Financial Accountant Resume Examples

Jul 18, 2024

|

12 min read

Mastering financial accountant resumes: tips to balance your skills and stand out from the ledger.

Rated by 348 people

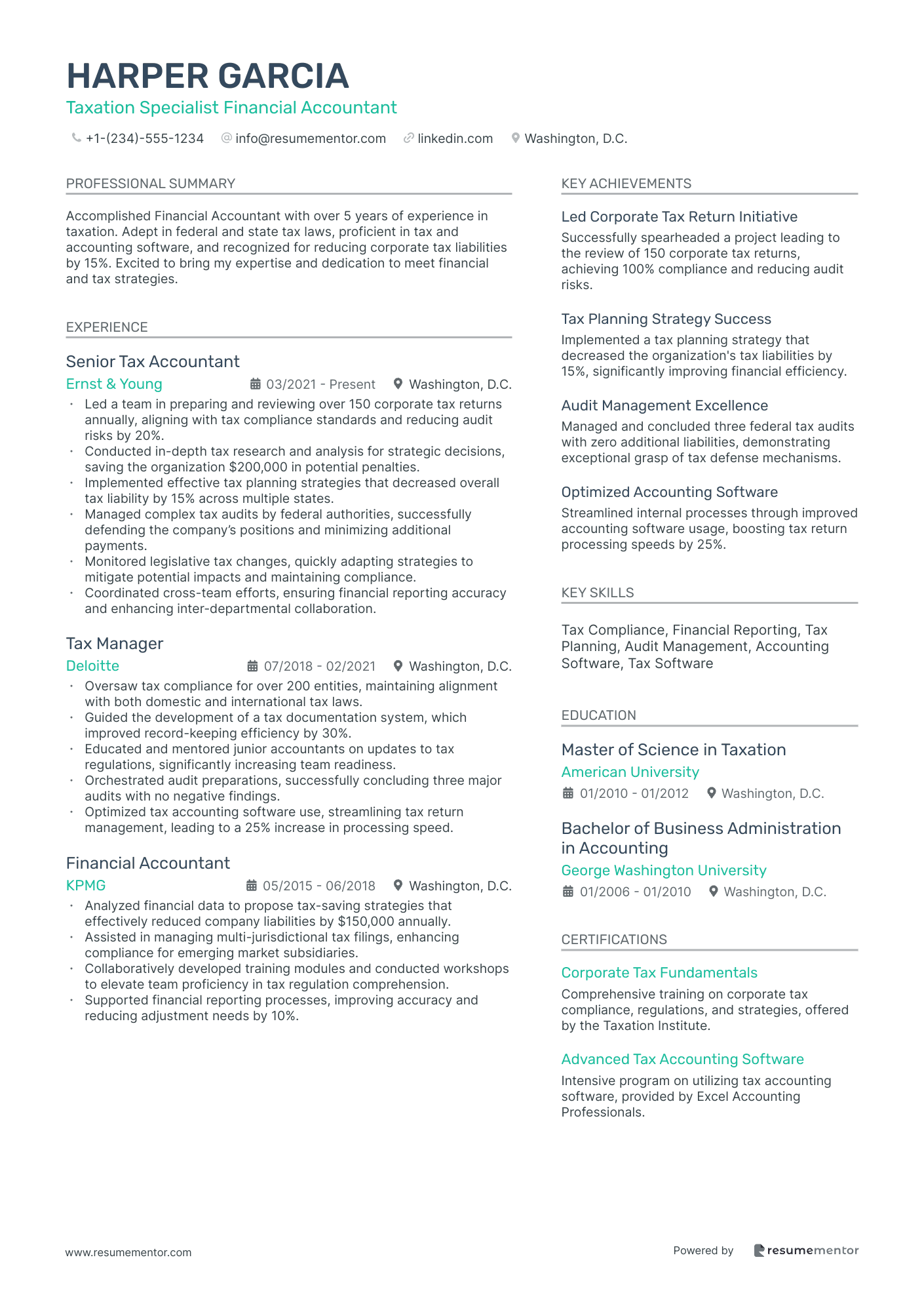

Taxation Specialist Financial Accountant

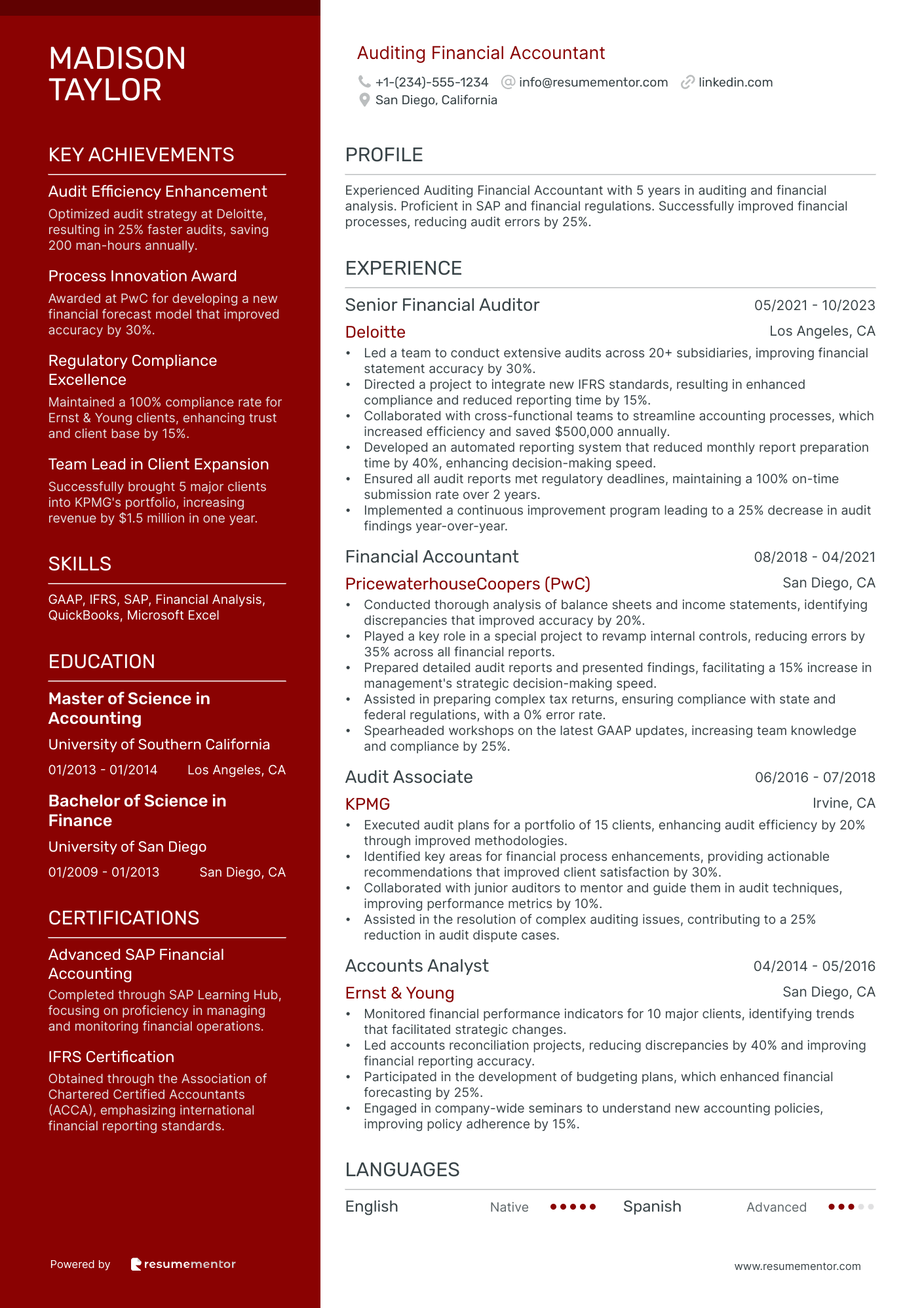

Auditing Financial Accountant

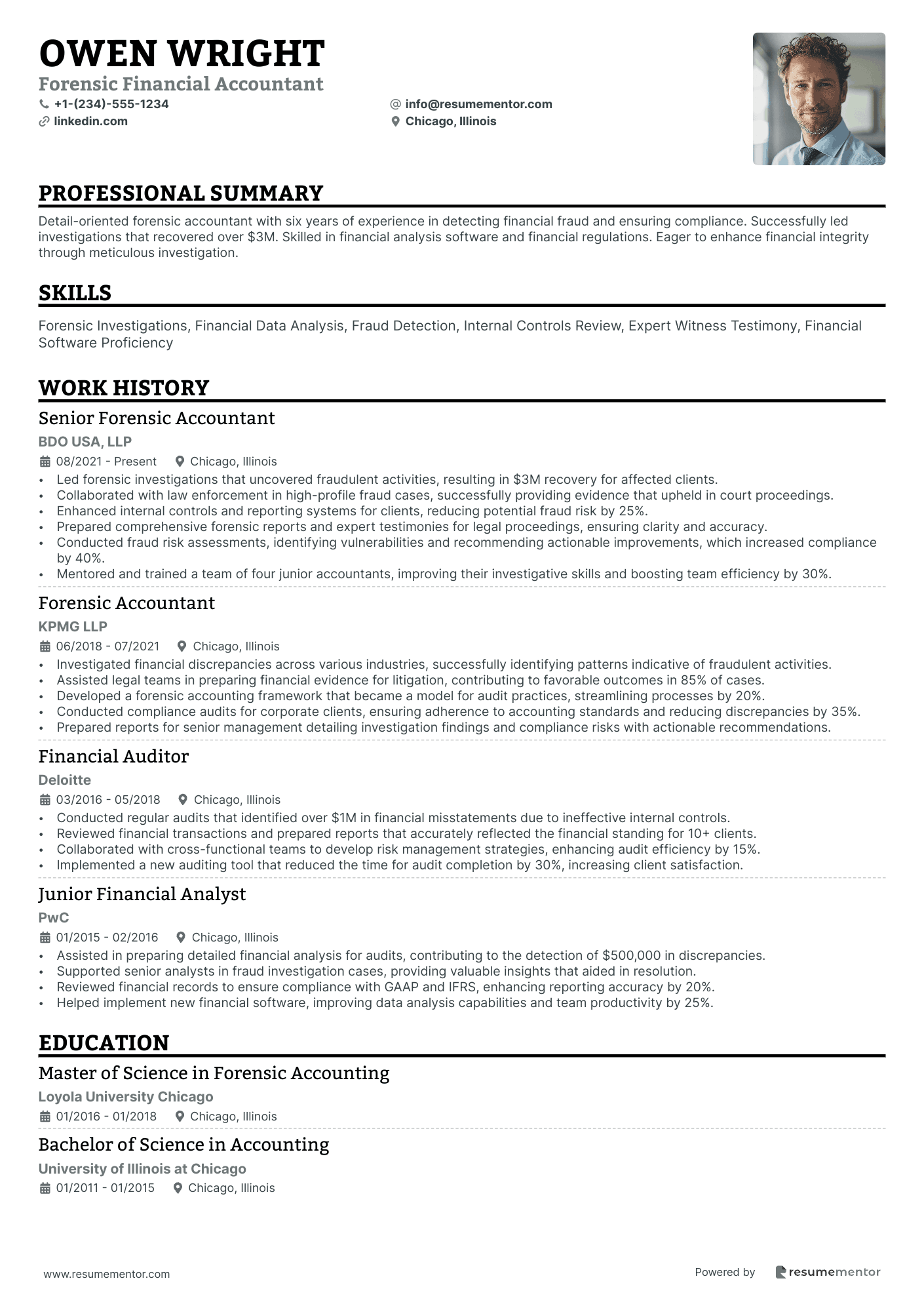

Forensic Financial Accountant

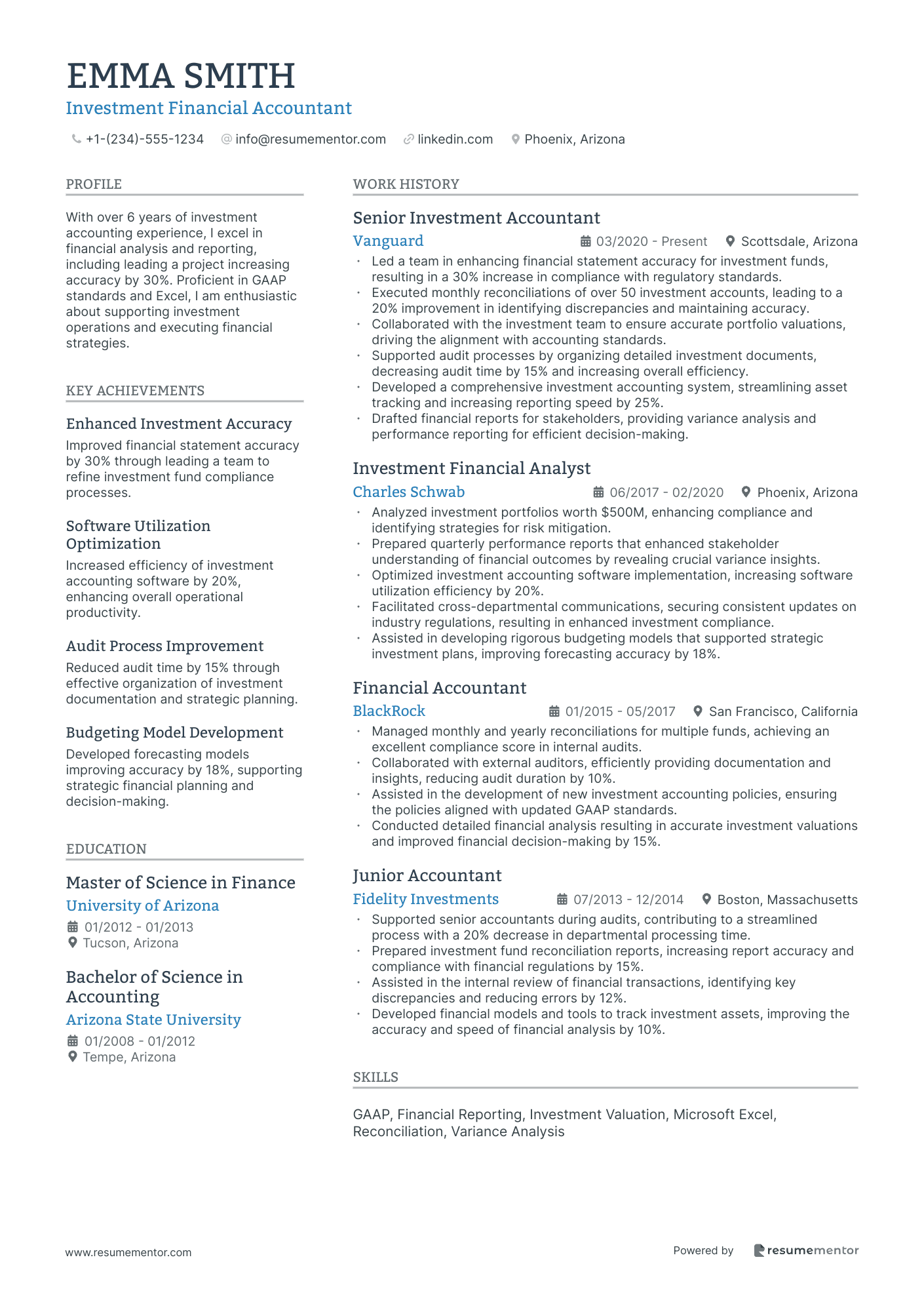

Investment Financial Accountant

Financial Accountant - Banking

Financial Accountant for Non-Profit Organizations

Property Management Financial Accountant

Capital Markets Financial Accountant

Corporate Finance Accountant

Government Financial Accountant

Taxation Specialist Financial Accountant resume sample

- •Led a team in preparing and reviewing over 150 corporate tax returns annually, aligning with tax compliance standards and reducing audit risks by 20%.

- •Conducted in-depth tax research and analysis for strategic decisions, saving the organization $200,000 in potential penalties.

- •Implemented effective tax planning strategies that decreased overall tax liability by 15% across multiple states.

- •Managed complex tax audits by federal authorities, successfully defending the company’s positions and minimizing additional payments.

- •Monitored legislative tax changes, quickly adapting strategies to mitigate potential impacts and maintaining compliance.

- •Coordinated cross-team efforts, ensuring financial reporting accuracy and enhancing inter-departmental collaboration.

- •Oversaw tax compliance for over 200 entities, maintaining alignment with both domestic and international tax laws.

- •Guided the development of a tax documentation system, which improved record-keeping efficiency by 30%.

- •Educated and mentored junior accountants on updates to tax regulations, significantly increasing team readiness.

- •Orchestrated audit preparations, successfully concluding three major audits with no negative findings.

- •Optimized tax accounting software use, streamlining tax return management, leading to a 25% increase in processing speed.

- •Analyzed financial data to propose tax-saving strategies that effectively reduced company liabilities by $150,000 annually.

- •Assisted in managing multi-jurisdictional tax filings, enhancing compliance for emerging market subsidiaries.

- •Collaboratively developed training modules and conducted workshops to elevate team proficiency in tax regulation comprehension.

- •Supported financial reporting processes, improving accuracy and reducing adjustment needs by 10%.

- •Reviewed tax document submissions for completeness, ensuring regulatory accuracy, reducing processing errors by 12%.

- •Conducted preliminary tax calculations in preparation for senior analysis, assisting in timely reporting.

- •Researched state and local tax incentives, aiding in the acquisition of over $50,000 in business credits.

- •Maintained meticulous records of tax returns and correspondence, improving data retrieval speed by 20%.

Auditing Financial Accountant resume sample

- •Led a team to conduct extensive audits across 20+ subsidiaries, improving financial statement accuracy by 30%.

- •Directed a project to integrate new IFRS standards, resulting in enhanced compliance and reduced reporting time by 15%.

- •Collaborated with cross-functional teams to streamline accounting processes, which increased efficiency and saved $500,000 annually.

- •Developed an automated reporting system that reduced monthly report preparation time by 40%, enhancing decision-making speed.

- •Ensured all audit reports met regulatory deadlines, maintaining a 100% on-time submission rate over 2 years.

- •Implemented a continuous improvement program leading to a 25% decrease in audit findings year-over-year.

- •Conducted thorough analysis of balance sheets and income statements, identifying discrepancies that improved accuracy by 20%.

- •Played a key role in a special project to revamp internal controls, reducing errors by 35% across all financial reports.

- •Prepared detailed audit reports and presented findings, facilitating a 15% increase in management's strategic decision-making speed.

- •Assisted in preparing complex tax returns, ensuring compliance with state and federal regulations, with a 0% error rate.

- •Spearheaded workshops on the latest GAAP updates, increasing team knowledge and compliance by 25%.

- •Executed audit plans for a portfolio of 15 clients, enhancing audit efficiency by 20% through improved methodologies.

- •Identified key areas for financial process enhancements, providing actionable recommendations that improved client satisfaction by 30%.

- •Collaborated with junior auditors to mentor and guide them in audit techniques, improving performance metrics by 10%.

- •Assisted in the resolution of complex auditing issues, contributing to a 25% reduction in audit dispute cases.

- •Monitored financial performance indicators for 10 major clients, identifying trends that facilitated strategic changes.

- •Led accounts reconciliation projects, reducing discrepancies by 40% and improving financial reporting accuracy.

- •Participated in the development of budgeting plans, which enhanced financial forecasting by 25%.

- •Engaged in company-wide seminars to understand new accounting policies, improving policy adherence by 15%.

Forensic Financial Accountant resume sample

- •Led forensic investigations that uncovered fraudulent activities, resulting in $3M recovery for affected clients.

- •Collaborated with law enforcement in high-profile fraud cases, successfully providing evidence that upheld in court proceedings.

- •Enhanced internal controls and reporting systems for clients, reducing potential fraud risk by 25%.

- •Prepared comprehensive forensic reports and expert testimonies for legal proceedings, ensuring clarity and accuracy.

- •Conducted fraud risk assessments, identifying vulnerabilities and recommending actionable improvements, which increased compliance by 40%.

- •Mentored and trained a team of four junior accountants, improving their investigative skills and boosting team efficiency by 30%.

- •Investigated financial discrepancies across various industries, successfully identifying patterns indicative of fraudulent activities.

- •Assisted legal teams in preparing financial evidence for litigation, contributing to favorable outcomes in 85% of cases.

- •Developed a forensic accounting framework that became a model for audit practices, streamlining processes by 20%.

- •Conducted compliance audits for corporate clients, ensuring adherence to accounting standards and reducing discrepancies by 35%.

- •Prepared reports for senior management detailing investigation findings and compliance risks with actionable recommendations.

- •Conducted regular audits that identified over $1M in financial misstatements due to ineffective internal controls.

- •Reviewed financial transactions and prepared reports that accurately reflected the financial standing for 10+ clients.

- •Collaborated with cross-functional teams to develop risk management strategies, enhancing audit efficiency by 15%.

- •Implemented a new auditing tool that reduced the time for audit completion by 30%, increasing client satisfaction.

- •Assisted in preparing detailed financial analysis for audits, contributing to the detection of $500,000 in discrepancies.

- •Supported senior analysts in fraud investigation cases, providing valuable insights that aided in resolution.

- •Reviewed financial records to ensure compliance with GAAP and IFRS, enhancing reporting accuracy by 20%.

- •Helped implement new financial software, improving data analysis capabilities and team productivity by 25%.

Investment Financial Accountant resume sample

- •Led a team in enhancing financial statement accuracy for investment funds, resulting in a 30% increase in compliance with regulatory standards.

- •Executed monthly reconciliations of over 50 investment accounts, leading to a 20% improvement in identifying discrepancies and maintaining accuracy.

- •Collaborated with the investment team to ensure accurate portfolio valuations, driving the alignment with accounting standards.

- •Supported audit processes by organizing detailed investment documents, decreasing audit time by 15% and increasing overall efficiency.

- •Developed a comprehensive investment accounting system, streamlining asset tracking and increasing reporting speed by 25%.

- •Drafted financial reports for stakeholders, providing variance analysis and performance reporting for efficient decision-making.

- •Analyzed investment portfolios worth $500M, enhancing compliance and identifying strategies for risk mitigation.

- •Prepared quarterly performance reports that enhanced stakeholder understanding of financial outcomes by revealing crucial variance insights.

- •Optimized investment accounting software implementation, increasing software utilization efficiency by 20%.

- •Facilitated cross-departmental communications, securing consistent updates on industry regulations, resulting in enhanced investment compliance.

- •Assisted in developing rigorous budgeting models that supported strategic investment plans, improving forecasting accuracy by 18%.

- •Managed monthly and yearly reconciliations for multiple funds, achieving an excellent compliance score in internal audits.

- •Collaborated with external auditors, efficiently providing documentation and insights, reducing audit duration by 10%.

- •Assisted in the development of new investment accounting policies, ensuring the policies aligned with updated GAAP standards.

- •Conducted detailed financial analysis resulting in accurate investment valuations and improved financial decision-making by 15%.

- •Supported senior accountants during audits, contributing to a streamlined process with a 20% decrease in departmental processing time.

- •Prepared investment fund reconciliation reports, increasing report accuracy and compliance with financial regulations by 15%.

- •Assisted in the internal review of financial transactions, identifying key discrepancies and reducing errors by 12%.

- •Developed financial models and tools to track investment assets, improving the accuracy and speed of financial analysis by 10%.

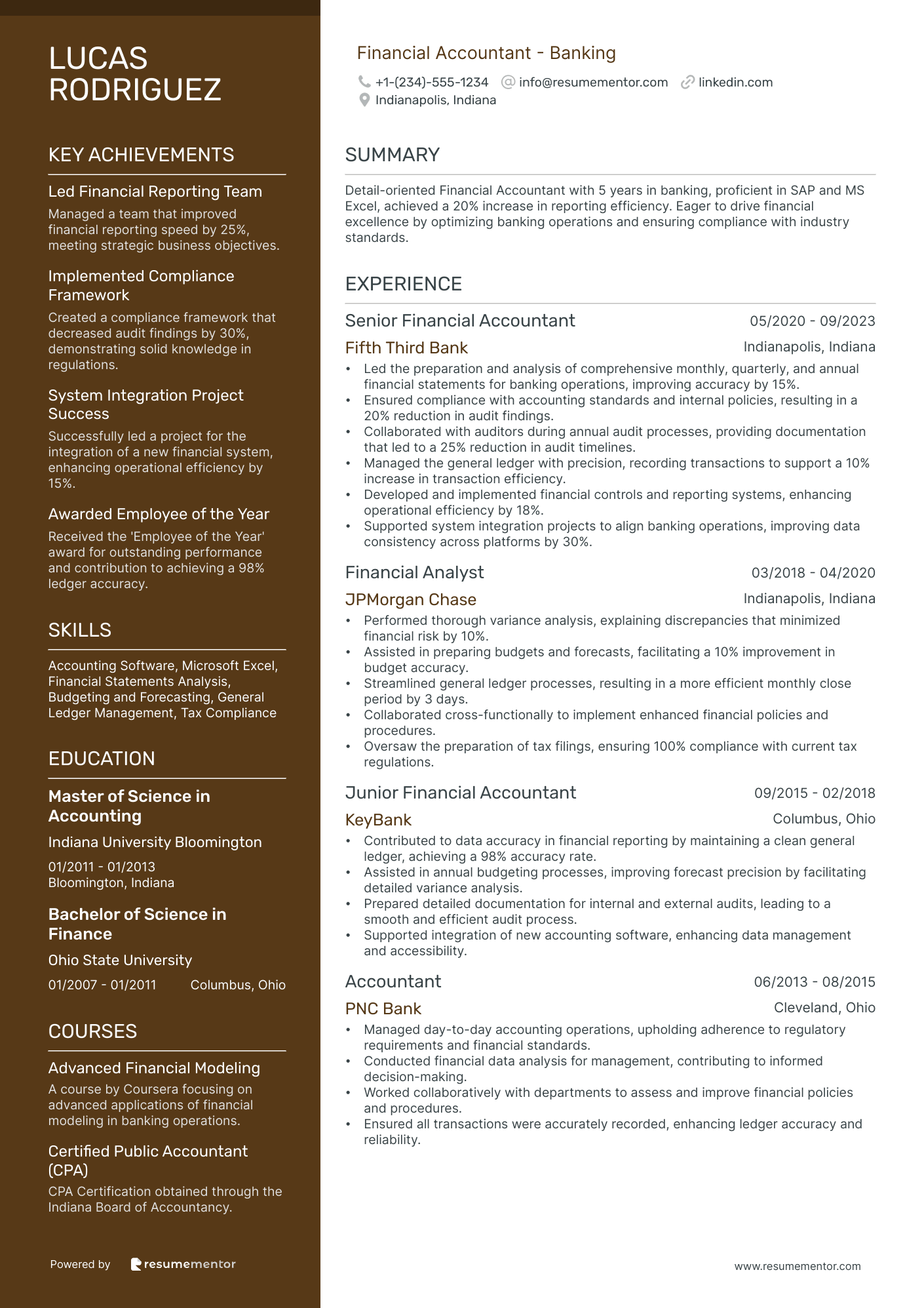

Financial Accountant - Banking resume sample

- •Led the preparation and analysis of comprehensive monthly, quarterly, and annual financial statements for banking operations, improving accuracy by 15%.

- •Ensured compliance with accounting standards and internal policies, resulting in a 20% reduction in audit findings.

- •Collaborated with auditors during annual audit processes, providing documentation that led to a 25% reduction in audit timelines.

- •Managed the general ledger with precision, recording transactions to support a 10% increase in transaction efficiency.

- •Developed and implemented financial controls and reporting systems, enhancing operational efficiency by 18%.

- •Supported system integration projects to align banking operations, improving data consistency across platforms by 30%.

- •Performed thorough variance analysis, explaining discrepancies that minimized financial risk by 10%.

- •Assisted in preparing budgets and forecasts, facilitating a 10% improvement in budget accuracy.

- •Streamlined general ledger processes, resulting in a more efficient monthly close period by 3 days.

- •Collaborated cross-functionally to implement enhanced financial policies and procedures.

- •Oversaw the preparation of tax filings, ensuring 100% compliance with current tax regulations.

- •Contributed to data accuracy in financial reporting by maintaining a clean general ledger, achieving a 98% accuracy rate.

- •Assisted in annual budgeting processes, improving forecast precision by facilitating detailed variance analysis.

- •Prepared detailed documentation for internal and external audits, leading to a smooth and efficient audit process.

- •Supported integration of new accounting software, enhancing data management and accessibility.

- •Managed day-to-day accounting operations, upholding adherence to regulatory requirements and financial standards.

- •Conducted financial data analysis for management, contributing to informed decision-making.

- •Worked collaboratively with departments to assess and improve financial policies and procedures.

- •Ensured all transactions were accurately recorded, enhancing ledger accuracy and reliability.

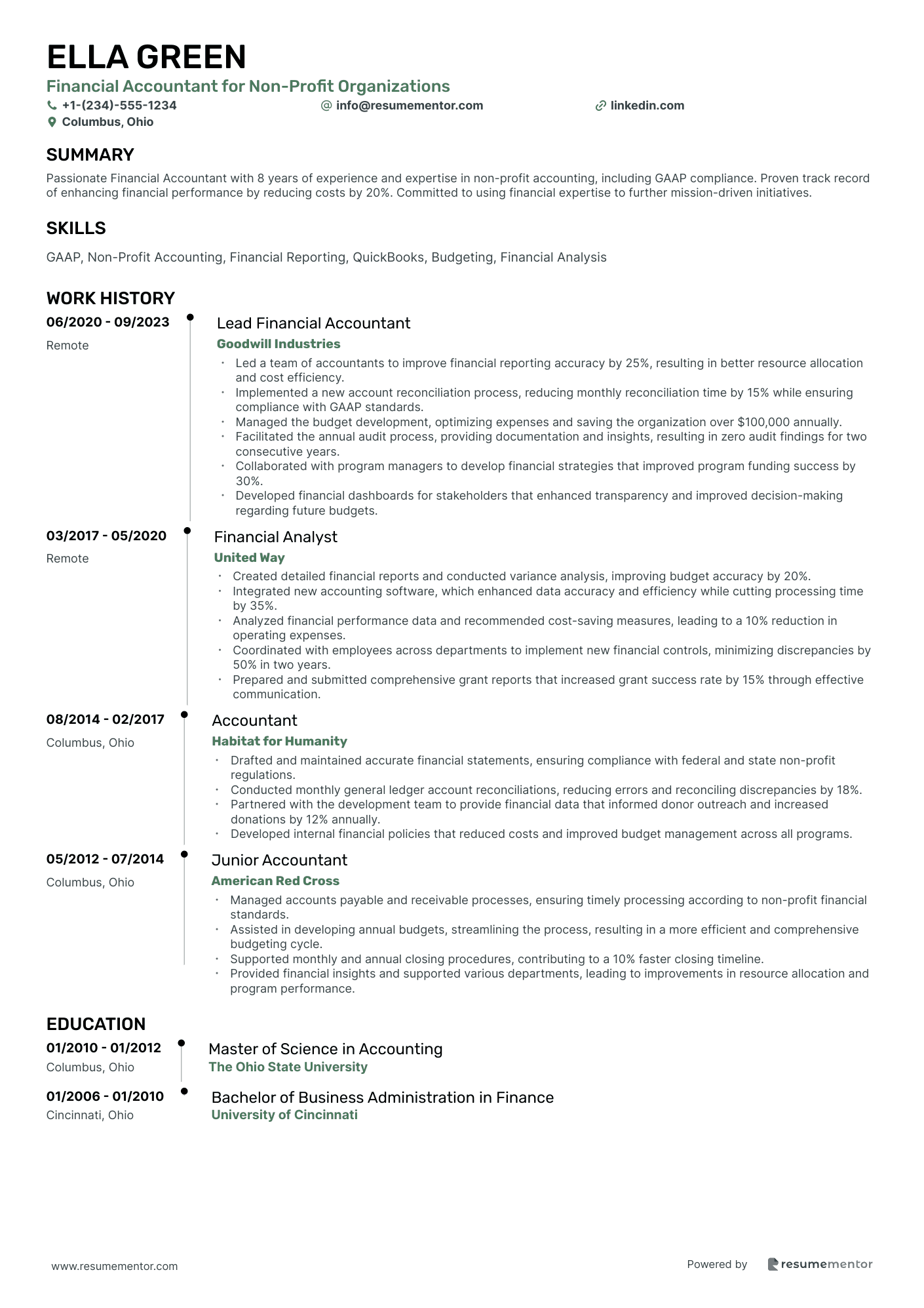

Financial Accountant for Non-Profit Organizations resume sample

- •Led a team of accountants to improve financial reporting accuracy by 25%, resulting in better resource allocation and cost efficiency.

- •Implemented a new account reconciliation process, reducing monthly reconciliation time by 15% while ensuring compliance with GAAP standards.

- •Managed the budget development, optimizing expenses and saving the organization over $100,000 annually.

- •Facilitated the annual audit process, providing documentation and insights, resulting in zero audit findings for two consecutive years.

- •Collaborated with program managers to develop financial strategies that improved program funding success by 30%.

- •Developed financial dashboards for stakeholders that enhanced transparency and improved decision-making regarding future budgets.

- •Created detailed financial reports and conducted variance analysis, improving budget accuracy by 20%.

- •Integrated new accounting software, which enhanced data accuracy and efficiency while cutting processing time by 35%.

- •Analyzed financial performance data and recommended cost-saving measures, leading to a 10% reduction in operating expenses.

- •Coordinated with employees across departments to implement new financial controls, minimizing discrepancies by 50% in two years.

- •Prepared and submitted comprehensive grant reports that increased grant success rate by 15% through effective communication.

- •Drafted and maintained accurate financial statements, ensuring compliance with federal and state non-profit regulations.

- •Conducted monthly general ledger account reconciliations, reducing errors and reconciling discrepancies by 18%.

- •Partnered with the development team to provide financial data that informed donor outreach and increased donations by 12% annually.

- •Developed internal financial policies that reduced costs and improved budget management across all programs.

- •Managed accounts payable and receivable processes, ensuring timely processing according to non-profit financial standards.

- •Assisted in developing annual budgets, streamlining the process, resulting in a more efficient and comprehensive budgeting cycle.

- •Supported monthly and annual closing procedures, contributing to a 10% faster closing timeline.

- •Provided financial insights and supported various departments, leading to improvements in resource allocation and program performance.

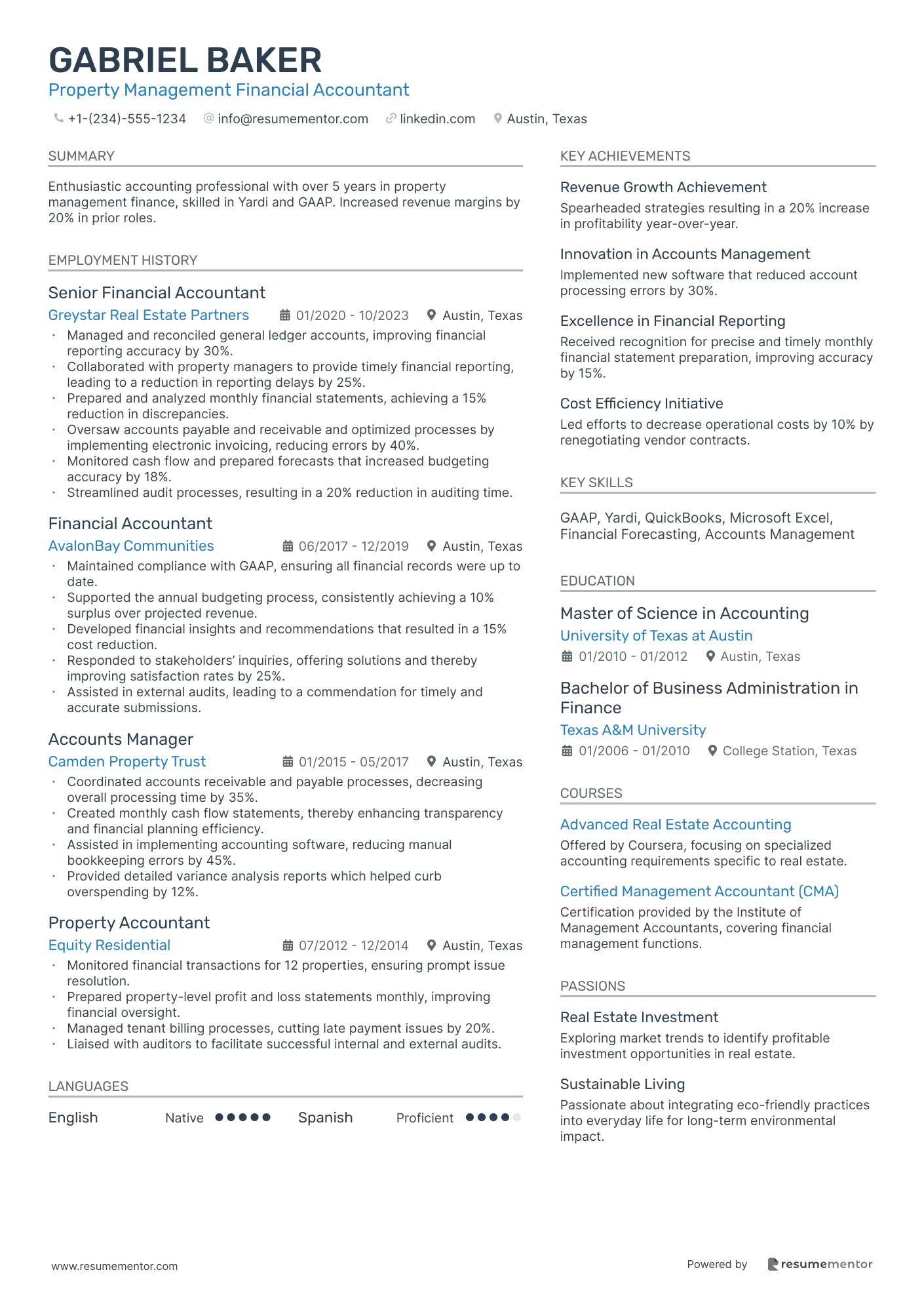

Property Management Financial Accountant resume sample

- •Managed and reconciled general ledger accounts, improving financial reporting accuracy by 30%.

- •Collaborated with property managers to provide timely financial reporting, leading to a reduction in reporting delays by 25%.

- •Prepared and analyzed monthly financial statements, achieving a 15% reduction in discrepancies.

- •Oversaw accounts payable and receivable and optimized processes by implementing electronic invoicing, reducing errors by 40%.

- •Monitored cash flow and prepared forecasts that increased budgeting accuracy by 18%.

- •Streamlined audit processes, resulting in a 20% reduction in auditing time.

- •Maintained compliance with GAAP, ensuring all financial records were up to date.

- •Supported the annual budgeting process, consistently achieving a 10% surplus over projected revenue.

- •Developed financial insights and recommendations that resulted in a 15% cost reduction.

- •Responded to stakeholders’ inquiries, offering solutions and thereby improving satisfaction rates by 25%.

- •Assisted in external audits, leading to a commendation for timely and accurate submissions.

- •Coordinated accounts receivable and payable processes, decreasing overall processing time by 35%.

- •Created monthly cash flow statements, thereby enhancing transparency and financial planning efficiency.

- •Assisted in implementing accounting software, reducing manual bookkeeping errors by 45%.

- •Provided detailed variance analysis reports which helped curb overspending by 12%.

- •Monitored financial transactions for 12 properties, ensuring prompt issue resolution.

- •Prepared property-level profit and loss statements monthly, improving financial oversight.

- •Managed tenant billing processes, cutting late payment issues by 20%.

- •Liaised with auditors to facilitate successful internal and external audits.

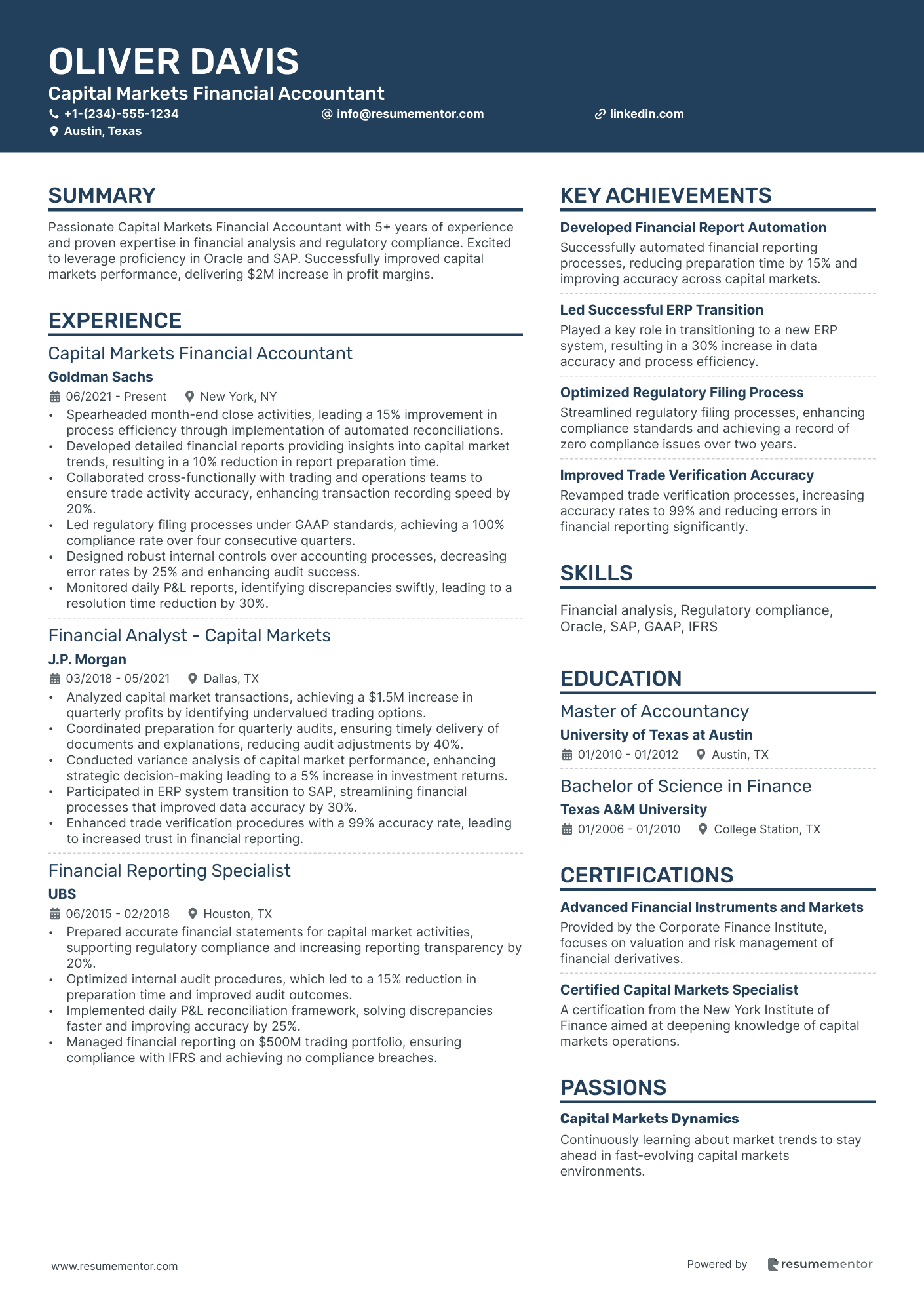

Capital Markets Financial Accountant resume sample

- •Spearheaded month-end close activities, leading a 15% improvement in process efficiency through implementation of automated reconciliations.

- •Developed detailed financial reports providing insights into capital market trends, resulting in a 10% reduction in report preparation time.

- •Collaborated cross-functionally with trading and operations teams to ensure trade activity accuracy, enhancing transaction recording speed by 20%.

- •Led regulatory filing processes under GAAP standards, achieving a 100% compliance rate over four consecutive quarters.

- •Designed robust internal controls over accounting processes, decreasing error rates by 25% and enhancing audit success.

- •Monitored daily P&L reports, identifying discrepancies swiftly, leading to a resolution time reduction by 30%.

- •Analyzed capital market transactions, achieving a $1.5M increase in quarterly profits by identifying undervalued trading options.

- •Coordinated preparation for quarterly audits, ensuring timely delivery of documents and explanations, reducing audit adjustments by 40%.

- •Conducted variance analysis of capital market performance, enhancing strategic decision-making leading to a 5% increase in investment returns.

- •Participated in ERP system transition to SAP, streamlining financial processes that improved data accuracy by 30%.

- •Enhanced trade verification procedures with a 99% accuracy rate, leading to increased trust in financial reporting.

- •Prepared accurate financial statements for capital market activities, supporting regulatory compliance and increasing reporting transparency by 20%.

- •Optimized internal audit procedures, which led to a 15% reduction in preparation time and improved audit outcomes.

- •Implemented daily P&L reconciliation framework, solving discrepancies faster and improving accuracy by 25%.

- •Managed financial reporting on $500M trading portfolio, ensuring compliance with IFRS and achieving no compliance breaches.

- •Assisted in implementing new accounting standards across divisions, ensuring seamless integration and achieving 100% compliance.

- •Analyzed financial data to identify areas for cost reductions, resulting in annual savings of $300K.

- •Developed budget forecasts by evaluating financial metrics, contributing to more accurate financial planning with a 90% forecast accuracy.

- •Collaborated with cross-departmental teams to optimize resource allocation, increasing operational efficiency by 10%.

Corporate Finance Accountant resume sample

- •Developed financial models that improved decision-making and generated a cost saving of $1.5M over two years.

- •Led a cross-functional team to optimize budget management processes, reducing cycle time by 40%.

- •Streamlined the monthly close process, which improved financial reporting speed by 30% and accuracy by 15%.

- •Implemented new financial reporting standards that ensured compliance with updated GAAP regulations.

- •Analyzed profitability reviews that identified potential revenue growth, increasing quarterly revenue by 10%.

- •Collaborated on a project that integrated innovative accounting software, enhancing reporting accuracy by 20%.

- •Prepared quarterly and annual financial statements in compliance with GAAP, improving report quality by 25%.

- •Conducted variance analysis that highlighted budget inconsistencies, leading to a year-end budget accuracy of 98%.

- •Collaborated on audits, resulting in no findings for three consecutive years, maintaining a clean audit record.

- •Analyzed cost structures, identifying inefficiencies that led to a reduction in overhead costs by $500K annually.

- •Supported financial systems integration project, resulting in a streamlined data management process.

- •Managed the preparation of detailed financial reports, reducing preparation time by 20% by implementing automated processes.

- •Conducted thorough financial reconciliation that improved data accuracy by 30% and reduced discrepancies.

- •Assisted in building comprehensive financial forecasts, promoting data-driven strategic planning company-wide.

- •Participated in the development and implementation of a new budgeting software that improved efficiency by 50%.

- •Supported month-end close process by reconciling accounts, achieving a 98% accuracy rate consistently.

- •Assisted in the development of financial forecasts, improving forecast accuracy by 15% through detailed data analysis.

- •Compiled comprehensive financial reports that facilitated informed management decisions and strategic planning.

- •Contributed to a project that enhanced internal controls, resulting in strengthened compliance and reduced risks.

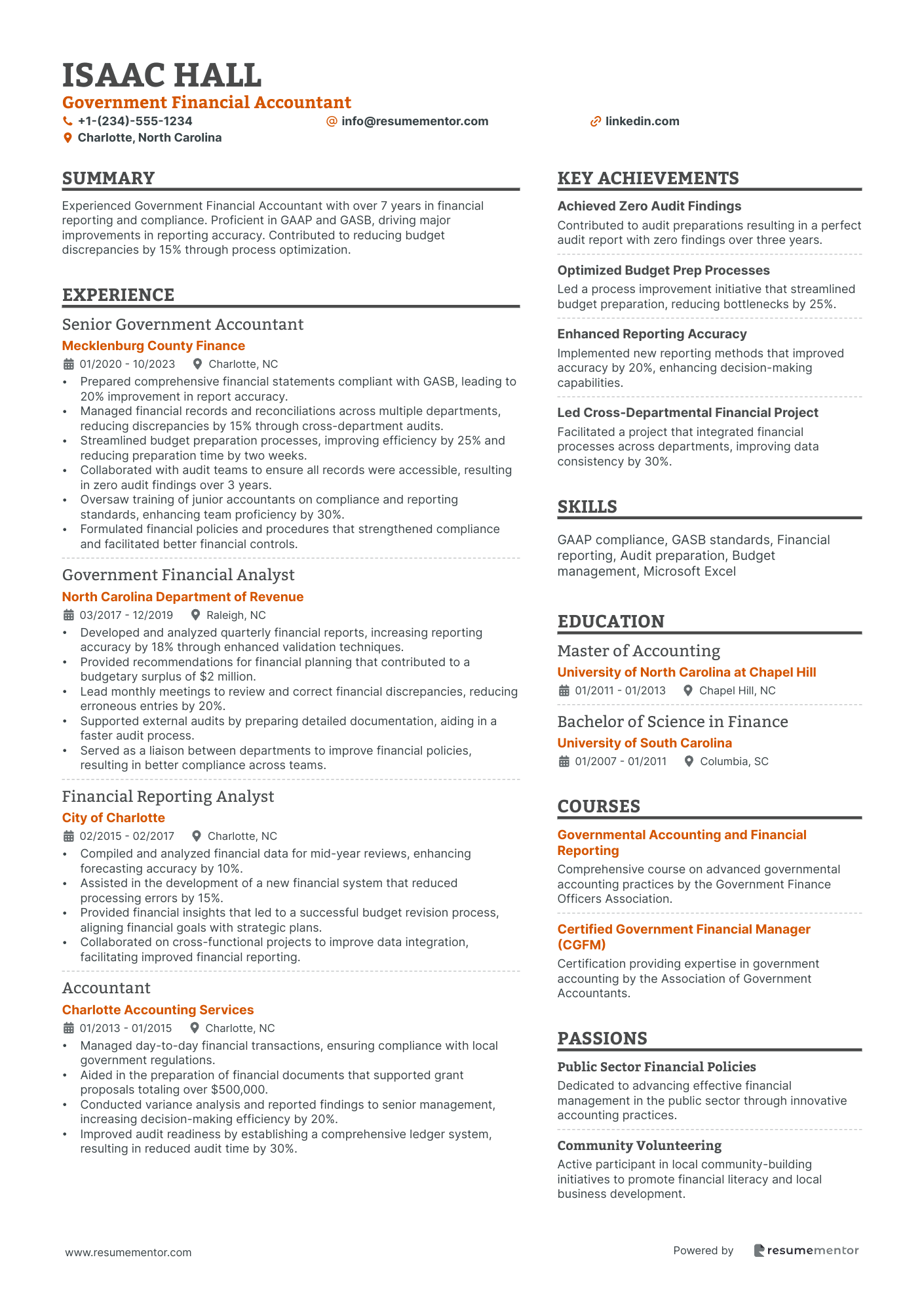

Government Financial Accountant resume sample

- •Prepared comprehensive financial statements compliant with GASB, leading to 20% improvement in report accuracy.

- •Managed financial records and reconciliations across multiple departments, reducing discrepancies by 15% through cross-department audits.

- •Streamlined budget preparation processes, improving efficiency by 25% and reducing preparation time by two weeks.

- •Collaborated with audit teams to ensure all records were accessible, resulting in zero audit findings over 3 years.

- •Oversaw training of junior accountants on compliance and reporting standards, enhancing team proficiency by 30%.

- •Formulated financial policies and procedures that strengthened compliance and facilitated better financial controls.

- •Developed and analyzed quarterly financial reports, increasing reporting accuracy by 18% through enhanced validation techniques.

- •Provided recommendations for financial planning that contributed to a budgetary surplus of $2 million.

- •Lead monthly meetings to review and correct financial discrepancies, reducing erroneous entries by 20%.

- •Supported external audits by preparing detailed documentation, aiding in a faster audit process.

- •Served as a liaison between departments to improve financial policies, resulting in better compliance across teams.

- •Compiled and analyzed financial data for mid-year reviews, enhancing forecasting accuracy by 10%.

- •Assisted in the development of a new financial system that reduced processing errors by 15%.

- •Provided financial insights that led to a successful budget revision process, aligning financial goals with strategic plans.

- •Collaborated on cross-functional projects to improve data integration, facilitating improved financial reporting.

- •Managed day-to-day financial transactions, ensuring compliance with local government regulations.

- •Aided in the preparation of financial documents that supported grant proposals totaling over $500,000.

- •Conducted variance analysis and reported findings to senior management, increasing decision-making efficiency by 20%.

- •Improved audit readiness by establishing a comprehensive ledger system, resulting in reduced audit time by 30%.

Crafting a resume as a financial accountant can feel like navigating through a jungle of numbers and qualifications. As you compile your skills and achievements, creating a cohesive resume often feels like a daunting task. Your financial expertise is your goldmine, but translating it into a compelling document that catches employers' eyes requires careful thought.

Deciding which accomplishments truly highlight your abilities can be tricky, and presenting your technical expertise in accounting can be even more challenging. This is where structure becomes critical. A well-designed resume template can serve as your compass, guiding you through the process and bringing clarity to your presentation. Consider exploring these resume templates to simplify your task.

In the competitive job market, every detail matters, and the format of your resume can make all the difference. Just like balancing a financial statement, clarity in your resume is crucial. A clear structure not only presents your value effectively but also ensures precision, making templates a valuable tool. How you tell your professional story could be the key to unlocking your next opportunity.

Key Takeaways

- Crafting a compelling financial accountant resume involves selecting the right format, utilizing modern fonts, and maintaining a clean layout to highlight your technical skills and career achievements effectively.

- An impactful resume for a financial accountant should focus on key sections: contact information, objective statement, professional experience with quantifiable achievements, education, relevant skills, and certifications.

- The reverse-chronological format is recommended, as it presents recent and significant achievements prominently, which is critical in accounting roles where continuity and recent experiences are valued.

- Incorporating skills like financial analysis and budget management, along with highlighting personal traits such as strong communication and problem-solving abilities, can enhance your resume's appeal to potential employers.

- Including additional sections like professional affiliations, continued education, or volunteer work can further distinguish your resume by demonstrating your active engagement in the field and commitment to continuous learning.

What to focus on when writing your financial accountant resume

A financial accountant resume needs to clearly communicate your skills in managing financial records, analyzing data, and ensuring compliance with regulations. By doing so, it demonstrates your ability to enhance a company's financial health, emphasizing both accuracy and attention to detail. — An effective resume begins with a well-structured format that helps recruiters quickly find the information they need.

How to structure your financial accountant resume

- Contact Information: This section should include your full name, phone number, professional email, and LinkedIn profile, ensuring that recruiters can easily reach out to you. Placing this information at the top of your resume makes it straightforward for hiring managers to contact you for the next steps.

- Objective Statement: Craft a brief statement that ties together your experience in financial accounting with your career goals, illustrating how you can add value to potential employers. Use this section to express not just what you've done, but also your enthusiasm and commitment to contributing positively to the company's financial strategy.

- Professional Experience: Here, list your previous roles in reverse chronological order. Focus on detailing your achievements in financial reporting, audit coordination, and regulatory compliance, all of which underscore your expertise. This section is crucial because it provides concrete examples of how your skills have been applied in real-world settings.

- Education: This section should mention your degree, the institution's name, and any relevant coursework or honors, which collectively demonstrate your understanding of accounting principles. Including reputable institutions and highlighting relevant coursework signals your foundational knowledge.

- Skills: Highlight specific expertise such as financial analysis, proficiency with accounting software like QuickBooks or SAP, and your knowledge of GAAP standards, making it evident that you possess the necessary technical know-how. Tailoring your skills to the job description can strengthen your appeal to recruiters.

- Certifications: Include relevant credentials like a CPA (Certified Public Accountant) or CMA (Certified Management Accountant) to reinforce your qualifications and expertise. These certifications can set you apart by showcasing a commitment to your professional development and credibility in the field.

To further distinguish your resume, consider adding sections like "Professional Affiliations" or "Continued Education," showcasing your active involvement in accounting groups or any additional courses you've completed. Now that we've covered the essentials, let's delve into each section in more detail.

Which resume format to choose

As a financial accountant, crafting the perfect resume involves selecting the right format to effectively highlight your skills and experience. The reverse-chronological format is ideal for this field because it places your most recent achievements at the forefront, making it easier for employers to recognize your career trajectory and reliability. This format is particularly valued in accounting, where continuity and recent experience can be crucial.

To enhance the visual appeal of your resume, opt for modern and readable fonts like Rubik, Montserrat, or Raleway. These fonts offer a clean and professional look, setting your resume apart from those using more traditional fonts like Arial or Times New Roman. A refined font choice subtly communicates your attention to detail and modern sensibility, both valuable traits in a financial accountant.

Saving your resume as a PDF is a best practice. This format preserves your layout no matter which device or software a potential employer uses to view it, ensuring that your information is always presented in a professional manner. Consistency and clarity are critical, especially in a detail-oriented field like accounting.

Don't overlook the importance of maintaining a clean and organized layout. Stick to 1-inch margins on all sides to create a balanced and spacious appearance. This not only makes your resume easier to read but also invites closer scrutiny of your qualifications. By blending all these elements, you'll create a resume that stands out in the competitive financial accounting landscape, effectively showcasing your abilities and professionalism.

How to write a quantifiable resume experience section

A strong financial accountant experience section centers on your achievements and the impact you've had in past roles, highlighting quantifiable results with dynamic action words. Structuring your entries in reverse chronological order lets you lead with the most relevant positions, maximizing their impact. By including up to 10-15 years of experience, you focus on roles that match your career goals, ensuring that the content aligns with what potential employers are looking for. Tailoring your resume to the job description is crucial; it involves highlighting key skills and accomplishments that resonate with the employer's needs. Kicking off each bullet point with a vibrant action verb captures attention and clearly illustrates how you’ve contributed to past successes.

- •Boosted reporting efficiency by 30% through system automation and process improvements.

- •Cut annual audit adjustments by 50% by setting up rigorous pre-audit procedures.

- •Steered a team of 4 junior accountants, raising team productivity by 20%.

- •Guided the successful integration of financial systems post-merger, trimming data discrepancies by 25%.

This experience section is effective because it goes beyond listing duties, focusing on achievements that showcase your real value. Each bullet point quantifies your impact, helping you stand out in a crowded job market. The reverse chronological order presents a clear career progression, while action words like "Boosted" and "Cut" weave a compelling story of leadership and initiative. By tailoring your resume to highlight competencies that match employer expectations, you ensure that your output aligns with what they value, making your resume not just a list of past roles, but a demonstration of what you can achieve moving forward.

Training and Development Focused resume experience section

A training and development-focused financial accountant resume experience section should effectively showcase how you have enhanced the skills and knowledge of your team in this area. Start by describing the projects or initiatives where you were instrumental in training team members, updating training materials, or streamlining onboarding processes. It's important to emphasize the direct impact of these efforts, such as improved accuracy, increased efficiency, or a better understanding of financial systems. By using action words and specific metrics, you can clearly demonstrate the value of your contributions.

In detailing your role, mention how you developed new training programs or facilitated workshops and webinars. Highlight innovative methods, like digital tools or interactive sessions, which you used to engage your audience. Ensure each bullet point illustrates how your efforts translated into measurable outcomes. Including success stories and detailed examples will help make your resume stand out, appealing to employers in search of your expertise in both finance and employee development.

Training and Development Specialist

ABC Financial Services

January 2020 - Present

- Led the development of a new training program that improved the accuracy of financial reporting by 30%.

- Delivered monthly workshops to enhance team knowledge, increasing process efficiency by 25%.

- Collaborated with leadership to revamp onboarding processes, reducing new hire training time by 20%.

- Created interactive e-learning modules that improved understanding of financial principles among 50 employees.

Skills-Focused resume experience section

A skills-focused financial accountant resume experience section should showcase expertise and accomplishments relevant to the job you desire. Start by highlighting the specific skills you've honed in previous roles, demonstrating your capability to handle similar tasks in the future. It's crucial to focus on achievements and outcomes that reflect your proficiency, using clear language and quantifying your impact with numbers when possible. Each bullet point should be directly tied to essential skills needed in financial accounting, providing a cohesive picture of your abilities.

In your experience section, link each role to the skills it helped you develop, creating a narrative of growth and capability. Rather than listing generic responsibilities, communicate how your actions drove important results. Each bullet point should illustrate the effective application of your skills to yield significant outcomes. This approach ensures that potential employers can easily see how your past experiences align with the skills required for the role you're pursuing.

Senior Accountant

XYZ Corp

June 2018 - Present

- Prepared monthly, quarterly, and annual financial statements, enhancing financial transparency by 20%.

- Streamlined accounting processes, reducing month-end closing time by 30%.

- Collaborated with teams to develop budgets, improving accuracy by 15% compared to previous years.

- Managed audits successfully, resulting in zero non-compliance findings over three consecutive years.

Leadership-Focused resume experience section

A Leadership-Focused financial accountant resume experience section should paint a clear picture of your ability to lead teams or projects effectively. Start by sharing instances where you inspired your team and drove efficiency or performance. Use numbers to highlight the tangible impact of your leadership, such as time or budget efficiencies achieved. Build on this by describing specific strategies or tools that were instrumental in your success, and don't forget to mention any accolades received for your leadership efforts.

When detailing your experiences, begin each bullet point with a strong action verb and center on your achievements rather than just your responsibilities. Offer a variety of leadership experiences, such as managing audits, spearheading financial analysis, or mentoring team members, to show the breadth of your skills. Tailor each example to reflect your unique leadership style and accomplishments, keeping in mind that potential employers are eager to see how your leadership can directly benefit their organization.

Senior Financial Accountant

Oceanic Financial Solutions

June 2018 - September 2023

- Led a team of 10 accountants to successfully manage a quarterly budget of $1.5 million, resulting in a 15% cost saving.

- Implemented a new financial reporting system that decreased error rates by 20% and increased reporting speed by 25%.

- Mentored junior staff, leading to a 30% increase in their productivity and a promotion for two team members within a year.

- Coordinated cross-departmental meetings to enhance collaboration, improving communication and project delivery by 35%.

Growth-Focused resume experience section

A growth-focused financial accountant resume experience section should highlight your impact on company success by demonstrating your role in driving financial growth and improvements. Start with a clear timeline of your roles and highlight achievements that reflect your expertise in financial analysis and strategy. Emphasize how you enhanced financial efficiencies and supported successful initiatives by analyzing data to guide decision-making. Your experience should show a balance between managing routine tasks and making substantial contributions to the organization’s financial health.

To make your accomplishments stand out, use active language and quantify your impact whenever possible. Describe initiatives you led to improve processes, reporting accuracy, or achieve significant financial savings. This will paint a picture of your proven ability to support and drive company growth, offering potential employers a glimpse of your potential contributions.

Senior Financial Accountant

ABC Financial Services

Jan 2020 - Present

- Led financial analysis that increased company profits by 15% through optimized expense management.

- Implemented budget tracking systems, boosting forecasting accuracy by 20%.

- Analyzed quarterly reports to identify cost reduction areas, saving $50,000 annually.

- Developed financial models supporting strategic decisions, driving a 25% growth in revenue.

Write your financial accountant resume summary section

A detail-focused financial accountant resume summary should effectively showcase your expertise and achievements in a way that catches a potential employer’s attention. This summary is your chance to quickly communicate why you’re the best fit for the job by emphasizing your top credentials. Highlight technical skills, key accomplishments, and personal traits that align with what the employer is seeking. For example:

In this example, you clearly articulate your years of experience, pinpoint tangible achievements, and emphasize both technical expertise and personal qualities that resonate with the role. When describing yourself, it’s crucial to concentrate on achievements and skills that distinguish you and align with the job description. Understanding the differences between various resume sections can help refine your approach. A resume summary provides a snapshot of your career, making it perfect for experienced professionals. A resume objective, meanwhile, focuses on career goals, often used by those starting out. Combining elements of both, a resume profile allows for more detailed storytelling. A summary of qualifications zeroes in on specific skills tailored to job requirements. Shape this section to reflect your experience level and the role you’re targeting.

Listing your financial accountant skills on your resume

A skills-focused financial accountant resume should effectively showcase both your technical abilities and personal strengths. You can choose to have a dedicated skills section or seamlessly incorporate your skills into your work experience and summary to create a cohesive narrative. Highlighting strengths such as a keen eye for detail or an analytical mindset complements essential soft skills like communication and teamwork. This approach paints a comprehensive picture of your capabilities.

Hard skills are crucial because they demonstrate your technical proficiency, such as expertise in accounting software or financial analysis. Including a mix of the right skills and strengths enriches your resume with keywords. These keywords are crucial because applicant tracking systems (ATS) often use them to sort through applications. This strategy increases the likelihood that your resume will catch the eye of hiring managers.

Here's an example of a well-crafted standalone skills section that achieves this balance:

This example works well because it focuses on skills that are directly relevant to a financial accountant, ensuring the section is rich with meaningful content that recruiters can quickly assess. Having specific skills instead of generic ones makes this section particularly effective.

Best hard skills to feature on your financial accountant resume

Financial accountants rely on particular hard skills to handle complex tasks efficiently. These skills illustrate your competency with industry-specific tools and standards, allowing you to perform your role with precision.

Hard Skills

- Financial Analysis

- Budget Management

- Generally Accepted Accounting Principles (GAAP)

- Tax Planning and Preparation

- Auditing

- Advanced Microsoft Excel

- SAP ERP

- QuickBooks Proficiency

- Financial Reporting

- Internal Controls

- Risk Management

- Forecasting

- Account Reconciliation

- Regulatory Compliance

- Data Entry Speed and Accuracy

Best soft skills to feature on your financial accountant resume

While technical know-how is critical, soft skills are equally important for a financial accountant. These skills highlight your ability to work collaboratively, solve problems effectively, and contribute positively to your team dynamics, reflecting how you interact within a workplace setting.

Soft Skills

- Attention to Detail

- Strong Communication

- Problem-Solving

- Time Management

- Adaptability

- Critical Thinking

- Teamwork

- Ethical Judgment

- Dependability

- Stress Management

- Negotiation Skills

- Decision-Making

- Organizational Skills

- Initiative

- Interpersonal Skills

How to include your education on your resume

The education section of your financial accountant resume is crucial. It highlights your academic achievements and shows you're qualified for the job. Tailor your education section to the job you're applying for. Only include education that's relevant to the position. You don't need to list every course or degree if it doesn't matter to the role.

To include your GPA, it's best to do so if it's 3.5 or higher. Mention "cum laude" honors if you graduated with them. When listing a degree, include the degree type, name of the institution, and the date range. Avoid clutter by keeping this section straightforward.

Here's an incorrect example of an education section:

A correct example looks like this:

This example is effective because it directly relates to the financial accountant role. It includes a strong GPA and a relevant degree. Showing these achievements helps you stand out as a candidate. It keeps the information concise and focused, which hiring managers appreciate.

How to include financial accountant certificates on your resume

Including a certificates section in your financial accountant resume is crucial. Certificates showcase your specialized skills and knowledge. They can also be placed in the header for easy visibility.

List the name of each certificate, include the date you obtained it, and add the issuing organization. This clearly highlights your qualifications and keeps your resume organized.

A good standalone certificates section might look like this:

This example works well because it shows relevant credentials that are recognized in the industry. Both certificates are issued by reputable organizations, aiding in the credibility of your skills.

Extra sections to include in your financial accountant resume

Crafting a winning resume for a financial accountant involves more than just listing your work experience and skills. Adding sections that highlight your language skills, hobbies, volunteer work, and the books you've read can make your resume stand out.

- Language section — Show your multilingual skills to impress employers and demonstrate cultural awareness and adaptability. Listing languages you speak also indicates effective communication skills in diverse business settings.

- Hobbies and interests section — Share your hobbies to showcase a well-rounded personality and interests that align with company culture. Including hobbies related to finance, like investment clubs, adds relevance.

- Volunteer work section — Highlight volunteer work to show your commitment to social causes and your ability to manage tasks outside of professional duties. Volunteering in financial roles or community service also underscores a strong sense of ethics and responsibility.

- Books section — Mention books you've read that are related to finance or personal development to show your continuous learning and passion for the field. This section can reveal your dedication to staying current with industry trends.

In Conclusion

In conclusion, building an impressive financial accountant resume involves carefully highlighting your achievements and skills while ensuring clarity and precision. By using a structured template, you can guide potential employers through your professional story in a clear and organized way. Your resume should focus on showcasing your ability to manage financial records, analyze data, and ensure compliance, all of which are essential traits of a successful financial accountant.

Choosing the right format is crucial, with the reverse-chronological approach often being the most effective. It ensures your most recent accomplishments are prominently displayed, reflecting your development and reliability. Incorporate quantifiable achievements to demonstrate your impact effectively, using action words to engage potential employers. Remember to tailor your resume to each job application by aligning your experiences and skills with the job description, increasing your chances of standing out.

Your education and certifications sections play a significant role in showcasing your qualifications. Including relevant degrees and prestigious certifications highlights your commitment to continuous learning and sets you apart in a competitive job market. Additionally, extra sections like language skills, volunteer work, and hobbies can enrich your resume by adding depth and showing character traits that hiring managers value.

Maintaining a clean and organized resume layout preserves its readability, while selecting modern and professional fonts can subtly convey your attention to detail. Finally, saving your resume as a PDF ensures the format remains intact, presenting your information professionally across all devices. By strategically crafting each component, your resume becomes not just a reflection of your career history, but a tool that opens doors to new opportunities in the financial accounting field.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.