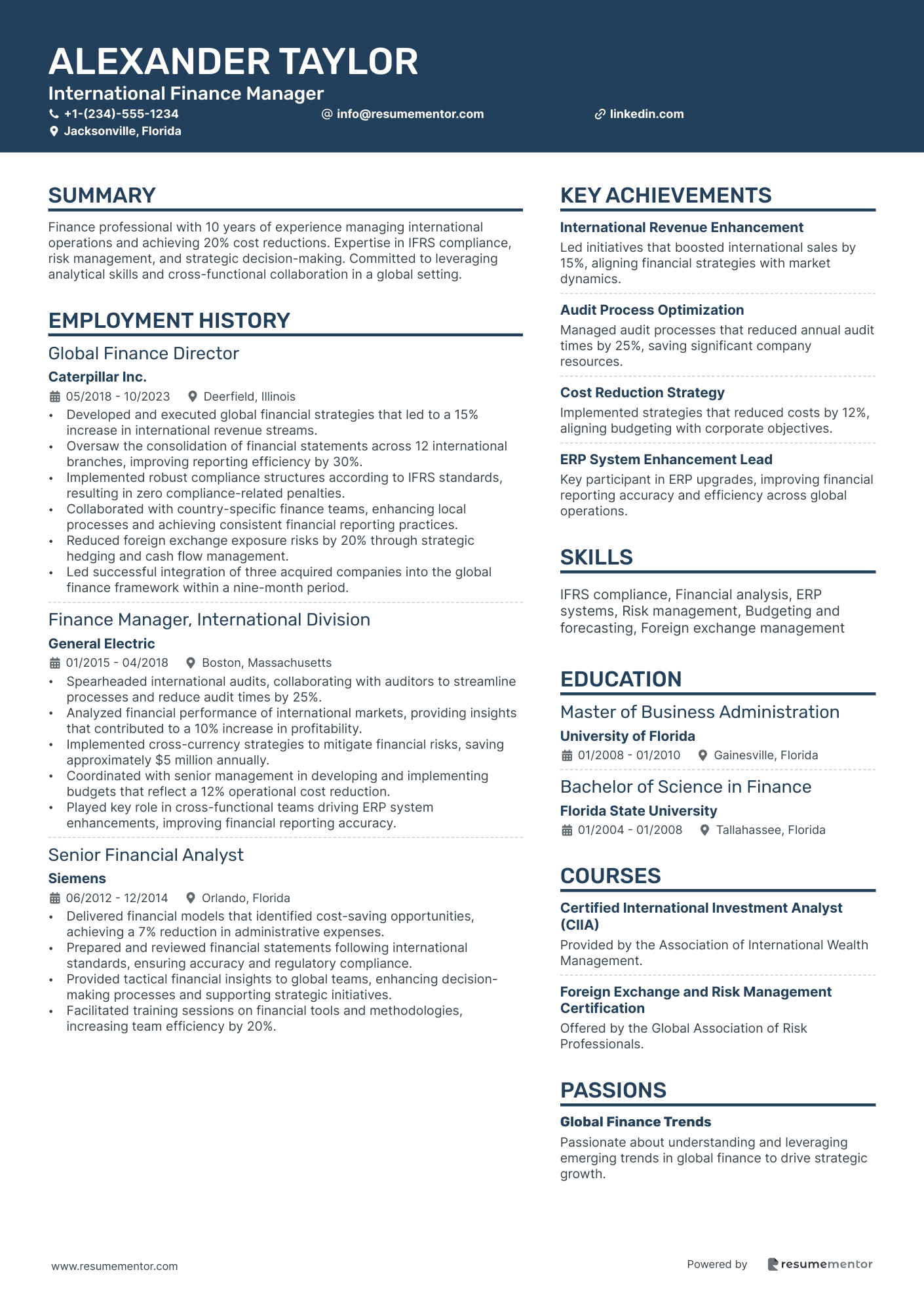

International Finance Manager

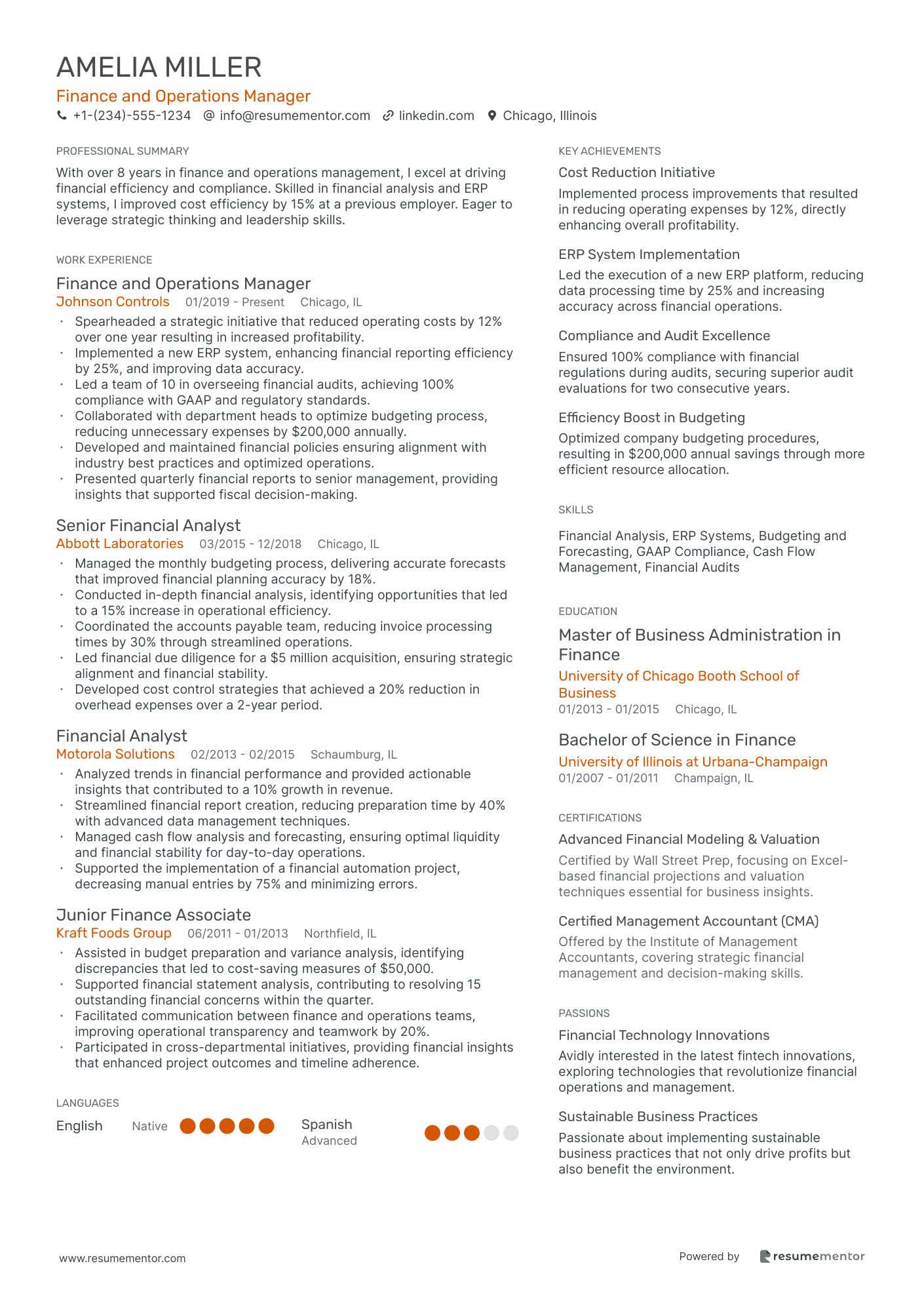

Finance and Operations Manager

Capital Budgeting Finance Manager

Real Estate Finance Manager

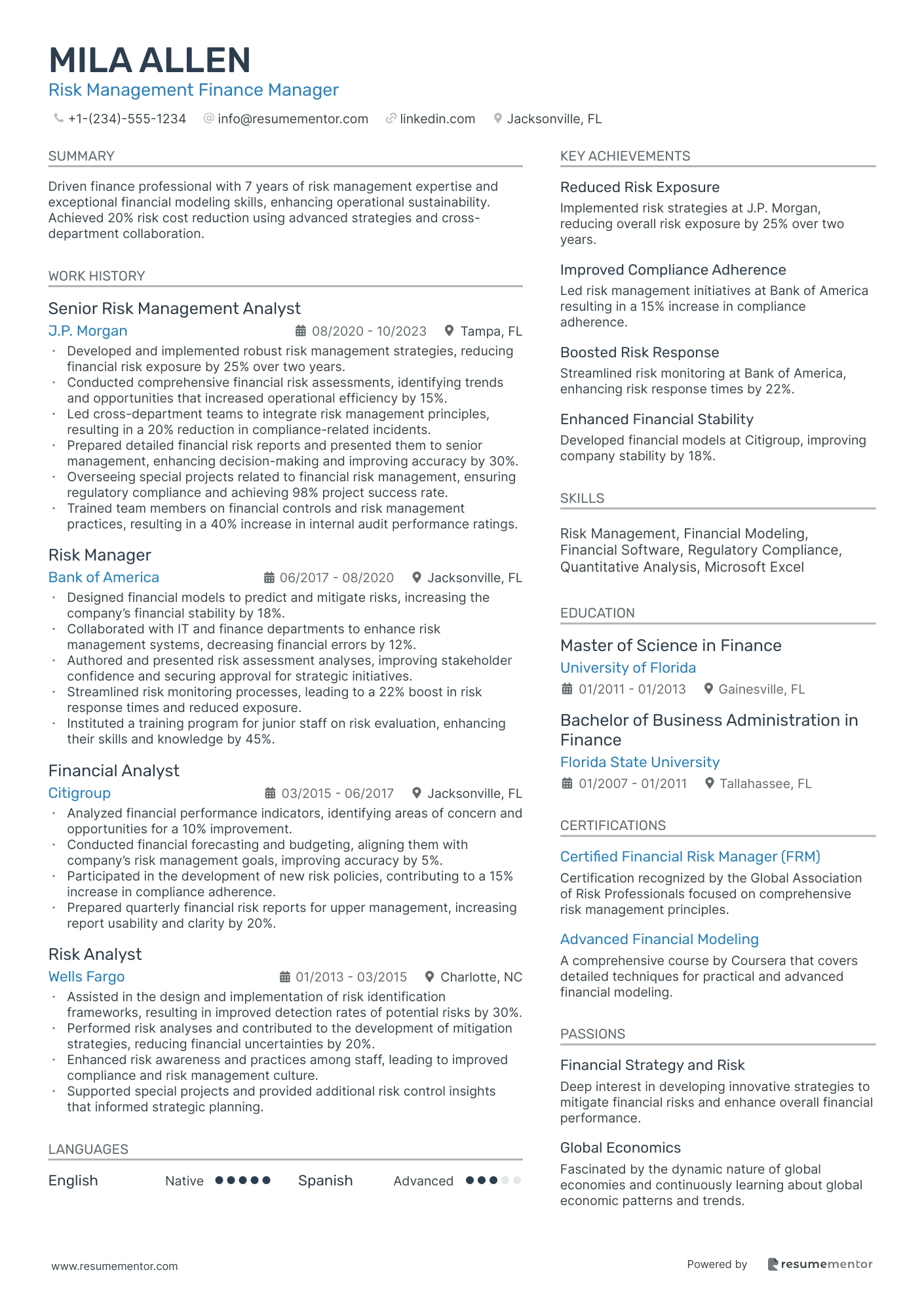

Risk Management Finance Manager resume sample

- •Developed and implemented robust risk management strategies, reducing financial risk exposure by 25% over two years.

- •Conducted comprehensive financial risk assessments, identifying trends and opportunities that increased operational efficiency by 15%.

- •Led cross-department teams to integrate risk management principles, resulting in a 20% reduction in compliance-related incidents.

- •Prepared detailed financial risk reports and presented them to senior management, enhancing decision-making and improving accuracy by 30%.

- •Overseeing special projects related to financial risk management, ensuring regulatory compliance and achieving 98% project success rate.

- •Trained team members on financial controls and risk management practices, resulting in a 40% increase in internal audit performance ratings.

- •Designed financial models to predict and mitigate risks, increasing the company’s financial stability by 18%.

- •Collaborated with IT and finance departments to enhance risk management systems, decreasing financial errors by 12%.

- •Authored and presented risk assessment analyses, improving stakeholder confidence and securing approval for strategic initiatives.

- •Streamlined risk monitoring processes, leading to a 22% boost in risk response times and reduced exposure.

- •Instituted a training program for junior staff on risk evaluation, enhancing their skills and knowledge by 45%.

- •Analyzed financial performance indicators, identifying areas of concern and opportunities for a 10% improvement.

- •Conducted financial forecasting and budgeting, aligning them with company’s risk management goals, improving accuracy by 5%.

- •Participated in the development of new risk policies, contributing to a 15% increase in compliance adherence.

- •Prepared quarterly financial risk reports for upper management, increasing report usability and clarity by 20%.

- •Assisted in the design and implementation of risk identification frameworks, resulting in improved detection rates of potential risks by 30%.

- •Performed risk analyses and contributed to the development of mitigation strategies, reducing financial uncertainties by 20%.

- •Enhanced risk awareness and practices among staff, leading to improved compliance and risk management culture.

- •Supported special projects and provided additional risk control insights that informed strategic planning.

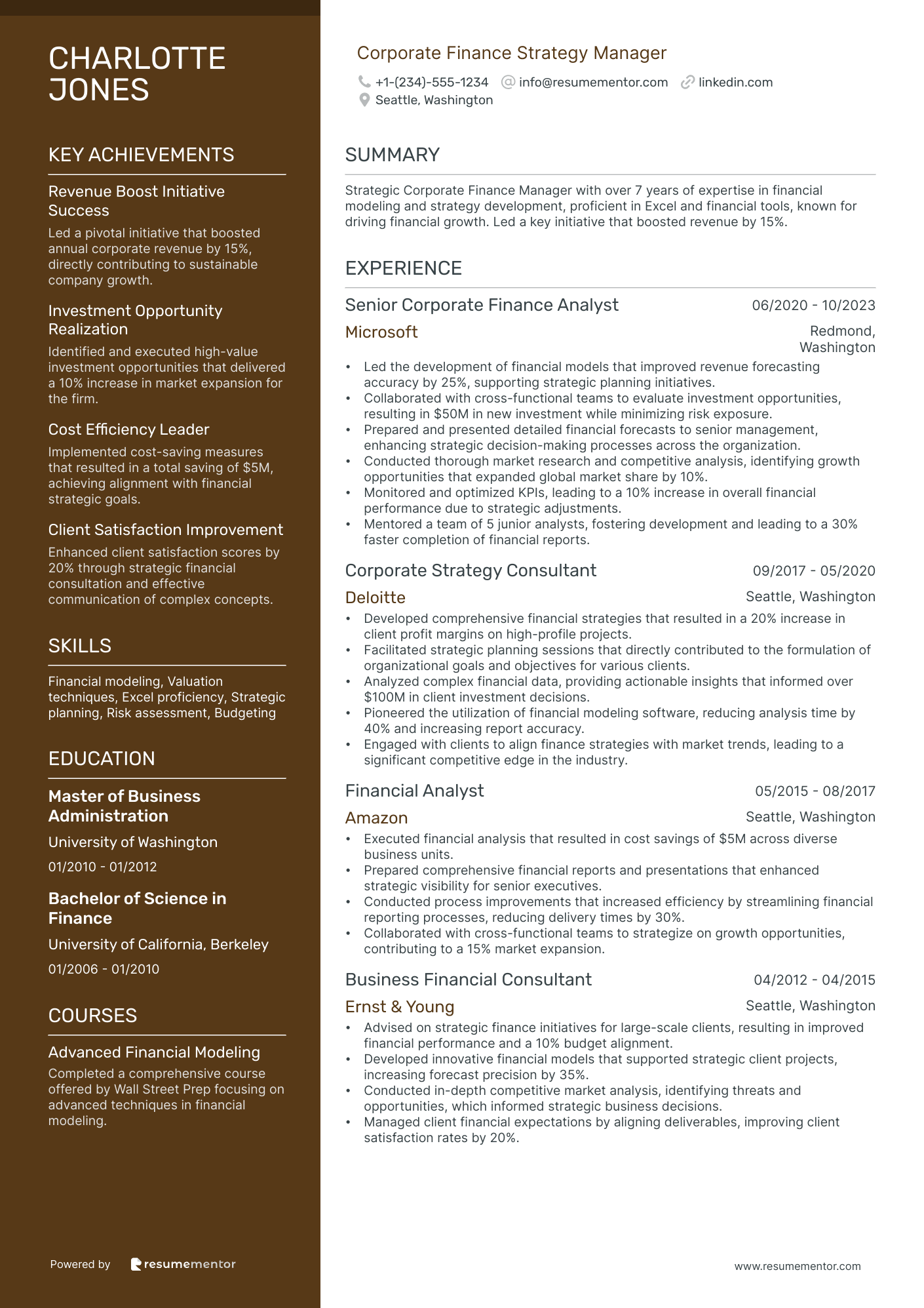

Corporate Finance Strategy Manager resume sample

- •Led the development of financial models that improved revenue forecasting accuracy by 25%, supporting strategic planning initiatives.

- •Collaborated with cross-functional teams to evaluate investment opportunities, resulting in $50M in new investment while minimizing risk exposure.

- •Prepared and presented detailed financial forecasts to senior management, enhancing strategic decision-making processes across the organization.

- •Conducted thorough market research and competitive analysis, identifying growth opportunities that expanded global market share by 10%.

- •Monitored and optimized KPIs, leading to a 10% increase in overall financial performance due to strategic adjustments.

- •Mentored a team of 5 junior analysts, fostering development and leading to a 30% faster completion of financial reports.

- •Developed comprehensive financial strategies that resulted in a 20% increase in client profit margins on high-profile projects.

- •Facilitated strategic planning sessions that directly contributed to the formulation of organizational goals and objectives for various clients.

- •Analyzed complex financial data, providing actionable insights that informed over $100M in client investment decisions.

- •Pioneered the utilization of financial modeling software, reducing analysis time by 40% and increasing report accuracy.

- •Engaged with clients to align finance strategies with market trends, leading to a significant competitive edge in the industry.

- •Executed financial analysis that resulted in cost savings of $5M across diverse business units.

- •Prepared comprehensive financial reports and presentations that enhanced strategic visibility for senior executives.

- •Conducted process improvements that increased efficiency by streamlining financial reporting processes, reducing delivery times by 30%.

- •Collaborated with cross-functional teams to strategize on growth opportunities, contributing to a 15% market expansion.

- •Advised on strategic finance initiatives for large-scale clients, resulting in improved financial performance and a 10% budget alignment.

- •Developed innovative financial models that supported strategic client projects, increasing forecast precision by 35%.

- •Conducted in-depth competitive market analysis, identifying threats and opportunities, which informed strategic business decisions.

- •Managed client financial expectations by aligning deliverables, improving client satisfaction rates by 20%.

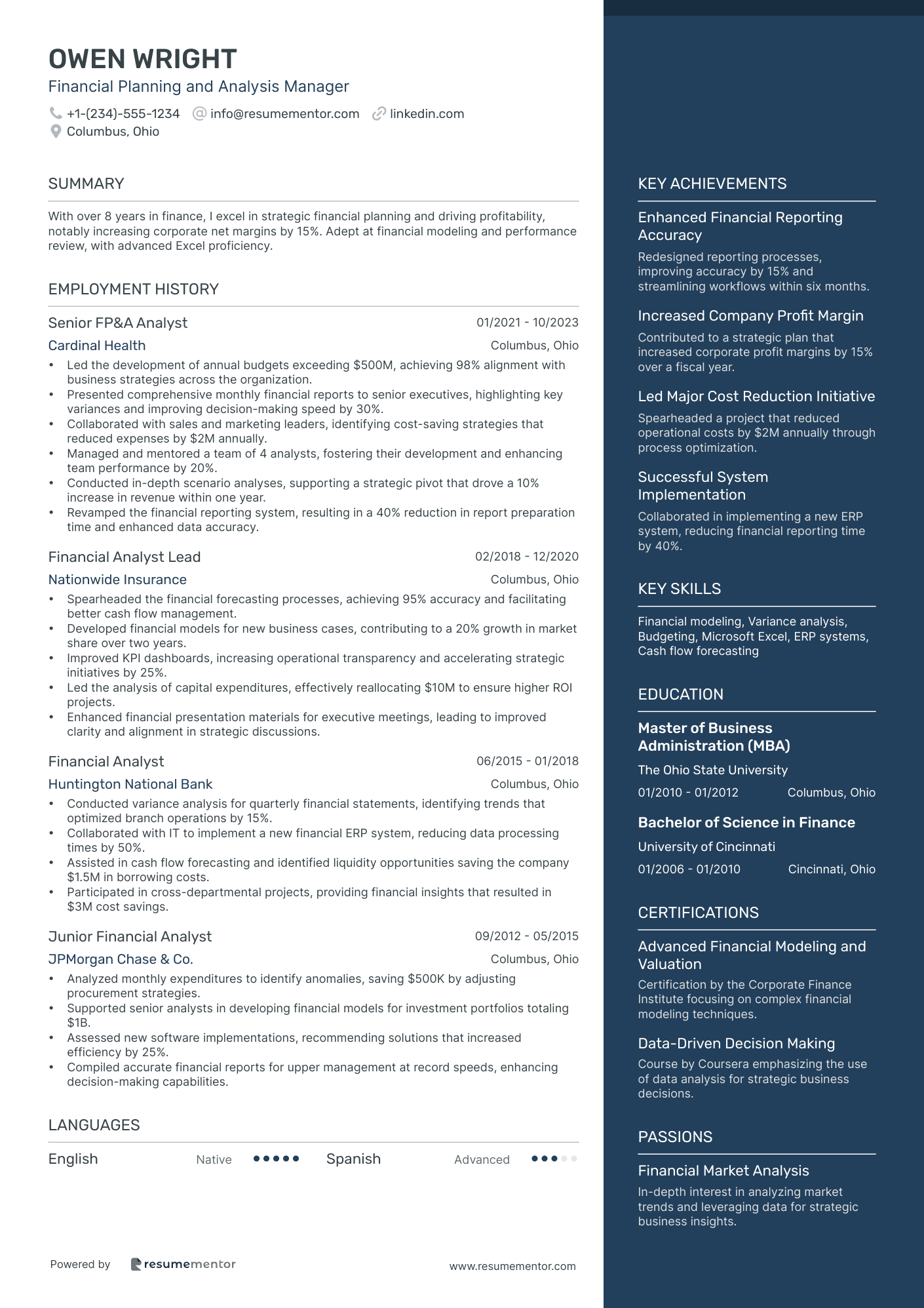

Financial Planning and Analysis Manager resume sample

- •Led the development of annual budgets exceeding $500M, achieving 98% alignment with business strategies across the organization.

- •Presented comprehensive monthly financial reports to senior executives, highlighting key variances and improving decision-making speed by 30%.

- •Collaborated with sales and marketing leaders, identifying cost-saving strategies that reduced expenses by $2M annually.

- •Managed and mentored a team of 4 analysts, fostering their development and enhancing team performance by 20%.

- •Conducted in-depth scenario analyses, supporting a strategic pivot that drove a 10% increase in revenue within one year.

- •Revamped the financial reporting system, resulting in a 40% reduction in report preparation time and enhanced data accuracy.

- •Spearheaded the financial forecasting processes, achieving 95% accuracy and facilitating better cash flow management.

- •Developed financial models for new business cases, contributing to a 20% growth in market share over two years.

- •Improved KPI dashboards, increasing operational transparency and accelerating strategic initiatives by 25%.

- •Led the analysis of capital expenditures, effectively reallocating $10M to ensure higher ROI projects.

- •Enhanced financial presentation materials for executive meetings, leading to improved clarity and alignment in strategic discussions.

- •Conducted variance analysis for quarterly financial statements, identifying trends that optimized branch operations by 15%.

- •Collaborated with IT to implement a new financial ERP system, reducing data processing times by 50%.

- •Assisted in cash flow forecasting and identified liquidity opportunities saving the company $1.5M in borrowing costs.

- •Participated in cross-departmental projects, providing financial insights that resulted in $3M cost savings.

- •Analyzed monthly expenditures to identify anomalies, saving $500K by adjusting procurement strategies.

- •Supported senior analysts in developing financial models for investment portfolios totaling $1B.

- •Assessed new software implementations, recommending solutions that increased efficiency by 25%.

- •Compiled accurate financial reports for upper management at record speeds, enhancing decision-making capabilities.

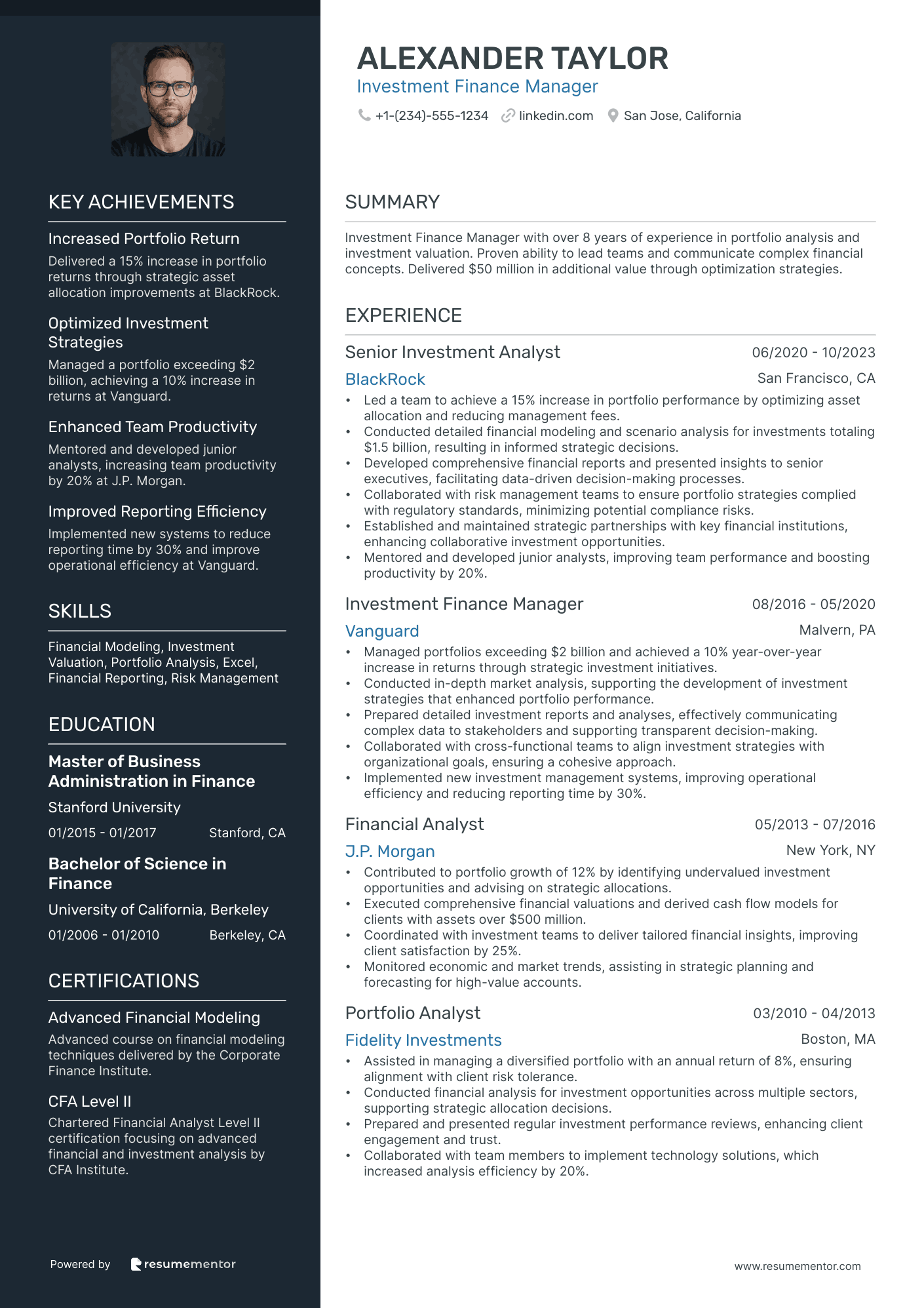

Investment Finance Manager resume sample

- •Led a team to achieve a 15% increase in portfolio performance by optimizing asset allocation and reducing management fees.

- •Conducted detailed financial modeling and scenario analysis for investments totaling $1.5 billion, resulting in informed strategic decisions.

- •Developed comprehensive financial reports and presented insights to senior executives, facilitating data-driven decision-making processes.

- •Collaborated with risk management teams to ensure portfolio strategies complied with regulatory standards, minimizing potential compliance risks.

- •Established and maintained strategic partnerships with key financial institutions, enhancing collaborative investment opportunities.

- •Mentored and developed junior analysts, improving team performance and boosting productivity by 20%.

- •Managed portfolios exceeding $2 billion and achieved a 10% year-over-year increase in returns through strategic investment initiatives.

- •Conducted in-depth market analysis, supporting the development of investment strategies that enhanced portfolio performance.

- •Prepared detailed investment reports and analyses, effectively communicating complex data to stakeholders and supporting transparent decision-making.

- •Collaborated with cross-functional teams to align investment strategies with organizational goals, ensuring a cohesive approach.

- •Implemented new investment management systems, improving operational efficiency and reducing reporting time by 30%.

- •Contributed to portfolio growth of 12% by identifying undervalued investment opportunities and advising on strategic allocations.

- •Executed comprehensive financial valuations and derived cash flow models for clients with assets over $500 million.

- •Coordinated with investment teams to deliver tailored financial insights, improving client satisfaction by 25%.

- •Monitored economic and market trends, assisting in strategic planning and forecasting for high-value accounts.

- •Assisted in managing a diversified portfolio with an annual return of 8%, ensuring alignment with client risk tolerance.

- •Conducted financial analysis for investment opportunities across multiple sectors, supporting strategic allocation decisions.

- •Prepared and presented regular investment performance reviews, enhancing client engagement and trust.

- •Collaborated with team members to implement technology solutions, which increased analysis efficiency by 20%.

Healthcare Finance Manager resume sample

- •Spearheaded the development of a $150 million annual budget, ensuring alignment with strategic objectives and a 5% reduction in operating costs.

- •Led monthly financial analysis presentations to senior executives, resulting in informed decision-making on budget allocations and resource management.

- •Implemented a comprehensive financial dashboard that provided real-time KPIs to stakeholders, enhancing transparency and performance visibility.

- •Collaborated with clinical teams to assess financial impact of new healthcare programs, leading to a 15% increase in revenue.

- •Ensured compliance with federal and state regulations, mitigating audit risks and maintaining high standards of financial governance.

- •Mentored and developed a team of 4 finance professionals, fostering a collaborative environment and achieving a 10% increase in team performance.

- •Managed monthly and quarterly financial reporting processes, improving accuracy by 12% and enabling efficient strategic planning.

- •Conducted detailed financial analysis of reimbursement methodologies, enhancing understanding and optimizing insurance contract negotiations.

- •Developed financial models to evaluate capital investment projects, contributing to a 7% increase in ROI across department initiatives.

- •Collaborated with cross-functional teams to streamline financial operations, resulting in a 20% reduction in accounts processing time.

- •Led training sessions on financial software and tools, increasing proficiency across departments and improving data-driven decision-making.

- •Supported financial planning and forecasting efforts, resulting in budget adjustments that improved department profitability by 8%.

- •Utilized ERP systems to enhance financial data analysis, leading to more accurate reporting and reduced manual errors by 15%.

- •Partnered with operational teams to identify cost-saving initiatives that lowered overall healthcare delivery expenses by 10%.

- •Assisted in the development of long-term financial strategies, enabling sustainable growth and maintaining a competitive edge.

- •Performed financial reconciliations and journal entries, ensuring accurate financial statements and compliance with GAAP standards.

- •Enhanced accounts receivable and payable processes, reducing cycle times by 18% and improving cash flow management.

- •Coordinated audit preparations, resulting in a successful audit outcome with zero significant findings or observations.

- •Participated in the implementation of new ERP systems, facilitating improved data management and reporting efficiency.

Nonprofit Finance Manager resume sample

- •Oversaw financial operations resulting in a 20% improvement in budget adherence and maintaining compliance with all relevant regulations.

- •Implemented financial controls that increased financial transparency, resulting in a 15% reduction in audit discrepancies.

- •Managed and coordinated the annual budgeting process, leading to a $1.5M balanced budget that aligned with organizational goals.

- •Prepared and analyzed monthly financial statements, providing strategic insights that contributed to a 10% cost reduction.

- •Developed and conducted financial training workshops for staff, enhancing financial literacy across all departments.

- •Coordinated successful completion of financial audits, achieving high compliance ratings from auditors.

- •Analyzed financial statements to provide actionable insights that led to an optimized spending strategy, saving 8% annually.

- •Collaborated with program managers to create and monitor budgets of over $3M, ensuring alignment with organizational objectives.

- •Processed payroll, accounts payable, and receivable, enhancing accuracy and efficiency through process improvements.

- •Provided financial reports for funding authorities, resulting in continued grant funding and donor support worth $500k annually.

- •Developed strategic financial plans with the executive team that supported a 12% growth in program funding.

- •Managed daily financial operations, including budget forecasting and reporting, improving accuracy by 95%.

- •Led a team in the implementation of an advanced financial software system, enhancing financial reporting processes.

- •Ensured compliance with state and federal regulations, reducing potential penalties and liabilities by 70%.

- •Assisted in development of financial strategies and provided fiscal recommendations to enhance organizational sustainability.

- •Managed financial records and systems, overseeing all accounting operations for an annual budget exceeding $2M.

- •Coordinated quarterly financial review sessions, providing essential insights into fiscal health and areas for improvement.

- •Developed and maintained financial policies, ensuring consistent adherence to organizational standards.

- •Assisted in successful grant management by preparing detailed financial reports, resulting in $300k in renewed funding.

International Finance Manager resume sample

- •Developed and executed global financial strategies that led to a 15% increase in international revenue streams.

- •Oversaw the consolidation of financial statements across 12 international branches, improving reporting efficiency by 30%.

- •Implemented robust compliance structures according to IFRS standards, resulting in zero compliance-related penalties.

- •Collaborated with country-specific finance teams, enhancing local processes and achieving consistent financial reporting practices.

- •Reduced foreign exchange exposure risks by 20% through strategic hedging and cash flow management.

- •Led successful integration of three acquired companies into the global finance framework within a nine-month period.

- •Spearheaded international audits, collaborating with auditors to streamline processes and reduce audit times by 25%.

- •Analyzed financial performance of international markets, providing insights that contributed to a 10% increase in profitability.

- •Implemented cross-currency strategies to mitigate financial risks, saving approximately $5 million annually.

- •Coordinated with senior management in developing and implementing budgets that reflect a 12% operational cost reduction.

- •Played key role in cross-functional teams driving ERP system enhancements, improving financial reporting accuracy.

- •Delivered financial models that identified cost-saving opportunities, achieving a 7% reduction in administrative expenses.

- •Prepared and reviewed financial statements following international standards, ensuring accuracy and regulatory compliance.

- •Provided tactical financial insights to global teams, enhancing decision-making processes and supporting strategic initiatives.

- •Facilitated training sessions on financial tools and methodologies, increasing team efficiency by 20%.

- •Conducted comprehensive financial analysis influencing revenue growth strategies, leading to a 5% increase in business growth.

- •Managed monthly financial reporting, optimizing data processes to cut preparation time by 40%.

- •Collaborated with cross-border finance teams to ensure accurate and consistent reporting across 8 markets.

- •Assisted in currency risk assessments, supporting the decision-making process in minimizing exposure.

Finance and Operations Manager resume sample

- •Spearheaded a strategic initiative that reduced operating costs by 12% over one year resulting in increased profitability.

- •Implemented a new ERP system, enhancing financial reporting efficiency by 25%, and improving data accuracy.

- •Led a team of 10 in overseeing financial audits, achieving 100% compliance with GAAP and regulatory standards.

- •Collaborated with department heads to optimize budgeting process, reducing unnecessary expenses by $200,000 annually.

- •Developed and maintained financial policies ensuring alignment with industry best practices and optimized operations.

- •Presented quarterly financial reports to senior management, providing insights that supported fiscal decision-making.

- •Managed the monthly budgeting process, delivering accurate forecasts that improved financial planning accuracy by 18%.

- •Conducted in-depth financial analysis, identifying opportunities that led to a 15% increase in operational efficiency.

- •Coordinated the accounts payable team, reducing invoice processing times by 30% through streamlined operations.

- •Led financial due diligence for a $5 million acquisition, ensuring strategic alignment and financial stability.

- •Developed cost control strategies that achieved a 20% reduction in overhead expenses over a 2-year period.

- •Analyzed trends in financial performance and provided actionable insights that contributed to a 10% growth in revenue.

- •Streamlined financial report creation, reducing preparation time by 40% with advanced data management techniques.

- •Managed cash flow analysis and forecasting, ensuring optimal liquidity and financial stability for day-to-day operations.

- •Supported the implementation of a financial automation project, decreasing manual entries by 75% and minimizing errors.

- •Assisted in budget preparation and variance analysis, identifying discrepancies that led to cost-saving measures of $50,000.

- •Supported financial statement analysis, contributing to resolving 15 outstanding financial concerns within the quarter.

- •Facilitated communication between finance and operations teams, improving operational transparency and teamwork by 20%.

- •Participated in cross-departmental initiatives, providing financial insights that enhanced project outcomes and timeline adherence.

Capital Budgeting Finance Manager resume sample

- •Led a cross-functional team in developing a robust capital budgeting strategy, which accounted for over $100 million in annual projects, aligning with strategic goals.

- •Collaborated with operations to identify investment opportunities that increased project approval rates by 25% through improved financial viability assessments.

- •Directed the preparation of financial analyses, presenting cost-benefit analyses that led to an average 18% improvement in ROI across evaluated projects.

- •Developed and implemented forecasting models that enhanced capital expenditure tracking, leading to a 15% reduction in overspending on projects.

- •Regularly reviewed capital investments and presented findings that informed strategic decisions and resulted in a 20% increase in overall project efficiency.

- •Mentored a team of junior analysts, enhancing their financial modeling skills, which increased team capacity to handle complex project evaluations by 30%.

- •Assessed over 50 capital investment proposals, providing detailed financial reports and recommendations, significantly improving capital allocation strategies.

- •Implemented a new financial tracking system that improved the accuracy of financial reporting by 40%, supporting better decision-making processes.

- •Conducted in-depth ROI and IRR analyses for multiple projects, leading to the successful optimization of capital resource deployment by 28%.

- •Continuously monitored economic trends and regulatory changes, ensuring consistent alignment of capital budgeting processes with industry standards.

- •Presented financial insights and strategies to senior executives, resulting in a 35% improvement in the alignment of projects with corporate objectives.

- •Contributed to the creation of comprehensive financial models for capital expenditures, enhancing the company's ability to forecast accurately and manage budgets.

- •Played a key role in evaluating financial performance of projects totaling $70 million, helping steer them to successful completion.

- •Worked closely with departments to implement a standard approach for investment evaluations, which increased the efficiency of capital investment processes by 22%.

- •Provided financial guidance that increased stakeholder confidence in budgeting decisions, ultimately improving capital allocation strategy.

- •Developed initial financial models for small to midsize projects, contributing to an 18% increase in forecast accuracy.

- •Analyzed financial feasibility of proposed investments, successfully supporting senior analysts with data that led to 15% higher approval rates.

- •Assisted in tracking financial performance of ongoing projects, providing data-driven insights that resulted in an enhanced project management system.

- •Supported senior team members in presenting financial data, ensuring that all presentations met corporate standards and strategic alignment.

Real Estate Finance Manager resume sample

- •Conducted detailed financial analysis on potential real estate acquisitions leading to a 15% increase in successful investments.

- •Created dynamic financial models improving investment decision-making accuracy by 25% within the first year.

- •Collaborated with cross-functional teams to develop budget forecasts, resulting in a 30% improvement in budget accuracy.

- •Provided comprehensive financial reports for senior management, leading to earlier decision-making on 40% of projects.

- •Streamlined cash flow management processes, enhancing liquidity position by 35% over two fiscal years.

- •Developed a strategic financial plan that boosted portfolio performance, achieving a 20% higher return on assets.

- •Led financial modeling for major projects, contributing to a 50% reduction in forecasting errors.

- •Assisted in due diligence for new properties, providing data that reduced acquisition risks by 10%.

- •Prepared stakeholder presentations, improving clarity of financial insights by 40% and enhancing stakeholder engagement.

- •Monitored real estate portfolio performance, yielding a 15% increase in net operating income over two years.

- •Evaluated market trends and their impact on real estate investments, resulting in a 20% improvement in risk mitigation strategies.

- •Managed cash flow for client portfolios, achieving a 25% increase in efficient capital allocation for projects.

- •Developed comprehensive financial reports that enhanced transparency and reduced reporting time by 15%.

- •Supported budgeting processes resulting in a 20% more accurate financial forecast for property projects.

- •Conducted detailed market analysis, leading to strategic investment decisions that increased ROI by 18%.

- •Applied financial models to assess property valuations, increasing accuracy of asset appraisal by 30%.

- •Contributed to market research initiatives resulting in improved strategic investment recommendations.

- •Collaborated with cross-departmental teams in developing streamlined processes that lowered operational costs by 15%.

- •Analyzed economic indicators to guide investment strategies, resulting in enhanced portfolio performance.

Writing a finance manager resume can feel like balancing a very tricky budget. You may wonder how to fit years of experience, varied skills, and your greatest career achievements onto just one or two pages. The competition is fierce, and first impressions count more than ever. The pressure to stand out can make crafting the perfect resume overwhelming. Tailoring your resume to fit each job application can be a time-consuming puzzle. No wonder many finance managers find it challenging to capture their qualifications concisely and attractively.

Choosing the right resume template is crucial. An effective layout highlights your strengths and directs attention to your most relevant skills and experiences. With the right template, your resume becomes a powerful tool in securing that interview.

Don't miss out — we offer more than 700 resume examples to help you craft the perfect resume! Explore them now to boost your chances of landing your dream job.

Key Takeaways

- Choosing the right resume template is crucial for highlighting your strengths and directing attention to your most relevant skills and experiences.

- Your finance manager resume should include essential sections like Contact Information, Professional Summary, Key Skills, Work Experience, Education, and Certifications, with optional additions for a more complete picture.

- The ideal resume format for a finance manager is the reverse-chronological format, with modern fonts and clear section headings to ensure readability by Applicant Tracking Systems (ATS).

- The experience section should focus on specific accomplishments, using strong action words and concrete numbers to demonstrate your value and impact.

- Additional sections like Language Skills, Hobbies, Volunteer Work, and Books can enrich your resume and provide potential employers with a well-rounded view of your personality and professional interests.

What to focus on when writing your finance manager resume

A finance manager resume should clearly show your skills in managing money. Highlight your ability to make smart financial plans and lead a team. Show your experience in budgeting, forecasting, and creating reports. Make sure to add these key points to boost your impact:

- Managed annual budgets of over $1 million

- Cut costs by 15% through identifying inefficiencies

- Improved cash flow by leading process improvements

Must have information on your finance manager resume

When crafting your finance manager resume, you need to include essential sections that highlight your skills and experiences effectively.

- Contact Information

- Professional Summary

- Key Skills

- Work Experience

- Education

- Certifications

Additional sections like Professional Affiliations or Volunteer Experience can further bolster your resume. These can provide a more complete picture of your background and expertise.

Which resume format to choose

The ideal resume format for a finance manager should be the reverse-chronological format, which showcases your most recent experience first. You may want to opt for modern fonts like Rubik or Montserrat for a fresh and professional look, steering away from the overused Arial and Times New Roman. Always save your resume as a PDF to ensure it remains formatted properly across different devices. Keep your margins at around one inch to ensure a clean and uncluttered look. Use clear section headings such as "Experience" and "Education," which help Applicant Tracking Systems (ATS) read your resume accurately.

Your finance manager resume should include specific sections to highlight your qualifications and expertise in the field:

- Contact Information

- Professional Summary

- Work Experience

- Skills

- Education

- Certifications

- Achievements

- References (optional)

Resume Mentor's free resume builder can guide you through creating a flawless resume that meets all these guidelines.

How to write a quantifiable resume experience section

When crafting a finance manager resume, the experience section is your chance to shine. Begin with the most recent job and work backwards. Aim to include roles from the past 10-15 years, focusing on those relevant to finance management. Stick to job titles that align with finance, even if you wore multiple hats in previous positions. Tailoring your resume for each job application can significantly improve your chances. Use action words like "led," "managed," "developed," and "enhanced" to make your achievements stand out.

Here's an experience section done poorly:

- •Managed budgets

- •Led finance team

- •Improved financial systems

- •Assisted with budgets

- •Financial reporting

- •Client communication

- •Supported finance team

- •Admin tasks

- •Handled files and documents

The poor example fails because it uses vague language and lacks specifics. The action words are weak and the bullets do not show concrete achievements. This fails to set the applicant apart from others.

Now, let's look at an outstanding finance manager resume experience example:

- •Reduced operating expenses by 15% through strategic budget planning

- •Improved financial forecasting accuracy by 20% using advanced modeling techniques

- •Led a team of 10 finance professionals, resulting in a 30% increase in team efficiency

- •Oversaw monthly financial reporting, reducing errors by 25%

- •Collaborated with cross-functional teams to streamline accounting processes, saving 10% in costs

- •Developed client financial models, contributing to a 15% increase in client acquisition

- •Enhanced document management system, improving efficiency by 15%

- •Assisted in budget preparation, enabling a 10% reduction in departmental spending

- •Supported daily finance operations, resulting in a 20% increase in operational efficiency

This example shines because it uses strong action words and specific numbers. It clearly demonstrates achievements, making it easy for hiring managers to see the value you bring. Each bullet shows how your actions impacted the company, making your experience unforgettable.

Finance manager resume experience examples

So you've crunched the numbers and now you need to punch up your resume? Don't worry, we've got your back. Here's a comprehensive list of resume experience sections for a finance manager—the perfect way to make sure your career is minty fresh!

Achievement-focused

Highlight impressive achievements that showcase your contributions to past employers.

Finance Manager

XYZ Corp

Jan 2019 - Present

- Streamlined budget allocation leading to a 20% increase in annual revenue.

- Introduced cost-saving strategies, saving the company $500,000 annually.

- Developed an investment portfolio that achieved a 15% return rate.

Skills-focused

Showcase your key skills relevant to financial management.

Senior Financial Analyst

ABC Company

Feb 2017 - Dec 2018

- Conducted thorough financial analysis to guide strategic planning.

- Prepared detailed financial reports for senior management and stakeholders.

- Utilized advanced Excel and financial modeling techniques for forecasting.

Responsibility-focused

Highlight the primary responsibilities in your previous role.

Finance Manager

DEF, Inc.

Mar 2015 - Jan 2017

- Oversaw the management of a $10 million budget.

- Supervised a team of 5 junior analysts, ensuring accuracy and timeliness.

- Ensured compliance with legal and regulatory requirements for all financial operations.

Project-focused

Emphasize specific projects you successfully managed or contributed to.

Project Finance Manager

GHI Solutions

Jun 2013 - Feb 2015

- Led a financial transformation project reducing cost by 10%.

- Collaborated with IT to implement a new financial software system.

- Trained staff on new financial processes and software tools.

Result-focused

Focus on the tangible results of your efforts.

Finance Manager

JKL Enterprises

Sep 2011 - May 2013

- Implemented process improvements enhancing financial efficiency by 30%.

- Reduced monthly closing cycle from 10 to 5 days.

- Increased profitability by improving cash flow management.

Industry-Specific Focus

Make your experience relevant to the specific industry you worked in.

Finance Manager, Retail

MNO Retail Group

Jan 2010 - Aug 2011

- Managed financial operations for 50+ retail outlets.

- Developed financial models to predict sales trends and inventory needs.

- Reduced inventory wastage by 15% through effective financial planning.

Problem-Solving Focused

Detail the problem-solving skills you have demonstrated in your role.

Financial Analyst

PQR Solutions

Oct 2008 - Dec 2009

- Identified and resolved complex financial discrepancies saving the company $200,000.

- Developed a comprehensive risk management plan.

- Improved financial reporting accuracy by 25%.

Innovation-focused

Share how you brought innovative ideas to your workplace.

Finance Manager

STU Digital

May 2007 - Sep 2008

- Introduced a digital budgeting process, enhancing efficiency by 40%.

- Created innovative financial dashboards for real-time analysis.

- Implemented a new expense tracking system reducing expenses by 12%.

Leadership-focused

Discuss your leadership experience and the impact it had on your team.

Senior Finance Manager

VWX Enterprises

Apr 2006 - Apr 2007

- Led a team of 10 finance professionals overseeing the company's financial health.

- Mentored junior staff, resulting in five promotions within a year.

- Fostered a collaborative team environment improving productivity by 15%.

Customer-focused

Explain how you managed client relationships and customer satisfaction.

Financial Consultant

YZA Financial Services

Feb 2004 - Mar 2006

- Managed client portfolios enhancing returns by 10% annually.

- Developed strong client relationships resulting in 20% increase in client retention.

- Customized financial strategies based on individual client needs.

Growth-focused

Focus on how you drove growth in your previous role.

Growth Finance Manager

BCD Innovations

Jun 2001 - Jan 2004

- Developed growth strategies increasing market share by 15%.

- Analyzed market trends to inform financial decisions.

- Managed financial planning for new product launches.

Efficiency-focused

Showcase your ability to enhance operational efficiency.

Finance Manager

EFG Corp

Jul 1999 - May 2001

- Optimized financial processes, increasing efficiency by 20%.

- Reduced operational costs by $300,000 through process improvements.

- Implemented a streamlined financial reporting system.

Technology-focused

Discuss your experience with financial technologies and software.

Finance Technology Manager

HIK Technologies

Mar 1997 - Jun 1999

- Implemented an advanced ERP system improving financial accuracy.

- Utilized big data analytics for financial forecasting.

- Automated financial reporting resulting in a 50% time reduction.

Collaboration-focused

Highlight your ability to work as part of a team and cross-functional collaborations.

Financial Coordinator

LMN Group

May 1995 - Feb 1997

- Worked with various departments to align financial objectives.

- Facilitated inter-departmental financial planning sessions.

- Promoted teamwork enhancing overall company financial performance.

Training and Development-focused

Detail your experience in training and developing your team.

Training Finance Manager

NOP Financials

Jan 1993 - Apr 1995

- Created training programs for new finance hires.

- Provided continuous professional development opportunities for staff.

- Mentored team members contributing to career advancement.

Write your finance manager resume summary section

When crafting your resume summary as a finance manager, aim to present a snapshot of your most relevant skills, experiences, and accomplishments. Use this section to grab the hiring manager's attention. Keep it concise and focused on what makes you a strong candidate.

Describing yourself effectively in this section requires clarity and specificity. Highlight your strengths, such as your skills in financial analysis, budget management, and forecasting. Emphasize your track record in improving financial processes or achieving key financial goals. Being specific about your achievements and experiences will help differentiate you from other candidates.

Understanding the distinctions between resume sections can be essential. A resume summary provides a brief overview of your professional experience and key skills. A resume objective, on the other hand, focuses on your career goals and what you aim to achieve in the role. A resume profile is similar to a summary but can be slightly more detailed and tailored to match the job description. Finally, a summary of qualifications lists your key skills and accomplishments without going into much detail about your experiences.

Here is an example of a poorly written resume summary:

This summary is bad because it is too vague and lacks specifics. It doesn't provide a clear picture of your unique skills or achievements. The language is generic and doesn't demonstrate your expertise or the value you can bring to the company.

Now, here's an example of a well-written summary:

This summary is good because it clearly outlines your extensive experience and specific accomplishments. It highlights critical skills relevant to the role, such as financial planning and budget management. Specific achievements, like reducing costs and increasing revenue, add value to your application and make you stand out.

Listing your finance manager skills on your resume

When writing the skills section of your finance manager resume, you have the option to create a standalone section or incorporate your skills into other parts of your resume, such as the experience and summary sections. This flexibility allows you to highlight your strengths and soft skills prominently.

Strengths and soft skills refer to interpersonal and social skills, like leadership and communication, which are crucial for effectively performing a role. Hard skills, on the other hand, are specific, teachable abilities or knowledge sets acquired through training or experience, such as financial analysis or budgeting.

Identifying and presenting your skills and strengths effectively is key to making your resume stand out. Skills and strengths can serve as resume keywords, helping your resume get noticed by applicant tracking systems (ATS) and hiring managers.

Including specific and relevant skills in your resume demonstrates your qualifications and expertise in finance management. The given example showcases essential skills like project management and financial reporting, which are crucial for a finance manager. Making your skills section concise and relevant ensures that hiring managers can quickly identify your fit for the role.

Best hard skills to feature on your finance manager resume

Hard skills for a finance manager should show your ability to handle financial tasks, analyze data accurately, and develop strategies for business growth. These skills should communicate your technical proficiency and ability to manage financial operations.

Hard Skills

- Financial Analysis

- Budgeting

- Forecasting

- Financial Reporting

- Excel and Financial Modeling

- Risk Management

- Audit Management

- Cash Flow Management

- Cost Reduction Strategies

- Data Analysis

- Compliance

- ERP Systems

- Financial Planning

- Tax Preparation

- Investment Strategies

Best soft skills to feature on your finance manager resume

Soft skills for a finance manager should reflect your ability to lead teams, communicate effectively, and manage time efficiently. These skills should communicate your interpersonal abilities and your capability to work under pressure.

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Adaptability

- Decision-Making

- Integrity

- Negotiation

- Emotional Intelligence

- Conflict Resolution

- Multitasking

- Organizational Skills

- Client Relationship Management

How to include your education on your resume

The education section is an important part of your finance manager resume. This section should be tailored specifically to the job you are applying for; irrelevant education should not be included. Make sure to list the degree clearly and include specific honors such as cum laude if applicable. If you have a notable GPA, it's fine to include it, especially if you are a recent graduate.

Here is an example of a bad education section. It is not tailored or well organized.

This example is bad because the degree is not relevant to the field of finance, the GPA is low, and the institution and location are vague.

Here is an example of a good education section. This one is focused and clear.

This example is good because it includes a reputable degree that is directly relevant to the finance industry. The high GPA and specific dates of study further enhance its impact.

How to include finance manager certificates on your resume

The certificates section is an important part of your finance manager resume as it highlights your additional qualifications and expertise. To effectively include this section, list the name of each certificate, include the date you received or completed it, and add the issuing organization or institution. This not only shows your commitment to ongoing education but also ensures credibility.

Certificates can also be prominently showcased in the header of your resume. For example: "John Doe, CFA, CPA, MBA." This immediate visibility can catch the eye of hiring managers and set you apart.

Here’s a good example of a standalone certificates section:

Why is this example good? It includes three highly relevant and respected certifications in the finance industry. Listing the CFA, CPA, and FRM shows proficiency in financial analysis, accounting, and risk management. Each item includes the issuing organization, adding legitimacy. This clear, concise format makes it easy for hiring managers to recognize your qualifications quickly.

Extra sections to include in your finance manager resume

Your resume as a finance manager should not only showcase your expertise in financial planning, analysis, and strategy but also present a well-rounded picture of who you are. Including various sections that reflect your language skills, personal interests, volunteer work, and reading habits can underscore your unique qualities and make your resume stand out.

Language section—List any additional languages you speak fluently. This can highlight your ability to communicate and work in diverse environments, which is valuable in global finance roles.

Hobbies and interests section—Mention interests such as chess, jogging, or cooking. These show that you have a balanced life and can relieve stress, which is crucial for a high-pressure job.

Volunteer work section—Include experiences like volunteer accounting for non-profits or teaching financial literacy. This can demonstrate your commitment to community and your willingness to use your skills to help others.

Books section—List finance-related books you have read, such as "The Intelligent Investor" or "Corporate Finance." This shows your dedication to continuing education and staying updated in your field.

Each of these sections can enrich your resume and give potential employers an insight into your personality and passions, helping them see you as a more complete candidate.

Pair your finance manager resume with a cover letter

A cover letter is a one-page document that accompanies your resume when you apply for a job. It introduces you to the hiring manager and highlights your skills and experience that are most relevant to the position. Cover letters can help you by providing an opportunity to explain why you are a perfect fit for the job and giving you a chance to showcase your communication skills.

For a finance manager, a cover letter should focus on your ability to manage budgets, forecast financial trends, and analyze financial performance. Mention specific achievements, like how you improved financial processes or saved costs in previous roles. Emphasize your leadership skills and your understanding of financial regulations. Highlighting your background in finance, such as a degree in finance or accounting and relevant certifications, can also make your application more compelling.

Ready to make your cover letter stand out? Use Resume Mentor's cover letter builder for a simple and efficient way to create a professional cover letter. Exporting as a PDF ensures that your formatting stays intact and your content is protected.

Emma Smith

Philadelphia, Pennsylvania

+1-(234)-555-1234

help@resumementor.com

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.