Finance Student Resume Examples

Jul 18, 2024

|

12 min read

Crafting your perfect finance student resume: Balance your skills and experience to invest in a bright future.

Rated by 348 people

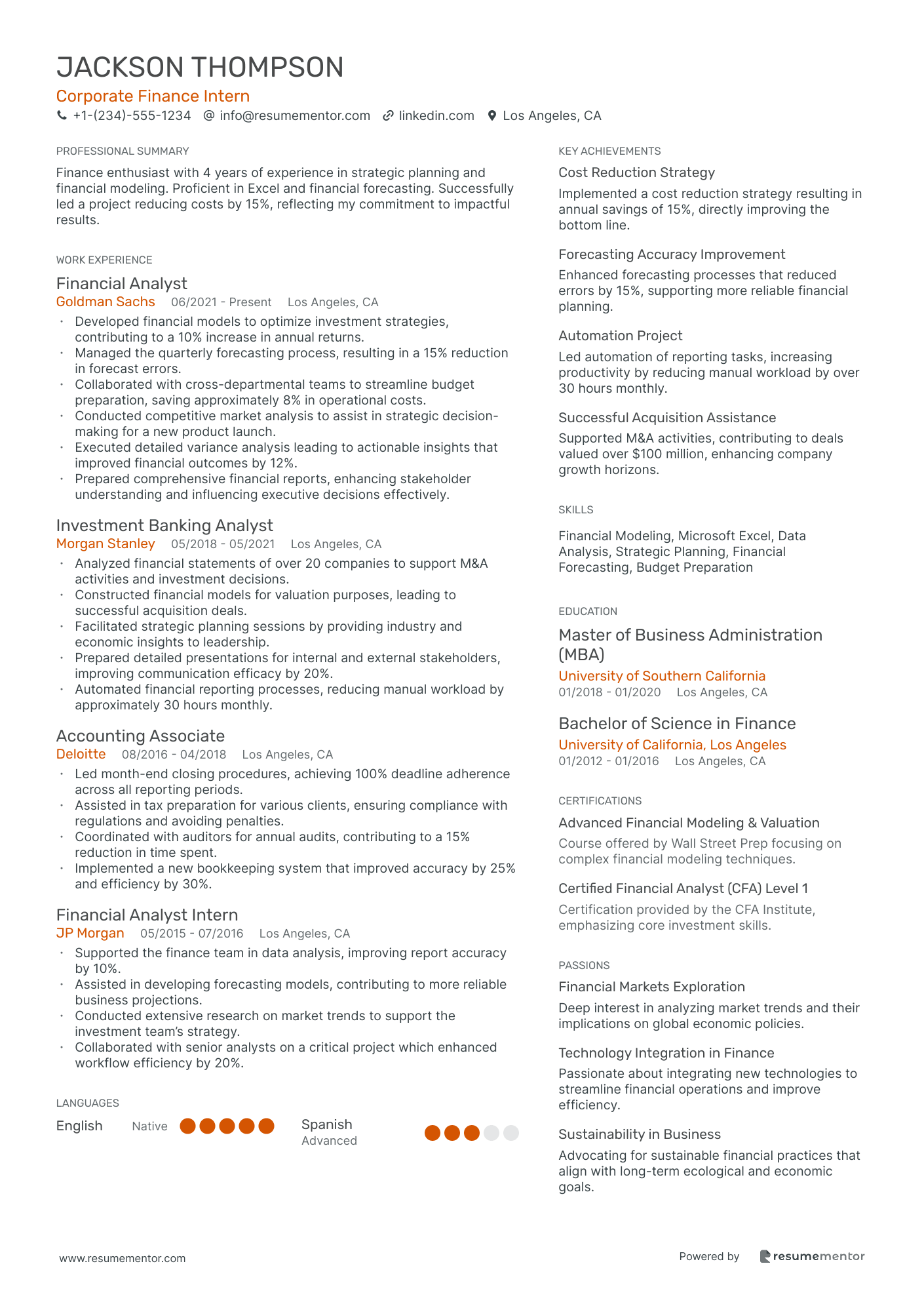

Corporate Finance Intern

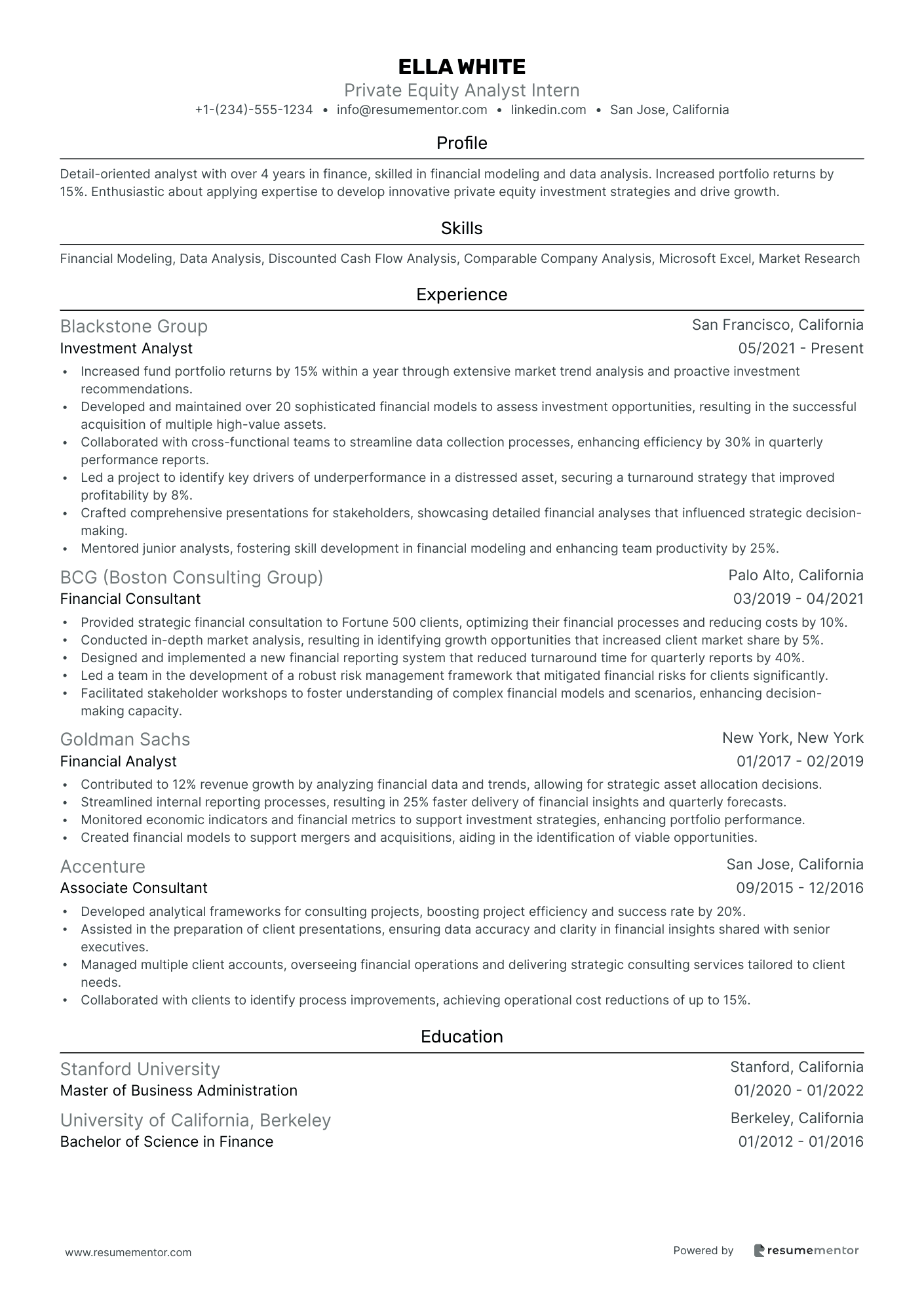

Private Equity Analyst Intern

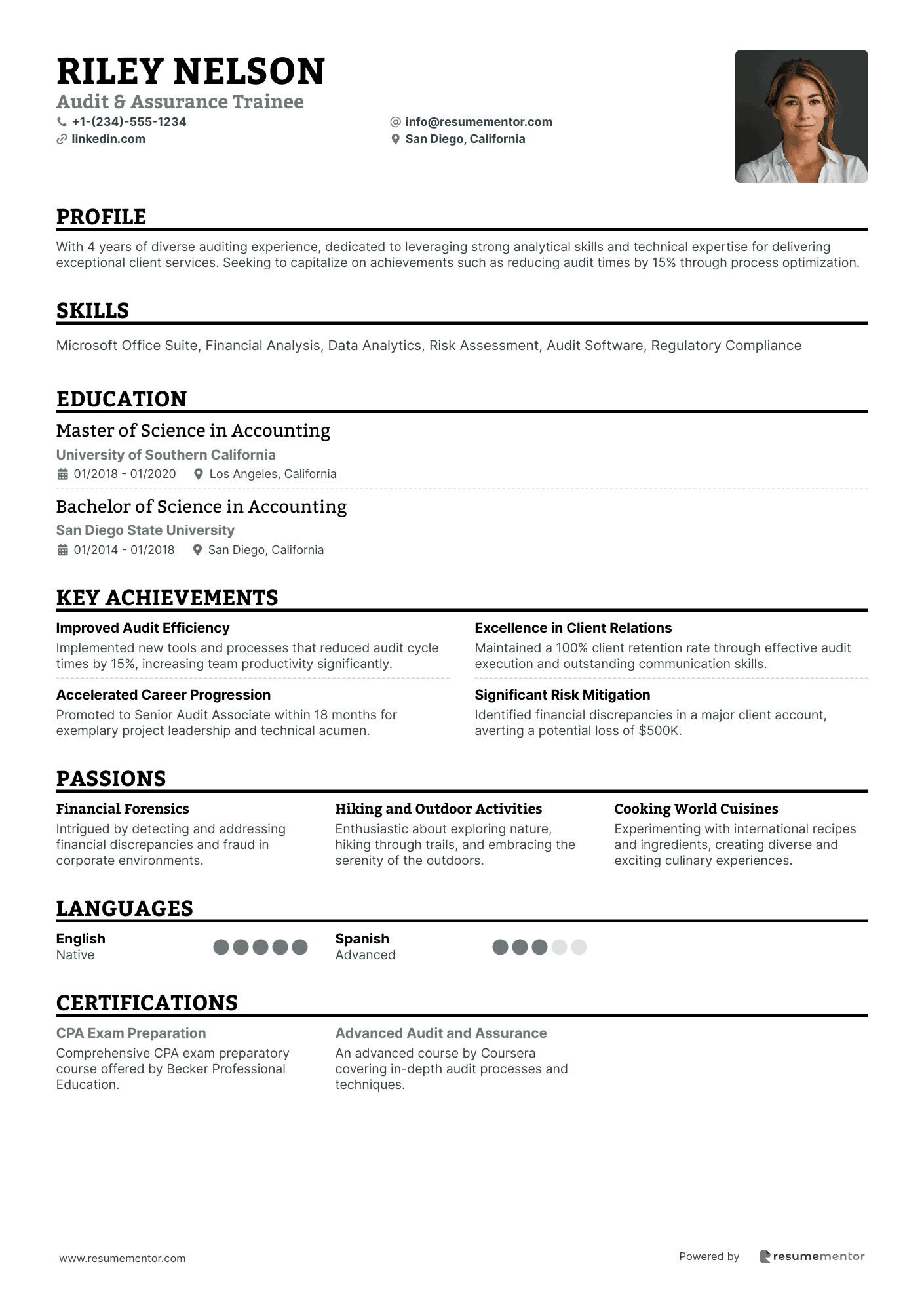

Audit & Assurance Trainee

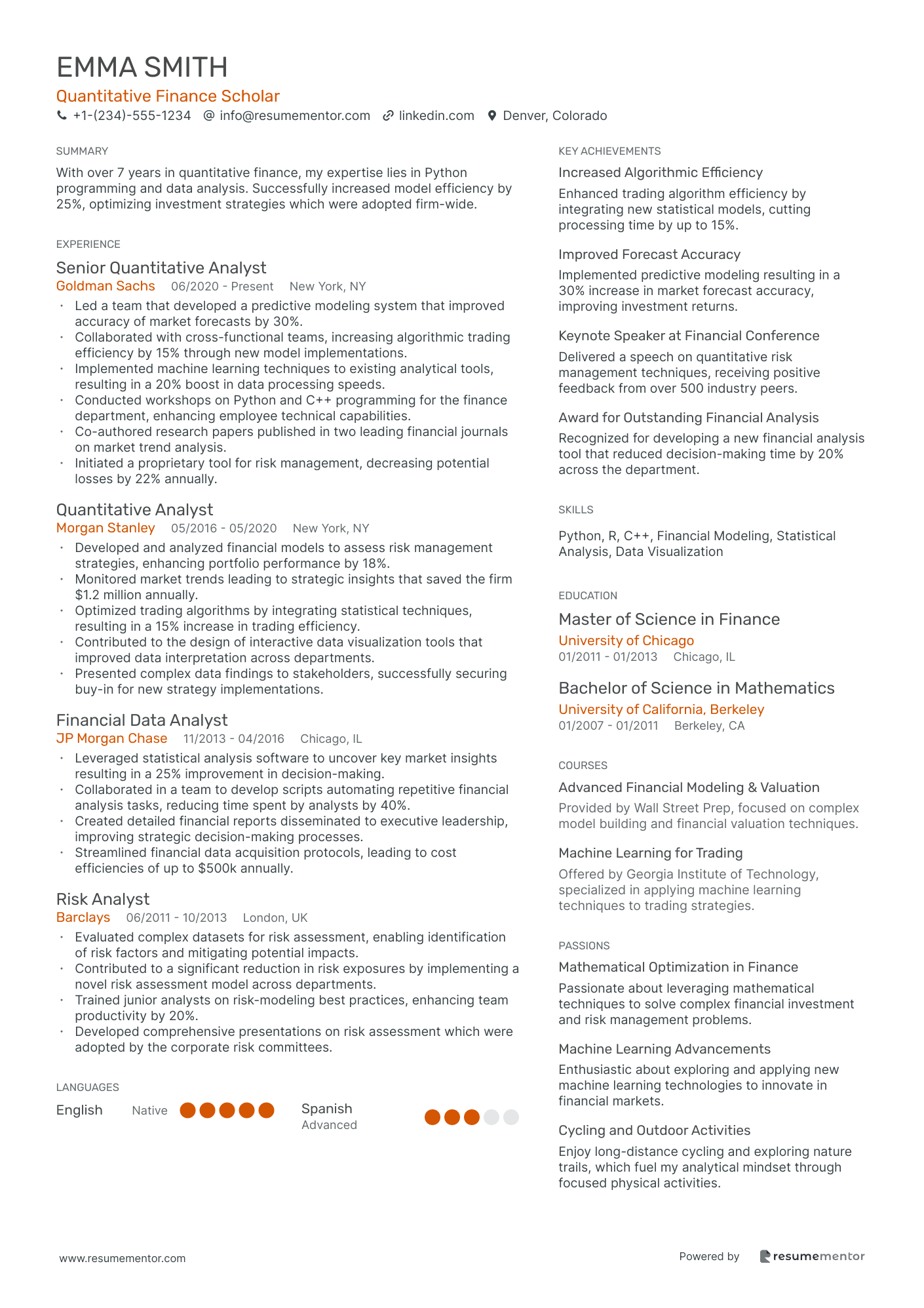

Quantitative Finance Scholar

Financial Risk Management Intern

Tax Consultant Apprentice

Equity Research Trainee

Financial Analytics Intern

Corporate Finance Intern resume sample

- •Developed financial models to optimize investment strategies, contributing to a 10% increase in annual returns.

- •Managed the quarterly forecasting process, resulting in a 15% reduction in forecast errors.

- •Collaborated with cross-departmental teams to streamline budget preparation, saving approximately 8% in operational costs.

- •Conducted competitive market analysis to assist in strategic decision-making for a new product launch.

- •Executed detailed variance analysis leading to actionable insights that improved financial outcomes by 12%.

- •Prepared comprehensive financial reports, enhancing stakeholder understanding and influencing executive decisions effectively.

- •Analyzed financial statements of over 20 companies to support M&A activities and investment decisions.

- •Constructed financial models for valuation purposes, leading to successful acquisition deals.

- •Facilitated strategic planning sessions by providing industry and economic insights to leadership.

- •Prepared detailed presentations for internal and external stakeholders, improving communication efficacy by 20%.

- •Automated financial reporting processes, reducing manual workload by approximately 30 hours monthly.

- •Led month-end closing procedures, achieving 100% deadline adherence across all reporting periods.

- •Assisted in tax preparation for various clients, ensuring compliance with regulations and avoiding penalties.

- •Coordinated with auditors for annual audits, contributing to a 15% reduction in time spent.

- •Implemented a new bookkeeping system that improved accuracy by 25% and efficiency by 30%.

- •Supported the finance team in data analysis, improving report accuracy by 10%.

- •Assisted in developing forecasting models, contributing to more reliable business projections.

- •Conducted extensive research on market trends to support the investment team’s strategy.

- •Collaborated with senior analysts on a critical project which enhanced workflow efficiency by 20%.

Private Equity Analyst Intern resume sample

- •Increased fund portfolio returns by 15% within a year through extensive market trend analysis and proactive investment recommendations.

- •Developed and maintained over 20 sophisticated financial models to assess investment opportunities, resulting in the successful acquisition of multiple high-value assets.

- •Collaborated with cross-functional teams to streamline data collection processes, enhancing efficiency by 30% in quarterly performance reports.

- •Led a project to identify key drivers of underperformance in a distressed asset, securing a turnaround strategy that improved profitability by 8%.

- •Crafted comprehensive presentations for stakeholders, showcasing detailed financial analyses that influenced strategic decision-making.

- •Mentored junior analysts, fostering skill development in financial modeling and enhancing team productivity by 25%.

- •Provided strategic financial consultation to Fortune 500 clients, optimizing their financial processes and reducing costs by 10%.

- •Conducted in-depth market analysis, resulting in identifying growth opportunities that increased client market share by 5%.

- •Designed and implemented a new financial reporting system that reduced turnaround time for quarterly reports by 40%.

- •Led a team in the development of a robust risk management framework that mitigated financial risks for clients significantly.

- •Facilitated stakeholder workshops to foster understanding of complex financial models and scenarios, enhancing decision-making capacity.

- •Contributed to 12% revenue growth by analyzing financial data and trends, allowing for strategic asset allocation decisions.

- •Streamlined internal reporting processes, resulting in 25% faster delivery of financial insights and quarterly forecasts.

- •Monitored economic indicators and financial metrics to support investment strategies, enhancing portfolio performance.

- •Created financial models to support mergers and acquisitions, aiding in the identification of viable opportunities.

- •Developed analytical frameworks for consulting projects, boosting project efficiency and success rate by 20%.

- •Assisted in the preparation of client presentations, ensuring data accuracy and clarity in financial insights shared with senior executives.

- •Managed multiple client accounts, overseeing financial operations and delivering strategic consulting services tailored to client needs.

- •Collaborated with clients to identify process improvements, achieving operational cost reductions of up to 15%.

Audit & Assurance Trainee resume sample

Quantitative Finance Scholar resume sample

- •Led a team that developed a predictive modeling system that improved accuracy of market forecasts by 30%.

- •Collaborated with cross-functional teams, increasing algorithmic trading efficiency by 15% through new model implementations.

- •Implemented machine learning techniques to existing analytical tools, resulting in a 20% boost in data processing speeds.

- •Conducted workshops on Python and C++ programming for the finance department, enhancing employee technical capabilities.

- •Co-authored research papers published in two leading financial journals on market trend analysis.

- •Initiated a proprietary tool for risk management, decreasing potential losses by 22% annually.

- •Developed and analyzed financial models to assess risk management strategies, enhancing portfolio performance by 18%.

- •Monitored market trends leading to strategic insights that saved the firm $1.2 million annually.

- •Optimized trading algorithms by integrating statistical techniques, resulting in a 15% increase in trading efficiency.

- •Contributed to the design of interactive data visualization tools that improved data interpretation across departments.

- •Presented complex data findings to stakeholders, successfully securing buy-in for new strategy implementations.

- •Leveraged statistical analysis software to uncover key market insights resulting in a 25% improvement in decision-making.

- •Collaborated in a team to develop scripts automating repetitive financial analysis tasks, reducing time spent by analysts by 40%.

- •Created detailed financial reports disseminated to executive leadership, improving strategic decision-making processes.

- •Streamlined financial data acquisition protocols, leading to cost efficiencies of up to $500k annually.

- •Evaluated complex datasets for risk assessment, enabling identification of risk factors and mitigating potential impacts.

- •Contributed to a significant reduction in risk exposures by implementing a novel risk assessment model across departments.

- •Trained junior analysts on risk-modeling best practices, enhancing team productivity by 20%.

- •Developed comprehensive presentations on risk assessment which were adopted by the corporate risk committees.

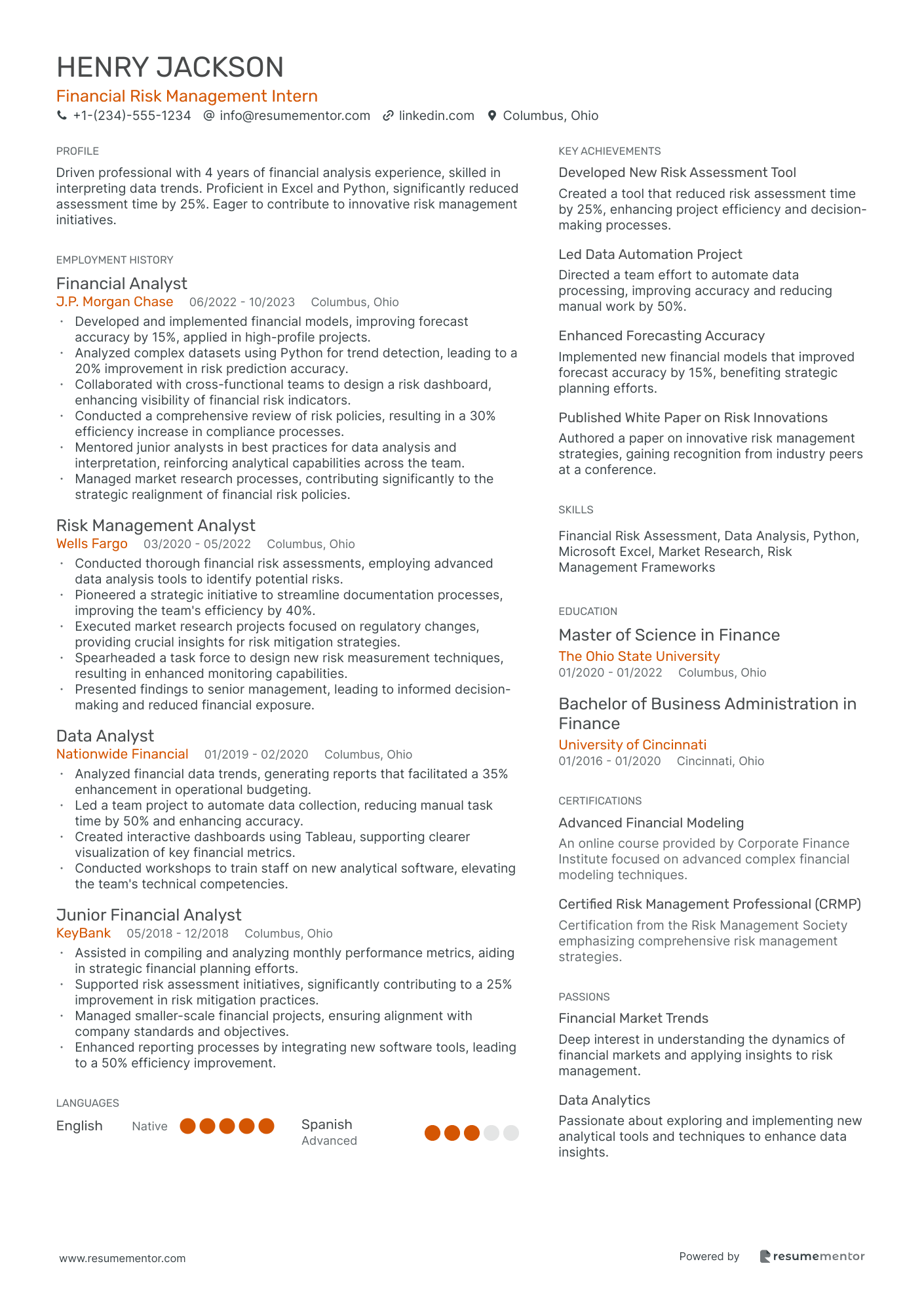

Financial Risk Management Intern resume sample

- •Developed and implemented financial models, improving forecast accuracy by 15%, applied in high-profile projects.

- •Analyzed complex datasets using Python for trend detection, leading to a 20% improvement in risk prediction accuracy.

- •Collaborated with cross-functional teams to design a risk dashboard, enhancing visibility of financial risk indicators.

- •Conducted a comprehensive review of risk policies, resulting in a 30% efficiency increase in compliance processes.

- •Mentored junior analysts in best practices for data analysis and interpretation, reinforcing analytical capabilities across the team.

- •Managed market research processes, contributing significantly to the strategic realignment of financial risk policies.

- •Conducted thorough financial risk assessments, employing advanced data analysis tools to identify potential risks.

- •Pioneered a strategic initiative to streamline documentation processes, improving the team's efficiency by 40%.

- •Executed market research projects focused on regulatory changes, providing crucial insights for risk mitigation strategies.

- •Spearheaded a task force to design new risk measurement techniques, resulting in enhanced monitoring capabilities.

- •Presented findings to senior management, leading to informed decision-making and reduced financial exposure.

- •Analyzed financial data trends, generating reports that facilitated a 35% enhancement in operational budgeting.

- •Led a team project to automate data collection, reducing manual task time by 50% and enhancing accuracy.

- •Created interactive dashboards using Tableau, supporting clearer visualization of key financial metrics.

- •Conducted workshops to train staff on new analytical software, elevating the team's technical competencies.

- •Assisted in compiling and analyzing monthly performance metrics, aiding in strategic financial planning efforts.

- •Supported risk assessment initiatives, significantly contributing to a 25% improvement in risk mitigation practices.

- •Managed smaller-scale financial projects, ensuring alignment with company standards and objectives.

- •Enhanced reporting processes by integrating new software tools, leading to a 50% efficiency improvement.

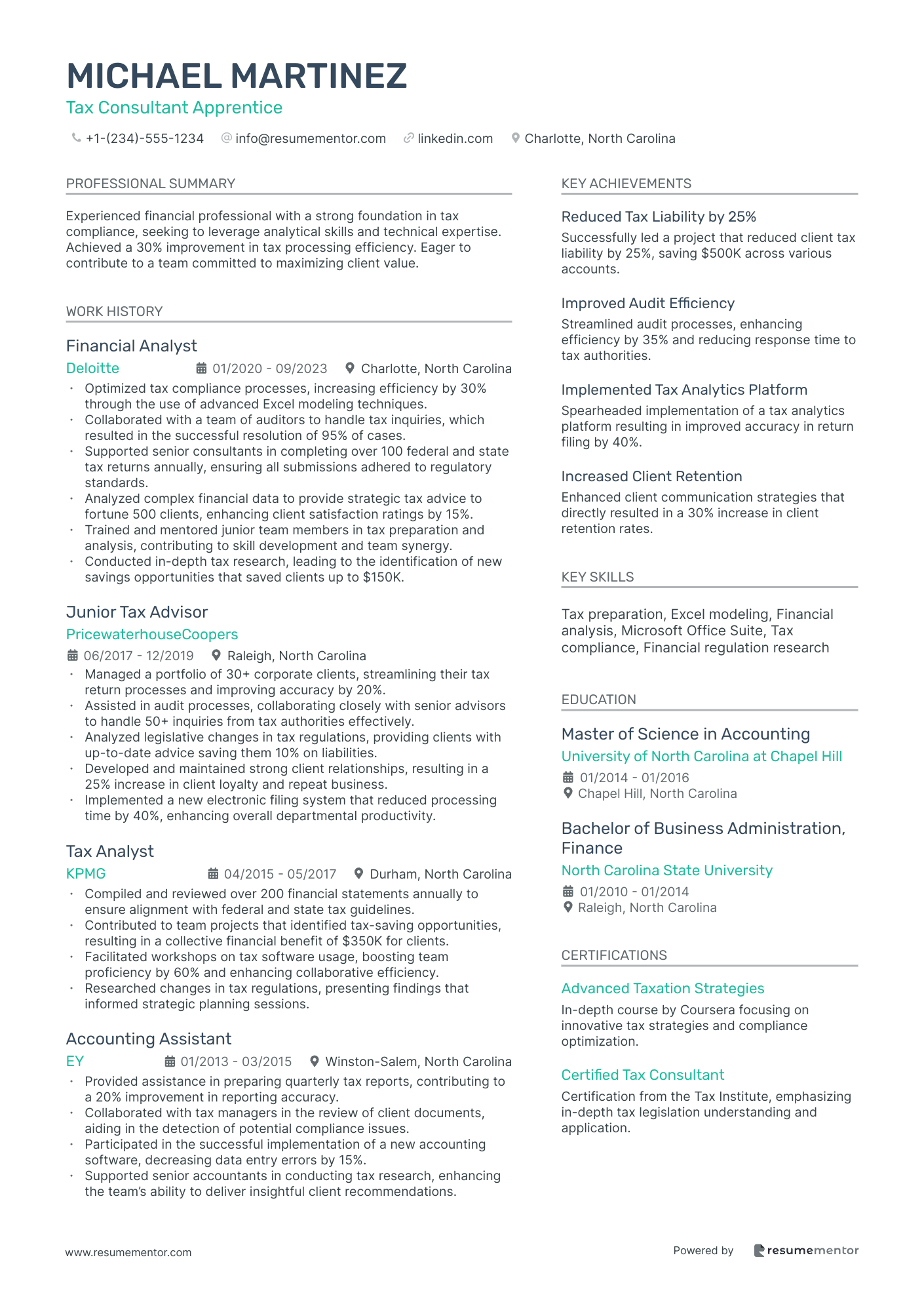

Tax Consultant Apprentice resume sample

- •Optimized tax compliance processes, increasing efficiency by 30% through the use of advanced Excel modeling techniques.

- •Collaborated with a team of auditors to handle tax inquiries, which resulted in the successful resolution of 95% of cases.

- •Supported senior consultants in completing over 100 federal and state tax returns annually, ensuring all submissions adhered to regulatory standards.

- •Analyzed complex financial data to provide strategic tax advice to fortune 500 clients, enhancing client satisfaction ratings by 15%.

- •Trained and mentored junior team members in tax preparation and analysis, contributing to skill development and team synergy.

- •Conducted in-depth tax research, leading to the identification of new savings opportunities that saved clients up to $150K.

- •Managed a portfolio of 30+ corporate clients, streamlining their tax return processes and improving accuracy by 20%.

- •Assisted in audit processes, collaborating closely with senior advisors to handle 50+ inquiries from tax authorities effectively.

- •Analyzed legislative changes in tax regulations, providing clients with up-to-date advice saving them 10% on liabilities.

- •Developed and maintained strong client relationships, resulting in a 25% increase in client loyalty and repeat business.

- •Implemented a new electronic filing system that reduced processing time by 40%, enhancing overall departmental productivity.

- •Compiled and reviewed over 200 financial statements annually to ensure alignment with federal and state tax guidelines.

- •Contributed to team projects that identified tax-saving opportunities, resulting in a collective financial benefit of $350K for clients.

- •Facilitated workshops on tax software usage, boosting team proficiency by 60% and enhancing collaborative efficiency.

- •Researched changes in tax regulations, presenting findings that informed strategic planning sessions.

- •Provided assistance in preparing quarterly tax reports, contributing to a 20% improvement in reporting accuracy.

- •Collaborated with tax managers in the review of client documents, aiding in the detection of potential compliance issues.

- •Participated in the successful implementation of a new accounting software, decreasing data entry errors by 15%.

- •Supported senior accountants in conducting tax research, enhancing the team’s ability to deliver insightful client recommendations.

Equity Research Trainee resume sample

- •Developed comprehensive financial models that improved investment decision accuracy by 25%, resulting in enhanced client portfolios.

- •Conducted detailed analysis of financial statements to assess company performance, reducing error rates by 20%.

- •Led a team project to evaluate market trends which increased investment returns by 10% year-over-year.

- •Prepared and presented research reports that improved internal decision-making processes by offering relevant insights.

- •Collaborated with cross-functional teams to streamline the research process, saving 10 hours per month in report generation.

- •Monitored and analyzed competitive landscapes to identify key opportunities, increasing client acquisition by 5%.

- •Assisted in financial statement analysis, enhancing the accuracy of quarterly reports by 15%, impacting investment decisions positively.

- •Participated in industry research projects determining new market opportunities that increased revenue by 8%.

- •Developed PowerPoint presentations summarizing investment opportunities, aiding executives in strategic decisions and forecasts.

- •Streamlined data entry and bottom-line analysis to improve report generation time by 30% using advanced Excel techniques.

- •Collaborated effectively with senior analysts to fine-tune financial models, delivering a 20% increase in prediction capabilities.

- •Monitored budget expenditures and financial performance metrics, leading to a 12% reduction in unnecessary costs.

- •Implemented improved workflow processes resulting in enhanced efficiency across the finance department by 10%.

- •Conducted market analysis that provided a 7% boost in client satisfaction through strategic budget adjustments.

- •Trained new team members in financial analysis software, increasing department productivity by 15% over six months.

- •Compiled comprehensive research reports, resulting in a 25% improvement in departmental knowledge bases.

- •Supported senior analysts in preparing analytical materials that contributed to 30% more accurate forecasting.

- •Assisted in database management, which streamlined historical data retrieval processes, saving two hours weekly.

- •Participated in workshops leading to improved analytical skills that helped reduce analytical errors by 10%.

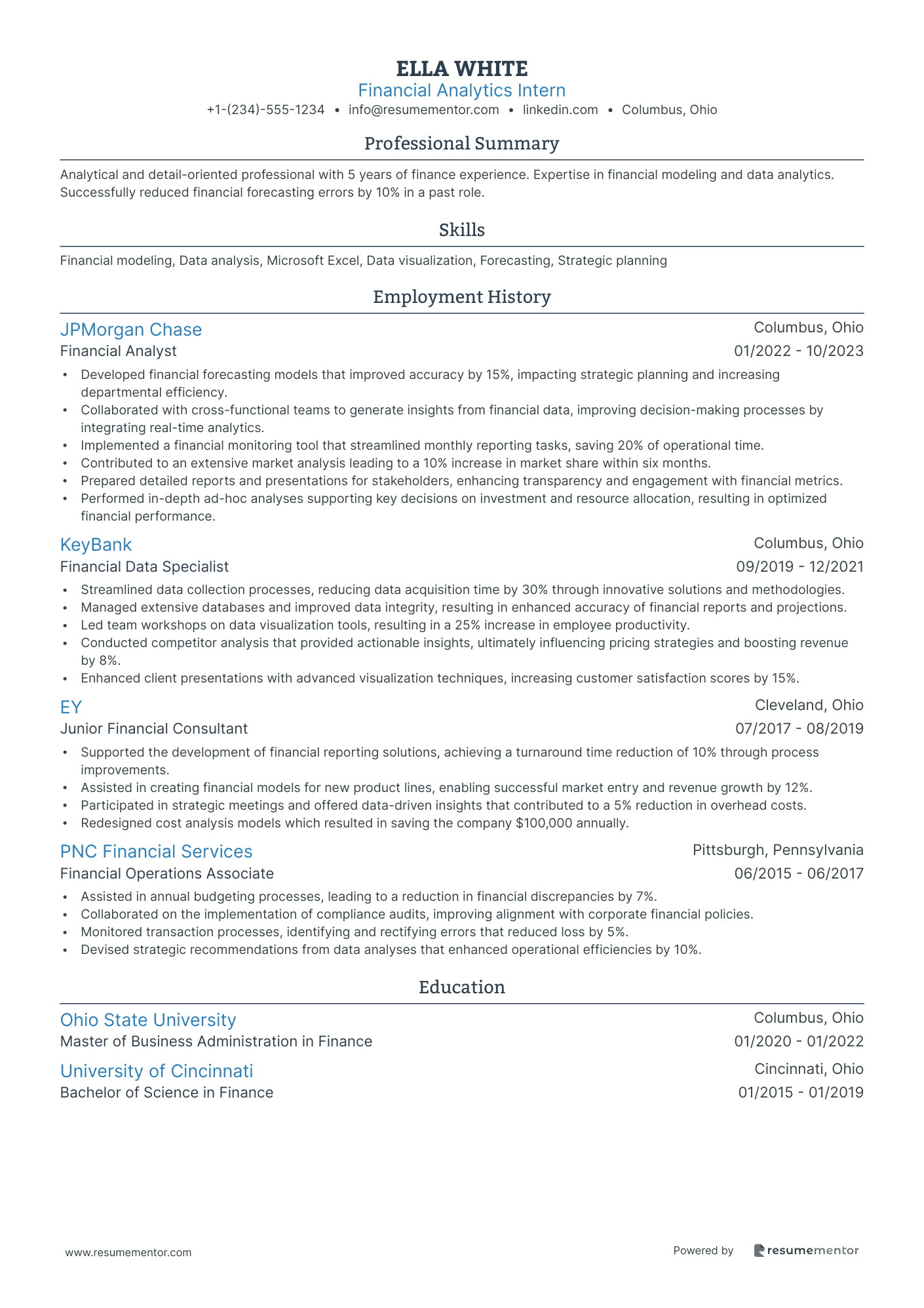

Financial Analytics Intern resume sample

- •Developed financial forecasting models that improved accuracy by 15%, impacting strategic planning and increasing departmental efficiency.

- •Collaborated with cross-functional teams to generate insights from financial data, improving decision-making processes by integrating real-time analytics.

- •Implemented a financial monitoring tool that streamlined monthly reporting tasks, saving 20% of operational time.

- •Contributed to an extensive market analysis leading to a 10% increase in market share within six months.

- •Prepared detailed reports and presentations for stakeholders, enhancing transparency and engagement with financial metrics.

- •Performed in-depth ad-hoc analyses supporting key decisions on investment and resource allocation, resulting in optimized financial performance.

- •Streamlined data collection processes, reducing data acquisition time by 30% through innovative solutions and methodologies.

- •Managed extensive databases and improved data integrity, resulting in enhanced accuracy of financial reports and projections.

- •Led team workshops on data visualization tools, resulting in a 25% increase in employee productivity.

- •Conducted competitor analysis that provided actionable insights, ultimately influencing pricing strategies and boosting revenue by 8%.

- •Enhanced client presentations with advanced visualization techniques, increasing customer satisfaction scores by 15%.

- •Supported the development of financial reporting solutions, achieving a turnaround time reduction of 10% through process improvements.

- •Assisted in creating financial models for new product lines, enabling successful market entry and revenue growth by 12%.

- •Participated in strategic meetings and offered data-driven insights that contributed to a 5% reduction in overhead costs.

- •Redesigned cost analysis models which resulted in saving the company $100,000 annually.

- •Assisted in annual budgeting processes, leading to a reduction in financial discrepancies by 7%.

- •Collaborated on the implementation of compliance audits, improving alignment with corporate financial policies.

- •Monitored transaction processes, identifying and rectifying errors that reduced loss by 5%.

- •Devised strategic recommendations from data analyses that enhanced operational efficiencies by 10%.

Crafting a finance student resume can feel like piecing together a complex financial puzzle. You have essential elements, like education, internships, and financial skills, but it's the integration that matters. Your resume is your first investment in your career, and its effectiveness determines the returns you’ll achieve. Many face pitfalls, such as emphasizing experiences that don’t align with financial expertise or missing key competencies. This can make you miss out on valuable opportunities in the industry.

Here, a well-designed resume template becomes your blueprint. Using a resume template helps you organize your credentials in a coherent and professional manner. This structured approach not only saves you from the hassle of formatting but also ensures your qualifications speak directly to finance recruiters.

Effectively showcasing your skills in data analysis or risk assessment is crucial for capturing recruiters' attention. A cohesive resume ensures these strengths are clear to hiring managers, allowing them to see your true potential. Whether targeting internships at investment banks or full-time roles in corporate finance, presenting the right skills and achievements is vital for standing out.

As you move forward in your career journey, remember that your resume is more than a list; it tells your story. It should clearly convey the unique value you offer to future employers in the world of finance.

Key Takeaways

- The importance of a finance student resume lies in its ability to clearly present education, internships, and relevant financial skills, forming the foundation of the candidate's career.

- Utilizing a well-designed resume template organizes credentials in a coherent manner, increasing the likelihood of capturing the attention of finance recruiters.

- Showcasing data analysis and risk assessment skills, along with quantifiable outcomes, emphasizes practical impact and aligns the resume with potential employer expectations.

- Proper formatting, including the chronological order of experiences and PDF saving, ensures clarity and consistency while facilitating recruiter review.

- Integrating additional sections like language skills, hobbies, and volunteer work can further highlight unique strengths and set the candidate apart in the finance industry.

What to focus on when writing your finance student resume

Your finance student resume should clearly express your enthusiasm for the field while highlighting key skills, achievements, and relevant experiences. This helps recruiters see how your background and interests align with their needs, making you an appealing candidate. Presenting yourself as both dynamic and detail-oriented is crucial.

How to structure your finance student resume

- Contact Information: Ensure your name, phone number, email, and LinkedIn profile are updated and easy to read. These details serve as your first impression, setting the tone for a professional engagement. Including a professional-looking email address and an active LinkedIn profile with industry-related posts or connections can establish credibility. The way you present this information immediately demonstrates your attention to detail and professionalism.

- Objective or Summary: Use this section to capture your deep interest in finance and articulate your career aspirations. A well-crafted statement tailored to the industry can immediately engage recruiters. By mentioning a specific finance niche you're passionate about or a future career goal, you create a focused narrative. This section serves as your elevator pitch, giving recruiters a quick sense of who you are and what you stand for professionally.

- Education: Highlight your current degree program, major, university, and anticipated graduation date. Showing achievements like a high GPA (3.5 or above), and listing relevant courses or honors, emphasizes your commitment to finance. Indicating participation in finance clubs or relevant academic projects can further showcase your proactive stance in gaining industry knowledge. These educational experiences create a foundation that supports your objective statement.

- Relevant Experience: Share internships, part-time jobs, or volunteer work that connects to finance. By detailing your duties and using quantifiable outcomes, such as increased efficiency or cost savings, you demonstrate your practical impact and problem-solving abilities. Including specific financial tools or methodologies you used, highlights your hands-on skills. Describing how these experiences relate directly to the role you are applying for creates a seamless transition from your educational background to real-world application.

- Skills: Focus on the skills critical to finance, including financial analysis, data modeling, and proficiency with tools like Excel or QuickBooks. These skills illustrate your readiness to contribute effectively to a finance team. Mentioning how these skills were applied in internships or projects can underscore your practical expertise. Connecting these skills to industry trends or upcoming projects aligns your abilities with employer expectations.

- Certifications or Training: Listing finance-related certifications or training, such as Bloomberg Market Concepts or CFA Level I preparation, reinforces your dedication to continuous learning in the field. Detailing the competencies gained from these certifications can differentiate you from candidates with only academic credentials. This section supports your narrative as a committed and capable finance professional.

For a more comprehensive resume, consider adding optional sections like languages, leadership roles, finance-related projects, or professional associations. These additions can further highlight your unique strengths and set you apart in the finance industry. Below, we'll dive into each section in more depth, ensuring you have the best strategies for crafting a standout resume.

Which resume format to choose

Crafting a finance student resume begins with selecting the right format. In the finance sector, a chronological format is the most effective because it allows you to highlight your educational background and any relevant work or internship experiences in a straightforward timeline. This is crucial in a field that values clear progression and a logical demonstration of skills over time.

Choosing appropriate fonts plays a significant role in the overall presentation. Modern fonts like Lato, Montserrat, and Raleway offer a sleek, polished look that aligns well with the style sought after in finance. These fonts are clear and easy to read, which is vital when employers are quickly scanning through many applications. Sticking to a font size between 10 and 12 points ensures that your text is legible without overwhelming the page.

Saving your resume as a PDF is essential in maintaining your chosen format and layout. This consistency is key, as file types like Word can appear differently depending on the device or software version used by recruiters. A PDF ensures that your resume remains intact, with all credentials and achievements presented just as you intended.

Finally, setting your margins at one inch on all sides creates a neat and organized appearance. This standard margin size not only keeps your resume looking tidy but also ensures there's ample white space for readability. Adequate spacing helps guide the recruiter’s eye through your sections, making it more likely they’ll focus on your key accomplishments and skills.

By giving attention to these details, you can write a finance student resume that stands out for its clarity and professionalism, increasing your chances of making a positive impression on future employers.

How to write a quantifiable resume experience section

For a finance student, crafting a strong resume experience section is crucial because it effectively highlights your practical skills and notable achievements. Start by focusing on experiences such as internships, part-time jobs, or volunteer roles that best demonstrate your financial acumen. Organizing this section in reverse chronological order allows employers to easily see your most current and relevant skills. Generally, limit the entries to the last 10 years or the most applicable experiences to the job.

Tailoring your resume for each application is a key step in standing out. Adjust it to emphasize the experiences that align most closely with the job description. When selecting job titles, choose those that reflect a clear progression in finance, regardless if they were part-time or volunteer. Use impactful action verbs like "analyzed," "developed," "implemented," and "collaborated" to underscore your contributions and initiative.

Here’s a refined finance student resume experience example:

- •Developed a financial model that reduced operating costs by 10%.

- •Collaborated with a team of analysts to optimize investment strategies, leading to a 15% increase in portfolio returns.

- •Analyzed quarterly financial statements to identify trends and presented findings to senior management, resulting in strategic changes.

- •Implemented a new data visualization tool, improving monthly report efficiency by 20%.

This experience section excels by detailing quantifiable achievements that clearly demonstrate a significant impact. By listing a relevant position and workplace, it instantly communicates industry experience. Each bullet point ties directly to a measurable result, such as boosting portfolio returns or improving report efficiency, which highlights your effectiveness. Using precise dates and action-focused language creates a vivid picture of your responsibilities and accomplishments, connecting your skill set with potential employer needs and aligning with desired job roles in finance. This approach not only highlights a detail-oriented and results-driven mindset but also resonates strongly with recruiters looking for proven contributors.

Result-Focused resume experience section

A finance-focused resume experience section should clearly showcase your ability to achieve significant outcomes that appeal to potential employers. Highlight relevant roles, such as internships and part-time positions, to provide evidence of your practical experience in the finance world. Instead of merely listing tasks, demonstrate how your contributions directly supported team or company goals. Quantify your successes with numbers, presenting a tangible measure of your accomplishments. Each point should underscore skills that are highly valued in finance, like analytical abilities, attention to detail, or proficiency with financial tools.

Use clear and concise language to organize your experience, integrating action verbs that emphasize your initiative and productivity. Ensure each bullet point reflects meaningful outcomes, such as increasing efficiency, cutting costs, or improving client satisfaction. This not only strengthens your resume but also demonstrates your capability to deliver tangible results, capturing the attention of employers in the finance industry.

Intern

ABC Investment Bank

June 2023 - August 2023

- Conducted detailed financial analysis and created reports that led to a 10% increase in investment portfolios.

- Collaborated with a team to develop new market strategies, resulting in a 12% rise in client acquisition.

- Assisted in preparing financial documents for high-profile projects, reducing review time by 15%.

- Utilized Excel and financial software to streamline data processing, enhancing productivity by 20%.

Responsibility-Focused resume experience section

A responsibility-focused finance student resume experience section should clearly convey how you’ve contributed and made a difference in your roles. Start by highlighting the key responsibilities where you have taken the lead, showcasing your ability to handle important tasks and manage projects effectively. Use strong, action-oriented language that depicts how you have driven progress and successfully implemented solutions, illustrating your capacity for leadership and initiative.

Provide specific examples of your contributions to create a compelling narrative. Detail how you achieved tangible results, such as improving efficiency, reducing costs, or fostering growth, and support these achievements with numbers when possible to make them stand out. This narrative helps potential employers understand the depth of your work ethic and reliability, painting a vivid picture of how your responsibilities have been integral to the success of your team or company.

Finance Intern

Global Finance Corp

May 2021 - August 2023

- Analyzed financial data to assist in decision-making, resulting in a 10% improvement in quarterly projections.

- Collaborated with the finance team to develop a new budget plan, reducing unnecessary expenses by $15,000.

- Coordinated with various departments to streamline financial reporting, decreasing report generation time by 20%.

- Assisted in preparing presentations for stakeholders, enhancing communication with investors.

Technology-Focused resume experience section

A technology-focused finance student resume experience section should effectively showcase how you integrate financial knowledge with technological skills. Begin by highlighting projects where you leveraged technology to tackle financial challenges or improve existing processes, ensuring to emphasize the outcomes. Use specific metrics to quantify your achievements, making your contributions clear and impactful. Illustrate how technology was a key aspect of your roles, whether through data analysis, software management, or system optimization, to demonstrate your competency.

Clearly list your roles with appropriate timeframes, selecting a title that reflects your tech-oriented achievements. In the bullet points, detail your accomplishments with a focus on the tools or technologies utilized, connecting each to the financial improvements or innovations you spearheaded. Personalize each experience to highlight your unique contributions, demonstrating the valuable skills you bring to a finance-tech environment.

Finance Technology Intern

Innovative Finance Solutions

June 2021 - August 2022

- Created a financial data dashboard with Python, improving decision-making efficiency by 30%

- Implemented SAP systems to streamline accounting processes, reducing errors by 15%

- Led a team in integrating machine learning for enhanced risk assessment, increasing accuracy by 25%

- Collaborated with various teams to enhance banking app experience, elevating user engagement by 20%

Project-Focused resume experience section

A project-focused finance student resume experience section should effectively showcase your accomplishments and contributions to various projects. Start by clearly stating your roles and highlighting the results you've achieved. Use bullet points for clarity and make sure to focus on how your efforts made a tangible impact. It's important to illustrate not just what you did, but also how you collaborated with others, solved problems, and contributed to the overall success of the projects.

Begin by listing the dates and the project title, noting the type of work involved. With each bullet point, describe an action you took, the skills you used, and the outcomes achieved. Keep the language simple and straightforward to ensure clarity. By organizing your experience in this way, you create a cohesive picture of your abilities and the value you bring to future opportunities.

Finance Intern

ABC Financial Services

June 2022 - August 2022

- Analyzed financial data using Excel and uncovered cost-saving opportunities, leading to a 10% reduction in project expenses. This analysis was key in optimizing financial strategies.

- Collaborated with a team to create a new budgeting system that improved forecast accuracy by 15%, directly enhancing decision-making processes.

- Developed a comprehensive financial report on market trends and presented it to senior management, which played a pivotal role in influencing strategic investment decisions.

- Assisted in preparing quarterly financial statements, ensuring compliance with industry regulations, and strengthening the company's financial reporting integrity.

Write your finance student resume summary section

A finance-focused student resume summary should effectively showcase your most relevant skills and experiences. Serving as a snapshot, this summary provides hiring managers with a quick insight into what makes you a strong candidate. Here's an example that captures the essence of a standout finance student:

This example is effective because it clearly highlights your relevant skills and achievements, demonstrating why you are a good fit for the role. By stating your strengths and accomplishments succinctly, you ensure that hiring managers quickly understand your value. Your language should be confident and direct, leaving no doubt about your capabilities.

When crafting your resume summary, focus on describing yourself through skills and traits that align with the desired position. This summary acts as a gateway to your background, capturing the reader's attention by emphasizing your key skills, experiences, and goals.

Grasping the distinctions between a resume summary and a resume objective is crucial; while a summary focuses on what you’ve accomplished and can offer to the employer, an objective outlines your career aspirations within the company. Furthermore, a resume profile provides a comprehensive blend of your professional and personal traits, and a summary of qualifications zeroes in on specific skills or experiences in bullet points. Understanding these nuances helps you tailor your resume to effectively align with your career objectives.

Listing your finance student skills on your resume

A finance-focused student resume should effectively use the skills section to showcase your capabilities. You can list your skills separately or weave them into your experience and summary to create a cohesive narrative. Highlighting your strengths through soft skills like communication and teamwork shows that you work well with others. Meanwhile, hard skills such as financial analysis or Excel proficiency illustrate your technical know-how. Together, these skills and strengths act as keywords, helping your resume gain attention from hiring managers and Applicant Tracking Systems.

Here's an example of a skills section in JSON format:

This skills section performs well because it offers a balanced mix of critical finance-related skills. Each skill aligns with industry needs, enhancing your attractiveness to potential employers.

Best hard skills to feature on your finance student resume

Hard skills in your resume are essential, as they demonstrate your ability to handle specific financial tasks. For finance students, hard skills should convey a strong understanding of finance concepts and a readiness to apply them. Consider these 15 critical hard skills:

Hard Skills

- Financial Analysis

- Proficiency in Microsoft Excel

- Data Interpretation

- Risk Management

- Investment Strategies

- Budgeting and Forecasting

- Financial Modeling

- Quantitative Analysis

- Accounting Principles

- Statistical Analysis

- Capital Markets

- Corporate Finance

- Portfolio Management

- Use of Financial Software (e.g., QuickBooks)

- Business Valuation

Best soft skills to feature on your finance student resume

Equally important are the soft skills that demonstrate your ability to adapt and collaborate in a team setting. For finance students, these skills highlight your potential to thrive in dynamic environments. Here are 15 essential soft skills:

Integrating these skills thoughtfully into your resume will help you make a strong impression in finance roles.

Soft Skills

- Communication

- Teamwork

- Problem-Solving

- Critical Thinking

- Adaptability

- Time Management

- Attention to Detail

- Leadership

- Motivation

- Emotional Intelligence

- Conflict Resolution

- Creativity

- Initiative

- Networking

- Negotiation Skills

How to include your education on your resume

The education section is a crucial part of your finance student resume. It shows where and how you learned your skills. It's essential to tailor this section to match the job you want. If some education doesn't relate to finance, it’s best to leave it out. Listing your degree should be straightforward. Include the degree name, institution, and graduation date. If your GPA is strong, include it. Write it as “GPA: X.XX/4.00.” Put "cum laude" or other honors directly after your degree, like “Bachelor of Science in Finance, cum laude.” Make sure your education section matches the finance roles you apply for.

Here is an example of a poor education section:

Now, here's an excellent example:

This example is good because it focuses on relevant education. The degree fits finance roles perfectly. The chosen university is well-known. The inclusion of a high GPA and honors like "cum laude" showcases academic excellence, making you stand out more to employers.

How to include finance student certificates on your resume

Including a certificates section is vital for a finance student resume. First, list the name of the certificate. Second, include the date you received it. Third, add the issuing organization. Certificates can also be included in the header for quick visibility.

For example:

Here’s a good example of a standalone certificates section:

[here was the JSON object 2]

This example is strong because the certificates listed, such as CFA and FRM, are relevant to finance. They show a commitment to the field and verify your skills. These industry-recognized certificates make your resume stand out to employers. Utilizing clear formatting makes it easy for hiring managers to find this information quickly.

Extra sections to include in your finance student resume

Crafting a compelling resume as a finance student is crucial for landing internships and job opportunities. Your resume should highlight your skills, experiences, and unique attributes to make a strong impression on potential employers. Including sections that go beyond standard experiences can set you apart from other applicants.

- Language section — Highlight command of different languages to show your communication skills and cultural awareness.

- Hobbies and interests section — Showcase personal interests to display a well-rounded character, indicating good work-life balance.

- Volunteer work section — Demonstrate commitment to community service and leadership, which are valued attributes in finance roles.

- Books section — List relevant finance or business books you have read to show dedication to your field and continuous learning.

Integrating these sections into your resume can emphasize your diverse skills and enhance your appeal to employers in the finance sector.

In Conclusion

In conclusion, creating a finance student resume is similar to compiling a comprehensive financial report; every section is essential for presenting your complete professional picture. Your resume serves as the first step toward your desired career path, and how effectively it conveys your skills and experiences determines the opportunities you will attract. By strategically highlighting pertinent experiences, such as internships and relevant coursework, you set yourself apart from other candidates. Employing a clear format and utilizing professional resume templates ensures your information is presented in a reader-friendly and engaging manner.

Focusing on quantifiable achievements and practical skills, particularly in finance areas like data analysis and budgeting, is vital to capturing a recruiter’s attention. Moreover, infusing your resume with both hard and soft skills illustrates your readiness to tackle real-world challenges effectively. Certificates, formidable educational achievements, and additional sections, like languages or volunteer work, further enrich your profile, showcasing a dedication to both personal and professional growth. Opting for a polished, chronological format not only aids recruiters in swiftly comprehending your educational and professional timeline but also facilitates highlighting key accomplishments.

In the end, a well-crafted resume does more than list your qualifications; it tells a compelling story of your journey and potential in the finance world. By prioritizing clarity, relevance, and professionalism, you increase your chances of making a lasting impression on prospective employers. Your goal is to make the resume not only a reflection of your past achievements but a forecast of the exceptional value you bring to the finance industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.