Finance Specialist Resume Examples

Jul 18, 2024

|

12 min read

Enhance your finance specialist resume with key techniques to get hired. Show off your analytical skills, financial knowledge, and experience to prove you’re the top dollar expert they need.

Rated by 348 people

Investment Finance Specialist

Corporate Finance Specialist

Public Finance Specialist

Personal Finance Specialist

Finance Compliance Specialist

Financial Reporting Specialist

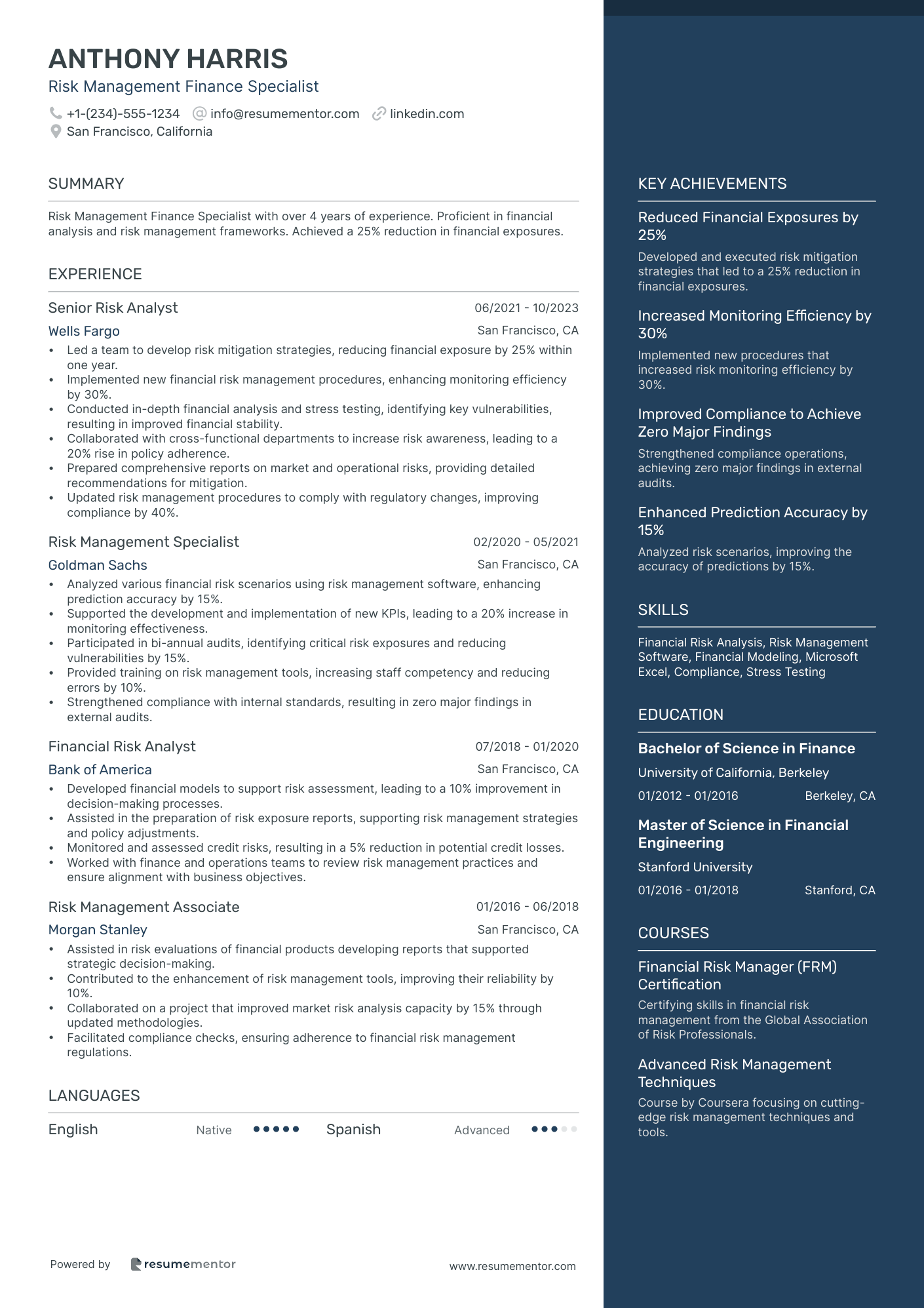

Risk Management Finance Specialist

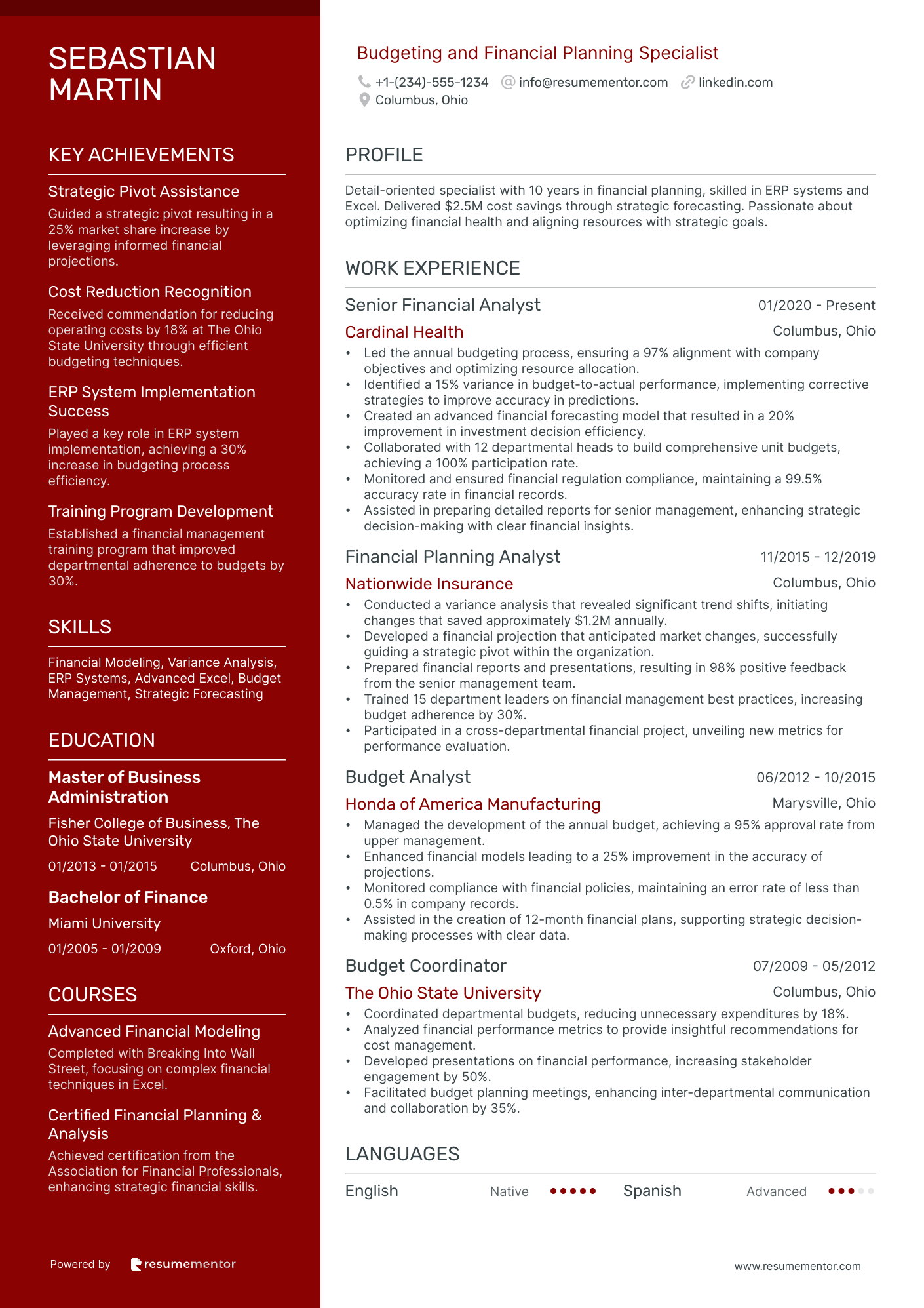

Budgeting and Financial Planning Specialist

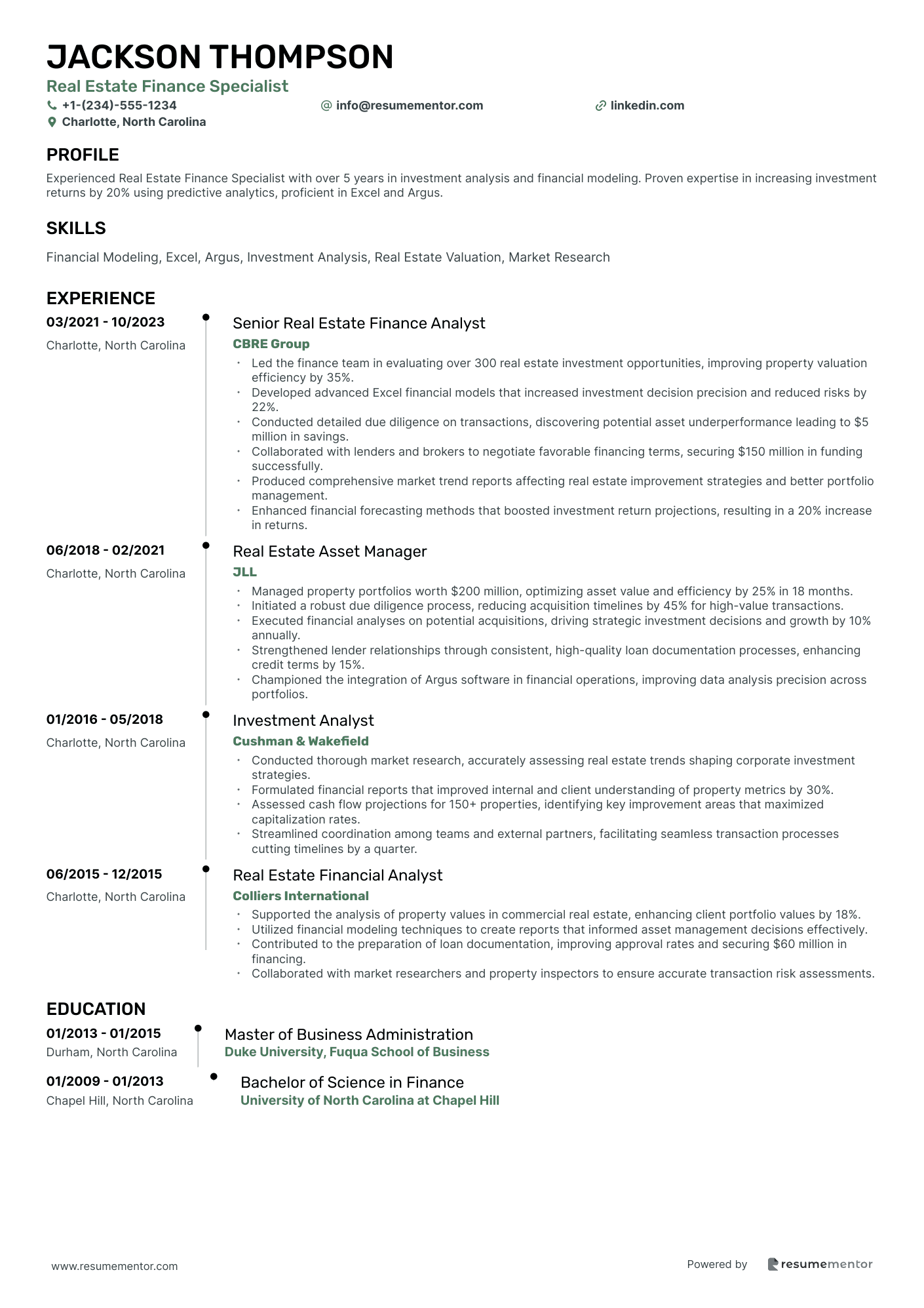

Real Estate Finance Specialist

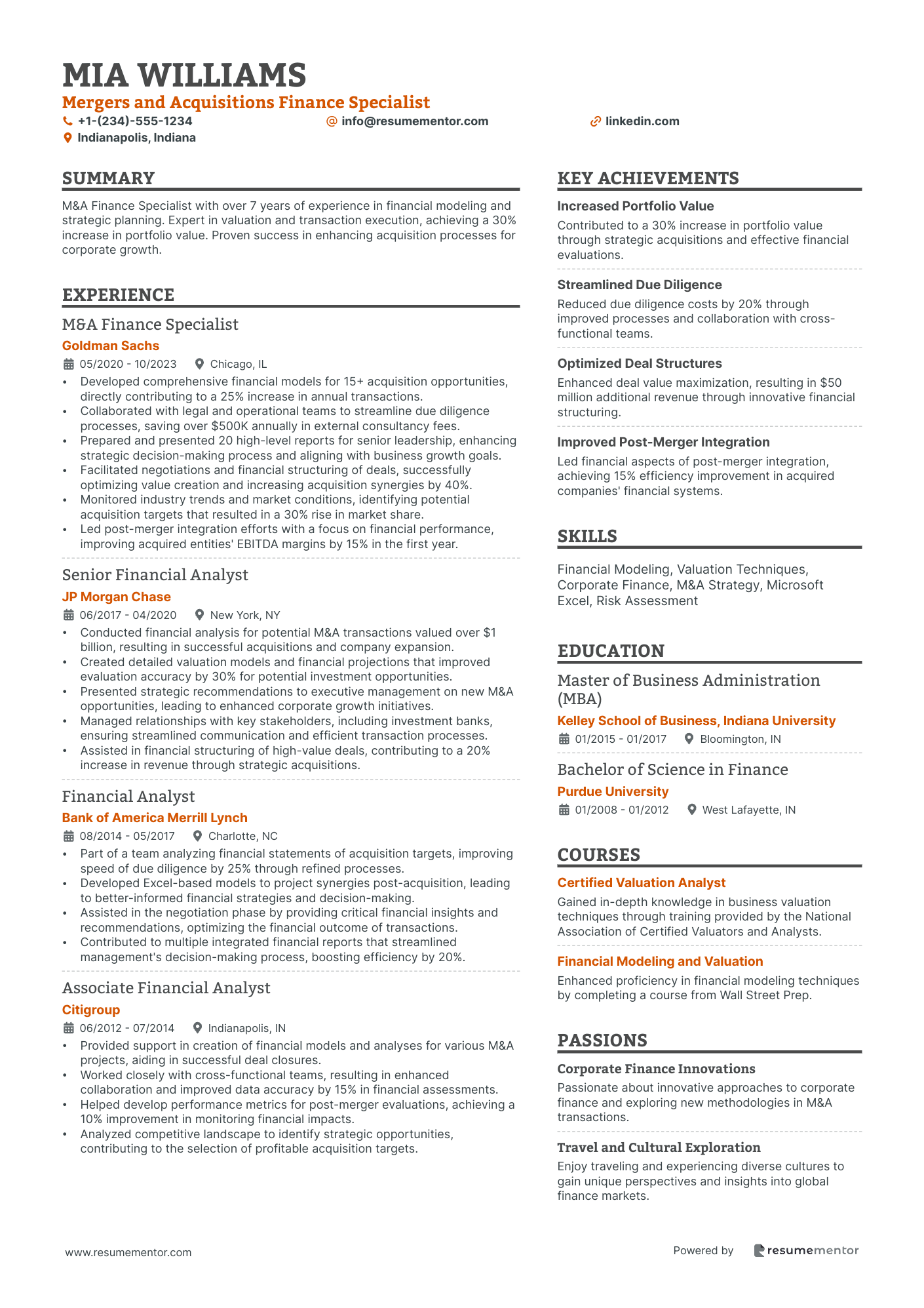

Mergers and Acquisitions Finance Specialist

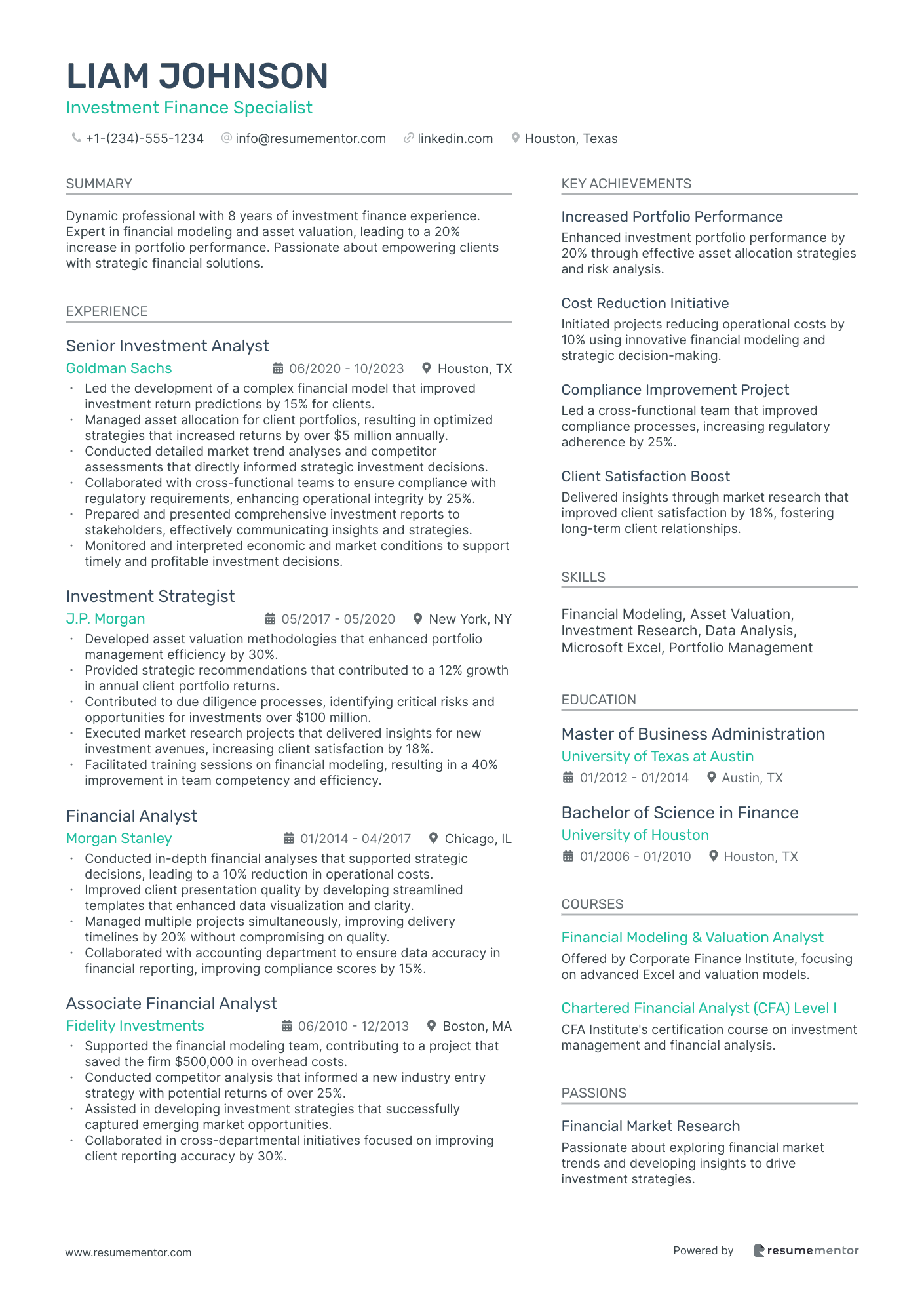

Investment Finance Specialist resume sample

- •Led the development of a complex financial model that improved investment return predictions by 15% for clients.

- •Managed asset allocation for client portfolios, resulting in optimized strategies that increased returns by over $5 million annually.

- •Conducted detailed market trend analyses and competitor assessments that directly informed strategic investment decisions.

- •Collaborated with cross-functional teams to ensure compliance with regulatory requirements, enhancing operational integrity by 25%.

- •Prepared and presented comprehensive investment reports to stakeholders, effectively communicating insights and strategies.

- •Monitored and interpreted economic and market conditions to support timely and profitable investment decisions.

- •Developed asset valuation methodologies that enhanced portfolio management efficiency by 30%.

- •Provided strategic recommendations that contributed to a 12% growth in annual client portfolio returns.

- •Contributed to due diligence processes, identifying critical risks and opportunities for investments over $100 million.

- •Executed market research projects that delivered insights for new investment avenues, increasing client satisfaction by 18%.

- •Facilitated training sessions on financial modeling, resulting in a 40% improvement in team competency and efficiency.

- •Conducted in-depth financial analyses that supported strategic decisions, leading to a 10% reduction in operational costs.

- •Improved client presentation quality by developing streamlined templates that enhanced data visualization and clarity.

- •Managed multiple projects simultaneously, improving delivery timelines by 20% without compromising on quality.

- •Collaborated with accounting department to ensure data accuracy in financial reporting, improving compliance scores by 15%.

- •Supported the financial modeling team, contributing to a project that saved the firm $500,000 in overhead costs.

- •Conducted competitor analysis that informed a new industry entry strategy with potential returns of over 25%.

- •Assisted in developing investment strategies that successfully captured emerging market opportunities.

- •Collaborated in cross-departmental initiatives focused on improving client reporting accuracy by 30%.

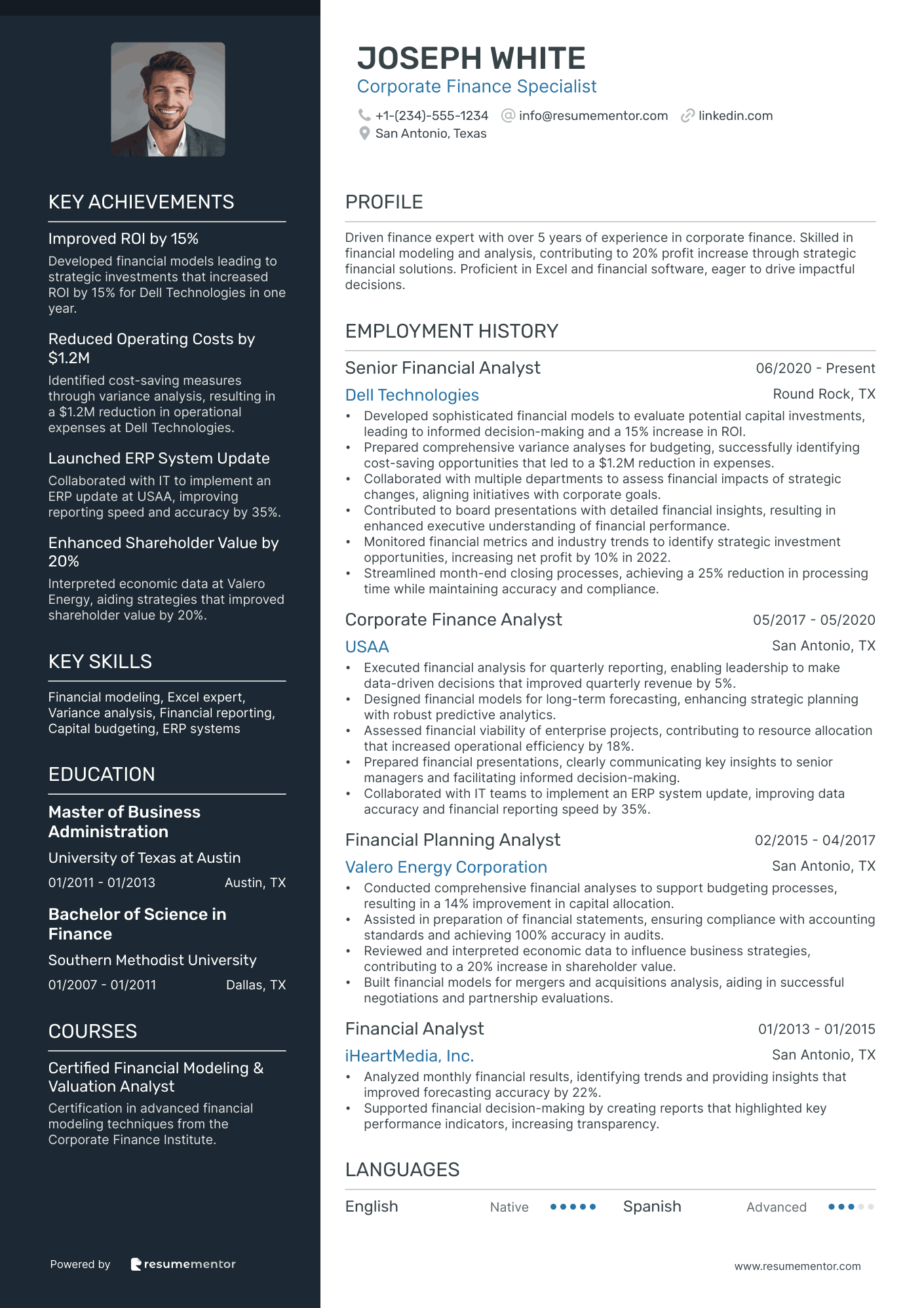

Corporate Finance Specialist resume sample

- •Developed sophisticated financial models to evaluate potential capital investments, leading to informed decision-making and a 15% increase in ROI.

- •Prepared comprehensive variance analyses for budgeting, successfully identifying cost-saving opportunities that led to a $1.2M reduction in expenses.

- •Collaborated with multiple departments to assess financial impacts of strategic changes, aligning initiatives with corporate goals.

- •Contributed to board presentations with detailed financial insights, resulting in enhanced executive understanding of financial performance.

- •Monitored financial metrics and industry trends to identify strategic investment opportunities, increasing net profit by 10% in 2022.

- •Streamlined month-end closing processes, achieving a 25% reduction in processing time while maintaining accuracy and compliance.

- •Executed financial analysis for quarterly reporting, enabling leadership to make data-driven decisions that improved quarterly revenue by 5%.

- •Designed financial models for long-term forecasting, enhancing strategic planning with robust predictive analytics.

- •Assessed financial viability of enterprise projects, contributing to resource allocation that increased operational efficiency by 18%.

- •Prepared financial presentations, clearly communicating key insights to senior managers and facilitating informed decision-making.

- •Collaborated with IT teams to implement an ERP system update, improving data accuracy and financial reporting speed by 35%.

- •Conducted comprehensive financial analyses to support budgeting processes, resulting in a 14% improvement in capital allocation.

- •Assisted in preparation of financial statements, ensuring compliance with accounting standards and achieving 100% accuracy in audits.

- •Reviewed and interpreted economic data to influence business strategies, contributing to a 20% increase in shareholder value.

- •Built financial models for mergers and acquisitions analysis, aiding in successful negotiations and partnership evaluations.

- •Analyzed monthly financial results, identifying trends and providing insights that improved forecasting accuracy by 22%.

- •Supported financial decision-making by creating reports that highlighted key performance indicators, increasing transparency.

Public Finance Specialist resume sample

- •Managed a $500 million budget growth for municipal projects, enhancing resource allocation, and strategic financial planning.

- •Led financial analysis teams in assessing public financing options resulting in increased project financing efficiency by 20%.

- •Developed comprehensive financial reports for public agencies, delivering actionable insights leading to improved fiscal policies.

- •Collaborated with government officials to ensure transparency in project finance strategies, facilitating better stakeholder engagement.

- •Implemented financial forecasting models increasing accuracy in budget projections by 15% over two fiscal years.

- •Coordinated public finance market research identifying funding opportunities, aiding strategic decision-making for high-impact projects.

- •Analyzed financial data for $250 million municipal bond projects, streamlining reporting processes and enhancing accuracy.

- •Participated in client meetings, articulating complex financial concepts clearly contributing to a 95% client satisfaction rate.

- •Assisted in the development and management of municipal budgets, reducing overhead costs by 12% annually.

- •Collaborated with teams to prepare and deliver financial presentations, significantly improving stakeholder approval ratings.

- •Conducted compliance reviews maintaining adherence to local, state, and federal public finance regulations for audits.

- •Advised public sector clients on financial strategy, enhancing budget efficiency by optimizing funds allocation.

- •Implemented financial management software solutions, increasing client project management efficiency by 18%.

- •Provided expert advice on public financing legislation, positively impacting client financial compliance rates by 10%.

- •Conducted financial market studies helping clients to align their strategies with evolving economic trends and challenges.

- •Supported various governmental departments in financial audits, achieving 100% compliance with federal regulations.

- •Developed and implemented financial models for investment strategies, enhancing government asset management by 25%.

- •Engaged with community organizations to discuss finance initiatives, leading to improved community relations and project support.

- •Prepared detailed financial analysis documents, facilitating well-informed decisions in public finance initiatives.

Personal Finance Specialist resume sample

- •Guided over 200 clients in developing personalized financial plans, resulting in an average portfolio growth of 15% annually.

- •Conducted detailed analysis of clients' financial status, uncovering opportunities to optimize investments and save an average of $5,000 annually.

- •Educated clients on diverse financial products, increasing their engagement with investment products by 30% over two years.

- •Produced comprehensive financial reports for client meetings, enhancing decision-making efficiency by 40%.

- •Presented nine financial seminars, attracting over 300 participants and improving client acquisition rates by 20%.

- •Consistently stayed updated with industry trends, increasing the adoption of innovative financial solutions by 25%.

- •Provided strategic guidance on investment opportunities resulting in portfolio diversification for over 100 clients.

- •Managed clients' financial data, identifying and acting on improvement opportunities that increased savings efficiency by 25%.

- •Collaborated in the development of an investment strategy framework that improved client retention by 15%.

- •Designed budgeting workshops that led to the successful financial planning of 150 attendees, enhancing budgeting skills.

- •Collaborated with legal advisors to ensure clients' plans were compliant, thus improving regulatory adherence by 40%.

- •Assisted in the creation of personalized financial plans, achieving a client satisfaction rate of 95%.

- •Analyzed market trends to provide actionable insights, boosting clients' confidence in investment decisions by 33%.

- •Implemented new financial software solutions that increased analytical efficiency by 20%.

- •Prepared detailed income and expense reports for clients, improving financial understanding and strategy execution.

- •Contributed to the development of retirement strategies for over 50 clients, securing an average 20% increase in planned retirement savings.

- •Assisted clients in managing monthly budgets, which resulted in reducing unnecessary expenditure by 18% on average.

- •Participated in team projects to enhance service offerings, leading to a 10% increase in client inquiries.

- •Leveraged financial analysis tools to evaluate clients' investments, achieving a strategic realignment that increased portfolio returns by 12%.

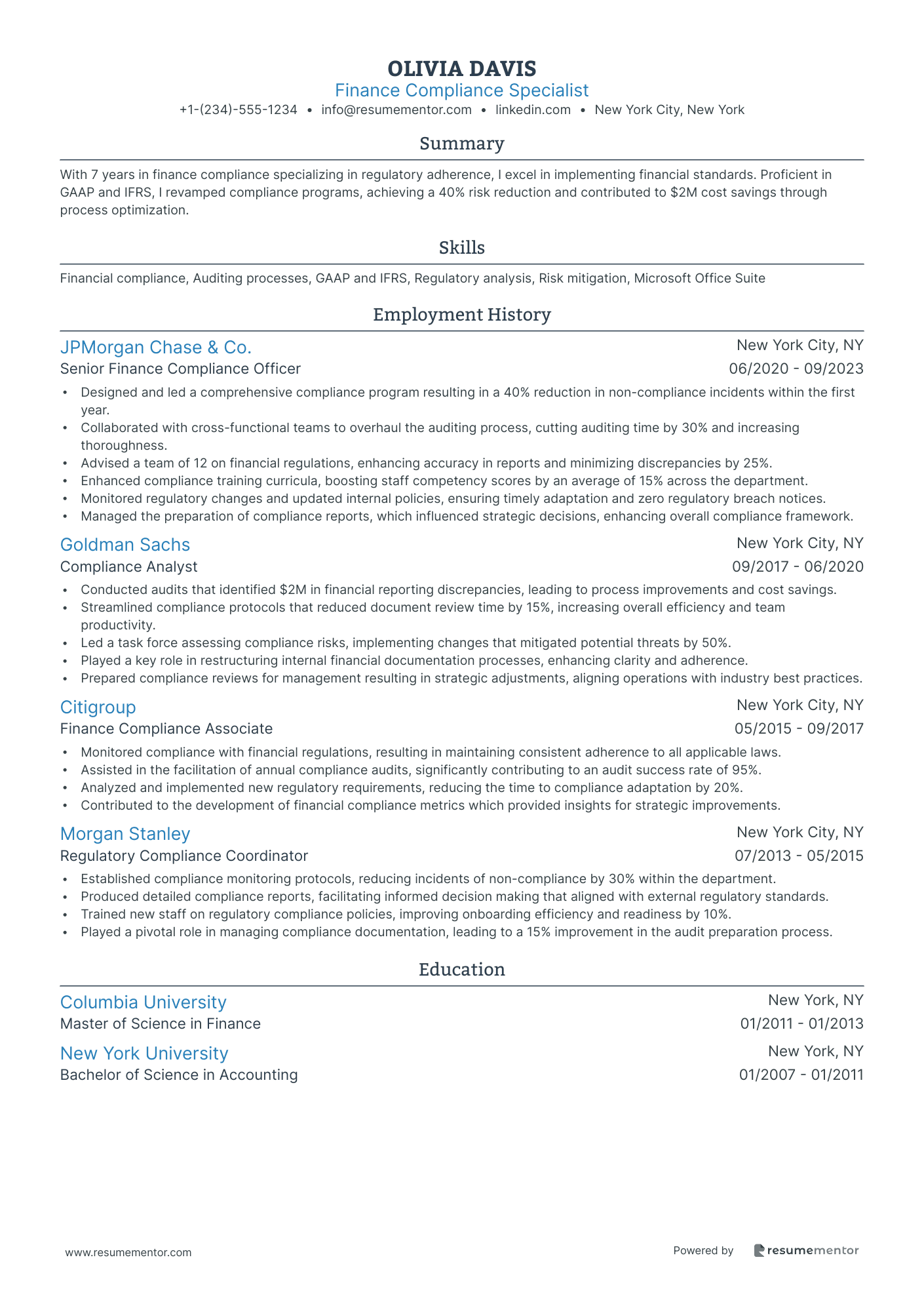

Finance Compliance Specialist resume sample

- •Designed and led a comprehensive compliance program resulting in a 40% reduction in non-compliance incidents within the first year.

- •Collaborated with cross-functional teams to overhaul the auditing process, cutting auditing time by 30% and increasing thoroughness.

- •Advised a team of 12 on financial regulations, enhancing accuracy in reports and minimizing discrepancies by 25%.

- •Enhanced compliance training curricula, boosting staff competency scores by an average of 15% across the department.

- •Monitored regulatory changes and updated internal policies, ensuring timely adaptation and zero regulatory breach notices.

- •Managed the preparation of compliance reports, which influenced strategic decisions, enhancing overall compliance framework.

- •Conducted audits that identified $2M in financial reporting discrepancies, leading to process improvements and cost savings.

- •Streamlined compliance protocols that reduced document review time by 15%, increasing overall efficiency and team productivity.

- •Led a task force assessing compliance risks, implementing changes that mitigated potential threats by 50%.

- •Played a key role in restructuring internal financial documentation processes, enhancing clarity and adherence.

- •Prepared compliance reviews for management resulting in strategic adjustments, aligning operations with industry best practices.

- •Monitored compliance with financial regulations, resulting in maintaining consistent adherence to all applicable laws.

- •Assisted in the facilitation of annual compliance audits, significantly contributing to an audit success rate of 95%.

- •Analyzed and implemented new regulatory requirements, reducing the time to compliance adaptation by 20%.

- •Contributed to the development of financial compliance metrics which provided insights for strategic improvements.

- •Established compliance monitoring protocols, reducing incidents of non-compliance by 30% within the department.

- •Produced detailed compliance reports, facilitating informed decision making that aligned with external regulatory standards.

- •Trained new staff on regulatory compliance policies, improving onboarding efficiency and readiness by 10%.

- •Played a pivotal role in managing compliance documentation, leading to a 15% improvement in the audit preparation process.

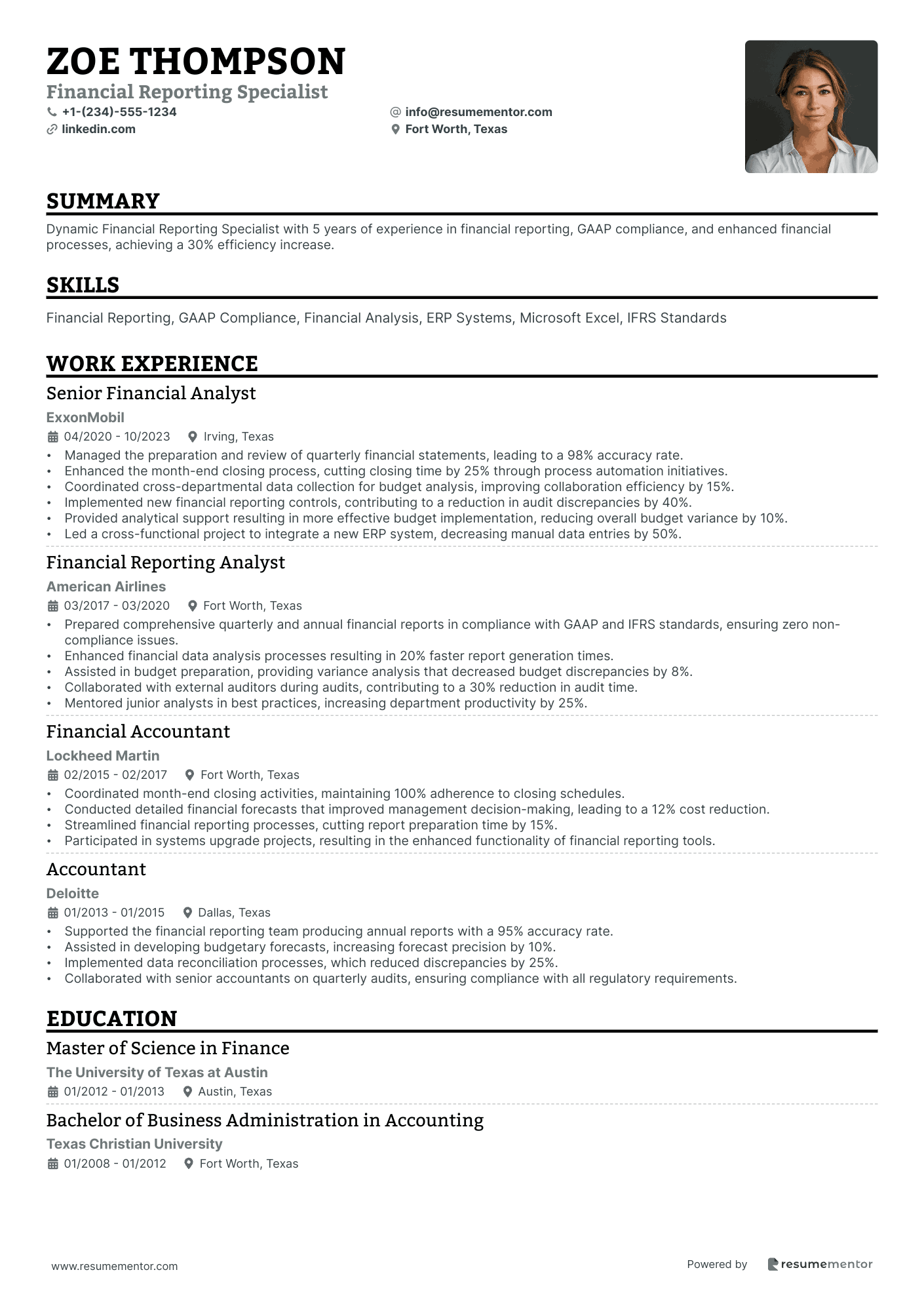

Financial Reporting Specialist resume sample

- •Managed the preparation and review of quarterly financial statements, leading to a 98% accuracy rate.

- •Enhanced the month-end closing process, cutting closing time by 25% through process automation initiatives.

- •Coordinated cross-departmental data collection for budget analysis, improving collaboration efficiency by 15%.

- •Implemented new financial reporting controls, contributing to a reduction in audit discrepancies by 40%.

- •Provided analytical support resulting in more effective budget implementation, reducing overall budget variance by 10%.

- •Led a cross-functional project to integrate a new ERP system, decreasing manual data entries by 50%.

- •Prepared comprehensive quarterly and annual financial reports in compliance with GAAP and IFRS standards, ensuring zero non-compliance issues.

- •Enhanced financial data analysis processes resulting in 20% faster report generation times.

- •Assisted in budget preparation, providing variance analysis that decreased budget discrepancies by 8%.

- •Collaborated with external auditors during audits, contributing to a 30% reduction in audit time.

- •Mentored junior analysts in best practices, increasing department productivity by 25%.

- •Coordinated month-end closing activities, maintaining 100% adherence to closing schedules.

- •Conducted detailed financial forecasts that improved management decision-making, leading to a 12% cost reduction.

- •Streamlined financial reporting processes, cutting report preparation time by 15%.

- •Participated in systems upgrade projects, resulting in the enhanced functionality of financial reporting tools.

- •Supported the financial reporting team producing annual reports with a 95% accuracy rate.

- •Assisted in developing budgetary forecasts, increasing forecast precision by 10%.

- •Implemented data reconciliation processes, which reduced discrepancies by 25%.

- •Collaborated with senior accountants on quarterly audits, ensuring compliance with all regulatory requirements.

Risk Management Finance Specialist resume sample

- •Led a team to develop risk mitigation strategies, reducing financial exposure by 25% within one year.

- •Implemented new financial risk management procedures, enhancing monitoring efficiency by 30%.

- •Conducted in-depth financial analysis and stress testing, identifying key vulnerabilities, resulting in improved financial stability.

- •Collaborated with cross-functional departments to increase risk awareness, leading to a 20% rise in policy adherence.

- •Prepared comprehensive reports on market and operational risks, providing detailed recommendations for mitigation.

- •Updated risk management procedures to comply with regulatory changes, improving compliance by 40%.

- •Analyzed various financial risk scenarios using risk management software, enhancing prediction accuracy by 15%.

- •Supported the development and implementation of new KPIs, leading to a 20% increase in monitoring effectiveness.

- •Participated in bi-annual audits, identifying critical risk exposures and reducing vulnerabilities by 15%.

- •Provided training on risk management tools, increasing staff competency and reducing errors by 10%.

- •Strengthened compliance with internal standards, resulting in zero major findings in external audits.

- •Developed financial models to support risk assessment, leading to a 10% improvement in decision-making processes.

- •Assisted in the preparation of risk exposure reports, supporting risk management strategies and policy adjustments.

- •Monitored and assessed credit risks, resulting in a 5% reduction in potential credit losses.

- •Worked with finance and operations teams to review risk management practices and ensure alignment with business objectives.

- •Assisted in risk evaluations of financial products developing reports that supported strategic decision-making.

- •Contributed to the enhancement of risk management tools, improving their reliability by 10%.

- •Collaborated on a project that improved market risk analysis capacity by 15% through updated methodologies.

- •Facilitated compliance checks, ensuring adherence to financial risk management regulations.

Budgeting and Financial Planning Specialist resume sample

- •Led the annual budgeting process, ensuring a 97% alignment with company objectives and optimizing resource allocation.

- •Identified a 15% variance in budget-to-actual performance, implementing corrective strategies to improve accuracy in predictions.

- •Created an advanced financial forecasting model that resulted in a 20% improvement in investment decision efficiency.

- •Collaborated with 12 departmental heads to build comprehensive unit budgets, achieving a 100% participation rate.

- •Monitored and ensured financial regulation compliance, maintaining a 99.5% accuracy rate in financial records.

- •Assisted in preparing detailed reports for senior management, enhancing strategic decision-making with clear financial insights.

- •Conducted a variance analysis that revealed significant trend shifts, initiating changes that saved approximately $1.2M annually.

- •Developed a financial projection that anticipated market changes, successfully guiding a strategic pivot within the organization.

- •Prepared financial reports and presentations, resulting in 98% positive feedback from the senior management team.

- •Trained 15 department leaders on financial management best practices, increasing budget adherence by 30%.

- •Participated in a cross-departmental financial project, unveiling new metrics for performance evaluation.

- •Managed the development of the annual budget, achieving a 95% approval rate from upper management.

- •Enhanced financial models leading to a 25% improvement in the accuracy of projections.

- •Monitored compliance with financial policies, maintaining an error rate of less than 0.5% in company records.

- •Assisted in the creation of 12-month financial plans, supporting strategic decision-making processes with clear data.

- •Coordinated departmental budgets, reducing unnecessary expenditures by 18%.

- •Analyzed financial performance metrics to provide insightful recommendations for cost management.

- •Developed presentations on financial performance, increasing stakeholder engagement by 50%.

- •Facilitated budget planning meetings, enhancing inter-departmental communication and collaboration by 35%.

Real Estate Finance Specialist resume sample

- •Led the finance team in evaluating over 300 real estate investment opportunities, improving property valuation efficiency by 35%.

- •Developed advanced Excel financial models that increased investment decision precision and reduced risks by 22%.

- •Conducted detailed due diligence on transactions, discovering potential asset underperformance leading to $5 million in savings.

- •Collaborated with lenders and brokers to negotiate favorable financing terms, securing $150 million in funding successfully.

- •Produced comprehensive market trend reports affecting real estate improvement strategies and better portfolio management.

- •Enhanced financial forecasting methods that boosted investment return projections, resulting in a 20% increase in returns.

- •Managed property portfolios worth $200 million, optimizing asset value and efficiency by 25% in 18 months.

- •Initiated a robust due diligence process, reducing acquisition timelines by 45% for high-value transactions.

- •Executed financial analyses on potential acquisitions, driving strategic investment decisions and growth by 10% annually.

- •Strengthened lender relationships through consistent, high-quality loan documentation processes, enhancing credit terms by 15%.

- •Championed the integration of Argus software in financial operations, improving data analysis precision across portfolios.

- •Conducted thorough market research, accurately assessing real estate trends shaping corporate investment strategies.

- •Formulated financial reports that improved internal and client understanding of property metrics by 30%.

- •Assessed cash flow projections for 150+ properties, identifying key improvement areas that maximized capitalization rates.

- •Streamlined coordination among teams and external partners, facilitating seamless transaction processes cutting timelines by a quarter.

- •Supported the analysis of property values in commercial real estate, enhancing client portfolio values by 18%.

- •Utilized financial modeling techniques to create reports that informed asset management decisions effectively.

- •Contributed to the preparation of loan documentation, improving approval rates and securing $60 million in financing.

- •Collaborated with market researchers and property inspectors to ensure accurate transaction risk assessments.

Mergers and Acquisitions Finance Specialist resume sample

- •Developed comprehensive financial models for 15+ acquisition opportunities, directly contributing to a 25% increase in annual transactions.

- •Collaborated with legal and operational teams to streamline due diligence processes, saving over $500K annually in external consultancy fees.

- •Prepared and presented 20 high-level reports for senior leadership, enhancing strategic decision-making process and aligning with business growth goals.

- •Facilitated negotiations and financial structuring of deals, successfully optimizing value creation and increasing acquisition synergies by 40%.

- •Monitored industry trends and market conditions, identifying potential acquisition targets that resulted in a 30% rise in market share.

- •Led post-merger integration efforts with a focus on financial performance, improving acquired entities' EBITDA margins by 15% in the first year.

- •Conducted financial analysis for potential M&A transactions valued over $1 billion, resulting in successful acquisitions and company expansion.

- •Created detailed valuation models and financial projections that improved evaluation accuracy by 30% for potential investment opportunities.

- •Presented strategic recommendations to executive management on new M&A opportunities, leading to enhanced corporate growth initiatives.

- •Managed relationships with key stakeholders, including investment banks, ensuring streamlined communication and efficient transaction processes.

- •Assisted in financial structuring of high-value deals, contributing to a 20% increase in revenue through strategic acquisitions.

- •Part of a team analyzing financial statements of acquisition targets, improving speed of due diligence by 25% through refined processes.

- •Developed Excel-based models to project synergies post-acquisition, leading to better-informed financial strategies and decision-making.

- •Assisted in the negotiation phase by providing critical financial insights and recommendations, optimizing the financial outcome of transactions.

- •Contributed to multiple integrated financial reports that streamlined management's decision-making process, boosting efficiency by 20%.

- •Provided support in creation of financial models and analyses for various M&A projects, aiding in successful deal closures.

- •Worked closely with cross-functional teams, resulting in enhanced collaboration and improved data accuracy by 15% in financial assessments.

- •Helped develop performance metrics for post-merger evaluations, achieving a 10% improvement in monitoring financial impacts.

- •Analyzed competitive landscape to identify strategic opportunities, contributing to the selection of profitable acquisition targets.

Crafting a finance specialist resume that accurately reflects your financial acumen and analytical skills can be as intricate as solving a complex investment puzzle. In a field that demands precision and clarity, your resume should embody these same qualities. Though you're adept with numbers, translating your experience and detailed technical expertise into clear, compelling words can feel overwhelming. Aligning your achievements and financial insights seamlessly on paper is crucial to showcasing your value.

In today's fast-paced job market, the need to captivate a recruiter’s attention quickly cannot be overstated. This is where a well-structured resume template comes into play, offering a framework that highlights your strengths succinctly and effectively. Using a resume template not only guides you in organizing your information but also ensures that your document is both concise and impactful, without overwhelming the reader.

Your task is to infuse this template with your unique career journey and accomplishments, transforming it into a document that stands out. Leveraging resources like resume templates can help you add structure and clarity, illuminating your finance expertise in the best possible light and leaving no room for missed opportunities.

Let this guide assist you in converting your complex financial experience into words that resonate with hiring managers. Let's dive in and use a template that empowers your application to shine.

Key Takeaways

- Focus on aligning achievements and financial insights in your resume to showcase your value and expertise.

- Use a resume template to structure the document effectively, ensuring clarity and conciseness.

- Highlight your financial expertise and business impact logically, emphasizing roles and achievements with quantifiable results.

- Choose a chronological format and modern fonts for a clean, professional look, saving the document as a PDF to maintain formatting.

- Feature both hard and soft skills relevant to the finance industry, ensuring they align with job descriptions to enhance visibility to recruiters.

What to focus on when writing your finance specialist resume

A finance specialist resume should clearly convey your financial expertise and highlight your ability to enhance business performance. It's crucial for recruiters to quickly grasp your skills in financial analysis, budgeting, and strategic planning. To do this, ensure your resume shows how you’ve successfully supported the financial health and goals of past employers—this is the essence of writing an impactful finance specialist resume.

How to structure your finance specialist resume

- Contact Information: At the top, include your full name, phone number, and professional email. Consider adding your LinkedIn profile for more context about your professional background—this sets the stage for effective communication.

- Professional Summary: Start with a brief overview of your finance experience and key skills. Be sure to mention your specialization, like financial modeling or risk management, to immediately give recruiters a sense of your focus. Highlight any notable achievements or recognitions that further establish your expertise, capturing attention from the outset.

- Work Experience: Here, detail your previous roles with an emphasis on how you’ve made an impact, such as improving financial processes or increasing revenue. Present these achievements using bullet points and strong action verbs to make them stand out. Quantify your contributions whenever possible, as numbers can effectively demonstrate success—this builds your credibility.

- Education: Follow with your educational background. List degrees like a Bachelor's or Master's in Finance or Accounting, and include any certifications, such as a CFA or CPA, that underscore your professional credentials. Education can reflect your commitment to the field and readiness to meet complex financial challenges—this underlines your qualifications.

- Skills: Highlight key skills that align with the finance industry, like data analysis, financial forecasting, and proficiency in financial software such as SAP or QuickBooks. Tailor these skills to mirror job descriptions where possible. The skills section allows you to showcase your technical prowess—this paves the way to demonstrate your value to potential employers.

- Technical Proficiency: Conclude with any specialized software and tools you use frequently in finance, such as advanced Excel capabilities or ERP systems, demonstrating your technical edge in the field. This section complements your skills by detailing your hands-on experience with essential tools—below, we will delve deeper into the resume format and explore each section in greater depth.

Which resume format to choose

Crafting a resume as a finance specialist requires thoughtful decisions to align with the expectations of your industry. Begin with a chronological format because it lets you effectively showcase your work history and highlight the consistent career progression valued in finance roles. To enhance this presentation, choose modern fonts like Raleway, Lato, or Montserrat; these fonts offer a clean and professional look while being easy to read, which is vital in maintaining focus on your qualifications. Always save your resume as a PDF to ensure it maintains its formatting across different platforms, preserving your meticulous design. Proper layout is equally important, so stick to one-inch margins to give your content enough breathing room, making it easier to follow and visually appealing. Together, these choices ensure your resume presents you as a clear and organized finance professional, ready to meet the industry's demands.

How to write a quantifiable resume experience section

A strong finance specialist resume experience section can effectively grab a recruiter's attention by highlighting quantifiable achievements and demonstrating your impact. Start with reverse chronological order to emphasize recent roles, keeping entries within the past 10-15 years. Choose job titles relevant to the desired position and customize each entry with keywords from the job ad. Using action words like "managed," "optimized," "increased," and "led" helps convey your contributions powerfully.

- •Boosted portfolio profitability by 25% through strategic investments.

- •Cut operational expenses by $1 million annually with cost-saving initiatives.

- •Led a cross-functional team to enhance financial reporting accuracy by 30%.

- •Strengthened client relationships, resulting in a 40% rise in client retention.

This experience section connects seamlessly to the role by speaking directly to key skills and achievements important for a finance specialist. By presenting specific, quantifiable outcomes, it highlights your ability to significantly impact the employer, thus captivating hiring managers. Each bullet point brings out a different area of expertise, maintaining diversity and engagement. The choice of active language like “boosted,” “cut,” and “led” illustrates your direct influence in achievements and connects naturally to the tailored content. This alignment with job descriptions highlights your understanding of finance, portraying you as a valuable candidate ready to make a substantial difference.

Customer-Focused resume experience section

A customer-focused finance specialist resume experience section should emphasize how you've successfully supported and satisfied clients in previous roles. Start by sharing instances where your strong communication skills, problem-solving abilities, and commitment to outstanding service have notably enhanced client satisfaction. Describe situations where you exceeded customer expectations and strengthened relationships, while including specific, quantifiable achievements to illustrate your success.

Clearly detail how you've delivered exceptional customer service or support by using examples where you leveraged your finance expertise. Highlight scenarios where process improvements led to better customer experiences, and engage the reader with action verbs while quantifying results to underscore your impact. Your proactive approach and dedication to customer satisfaction should seamlessly weave through every example, making your experience stand out.

Finance Specialist

ABC Financial Solutions

June 2020 - Present

- Resolved client financial inquiries, achieving a 95% customer satisfaction rating.

- Implemented a new account management process, reducing response time by 30%.

- Trained team members on customer-focused techniques, resulting in improved service quality.

- Analyzed customer feedback to develop more effective communication strategies.

Problem-Solving Focused resume experience section

A problem-solving focused finance specialist resume experience section should begin by illustrating situations where you identified financial issues and took decisive actions to resolve them. This not only highlights your ability to overcome challenges but also underscores your proactive nature. Using bullet points, detail your specific contributions and the impact they had, ensuring to include clear, quantifiable outcomes to make your achievements stand out. Keeping the language straightforward ensures that your accomplishments are easy to understand.

When elaborating on your role, connect your strategies to the positive outcomes they generated. Mention any tools or methodologies you utilized to enhance financial processes or performance, such as implementing new technologies, streamlining workflows, or uncovering cost-saving opportunities. By focusing on these aspects, you show how your actions led to meaningful improvements for the organization, effectively tying your efforts to the overall success of the company.

Finance Specialist

Tech Solutions Inc.

June 2020 - Present

- Increased company savings by 15% through strategic budget analysis and cost-cutting measures.

- Developed a reporting system that improved financial accuracy by 20%, enhancing decision-making processes.

- Implemented a new financial planning tool that streamlined budgeting timeline by 30%.

- Resolved discrepancies in financial statements, boosting company trust and reducing audit risks.

Training and Development Focused resume experience section

A training and development-focused resume experience section for a finance specialist should clearly convey how you've contributed to the growth and efficiency of your team. Begin by showcasing specific roles where you've spearheaded training initiatives, such as mentoring colleagues, leading workshops, or developing new programs. Explain your accomplishments by highlighting your proactive actions and the positive changes they sparked within your organization. Use vivid action words and include quantifiable results to effectively illustrate your impact.

Connect your contributions by addressing each experience as part of a larger narrative of improvement and innovation. Focus on how you've customized training initiatives to streamline financial procedures or build a knowledge-sharing culture. Demonstrating these efforts not only showcases your expertise but also your commitment to advancing in the finance field. Here's an example that captures this approach:

Finance Specialist

Global Financial Solutions

June 2019 - Present

- Designed and led training programs, boosting team efficiency by 30%.

- Guided junior team members in financial analysis, cutting reporting errors by 25%.

- Worked with other teams to raise financial literacy, aiding better decision-making.

- Promoted continuous learning via monthly workshops, increasing team satisfaction by 15%.

Efficiency-Focused resume experience section

An efficiency-focused finance specialist resume experience section should clearly highlight your achievements in streamlining processes. Start by selecting specific instances where you enhanced operational efficiency in your previous roles, explaining how your actions benefited the company. By providing quantifiable outcomes, you showcase your ability to make finance operations more effective.

Maintain a sharp focus by illustrating how you tackled challenges, such as eliminating bottlenecks, and share the innovative solutions you implemented along with the resulting time or cost savings. Use straightforward, active language to communicate your role clearly, ensuring that employers can readily grasp your valuable contributions.

Senior Financial Analyst

ABC Financial Services

July 2021 - August 2023

- Conducted a thorough analysis of financial workflow to spot inefficiencies.

- Redesigned the budgeting process, slashing the time needed by 30%.

- Rolled out new software tools, halving the time for report generation.

- Trained the team on new financial protocols, increasing productivity by 20%.

Write your finance specialist resume summary section

A finance-focused resume summary should effectively highlight your skills and achievements in a way that grabs the employer's attention. If you're a finance specialist, make this section paint a clear picture of what you bring to the table. It's your moment to shine succinctly and powerfully. Consider how a finance specialist might present their summary:

This example weaves together specific achievements and essential skills relevant to the job. Numbers and concrete examples demonstrate your impact and leave a lasting impression on recruiters. A resume summary focuses on your past experiences, underscoring why you're a standout candidate.

When crafting your summary, use clear and specific language to effectively describe yourself. Key skills, years of experience, and notable accomplishments should connect directly to the job description, ensuring alignment and attention-grabbing content.

If exploring alternatives like a resume objective, keep in mind that it leans more on future aspirations than past achievements. Unlike a summary, which is ideal for those with rich career histories, an objective suits beginners or career changers aiming to highlight their goals.

Balancing summary and objective elements can also yield a resume profile that spotlights both skills and career ambitions. A summary of qualifications serves to list key skills or experiences succinctly. Each option offers a strategic way to tailor your section based on your experience and the role you're pursuing, ensuring your resume is both impactful and memorable.

Listing your finance specialist skills on your resume

A skills-focused finance specialist resume should effectively communicate your unique value by showcasing what sets you apart in the industry. Start by presenting your skills as either a standalone section or weaving them into your experience or summary. Highlighting your strengths often means putting a spotlight on your soft skills, those invaluable interpersonal qualities like communication and teamwork, which shape how you interact with colleagues and clients. In tandem with this, hard skills are essential too. These are specific, teachable abilities such as financial modeling and data analysis that demonstrate your technical expertise and acumen.

Your skills and strengths serve a dual purpose as keywords, making your resume more visible to employers seeking candidates with your specific capabilities. Consider this streamlined JSON layout for your skills section, tailored to the finance specialist role:

This approach is effective because it keeps the reader focused on the key competencies that matter most in a finance role. This structure is clear and easy to navigate, showcasing what skills you bring to the table in a straightforward manner.

Best hard skills to feature on your finance specialist resume

For a finance specialist, your hard skills should believably underline the technical expertise and proficiency necessary for financial tasks. These competencies reflect your specialization and depth of knowledge in various finance-related domains.

Hard Skills

- Financial Analysis

- Budget Management

- Data Interpretation

- Risk Assessment

- Investment Strategies

- Accounting Principles

- Regulatory Compliance

- Financial Reporting

- Econometric Modeling

- Portfolio Management

- Tax Planning

- Asset Allocation

- Cost Analysis

- Strategic Planning

- Mergers and Acquisitions

Best soft skills to feature on your finance specialist resume

Meanwhile, soft skills should shine a light on your capability to work harmoniously with others, tackle problems effectively, and communicate clearly. These personal qualities reveal how you can connect and build relationships, a crucial aspect of succeeding in finance.

Soft Skills

- Communication

- Teamwork

- Problem-Solving

- Leadership

- Time Management

- Adaptability

- Attention to Detail

- Critical Thinking

- Decision Making

- Negotiation

- Networking

- Stress Management

- Customer Service

- Empathy

- Conflict Resolution

How to include your education on your resume

An education section is a vital part of your finance specialist resume. It showcases your academic background and can set you apart from other candidates. Tailor this section to the job you're applying for, and omit any education that isn’t relevant to finance. Including your GPA can be beneficial, but consider only including it if it is impressive. Listing “cum laude” honors can highlight your academic achievements and should be included when applicable. When listing a degree, be clear and precise.

Now for an example that doesn't work:

- •Focused on sculpture and design

And here’s an excellent example:

The second example is outstanding because it aligns with the finance role, showing a relevant degree. The cum laude distinction and high GPA indicate strong academic performance. Excluding the location streamlines the focus, making it resume-ready. This educational background suggests you have the knowledge needed for a finance position.

How to include finance specialist certificates on your resume

Including a certificates section on your finance specialist resume is crucial. It shows prospective employers your commitment to continuous learning and staying updated in your field. List the name of each certificate clearly. Include the date when you obtained the certificate to reflect your most recent qualifications. Add the issuing organization to lend credibility and show the source of your expertise.

Certificates can also be featured in your resume header for immediate visibility. For example, you could write: "John Doe, CFA, CPA" right after your name, emphasizing your top qualifications.

The example above is effective because it lists significant and highly respected certificates related to finance. Including the issuing organizations, like CFA Institute and American Institute of CPAs, adds authority to your resume. This approach makes your qualifications clear and emphasizes your expertise right away, helping you stand out to hiring managers.

Extra sections to include in your finance specialist resume

Creating a well-rounded resume can significantly boost your chances of catching the eye of potential employers, especially in specialized fields like finance. Including various sections that highlight your diverse skills and experiences can set you apart from other candidates.

- Language section—Showcase fluency in multiple languages to demonstrate your ability to engage with international clients or markets.

- Hobbies and interests section—Include activities that reflect your analytical skills or teamwork abilities, like chess or team sports.

- Volunteer work section—Highlight volunteer experiences to show your commitment to community service and your ability to manage multiple responsibilities.

- Books section—List finance-related books you have read to prove your initiative in continuing education and staying updated in your field.

These sections can add depth to your resume, making it more than just a list of job duties and showing that you are a well-rounded individual.

In Conclusion

In conclusion, creating a finance specialist resume that captures your breadth of skills and expertise is essential for standing out in a competitive job market. Your resume should reflect your understanding of finance with precision, gaining the trust of hiring managers. Utilize a clear resume template to structure your experiences, achievements, and qualifications in an organized manner. Integrating quantifiable achievements and making use of active language in your experience section are effective strategies to showcase your financial impact. A balance between demonstrating technical proficiency and highlighting soft skills, such as communication and adaptability, ensures a well-rounded portrayal of your capabilities. Additionally, presenting certifications and educational background with key achievements fortifies your professional image. Including optional sections like volunteer work or language proficiency enriches your resume, demonstrating a diverse skill set beyond financial expertise. Customize each section to reflect the role you're targeting, ensuring each entry aligns with the employer’s requirements. Remember, every part of your resume should work together to present you as a competent and accomplished finance specialist ready to tackle any challenge. By adapting these strategies, your resume will not only exemplify your technical acumen but also your readiness to contribute meaningfully to potential employers.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.