Financial Advisor Resume Examples

Jul 18, 2024

|

12 min read

Craft a winning financial advisor resume that wows employers and secures your next role in finance. Discover essential tips, key skills, and common mistakes to avoid to maximize your potential in this competitive field.

Rated by 348 people

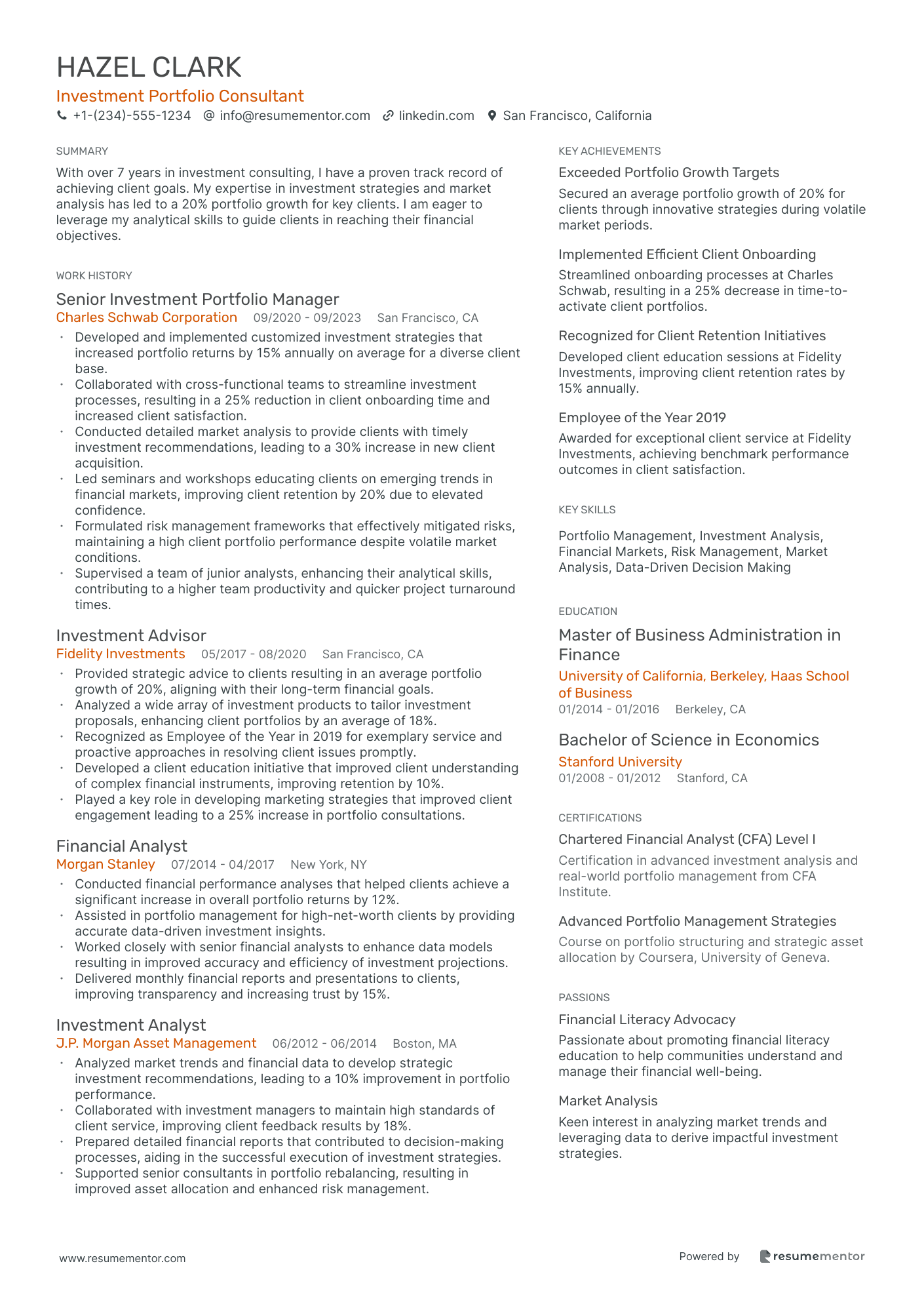

Investment Portfolio Consultant

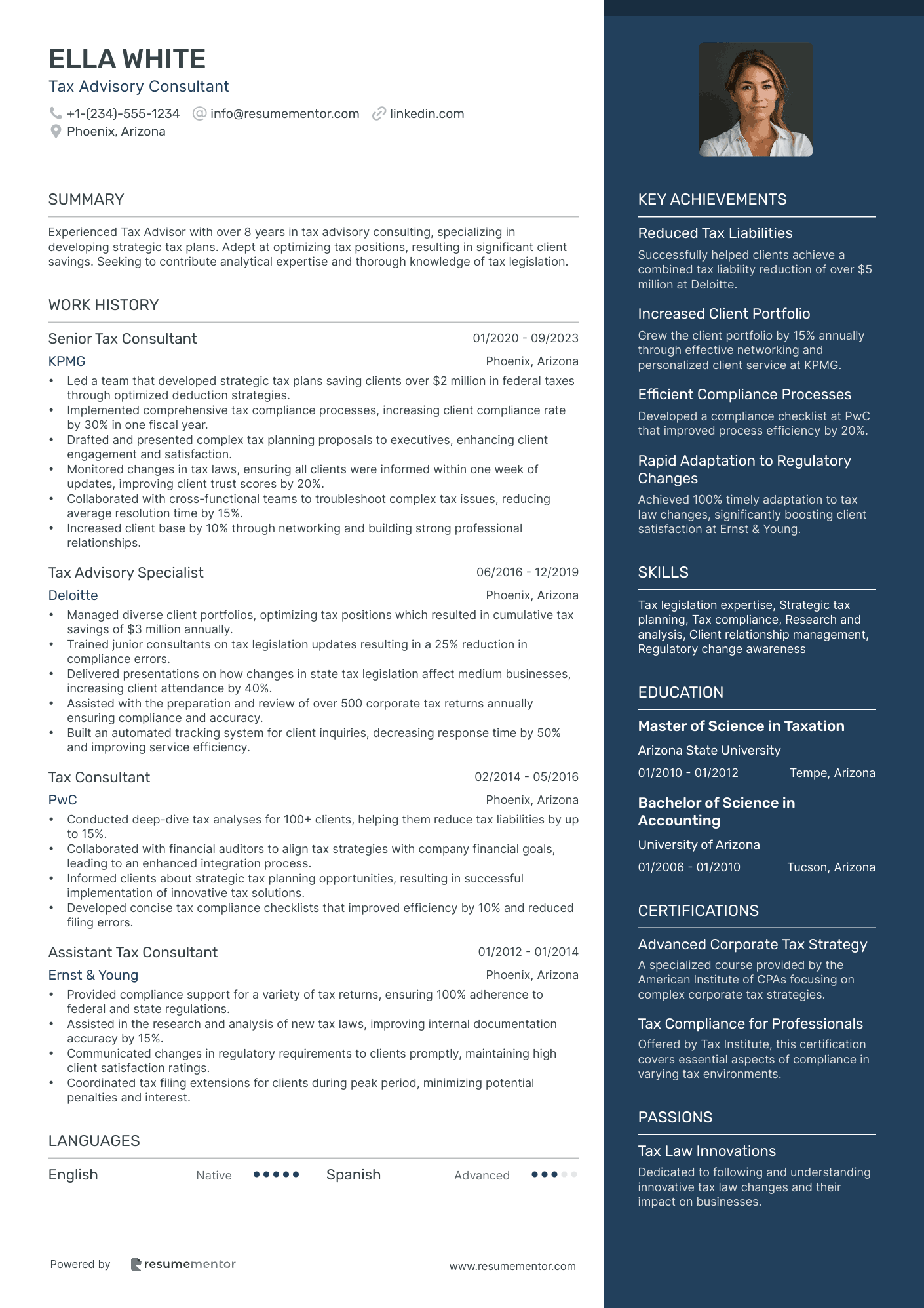

Tax Advisory Consultant

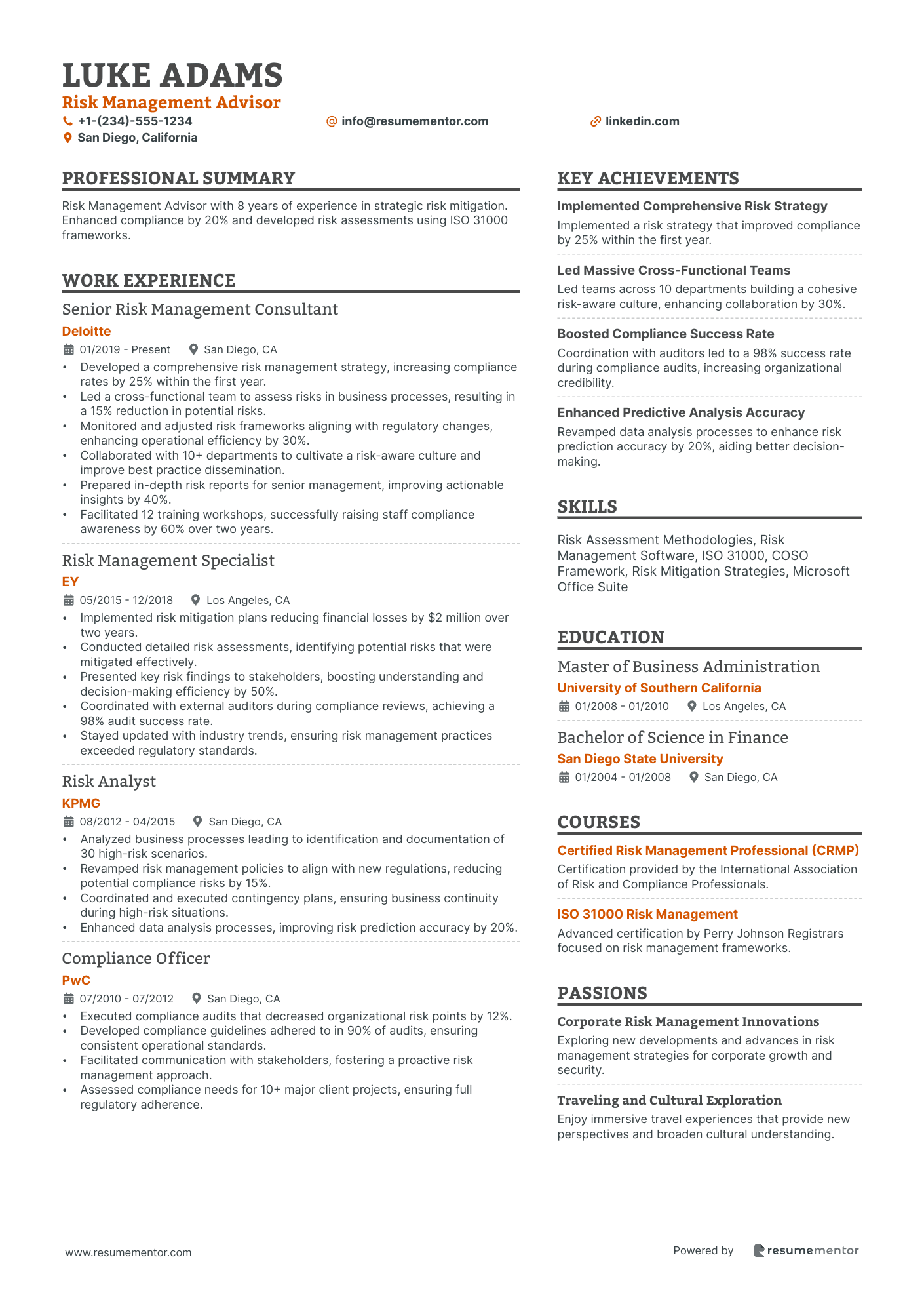

Risk Management Advisor

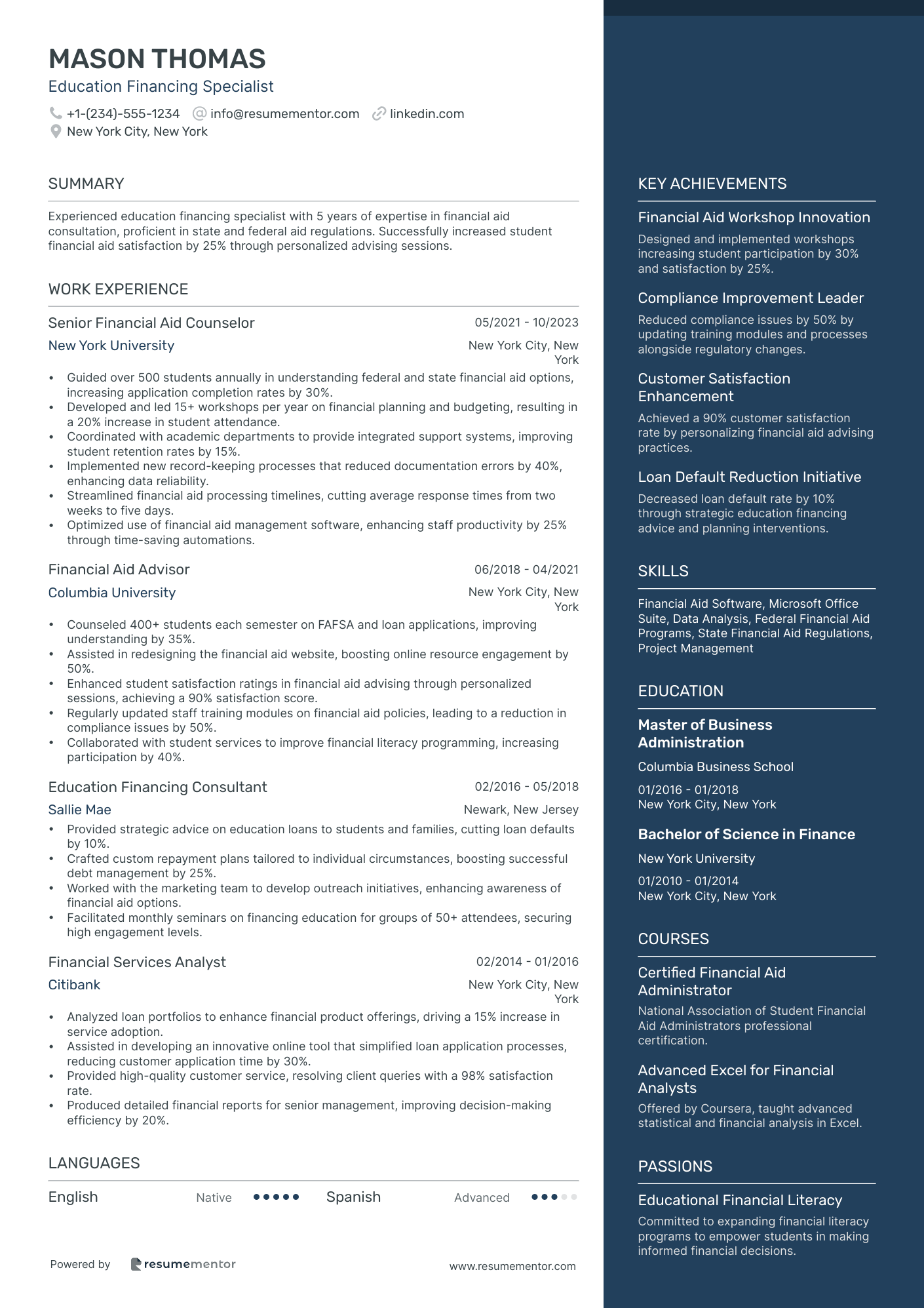

Education Financing Specialist

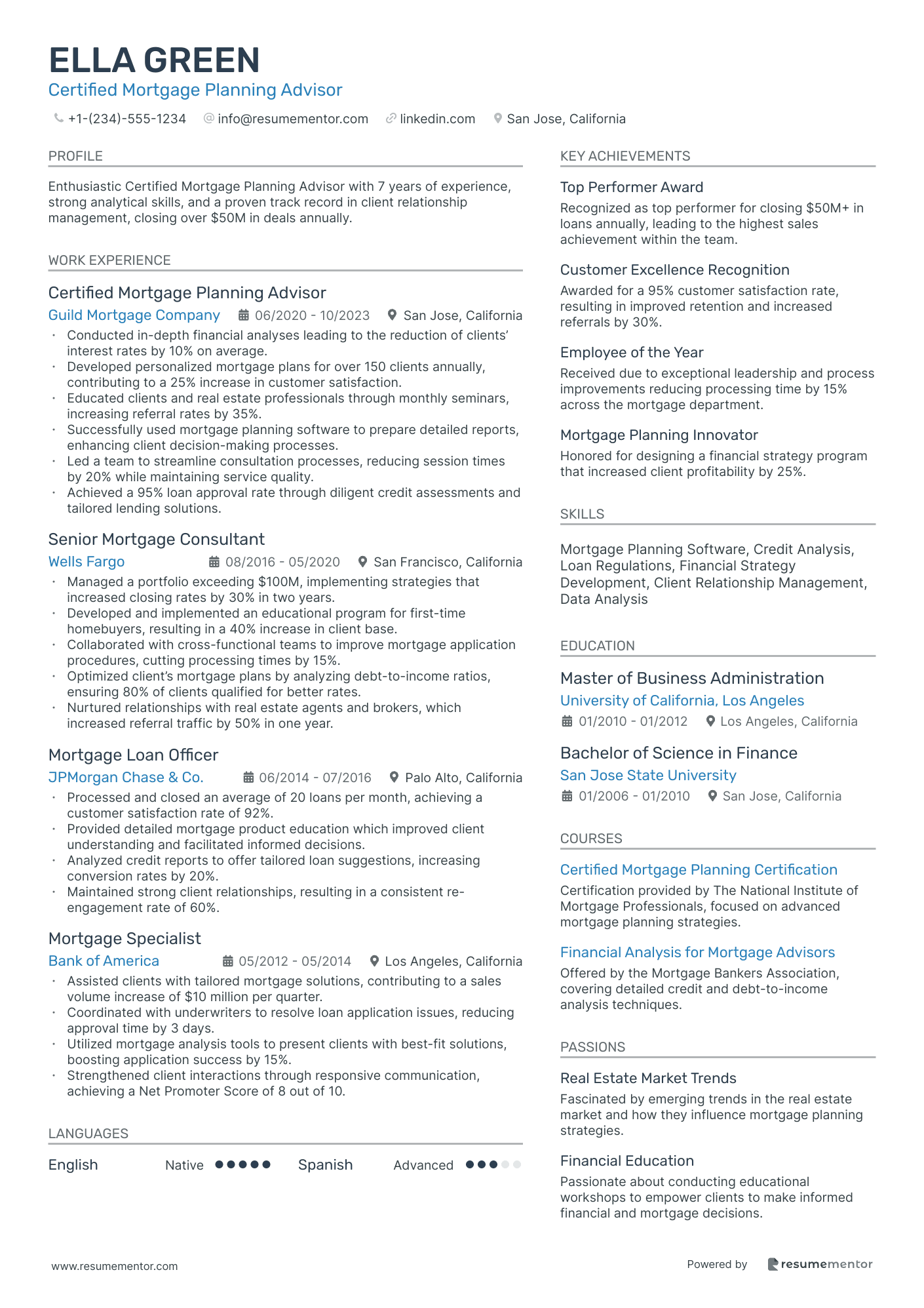

Certified Mortgage Planning Advisor

Investment Portfolio Consultant resume sample

- •Developed and implemented customized investment strategies that increased portfolio returns by 15% annually on average for a diverse client base.

- •Collaborated with cross-functional teams to streamline investment processes, resulting in a 25% reduction in client onboarding time and increased client satisfaction.

- •Conducted detailed market analysis to provide clients with timely investment recommendations, leading to a 30% increase in new client acquisition.

- •Led seminars and workshops educating clients on emerging trends in financial markets, improving client retention by 20% due to elevated confidence.

- •Formulated risk management frameworks that effectively mitigated risks, maintaining a high client portfolio performance despite volatile market conditions.

- •Supervised a team of junior analysts, enhancing their analytical skills, contributing to a higher team productivity and quicker project turnaround times.

- •Provided strategic advice to clients resulting in an average portfolio growth of 20%, aligning with their long-term financial goals.

- •Analyzed a wide array of investment products to tailor investment proposals, enhancing client portfolios by an average of 18%.

- •Recognized as Employee of the Year in 2019 for exemplary service and proactive approaches in resolving client issues promptly.

- •Developed a client education initiative that improved client understanding of complex financial instruments, improving retention by 10%.

- •Played a key role in developing marketing strategies that improved client engagement leading to a 25% increase in portfolio consultations.

- •Conducted financial performance analyses that helped clients achieve a significant increase in overall portfolio returns by 12%.

- •Assisted in portfolio management for high-net-worth clients by providing accurate data-driven investment insights.

- •Worked closely with senior financial analysts to enhance data models resulting in improved accuracy and efficiency of investment projections.

- •Delivered monthly financial reports and presentations to clients, improving transparency and increasing trust by 15%.

- •Analyzed market trends and financial data to develop strategic investment recommendations, leading to a 10% improvement in portfolio performance.

- •Collaborated with investment managers to maintain high standards of client service, improving client feedback results by 18%.

- •Prepared detailed financial reports that contributed to decision-making processes, aiding in the successful execution of investment strategies.

- •Supported senior consultants in portfolio rebalancing, resulting in improved asset allocation and enhanced risk management.

Tax Advisory Consultant resume sample

- •Led a team that developed strategic tax plans saving clients over $2 million in federal taxes through optimized deduction strategies.

- •Implemented comprehensive tax compliance processes, increasing client compliance rate by 30% in one fiscal year.

- •Drafted and presented complex tax planning proposals to executives, enhancing client engagement and satisfaction.

- •Monitored changes in tax laws, ensuring all clients were informed within one week of updates, improving client trust scores by 20%.

- •Collaborated with cross-functional teams to troubleshoot complex tax issues, reducing average resolution time by 15%.

- •Increased client base by 10% through networking and building strong professional relationships.

- •Managed diverse client portfolios, optimizing tax positions which resulted in cumulative tax savings of $3 million annually.

- •Trained junior consultants on tax legislation updates resulting in a 25% reduction in compliance errors.

- •Delivered presentations on how changes in state tax legislation affect medium businesses, increasing client attendance by 40%.

- •Assisted with the preparation and review of over 500 corporate tax returns annually ensuring compliance and accuracy.

- •Built an automated tracking system for client inquiries, decreasing response time by 50% and improving service efficiency.

- •Conducted deep-dive tax analyses for 100+ clients, helping them reduce tax liabilities by up to 15%.

- •Collaborated with financial auditors to align tax strategies with company financial goals, leading to an enhanced integration process.

- •Informed clients about strategic tax planning opportunities, resulting in successful implementation of innovative tax solutions.

- •Developed concise tax compliance checklists that improved efficiency by 10% and reduced filing errors.

- •Provided compliance support for a variety of tax returns, ensuring 100% adherence to federal and state regulations.

- •Assisted in the research and analysis of new tax laws, improving internal documentation accuracy by 15%.

- •Communicated changes in regulatory requirements to clients promptly, maintaining high client satisfaction ratings.

- •Coordinated tax filing extensions for clients during peak period, minimizing potential penalties and interest.

Risk Management Advisor resume sample

- •Developed a comprehensive risk management strategy, increasing compliance rates by 25% within the first year.

- •Led a cross-functional team to assess risks in business processes, resulting in a 15% reduction in potential risks.

- •Monitored and adjusted risk frameworks aligning with regulatory changes, enhancing operational efficiency by 30%.

- •Collaborated with 10+ departments to cultivate a risk-aware culture and improve best practice dissemination.

- •Prepared in-depth risk reports for senior management, improving actionable insights by 40%.

- •Facilitated 12 training workshops, successfully raising staff compliance awareness by 60% over two years.

- •Implemented risk mitigation plans reducing financial losses by $2 million over two years.

- •Conducted detailed risk assessments, identifying potential risks that were mitigated effectively.

- •Presented key risk findings to stakeholders, boosting understanding and decision-making efficiency by 50%.

- •Coordinated with external auditors during compliance reviews, achieving a 98% audit success rate.

- •Stayed updated with industry trends, ensuring risk management practices exceeded regulatory standards.

- •Analyzed business processes leading to identification and documentation of 30 high-risk scenarios.

- •Revamped risk management policies to align with new regulations, reducing potential compliance risks by 15%.

- •Coordinated and executed contingency plans, ensuring business continuity during high-risk situations.

- •Enhanced data analysis processes, improving risk prediction accuracy by 20%.

- •Executed compliance audits that decreased organizational risk points by 12%.

- •Developed compliance guidelines adhered to in 90% of audits, ensuring consistent operational standards.

- •Facilitated communication with stakeholders, fostering a proactive risk management approach.

- •Assessed compliance needs for 10+ major client projects, ensuring full regulatory adherence.

Education Financing Specialist resume sample

- •Guided over 500 students annually in understanding federal and state financial aid options, increasing application completion rates by 30%.

- •Developed and led 15+ workshops per year on financial planning and budgeting, resulting in a 20% increase in student attendance.

- •Coordinated with academic departments to provide integrated support systems, improving student retention rates by 15%.

- •Implemented new record-keeping processes that reduced documentation errors by 40%, enhancing data reliability.

- •Streamlined financial aid processing timelines, cutting average response times from two weeks to five days.

- •Optimized use of financial aid management software, enhancing staff productivity by 25% through time-saving automations.

- •Counseled 400+ students each semester on FAFSA and loan applications, improving understanding by 35%.

- •Assisted in redesigning the financial aid website, boosting online resource engagement by 50%.

- •Enhanced student satisfaction ratings in financial aid advising through personalized sessions, achieving a 90% satisfaction score.

- •Regularly updated staff training modules on financial aid policies, leading to a reduction in compliance issues by 50%.

- •Collaborated with student services to improve financial literacy programming, increasing participation by 40%.

- •Provided strategic advice on education loans to students and families, cutting loan defaults by 10%.

- •Crafted custom repayment plans tailored to individual circumstances, boosting successful debt management by 25%.

- •Worked with the marketing team to develop outreach initiatives, enhancing awareness of financial aid options.

- •Facilitated monthly seminars on financing education for groups of 50+ attendees, securing high engagement levels.

- •Analyzed loan portfolios to enhance financial product offerings, driving a 15% increase in service adoption.

- •Assisted in developing an innovative online tool that simplified loan application processes, reducing customer application time by 30%.

- •Provided high-quality customer service, resolving client queries with a 98% satisfaction rate.

- •Produced detailed financial reports for senior management, improving decision-making efficiency by 20%.

Certified Mortgage Planning Advisor resume sample

- •Conducted in-depth financial analyses leading to the reduction of clients’ interest rates by 10% on average.

- •Developed personalized mortgage plans for over 150 clients annually, contributing to a 25% increase in customer satisfaction.

- •Educated clients and real estate professionals through monthly seminars, increasing referral rates by 35%.

- •Successfully used mortgage planning software to prepare detailed reports, enhancing client decision-making processes.

- •Led a team to streamline consultation processes, reducing session times by 20% while maintaining service quality.

- •Achieved a 95% loan approval rate through diligent credit assessments and tailored lending solutions.

- •Managed a portfolio exceeding $100M, implementing strategies that increased closing rates by 30% in two years.

- •Developed and implemented an educational program for first-time homebuyers, resulting in a 40% increase in client base.

- •Collaborated with cross-functional teams to improve mortgage application procedures, cutting processing times by 15%.

- •Optimized client’s mortgage plans by analyzing debt-to-income ratios, ensuring 80% of clients qualified for better rates.

- •Nurtured relationships with real estate agents and brokers, which increased referral traffic by 50% in one year.

- •Processed and closed an average of 20 loans per month, achieving a customer satisfaction rate of 92%.

- •Provided detailed mortgage product education which improved client understanding and facilitated informed decisions.

- •Analyzed credit reports to offer tailored loan suggestions, increasing conversion rates by 20%.

- •Maintained strong client relationships, resulting in a consistent re-engagement rate of 60%.

- •Assisted clients with tailored mortgage solutions, contributing to a sales volume increase of $10 million per quarter.

- •Coordinated with underwriters to resolve loan application issues, reducing approval time by 3 days.

- •Utilized mortgage analysis tools to present clients with best-fit solutions, boosting application success by 15%.

- •Strengthened client interactions through responsive communication, achieving a Net Promoter Score of 8 out of 10.

Creating a compelling financial advisor resume is like crafting a detailed financial plan for your clients, where each section builds toward a cohesive narrative. As a financial advisor, capturing the depth of your expertise and dedication to clients in a clear, concise format is essential to this narrative. Your strong analytical skills and strategic planning ability are your assets, but expressing them on paper requires careful attention.

A resume template can make this process smoother, giving you a structured layout to weave your qualifications and experiences into a compelling story. With a template, you can highlight key skills like investment strategies and risk management in an organized manner, ensuring nothing gets lost in translation.

Connecting your financial expertise to real-world client benefits is crucial. Your resume should paint a picture of how you assess risk, navigate financial markets, and create tailored solutions for clients. This demonstrates not just your skills but your role in guiding clients toward financial stability with trust and transparency.

By crafting a well-organized resume, you showcase your professionalism and attention to detail—qualities your clients expect in a trusted advisor. Through clear communication and proven results, you distinguish yourself from other candidates. Your resume becomes more than a document; it becomes a testament to your career's impact. Prepare to present your best self with a resume that effectively captures your financial insight and dedication.

Key Takeaways

- A financial advisor resume should clearly present contact information, a professional summary, detailed work experience, education, skills, and achievements to highlight your expertise effectively.

- Utilizing a chronological format and including quantifiable experiences with action verbs will enhance your resume's impact by showcasing career progression and tangible contributions.

- Highlighting your technical skills, like financial analysis and investment strategies, alongside soft skills, such as communication and problem-solving, demonstrates your comprehensive capabilities.

- Education and certifications should be relevant and accurately detailed to validate your expertise and commitment to the field of financial advising.

- Additional sections, like language skills and volunteer work, can differentiate you by showcasing your personality, continuous learning, and community involvement.

What to focus on when writing your financial advisor resume

A financial advisor resume should convey your ability to manage and grow clients' wealth effectively, showcasing your financial expertise, client relations skills, and a proven track record of success. Begin with clear Contact Information—your name, phone number, email, and LinkedIn profile should stand out to ensure easy access for recruiters. A well-crafted Professional Summary can provide a compelling snapshot of your experience in financial planning and client satisfaction, emphasizing your value from the outset. Describe your Work Experience by focusing on key roles you've held, like asset management, retirement planning, or investment advising, to illustrate your hands-on expertise in the field. Your Education section should include your degree in finance or a related field, as well as essential certifications like CFP or Series 7, demonstrating your commitment to staying informed and certified. In the Skills section, highlight specific strengths such as investment strategy, risk management, and financial forecasting, tying these abilities directly to success in financial advising. Use concrete Achievements to underscore your background by presenting quantifiable successes, such as portfolio growth percentages or the number of clients acquired. To round out this overview, consider including optional sections like "Languages" or "Volunteer Experience" that highlight additional skills or your involvement in the community. This guide on building a comprehensive financial advisor resume will now focus on the essential sections in greater depth.

How to structure your financial advisor resume

- Contact Information

- Professional Summary

- Work Experience

- Education

- Skills

- Achievements

Which resume format to choose

Crafting a financial advisor resume becomes straightforward with the right approach. Choosing a chronological format is key, as it effectively showcases your experience and career progression, helping potential employers see your stability and growth in the financial industry.

To make your resume visually appealing, select modern fonts like Lato, Raleway, or Montserrat. These fonts offer a professional look while maintaining readability, subtly setting your resume apart from others that may rely on more traditional choices like Arial or Times New Roman.

Saving your resume as a PDF is a crucial step. This ensures that your formatting remains consistent, no matter what device or platform it's viewed on, reflecting the precise and organized nature expected in financial advising.

Maintaining one-inch margins provides a clean, open layout, which helps your information flow naturally and makes it easier for hiring managers to navigate each section of your resume. Every detail works together to effectively communicate your skills and experiences, ensuring you make a strong impression as a qualified financial advisor.

How to write a quantifiable resume experience section

In your financial advisor resume, the experience section plays a pivotal role in showcasing your past successes and contributions. You should spotlight specific, quantifiable achievements that reveal your impact, making it easy for potential employers to see how you’ve made a difference in your previous roles. Arrange this section in reverse chronological order, starting with your most recent position. Prioritize experiences that directly relate to the job you’re aiming for, ideally focusing on the last 10 to 15 years to ensure relevance. Essentially, you’re tailoring this section by reflecting the job's core duties and key skills, which makes it a near-perfect match. Strong action words like "developed," "increased," "managed," and "improved" help in articulating your accomplishments effectively.

- •Increased client portfolio value by an average of 30% through strategic investments.

- •Designed personalized financial plans that drove client satisfaction scores to 95%.

- •Managed over $200 million in assets, prioritizing risk management and growth.

- •Trained and guided a team of junior advisors, boosting team revenue by 15%.

This experience section is highly effective because it seamlessly ties your achievements to the role’s essentials. By focusing on quantifiable results like portfolio value increases and high satisfaction scores, you clearly illustrate your ability to deliver impressive outcomes. These detailed metrics make your accomplishments tangible and relatable, thus creating a memorable impression that resonates well in the financial advising sector.

Technology-Focused resume experience section

A technology-focused financial advisor resume experience section should highlight your ability to integrate financial expertise with technological innovations. Focus on specific projects where tech played a crucial part, and explain how these advancements improved client outcomes or increased efficiency. Use accessible language that anyone can follow, without diving into complex jargon. Employ action verbs to convey your active role in harnessing technology for financial success.

Start with your employment dates, job title, and company name. In your bullet points, emphasize the tech aspects of your work. Detail any financial software you utilized or introduced and support it with clear metrics to showcase your impact. This approach helps potential employers immediately understand the unique contributions you can make in a tech-savvy financial environment.

Financial Advisor

Future Wealth Advisors

March 2020 - Present

- Implemented a new financial software system that cut analysis time by 30%.

- Conducted training sessions on digital tools for financial planning, leading to a 20% increase in team productivity.

- Developed an app that personalized investment strategies for clients, resulting in a 15% client satisfaction boost.

- Streamlined data reporting by integrating AI, enhancing decision-making processes across the finance team.

Result-Focused resume experience section

A result-focused financial advisor resume experience section should effectively communicate your achievements and their impact on the company and its clients. Highlight how your strategic actions led to tangible outcomes, using clear and straightforward language to show your ability to meet financial goals and address client needs. By sharing the benefits of your work, you present yourself as a solution-oriented professional.

Organize your accomplishments with bullet points, focusing on results rather than listing tasks. This format not only enhances readability but also clearly illustrates the value you bring to an organization. Use metrics, such as percentages or dollar amounts, to demonstrate the impact of your contributions. For example, you might emphasize success in boosting client retention or growing portfolios. By presenting your achievements in this way, you offer a compelling picture of your track record and potential to deliver similar results in a new role.

Senior Financial Advisor

Future Wealth Management

June 2018 - Present

- Boosted client portfolio value by 25% over two years through strategic investment advice.

- Implemented a new client onboarding process that enhanced client satisfaction by 40%.

- Developed customized financial plans resulting in a 30% increase in client retention rates.

- Led monthly financial workshops, increasing community engagement by 50%.

Project-Focused resume experience section

A project-focused financial advisor resume experience section should highlight where your expertise made a real difference. Start by selecting projects that showcase your strengths and align with the job you want. It's important to detail the project's scope, your role, objectives, financial strategies you used, and the outcomes achieved. Use metrics or data to vividly illustrate the success of these projects, making your achievements compelling and easy to understand.

Make sure each project clearly outlines your contribution and its impact on the organization. Keep descriptions concise yet powerful, ensuring the reader quickly grasps the value you provided. Steer clear of confusing industry jargon, opting for straightforward language that highlights your strategic thinking and problem-solving abilities. This approach makes clear how you drive results in a relatable and engaging way.

Senior Financial Advisor

Wealth Management Group

June 2020 - December 2022

- Created personalized retirement plans for over 150 clients, boosting savings by an average of 25%.

- Introduced a proactive engagement strategy that increased client retention by 40%.

- Adjusted investment strategies based on market trends, enhancing portfolio performance by 15%.

- Led a team to digitize client reports, improving transparency and reducing processing time by 30%.

Growth-Focused resume experience section

A growth-focused financial advisor resume experience section should highlight how you've driven client growth and built robust portfolios. Focus on specific achievements rather than general duties to create a powerful impact. Starting each bullet with strong action verbs and incorporating numbers or percentages will effectively convey your contributions. This approach not only clarifies your impact but also demonstrates the tangible value you bring to a prospective employer's team.

Ensure each role clearly showcases your ability to attract new clients, enhance existing accounts, or increase assets under management. Keep the descriptions concise yet meaningful, emphasizing your expertise in financial planning, investment strategy, and client relations. Including awards or recognitions can further underscore your dedication and success. Tailor everything to be relevant to the position you're targeting, making it easy for employers to visualize how you can drive their growth and success.

Financial Advisor

Greenfield Financial Advisors

May 2018 - Present

- Increased client base by 30% over two years with targeted marketing and networking strategies.

- Developed customized investment plans leading to average client portfolio growth of 15% annually.

- Spearheaded a client referral program, boosting new client acquisitions by 25%.

- Received 'Outstanding Performance' award in 2020 for exceptional client satisfaction and retention.

Write your financial advisor resume summary section

A skills-focused financial advisor resume experience section should effectively capture your strengths in a concise manner. If you are an experienced advisor, highlighting your top achievements and key skills is essential. Use simple language that still demonstrates your expertise, engaging potential employers and encouraging them to learn more about you. Consider this example:

This type of summary is effective because it highlights your extensive experience and successful results, all while showcasing your specific skills. Incorporating numbers and tangible outcomes makes the summary even more impactful. When crafting such a section, it's important to remember that a summary focuses on showcasing your experience and skills in brief. If you're just starting out, consider a resume objective, which emphasizes your career goals and enthusiasm. Unlike a summary, a resume objective details your aspirations in the field, helping you connect your intentions with potential opportunities. A resume profile combines elements of both approaches but is broader, giving a general overview. Lastly, a summary of qualifications lists your top skills and experiences. Although these sections may appear similar, each has a distinct role in shaping how you present yourself. By considering your experience and the qualities employers are seeking, you can decide which approach best fits your needs.

Listing your financial advisor skills on your resume

A well-focused financial advisor resume should thoughtfully highlight your skills in a way that grabs attention. You have the choice to create a dedicated skills section or incorporate your skills within your experience and summary sections. Showcasing your strengths and soft skills is crucial, as these traits enhance your ability to build client relationships. Meanwhile, hard skills represent the technical expertise and industry knowledge you've gained through your career and education.

Skills and strengths don’t just stand alone; they serve as vital keywords throughout your resume. These keywords increase your chances of standing out in Applicant Tracking Systems (ATS) and making an impression on hiring managers. By clearly highlighting your relevant skills and strengths, you position yourself as a strong fit for the role and align with the job description provided.

Here's a sample of a standalone skills section:

This skill section is precise and thorough, listing essential capabilities expected of financial advisors. Each skill aligns with industry standards, making it easy for employers to quickly assess your qualifications. Balancing both hard and soft skills shows you as a rounded candidate ready for diverse challenges.

Best hard skills to feature on your financial advisor resume

Financial advisors need robust hard skills that demonstrate their expertise in managing financial tasks. These skills clearly show your ability to strategize and support clients in achieving their financial goals.

Hard Skills

- Financial Analysis

- Investment Strategy Development

- Risk Assessment

- Portfolio Management

- Tax Planning and Preparation

- Compliance with Financial Regulations

- Financial Modeling

- Estate Planning

- Asset Allocation

- Retirement Planning

- Economic Fundamentals

- Financial Product Knowledge

- Credit Analysis

- Financial Software Proficiency (e.g., Excel, Bloomberg)

- Wealth Management

Best soft skills to feature on your financial advisor resume

Soft skills reflect your personal interaction tactics and emotional intelligence. These skills highlight your effectiveness in communication, building strong client relations, and understanding client needs deeply.

Soft Skills

- Communication

- Active Listening

- Empathy

- Problem Solving

- Time Management

- Critical Thinking

- Decision-Making

- Negotiation

- Adaptability

- Customer Service

- Conflict Resolution

- Detail Orientation

- Interpersonal Skills

- Persuasion

- Trustworthiness

How to include your education on your resume

The education section is a crucial part of your financial advisor resume. It showcases your academic credentials and sets the foundation for your expertise in financial advising. Tailor this section to fit the job you're applying for, highlighting degrees relevant to the financial industry. Leave out any irrelevant educational experiences that may distract from your main qualifications.

When including a GPA, only do so if it's above 3.0; otherwise, it may not add value to your application. If you've graduated with honors, such as cum laude, include that distinction to showcase your academic achievements. Listing your degree properly involves specifying the degree type, the institution, and the year of graduation.

Consider a wrong and a correct example of an education section. A wrong example may include unrelated degrees or confusing information. A good example features relevant qualifications and clear, concise information.

JSON Format Example for a Wrong Education Section:

JSON Format Example for a Right Education Section:

The correct example is effective because it includes a degree pertinent to financial advisory roles, specifies an impressive GPA, and honors, enhancing your candidacy. With relevant academic details clearly displayed, this section effectively supports your professional qualifications as a financial advisor.

How to include financial advisor certificates on your resume

Adding a certificates section to your financial advisor resume is crucial as it showcases your specialized skills and qualifications. Certificates can also be highlighted in the resume header for immediate attention. List the name of each certificate accurately. Include the date you received each certificate. Add the name of the issuing organization to validate your credentials.

For example, in a resume header, you could format it like this: "John Doe, Certified Financial Planner (CFP) - Chartered Financial Analyst (CFA)." This makes your certifications instantly noticeable.

Here is a well-structured certificates section to use as a standalone:

This example is effective because it lists widely recognized certificates relevant to financial advisory roles. The issuing organizations are well-known, adding credibility. The clear format makes it easy for hiring managers to quickly identify your qualifications.

Extra sections to include in your financial advisor resume

Building a compelling financial advisor resume is key to standing out and landing your dream job. A well-rounded resume not only highlights your skills but also showcases your personality and range of experiences.

Language section—Showcase your multilingual skills to appeal to diverse clients and global firms. Indicating language proficiency can add immense value in client communication and expanding your market reach.

Hobbies and interests section—Include hobbies to paint a fuller picture of your personality and soft skills. This can also reflect your ability to relate to clients on a personal level, fostering deeper connections.

Volunteer work section—Detail volunteer activities to demonstrate leadership and commitment to community service. This shows potential employers your strong ethics and dedication beyond financial gains.

Books section—List relevant books you've read to highlight your dedication to continuous learning. This endorses your passion for staying updated with financial trends and theories.

Balancing these personal touches with your professional experience provides a comprehensive view of who you are. Infusing these sections adds depth and substance to your resume. You'll be better equipped to showcase your unique qualities and draw attention from hiring managers.

In Conclusion

In conclusion, creating a strong financial advisor resume is akin to developing a solid financial plan for your clients, where every detail contributes to the overall picture of your capabilities. Your resume is your opportunity to showcase your analytical skills, strategic planning abilities, and real-world achievements that set you apart as a trusted advisor. By using structured resume templates, you ensure that every section, from work experience to education, is presented clearly and effectively. This clarity helps potential employers instantly see the value you bring.

Choosing the right format and making sure your resume maintains its visual integrity across platforms is crucial, as it reflects your meticulous attention to detail—a key trait for success in financial advising. Equally important is using quantifiable metrics in your experience section to provide tangible proof of your past successes, allowing employers to visualize the impact you could bring to their organization.

Intertwining your hard and soft skills throughout the resume solidifies your proficiency and approachability, making you a well-rounded candidate. Incorporating a summary or objective allows you to encapsulate your career achievements succinctly, leaving a lasting impression on hiring managers. Furthermore, additional sections, such as certifications and extracurricular activities, enrich your resume by painting a more comprehensive picture of your professional journey and personal interests.

By meticulously tailoring your resume to the financial industry, you position yourself as a candidate capable of both managing complex financial scenarios and fostering client relationships, while reflecting a commitment to personal and professional growth. This holistic approach not only enhances your appeal to employers but also demonstrates your readiness to make a meaningful impact in the financial sector.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.