Financial Controller Resume Examples

Mar 24, 2025

|

12 min read

Master your financial controller resume with these expert tips. Ensure it balances your skills and experience like a finely-tuned ledger. Learn how to impress your future employer with a resume that adds up perfectly.

Rated by 348 people

Corporate Financial Controller

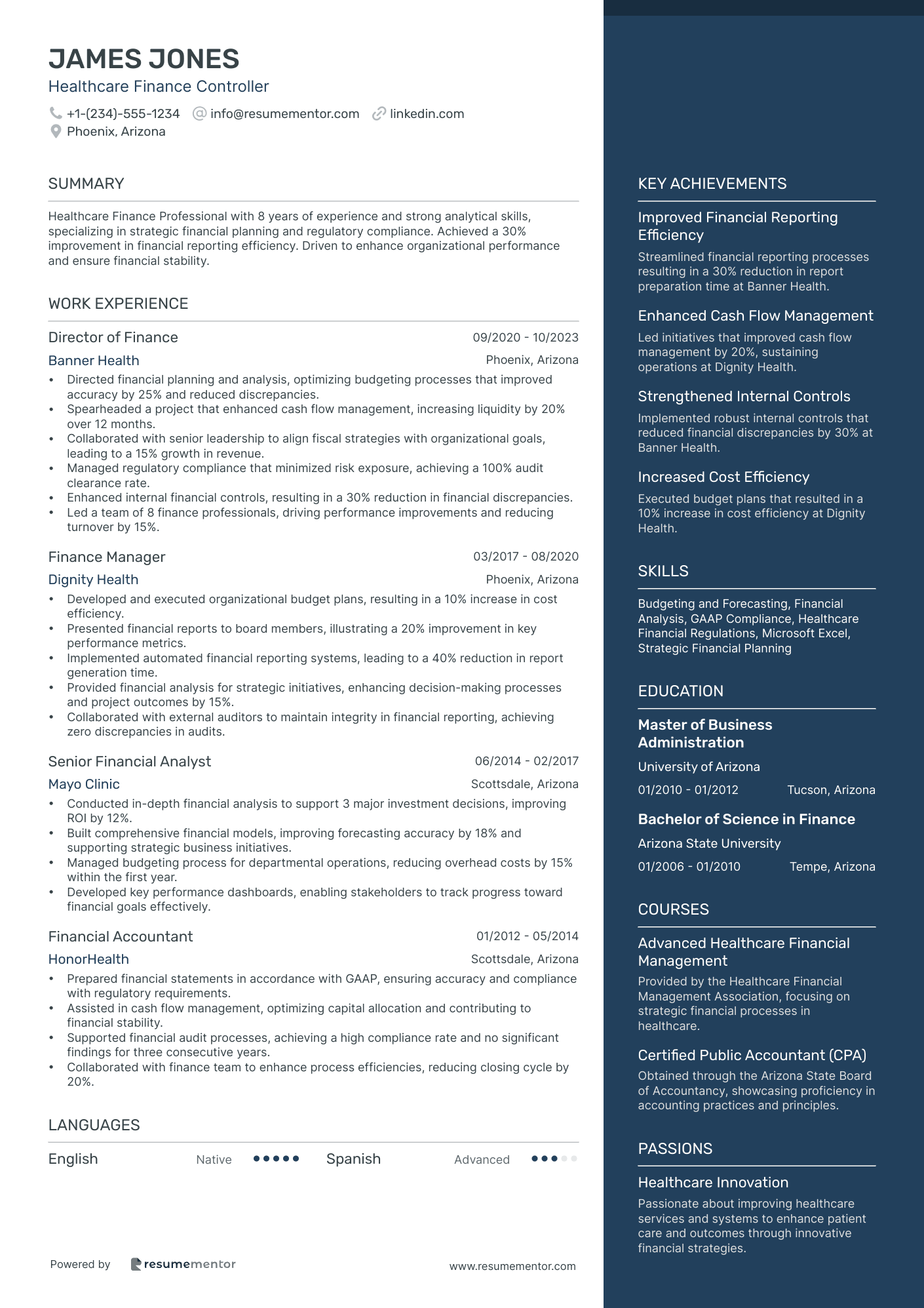

Healthcare Finance Controller

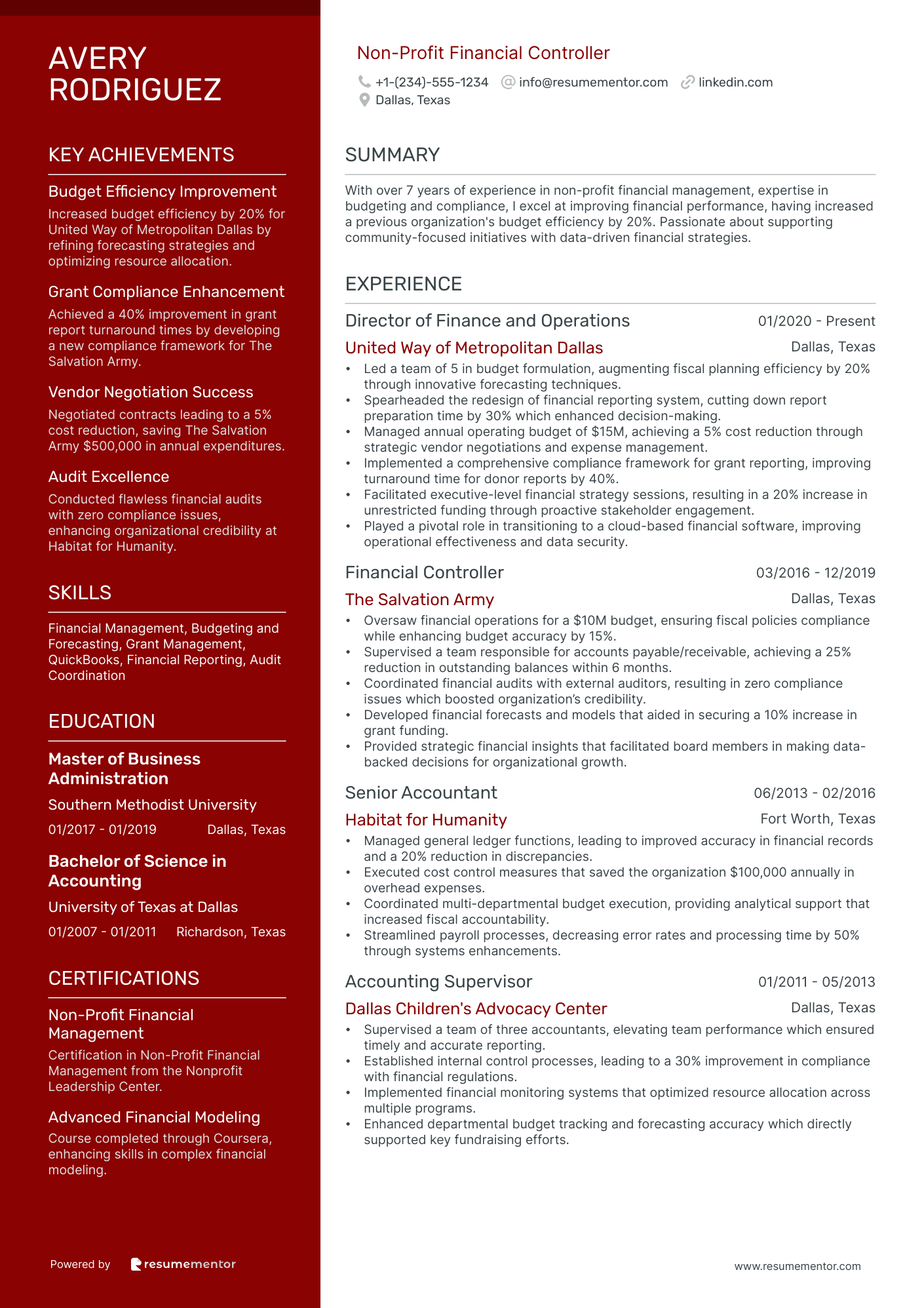

Non-Profit Financial Controller

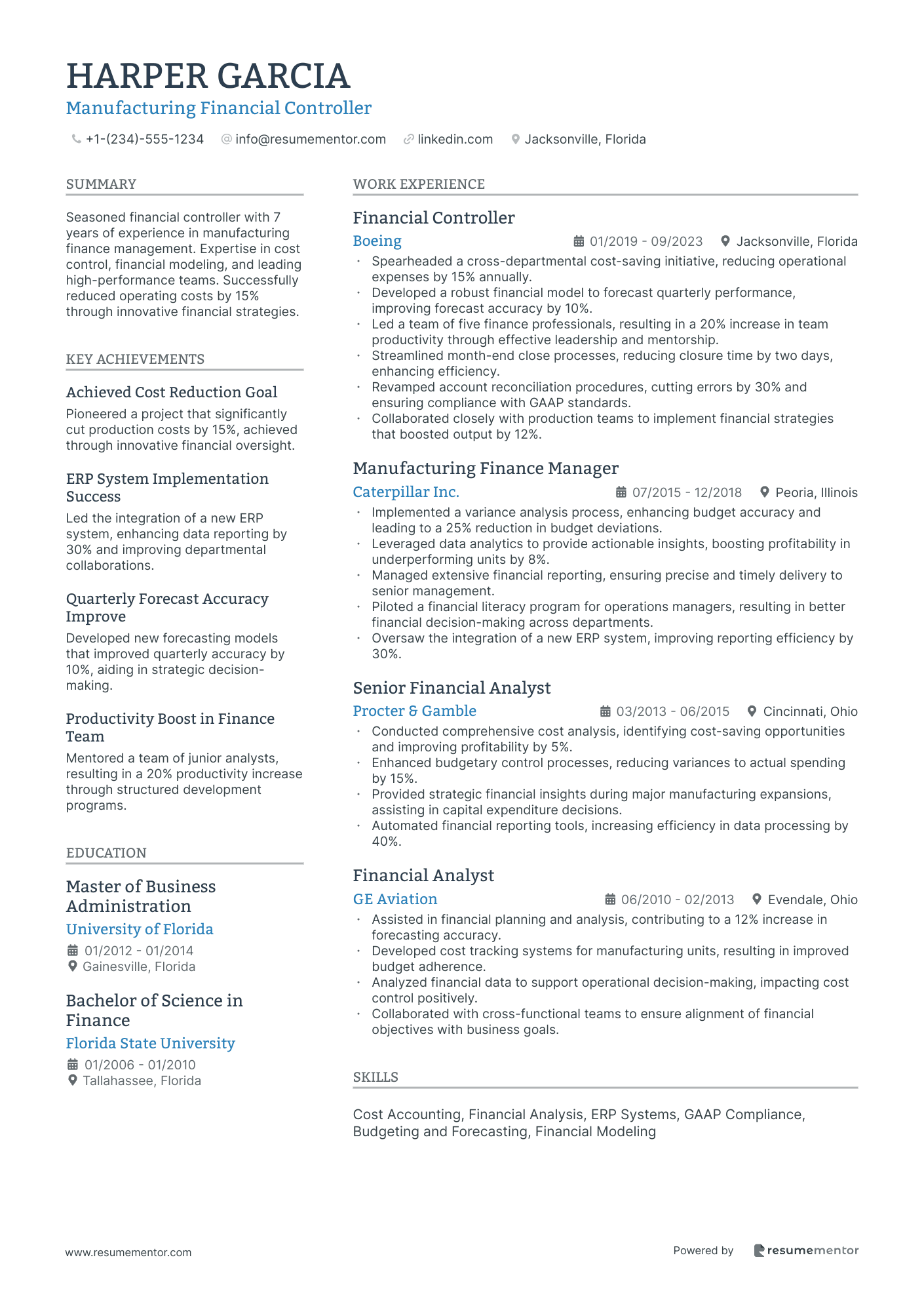

Manufacturing Financial Controller

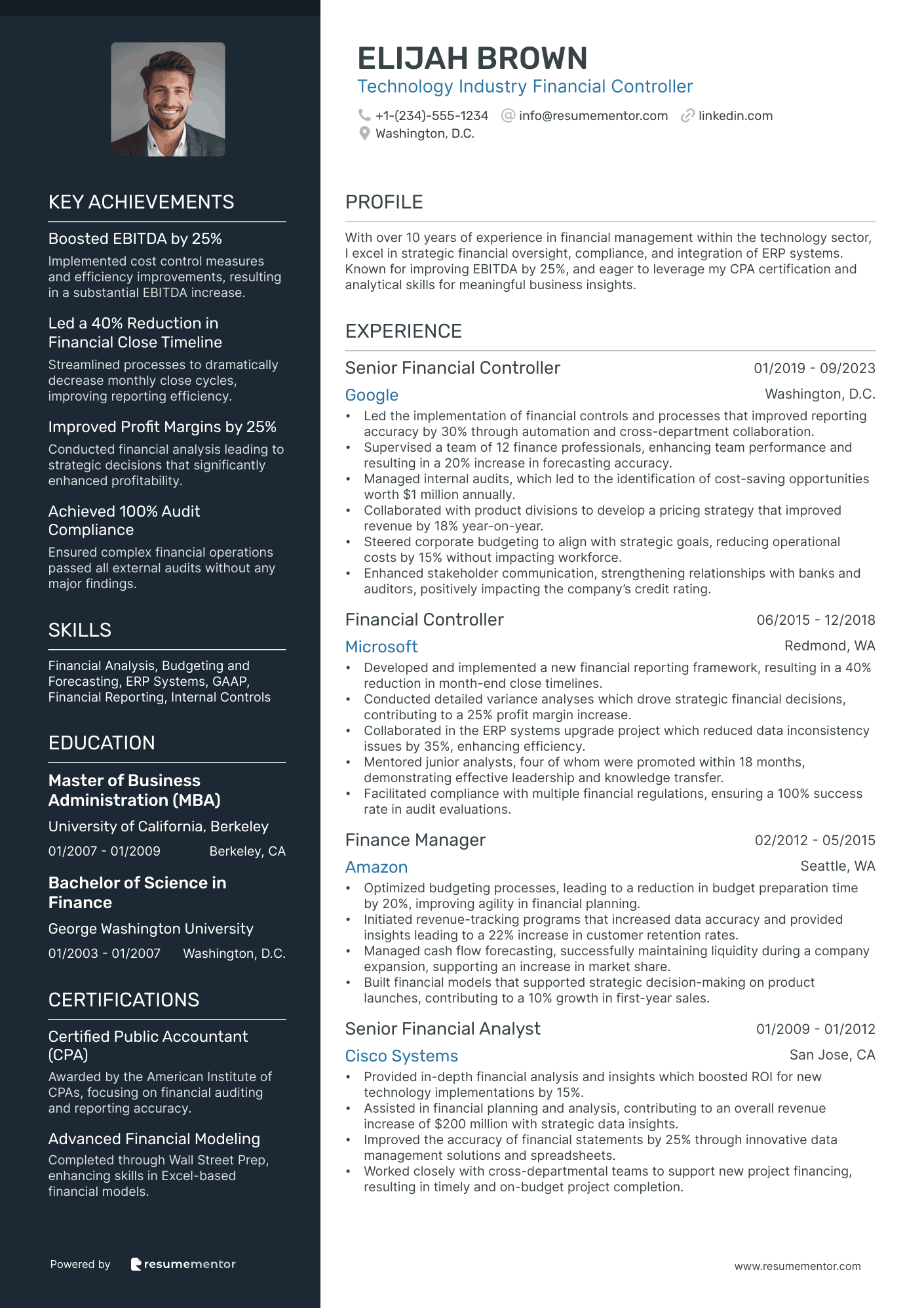

Technology Industry Financial Controller

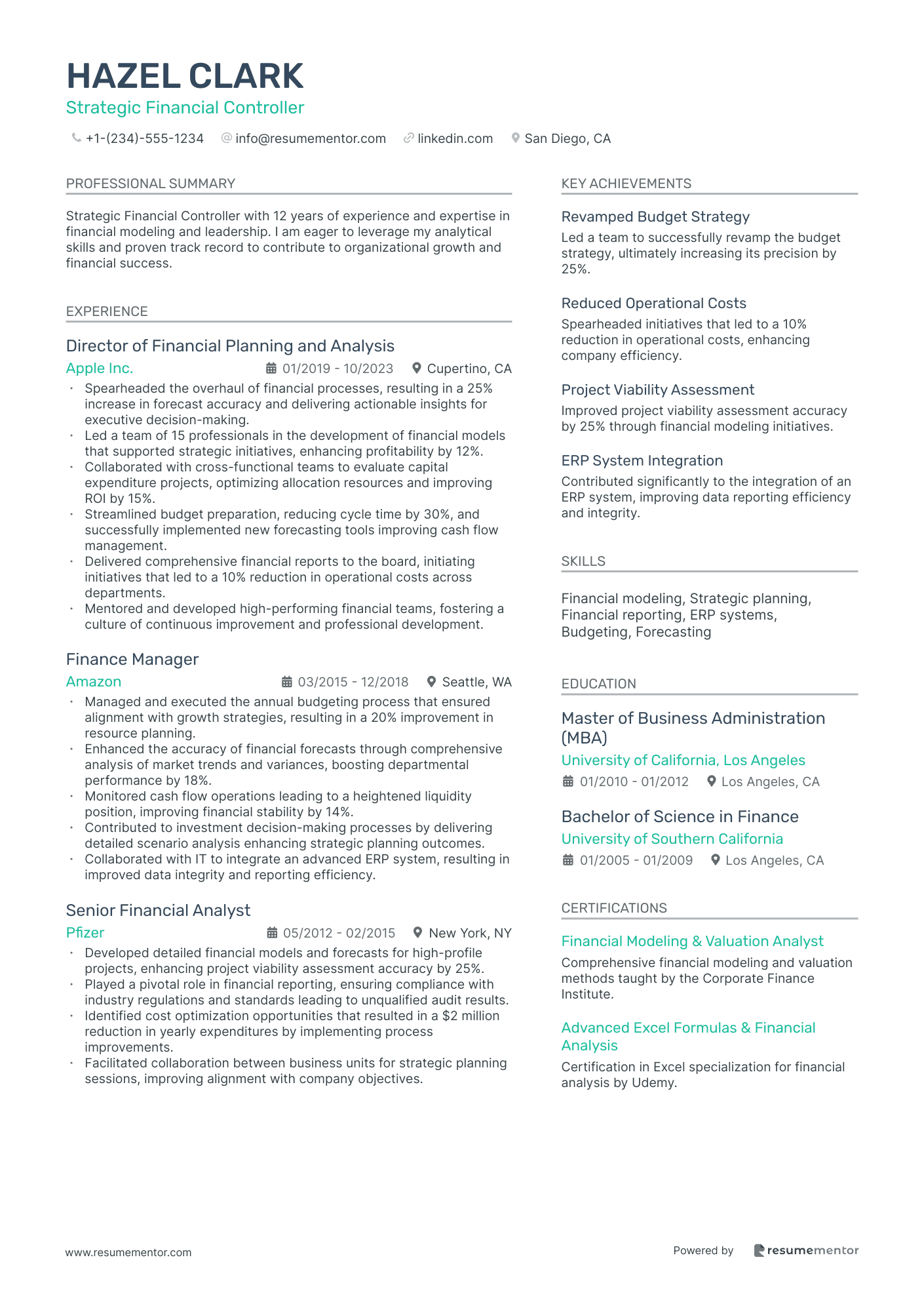

Strategic Financial Controller

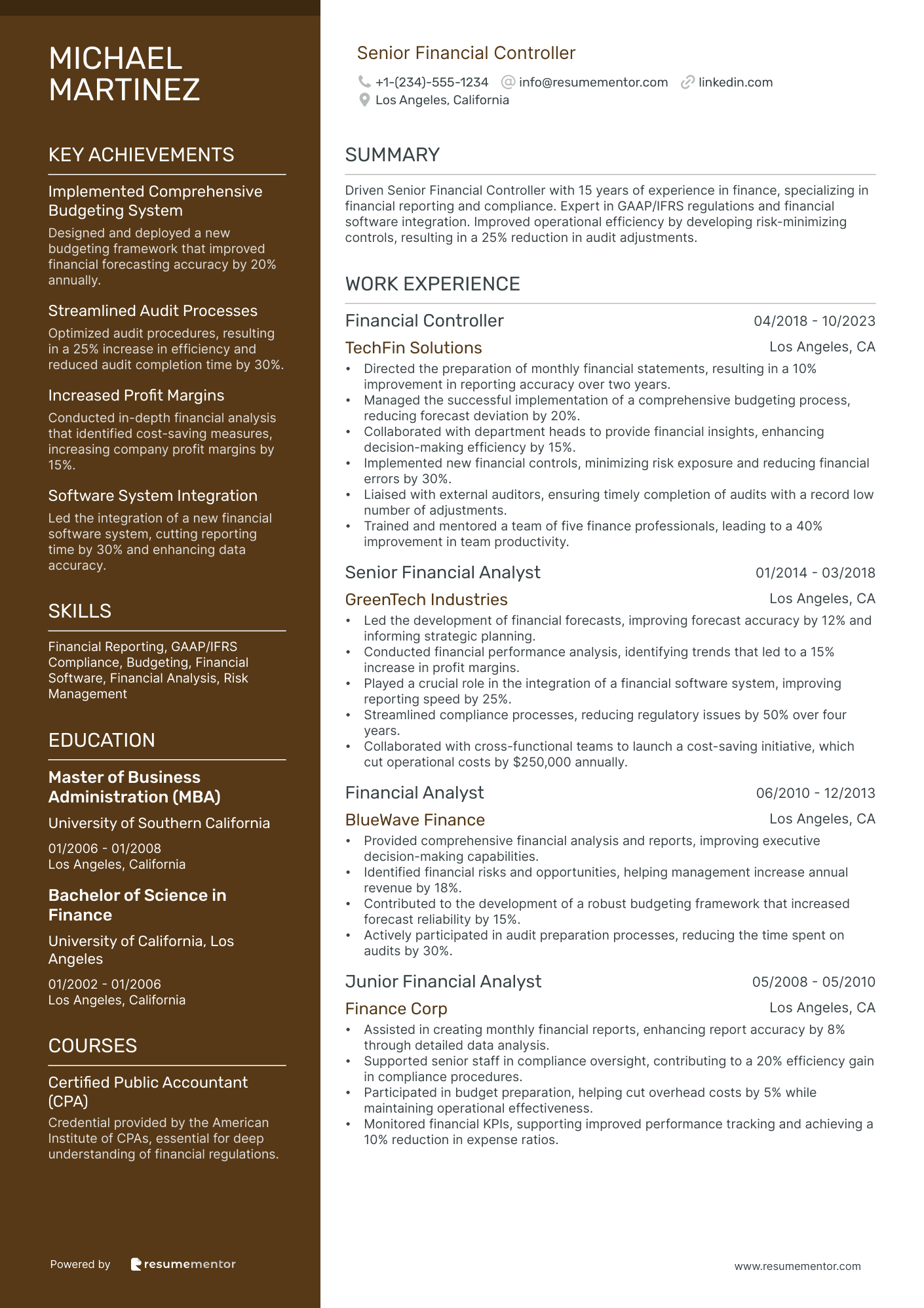

Senior Financial Controller

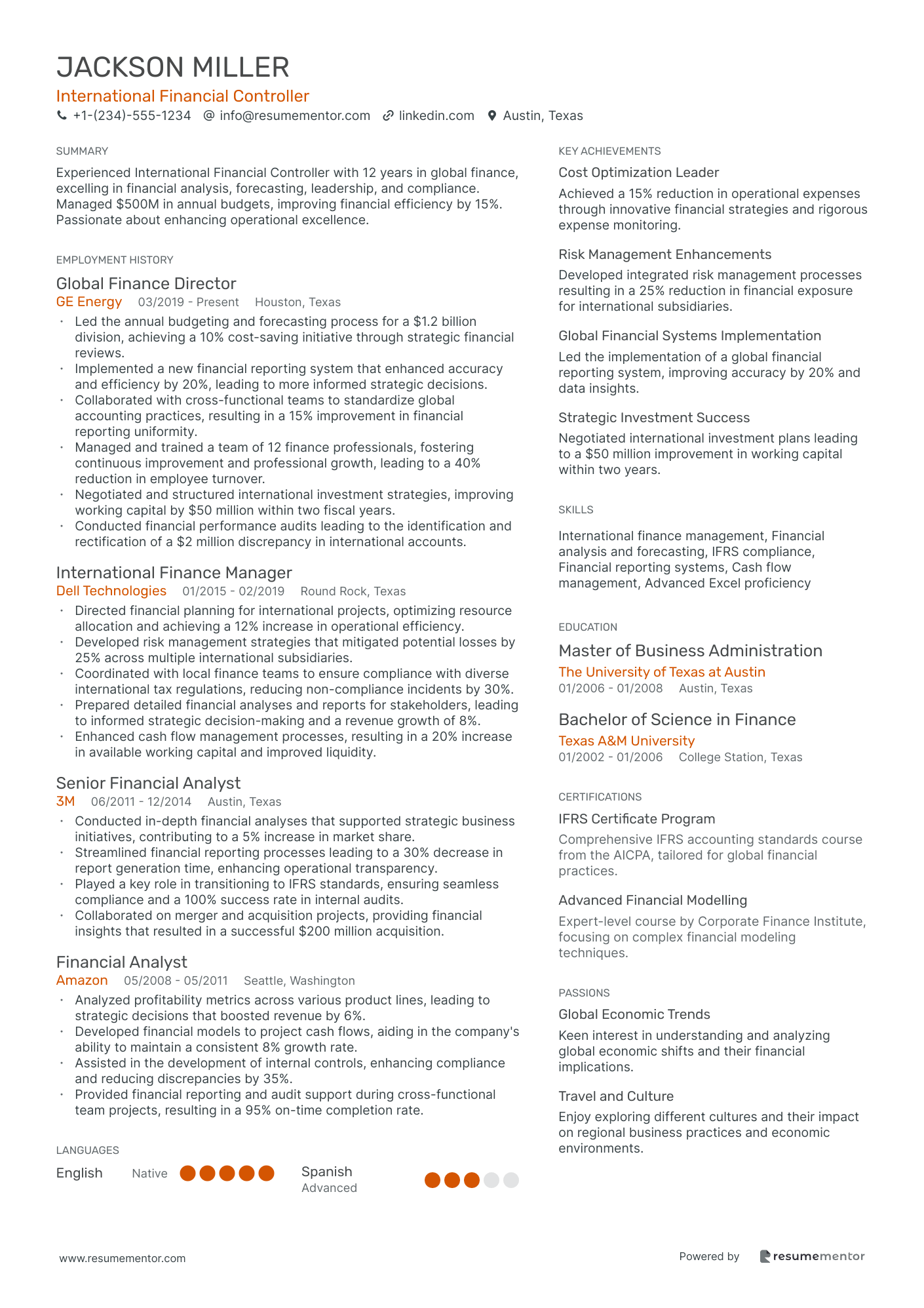

International Financial Controller

Startup Financial Controller

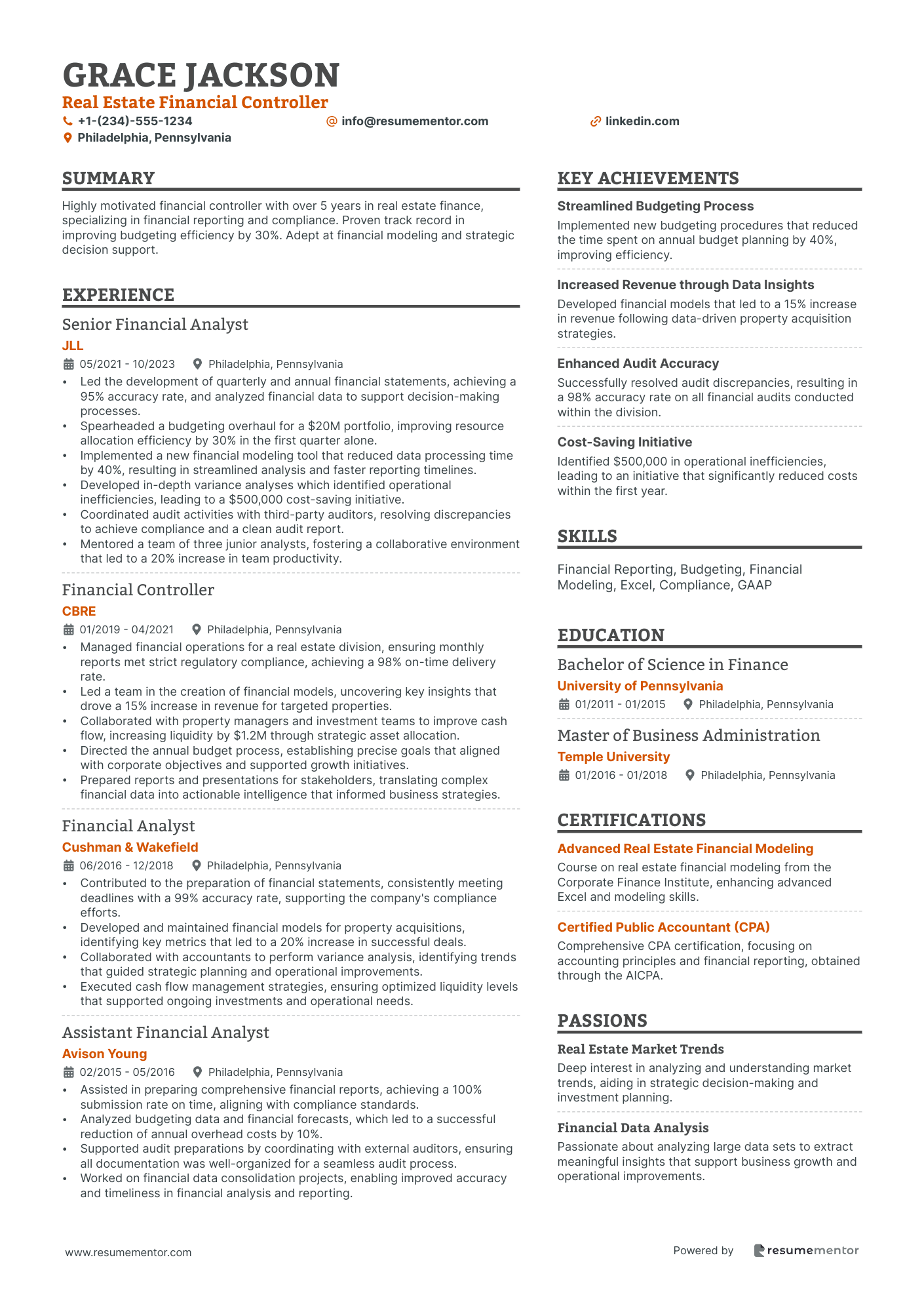

Real Estate Financial Controller

Corporate Financial Controller resume sample

- •Led financial statement preparation, improving reporting accuracy by 25% through analytical review and process automation.

- •Enhanced the annual budgeting process, resulting in a 20% reduction in operational costs through strategic financial planning.

- •Collaborated with executive management, delivering actionable insights that boosted revenue growth by 18% year over year.

- •Strengthened financial regulations adherence, aligning internal policies to reduce compliance risks by 30%.

- •Implemented internal controls that led to a $3 million decrease in financial risk exposure.

- •Mentored accounting staff, fostering a culture of accountability and achieving a 15% increase in productivity.

- •Spearheaded cross-departmental budget analytics, uncovering inefficiencies and contributing to a 15% cost saving.

- •Developed long-term forecasting models that improved profit margin predictions, increasing accuracy by 40%.

- •Conducted quarterly financial performance reviews, providing insights that led to a 10% increase in efficiency.

- •Coordinated with external auditors, ensuring a smooth annual audit process with 100% compliance.

- •Revised financial reporting procedures, decreasing reporting timelines by two weeks and enhancing data reliability.

- •Analyzed financial statements, leading to a 25% improvement in financial data insights and presentations.

- •Managed a financial team, enhancing skill development and resulting in a 20% boost in team performance metrics.

- •Conducted financial risk assessments that helped minimize risks by $1 million through improved internal controls.

- •Enhanced cash flow management strategies, positively impacting liquidity by 15%.

- •Developed financial models that contributed to a 10% increase in predictive accuracy for budget forecasting.

- •Provided strategic financial recommendations, optimizing capital structure to enhance long-term financial stability.

- •Conducted internal audits which led to a significant decrease in financial discrepancies, improving compliance by 20%.

- •Collaborated on interdepartmental projects, streamlining financial processes and boosting productivity by 12%.

Healthcare Finance Controller resume sample

- •Directed financial planning and analysis, optimizing budgeting processes that improved accuracy by 25% and reduced discrepancies.

- •Spearheaded a project that enhanced cash flow management, increasing liquidity by 20% over 12 months.

- •Collaborated with senior leadership to align fiscal strategies with organizational goals, leading to a 15% growth in revenue.

- •Managed regulatory compliance that minimized risk exposure, achieving a 100% audit clearance rate.

- •Enhanced internal financial controls, resulting in a 30% reduction in financial discrepancies.

- •Led a team of 8 finance professionals, driving performance improvements and reducing turnover by 15%.

- •Developed and executed organizational budget plans, resulting in a 10% increase in cost efficiency.

- •Presented financial reports to board members, illustrating a 20% improvement in key performance metrics.

- •Implemented automated financial reporting systems, leading to a 40% reduction in report generation time.

- •Provided financial analysis for strategic initiatives, enhancing decision-making processes and project outcomes by 15%.

- •Collaborated with external auditors to maintain integrity in financial reporting, achieving zero discrepancies in audits.

- •Conducted in-depth financial analysis to support 3 major investment decisions, improving ROI by 12%.

- •Built comprehensive financial models, improving forecasting accuracy by 18% and supporting strategic business initiatives.

- •Managed budgeting process for departmental operations, reducing overhead costs by 15% within the first year.

- •Developed key performance dashboards, enabling stakeholders to track progress toward financial goals effectively.

- •Prepared financial statements in accordance with GAAP, ensuring accuracy and compliance with regulatory requirements.

- •Assisted in cash flow management, optimizing capital allocation and contributing to financial stability.

- •Supported financial audit processes, achieving a high compliance rate and no significant findings for three consecutive years.

- •Collaborated with finance team to enhance process efficiencies, reducing closing cycle by 20%.

Non-Profit Financial Controller resume sample

- •Led a team of 5 in budget formulation, augmenting fiscal planning efficiency by 20% through innovative forecasting techniques.

- •Spearheaded the redesign of financial reporting system, cutting down report preparation time by 30% which enhanced decision-making.

- •Managed annual operating budget of $15M, achieving a 5% cost reduction through strategic vendor negotiations and expense management.

- •Implemented a comprehensive compliance framework for grant reporting, improving turnaround time for donor reports by 40%.

- •Facilitated executive-level financial strategy sessions, resulting in a 20% increase in unrestricted funding through proactive stakeholder engagement.

- •Played a pivotal role in transitioning to a cloud-based financial software, improving operational effectiveness and data security.

- •Oversaw financial operations for a $10M budget, ensuring fiscal policies compliance while enhancing budget accuracy by 15%.

- •Supervised a team responsible for accounts payable/receivable, achieving a 25% reduction in outstanding balances within 6 months.

- •Coordinated financial audits with external auditors, resulting in zero compliance issues which boosted organization’s credibility.

- •Developed financial forecasts and models that aided in securing a 10% increase in grant funding.

- •Provided strategic financial insights that facilitated board members in making data-backed decisions for organizational growth.

- •Managed general ledger functions, leading to improved accuracy in financial records and a 20% reduction in discrepancies.

- •Executed cost control measures that saved the organization $100,000 annually in overhead expenses.

- •Coordinated multi-departmental budget execution, providing analytical support that increased fiscal accountability.

- •Streamlined payroll processes, decreasing error rates and processing time by 50% through systems enhancements.

- •Supervised a team of three accountants, elevating team performance which ensured timely and accurate reporting.

- •Established internal control processes, leading to a 30% improvement in compliance with financial regulations.

- •Implemented financial monitoring systems that optimized resource allocation across multiple programs.

- •Enhanced departmental budget tracking and forecasting accuracy which directly supported key fundraising efforts.

Manufacturing Financial Controller resume sample

- •Spearheaded a cross-departmental cost-saving initiative, reducing operational expenses by 15% annually.

- •Developed a robust financial model to forecast quarterly performance, improving forecast accuracy by 10%.

- •Led a team of five finance professionals, resulting in a 20% increase in team productivity through effective leadership and mentorship.

- •Streamlined month-end close processes, reducing closure time by two days, enhancing efficiency.

- •Revamped account reconciliation procedures, cutting errors by 30% and ensuring compliance with GAAP standards.

- •Collaborated closely with production teams to implement financial strategies that boosted output by 12%.

- •Implemented a variance analysis process, enhancing budget accuracy and leading to a 25% reduction in budget deviations.

- •Leveraged data analytics to provide actionable insights, boosting profitability in underperforming units by 8%.

- •Managed extensive financial reporting, ensuring precise and timely delivery to senior management.

- •Piloted a financial literacy program for operations managers, resulting in better financial decision-making across departments.

- •Oversaw the integration of a new ERP system, improving reporting efficiency by 30%.

- •Conducted comprehensive cost analysis, identifying cost-saving opportunities and improving profitability by 5%.

- •Enhanced budgetary control processes, reducing variances to actual spending by 15%.

- •Provided strategic financial insights during major manufacturing expansions, assisting in capital expenditure decisions.

- •Automated financial reporting tools, increasing efficiency in data processing by 40%.

- •Assisted in financial planning and analysis, contributing to a 12% increase in forecasting accuracy.

- •Developed cost tracking systems for manufacturing units, resulting in improved budget adherence.

- •Analyzed financial data to support operational decision-making, impacting cost control positively.

- •Collaborated with cross-functional teams to ensure alignment of financial objectives with business goals.

Technology Industry Financial Controller resume sample

- •Led the implementation of financial controls and processes that improved reporting accuracy by 30% through automation and cross-department collaboration.

- •Supervised a team of 12 finance professionals, enhancing team performance and resulting in a 20% increase in forecasting accuracy.

- •Managed internal audits, which led to the identification of cost-saving opportunities worth $1 million annually.

- •Collaborated with product divisions to develop a pricing strategy that improved revenue by 18% year-on-year.

- •Steered corporate budgeting to align with strategic goals, reducing operational costs by 15% without impacting workforce.

- •Enhanced stakeholder communication, strengthening relationships with banks and auditors, positively impacting the company’s credit rating.

- •Developed and implemented a new financial reporting framework, resulting in a 40% reduction in month-end close timelines.

- •Conducted detailed variance analyses which drove strategic financial decisions, contributing to a 25% profit margin increase.

- •Collaborated in the ERP systems upgrade project which reduced data inconsistency issues by 35%, enhancing efficiency.

- •Mentored junior analysts, four of whom were promoted within 18 months, demonstrating effective leadership and knowledge transfer.

- •Facilitated compliance with multiple financial regulations, ensuring a 100% success rate in audit evaluations.

- •Optimized budgeting processes, leading to a reduction in budget preparation time by 20%, improving agility in financial planning.

- •Initiated revenue-tracking programs that increased data accuracy and provided insights leading to a 22% increase in customer retention rates.

- •Managed cash flow forecasting, successfully maintaining liquidity during a company expansion, supporting an increase in market share.

- •Built financial models that supported strategic decision-making on product launches, contributing to a 10% growth in first-year sales.

- •Provided in-depth financial analysis and insights which boosted ROI for new technology implementations by 15%.

- •Assisted in financial planning and analysis, contributing to an overall revenue increase of $200 million with strategic data insights.

- •Improved the accuracy of financial statements by 25% through innovative data management solutions and spreadsheets.

- •Worked closely with cross-departmental teams to support new project financing, resulting in timely and on-budget project completion.

Strategic Financial Controller resume sample

- •Spearheaded the overhaul of financial processes, resulting in a 25% increase in forecast accuracy and delivering actionable insights for executive decision-making.

- •Led a team of 15 professionals in the development of financial models that supported strategic initiatives, enhancing profitability by 12%.

- •Collaborated with cross-functional teams to evaluate capital expenditure projects, optimizing allocation resources and improving ROI by 15%.

- •Streamlined budget preparation, reducing cycle time by 30%, and successfully implemented new forecasting tools improving cash flow management.

- •Delivered comprehensive financial reports to the board, initiating initiatives that led to a 10% reduction in operational costs across departments.

- •Mentored and developed high-performing financial teams, fostering a culture of continuous improvement and professional development.

- •Managed and executed the annual budgeting process that ensured alignment with growth strategies, resulting in a 20% improvement in resource planning.

- •Enhanced the accuracy of financial forecasts through comprehensive analysis of market trends and variances, boosting departmental performance by 18%.

- •Monitored cash flow operations leading to a heightened liquidity position, improving financial stability by 14%.

- •Contributed to investment decision-making processes by delivering detailed scenario analysis enhancing strategic planning outcomes.

- •Collaborated with IT to integrate an advanced ERP system, resulting in improved data integrity and reporting efficiency.

- •Developed detailed financial models and forecasts for high-profile projects, enhancing project viability assessment accuracy by 25%.

- •Played a pivotal role in financial reporting, ensuring compliance with industry regulations and standards leading to unqualified audit results.

- •Identified cost optimization opportunities that resulted in a $2 million reduction in yearly expenditures by implementing process improvements.

- •Facilitated collaboration between business units for strategic planning sessions, improving alignment with company objectives.

- •Conducted in-depth variance analyses and supported forecasting processes, contributing to a 15% enhancement in forecast reliability.

- •Assisted with the preparation of financial statements, ensuring compliance with GAAP and providing comprehensive insights for management.

- •Executed comprehensive scenario planning and financial recommendations that directly supported investment decision making and effectiveness.

- •Streamlined financial reporting processes, leading to a 20% reduction in report turnaround time and improved data accessibility.

Senior Financial Controller resume sample

- •Directed the preparation of monthly financial statements, resulting in a 10% improvement in reporting accuracy over two years.

- •Managed the successful implementation of a comprehensive budgeting process, reducing forecast deviation by 20%.

- •Collaborated with department heads to provide financial insights, enhancing decision-making efficiency by 15%.

- •Implemented new financial controls, minimizing risk exposure and reducing financial errors by 30%.

- •Liaised with external auditors, ensuring timely completion of audits with a record low number of adjustments.

- •Trained and mentored a team of five finance professionals, leading to a 40% improvement in team productivity.

- •Led the development of financial forecasts, improving forecast accuracy by 12% and informing strategic planning.

- •Conducted financial performance analysis, identifying trends that led to a 15% increase in profit margins.

- •Played a crucial role in the integration of a financial software system, improving reporting speed by 25%.

- •Streamlined compliance processes, reducing regulatory issues by 50% over four years.

- •Collaborated with cross-functional teams to launch a cost-saving initiative, which cut operational costs by $250,000 annually.

- •Provided comprehensive financial analysis and reports, improving executive decision-making capabilities.

- •Identified financial risks and opportunities, helping management increase annual revenue by 18%.

- •Contributed to the development of a robust budgeting framework that increased forecast reliability by 15%.

- •Actively participated in audit preparation processes, reducing the time spent on audits by 30%.

- •Assisted in creating monthly financial reports, enhancing report accuracy by 8% through detailed data analysis.

- •Supported senior staff in compliance oversight, contributing to a 20% efficiency gain in compliance procedures.

- •Participated in budget preparation, helping cut overhead costs by 5% while maintaining operational effectiveness.

- •Monitored financial KPIs, supporting improved performance tracking and achieving a 10% reduction in expense ratios.

International Financial Controller resume sample

- •Led the annual budgeting and forecasting process for a $1.2 billion division, achieving a 10% cost-saving initiative through strategic financial reviews.

- •Implemented a new financial reporting system that enhanced accuracy and efficiency by 20%, leading to more informed strategic decisions.

- •Collaborated with cross-functional teams to standardize global accounting practices, resulting in a 15% improvement in financial reporting uniformity.

- •Managed and trained a team of 12 finance professionals, fostering continuous improvement and professional growth, leading to a 40% reduction in employee turnover.

- •Negotiated and structured international investment strategies, improving working capital by $50 million within two fiscal years.

- •Conducted financial performance audits leading to the identification and rectification of a $2 million discrepancy in international accounts.

- •Directed financial planning for international projects, optimizing resource allocation and achieving a 12% increase in operational efficiency.

- •Developed risk management strategies that mitigated potential losses by 25% across multiple international subsidiaries.

- •Coordinated with local finance teams to ensure compliance with diverse international tax regulations, reducing non-compliance incidents by 30%.

- •Prepared detailed financial analyses and reports for stakeholders, leading to informed strategic decision-making and a revenue growth of 8%.

- •Enhanced cash flow management processes, resulting in a 20% increase in available working capital and improved liquidity.

- •Conducted in-depth financial analyses that supported strategic business initiatives, contributing to a 5% increase in market share.

- •Streamlined financial reporting processes leading to a 30% decrease in report generation time, enhancing operational transparency.

- •Played a key role in transitioning to IFRS standards, ensuring seamless compliance and a 100% success rate in internal audits.

- •Collaborated on merger and acquisition projects, providing financial insights that resulted in a successful $200 million acquisition.

- •Analyzed profitability metrics across various product lines, leading to strategic decisions that boosted revenue by 6%.

- •Developed financial models to project cash flows, aiding in the company's ability to maintain a consistent 8% growth rate.

- •Assisted in the development of internal controls, enhancing compliance and reducing discrepancies by 35%.

- •Provided financial reporting and audit support during cross-functional team projects, resulting in a 95% on-time completion rate.

Startup Financial Controller resume sample

- •Spearheaded financial strategy leading to a 20% increase in operational efficiency, significantly enhancing profit margins.

- •Developed comprehensive financial reports that improved decision-making and stakeholders' insights by 35%.

- •Managed a successful year-end audit process, reducing audit duration by 30% while maintaining compliance.

- •Implemented cutting-edge accounting software that streamlined the budget monitoring process, saving 50 man-hours monthly.

- •Optimized internal control systems, reducing financial discrepancies by 40% and minimizing risk.

- •Conducted detailed financial trend analysis, forecasting a 25% revenue growth over the next fiscal year.

- •Orchestrated the budgeting process for multiple departments, achieving alignment with organizational goals by 97%.

- •Guided the finance team through external audits, resulting in zero compliance issues over three consecutive years.

- •Enhanced cash flow management, resulting in a 15% improvement in working capital efficiency.

- •Developed a new financial forecasting model, resulting in a more accurate budget variance analysis by 20%.

- •Fostered cross-departmental collaboration, leading to improved financial insights and more informed business decisions.

- •Reduced reporting errors by 25% through the implementation of rigorous review processes in monthly closings.

- •Trained and mentored junior accountants, improving departmental efficiency and employee retention by 15%.

- •Initiated strategic cost-saving measures, which resulted in a 12% reduction of overheads within a fiscal year.

- •Played a pivotal role in the transition to a new ERP system, facilitating seamless integration with legacy financial data.

- •Performed in-depth financial analysis, contributing to strategic initiatives that increased revenue by 10%.

- •Assisted in the development of a predictive analytics tool, strengthening revenue forecasting accuracy by 18%.

- •Conducted variance analysis on financial statements, identifying discrepancies and recommending corrective actions.

- •Collaborated with IT for data integrity in financial systems, boosting reliability of reporting metrics by 30%.

Real Estate Financial Controller resume sample

- •Led the development of quarterly and annual financial statements, achieving a 95% accuracy rate, and analyzed financial data to support decision-making processes.

- •Spearheaded a budgeting overhaul for a $20M portfolio, improving resource allocation efficiency by 30% in the first quarter alone.

- •Implemented a new financial modeling tool that reduced data processing time by 40%, resulting in streamlined analysis and faster reporting timelines.

- •Developed in-depth variance analyses which identified operational inefficiencies, leading to a $500,000 cost-saving initiative.

- •Coordinated audit activities with third-party auditors, resolving discrepancies to achieve compliance and a clean audit report.

- •Mentored a team of three junior analysts, fostering a collaborative environment that led to a 20% increase in team productivity.

- •Managed financial operations for a real estate division, ensuring monthly reports met strict regulatory compliance, achieving a 98% on-time delivery rate.

- •Led a team in the creation of financial models, uncovering key insights that drove a 15% increase in revenue for targeted properties.

- •Collaborated with property managers and investment teams to improve cash flow, increasing liquidity by $1.2M through strategic asset allocation.

- •Directed the annual budget process, establishing precise goals that aligned with corporate objectives and supported growth initiatives.

- •Prepared reports and presentations for stakeholders, translating complex financial data into actionable intelligence that informed business strategies.

- •Contributed to the preparation of financial statements, consistently meeting deadlines with a 99% accuracy rate, supporting the company's compliance efforts.

- •Developed and maintained financial models for property acquisitions, identifying key metrics that led to a 20% increase in successful deals.

- •Collaborated with accountants to perform variance analysis, identifying trends that guided strategic planning and operational improvements.

- •Executed cash flow management strategies, ensuring optimized liquidity levels that supported ongoing investments and operational needs.

- •Assisted in preparing comprehensive financial reports, achieving a 100% submission rate on time, aligning with compliance standards.

- •Analyzed budgeting data and financial forecasts, which led to a successful reduction of annual overhead costs by 10%.

- •Supported audit preparations by coordinating with external auditors, ensuring all documentation was well-organized for a seamless audit process.

- •Worked on financial data consolidation projects, enabling improved accuracy and timeliness in financial analysis and reporting.

As a financial controller, you're at the helm of your company's financial ship, steering it through the intricate seas of accounting, auditing, and compliance. With your role demanding precision and expertise in managing numbers, it's crucial to reflect these skills effectively on your resume. Yet, condensing years of experience into a concise and impactful format can be a tricky task.

You know the pressure of making your resume capture your financial expertise while also tangling the interest of potential employers. In today's competitive job market, standing out is more important than ever, and this is where a structured approach becomes your greatest ally. Using a resume template can simplify this overwhelming process and provide the organization you need.

A selection of templates helps you lay a solid foundation for your resume, making it easier to highlight your strengths and significant accomplishments. This structured format allows you to clearly showcase your analytical skills, attention to detail, and experience in managing financial reporting and controls. Anchoring your resume in a well-chosen template not only saves time but also ensures a consistent presentation, making your capabilities stand out.

This guide will help you seamlessly craft a standout resume, preparing you to navigate the job market with confidence. You have the expertise—let's make sure your resume reflects it, paving the way to new career opportunities.

Key Takeaways

- The resume of a financial controller should reflect expertise in managing financial operations, highlighting precision and analytical skills through structured templates.

- Key sections include contact information, a professional summary with achievements, work experience in reverse chronological order, and a comprehensive list of both hard and soft skills.

- Preferable section formatting involves using bullet points for clear accomplishments and choosing readable fonts, while ensuring the resume is saved in a consistent PDF format.

- Quantifiable achievements, where possible, should be emphasized, using metrics to illustrate the impact and effectiveness of implemented financial strategies, systems, and solutions.

- Additional resume sections can include certifications, volunteer experiences, or hobbies to present a well-rounded profile that highlights continuous learning and community engagement.

What to focus on when writing your financial controller resume

A financial controller resume should tell the recruiter that you have the skills and experience to manage financial operations effectively. Convey your ability to oversee accounting processes while ensuring regulatory compliance and supporting strategic planning. Demonstrating your expertise in financial analysis and budget management is crucial.

How to structure your financial controller resume

- Contact Information: Start with your name, phone number, and professional email address, making sure it's easy for recruiters to find this vital information. Providing a LinkedIn profile link can also be beneficial, as it allows potential employers to learn more about your professional background and network.

- Professional Summary: Provide a snapshot of your years in financial management, emphasizing key achievements and your drive to enhance financial performance. Use this section to highlight specific strengths, such as leading successful mergers or implementing cost-saving measures, which can capture a recruiter's attention.

- Work Experience: Detail your past roles in reverse chronological order, focusing on accomplishments like cost reduction and improved financial reporting accuracy, to show your impact. Include quantifiable results, such as percentage savings or revenue growth, to give your achievements more weight and context.

- Skills: Highlight your strengths in financial forecasting, proficiency with ERP systems, and GAAP knowledge. Adding software skills like QuickBooks or SAP can further showcase your technical abilities. It's essential to specifically list tools and methodologies that are directly applicable to financial controlling, helping to underline your technical competence.

- Education: List your degree in finance, accounting, or a related field, and include any certifications such as CPA or CMA to bolster your credentials. Continuing education or any relevant courses you have completed can demonstrate a commitment to staying informed about advancements in the field.

- Achievements and Awards: Recognize any honors for financial leadership or successful projects, emphasizing your contributions to past employers’ success. Showcasing awards or acknowledgments tells a story of consistent performance and professionalism.

Consider adding optional sections like Professional Affiliations or Volunteer Experience to round out your career story and provide a fuller picture of your professional journey. As you prepare your resume, think about the format that best suits your qualifications—below, we’ll cover each section more in-depth.

Which resume format to choose

Crafting your resume as a financial controller means focusing on professionalism and expertise. The reverse-chronological format is your ally here, as it allows you to spotlight your latest and most important roles first, helping hiring managers track your career development easily. When it comes to font choice, opting for modern options like Lato, Montserrat, or Raleway subtly conveys a sense of contemporary professionalism, enhancing the overall presentation without overpowering the content. Saving your resume as a PDF is a crucial step; this ensures that all the careful formatting you've put into making your resume look polished will stay consistent, no matter what device it's viewed on. Keeping one-inch margins on all sides of the document is an easy way to ensure there's enough white space, which makes your resume both more visually appealing and easier to read. Each of these elements should integrate smoothly to highlight the precision and meticulous nature that are expected in a financial controller, ensuring that you make a strong and positive first impression.

How to write a quantifiable resume experience section

Your experience section can truly differentiate you as a financial controller by effectively showcasing your skills and achievements. Using action verbs like "streamlined," "analyzed," and "improved" adds energy to your narrative and highlights your proactive approach. Structuring it in reverse chronological order allows you to keep your most recent and relevant experience front and center, making it easier for employers to grasp your career progression. Tailoring your details to the job description ensures that your resume reflects the specific skills and experiences the employer is looking for, increasing your chances of standing out. By highlighting job titles that align with the role you seek and including quantifiable achievements, you clearly demonstrate your impact and relevance.

- •Reduced operating costs by 15% by refining processes.

- •Oversaw a $50M budget to align with corporate financial goals.

- •Implemented a new accounting system, cutting month-end closing time by 40%.

- •Led a team of 8 financial analysts, enhancing productivity by 20%.

This experience section effectively captures your impact as a financial controller by interweaving quantifiable achievements with your professional narrative. By using specific action words and aligning the content with the job description, your resume speaks directly to the employer's needs, enhancing your appeal. The clear language, coupled with a well-organized structure, ensures that your career highlights are easily accessible, allowing potential employers to quickly see your strengths and contributions. This cohesion between your roles, responsibilities, and achievements creates a seamless flow that emphasizes your value as a candidate.

Innovation-Focused resume experience section

An innovation-focused financial controller resume experience section should clearly demonstrate your ability to drive change and streamline processes. Start by highlighting the fresh ideas and improvements you've brought to your previous roles, focusing on how these efforts directly benefited the company. Consider the innovative solutions you've implemented and detail the positive outcomes, using numbers to show the real impact of your contributions. Presenting this information in bullet format can help potential employers quickly grasp the essence of your achievements.

In crafting your bullet points, emphasize how your actions led to successful results by using action verbs like "developed," "implemented," and "designed" to reflect your proactive role. Instead of making generic statements, focus on how your unique contributions positively affected the organization. Make sure each point highlights your ability to drive innovation and improve efficiency. Aim for concise clarity, providing just enough detail to emphasize your expertise without overwhelming the reader.

Financial Controller

XYZ Corporation

January 2019 - Present

- Developed a new budgeting system that reduced annual costs by 15%.

- Implemented an automated reporting tool, improving financial analysis speed by 20%.

- Designed a cross-departmental workshop to foster financial innovation and efficiency.

- Led a project to integrate AI technology, saving 200 man-hours monthly and enhancing accuracy.

Industry-Specific Focus resume experience section

A financial controller-focused resume experience section should zero in on the skills and achievements that best fit the role you're pursuing. Begin by identifying the responsibilities you've held that align closely with your target position, using facts and figures to highlight your impact. This approach not only underscores your expertise but also clearly demonstrates the value you bring.

Next, organize your roles in reverse chronological order, starting with your most recent position. For each job, list specific accomplishments that illustrate your financial control skills. Bullet points help make your achievements easy for employers to see. Keep each entry concise and relevant, ensuring every point enhances your application.

Senior Financial Controller

Tech Solutions Corp

June 2019 - Present

- Led the deployment of new financial software that improved reporting efficiency by 30%.

- Streamlined budget management processes, decreasing overall budget variances by 15%.

- Developed a new forecasting model that increased accuracy by 20%.

- Collaborated with cross-functional teams to enhance the understanding of financial data.

Technology-Focused resume experience section

A technology-focused financial controller resume experience section should effortlessly blend your expertise in financial management with your skill in leveraging technology. Begin by including your work dates, job title, and company name. Use bullet points to detail specific achievements, focusing on how technology improved financial processes. Highlight initiatives you've led, showcasing how tech upgrades or digital transitions resulted in measurable benefits.

Whenever possible, include metrics to illustrate the success of these initiatives and emphasize your collaboration with IT teams when implementing new software or automating tasks. This paints a vivid picture for future employers of your ability to drive technological advancements in finance, ultimately improving efficiency and accuracy.

Financial Controller

Tech Solutions Corp

June 2020 - Present

- Implemented a new ERP system that improved data accuracy by 30%

- Automated monthly financial reporting, reducing processing time by 50%

- Collaborated with IT to streamline financial workflows, enhancing efficiency by 20%

- Led the integration of AI tools in financial analysis, increasing forecast accuracy by 15%

Achievement-Focused resume experience section

A financial controller achievement-focused resume experience section should showcase your accomplishments and the impact you've had in your roles. Start each bullet with a strong action verb to highlight your proactive approach. Use numbers or percentages to give context to your achievements, demonstrating your ability to solve problems and improve financial processes. Instead of just listing responsibilities, focus on how you added value to your previous roles.

Incorporate a balance of soft and hard skills to illustrate your versatility. Highlight examples where you led a team, hit financial targets, or streamlined reporting processes. By keeping your language clear and simple, you make it easy for recruiters to quickly see the benefits you brought to your past employers. Focus on conveying your achievements concisely to ensure they grab attention.

Financial Controller

TechFinance Solutions

June 2018 - April 2023

- Streamlined monthly financial reporting process, cutting report preparation time by 25%.

- Led a team of five to integrate new financial software, boosting reporting accuracy by 30% in three months.

- Enhanced budget forecasting, leading to annual cost savings of $400,000.

- Conducted internal audits that revealed compliance issues, resulting in corrective measures and better governance.

Write your financial controller resume summary section

A finance-focused financial controller resume summary should present a clear and compelling snapshot of your career. If you have significant experience, this section should highlight your qualifications, accomplishments, and what you offer a potential employer. Think of it as the opening statement that defines your professional identity. It’s helpful to include your years of experience, skills, and major achievements. For example:

This summary is effective because it clearly establishes the role and expertise of the candidate, showcases specific accomplishments, and highlights a significant impact that would appeal to a potential employer. This approach turns your resume from a list of responsibilities into a narrative of your professional journey.

Describing yourself effectively in a resume summary means crafting a confident yet genuine statement. Use straightforward and clear language to focus on your unique qualities and relevant skills. This can help seamlessly connect your past experiences to the new role you’re targeting.

It’s important to distinguish a resume summary from similar terms. A resume summary offers a brief overview of your experience and achievements, which is ideal for experienced professionals. In contrast, a resume objective articulates career goals and suits those at the beginning of their careers. Meanwhile, a resume profile provides broader insights into both professional and personal traits, while a summary of qualifications highlights key skills in bullet points. Each serves a unique purpose, and choosing the right one can enhance your application.

Listing your financial controller skills on your resume

A finance-focused financial controller resume should have a well-structured skills section that stands out. You can choose to make it a standalone section or seamlessly weave it into your experience and summary parts. Highlighting your strengths and soft skills demonstrates your ability to work collaboratively, which is crucial in team settings. Hard skills, on the other hand, are the technical abilities like financial analysis and computer proficiency. Together, these skills serve as important keywords, helping your resume capture the attention of recruiters and pass through Applicant Tracking Systems (ATS) with ease.

Here's a sample skills section formatted in JSON:

This example is effective because it clearly lists essential skills for a financial controller, showcasing your industry expertise. These skills ensure your resume is noticed by automated systems scanning for relevant keywords, making it more likely to catch the eyes of recruiters.

Best hard skills to feature on your financial controller resume

As a financial controller, it's vital to feature hard skills that convey precision and expertise. These skills signify your capability to manage and interpret financial data and systems effectively.

Hard Skills

- Financial analysis

- Budgeting and forecasting

- Regulatory compliance

- Internal controls

- Financial modeling

- Cost management

- Audit planning

- ERP systems

- Variance analysis

- Financial reporting

- Tax planning

- Risk management

- Cash flow management

- Data analysis

- Performance metrics

Best soft skills to feature on your financial controller resume

Equally important are the soft skills that underscore your leadership and communication prowess. These skills show your ability to guide and cooperate within financial teams.

Soft Skills

- Attention to detail

- Communication

- Problem-solving

- Critical thinking

- Leadership

- Organization

- Time management

- Decision-making

- Adaptability

- Negotiation

- Conflict resolution

- Collaboration

- Strategic planning

- Emotional intelligence

- Initiative

How to include your education on your resume

An education section is an essential part of your financial controller resume. It highlights your academic background and qualifications, demonstrating to employers that you have the relevant knowledge for the job. Tailor this section to fit the specific role by including only relevant education. If certain courses or degrees are unrelated to the financial controller position, it's best to leave them out. Listing your degree on your resume should include the degree name, the institution, and the dates attended. If you had a strong GPA, consider including it, especially if you graduated recently; format it using the scale, e.g., 3.8/4.0. Graduating with honors like cum laude should also be mentioned, as it reflects your academic excellence.

Here's an incorrect and correct example to illustrate the difference:

The second example is outstanding because it directly relates to the financial controller position. It emphasizes a degree in Accounting, which is relevant for the role. Mentioning the cum laude honor and the high GPA of 3.8/4.0 illustrates academic dedication and achievement, highlighting your strong background in the necessary field. These targeted details ensure your education section effectively supports your application for a financial controller position.

How to include financial controller certificates on your resume

Including a certificates section in your resume is important, especially for a financial controller role. Certifications highlight your expertise and commitment to your field, making you stand out to potential employers. List the name of each certificate clearly so it's easy to read. Include the date when you achieved each certification to show the timeline of your professional development. Add the issuing organization that provided the certification to give your qualifications more credibility.

Positioning certificates in the header can also be effective, giving them prominence. For example, you can include: "Certified Public Accountant (CPA), AICPA - 2020." This approach highlights your key qualifications right away.

Here's an example of a well-crafted certificates section. It showcases certifications relevant to a financial controller, such as: Certified Public Accountant (CPA) by the AICPA, demonstrating accounting expertise. Chartered Financial Analyst (CFA) by the CFA Institute, showing investment analysis skills. Certified Management Accountant (CMA) by the IMA for proficiency in financial management. This example is strong because it includes widely recognized certifications that employers value highly, adding weight to your qualifications.

This section uses well-respected certifications relevant to the job, underscoring your readiness for the role.

Extra sections to include on your financial controller resume

Creating a well-rounded resume is crucial for showcasing your qualifications as a financial controller. While core skills and experience remain central, including additional sections can provide a more comprehensive view of your capabilities and character.

Language section — Highlight your ability to communicate in multiple languages to enhance your versatility in a global business setting. Demonstrating proficiency in languages like Spanish or Mandarin can set you apart in markets where these languages are valuable.

Hobbies and interests section — Include this section to give employers insight into your personality and work-life balance. Sharing interests like chess or hiking can illustrate analytical skills and stress management.

Volunteer work section — Detail your volunteer experiences to showcase your commitment to social responsibility and community engagement. Participation in financial literacy programs may reveal your passion for educating others and skill with numbers.

Books section — Mention books you’ve read related to finance to demonstrate continuous learning and industry awareness. Sharing insights gained from works like "The Intelligent Investor" can highlight your dedication to staying informed and improving your financial acumen.

These additional sections can make your resume more compelling and reflect a well-rounded candidate. Tailor your resume with relevant details to enhance your profile.

In Conclusion

In conclusion, crafting an effective financial controller resume is essential in showcasing your ability to steer a company’s financial operations. By applying a structured approach, you ensure that your expertise is conveyed clearly and concisely, capturing the attention of potential employers. Incorporating a mix of quantifiable achievements, relevant skills, and professional experiences can make your resume stand out in a competitive market. Highlighting your education and certifications adds credibility and emphasizes your readiness for the role.

Don't overlook the importance of the resume summary; it should provide a snapshot of your qualifications and significant accomplishments. Tailoring your experience section to reflect the specific job description ensures relevance and appeal. By using action verbs and providing clear evidence of your impact, your narrative will resonate with employers looking for proactive and innovative leaders in financial control.

Additional sections — such as language skills, volunteer experience, and interests in relevant books — offer a complete picture of your capabilities and character. These elements demonstrate your broader competencies and commitment to personal growth, setting you apart as a well-rounded candidate. Ensuring each section of your resume is thoughtfully crafted reinforces your profile's impact, enhancing your chances of securing new career opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.