Finance Service Manager Resume Examples

Jul 18, 2024

|

12 min read

Nail your finance service manager resume: tips to bank on your experience and skills to get hired.

Rated by 348 people

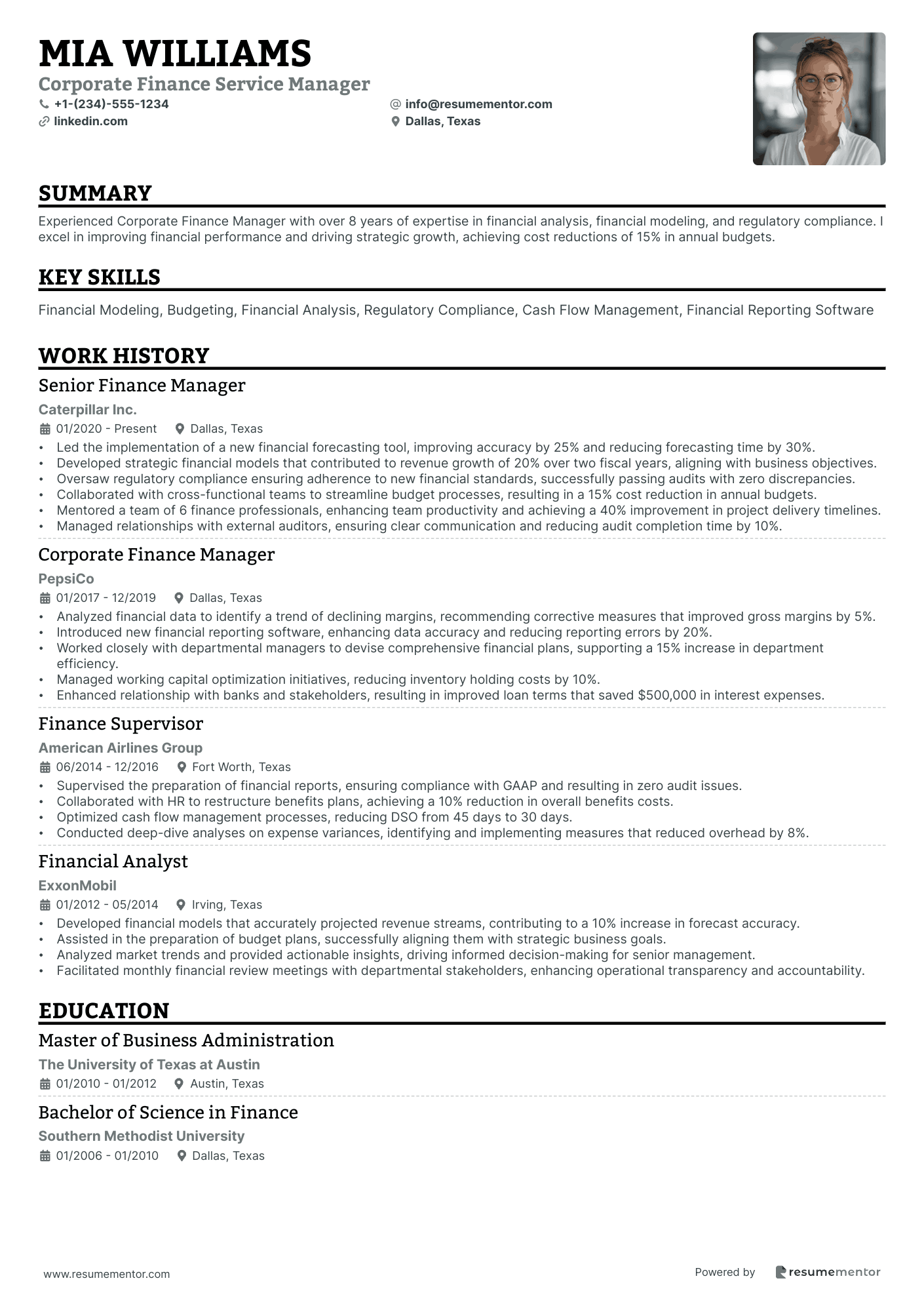

Corporate Finance Service Manager

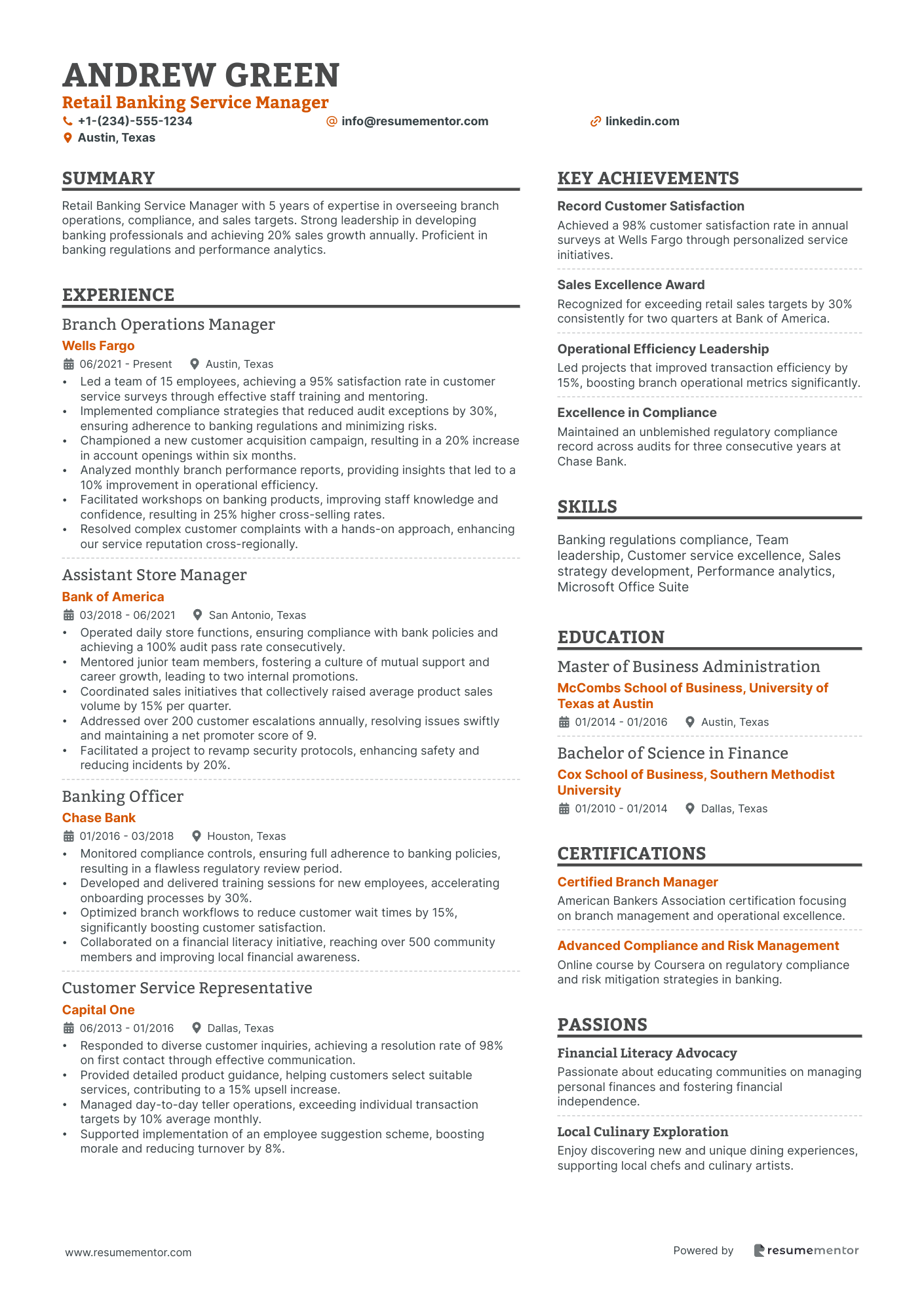

Retail Banking Service Manager

Investment Management Service Manager

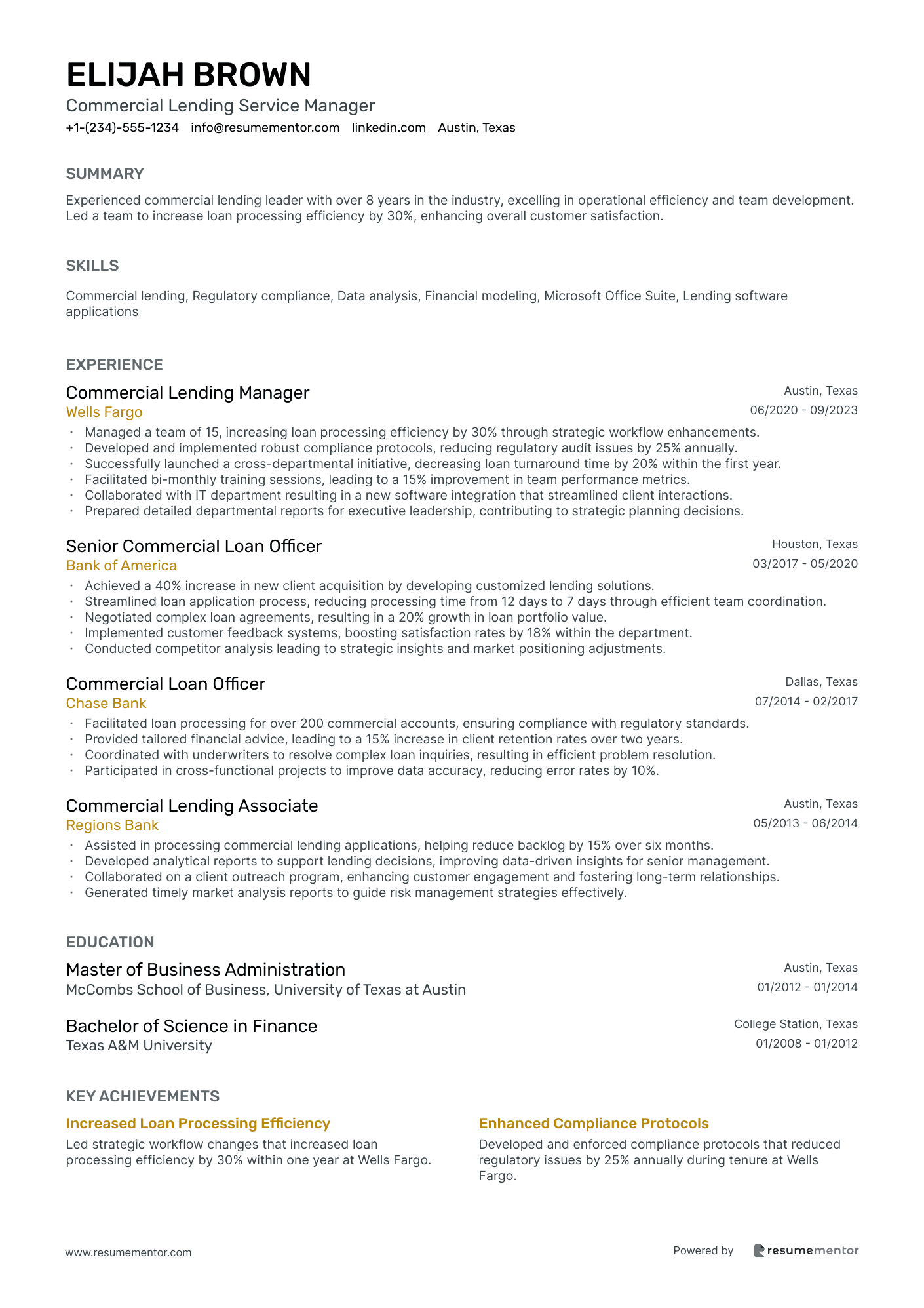

Commercial Lending Service Manager

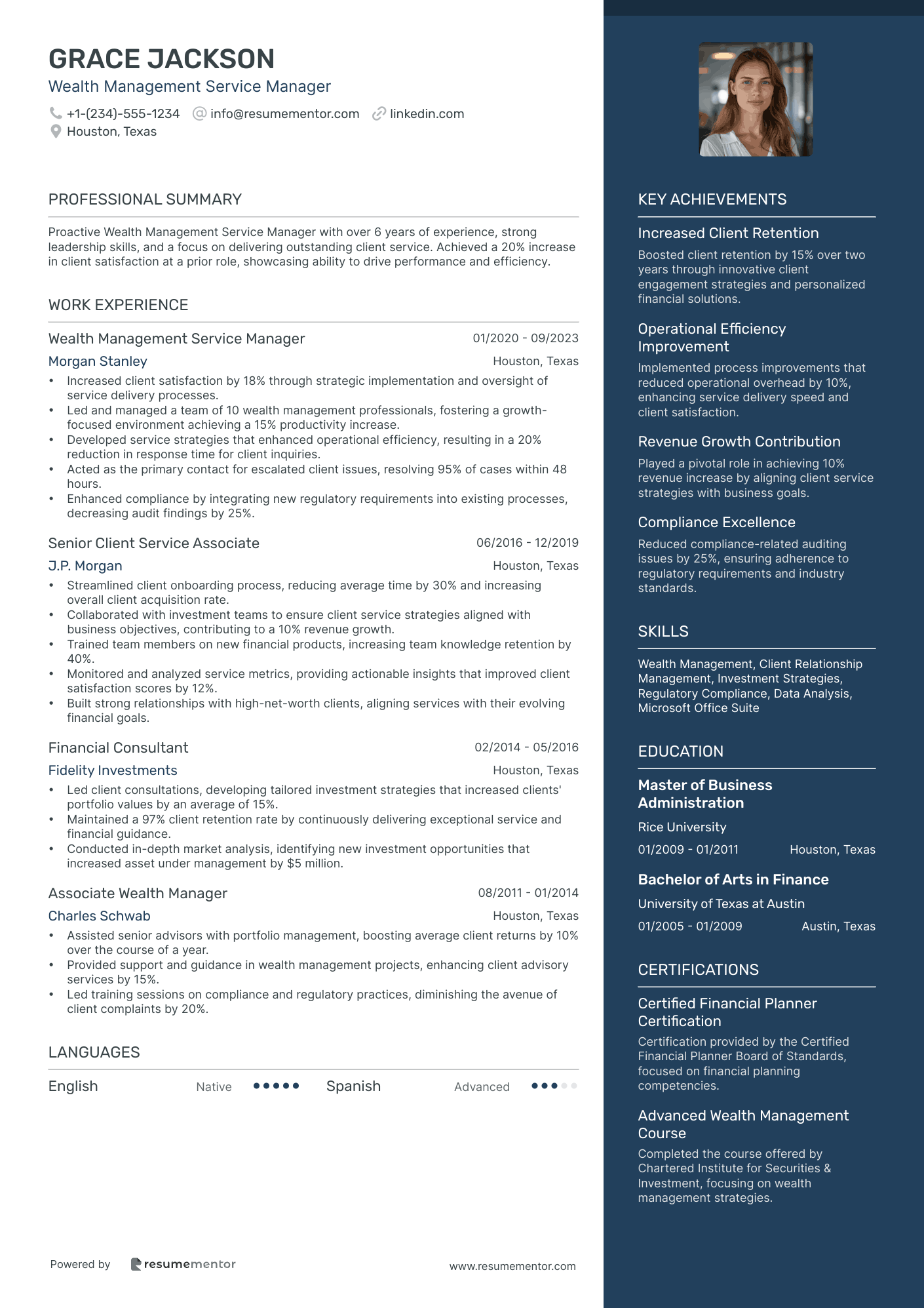

Wealth Management Service Manager

Treasury Services Financial Manager

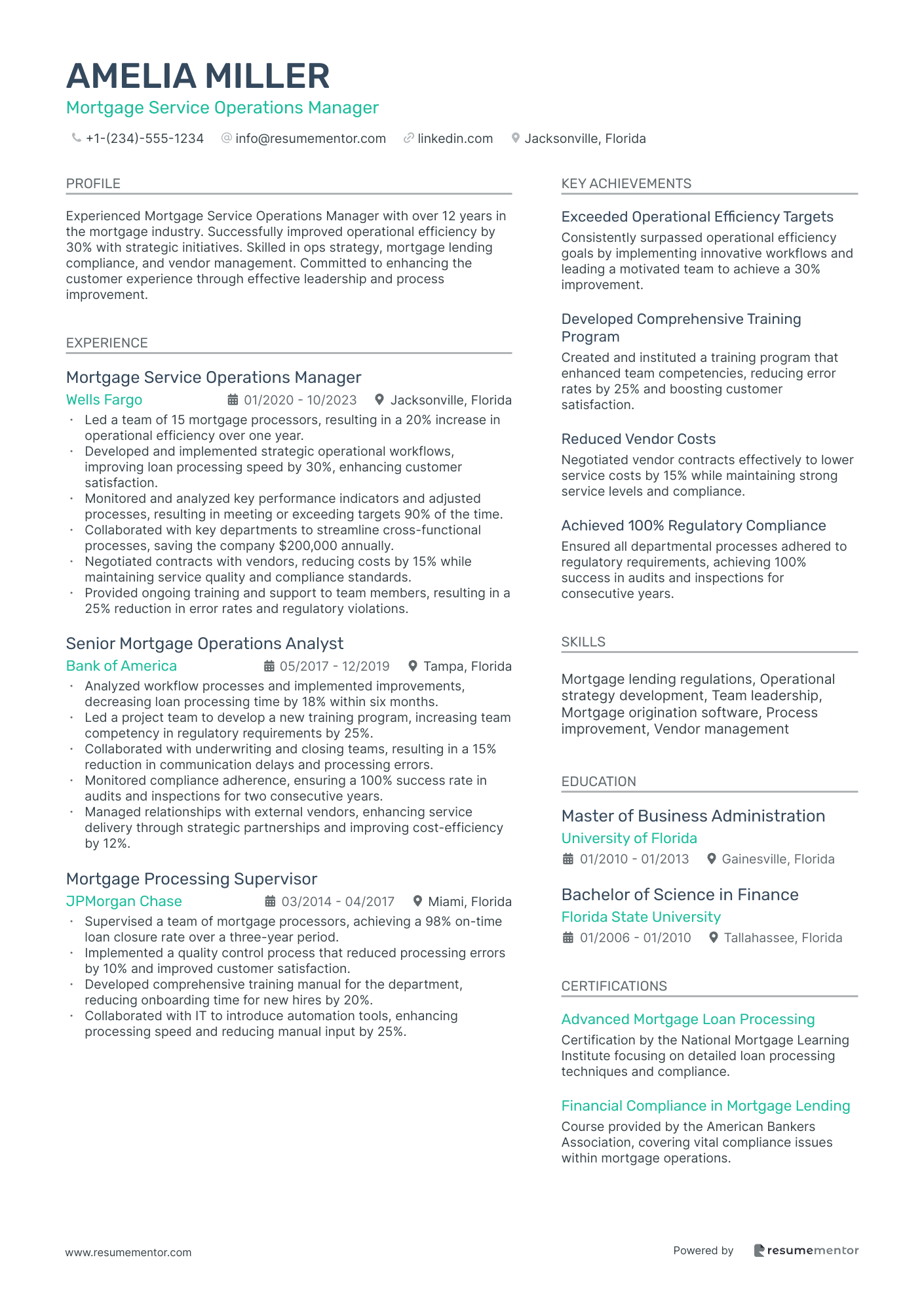

Mortgage Service Operations Manager

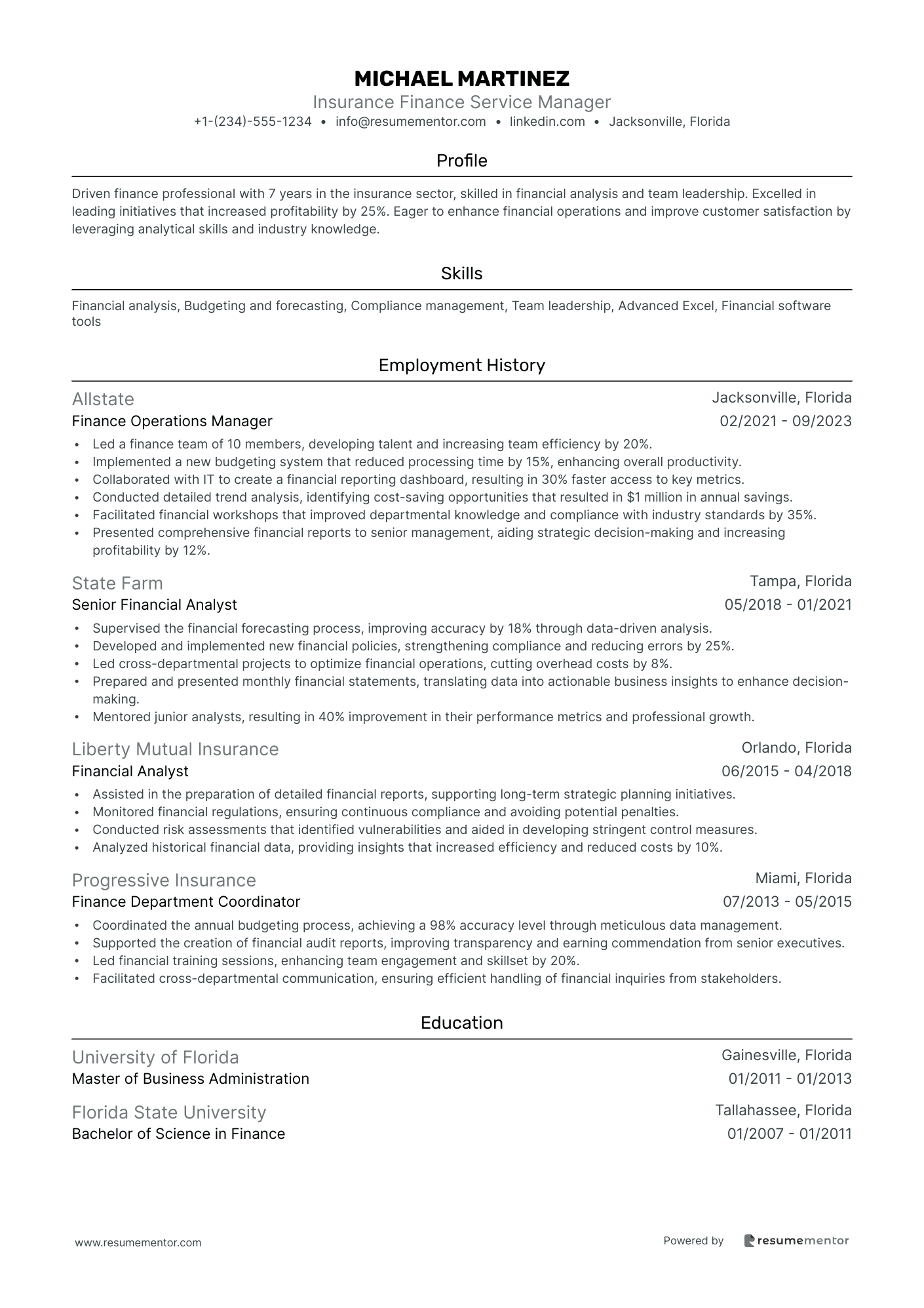

Insurance Finance Service Manager

Private Equity Service Manager

Financial Risk Service Manager

Corporate Finance Service Manager resume sample

- •Led the implementation of a new financial forecasting tool, improving accuracy by 25% and reducing forecasting time by 30%.

- •Developed strategic financial models that contributed to revenue growth of 20% over two fiscal years, aligning with business objectives.

- •Oversaw regulatory compliance ensuring adherence to new financial standards, successfully passing audits with zero discrepancies.

- •Collaborated with cross-functional teams to streamline budget processes, resulting in a 15% cost reduction in annual budgets.

- •Mentored a team of 6 finance professionals, enhancing team productivity and achieving a 40% improvement in project delivery timelines.

- •Managed relationships with external auditors, ensuring clear communication and reducing audit completion time by 10%.

- •Analyzed financial data to identify a trend of declining margins, recommending corrective measures that improved gross margins by 5%.

- •Introduced new financial reporting software, enhancing data accuracy and reducing reporting errors by 20%.

- •Worked closely with departmental managers to devise comprehensive financial plans, supporting a 15% increase in department efficiency.

- •Managed working capital optimization initiatives, reducing inventory holding costs by 10%.

- •Enhanced relationship with banks and stakeholders, resulting in improved loan terms that saved $500,000 in interest expenses.

- •Supervised the preparation of financial reports, ensuring compliance with GAAP and resulting in zero audit issues.

- •Collaborated with HR to restructure benefits plans, achieving a 10% reduction in overall benefits costs.

- •Optimized cash flow management processes, reducing DSO from 45 days to 30 days.

- •Conducted deep-dive analyses on expense variances, identifying and implementing measures that reduced overhead by 8%.

- •Developed financial models that accurately projected revenue streams, contributing to a 10% increase in forecast accuracy.

- •Assisted in the preparation of budget plans, successfully aligning them with strategic business goals.

- •Analyzed market trends and provided actionable insights, driving informed decision-making for senior management.

- •Facilitated monthly financial review meetings with departmental stakeholders, enhancing operational transparency and accountability.

Retail Banking Service Manager resume sample

- •Led a team of 15 employees, achieving a 95% satisfaction rate in customer service surveys through effective staff training and mentoring.

- •Implemented compliance strategies that reduced audit exceptions by 30%, ensuring adherence to banking regulations and minimizing risks.

- •Championed a new customer acquisition campaign, resulting in a 20% increase in account openings within six months.

- •Analyzed monthly branch performance reports, providing insights that led to a 10% improvement in operational efficiency.

- •Facilitated workshops on banking products, improving staff knowledge and confidence, resulting in 25% higher cross-selling rates.

- •Resolved complex customer complaints with a hands-on approach, enhancing our service reputation cross-regionally.

- •Operated daily store functions, ensuring compliance with bank policies and achieving a 100% audit pass rate consecutively.

- •Mentored junior team members, fostering a culture of mutual support and career growth, leading to two internal promotions.

- •Coordinated sales initiatives that collectively raised average product sales volume by 15% per quarter.

- •Addressed over 200 customer escalations annually, resolving issues swiftly and maintaining a net promoter score of 9.

- •Facilitated a project to revamp security protocols, enhancing safety and reducing incidents by 20%.

- •Monitored compliance controls, ensuring full adherence to banking policies, resulting in a flawless regulatory review period.

- •Developed and delivered training sessions for new employees, accelerating onboarding processes by 30%.

- •Optimized branch workflows to reduce customer wait times by 15%, significantly boosting customer satisfaction.

- •Collaborated on a financial literacy initiative, reaching over 500 community members and improving local financial awareness.

- •Responded to diverse customer inquiries, achieving a resolution rate of 98% on first contact through effective communication.

- •Provided detailed product guidance, helping customers select suitable services, contributing to a 15% upsell increase.

- •Managed day-to-day teller operations, exceeding individual transaction targets by 10% average monthly.

- •Supported implementation of an employee suggestion scheme, boosting morale and reducing turnover by 8%.

Investment Management Service Manager resume sample

- •Led a team of 10 professionals, achieving a 30% increase in client satisfaction scores over a year through strategic service implementations.

- •Developed and monitored client service strategies, aligning them with company goals, which improved client retention by 20%.

- •Collaborated with portfolio managers to refine investment strategies that increased client portfolio returns by 15% annually.

- •Conducted comprehensive portfolio reviews, resulting in more accurate and timely client updates, enhancing decision-making processes.

- •Managed high-level client inquiries, resolving 95% of issues within 24 hours, thereby boosting efficiency and client trust.

- •Prepared detailed performance reports for senior management that highlighted service successes, which influenced strategic investment decisions.

- •Spearheaded a project to automate report generation processes, saving 15% of team time and resources.

- •Fostered strong client relationships by implementing tailored investment solutions, increasing satisfaction metrics by 25%.

- •Conducted portfolio assessments that contributed to strategic shifts, enhancing client portfolios by an average of 10%.

- •Collaborated with cross-functional teams to streamline services, resulting in a 20% improvement in service delivery speed.

- •Developed training programs for new team members, which improved onboarding efficiency and reduced training time by 30%.

- •Analyzed market trends to support the development of competitive investment strategies, enhancing client fund performance by 12%.

- •Provided in-depth financial analysis and forecasts that informed key investment decisions, leading to improved risk management.

- •Worked closely with advisors to understand client needs, which resulted in customized portfolio solutions and higher client retention.

- •Assisted in the preparation of high-level presentations for stakeholders, influencing strategic direction and investment focus.

- •Supported senior analysts with research that contributed to key investment strategies, achieving a 10% increase in portfolio growth.

- •Conducted data analysis on various asset classes, aiding in the formulation of reports that guided investment choices.

- •Maintained up-to-date client account records, improving data accuracy and enabling better portfolio management.

- •Enhanced communication with clients, resolving queries efficiently and strengthening client-advisor relationships.

Commercial Lending Service Manager resume sample

- •Managed a team of 15, increasing loan processing efficiency by 30% through strategic workflow enhancements.

- •Developed and implemented robust compliance protocols, reducing regulatory audit issues by 25% annually.

- •Successfully launched a cross-departmental initiative, decreasing loan turnaround time by 20% within the first year.

- •Facilitated bi-monthly training sessions, leading to a 15% improvement in team performance metrics.

- •Collaborated with IT department resulting in a new software integration that streamlined client interactions.

- •Prepared detailed departmental reports for executive leadership, contributing to strategic planning decisions.

- •Achieved a 40% increase in new client acquisition by developing customized lending solutions.

- •Streamlined loan application process, reducing processing time from 12 days to 7 days through efficient team coordination.

- •Negotiated complex loan agreements, resulting in a 20% growth in loan portfolio value.

- •Implemented customer feedback systems, boosting satisfaction rates by 18% within the department.

- •Conducted competitor analysis leading to strategic insights and market positioning adjustments.

- •Facilitated loan processing for over 200 commercial accounts, ensuring compliance with regulatory standards.

- •Provided tailored financial advice, leading to a 15% increase in client retention rates over two years.

- •Coordinated with underwriters to resolve complex loan inquiries, resulting in efficient problem resolution.

- •Participated in cross-functional projects to improve data accuracy, reducing error rates by 10%.

- •Assisted in processing commercial lending applications, helping reduce backlog by 15% over six months.

- •Developed analytical reports to support lending decisions, improving data-driven insights for senior management.

- •Collaborated on a client outreach program, enhancing customer engagement and fostering long-term relationships.

- •Generated timely market analysis reports to guide risk management strategies effectively.

Wealth Management Service Manager resume sample

- •Increased client satisfaction by 18% through strategic implementation and oversight of service delivery processes.

- •Led and managed a team of 10 wealth management professionals, fostering a growth-focused environment achieving a 15% productivity increase.

- •Developed service strategies that enhanced operational efficiency, resulting in a 20% reduction in response time for client inquiries.

- •Acted as the primary contact for escalated client issues, resolving 95% of cases within 48 hours.

- •Enhanced compliance by integrating new regulatory requirements into existing processes, decreasing audit findings by 25%.

- •Streamlined client onboarding process, reducing average time by 30% and increasing overall client acquisition rate.

- •Collaborated with investment teams to ensure client service strategies aligned with business objectives, contributing to a 10% revenue growth.

- •Trained team members on new financial products, increasing team knowledge retention by 40%.

- •Monitored and analyzed service metrics, providing actionable insights that improved client satisfaction scores by 12%.

- •Built strong relationships with high-net-worth clients, aligning services with their evolving financial goals.

- •Led client consultations, developing tailored investment strategies that increased clients' portfolio values by an average of 15%.

- •Maintained a 97% client retention rate by continuously delivering exceptional service and financial guidance.

- •Conducted in-depth market analysis, identifying new investment opportunities that increased asset under management by $5 million.

- •Assisted senior advisors with portfolio management, boosting average client returns by 10% over the course of a year.

- •Provided support and guidance in wealth management projects, enhancing client advisory services by 15%.

- •Led training sessions on compliance and regulatory practices, diminishing the avenue of client complaints by 20%.

Treasury Services Financial Manager resume sample

- •Managed a comprehensive $500 million capital structure, optimizing liquidity strategies to cut financing costs by 22% and improve cash flow projections.

- •Led a team of 10 financial analysts, guiding data-driven strategies resulting in a 30% reduction in treasury operational costs.

- •Spearheaded a project for restructuring company investments which increased annual returns by 12%, minimizing associated risks.

- •Collaborated cross-functionally to develop a new financial forecasting model, enhancing budget accuracy by 15% over the previous fiscal year.

- •Ensured compliance with international financial regulations, maintaining operational efficacy and mitigating audit risks by 20%.

- •Prepared comprehensive reports for senior management, highlighting insights from financial trends, which improved decision-making efficiency.

- •Supervised daily cash management and liquidity forecasting, improving day-to-day treasury operations efficiency by 35%.

- •Developed strategies optimizing cash flow across a portfolio worth over $200 million, enhancing financial health significantly.

- •Monitored and evaluated key performance metrics, contributing to a 10% year-over-year growth in treasury performance.

- •Initiated collaborative workshops with cross-departmental teams fostering a united approach, enhancing budget accuracy by 18%.

- •Played a pivotal role by leading Treasury Department audits, decreasing compliance issues by 25%.

- •Executed cash flow analysis and liquidity management, increasing the company’s cash reserves efficiency by 20%.

- •Conducted market analysis and investment assessment, leading to a quarterly 8% rise in investment returns.

- •Provided detailed financial reports that helped optimize the allocation of resources across various departments.

- •Strengthened banking relationships, negotiating reduced costs and improving corporate financial transaction efficiencies by 10%.

- •Developed and implemented financial models, increasing the accuracy of company forecasts and saving $1 million annually.

- •Conducted comprehensive financial analysis, identifying cost-effective measures that reduced expenses by 15%.

- •Initiated strategic insights which led to improved financial planning processes within the firm.

- •Built strong working relationships with external banks, negotiating favorable terms for credit facilities.

Mortgage Service Operations Manager resume sample

- •Led a team of 15 mortgage processors, resulting in a 20% increase in operational efficiency over one year.

- •Developed and implemented strategic operational workflows, improving loan processing speed by 30%, enhancing customer satisfaction.

- •Monitored and analyzed key performance indicators and adjusted processes, resulting in meeting or exceeding targets 90% of the time.

- •Collaborated with key departments to streamline cross-functional processes, saving the company $200,000 annually.

- •Negotiated contracts with vendors, reducing costs by 15% while maintaining service quality and compliance standards.

- •Provided ongoing training and support to team members, resulting in a 25% reduction in error rates and regulatory violations.

- •Analyzed workflow processes and implemented improvements, decreasing loan processing time by 18% within six months.

- •Led a project team to develop a new training program, increasing team competency in regulatory requirements by 25%.

- •Collaborated with underwriting and closing teams, resulting in a 15% reduction in communication delays and processing errors.

- •Monitored compliance adherence, ensuring a 100% success rate in audits and inspections for two consecutive years.

- •Managed relationships with external vendors, enhancing service delivery through strategic partnerships and improving cost-efficiency by 12%.

- •Supervised a team of mortgage processors, achieving a 98% on-time loan closure rate over a three-year period.

- •Implemented a quality control process that reduced processing errors by 10% and improved customer satisfaction.

- •Developed comprehensive training manual for the department, reducing onboarding time for new hires by 20%.

- •Collaborated with IT to introduce automation tools, enhancing processing speed and reducing manual input by 25%.

- •Originated and closed over $30 million in mortgage loans, contributing to the organization's annual sales goal by 10%.

- •Provided expert guidance on loan types and terms, helping clients choose the best mortgage products for their needs.

- •Maintained strong relationships with realtors and clients, resulting in a 95% referral rate.

- •Ensured compliance with all legal regulations and internal policies, achieving a zero-violation record during tenure.

Insurance Finance Service Manager resume sample

- •Led a finance team of 10 members, developing talent and increasing team efficiency by 20%.

- •Implemented a new budgeting system that reduced processing time by 15%, enhancing overall productivity.

- •Collaborated with IT to create a financial reporting dashboard, resulting in 30% faster access to key metrics.

- •Conducted detailed trend analysis, identifying cost-saving opportunities that resulted in $1 million in annual savings.

- •Facilitated financial workshops that improved departmental knowledge and compliance with industry standards by 35%.

- •Presented comprehensive financial reports to senior management, aiding strategic decision-making and increasing profitability by 12%.

- •Supervised the financial forecasting process, improving accuracy by 18% through data-driven analysis.

- •Developed and implemented new financial policies, strengthening compliance and reducing errors by 25%.

- •Led cross-departmental projects to optimize financial operations, cutting overhead costs by 8%.

- •Prepared and presented monthly financial statements, translating data into actionable business insights to enhance decision-making.

- •Mentored junior analysts, resulting in 40% improvement in their performance metrics and professional growth.

- •Assisted in the preparation of detailed financial reports, supporting long-term strategic planning initiatives.

- •Monitored financial regulations, ensuring continuous compliance and avoiding potential penalties.

- •Conducted risk assessments that identified vulnerabilities and aided in developing stringent control measures.

- •Analyzed historical financial data, providing insights that increased efficiency and reduced costs by 10%.

- •Coordinated the annual budgeting process, achieving a 98% accuracy level through meticulous data management.

- •Supported the creation of financial audit reports, improving transparency and earning commendation from senior executives.

- •Led financial training sessions, enhancing team engagement and skillset by 20%.

- •Facilitated cross-departmental communication, ensuring efficient handling of financial inquiries from stakeholders.

Private Equity Service Manager resume sample

- •Led a team of 10 service specialists, achieving a 94% satisfaction rate among private equity clients over the past year.

- •Implemented new operational procedures, improving service delivery time by 30% and enhancing client responsiveness.

- •Collaborated with finance and compliance teams to ensure seamless operations, resulting in 100% regulatory compliance.

- •Analyzed feedback, reducing client churn by 15% through tailored support strategies and follow-ups.

- •Developed comprehensive onboarding process improving transition experience for 50+ new clients annually.

- •Prepared quarterly reports for senior management, highlighting a 25% improvement in operational efficiency.

- •Managed a portfolio of over 50 private equity clients, maintaining an 88% retention rate over two years.

- •Streamlined reporting processes, reducing preparation time by 20% and improving accuracy of client updates.

- •Facilitated cross-department communication, enhancing service delivery efficiency by 15% for high-value clients.

- •Led client feedback initiatives, increasing satisfaction scores by 10% through targeted service improvements.

- •Composed detailed presentations for executive teams, showcasing a 12% annual increase in client satisfaction metrics.

- •Analyzed operational metrics, pinpointing bottlenecks that led to a 15% increase in productivity.

- •Supported the service team by providing data-driven insights, reducing administrative errors by 25%.

- •Assisted in the development of a new client onboarding system, enhancing user experience and reducing setup time by 20%.

- •Collaborated with legal to update compliance frameworks, ensuring all client interactions complied with industry regulations.

- •Coordinated service requests, achieving a 90% fulfillment rate within designated SLAs for private equity clients.

- •Worked with cross-functional teams to develop new service protocols, increasing service delivery speed by 15%.

- •Implemented feedback tools that contributed to a 10% improvement in client relationship management.

- •Facilitated team training sessions, boosting team member productivity by 20% over a 12-month period.

Financial Risk Service Manager resume sample

- •Developed comprehensive risk management frameworks that decreased credit risk exposure by 30% over a two-year period.

- •Led a cross-functional project on risk assessment methodologies, resulting in a 25% improvement in policy compliance.

- •Conducted detailed financial risk reports that enhanced decision-making processes by effectively communicating complex statistical data.

- •Implemented risk mitigation strategies that improved market risk resilience by 20%, contributing to overall organizational stability.

- •Facilitated staff training sessions on risk management principles, increasing team proficiency and compliance adherence by 15%.

- •Advised senior management on risk trends, leading to the adoption of three proactive risk management strategies.

- •Performed regular risk analyses that informed strategic decisions and enhanced risk awareness across 10 departments.

- •Collaborated with IT teams to integrate risk management software, leading to a 40% increase in risk data accuracy.

- •Prepared risk exposure reports for senior executives, aiding in the strategic planning of operational risk mitigation.

- •Monitored regulatory changes and advised departments, ensuring compliance and adapting strategies to meet new standards.

- •Engaged with stakeholders to refine risk assessment processes, resulting in a 20% reduction in operational inconsistencies.

- •Analyzed market trends and risks that contributed to a 15% reduction in investment portfolio volatility.

- •Managed liquidity risk assessments, maximizing asset allocation strategies and reinforcing liquidity management practices.

- •Developed reports on credit risk exposures that facilitated more informed lending decisions and risk-adjusted performance.

- •Executed compliance checks and audits, which improved adherence to regulatory demands and reduced audit discrepancies.

- •Assisted in the creation and implementation of risk procedures that boosted department efficiency by 10%.

- •Collaborated with finance teams to identify and mitigate credit risks, strengthening internal controls.

- •Supported senior management in developing presentations for regulatory meetings, enhancing risk management visibility.

- •Performed analysis on potential market risks, contributing to the strategic development of financial products.

As a finance service manager, you're the strategic driver steering your organization's financial ship, yet crafting your resume can feel like navigating through uncharted waters. Your resume needs to balance your financial expertise with your leadership qualities, weaving them into a cohesive story that captures the attention of hiring managers. The challenge lies in showcasing your broad skills while maintaining clarity and precision, without overwhelming the reader.

This task can become daunting, as effectively conveying both your financial acumen and managerial flair is no small feat. Here, a reliable resume template can be your compass, offering guidance on how to structure your information seamlessly. By using a template, you can avoid the pitfalls of creating a resume that's either too dense or too sparse.

A well-chosen template ensures your resume remains clean, organized, and engaging, with sections that naturally guide the reader through your career journey. If you're unsure where to start, explore these resume templates to find one that suits your needs.

Think of your resume as more than just a list of past jobs; it's your personal marketing tool designed to paint a vivid picture of your ability to lead and optimize financial operations. With the right framework, your resume can set the stage for conversations that will propel your career forward.

Key Takeaways

- To write a compelling finance service manager resume, balance your financial expertise with leadership skills, weaving them into a cohesive narrative that attracts hiring managers.

- Utilize a structured resume template to organize information clearly and avoid overwhelming readers with too much detail; this keeps the document clean and engaging.

- Your experience section should highlight quantifiable achievements through strong action verbs and measurable outcomes, showcasing your leadership and financial success.

- Pairing modern resume formats with fonts like Raleway or Montserrat ensures readability, while saving the document as a PDF maintains consistency across devices.

- Incorporate a dedicated skills section on your resume, focusing on both hard and soft skills relevant to finance service management, like financial analysis and leadership.

What to focus on when writing your finance service manager resume

Your finance service manager resume should effectively communicate your leadership abilities, financial know-how, and problem-solving skills to the recruiter—highlighting your capacity to drive financial success and lead service teams is crucial. Emphasize expertise in financial planning and managing customer relationships to make a strong impression.

How to structure your finance service manager resume

- Contact Information: Your name, phone number, email, and LinkedIn profile should be prominently displayed at the top of your resume, ensuring that recruiters can easily reach you. Including a professional email and an updated LinkedIn profile reflects attention to detail and professionalism—laying a strong foundation for your document.

- Professional Summary: A concise, impactful summary serves as your elevator pitch, summarizing years of experience in finance management. Highlight leadership skills and major achievements while using keywords such as "financial strategy" and "customer-focused solutions" to effectively introduce the unique value you bring—this section sets the stage for your accomplishments.

- Work Experience: Detailing your previous roles involves more than listing duties; focus on management skills and financial successes, providing specific results like improved efficiency metrics or increased revenue. These examples present you as a candidate capable of delivering tangible results—practical achievements are key to showcasing your impact on past organizations.

- Skills: Highlight key finance-specific abilities, such as financial analysis, budget management, and regulatory compliance knowledge. Including software proficiencies like QuickBooks or SAP demonstrates your technical abilities, bolstering your resume by showing you're equipped with necessary tools—skills that complement your experience and expertise.

- Education: Your educational background provides a foundation for your financial knowledge. Note finance or business-related degrees along with any certifications such as CFA or CPA. These credentials validate your expertise and show commitment to professional growth—creating a seamless narrative from education to practical experience.

- Achievements: Ending with a section on achievements allows you to spotlight awards or recognitions in financial management or service excellence. This reinforces the value you bring and your dedication to professional excellence—transitioning smoothly into the next portion where we will delve deeper into each resume section.

Which resume format to choose

Selecting the optimal resume format is crucial for a finance service manager to effectively highlight career progression. A chronological format is ideal because it underscores your experience and growth, making it easy for potential employers to see your professional journey. Complement this with modern fonts like Raleway, Montserrat, or Lato. These fonts offer a clean aesthetic that enhances readability, setting your resume apart without overwhelming the content. Always save your resume as a PDF to maintain its layout and ensure it looks consistent on any device an employer might use. Pay attention to your margins, too—aim for one inch on all sides. This approach ensures enough white space, helping key details about your background and skills stand out clearly. When these elements—format, fonts, file type, and margins—are thoughtfully combined, they effectively showcase your qualifications and experience, making your resume a powerful tool in your job search.

How to write a quantifiable resume experience section

Your finance service manager experience section is the heart of your resume, where potential employers see your fit for their needs. Start by listing your most recent job and work backward in reverse chronological order; this helps clearly show your career progression. Focusing on the last 10-15 years ensures the experiences are relevant and impactful.

Tailoring this section is key to standing out. Adjust your descriptions to align with the job ad you’re applying for. Identify keywords and skills from the ad and integrate them into your resume seamlessly. Action words like "optimized," "enhanced," and "achieved" will make your accomplishments resonate with employers.

Include job titles related to finance service management, highlighting responsibilities in budgeting, customer service, and team leadership. Connect your achievements to measurable outcomes with percentages, dollar figures, and other quantifiers to underscore your impact, enhancing the effectiveness of your application.

- •Increased client satisfaction by 20% through streamlined customer service protocols.

- •Reduced operational costs by 15% annually by implementing new financial software solutions.

- •Managed a team of 15, leading to a 30% improvement in department productivity.

- •Generated $2 million in new revenue streams through strategic market analysis and client engagement.

This experience section effectively grabs attention by making your achievements both relevant and easy to understand. Each bullet point showcases a quantifiable impact, helping employers quickly grasp the level of your contributions. Using strong action words alongside clear figures solidifies your capability. This isn’t just listing responsibilities; it’s about demonstrating real results. By weaving in job ad keywords, your application becomes even more attractive and compelling to hiring managers.

Achievement-Focused resume experience section

A finance-focused resume experience section for a service manager should clearly demonstrate your leadership and the impact of your efforts. It's important to highlight specific accomplishments that illustrate the value you've added to the organization. Use strong action verbs to draw attention to how you solved problems, boosted revenue, cut costs, or enhanced efficiency. Quantifying these achievements provides potential employers with a clear understanding of your contributions.

Each bullet should emphasize outcomes rather than just duties, showing exactly how you've applied your skills to achieve significant results. By describing your alignment with organizational goals, your collaboration with team members, and the innovative strategies and tools you employed, you convey what you accomplished and how it directly benefited the organization.

Finance Service Manager

ABC Financial Services

June 2019 - Present

- Led a team to develop and execute a new financial strategy that increased revenue by 20% within the first year.

- Implemented cost-saving measures that reduced annual operating expenses by 15%, boosting overall profitability.

- Collaborated with senior management to refine financial processes, cutting processing times by 30%.

- Oversaw a customer service improvement project that led to a 25% increase in client satisfaction scores.

Result-Focused resume experience section

A result-focused finance service manager resume experience section should clearly showcase your achievements and the impact you've made in past roles. Begin by emphasizing specific results that demonstrate your ability to drive financial success. Use numbers to quantify your accomplishments, showing the tangible value you've delivered. Each bullet point should start with a strong action verb, providing a quick snapshot of your contributions.

To effectively highlight your skills, think about key achievements that reflect your proficiency in managing finances. Successful budget management, cost reductions, and improvements in financial processes are prime examples to showcase. Keep the format consistent for easy reading, and use parallel structure in your bullet points to make your accomplishments stand out. By presenting your results clearly and concisely, you will create a powerful and compelling experience section for your resume.

Finance Service Manager

Acme Finance Solutions

June 2018 - Present

- Increased annual revenue by 15% through strategic financial planning.

- Reduced departmental costs by 20% by optimizing budget allocations and renegotiating supplier contracts.

- Implemented new financial reporting system, decreasing report generation time by 50%.

- Led a team of 10, achieving over 90% customer satisfaction in service delivery.

Technology-Focused resume experience section

A Technology-Focused finance service manager resume experience section should spotlight your ability to enhance financial processes through the use of advanced technologies. Start by listing your job titles and employment dates to clearly establish the timeline of your professional journey. Focus on highlighting specific projects where you applied your technological expertise to improve financial operations, detailing both your role and the successful outcomes achieved. Emphasize these accomplishments with quantifiable results, like cost savings or increased efficiencies, to demonstrate your impact effectively.

Incorporate action words and clear, measurable outcomes to make your contributions stand out. This allows potential employers to quickly grasp the value you bring. Keep the language simple and directly related to the current technological trends impacting the finance industry, ensuring a good fit with the job you are pursuing. Here's how you might format this section:

Finance Service Manager

TechSavvy Financials

June 2018 - Present

- Implemented a cloud-based financial reporting system, reducing processing time by 30%.

- Developed a mobile banking platform for enhanced client accessibility, increasing user engagement by 40%.

- Collaborated with IT teams to integrate AI analytics, leading to a 25% reduction in operational costs.

- Conducted workshops to train staff on new technologies, improving team proficiency and productivity by 50%.

Growth-Focused resume experience section

A growth-focused finance service manager resume experience section should vividly illustrate your pivotal role in enhancing a company’s financial health and market presence. Begin by recounting specific instances where your strategic actions led to increased revenue, operational efficiency, or cost optimization. Make sure to highlight the particular steps you took and the measurable impact, such as boosting profits or uncovering new growth opportunities. Tailor each entry to emphasize your strategic influence and leadership in driving financial success, making it clear how your efforts contributed to the organization's expansion.

In each experience entry, connect the dots by showing how your achievements linked to overall company growth. Use bullet points to detail your responsibilities and the significant outcomes of your work, ensuring a seamless transition between your strategies and their results. Every point should underline your knack for developing and implementing effective financial strategies. This approach paints a comprehensive picture for potential employers, clearly showcasing your track record in strengthening the financial footing and growth of companies you’ve managed, thereby exemplifying your expertise as a growth-focused finance service manager.

Finance Service Manager

Growth Finance Corp.

June 2020 - Present

- Developed and implemented a financial strategy that increased company revenue by 30% over two years.

- Reduced operational costs by 15% through process streamlining and renegotiating vendor contracts.

- Led a team to explore new market opportunities, contributing to a 20% increase in customer base.

- Improved financial reporting systems, enhancing decision-making processes for senior management.

Write your finance service manager resume summary section

A finance-focused resume summary for a service manager should effectively make your strengths and achievements stand out at first glance. As a finance service manager, you need to clearly present your experience and skills to showcase why you're the ideal fit for the role. Emphasizing your years of experience, specific skills, and notable achievements can set you apart. For example, you might highlight:

This kind of summary is effective because it is brief yet highlights key strengths and specific achievements, thereby making you memorable. Understanding how this section connects with other parts of your resume is vital. While a summary provides an overview of your career achievements, a resume objective is more about your career ambitions and is often used when you're starting out. Unlike a summary, a resume profile is written in paragraph form, while a summary of qualifications presents bullet points of skills and achievements. Choosing the right format depends on your career stage and goals. With significant experience, a summary is often best. If you're new, a resume objective might be more fitting. Tailor these elements to the job you’re pursuing, focusing on skills that make you the optimal choice. Keeping your language clear and purposeful will help hiring managers quickly recognize your value.

Listing your finance service manager skills on your resume

A skills-focused finance service manager resume should effectively highlight your abilities and strengths to make your application stand out. You can showcase your skills as a separate section or weave them into sections like experience and summary. Skills are often categorized into strengths and soft skills, which include natural abilities like communication, leadership, and teamwork, and these help you easily connect with others. On the other hand, hard skills are specific, measurable abilities you can learn, such as financial analysis or budgeting. Incorporating these skills and strengths as keywords in your resume also helps it stand out to employers who use keyword-based scanning tools.

Featuring a standalone skills section allows your resume to be quickly scanned by hiring managers. It focuses their attention on what you excel at without needing lengthy descriptions. The example below demonstrates how a clear and concise list effectively highlights the skills relevant to a finance service manager.

Example JSON format for a standalone skills section:

This example works well because it neatly presents your skills, making it easy for employers to see your qualifications at a glance. Each skill directly relates to the responsibilities of a finance service manager, enhancing the focus and relevance of your resume.

Best hard skills to feature on your finance service manager resume

Hard skills are crucial for demonstrating your ability to manage financial tasks and lead operations efficiently. They should showcase your expertise in project management, data analysis, and ensuring regulatory compliance. Consider these hard skills as essential for the role:

Hard Skills

- Financial Analysis

- Risk Management

- Budgeting and Forecasting

- Financial Reporting

- Data Analysis

- Regulatory Compliance

- Portfolio Management

- Strategic Planning

- Financial Software Proficiency

- Cost Benefit Analysis

- Financial Modeling

- Investment Strategies

- Auditing

- Treasury Operations

- Cash Flow Management

Best soft skills to feature on your finance service manager resume

Soft skills are equally important in highlighting how you work well with others and navigate complex situations smoothly. Featuring these skills can indicate your ability to thrive in various company cultures. Here are some vital soft skills to consider:

Soft Skills

- Communication

- Leadership

- Problem-Solving

- Adaptability

- Team Collaboration

- Attention to Detail

- Critical Thinking

- Decision-Making

- Emotional Intelligence

- Time Management

- Negotiation

- Conflict Resolution

- Customer Service

- Ethical Judgement

- Initiative and Drive

How to include your education on your resume

An education section is an important part of your resume, especially when applying for a finance service manager position. It's crucial to tailor this section to the specific job you're applying for, meaning any irrelevant education should be omitted. This helps to ensure that the hiring manager quickly sees the qualifications most pertinent to their needs. If you have a high GPA or graduated with honors, such as cum laude, make sure to mention it as it can be a differentiator. When listing your degree on your resume, include the degree name, the institution, and the graduation date.

GPA is typically included if it's above a 3.0. If your GPA is 3.5 or higher, it can be beneficial to showcase this achievement, as it signals strong academic performance. For cum laude or other honors, you can include it next to your degree title.

Here's an incorrect and correct example of how to list the education section:

The second example effectively highlights a relevant degree for a finance service manager role, showcasing an impressive GPA from a prestigious business school. This signals to potential employers both the candidate's expertise in finance and their commitment to high academic standards. The inclusion of location and date range adds further clarity and context.

How to include finance service manager certificates on your resume

Including a certificates section is an important part of any finance service manager resume. Start by listing the name of each certificate you've earned. Include the date you were awarded the certificate to provide context for its relevance. Add the issuing organization to give credibility to your expertise. Ensure these details are accurate and easy to read. Certificates showcase your commitment to professional development and specific areas of expertise relevant to the position.

For even more prominence, some certificates can be included in the header of the resume. For example, "John Doe, CFA, CPA." This immediately communicates your qualifications to potential employers.

Here's an example of a well-crafted certificates section:

This example is effective because it lists relevant certificates for a finance service manager, such as CFA and CPA, which are highly respected in the industry. Including the issuer, like CFA Institute and AICPA, adds credibility. The section is concise and easy to read, highlighting key qualifications at a glance.

Extra sections to include in your finance service manager resume

Navigating the world of finance requires a blend of expertise, dedication, and the ability to communicate effectively. As a finance service manager, building a resume that highlights your diverse skills and experiences is essential to catching a potential employer's eye. Including sections on languages, hobbies, volunteer work, and books can give a more complete picture of your capabilities beyond just your professional experience.

Language section— Include languages you speak to show your ability to communicate with a broader audience. Highlighting language skills can demonstrate your versatility and cultural awareness.

Hobbies and interests section— Showcase your hobbies to illustrate your well-rounded personality. Revealing personal interests can help you connect with your interviewers on a more relatable level.

Volunteer work section— Document your volunteer experiences to show your community involvement and leadership skills. Pointing out volunteer activities can evidence your commitment to social responsibility.

Books section— Share books you’ve read to signal your drive for continuous learning. Listing relevant finance or management books can underscore your dedication to professional excellence.

Including these sections in your resume can offer a fuller picture of who you are, making you stand out in the hiring process.

In Conclusion

In conclusion, a well-crafted finance service manager resume acts as your personal introduction to potential employers, making the difference between landing an interview and being overlooked. Your resume should frame your professional journey, blending financial expertise and leadership capabilities into a compelling narrative. Utilizing templates can guide the structure to keep your information clear and appealing. Always ensure your contact information is easy to find, paired with a professional summary that acts as your pitch to highlight your leadership, financial planning skills, and your track record of driving results.

Your work experience should detail not just where you've been, but how you've made measurable impacts, using quantifiable metrics to show success. Choose a resume format that logically presents your career path, using fonts and layouts that enhance readability. Skills listed should echo the specific demands of the role, balancing hard skills like budget management with soft skills such as communication. Education and certifications should serve to bolster your qualifications, emphasizing relevant degrees and reputable certifications.

Including extra sections like languages, hobbies, and volunteer activities can give a fuller sense of your character, setting you apart by highlighting a more comprehensive picture of your abilities and interests. Each component of your resume contributes to the story you tell about your professional journey and potential, ensuring that you stand out among other candidates. By following these guidelines, you enhance your chances of making a lasting impression and securing the job you desire.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.